Online Reviews Matter: How Can Platforms Benefit from Online Reviews?

Abstract

1. Introduction

2. Literature Review

3. Model Description

3.1. Platform With Low-quality Online Reviews

3.2. Platform With High-quality Online Reviews

4. Equilibrium Analysis

4.1. Equilibrium for Platform With Low-quality Online Reviews

4.2. Equilibrium for Platform with High-quality Online Reviews

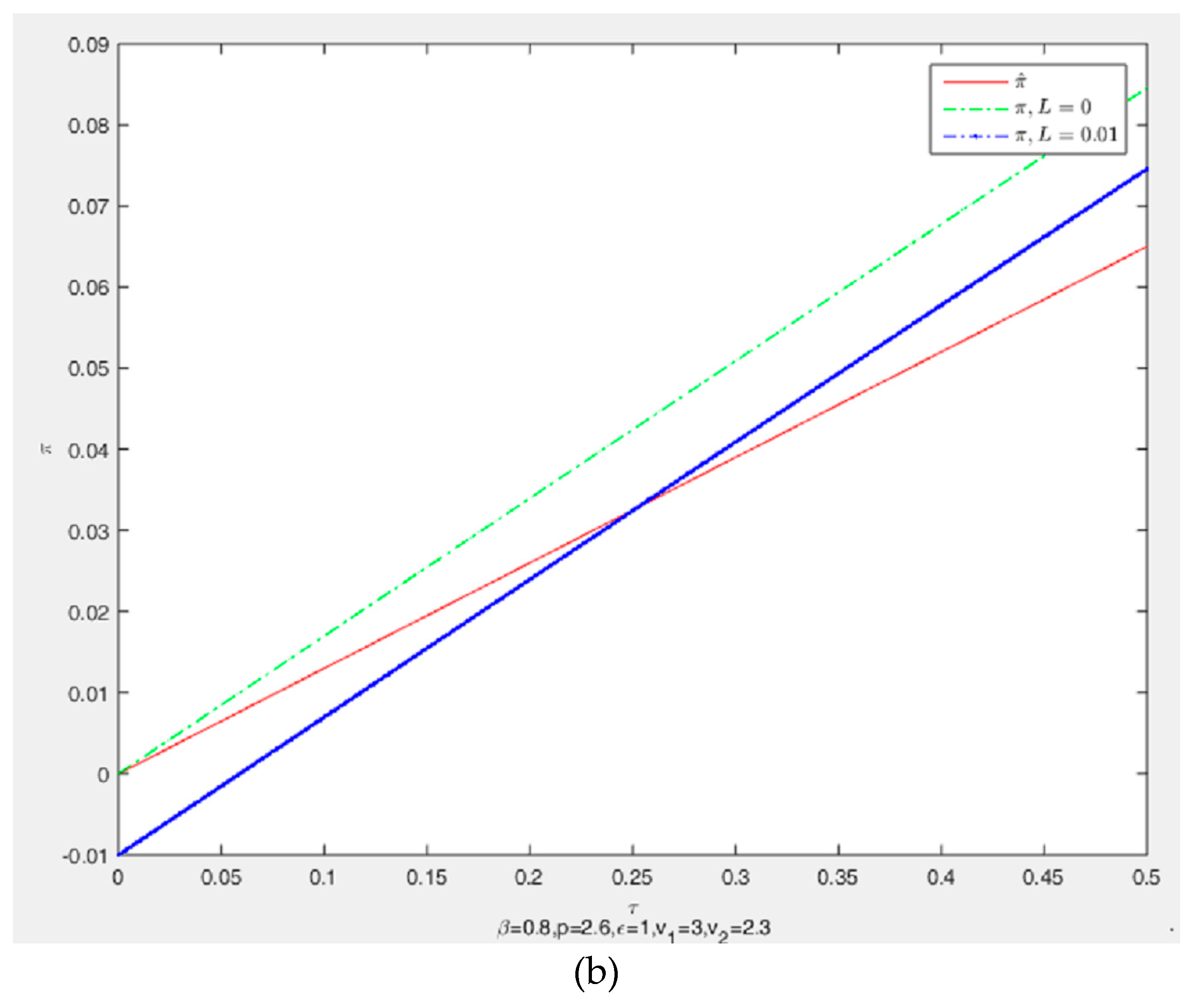

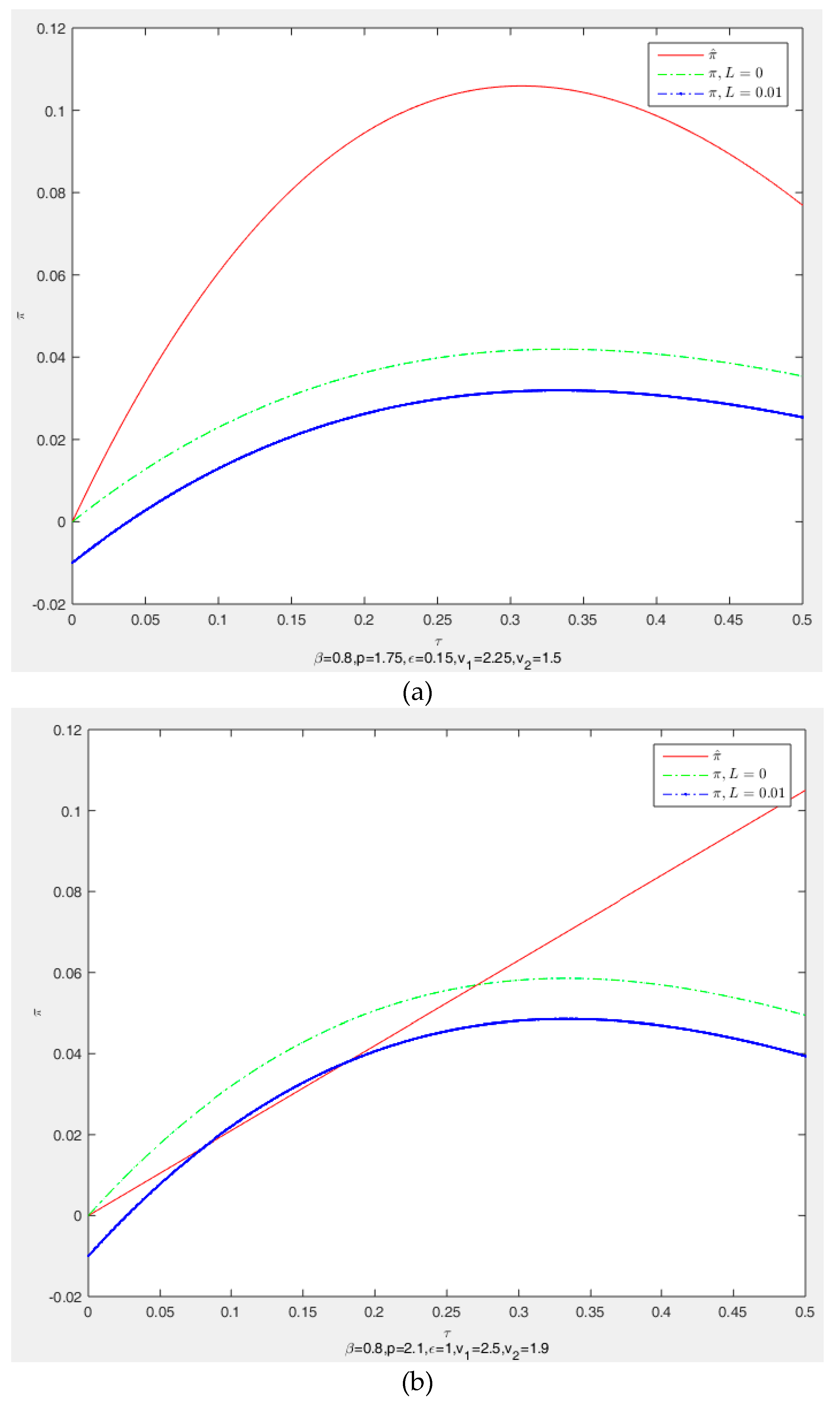

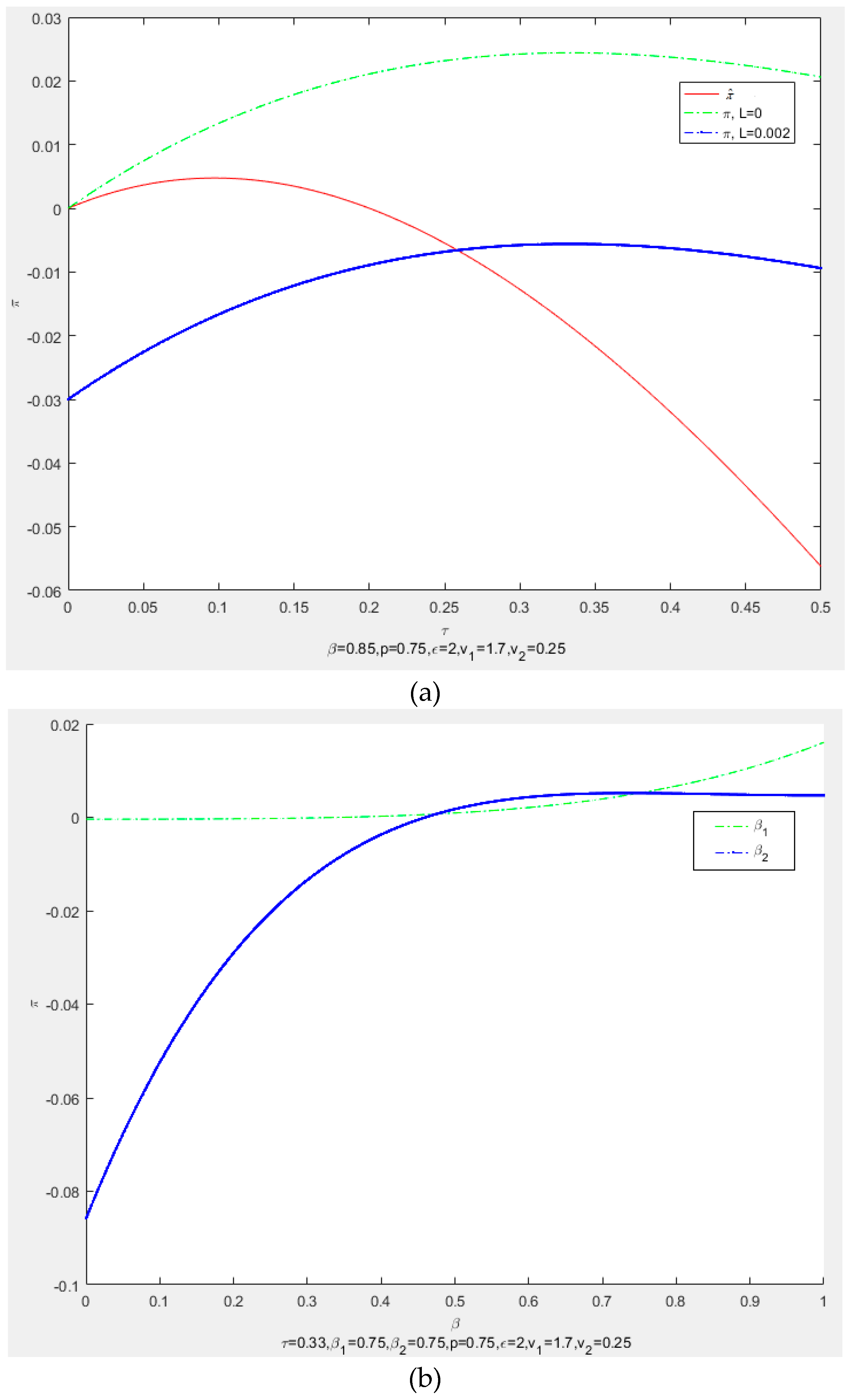

5. Results and Discussion

- (i)

- if , then , the platform cannot benefit from online reviews; and,

- (ii)

- if , then , the platform can benefit from online reviews.

- (i)

- the optimal commission rate is high; that is, ;

- (ii)

- is increasing in and .

6. Conclusions

6.1. Implications

6.2. Limitations

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Supervision Department of Internet-Based Commodities of SAIC. The orient-able monitoring results of internet-based commodities in the second half of 2014 published by SAIC. Available online: http://www.cac.gov.cn/2015-01/24/c_1114117219.htm. (accessed on 23 January 2015).

- Garvin, D.A. What does product quality really mean? Manag. Rev. 1984, 26, 25–43. [Google Scholar]

- Hong, Y.; Pavlou, P.A. Product fit uncertainty in online markets: Nature, effects, and antecedents. Inf. Syst. Res. 2014, 25, 328–344. [Google Scholar] [CrossRef]

- Qazi, A.; Syed, K.B.S.; Raj, R.G.; Cambria, E.; Tahir, M.; Alghazzawi, D. A concept-level approach to the analysis of online review helpfulness. Comp. Hum. Behav. 2016, 58, 75–81. [Google Scholar] [CrossRef]

- Chen, Y.; Xie, J. Online consumer review: Word-of-mouth as a new element of marketing communication mix. Manag. Sci. 2008, 54, 477–491. [Google Scholar] [CrossRef]

- Singh, J.P.; Irani, S.; Rana, N.P.; Dwivedi, Y.K.; Saumya, S.; Roy, P.K. Predicting the ‘helpfulness’ of online consumer reviews. J. Bus. Res. 2016, 70, 346–355. [Google Scholar] [CrossRef]

- Li, J.; Zhang, R.; Xu, Y. Evolutionary game between E-commerce platform supervision and merchants selling fakes. J. Syst. Eng. 2018, 33, 649–661. [Google Scholar]

- Chen, J.; Xu, H.; Whinston, A.B. Whinston. Moderated online communities and quality of user-generated content. J. Manag. Inf. Syst. 2011, 28, 237–268. [Google Scholar] [CrossRef]

- Chen, L.; Jiang, T.; Li, W.; Geng, S.; Hussain, S. Who should pay for online reviews? Design of an online user feedback mechanism. Electron. Commer. Res. Appl. 2017, 23, 38–44. [Google Scholar] [CrossRef]

- Wang, C.; Yang, D.; Wang, Z.; Hu, R. Dual-channel strategy of brand manufactures considering the threat of counterfeits. Sci. Res. Manag. 2016, 37, 144–153. [Google Scholar]

- Zhang, X.; Xie, H.; Zhao, J.; Lui, J. Understanding assimilation-contrast effects in online rating systems: modelling, debiasing, and applications. ACM Trans. Inf. Syst. 2019, 38, 1–24. [Google Scholar] [CrossRef]

- Besbes, O.; Scarsini, M. On information distortions in online ratings. Oper. Res. 2018, 66, 597–610. [Google Scholar] [CrossRef]

- Basu, A.; Bhaskaran, S.; Mukherjee, R. An analysis of search and authentication strategies for online matching platform. Manag. Sci. 2019, 65, 1949–2443. [Google Scholar] [CrossRef]

- Ifrach, B.; Maglaras, C.; Scarsini, M.; Zseleva, A. Bayesian social learning from consumer reviews. Oper. Res. 2019, 67, 1209–1221. [Google Scholar] [CrossRef]

- Armstrong, M. Competition in two-sided markets. Rand J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Rochet, J.-C.; Tirole, J. Platform competition in two-sided markets. Eur. Econ. Assoc. 2003, 4, 990–1029. [Google Scholar] [CrossRef]

- Chen, J.; Fan, M.; Li, M. Advertising versus brokerage model for online trading platform. MIS Q. 2016, 40, 575–596. [Google Scholar] [CrossRef]

- Jullien, B. Two-sided markets and electronic intermediaries. CESIFo Econ. Stud. 2005, 51, 233–260. [Google Scholar] [CrossRef]

- Ferrante, M. China’s renewed attention to the fight against counterfeit products sold online: The impact of Taobao’s new policy and punishments. J. Internet Law 2015, 18, 3–9. [Google Scholar]

- Xiaoli, G. Fake commodity governance in the era of e-commerce: Legal dilemmas and its countermeasures. J. Hunan Univ. Sci. Technol. 2016, 19, 98–104. [Google Scholar]

- Zhu, F.; Zhang, X. Impact of online consumer reviews on sales: The moderating role of product and consumer characteristics. J. Mark. 2010, 74, 133–148. [Google Scholar] [CrossRef]

- Meng, Y.; Wang, H.W.; Wang, W. The effect of electronic word-of-mouth on sales through fine-gained sentiment analysis. Manag. Rev. 2017, 29, 144–154. [Google Scholar]

- Kwark, Y.; Chen, J.; Raghunathan, S. Platform or wholesale? A strategic tool for online retailers to benefit from product reviews. MIS Q. 2016. [Google Scholar] [CrossRef]

- Liu, Q.B.; Karahanna, E. The dark side of reviews: The swaying effects of online product reviews on attribute preference construction. MIS Q. 2017, 41, 427–448. [Google Scholar] [CrossRef]

- Shihab, M.R.; Putri, A.P. Negative online reviews of popular products: Understanding the effects of review proportion and quality on consumers’ attitude and intention to buy. Electron. Commer. Res. 2019, 19, 159–187. [Google Scholar] [CrossRef]

- Yin, D.; Mitra, S.; Zhang, H. When do consumers value positive vs. negative reviews? An empirical investigation of confirmation bias in online word of mouth. Inf. Syst. Res. 2016, 27, 131–144. [Google Scholar] [CrossRef]

- Ajorlou, A.; Jadbabaie, A.; Kakhbod, A. Dynamic pricing in social networks: The word-of-mouth effect. Manag. Sci. 2018, 64, 971–979. [Google Scholar] [CrossRef]

- Chen, L.; Li, W.; Chen, H.; Geng, S. Detection of fake reviews: Analysis of sellers’ manipulation behavior. Sustainability 2019, 11, 4802. [Google Scholar] [CrossRef]

- Lin, I.C.; Wu, H.L.; Li, S.F.; Cheng, C.Y. A fair reputation system for use in online auctions. J. Bus. Res. 2015, 68, 878–882. [Google Scholar] [CrossRef]

- Zhao, H.; Yang, X.; Li, X. An incentive mechanism to reinforce truthful reports in reputation systems. J. Netw. Comput. Appl. 2012, 35, 951–961. [Google Scholar] [CrossRef]

- Hong, Y.; Chen, P.Y.; Hitt, L.M. Measuring product type with dynamics of online product review variance. In Proceedings of the 2012 International Conference on Information Systems, Orlando, FL, USA, 16–19 December 2012. [Google Scholar]

- Lin, Y.M.; Wang, X.L.; Zhou, T.Z. Survey on quality evaluation and control of online reviews. J. Softw. 2014, 25, 506–527. [Google Scholar]

- Chen, R.; Sharman, R.; Rao, R.; Upadhyaya, S.J. Data model development for fire related extreme events: An activity thepry approach. MIS Q. 2013, 1, 125–147. [Google Scholar] [CrossRef]

- Hagiu, A. Two-sided platform: Product variety and pricing structures. J. Econ. Manag. Strateg. 2009, 18, 1011–1043. [Google Scholar] [CrossRef]

- Hagiu, A. Pricing and commitment by two-sided platforms. Rand J. Econ. 2006, 37, 720–737. [Google Scholar] [CrossRef]

- Dou, G.; He, P.; Xu, X. One-side value-added service investment and pricing strategies for a two-sided platform. Int. J. Prod. Res. 2016, 54, 3808–3821. [Google Scholar] [CrossRef]

- Roger, G.; Vasconcelos, L. Platform pricing structure and moral hazard. J. Econ. Manag. Strateg. 2014, 23, 527–547. [Google Scholar] [CrossRef]

- Jin, G.Z.; Rysman, M. Platform pricing at sports card conventions. J. Ind. Econ. 2015, 4, 704–735. [Google Scholar] [CrossRef]

- Kung, L.C.; Zhong, G.Y. The optimal pricing strategy for two-sided platform delievery in the sharing economy. Transp. Res. Part E 2017, 15, 1–15. [Google Scholar] [CrossRef]

- Gao, M. Platform pricing in mixed two-sided markets. Int. Econ. Rev. 2018, 59, 1103–1129. [Google Scholar] [CrossRef]

- Flores-Fillol, R.; Iozzi, A.; Valletti, T. Platform pricing and consumer forsight: The case of airports. J. Econ. Manag. Strateg. 2018, 27, 705–725. [Google Scholar] [CrossRef]

- Staake, T.; Thiesse, F.; Fleisch, E. The emergence of counterfeit trade: A literature review. Eur. J. Mark. 2009, 43, 320–349. [Google Scholar] [CrossRef]

- Li, L.; Chai, Y.; Liu, Y. Inter-group and intra-group externalities of two-sided markets in electronic commerce. J. Serv. Sci. Manag. 2011, 4, 52–58. [Google Scholar] [CrossRef]

- Rochwta, J.C.; Tirole, J. Two-sided markets: A progress report. RAND J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Ho, Y.C.; Wu, J.; Tan, Y. Disconfirmation effect on online rating behavior: A structural model. Inf. Syst. Res. 2017, 28, 626–642. [Google Scholar] [CrossRef]

- Wang, H.; Du, R.; Li, J.; Fan, W. Subdivided or aggregated online review systems: Which is better for online takeaway vendors? Electron. Commer. Res. 2018, 6, 1–30. [Google Scholar] [CrossRef]

- Korfiatis, N.; Garcia-Bariocanal, E.; Sanchez-Alonso, S. Evaluating content quality and helpfulness of online product reviews: The interplay of review helpfulness vs. review content. Electron. Commer. Res. Appl. 2012, 11, 205–217. [Google Scholar] [CrossRef]

- Thakur, S. A reputation management mechanism that incorporates accountability in online ratings. Electron. Commer. Res. 2019, 19, 23–57. [Google Scholar] [CrossRef]

- Kwark, Y.; Chen, J.; Raghunathan, S. Online product reviews: Implications for retailers and competing manufacturers. Inf. Syst. Res. 2014, 25, 93–110. [Google Scholar] [CrossRef]

| Notation | Definition and Comments | |

|---|---|---|

| commission rate for each sale | ||

| natural selection rate | ||

| accuracy rate of online reviews | ||

| cost of moderating quality of online reviews | ||

| . | mass of participating high-quality sellers | |

| mass of participating low-quality sellers | ||

| mass of participating buyers | ||

| value of high-quality product | ||

| value of low-quality product | ||

| product price | ||

| average cost difference between high-quality and low-quality product | ||

| high-quality seller’s fixed cost of providing a product | ||

| low-quality seller’s fixed cost of providing a product | ||

| buyer’s opportunity cost | ||

| high-quality sellers’ revenue from trading | ||

| low-quality sellers’ revenue from trading | ||

| buyers’ expected surplus from trading | ||

| platform’ s revenue from trading | ||

| Conditions | Optimal commission rates | |

|---|---|---|

| If , If , | ||

| If , If , | ||

| If , If , | ||

| 0 | ||

| Conditions | Optimal commission rates |

|---|---|

| 0 |

| Conditions | Optimal commission rates |

|---|---|

| 0 |

| Conditions | Optimal commission rates | |

|---|---|---|

| 0 | ||

| Conditions | Optimal commission rates |

|---|---|

| 0 |

| Conditions | Optimal commission rates |

|---|---|

| 0 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, X.; Dong, R.; Li, W.; Jia, Y.; Chen, L. Online Reviews Matter: How Can Platforms Benefit from Online Reviews? Sustainability 2019, 11, 6289. https://doi.org/10.3390/su11226289

Du X, Dong R, Li W, Jia Y, Chen L. Online Reviews Matter: How Can Platforms Benefit from Online Reviews? Sustainability. 2019; 11(22):6289. https://doi.org/10.3390/su11226289

Chicago/Turabian StyleDu, Xueke, Rui Dong, Wenli Li, Yibo Jia, and Lirong Chen. 2019. "Online Reviews Matter: How Can Platforms Benefit from Online Reviews?" Sustainability 11, no. 22: 6289. https://doi.org/10.3390/su11226289

APA StyleDu, X., Dong, R., Li, W., Jia, Y., & Chen, L. (2019). Online Reviews Matter: How Can Platforms Benefit from Online Reviews? Sustainability, 11(22), 6289. https://doi.org/10.3390/su11226289