Corporate Governance Structure, Financial Capability, and the R&D Intensity in Chinese Sports Sector: Evidence from Listed Sports Companies

Abstract

1. Introduction

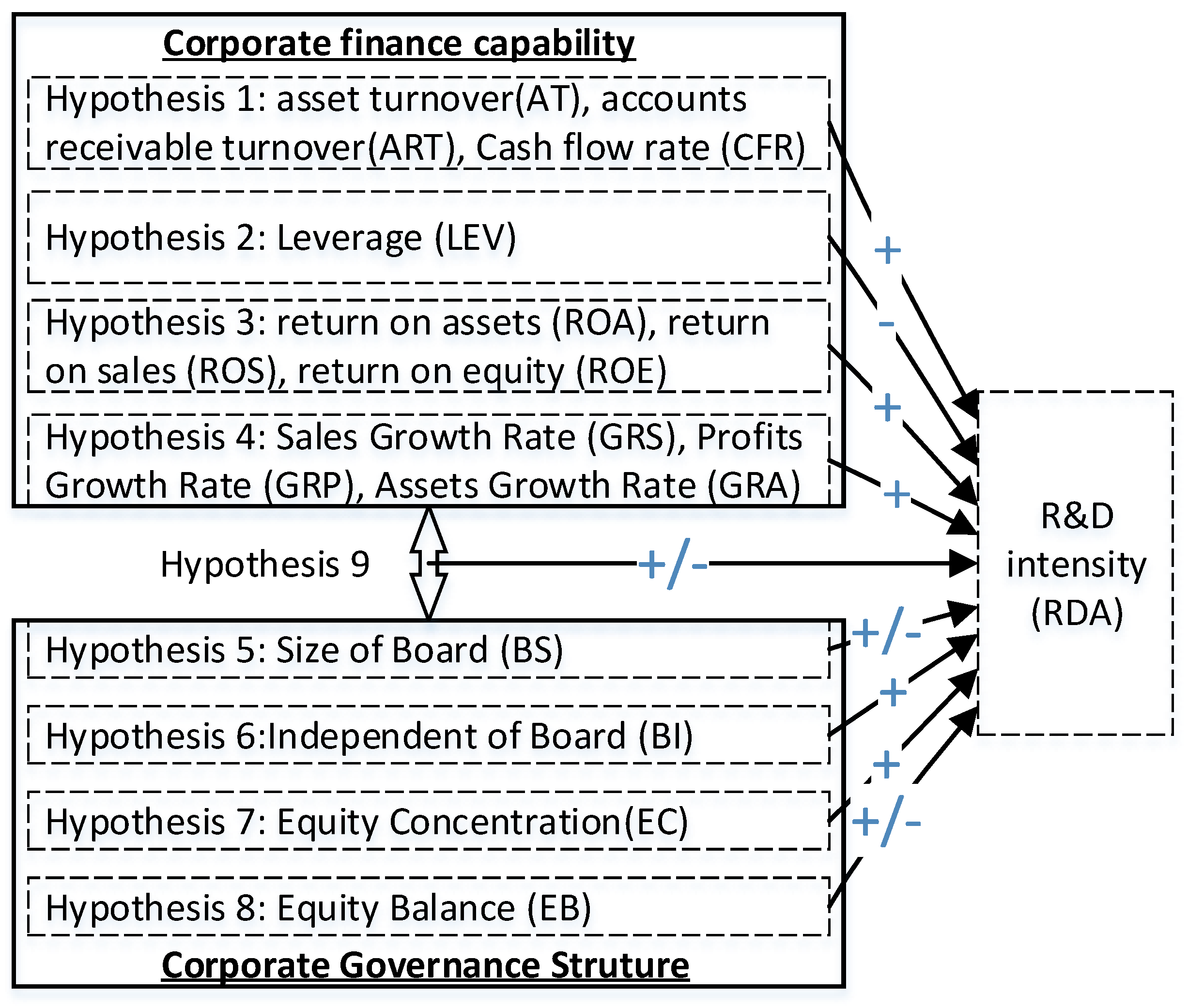

- What is the relationship between corporate financial capability and R&D intensity in Chinese sports firms?

- How do corporate governance structures affect R&D intensity in Chinese sports firms?

- Are the effects of corporate financial capability on R&D intensity in Chinese sports firms different for firms with different governance structures?

2. Theoretical Framework and Hypothesis Development

2.1. Corporate Financial Capability Impacting R&D Investment

2.2. Corporate Governance Structure Impacting R&D Investment

2.3. The Interaction Effect between Corporate Financial Capability and Corporate Governance Structure

3. Materials and Methods

3.1. Research Variables

3.2. Empirical Models

3.3. Research Context

4. Results

5. Discussion, Conclusions, and Suggestions

5.1. Discussion and Conclusions

5.2. Suggestions

Author Contributions

Funding

Conflicts of Interest

References

- Savić, Z.; Ranđelović, N.; Stojanović, N.; Stanković, V.; Šiljak, V. The Sports Industry and Achieving Top Sports Results. Phys. Educ. Sport 2017, 15, 513–522. [Google Scholar] [CrossRef]

- Sports & Recreation Business Statistics Analysis, Business and Industry Statistics. Available online: https://www.plunkettresearch.com/statistics/sports-industry/ (accessed on 27 November 2019).

- Zhang, J.J.; Cianfrone, B.A.; Sun, P. Sport coaching and management. In Introduction to Kinesiology and Recreation; Reeve, T.G., Dornier, L.A., Yu, T., Yan, Z., Liang, G.L., Eds.; Educational Science: Beijing, China, 2015; pp. 296–320. [Google Scholar]

- Means, J.; Nauright, J. Going global: The NBA sets its sights on Africa. Int. J. Sports Mark. Spons. 2007, 3, 40–50. [Google Scholar] [CrossRef]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. What promotes R&D? Comparative evidence from around the world. Res. Policy 2017, 46, 447–462. [Google Scholar]

- Carboni, O.A. The Effect of Public Support on Investment and R&D: An Empirical Evaluation on European Manufacturing Firms. Technol. Forecast. Soc. Chang. 2017, 117, 282–295. [Google Scholar]

- Porter, M.E.; Millar, V.E. How information gives you competitive advantage. Harv. Bus. Rev. 1985, 63, 1949–1974. [Google Scholar]

- Honoré, F.; Munari, F.; de La Potterie, B.V.P. Corporate governance practices and companies’ R&D intensity: Evidence from European countries. Res. Policy 2015, 44, 533–543. [Google Scholar]

- Dong, J.; Gou, Y. Corporate governance structure, managerial discretion, and the R&D investment in China. Int. Rev. Econ. Financ. 2010, 19, 180–188. [Google Scholar]

- Lee, C.; Park, G.; Kang, J. The impact of convergence between science and technology on innovation. J. Technol. Transf. 2018, 43, 522–544. [Google Scholar] [CrossRef]

- Chintrakarn, P.; Jiraporn, P.; Sakr, S.; Lee, S.M. Do co-opted directors mitigate managerial myopia? Evidence from R&D investments. Financ. Res. Lett. 2016, 17, 285–289. [Google Scholar]

- Brown, J.R.; Martinsson, G.; Petersen, B.C. Do financing constraints matter for R&D? Eur. Econ. Rev. 2012, 56, 1512–1529. [Google Scholar]

- Yung, C. Making waves: To innovate or be a fast second. J. Financ. Quant. Anal. 2016, 51, 415–433. [Google Scholar] [CrossRef]

- Pham, L.T.M.; Vo, L.V.; Le, H.T.T.; Le, D.V. Asset liquidity and firm innovation. Int. Rev. Financ. Anal. 2018, 58, 225–234. [Google Scholar] [CrossRef]

- Howell, S.T. Financing Constraints as Barriers to Innovation: Evidence from R&D Grants to Energy Startups. Available online: https://economics.yale.edu/sites/default/files/howell_innovation_finance_jmp_jan7.pdf (accessed on 27 November 2019).

- Hu, J.; Guo, L.; Zhu, F. Regional Financial Developments and Research and Development Investment–Cash Flow Sensitivity: Evidence on Chinese Public High-Tech Companies. Int. Rev. Financ. 2017, 17, 627–643. [Google Scholar] [CrossRef]

- Vo, L.V.; Le, H.T.T. Strategic growth option, uncertainty, and R&D investment. Int. Rev. Financ. Anal. 2017, 51, 16–24. [Google Scholar]

- Seifert, B.M.; Gonenc, H. Creditor Rights and R&D Expenditures. Corp. Gov. Int. Rev. 2012, 20, 3–20. [Google Scholar]

- Baum, C.F.; Caglayan, M.; Talavera, O. The Effects of Future Capital Investment and R&D Expenditures on Firms’ Liquidity. Rev. Int. Econ. 2013, 21, 459–474. [Google Scholar]

- Berentsen, A.; Breu, M.R.; Shi, S. Liquidity, innovation, and growth. J. Monet. Econ. 2012, 59, 721–737. [Google Scholar] [CrossRef]

- Lin, Z.J.; Liu, S.; Sun, F. The Impact of Financing Constraints and Agency Costs on Corporate R&D Investment: Evidence from China. Int. Rev. Financ. 2017, 17, 3–42. [Google Scholar]

- Holmstrom, B. Agency Costs and Innovation. J. Econ. Behav. Organ. 1989, 12, 305–327. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; Hall, B.H., Rosenberg, N., Eds.; Elsevier: North Holland, The Netherlands, 2010. [Google Scholar]

- Delen, D.; Kuzey, C.; Uyar, A. Measuring firm performance using financial ratios: A decision tree approach. Expert Syst. Appl. 2013, 40, 3970–3983. [Google Scholar] [CrossRef]

- Klingenberg, B.; Timberlake, R.; Geurts, T.G.; Brown, R.J. The relationship of operational innovation and financial performance—A critical perspective. Int. J. Prod. Econ. 2013, 142, 317–323. [Google Scholar] [CrossRef]

- Teirlinck, P. Configurations of strategic R&D decisions and financial performance in small-sized and medium-sized firms. J. Bus. Res. 2017, 74, 55–65. [Google Scholar]

- Li, L.; Qu, X.H.; Xiao, H. Capitalization of R&D Expenditures: Real Signal Transmission or Earnings Management. J. Audit. Econ. 2013, 1, 60–69. (In Chinese) [Google Scholar]

- Kuo, H.; Wang, L.; Yeh, L. The role of education of directors in influencing firm R&D investment. Asia Pac. Manag. Rev. 2018, 23, 108–120. [Google Scholar]

- Schmid, T.; Achleitner, A.K.; Ampenberger, M.; Kaserer, C. Family firms and R&D behavior - new evidence from a large-scale survey. Res. Policy 2014, 43, 233–244. [Google Scholar]

- Hao, K.Y.; Jaffe, A.B. Effect of Liquidity on Firms’ R&D Spending. Econ. Innov. New Technol. 1993, 2, 275–282. [Google Scholar]

- Guariglia, A.; Liu, P. To what extent do financing constraints affect Chinese firms’ innovation activities? Int. Rev. Financ. Anal. 2014, 36, 223–240. [Google Scholar] [CrossRef]

- Himmelberg, C.P.; Petersen, B.C. R&D and internal finance: A panel study of small firms in high-tech industries. Rev. Econ. Stat. 1994, 76, 38–51. [Google Scholar]

- Huang, Y.S.; Wang, C.J. Corporate governance and risk-taking of Chinese firms: The role of board size. Int. Rev. Econ. Financ. 2015, 37, 96–113. [Google Scholar] [CrossRef]

- Hillier, D.; Pindado, J.; Queiroz, V.; Torre, C. The impact of country-level corporate governance on research and development. J. Int. Bus. Stud. 2011, 42, 76–98. [Google Scholar] [CrossRef]

- Chiao, C. The Relationship between R&D and Physical Investment of Firms in Science-Based Industries. Appl. Econ. 2001, 33, 23–35. [Google Scholar]

- Masood, A.; Shah, A. Corporate Governance and Cash Holdings in Listed non-financial Firms in Pakistan. Bus. Rev. 2014, 9, 48–72. [Google Scholar]

- Friend, I.; Lang, H.H.P. An empirical test of the impact of management self-interest on corporate capital structure. J. Financ. 1988, 43, 271–283. [Google Scholar] [CrossRef]

- Badia, M.M.; Slootmaekers, V. The Missing Link between Financial Constraints and Productivity. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/The-Missing-Link-Between-Financial-Constraints-and-Productivity-22823 (accessed on 27 November 2019).

- Koku, P.S. R&D expenditure and profitability in the pharmaceutical industry in the United States. J. Appl. Manag. Account. Res. 2010, 8, 167–173. [Google Scholar]

- Becker, B.; Hall, S.G. Foreign direct investment in R&D and exchange rate uncertainty. Open Econ. Rev. 2009, 20, 207–223. [Google Scholar]

- Coad, A.; Rao, R. Firm Growth and R&D in New Firm Growth. Econ. Innov. New Technol. 2010, 19, 127–145. [Google Scholar]

- Lee, P.M.; O’Neill, H.M. Ownership structures and R&D investments of U.S. and Japanese firms, agency and stewardship perspectives. Acad. Manag. J. 2003, 46, 212–225. [Google Scholar]

- Cazier, R.A. Measuring R&D curtailment among short-horizon CEOs. J. Corp. Financ. 2011, 17, 584–594. [Google Scholar]

- Stam, E.; Wennberg, K. The Roles of R&D in New Firm Growth. Small Bus. Econ. 2009, 33, 77–89. [Google Scholar]

- Mudambi, R.; Swift, T. Proactive R&D management and firm growth: A punctuated equilibrium model. Res. Policy 2011, 40, 429–440. [Google Scholar]

- Patel, P.C.; Guedes, M.J.; Soares, N.; da Conceição Gonçalves, V. Strength of the association between R&D volatility and firm growth: The roles of corporate governance and tangible asset volatility. J. Bus. Res. 2018, 88, 282–288. [Google Scholar]

- Driver, C.; Guedes, M.J.C. Research and development, cash flow, agency and governance: UK large companies. Res. Policy 2012, 41, 1565–1577. [Google Scholar] [CrossRef]

- Munari, F.; Oriani, R.; Sobrero, M. The effects of owner identity and external governance systems on R&D investments: A study of Western European firms. Res. Policy 2010, 39, 1093–1104. [Google Scholar]

- Alonso-Borrego, C.; De Madrid, F., III; Javier Forcadell, F.; Carlos, J. Corporate Diversification and R&D Intensity Dynamics. Available online: https://www.researchgate.net/publication/228737358 (accessed on 27 November 2019).

- Ayyagari, M.; Demirgüç-Kunt, A.; Maksimovic, V. Firm innovation in emerging markets: The role of finance, governance and competition. J. Financ. Quant. Anal. 2011, 46, 1545–1580. [Google Scholar] [CrossRef]

- Lv, D.D.; Chen, W.; Zhu, H.; Lan, H. How does inconsistent negative performance feedback affect the R&D investments of firms? A study of publicly listed firms. J. Bus. Res. 2019, 102, 151–162. [Google Scholar]

- Kor, Y.Y. Direct and interaction effects of top management team and board compositions on R&D investment strategy. Strateg. Manag. J. 2006, 27, 1081–1099. [Google Scholar]

- Deutsch, Y. The impact of board composition on firms’ critical decisions: A meta-analytic review. J. Manag. 2005, 31, 424–444. [Google Scholar] [CrossRef]

- Dalton, D.; Hitt, M.A.; Certo, S.T.; Dalton, C.M. The fundamental agency problem and its mitigation: Independence, equity, and the market for corporate control. Acad. Manag. Ann. 2007, 1, 1–64. [Google Scholar] [CrossRef]

- Finegold, D.; Benson, G.S.; Hecht, D. Corporate boards and company performance: Review of research in light of recent reforms. Corp. Gov. Int. Rev. 2007, 15, 865–878. [Google Scholar] [CrossRef]

- Baysinger, B.D.; Hoskisson, R.E. The composition of boards of directors and strategy control: Effects on corporate strategy. Acad. Manag. Rev. 1990, 15, 72–87. [Google Scholar] [CrossRef]

- Yoo, T.; Sung, T. How outside directors facilitate corporate R&D investment? Evidence from large Korean firms. J. Bus. Res. 2015, 68, 1251–1260. [Google Scholar]

- Balsmeier, B.; Fleming, L.; Manso, G. Independent boards and innovation. J. Financ. Econ. 2017, 123, 536–557. [Google Scholar] [CrossRef]

- Yermack, D. Higher market valuation of companies with a small board of directors. J. Financ. Econ. 1996, 35, 451–469. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Pedersen, T.; Thomsen, S. Business systems and corporate governance. Int. Stud. Manag. Organ. 1999, 29, 43–59. [Google Scholar] [CrossRef]

- Stein, J.C. Agency, information and corporate investment. In Handbook of the Economics of Finance, 1st ed.; Constantinides, G.M., Harris, M., Stulz, R.M., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, Chapter 2; pp. 111–165. Available online: https://www.nber.org/papers/w8342.pdf (accessed on 27 November 2019).

- Levin, R.G.; Klevorick, A.K.; Nelson, R.R.; Winter, S.G. Appropriating the returns from industrial research and development. Brook. Pap. Econ. Act. 1987, 3, 783–831. [Google Scholar] [CrossRef]

- Ito, K.; Pucik, V. R&D spending, domestic competition, and export performance of Japanese manufacturing firms. Strateg. Manag. J. 1993, 14, 61–75. [Google Scholar]

- Wang, C. Board size and firm risk-taking. Rev. Quant. Financ. Account. 2012, 38, 519–542. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. Rev. Financ. Econ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Shaikh, I.A.; Peters, L. The value of board monitoring in promoting R&D: A test of agency-theory in the US context. J. Manag. Gov. 2018, 22, 339–363. [Google Scholar]

- Li, Z.F. Mutual monitoring and corporate governance. J. Bank. Financ. 2014, 45, 255–269. [Google Scholar]

- Li, Z.F. Mutual Monitoring and Agency Problems. SSRN Electron. J. 2014, 1–40. Available online: https://www.researchgate.net/publication/272305464_Mutual_Monitoring_and_Agency_Problems (accessed on 27 November 2019). [CrossRef]

- Morck, R.; Shleifer, A.; Vishny, R. Management ownership and market valuation: An empirical analysis. J. Financ. Econ. 1988, 20, 293–315. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Core, J.; Guay, W. The use of equity grants to manage optimal equity incentive levels. J. Account. Econ. 1999, 28, 151–184. [Google Scholar] [CrossRef]

- Li, F.; Lin, S.; Sun, S.; Tucker, A. Risk-Adjusted Inside Debt. Glob. Financ. J. 2018, 35, 12–42. [Google Scholar] [CrossRef]

- Kini, O.; Williams, R. Tournament incentives, firm risk, and corporate policies. J. Financ. Econ. 2012, 103, 350–376. [Google Scholar] [CrossRef]

- Coles, J.C.; Li, Z.F.; Wang, Y. Industry Tournament Incentives. Rev. Financ. Stud. 2018, 31, 1418–1459. [Google Scholar] [CrossRef]

- Michelino, F.; Lamberti, E.; Cammarano, A.; Caputo, M. Measuring Open Innovation in the Bio-Pharmaceutical Industry. Creat. Innov. Manag. 2015, 24, 4–29. [Google Scholar] [CrossRef]

- O’Brien, J.P.; David, P. Reciprocity and R&D search: Applying the behavioral theory of the firm to a communitarian context. Strateg. Manag. J. 2014, 35, 550–565. [Google Scholar]

- Order, No. 17 of the National Bureau of Statistics of the People’s Republic of China. National Statistical Classification of Sports Industry. 6 September 2015. Available online: http://www.gov.cn/gongbao/content/2015/content_2978273.htm (accessed on 27 November 2019). (In Chinese)

- Pearson, D.W.; Curtis, R.L.; Haney, C.A.; Zhang, J.J. Sport films: Social dimensions over time 1930–1995. J. Sport Soc. Issues 2003, 27, 145–161. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Alam, A.; Uddin, M.; Yazdifar, H. Institutional determinants of R&D investment: Evidence from emerging markets. Technol. Forecast. Soc. Chang. 2019, 138, 34–44. [Google Scholar]

- Zhang, J.; Guan, J. The time-varying impacts of government incentives on innovation. Technol. Forecast. Soc. Chang. 2018, 135, 132–144. [Google Scholar] [CrossRef]

- Wang, Y.; You, C. Research on the correlation relationship between input and performance. Commun. Financ. Account. 2009, 12, 14–16. (In Chinese) [Google Scholar]

- Hottenrott, H.; Peters, B. Innovative capability and financing constraints for innovation: More money, more innovation? Rev. Econ. Stat. 2012, 94, 1126–1142. [Google Scholar] [CrossRef]

- Sasidharan, S.; Lukose, P.J.J.; Komera, S. Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. Q. Rev. Econ. Financ. 2015, 55, 28–39. [Google Scholar]

- Podolski, E.J. Free Cash Flow and R&D Productivity. 29 June 2016. Available online: https://ssrn.com/abstract=2564308 (accessed on 27 November 2019).

- Dasgupta, S.; Noe, T.H.; Wang, Z. Where did all the dollars go? The effect of cash flows on capital and asset structure. J. Financ. Quant. Anal. 2011, 46, 1259–1294. [Google Scholar] [CrossRef]

- Sasaki, T. Financial cash flows and research and development investment. Pac. Basin Financ. J. 2016, 39, 1–15. [Google Scholar] [CrossRef]

- Mishra, D. Multiple large shareholders and corporate risk taking: Evidence from East Asia. Corp. Gov. Int. Rev. 2011, 19, 507–528. [Google Scholar] [CrossRef]

- Lazzarotti, V.; Pellegrini, L. An explorative study on family firms and open innovation breadth: Do non-family managers make the difference? Eur. J. Int. Manag. 2015, 9, 179–200. [Google Scholar] [CrossRef]

| Variables (Abbreviation) | Measurement | ||

|---|---|---|---|

| R&D intensity (RDA) | The ratio of R&D expenditures to total assets | ||

| Corporate governance structure | Equity concentration (EC) | The shareholding ratio of the first major shareholder | |

| Equity balances (EB) | The shareholding ratio sum from the second to fifth shareholders | ||

| Size and independence | Size of the board (BS) | All the total numbers of directions on the board | |

| Independence of board (BI) | A percentage of the independent directors on the board | ||

| Corporate financial capability | Profitability | Return on assets (ROA) | The ratio of net income to total assets |

| Return on sales (ROS) | The ratio of net income to sales | ||

| Return on equity (ROE) | The ratio of net income to equity | ||

| Growth | Sales growth rate (GRS) | The annual percentage growth in sales from the previous year | |

| Profits growth rate (GRP) | The annual percentage growth in profits from the previous year | ||

| Assets growth rate (GRA) | The annual percentage growth in assets from the previous year | ||

| Operating | Asset turnover (AT) | The ratio of sales to average total assets | |

| Accounts receivable turnover (ART) | The ratio of sales to average account receivable | ||

| Cash flow rate (CFR) | The ratio of net cash flows generated in business activities to initial total assets | ||

| Solvency | Leverage (LEV) | The ratio of total debt to total assets | |

| Variables | Minimum | Maximum | Mean | Std. Deviation |

|---|---|---|---|---|

| RDA | 0 | 0.44 | 0.0405 | 0.05822 |

| ROS | −1.87 | 1.02 | 0.0121 | 0.34992 |

| ROE | −8.67 | 1.11 | −0.1850 | 1.33909 |

| ROA | −0.97 | 0.62 | 0.0039 | 0.24605 |

| LEV | 0.01 | 2.59 | 0.4515 | 0.34218 |

| CFR | −1.27 | 0.63 | 0.0041 | 0.23469 |

| ART | 0 | 277.14 | 15.5607 | 41.51761 |

| AT | 0.15 | 3.14 | 1.1407 | 0.71957 |

| GRA | −0.62 | 3 | 0.4587 | 0.71596 |

| GRS | −0.59 | 18,524.68 | 223.5341 | 2033.31015 |

| GRP | −28.26 | 11.20 | −0.4737 | 4.66542 |

| EC | 0.20 | 0.99 | 0.5195 | 0.18665 |

| EB | 0.01 | 0.72 | 0.3608 | 0.14349 |

| BS | 5 | 12 | 5.6867 | 1.33369 |

| BI | 0 | 0.40 | 0.0209 | 0.08325 |

| Variable | Abbreviation | Model 1 | Model 2 | Model 3 |

|---|---|---|---|---|

| (Constant) | 0.039 *** (0.013) | 0.065 (0.071) | −0.008 (0.057) | |

| Profitability | ROS | −0.019 (0.028) | −0.002 (0.032) | |

| ROE | 0.013 ** (0.006) | 0.012 ** (0.006) | ||

| ROA | −0.082 (0.052) | −0.085 (0.053) | ||

| Solvency | LEV | −0.057 *** (0.020) | −0.043 ** (0.021) | |

| Operating | CFR | −0.145 *** (0.032) | −0.147 *** (0.032) | |

| ART | 0 ** (0) | 0 ** (0) | ||

| AT | 0.029 *** (0.007) | 0.028 *** (0.007) | ||

| Growth | GRA | −0.011 (0.008) | −0.010 (0.008) | |

| GRS | −0 (0) | −0 (0) | ||

| GRP | 0.005 *** (0.001) | 0.005 *** (0.001) | ||

| Governance | EC | −0.041 (0.058) | 0.036 (0.047) | |

| EB | 0.055 (0.073) | 0.104 * (0.060) | ||

| BS | −0.004 (0.006) | −0.002 (0.005) | ||

| BI | −0.056 (0.086) | 0.004 (0.071) | ||

| F-value | 7.201 *** | 1.642 | 5.489 *** | |

| R-squared | 0.500 | 0.078 | 0.531 | |

| Variable | Model 4 | Model 5 | Model 6 | |||

|---|---|---|---|---|---|---|

| (Constant) | 0.019 * (0.010) | (Constant) | 0.050 ** (0.012) | (constant) | 0.048 *** (0.012) | |

| Profitability | ROS*EB | 0.003 (0.064) | ROS*EC | −0.068 (0.012) | ROS*BS | 0 (0.004) |

| ROE*EB | 0.029 ** (0.014) | ROE*EC | 0.032 ** (0.013) | ROE*BS | 0.002 ** (0.001) | |

| ROA*EB | −0.125 (0.115) | ROA*EC | −0.217 * (0.121) | ROA*BS | −0.018 * (0.009) | |

| Solvency | LEV*EB | –0.019 (0.057) | LEV*EC | −0.129 *** (0.047) | LEV*BS | −0.011 *** (0.003) |

| Operating | CFR*EB | −0.370 *** (0.072) | CFR*EC | −0.223 *** (0.067) | CFR*BS | −0.026 *** (0.006) |

| ART*EB | 0.001 ** (0) | ART*EC | 0.001 ** (0) | ART*BS | 0 ** (0) | |

| AT*EB | 0.067 *** (0.017) | AT*EC | 0.052 *** (0.015) | AT*BS | 0.004 *** (0.001) | |

| Growth | GRA*EB | −0.024 (0.017) | GRA*EC | −0.019 (0.016) | GRA*BS | −0.003 ** (0.01) |

| GRS*EB | −0 (0) | GRS*EC | −0 (0) | GRS*BS | 0 (0) | |

| GRP*EB | 0.011 *** (0.003) | GRP*EC | 0.010 *** (0.003) | GRP*BS | 0.001 *** (0) | |

| F-value | 9.271 *** | 4.433 *** | 6.255 *** | |||

| R-squared | 0.563 | 0.381 | 0.465 | |||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, G.; Zhang, J.J.; Pifer, N.D. Corporate Governance Structure, Financial Capability, and the R&D Intensity in Chinese Sports Sector: Evidence from Listed Sports Companies. Sustainability 2019, 11, 6810. https://doi.org/10.3390/su11236810

Chen G, Zhang JJ, Pifer ND. Corporate Governance Structure, Financial Capability, and the R&D Intensity in Chinese Sports Sector: Evidence from Listed Sports Companies. Sustainability. 2019; 11(23):6810. https://doi.org/10.3390/su11236810

Chicago/Turabian StyleChen, Gang, James J. Zhang, and N. David Pifer. 2019. "Corporate Governance Structure, Financial Capability, and the R&D Intensity in Chinese Sports Sector: Evidence from Listed Sports Companies" Sustainability 11, no. 23: 6810. https://doi.org/10.3390/su11236810

APA StyleChen, G., Zhang, J. J., & Pifer, N. D. (2019). Corporate Governance Structure, Financial Capability, and the R&D Intensity in Chinese Sports Sector: Evidence from Listed Sports Companies. Sustainability, 11(23), 6810. https://doi.org/10.3390/su11236810