The Common Good Provision Scale (CGP): A Tool for Assessing People’s Orientation towards Economic and Social Sustainability

Abstract

1. Introduction

2. Materials and Methods

2.1. Participants and Design

2.2. Measures

2.3. Statistical Analysis

3. Results

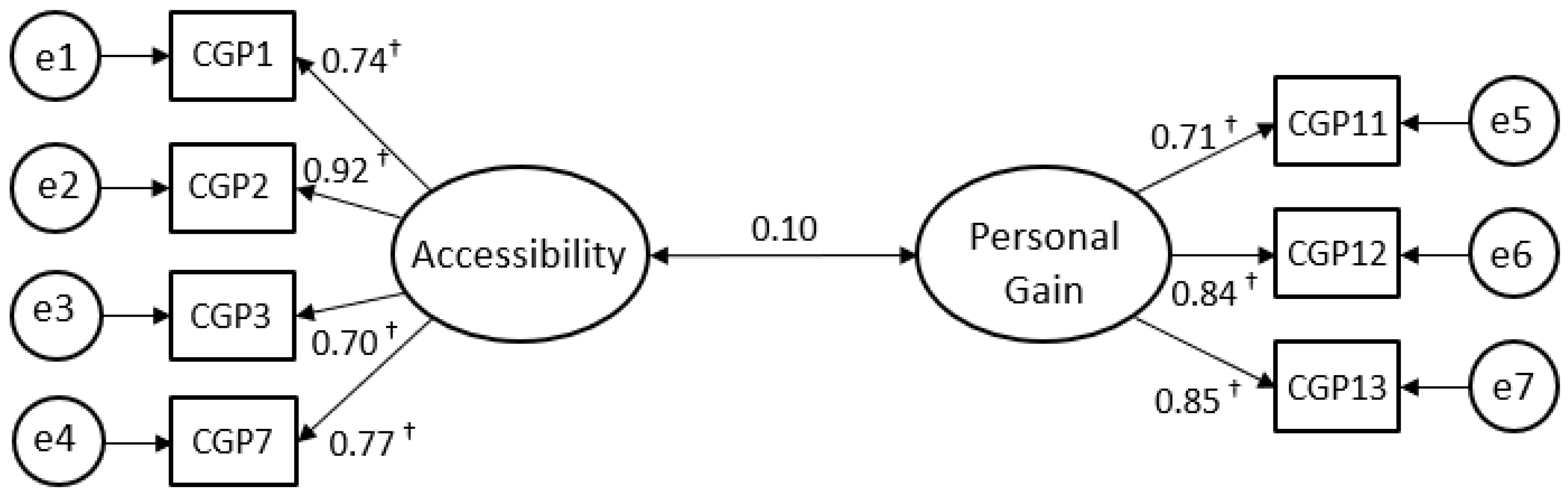

3.1. Scale Structure and Psychometric Properties

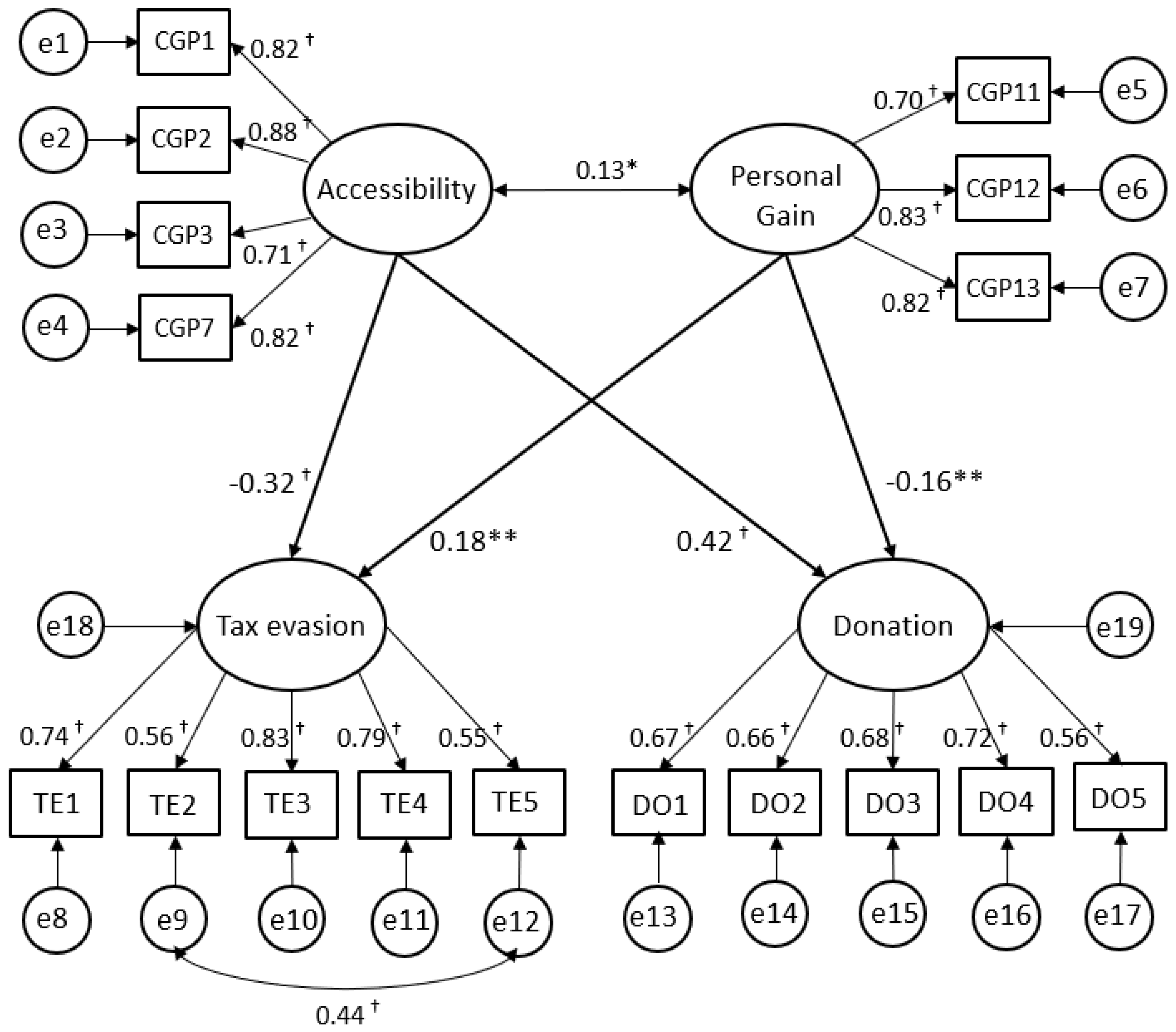

3.2. Nomological Network Analysis and Criterion Validity

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Donation Scale (DO) | |

|---|---|

| Si immagini le seguenti situazioni che descrivono come Lei potrebbe effettuare delle donazioni in beneficenza. Per favore, indichi quanto sia probabile la scelta delle seguenti possibilità su una scala da 1 a 9 (1 = per nulla probabile, 9 = estremamente probabile) | |

| [Imagine the following situations that describe how you could make a charitable donation. On a scale from 1 to 9 (1 = not at all likely, 9= extremely likely), please indicate how likely it is that you would make a donation] | |

| DO1 | Potrebbe vedere in televisione lo spot di una grande associazione che si impegna a migliorare le condizioni di vita dei bambini in Africa. Quanto è probabile che decida di effettuare una donazione a favore di questa associazione? |

| [You could see on TV a campaign from a big organization that is committed to improving the life conditions of African children. How likely it is that you would make a donation to this organization?] | |

| DO2 | Potrebbe sentir parlare di un’importante associazione ambientalista che si occupa della salvaguardia e tutela dell’ambiente a livello internazionale. Quanto è probabile che decida di effettuare una donazione a favore di questa associazione? |

| [You could hear about an important environmental organization that is committed to safeguarding the environment at international level. How likely it is that you would make a donation to this organization?] | |

| DO3 | Potrebbe vedere nella piazza della sua città un banchetto che promuove una prestigiosa associazione impegnata nella ricerca e nella lotta contro il cancro. Quanto è probabile che decida di effettuare una donazione a favore di questa associazione? |

| [You could see in your town square a stand that promotes a well-known organization that is committed to fighting against cancer. How likely it is that you would make a donation to this organization?] | |

| DO4 | Recentemente alcune città italiane sono state colpite da una scossa di terremoto. Un’associazione che opera sul territorio nazionale si sta impegnando nel dare supporto ai terremotati. Quanto è probabile che decida di effettuare una donazione a favore di questa associazione? |

| [An earthquake recently struck some Italian cities. A national association is committed to supporting the victims. How likely it is that you would make a donation to this organization?] | |

| DO5 | Potrebbe venire a conoscenza di un’associazione locale che opera a favore della sua comunità di appartenenza. Quanto è probabile che decida di effettuare una donazione a favore di questa associazione? |

| [You could become aware of a local association that works to support your local community. How likely it is that you would make a donation to this organization?] | |

References

- Keeble, B.R. The Brundtland report: Our common future. Med. War 1988, 4, 17–25. [Google Scholar] [CrossRef]

- Di Fabio, A. Intrapreneurial Self-Capital: A New Construct for the 21st Century. J. Employ. Couns. 2014, 51, 98–111. [Google Scholar] [CrossRef]

- Di Fabio, A.; Kenny, M.E. From Decent Work to Decent Lives: Positive Self and Relational Management (PS&RM) in the Twenty-First Century. Front. Psychol. 2016, 7. [Google Scholar] [CrossRef]

- Di Fabio, A.; Rosen, M.A. Opening the Black Box of Psychological Processes in the Science of Sustainable Development: A New Frontier. Eur. J. Sustain. Dev. Res. 2018, 2, 47. [Google Scholar] [CrossRef]

- Di Fabio, A. The psychology of sustainability and sustainable development for well-being in organizations. Front. Psychol. 2017, 8, 1534. [Google Scholar] [CrossRef] [PubMed]

- Etzioni, A. Common Good. The Encyclopedia of Political Thought; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2014; pp. 603–610. [Google Scholar]

- Mastromatteo, G.; Solari, S. The Idea of “Common Good” and the Role of the State in Present Day Social Economics. Riv. Int. Sci. Soc. 2014, 1, 85–102. [Google Scholar]

- Plant, R. Modern Political Thought; Blackwell: Oxford, UK, 1991. [Google Scholar]

- Musgrave, R.A. Cost-Benefit Analysis and the Theory of Public Finance. J. Econ. Lit. 1969, 7, 797–806. [Google Scholar]

- Samuelson, P.A. Contrast between Welfare Conditions for Joint Supply and for Public Goods. Rev. Econ. Stat. 1969, 51, 26–30. [Google Scholar] [CrossRef]

- Murphy, T.; Parkey, J. An economic analysis of the philosophical common good. Int. J. Soc. Econ. 2016, 43, 823–840. [Google Scholar] [CrossRef]

- Castiglioni, C.; Lozza, E.; Bosio, A.C. Lay People Representations on the Common Good and Its Financial Provision. Sage Open 2018, 8. [Google Scholar] [CrossRef]

- Felber, C. Change Everything: Creating an Economy for the Common Good; Zed Books Ltd.: London, UK, 2015. [Google Scholar]

- Barham, L.; Eagleson, M. Sustainability agendas in education and employment: Approaches and dilemmas. Presented at Green Guidance: A Time for Action. In Proceedings of the Green Guidance: A Time for Action, Symposium Conducted at the IAEVG International Conference, Montpellier, France, 24–27 September 2013. [Google Scholar]

- Schiefer, D.; van der Noll, J. The Essentials of Social Cohesion: A Literature Review. Soc. Indic. Res. 2017, 132, 579–603. [Google Scholar] [CrossRef]

- Council of Europe. Concerted Development of Social Cohesion Indicators. Method Guide; Council of Europe Publishing: Strasbourg, France, 2005. [Google Scholar]

- Jenson, J. Mapping Social Cohesion: The State of Canadian Research; Canadian Policy Research Networks: Ottawa, CA, USA, 1998. [Google Scholar]

- Schmeets, H.; Te Riele, S. Declining Social Cohesion in The Netherlands? Soc. Indic. Res. 2014, 115, 791–812. [Google Scholar] [CrossRef]

- Castiglioni, C.; Lozza, E.; van Dijk, E.; van Dijk, W.W. Two sides of the same coin? An investigation on the effects of frames on tax compliance and charitable giving. Palgr. Commun. 2019. under review. [Google Scholar]

- Lozza, E.; Bonanomi, A.; Castiglioni, C.; Bosio, A.C. Consumer sentiment after the global financial crisis. J. Mark. Res. Soc. 2016, 58, 671–691. [Google Scholar] [CrossRef]

- Lozza, E.; Castiglioni, C.; Bonanomi, A. The effects of changes in job insecurity on daily consumption and major life decisions. Econ. Ind. Dem. 2017. Available online: https://journals.sagepub.com/doi/full/10.1177/0143831X17731611 (accessed on 6 January 2019). [CrossRef]

- Castiglioni, C.; Lozza, E.; Cullis, J.; Jones, P.; Lewis, A. Is benefit fraud more or less wrong than tax evasion? An exploratory study in the perspective of fiscal psychology. Psic. Soc. 2014, 9, 291–308. [Google Scholar]

- Cullis, J.; Jones, P.; Lewis, A.; Castiglioni, C.; Lozza, E. Do poachers make harsh gamekeepers? Attitudes to tax evasion and to benefit fraud. J. Behav. Exp. Econ. 2015, 58, 124–131. [Google Scholar] [CrossRef]

- Lozza, E.; Castiglioni, C. Tax climate in the national press: A new tool in tax behaviour research. J. Soc. Pol. Psychol. 2018, 6, 401–419. [Google Scholar] [CrossRef]

- Cronbach, L.J.; Meehl, P.E. Construct validity in psychological tests. Psychol. Bull. 1955, 52, 281–302. [Google Scholar] [CrossRef] [PubMed]

- Doolittle, A.; Faul, A.C. Civic Engagement Scale: A Validation Study. Sage Open 2013, 3. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations Across Nations; Sage publications: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Yoo, B.; Donthu, N.; Lenartowicz, T. Measuring Hofstede’s five dimensions of cultural values at the individual level: Development and validation of CVSCALE. J. Int. Consum. Mark. 2011, 23, 193–210. [Google Scholar]

- Kirchler, E.; Wahl, I. Tax compliance inventory TAX-I: Designing an inventory for surveys of tax compliance. J. Econ. Psychol. 2010, 31, 331–346. [Google Scholar] [CrossRef] [PubMed]

- Berti, C.; Kastlunger, B.; Kirchler, E. The slippery slope of the tax behavior: Italian validation of a compliance inventory. Giornale Italiano di Psicologia 2013, 40, 377–408. [Google Scholar]

- Conway, J.M.; Huffcutt, A.I. A review and evaluation of exploratory factor analysis practices in organizational research. Organ. Res. Methods 2003, 6, 147–168. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis, 7th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 1998. [Google Scholar]

- Arbuckle, J.L. Amos 5.0; Amos Development Corporation: Chicago, IL, USA, 2003. [Google Scholar]

- Hu, L.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. Mulidscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Beavers, A.S.; Lounsbury, J.W.; Richards, J.K.; Huck, S.W.; Skolits, G.J.; Esquivel, S.L. Practical Considerations for Using Exploratory Factor Analysis in Educational Research. Pract. Assess. Res. Eval. 2013, 18. [Google Scholar]

- Lerner, M.J. The Belief in a Just World: A Fundamental Delusion; Lerner, M.J., Ed.; Springer US: Boston, MA, USA, 1980; pp. 247–269. [Google Scholar]

- Adams, J.S. Towards an understanding of inequity. J. Abnorm. Soc. Psychol. 1963, 67, 422–436. [Google Scholar] [CrossRef]

- Walster, E.; Walster, G.W.; Berscheid, E. Equity: Theory and Research; Allyn & Bacon: Boston, MA, USA, 1978. [Google Scholar]

- Ramayah, T.; Rahbar, E. Greening the Environment through Recycling: An Empirical Study. Manag. Environ. Qual. Int. J. 2013, 24, 782–801. [Google Scholar] [CrossRef]

- Lozza, E.; Cornaggia, C.; Castiglioni, C. Il recupero di antichi habiti: un’indagine storica e psicologica sul consumo di abbigliamento usato. Psic. Soc. 2018, in press. [Google Scholar]

- Castiglioni, C.; Lozza, E.; Libreri, C.; Anselmi, P. Increasing employability in the emerging tourism sector in Mozambique: Results of a qualitative study. Dev. S. Afr. 2017, 34, 245–259. [Google Scholar] [CrossRef]

- Niebuur, J.; van Lente, L.; Liefbroer, A.C.; Steverink, N.; Smidt, N. Determinants of Participation in Voluntary Work: A Systematic Review and Meta-analysis of Longitudinal Cohort Studies. BMC Public Health 2018, 18, 1213. [Google Scholar] [CrossRef] [PubMed]

- Organ, D.W. Organizational Citizenship Behavior: It’s Construct Clean-Up Time. Hum. Perform. 1997, 10, 85–97. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Scaratti, G.; Ivaldi, S.; Frassy, J. Networking and Knotworking Practices: Work Integration as Situated Social Process. J. Workplace Learn. 2017, 29, 2–23. [Google Scholar] [CrossRef]

- Scaratti, G.; Ivaldi, S. Manager on the Ground. A Practice Based Approach for Developing Management Education: Lessons from Complex and Innovative Organizations. Bollettino di Psicologia Applicata 2015, 272, 42–57. [Google Scholar]

- Hadorn, G.H.; Bradley, D.; Pohl, C.; Rist, S.; Wiesmann, U. Implications of transdisciplinarity for sustainability research. Ecol. Econ. 2006, 60, 119–128. [Google Scholar] [CrossRef]

- Costanza, R.; Daly, H.E.; Bartholomew, J.W. Goals, agenda, and policy recommendations for ecological economics. In Ecological Economics: The Science and Management of Sustainability; Costanza, R., Ed.; Columbia University Press: New York, NY, USA, 1991; pp. 1–20. [Google Scholar]

| Common Good Provision (CGP) | |

|---|---|

| Se contribuisco al bene comune lo faccio soprattutto per… [If I provide for the common good, I do so…] | |

| CGP1 | …per contribuire a soddisfare le necessità di tutti |

| […to provide for everyone’s needs] | |

| CGP2 | …per garantire la sua accessibilità a tutti |

| […to make it accessible to everyone] | |

| CGP3 | …per non avere cittadini di serie A e di serie B |

| […not to have first and second-class citizens] | |

| CGP4 | …per aumentare i servizi e i comfort a disposizione |

| […to increase services and amenities available] | |

| CGP5 | …per aumentare sempre di più il benessere |

| […to increase general wellbeing] | |

| CGP6 | … per avere una serie di servizi che semplificano la vita |

| […to have a number of services that make life easier] | |

| CGP7 | …per garantire il suo accesso gratuito a tutti |

| […to make it free for anyone to access] | |

| CGP8 | … per garantire l’uguaglianza nella nostra società |

| […to have an equal and just society] | |

| CGP9 | …perchè altrimenti rischieremmo di perderlo |

| […because we may otherwise risk losing it] | |

| CGP10 | …per salvaguardare i beni che ci circondano |

| […to safeguard the goods that surround us] | |

| CGP11 | …anche per avere un ritorno personale |

| […to get a personal return] | |

| CGP12 | …perchè so che ne trarrò beneficio anche a livello personale |

| […because I know I will also benefit on personal level] | |

| CGP13 | …perchè so che ne trarrò vantaggio anch'io |

| […because I know it will be advantageous to me] | |

| CGP14 | … perché significa contribuire anche al mio benessere personale |

| […because it will also provide for my personal wellbeing] | |

| Item | M | SD | Md | A | K |

|---|---|---|---|---|---|

| CGP1 | 6.38 | 1.80 | 6 | −0.70 | 0.63 |

| CGP2 | 6.46 | 1.78 | 7 | −0.74 | 0.52 |

| CGP3 | 6.24 | 2.06 | 6 | −0.59 | −0.05 |

| CGP4 | 6.50 | 1.69 | 7 | −0.68 | 0.59 |

| CGP5 | 6.36 | 1.70 | 6 | −0.57 | 0.66 |

| CGP6 | 6.53 | 1.81 | 7 | −0.88 | 0.83 |

| CGP7 | 6.00 | 1.92 | 6 | −0.46 | −0.09 |

| CGP8 | 6.38 | 1.89 | 7 | −0.67 | 0.49 |

| CGP9 | 6.46 | 1.82 | 7 | −0.73 | 0.49 |

| CGP10 | 6.64 | 1.53 | 7 | −0.54 | 0.71 |

| CGP11 | 4.73 | 2.24 | 5 | −0.11 | −0.89 |

| CGP12 | 5.46 | 2.18 | 6 | −0.40 | −0.58 |

| CGP13 | 5.58 | 2.12 | 6 | −0.51 | −0.25 |

| CGP14 | 6.07 | 1.94 | 6 | −0.75 | 0.40 |

| CGP1 | CGP2 | CGP3 | CGP4 | CGP5 | CGP6 | CGP7 | CGP8 | CGP9 | CGP10 | CGP11 | CGP12 | CGP13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CGP1 | 1.00 | ||||||||||||

| CGP2 | 0.76 † | 1.00 | |||||||||||

| CGP3 | 0.61 † | 0.62 † | 1.00 | ||||||||||

| CGP4 | 0.39 † | 0.41 † | 0.36 † | 1.00 | |||||||||

| CGP5 | 0.44 † | 0.40 † | 0.31 † | 0.55 † | 1.00 | ||||||||

| CGP6 | 0.40 † | 0.40 † | 0.36 † | 0.62 † | 0.49 † | 1.00 | |||||||

| CGP7 | 0.70 † | 0.70 † | 0.62 † | 0.44 † | 0.49 † | 0.40 † | 1.00 | ||||||

| CGP8 | 0.64 † | 0.67 † | 0.70 † | 0.32 † | 0.40 † | 0.38 † | 0.63 † | 1.00 | |||||

| CGP9 | 0.53 † | 0.49 † | 0.37 † | 0.39 † | 0.41 † | 0.42 † | 0.46 † | 0.34 † | 1.00 | ||||

| CGP10 | 0.47 † | 0.44 † | 0.28 † | 0.42 † | 0.45 † | 0.34 † | 0.36 † | 0.36 † | 0.54 † | 1.00 | |||

| CGP11 | −0.05 | 0.06 | 0.05 | 0.22 † | 0.21 † | 0.28 † | −0.02 | −0.01 | 0.07 | 0.05 | 1.00 | ||

| CGP12 | 0.15 * | 0.13 * | 0.09 | 0.35 † | 0.30 † | 0.36 † | 0.13 * | 0.10 | 0.20 ** | 0.16 ** | 0.57 † | 1.00 | |

| CGP13 | 0.10 | 0.18 ** | 0.08 | 0.38 † | 0.26 † | 0.38 † | 0.17 ** | 0.08 | 0.21 † | 0.22 † | 0.55 † | 0.66 † | 1.00 |

| CGP14 | 0.31 † | 0.30 † | 0.26 † | 0.54 † | 0.44 † | 0.47 † | 0.32 † | 0.29 † | 0.46 † | 0.41 † | 0.35 † | 0.57 † | 0.53 † |

| Common Good Provision (CGP) | ||

|---|---|---|

| Se contribuisco al bene comune lo faccio soprattutto per… [If I provide for the common good, I do so…] | ||

| Accessibility | CGP1 | …per contribuire a soddisfare le necessità di tutti |

| […to provide for everyone’s needs] | ||

| CGP2 | …per garantire la sua accessibilità a tutti | |

| […to make it accessible to everyone] | ||

| CGP3 | …per non avere cittadini di serie A e di serie B | |

| […not to have first and second-class citizens] | ||

| CGP7 | …per garantire il suo accesso gratuito a tutti | |

| […to make it free for anyone to access] | ||

| Personal Gain | CGP11 | …anche per avere un ritorno personale |

| […to get a personal return] | ||

| CGP12 | …perchè so che ne trarrò beneficio anche a livello personale | |

| […because I know I will also benefit on personal level] | ||

| CGP13 | …perchè so che ne trarrò vantaggio anch'io | |

| […because I know it will be advantageous to me] | ||

| Scale | M | SD | Md | Skewness | Kurtosis | Alpha | Accessibility |

| Accessibility | 6.27 | 1.64 | 6.25 | −0.57 | 0.69 | 0.89 | 1.00 |

| Personal Gain | 5.26 | 1.86 | 5.33 | −0.32 | −0.33 | 0.81 | 0.12 * |

| CGP | CES att | CES beh | CO |

|---|---|---|---|

| Accessibility | 0.57 † | 0.33 † | 0.40 † |

| Personal Gain | 0.01 | 0.00 | −0.04 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Castiglioni, C.; Lozza, E.; Bonanomi, A. The Common Good Provision Scale (CGP): A Tool for Assessing People’s Orientation towards Economic and Social Sustainability. Sustainability 2019, 11, 370. https://doi.org/10.3390/su11020370

Castiglioni C, Lozza E, Bonanomi A. The Common Good Provision Scale (CGP): A Tool for Assessing People’s Orientation towards Economic and Social Sustainability. Sustainability. 2019; 11(2):370. https://doi.org/10.3390/su11020370

Chicago/Turabian StyleCastiglioni, Cinzia, Edoardo Lozza, and Andrea Bonanomi. 2019. "The Common Good Provision Scale (CGP): A Tool for Assessing People’s Orientation towards Economic and Social Sustainability" Sustainability 11, no. 2: 370. https://doi.org/10.3390/su11020370

APA StyleCastiglioni, C., Lozza, E., & Bonanomi, A. (2019). The Common Good Provision Scale (CGP): A Tool for Assessing People’s Orientation towards Economic and Social Sustainability. Sustainability, 11(2), 370. https://doi.org/10.3390/su11020370