Resource Price Fluctuations, Resource Dependence and Sustainable Growth

Abstract

:1. Introduction

2. Literature Review

3. Econometric Tests

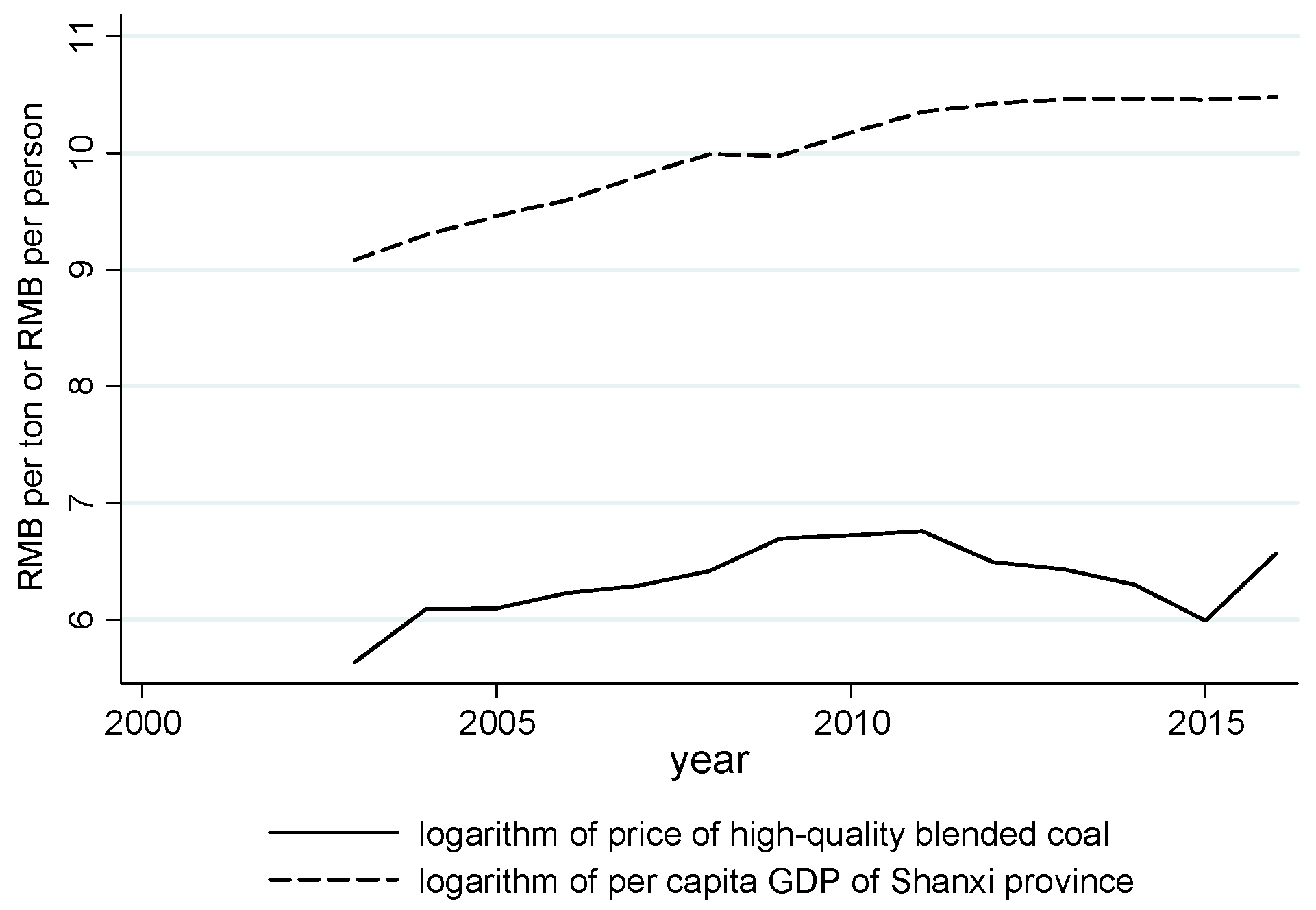

3.1. Model Specification and Variable Declaration

3.2. Data Sample

3.3. Estimation Methods

3.4. Econometric Results and Analysis

4. Indirect Effects and Total Effects Analysis of Resource Curse

4.1. Indirect Effects Estimation

4.2. Total Effects of Resource Curse

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Sachs, J.D.; Warner, A.M. Natural Resource Abundance and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Sachs, J.D.; Warner, A.M. Fundamental sources of long-run growth. Am. Econ. Rev. 1997, 87, 184–188. [Google Scholar]

- Sachs, J.D.; Warner, A.M. The big push, natural resource booms and growth. J. Dev. Econ. 1999, 59, 43–76. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Song, M.; Wang, J.; Zhao, J. Coal endowment, resource curse, and high coal-consuming industries location: Analysis based on large-scale data. Resour. Conserv. Recycl. 2018, 129, 333–344. [Google Scholar] [CrossRef]

- Lu, C.; Wang, D.; Meng, P.; Yang, J.; Pang, M.; Wang, L. Research on resource curse effect of resource-dependent cities: Case study of Qingyang, Jinchang and Baiyin in China. Sustainability 2019, 11, 91. [Google Scholar] [CrossRef]

- Douglas, S.; Walker, A. Coal mining and the resource curse in the eastern United States. J. Reg. Sci. 2017, 57, 568–590. [Google Scholar] [CrossRef]

- Atkinson, G.; Hamilton, K. Savings, growth and the resource curse hypothesis. World Dev. 2003, 31, 1793–1807. [Google Scholar] [CrossRef]

- Deller, S.C.; Schreiber, A. Mining and community economic growth. Rev. Reg. Stud. 2012, 42, 121–141. [Google Scholar]

- Deller, S. Does mining influence rural economic growth? J. Reg. Anal. Policy 2014, 44, 36–48. [Google Scholar]

- Sarmidi, T.; Hook Law, S.; Jafari, Y. Resource curse: New evidence on the role of institutions. Int. Econ. J. 2014, 28, 191–206. [Google Scholar] [CrossRef]

- Betz, M.R.; Partridge, M.D.; Farren, M.; Lobao, L. Coal mining, economic development, and the natural resources curse. Energy Econ. 2015, 50, 105–116. [Google Scholar] [CrossRef]

- Perez-Sebastian, F.; Raveh, O. The natural resource curse and fiscal decentralization. Am. J. Agric. Econ. 2015, 98, 212–230. [Google Scholar] [CrossRef]

- Kim, D.H.; Lin, S.C. Natural resources and economic development: New panel evidence. Environ. Resour. Econ. 2017, 66, 363–391. [Google Scholar] [CrossRef]

- Badeeb, R.A.; Lean, H.H.; Clark, J. The evolution of the natural resource curse thesis: A critical literature survey. Resour. Policy 2017, 51, 123–134. [Google Scholar] [CrossRef]

- Marchand, J.; Weber, J. Local labor markets and natural resources: A synthesis of the literature. J. Econ. Surv. 2018, 32, 469–490. [Google Scholar] [CrossRef]

- Zhang, Q.; Brouwer, R. Is China affected by the resource curse? A critical review of the Chinese literature. J. Policy Model. 2019, in press. Available online: www.sciencedirect.com/science/article/pii/S0161893819300900 (accessed on 10 November 2019). [CrossRef]

- Ploeg, F.V.D.; Poelhekke, S. Volatility and the natural resource curse. Oxf. Econ. Pap. 2009, 61, 727–760. [Google Scholar] [CrossRef]

- Brunnschweiler, C.N.; Bulte, E.H. The resource curse revisited and revised: A tale of paradoxes and red herrings. J. Environ. Econ. Manag. 2008, 55, 248–264. [Google Scholar] [CrossRef]

- Mehrara, M. Reconsidering the resource curse in oil-exporting countries. Energy Policy 2009, 37, 1165–1169. [Google Scholar] [CrossRef]

- Shao, S.; Yang, L. Natural resource dependence, human capital accumulation, and economic growth: A combined explanation for the resource curse and the resource blessing. Energy Policy 2014, 74, 632–642. [Google Scholar] [CrossRef]

- Lederman, D.; Maloney, W.F.; Dunning, T.; Shelton, C.A. In search of the missing resource curse. Economía 2008, 9, 1–57. [Google Scholar] [CrossRef]

- Gylfason, T.; Herbertsson, T.T.; Zoega, G. A mixed blessing: Natural resources and economic growth. Macroecon. Dyn. 1999, 3, 204–225. [Google Scholar] [CrossRef]

- Wood, A.; Berge, K. Exporting manufactures: Human resources, natural resources, and trade policy. J. Dev. Stud. 1997, 34, 35–59. [Google Scholar] [CrossRef]

- Stijns, J.-P.C. Natural resource abundance and economic growth revisited. Resour. Policy 2005, 30, 107–130. [Google Scholar] [CrossRef]

- Hamilton, K.; Ruta, G.; Tajibaeva, L. Capital accumulation and resource depletion: A Hartwick rule counterfactual. Environ. Resour. Econ. 2006, 34, 517–533. [Google Scholar] [CrossRef]

- Conrad, R.; Acemoglu, D.; Borjas, G.J.; Rodrik, D.; Rotemberg, J.J. The elusive curse of oil. Rev. Econ. Stat. 2009, 91, 586–598. [Google Scholar]

- Kellard, N.; Wohar, M.E. On the prevalence of trends in primary commodity prices. J. Dev. Econ. 2006, 79, 146–167. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econ. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Papyrakis, E.; Gerlagh, R. The resource curse hypothesis and its transmission channels. J. Comp. Econ. 2004, 32, 181–193. [Google Scholar] [CrossRef]

- Zidouemba, P.R.; Elitcha, K. Foreign direct investment and total factor productivity: Is there any resource curse? Modif. Econ. 2018, 9, 463–483. [Google Scholar] [CrossRef]

- Gylfason, T.; Zoega, G. Natural resources and economic growth: The role of investment. World Econ. 2006, 29, 1091–1115. [Google Scholar] [CrossRef]

- Koren, M.; Tenreyro, S. Volatility and development. Q. J. Econ. 2007, 122, 243–287. [Google Scholar] [CrossRef]

| Variables | Symbol | Variables Declaration | Unit | Observations | Mean Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|---|---|

| Real per capita GDP | Y | taking natural logarithm | RMB per person | 700 | 8.7785 | 0.7924 | 7.0273 | 10.9139 |

| Resource dependence | L | employment share of mining industries in employment | % | 700 | 1.2563 | 1.3744 | 0.0041 | 9.9798 |

| Quadratic term of resource dependence | L2 | - | % | 700 | 3.4641 | 9.5188 | 0 | 99.5982 |

| Cubic term of resource dependence | L3 | - | % | 700 | 15.9864 | 81.4661 | 0 | 993.98 |

| Growth rate of resource price | P | purchase price index of fuel, raw materials, and power −1 | % | 700 | 6.8679 | 10.0762 | −11.4 | 73.9 |

| Physical capital investment | K | total investment in fixed assets/GDP | % | 700 | 45.1193 | 16.7744 | 20.5166 | 99.4655 |

| Human capital investment | EDU | number of college students per 10,000 population | person | 700 | 99.0689 | 81.3222 | 8.5956 | 398.8151 |

| Degree of opening-up | OPE | total volume of imports and exports/GDP | % | 700 | 31.3993 | 41.1596 | 3.1631 | 217.3435 |

| Innovation input | RD | share of researchers’ employment in the total employment | % | 700 | 1.2808 | 0.9411 | 0.4879 | 7.1656 |

| Explanatory Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Yt-1 | 0.98279 *** (0.00691) | 0.950 *** (0.00477) | 0.984 *** (0.00584) | 0.949 *** (0.00438) |

| L | −0.00258 (0.01000) | −0.0249 (0.0158) | 0.00081 (0.00333) | −0.0124 * (0.00688) |

| L2 | −0.00015 (0.00307) | 0.00432 (0.00388) | -0.00034 (0.00041) | 0.00083 (0.00063) |

| L3 | 0.00003 (0.00022) | −0.000244 (0.000244) | ||

| K | 0.00065 *** (0.00011) | 0.00098 *** (0.00012) | 0.00067 *** (0.0001) | 0.00099 *** (0.00009) |

| EDU | 0.00015 *** (0.00004) | 0.000294 *** (0.00003) | 0.000145 *** (0.00003) | 0.000305 *** (0.00004) |

| OPE | 0.00011 ** (0.00006) | 0.000447 *** (0.00008) | 0.000122 * (0.00007) | 0.000453 *** (0.00007) |

| RD | −0.00971 *** (0.00142) | 0.00855 *** (0.00210) | −0.00969 ***(0.00143) | 0.00858 *** (0.00198) |

| Constant term | 0.21929 *** (0.05763) | 0.208 *** (0.0431) | ||

| Estimation method | System GMM | Differential GMM | System GMM | Differential GMM |

| AR(1)-p value | 0.031 | 0.004 | 0.031 | 0.004 |

| AR(2)-p value | 0.033 | 0.019 | 0.035 | 0.019 |

| Hansen test-p value | 1.000 | 1.000 | 1.000 | 1.000 |

| Explanatory Variables | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 |

|---|---|---|---|---|---|---|

| Yt-1 | 0.993 *** (0.00618) | 0.957 *** (0.00427) | 0.990 *** (0.00590) | 0.959 *** (0.00449) | 0.991 *** (0.00566) | 0.951 *** (0.00346) |

| L | 0.0146 (0.0271) | −0.0213 * (0.0120) | 0.00110 (0.00536) | −0.0131 ** (0.00591) | -0.0023 *** (0.00046) | −0.0099 *** (0.00284) |

| L2 | −0.00555 (0.00857) | 0.00376 (0.00258) | −0.00043 (0.00066) | 0.00087 * (0.00049) | ||

| L3 | 0.000419 (0.000633) | −0.000220 (0.000163) | ||||

| P | 0.00098 *** (0.00007) | 0.0006 *** (0.00006) | 0.0010 *** (0.00005) | 0.00069 *** (0.00005) | 0.0010 *** (0.00007) | 0.00064 *** (0.00004) |

| K | 0.00052 *** (0.00013) | 0.0008 *** (0.00012) | 0.0005 *** (0.00011) | 0.00089 *** (0.00010) | 0.0005 *** (0.00009) | 0.00085 *** (0.00008) |

| EDU | 0.0001 *** (0.00003) | 0.0002 *** (0.00003) | 0.0001 *** (0.00003) | 0.0002 *** (0.00004) | 0.0001 *** (0.00003) | 0.0003 *** (0.00003) |

| OPE | 0.00007 (0.00011) | 0.00036 *** (0.00009) | 0.00006 (0.00008) | 0.000328 *** (0.00008) | 0.00002 (0.00006) | 0.00026 *** (0.00004) |

| RD | −0.0079 *** (0.00119) | 0.00683 *** (0.00213) | −0.008 *** (0.00137) | 0.00585 *** (0.00180) | −0.0077 *** (0.00146) | 0.00614 *** (0.00118) |

| Constant term | 0.125 ** (0.0561) | 0.154 *** (0.0424) | 0.150 *** (0.0437) | |||

| Estimation method | System GMM | Differential GMM | System GMM | Differential GMM | System GMM | Differential GMM |

| AR(1)-p value | 0.004 | 0.003 | 0.004 | 0.003 | 0.004 | 0.003 |

| AR(2)-p value | 0.134 | 0.128 | 0.155 | 0.131 | 0.157 | 0.176 |

| Hansen test-p value | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 |

|---|---|---|---|---|---|---|---|---|

| Explained variables | K | K | EDU | EDU | OPE | OPE | RD | RD |

| Lagged explained variables | 1.01 *** (0.003) | 1.018 *** (0.003) | 0.96 *** (0.001) | 0.95 *** (0.0013) | 0.97 *** (0.000) | 0.97 *** (0.000) | 0.626 *** (0.0085) | 0.626 *** (0.0068) |

| L | −2.145 *** (0.321) | −1.749 *** (0.397) | −6.141 *** (0.359) | −6.443 *** (0.319) | −0.43 *** (0.082) | −0.44 *** (0.109) | −0.067 *** (0.004) | −0.064 *** (0.0023) |

| P | −0.174 *** (0.0061) | 0.219 *** (0.003) | 0.31 *** (0.003) | 0.0004 * (0.0002) | ||||

| Constant term | 1.500 *** (0.110) | −0.237 (0.293) | ||||||

| Estimation term | Differential GMM | Differential GMM | Differential GMM | Differential GMM | System GMM | System GMM | Differential GMM | Differential GMM |

| AR(1)-p value | 0.000 | 0.000 | 0.118 | 0.101 | 0.066 | 0.069 | 0.073 | 0.072 |

| AR(2)-p value | 0.223 | 0.187 | 0.137 | 0.188 | 0.349 | 0.248 | 0.161 | 0.168 |

| Hansen test-p value | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Transmission Channel | Coefficient Estimation Value (Table 2 and Table 3) | Coefficient Estimation Value (Table 4) | Second Volume Third Volume | Relative Influence Degree |

|---|---|---|---|---|

| K | 0.000857 | −1.749 | −0.0015 | 36.6% |

| EDU | 0.000326 | −6.443 | −0.0021 | 51.2% |

| OPE | 0.000261 | −0.441 | −0.0001 | 2.4% |

| RD | 0.00614 | −0.0644 | −0.0004 | 9.8% |

| Total | −0.0041 | 100% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Wang, S.; Yang, C.-F.; Jiang, S.-N.; Li, Y.-J. Resource Price Fluctuations, Resource Dependence and Sustainable Growth. Sustainability 2019, 11, 6371. https://doi.org/10.3390/su11226371

Wang H, Wang S, Yang C-F, Jiang S-N, Li Y-J. Resource Price Fluctuations, Resource Dependence and Sustainable Growth. Sustainability. 2019; 11(22):6371. https://doi.org/10.3390/su11226371

Chicago/Turabian StyleWang, Hua, Shi Wang, Cheng-Fu Yang, Sheng-Nan Jiang, and Yun-Juan Li. 2019. "Resource Price Fluctuations, Resource Dependence and Sustainable Growth" Sustainability 11, no. 22: 6371. https://doi.org/10.3390/su11226371

APA StyleWang, H., Wang, S., Yang, C.-F., Jiang, S.-N., & Li, Y.-J. (2019). Resource Price Fluctuations, Resource Dependence and Sustainable Growth. Sustainability, 11(22), 6371. https://doi.org/10.3390/su11226371