1. Introduction

Australia experienced rapid growth in real estate prices between 2010–2017 [

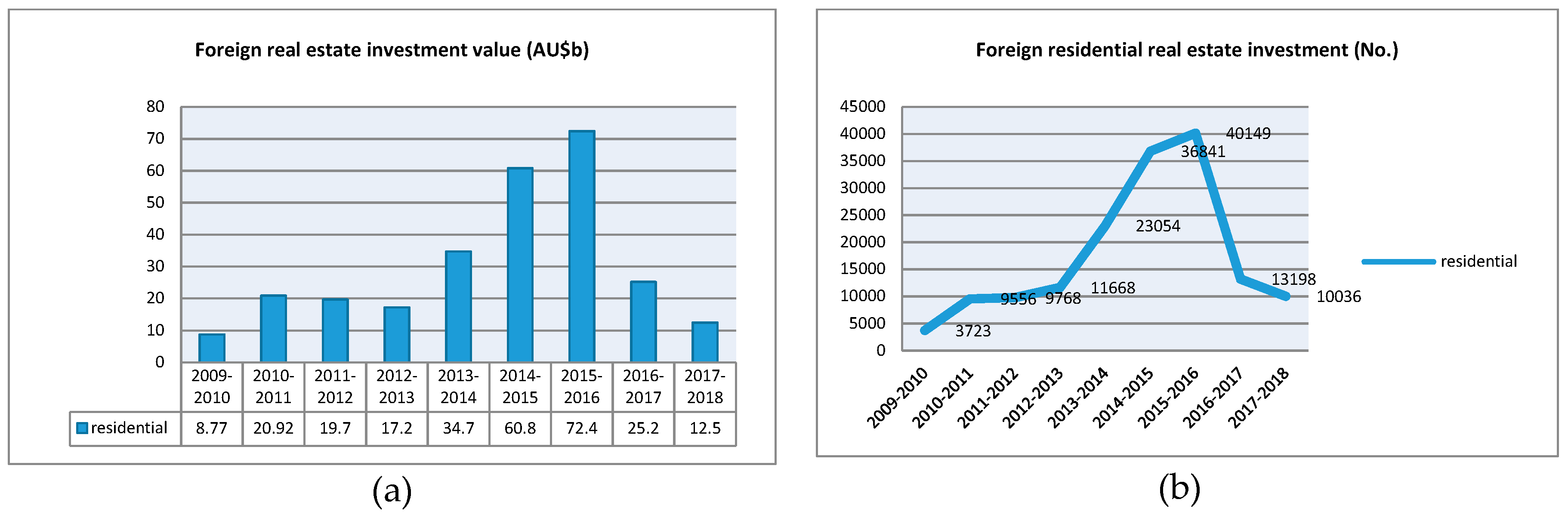

1]. During this period, there were concerns about the growing number of foreign investors purchasing property in Australia, especially regarding investors from China. However, the Australian housing market has slowed since 2017, highlighted by a decline in foreign real estate investment (

Figure 1). The changes in the Australian housing market are closely related to the changes in the global economic, geopolitical, and regulatory environment.

China and India alone accounted for 44% of the global economy’s increase since the beginning of the 21st century. As a result, the growing number of members of the Chinese middle class and upper-middle class has played an important role in the global elite [

11]. The growing middle class has becoming increasingly engaged in transnational investment, migration, and education. In 2016, Paris pointed out that 2.8 million high-net-worth (HNW) Chinese individuals were conducting or considering investment or migration overseas. Australia, Canada, and the USA are becoming popular destinations for Asian investors. The growing number of transnational migrants and investors has become an issue in academic, policy, and public debates in these countries [

12,

13,

14,

15]. After shifting toward marketization, China faced a serious increase in speculative housing investment and housing affordability issues through its rapidly expanding middle and upper-middle class groups in the past 30 years. In 2010, China’s government began to control housing price increases by restraining demand through increased taxation on housing investment. China also restricted credit access for purchasing secondhand housing and imposed restrictions on the number of property investments that a single family could own in 46 large cities in China. Thus, since 2010, both individual investors and institutions from China have expanded their real estate investment into the global market [

16].

From 2009 to 2017, Australian regulations and rules for foreign real estate investment were relaxed as part of an attempt to provide more housing supply in Australia. Foreign investors could apply to the Foreign Investment Review Board (FIRB) to obtain approval for investing in Australia. The investors purchasing new buildings could obtain FIRB approval with no restrictions. In terms of the established dwellings, temporary residents such as students could also apply to invest for their own use. The definition of new building has been expanded since 2009, meaning homes constructed within 12 months could be defined as new buildings as well. A series of restrictions were also lifted, for example, on foreign purchasers of vacant land, or price ceilings affecting the price of properties bought by those holding a student visa which could apply to off-the-plan properties within a development [

3,

4].

However, since 2017, the Australian real estate market has experienced a significant downturn. For instance, in Sydney, the property market peaked in mid-2017 and then real estate values in Sydney fell by 13.2% [

1]. The decline of foreign residential real estate investment between 2017 and 2019 has been highlighted in the current Australian property market. The foreign residential real estate investment approvals were

$12.5 billion in the 2018 financial year, a major decline from

$17.5 billion from 2017 [

10].

Liser and Groh [

17] argued that capital markets and the regulatory environment heavily influence and differentiate domestic and overseas property investment decisions. However, the foreign real estate investment has not been investigated from the perspective of transnational individual practice, especially concerning the individual’s social and cultural habitus. In transnational space, the theory of ‘habitus’ used to apply in the research of immigration studies. Regarding foreign real estate investment research, the ‘habitus’ theory can also be applied to examine this area, which helps to enrich the academic literature. Specifically, the relationship between investment and the living habitus of the Chinese with the boom and bust of foreign real estate investment in Sydney should be identified. Additionally, it should be noted that the Australian local living habitus has been protected by the local policymakers through policies limiting foreign real estate investment from 2017. Furthermore, the bust of foreign real estate investment in Australia remains under-researched. This article contributed to the research gap by exploring reasons why the foreign investment experienced a significant boom and bust through the ‘habitus’ theory. This article focused, in particular, on why the Australian housing market has been a good choice for global real estate investors from 2017 to 2019, including global policy changes, the role of off-the-plan apartment sales, and the possible implications of the changes on the future housing industry in Sydney, namely: (1) The loss of investors, (2) the diversification of housing products, and (3) the evolution of the labor force.

2. Empirical Research Gap Analysis

In terms of an empirical research gap, the existing literature examined the factors underpinning the boom of foreign real estate investment in Australia and its impacts on the local housing market, community, and urban landscape. However, since 2017, while the foreign real estate investment declined significantly, there have been few academic scholars who have conducted research on the drivers of the current ‘bust’ and the changes in the property market in Australia after the ‘bust’ began. In the previous literature, there are scholars who blamed the apartment boom in the Australian housing market from 2010, but there is little research exploring the relationship between the apartment boom in Australia and the boom and bust of foreign real estate investment. Furthermore, there has been little investigation into the massive sales of off-the-plan properties, which have also been a significant phenomenon during the ‘boom and bust’ period.

A number of processes have affected the real estate market in Australia. The literature on Australian cities has usually focused on foreign capital flows and individual investments at a macro level during the boom period [

16,

18,

19,

20]. However for the foreign property investment ‘bust’ period, there has been little academic work undertaken.

It has been identified that the growth of foreign real estate investment in Sydney has been related to the increase of Chinese migrants [

20] and overseas education programs operating in Australia. Transnational real estate investment practices and processes have been affected by rising levels of globalization and the growing cross-national mobility of people, capital, and information [

21]. Sydney’s Chinatown has been examined from the perspectives of the role of the Chinese diaspora, while scholars have pointed out that Chinatown is becoming a favored location for real estate investment agency services and a good place for investment for Chinese buyers [

13]. Rogers, Lee, and Yan [

14] explored the contribution of translocal sales agents for enabling Chinese investment in Australia. Liu and Gurran [

16] discussed their relationship with the boom of foreign property investment in Australia in addition to the contributing role of the Australian policy environment, as well as the changes in China’s domestic real estate market. The motivations of different investor groups are not the same. The New Middle Class (NMC) from Asia that invest in Australia are heavily influenced by family plans for migration and education [

22], which are different from the practices and motivations of ultra-high net-worth individual (UHNWI) and ultra-ultra-high net-worth individual (UUHNWI) investors. Rogers and Robertson [

22] suggested that foreign real estate investment should be considered as a familial strategy to obtain educational and immigration goals. Wong [

23] showed that the foreign individual buyers who are active in the Australian real estate market are motivated by their own migration plans, financial security, and their children’s education. Thus, the restriction of China’s domestic housing investment since 2009 and the ongoing development of globalization encouraged Chinese investors to search for overseas investment opportunities for their surplus capital [

21].

The increase of middle-class and super-rich foreign investors in global real estate markets from countries such as in China, India, Russia, Brazil, and South Africa have received some deep-seated cultural and political sensitivities [

14]. Various cultural, social, political, and historical real estate processes and practices develop their own spatial and temporal genealogies in different cities and countries [

12]. Thus, the influence of foreign investment in Sydney, Australia has its own development characteristics. The high levels of discontent among Sydney residents regarding foreign investment has been pointed out by Rogers, Wong, and Nelson [

24], with Chinese investors being a key target of this discontent. Several studies have proven the considerable negative impacts of transnational real estate investment in host cities, such as the unaffordable housing prices [

25], the alien building forms [

26], and the transformation of the traditional neighborhood [

14,

27]. In terms of the changes to the urban landscape, Fincher and Costello [

28] examined transnational housing production in Melbourne, focusing on the narratives of high-rise housing development, in particular the developers’ and potential occupants’ perceptions. Their research concentrated on the processes of space consumption and the reshaping of the urban landscape through high-rise building development. Transnationalism in this research refers specifically to transnational consumers. Rogers, Wong, and Nelson [

24] asserted that local residents also lack confidence in how the government is regulating foreign investment.

3. New Theoretical Lens for Foreign Real Estate Investment Research—‘Habitus’

The existing academic literature which has discussed the changes in foreign real estate investment has predominantly focused on international capital accumulation, immigration growth, and international capital flow. In this research, we provided a new lens to explore foreign real estate investment: Individual practice ‘habitus’. There is currently no literature which examines foreign real estate investment through ‘habitus’, that is, the cultural and personal preferences which influences investors when engaging in global practices. Though the Chinese ‘habitus’ may not be the main driver of the boom and bust of foreign real estate investment in Australia from 2013 to 2019, it has played an important role in the apartment sales boom during the period. Rachel Weber [

29] opposed the idea that real estate booms when the city grows and innovates, arguing that financial incentives instead push developers to erect new apartment buildings and office towers. Weber [

29] explored the case of the ‘Millennial Boom’ during the early 2000s in Chicago and highlighted that the global and local pressures which led to the overbuilding of new properties resulted in the apartment boom loop’s expansion. The complex financial intermediary provided an influx of cheap cash, contributing to transforming the housing demand into a speculative bubble. In this situation, the pricing of property and its supply does not have a solid connection to the market. Gavin Shatkin [

30] examined Asian cities and offered insight into a state-led, but profit-driven, transformation of urban land, property, space, and governance. The relationship between the domestic housing market and the historic transformation in global capitalism has been investigated and suggests that the housing system tends to be international [

31]. McKenzie and Atkinson [

32] explored London’s housing market and investigated the role of international wealth and property investment in shifting homes into assets in order to obtain capital accumulation.

‘Sydney Boom and Sydney Bust‘ [

33] illustrated the overarching factors of the property boom from 1968 to 1974 in Sydney and the effects this had on property in the city, as well as the transformative nature of Sydney and Australia in the contemporary age. The author argued that the external capital and immigration waves affected the uneven development in Sydney’s growth. According to previous literature, the changing capital market is an important force under the boom of property in Sydney. However, the real estate boom and bust has not been explored from the perspective of individual practice ‘habitus’.

Habitus is a structured system of dispositions [

34] (p. 70) that is formed by an individual’s conditions of existence. The concept of class-divided space is fundamental to the theory of ‘habitus’. Class-divided space refers to the subjective dimension of social reality. The ‘habitus’ is not composed by the collection of attributes or inherent characteristics, but rather a frame of reference that includes the imprint of objective social structures, which then generates the views and practices of individuals [

34] (p. 72). An individual’s life within the family and in the education system during their formative years creates their primary and class habitus, inculcating their way of being, living, and knowing. The class and primary habitus are carried into the individual’s future practices. As they grow, the individual has the adaptability to continue to develop the capabilities and dispositions necessary to enter specific fields [

34,

35,

36].

The foreign real estate investment of this research occurs in a transnational space. As such, literature relating to transnational practice and cultural production was reviewed to provide a theoretical foundation for analysis. In this research, transnational practice refers to activities that simultaneously transcend and link people or institutions across more than one nation-state [

37,

38]. The aim of transnational activities is capital accumulation [

39]. When individuals operate in a transnational space, the theory of habitus must be extended and modified to reflect transnational practice. Ong [

40] utilized Bourdieu’s theory to observe the practice of Hong Kong migrants through the flexible strategies of accumulation in both economic and cultural terms. These transnational arenas are not only business environments, but settings where competing hierarchies of cultural distinction assess the symbolic status of locals and, more critically, newcomers, regardless of how cosmopolitan they are in practice [

40]. Bourdieu observed that the various capitals—economic, social-cultural, and symbolic—are mutually convertible and can also be converted into personal power, thereby defining one’s life chances or social trajectory [

40].

Economic capital can be converted into other forms of capital, but other forms of capital cannot be converted into economic capital [

40]. In terms of cultural capital, when accumulation strategies are the means for propelling an individual across cultural and geopolitical spaces, the deliberate acquisition of cultural capital is a common means of shifting the criteria of symbolic power when encountering the new field. Furthermore, Ong argued that ‘structural limits to the cultural capital accumulation’ should exist, as “…where there is accumulation and credit, there must be loss and debit” [

40] (p. 91). In transnational mobility, newcomers may experience difficulties converting previously acquired cultural capital into social capital as a result of the mismatch between the racial identity of their symbolic capital, which may be associated with low social value in the host group.

Though Ong [

40] discussed the limits of cultural capital accumulation that are apparent with immigrants, it is also applicable to describe the practice of foreign real estate investment. Wilson and Dissanayake [

41] and Donald, Hendon, and Herbig [

42] highlighted the importance of cultural dimensions and how culture influences transnational practice. Differing cultures not only affect the range of strategies practitioners develop, but the ways in which they are implemented.

When we talk about [the] Chinese subject, it conveys the sense that people identifiable as Chinese exist in their own world, and even when they participate in global processes, they continue to remain culturally distinct.

Ong [

40] proposed to place human practices and cultural logics at the center of the discussion on globalization, based on the premise that peoples’ everyday activities are a form of cultural politics underlined by different power contexts. There is a new class of migrant professionals who demonstrate flexibility on two fronts: (1) They are professionally adaptable to a variety of situations, and (2) they are culturally flexible regarding Western and Asian values. They are cultural intermediaries between the West and Asia. Transnational arrangements can be interpreted as capital accumulation strategies that certain elite individuals have adapted to evade, deflect, and take advantage of political and economic conditions in specific fields in the world. This is achieved by pitching the transnational practice as constitutive of the third culture dimensions to the capitalism of Western ideas [

40]. ‘Translingual practice - Literature, National Culture, and Translated Modernity: China, 1900-1937′ [

43] provided a significant exploration into translingual practice by focusing on the process of new words, meanings, discourses, and modes of representation which arise and circulate within the host language due to the collision with the guest language. Liu [

43] used the term ‘translingual practice’ instead of ‘translation’ to emphasize the fact that this includes nonlinguistic practices. Her arguments have created an important framework for this research regarding transnational real estate investment. For instance, the term ‘translation’ has connection with the original idea as no more or no less than a trope of equivalence. However, when knowledge passes from the guest language to the host language, it inevitably takes on new meanings in its new linguistic environment.

In terms of built environment studies, in ‘The Changing Landscape of Hybridity: A Reading of Ethnic Identity and Urban Form in Vancouver’, Lu [

44] utilized the notion of a ‘hybrid product’ to represent the invasion of the previous landscape by the alien-built forms—“monster houses”. In the article, Lu identified the different hybrid patterns of Vancouver in different periods. In the process of hybridization, which includes reproductions, reductions, and translation, new forms of knowledge, new modes of differentiation, and new sites of power are produced [

45]. It is impossible to understand modern Chinese transnational practice by merely referring to old scripts of push-pull factors. Instead, there needs to be increased focus on their ‘habitus’ of capital accumulation across the national borders and singular political entities [

46,

47]. The transnational practice of foreign real estate investment should be considered the cultural dimension in order to be fully understood.

4. Research Design

This article provided a new theoretical lens—‘habitus’—to examine foreign real estate investment and included empirical evidence by examining the boom and bust of foreign real estate investment in Sydney and the role of massive sales of an off-the-plan apartment in Sydney.

Greater Sydney is a popular location for migrants, overseas students, tourists, international investors, and business [

48]. The housing industry in Sydney is increasingly affected by the flow of people, capital, and information beyond the Australia’s borders in its production and consumption [

49]. Since 2010, Sydney has experienced a rapid growth in direct foreign investment in real estate, with the performance of Chinese investors being particularly outstanding [

2,

3,

4,

5,

6,

7,

8,

9]. Observing the boom and bust of foreign real estate investment in Sydney provides empirical evidence on how ‘habitus’ influences foreign investors’ practices.

This article is part of an ongoing research project that has been conducted from 2017 to 2019. This project’s aim was to study global developers’ responses to the changes in the Australian housing market. Empirical data for this study was collected in the following ways: (1) Primary data from interviews, (2) secondary literature review data, and (3) primary material culture data (

Table 1).

A range of participants were recruited for the research to reduce data contamination, given the high stakes nature of the housing industry and the potential for participants to provide biased or misleading information. Four groups of participants were selected to interview: Five property developers, five built environment consultants, five real estate agents, and five Chinese property buyers.

A semi-structured interview was an appropriate method for investigating the notion of ‘habitus’ [

39], implementing defined questions while allowing further development of those answers and adding open-ended questions. In order to explore the issue in greater depth, the researcher asked multiple questions about the themes from a variety of different angles.

The questions encouraged an open-ended discussion about the participant’s views, practices, and knowledge. The interviewer directed the conversation but allowed participants to tell their own story, which differed from participant to participant. The interview themes included sections on current employment, work organization, views of the product in context of the boom and downturn of the market, views of marketing advertisement during the market decline, views of the long-term development in the declining market period, views of the customers in the declining market, and the views of the labor force of housing industry during the declining market period. The participants’ answers were recorded by the researcher in a handwritten on-field notebook.

Interviews with real estate professionals provided significant data regarding foreign real estate investment changes in Sydney. The respondents’ answers were based on their many years of professional knowledge and experience, providing the authors with an in-depth of understanding through each specific example about the practices of investors.

In addition, the authors analyzed a large corpus of publicly available documents including real estate development policy, foreign real estate investment policy and data, industry materials, and academic literature. The analysis of policy documents was intrinsic to understanding foreign real estate investment in Sydney. Through analyzing the information in the documents, the response of the government to the foreign real estate investment was understood. The industry materials and the academic literature also provided further insight regarding the responses of real estate professionals to the housing market in Sydney.

Moreover, the authors analyzed cultural materials of 40 projects developed in different time periods (2010–2012; 2013–2017; 2017–2019). In this research project, the researchers mainly collected text as the material cultural data. The texts were collected from real estate websites, real estate projects flyers, brochures, and other visual materials. Cultural material is important for the analysis of the social world. Cultural material is composed of the usage, consumption, creation and trade of objects. In this study, the text and media were collected as the major material for analysis [

50]. Texts are not only written products, but texts can also be words, colors, images, and other meaningful aspects of information [

50]. Texts as elements of social events have causal effects. For example, texts reflect the changes of our knowledge, beliefs, attitudes, and values. Additionally, the advertising and other commercial texts that people experience contribute to shaping their identities as consumers and their preferences. Texts effects can include changes in the material world, such as changes in urban design, or the architecture and design of particular types of buildings [

50]. Furthermore, texts are not neutral, they are socially constructed. Creators of texts have choices in selecting text forms, content, language, and certain views to shape reader perception. Thus, texts can reflect changes in peoples’ beliefs, attitudes, values and behaviors, social relations, and in the material world as well.

The cultural material analysis was based on the collection of promotional brochures and the analysis of the pictures and texts on the brochures advertising housing products. Changes in the real estate industry were identified through observing the differences in housing product advertisements.

5. The Boom and Bust of Foreign Residential Real Estate Investment and the Slowing Market

The FIRB data indicates that the value of an approved foreign investment in residential property in Australia has increased from AU

$6 billion annually in the 1990s to more than

$17 billion in 2012/13. There was a dramatic growth of 322% to AU

$72 billion in 2015/16. The housing market peaked in mid-2017, especially in Sydney. In 2017, ANZ found foreign nationals owned more than 400,000 Australian homes. Specifically, foreign investors bought between 30,000 and 50,000 new dwellings in 2015–2016 [

51]. There was a significant decline of individual foreign real estate purchases in 2017, with a value of AU

$5 billion and a foreign purchasing approval number of less than 10,000 (

Figure 2).

According to FIRB [

10], there were 10,036 residential properties investment applications approved, equivalent to a value of AU

$12.5 billion from mid-2017 to mid-2018. In comparison to 2016-17, there was a decline of 3162 approvals and AU

$17.5 billion decreased in value. The figure indicates a reduction in foreign demand for Australian residential real estate. Of that decline, 74% can be attributed to a fall in new dwelling approvals. However, China still accounted for a large proportion of residential real estate investment approval, despite a significant decline in demand from Chinese investors. According to Juwai’s report, buyers from China were the top overseas buyers in number and the value of residential real estate investment in 2011–2017 [

52]. The volume of Chinese investors has since fallen by 26.8% to AU

$24 billion in 2017 compared to the previous year [

52]. Juwai estimated that AU

$100 billion was spent on new dwelling sales in 2018, with AU

$25 billion being spent by foreign buyers, three-quarters of whom were from China.

The USA, Canada, New Zealand, and Australia all experienced significant drops in Chinese real estate investment from 2017 [

52]. Chinese expenditure on Australian residential property purchased in 2017 was

$19.4 billion, which was

$8.8 billion less than in 2016. In 2018, Chinese residential buying inquiries saw a 20% reduction compared to the previous year. Chinese investment in Australian property had increased steadily from 2009. By 2016, investment by mainland Chinese purchasers in the Australian real estate market had grown to AU

$31,912 million, which was more than 10 times than 2010. However, in 2017, the number dropped to AU

$15,253 million, which was close to 50% of the rate recorded in 2016. The biggest difference in the market in 2017 was the housing price they targeted. Initially, it was wealthy Chinese buyers purchasing million-dollar properties in cash. In mid-2017, market changed, with lower-priced homes becoming more attractive for Chinese middle-class buyers who usually purchase with loan assistance. Additionally, the luxury property market exchange has been less affected by market changes.

Another factor has had a significant effect on the housing market: The number of new building construction approvals has declined in New South Wales (NSW), but has increased in Victoria and Western Australia. The decrease of new dwelling approvals instigated the fall in residential real estate approval [

10]. Furthermore, the reduction of the foreign residential real estate investment in Australia had an impact on the domestic market, resulting in the decline of housing prices and construction activities.

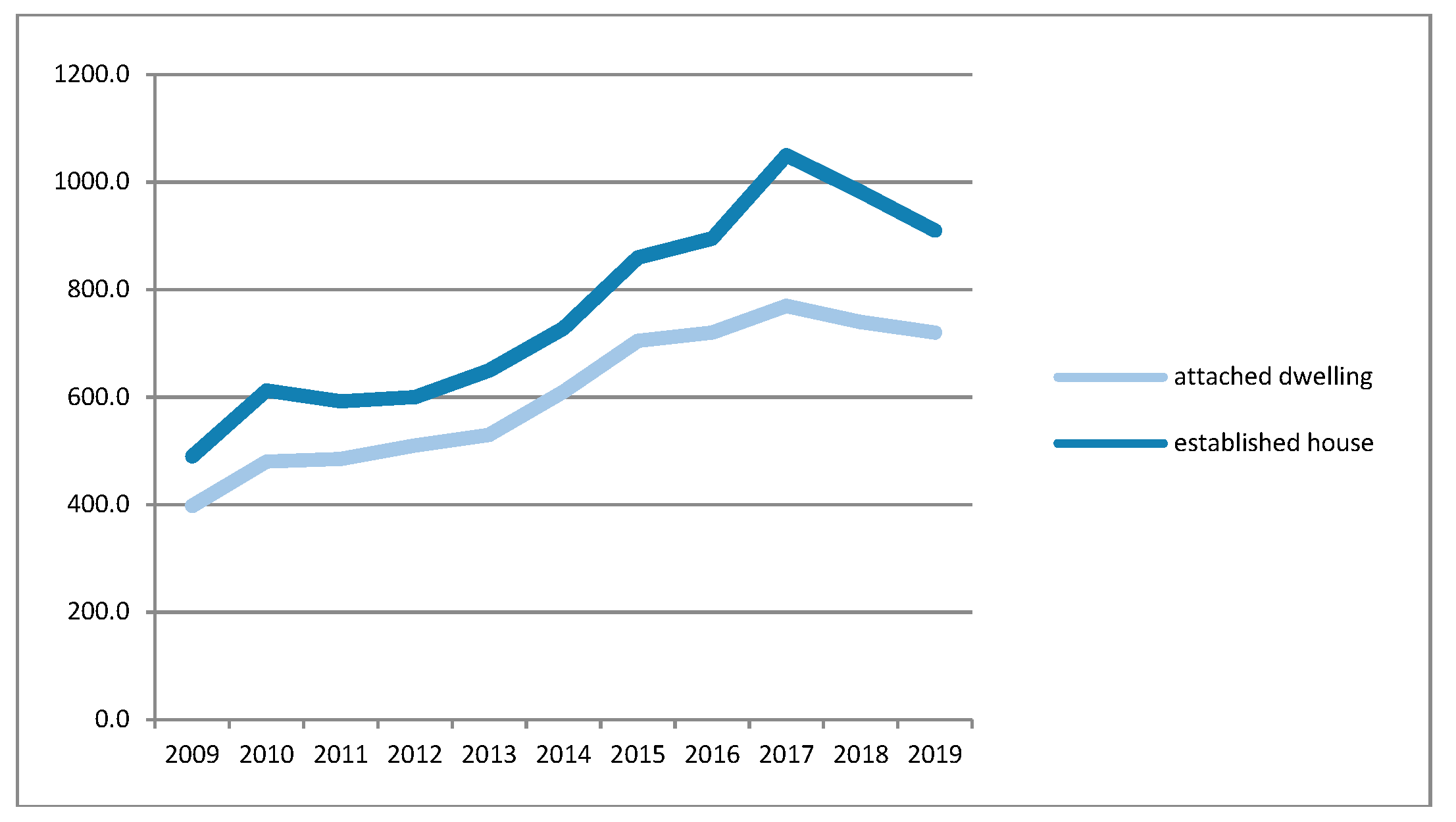

In March 2010, according to [

1], the housing prices increased at an unprecedented 20% from 2009 to 2010 in Australia. The Australia Bureau of Statistics (ABS) provided data showing that Australian housing prices increased by 9.8% and Sydney’s housing prices increased by 15.2% in 2013. The price continued to grow rapidly until mid-2017. During that period, the median house price in Sydney was

$1,178,417 and the median unit price was

$757,991 [

1] (

Figure 3).

From mid-2017 to 2019, there was a continuing fall in housing price. Following 20 months of consecutive decline, prices have now fallen by 8.2%, surpassing the previous record in the early 1980s [

53]. The housing price of Sydney declined 13.2% from 2017–2019 [

1]. As the figures indicate, the housing market in Australia slowed down from mid-2017 following a dramatic growth period during 2010 to 2017. The timeline of the housing price changes is reflected in the period of boom and bust in foreign real estate investment. The mutual influence between the domestic housing market and the foreign residential real estate investment needs to be explored further.

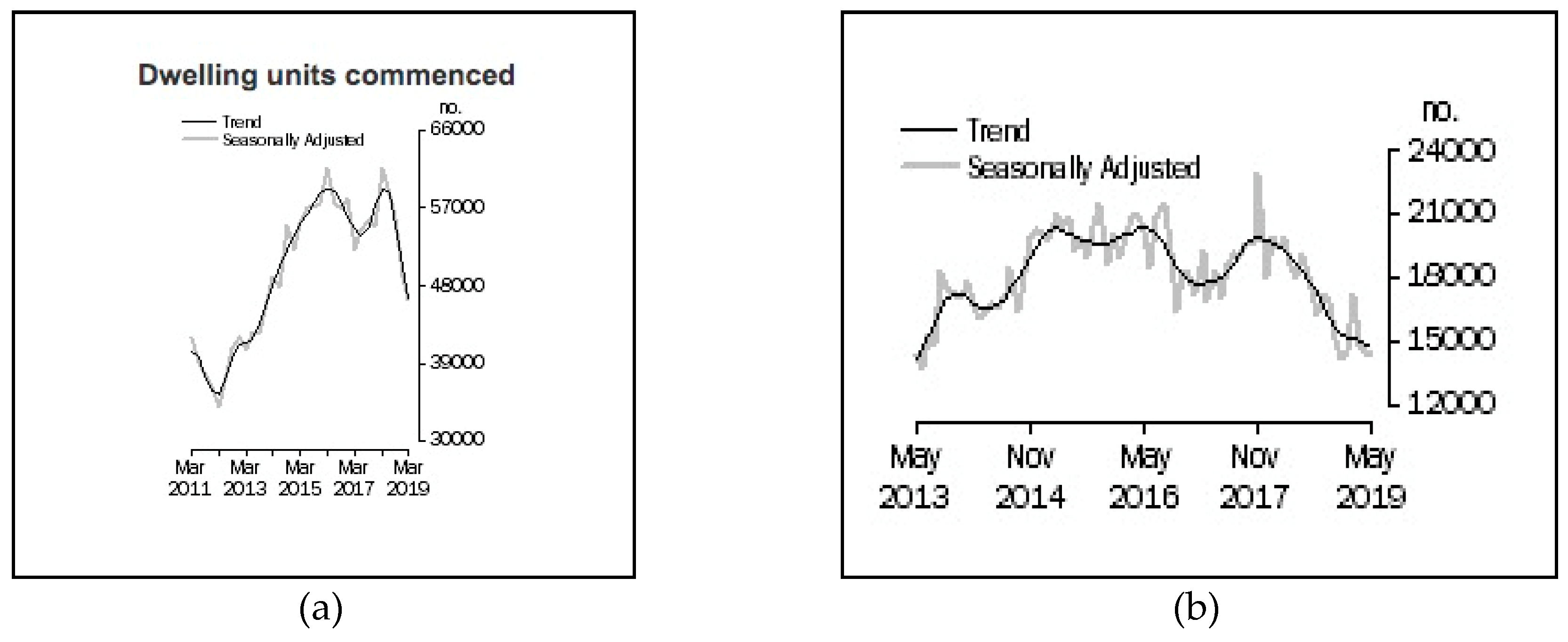

The slowing housing market is evidenced through the decline of building activity levels since 2017, corresponding to a reduction in building approvals as of July 2018 and a decline in new home sales [

1]. According to the ABS [

54], both the number of construction projects approved and commenced for dwelling units experienced a significant decline since 2017 (

Figure 4). Due to the decrease in demand by foreign investors for Australian housing and the falling value in domestic housing, the real estate development firms operating in Australia stopped or delayed the commencement of residential construction projects, many of which had already received design approval. Some land acquired by developers before the decline have no plans for development due to the unstable market. It was estimated this may lead to a decline in housing supply in 2020 and an increase in the unemployment rate in the construction industry.

6. Off-The-Plan Apartments and the Apartment Boom

Off-the-plan property has played a significant role in foreign investment in the Australian real estate market. Off-the-plan property refers to a property that has not yet been constructed. Buying off-the-plan property enables investors and homebuyers to buy a property at a lower price during a time in which the property price is continuing to rise.

Off-the-plan apartment sales in Australia are popular among the Chinese investment community. In terms of foreign investment regulations, a new building presents fewer barriers for offshore investors when purchasing. However, there are also underlying factors influencing this preference to be considered, relating to the ‘habitus’ of Chinese sociocultural behaviors. According to an interview with a Chinese real estate agent in Sydney (2019):

When there was an apartment project that went on sale, more than 90% of the off-the-plan apartments were purchased by Chinese-background buyers. However, after the settlement of the apartment project, you could see that the races of people who moved in were diverse.

This can be attributed to the local people not being familiar with buying off-the-plan properties, as well as living in an apartment not being a preferred lifestyle for Australian nationals. However, in China, living in an apartment is standard. The Chinese who migrate to Australia are accustomed to living in large cities in China and are familiar with living in high-rise apartments close to public transportation and shopping centers. Thus, to residents of a Chinese background, buying an apartment in Australia is an acceptable option.

In China, buying off-the-plan property is a common practice. When buying off-the-plan property, buyers do not have the opportunity to see the exact layout of what they are buying. Instead, they must use their imagination with the aid of layout pictures provided in brochures. Most projects build a display suite for potential buyers to see the construction materials, decorations, fixtures, and so on. However, the developers usually show the premium features in the display suite, which requires additional payment to obtain. Thus, potential buyers are unable to view the actual property when purchasing and might need to wait two to three years before the project is complete. Buyers may also face the potential risk of quality issues. Thus, buying an off-the-plan property is outside the norm for Australian nationals and is not their preferred practice.

The habitus consists of the abstract mental habits, schemes of perception, classification, appreciation, feeling, and action [

39]. In this article, it was argued that buying an off-the-plan apartment is a habit for Chinese buyers when purchasing property in China, therefore this kind of property is more acceptable to them. Furthermore, according to an interview conducted with real estate agents, Chinese buyers can visualize the floor plan well compared to the local buyers.

The Chinese language is written with hieroglyphics but English is not. Chinese people have a habit of imagining things through reading pictures. I think that is the reason why the Chinese can understand the floor plan well but local people prefer to look at the real rooms. I met with a Chinese couple to see our project. I took them to the project site and there was nothing on the site at that time. I just described what would be built by using description and my gestures, and they were satisfied with my service and my communication was effective and convincing. However, I also took a local couple to the project site and I tried to explain through description, floor plan pictures, and let them imagine, but I ended up confusing them.

(An interview with a real estate agent in Sydney, 2019)

Apart from the difference in the acceptance of off-the-plan apartments between Chinese people and Australian nationals, there is also the Chinese investment ‘habitus’ which must be explored to further explain the Chinese preference for off-the-plan properties. As mentioned above, when a project commenced and off-the-plan apartments were being initially sold, 90% of buyers were of Chinese background. When the project was finalized, the residents were of diverse backgrounds. This can be attributed to the practice of Chinese-background buyers selling their properties before financial settlement. We can investigate the investment form through an example:

A Chinese man bought a two-bedroom off-the-plan apartment at about AU$650,000 in 2013 in Sydney. He only paid the 10% of the payment to exchange the contract and he just waited. After two years, three months before the financial settlement date, from 2013 to 2015 the housing price increased on average by 10% per year and he sold the property at about AU$780,000. Thus, the Chinese man only spent AU$65,000 and earned AU$130,000 in two years by investing in an off-the-plan apartment in Sydney.

(An interview with a real estate agent in Sydney, 2019)

Real estate agents in Sydney referred to this form of investment as ‘leverage investment’, where investors take advantage of the continual housing price growth. This profitable investment form was also a reason why Chinese buyers preferred to invest in the Australian housing market from 2010 to 2017.

In response to the increasing demand for housing in Australia, a large number of apartment projects were planned. During the ‘boom’ period, almost 40% of the apartments were bought by foreign investors [

1]. The rapid increase of apartment projects in Australia from 2013 to 2017 increased the housing stock dramatically. At the same time, changes in foreign investment policy had dampened the demand of global buyers. The oversupply of housing stock and the loss of foreign buyers contributed to market saturation of the remaining residential properties available.

The off-the-plan apartment is a kind of product that relies on future demand. Foreign investors buying properties in Australia is not a stable demand. Thus, when the housing market slows down, the policy environment changes and foreign investors leave, the housing stock is oversupplied for the local buyers. The housing stock in Sydney cannot be consumed until 2020.

(An interview with a property developer in Sydney, 2019)

The Australian housing market has slowed and the housing prices in capital cities have been declining since September 2017. During the declining market period, purchasing off-the-plan property has become unpopular due to the continuing decline in property price. Some buyers who purchased an off-the-plan property in 2016 or 2017 refused to pay the financial settlement when construction was completed, as the lack of price growth and difficulties in sourcing a new buyer to sell to before settlement significantly reduced their investment profits.

When I bought a two-bedroom apartment at the price of AU$865,000, I paid 10% of the total price for the contract in 2016. The project was completed at the end of 2018, but the price of the two bedroom apartments nearby had fallen to around AU$700,000. If I still completed the financial settlement as per the contract I signed in 2016, it means I would lose more than AU$165,000 more than I paid. Additionally, the bank’s valuation of the apartment would be lower, and the credit I can apply for would also be lower. Moreover, the housing price may keep declining.

(An interview with a buyer in Sydney, 2019)

Many buyers no longer closed deals, exacerbating the oversaturation situation by sending many previously sold properties back onto the market. Overproduction of apartments has played an important role in the declining of the housing market. The prosperity of off-the-plan property sales between 2013 and 2017 in Australia also contributed to the decreased demand for housing in later years.

7. Policy Landscape Changes

The policy for foreign real estate investment in Australia changed in response to the influx of apartment construction and housing price increases from 2013 to 2017. During the housing market boom period, high levels of public concern and discontent about foreign investment were expressed among Sydneysiders, with Chinese investors being a key target of this discontent [

24]. The increase of Chinese-background residents moving in to the local community, the changing built form, and the significant growth of dwelling prices offended the local communities’ original living ‘habitus’. The Australian government responded to this displeasure by implementing policy changes to protect the Australian nationals’ legitimate rights. The policy landscape for foreign real estate investment can be investigated from the perspective of ‘habitus’ as well. Both Australian and Chinese policies are discussed in the following section.

7.1. Australian Policy Environment

Prior to 2017, in order to create additional employment opportunities in the real estate sector and contribute to economic growth, the Australian government’s policy was to direct foreign investment capital into new buildings. The government also obtained revenue through these construction projects by stamp duty and taxation charge. Increasing individual foreign real estate investment in new housing construction increased housing supply and addressed housing pressures [

55]. The federal policy put forward by the government aimed to channel foreign investment into new residential construction, with the stated objective of increasing housing supply, creating jobs, and supporting economic growth. Non-resident foreign nationals were restricted from buying established properties in Australia [

10].

However, in 2017, contracts cited that an increase in foreign resident stamp duty, foreign investment application fees, and stricter lending policies led to a dampening of foreign demand [

10]. On 1 July 2017, foreign investors experienced an increase in the transfer duty surcharge from 4% to 8%, and the land tax surcharge rose from 0.75% per annum to 2% per annum from the 2018 land tax year. The application fee for purchasing a property by foreign nationals must be paid before obtaining approval. An application fee of AU

$5000 must be paid for a property valued at AU

$1 million or less. The application fee increases to AU

$10,000 for a property valued over AU

$1 million, and for every AU

$1 million increase in housing value, the application fee is increased by AU

$10,000. Additionally, the stamp duty surcharge for New South Wales was increased from 4% to 8% for foreign purchasers [

9].

A vacancy fee was also introduced by the government in 2017 to ensure that more homes were available for Australians. This applies to any property bought by a foreign national which has been left vacant for more than six months in one year. Foreigners must also pay the vacancy fee if the property has been vacant for more than 183 days in the previous 12 months [

10].

Concurrent to these new policy changes, the Australian banks tightened their lending practices for both domestic and foreign investors. There are four major banks in Australia: NAB, Westpac, ANZ, and Commonwealth Bank, all of which increased home loan rates. According to the Australian Prudential Regulation Authority’s [

56] residential property exposure statistics for authorized deposit-taking institutions, new home lending volumes fell by

$25.1 billion (6.5%) in 2018. The decline was driven by a sharp reduction in new investment lending, which dropped by

$17.7 billion (14%), from

$126.9 billion to

$109.2 billion, over the same period. The downturn in the credit space has been driven by the tightening of lending standards by lenders following scrutiny from regulators and from the Banking Royal Commission.

7.2. China’s Policy Environment

As Liu and Gurran [

16] argued, the government policies in China are just as important in understanding the situation surrounding foreign investment in Australian real estate as Australia’s domestic policies. In order to dampen the demand for domestic housing investment, China implemented heavy taxes, restrictions on the number of properties that can be purchased by a family, and less credit space policies.

Since the enactment of the purchase restriction policy and the changes to the domestic housing market in China, both Chinese developers and individual investors expanded their investment into the global real estate market [

16,

57]. In the 1990s, a Go Aboard Policy was put forward, encouraging Chinese companies to pursue direct investment in overseas development. The goal of the policy was to ensure the access to important raw materials and advanced technology, as well as brand name acquisition. In some instances, the Chinese government provided the necessary funds for overseas expansion, although most companies that invested overseas were usually at least partially owned by the government [

58]. Since the 2000s, through support gained by government funding and policies, China’s overseas investments grew significantly [

58].

Prior to 2016, the major policies and overall strategy, as well as the frequency of policies issued, were all focused on encouraging offshore investment. In 2016, the overseas investment reached its peak, leading to the depreciation of the renminbi (RMB) and the massive outflow of capital. The response from the Chinese government intended to regulate ‘irrational deals’, which included hotels, cinemas, and sports clubs in foreign development projects. The Chinese President, Xi, described foreign investment as a national security affair and some of China’s largest companies, including Wanda, Ampang, and the Hainan Airlines (HNA) Group were closely scrutinized. New rules and regulations were introduced by China’s National Development and Reform Commission, limiting investment across national boards in 2016. The rules also required that all foreign investment deals by Chinese companies be reported through the online system, which has been under government supervision since March 2017. Deals over US

$300 million required specific approval prior to application [

59]. These series of regulations forced Chinese firms to reconsider their overseas investment plans and strategies.

However, the explanation provided in these regulations raised some confusion for the public. The explanation stated that as long as the funds were recovered from the existing overseas properties or raised by non-Chinese banks, Chinese investors were permitted to redeploy funds overseas. Companies that did not utilize government-provided funds to build projects were not eligible for this concession. For projects that fit within the scope of the ‘One Belt One Road’ policy, no official approval was required regardless of whether the funds were withdrawn from China. Furthermore, the overseas investments made in infrastructure and developing business centers were also exempt from this requirement or were not recognized under this policy. It is clear that the regulations introduced targeted companies rather than Chinese individuals. As of July 1, 2017, individual outbound investment to Australia has experienced tightened capital control. A key policy known as the ‘capital export restriction’ has reduced the amount of capital that individuals could move offshore. According to The People’s Bank of China [

59], a Chinese national can move no more than

$50,000 through foreign exchange in one calendar year. Beyond this amount, a more detailed justification is required, and the money cannot be used to purchase real estate or securities investment abroad.

7.3. Global and Domestic Policy Changes

As noted above, China’s capital restriction was designed to limit China’s overseas investment. The impact of this policy was a key focus for the interviews.

From the perspective of the real estate agent interviewees, the strict rules were effective in dampening demand of Chinese buying residential real estate in Australia. A real estate agent in Sydney said:

A large proportion of Chinese investors worried about how to take their money out of China. We provided our clients with some legal strategies, but the Chinese clients usually complain that the trading procedures are too cumbersome and risky. Due to the restrictions, some potential buyers will choose to invest in China’s real estate instead. Some of the second-tier and third-tier cities have stopped the purchase restriction policy and the housing prices in these cities have experienced an upward trend.

(An interview with a real estate agent in Sydney, 2019)

The capital restriction rule also influenced the investment of Chinese real estate developers in Australia. Some Chinese real estate developers were unable to transfer financial capital abroad, reliant upon the branch offices overseas to continue operating by themselves. Many of these Chinese developers began venturing into the overseas market from 2010 onward, and their overseas branches lacked the financial capacity to remain viable for further investment. In this situation, many companies opted to sell their previously purchased land and temporarily withdrew from Australia’s property market.

China’s capital control rules blocked Chinese developers’ development at both the land acquisition stage and the marketing stage. It means that we cannot gain enough finances to purchase land at the beginning of a project and the Chinese buyers who used to make up a large proportion of our project sales have also found it difficult to reach financial settlement as well.

(An interview with a Chinese developer in Sydney, 2019)

The increase in stamp duty costs also contributed to the loss of interest by foreign investors in purchasing Australian real estate. For example, in NSW, a foreign buyer must pay 12% of the total property price as stamp duty. They also must apply for foreign investment approval and pay the appropriate application fees.

The high cost of stamp duty in Australia made the foreign investors shift their property purchases to invest in other countries such as the USA, Canada, and South-East Asia. The foreign investors will buy properties in a country that has a friendly foreign investment policy.

(An interview with a real estate agent in Sydney, 2019)

Most of the interviewees’ responses attributed the strict lending policy as being the main issue blocking major foreign investments. Banks in Australia either refused to lend to foreign investors or reduced the lending amount available. The downturn experienced in the credit space resulted in the loss of foreign investment.

During the foreign real estate boom period, off-the-plan property was the most popular product for foreign buyers, especially Chinese buyers. Do you know why? Off-the-plan property is the kind of product that you can pay for separately. You only need to pay 10% of the total housing price to exchange the contract and then you just need to wait for the settlement of the project. Some foreign investors sold their property before financial settlement and earned a profit from the increase of housing value. At that time in the housing market in Australia, Sydney was extremely hot - everyone wanted to have a property there, thus it was easy for investors to sell their property. This kind of investment is called ‘leverage investment’. The investors took advantage of the off-the-plan property purchase rules and bank lending to obtain greater profits. Now it has become difficult for foreign investors to obtain financial settlement as a result of stricter bank lending practices. Buyers usually need to pay off the full amount when they purchase a property. The ‘leverage investment’ is no longer beneficial and effective.

(An interview with a real estate agent in Sydney, 2019)

Some investors’ real estate investments are to obtain housing their children who might be studying at an Australian university, and the property is sold after their children’s graduation. However, if they need to make loan repayments for a property, they consider it to be a high-cost investment. Furthermore, as the Australian housing price is continuing decline, purchasing Australian property is a risky investment currently. Instead of buying a property, they instead rent student accommodation or a luxury apartment for their children.

(An interview with a real estate agent in Sydney, 2019)

According to the interviews, it is clear that policy changes heavily influence foreign investment in the Australian housing market. Global investors prefer countries with friendly foreign investment regulations and immigration rules. As a result of the changes made to global policy, global investors have shifted their focus to other countries, such as Canada and Southeast Asia, to find investment opportunities. The policy changes helped to lower the housing prices in Australia capital cities and effectively slowed large-scale apartment construction projects. Public perception of foreign real estate investment in Australia has been a topic of concern for local authorities, with the Australian ‘habitus’ being respected by policy-makers as well. The foreign ‘habitus’ contributed to the boom of foreign real estate investment in Australia, while the local ‘habitus’ limited the frenzied development the ‘boom’ created.

8. The Research Limitations and Road Map for Future Research

This research examined the decline of foreign real estate investment in Sydney from the perspective of ‘habitus’. The bust also represents further implications for the housing industry across Australia. Further empirical research is needed with regard to the effects of foreign real estate investment decline in Sydney. Based on the analysis of existing data, the following section provides a preliminary hypothesis of potential trends in Australia’s housing industry in Australia following the market decline since mid-2017 for future researchers to examine. The ‘bust’ of foreign real estate investment in Australia has an impact on the future development of Australia’s housing sector. The implications were explored from three different perspectives: (1) The loss of investors (both local and global), (2) the labor force changes, and (3) the diversified housing products.

Instead of an investors’ market, the Australian real estate market is going to become a rigid-demand buyer’s market. The buyers will be composed of new immigrants, downsizers, upgraders and first-home buyers.

(An interview with a property developer in Sydney, 2019)

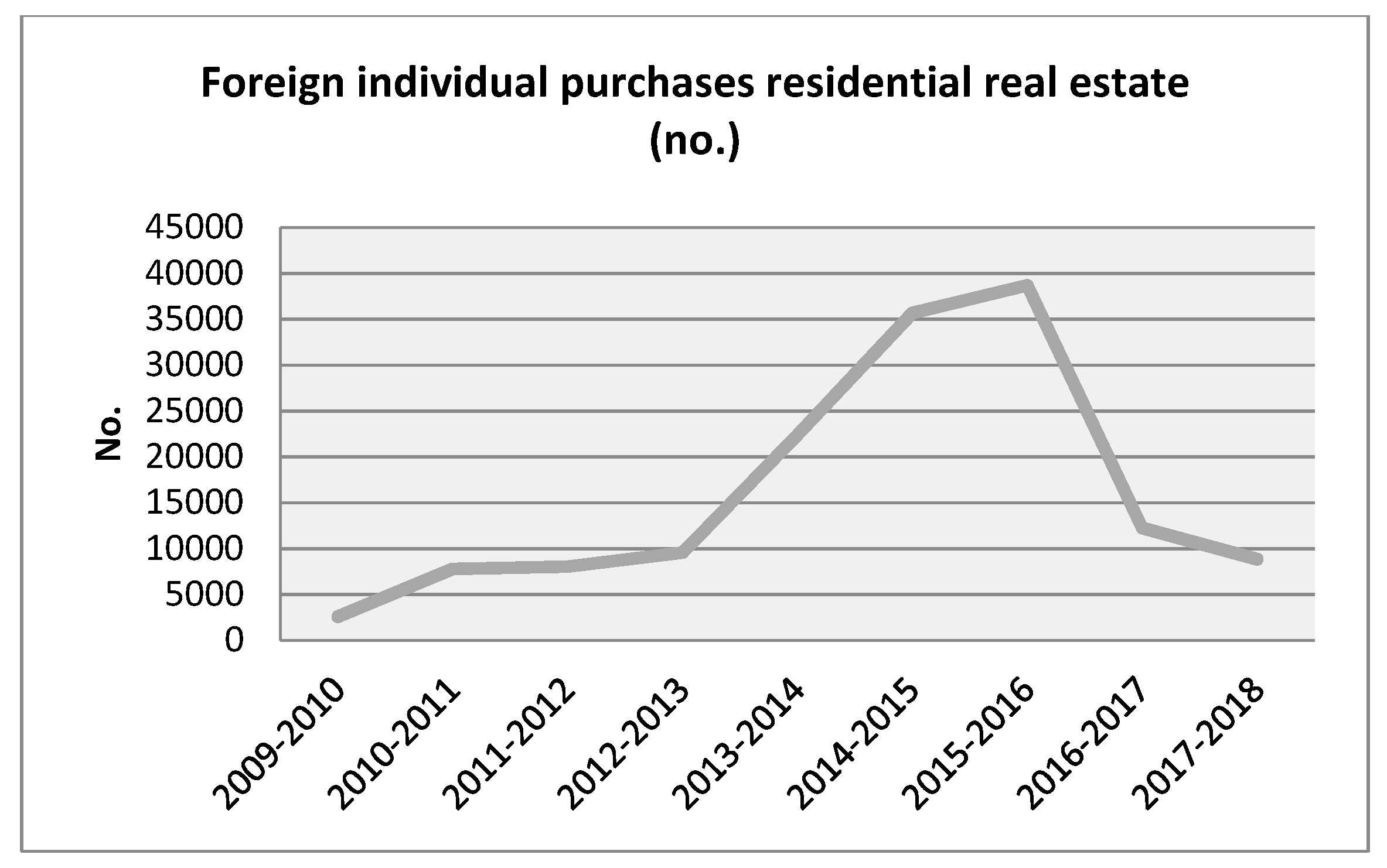

The residential real estate market in Australia from 2013 to 2017 was mainly composed of global and domestic investors. As the figure shows, there has been a sharp decrease in residential real estate purchases made by foreign individuals since 2017 (

Figure 5). As a result of the policy changes and the slowing housing market in Australia, foreign investors left the market. The new buyers of residential real estate are purchasing properties for their own use. The number of first-home buyers has risen significantly:

I bought a one-bedroom apartment at the end of 2018 because of the lower price. I could negotiate with the developer to provide me with upgraded decorations and they also promised to give me a full set of furniture as a gift. I think this is the right time for me to buy a home for myself.

(An interview with a buyer in Sydney, 2019)

Lower housing prices in the current market have allowed properties to become more affordable than before. The exit of foreign investors has provided an opportunity for the rigid demand buyers to enter the housing market and own a home for themselves.

According to the analysis of 20 real estate companies’ websites and brochures, the research demonstrated that the residential products developed since 2018 have changed in comparison to the projects they developed before the declining market. Some developers have shifted their primary selling point to affordability in order to target first-time home buyers in Australia. For example, there is a global developer undertaking a building project of 500 apartments in Sydney. The price of a two-bedroom apartment in this project will be approximately AU$650,000, falling within government requirements to enable buyers to apply for the first-time home buyer grant.

Other global developers have shifted to developing other types of projects, such as retirement homes, student accommodation, and ‘house and land package’ projects. The interviews demonstrated that the developers continue to expand their business through the diversification of their offered products. The future development of apartment projects is no longer a key focus for these developers. Instead, as the housing supply becomes increasingly varied, there are more products for rigid-demand buyers to choose between.

We must change, the market is not as big as before, and the buyers are searching for a project that can match their own preferences. Since they will use the property themselves, these buyers have requirements for the design, layout, and decorations. Before 2017, the buyers were all rushing to buy —there were few customers carefully considering whether the property was appropriate for them. Now, we will develop projects for the particular buyers; we will think about their needs and preferences in order to obtain more customers in the cold market.

(An interview with a property developer in Sydney, 2019)

Competition between residential projects contributes to the enhancement of product quality. The declining market provides a screening process of actors in the industry. The significant decline of building activities has highlighted various issues currently being faced in Australia’s real estate sector.

Quality issues have been found in multiple apartment projects that were developed between 2013 to 2017. During this period, the market was saturated with products but there were insufficient consultants and builders to meet demand. There were builders and consultants who took on too many jobs that were beyond their capabilities. The phenomenon left behind potential quality issues throughout properties developed in this time.

(An interview with a civil engineer consultant in Sydney, 2019)

I think 30% of real estate agents have moved to other industries, such as Airbnb agents. I have a friend who had a real estate agency company but now she has shut down her company and sold her store. She used to earn AU$500,000 ever year but she only earned AU$200,000 in 2018 and the situation would only grow worse. AU$200,000 is not enough to cover her operating costs. She owned a company before; it was so difficult that it made her give up her career of many years.

(An interview with a real estate agent in Sydney, 2019)

In addition to the challenges faced by real estate agents, consultant company employees, including architects, landscape architects, interior designers, and civil engineers, have also faced significant challenges since 2019, [

60,

61,

62]. However, the intensified competition in the slowing market can also eliminate uncompetitive employees and companies as well. When the Australian housing market was prosperous, many underqualified professionals also joined the industry.

During the boom period, there were too many projects waiting for commencement, but there were not enough builders and sub-contractors available. There were some people who joined this industry with very low requirements. There were developers that did not have adequate experience in housing development in Australia to be able to compare which builder was more experienced and professional. This resulted in some housing projects being completed with low-level designs and construction quality.

(An interview with a real estate agent in Sydney, 2019)

I was dismissed from an architecture company. I was a graduate architect, but in 2018 my boss asked me to take on reception duties because there was not enough relevant work for me to do with so many other architects already employed. In 2019, my boss fired me because they could not afford to pay so many employees’ wages. I decided to go back to university and I will do a Master’s Degree of Architecture. It will help me to become a registered architect in future.

(An interview with a built environment consultant in Sydney, 2019)

The market decline and the exit of foreign investors have required companies to upgrade their product offerings and contribute to improving professional competence in the workforce. These three salient implications can be examined through the theory of ‘habitus’ as well (

Table 2).

9. Conclusions

This paper used the lens of transnational habitus to examine the decline of foreign investment in Australian residential real estate, with a particular emphasis placed on the investment practices of Chinese foreign investors. The Chinese living and investment habitus has contributed to the off-the-plan apartment sales in Sydney during the ‘boom’ era of foreign real estate investment, while the protection of the local living habitus was undertaken by the Australian authorities through policy changes. Twenty in-depth interviews with real estate developers, built environment consultants, real estate agents, and Chinese buyers in Sydney highlighted the important role that individual practice habitus plays in influencing transnational real estate investment practices and policy creation. Analysis of the interviews highlighted three main implications of the decline in foreign real estate investment on the Australian housing industry.

Although the investment and living habitus were not the main causes for the boom of foreign real estate investment in Sydney, nor were the local living habitus and the discontent regarding foreign real estate investment major factors in instigating policy changes to limit foreign investors, it cannot be denied that they are influential factors. This paper’s main aim was to argue that transnational habitus is a viable new lens to explore such issues and the social and cultural dimensions of an individual’s transnational practice play an important role in their practice processes in transnational spaces.

The policy changes introduced in Australia by the government aimed to protect the local community’s legitimate rights and demands, effectively limiting the foreign investors’ activities in the real estate industry. The foreign investors ceased investing in Australia, shifting instead to other countries which were more aligned with their investment habitus. The loss of foreign investors in Australia has led to an apartment oversupply issue in capital cities such as Sydney and Brisbane. The resulting oversupply in the domestic housing market has contributed to the falling housing prices and a reduction in construction activities.

At the same time, this paper also highlighted the influential role of dualistic individual habitus in the increasingly globalized condition of the real estate market. In the case of Sydney, the off-the-plan apartment products were acceptable for the Chinese living habitus, as well as to purchase as ‘leverage investment’ to earn a significant profit during the housing market boom period from 2013 to 2017. In 2017, both the Australian and Chinese governments acted to restrict transnational investment. The Australian government controlled speculative housing demand, moderating housing prices to enable more local buyers to achieve homeownership. The authorities also considered the local community’s discontent in the housing market and the obvious alteration of neighboring built environments caused by the dramatic growth of foreign investment. The Australian government policymakers protected the local individual’s living habitus by limiting foreign investors’ activities.

Through analysis of the interviews, the results highlighted the impact of the decline of foreign real estate investment in Australia, but further exploration is necessary. Thus, the three potential implications have been put forward for future research. First, as housing construction activities are reduced and housing prices fall, the foreign investors leave the Australian housing market. In reaction to the slowing down of the construction activities, the workforce in the Australian real estate sector now faces a competitive situation. The final implication suggests that the loss of foreign investors in the Australian market requires the housing product to be changed to satisfy different buyer groups in order to remain economically viable.