1. Introduction

Following the concept of Christensen [

1], disruptive technologies have been highly regarded in technology and innovation management. In short, Christensen’s concept describes a paradox: A currently less potent technology is more likely to disrupt an incumbent technology than a currently more potent one. For this paradox, several practical examples have been found, as will be explained in

Section 2.1 [

2,

3,

4,

5].

So far, the concept of disruptive innovation has been criticized for mainly regarding disruptive innovation from an ex-post perspective. Further, only successful examples for disruptive technologies have been investigated in a qualitative manner, not including examples that do not fit into the concept [

2]. In response to the call for measurement models for disruptive technologies [

6], different concepts for the quantitative evaluation of disruptive innovation have been developed [

7,

8,

9]. Without the possibility of ex-ante prediction of disruptive innovation, Danneels [

2] as well as Govindarajan and Kopalle [

10] disregard the concept of disruptive innovation to have a significant practical relevance. Still, ex-ante prediction of disruptive innovation has been scarcely attempted [

2,

9,

10,

11].

This paper is dedicated to close this research gap in the field of battery technologies. It applies the hazard model by Sood and Tellis [

9], utilizing it for ex-ante prediction (from here on ‘prediction’). Several authors suggest the investigation of battery technologies, in which disruptive developments are predicted [

12,

13,

14,

15]. Further, the field of battery technologies is subject of current investigations regarding the emergence of new technologies. This relates, for instance, to the predominant technology, lithium-ion batteries. The increased need for lithium-ion batteries shows its negative sides, for instance, environmental pollution for raw materials mining, or problems with recycling. This development becomes increasingly relevant through the emergence of battery electric cars and stationary energy storage for regenerative energies or smart energy networks [

16,

17,

18]. In summary, the current problems with lithium-ion batteries, opposing sustainability goals, could counteract the sustainability goals intended by battery electric cars or smart energy networks. Therefore, the paper attempts to find possible disruptive technologies in the field of battery technologies.

For this purpose, the paper takes an approach from innovation management literature, disruptive innovation. Thereby, leaving the technological perspective on battery technologies, the paper intends to identify battery technologies that could be potentially disruptive from an innovation management perspective, and transfer this finding to the field of battery technologies.

We utilize the expert knowledge of 53 experts from different research institutions within the modified model of Sood and Tellis [

9]. The model developed by Sood and Tellis [

9] builds on heuristics that characterize disruptive innovation, which is transferred to an ex-ante perspective on disruptive innovation for this paper. Thereby, the paper attempts to transfer characteristics proven to be symptomatic for disruptive innovation in the past to a perspective in the future. The paper finds that, according to the respondents, redox-flow batteries could pose a potential disruptive innovation within the field of battery technologies with a market introduction in about ten years.

This paper is structured as follows: In

Section 2, we give a brief overview regarding the concept of disruptive innovation, the hazard model of Sood and Tellis [

9], and introduce several battery technologies.

Section 3 illustrates our research method,

Section 4 the results, whereas

Section 5 presents our results, followed by a discussion and conclusion in

Section 6.

4. Results

Table 2 subsumes the results of the hypothesis tested. The descriptive results can be obtained from

Table A1 in the appendix.

To test hypotheses one to three, the results were analyzed using a two-dimensional cross

Table 3. If battery technologies are considered separately, the following picture emerges: The question whether lithium-ion batteries would have prevailed over NiMH batteries due to the higher energy density was answered in the affirmative by 46 out of 52 (88.5%) of the respondents. In contrast, 36 out of 49 (73.5%) respondents believed that redox-flow batteries would attack the lower market segment. The results of the lithium-ion batteries and redox-flow batteries were summarized in a cross

Table 3 in order to be able to make a qualified statement for both the lower attack and the upper attack. As with Sood and Tellis [

9] several potentially disruptive technologies were compared.

Regarding H1 and H2, we found that 52.4 percent of experts expected a lower attack by pioneers, whereas 47.6 percent assumed an attack from established enterprises. We could not find any significant correlation between the form of attack and form of enterprise, which corroborates extant findings [

9]. The frequency distribution among our sample supports Danneels [

2] and opposes Christensen [

1]. Similarly, we could not confirm the claim of Christensen [

1] that established that enterprises primarily attack the upper market segment, as 61.5 percent of experts stated that upper attacks derived from pioneers. These results corroborate Sood and Tellis [

9] who found a quite similar number of 58 percent in their study.

Concerning H3, only 31 percent of experts expected a cheaper technology introduced successfully onto the market as less potent. We hereby found a significant correlation (

p = 0.022) between price and capability, opposing Christensen [

1] and supporting Sood and Tellis [

9], who found a ratio of 88 to 12 percent. Our experts were therefore in-line with historical data obtained regarding lithium-ion batteries.

For hypothesis 4 to 7, we used Cox-regression modeling to test whether the covariates E, S, C and P shorten the timespan until disruption. We applied the data obtained regarding redox-flow batteries, as our experts considered redox-flow as a potential low-end attack, which is still before market entrance. Therefore, the Cox-model with the consideration of the time until market introduction could be applied.

Table 4 shows the results for the Cox-regression performed to determine the hazard for disruption [

9].

We could not confirm H4, claiming that disruptive innovations were predominantly introduced by pioneers. Regarding the results of the regression, we found that the timespan until potential disruption was not altered (B = 0.026, Exp (B) = 1.026). This result opposes the findings of Sood and Tellis [

9], who state that established enterprises increase hazard of disruption.

H5, claiming that lower attack increases the risk of disruption, could not be concluded from our study, as we only investigated technology disruptions, but not firm or demand disruptions.

For H6A and H6B, only 35.7 percent of experts expected lower attacks from small, newly founded enterprises especially for this purpose. We found that the disruption hazard was halved for especially founded enterprises (B = −0.521, Exp (B) = 0.594). Supporting several authors [

9,

52,

58], our experts state large enterprises to be the predominant drivers for disruptive innovations in the field of battery technologies. However, it has to be noted that Sood and Tellis [

9] only confirm this hypothesis for firm disruption, not for technology disruption.

For H7, we found that a lower price increases disruption hazard by the factor of 1.4 (B = 0.359, Exp (B) = 1.432). This means that our experts expected a lower attack to have a higher price at the beginning. A lower price also increases disruption hazard according to Sood and Tellis [

9]. For the energy density P, we could not find an influence on the time of market entrance of redox-flow batteries.

In summary, we confirmed hypothesis 1 to 3 for the field of battery technologies. For hypothesis 4 to 7, we could only confirm H7 that a lower price increases the probability of disruption regarding battery technologies.

5. Discussion

The assumption that redox-flow batteries will be commercially successful in the near future is supported by the fact that the technology has been researched since the 1960s [

36], and that the battery is considered advantageous especially in the stationary area [

33]. Even though NaMeCl2 batteries for high-temperature batteries are already produced by one manufacturer [

35], it is not yet possible to speak of a commercial market breakthrough. The experts’ assessment of zinc-air and lithium-air batteries coincides with the state of research, as the chemical processes cannot yet be fully controlled [

35].

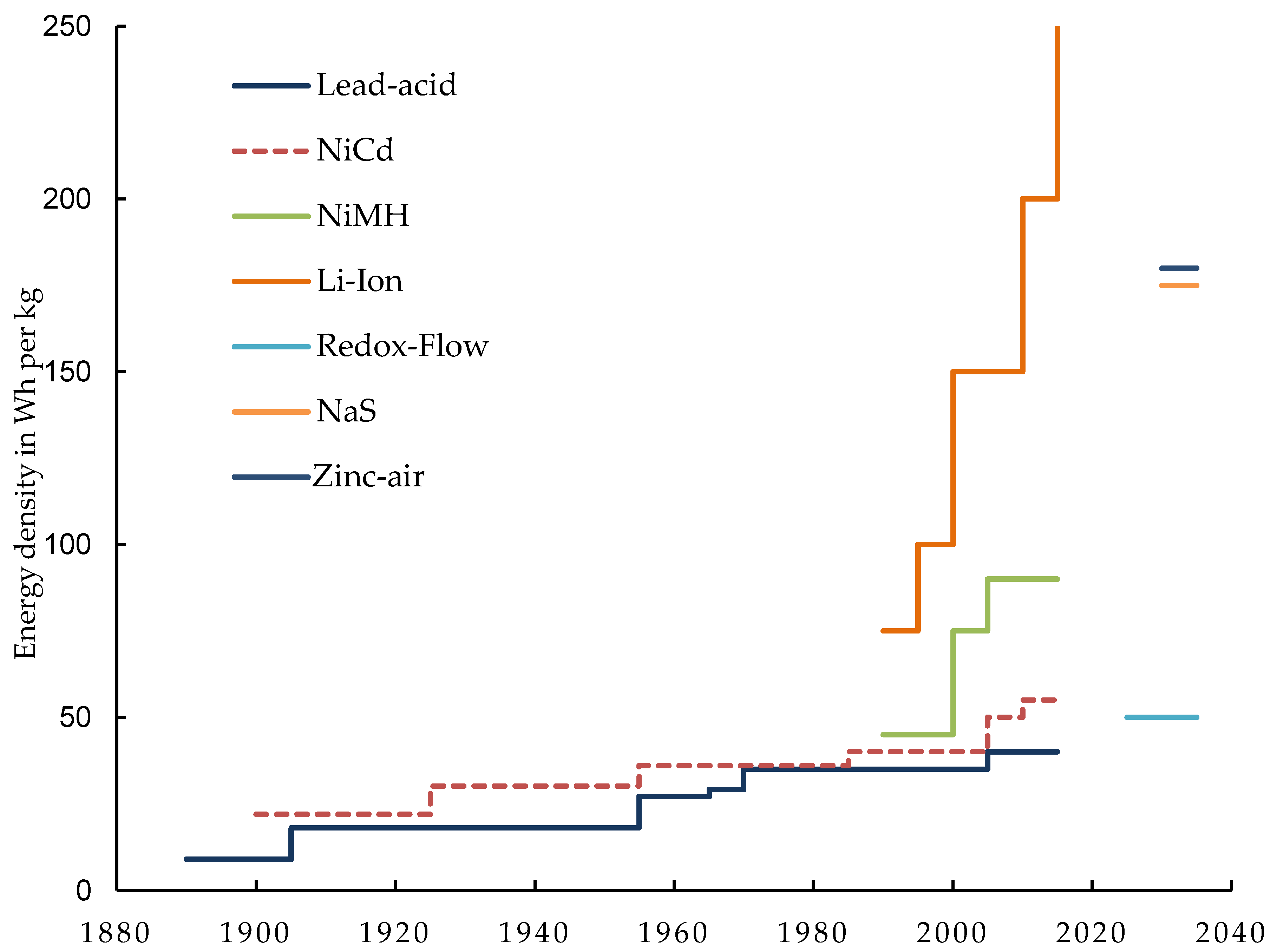

The performance assessment of lithium-ion batteries having a lower energy density, which is shared by almost a quarter of respondents, is difficult to understand, as the energy density of redox-flow batteries is currently more than 50% lower [

47]. As it is often the case for redox-flow batteries [

59], only the energy density of the electrolyte and not of the entire system may have been assessed for redox-flow batteries. On the other hand, for example [

56] states that redox flow systems in stationary use are up to 50% cheaper than Li-ion systems.

Further, it is striking that if it is assumed that the first commercial production of Li-ion batteries was carried out by Sony [

36], this fact seems to be unknown by 37 percent of respondents. This can be explained, for example because the areas of activity were mainly in the area of e-mobility and stationary storage, where companies other than Sony are seen as the first in the market. Therefore, a market-specific investigation is required for future research advances in this direction.

Both research into Sood and Tellis’ 36 markets [

9] and four different battery technologies have shown that an attack on the lower market segment is comparatively unlikely. Against the background that Christensen (1997) [

1] has identified a multitude of low-end disruptions within a very short time, using of the hard disk industry as the subject of his investigation, the occurrence of disruptive innovation proves to be industry-specific as well as technology-specific [

9].

In the more than 100-year history of energy storage, no technology with an initial lower energy density has become established. However, there is no empirical data on interruptions in this area. With the commercial introduction of redox flow batteries, which is expected by the experts surveyed within the next ten years, a technology with poorer performance could prevail for the first time.

As with H1, no significant correlations between established companies and evolutionary technology developments were identified for H2 either. However, it is unclear from which type of company the redox flow battery will ultimately be introduced. In contrast to Christensen’s [

1] findings that 80% of low-end disruptions in the hard disk industry come from pioneers, both the ex-post analysis of Sood and Tellis [

9] and the expert survey give an unclear picture, so that H1 could not be confirmed. Furthermore, the investigation of H4 does not show any connection between the risk of disruption and the nature of the company. However, the results also deviate from statements to the contrary, stating that disruptions mainly originate from established companies [

21,

22].

However, the studies do not reveal whether the term "pioneer" should be interpreted more in terms of a newly founded company or a company outside the industry. If the term pioneer is understood as a newly founded company, in contrast to the present study, the recognition that newly founded companies reduce the risk of disruption could serve as an explanation. An explanation for the results of both H1 and H2 as well as H4 could be that the nature of the company plays less of a role than the fact of what decisions are made in management. This assumption is also confirmed, which makes corporate success dependent on the efficiency of resource use, which assumes that a company is successful in a disruptive environment when it specifically withdraws capital from existing products and invests in new technologies [

57]. In contrast to the nature of the company, the price of the product showed that there is a correlation between the nature of the attack and the price level.

A possible explanation for the results obtained could be the idea of the low-end fringe-market encroachment [

4]. A niche market in which redox-flow batteries could become established is stationary applications, since energy density is only of secondary importance here and the costs over the entire service life are relevant rather than the price [

36]. Starting from the niche market of stationary energy storage devices, redox-flow batteries could become established in the lower price segment of other application areas in the coming decades, as there is already promising research on significant increases in energy density [

36]. In this context, however, another scenario is conceivable, namely that the market for stationary energy storage units is developing into a mass market itself and thus the performance parameters that were initially relevant for the niche market are now becoming suitable for mass production. This scenario would also be in line with Schmid and Druehl’s niche market concept [

4]. At first glance, the review of H7 seems to have led to the opposite, namely that a lower price increases the risk of disruption. Here too, the idea of the niche market disruption offers an explanatory approach. Thus it is possible that a technology that is initially positioned in a niche market is initially even more expensive, but at the time of entry into the mainstream market that has a lower price due to economies of scale [

4]. In summary, both the findings of Sood and Tellis [

9] and the present study show that it is possible to predict a disruption about the price level of a technology rather than about the nature of the company. If we look at the literature analysis carried out, we see that a large number of studies deal with the type of company that will experience a disruption rather than with the price. Therefore, future research on the price level in connection with disruptions is recommended, also in the area of battery storage.

As a further aspect, the embeddedness of batteries in smart energy networks has to be regarded, an aspect that is also raised in disruptive innovation literature in general or in adjacent fields [

61,

62,

63,

64,

65,

66]. Especially the combination of stationary usage, refueling of batteries in automotive applications, and the emergence of possible disruptions from other industries has to be mentioned in this context [

67]. In all cases, a possible lead user or lead application is required in order to support the emergence of disruptive innovation [

68].

Hence, the interrelations between possible applications of redox-flow batteries need to be integrated into future cell and systems design [

69,

70]. Although the identification of disruptive innovation theory on battery technologies is accompanied by several technological factors, its characteristics highlight a possible disruptive technological innovation that can be accompanied by technological research. A self-reinforcing effect is to be expected, namely that future disruptive developments such as renewable energies or the electrification of mobility [

15,

18] due to changed technology requirements and economies of scale through increased demand will encourage the development of new battery technologies.

6. Conclusions

6.1. Theoretical and Managerial Contribiton

This paper was among the first that attempts creating predictions for disruptive innovation [

2]. We included expert opinions for this prediction, as several authors disregard the interpolation of performance data to be predictive of disruption [

2,

7,

8].

Overall, several claims of Sood and Tellis [

9] can be confirmed for ex-ante analysis of disruptive innovation. Therefore, this paper contributes to the understanding of disruptive innovation, which is vital for the survival of industries [

1]. As 10 years is considered enough time to react, this insight can be an important contribution for the battery industry [

15,

18]. The development speed for new battery technologies will possibly increase on the background of renewable energies and battery electric vehicles.

The literature analysis has shown that the concept of disruptive innovation could be interpreted in many ways and was by no means firmly defined. The interpretations ranged from a predominantly qualitative definition such as Christensen [

1] to the other extreme, a qualitative description as carried out by Sood and Tellis [

9]. This range of definitions presents qualitative studies with the challenge that comparisons, especially to the statements of Christensen [

1], must always be carefully weighed up. Despite the weak points, Sood and Tellis [

9] close a research gap that had already been pointed out years before [

2,

10]. Particularly noteworthy here is the application of the model used by Lillard [

31] for analyzing the fertility of married couples to disruptive innovations. At this point, the present work has been taken up in order to determine the risk of discrimination with the help of the very popular Cox regression model, which is mostly used in medicine to analyze the death of patients. The Cox model has shown to what extent the time it takes for a disruption to occur depends on individual variables such as the company or the price. Since the existence of companies, if not even entire industries, depends on this topic [

1], all identifiable clues should be used for the detection of disruptions. The expert survey can offer a solution in contrast to the interpolation of existing performance data [

2,

7,

8], but also has several limitations, as described in the following.

6.2. Limitations

The usage of an expert survey has several limitations. First of all, the experts’ opinion might be subject to several personal biases, for instance self-selection of a preferred technology or that the experts are active in. Although the survey design did not allow for interpretation except for the expected time to market and performance increase, and standard deviations were on an acceptable level (see

Table A5 and

Table A6 in the

Appendix A), this limits the results notably. Therefore, the experts’ opinion could only be seen as a first hint for a possible disruption, not actually predicting disruption itself.

Second, since battery technologies are used in different applications, this also limits the generalizability of results. The result about experts disagreeing on who the introducer of lithium-ion batteries was in different industries limited the results significantly. The experts surveyed also noted in particular that there were a large number of markets in the energy storage sector, which, however, focused on very different performance criteria.

Third, it has to be mentioned that only 53 questionnaires were used. Therefore, several hypotheses could not be confirmed based on low reliability scores, which could have been proven with a larger sample.

In summary, the challenge of the present work was to develop a schema with which it was possible to check a prediction model without ex-post data or the interpolation of existing performance data. For this reason, the opinion of experts in the field of battery storage was used. Although presenting a novel approach, this also raised several challenges that result from integrating expert knowledge. Therefore, we want to stress out that the results could only serve as a thought-provoking approach for future research, but not predict a possible disruptive innovation without further verification. In order to address the limitations encountered, several avenues for future research are suggested in the following.

6.3. Suggestions for Future Research

First of all, the findings in the field of battery technologies must be separated for different areas of application. In view of Danneels’ [

2] recognition that technologies can be disruptive in one market and incremental in another, it would make sense to investigate battery storage technology on a market-specific basis.

Second, a targeted search should be made for early indicators that indicate disruptions in advance in order to check them with the known prediction models. The integration of expert opinions might be one, but should not be the only method used in a future attempt, as it has several limitations described above.

Third, in this paper as well as in Sood and Tellis [

9], the concept of disruption was essentially reduced to the lower performance compared to existing products. Christensen [

1] mentions efficiency as a central indicator of disruptions, but at the same time adds further characteristics of disruptions that have not been investigated in this paper.

In summary, the paper intended to highlight the importance of redox-flow batteries for future research. However, this estimation about redox-flow batteries was only drawn from the perspective of disruptive innovation while limited as it was based on an expert survey. It must therefore be enriched by further including technological, research perspectives.

Another future research avenue is the integration of further methods for prediction and evaluation of future technologies. These include, among others, the Delphi method, future-oriented technology analysis or future-oriented technology assessment [

71,

72,

73,

74]. Such methods can help to better understand and predict the underlying technological foundations, frame conditions and different forms of application for battery technologies in order to extend the findings of this paper.

In a broader context, future research could attempt to better understand the current initiatives in mobility and energy storage towards sustainability, and in manufacturing and digitization, often subsumed under the concept of Industry 4.0 [

75,

76,

77,

78,

79,

80,

81,

82].