Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment

Abstract

1. Introduction

2. Research Objectives

3. Methodology

- (1)

- Performed a literature review of research about sustainable investment;

- (2)

- Developed a classification framework;

- (a)

- Codified the papers as per the classification;

- (3)

- Analysis of review;

- (4)

- Identification of gaps and setting-up of future research agenda.

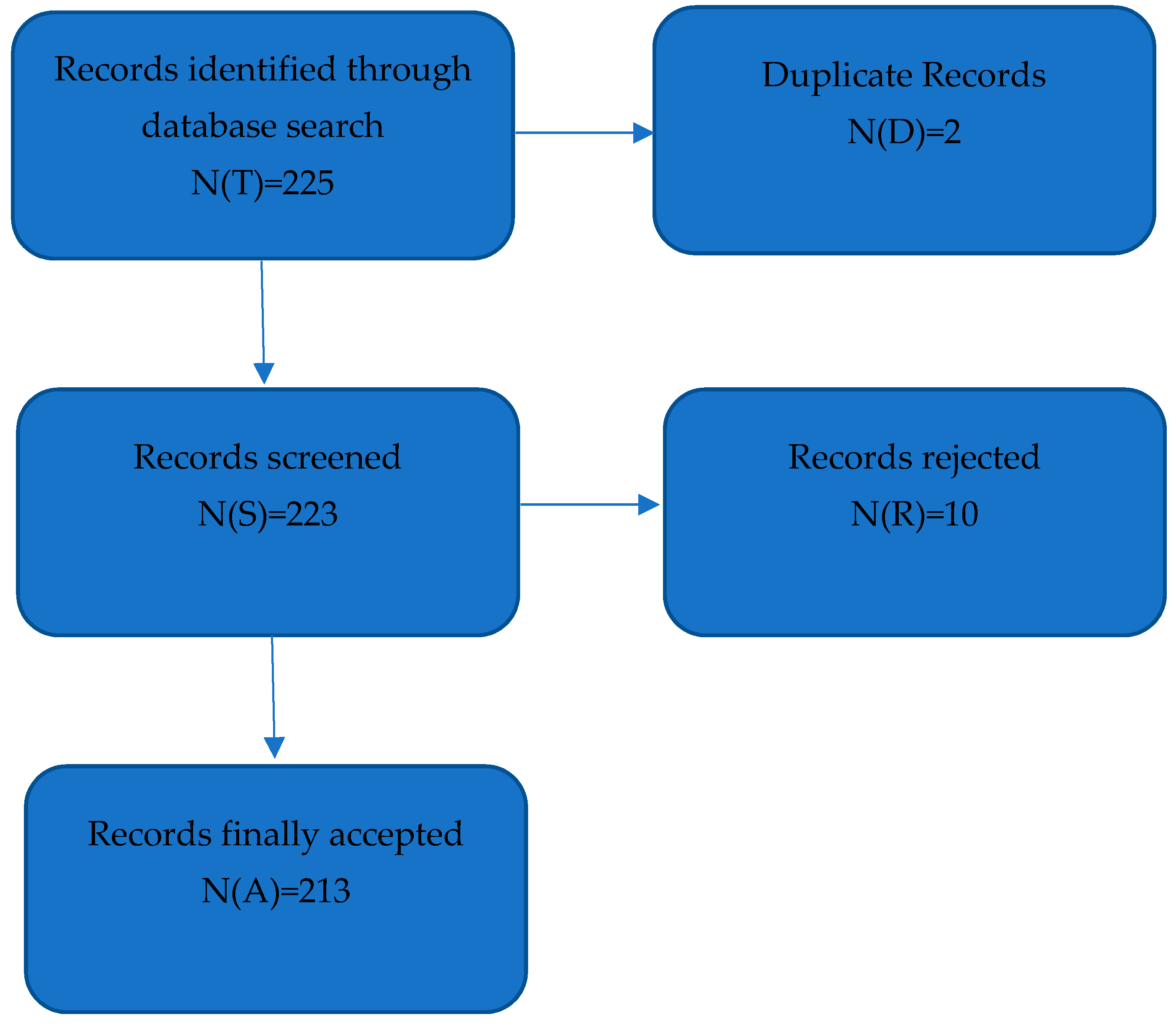

3.1. Flowchart Explaining Selection Process of Relevant Papers

3.2. Codes and Categories

4. Results and Discussion

4.1. Descriptive Analysis

4.1.1. Context

4.1.2. Geographic Region

4.1.3. Methodology

4.1.4. Topic

4.1.5. Approach

4.1.6. Results

4.1.7. Analysis Period

4.2. Thematic Discussion

4.2.1. Most Relevant Research Articles Related to Sustainable Investing and ESG

4.2.2. Methodology Adopted by the Existing Literature and Consequently the Perspectives Generated by the Results

4.2.3. Importance and Acceptability of ESG Framework as a Measure of Sustainable Investment Decision-Making Process

4.2.4. Variance in Existing Literature in Terms of Topic and Interchangeability of the Terms Sustainable Investment/Socially Responsible Investment/Responsible Investment/Ethical Investment/ESG Based Investment

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Carolina Rezende de Carvalho Ferreira, M.; Amorim Sobreiro, V.; Kimura, H.; Luiz de Moraes Barboza, F. A systematic review of literature about finance and sustainability. J. Sustain. Finance Invest. 2016, 6, 112–147. [Google Scholar] [CrossRef]

- Davies, P. The relevance of systematic reviews to educational policy and practice. Oxf. Rev. Educ. 2000, 26, 365–378. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed Management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Jabbour, C.J.C. Environmental training in organisations: From a literature review to a framework for future research. Resour. Conserv. Recycl. 2013, 74, 144–155. [Google Scholar] [CrossRef]

- Lage Junior, M.; Godinho Filho, M. Variations of the kanban system: Literature review and classification. Int. J. Prod. Econ. 2010, 125, 13–21. [Google Scholar] [CrossRef]

- Barker, R. Political Legitimacy and the State; Clarendon Press: Oxford, UK, 1990; ISBN 9780199682676. [Google Scholar]

- Epstein, M.J.; Yuthas, K. Measuring and Improving Social Impacts: A Guide for Nonprofits, Companies, and Impact Investors; Berrett-Koehler Publishers: San Francisco, CA, USA, 2014; ISBN 9781609949792. [Google Scholar]

- Richardson, B.J. Socially responsible investing for sustainability: Overcoming its incomplete and conflicting rationales. Transnatl. Environ. Law 2013, 2, 311–338. [Google Scholar] [CrossRef]

- Landier, A.; Nair, V.B. Investing for Change: Profit from Socially Responsible Investment; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review; Global Sustainable Investment Alliance: Washington, DC, USA, 2014. [Google Scholar]

- Croft, T. Up From Wall Street: The Responsible Investment Alternative; Cosimo Books: New York, NY, USA, 2009. [Google Scholar]

- Capelle-Blancard, G.; Monjon, S. Trends in the literature on socially responsible investment: Looking for the keys under the lamppost. Bus. Ethics 2012, 21, 239–250. [Google Scholar] [CrossRef]

- UNPRI Principles for Responsible Investors. The PRI is World’s Leading Proponent of Responsible Investment (2018, April). Available online: https://www.unpri.org (accessed on 10 Janurary 2018).

- O’Loughlin, J.; Thamotheram, R. Enhanced Analytics for a New Generation of Investor; University Superannuation Scheme: London, UK, 2006. [Google Scholar]

- Galbreath, J. ESG in Focus: The Australian Evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Bengtsson, E. A history of Scandinavian socially responsible investing. J. Bus. Ethics 2008, 82, 969–983. [Google Scholar] [CrossRef]

- Sreekumar Nair, A.; Ladha, R. Determinants of non-economic investment goals among Indian investors. Corp. Gov. Int. J. Bus. Soc. 2014, 14, 714–727. [Google Scholar] [CrossRef]

- Cadman, T. The Legitimacy of ESG Standards as an Analytical Framework for Responsible Investment. In Responsible Investment in Times of Turmoil; Springer: Dordrecht, The Netherlands, 2011; pp. 35–54. ISBN 978-94-007-4070-9. [Google Scholar]

- Hickman, K.A.; Teets, W.R.; Kohls, J.J. Social investing and modern portfolio theory. Am. Bus. Rev. 1999, 17, 72. [Google Scholar]

- Kempf, A.; Osthoff, P. SRI funds: Nomen est Omen. J. Bus. Finance Account. 2008, 35, 1276–1294. [Google Scholar] [CrossRef]

- Slager, R.; Gond, J.P.; Moon, J. Standardization as Institutional Work: The Regulatory Power of a Responsible Investment Standard. Organ. Stud. 2012, 33, 763–790. [Google Scholar] [CrossRef]

- Sharma, G.D.; Aryan, R.; Singh, S.; Kaur, T. A systematic review of literature about leadership and organization. Res. J. Bus. Manag. 2018, in press. [Google Scholar]

- Jain, M.; Sharma, G.D. Economics of Happiness: A systematic review and research agenda. In Proceedings of the BAM 2018 Conference Proceedings, Bristol, UK, 4–6 September 2018. [Google Scholar]

- Leme, A.; Martins, F.; Hornberger, K. The State of Impact Investing in Latin America: Regional Trends and Challenges Facing a Fast-Growing Investment Strategy; BAIN & COMPANY: Boston, MA, USA, 2014. [Google Scholar]

- Michelson, G.; Wailes, N.; Van Der Laan, S.; Frost, G. Ethical investment processes and outcomes. J. Bus. Ethics 2004, 52, 1–10. [Google Scholar] [CrossRef]

- Saltuk, Y.; El Idrissi, A. A Portfolio Approach to Impact Investment; JPMorgan Chase & Co.: London, UK, 2012. [Google Scholar]

- UNEP FI; UN Global Compact. Responsible Investment and Hedge Funds: A Discussion Paper; United Nations Environment Programme Finance Initiative (UNEP FI), United Nations Global Compact: Geneva, Switzerland, 2012. [Google Scholar]

- Herringer, A.; Firer, C.; Viviers, S. Key challenges facing the socially responsible investment (SRI) sector in South Africa. Invest. Anal. J. 2009, 2010, 11–26. [Google Scholar] [CrossRef]

- Kurtz, L.; Cooper, L.L.; Shimada, A. Sustainable Investing across Emerging Markets; Nelspon Capital: San Francisco, CA, USA, 2012. [Google Scholar]

- Schueth, S. Socially Responsible Investing in the United States. J. Bus. Ethics 2003, 43, 189–194. [Google Scholar] [CrossRef]

- Jones, S.; Van Der Laan, S.; Frost, G.; Loftus, J. The investment performance of socially responsible investment funds in Australia. J. Bus. Ethics 2008, 80, 181–203. [Google Scholar] [CrossRef]

- Social Impact Investment Taskforce. Impact Investment: The Invisible Heart of Markets; Social Impact Investment Taskforce: London, UK, 2014. [Google Scholar]

- Escrig-Olmedo, E.; María Rivera-Lirio, J.; Jesús Muñoz-Torres, M.; Ángeles Fernández-Izquierdo, M. Integrating multiple ESG investors’ preferences into sustainable investment: A fuzzy multicriteria methodological approach. J. Clean. Prod. 2017, 162, 1334–1345. [Google Scholar] [CrossRef]

- Höchstädter, A.K.; Scheck, B. What’s in a Name: An Analysis of Impact Investing Understandings by Academics and Practitioners. J. Bus. Ethics 2015, 132, 449–475. [Google Scholar] [CrossRef]

- Eccles, N.S.; Viviers, S. The Origins and Meanings of Names Describing Investment Practices that Integrate a Consideration of ESG Issues in the Academic Literature. J. Bus. Ethics 2011, 104, 389–402. [Google Scholar] [CrossRef]

- Sandberg, J.; Juravle, C.; Hedesström, T.M.; Hamilton, I. The heterogeneity of socially responsible investment. J. Bus. Ethics 2009, 87, 519–533. [Google Scholar] [CrossRef]

- Jitmaneeroj, B. Reform priorities for corporate sustainability. Manag. Decis. 2016, 54, 1497–1521. [Google Scholar] [CrossRef]

- Giamporcaro, S.; Pretorius, L. Sustainable and responsible investment (SRI) in South Africa: A limited adoption of environmental criteria. Invest. Anal. J. 2012, 41, 1–19. [Google Scholar] [CrossRef]

- Tamimi, N.; Sebastianelli, R. Transparency among S&P 500 companies: An analysis of ESG disclosure scores. Manag. Decis. 2017, 55, 1660–1680. [Google Scholar]

- Czerwińska, T.; Kaźmierkiewicz, P. ESG Rating in Investment Risk Analysis of Companies Listed on the Public Market in Poland. Econ. Notes 2015, 44, 211–248. [Google Scholar] [CrossRef]

- Dumas, C.; Louche, C. Collective Beliefs on Responsible Investment. Bus. Soc. 2016, 55, 427–457. [Google Scholar] [CrossRef]

- Revelli, C. Socially responsible investing (SRI): From mainstream to margin? Res. Int. Bus. Finance 2017, 39, 711–717. [Google Scholar] [CrossRef]

- Avetisyan, E.; Hockerts, K. The Consolidation of the ESG Rating Industry as an Enactment of Institutional Retrogression. Bus. Strategy Environ. 2017, 26, 316–330. [Google Scholar] [CrossRef]

- Lokuwaduge, C.S.D.S.; Heenetigala, K. Integrating Environmental, Social and Governance (ESG) Disclosure for a Sustainable Development: An Australian Study. Bus. Strategy Environ. 2017, 26, 438–450. [Google Scholar] [CrossRef]

- Paul, K. The effect of business cycle, market return and momentum on financial performance of socially responsible investing mutual funds. Soc. Responsib. J. 2017, 13, 513–528. [Google Scholar] [CrossRef]

- Chava, S.; Roberts, M.R. How Does Financing Impact Investment? J. Finance 2008, 63, 2085–2121. [Google Scholar] [CrossRef]

- Galema, R.; Plantinga, A.; Scholtens, B. The stocks at stake: Return and risk in socially responsible investment. J. Bank. Finance 2008, 32, 2646–2654. [Google Scholar] [CrossRef]

- Tsai, W.-H.; Chou, W.-C.; Hsu, W. The Sustainability Balanced Scorecard as a Framework for Selecting Socially Responsible Investment: An Effective MCDM Model Linked references are available on JSTOR for this article: The sustainability balanced scorecard as a framework for selecting soc. J. Oper. Res. Soc. 2009, 60, 1396–1410. [Google Scholar] [CrossRef]

- Hill, R.P.; Ainscough, T.; Shank, T.; Manullang, D. Corporate social responsibility and socially responsible investing: A global perspective. J. Bus. Ethics 2007, 70, 165–174. [Google Scholar] [CrossRef]

- Rosen, B.N.; Sandler, D.M.; Shani, D. Social Issues and Socially Responsible Investment Behavior: A Preliminary Empirical Investigation. J. Consum. Aff. 1991, 25, 221–234. [Google Scholar] [CrossRef]

- Lewis, A.; Mackenzie, C. Morals, money, ethical investing and economic psychology. Hum. Relations 2000, 53, 179–191. [Google Scholar] [CrossRef]

- Déjean, F.; Gond, J.-P.; Leca, B. Measuring the Unmeasured: An Institutional Entrepreneur Strategy in an Emerging Industry. Hum. Relat. 2004, 57, 741–764. [Google Scholar] [CrossRef]

- Lawrence, T.; Suddaby, R.; Leca, B. Institutional Work: Refocusing Institutional Studies of Organization. J. Manag. Inq. 2010, 20, 52–58. [Google Scholar] [CrossRef]

- Bakshi, R. Transforming markets in the 21st century: Socially responsible investing as a tool. Futures 2007, 39, 523–533. [Google Scholar] [CrossRef]

- Ghahramani, S. Sovereigns, Socially Responsible Investing, and the Enforcement of International Law Through Portfolio Investment and Shareholder Activism: The Three Models. Univ. PA J. Int. Law 2014, 35, 1073. [Google Scholar]

- Kiernan, M.J. Universal owners and ESG: Leaving money on the table? Corp. Gov. Int. Rev. 2007, 15, 478–485. [Google Scholar] [CrossRef]

- Martin, W. Socially responsible investing: Is your fiduciary duty at risk? J. Bus. Ethics 2009, 90, 549–560. [Google Scholar] [CrossRef]

- Pilaj, H. The Choice Architecture of Sustainable and Responsible Investment: Nudging Investors Toward Ethical Decision-Making. J. Bus. Ethics 2017, 140, 743–753. [Google Scholar] [CrossRef]

- Sievänen, R.; Sumelius, J.; Islam, K.M.Z.; Sell, M. From struggle in responsible investment to potential to improve global environmental governance through UN PRI. Int. Environ. Agreem. Polit. Law Econ. 2013, 13, 197–217. [Google Scholar] [CrossRef]

- Yung, R.; Siew, J. Critical Evaluation of Environmental, Social and Governance Disclosures of Malaysian Property and Construction Companies. Constr. Econ. Build. 2017, 17, 81–91. [Google Scholar]

- Gripne, S.L.; Kelley, J.; Merchant, K. Laying the Groundwork for a National Impact Investing Marketplace. Found. Rev. 2016, 8, 53–67. [Google Scholar] [CrossRef]

- Shi, X.; Qian, Y.; Dong, C. Economic and Environmental Performance of Fashion Supply Chain: The Joint Effect of Power Structure and Sustainable Investment. Sustainability 2017, 9, 961. [Google Scholar] [CrossRef]

- Nilsson, J. Investment with a conscience: Examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behavior. J. Bus. Ethics 2008, 83, 307–325. [Google Scholar] [CrossRef]

- Glac, K. Understanding socially responsible investing: The effect of decision frames and trade-off options. J. Bus. Ethics 2009, 87, 41–55. [Google Scholar] [CrossRef]

- Revelli, C. Re-embedding financial stakes within ethical and social values in socially responsible investing (SRI). Res. Int. Bus. Finance 2016, 38, 1–5. [Google Scholar] [CrossRef]

- Vanwalleghem, D. The real effects of sustainable & responsible investing? Econ. Lett. 2017, 156, 10–14. [Google Scholar]

- Blank, H.; Sgambati, G.; Truelson, Z. Best Practices in ESG Investing. J. Investig. 2016, 25, 103–112. [Google Scholar] [CrossRef]

- Limkriangkrai, M.; Koh, S.K.; Durand, R.B. Environmental, Social, and Governance (ESG) Profiles, Stock Returns, and Financial Policy: Australian Evidence. Int. Rev. Finance 2017, 17, 461–471. [Google Scholar] [CrossRef]

- Adam, A.M.; Shavit, T. How can a ratings-based method for assessing corporate social responsibility (CSR) provide an incentive to firms excluded from socially responsible investment indices to invest in CSR? J. Bus. Ethics 2008, 82, 899–905. [Google Scholar] [CrossRef]

- Aggarwala, R.T.; Frasch, C.A. The Philanthropy As One Big Impact Investment: A Framework For Evaluating A Foundation’s Blended Performance. Found. Rev. 2017, 9, 2. [Google Scholar] [CrossRef]

- Ballestero, E.; Bravo, M.; Pérez-Gladish, B.; Arenas-Parra, M.; Plà-Santamaria, D. Socially Responsible Investment: A multicriteria approach to portfolio selection combining ethical and financial objectives. Eur. J. Oper. Res. 2012, 216, 487–494. [Google Scholar] [CrossRef]

- Fabretti, A.; Herzel, S. Delegated portfolio management with socially responsible investment constraints. Eur. J. Finance 2012, 18, 293–309. [Google Scholar] [CrossRef]

- Dam, L.; Scholtens, B. Toward a theory of responsible investing: On the economic foundations of corporate social responsibility. Resour. Energy Econ. 2015, 41, 103–121. [Google Scholar] [CrossRef]

- Bilbao-Terol, A.; Arenas-Parra, M.; Cañal-Fernández, V.; Bilbao-Terol, C. Multi-criteria decision making for choosing socially responsible investment within a behavioral portfolio theory framework: A new way of investing into a crisis environment. Ann. Oper. Res. 2016, 247, 549–580. [Google Scholar] [CrossRef]

- Lee, K.-H.; Cin, B.C.; Lee, E.Y. Environmental Responsibility and Firm Performance: The Application of an Environmental, Social and Governance Model. Bus. Strategy Environ. 2016, 25, 40–53. [Google Scholar] [CrossRef]

- Ortas, E.; Álvarez, I.; Garayar, A. The Environmental, Social, Governance, and Financial Performance Effects on Companies that Adopt the United Nations Global Compact. Sustainability 2015, 7, 1932–1956. [Google Scholar] [CrossRef]

- Humphrey, J.E.; Lee, D.D.; Shen, Y. The independent effects of environmental, social and governance initiatives on the performance of UK firms. In Proceedings of the 23rd Australasian Finance and Banking Conference, Sydney, Australia, 15–17 December 2010; pp. 1–33. [Google Scholar]

- Talan, G.; Sharma, G.D. From business goals to societal goals via sustainable investment: An integrative review and research agenda. World Rev. Entrep. Manag. Sust. Dev. 2019. In Press. [Google Scholar]

- Del Bosco, B.; Misani, N. The effect of cross-listing on the environmental, social, and governance performance of firms. J. World Bus. 2016, 51, 977–990. [Google Scholar] [CrossRef]

- Sakuma, K.; Louche, C. Socially responsible investment in Japan: Its mechanism and drivers. J. Bus. Ethics 2008, 82, 425–448. [Google Scholar] [CrossRef]

- Sandberg, J. Socially Responsible Investment and Fiduciary Duty: Putting the Freshfields Report into Perspective. J. Bus. Ethics 2011, 101, 143–162. [Google Scholar] [CrossRef]

- Syed, A.M. Environment, social, and governance (ESG) criteria and preference of managers. Cogent Bus. Manag. 2017, 4, 1–13. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Crifo, P.; Forget, V.D.; Teyssier, S. The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. J. Corp. Finance 2015, 30, 168–194. [Google Scholar] [CrossRef]

- Dembinski, P.H.; Bonvin, J.M.; Dommen, E.; Monnet, F.-M. The Ethical foundation of Responsible Investment. J. Bus. Ethics 2003, 48, 203–213. [Google Scholar] [CrossRef]

- Du Rietz, S. When accounts become information: A study of investors’ ESG analysis practice. Scand. J. Manag. 2014, 30, 395–408. [Google Scholar] [CrossRef]

- Jansson, M.; Biel, A. Motives to engage in sustainable investment: A comparison between institutional and private investors. Sustain. Dev. 2011, 19, 135–142. [Google Scholar] [CrossRef]

- Kolstad, I. Three questions about engagement and exclusion in responsible investment. Bus. Ethics 2016, 25, 45–58. [Google Scholar] [CrossRef]

- Richardson, B.J. Keeping ethical investment ethical: Regulatory issues for investing for sustainability. J. Bus. Ethics 2009, 87, 555–572. [Google Scholar] [CrossRef]

- Schwartz, M.S. The “Ethics” of Ethical Investing. J. Bus. Ethics 2003, 43, 195–213. [Google Scholar] [CrossRef]

- De Zwaan, L.; Brimble, M.; Stewart, J. Member perceptions of ESG investing through superannuation. Sustain. Account. Manag. Policy J. 2015, 6, 79–102. [Google Scholar] [CrossRef]

- Eccles, N.S. UN principles for responsible investment signatories and the anti-apartheid SRI movement: A thought experiment. J. Bus. Ethics 2010, 95, 415–424. [Google Scholar] [CrossRef]

- Paetzold, F.; Busch, T. Unleashing the Powerful Few: Sustainable Investing Behaviour of Wealthy Private Investors. Organ. Environ. 2014, 27, 347–367. [Google Scholar] [CrossRef]

- Viviers, S.; Eccles, N.S.; Jongh, D.; Bosch, J.K.; Smit, E. v. d. M.; Buijs, A. Responsible investing in South Africa: Drivers, barriers and enablers. S. Afr. J. Bus. Manag. 2008, 39, 37–50. [Google Scholar]

- Carter, N.; Huby, M. Ecological citizenship and ethical investment. Env. Polit. 2005, 14, 255–272. [Google Scholar] [CrossRef]

- Mörth, U. Organizational Legitimation in the Age of Governing by Numbers: The Case of Regulatory Partnerships on ESG Issues and Financial Decisions. Globalizations 2014, 11, 369–384. [Google Scholar] [CrossRef]

- Nagy, Z.; Kassam, A.; Lee, L.-E. Can ESG Add Alpha? An Analysis of ESG Tilt and Momentum Strategies. J. Investig. 2016, 25, 113–124. [Google Scholar] [CrossRef]

- Przychodzen, J.; Gómez-Bezares, F.; Przychodzen, W.; Larreina, M. ESG issues among fund managers-factors and motives. Sustainability 2016, 8, 1078. [Google Scholar] [CrossRef]

- Rivoli, P. Making a Difference or Making a Statement? Finance Research and Socially Responsible Investment. Bus. Ethics Q. 2003, 13, 271–287. [Google Scholar] [CrossRef]

- Van Duuren, E.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Chelawat, H.; Trivedi, I.V. The business value of ESG performance: The Indian context. Asian J. Bus. Ethics 2016, 5, 195–210. [Google Scholar] [CrossRef]

- Soederberg, S. Socially responsible investment and the development agenda: Peering behind the progressive veil of non-financial benchmarking. Third World Q. 2007, 28, 1219–1237. [Google Scholar] [CrossRef]

- Amaeshi, K. Different markets for different folks: Exploring the challenges of mainstreaming responsible investment practices. J. Bus. Ethics 2010, 92, 41–56. [Google Scholar] [CrossRef]

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.; ángeles Muñoz-Torres, M.J. The effect of environmental, social and governance consistency on economic results. Sustainability 2016, 8, 1005. [Google Scholar] [CrossRef]

- Lee, D.D.; Humphrey, J.E.; Benson, K.L.; Ahn, J.Y.K. Socially responsible investment fund performance: The impact of screening intensity. Account. Finance 2010, 50, 351–370. [Google Scholar] [CrossRef]

- Mǎnescu, C. Stock returns in relation to environmental, social and governance performance: Mispricing or compensation for risk? Sustain. Dev. 2011, 19, 95–118. [Google Scholar] [CrossRef]

- Mitsuyama, N.; Shimizutani, S. Stock market reaction to ESG-oriented management: An event study analysis on a disclosing policy in Japan. Econ. Bull. 2015, 35, 1098–1108. [Google Scholar]

- Siew, R.Y.J. Predicting the behaviour of Australian ESG REITs using Markov chain analysis. J. Finance Manag. Prop. Constr. 2015, 20, 252–267. [Google Scholar] [CrossRef]

- Ortas, E.; Alvarez, I.; Garayar, A. The impact of institutional and social context on corporate environmental, social and governance performance of companies. J. Clean. Prod. 2015, 108, 673–684. [Google Scholar] [CrossRef]

- Soler-Domínguez, A.; Matallín-Sáez, J.C. Socially (ir)responsible investing? The performance of the VICEX Fund from a business cycle perspective. Finance Res. Lett. 2016, 16, 190–195. [Google Scholar] [CrossRef]

- Ur Rehman, R.; Zhang, J.; Uppal, J.; Cullinan, C.; Akram Naseem, M. Are environmental social governance equity indices a better choice for investors? An Asian perspective. Bus. Ethics 2016, 25, 440–459. [Google Scholar] [CrossRef]

| Category | Significance | Codes | Significance |

|---|---|---|---|

| 1 | Context | A | Developed Countries |

| B | Developing Countries | ||

| C | Not Specified | ||

| 2 | Geographic Region | A | USA and Canada |

| B | Europe | ||

| C | Japan, South Korea, Taiwan, and Singapore | ||

| D | Rest of Asia | ||

| E | Oceania | ||

| F | Rest of the world | ||

| G | Not Specified | ||

| 3 | Methodology | A | Concept/Model Building |

| B | Case Study | ||

| C | Empirical Testing | ||

| D | Review Paper | ||

| 4 | Topic | A | Socially Responsible/Ethical Investment |

| B | Responsible/Impact Investment | ||

| C | Sustainable Investment | ||

| D | ESG-based Investment | ||

| 5 | Approach | A | Advocates ESG approach |

| B | Gives a critique of ESG approach | ||

| C | Takes a neutral approach on ESG | ||

| D | Suggests a new approach other than ESG | ||

| E | Does not talk about ESG approach | ||

| 6 | Results | A | New Perspectives |

| B | Consistent with Literature | ||

| C | Reviews model with different dataset/time period | ||

| D | Comparative Study | ||

| 7 | Analysis Period | A | Less than 3 years |

| B | Between 3 and 5 years | ||

| C | Between 5 and 10 years | ||

| D | More than 10 Years | ||

| E | Not Applicable |

| Code(s) | Context | Geographic Region | Methodology | Topic | Approach | Results | Analysis Period |

|---|---|---|---|---|---|---|---|

| A | 124 (58%) | 31 (15%) | 25 (12%) | 110 (52%) | 56 (26%) | 55 (26%) | 11 (5%) |

| B | 19 (9%) | 41 (19%) | 25 (12%) | 23 (11%) | 32 (15%) | 69 (32%) | 10 (5%) |

| C | 69 (32%) | 8 (4%) | 60 (28%) | 12 (6%) | 19 (9%) | 44 (21%) | 23 (11%) |

| D | N/A | 11 (5%) | 35 (16%) | 21 (10%) | 5 (2%) | 45 (21%) | 101 (47%) |

| E | N/A | 12 (6%) | N/A | N/A | 101 (47%) | N/A | 68 (32%) |

| F | N/A | 6 (3%) | N/A | N/A | N/A | N/A | N/A |

| G | N/A | 70 (33%) | N/A | N/A | N/A | N/A | N/A |

| Multiple | 1 (0%) | 34 (16%) | 68 (32%) | 47 (22%) | 0 (0%) | 0 (0%) | 0 (0%) |

| Total | 213 (100%) | 213 (100%) | 213 (100%) | 213 (100%) | 213 (100%) | 213 (100%) | 213 (100%) |

| S. No. | Research Problems | Research Gaps | Relevant Studies |

|---|---|---|---|

| 1 | Development of a more holistic approach of sustainable investment (alternative to ESG) | Do pillars of ESG strategies have unequal impact on corporate sustainability? Are ESG disclosures consistent in terms of region, firm size, and its sector? | Jitmaneeroj [37]; Giamporcaro & Pretorius [38]; Tamimi & Sebastianelli [39]; Del Bosco & Misani [79]; Sakuma & Louche [80]; Sandberg [81]; Syed [82]; Velte [83] |

| How reliable is the valuation of a company based on ESG information? | Capelle-Blancard & Monjon [12]; Czerwińska & Kaźmierkiewicz [40]; Crifo, Forget, & Teyssier [84]; Dembinski, Bonvin, Dommen, & Monnet [85]; Du Rietz [86]; Jansson & Biel [87]; Kolstad [88]; Richardson [89]; Schwartz [90] | ||

| Is there an overlap and repetition in the related concepts of sustainable investment? | Michelson et al. [25]; Höchstädter & Scheck [34]; N. S. Eccles & Viviers [35]; Sandberg, Juravle, Hedesström, & Hamilton [36] | ||

| What are the barriers stopping sustainable investment from becoming mainstream? | Herringer et al. [28]; Dumas & Louche [41]; Revelli [42]; Kiernan [56]; de Zwaan, Brimble, & Stewart [91]; Eccles, N.S. [92]; Paetzold & Busch [93]; Viviers, Eccles, et al. [94] | ||

| What is the actual difference made by ESG rankings in terms of institutional change? | Avetisyan & Hockerts [43]; Lokuwaduge & Heenetigala [44]; Viviers, Bosch, Smit, & Buijs [94]; Carter & Huby [95]; Mörth [96]; Nagy, Kassam, & Lee [97]; Przychodzen, Gómez-Bezares, Przychodzen, & Larreina [98]; Rivoli [99]; van Duuren, Plantinga, & Scholtens [100] | ||

| 2 | Increase the scope of sustainable investment in developing countries | Why is sustainable investment not popular in Asia and other developing countries? | Herringer et al.; [28]; Schueth [30]; Sievänen et al. [59]; Chelawat & Trivedi [101]; Soederberg [102] |

| 3 | Measurement of financial and extra-financial returns obtained out of sustainable investments | What is the impact of ESG rankings on the financial performance of an organization? | Jitmaneeroj [37]; Limkriangkrai et al. [68]; K.-H. Lee et al. [75]; Del Bosco & Misani [79]; Velte [83]; Nagy et al. [97]; Amaeshi [103]; Ferrero-Ferrero, Fernández-Izquierdo, & Muñoz-Torres [104]; D. D. Lee, Humphrey, Benson, & Ahn [105]; Mǎnescu [106]; Mitsuyama & Shimizutani [107]; Siew [108]; Ortas, Alvarez, & Garayar [109] Soler-Domínguez & Matallín-Sáez [110]; Ur Rehman, Zhang, Uppal, Cullinan, & Akram Naseem [111] |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Talan, G.; Sharma, G.D. Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment. Sustainability 2019, 11, 353. https://doi.org/10.3390/su11020353

Talan G, Sharma GD. Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment. Sustainability. 2019; 11(2):353. https://doi.org/10.3390/su11020353

Chicago/Turabian StyleTalan, Gaurav, and Gagan Deep Sharma. 2019. "Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment" Sustainability 11, no. 2: 353. https://doi.org/10.3390/su11020353

APA StyleTalan, G., & Sharma, G. D. (2019). Doing Well by Doing Good: A Systematic Review and Research Agenda for Sustainable Investment. Sustainability, 11(2), 353. https://doi.org/10.3390/su11020353