1. Introduction

As Nakajima and Telyukova (2015) argue, older homeowners become borrowing-constrained as they age, especially due to the large medical expenses [

1]. An equity-borrowing product targeted toward elderly retirees who own their house can relax that constraint. Empirical studies support a similar possibility that up to 80% of homeowner households over age 69 could benefit from reverse mortgages [

2,

3]. Providing stable cash flows for retirees is an important factor in keeping an aging society sustainable and, for this purpose, public and private pension schemes have been developed in many countries.

However, the aging speed of Korea is too fast to handle with the existing pension scheme that saves money before retirement. Instead, the reliance on reverse mortgage products has been increasing recently. The reverse mortgage was introduced in 2007 under the Korea Housing Finance Corporation Act and is exclusively provided by the Housing Finance Corporation (HF). As of 2018, there were 51,080 active policies with an average monthly payment of $893. Considering that the average monthly payment was $411 in 2018 from the National Pension, it has successfully played a role in supplementing insufficient public pensions in Korea.

The poverty rate of the elderly aged 65 or older in Korea is 43.8%, more than triple the average of 14.0% in OECD members. Given the low subscription rate of the national pension, the poverty rate of the elderly is hard to improve easily as the aging population is making progress. Therefore, the role of the reverse mortgage will become more important in the future because elderly people have no choice but to seek other ways to raise living expenses, such as labor or business income, even after retirement.

Korea is not the first country to initiate the reverse mortgage program. In developed countries such as the United States, Europe, Australia, and Hong Kong with advanced financial markets, the reverse mortgage market was developed since the early 1980s. The successful growth of the reverse mortgage markets has attracted a volume of academic research [

4,

5,

6,

7,

8,

9,

10] as well. Lee et al. (2015) empirically showed that the reverse mortgage was an appropriate housing endowment among older retirees’ portfolios [

11]. Chen et al. (2010) built a modeling and pricing framework for the Home Equity Conversion Mortgage (HECM) program in the United States [

12]. They examined the premium structure of HECM loans to find that the collected premiums exceeded the value of the nonrecourse provision under the assumption that the refinancing rate was zero. Shan (2011) showed that higher house prices led to more reverse mortgage originations by combining the reverse mortgage data with county-level house price data [

13]. Because the total amount the borrower owes can grow quickly, most of the reverse mortgages are sold with a no-negative-equity-guarantee (NNEG), which protects the borrower by capping the redemption amount of the loan. Li et al. (2010) developed a framework for pricing the NNEG by viewing it as a European put option on the mortgaged property [

14]. In spite of the benefit of the reverse mortgage, only roughly 3% of eligible homeowners participate in the United States. Davidoff (2015) argued that the weak demand was more puzzling considering their finding that the put value has often exceeded closing costs, even ignoring other embedded options and using backward-looking expectations near the recent price-cycle peak [

15].

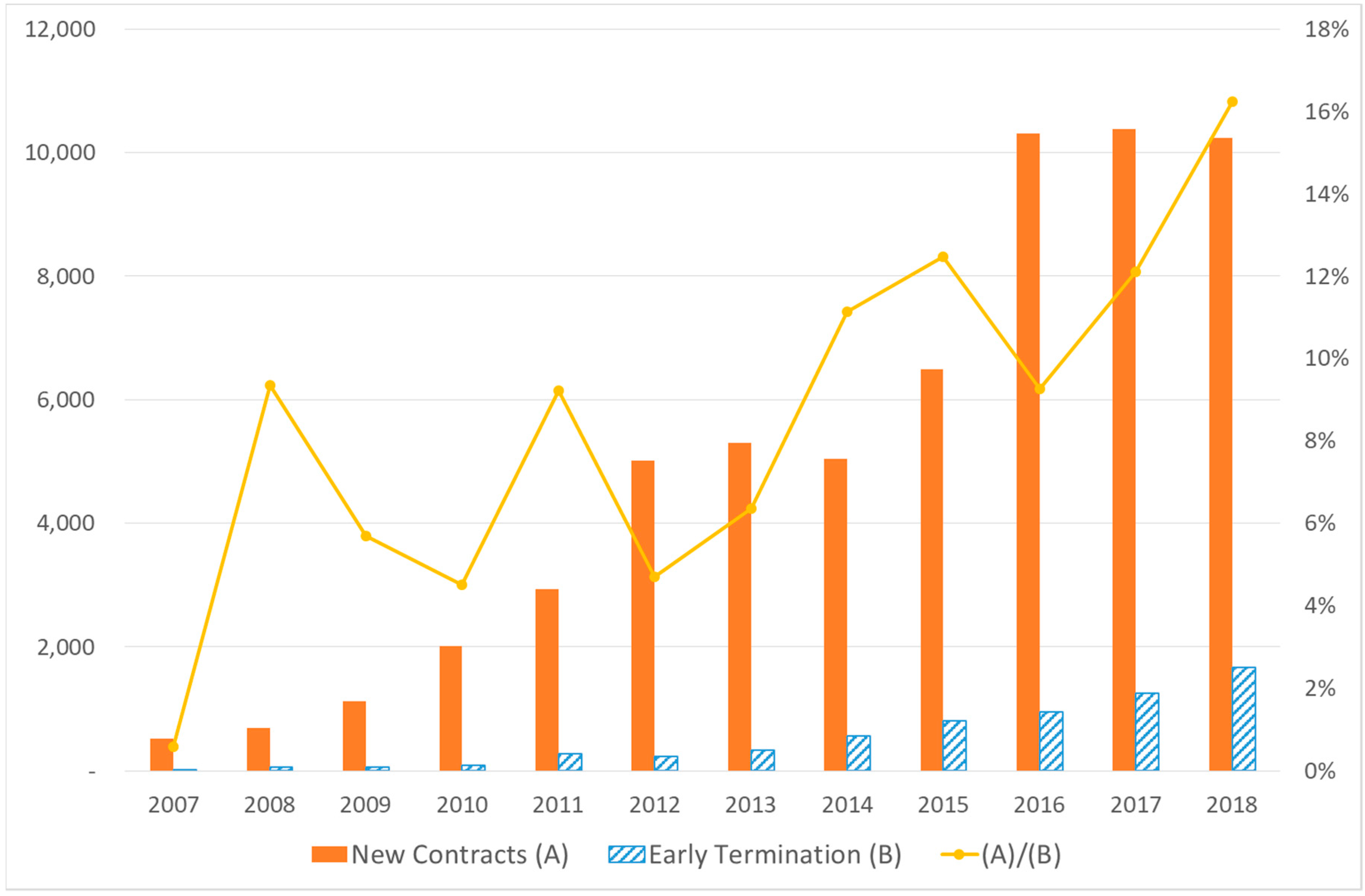

When taking out the reverse mortgage, the borrower can choose to receive either a lump sum at the inception or an income stream until the termination of the loan. In Korea, the lump sum reverse mortgage is available under the very strong condition that the lump sum payment should be used to pay off the existing mortgage loan. This strong condition would explain the fact that 98.8% of borrowers selected the income stream rather than the lump sum reverse mortgages in Korea. Thus, we focus on the income stream reverse mortgages in this study. The borrower would receive a higher monthly payment from the reverse mortgage for a more expensive house. Because the reverse mortgage sets the house value as of the first payment, it would be rational to terminate early and repurchase the product when the house price increases for receiving an increased payment. Apparently, the borrowers of reverse mortgages understand the relation between the monthly payment and the house price. According to

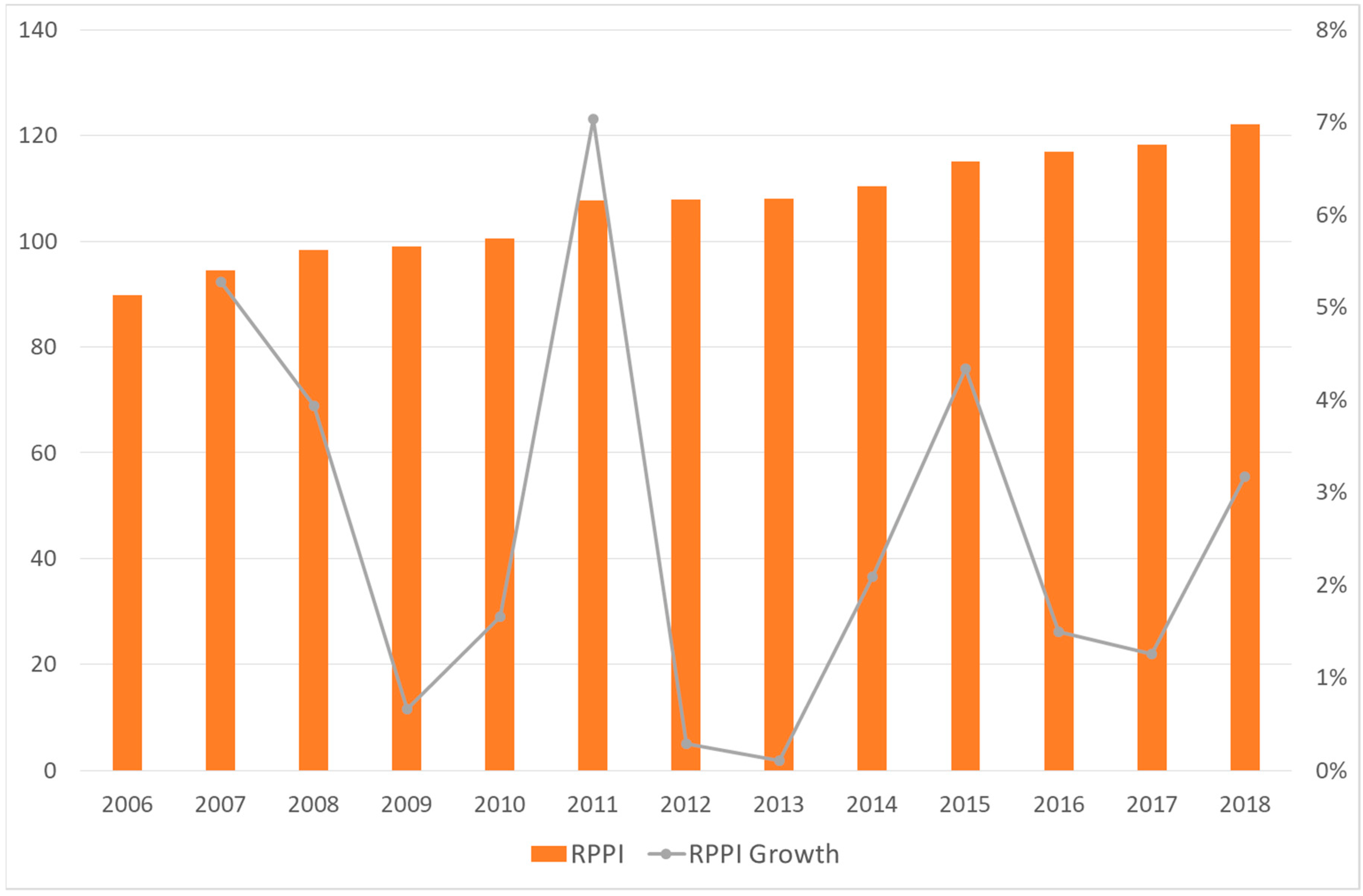

Figure 1, the ratio of early termination to new contracts jumped to 16% in 2018. The surge in early termination can be fully understood by the fact that Korea’s housing price index jumped more than 3% in 2018, as reported in

Figure 2.

At early termination, principal and interest payment on a mortgage, including the accumulated insurance premium and interest, should be paid to the lender. Thus, early termination may not always be a profitable option as housing prices have risen, and the borrower should be very cautious when she considers early termination. However, the actuarial pricing model for the reverse mortgage is very complex for ordinary retirees to understand, especially with the rapid changes in economic conditions such as house prices.

In this study, we examined the actuarial pricing model for the reverse mortgage product in Korea with various scenarios regarding major economic variables. By applying various scenarios, we provide numerical solutions for monthly payment and the break-even growth rate of house price over a retention period. Furthermore, considering the mortality improvement, which has been commonly observed in many developed countries since the late 20th century, we added the mortality improvement to the actuarial model by adjusting the mortality rate to provide the enhanced numerical solutions.

We find that, in order for the early-termination-and-repurchase strategy to be profitable, the realized growth rate of house price should be greater than the expected growth rate in the actuarial pricing model for the reverse mortgage payment. For a 65-year-old borrower, the house price should be increased by at least 5.7% and 8.6% if she wants to receive a higher monthly payment by exercising the strategy in 1 year and 2 years, respectively. If she received the payment from the initial reverse mortgage account for 10 years, the house price should be increased by more than 70% for the strategy to be profitable. Since the life expectancy of Korea is rapidly increasing, an even greater price increase is requested after considering the mortality improvement over the retention period from the initial contract. To add, for the older borrower, the greater growth rate of house price is required for the strategy to be profitable.

The remainder of this paper is organized as follows.

Section 2 describes the reverse mortgage in Korea,

Section 3 explains the data and the numerical solutions for the standard contracts,

Section 4 and

Section 5 provide the numerical solutions under the effect of house price increase and the effect of mortality improvement, respectively, and

Section 6 concludes.

2. Reverse Mortgage

Reverse mortgage provides a number of advantages for the borrowers and their heirs by allowing elderly homeowners to consume their housing equity without having to disrupt housing arrangements. The property rights over the house remain with the borrowers and the only amount due to the bank will be the sum accrued until their premature death. As Nakajima and Telyukova (2017) summarize, reverse mortgages differ from conventional mortgages as following [

16]:

- i.

Instead of paying interest and principal and accumulating home equity, reverse mortgages allow borrowers to cash out the home equity they have accumulated;

- ii.

Reverse mortgages are available only to borrowers aged 60 or older in Korea who are homeowners and live in their house;

- iii.

There is no predetermined due date because repayment of the borrowed amount is due when the borrowers move out or die;

- iv.

Reverse mortgage loans are nonrecourse.

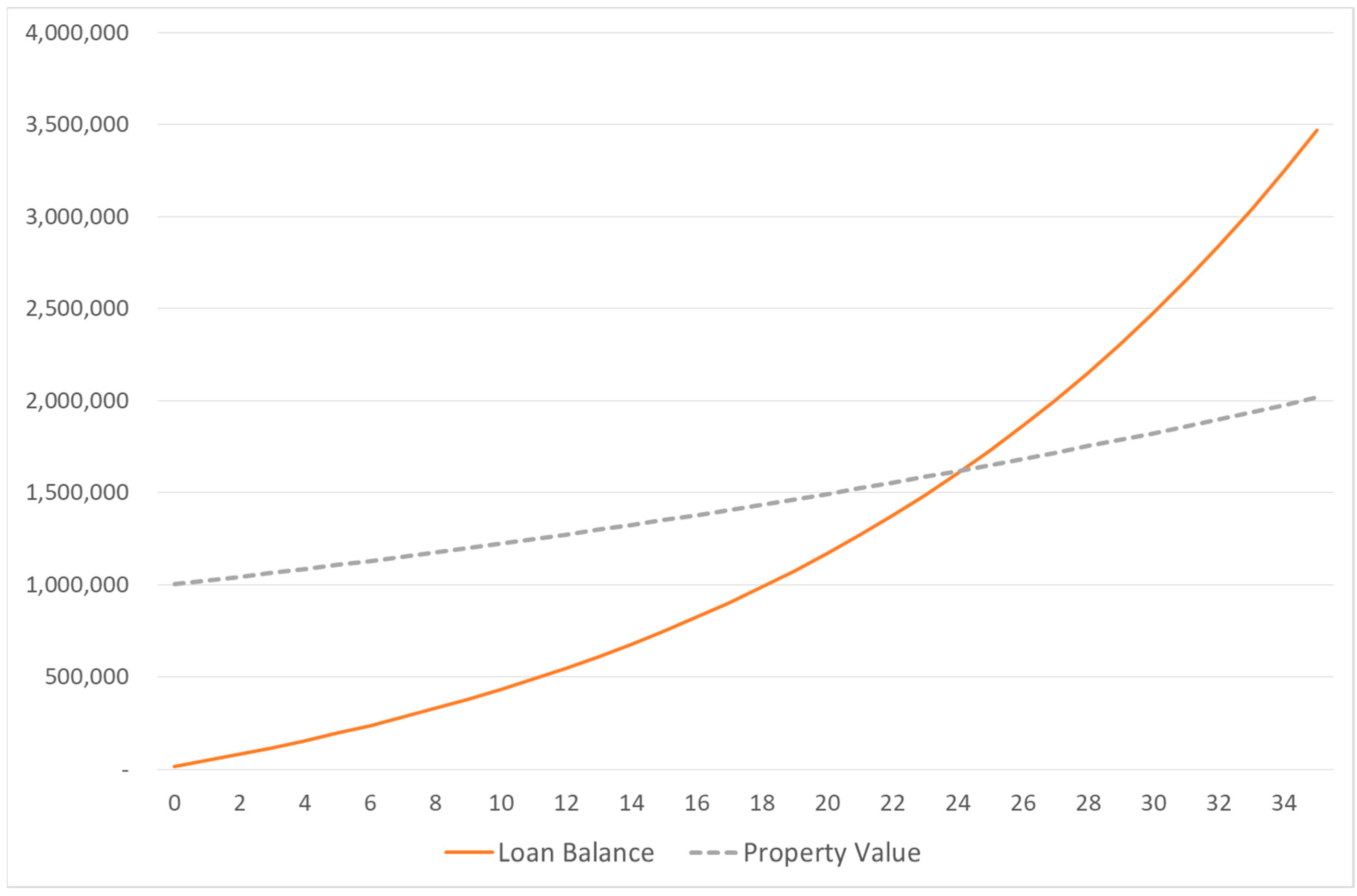

The outstanding balance of the loan and the property value would grow over time, but this loan balance would get bigger than the property value after a certain point of the time, which is called the cross-over point.

Figure 3 shows the loan balance and the property value of a typical reverse mortgage contract for a female borrower aged 65 in Korea. By assuming the initial property value of

$1,000,000 and the long term house price growth rate of 2% per year, the loan balance would be greater than the future property value after the 24th year. Thus, if the borrower survives longer than 24 years, she still enjoys the monthly payment from the reverse mortgage, while staying in the same house, which no longer holds any equity value.

Jang, Eom, and Kim (2011) provide the actuarial pricing model for the reverse mortgage as in the following equation based on the principal of equivalence [

17]:

where P(t) is the probability that the contract is terminated, L(t) is the loan balance, H(t) is the property value, S(t) is the probability that the contract remains active, and r(s) is the instantaneous interest rate.

This equation explains the well-known characteristics of reverse mortgages, such as the amount of the reverse mortgage loan, depending positively on the age of the borrower and the value of the property and negatively on the interest rate. In Equation (1), we employed a slightly different approach to Li et al. [

14], which is the standard pricing model for reverse mortgages in the literature. We tried to calculate the monthly payment with the predetermined premium rate, while they tried to find the fair price of the no-negative-equity-guarantee provision. In addition, they considered the rental yield, which we ignored. In fact, the Housing Finance Corporation (HF) determines the monthly payments of reverse mortgages based on Equation (1) without considering the rental yield.

Although the interest rate on the loan balance changes as rates in the market change, HF applies a long-term fixed interest rate when the monthly payment is calculated at the inception. Thus, we considered fixed roll up rates in our analysis. We calculated the monthly payment of reverse mortgages from Equation (1) to numerically investigate the effect of such risk factors as growth rate of house price, interest rates, and mortality rates.

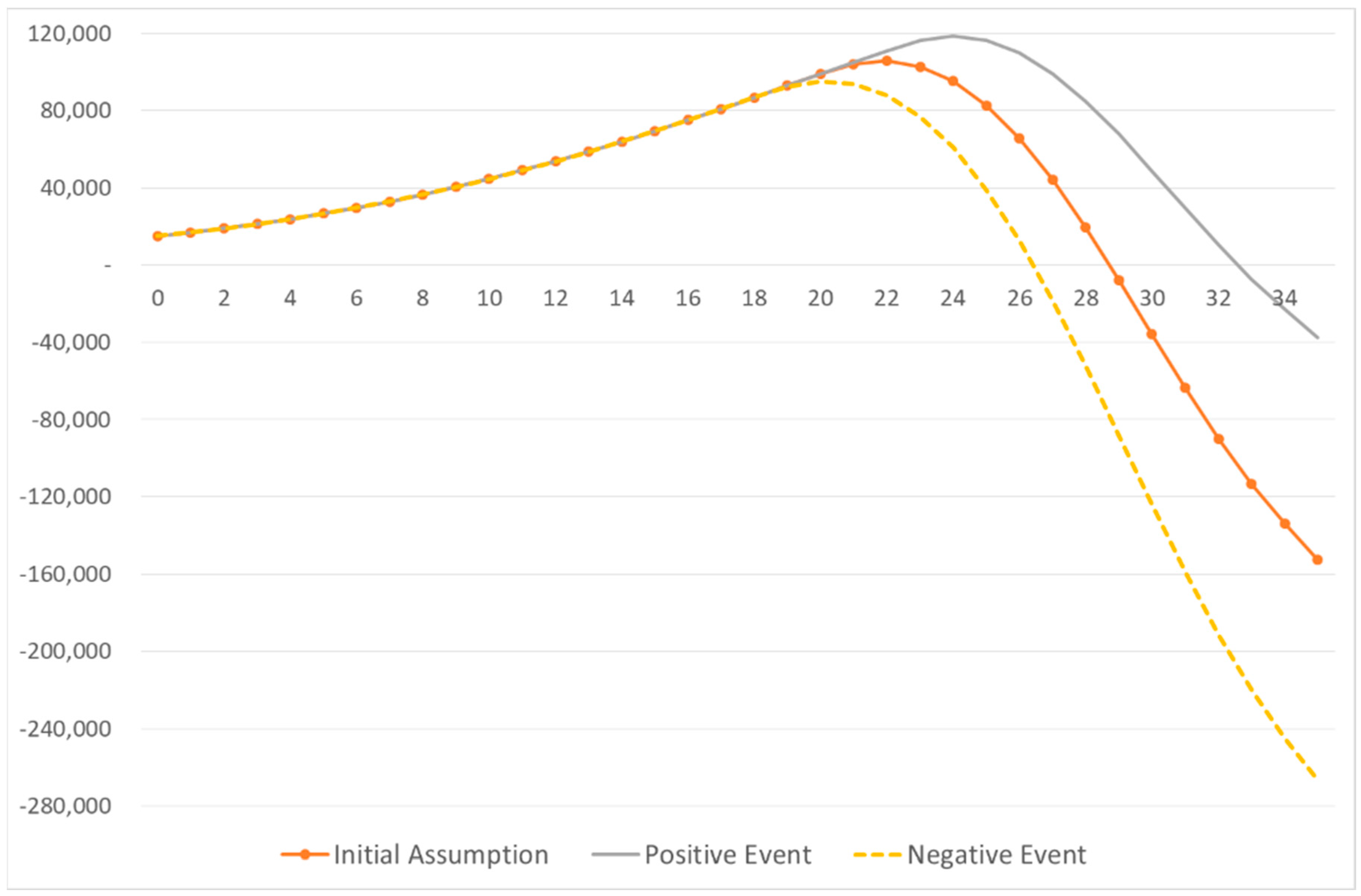

Figure 4 shows the changes in the profit of the reverse mortgage providers when the positive or negative events occur.

3. Data and Standard Monthly Payment

Although the actuarial model for reverse mortgage payment is publicly disclosed as in Equation (1), it is practically impossible for the elderly borrowers to understand and solve the equation to get the monthly payment. To test numerically whether the early termination is rational in changed economic conditions, we first calculated the standard monthly payments from the reverse mortgage in Korea based on Equation (1).

To solve Equation (1), we needed the information regarding the discount rate, the mortality rate, the house price growth rate, and the premium rate that is charged by HF. We collected the life table from Statistics Korea to get the mortality rate and the residential property price index from the Bank for International Settlements to get the house price growth rate. The premium rate is publicly announced in Korea: The initial rate of 1.50% and the monthly rate of 0.75% are currently applied. Because HF provides sample monthly payments of a reverse mortgage for a certain age on their website, we compared our solution from Equation (1) with these sample payments to calibrate the discount rate. Finally, the discount rate of 5% per year and the house price growth rate of 2% were employed in this study.

Table 1 reports the standard monthly payment from the reverse mortgage based on the actuarial model. Apparently, the greater the house price at the time of issuance, the more the borrower would receive from HF. For a 60-year-old borrower, she would receive

$1021 every month if her house value is

$500,000, but she would receive

$4085 if her house value is

$2,000,000. Furthermore, the reverse mortgage would pay more to older borrowers as their life expectancy is shorter. With the same

$1,000,000 house, a 90-year-old borrower would receive

$8864 every month, but a 60-year-old borrower would receive only

$2043.

4. The Effect of House Price Increase

In this section, we examined the effect of house price increase on the monthly payment after the early termination and repurchase of the reverse mortgage. As a representative contract, we selected the 65-year-old borrower with

$1,000,000 house value, as reported in

Table 1, and then we changed the house value across various retention periods.

Table 2 shows the new monthly payments from the reverse mortgage under the assumption that the borrower pays off the loan and repurchases the reverse mortgage after t years and that the house price has risen in the range of

$1,020,000 to

$1,500,000 over the retention periods. To distinguish the profitable conditions, we displayed the monthly payments in boldface type if the new payment was greater than the initial payment.

Suppose a 65-year-old borrower terminates and repurchases the reverse mortgage after five years from the first payment and the house price has increased to

$1,500,000 from its initial value of

$1,000,000 over the same five years. Because the borrower’s age has also increased to 70, the borrower might expect to receive

$4550 for the increased house price and age, according to

Table 1. However, as the existing loan principal, accrued interests, and insurance premium must be paid at the time of early termination, the remaining value of the house will be significantly lower than

$1,500,000, which leads to the monthly payments of

$3187. As the new payment is still greater than the original payment of

$2472, it is rational to consider the strategy of early termination and repurchase.

Due to the aforementioned interests and premiums, just because the house price has increased does not mean that the borrower can receive increased monthly payments from the early-termination-and-repurchase strategy. As reported in

Table 2, for a 65-year-old borrower, even if housing prices increased by 4% within one year of subscription, early termination and repurchase of the existing contract would result in monthly payments of only

$2431, which is less than the initial monthly payment of

$2472.

We also found the annual growth rate of house price (

) for the new monthly payment to be equal to the initial monthly payment in the last column of

Table 2. It is noteworthy that the house price should increase by more than 5.7% for the early-termination-and-repurchase strategy to be profitable in one year from the initial purchase of the reverse mortgage. Considering that the annual growth rate of house price assumed in

Table 1 is 2%, even double the assumed growth is not good enough to be profitable. We also note that the longer the retention period, the higher the house price growth rate is required to be profitable. For example, the house price should increase by more than 70.1% for the strategy to be profitable for the retention period of 10 years. Therefore, if early termination and repurchase are planned in anticipation of a rise in housing prices after the initial purchase of the reverse mortgage, it is desirable to realize it in the near future, such as one or two years, but it is not economically appropriate when a considerable period has elapsed.

As reported in

Table 1, even though the collateralized house prices are the same, the older borrowers would receive a higher monthly payment than the younger borrowers. Thus, the payment increase from the strategy would depend on the age of the borrower. In

Table 3, we report the new monthly payments from the reverse mortgage under the assumption that a 75-year-old borrower pays off the loan and repurchases the reverse mortgage after t years and that the house price has risen in the range of

$1,020,000 to

$1,500,000 over the retention periods.

For a 75-year-old borrower, like the 65-year-old borrower in

Table 2, the house price should increase greater than the assumed growth rate of 2% per year in Equation (1) for the strategy to be profitable, and the higher growth rate is required for the longer retention period. For example, 5.1% of the house price increase is good enough to get higher payments from the strategy, but 125.6% of the house price is required after 10 years from the initial purchase. We note that the

for a 75-year-old borrower in one year is 5.1% (in two years, 8.4%), which is slightly less than the

for a 65-year-old borrower. However, for a longer retention period than 3 years, the

for a 75-year-old borrower is greater than the

for a 65-year-old borrower.

5. The Effect of Mortality Improvement

The aging speed of the population in Korea is much faster than the rest of the world. According to the U.S. census bureau’s international population reports, the percentage of the total population of Korea aged 65 and over is expected to be 35.9% in 2050, which would make it the second oldest country next to Japan. The older proportion of the total population in Korea was only 3.8% in 1980, but it increased to 7.1% and 13.2% in 2000 and 2015, respectively. In addition, this ratio would be higher than 21% in 2026, which would lead Korea to becoming a super-aged society.

The main reason for the rapid aging population in Korea is the lower birth rate as well as the increase in life expectancy. As the life expectancy increases, the mortality rate in Equation (1) decreases. This mortality improvement would cause a reduced monthly payment from the new contract if the borrower decides to terminate the initial contract in t years. In order to reflect both house price increase and mortality improvement, we included the mortality improvement by reducing the mortality rate by 2% (i.e., q’ = 0.98 × q) in addition to all the assumptions made in

Section 4, and the results are reported in

Table 4. In order to overcome the mortality improvement by 2%, a greater house price increase is required for the early-termination-and-repurchase strategy to be profitable. For a 65-year-old borrower, the

is 6.4% in 1 year and 72.3% in 10 years, which are greater than the growth rates in

Table 2.

6. Conclusions and Implications

In this paper, we examined the condition upon which house price growth rate would make the early termination and repurchase of the reverse mortgage profitable in Korea. Because the reverse mortgage is a combined product with an annuity to the retirees, a bank loan with a collateral of their house, and an insurance to guarantee the repayment, the pricing formula for this product is very complicated. By solving the actuarial pricing model, we found numerical solutions for the monthly payments and the required growth rate of house price under various conditions, such as the borrower’s age and the secured house price.

The results showed that shortly after the purchase of the reverse mortgage, the borrower would enjoy the early termination and repurchase with less than 10% of house price growth. However, if the borrower received the monthly payments from the reverse mortgage for more than a couple of years, the house price would significantly increase from the initial price. The older the borrower, the greater the growth rate of house price is required for this strategy to be profitable. Finally, when we considered the improvement of mortality, the borrower needs even greater house price growth.