Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan

Abstract

1. Introduction

2. Review of the Chinese and Pakistani Banking Systems

2.1. Review of the Chinese Banking System

2.2. Review of the Pakistani Banking System

3. Literature Review and Hypotheses Development

3.1. Definition of IC

3.2. IC and Firm Performance

4. Methodology

4.1. Research Objectives

4.2. Variables

- (1)

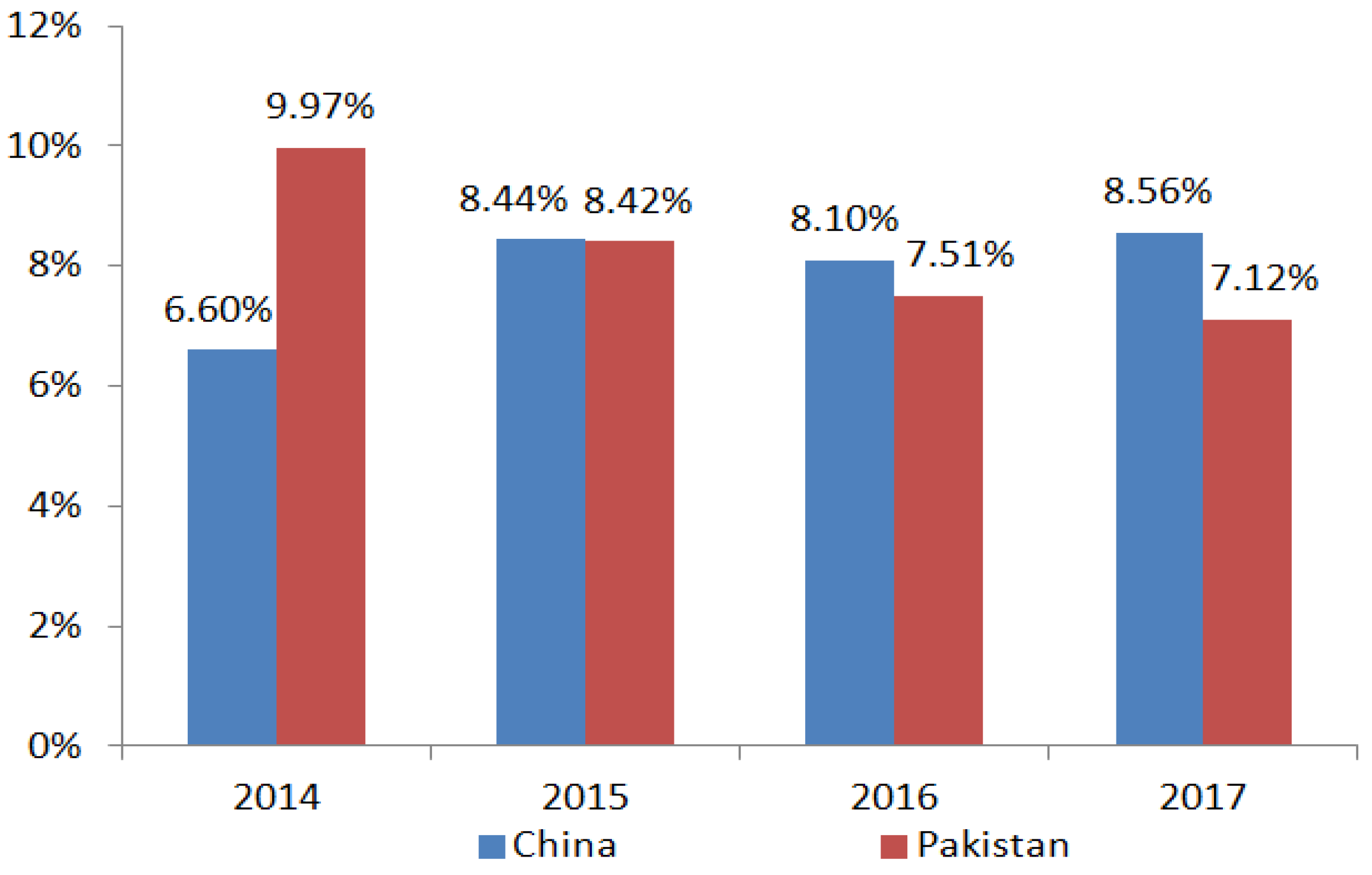

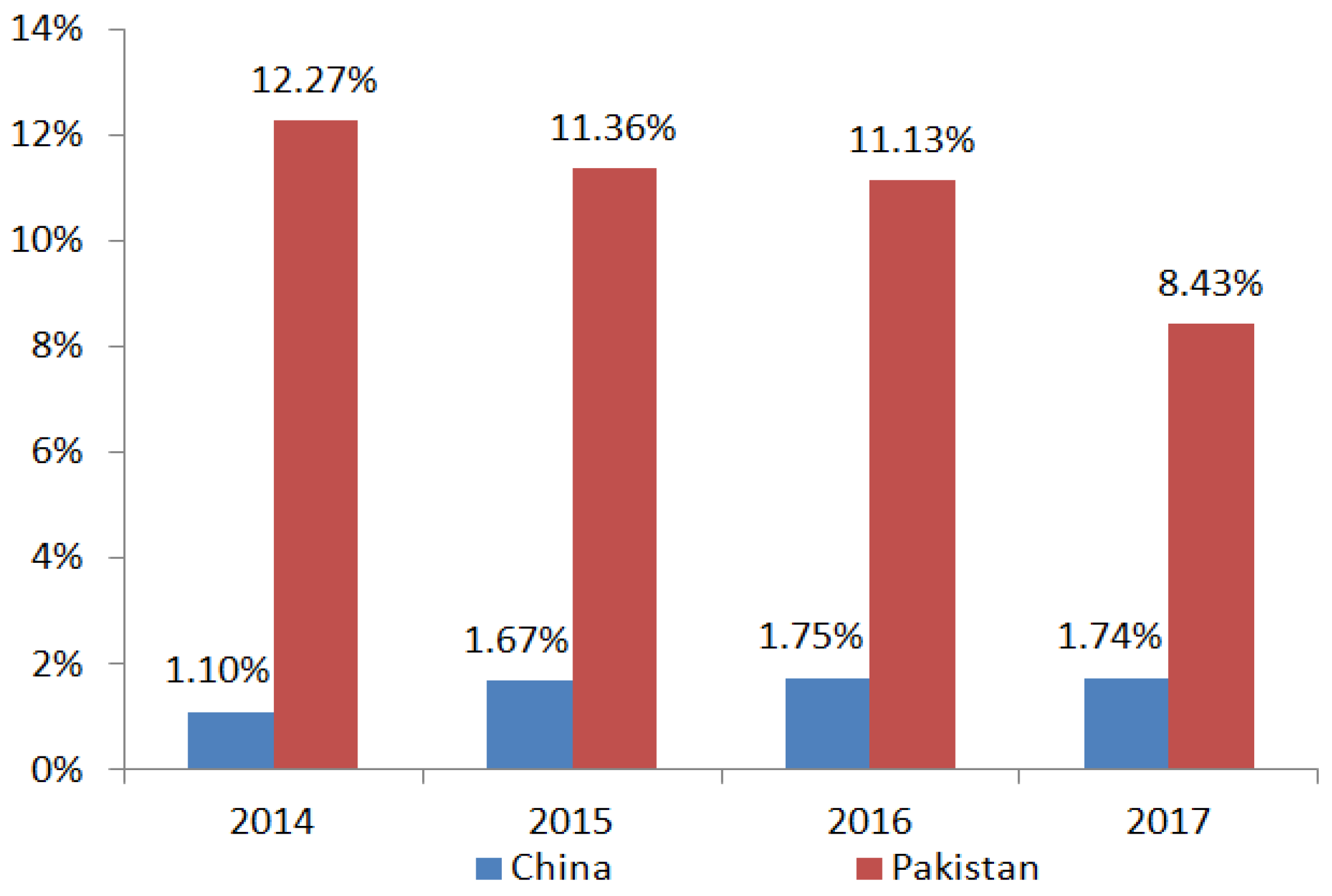

- Dependent variables. Guided by previous studies [4,5,11,16,17,63,64,69,71,72], ROA and ROE are used as the measure of profitability. ROA is measured as the ratio of a bank’s net income to average total assets, and ROE is measured as the ratio of a bank’s net income to average shareholders’ equity. Asset turnover ratio (ATO) is used to measure the productivity of listed banks, calculated by the ratio of bank’s revenue to average total assets. This measure of productivity is used in many previous IC studies [5,63,64,65,66,67].

- (2)

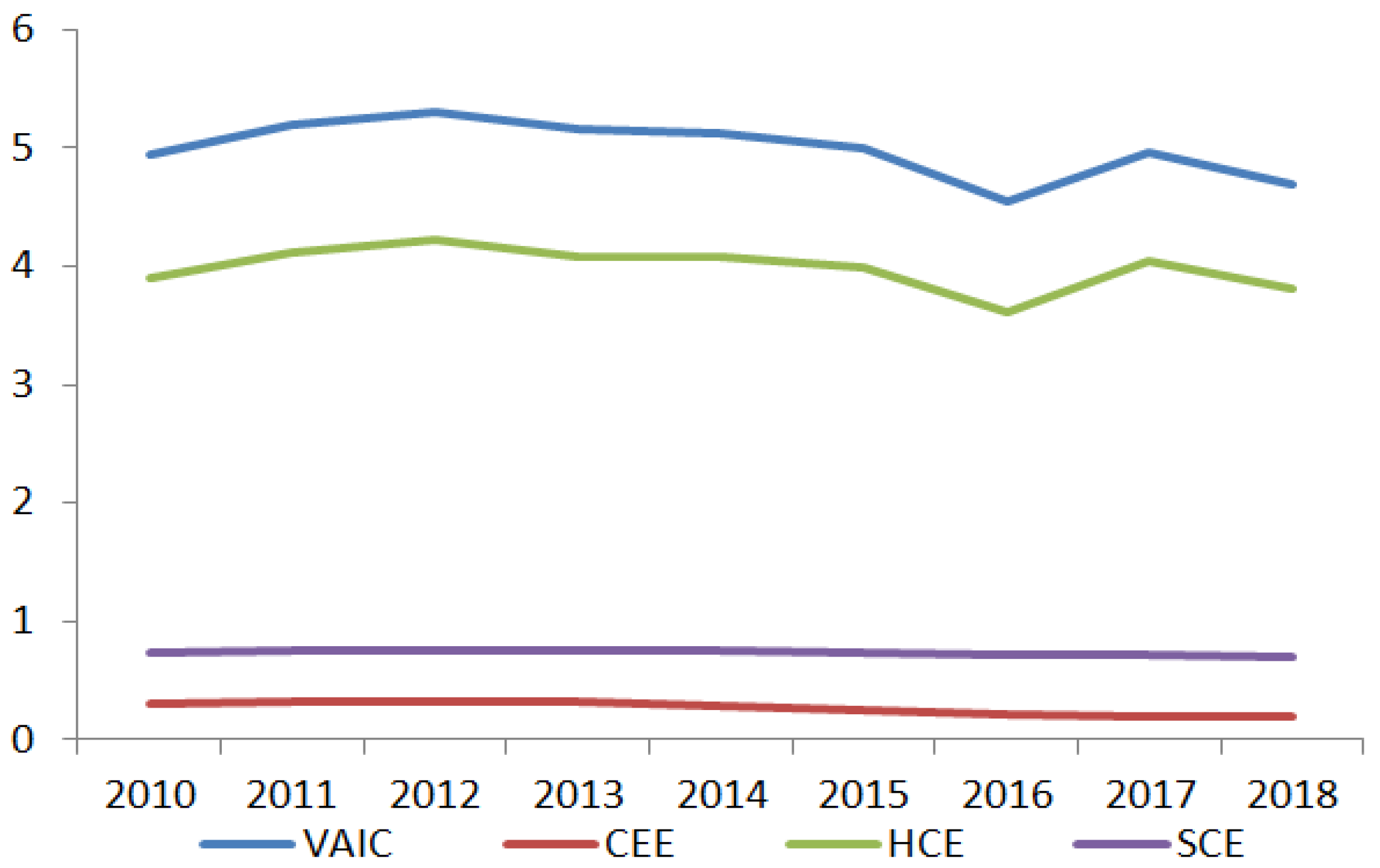

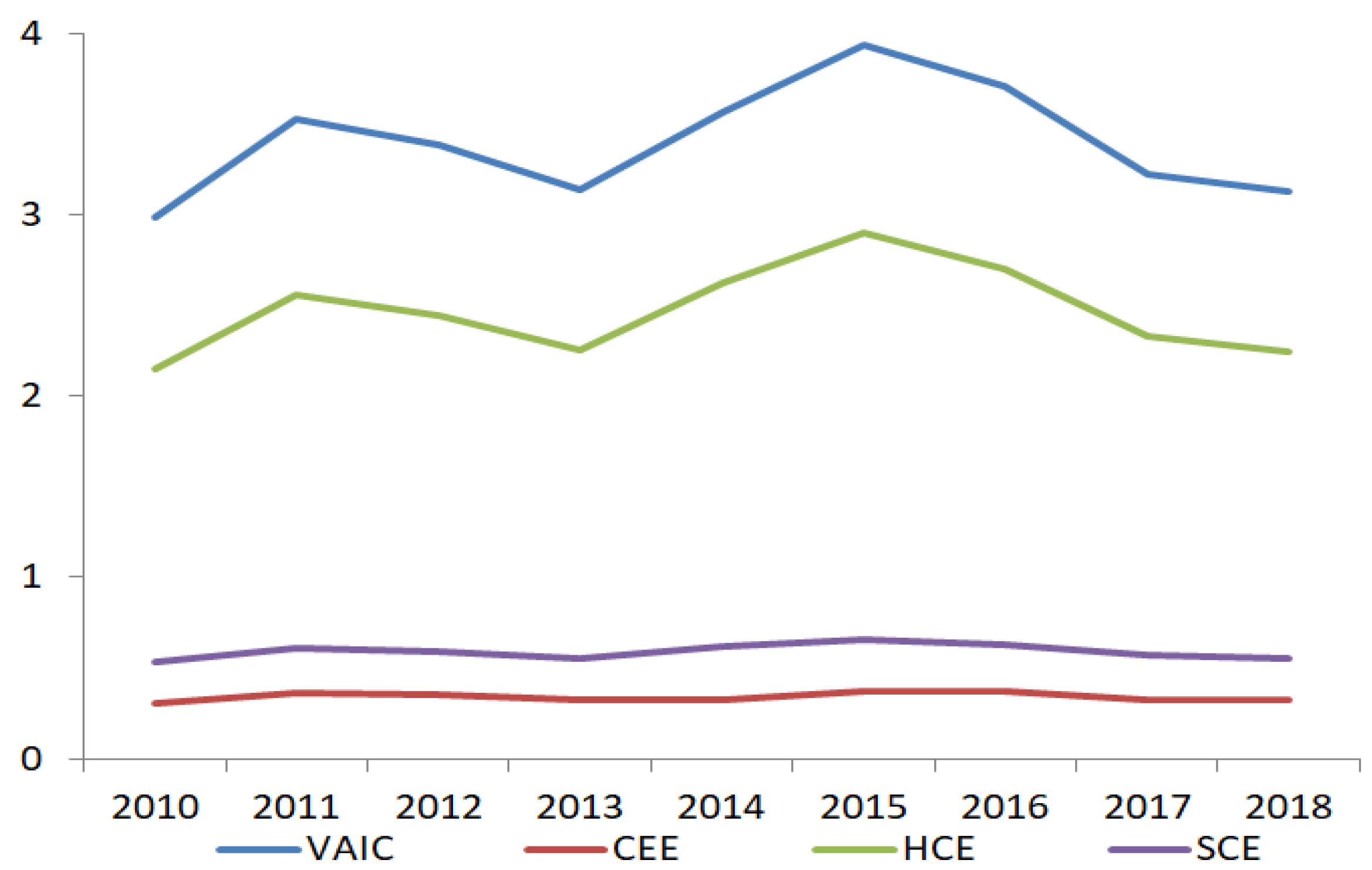

- Independent variables. The VAIC™ model is applied to measure the IC efficiency. IC and its components (CEE, HCE, and SCE) are measured as follows:CEE = VA/CE,HCE = VA/HC,SCE = (VA − HC)/VA,VAIC = CEE + HCE + SCE.In these computations, VA is the amount of value added to the listed banks. Guided by Meles et al. [6], Young et al. [9], Alhassan and Asare [13], Tran and Vo [17], Adesina [18], and Vidyarthi [21], VA is calculated as follows:VA = Total revenue generated by listed banks − all related costs + personnel cost (salaries, wages, and other benefits).CE is the physical and financial capital of listed banks, measured by total assets minus total liabilities. CEE indicates the banks’ ability to utilize their physical and financial capital efficiently. HC is defined as the total amount of capital invested in knowledge workers (including salaries, wages, and other benefits), measured by personnel costs in banks’ financial statements, as widely used in previous studies [11,17,62,73]. HCE and SCE indicate the efficiency of HC and SC. Thus, VAIC is the sum of CEE, HCE, and SCE.

- (3)

- Control variables. Guided by the literature [17,18,20,66,74,75,76], this study also controls for some bank characteristics by deploying three important variables: Bank size (SIZE), measured as the natural logarithm of total assets of listed banks; debt ratio (LEV), calculated by dividing total liabilities by total assets of listed banks; bank type (TYPE), which takes 1 if a bank is private-owned and if it is not; gross domestic product (GDP), measured as the natural logarithm of gross domestic product; and year dummy (YEAR). Table 3 presents a list of the variables used in this study with their description.

4.3. Models

5. Results

5.1. Descriptive Statistics

5.2. Diagnostic Tests

5.3. Regression Results

5.4. Robustness Check

β6COUNTRYi + β7YEARt + νi,t + µi,t,

β7GDPi,t + β8COUNTRYi + β9YEARt + νi,t + µi,t.

5.5. Additional Analysis on the Lagged Effect of IC

6. Discussion

7. Conclusions

- (1)

- IC has a positive impact on bank profitability and productivity in China and Pakistan.

- (2)

- Among VAIC components, CEE is the most influencing factor that explains higher profits for banks in China and Pakistan. In the Chinese context, CEE and SCE are found to be the main drivers of profit in the Chinese banking system. In the case of Pakistan, CEE and HCE mainly affect bank performance.

- (3)

- The lagged CEE and SCE positively affect Chinese banks’ performance. In Pakistan, only lagged HCE yields a positive effect on future profitability.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| IC | Intellectual capital |

| VAIC | Value added Intellectual Coefficient |

| CEE | Capital employed efficiency |

| HCE | Human capital efficiency |

| SCE | Structural capital efficiency |

| ROA | Return on assets |

| ROE | Return on equity |

| ATO | Asset turnover ratio |

Appendix A

| Bank’s Name | CEE | HCE | SCE | VAIC |

|---|---|---|---|---|

| Ping An Bank | 0.2584 | 3.2025 | 0.6870 | 4.1479 |

| Bank of Ningbo | 0.2736 | 3.5387 | 0.7131 | 4.5254 |

| Jiangyin Rural Commercial Bank | 0.1330 | 2.3931 | 0.5759 | 3.1021 |

| Rural Commercial bank of Zhangjiagang | 0.1460 | 2.5637 | 0.6092 | 3.3189 |

| Bank of Zhengzhou | 0.1442 | 3.3089 | 0.6978 | 4.1509 |

| SPD Bank | 0.2770 | 4.1232 | 0.7560 | 5.1562 |

| Hua Xia Bank | 0.2895 | 3.1872 | 0.6837 | 4.1604 |

| China Minsheng Bank | 0.3015 | 3.6494 | 0.7246 | 4.6755 |

| China Merchants Bank | 0.3275 | 3.5378 | 0.7161 | 4.5815 |

| Jiangsu Financial Leasing | 0.1954 | 16.4203 | 0.9383 | 17.5539 |

| Wuxi Rural Commercial Bank | 0.1691 | 3.7792 | 0.7353 | 4.6836 |

| Bank of Jiangsu | 0.1886 | 3.3467 | 0.7008 | 4.2361 |

| Bank of Hangzhou | 0.1660 | 2.8011 | 0.6428 | 3.6100 |

| Bank of Nanjing | 0.2369 | 4.2686 | 0.7645 | 5.2700 |

| Changshu Rural Commercial Bank | 0.2302 | 2.5700 | 0.6103 | 3.4104 |

| Industrial Bank | 0.2858 | 4.4571 | 0.7730 | 5.5160 |

| Bank of Beijing | 0.2215 | 5.6196 | 0.8201 | 6.66122 |

| Bank of Shanghai | 0.1550 | 4.8239 | 0.7924 | 5.7713 |

| Agricultural Bank of China | 0.3099 | 3.0552 | 0.6725 | 4.0377 |

| Bank of Communications | 0.2254 | 4.4016 | 0.7722 | 5.3992 |

| Industrial and Commercial Bank of China | 0.2964 | 4.2129 | 0.7625 | 5.2718 |

| Bank of Changsha | 0.2576 | 3.1703 | 0.6846 | 4.1126 |

| China Everbright Bank | 0.2621 | 3.9924 | 0.7483 | 5.0028 |

| Bank of Chengdu | 0.2357 | 3.8317 | 0.7390 | 4.8063 |

| China Construction Bank | 0.2913 | 4.1847 | 0.7609 | 5.2369 |

| Bank of China | 0.2491 | 3.8575 | 0.7406 | 4.8473 |

| Bank of Guiyang | 0.2452 | 3.9141 | 0.7440 | 4.9033 |

| China Citic Bank | 0.2519 | 3.7222 | 0.7263 | 4.7004 |

| Suzhou Rural Commercial Bank | 0.1615 | 2.5935 | 0.6130 | 3.3680 |

| Bank’s Name | CEE | HCE | SCE | VAIC |

|---|---|---|---|---|

| Allied Bank | 0.4013 | 3.0168 | 0.6661 | 4.0841 |

| Askari Bank | 0.3682 | 1.5202 | 0.6197 | 2.5081 |

| Bank Alfalah | 0.4007 | 2.0621 | 0.4918 | 2.9546 |

| Bank Al Habib | 0.5093 | 2.7537 | 0.6338 | 3.8968 |

| Bankislami Pakistan | 0.2334 | 1.2696 | 0.1792 | 1.6823 |

| Bank of Khyber | 0.2434 | 2.3342 | 0.5485 | 3.1261 |

| Bank of Punjab | 0.1872 | 1.5219 | −0.1908 | 1.5183 |

| Faysal Bank | 0.3237 | 1.8848 | 0.4199 | 2.6284 |

| Habib Bank | 0.3958 | 2.8865 | 0.6366 | 3.9189 |

| Habib Metropolitn Bank | 0.3461 | 2.9387 | 0.6559 | 3.9407 |

| JS Bank | 0.2611 | 1.5594 | −0.1096 | 1.7110 |

| MCB Bank | 0.3574 | 5.0547 | 0.7895 | 6.2015 |

| Meezan Bank | 0.5238 | 2.3257 | 0.5679 | 3.4174 |

| National Bank of Pakistan | 0.3289 | 1.9813 | 0.4792 | 2.7894 |

| Samba Bank | 0.1215 | 1.5168 | 0.2822 | 1.9206 |

| Standard Chartered Bank Pak | 0.6531 | 3.3884 | 0.6939 | 4.7354 |

| Silk Bank | 0.3200 | 1.1465 | −0.4330 | 1.0335 |

| Summit Bank | 0.0004 | 0.1941 | −2.9299 | −2.7354 |

| Soneri Bank | 0.2712 | 1.9330 | 0.4621 | 2.6662 |

| United Bank | 0.3661 | 3.8044 | 0.7304 | 4.9008 |

References

- Jordão, R.V.D.; de Almeida, V.R. Performance measurement, intellectual capital and financial sustainability. J. Intellect. Cap. 2017, 18, 643–666. [Google Scholar] [CrossRef]

- Torres, A.I.; Ferraz, S.S.; Santos-Rodrigues, H. The impact of knowledge management factors in organizational sustainable competitive advantage. J. Intellect. Cap. 2018, 19, 453–472. [Google Scholar] [CrossRef]

- Sardo, F.; Serrasqueiro, Z. Intellectual capital, growth opportunities, and financial performance in European firms: Dynamic panel data analysis. J. Intellect. Cap. 2018, 19, 747–767. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B.H. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 2018, 10, 4651. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B.H. Intellectual capital performance of the textile industry in emerging markets: A comparison with China and South Korea. Sustainability 2019, 11, 2354. [Google Scholar] [CrossRef]

- Meles, A.; Porzio, C.; Sampagnaro, G.; Verdoliva, V. The impact of intellectual capital efficiency on commercial banks performance: Evidence from the US. J. Multinatl. Financ. Manag. 2016, 36, 64–74. [Google Scholar] [CrossRef]

- Zhang, X. A Study on Performance of Chinese Commercial Banks: Based on Intellectual Capital. Master’s Thesis, Dalian University of Technology, Dalian, China, 2015. [Google Scholar]

- Firer, S.; Williams, S.M. Intellectual capital and traditional measures of corporate performance. J. Intellect. Cap. 2003, 4, 348–360. [Google Scholar] [CrossRef]

- Young, C.S.; Su, H.Y.; Fang, S.C.; Fang, S.R. Cross-country comparison of intellectual capital performance of commercial banks in Asian economies. Serv. Ind. J. 2009, 29, 1565–1579. [Google Scholar] [CrossRef]

- Zou, X.P.; Huan, T.C. A study of the intellectual capital’s impact on listed banks’ performance in China. Afr. J. Bus. Manag. 2011, 5, 5001–5009. [Google Scholar]

- Gigante, G. Intellectual capital and bank performance in Europe. Acc. Financ. Res. 2013, 2, 120–129. [Google Scholar] [CrossRef]

- Wang, W.K.; Lu, W.M.; Wang, Y.H. The relationship between bank performance and intellectual capital in East Asia. Qual. Quant. 2013, 47, 1041–1062. [Google Scholar] [CrossRef]

- Alhassan, A.L.; Asare, N. Intellectual capital and bank productivity in emerging markets: Evidence from Ghana. Manag. Decis. 2016, 54, 589–609. [Google Scholar] [CrossRef]

- Cabrita, M.D.M.F.; da Silva, M.D.R.; Rodrigues, A.M.G.; Dueñas, M.D.M. Competitiveness and disclosure of intellectual capital: An empirical research in Portuguese banks. J. Intellect. Cap. 2017, 18, 486–505. [Google Scholar] [CrossRef]

- Ozkan, N.; Cakan, S.; Kayacan, M. Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanb. Rev. 2017, 17, 190–198. [Google Scholar] [CrossRef]

- Tiwari, R.; Vidyarthi, H. Intellectual capital and corporate performance: A case of Indian banks. J. Acc. Emerg. Econ. 2018, 8, 84–105. [Google Scholar] [CrossRef]

- Tran, D.B.; Vo, D.H. Should bankers be concerned with Intellectual capital? A study of the Thai banking sector. J. Intellect. Cap. 2018, 19, 897–914. [Google Scholar] [CrossRef]

- Adesina, K.S. Bank technical, allocative and cost efficiencies in Africa: The influence of intellectual capital. N. Am. Econ. Financ. 2019, 48, 419–433. [Google Scholar] [CrossRef]

- Belal, A.R.; Mazumder, M.M.M.; Ail, M. Intellectual capital reporting practices in an Islamic bank: A case study. Bus. Ethics 2019, 28, 206–220. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.; Tariq, G.; Malik, A.; Javaid, H.M. Intellectual capital performance and profitability of banks: Evidence from pakistan. J. Risk Financ. Manag. 2019, 12, 56. [Google Scholar] [CrossRef]

- Vidyarthi, H. Dynamics of intellectual capitals and bank efficiency in India. Serv. Ind. J. 2019, 39, 1–24. [Google Scholar] [CrossRef]

- Sun, J.; Hou, J.W. Monetary and financial cooperation between China and the One Belt One Road countries. Emerg. Mark. Financ. Trade 2019, 55, 2609–2627. [Google Scholar] [CrossRef]

- Wu, S.Y.; Pan, Q.Z. Financial Cooperative Potential between China and Belt and Road Countries. Available online: https://www.tandfonline.com/doi/full/10.1080/1540496X.2018.1509207 (accessed on 28 July 2019).

- Gulzar, S.; Kayani, G.M.; Hui, X.F.; Ayub, U.; Rafique, A. Financial cointegration and spillover effect of global financial crisis: A study of emerging Asian financial markets. Ekon. Istraz. 2019, 32, 187–218. [Google Scholar] [CrossRef]

- Haneef, S.; Riaz, T.; Ramzan, M.; Rana, M.A.; Ishaq, H.M.; Karim, Y. Impact of risk management on non-performing loans and profitability of banking sector of Pakistan. Int. J. Bus. Soc. Sci. 2012, 3, 307–315. [Google Scholar]

- Xu, J.X.; Li, N.W.; Ahmad, M.I. Banking performance of China and Pakistan. Entrep. Sustain. Issues 2018, 5, 929–942. [Google Scholar] [CrossRef]

- Okazaki, K. Banking system reform in China: The challenges to improving its efficiency in serving the real economy. Asian Econ. Policy Rev. 2017, 12, 303–320. [Google Scholar] [CrossRef]

- Khan, M.U.; Hanif, M.N. Empirical evaluation of ‘structure-conduct-performance’ and ‘efficient-structure’ paradigms in banking sector of Pakistan. Int. Rev. Appl. Econ. 2019, 33, 682–696. [Google Scholar] [CrossRef]

- Pulic, A. Measuring the Performance of Intellectual Potential in Knowledge Economy. Available online: http://www.measuring-ip.at/Opapers/Pulic/Vaictxt.vaictxt.html (accessed on 26 June 2019).

- Chen, Y.B.; Shi, Y.; Wei, X.H.; Zhang, L.L. How does credit portfolio diversification affect banks’ return and risk? Evidence from Chinese listed commercial banks. Technol. Econ. Dev. Econ. 2014, 20, 332–352. [Google Scholar] [CrossRef]

- Fang, J.C.; Lau, C.K.M.; Lu, Z.; Tan, Y.; Zhang, H. Bank performance in China: A Perspective from Bank efficiency, risk-taking and market competition. Pac. Basin Financ. J. 2019, 56, 290–309. [Google Scholar] [CrossRef]

- Jiang, H.C.; Han, L.Y. Does income diversification benefit the sustainable development of Chinese listed banks? Analysis based on entropy and the Herfindahl-Hirschman index. Entropy 2018, 20, 255. [Google Scholar] [CrossRef]

- Cao, Y.J. China’s banking industry: Seeking development in change. Int. Financ. 2016, 6, 15–19. (In Chinese) [Google Scholar]

- Wang, X.Y. The Effects of Intellectual Capital on Performance of Commercial Banks—An Empirical Study Based on a Share Listed Commercial Banks. Master’s Thesis, Southwestern University of Finance and Economics, Chengdu, China, 2016. [Google Scholar]

- Jiang, H.C.; He, Y.F. Applying data envelopment analysis in measuring the efficiency of Chinese listed banks in the context of macroprudential framework. Mathematics 2018, 6, 184. [Google Scholar] [CrossRef]

- Yao, H.X.; Haris, M.; Tariq, G. Profitability determinants of financial institutions: Evidence from banks in Pakistan. Int. J. Financ. Stud. 2018, 6, 53. [Google Scholar] [CrossRef]

- Ma, Y.; Jalil, A. Financial development, economic growth and adaptive efficiency: A comparison between China and Pakistan. China World Econ. 2008, 16, 97–111. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.X.; Tariq, G.; Malik, A. An evaluation of performance of public sector financial institutions: Evidence from Pakistan. Int. J. Bus. Perform. Manag. 2019, 20, 145–163. [Google Scholar] [CrossRef]

- Edvinsson, L.; Sullivan, P. Developing a model for managing intellectual capital. Eur. Manag. J. 1996, 14, 356–364. [Google Scholar] [CrossRef]

- Harrison, S.; Sullivan, P.H. Profiting from intellectual capital: Learning from leading companies. J. Intellect. Cap. 2000, 1, 33–46. [Google Scholar] [CrossRef]

- Stewart, T.A. Intellectual Capital: The New Wealth of Organization; Doubleday: New York, NY, USA, 1997. [Google Scholar]

- Sveiby, K.E. Intellectual capital: Thinking ahead. Aust. CPA 1998, 68, 18–21. [Google Scholar]

- Bassi, L.J. Harnessing the power of intellectual capital. Train. Dev. 1997, 51, 25–30. [Google Scholar]

- Sveiby, K.E. The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets; Berrett-Koehler Publishers: San Francisco, CA, USA, 1997. [Google Scholar]

- Bontis, N. Intellectual capital: An exploratory study that develops measures and models. Manag. Decis. 1998, 36, 63–76. [Google Scholar] [CrossRef]

- Pulic, A. VAICTM—An accounting tool for IC management. Int. J. Technol. Manage. 2000, 20, 702–714. [Google Scholar] [CrossRef]

- Edvinsson, L.; Malone, M.S. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower; Harper Business: New York, NY, USA, 1997. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Translating Strategy into Action; Harvard Business Press: Boston, MA, USA, 1996. [Google Scholar]

- Nadeem, M.; Gan, C.; Nguyen, C. Does intellectual capital efficiency improve firm performance in BRICS economies? A dynamic panel estimation. Meas. Bus. Excell. 2017, 21, 65–85. [Google Scholar] [CrossRef]

- Goh, P.C. Intellectual capital performance of commercial banks in Malaysia. J. Intellect. Cap. 2005, 6, 385–396. [Google Scholar]

- Johnson, W.H.A. An integrative taxonomy of intellectual capital: Measuring the stock and flow of intellectual capital components in the firm. Int. J. Technol. Manag. 1999, 18, 562–575. [Google Scholar] [CrossRef]

- Morris, C. An industry analysis of the power of human capital for corporate performance: Evidence from South Africa. S. Afr. J. Econ. Manag. Sci. 2015, 18, 486–499. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in human capital. Am. Econ. Rev. 1961, 51, 1–17. [Google Scholar]

- Becker, G.S. Human Capital; Columbia University Press: New York, NY, USA, 1964. [Google Scholar]

- Bozbura, F.T. Measurement and application of intellectual capital in Turkey. Learn. Organ. 2004, 11, 357–367. [Google Scholar] [CrossRef]

- Hsu, L.C.; Wang, C.H. Clarifying the effect of intellectual capital on performance: The mediating role of dynamic capability. Br. J. Manag. 2012, 23, 179–205. [Google Scholar] [CrossRef]

- Mondal, A.; Ghosh, S.K. Intellectual capital and financial performance of Indian banks. J. Intellect. Cap. 2012, 13, 515–530. [Google Scholar] [CrossRef]

- Ting, I.W.K.; Lean, H.H. Intellectual capital performance of financial institutions in Malaysia. J. Intellect. Cap. 2009, 10, 588–599. [Google Scholar] [CrossRef]

- Kamath, G.B. The intellectual capital performance of the Indian banking sector. J. Intellect. Cap. 2007, 8, 96–123. [Google Scholar] [CrossRef]

- Saengchan, S. The Role of Intellectual Capital in Creating Value in the Banking Industry. Available online: https://www.docin.com/p-388310816.html (accessed on 29 June 2019).

- Joshi, M.; Cahill, D.; Sidhu, J.; Kansal, M. Intellectual capital and financial performance: An evaluation of the Australian financial sector. J. Intellect. Cap. 2013, 14, 264–285. [Google Scholar] [CrossRef]

- Poh, L.T.; Kilicman, A.; Ibrahim, S.N.I. On intellectual capital and financial performances of banks in Malaysia. Cogent Econ. Financ. 2018, 6, 1453574. [Google Scholar] [CrossRef]

- Gan, K.; Saleh, Z. Intellectual capital and corporate performance of technology-intensive companies: Malaysia evidence. Asian J. Bus. Acc. 2008, 1, 113–130. [Google Scholar]

- Xu, J.; Wang, B.H. Intellectual capital and financial performance of Chinese agricultural listed companies. Custos Agronegocio Line 2019, 15, 273–290. [Google Scholar]

- Shiu, H.J. The application of the value added intellectual coefficient to measure corporate performance: Evidence from technological firms. Int. J. Manag. 2006, 23, 356–364. [Google Scholar]

- Yao, H.X.; Haris, M.; Tariq, G.; Javaid, H.M.; Khan, M.A.S. Intellectual capital, profitability, and productivity: Evidence from Pakistani financial institutions. Sustainability 2019, 11, 3842. [Google Scholar] [CrossRef]

- Pal, K.; Soriya, S. IC performance of Indian pharmaceutical and textile industry. J. Intellect. Cap. 2012, 13, 120–137. [Google Scholar] [CrossRef]

- Nadeem, M.; Dumay, J.; Massaro, M. If you can measure it, you can manage it: A case of intellectual capital. Aust. Acc. Rev. 2019, 29, 395–407. [Google Scholar] [CrossRef]

- AL-Musali, M.A.; Ismail, K.N.I.K. Cross-country comparison of intellectual capital performance and its impact on financial performance of commercial banks in GCC countries. Int. J. Islamic Middle Eastern Financ. Manag. 2016, 9, 512–531. [Google Scholar] [CrossRef]

- Pakistan Stock Exchange Limited. Available online: http://www.psx.com.pk/psx/resource-and-tools/listings/listed-companies (accessed on 27 June 2019).

- Chen, W.J. The Impact of Intellectual Capital on the Performance of Commercial Banks. Master’s Thesis, Zhejiang University of Finance and Economics, Hangzhou, China, 2016. [Google Scholar]

- Xu, X.L.; Yang, X.N.; Zhan, L.; Liu, C.K.; Zhou, N.D.; Hu, M.M. Examining the relationship between intellectual capital and performance of listed environmental protection companies. Environ. Prog. Sustain. Energy 2017, 36, 1056–1066. [Google Scholar] [CrossRef]

- Gigante, G.; Previati, D. The Performance of Intellectual Capital and Banking: Some Empirical Evidence from the European Banking System. In New Issues in Financial Institutions Management; Fiordelisi, F., Molyneux, P., Previati, D., Eds.; Palgrave Macmillan: London, UK, 2010; pp. 41–58. [Google Scholar]

- Zhang, P. Research on the Influence of Intellectual Capital to Commercial Banks Performance in China—Based on the Panel Data of Listed Commercial Banks. Master’s Thesis, Anhui University of Finance and Economics, Bengbu, China, 2015. [Google Scholar]

- Feng, X.H. Research on the Impact of Intellectual Capital for China’s Commercial Banks’ Performance. Master’s Thesis, Harbin Institute of Technology, Harbin, China, 2017. [Google Scholar]

- Xu, X.L.; Liu, C.K. How to keep renewable energy enterprises to reach economic sustainable performance: From the views of intellectual capital and life cycle. Energy Sustain. Soc. 2019, 9, 7. [Google Scholar] [CrossRef]

- Smriti, N.; Das, N. The impact of intellectual capital on firm performance: A study of Indian firms listed in COSPI. J. Intellect. Cap. 2018, 19, 935–964. [Google Scholar] [CrossRef]

- Irawanto, D.W.; Gondomono, H.; Hussein, A.S. The effect of intellectual capital on a company’s performance moderated by its governance and IT strategy integration employed by banks listed in Indonesian stock exchange. S. Asian J. Manag. 2017, 11, 86–102. [Google Scholar] [CrossRef]

- Mohapatra, S.; Jena, S.K.; Mitra, A.; Tiwari, A.K. Intellectual capital and firm performance: Evidence from Indian banking sector. Appl. Econ. 2019, 51, 6054–6067. [Google Scholar] [CrossRef]

- Buallay, A. Intellectual capital and performance of Islamic and conventional banking: Empirical evidence from Gulf Cooperative Council countries. J. Manag. Dev. 2019, 38, 518–537. [Google Scholar] [CrossRef]

| Year | VAIC | CEE | HCE | SCE |

|---|---|---|---|---|

| 2010 | 4.9344 | 0.3034 | 3.8964 | 0.7346 |

| 2011 | 5.1918 | 0.3199 | 4.1220 | 0.7499 |

| 2012 | 5.3025 | 0.3211 | 4.2244 | 0.7571 |

| 2013 | 5.1517 | 0.3165 | 4.0854 | 0.7497 |

| 2014 | 5.1272 | 0.2929 | 4.0857 | 0.7486 |

| 2015 | 4.9924 | 0.2541 | 3.9949 | 0.7434 |

| 2016 | 4.5424 | 0.2153 | 3.6139 | 0.7132 |

| 2017 | 4.9647 | 0.2042 | 4.0481 | 0.7124 |

| 2018 | 4.6930 | 0.1878 | 3.8016 | 0.7036 |

| Year | VAIC | CEE | HCE | SCE |

|---|---|---|---|---|

| 2010 | 2.9864 | 0.3034 | 2.1485 | 0.5346 |

| 2011 | 3.5297 | 0.3617 | 2.5588 | 0.6092 |

| 2012 | 3.3863 | 0.3513 | 2.4442 | 0.5909 |

| 2013 | 3.1334 | 0.3222 | 2.2547 | 0.5565 |

| 2014 | 3.5625 | 0.3217 | 2.6222 | 0.6186 |

| 2015 | 3.9332 | 0.3761 | 2.9017 | 0.6554 |

| 2016 | 3.7045 | 0.3695 | 2.7047 | 0.6303 |

| 2017 | 3.2244 | 0.3241 | 2.3295 | 0.5707 |

| 2018 | 3.1250 | 0.3280 | 2.2429 | 0.5541 |

| Variable | Notation | Description |

|---|---|---|

| Return on assets | ROA | Net income/Average total assets |

| Return on equity | ROE | Net income/Average shareholders’ equity |

| Asset turnover ratio | ATO | Total revenue/Average total assets |

| Value added intellectual coefficient | VAIC | See Equation (4) |

| Capital employed efficiency | CEE | See Equation (1) |

| Human capital efficiency | HCE | See Equation (2) |

| Structural capital efficiency | SCE | See Equation (3) |

| Bank Size | SIZE | Logarithm of total assets of listed banks |

| Debt ratio | LEV | Ratio of total liabilities to total assets |

| Bank type | TYPE | Dummy variable that takes 1 if a bank is private-owned, 0 otherwise |

| Gross domestic product | GDP | Logarithm of gross domestic product |

| Year | YEAR | Dummy variable that takes 1 for the test year, 0 otherwise |

| Variable | N | Mean | Max | Min | Standard Deviation |

|---|---|---|---|---|---|

| ROA | 177 | 0.0105 | 0.0230 | 0.0059 | 0.0024 |

| ROE | 177 | 0.1631 | 0.2531 | 0.0780 | 0.0414 |

| ATO | 177 | 0.0284 | 0.0436 | 0.0143 | 0.0050 |

| VAIC | 177 | 4.9430 | 19.4447 | 2.6828 | 1.5900 |

| CEE | 177 | 0.2558 | 0.4085 | 0.1108 | 0.0662 |

| HCE | 177 | 3.9573 | 18.2711 | 2.0580 | 1.5424 |

| SCE | 177 | 0.7299 | 0.9453 | 0.5141 | 0.0591 |

| SIZE | 177 | 28.5061 | 30.9524 | 24.6287 | 1.5254 |

| LEV | 177 | 0.9323 | 0.9659 | 0.8134 | 0.0143 |

| TYPE | 177 | 0.75 | 1 | 0 | 0.437 |

| GDP | 177 | 31.8239 | 32.1312 | 31.3498 | 0.2419 |

| Variable | N | Mean | Max | Min | Standard Deviation | Difference t-Statistics |

|---|---|---|---|---|---|---|

| ROA | 179 | 0.0094 | 0.0318 | −0.0216 | 0.0089 | 1.614 |

| ROE | 179 | 0.1037 | 0.2825 | −0.8186 | 0.1410 | 5.380 *** |

| ATO | 179 | 0.0913 | 0.1288 | 0.0568 | 0.0169 | −47.443 *** |

| VAIC | 179 | 2.8761 | 8.0049 | −16.4274 | 2.4429 | 9.450 *** |

| CEE | 179 | 0.3325 | 3.4474 | −1.1687 | 0.2990 | −3.334 *** |

| HCE | 179 | 2.2661 | 6.7638 | −2.2570 | 1.2279 | 11.451 *** |

| SCE | 179 | 0.2775 | 2.5650 | −16.4939 | 1.6194 | 3.715 *** |

| SIZE | 179 | 16.6713 | 18.7232 | 14.1760 | 1.0344 | 85.761 *** |

| LEV | 179 | 0.9143 | 0.9840 | 0.7388 | 0.0415 | 5.462 *** |

| TYPE | 179 | 0.8492 | 1 | 0 | 0.3589 | −2.442 ** |

| GDP | 179 | 27.6856 | 28.0454 | 27.2066 | 0.2603 | 4.1383 *** |

| Variable | China | Pakistan | Full Sample | |||

|---|---|---|---|---|---|---|

| Coef. | PV | Coef. | PV | Coef. | PV | |

| ROA | 102.005 | 0.000 | 162.920 | 0.000 | 171.449 | 0.000 |

| ROE | 68.310 | 0.043 | 208.484 | 0.000 | 215.337 | 0.000 |

| ATO | 71.638 | 0.000 | 126.720 | 0.000 | 153.941 | 0.000 |

| VAIC | 90.558 | 0.000 | 182.291 | 0.000 | 202.580 | 0.000 |

| CEE | 90.928 | 0.000 | 149.686 | 0.000 | 158.866 | 0.000 |

| HCE | 82.481 | 0.003 | 77.887 | 0.000 | 149.608 | 0.000 |

| SCE | 66.374 | 0.000 | 224.981 | 0.000 | 263.392 | 0.000 |

| SIZE | 141.298 | 0.000 | 70.724 | 0.002 | 168.652 | 0.000 |

| LEV | 57.956 | 0.003 | 83.124 | 0.000 | 141.080 | 0.000 |

| GDP | 357.717 | 0.000 | 152.164 | 0.000 | 194.198 | 0.000 |

| Panel A: China | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | ROA | ROE | ATO | VAIC | CEE | HCE | SCE | SIZE | LEV | TYPE | GDP | VIF1 | VIF2 |

| ROA | 1 | ||||||||||||

| ROE | 0.670 *** | 1 | |||||||||||

| ATO | 0.689 *** | 0.522 *** | 1 | ||||||||||

| VAIC | 0.673 *** | 0.232 *** | 0.281 *** | 1 | 1.544 | ||||||||

| CEE | 0.580 *** | 0.938 *** | 0.605 *** | 0.056 | 1 | 3.024 | |||||||

| HCE | 0.646 *** | 0.183 *** | 0.258 *** | 0.999 *** | 0.008 | 1 | 5.333 | ||||||

| SCE | 0.601 *** | 0.414 *** | 0.152 ** | 0.780 *** | 0.203 *** | 0.757 *** | 1 | 4.168 | |||||

| SIZE | 0.177 *** | 0.264 *** | 0.154 ** | −0.097 | 0.340 *** | −0.123 * | 0.213 *** | 1 | 2.306 | 3.135 | |||

| LEV | −0.271 *** | 0.491 *** | −0.108 * | −0.449 *** | 0.538 *** | −0.483 *** | −0.094 | 0.194 *** | 1 | 2.512 | 3.163 | ||

| TYPE | −0.275 *** | −0.114 * | −0.128 ** | −0.006 | −0.165 ** | 0.006 | −0.117 * | −0.674 *** | 0.133 ** | 1 | 2.430 | 2.464 | |

| GDP | −0.396 *** | −0.751 *** | −0.333 *** | −0.088 | −0.722 *** | −0.050 | −0.255 *** | −0.101 * | −0.476 ** | 0.124 * | 1 | 1.738 | 2.748 |

| Panel B: Pakistan | |||||||||||||

| Variable | ROA | ROE | ATO | VAIC | CEE | HCE | SCE | SIZE | LEV | TYPE | GDP | VIF1 | VIF2 |

| ROA | 1 | ||||||||||||

| ROE | 0.822 *** | 1 | |||||||||||

| ATO | 0.176 ** | 0.025 | 1 | ||||||||||

| VAIC | 0.770 *** | 0.652 *** | 0.011 | 1 | 1.456 | ||||||||

| CEE | 0.466 *** | 0.616 *** | −0.074 | 0.442 *** | 1 | 1.302 | |||||||

| HCE | 0.923 *** | 0.745 *** | 0.065 | 0.770 *** | 0.442 *** | 1 | 2.286 | ||||||

| SCE | 0.375 *** | 0.305 *** | −0.018 | 0.843 *** | 0.147 ** | 0.322 *** | 1 | 1.132 | |||||

| SIZE | 0.464 *** | 0.417 *** | −0.340 *** | 0.459 *** | 0.281 *** | 0.511 *** | 0.253 *** | 1 | 1.676 | 2.083 | |||

| LEV | −0.318 *** | −0.102 | −0.305 *** | −0.153 ** | 0.041 | −0.261 *** | −0.041 | 0.295 *** | 1 | 1.267 | 1.533 | ||

| TYPE | 0.049 | 0.092 | 0.090 | 0.069 | 0.112 | 0.110 | −0.001 | −0.068 | −0.004 | 1 | 1.021 | 1.054 | |

| GDP | 0.005 | 0.141 ** | −0.779 *** | 0.142 ** | 0.162 ** | 0.103 * | 0.107 * | 0.367 *** | 0.233 *** | −0.003 | 1 | 1.180 | 1.195 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.191 *** | 1.912 *** | 0.465 *** | 0.137 *** | −0.386 | 1.479 *** |

| (7.331) | (4.577) | (5.737) | (3.385) | (−0.445) | (17.694) | |

| VAIC | 0.001 *** | 0.009 *** | 0.0003 | 0.002 *** | 0.032 *** | 0.001 *** |

| (9.356) | (7.115) | (1.075) | (11.764) | (8.056) | (2.774) | |

| SIZE | 0.0003 *** | 0.006 *** | 0.001 *** | 0.003 *** | 0.026 ** | −0.002 * |

| (3.289) | (3.330) | (3.328) | (6.146) | (2.591) | (−1.889) | |

| LEV | −0.050 *** | 1.023 *** | −0.142 *** | −0.063 *** | −0.260 | −0.031 |

| (−4.273) | (5.420) | (−3.880) | (−6.308) | (−1.210) | (−1.490) | |

| TYPE | −0.001 | 0.005 | 0.002 ** | 0.001 | 0.026 | 0.003 |

| (−0.345) | (0.742) | (2.079) | (0.701) | (1.174) | (1.517) | |

| GDP | −0.005 *** | −0.092 *** | −0.011 *** | −0.004 *** | 0.007 | −0.048 *** |

| (−7.977) | (−9.843) | (−5.896) | (−2.898) | (0.202) | (−15.106) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 66.772 *** | 83.547 *** | 12.148 *** | 81.369 *** | 28.480 *** | 63.244 *** |

| Adj. R2 | 0.651 | 0.701 | 0.241 | 0.693 | 0.436 | 0.636 |

| D.W. | 0.668 | 0.865 | 0.599 | 1.547 | 1.469 | 1.525 |

| N | 177 | 177 | 177 | 179 | 179 | 179 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.081 *** | 0.147 | 0.200 *** | 0.106 *** | −0.394 | 1.459 *** |

| (6.736) | (0.756) | (3.383) | (4.145) | (−0.571) | (17.389) | |

| CEE | 0.034 *** | 0.537 *** | 0.077 *** | 0.003 *** | 0.164 *** | −0.0005 |

| (27.651) | (27.307) | (12.975) | (3.600) | (6.886) | (−0.165) | |

| HCE | 0.00007 | −0.001 | 0.0002 | 0.006 *** | 0.068 *** | 0.003 *** |

| (1.021) | (−0.579) | (0.508) | (20.344) | (8.777) | (3.058) | |

| SCE | 0.014 *** | 0.190 *** | −0.012 | 0.001 *** | 0.006 | 0.0004 |

| (8.843) | (7.349) | (−1.596) | (3.304) | (1.451) | (0.774) | |

| SIZE | −0.0002 *** | −0.003 *** | 0.0003 | 0.001 * | −0.002 | −0.003 *** |

| (−4.146) | (−3.557) | (1.121) | (1.863) | (−0.254) | (−2.670) | |

| LEV | −0.109 *** | 0.125 | −0.233 *** | −0.023 *** | 0.141 | −0.011 |

| (−18.853) | (1.343) | (−8.289) | (−3.323) | (0.759) | (−0.483) | |

| TYPE | −0.001 *** | −0.002 | 0.002 ** | −0.001 * | −0.005 | 0.003 |

| (−3.170) | (−0.576) | (2.346) | (−1.756) | (−0.281) | (1.168) | |

| GDP | 0.001 * | −0.009 * | 0.001 | −0.004 *** | 0.007 | −0.048 *** |

| (1.772) | (−1.742) | (0.507) | (−3.682) | (0.276) | (−14.944) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 355.747 *** | 413.197 *** | 46.352 *** | 187.451 *** | 48.233 *** | 46.566 *** |

| Adj. R2 | 0.934 | 0.943 | 0.643 | 0.880 | 0.650 | 0.642 |

| D.W. | 1.121 | 1.523 | 0.921 | 1.464 | 1.290 | 1.574 |

| N | 177 | 177 | 177 | 179 | 179 | 179 |

| Variable | Model (12) | Model (13) | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | −1.096 | −4.933 | 3.187 *** | −0.120 | −8.052 | 0.938 |

| (0.735) | (3.949) | (0.678) | (0.121) | (9.173) | (0.931) | |

| DEPt−1 | 0.334 *** | 0.461 *** | 0.252 *** | 0.310 *** | 0.380 *** | 0.300 *** |

| (0.077) | (0.086) | (0.096) | (0.119) | (0.040) | (0.101) | |

| VAIC | 0.002 *** | 0.021 *** | 0.009 *** | |||

| (0.001) | (0.002) | (0.003) | ||||

| CEE | 0.003 | 0.104 *** | −0.014 ** | |||

| (0.003) | (0.040) | (0.006) | ||||

| HCE | 0.002 *** | 0.019 ** | 0.017 ** | |||

| (0.001) | (0.010) | (0.009) | ||||

| SCE | 0.001 *** | 0.020 *** | 0.009 * | |||

| (0.0001) | (0.004) | (0.005) | ||||

| SIZE | 0.002 * | 0.011 ** | 0.007 ** | 0.001 ** | 0.008 * | 0.004 |

| (0.001) | (0.005) | (0.003) | (0.0004) | (0.005) | (0.003) | |

| LEV | −0.145 *** | −0.496 ** | −1.008 *** | −0.073 *** | −0.410 * | −0.871 *** |

| (0.049) | (0.252) | (0.141) | (0.018) | (0.232) | (0.145) | |

| TYPE | 0.005 | 0.013 | 0.065 *** | 0.001 | 0.012 | 0.054 *** |

| (0.003) | (0.012) | (0.023) | (0.002) | (0.011) | (0.020) | |

| GDP | 0.043 | 0.188 | −0.087 *** | 0.006 | 0.299 | −0.119 ** |

| (0.027) | (0.137) | (0.023) | (0.004) | (0.332) | (0.049) | |

| COUNTRY | YES | YES | YES | YES | YES | YES |

| YEAR | YES | YES | YES | YES | YES | YES |

| F | 19.62 *** | 362.68 *** | 81.70 *** | 297.19 *** | 651.23 *** | 14.10 *** |

| Bank | 47 | 47 | 47 | 47 | 47 | 47 |

| Instruments | 21 | 23 | 23 | 25 | 24 | 24 |

| AR(1) | −1.71(0.087) | −1.56(0.118) | −1.58(0.114) | −1.61(0.108) | −1.88(0.061) | −1.80(0.072) |

| AR(2) | −0.98(0.328) | −0.87(0.383) | −0.85(0.397) | −1.44(0.150) | −0.68(0.498) | −0.35(0.729) |

| Hansen-J | 1.96(0.744) | 2.50(0.869) | 7.04(0.317) | 5.71(0.457) | 2.66(0.752) | 7.91(0.161) |

| C-statistics | 0.17(0.921) | 0.12(0.939) | 1.43(0.488) | 1.24(0.537) | 0.26(0.879) | 2.63(0.268) |

| N | 307 | 307 | 307 | 307 | 307 | 307 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.296 *** | 3.168 *** | 0.773 *** | 0.255 *** | 1.181 | 1.890 *** |

| (8.864) | (5.949) | (7.490) | (4.419) | (1.095) | (20.171) | |

| VAICt−1 | 0.001 *** | 0.008 *** | −0.001 | 0.001 *** | 0.015 *** | −0.0001 |

| (4.864) | (4.749) | (−1.613) | (6.000) | (4.044) | (−0.439) | |

| SIZE | 0.0003 *** | 0.005 ** | 0.001 *** | 0.003 *** | 0.040 *** | −0.0002 |

| (2.722) | (2.474) | (3.562) | (6.411) | (3.950) | (−0.242) | |

| LEV | −0.062 *** | 0.893 *** | −0.212 *** | −0.082 *** | −0.311 | −0.065 *** |

| (−0.373) | (3.929) | (−4.804) | (−6.684) | (−1.351) | (−3.237) | |

| TYPE | −0.00005 | 0.005 | 0.004 *** | 0.001 | 0.006 | 0.002 |

| (−0.132) | (0.727) | (3.013) | (0.745) | (0.261) | (1.231) | |

| GDP | −0.007 *** | −0.126 *** | −0.018 *** | −0.008 *** | −0.054 | −0.063 *** |

| (−10.104) | (−10.647) | (−7.992) | (−3.844) | (−1.331) | (−17.712) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 58.385 *** | 79.690 *** | 15.874 *** | 41.518 *** | 13.114 *** | 82.863 *** |

| Adj. R2 | 0.661 | 0.728 | 0.336 | 0.562 | 0.277 | 0.721 |

| D.W. | 0.728 | 0.734 | 0.747 | 1.515 | 1.363 | 1.245 |

| N | 148 | 148 | 148 | 159 | 159 | 159 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.183 *** | 0.987 *** | 0.387 *** | 0.244 *** | 1.414 | 1.889 *** |

| (7.190) | (2.739) | (4.434) | (4.616) | (1.358) | (20.143) | |

| CEEt−1 | 0.026 *** | 0.438 *** | 0.062 *** | 0.0001 | 0.073 ** | 0.0003 |

| (13.031) | (15.626) | (9.133) | (0.067) | (2.573) | (0.130) | |

| HCEt−1 | −0.00005 | 0.003 | −0.0001 | 0.004 *** | 0.034 *** | 0.001 |

| (−0.352) | (1.303) | (−0.198) | (7.713) | (3.646) | (1.546) | |

| SCEt−1 | 0.012 *** | 0.106 ** | −0.015 | 0.0003 | 0.003 | −0.001 * |

| (4.040) | (2.421) | (−1.411) | (1.188) | (0.704) | (−1.776) | |

| SIZE | −0.0003 *** | −0.004 *** | 0.0002 | 0.002 *** | 0.024 ** | −0.001 |

| (−2.829) | (−3.389) | (0.531) | (3.441) | (2.206) | (−1.209) | |

| LEV | −0.095 *** | 0.565 *** | −0.199 *** | −0.054 *** | −0.080 | −0.048 ** |

| (−8.017) | (3.369) | (−4.906) | (−4.386) | (−0.333) | (−2.192) | |

| TYPE | −0.001 ** | −0.007 * | 0.002 * | −0.0002 | −0.011 | 0.002 |

| (−2.497) | (−1.832) | (1.826) | (−0.176) | (−0.471) | (0.826) | |

| GDP | −0.003 *** | −0.045 *** | −0.006 *** | −0.008 *** | −0.062 | −0.063 *** |

| (−4.599) | (−5.037) | (−2.693) | (−4.084) | (−1.589) | (−17.766) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 112.442 *** | 188.891 *** | 34.858 *** | 41.047 *** | 12.559 *** | 60.942 *** |

| Adj. R2 | 0.841 | 0.899 | 0.617 | 0.640 | 0.339 | 0.726 |

| D.W. | 1.408 | 1.127 | 1.094 | 1.769 | 1.446 | 1.318 |

| N | 148 | 148 | 148 | 159 | 159 | 159 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.347 *** | 3.762 *** | 0.846 *** | 0.231 *** | 1.291 | 1.792 *** |

| (7.933) | (5.304) | (6.978) | (3.177) | (0.993) | (14.709) | |

| VAICt−2 | 0.0001 | 0.001 | −0.002 *** | 0.001 *** | 0.028 *** | −0.0002 |

| (0.954) | (0.317) | (−4.826) | (6.698) | (6.979) | (−0.451) | |

| SIZE | 0.0003 ** | 0.005 ** | 0.001 *** | 0.001 *** | 0.010 ** | −0.00005 |

| (2.561) | (2.267) | (4.004) | (5.015) | (2.071) | (−0.112) | |

| LEV | −0.061 *** | 0.983 *** | −0.171 *** | −0.047 *** | 0.192 | −0.076 *** |

| (−3.108) | (3.071) | (−3.127) | (−3.558) | (0.817) | (−3.466) | |

| TYPE | 3.310E-06 | 0.004 | 0.004 *** | −0.0002 | −0.008 | 0.002 |

| (0.008) | (0.622) | (3.509) | (−0.127) | (−0.336) | (0.882) | |

| GDP | −0.009 *** | −0.146 *** | −0.022 *** | −0.007 ** | −0.053 | −0.059 *** |

| (−9.835) | (−9.764) | (−8.479) | (−2.494) | (−1.089) | (−13.026) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 35.082 *** | 61.155 *** | 20.432 *** | 37.608 *** | 18.527 *** | 47.705 *** |

| Adj. R2 | 0.587 | 0.715 | 0.4447 | 0.570 | 0.388 | 0.629 |

| D.W. | 0.916 | 0.874 | 0.890 | 1.888 | 1.703 | 1.424 |

| N | 121 | 121 | 121 | 139 | 139 | 139 |

| Variable | China | Pakistan | ||||

|---|---|---|---|---|---|---|

| ROA | ROE | ATO | ROA | ROE | ATO | |

| Constant | 0.261 *** | 2.466 *** | 0.619 *** | 0.248 *** | 1.164 | 1.798 *** |

| (6.448) | (3.680) | (5.551) | (3.394) | (0.878) | (14.436) | |

| CEEt−2 | 0.017 *** | 0.266 *** | 0.048 *** | 0.001 | 0.037 | 0.002 |

| (5.958) | (5.628) | (6.121) | (0.715) | (1.342) | (0.605) | |

| HCEt−2 | −0.001 | −0.005 | −0.001 | 0.002 *** | 0.018 * | −0.001 |

| (−1.193) | (−0.514) | (−0.542) | (4.585) | (1.882) | (−0.678) | |

| SCEt−2 | 0.017 * | 0.148 | −0.011 | 0.001 *** | 0.031 *** | −0.0001 |

| (1.952) | (1.032) | (−0.458) | (3.922) | (6.001) | (−0.245) | |

| SIZE | −0.0002 * | −0.004 | 0.00002 | 0.001 *** | 0.013 ** | 0.00006 |

| (−1.677) | (−1.537) | (0.043) | (3.316) | (2.347) | (0.107) | |

| LEV | −0.075 *** | 0.768 *** | −0.210 *** | −0.042 *** | 0.144 | −0.079 *** |

| (−4.346) | (2.678) | (−4.410) | (−3.189) | (0.599) | (−3.506) | |

| TYPE | −0.001 * | −0.007 | 0.002 ** | −0.0003 | −0.006 | 0.002 |

| (−1.982) | (−1.130) | (1.991) | (−0.279) | (−0.277) | (0.822) | |

| GDP | −0.006 *** | −0.096 *** | −0.012 *** | −0.008 *** | −0.046 | −0.059 *** |

| (−6.109) | (−6.054) | (−4.714) | (−2.770) | (−0.937) | (−12.758) | |

| YEAR | Included | Included | Included | Included | Included | Included |

| F | 38.675 *** | 60.029 *** | 25.373 *** | 27.959 *** | 13.341 *** | 33.772 *** |

| Adj. R2 | 0.687 | 0.775 | 0.587 | 0.578 | 0.385 | 0.624 |

| D.W. | 1.115 | 1.061 | 0.915 | 1.802 | 1.804 | 1.417 |

| N | 121 | 121 | 121 | 139 | 139 | 139 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, J.; Haris, M.; Yao, H. Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan. Sustainability 2019, 11, 6582. https://doi.org/10.3390/su11236582

Xu J, Haris M, Yao H. Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan. Sustainability. 2019; 11(23):6582. https://doi.org/10.3390/su11236582

Chicago/Turabian StyleXu, Jian, Muhammad Haris, and Hongxing Yao. 2019. "Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan" Sustainability 11, no. 23: 6582. https://doi.org/10.3390/su11236582

APA StyleXu, J., Haris, M., & Yao, H. (2019). Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan. Sustainability, 11(23), 6582. https://doi.org/10.3390/su11236582