1. Introduction

Understanding the price fluctuations in the real estate market is of importance because fluctuations in real estate prices have a significant impact on the soundness and profitability of the banking sector. One extreme case of the impact can be seen in the recent financial crisis caused by defaults on subprime mortgage loans in the United States [

1,

2,

3]. In 2007, a significant drop in the United States housing prices caused subprime mortgage loans to start defaulting, and it eventually became a reason for a global financial crisis. As seen in this spiral effect, the reason that the real estate market sustainability is highly influential on banking sector sustainability is that banks not only own real estate as assets but also engage in mortgage lending [

4].

Generally, banks ask for collateral when offering loans, rather than making an effort to evaluate potential borrowers themselves. Banks make lending decisions based on the collateral borrowers provide [

5]. There is no way for a bank to force a loan repayment unless the borrower provides collateral [

6]. Even if the borrower fails to repay the loan, if the value of the real estate rises, the recovery rate is very high [

1]. Thus, real estate is mainly used as collateral [

7]; banks determine the interest rate of the loan according to the value of the collateral assets such as quality, liquidity, and price volatility provided as collateral. In addition, the credit market is an imperfect market in which information asymmetry exists between the lender and the borrower, the collateral plays a role in preventing the moral hazard of the borrower.

The value of general assets is estimated by discounting the expected cash flows from the assets. For example, if a bank wants to extend the volume of lending and the borrower can borrow at a lower interest rate, then the present value of the real estate may increase as the discount rate decreases [

7]. This process considers not only the interest rate on loans, but also macroeconomic fundamentals such as GDP growth rate, price level, and business cycles.

However, there are some unique characteristics that distinguish real estate from other assets. Real estate is a non-standardized asset that differs from other assets in quality and is clearly geographically segmented. There is also no standardized exchange or central trading hub. These characteristics increase information asymmetry between buyers and sellers and leave a margin for price negotiation. In this process, high transaction costs will occur. Another distinguishing feature of real estate is the difficulty in responding promptly to supply responses because of constraints such as having to look for suitable sites and long construction periods [

4,

8]. In addition, real estate prices are significantly affected by government policies and loan regulations [

9]. Thus, there is a possibility that the economic logical relationship which applies to other assets weakens in case of real estate.

Under these conditions, fluctuations in real estate prices can affect the bank performance in two ways. First, an increase in real estate prices increases the value of bank assets, thereby increasing the value owned by the bank and held as collateral. It reduces the probability of falling into financial distress by lowering the risk on bank assets. This is the so-called collateral value hypothesis. The rise in real estate prices will raise bank stability and lower the probability of default [

2,

5,

10].

Conversely, increasing real estate prices may also increase banks’ risk. Moral hazard and the problem of adverse selection can be induced [

11]. If real estate prices increase, risky borrowers who assume that prices will continue to rise demand additional credit. If banks also believe that real estate prices will continue to rise, they may issue a loan at unreasonably low interest rates. Banks believe that the risk associated with mortgage lending is low. In this case, if the price of real estate reverses, the bank is in danger of being in financial trouble; this is known as the deviation hypothesis [

12]. If real estate prices deviate excessively from fundamentals and the price volatility increases, banks’ probability of default also increases. As such, fluctuations in real estate prices can have both positive and negative impact on the bank performance.

Despite the great impact of housing price fluctuations on bank performance, it is unclear whether the rise in real estate prices leads to an increase in bank lending or vice versa. The rise in mortgage value because of the rise in real estate prices may lead to an increase in bank lending. On the other hand, sufficient liquidity because of the expansion of bank lending and an increase in real estate demand could lead to an increase in real estate prices [

6,

12]. Otherwise, optimistic expectations for future economic conditions may lead to an increase in real estate prices [

7].

In most countries, residential real estate is a larger part of the national economy. Residential real estate accounts for the largest part of household net wealth and accounts for 30% of the world wealth, greater than bonds or stocks [

13]. As a house is one of the most expensive consumer goods, households have to rely on bank lending to buy a house. As a mortgage lender, banks are sensitive to changes in property prices. If borrowers fail to repay loans, banks’ default risk will increase.

Korea is no exception to this phenomenon. The proportion of real estate accounts for two-thirds of household total assets [

14]. This figure is much higher than other developed countries. Because of the high proportion of real estate, the Korean banking industry may therefore be more sensitive to changes in real estate prices. Therefore, the Korean government is making efforts to stabilize real estate prices by implementing various real estate policies. The real estate policy in Korea is divided into two categories [

15]. One is a price stabilization policy to prevent overheating of the market and the other is an active economic stimulus policy to recover a sluggish market. Specifically, in terms of price stabilization, demand control policies are mainly used such as trade regulation, tax strengthening, and financial regulation. Second, the economic stimulus policy includes easing regulations and vitalizing demand through funding and tax support. Since the first real estate policy in 1967, the government has issued more than 60 real estate-related policies, but nonetheless, the real estate market in Korea has been very unstable [

15,

16,

17]. It is possible to expect that the stability and performance of banks will be very unstable because of such unstable housing prices in Korea. For this reason, it is very meaningful to examine the effect of real estate price changes on bank performance in Korea.

In this paper, we empirically analyze the relationship between housing price fluctuations and the bank performance in Korea. The first goal is to identify the causal relationship between changes in housing prices and bank lending. It is well-known that there is a positive correlation between real estate prices and bank lending in both developed and developing countries [

12]. It is also reported that financial and housing markets in Korea have been highly correlated since the financial crisis of 1997, when deregulation and financial liberalization began [

14]. However, the direction of causality between the two variables is not clear. Thus, we examine whether changes in housing prices could cause an increase in the volume of bank lending or vice versa.

Next, we examine whether fluctuations in housing prices have a significant effect on bank performance. As the proportion of real estate mortgage loans in banks’ total loans increases, changes in the value of real estate mortgage loans and of collateral assets will impact the bank performance. In addition, interest income from real estate loans which account for a large portion of bank’s total profits also directly improves banks’ performance [

17]. Thus, we investigate the effect of real estate price changes on bank performance using return on assets (ROA), which is a measure of profitability, and non-performing loans (NPL), which is a measure of asset soundness.

The main findings are as follows. First, changes in housing prices affect bank lending decisions. If housing prices increase, banks increase their lending. Pro-cyclicality becomes more prominent in regional banks. In fact, the decline in housing prices is enough incentive for banks to reduce their loans. If housing prices fall, it will increase bad loans, which should add additional loan loss provision. In this case, banks will be forced to reduce the capital ratio by reducing risky assets [

18]. Second, changes in housing prices affect banks’ asset quality. If housing prices rise, banks’ asset soundness will improve. As the value of collateral rises, the bad loan ratio (non-performing loans) is reduced. This is a consistent phenomenon regardless of the real estate business cycle. Third, changes in housing prices have a greater impact on bank profitability during real estate business recession than during booms. Because of the lending competition in a real estate business boom, bank profitability is unlikely to improve. However, profitability will deteriorate severely because of the deterioration of existing loan assets while new loans are decreasing during a recession [

17].

The financial sector has a relatively high entry barrier. Excessive competition among financial institutions may cause risky investment, resulting in large-scale insolvency and financial market instability. When the banking industry takes a hit, the entire national economy is threatened. Therefore, securing the profitability and soundness of banks is very important. Only the sustainable growth of banks can guarantee the sound development of the national economy. In this context, this study is meaningful in that it analyzes the relationship between the changes in housing prices, which account for a large portion of the national economy, and the sustainable growth of banks.

This study has the following limitations. Because of limitations in data availability, the analysis period begins from 2000; it is necessary to extend the research period with long-term data. In addition, housing price fluctuations may vary by region. It would be more meaningful to be able to utilize local real estate price data and local real estate loan information.

The remainder of this paper is organized as follows. We review the relevant literature in

Section 2.

Section 3 describes the data and empirical methodology.

Section 4 provides empirical results. Finally,

Section 5 provides concluding remarks.

2. Literature Review

Banks play an important role in financing real estate projects as lenders. Thus, because of the important role of banks as lenders, it is not surprising that there is a correlation between fluctuations in real estate prices and bank performance. Extensive studies have been conducted in the past decade, and interest in this field has been increasing. However, commercial and residential real estate cannot be analyzed together because they have different business cycles and interact differently with the financial system or the real economic situation [

19]. Thus, previous studies either analyze commercial properties or residential properties.

There is significant evidence on the relationships between residential property prices and bank performance. Gerlach and Peng [

12] argue that property prices are closely correlated with bank lending. Specifically, residential property prices adjust bank lending in Hong Kong, rather than vice versa. This phenomenon is more strongly significant in banks that have higher proportion of real estate loans. Blaško and Sinkey [

20] document that since the 1990s, commercial banks have moved their assets to real estate loans. They find that less-specialized banks that hold 40% or more of their total assets as secured real estate loans have a higher insolvency probability. Goodhart and Hofmann [

21] examine the interaction between housing price, money, credit, and macroeconomy. They argue that there are multidirectional relationships between all these variables. Money growth influences housing prices and credit, credit affects money and housing prices, and house price also affects credit and money. Koetter and Poghosyan [

4] also find that the deviation of real estate prices tends to be negatively associated with bank instability, but not with price level changes. Pan and Wang [

2] argue that residential property price changes have a negative impact on banks’ NPL. As housing prices rise, the NPL ratio falls. In addition, this phenomenon is stronger during an economic boom rather than bust. At this time, the stability of banks could deteriorate. Hott [

3] argues that although changes in real estate prices may hurt banks, banks decisions ultimately cause real estate price changes because bank loans create property bubbles. Che et al. [

7] argue that bank loans play a crucial role in increasing property prices in China; as banks increase loans, property prices rise. Zhang et al. [

1] also investigated the Chinese property market. They suggest that regional banks’ profits stem from the rapid increase in real estate investment. Therefore, when the housing market is in recession, bank stability is weakened; the housing market downturn raises banks’ NPL.

There is relatively limited evidence on whether commercial property prices are related to bank performance. Davis and Zhu [

9] argue that commercial property prices are closely related to bank performance at the micro level. Specifically, there is a positive relationship between commercial property prices and bank profitability, and a negative relationship between net interest margin and bad loan ratios. This phenomenon is consistent even after controlling for various factors that are known to affect the bank performance. Moreover, the relationship is positively related to the size of the bank. In an empirical study of 17 countries, Davis and Zhu [

19] argue that property prices have a strong correlation with bank lending; there is a positive relationship in the short-term, but the long-term relationship is negative.

Some studies analyze both commercial and residential real estate. Arpa et al. [

22] suggested that real estate prices are positively related with the operating income of banks in Austria. Rising housing prices should increase the profitability of real estate subsidiaries held by banks. In addition, rising housing prices increase demand for mortgage loans, which improves bank profitability. He et al. [

23] argue that that banks’ stock returns are very sensitive to changes in total real estate returns such as construction and development, residential, and nonresidential loans.

To assess the impact of real estate price fluctuations on a bank’s performance, we choose testing variables based on the literature as follows. The most widely used variable to measure bank performance is NPL [

1,

2,

24,

25,

26,

27]. ROA is also a very popular measure to assess bank performance [

28,

29,

30,

31,

32,

33,

34,

35]. Other variables are bank failure rates [

36,

37], net interest margin [

38], growth in loans [

39], and probability of distress events [

4].

Studies on bank performance either focus on a single country [

33,

34,

35,

40,

41,

42,

43,

44] and or on a panel of countries [

32,

45,

46,

47,

48]. Many focus mainly on developed countries such as the United States and Europe, and there are very few studies on emerging countries and Asia. We fill this gap by analyzing the economy of Korea which can be regarded as a leading market of emerging countries.

3. Data and Methodology

The purpose of this study is to examine whether fluctuations in real estate prices affect bank lending decisions and performance. To do this, we estimate Model (1). We construct a fixed effects model to estimate Model (1).

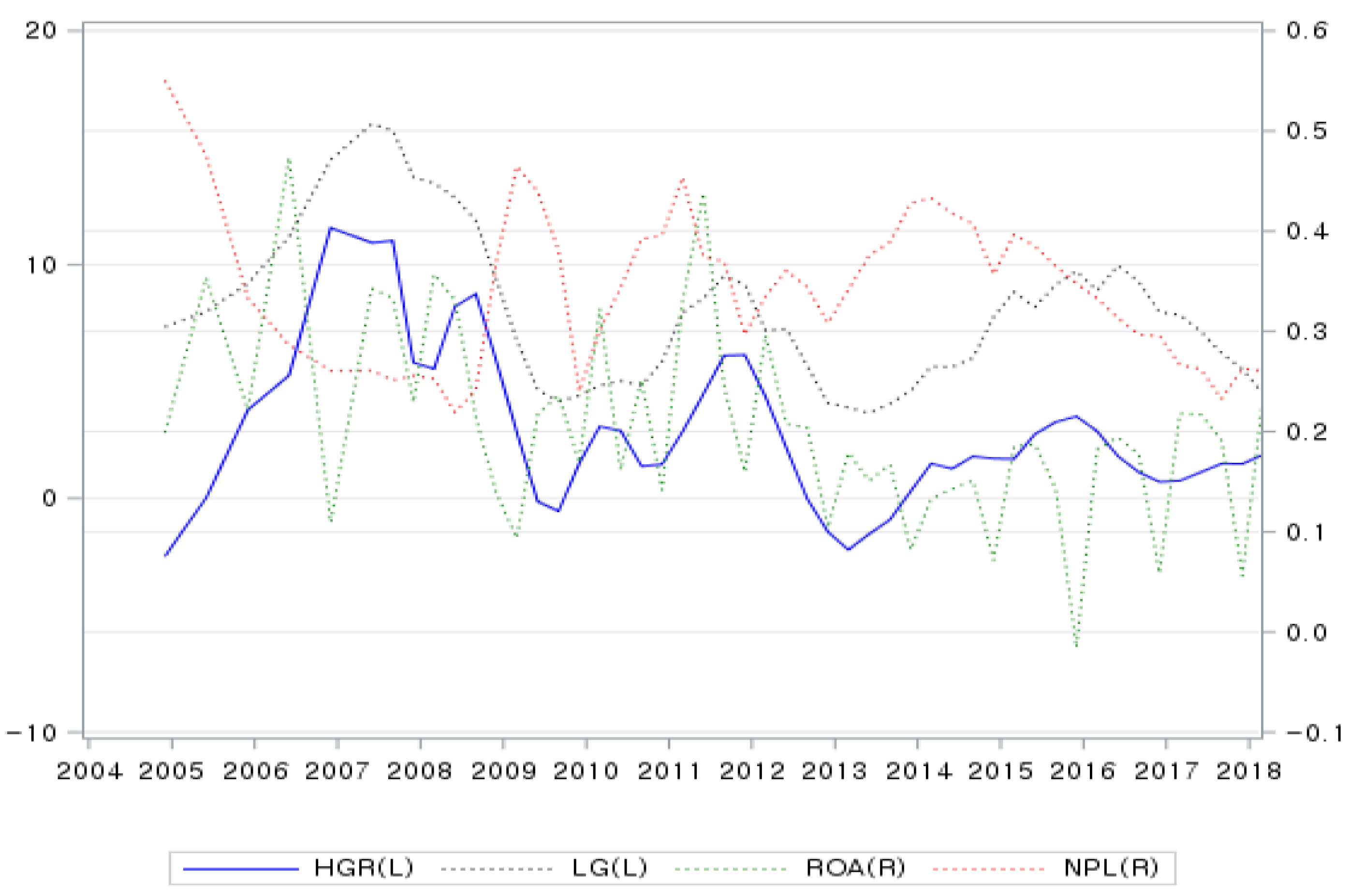

where

denotes bank performance, which is calculated using the lending growth rate (LG), ROA, and non-performing loans (NPL). Loan growth rate is calculated as the growth rate of the loan against the same period of the previous year. ROA is calculated by dividing net income before income tax by total assets (average). The ratio of bad loans is calculated by dividing the assets classified as doubtful and estimated losses by the total assets.

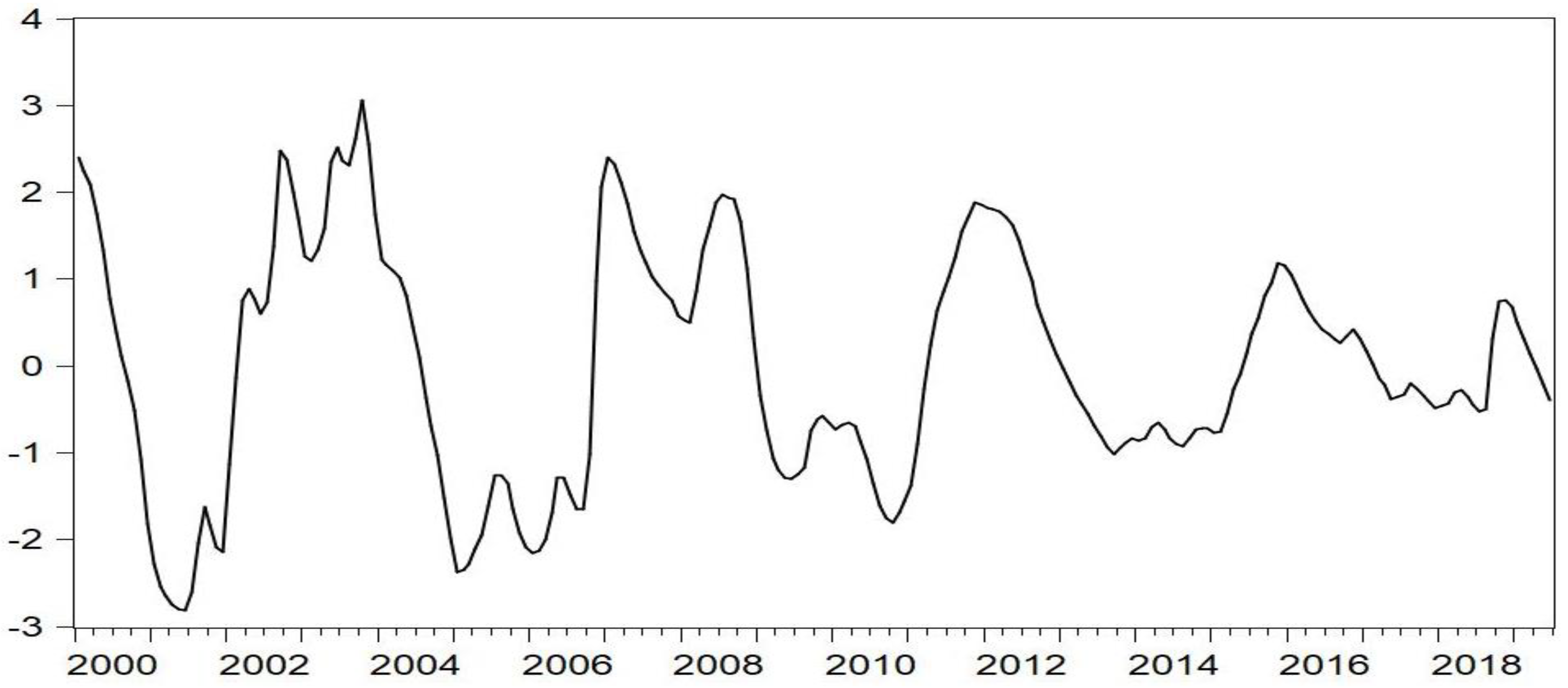

(housing price growth rate), which is a main variable in this study is a proxy for housing price fluctuation and is calculated as the year-on-year growth rate of the home price index announced by the Korea Appraiser Board. The real estate market in Korea can be divided into residential real estate and commercial real estate [

49]. Residential real estate is primarily privately owned and evenly distributed throughout the country. Commercial real estate, on the other hand, is primarily owned by companies and concentrated in urban areas. In addition, unlike commercial real estate, where the income from rent is invested, apartments are aimed at capital gains as prices rise. Therefore, in order to observe the impact of changes in real estate prices, housing prices is mainly used rather than other variables such as land price, rent, and commercial real estate fluctuations [

17,

18].

represents macroeconomic variables that include call rate, GDP growth rate (GDPGR), and consumer price index growth rate (CPIGR).

is the characteristic variable of individual bank

i. The characteristics of individual banks include the following variables. First, the capital ratio (CAPR) is calculated by dividing the capital by total assets. This is a variable for measuring the lending ability of the bank in terms of financing. Loan ratio (LOANR) is calculated by dividing the loan by total assets. It measures the risk exposure of bank loans. Interest revenue (INR) is calculated by dividing the interest income by operating income. It is an indicator for determining the proportion of interest income in bank operating income. Loan constitution (LOANCONS) is calculated by dividing business loans by household loans. This is an indicator for measuring the relative risk of household lending.

Only commercial banks and regional banks are included in our sample and specialized banks are excluded. The number of banks, which was close to 30 before the financial crisis in 1997, decreased to 12 by 2018. As of December 2018, the number of commercial and regional banks is six. Mergers between banks have been steadily taking place to strengthen bank competitiveness after the financial crisis of 1997. The data are obtained from Statistics Korea, Korea Appraisal Board, and the Financial Statistics Information System of the Financial Supervisory Service. The sample period is from 2000 to 2018.

Table 1 reports the summary statistics. Panel A presents the results for the whole sample, while Panel B reports the results for commercial and regional banks. Panel A reveals that the housing price index increased by about 3.96% per annum during the sample period. Although it is higher than the CPI growth rate, it is lower than the GDPGR. Panel B shows that the loan growth rate, loan ratio, interest revenue, and loan constitution of regional banks are higher than those of commercial banks. This indicates that regional banks are lending more to risky borrowers.

5. Conclusions

This study analyzed the effects of housing price changes on bank lending decision and bank performance. Since banks not only have real estate as assets, but also directly provide mortgage loans, fluctuations in housing prices can directly affect the bank’s soundness and profitability.

Major empirical results are summarized as follows. First, changes in housing prices affect bank lending decisions. Pro-cyclicality becomes more prominent in regional banks. In fact, the decline in housing prices is enough incentive for banks to reduce their loans. If housing prices fall, it will increase bad loans, which should add additional loan loss provision. Second, changes in housing prices affect banks’ asset quality. If housing prices rise, banks’ asset soundness will improve. As the value of collateral rises, the bad loan ratio (non-performing loans) is reduced. This is a consistent phenomenon regardless of the real estate business cycle. Third, changes in housing prices have a greater impact on bank profitability during real estate business recession than during booms. Because of the lending competition in a real estate business boom, bank profitability is unlikely to improve. However, profitability will deteriorate severely because of the deterioration of existing loan assets while new loans are decreasing during a recession. Therefore, be careful not to overload the loan when the housing market is in boom.

Korean households hold most of their assets as real estate. The proportion of real estate in the national household assets is higher than two-thirds. Therefore, it is very meaningful to analyze the relationship between housing prices and bank performance. It is worth investigating the systematic analysis of the relationship using data from individual bank levels rather than the entire banking industry and growth rate of the home price index proxy for housing price. However, because of the limitations in data availability, the analysis period begins from 2000. It is necessary to extend the research period with long-term data. In addition, real estate price fluctuations may vary by region because it is distributed throughout the country. Thus, it would be more meaningful to be able to utilize local real estate price data and local real estate loan information.