Abstract

Intellectual capital (IC) is considered to be a main driver of organizational success in the knowledge economy. This study examines the impacts of three IC components, including human capital (HC), structural capital (SC), and relational capital (RC), on technological innovation and firm performance. Data are collected from 1112 manufacturing listed companies in China during 2013–17. Using partial least squares structural equation modeling (PLS-SEM), the results show that HC and SC exert a positive impact on firm performance while RC has a negative impact; SC has a positive influence on technological innovation while HC has a negative influence; technological innovation can enhance the firm’s performance. In addition, technological innovation partially mediates the relationship between SC and firm performance. This study will bridge the gap in research by investigating the impacts of IC components on technological innovation and firm performance in developing countries.

1. Introduction

Intellectual capital (IC), which is related to creating value for companies, can bring competitive advantage and superior performance to companies in the knowledge economy [1,2,3,4,5,6]. IC is also considered an added value to physical and financial assets [7].

Some researchers [8,9,10] have asserted that manufacturing firms can improve their performance and productivity through technological innovation. Technological innovation determines a firm’s performance and its survival or extinction [11]. Trott [12] also stated that innovation is an engine of growth. Manufacturing companies may implement the product differentiation strategy by product innovation and reduce manufacturing costs and shorten production cycle by process innovation.

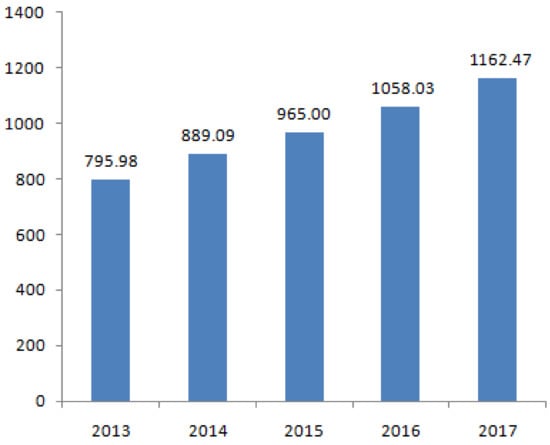

In 2015, “Made in China 2025” strategy aimed to steer China to transform industrial structure in manufacturing industry. Nowadays, facing great pressures such as rising labor costs and low energy efficiency, manufacturing companies are seeking new ways to maintain competitive advantage [13]. Manufacturing companies are more inclined to frequent technological innovation [14]. From the China Statistical Yearbook on Science and Technology, Figure 1 shows that research and development (R&D) expenditures increased from 795.98 billion yuan in 2013 to 1162.47 billion yuan in 2017 in China’s manufacturing sector. IC, a new type of capital, can provide manufacturing companies with new innovative ideas and thoughts.

Figure 1.

R&D expenditures in China’s manufacturing industry during 2013–17 (billion yuan).

For manufacturing companies, does IC affect their technological innovation and performance? What is the function of technological innovation in the relation between IC and firm performance? This study attempts to address the two questions.

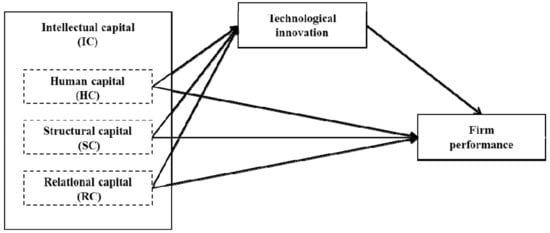

We modify the Value Added Intellectual Coefficient (VAICTM) model proposed by Pulic [15] as the measurement of IC. This study divides IC into three components: human capital (HC), structural capital (SC), and relational capital (RC). According to the resource-based view (RBV) [16,17], the conceptual framework was shown in Figure 2. The RBV addresses the issue on how to acquire and exploit distinct resources to achieve competitive performance of an organization. The conceptual framework indicates three components of IC that influence both technological innovation and firm performance. Moreover, whether technological innovation has the mediating role is also examined in this framework. In this study, the partial least squares structural equation modeling (PLS-SEM) is applied to test these relationships.

Figure 2.

Conceptual framework.

The study’s contributions are presented in three ways. First, the contribution of IC to organizational success in developing economies has been largely focused on by researchers in recent years. Our study fills the gap by determining the impacts of different IC components on the performance of China’s manufacturing listed companies because China, the largest developing country, is experiencing great economic transformation. Second, current literature on measuring the contributions of IC to innovation and in-depth studies of IC components and innovation [18] are lacking. Verbano and Crema [19] reiterated that it is important to examine how IC components influence innovation and performance. The relationship between IC and technological innovation has become an interesting topic for both academia and industry. This study attempts to explain the causal nexus between IC and technological innovation. This study also investigates the mediating effect of technological innovation on the relation between IC components and firm performance. Finally, this study can guide managers of manufacturing companies how to combine IC resources with technological innovation to maintain superior firm performance.

2. Literature Review and Hypotheses Development

2.1. IC and Its Components

As early as 1836, IC was simply defined as the sum of individual knowledge and skills. Subsequently, IC was completely defined by Stewart [20] as the synthesis of an individual’s knowledge and capabilities that can bring competitive advantage to a firm. Although his definition of IC is widely accepted by scholars in the world, there is still no uniform definition of IC [21,22,23].

Although different names are used to address IC components, it is generally believed that IC comprises HC, SC, and RC [24,25,26]. HC is correlated with employees’ knowledge, skills, satisfaction, and motivation [24,27,28]. HC is a fundamental asset in an organization [29,30]. HC also includes the competence and knowledge that the cooperation of employees or divisions has brought up [31]. The appropriate development of employees’ capabilities can produce better results in organizational performance [32].

SC, the capturing of HC, refers to the knowledge that belongs to an organization after employees go home. It comprises organizational structures, procedures, processes, administrative programs, and culture [18,27,28,33,34]. SC builds the infrastructure that HC needs to create value. It is retained in the organization even if all employees leave [35].

RC deals with the relationships of associates of an organization and their loyalty to a company as well as the relationships with external groups [21,27,28,36]. Customer relationships are considered the most important type of RC [33]. In some studies, customer capital is used instead of RC as one of three sub-components [37].

2.2. IC and Firm Performance

A majority of literature has explored the impacts of different IC components on the business performance at firm-level. For example, a study by Ting and Lean [38] showed that IC components (physical capital, HC, and SC) are significantly associated with the profitability of Malaysian financial institutions. Zangoueinezhad and Moshabaki [39] confirmed that SC can enable firms to improve the quality of both products and processes with minimum cost, which leads to business success. Barkat et al. [3] argued that all IC components have positive direct and indirect impacts on the performance of textile companies in Pakistan, except for SC. Analyzing the data of financial institutions in Pakistan, Haris et al. [40] documented that HC exhibits a positive impact on bank profitability while SC has a negative impact. Nadeem et al. [41], using an adjusted-VAICTM model, found that IC and its components (human, innovation and physical capitals) positively influence firm performance. Xu and Li [42] determined the impact of IC on firm performance in the context of China’s manufacturing small and medium-sized enterprises (SMEs). They found that HC, SC, and RC positively affect corporate profitability. Using the VAICTM model and modified VAICTM model, Xu and Wang [5] documented that HC, SC, and RC positively affect the profitability of textile companies in two emerging countries (i.e., China and South Korea). The findings of Xu and Wang [6] showed that HC has a significant and positive impact on the profitability of Chinese agricultural listed companies. Therefore, we come to the following set of hypotheses:

Hypothesis 1a (H1a).

A positive relationship exists between HC and firm performance.

Hypothesis 1b (H1b).

A positive relationship exists between SC and firm performance.

Hypothesis 1c (H1c).

A positive relationship exists between RC and firm performance.

2.3. IC and Technological Innovation

IC is regarded as a driving source for innovation [14,43,44]. The findings of Hsu and Fang [45] suggested that IC positively affects enterprise innovation through organizational learning.

Regarding IC components, HC is the precondition and guarantee for firm’s technological innovation [46]. Employees’ ability and quality are closely related to firm’s HC structure. Employees’ continuous learning can quickly convert organizational knowledge into business value, and enable firms to develop competitive behaviors, which is conducive to technological innovation. The process of technological innovation requires continuous learning of new knowledge and technologies. This process is also the accumulation of HC stock. Rhyne et al. [47] found that the characteristics of executives (e.g., knowledge, experience and skills) significantly affect a firm’s technological innovation, while the number of technicians and executives is positively correlated with innovation performance of new product. Park et al. [48] found that skills and behaviors of employees are positively related to ambidextrous technological innovation. However, Duodu and Rowlinson [49] argued that there is no direct link between HC and innovation in construction firms in Hong Kong. Therefore, the second hypothesis is proposed as follows:

Hypothesis 2a (H2a).

A positive relationship exists between HC and technological innovation.

SC provides the environment and conditions for employees to learn knowledge and skills and stimulate their enthusiasm for innovation. Corporate culture can enable enterprises to formulate innovation strategies, which can positively affect the process of technology innovation [50,51]. The knowledge and experiences can promote firm’s innovation because firms generally utilize them to generate new products or services [52]. Most findings [53,54,55,56,57] suggested SC positively affect innovation performance. However, Zhang and Lv [14] found the relation between SC and technological innovation is insignificant in Chinese high-technology manufacturing firms. Therefore, we formulate the following hypothesis:

Hypothesis 2b (H2b).

A positive relationship exists between SC and technological innovation.

The acquisition and analysis of knowledge and information can make companies get technological innovation. Through RC, organizations can obtain more innovative ideas by learning from other experiences [3,58] and sharing knowledge and information with their vendors, suppliers, and consumers. Internal RC can strengthen the connections between internal members, contribute to knowledge sharing and transformation, and optimize the SC. Technological innovation activities need the effective cooperation of various departments, and good RC can reduce the resistance in the process of technological innovation [44,59,60]. In addition, external RC can provide a new way for companies to search for new knowledge and enrich the company’s internal resources [61]. Verbano and Crema [19] found that relations with external partners can help SMEs to achieve radical technology innovation performance. Companies should focus more on RC to improve consumers’ acceptance of their new products. Therefore, we formulate the following hypothesis:

Hypothesis 2c (H2c).

A positive relationship exists between RC and technological innovation.

2.4. Technological Innovation and Firm Performance

Companies with high technological innovation capability can achieve substantial performance [62,63,64]. Organizations with high levels of innovation tend to improve their performance faster than those without innovative activities [65]. For SMEs in food machinery industry, Bigliardi [66] confirmed that firms’ financial performance improves with the increase in innovation level. The findings of Bockova and Zizlavsky [67] showed that companies invest more into innovation tend to yield stronger financial performance in Czech manufacturing industry. Taking intangible assets as innovation proxy, Bistrova et al. [68] suggested that companies that have higher innovation potential can generate higher profits. Jancenelle et al. [69] examined the relation between corporate entrepreneurship and market performance and concluded that some aspects of innovativeness positively impact market performance. The findings of Ho et al. [70] also showed that a firm’s innovation capability significantly contributes to its financial performance in agricultural value chain in Vietnam, an emerging economy. Lee et al. [71] argued that organizational innovation has a direct and positive impact on the performance of low-tech firms in South Korea. Ramadani et al. [72] also provided evidence of a positive link from innovation activities to firm performance in transition economies. Wang [73], taking SMEs as the sample, found that innovativeness is positively related to firm performance. Accordingly, our third hypothesis is stated as follows:

Hypothesis 3 (H3).

A positive relationship exists between technological innovation and firm performance.

2.5. The Mediating Effect of Technological Innovation

IC, together with physical capital, is the driver of enterprise performance. Meanwhile, IC constitutes the basis of technological innovation. If high-tech enterprises lose the advantage of technological innovation ability, their products or services will eventually be eliminated by the market.

Among IC components, HC with diverse knowledge, ideas, and skills are related to the development of product innovation. For instance, Donate et al. [74] argued that HC is the foundation of innovation capability and it takes several years to develop HC resources. If an organization pays less attention to HC, its innovation capability will be largely affected [3]. Good working environment can help organizations to reduce working hours and information exchange platforms can encourage employees to share their opinions associated with organizational targets. Such structural assets can promote prevailing knowledge and affect innovation capability. Organizations that have well-organized SC will support their innovative activities. If a firm has a close customer relationship, it will result in the enhanced progress of innovation [3]. SC and RC can guarantee the realization of technological innovation and corporate performance from inside and outside.

In the context of Pakistan, Barkat et al. [3] found that mediating role of innovation plays in the relationships between HC and firm performance and between RC and firm performance. For SMEs, McDowell et al. [75] suggested that innovativeness mediates the link from human and organizational capital to small firm’s performance. Therefore, we propose the following set of hypotheses:

Hypothesis 4a (H4a).

Technological innovation mediates the relationship between HC and firm performance.

Hypothesis 4b (H4b).

Technological innovation mediates the relationship between SC and firm performance.

Hypothesis 4c (H4c).

Technological innovation mediates the relationship between RC and firm performance.

3. Methodology

3.1. Sample Collection

The sample comprises manufacturing companies listed on the Shanghai and Shenzhen stock exchanges during 2013–2017. After 2012, Chinese listed companies are required to disclose the information about R&D expenditure in the financial reports. After removing companies with missing information, companies listed after the year 2013, companies without R&D investment for five consecutive years, companies issuing other kinds of shares, and special treatment (ST) companies [76,77], 5560 observations for 1112 manufacturing listed companies are left for estimation in the present study. Financial data are retrieved from the RESSET database [78].

3.2. Variable Measurement

For the dependent variable, firm performance is measured with return on assets (ROA), consistent with previous literature [1,5,6,22,23,30,41,42,79]. ROA measures how efficiently a firm utilizes and manages its assets to produce profits during a certain period. The calculation formula is as follows:

ROA = Net income/Average total assets

Pulic [15]’s VAICTM model, a widely accepted and popular IC measurement method, is easy to calculate using data retrieved from the audited financial reports, which provides a standardized measure [80]. In addition, this model allows comparison among organizations [81]. However, this model also has some limitations. Ståhle et al. [82] argued that this model does not deal with IC because it only signifies the efficiency of the workforce and capital investment of a firm. In addition, there is an incomplete measurement of SC. Guided by previous literature [5,42,55,56,79], Pulic [15] VAICTM model is modified to measure IC by adding one variable, RC. This measure is designed to indicate IC efficiency of a company. Companies with high IC value can better utilize physical assets and IC to create potential value [83]. The calculation procedures are as follows:

where VA is the value added of a firm; OUT the total revenues; IN the total expenses excluding employee expenditures; HCE the human capital efficiency; HC the human capital, measured by total employee expenditures; SCE the structural capital efficiency; RCE the relational capital efficiency; RC the relational capital, measured by selling expenses.

VA = OUT − IN

HCE = VA/HC

SCE = (VA − HC)/VA

RCE = RC/VA

In the new Chinese Accounting Standards, three types of expenses (i.e., administrative expenses, selling expenses, and interest expenses) are reported in the income statement. Selling expenses include such things as advertising costs, exhibition expenses, sales commissions, and shipping charges. In this study, we use selling expenses to measure RC.

For the mediating variable, scholars generally use four primary indicators to measure technological innovation: (1) R&D expenditure [84,85], (2) patent counts [86], (3) statistics on new product introduction [87], and (4) innovation survey data [14]. In this study, the log of R&D expenditure (RD) is used to measure technological innovation.

We also use firm size (SIZE), debt ratio (LEV), sales growth rate (SALES), and year (YEAR) as control variables. SIZE is the natural logarithm of total assets. LEV is the ratio of total liabilities to total assets. SALES is the growth rate of sales revenue of a company’s products or services, typically from year to year. YEAR is a dummy variable that takes 1 for the test year and 0 otherwise. Moreover, we winsorized all continuous variables used in this study at 1% and 99% for reducing the potential bias caused by spurious values [88]. Finally, descriptive statistics of the sample are demonstrated in Table 1.

Table 1.

Descriptive statistics.

The mean value of ROA is 0.0641 with maximum value of 0.2928 and minimum value of −0.1954, suggesting that the level of firm’s profitability varies among manufacturing companies. The mean value of HCE (3.6388) is greater than the mean value of SCE (0.6688) and RCE (0.1806), which indicates that human resources are the driving force of value creation in manufacturing companies. This is consistent with Bayraktaroglu et al. [30] who collected data from Turkish manufacturing firms and Phusavat et al. [89] who chose leading manufacturing firms in Thailand as the sample. RD, the mediating variable, has the mean value of 17.8975. In addition, the mean values of SIZE, LEV, and SALES are 22.0394, 0.3904, and 0.1490, respectively.

4. Empirical Results

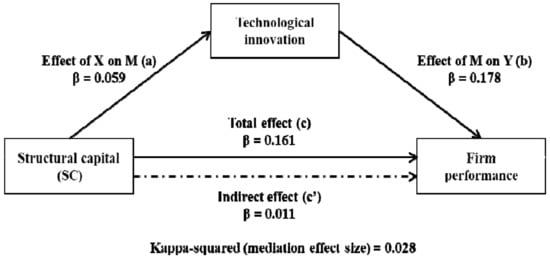

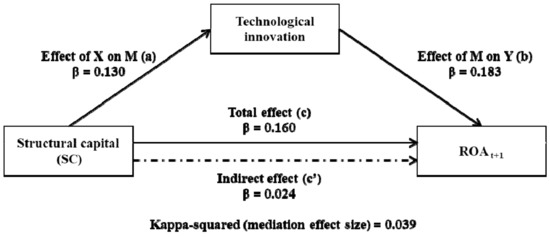

The PLS-SEM is applied to analyze the sample. It not only can cope with variables with multivariate measurements, but also can well measure a model that uses single-item constructs [90]. Therefore, we believe that it is a suitable statistical approach in this study. Further, the results of correlation analysis are shown in Table 2. Table 3 and Figure 3 show the results of path analyses and mediation analyses.

Table 2.

Correlation analysis.

Table 3.

Estimation results of the path analyses.

Figure 3.

Relationship between SC and ROA with technological innovation as a mediator.

4.1. Model Fit

The standardized root mean square residual (SRMR) and the explained variance R2 indicate that the overall quality of the research model hold a good fit. First, the SRMR of our model is 0.000, which is greatly less than 0.1, indicating the data analyses provides shows adequate overall model fit evaluate goodness of saturated model fit [91]. In addition, the explained variance R2 values of the RD and ROA are 0.291 and 0.471, respectively, which suggests that this current research model has good explanatory power [92,93]. Finally, the correlation relationships among both independent and dependent variables were determined, and Table 2 shows the discriminant validity of all construct. Overall, our research model holds a good model fit for further analysis.

4.2. Direct Effect

The direct relationships among IC, RD, and ROA are investigated and shown in Table 3. H1a is supported, because the path coefficient of HCE on ROA is positive and significant (β = 0.318, p < 0.001). H1b is also accepted at the 1% significant level (β = 0.150, p < 0.01), which indicates that SCE positively affects ROA. However, H1c is observed to be rejected, since the results of path analyses show the impact of RCE on ROA is negative and significant (β = −0.095, p < 0.001).

Further, the direct relationships of HC, SC, RC, and technological innovation also are quantified. The result with respect to H2a shows that HCE negatively and significantly affects (β = −0.107, p < 0.001), which suggests H2a is rejected. In contrast, there is a significant and positive relation between SCE and RD (β = 0.059, p < 0.001), thus H2b is found to be supported. H2c is not accepted, because the path coefficient of RCE on RD is negative and insignificant (β = 0.005, p = 0.634).

Finally, H3 is found to be fully supported. The results of the path analyses show the direct effect of RD on ROA is positive and significant (β = 0.178, p < 0.001).

4.3. Mediation Analyses

Following with the guidelines of Preacher and Kelley [94], which allows us to measure the size of mediation effect, Figure 3 indicates that technological innovation merely plays a mediating role in the relationship between SC and firm performance. First, because the relationship between SCE and RD is negative and significant, thus H4a is rejected. Second, H4c, which predicts that technological innovation mediates the relationship between RC and firm performance, is also found to be rejected due to the insignificant relationship between RCE and RD. Third, H4b is found to be supported. As shown in Figure 3, SC exhibits significant direct positive effect on technological innovation (path a) and technological innovation also has a positive and significant relationship with firm performance (path b). In addition, the results indicate that the indirect relationship between SC and firm performance (path c’) is significant and positive (β = 0.011, p < 0.001) and the total effect of SC on firm performance (path c) is also found to be positive and significant (β = 0.161, p < 0.001). Finally, the Kappa-squared (K2), as an index of mediation effect size, was calculated by the recommended procedure of Preacher and Kelley [94] and the results shown the K2 is 0.028, suggesting that technological innovation plays a mediating role in the link from SC to firm performance [92,93]. Overall, we found that technological innovation partially mediates the positive link from SC to firm performance.

4.4. Robustness Check

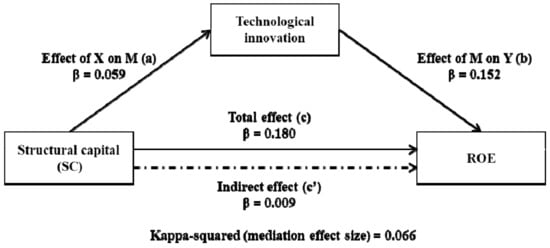

In this study, we also use return on equity (ROE) instead of ROA as another indicator to re-measure firm performance. As shown in Table 4 and Figure 4, the empirical results remain materially unchanged, which indicates that our conclusion is robust.

Table 4.

Estimation results of robustness check.

Figure 4.

Relationship between SC and ROE with technological innovation as a mediator.

In addition, we also examined the relationship between one-year lagged variables and ROA. The results are shown in Table 5 and Figure 5, which are also in line with our previous results.

Table 5.

Estimation results.

Figure 5.

Relationship between SC and ROA t+1 with technological innovation as a mediator.

5. Discussion

The study aims to investigate the relationships among IC, technological innovation and firm performance in China’s manufacturing sector by conducting a panel dataset over the period 2013–2017. The following arguments on this relationship are put forward through the analysis of empirical findings.

HC is found to have a positive impact on ROA, supporting H1a. Developing human assets is important for business success especially in the competitive market environment [3]. This is in line with the findings of Xu and Li [42], Phusavat et al. [89], Felício et al. [95], and Andreeva and Garanina [96].

SC exhibits a positive and significant impact on firm performance. Therefore, H1b is fully accepted. This suggests that investment in non-physical capital (e.g., systems and procedures) can generate high profitability for Chinese manufacturing listed companies, inconsistent with Ting and Lean [38], Haris et al. [40], Andreeva and Garanina [96], Mondal and Ghosh [97], and Tran and Vo [98]. During the economic transformation, Chinese manufacturing listed companies have realized the important role of SC in generating superior performance.

Empirical results show a non-significant relationship between RC and ROA, rejecting H1c. This is similar to the prior studies of Nimtrakoon [79] and Tripathy et al. [99]. However, Xu and Wang [5] argued that RC has a positive impact on textile company’s profitability in China. Xu and Wang [100] found that RC is the most influential contributor to firm performance in Korean manufacturing industry. In fact, social networks (i.e., guanxi) that play a crucial role are deeply rooted in the traditional Chinese cultural [101,102].

Opposite to H2a, the negative impact of HCE on RD confirms that human redundancy cannot lead to higher technological innovation capability. This suggests that manufacturing companies do not pay much attention to the accumulation of employees with professional and technical talents that play a crucial role in R&D activities. However, Martín-de Castro et al. [103] argued that human resources can improve product innovation.

SCE positively influences firm’s technological innovation, which supports our H2b. It turns out that database and institutionalized knowledge stored in a company can promote its technological innovation [14]. In addition, an innovation culture can enable employees to communicate their opinions openly, which provides employees some opportunities to participate in decision making [104]. Prajogo and Ahmed [105] suggested that a good environment for supporting innovation should be created and maintained within firms.

RCE has no impact on technological innovation, rejecting H2c. Contrary to Subramaniam and Youndt [18] and O’Reilly and Tushman [106], they concluded that powerful social networks are important for a firm to pursue technological innovation.

Technological innovation has a significantly positive effect on ROA, which implies that manufacturing companies are utilizing such technological innovation to make them competitive. This is in line with the findings of a large body of literature (e.g., [73,85,107,108,109,110]).

Technological innovation partially mediates the relationship between SC and firm performance. On one hand, SC can directly affect ROA. On the other hand, SC has an indirect effect on ROA in the process of innovation. However, contrary to the textile industry in Pakistan, Barkat et al. [3] concluded that innovation has the mediating role between IC components (i.e., HC, RC, and technological capital) and organizational performance. In addition, the mediating role of technology innovation between HC and RC and ROA does not exist.

6. Conclusions

This study is to investigate the effects of three IC components (i.e., HC, SC, and RC) on technological innovation and the performance of manufacturing industry in China. In this regard, the research hypotheses are developed and tested through PLS-SEM. The main conclusions can be summarized as follows:

(1) HC and SC exert a significant and positive impact on the performance of Chinese manufacturing companies, whereas RC has a negative impact on firm performance.

(2) HC negatively affects firm’s technological innovation while SC positively impacts it. The relationship between RC and technological innovation is not significant.

(3) Technological innovation can enhance the performance of manufacturing listed companies in China.

(4) A partial mediating effect occurs from technological innovation in the relationship between SC and firm performance.

This study provides the following implications for managers of manufacturing listed companies with respect to IC allocation and technological innovation that can improve firm performance:

(1) Chinese manufacturing companies should emphasize the role of HC and invest more in human resources to improve employees’ skills, competence, motivation, and experience by continuous learning. Employees also should be encouraged to transfer their experiences and knowledge to others [111].

(2) Chinese manufacturing companies should develop their SC by having a clear knowledge strategy, implementing information systems and tools, training employees, and other human resources practices. In addition, they should create good corporate culture to encourage their employees to make innovations.

(3) Corporate managers should also keep good connections with their suppliers and customers to build good image and gain customers’ loyalty. Meanwhile, they should construct technological innovation networks through their social networks.

(4) Chinese manufacturing companies should make more investment in innovation activities and implement agile innovation management [112] in order to maintain high levels of innovative capability and improve their competitive advantage in the fierce market. Corporate R&D division should transform the input management into the out management by utilizing IC resources in a more positive way [113].

This study has some limitations. Firstly, this study focuses only on manufacturing sector in China. One direction for further research is to include other industries with different investment environments. Secondly, different types of technological innovation (e.g., product innovation and process innovation) should be taken into account. These will be included in further studies.

Author Contributions

Conceptualization, J.X.; methodology, F.L.; software, F.L.; formal analysis, J.X. and F.L.; data curation, J.X. and Y.S.; writing—original draft preparation, J.X. and F.L.; writing—review and editing, J.X., Y.S., W.Y. and F.L.; funding acquisition, W.Y.

Funding

The research was supported by Projects of the National Social Science Foundation of China (Grant No. 17BGL043).

Acknowledgments

We would like to thank the editor and the anonymous reviewers for their valuable comments and suggestions.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Chen, M.C.; Cheng, S.J.; Hwang, Y. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intellect. Cap. 2005, 6, 159–176. [Google Scholar] [CrossRef]

- Lentjušenkova, O.; Lapina, I. The transformation of the organization’s intellectual capital: From resource to capital. J. Intellect. Cap. 2016, 17, 610–631. [Google Scholar] [CrossRef]

- Barkat, W.; Beh, L.S.; Ahmed, A.; Ahmed, R. Impact of intellectual capital on innovation capability and organizational performance: An empirical investigation. Serbian J. Manag. 2018, 13, 365–379. [Google Scholar]

- Ginesti, G.; Caldarelli, A.; Zampella, A. Exploring the impact of intellectual capital on company reputation and performance. J. Intellect. Cap. 2018, 19, 915–934. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B.H. Intellectual capital performance of the textile industry in emerging markets: A comparison with China and South Korea. Sustainability 2019, 11, 2354. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B.H. Intellectual capital and financial performance of Chinese agricultural listed companies. Custos Agronegocio Line 2019, 15, 273–290. [Google Scholar]

- Bueno, E.; Salmador, M.P.; Rodríguez, Ó. The role of social capital in today’s economy: Empirical evidence and proposal of a new model of intellectual capital. J. Intellect. Cap. 2004, 5, 556–574. [Google Scholar] [CrossRef]

- Yam, R.C.M.; Lo, W.; Tang, E.P.Y.; Lau, A.K.W. Analysis of sources of innovation, technological innovation capabilities, and performance: An empirical study of Hong Kong manufacturing industries. Res. Policy 2011, 40, 391–402. [Google Scholar] [CrossRef]

- Raymond, L.; Bergeron, F.; Croteau, A.M. Innovation capability and performance of manufacturing SMEs: The paradoxical effect of IT integration. J. Organ. Comput. Electron. Commer. 2013, 23, 249–272. [Google Scholar] [CrossRef]

- Kafetzopoulos, D.; Psomas, E. The impact of innovation capability on the performance of manufacturing companies The Greek case. J. Manuf. Technol. Manag. 2015, 26, 104–130. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Su, X.; Wang, H.; Zou, R.Y. Intellectual capital and technological dynamic capability: Evidence from Chinese enterprises. J. Intellect. Cap. 2019. [Google Scholar] [CrossRef]

- Trott, P. Innovation Management and New Product Development, 6th ed.; Pearson Education Limited: Harlow, UK, 2016. [Google Scholar]

- Xu, J.; Sim, J.W. Are costs really sticky and biased? Evidence from manufacturing listed companies in China. Appl. Econ. 2017, 49, 5601–5613. [Google Scholar] [CrossRef]

- Zhang, H.Y.; Lv, S. Intellectual capital and technological innovation: The mediating role of supply chain learning. Int. J. Innov. Sci. 2015, 7, 199–210. [Google Scholar] [CrossRef]

- Pulic, A. VAICTM—An accounting tool for IC management. Int. J. Technol. Manag. 2000, 20, 702–714. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Peteraf, M.A.; Barney, J.B. Unraveling the resource-based tangle. Manag. Decis. Econ. 2003, 24, 309–323. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The influence of intellectual capital on the types of innovative capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef]

- Verbano, C.; Crema, M. Linking technology innovation strategy, intellectual capital and technology innovation performance in manufacturing SMEs. Technol. Anal. Strateg. Manag. 2016, 28, 524–540. [Google Scholar] [CrossRef]

- Stewart, T.A. Your company’s most valuable asset: Intellectual capital. Fortune 1994, 3, 68–74. [Google Scholar]

- Khalique, M.; Bontis, N.; bin Shaari, J.A.N.; Isa, A.H.M. Intellectual capital in small and medium enterprises in Pakistan. J. Intellect. Cap. 2015, 16, 224–238. [Google Scholar] [CrossRef]

- Dzenopoljac, V.; Yaacoub, C.; Elkanj, N.; Bontis, N. Impact of intellectual capital on corporate performance: Evidence from the Arab region. J. Intellect. Cap. 2017, 18, 884–903. [Google Scholar] [CrossRef]

- Sardo, F.; Serrasqueiro, Z. Intellectual capital, growth opportunities, and financial performance in European firms: Dynamic panel data analysis. J. Intellect. Cap. 2018, 19, 747–767. [Google Scholar] [CrossRef]

- Stewart, T.A. Intellectual Capital: The New Wealth of Organization; Doubleday: New York, NY, USA, 1997. [Google Scholar]

- Sveiby, K.E. The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets; Berrett-Koehler Publishers: San Francisco, CA, USA, 1997. [Google Scholar]

- Andriessen, D. Making Sense of Intellectual Capital; Elsevier: Burlington, MA, USA, 2004. [Google Scholar]

- Bontis, N.; Keow, W.C.C.; Richardson, S. Intellectual capital and business performance in Malaysian industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef]

- Vaz, C.R.; Selig, P.M.; Viegas, C.V. A proposal of intellectual capital maturity model (ICMM) evaluation. J. Intellect. Cap. 2019, 20, 208–234. [Google Scholar] [CrossRef]

- Curado, C. Perceptions of knowledge management and intellectual capital in the banking industry. J. Intellect. Cap. 2008, 12, 141–155. [Google Scholar] [CrossRef]

- Bayraktaroglu, A.E.; Calisir, F.; Baskak, M. Intellectual capital and firm performance: An extended VAIC model. J. Intellect. Cap. 2019, 20, 406–425. [Google Scholar] [CrossRef]

- Swart, J. Intellectual capital: Disentangling an enigmatic concept. J. Intellect. Cap. 2006, 7, 136–159. [Google Scholar] [CrossRef]

- Barrena-Martinez, J.; López-Fernández, M.; Romero-Fernández, P.M. The link between socially responsible human resource management and intellectual capital. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 71–81. [Google Scholar] [CrossRef]

- Bontis, N. Intellectual capital: An exploratory study that develops measures and models. Manag. Decis. 1998, 36, 63–76. [Google Scholar] [CrossRef]

- Gates, S.; Langevin, P. Human capital measures, strategy, and performance: HR manager’ perceptions. Account. Audit. Account. J. 2010, 23, 111–132. [Google Scholar] [CrossRef]

- Stewart, T.; Ruckdeschel, C. Intellectual capital: The new wealth of organizations. Perform. Improv. 1998, 37, 56–59. [Google Scholar] [CrossRef]

- Kim, D.Y.; Kumar, V. A framework for prioritization of intellectual capital indicators in R&D. J. Intellect. Cap. 2009, 10, 277–293. [Google Scholar]

- Ferreira, A.I.; Martinez, L.F. Intellectual capital: Perceptions of productivity and investment. Rev. Adm. Contemp. 2011, 15, 249–260. [Google Scholar] [CrossRef]

- Ting, I.W.K.; Lean, H.H. Intellectual capital performance of financial institutions in Malaysia. J. Intellect. Cap. 2009, 10, 588–589. [Google Scholar] [CrossRef]

- Zangoueinezhad, A.; Moshabaki, A. The role of structural capital on competitive intelligence. Ind. Manag. Data Syst. 2009, 109, 262–280. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.X.; Tariq, G.; Malik, A.; Javaid, H.M. Intellectual capital performance and profitability of banks: Evidence from Pakistan. J. Risk Financ. Manag. 2019, 12, 56. [Google Scholar] [CrossRef]

- Nadeem, M.; Dumay, J.; Massaro, M. If you can measure it, you can manage it: A case of intellectual capital. Aust. Account. Rev. 2019, 29, 395–407. [Google Scholar] [CrossRef]

- Xu, J.; Li, J.S. The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. J. Intellect. Cap. 2019. [Google Scholar] [CrossRef]

- Chen, J.; Zhao, X.T.; Wang, Y.D. A new measurement of intellectual capital and its impact on innovation performance in an open innovation paradigm. Int. J. Technol. Manag. 2015, 67, 1–25. [Google Scholar] [CrossRef]

- Li, J.Y.; Yu, D.K. The path to innovation: The antecedent perspective of intellectual capital and organizational character. Front. Psychol. 2018, 9, 2445. [Google Scholar] [CrossRef]

- Hsu, Y.H.; Fang, W. Intellectual capital and new product development performance: The mediating role of organizational learning capability. Technol. Forecast. Soc. Chang. 2009, 76, 664–677. [Google Scholar] [CrossRef]

- Soo, C.; Tian, A.W.; Teo, S.T.T.; Cordery, J. Intellectual capital-enhancing HR, absorptive capacity, and innovation. Hum. Resour. Manag. 2017, 56, 431–454. [Google Scholar] [CrossRef]

- Rhyne, L.C.; Teagarden, M.B.; den Panhuyzen, W.V. Technology-based competitive strategies: The relationship of culture dimension to new product innovation. J. High Technol. Manag. Res. 2002, 13, 249–277. [Google Scholar] [CrossRef]

- Park, O.; Bae, J.; Hong, W. High-commitment HRM system, HR capability, and ambidextrous technological innovation. Int. J. Hum. Resour. Manag. 2019, 30, 1526–1548. [Google Scholar] [CrossRef]

- Duodu, B.; Rowlinson, S. Intellectual capital for exploratory and exploitative innovation: Exploring linear and quadratic effects in construction contractor firms. J. Intellect. Cap. 2019, 20, 382–405. [Google Scholar] [CrossRef]

- Teece, D.J. Firm organization, industrial structure, and technological innovation. J. Econ. Behav. Organ. 1996, 31, 193–224. [Google Scholar] [CrossRef]

- Zhou, Y.L.; Dou, X.M. Study on influence of corporation culture on the course of technology innovation. Technol. Innov. Manag. 2005, 26, 78–80. (In Chinese) [Google Scholar]

- Kianto, A.; Sáenz, J.; Aramburu, N. Knowledge-based human resource management practices, intellectual capital and innovation. J. Bus. Res. 2017, 81, 11–20. [Google Scholar] [CrossRef]

- Tseng, C.Y.; Goo, Y.J.J. Intellectual capital and corporate value in an emerging economy: Empirical study of Taiwanese manufacturers. R D Manag. 2005, 35, 187–200. [Google Scholar] [CrossRef]

- Delgado-Verde, M.; Castro, G.M.; Navas-López, J.E. Organizational knowledge assets and innovation capability: Evidence from Spanish manufacturing firms. J. Intellect. Cap. 2011, 12, 5–19. [Google Scholar] [CrossRef]

- Buenechea-Elberdin, M.; Sáenz, J.; Kianto, A. Knowledge management strategies, intellectual capital, and innovation performance: A comparison between high- and low-tech firms. J. Knowl. Manag. 2018, 22, 1757–1781. [Google Scholar] [CrossRef]

- Cabrilo, S.; Dahms, S. How strategic knowledge management drives intellectual capital to superior innovation and market performance. J. Knowl. Manag. 2018, 22, 621–648. [Google Scholar] [CrossRef]

- Cabrilo, S.; Kianto, A.; Milic, B. The effect of IC components on innovation performance in Serbian companies. VINE J. Inf. Knowl. Manag. Syst. 2018, 48, 448–466. [Google Scholar] [CrossRef]

- Cousins, P.D.; Handfield, R.B.; Lawson, B.; Petersen, K.J. Creating supply chain relational capital: The impact of formal and informal socialization processes. J. Oper. Manag. 2006, 24, 851–863. [Google Scholar] [CrossRef]

- Ghorbani, M.; Mofaredi, B.; Bashiriyan, S. Study of the relationship between intellectual capital management and organizational innovation in the banks. Afr. J. Bus. Manag. 2012, 6, 5208–5217. [Google Scholar]

- Castro, G.M.D.; Delgado-Verde, M.; Amores-Salvadó, J.; Navas-López, J.E. Linking human, technological, and relational assets to technological innovation: Exploring a new approach. Knowl. Manag. Res. Pract. 2013, 11, 123–132. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Boston, MA, USA, 2003. [Google Scholar]

- Vila, N.; Kuster, I. The importance of innovation in international textile firms. Eur. J. Mark. 2007, 41, 17–36. [Google Scholar] [CrossRef]

- Ferraresi, A.A.; Quandt, C.O.; dos Santos, S.A.; Frega, J.R. Knowledge management and strategic orientation: Leveraging innovativeness and performance. J. Knowl. Manag. 2012, 16, 688–701. [Google Scholar] [CrossRef]

- Nasir, H.; Mansor, M.F.; Abu, N.H. The moderating effect of intellectual capital on the relationship of innovation practices in SME’s performance. Adv. Sci. Lett. 2015, 21, 1409–1412. [Google Scholar] [CrossRef]

- Roper, S.; Du, J.; Love, J.H. Modelling the innovation value chain. Res. Policy 2008, 37, 961–977. [Google Scholar] [CrossRef]

- Bigliardi, B. The effect of innovation on financial performance: A research study involving SMEs. Innov. Manag. Policy Pract. 2013, 15, 245–255. [Google Scholar] [CrossRef]

- Bockova, N.; Zizlavsky, O. Innovation and financial performance of a company: A study from Czech manufacturing industry. Transform. Bus. Econ. 2016, 15, 156–175. [Google Scholar]

- Bistrova, J.; Lace, N.; Tamosiuniene, R.; Kozlovskis, K. Does firm’s higher innovation potential lead to its superior financial performance? Case of CEE countries. Technol. Econ. Dev. Econ. 2017, 23, 375–391. [Google Scholar] [CrossRef]

- Jancenelle, V.E.; Storrud-Barnes, S.; Javalgi, R.R.G. Corporate entrepreneurship and market performance: A content analysis of earnings conference calls. Manag. Res. Rev. 2017, 40, 352–367. [Google Scholar] [CrossRef]

- Ho, K.L.P.; Nguyen, C.N.; Adhikari, R.; Miles, M.P.; Bonney, L. Exploring market orientation, innovation, and financial performance in agricultural value chains in emerging economies. J. Innov. Knowl. 2018, 3, 154–163. [Google Scholar] [CrossRef]

- Lee, R.; Lee, J.H.; Garrett, T.C. Synergy effects of innovation on firm performance. J. Bus. Res. 2019, 99, 507–515. [Google Scholar] [CrossRef]

- Ramadani, V.; Hisrich, R.D.; Alili, H.A.; Dana, L.P.; Panthi, L.; Abazi-Bexheti, L. Product innovation and firm performance in transition economies: A multi-stage estimation approach. Technol. Forecast. Soc. Chang. 2019, 140, 271–280. [Google Scholar] [CrossRef]

- Wang, D.S. Association between technological innovation and firm performance in small and medium-sized enterprises: The moderating effect of environmental factors. Int. J. Innov. Sci. 2019, 11, 227–240. [Google Scholar] [CrossRef]

- Donate, M.J.; Peña, I.; de Pablo, J.D.S. HRM practices for human and social capital development: Effects on innovation capabilities. Int. J. Hum. Resour. Manag. 2016, 27, 928–953. [Google Scholar] [CrossRef]

- McDowell, W.C.; Peake, W.O.; Coder, L.; Harris, M.L. Building small firm performance through intellectual capital development: Exploring innovation as the “black box”. J. Bus. Res. 2018, 88, 321–327. [Google Scholar] [CrossRef]

- Chou, P.L.; Lin, J.J.; Yao, C.H.; Kuo, H.Y. Evaluation on financial risk and abnormal return: Evidence from China’s listed companies. J. Stat. Manag. Syst. 2009, 12, 775–791. [Google Scholar] [CrossRef]

- Green, W.; Czernkowski, R.; Wang, Y. Special treatment regulation in China: Potential unintended consequences. Asian Rev. Account. 2009, 17, 198–211. [Google Scholar] [CrossRef]

- RESSET. Available online: http://db.resset.com/ (accessed on 9 September 2019).

- Nimtrakoon, S. The relationship between intellectual capital, firms’ market value and financial performance: Empirical evidence from the ASEAN. J. Intellect. Cap. 2015, 16, 587–618. [Google Scholar] [CrossRef]

- Shiu, H. The application of the value added intellectual coefficient to measure corporate performance: Evidence from technological firms. Int. J. Manag. 2006, 23, 356–365. [Google Scholar]

- Maditinos, D.; Chatzoudes, D.; Tsairidis, C.; Theriou, G. The impact of intellectual capital on firms’ market value and financial performance. J. Intellect. Cap. 2011, 12, 132–151. [Google Scholar] [CrossRef]

- Ståhle, P.; Ståhle, S.; Aho, S. Value added intellectual coefficient (VAIC): A critical analysis. J. Intellect. Cap. 2011, 12, 531–551. [Google Scholar] [CrossRef]

- Williams, S.M. Diversity in Corporate Governance and Its Impact on Intellectual Capital Performance in an Emerging Economy. Available online: http://pdfs.semanticsholar.org/41d9/62cb9f31a70289a01d69350ec5a172b88beb.pdf (accessed on 19 July 2019).

- Leitner, K.H. Intellectual capital, innovation, and performance: Empirical evidence from SMEs. Int. J. Innov. Manag. 2015, 19, 1550060. [Google Scholar] [CrossRef]

- Amin, S.; Aslam, S. Intellectual capital, innovation and firm performance of pharmaceuticals: A study of the London Stock Exchange. J. Inf. Knowl. Manag. 2017, 16, 1750017. [Google Scholar] [CrossRef]

- Bosworth, D.; Rogers, M. Market value, R&D and intellectual property: An empirical analysis of large Australian firms. Econ. Rec. 2001, 77, 323–337. [Google Scholar]

- Schoenecker, T.; Swanson, L. Indicators of firm technological capability: Validity and performance implications. IEEE Trans. Eng. Manag. 2002, 49, 36–44. [Google Scholar] [CrossRef]

- Wilcox, R.R. Applying Contemporary Statistical Techniques; Academic Press: San Diego, CA, USA, 2003. [Google Scholar]

- Phusavat, K.; Comepa, N.; Sitko-Lutek, A.; Ooi, K.B. Interrelationships between intellectual capital and performance: Empirical examination. Ind. Manag. Data Syst. 2011, 111, 810–829. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Sarstedt, M.; Fuchs, C.; Wilczynski, P.; Kaiser, S. Guidelines for choosing between multi-item and single-item scales for construct measurement: A predictive validity perspective. J. Acad. Mark. Sci. 2012, 40, 434–449. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Lawrence Earlbaum Associates: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Cohen, J.; Cohen, P.; West, S.; Aiken, L. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences; Routledge: Abingdon, UK, 2013. [Google Scholar]

- Preacher, K.J.; Kelley, K. Effect size measures for mediation models: Quantitative strategies for communicating indirect effects. Psychol. Methods 2011, 16, 93–115. [Google Scholar] [CrossRef]

- Felício, J.A.; Couto, E.; Caiado, J. Human capital, social capital and organizational performance. Manag. Decis. 2014, 52, 350–364. [Google Scholar] [CrossRef]

- Andreeva, T.; Garanina, T. Do all elements of intellectual capital matter for organizational performance? Evidence from Russian context. J. Intellect. Cap. 2016, 17, 397–412. [Google Scholar] [CrossRef]

- Mondal, A.; Ghosh, S.K. Intellectual capital and financial performance of Indian banks. J. Intellect. Cap. 2012, 13, 515–530. [Google Scholar] [CrossRef]

- Tran, B.D.; Vo, D.H. Should bankers be concerned with Intellectual capital? A study of the Thai banking sector. J. Intellect. Cap. 2018, 19, 897–914. [Google Scholar] [CrossRef]

- Tripathy, T.; Gil-Alana, L.A.; Sahoo, D. The effect of intellectual capital on firms’ financial performance: An empirical investigation in India. Int. J. Learn. Intellect. Cap. 2015, 12, 342–371. [Google Scholar] [CrossRef]

- Xu, J.; Wang, B.H. Intellectual capital, financial performance and companies’ sustainable growth: Evidence from the Korean manufacturing industry. Sustainability 2018, 12, 4651. [Google Scholar] [CrossRef]

- Shi, Y.D.; Cheng, M. Impact of political, guanxi ties on corporate value Evidence from the technology-intensive firms in China. Chin. Manag. Stud. 2016, 10, 242–255. [Google Scholar] [CrossRef]

- Du, M.F.; Gao, H.Z.; Zhang, J. Toward a guanxi-bases view of structural holes in sales gatekeeping: A qualitative study of sales practices in China. Ind. Mark. Manag. 2019, 76, 109–122. [Google Scholar] [CrossRef]

- Martín-de Castro, G.; Delgado-Verde, M.; Navas-López, J.E.; Cruz-González, J. The moderating role of innovation culture in the relationship between knowledge assets and product innovation. Technol. Forecast. Soc. Chang. 2013, 80, 351–363. [Google Scholar] [CrossRef]

- Akgün, A.E.; Keskin, H.; Byrne, J. Procedural justice climate in new product development teams: Antecedents and consequences. J. Prod. Innov. Manag. 2010, 27, 1096–1111. [Google Scholar] [CrossRef]

- Prajogo, D.I.; Ahmed, P.K. Relationships between innovation stimulus, innovation capacity, and innovation performance. R D Manag. 2006, 36, 499–515. [Google Scholar] [CrossRef]

- O’Reilly, C.A.; Tushman, M.L. The ambidextrous organisation. Harv. Bus. Rev. 2004, 82, 74. [Google Scholar]

- Shin, N.; Kraemer, K.L.; Dedrick, J. R&D, value chain location and firm performance in the global electronics industry. Ind. Innov. 2009, 16, 315–330. [Google Scholar]

- Sharma, C. R&D and firm performance: Evidence from the Indian pharmaceutical industry. J. Asia Pac. Econ. 2012, 17, 332–342. [Google Scholar]

- Zhu, G.L.; Zhang, Y.; Chen, K.H.; Yu, J. The impact of R&D intensity on firm performance in an emerging market: Evidence from China’s electronics manufacturing firms. Asian J. Technol. Innov. 2017, 25, 41–60. [Google Scholar]

- Rajapathirana, R.P.J.; Hui, Y. Relationship between innovation capability, innovation type, and firm performance. J. Innov. Knowl. 2018, 3, 44–55. [Google Scholar] [CrossRef]

- Roozitalab, A.; Majidi, M. Factors affecting on improvement employee empowerment (Case study: Saipa Corporation). Int. Rev. 2017, 1–2, 9–17. [Google Scholar] [CrossRef]

- Krstić, M.; Skorup, A.; Lapčević, G. Trends in agile innovation management. Int. Rev. 2018, 3–4, 58–70. [Google Scholar] [CrossRef]

- Nakahara, T. Innovation management using intellectual capital. Int. J. Entrep. Innov. Manag. 2001, 1, 96–110. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).