Abstract

Financial illiteracy and underinsurance have been revealed to be critical issues in the financial sustainability and well-being of families. However, studies show that financial literacy does not necessarily translate to insurance literacy, and more specialized education can improve insurance literacy. Little is known about the impact of insurance illiteracy on the inclination to seek and retain insurance. Considering this gap, our study aimed to investigate the direct and indirect effect of consumers’ insurance literacy on purchasing decisions of personal insurance. The study sample consists of middle-class consumers in Sri Lanka. A total of 300 valid questionnaires were collected and analyzed using a variance-based structural equation modeling. The results revealed that insurance literacy directly, and through its mediators of trust, perceived benefits, and favorable attitudes towards insurance, impacts the behavioral intention, significantly and positively. The cognition-based trust affected the purchase intention only through its mediators. Additionally, there is a significant difference between those who are having and not having insurance in terms of insurance literacy, trustfulness, and perceived value of insurance. This study is relatively a pioneer study, and findings will be of great interest to academicians and policymakers to encourage personal insurance as a tool in achieving financial security and well-being.

1. Introduction

Technological advancements and market innovations have created a sophisticated financial industry, in which a wide range of providers offer a broad spectrum of complex financial products and services [1]. These advances have given people more options and superior flexibility in creating financial plans that best suit their needs. However, these complicated and specialized financial products and services require consumers to be fully informed, educated, and actively engage in managing their finances. Therefore, financial literacy has attracted the attention of government, academia, and industry, as it plays a crucial role in consumers’ financial decision-making, such as investment, retirement saving, debt management, and insurance. However, it is often the case that not all groups in society have the required literacy to understand information about different financial products, which may be vital for their financial wellbeing. One such financial product is personal insurance [2]. The types of personal insurance include life insurance, total and permanent disability (TPD), income protection (IP), and critical illness covers (trauma cover).

The protection of people and assets is a critical component of sustainable development. Without adequate insurance, it is unlikely that sustainable development is genuinely achievable [3]. The insurance mechanism helps to absorb the financial burden caused by adverse events by transferring losses of the individual to an insurance company. The importance of insurance can also be seen when considering the economic cost of an inadequate amount of personal insurance. For example, Warner [4], in a study conducted in Australia, revealed that personal insurance policies cover only 61% of the basic needs (Basic needs defined as the minimum required to pay all non-mortgage debt and sustain the current living standards until age 65 or until children reach age 21) (protection requirement), 37% of income replacement level (The income replacement level defined as the level required to replace the expected net income of the insured and maintain current living standards until the insured would have reached age 65), 13% of total and permanent disability (TPD) cover, and 16% of income protection covers of their respective needs. These results validate the conclusion of Tim. Higgins and Steven. Roberts [5]. In the case of Sri Lanka, the number of life policies in force as a percentage of the labor force is 35.51% [6]. This evidence showed that the majority of the people were uninsured and exposed to both health crisis and financial hardship caused by adverse events resulting in death, illness, disability, or injury to the income earners of the families. A personal insurance plan would possibly provide financial resources to support the claimants or their dependents in case of such adverse events. Concerning the reasons for non-insurance or underinsurance, past studies conclude that the majority of people have poor knowledge of personal insurance, while many are unaware of the importance and the value of personal insurance [2,7,8]. It is argued that people with higher insurance literacy are likely to take an active and responsible role in considering the appropriate level of personal insurance coverage or seek professional advice about its effect. The most critical finding relating to insurance literacy is that financial literacy does not necessarily translate to insurance literacy, and it requires specialized education to improve it [8], whereas consumers’ insurance literacy is quite low [2,7,9]. Moreover, past studies evidence that most people believe that life insurance is too expensive, difficult to understand, and a hassle to obtain; therefore, they prefer general insurance over personal insurance. More clearly, people usually insure their motor vehicles; however, they fail to protect themselves or their families from accidents, injuries, disability, or death. This preference for general insurance above personal insurance may reflect more value for physical assets rather than for personal capital.

Insurance literacy encompasses the knowledge and cognitive skills with a set of desirable attitudes, behaviors, and certain external enabling factors. A well-developed program of information and advice that educates consumers about alternative risk management tools, the value of insurance, their obligations in the process, and highlights cases of successful policy outcomes could lead to improve consumers’ insurance literacy. Such improvements might challenge behavioral biases while also attempting to reposition the industry. Despite its importance, only a few academic studies have given attention to how insurance literacy is measured and its impact on purchasing decisions [2,7,8,10,11,12]. Additionally, past studies on insurance literacy highlighted the necessity of having research focused primarily on the measurement of consumers’ insurance literacy [2,7,8,13].

Therefore, the present study aims to investigate the direct and indirect effect of consumer’s insurance literacy on purchasing behavior of personal insurance using a trust-based decision-making model in the context of middle-class consumers in Sri Lanka. The rest of the paper is structured as follows. The first section reviewed the relevant literature and developed the conceptual framework. The next section discussed the adopted methodology, followed by the results, findings, and discussion. Lastly, the conclusion, together with limitations, implications, and future research directions are highlighted.

2. Literature Review and Hypothesis Development

2.1. Personal Insurance Products

Insurance helps alleviate the financial burden caused by adverse events (Adverse events include premature death, terminal illness, inability to work due to injury or disability, or total incapacity) by transferring losses of an individual to an insurance company [14]. The insurance industry has two branches; life insurance and general insurance. Personal insurance covers life insurances for individuals, while general insurance covers physical assets and liabilities. Types of general insurance include motor insurance, house and content insurance, business insurance. Different kinds of personal insurance include life insurance, total and permanent disability insurance (TPD), income protection (IP), and critical illness (trauma cover) [2]. Where, Life insurance provides a payment to a beneficiary when the insured individual dies. Total permanent disability (TPD) is a lump sum payment to the insured when he/she is totally or permanently disabled or has cognitive inadequacies. Critical illness cover (trauma cover) is paid to the insured when he/she is diagnosed with a traumatic medical condition, such as cancer, stroke, heart attack, etc. Income protection (IP) is paid to the insured when he/ she is unable to work due to illness or disability. As a summary, it can conclude that personal insurance provides financial resources to support the claimant and/or their dependents; however, this would not alleviate the physical or emotional impact of the event, while at least the economic aspects of the situation may be mitigated [2].

According to the existing literature, many people believe that life insurance is too expensive, difficult to understand, and a hassle to obtain. Due to this misunderstanding, they prefer general insurance over personal insurance. This preference may also be driven by the fact that individuals may value physical assets over personal capital.

This study aims to gain a better understanding of the impact of consumers’ insurance literacy regarding personal insurance decision-making. It is argued that when a person’s insurance literacy is high, he/she is more likely to take an active and responsible approach when considering the appropriate level of personal insurance coverage (or seek professional advice for that purpose). According to Tania Driver [2], the majority of people have poor knowledge of personal insurance and with many unaware of the value and importance of those policies. Past studies validate individuals’ preference for general insurance but highlight the subsequent lack of trust and impact of behavioral decision-making biases in such decisions.

The literature on behavioral finance confirmed that the decision-making process of a person subjects to biases and non-rational outcomes [15]. This justification is vastly applied to insurance purchasing decisions. When individuals are optimistic and overconfident, they are less likely to assess the risks comprehensively and will leave themselves exposed to risk. Hence, people are unaware of preventive strategies like insurance to protect from risky events, particularly low probability and high impact risks [2,16].

One of the basic principles of behavioral finance is that people lack an adequate understanding of risk concepts and probability [15]. Hence, people can be scared of an event more than the possible financial and emotional impact of the event [17]. Therefore, the decision to purchase insurance may not be driven by the impact of potential loss, but the frequency with which the loss is likely to take place [18]. Accordingly, individuals tend to pay much for insuring themselves against high-frequency risks, although financial impacts are low (for example, general insurance events). However, they fail to insurance against low-frequency risks, but with high financial impacts (personal insurance events) [2].

Hence, this study contributes to both insurance and finance literacy literature by empirically examining the impact of consumer’s insurance literacy on the behavioral intention to purchase persona insurance. Additionally, it provides evidence of the drivers of personal insurance decision-making, which is relevant to financial planners, insurance advisors, insurance product developers, and regulators.

2.2. Behavioral Intention and Personal Insurance

According to existing literature, the theory of reasoned action (TRA) [19], the theory of planned behavior (TPB) [20], the technology acceptance model [21], and many studies in other disciplines evidence that consumers intention is a significant predictor of their actual behavior. The relationship between intention and behavior is based on the assumption that human beings attempt to make rational decisions based on the information available to them [22]. Thus, a person’s behavioral intention to perform ( or not to perform) is the immediate determinant of the person’s actual behavior [23]. Analyzing 422 past studies, Sheeran [24] validated that intention predicted behavior and defined the intention as “instructions that people give themselves to behave in certain ways”. Based on the intention and behavior relationship, the researcher justifies that inclination to purchase insurance is a predictor of a consumer’s actual behavior or purchase decision. In this study, behavioral intention is defined as the consumer’s willingness to purchase a personal insurance plan.

2.3. The Mediating Role of Attitude and Behavioral Intention

Attitude is a well-read predisposition to behave in a consistently favorable or unfavorable manner for a given object [20,23]. Theoretically, the relationship between attitude and behavioral intention is justified based on the theory of planned behavior (TPB) [20]. According to TPB, attitude correlates with an individual’s intentions. Hence it could be a predictor of individual behavior [23,25,26]. Following the same norm, this study assumes that individuals with a favorable attitude towards personal insurance are more likely to purchase personal insurance plans.

This relationship has verified in many studies in various disciplines [17,26,27,28]. Therefore, the present study assumes that a consumer who has a favorable attitude towards personal insurance is more likely to purchase it. Moreover, Tania Driver [2] revealed that consumer’s trustfulness based on understanding would be the leading cause behind the positive attitude on insurance, while poor understanding and lack of trust create negative attitudes on insurance. Based on the above arguments, the following hypotheses were developed.

Hypothesis 1.

Consumer’s favorable attitudes towards insurance positively affects behavioral intention to purchase personal insurance.

Hypothesis 2.

Favorable attitude towards insurance mediate the relationship between consumers’ insurance literacy and behavioral intention to purchase a personal insurance product.

2.4. The Antecedent of Consumers’ Attitude toward Buying Personal Insurance

Fishbein and Ajzen [19] suggested a positive direct link between attitude and behavior. The theory supports that belief affects attitude, which in turn affects intention. Various belief has been developed around insurance and financial service products. For example, product factors, social factors, and personal factors. However, there are only a few studies that examined the effect of knowledge, trust, and perceived value on consumers’ attitudes towards purchasing personal insurance products. As such, the current study focus on addressing the gap in the literature.

The knowledge, trust, and perceived value could be considered as important cognitive and emotional determinants that lead individual behavior in the purchase, selection, usage, goods and services. For this study, three kinds of cognitive beliefs were considered: consumer’s insurance literacy (insurance-related knowledge and skills), trustful belief, and perceived product value.

2.4.1. Consumers’ Insurance Literacy

Understanding consumers’ financial decision making under risk and uncertainty is a much complex and challenging task. Decision making in insurance is not rational, and behavioral biases are usually involved [17,29,30]. Therefore, improved financial literacy is the key to informed decisions, protected consumers, financial independence, and peace of mind. Foremost literature revealed that financial literacy does not necessarily translate into insurance literacy, and more specialized education can improve insurance literacy [2,8]. According to Lusardi and Mitchell [31], financial literacy encompasses the knowledge and cognitive skills with a set of desirable attitudes, behaviors, and external enabling factors. Likewise in this study, the researcher conceptualizes consumers’ insurance literacy as the attainment of knowledge and skills necessary to select and use insurance services for the betterment of the financial wellbeing of individuals. According to Tania Driver [2], insurance literacy is one of the critical reasons for the underinsurance problem. The process leading towards insurance literacy is called insurance education, and the ultimate goal of insurance literacy is to accomplish behavioral changes, reflected in higher acceptance and better utilization of insurance products to achieve consumers’ financial well-being [32].

A consumer survey conducted by Zurich Financial Service and Financial Planning Association of Australia defined life insurance literacy concerning knowledge and understanding of the scope of cover provided by a particular life insurance policy [12]. This definition addresses only the knowledge dimensions and does not focus on the application of knowledge when making decisions. A US field survey conducted by Tennyson [7] assesses consumers’ knowledge, confidence, and capability in insurance decision making. This study assessed consumers’ insurance knowledge and also asked respondents to self-report their confidence in insurance decision making. The study result concluded that insurance literacy most significantly correlates with financial education and interest in personal finance, whereas the confidence was related to insurance decision making and information source preferred by consumers. A more recent study conducted by Lin and Bruhn [8] investigated whether higher financial literacy can be translated to better performance in making insurance decisions. This study suggested a comparatively broad operational definition for the insurance literacy, which incorporates the understanding of individuals’ perceived risk exposure too into consideration. According to Lin and Bruhn [8], the insurance literacy defined as “understanding the concept of insurance and being knowledgeable and informed about insurance products under consideration; having a reasonable understanding of the risks covered by the insurance policy under consideration; and being able to apply the knowledge and understanding to evaluate insurance options and make insurance decisions that are consistent with the perceived risks”. However, this operational definition does not address the consumer’s understanding and confidence to find and evaluate the basic responsibility of the insured once purchased. For example, all the insured should be aware that they have a contractual duty to disclose all the material information relating to the subject matter insured at the inception and during the policy period. When developing a measure for insurance literacy, attention should be given to including such necessary knowledge and skill components.

The researcher conceptualizes the construct consumer’s insurance literacy based on the measurement approaches proposed by Xue, Gepp [33], and Weedige Sampath Sanjeewa and Ouyang Hongbing [34]. Accordingly, six content areas of insurance literacy were identified; understanding risk exposure, risk mitigation strategies, insurance concept, principles and benefits, features of insurance products, rights and duties of insured, and information sources. Accordingly, this study suggests that consumer’s level of insurance literacy, directly and indirectly, influences favorable attitudes and behavioral intention of personal insurance. The indirect effect mediates the trustful belief, perceived product benefits, and perceived product risk on the intention to purchase personal insurance. Based on the above, the researcher developed the following hypotheses:

Hypothesis 3.

The level of consumer’s insurance literacy positively affects favorable attitudes towards personal insurance.

Hypothesis 4.

The level of consumer’s insurance literacy positively affects consumer’s trustfulness of insurance.

Hypothesis 5.

The level of consumer’s insurance literacy positively affects perceived product benefits of personal insurance.

Hypothesis 6.

The level of consumer’s insurance literacy negatively affects perceived product risk of personal insurance.

Hypothesis 7.

The level of consumer’s insurance literacy positively affects behavioral intention to purchase personal insurance.

Hypothesis 8.

There is a significant difference between those who are having and not having insurance in terms of insurance literacy.

2.4.2. Trustful Belief on Insurance

Insurance is a contract that applies the principle of utmost good faith, by which both parties in the contract have a duty to disclose all the material information to the other party. Hence, it is obvious that without having trust in both parties, a contract of insurance cannot be initiated and continue. In insurance, the trust of each party operates as a contractual obligation, and neither party is unable to violate the contract (i.e., there is legal protection to the parties of an insurance contract regarding contractual obligations of each other). Notably, in the pre-purchase stage of insurance, consumer’s perceived trust plays a pivotal role in motivating an individual to use the insurance service as their financial solutions. In this study, consumer’s perceived trust defined as a consumer’s subjective belief that the sales personnel or company or insurance policy itself will fulfill its contractual obligations as the consumer understand to them.

In the early stage, research on trust has focused primarily on interpersonal trusts, such as a consumer’s trust in a salesperson. More recently trust has been defined as a multi-dimensional concept related to multiple targets: salesperson, product, and company [35]. The existing literature of consumers’ decision-making behavior evidence that consumers trust in insurance product and service play a critical role in decision making in insurance [2,7,36]. Due to the inherent nature of insurance, consumers will always experience some level of risk about the industry, product, providing company, and sales personals. When consumers act under uncertain situations, trust comes into play as a solution for the specific problems of risk [37]. According to Gambetta [38], trust is especially relevant in conditions of ignorance or uncertainty concerning the unknown or unknowable actions of others. Hence, trust is a fundamental element in dealing with products like insurance. Naradda Gamage, Lin [39] considered that trust is based on the confidence of an individual in how another person or institution will behave in the future. Observing a lack of trust in the insurance industry in developing countries Guiso, Sapienza [40] concluded that trust in financial institutions strongly affects savings and other financial instruments like insurance and is a strong incentive for economic behavior.

The existing literature of trust provided different views regarding the relationship between risk and trust. For example, whether the trust is a by-product of risk or the same as a trust or an antecedent of risk. It is common to identify risk and trust as different concepts [37,41,42]. According to Mayer, Davis [41], trust is identified as a behavioral perspective of one person based on his belief about the characteristics of others. Luhmann [37] concludes that trust is a crucial determinant of action in a situation where the perceived risk is with unfavorable outcomes. However, trust may not be involved in all risk-taking behaviors. For example, trust is not the sole predictor of insurance purchasing decisions. Individuals may take an insurance purchasing decision with a low level of trust about the company, product, or sales representative. Other factors like premium discount or other perceived non-financial benefits may also affect insurance purchasing decisions. As recognized in the perceived value hypothesis, this reflects the powerful motivation that perceived value can exercise on a purchase decision.

Therefore, based on the above argument, we can conclude that trust can operate in two ways to alleviate the effect of risk on insurance purchasing decisions. First, trust is relevant in situations where no person must enter into a risky decision where he/she has incomplete control over the outcome [42,43,44]. Therefore, as trust increases, consumers are likely to perceive less risk than if the trust is absent. The effect of trust is mediated by risk on the consumer’s intention to purchase. Second, empirical studies on trust validated there is a direct relationship between trust and willingness to purchase intangible products like insurance [45,46,47]. Therefore, the researcher expects that an increase in trustfulness will directly and through its two mediators (perceived risk and perceived benefits) affects behavioral intention towards purchasing personal insurance products. Based on these arguments, the researcher hypotheses that:

Hypothesis 9.

Trustful belief of insurance positively affects favorable attitudes to purchase personal insurance solutions.

Hypothesis 10.

Trustful belief of insurance positively affects the consumer’s perceived product benefit of personal insurance.

Hypothesis 11.

Trustful belief of insurance negatively affects the consumer’s perceived risk of insurance of personal insurance.

Hypothesis 12.

Trustful belief of insurance mediate the relationship between consumer’s insurance literacy and favorable attitudes towards purchasing personal insurance solutions.

Hypothesis 13.

Trustful belief of insurance mediate the relationship between consumer’s insurance literacy and perceived product benefit.

Hypothesis 14.

Trustful belief of insurance mediate the relationship between consumer’s insurance literacy and perceived risk of insurance.

2.4.3. Perceived Product Value of Insurance

Following the extended valence framework, Kim, Ferrin [48] and Fishbein and Ajzen [19], identify the perceived value (PV) as “the worth that a product or service has in the mind of the consumer” [49]. Perceived value is based on qualitative measures such as emotional, social, and cultural factors; thus, it is subjective. Perceived value combines fact and attitude to direct whether or not people think that they are getting or will get their money’s worth. A consumer’s perceived value converts to the price that they are willing to pay for a good or service. Additionally, customers place value based on the product’s analytical ability to fulfill a need and provider satisfaction.

In this study, the researcher defines perceived value as a consumer’s belief about the extent to which he/she will become better off by buying a personal insurance product. Insurance consumers tell that they purchase insurance policies because they perceive many benefits such as payment of losses, complying with legal requirements, managing cash flow uncertainty, promoting risk control activity, efficient use of an individual’s resources, support for an individual’s credit and peace of mind. Therefore, contrary to perceived risk, consumer’s perceived value of insurance provides a significant incentive for purchasing insurance products. Accordingly, when consumers perceived more value on insurance solutions, they are more likely to purchase insurance. Hence the researcher proposed that:

Hypothesis 15.

Perceived product benefits of insurance positively affect favorable attitudes to purchase personal insurance solutions.

Hypothesis 16.

Perceived product risk negatively affects favorable attitudes to purchase personal insurance solutions.

Hypothesis 17.

Perceived product benefits of insurance mediate the relationship between insurance literacy and favorable attitude towards the insurance.

Hypothesis 18.

Perceived product risk of insurance mediate the relationship between insurance literacy and favorable attitude towards the insurance.

2.5. Profile of Sri Lanka Economy, Society, and Insurance Industry

This study was carried out in the context of Sri Lanka. Sri Lanka is an island lying southeast of India, with a total population of 22.2 million in 2018 and is a multi-cultural, multi-ethnic identity, and a middle-income country [50]. Sri Lanka has been enjoying a higher level of economic growth after defeating the long-standing terrorism problem in 2009. Additionally, the country is experiencing changes in social and demographic structures with an ageing population, declining contribution of agricultural sectors, the falling size of the family, and the increasing migration of rural residents to cities [50,51,52,53,54]. This transition in the socio-economic and demographic patterns indicates that tradition and convention are loosening, which is likely to have both a direct and an indirect impact on an individual’s attitudes towards risk and insurance. While an increasing level of consumers’ awareness, expansion of the middle-income class of the society, and limitation of government-supported welfare benefits are encouraging motives for insurance marketers to look for growth in the future.

Similarly, in Sri Lankan society, the educated young generation tends to postpone their marriage until they complete their education and carrier goals. The delay in marriage and its contribution towards a reduction in the level of fertility affects the size of individual families as well as population growth [52]. Additionally, traditionally, society expects when children grow up, they will be looking after their parents at the time of disability or illness and provide economic support in their old age. However, because of late marriage, children may still involve in higher education when their parents are getting closer to retirement. Further, after completing higher education, most of the young people tend to settle in major cities or urban areas to engage in their jobs. Therefore, they are no longer able to rely on mutual support of their families and now need to search for an extended source of financial independence.

According to Swiss-Re [54], and Sampath Sanjeewa Weedige and Ouyang Hongbing [55], Sri Lanka is considered as an emerging insurance market in South Asia. However, when comparing with other countries in the region, Sri Lankan’s insurance penetration is at a low level of 1.21% (2016) (life 0.54 %, general 0.67%) [56]. Although Sri Lanka is a middle-income country, insurance penetration lags behind other developed and developing countries in the Asian region. For example, India (3.5%), Japan (9.5%), South Korea (12.1%), and Singapore (7.5%) [57]. Whereas, the insurance density of Sri Lanka is also at a low level of US$40 in 2016–2017 [56], compared to the world average of $638 [57].

2.6. Conceptual Framework

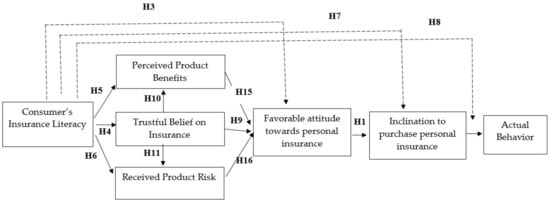

Based on the above theoretical and conceptual justifications, the researcher constructed the conceptual framework of the study as given below (Figure 1).

Figure 1.

Conceptual Framework.

3. Methodology

3.1. Measurement of the Variables

To conceptualize the constructs of the study model, we rely on the existing scales, whatever possible, with minor alterations to fit the constructs to our context. The behavioral intention was measured using a self-constructed four-item scale developed using the criteria Ajzen [58]. The construct perceived risk was assessed using the six-items proposed by DelVecchio [59], which measure the financial risk and performance risk of the financial product. Perceived benefits measured on a five-item scale proposed by Bosmans and Baumgartner [60] and which initially focused on measuring the product’s ability to prevent adverse outcomes. Three-items scale used to measure the construct trust following the criteria of Mechanic [61].

Since no scale has yet been proposed to measure the level of consumer’s insurance literacy, we developed a quiz, including 12 questions using the measurement approach of Weedige Sampath Sanjeewa and Ouyang Hongbing [34]. The questions focused on insurance principles, product features, and the rights and duties of consumers. All items measuring the literacy were formatted as agree disagree, with “do not know” answers allows. The questions included in the assessment are displayed in the Appendix A. The overall score of the insurance literacy assessment ranged from a low of 0 (0%) to a high of 10 (100%). For all scales except insurance literacy, we used 5-point Likert-type scales ranging from “strongly agree” to “strongly disagree.”

3.2. Sampling and Data Collection

Primary data for the study obtained through the questionnaire survey. Since the research focuses on the decision-making behavior of middle-class consumers in Sri Lanka who are having the purchasing power of insurance products, a stratified random sample, which comprised government and private sector senior managers/officers, managers, academics, professionals, executives, and entrepreneurs were selected to the study sample. The reason for selecting middle-class consumers as the study sample justified on the basis that middle-class consumers are often a key target for consumer-focused businesses because they are the foundation of the consumer market and the driver of domestic demand. Additionally, middle-class consumers tend to focus on the family, plan for the future, and place an importance on their image. They are increasingly health-aware and eco-friendly while also choosing convenience in almost all aspects of life. These values and attitudes influence most purchasing decisions they make. Similarly, emerging markets middle classes can differ significantly in their spending habits and priorities [62,63].

Concerning sample size, Churchill [64] contended that the sample size of a regional consumer behavior study should range between 200 to 500 responses. Since this study focused on middle income-class individuals as the sampling unit, the sample size was needed to fall within that range. Hence obtaining a 300 questionnaire from the selected social group would be a sufficient sample size for the analysis. Additionally, respondents were required to be in the age group of 18–59 years since this group represents the active workforce with sufficiently knowledgeable to make financial decisions and have purchasing power [65,66]. In total, 450 questionnaires were distributed, out of which 389 questionnaires were received, and finally, 300 valid questionnaires were selected for further analysis. Smart-PLS 3 software used to analyze the data.

3.3. Common Method Bias

Common method bias is an issue in a quantitative investigation and other self-report survey base studies. Additionally, it occurs when the data collected from a single source [67]. Procedural design and statistical control recommended reducing the probability of common method bias [68]. In this study, following Podsakoff, MacKenzie [69], we address the common method bias at the questionnaire design stage and using statistical techniques after the data were collected. We used Harman’s single factor test whereby factor analysis was done loading all the items, and if one factor emerges, explaining the majority of the variance, then common method variance exists.

According to Kock [70], common method bias, in the context of partial least squares structural equation modeling (PLS-SEM), is a phenomenon that is caused by the measurement method used in the SEM study and not by the network of causes and effects in the model being studied. [70], Ned Kock and Lynn [71] proposed the full collinearity test as a comprehensive procedure for the simultaneous assessment of both vertical and lateral collinearity. Moreover, the occurrence of a VIF higher than 3.3 is proposed as an indication of pathological collinearity, and also as an indication that a model may be contaminated by common method bias. Therefore, if all VIFs resulting from a full collinearity test are equal to or lower than 3.3, the model can be considered free of common method bias [70]. Accordingly, statistical results show that common method bias is not an issue in our study, and we can proceed to main estimations of data analysis.

3.4. Structural Equation Modelling

Compared to the first generation data analysis techniques, SEM analysis is preferred to perform parameter evaluation (measurement model) and hypothesis testing (structural relationship) of a casual model [72]. Additionally, variance-based SEM (VB-SEM), including PLS path-modeling, gets the outstanding attention of researchers in behavioral studies [66,72,73,74,75,76]. Additionally, PLS does not mandatorily require parametric assumptions like the normality of data distribution and sample size [77,78], hence PLS path-modelling is recommended when the primary concern of the analysis is the prediction accuracy, or prediction originated [72,75,76]. According to Hair, Ringle [75], it is appropriate to perform PLS-SEM when several latent constructs are measured by several indicators as confirmatory analysis. Similarly, the methodological procedure of PLS also allows researchers to measure heterogeneity within path modeling. In this study, we used the Smart PLS 3.0 software to analyze the model developed. Following the two-stage analytical approach recommended by Chin [78] and Anderson and Gerbing [79], this study tested the measurement model and the structural model (see [66,72,80]. Additionally, in order to test the significance of the path coefficients and loadings, a bootstrapping (resampling = 5000) method was used [81].

3.5. Results

3.5.1. Profile of the Respondents

Table 1 shows the demographic profile of the respondents. The male frequency is 154 (51.48%) of the total, while the female frequency is 146 (48.52%). The minimum frequency from the total respondents of 300 is equal to 17 (5.57%) relevant to the age group of 50–59 years. Out of total respondents (300), the majority (55%) have post-graduate educational qualifications (master’s degree 45.57% and doctoral degree 9.51%). Furthermore, more than 70% of the respondents have monthly income Rs. 61,000 or above. Additionally, 158 (52.79%) of the respondents occupy in the private sector, while 126 (41.97%) occupy the government sector. Respondents’ experience of personal insurance shows that 99 (33.11%) of the respondents already having personal insurance cover (life, income protection, disability, critical illness), while the majority, 201 (66.89%), do not have personal insurance covers. Respondents’ educational background relating to insurance, risk management, or personal finance management shows that only 28.2% of the respondents have such formal education, while 71.8% do not have any formal education of insurance or risk management or personal finance handling.

Table 1.

Demographic profile of the respondents.

3.5.2. Assessment of the Measurement Model

As recommended by Hair and Joe [81] and Hair and Risher [82], convergent validity is confirmed when the loadings greater than 0.7 (> 0.70), composite reliability is greater than 0.7 (> 0.7), and average variance extracted (AVE) is greater than 0.5 (> 0.5). Table 2 shows that the criteria for convergent validity were achieved.

Table 2.

Construct reliability and validity.

Discriminant validity of the measurement model was assessed using Fornell and Larcker [83] method (Table 3) and loading and cross-loading criteria (Table 4). Fornell and Larcker [83] criteria require the square root of the average variance extracted (AVE) to be higher than the correlations of any other latent variables. Additionally, loading and cross-loading criteria require an indicator’s loading with its construct are in all cases higher than all of its cross-loading with other constructs. The empirical results (Table 3 and Table 4) show that there is a discriminant validity between all constructs based on this two criteria (Fornell–Larcker criteria and loading and cross-loading criteria). Therefore, with these two test, we have shown that the measures in the study have sufficient convergent and discriminant validity.

Table 3.

Discriminant validity: Fornell–Larcker criterion.

Table 4.

Discriminant validity–loading and cross-loading criterion.

3.5.3. Structured Model

After validating the measurement model, the structural model was assessed, which involves the assessment of the coefficient of determination (R2), the blindfolding-based cross-validated redundancy measure Q2, as well as the statistical significance and relevance of the path coefficients [82]. Additionally, earlier studies recommend assessing the model’s out-of-sample predictive power by using the PLSpredict procedure [84,85]. Before assessing the structural model, collinearity of the constructs was assessed, and results show that collinearity is not an issue in the study (the tolerance value >0.20; variance inflation factor (VIF) <5) [75,80] see Table 2. Therefore, the significance of path coefficients, variance explained (R2), predictive relevance (Q2), and PLSpredict were evaluated.

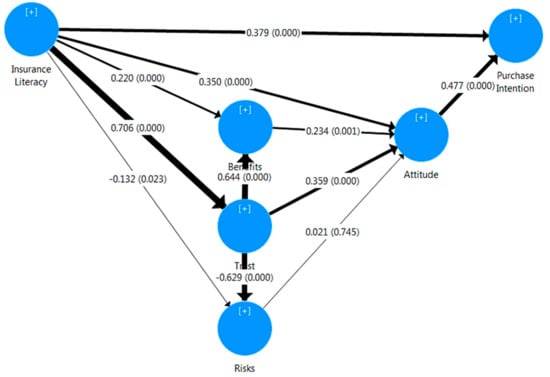

Table 5 shows the estimates for the path coefficients obtained by performing the PLS-SEM algorithm to assess the hypothesized relationships between constructs. The significance of the path coefficient was examined by performing bootstrapping 5000 resamples and no sign change option. The results show that most of the structural model relationships are significant (Table 5). Additionally, Figure 2 demonstrates relative value highlighted path coefficients and p-values of the structural model.

Table 5.

Hypothesis testing.

Figure 2.

Structural model with path coefficients and p-values (highlighted relative values of the paths).

First, we look at the predictors of trust, insurance literacy (β = 0.706, p < 0.01) was positively related to the trustful belief on insurance. Then, we explore predictors of favorable attitude towards insurance, trustful belief (β = 0.359, p < 0.01), insurance literacy (β = 0.350, p < 0.01), and perceived product benefits (β = 0.234, p < 0.01) were significantly and positively related to the favorable attitude towards personal insurance, while perceived product risk (β = 0.021, p > 0.05) does not significantly affect to the consumers attitude on personal insurance. Next, we look at predictors of perceived product benefits, insurance literacy (β = 0.220, p < 0.01), and trust (β = 0.644, p < 0.01) were positively related. Further, we investigate predictors of perceived product risk, trustful belief about insurance (β= −0.629, p < 0.01), and insurance literacy (β = −0.132, p < 0.01), were negatively related to perceived product risk. Finally, the most important predictor, behavioral intention to purchase personal insurance construct was examined. The favorable attitude (β = 0.477, p < 0.01) and insurance literacy (β = 0.379, p < 0.01) were significantly and positively related to the behavioral intention to purchase personal insurance. Therefore, hypothesis H1, H3, H4, H5, H6, H7, H8, H9, H10, H15, and H17 were supported, and only hypothesis seven (H16) was rejected (see Table 5).

Then, we look at the mediating effect of trust, perceived risk, perceived benefits towards a favorable attitude on insurance. Insurance literacy → trustful belief → favorable attitude (β = 0.253, p < 0.01, BC0.95LL = 0.132 and UL = 0.383) is significantly mediated by trustful belief towards favorable attitude insurance (where, BC =bias corrected confidence interval, LL= lower level, UL= upper level). Similarly, literacy → benefits → favorable attitude (β=0.051, p<0.01, BC0.95LL = 0.018, and UL = 0.097) is significantly mediated by perceived product benefit towards the favorable attitude of insurance. Further, consumers’ favorable attitude on insurance acts as a mediator between insurance literacy intentions to purchase personal insurance solutions. Literacy → favorable attitude → intention (β = 0.167 p < 0.01, BC0.95LL = 0.109 and UL = 0.228);

As proposed by Preacher and Hayes [86], the indirect effect did not straddle a 0 (zero) in between, indicating that there is mediation. Hence, we can conclude that the mediation effect is statistically significant, indicating that H2, H12, H13, H14, and H17 are supported. However, H18 does not support and concluded that consumers’ insurance literacy is not mediated by perceived product risk towards a favorable attitude on insurance (See Table 5).

To assess the in-sample model fit, we considered the R2 values of the endogenous latent variables in the path model. Table 6 shows the R2 values of the endogenous latent variables calculated from the PLS algorithm option. The R2 of purchase intention was 0.641 (i.e., all the predictors explained 64.1% of the variance in purchase intention considered as moderate (R2 > 0.50)), whereas favorable attitude on insurance had a 0.697, which indicates that all the predictors of attitude can explain 69.7% of the variance of construct favorable attitude and is considered moderate endogenous construct. Similarly, the R2 value of perceived product benefits (0.633), perceived product risk (0.530), and trust of insurance (0.498) are considered moderate endogenous constructs in explaining the variance of intention [75,82].

Table 6.

Results of R2 and Q2.

In addition to R2 values as a criterion of predictive accuracy, we performed the predictive power of the model using the predictive relevance Q2 and out-of-sample predictive power measured with PLSpredict. As suggested by Hair and Joe [81,82], blindfolding procedure should only be applied to endogenous constructs that have a reflective measurement (multiple items or single items). As shown in Table 6, all Q2 values are considered above 0 (zero), which indicates that the model’s predictive relevance for the endogenous constructs was supported. As a relative measure of predictive relevance, the Q2 values of our model indicate that all exogenous constructs had considerable predictive relevance (Q2 > 0.35) [81,82,83] (See Table 7).

Table 7.

PLSpredict results of the model.

Similarly, we performed the PLSpredict to recognize the predictive power of the model; and compared the root mean squared error (RMSE) values from PLS-SEM analysis with the naïve LM benchmark (Table 7). According to PLSpredict, the majority of the dependent construct indicators in the PLS-SEM analysis produces higher prediction error compared to the naïve LM benchmark [82], concluding the model has a lower predictive power (PLE-SEM results yield higher prediction error in terms of RMSE for the majority indicators), see Table 7.

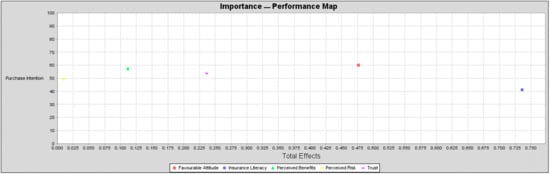

After assessing the predictive power of the model, we examined the construct’s total effect, defined as the sum of direct and all indirect effects, performing the importance–performance map analysis (IPMA). According to Rigdon [87], IPMA compares the structural model’s total effects on a selected construct to average the latent variable scores of the construct’s predecessors. Figure 3 shows the result of IPMA performed to purchase intention, and it shows that consumer’s insurance literacy plays a crucial role in contributing to the highest level of total effect with average importance on purchase intention.

Figure 3.

Importance– performance map analysis (IPMA) (standardize effects).

We performed the multi-group analysis (MGA) to test the H8. As shown in Table 8, MGA supported the hypothesis and proved that there is a significant difference between those who are having and not having insurance in terms of insurance literacy, trustfulness, and perceived value of insurance.

Table 8.

Multi-group analysis (MGA) results.

According to Hair and Joe [81], the decision criteria of the multi-group analysis is, if the p-value of path coefficients difference is less than 0.05 or greater than 0.95, the difference is significant. As shown in Table 8, MGA results indicate favorable attitude and intention (Attitude → Intention) is significantly different between the consumers who are already having a personal insurance product from the consumers who do not have an insurance policy (β = 0.336, p > 0.95). Similarly, the results shows that consumers’ level of insurance literacy and perceived product risk (Literacy → Risk), level of insurance literacy and trustful belief on insurance (Literacy → Trust), and perceived product benefits favorable attitude towards personal insurance (Benefits → Attitude) are significantly different from the consumers who are already having a life insurance and consumers who do not have an insurance policy. The Supplementary Materials provided the data file and the respective analysis results.

4. Discussion

The objective of the study was to investigate the direct and indirect effect of consumers’ insurance literacy on the behavioral intention to purchase personal insurance in the context of middle-class consumers in Sri Lanka. To identify the effect, we developed a comprehensive model based on the extended valence framework [22] and the theory of planned behavior [23]. Primarily the study model attempted to understand the effect of people’s insurance-related knowledge and skills on the behavioral intention to purchase insurance products. Additionally, the relationship between attitude and behavioral intention to purchase personal insurance was examined. From the results, the consumers’ insurance literacy directly and indirectly, through its mediators, trustful belief, and perceived benefits, significantly and positively affected their favorable attitude towards personal insurance. Overall, the findings of this research show that all the hypotheses except two (H16 and H18) were supported, and are consistent with the findings of other studies based on the theory of planned behavior and extended value framework [22,25,26]. Additionally, predictors of attitude to purchase intention explained 0.697 of the variance, while predictors of favorable attitude explained 0.801 of the variance. Moreover, the R2 value of perceived product benefits (0.633), perceived product risk (0.530), and trust of insurance (0.498) were considered as moderate endogenous constructs in explaining the variance of behavioral intention.

In explaining hypotheses, data established support for the decision bases on knowledge, trust, and value linking typical decision-making chain of beliefs, attitude, and behavioral intention to purchase insurance solutions, which is consistent with TPB, extended value framework, and past studies. It implies that consumers’ insurance literacy (knowledge and skills) related to insurance is a crucial factor that has a significant and positive direct impact on behavioral intention to purchase while indirectly impact via trust, attitude, and perceived benefits. In the context of personal insurance, it is expected that consumers with a higher level of insurance literacy have an increased trust and perceived value of insurance products with a more favorable attitude towards buying insurance solutions, thus will have more favorable behavioral intention to purchase personal insurance plans.

This study hypothesized that trust affects purchase intention indirectly through its mediators, perceived risk, perceived benefits, and favorable attitude. The findings demonstrated that consumer’s insurance literacy significantly and positively related to an individual’s trustful belief of insurance. Additionally, the trustful belief of insurance significantly and positively mediates the relationship between knowledge and perceived product benefit of personal insurance. This is in line with the extended valence framework of Kim, Ferrin [22], and the valence framework of Peter [88]. Additionally, a favorable attitude towards insurance significantly and positively mediates the consumer’s insurance literacy, perceived benefits, and trustful belief. However, attitude does not significantly mediate the consumers’ perceived product risk of insurance and is in line with extended valence formwork.

According to TPB, an individual’s attitude towards a particular behavior depends on his/her beliefs. More clearly, an individual’s trust based on knowledge and understanding is more likely to shape the belief towards insurance, motivating themselves to perform an action that is favorable to them. Furthermore, the results of this study are in agreement with previous studies that found trustful and value-perceived individuals are more motivated to show positive behavior in terms of favorable attitude.

Concerning the role of consumers’ insurance literacy, this study documents that perceived product benefit and favorable attitude towards insurance partially mediate (complementary) the relationship between insurance literacy and behavioral intention to purchase personal insurance products. This implies that consumers with higher levels of insurance literacy are likely to make insurance purchases based on perceived product benefits and favorable attitudes. These findings provide several managerial implications to improve the purchase of personal insurance solutions in Sri Lankan society and emerging economies in the world.

5. The Theoretical and Practical Contribution

This study contributes significantly to the theory and practical aspects of understanding decision making in insurance. Theoretically, this study has developed the knowledge and trust-based decision-making model to describe the consumer purchasing behavior of personal insurance products. Additionally, this is a comprehensively new study that tested the mediating role of favorable attitudes towards the behavioral intention to purchase personal insurance products. Similarly, this study has developed a relatively new linkage (i.e., the effect of consumer’s insurance literacy on behavioral intention to purchase insurance). Hence, this study is likely to contribute significantly to the theory of consumer behavior regarding the purchase of personal insurance products in a non-western middle-class context. Most importantly, this study contributes to the theory of planned behavior by incorporating knowledge and trust as an antecedent of consumer attitude. Previous studies focused on three types of beliefs (i.e., normative, control, and behavioral beliefs), yet less attention was given to perceptive belief.

Practically, this study has tested the direct and indirect relationship in a new research context (i.e., middle-class consumers), representing a well-educated active social group including managers, executives, professional, and small and medium enterprise (SME) entrepreneurs in Sri Lanka. The study results emphasize that consumers’ insurance-related knowledge and trust play a crucial role in the decision-making process of personal insurance and ultimately affect to financial sustainability of individuals, groups, and nations socially and economically. The multi-group analysis shows that there is a significant difference between those who are having and not having insurance in terms of insurance literacy, trustfulness, and perceived value of insurance.

Therefore, governments, regulators, and decision-makers in Sri Lanka are recommended strongly to establish a personal risk management culture through the education system at school, college, and university level, to make people aware about the advantages and essentialness of using insurance solutions to advance the quality life in Sri Lanka, while reducing the burden of the government budget in social expenses. Additionally, conferences, seminars, and public talks can be organized privately and publicly to address the importance of having a personal insurance plan for a quality life and the financial security of their families.

6. Conclusions

Non-insurance and underinsurance of risk hinder human development [57]. At the individual, household, or small and medium level enterprise, risks and shocks have different short and long term consequences. Additionally, uninsured risks may, after a substantial financial burden, drag households back into poverty and influence human development, such as health and education accomplishment [89]. Hence, governments and regulators need to make suitable policy decisions to improve the performance of the insurance sector.

Understanding consumers’ financial decision making under risk and uncertainty is complex and challenging. Additionally, decision making in insurance is not rational, and behavioral biases are usually involved [17,29]. Therefore, improved financial literacy is the key to informed decisions, protected consumers, financial independence, and peace of mind. Recent literature revealed that financial literacy does not necessarily translate to insurance literacy, and only a more specialized education can improve insurance literacy [8]. Whereas, literature shows that consumers’ insurance literacy is quite low. Similarly, this study revealed that there is a significant difference in the level of insurance literacy, trustful belief, and attitude on insurance between the two groups of individuals who are having insurance and not having groups.

Further, insurance literacy encompasses the knowledge and cognitive skills with a set of desirable attitudes, behaviors, and external enabling factors. A well-developed program of information and advice that educates consumers about alternative risk management tools, the values of insurance, their obligations in the process, and highlights cases of successful policy outcomes could lead to improve consumers’ insurance literacy, and such improvements challenge behavioral biases while also attempting to reposition the industry. This study investigated the impact of consumers’ insurance literacy on the purchasing intention using a trust-based decision-making model in the context of educated middle-class consumers in Sri Lanka.

It is expected that both academicians and industry practitioners can benefit from the findings of this study. As mentioned before, knowledge and trust about insurance products and services play a significant role in creating a favorable attitude towards insurance and cause to improve consumption.

Although this study has its merits in regards to testing sensible new linkages and to providing some useful findings regarding the issue, it is not beyond some limitations. However, the limitations of our study may serve as future research directions for other studies in the fields. First, one could test the model presented in our study in different financial product categories and examine the possible differences. Second, it also recommended that consumer’s insurance literacy can be included in the model as a moderator. In a nutshell, the present study opens up the avenue for future researchers in the area of consumers’ insurance literacy towards trust, perceived product benefits, and favorable attitudes towards insurance.

Supplementary Materials

The following are available online at https://www.mdpi.com/2071-1050/11/23/6795/s1: Figure S1: Conceptual Framework; Figure S2: Structural Model; Figure S3: IPMA; Data File; Analysis Report.

Author Contributions

Conceptualization, W.S.S.; methodology, S.S.W.; software, S.S.W.; validation, S.S.W., H.O., and Y.L.; formal analysis, S.S.W.; investigation, S.S.W.; resources, S.S.W., H.O., and Y.L.; data curation, S.S.W.; writing—original draft preparation, S.S.W.; writing—review and editing, S.S.W., H.O., and Y.L.; visualization, S.S.W.; supervision, H.O.; project administration, H.O. and Y.L.; funding acquisition, H.O., Y.L., and Y.G.

Funding

This research was funded by Ministry of Education (China) Humanity and Social Science Planned Project, grant number [19YJA790067].

Acknowledgments

The author gratefully acknowledges financial support from the Ministry of Education (China) Humanity and Social Science Project [Grant No. 19YJA790067] and Collaborative Innovation Center of Industrial Upgrading and Regional Finance (Hubei).

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

| Favorable Attitude on Insurance | |

| A1 | I have a positive attitude on insurance and believe that insurance is an essential service for people |

| A2 | I think the purchase of a personal insurance plan is a good thing to do |

| A3 | I think the purchase of a personal insurance plan is valuable |

| Trustful Belief | |

| T1 | Based on my belief about insurance, I think it is honest and trustworthy |

| T2 | Based on my belief about insurance, I think it cares about customers |

| T3 | Based on my belief about insurance, I think it is well regulated and trustful |

| T4 | Based on my belief about insurance, I think it is predictable |

| Perceived Product Benefits | |

| PB1 | Insurance reduces or eliminates losses hidden in life’s uncertainty |

| PB2 | Insurance provides stability for wealth planning |

| PB3 | Insurance serves as capital or wealth accumulation |

| PB4 | Insurance provides financial relief to society |

| PB5 | With the insurance policy, I obtain a sense of security |

| PB5 | The insurance policy assists me to plan my personal financial management |

| Perceived Product Risk | |

| PR1 | Given the financial expenses associated with purchasing an insurance product, there is a substantial financial risk |

| PR2 | Considering the investment involved, purchasing the insurance product would be risky |

| PR3 | I am unsure whether I can get desired protection from insurance company |

| PR4 | I am unsure whether I can get desired protection from the insurance policy |

| PR5 | I am afraid that insurance will create unnecessary problems at the time of claim |

| PR6 | Failure to perform the desired outcome, the insurance poses a threat to the physical well-being of me and my dependents |

| Intention to Purchase Personal Insurance Plan | |

| PI1 | I am likely to purchase personal insurance plans ( life, income protection, critical illness, and accidental insurance ) in the future |

| PI2 | I would like to know how a personal insurance plan is better than a savings account or other safety property |

| PI3 | I know the value of personal insurance and want to purchase as soon as possible |

| PI4 | I predict, given the chance, I will purchase life/health/accidental/income protection insurance plan in future |

| Consumers’ Insurance Literacy [answer] | |

| IL1 | The main purpose of insurance is to reduce the financial burden of risk faced by the consumer [agree] |

| IL2 | Insurance is the best risk management tool when the chance of loss is low and the loss severity is high [agree] |

| IL3 | Non-disclosure or misrepresentation of information relating to the subject matter insured may cause to reject the insurance claim [agree] |

| IL4 | A larger deductible (policy excess) on an insurance policy is always a bad deal for the consumer because the insurer pays less of the consumer’s losses [disagree] |

| IL5 | Life insurance has more value for a couple with children than for a couple whose children are grown [agree] |

| IL6 | Purchasing an insurance policy directly without involvement of an agent or broker is always cheap and beneficial [disagree] |

| IL7 | Consumers are protected against insurance company bankruptcies by state funds that pay some of the claims of bankrupt insurers [agree] |

| IL8 | An annuity offers the same type of insurance protection as an investment-based or cash-value life insurance policy [disagree] |

| IL9 | A homeowners’ insurance policy will often pay the medical expenses of a guest who is injured on your property [agree] |

| IL10 | It is often a good idea to buy less insurance for an old automobile than for a new automobile |

| IL11 | Premium paid for general insurance covers like health, home insurance, and accidental insurance can get a maturity value after a specific period of time [disagree] |

| IL12 | After buying an insurance policy, the customers’ responsibility is finished and the insurance company is liable to pay any kind of damages that arise during the policy period [disagree] |

References

- Hira, T.K. Financial Sustainability and Personal Finance Education. In Handbook of Consumer Finance Research; Springer: Cham, Switzerland, 2016; pp. 357–366. [Google Scholar]

- Driver, T.; Brimble, M.; Freudenberg, B.; Hunt, K.H.M. Insurance Literacy in Australia: Not Knowing the Value of Personal Insurance. Financ. Plan. Res. J. 2018, 4, 53–75. [Google Scholar]

- Wanczeck, S.; McCord, M.; Wiedmaier-Pfister, M.; Biese, K. Inclusive Insurance and the Sustainable Development Goals—How Insurance Contributes to the 2030 Agenda for Sustainable Development; GIZ: Bonn, Germany, 2017. [Google Scholar]

- Warner, R. Australia’s Relentless Underinsurance Gap. 2016. Available online: https://www.ricewarner.com/australias-relentless-underinsurance-gap/ (accessed on 25 September 2019).

- Higgins, T.; Roberts, S. Financial Wellbeing, Actions and Concerns—Preliminary Findings from a Survey of Elderly Australians; The Institute of Actuaries of Australia: Sydney, NSW, Australia, 2011; pp. 1–45. [Google Scholar]

- IRCSL. Annual Report 2017; Insurance Regulatory Commision of Sri Lanka: Colombo, Sri Lanka, 2018. [Google Scholar]

- Tennyson, S. Consumers’ insurance literacy: Evidance from survey data. Financ. Serv. Rev. 2011, 20, 165–179. [Google Scholar]

- Lin, X.; Bruhn, A.; William, J. Extending financial literacy to insurance literacy: A survey approach. Account. Financ. 2019, 59, 685–713. [Google Scholar] [CrossRef]

- Bristow, B.J.; Tennyson, S. Insurance Choices: Knowledge, Confidence and Competence of New York Consumers. In Final Report; Cornell University: Ithaca, NY, USA, 2001. [Google Scholar]

- McCormack, L.; Bann, C.; Uhrig, J.; Berkman, N.; Rudd, R. Health insurance literacy of older adults. J. Consum. Aff. 2009, 43, 223–248. [Google Scholar] [CrossRef]

- Peterlechner, L. Insurance Literacy Efforts of the German Development Cooperation, in Voices from the fiel; Peterlechner, L., Ed.; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH: Bonn, Germany, 2017. [Google Scholar]

- CoreData. The Life Insurance Literacy Gap (Zurich Financial Services Australia and Financial Planning Association of Australia; Zurich: Sydney, Australia, 2014; pp. 1–48. [Google Scholar]

- Uddin, M.A. Microinsurance in India: Insurance literacy and demand. Bus. Econ. Horiz. 2017, 13, 182–191. [Google Scholar] [CrossRef]

- Scriven, D. Guide to Life Protection and Planning, 2nd ed.; CCH Australia Limited: Sydney, Australia, 2008. [Google Scholar]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Trevelyan, R. Optimism, overconfidence and entrepreneurial activity. Manag. Decis. 2008, 46, 986–1001. [Google Scholar] [CrossRef]

- Shanteau, J. Decision Making Under Risk: Applications to Insurance Purchasing. Adv. Consum. Res. 1992, 19, 177–181. [Google Scholar]

- Kunreuther, H. Why aren’t they insured? J. Insur. 1979, 5, XL. [Google Scholar]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research Reading; Addison-Wesley: Boston, MA, USA, 1975. [Google Scholar]

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. Trust and Satisfaction, Two Stepping Stones for Successful E-Commerce Relationships: A Longitudinal Exploration. Inf. Syst. Res. 2009, 20, 237–257. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitudes and Predicting Social Behavior; Prentice-Hall: Englewood Cliffs, NJ, USA, 1980. [Google Scholar]

- Sheeran, P. Intention—Behavior Relations: A Conceptual and Empirical Review. Eur. Rev. Soc. Psychol. 2002, 12, 1–36. [Google Scholar] [CrossRef]

- Omar, O.E.; Owusu-Frimpong, N. Life Insurance in Nigeria: An Application of the Theory of Reasoned Action to Consumers’ Attitudes and Purchase Intention. Serv. Ind. J. 2007, 27, 963–976. [Google Scholar] [CrossRef]

- Memarista, G.; Brahmana, R.; Brahmana, R.K. Planned Behaviour in Purchasing Health Insurance. South East Asian J. Manag. 2018, 12, 43–64. [Google Scholar] [CrossRef]

- De Leeuw, A.; Valois, P.; Ajzen, I.; Schmidt, P. Using the theory of planned behavior to identify key beliefs underlying pro-environmental behavior in high-school students: Implications for educational interventions. J. Environ. Psychol. 2015, 42, 128–138. [Google Scholar] [CrossRef]

- Dzulkipli, M.R.; Zainuddin, N.N.N.; Maon, S.N.; Jamal, A.; Omar, M.K. Intention to Purchase Medical and Health Insurance: Application of Theory of Planned Behavior. Adv. Sci. Lett. 2017, 23, 10515–10518. [Google Scholar] [CrossRef]

- Sum, R.M.; Nordin, N. Decision Making Biases in Insurance Purchasing. J. Adv. Res. Soc. Behav. Sci. 2018, 10, 165–179. [Google Scholar]

- Kusev, P.; Purser, H.; Heilman, R.M.; Cooke, A.J.; Van Schaik, P.; Baranova, V.; Martin, R.; Ayton, P. Understanding Risky Behavior: The Influence of Cognitive, Emotional and Hormonal Factors on Decision-Making under Risk. Front. Psychol. 2017, 8, 469. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Wells, B.; Epermanis, K.; Gibson, J.P. The Effect of Insurance Education on Consumer Attitudes: A Study of the Property and Casualty Industry. J. Financ. Educ. 2015, 41, 47–65. [Google Scholar]

- Xue, R.; Gepp, A.; O’Neill, T.J.; Stern, S.; Vanstone, B.J. Financial literacy amongst elderly Australians. Account. Financ. 2019, 59, 887–918. [Google Scholar] [CrossRef]

- Sanjeewa, W.S.; Ouyang, H. Consumers’ Insurance Literacy: Literature Review, Conceptual Definition, and Approach for a Measurement Instrument. Eur. J. Bus. Manag. 2019, 11, 49–65. [Google Scholar]

- Plank, R.E.; Reid, D.A.; Pullins, E.B. Perceived Trust in Business-to-Business Sales: A New Measure. J. Pers. Sell. Sales Manag. 1999, 19, 61–71. [Google Scholar]

- Lin, C.; Hsiao, Y.-J.; Yeh, C.-Y. Financial literacy, financial advisors, and information sources on demand for life insurance. Pac.-Basin Financ. J. 2017, 43, 218–237. [Google Scholar] [CrossRef]

- Luhmann, N. Familiarity, Confidence, Trust: Problems and Perspectives. I Gambetta, Diego (Red.). In Trust: Making and Breaking Cooperative Relations; Gambetta, D., Ed.; Blackwell; University of Oxford: Oxford, UK, 1988; pp. 94–107. [Google Scholar]

- Gambetta, D. Trust: Making and Breaking Cooperative Relations; Blackwell: New York, NY, US, 1988; Volume 52, pp. 213–238. [Google Scholar]

- Gamage, S.K.N.; Lin, L.; Haq, I.u. Economic & Demographic Characterictics, Social Capital And Demand For Life Insurance: Evidence From Central Region Of Sri Lanka. Ecoforum J. 2016, 5, 2. [Google Scholar]

- Guiso, L.; Sapienza, P.; Zingales, L. Trusting the Stock Market. J. Financ. 2008, 63, 2557–2600. [Google Scholar] [CrossRef]

- Mayer, R.C.; Davis, J.H.; Schoorman, F.D. An Integrative Model of Organizational Trust. Acad. Manag. Rev. 1995, 20, 709–734. [Google Scholar] [CrossRef]

- Deutsch, M. The Effect of Motivational Orientation upon Trust and Suspicion. Hum. Relations 1960, 13, 123–139. [Google Scholar] [CrossRef]

- Ratnasingham, P. The importance of trust in electronic commerce. Internet Res. 1998, 8, 313–321. [Google Scholar] [CrossRef]

- Rousseau, D.M.; Sitkin, S.B.; Camerer, C. Not so Different Aftr All: A Cross-Discipline View of Trust. Acad. Manag. Rev. 1998, 23, 393–404. [Google Scholar] [CrossRef]

- Sin, T.S.; Chee, L.C. A Preliminary Study on the Relationship between Psychographic Factors and the Purchase of Life Insurance. Int. J. Manag. Stud. 2017, 24, 1–22. [Google Scholar]

- Hilliard, J.I.; Pottier, S.W.; Xu, J. Trust-Preferred Securities and Insurer Financing Decisions. J. Risk Insur. 2018, 85, 219–244. [Google Scholar] [CrossRef]

- Chen, M.-F.; Mau, L.-H. The impacts of ethical sales behaviour on customer loyalty in the life insurance industry. Serv. Ind. J. 2009, 29, 59–74. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Lai, A.W. Consumer Values, Product Benefits and Customer Value: A Consumption Behavior Approach. Adv. Consum. Res. 1995, 22, 381–388. [Google Scholar]

- CBSL. Economic and Social Statistics of Sri Lanka; Central Bank of Sri Lanka: Colombo, Sri Lanka, 2018. [Google Scholar]

- De Silva, W.I. The Age Structure Transition and the Demographic Dividend: An Opportunity for Rapid Economic Take-off in Sri Lanka. Sri Lanka J. Adv. Soc. Stud. 2013, 2, 3–46. [Google Scholar] [CrossRef]

- Silva, W.I.D. Correlates of Marital Postponment in Sri Lanka. J. Fam. Welf. 2000, 46, 42–50. [Google Scholar]

- Briones, R.M. Transformation and diversification of the rural economy in Asia. In The IFAD Research Series; Philippine Institute for Development Studies: Rome, Italy, 2017. [Google Scholar]

- Swiss-Re. Sigma—World Insurance in 2017 No 03/2018; Swiss Re Institute: Zurich, Switzerland, 2018; pp. 1–51. [Google Scholar]

- Sanjeewa, W.S.; Hongbing, O.; Hashmi, S.H. Determinants of Life Insurance Consumption in Emerging Insurance Markets of South-Asia. Int. J. Inf. Business Manag. 2019, 11, 109–129. [Google Scholar]

- IBSL. Annual Report 2016; Insurance Board of Sri Lanka: Colombo, Sri Lanka, 2016. [Google Scholar]

- Swiss-Re. Swiss-Re. Swiss Re Sigma 04/2017. In Insurance: Adding Value to Development in Emerging Markets; Swiss Re Institute: Zurich, Switzerland, 2018; p. 40. [Google Scholar]

- Ajzen, I.B. Constructing a TpB Questionnaire: Conceptual and Methodological Considerations; 2002. Available online: https://pdfs.semanticscholar.org/0574/b20bd58130dd5a961f1a2db10fd1fcbae95d.pdf. (accessed on 29 November 2019).

- DelVecchio, D. Brand-Extension Price Premiums: The Effects of Perceived Fit and Extension Product Category Risk. J. Acad. Mark. Sci. 2005, 33, 184–196. [Google Scholar] [CrossRef]

- Bosmans, A.; Baumgartner, H. Goal-Relevant Emotional Information: When Extraneous Affect Leads to Persuasion and When It Does Not. J. Consum. Res. 2005, 32, 424–434. [Google Scholar] [CrossRef]

- Mechanic, D. The functions and limitations of trust in the provision of medical care. J. Heal. Politi- Policy Law 1998, 23, 661–686. [Google Scholar] [CrossRef] [PubMed]

- Kharas, H. The Emerging Middle Class in Developing Countries; Working Paper No. 285; OECD, Development Centre: Paris, France, 2010. [Google Scholar]

- Wickramasinghe, S.M.; Pranava, M.D. Profiling the Traditional Sri Lankan Middle-class Consumer. In Postgraduate Institute of Management (PIM).; University of Sri Jayewardenepura Colombo: Nugegoda, Sri Lanka, 2013. [Google Scholar]

- Churchill, G.A.D.I. Marketing Research: Methodological Foundations, 9th ed.; Thomson/South-Western: Mason, OH, USA, 2005. [Google Scholar]

- Rizomyliotis, I.; Konstantoulaki, K.; Kaminakis, K.; Giovanis, A.; Papastathopoulos, A. Antecedents of customer loyalty in the mobile telecommunication market a cross-cultural investigation. Acad. Marketing Stud. J. 2018, 22. [Google Scholar]

- Quoquab, F.; Pahlevan, S.; Mohammad, J.; Thurasamy, R. Factors affecting consumers’ intention to purchase counterfeit product. Asia Pac. J. Mark. Logist. 2017, 29, 837–853. [Google Scholar] [CrossRef]

- Avolio, B.J.; Yammarino, F.J.; Bass, B.M. Identifying Common Methods Variance With Data Collected From A Single Source: An Unresolved Sticky Issue. J. Manag. 1991, 17, 571–587. [Google Scholar] [CrossRef]

- Reio, T.G., Jr. The Threat of Common Method Variance Bias to Theory Building. Hum. Resour. Dev. Rev. 2010, 9, 405–411. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Kock, N. Common method bias in PLS-SEM: A full collinearity assessment approach. Int. J. E-Collab. 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Kock, N.; Lynn, G. Lateral Collinearity and Misleading Results in Variance-Based SEM: An Illustration and Recommendations. J. Assoc. Inf. Syst. 2012, 13, 546–580. [Google Scholar]

- Rezaei, S. Segmenting consumer decision-making styles (CDMS) toward marketing practice: A partial least squares (PLS) path modeling approach. J. Retail. Consum. Serv. 2015, 22, 1–15. [Google Scholar] [CrossRef]

- Henseler, J.; Chin, W.W. A Comparison of Approaches for the Analysis of Interaction Effects Between Latent Variables Using Partial Least Squares Path Modeling. Struct. Equ. Model. A Multidiscip. J. 2010, 17, 82–109. [Google Scholar] [CrossRef]

- Reinartz, W.; Haenlein, M.; Henseler, J. An empirical comparison of the efficacy of covariance-based and variance-based SEM. Int. J. Res. Mark. 2009, 26, 332–344. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Sarstedt, M. A review of recent approaches for capturing heterogeneity in partial least squares path modelling. J. Model. Manag. 2008, 3, 140–161. [Google Scholar] [CrossRef]

- Vinzi, V.E.; Trinchera, L.; Amato, S. PLS Path Modeling: From Foundations to Recent Developments and Open Issues for Model Assessment and Improvement. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 47–82. [Google Scholar]

- Chin, W.W. How to Write Up and Report PLS Analyses. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Esposito Vinzi, V., Chin, W.W., Henseler, J., Wang, H., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 655–690. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Rezaei, S.; Ali, F.; Amin, M.; Jayashree, S. Online impulse buying of tourism products: The role of web site personality, utilitarian and hedonic web browsing. J. Hosp. Tour. Technol. 2016, 7, 60–83. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M.; Hair, J.F. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]