Pricing Decisions in Closed-Loop Supply Chains with Peer-Induced Fairness Concerns

Abstract

1. Introduction

- The equilibrium solution of CLSC models in the cases of symmetrical and asymmetrical information of fairness concerns.

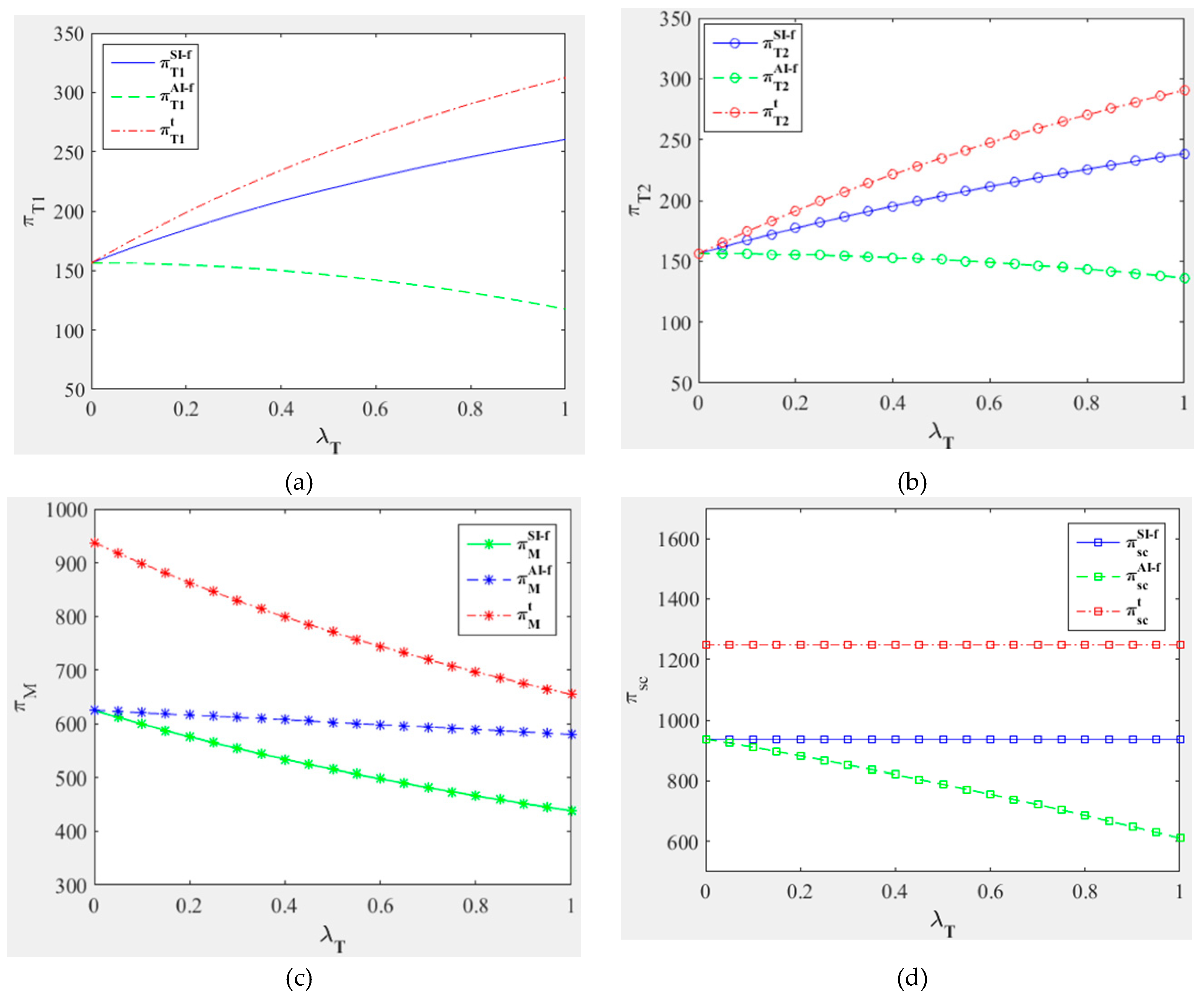

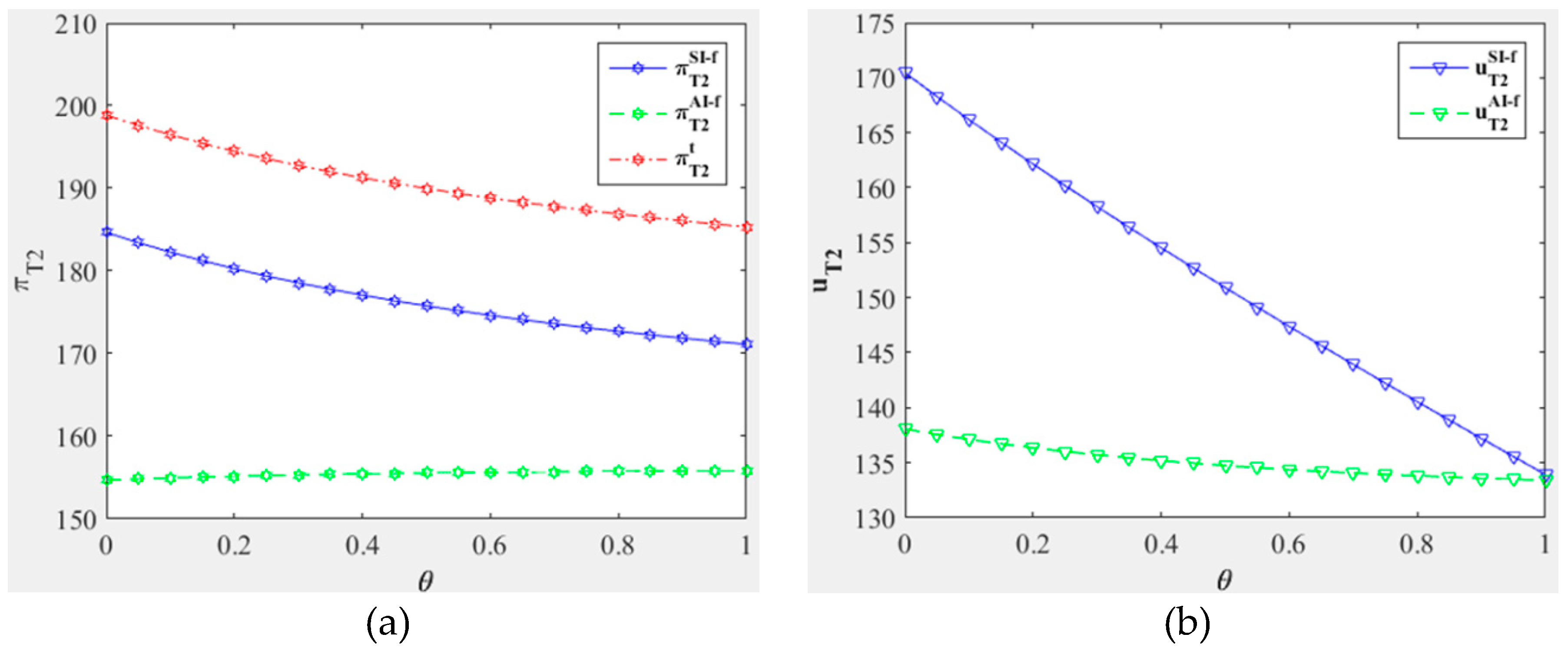

- The influence of distributional fairness concerns coefficient and peer-induced fairness concerns coefficient on the equilibrium solution of CLSC models.

- How to design an incentive contract to achieve Pareto improvement in the CLSC.

2. Literature Review

3. Pricing Decisions in A CLSC Under Fairness Neutral

3.1. Problem Description

3.2. Parametric Hypothesis and Symbols

3.3. Optimal Decisions in a CLSC under Fairness Neutral

3.3.1. Centralized Decision Case

3.3.2. Decentralized Decision Case

4. Pricing Decisions in a CLSC with Fairness Concerns

4.1. Reference Framework of Nash Bargain Fairness Concerns

4.2. Optimal Pricing Decisions under Symmetrical Information of Fairness Concerns

4.3. Optimal Pricing Decisions under Asymmetrical Information of Fairness Concerns

5. An Incentive Contract under Symmetrical Information of Fairness Concerns

6. Numerical Analysis

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- European Parliament, Council of the European Union. Directive 2006/12/EC of the European Parliament and Council of the European Union of 5 April 2006 on waste. Off. J. Eur. Union 2006, OJL 114, 9–21. [Google Scholar]

- Ministry of the Environment Government of Japan. Waste Management and Public Cleansing Law. 2005. Available online: http://www.env.go.jp/en/laws/recycle/01.pdf (accessed on 12 June 2018).

- CalRecycle. Revised Electronic Waste Recovery and Recycling Regulations. 2012. Available online: http://www.calrecycle.ca.gov/Laws/Regulations/Title14/Chap08pt2/EwasteRec12.pdf (accessed on 23 May 2019).

- European Parliament, Council of the European Union. Directive 2012/19/EU of the European Parliament and of the Council of 4 July 2012 on waste electrical and electronic equipment (WEEE). Off. J. Eur. Union 2012, OJL 197, 38–71. [Google Scholar]

- Order of the State Council of the People’s Republic of China (No.551). Regulation on the Administration of the Recovery and Disposal of Waste Electrical and Electronic Products. 2009. Available online: http://www.gov.cn/zwgk/2009-03/04/content_1250419.htm (accessed on 28 February 2009).

- Smith, V.M.; Keoleian, G.A. The Value of Remanufactured Engines: Life-Cycle Environmental and Economic Perspectives. J. Ind. Ecol. 2004, 8, 193–221. [Google Scholar] [CrossRef]

- Atasu, A.; Van Wassenhove, L.N.; Sarvary, M. Efficient Take-Back Legislation. Prod. Oper. Manag. 2009, 18, 243–258. [Google Scholar] [CrossRef]

- Heese, H.S.; Cattani, S.K.; Ferrer, G.; Gilland, W.; Roth, A.V. Competitive advantage through take-back of used products. Eur. J. Oper. Res. 2005, 164, 143–157. [Google Scholar] [CrossRef]

- Kahneman, D.; Tveraky, A. Prospect theory: An analysis of decisionunder risk. Econometrical 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Kahneman, D.; Knetsch, J.L.; Thaler, R. Fairness, competition on profit seeking: Entitlements in the market. Am. Econ. Rev. 1986, 76, 728–741. [Google Scholar]

- Scheer, L.K.; Kumar, N.; Steenkamp, J.B.E. Reactions to perceived inequity in U.S. and Dutch inter-organizational relationships. Acad. Manag. J. 2003, 46, 303–316. [Google Scholar]

- Fehr, E.; Schmidt, K.M. A theory of fairness, competition and cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Ruffle, B.J. More is better, but Fair is fair: Tipping in dictator and ultimatum games. Games Econ. Behav. 1998, 23, 247–265. [Google Scholar] [CrossRef]

- Pu, X.; Gong, L.; Han, G. A feasible incentive contract between a manufacturer and his fairness-sensitive retailer engaged in strategic marketing efforts. J. Intell. Manuf. 2019, 30, 193–206. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, Y.; Zhong, Y. A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. Int. J. Prod. Res. 2017, 55, 5287–5304. [Google Scholar] [CrossRef]

- Ho, T.H.; Su, X.M. Peer-induced Fairness in Games. Am. Econ. Rev. 2009, 99, 2022–2049. [Google Scholar] [CrossRef]

- Shi, Y.; Zhu, J. Game-theoretic analysis for supply chain with distributionalal and peer-induced fairness concerned retailers. Manag. Sci. Eng. 2014, 8, 78–84. [Google Scholar]

- Du, S.; Wei, L.; Zhu, Y.; Nie, T. Peer-regarding fairness in supply chain. Int. J. Prod. Res. 2018, 56, 3384–3396. [Google Scholar] [CrossRef]

- Nie, T.; Du, S. Dual-fairness supply chain with quantity discount contracts. Eur. J. Oper. Res. 2017, 258, 491–500. [Google Scholar] [CrossRef]

- Qin, Y.; Wei, G.; Dong, J. The signaling game model under asymmetric fairness-concern information. Clust. Comput. 2017, 1–16. [Google Scholar] [CrossRef]

- Ho, T.H.; Zhang, J.J. Designing pricing contracts for boundedly rational customers: Does the framing of the fixed fee matter? Manag. Sci. 2008, 54, 686–700. [Google Scholar] [CrossRef]

- Christoph, H.L.; Wu, Y. Social Preferences and Supply Chain Performance: An Experimental Study. Manag. Sci. 2008, 54, 1835–1849. [Google Scholar]

- Cui, T.H.; Raju, J.S.; Zhang, Z.J. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar]

- Mathies, C.; Gudergan, S.P. The role of fairness in modeling customer choice. Australas. Mark. J. 2011, 19, 22–29. [Google Scholar] [CrossRef]

- Han, X.H.; Feng, B.; Pu, X.J. Modeling decision behaviors in pricing game of closed-loop supply chains. J. Oper. Res. Soc. 2015, 66, 1052–1060. [Google Scholar] [CrossRef]

- Ma, P.; Li, K.W.; Wang, Z.J. Pricing decisions in closed-loop supply chains with marketing effort and fairness concerns. Int. J. Prod. Res. 2017, 55, 6710–6731. [Google Scholar] [CrossRef]

- Fehr, E.; Goette, L.; Zehnder, C. A Behavioral Account of the Labor Market: The Role of Fairness Concerns; Discussion Paper No. 3901; IZA: Bonn, Germany, 2008. [Google Scholar]

- Ho, T.H.; Su, X.M.; Wu, Y. Distributionalal and peer-induced fairness in supply chain contract design. Prod. Oper. Manag. 2014, 23, 161–175. [Google Scholar] [CrossRef]

- Caliskan-Demirag, O.; Chen, Y.H.; Li, J.B. Channel coordination under fairness concerns and nonlinear demand. Eur. J. Oper. Res. 2010, 207, 1321–1326. [Google Scholar] [CrossRef]

- Ozgun, C.D.; Chen, Y.H.; Li, J. Chanel coordination under fairness concerns and nonlinear demand. Eur. J. Oper. Res. 2010, 207, 1321–1326. [Google Scholar]

- Du, S.F.; Nie, T.F.; Chu, C.B.; Yu, Y.G. Reciprocal supply chain with intention. Eur. J. Oper. Res. 2014, 239, 389–402. [Google Scholar] [CrossRef]

- Zhang, F.; Ma, J.H. Reseach on the complex features about a dual-channel supply chain with a faircaring retailer. Commun. Nonlinear Sci. Numer. Simul. 2016, 30, 151–167. [Google Scholar] [CrossRef]

- Katok, E.; Olsen, T.; Pavlov, V. Wholesale pricing under mild and privately known concerns for fairness. Prod. Oper. Manag. 2014, 23, 285–302. [Google Scholar] [CrossRef]

- Pavlov, V.; Katok, E. Fairness and Coordination Failures in Supply Chain Contracts. Working Paper. 2009. Available online: https://ssrn.com/abstract=2623821 (accessed on 7 July 2011).

- Katok, E.; Pavlov, V. Fairness in supply chain contracts: A laboratory study. J. Oper. Manag. 2013, 31, 129–137. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N.; Diabat, A. Overview of coordination contracts within forward and reverse supply chains. J. Clean. Prod. 2013, 47, 319–334. [Google Scholar] [CrossRef]

- Zeng, A.Z. Coordination mechanisms for a three-stage reverse supply chain to increase profitable returns. Nav. Res. Logist. 2013, 60, 31–45. [Google Scholar] [CrossRef]

- Li, Y.; Da, Q.; Cai, M. Coordinated contract in reverse supply chain with collection volume agreement. In Proceedings of the IEEE International Conference on E-Product E-Service and E-Entertainment, Henan, China, 7–9 November 2010; pp. 1–4. [Google Scholar]

- Huang, X.; Choi, S.M.; Ching, W.K.; Siu, T.K.; Huang, M. On supply chain coordination for false failure returns: A quantity discount contract approach. Int. J. Prod. Econ. 2011, 133, 634–644. [Google Scholar] [CrossRef]

- Xu, Z. Option contract model of e-waste recycling reverse supply chain coordination. In Proceedings of the IEEE International Conference on Service Systems and Service Management, Tianjin, China, 25–27 June 2011; pp. 1–6. [Google Scholar]

- Zhang, Z.Z.; Wang, Z.J.; Liu, L.W. Retail services and pricing decisions in a closed-loop supply chain with remanufacturing. Sustainability 2015, 7, 2373–2396. [Google Scholar] [CrossRef]

- Huang, Z.; Nie, J.; Tsai, S. Dynamic Collection Strategey and Coordination of a Remanufacturing Closed-Loop Supply Chain under Uncertainty. Sustainability 2017, 9, 683. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shu, Y.; Dai, Y.; Ma, Z. Pricing Decisions in Closed-Loop Supply Chains with Peer-Induced Fairness Concerns. Sustainability 2019, 11, 5071. https://doi.org/10.3390/su11185071

Shu Y, Dai Y, Ma Z. Pricing Decisions in Closed-Loop Supply Chains with Peer-Induced Fairness Concerns. Sustainability. 2019; 11(18):5071. https://doi.org/10.3390/su11185071

Chicago/Turabian StyleShu, Yadong, Ying Dai, and Zujun Ma. 2019. "Pricing Decisions in Closed-Loop Supply Chains with Peer-Induced Fairness Concerns" Sustainability 11, no. 18: 5071. https://doi.org/10.3390/su11185071

APA StyleShu, Y., Dai, Y., & Ma, Z. (2019). Pricing Decisions in Closed-Loop Supply Chains with Peer-Induced Fairness Concerns. Sustainability, 11(18), 5071. https://doi.org/10.3390/su11185071