Environmental Upgrading and Suppliers’ Agency in the Leather Global Value Chain

Abstract

1. Introduction

2. Environmental Upgrading and Sustainability Strategies: Exploring the Role of Suppliers

2.1. Environmental Upgrading in Global Value Chains

2.2. Drivers of Environmental Upgrading

2.3. Environmental Upgrading and Suppliers’ Agency

3. Methodology and Empirical Setting

3.1. The Empirical Context

3.2. Data Sources

- Technicians who led the development of new technologies (being the R&D managers), asking about the technical details of the project and the expected economic and social implications of their introduction,

- The CEO of the firms involved to understand the drivers of the introduction of the technologies, their role within the broader strategy of growth of the companies, and potential bottlenecks that might hinder the diffusion of technologies.

- Documentary information, including project documents, corporate documents, and industry reports. All the projects documents, including the LCA analysis performed as part of the project, can be accessed at https://www.greenlifeproject.eu/. In particular, industry reports were particularly useful in quantifying leather value chain publications by the following institutions:

- Participation in public events of the GreenLIFE project, where, other than technicians and CEO of the partners, representatives of the industry and local institutions have commented on the results of the projects.

- Direct observation: all interviews have been conducted at firms’ facilities to enable a deeper understanding of the technology developed and provide additional information on the companies interviewed.

4. Results

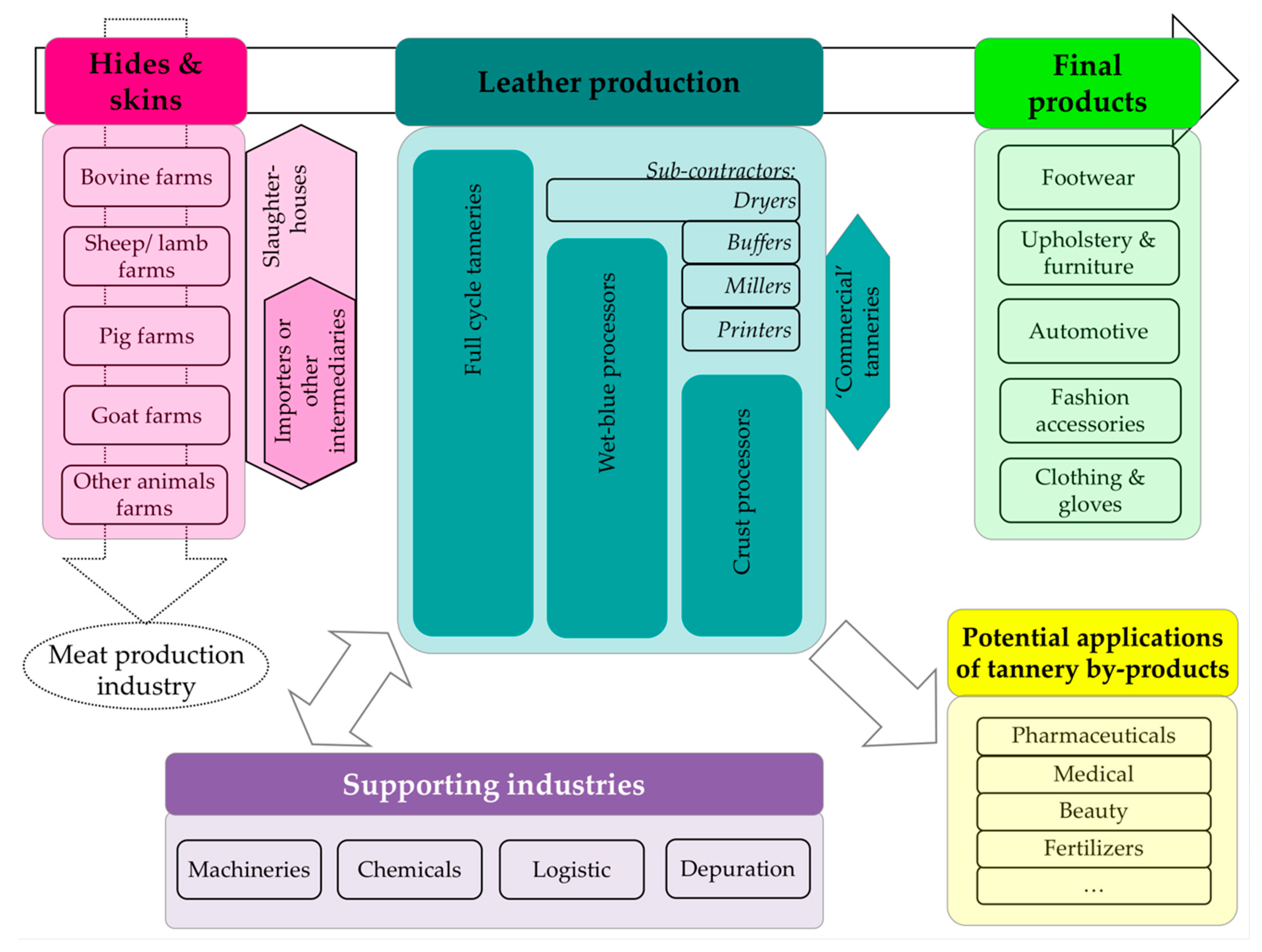

4.1. The Leather Global Value Chain: Input–Output Structure and the Actors Involved

4.1.1. Hides and Skins

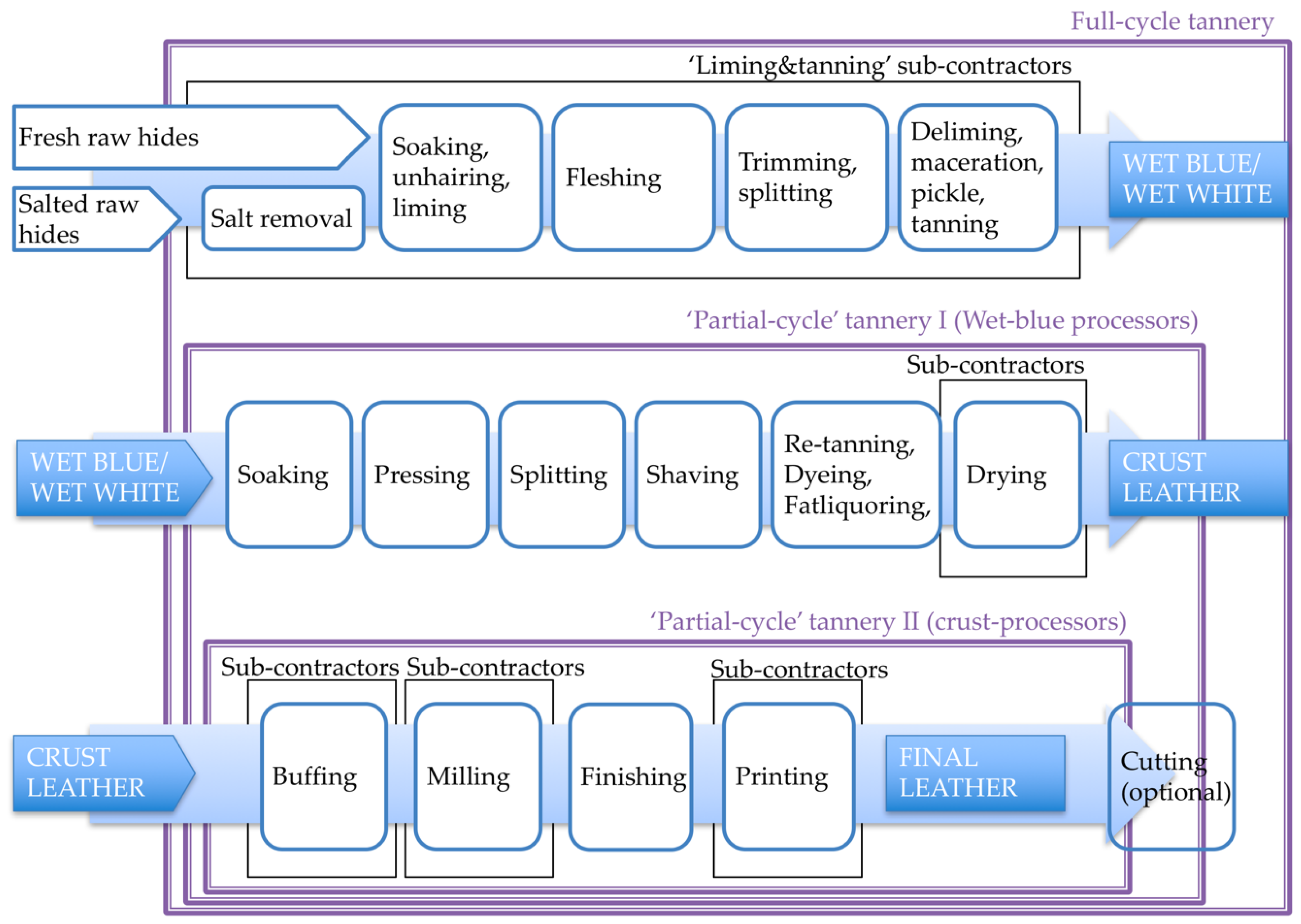

4.1.2. Finished Leather Production

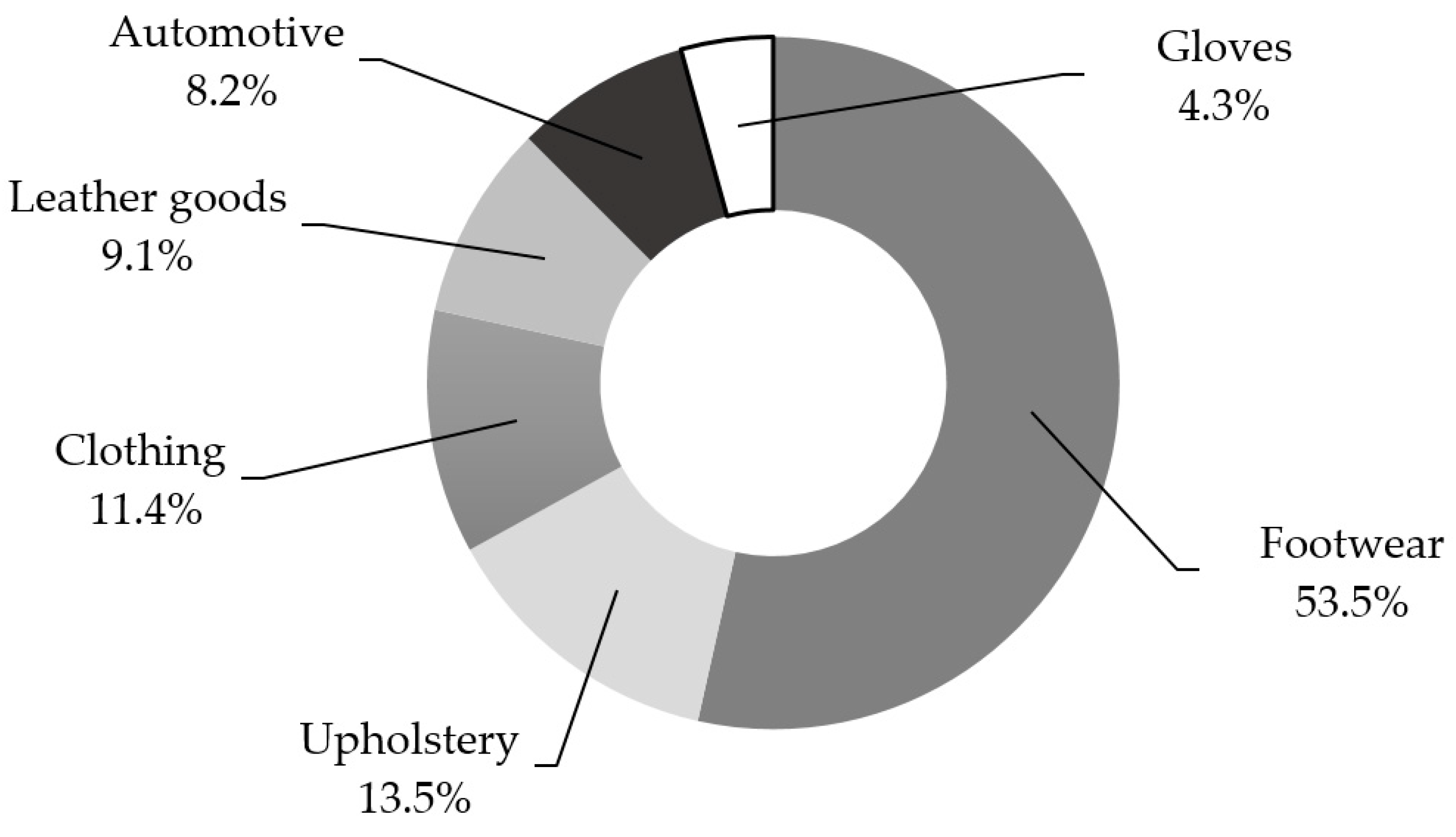

4.1.3. Final Products Using Leather as an Input

4.1.4. Supporting Industries

4.2. Environmental Upgrading in the Leather Value Chain: The GreenLIFE Case

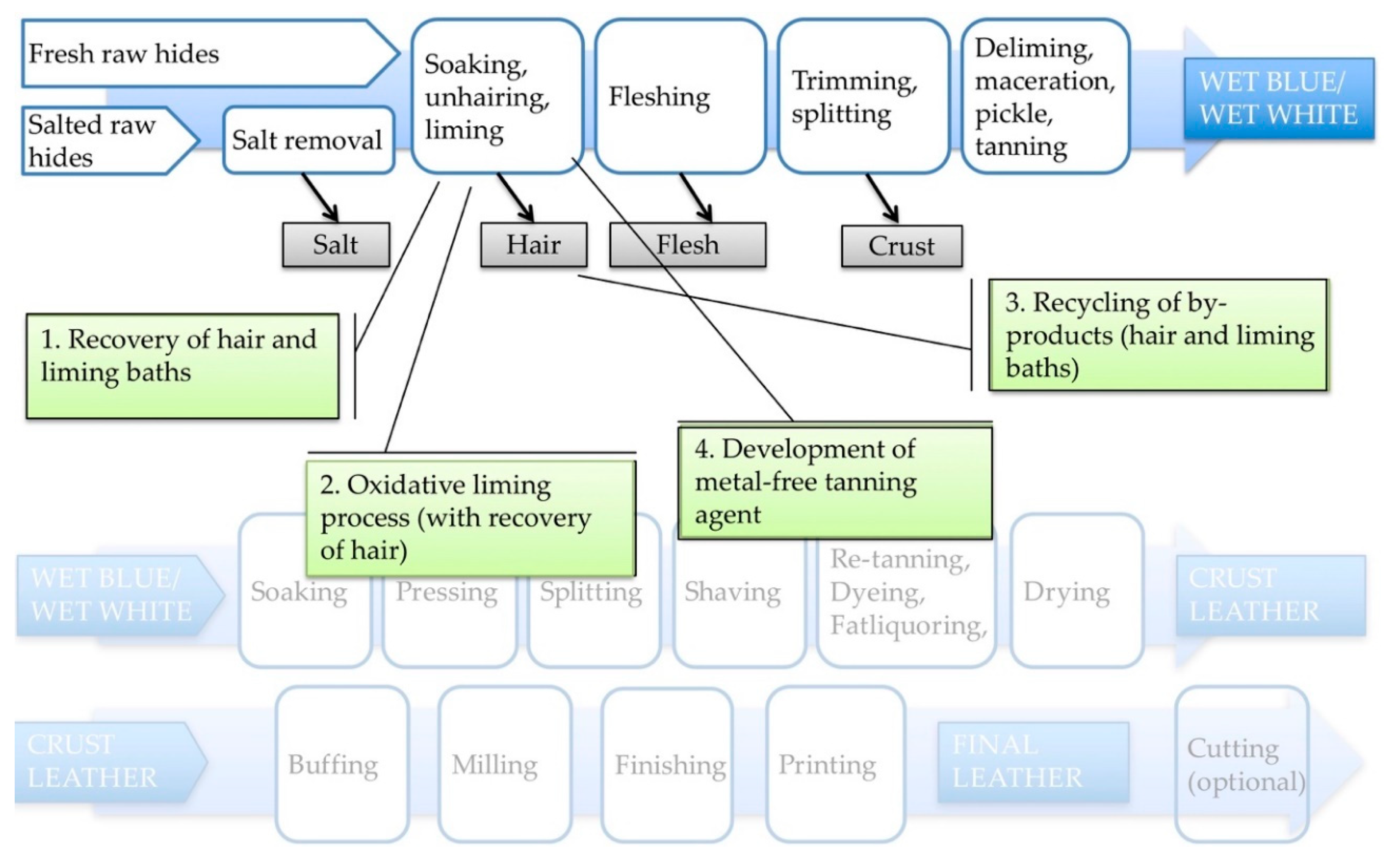

- In the traditional process, several by-products are realized during the first stage of leather production, which are sent to landfills after the (costly) treatment of water. A first innovation developed within GreenLife addressed the possibility of collecting and reusing water used during the liming process, so as to collect the hair (the by-product of this process). According to the LCA analysis and tests carried out directly by the project partners, multiple figures of improvement arise. Thanks to the new process, a 70% reduction in the use of water and 20% in sodium hydrosulphide (in beamhouse operations) were measured. According to the LCA analysis performed, the new process might allow a 6% reduction in electric energy, 12% in methane, and 24.4% in wastewater. More importantly, the new process allowed the recovery of a quantity of hair equal to 10% to 12% of the weight of the raw hides and skins used, which could be used in other applications (e.g., for the production of fertilizers).

- Traditional liming involves the use of sulfide/sodium hydrosulphide. Within GreenLIFE projects, firms have been experimenting with a new liming process based on the use of oxygenated water, which is not a pollutant. Hair recovery (developed in the first innovation) has been implemented into this new process. The LCA analysis performed suggested that this process allows for an additional saving of 18% of water and 15% of chemicals (in the beamhouse operations). Furthermore, it reduces several pollutants: 100% in the sulfides, 32% in suspended solids, 43% in COD, and 42% in TOC (compared to the traditional process).

- The firms have also experimented with a new process to treat the hair, one of the by-products produced by the process. The traditional process usually involves chemically dissolving the hair, which, therefore, represents an additional pollutant to treat once the water reaches the water treatment plant. A new process has been developed that uses an innovative hydrolysis technique to process the solid hair that is collected via innovations 1 and 2 and extract the keratin present in this by-product, which is suitable for use as fertilizer in farming. Additionally, a technique has been developed to collect and reuse the organic protein fraction of calcinol baths, another by-product collected from innovation 1. Such a technique recovers 25% of solid materials (solid substances dissolved or suspended in water), mainly composed of organic material and minerals for the production of valuable solid fertilizer.

- Finally, the firms have developed a new tanning agent from renewable sources based on natural polymers instead of chrome. Technical analysis on the environmental outcomes of this specific innovation has not yet been implemented.

4.3. Motivations for Greening and Suppliers’ Agency

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lozano, R. A holistic perspective on corporate sustainability drivers. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 32–44. [Google Scholar] [CrossRef]

- De Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar]

- Niesten, E.; Jolink, A.; Lopes de Sousa Jabbour, A.B.; Chappin, M.; Lozano, R. Sustainable collaboration: The impact of governance and institutions on sustainable performance. J. Clean. Prod. 2017, 155, 1–6. [Google Scholar] [CrossRef]

- Poulsen, R.T.; Ponte, S.; Sornn-Friese, H. Environmental upgrading in global value chains: The potential and limitations of ports in the greening of maritime transport. Geoforum 2018, 89, 83–95. [Google Scholar] [CrossRef]

- De Marchi, V.; Di Maria, E.; Krishnan, A.; Ponte, S. Environmental upgrading in global value chains. In Handbook on Global Value Chains; Ponte, S., Gereffi, G., Raj-Reichert, G., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2019; pp. 310–323. [Google Scholar]

- De Marchi, V.; Di Maria, E.; Ponte, S. The greening of global value chains: Insights from the furniture industry. Compet. Chang. 2013, 17, 299–318. [Google Scholar] [CrossRef]

- Krishnan, A. Re-thinking the environmental dimensions of upgrading and embeddedness in production networks: The case of Kenyan horticulture farmers. Ph.D. Dissertation, University of Manchester, Manchester, UK, 2017. [Google Scholar]

- Sako, M.; Zylberberg, E. Supplier strategy in global value chains: Shaping governance and profiting from upgrading. Socio-Economic Rev. 2017, 17, 687–707. [Google Scholar] [CrossRef]

- Nadvi, K.; Raj-Reichert, G. Governing health and safety at lower tiers of the computer industry global value chain. Regul. Gov. 2015, 9, 243–258. [Google Scholar] [CrossRef]

- Giuliani, E.; de Marchi, V.; Rabellotti, R. Do Global Value Chains Offer Developing Countries Learning and Innovation Opportunities? Eur. J. Dev. Res. 2017, 30, 389–407. [Google Scholar]

- Carswell, G.; De Neve, G. Labouring for global markets: Conceptualising labour agency in global production networks. Geoforum 2013, 44, 62–70. [Google Scholar] [CrossRef]

- Krauss, J.; Krishnan, A. Global Decisions and Local Realities: Priorities and Producers’ Upgrading Opportunities in Agricultural Global Production Networks. UNFSS Discussion paper no. 7. 2016. [Google Scholar]

- Gereffi, G. Global value chains in a post-Washington Consensus world. Rev. Int. Polit. Econ. 2014, 21, 9–37. [Google Scholar] [CrossRef]

- De Marchi, V.; Di Maria, E.; Ponte, S. Multinational firms and the management of global networks: Insights from global value chain studies. In Orchestration of the Global Network Organization; Emerald: Bingley, UK, 2014; Volume 27, pp. 463–486. ISBN 1571-5027. [Google Scholar]

- Gereffi, G.; Fernandez-Stark, K. Global Value Chain Analysis: A Primer; Duke Center on Globalizatgion, Governance and Competitiveness: Durham, NC, USA, 2016. [Google Scholar]

- Khattak, A.; Pinto, L. A systematic literature review of the environmental upgrading in global value chains and future research agenda. J. Distrib. Sci. 2018, 16, 11–19. [Google Scholar] [CrossRef]

- De Marchi, V.; Di Maria, E.; Micelli, S. Environmental Strategies, Upgrading and Competitive Advantage in Global Value Chains. Bus. Strateg. Environ. 2013, 22, 62–72. [Google Scholar] [CrossRef]

- Ponte, S. Business, Power and Sustainability in a World of Global Value Chains; Zed Books: London, UK, 2019. [Google Scholar]

- Boons, F. Greening products: A framework for product chain management. J. Clean. Prod. 2002, 10, 495–505. [Google Scholar] [CrossRef]

- Webster, K.; MacArthur, E. The Circular Economy: A Wealth of Flows, 2nd ed.; EllenMacArthur Foundation Publishing: Cowes, UK, 2017. [Google Scholar]

- Liu, S.; Kasturiratne, D.; Moizer, J. A hub-and-spoke model for multi-dimensional integration of green marketing and sustainable supply chain management. Ind. Mark. Manag. 2012, 41, 581–588. [Google Scholar] [CrossRef]

- Cainelli, G.; Mazzanti, M.; Zoboli, R. Environmentally oriented innovative strategies and firm performance in services. Micro-evidence from Italy. Int. Rev. Appl. Econ. 2011, 25, 61–85. [Google Scholar] [CrossRef]

- Cainelli, G.; De Marchi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lin, Y.H.; Lin, C.Y.; Chang, C.W. Enhancing green absorptive capacity, green dynamic capacities and green service innovation to improve firm performance: An analysis of Structural Equation Modeling (SEM). Sustainability 2015, 7, 15674–15692. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Rodríguez, A.L.; De Marchi, V. Absorptive capacity and relationship learning mechanisms as complementary drivers of green innovation performance. J. Knowl. Manag. 2018, 22, 432–452. [Google Scholar] [CrossRef]

- Geffen, C.A.; Rothenberg, S. Suppliers and environmental innovation. Int. J. Oper. Prod. Manag. 2000, 20, 166–186. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Nikolakis, W.; John, L.; Krishnan, H. How blockchain can shape sustainable global value chains: An Evidence, Verifiability, and Enforceability (EVE) Framework. Sustainability 2018, 10, 3926. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, A.B.; Jabbour, C.J.C.; Godinho Filho, M.; Roubaud, D. Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Ann. Oper. Res. 2018, 270, 273–286. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef]

- Devinney, T.M.; Auger, P.; Eckhardt, G.M. The Myth of the Ethical Consumer; Cambridge University Press: New York, NY, USA, 2010; ISBN 9780802094674. [Google Scholar]

- Bush, S.R.; Oosterveer, P.; Bailey, M.; Mol, A.P.J.J. Sustainability governance of chains and networks: A review and future outlook. J. Clean. Prod. 2015, 107, 8–19. [Google Scholar] [CrossRef]

- Lee, J.; Gereffi, G. Global value chains, rising power firms and economic and social upgrading. Crit. Perspect. Int. Bus. 2015, 11, 319–339. [Google Scholar] [CrossRef]

- Ponte, S.; Ewert, J. Which Way is “Up” in Upgrading? Trajectories of Change in the Value Chain for South African Wine. World Dev. 2009, 37, 1637–1650. [Google Scholar] [CrossRef]

- Choksy, U.S.; Sinkovics, N.; Sinkovics, R.R. Exploring the relationship between upgrading and capturing profits from GVC participation for disadvantaged suppliers in developing countries. Can. J. Adm. Sci. 2017, 34, 356–386. [Google Scholar] [CrossRef]

- Van Biesebroeck, J.; Sturgeon, T.J. Effects of the 2008-09 crisis on the automotive industry in developing countries: A global value chain perspective. In Global Value Chains in a Postcrisis World; Cattaneo, O., Gereffi, G., Staritz, C., Eds.; World Bank Publications: Washington, DC, USA, 2010. [Google Scholar]

- Azmeh, S.; Nadvi, K. Asian firms and the restructuring of global value chains. Int. Bus. Rev. 2014, 23, 708–717. [Google Scholar] [CrossRef]

- Blackman, A. Informal sector pollution control: What policy options do we have? World Dev. 2000, 28, 2067–2082. [Google Scholar] [CrossRef]

- Randelli, F.; Lombardi, M. The Role of Leading Firms in the Evolution of SME Clusters: Evidence from the Leather Products Cluster in Florence. Eur. Plan. Stud. 2014, 22, 1199–1211. [Google Scholar] [CrossRef]

- Tewari, M.; Pillai, P. Global standards and the dynamics of environmental compliance in India’s leather industry. Oxford Dev. Stud. 2005, 33, 245–267. [Google Scholar] [CrossRef]

- FAO. World Statistical Compendium for Raw Hides and Skins, Leather and Leather Footwear 1999–2015; Food and Agriculture Organization of the United States (FAO): Rome, Italy, 2016. [Google Scholar]

- UNIC. Relazione Del Presidente; Unione Nazionale Industria Conciaria (UNIC): Rome, Italy, 2016. [Google Scholar]

- Belussi, F. The international resilience of Italian industrial districts/clusters (ID/C) between knowledge—re-shoring and manufacturing off (near)-shoring. J. Reg. Res. 2015, 32, 89–113. [Google Scholar]

- Belussi, F.; Sedita, S.R. L’evoluzione del modello distrettuale: La“ delocalizzazione inversa” e il caso del distretto della concia di Arzignano. Econ. e Polit. Ind. 2008, 2, 51–72. [Google Scholar]

- Da Ronch, B.; Di Maria, E.; Micelli, S. Clusters Go Green: Drivers of environmental sustainability in local networks of SMEs. Int. J. Inf. Syst. Soc. Chang. 2013, 4, 37–52. [Google Scholar] [CrossRef]

- Yin, R. Case Study Research: Design and Methods; Applied Social Research Methods; SAGE Publications: Thousand Oaks, CA, USA, 2009; ISBN 9781412960991. [Google Scholar]

- UNIC. Rapporto di sostenibilità; Unione Nazionale Industria Conciaria (UNIC): Rome, Italy, 2016. [Google Scholar]

- COTANCE. Social and Environmental Report. the European leather industry; European Confederation of the Leather Industry (COTANCE): Brussels, Belgium, 2012. [Google Scholar]

- Frederick, S. Global value chain mapping. In Handbook on Global Value Chains; Ponte, S., Gereffi, G., Raj-Reichert, G., Eds.; Edward Elgar: Cheltenham, UK, 2019; pp. 29–53. [Google Scholar]

- UNIDO. Future trends in the World Leather and Leather Products Industry and Trade; United Nations Industrial development Organization (UNIDO): Wien, Austria, 2010. [Google Scholar]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Orsato, R.J. Competitive Environmental Strategies. Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar]

- Giuliani, E. Why multinational enterprises may be causing more inequality than we think. Multinatl. Bus. Rev. 2019, 27, 221–225. [Google Scholar] [CrossRef]

- Dallas, M.P.; Ponte, S.; Sturgeon, T.J. Power in global value chains. Rev. Int. Polit. Econ. 2019, 26, 666–694. [Google Scholar] [CrossRef]

| Sector | Company/Institution | Number of Interviews | Role of Interviewees |

|---|---|---|---|

| Tanning industry | Dani | 3 | Technicians |

| 1 | CEO | ||

| Gruppo Mastrotto | 2 | Technicians | |

| 1 | CEO | ||

| Chemicals | IKEM | 1 | Technician |

| 1 | CEO | ||

| Ilsa | 1 | Technician | |

| 1 | CEO | ||

| Depuration | Acque del Chiampo | 2 | Technicians |

| Chemicals | Corichem | 1 | Technician |

| Machineries | Erretre | 1 | Technician |

| Municipality | Arzignano | 1 | City major |

| Chiampo | 1 | City major | |

| Leather district | Distretto della Pelle | 1 | CEO |

| Global | Europe | |||

|---|---|---|---|---|

| Key Companies | Country | Key Companies | Country | |

| Footwear | Bata Shoes | Switzerland | Adidas AG | Germany |

| NIKE Inc. | USA | Bata Shoes | Switzerland | |

| Adidas AG | Germany | Deichmann SE | Germany | |

| Deichmann SE | Germany | NIKE, Inc. | USA | |

| Luggage and leather goods | Wal-Mart Stores, Inc. | USA | Kering SA | France |

| LVMH Moet Hennessy Louis Vuitton SA | France | Marks and Spencer Group plc | UK | |

| Isetan Mitsukoshi Holdings Ltd. | Japan | LVMH Moet Hennessy Louis Vuitton SA | France | |

| J. C. Penney Company, Inc. | USA | Compagnie Financiere Richemont SA | Switzerland | |

| Automotive | General Motors | USA | Bayerische Motoren Werke AG (BMW Group) | Germany |

| Honda | Japan | PSA Peugeot Citroen | France | |

| Toyota | Japan | Renault S.A. | France | |

| Volkswagen | Germany | Volkswagen | Germany | |

| Suppliers (Tanneries) | Supporting Industries (Chemical Companies) | Buyers (Fashion or Automotive Companies) | ||

|---|---|---|---|---|

| Economic benefits | Improved products | |||

| Strengthening market position | ||||

| Improved visibility to clients | ||||

| Better control of production activities | ||||

| Speed in the production process | ||||

| Chemical costs reduction | ||||

| Water costs reduction | ||||

| Other production costs reduction | ||||

| Deputation/by-product related-cost reduction | ||||

| Reduced costs for end-of-life treatment | ||||

| Economic costs | Investments in new equipment | |||

| Investments in training | ||||

| Costs for recovery, storing and treating by-products | ||||

| Higher costs for chemicals | ||||

| Reducing the role of existing product |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

De Marchi, V.; Di Maria, E. Environmental Upgrading and Suppliers’ Agency in the Leather Global Value Chain. Sustainability 2019, 11, 6530. https://doi.org/10.3390/su11236530

De Marchi V, Di Maria E. Environmental Upgrading and Suppliers’ Agency in the Leather Global Value Chain. Sustainability. 2019; 11(23):6530. https://doi.org/10.3390/su11236530

Chicago/Turabian StyleDe Marchi, Valentina, and Eleonora Di Maria. 2019. "Environmental Upgrading and Suppliers’ Agency in the Leather Global Value Chain" Sustainability 11, no. 23: 6530. https://doi.org/10.3390/su11236530

APA StyleDe Marchi, V., & Di Maria, E. (2019). Environmental Upgrading and Suppliers’ Agency in the Leather Global Value Chain. Sustainability, 11(23), 6530. https://doi.org/10.3390/su11236530