An Agent-Based Two-Stage Trading Model for Direct Electricity Procurement of Large Consumers

Abstract

1. Introduction

2. Description of Direct Electricity Procurement

2.1. Bilateral Contracts and Direct Electricity Procurement

2.2. Trading Modes of Direct Electricity Procurement

2.3. Transaction Price of Direct Electricity Procurement

2.4. Description of Risk Preference

3. Two-Stage Trading Model of Direct Electricity Procurement

3.1. Direct Electricity Procurement Involving Multiple Participants

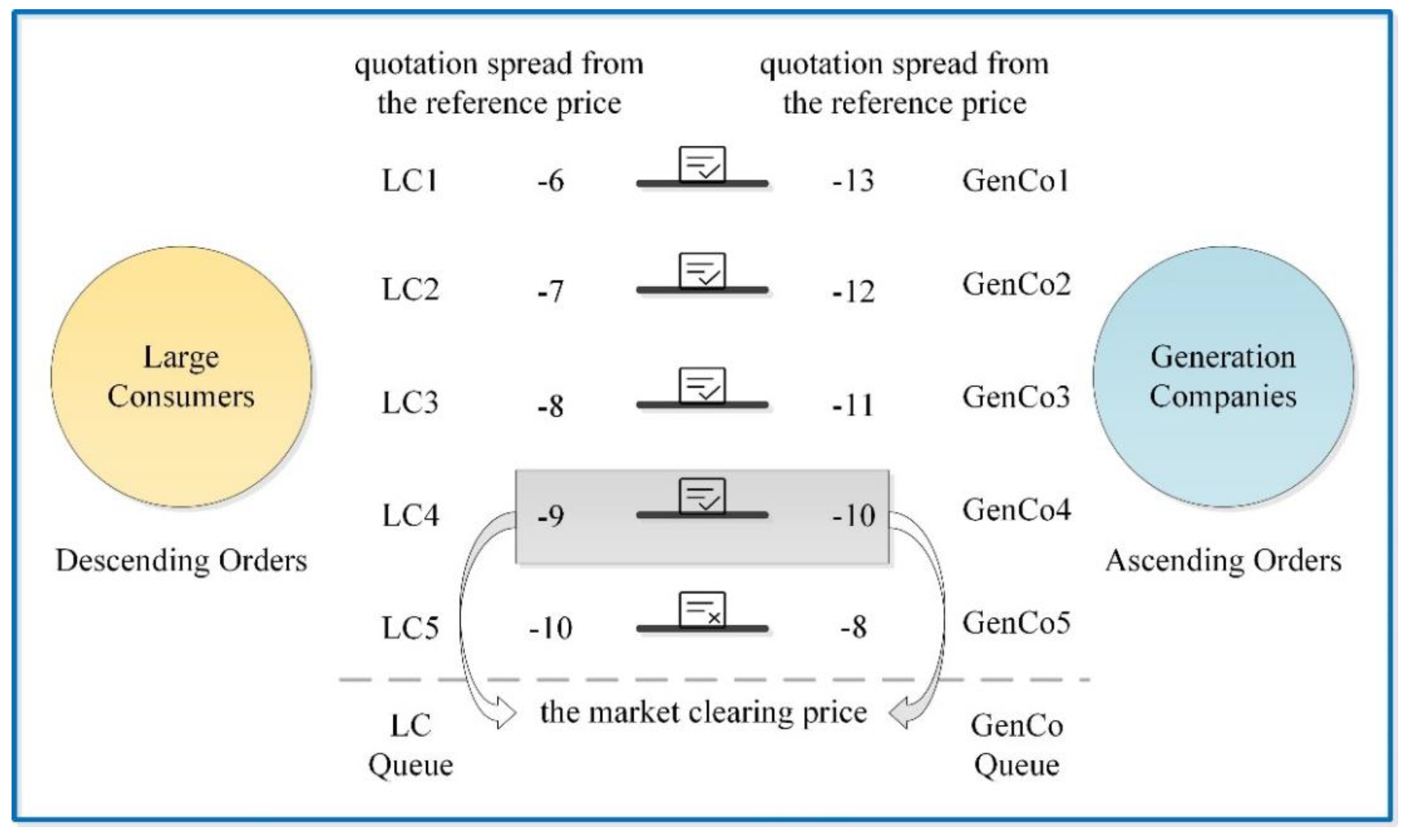

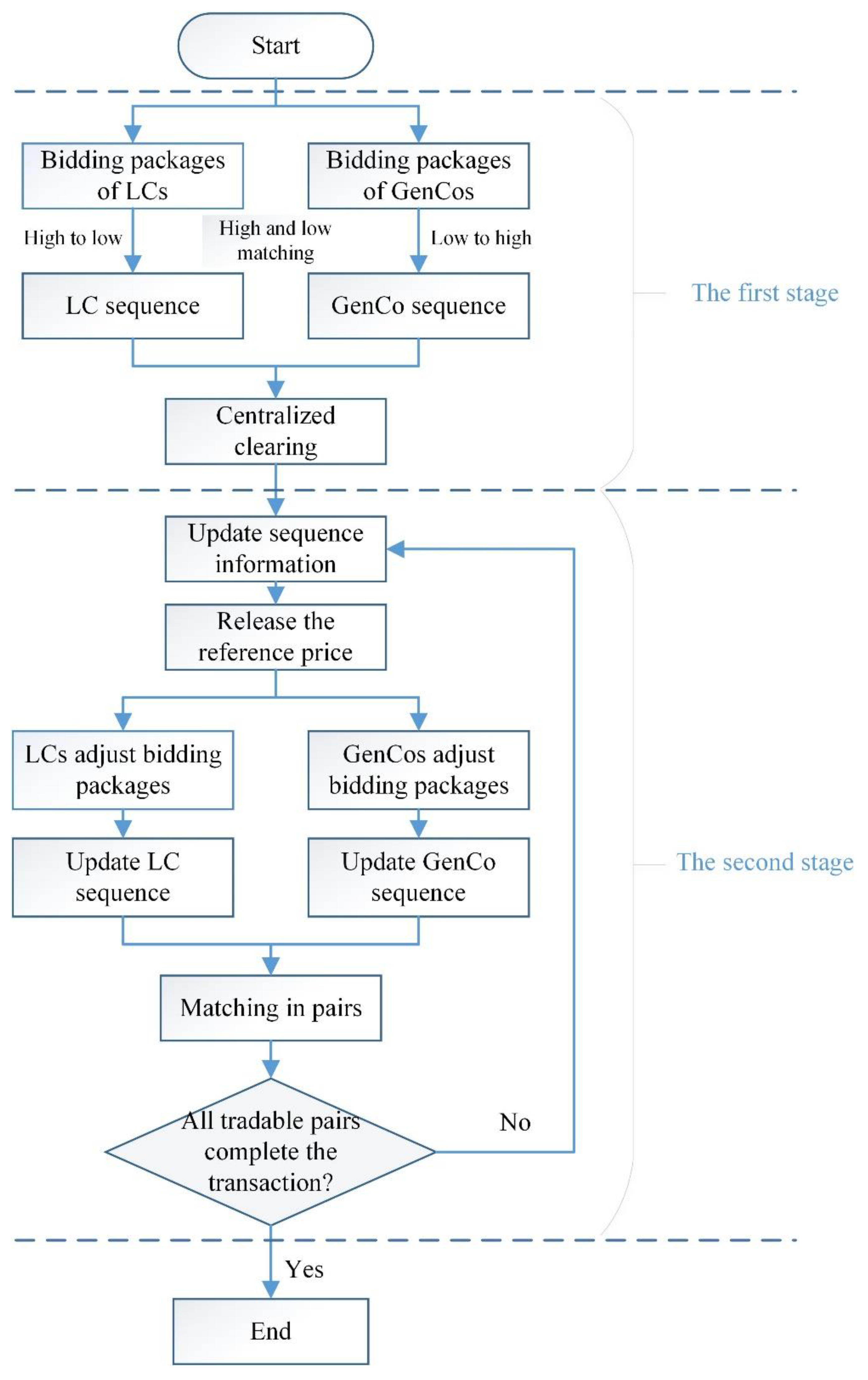

3.2. Trading Mechanism Design of Direct Electricity Procurement

3.3. Agent-Based Trading Model of Direct Electricity Procurement

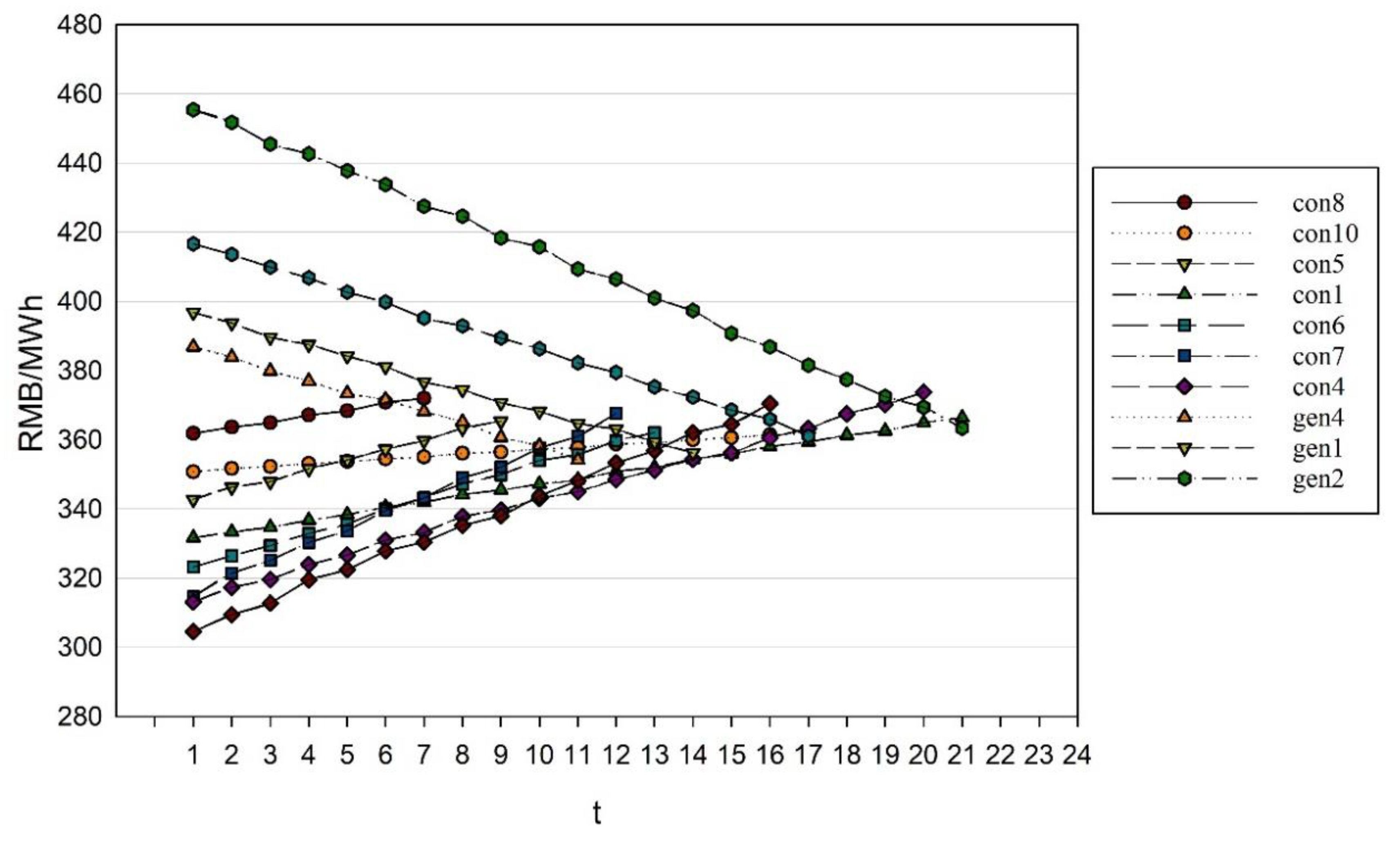

4. Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Yang, Y.; Bao, M.; Ding, Y.; Song, Y.; Lin, Z.; Shao, C. Review of information disclosure in different electricity markets. Energies 2018, 11, 3424. [Google Scholar] [CrossRef]

- Litvinov, E.; Zhao, F.; Zheng, T. Electricity Markets in the United States: Power Industry Restructuring Processes for the Present and Future. IEEE Power Energy Mag. 2019, 17, 32–42. [Google Scholar] [CrossRef]

- Hobbs, B.F.; Oren, S.S. Three Waves of U.S. Reforms: Following the Path of Wholesale Electricity Market Restructuring. IEEE Power Energy Mag. 2019, 17, 73–81. [Google Scholar] [CrossRef]

- Hogan, W.W. Market design practices: Which ones are best? IEEE Power Energy Mag. 2019, 17, 100–104. [Google Scholar] [CrossRef]

- Dagoumas, A. Impact of Bilateral Contracts on Wholesale Electricity Markets: In a Case Where a Market Participant Has Dominant Position. Appl. Sci. 2019, 9, 382. [Google Scholar] [CrossRef]

- Qing, X.I.A.; Yang, B.; Haiwang, Z. Institutional design and suggestions for promotion of direct electricity purchase by large consumers in China. Autom. Electr. Power Syst. 2013, 37, 1–7. [Google Scholar]

- Lopes, F.; Algarvio, H.; Coelho, H.; Lopes, F. Bilateral contracting in multi-agent electricity markets: Negotiation strategies and a case study. In Proceedings of the 2013 10th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 27–31 May 2013; pp. 1–8. [Google Scholar]

- Conejo, A.J.; Contreras, J.; Espínola, R.; Plazas, M.A. Forecasting electricity prices for a day-ahead pool-based electric energy market. Int. J. Forecast. 2005, 21, 435–462. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F. Risk Management and Bilateral Contracts in Multi-agent Electricity Markets. Comput. Netw. 2014, 430, 297–308. [Google Scholar]

- Bharti, D.; De, M. A new graph theory based loss allocation framework for bilateral power market using diakoptics. Int. J. Electr. Power Energy Syst. 2016, 77, 395–403. [Google Scholar] [CrossRef]

- Marí, L.; Nabona, N.; Pagès-Bernaus, A. Medium-term power planning in electricity markets with pool and bilateral contracts. Eur. J. Oper. Res. 2017, 260, 432–443. [Google Scholar] [CrossRef]

- Tang, Y.; Ling, J.; Wu, C.; Chen, N.; Liu, X.; Gao, B. Game-Theoretic Optimization of Bilateral Contract Transaction for Generation Companies and Large Consumers with Incomplete Information. Entropy 2017, 19, 272. [Google Scholar] [CrossRef]

- Aalami, H.A.; Nojavan, S. Energy storage system and demand response program effects on stochastic energy procurement of large consumers considering renewable generation. IET Gener. Transm. Distrib. 2015, 10, 107–114. [Google Scholar] [CrossRef]

- Foley, A.; Gallachóir, B.Ó.; Hur, J.; Baldick, R.; McKeogh, E.; Foley, A. A strategic review of electricity systems models. Energy 2010, 35, 4522–4530. [Google Scholar] [CrossRef]

- Zhong, P.; Zhang, W.; Xu, B. A risk decision model of the contract generation for hydropower generation companies in electricity markets. Electr. Power Syst. Res. 2013, 95, 90–98. [Google Scholar] [CrossRef]

- Hatami, A.R.; Seifi, H.; Sheikh-El-Eslami, M.K. Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electr. Power Syst. Res. 2009, 79, 246–254. [Google Scholar] [CrossRef]

- Shinde, P.U.; Deshmukh, S.R. Risk management in electricity market by portfolio optimization. In Proceedings of the 2014 Annual IEEE India Conference (INDICON), Pune, India, 11–13 December 2014; pp. 1–6. [Google Scholar]

- Mathuria, P.; Bhakar, R. Info-Gap Approach to Manage GenCo’s Trading Portfolio with Uncertain Market Returns. IEEE Trans. Power Syst. 2014, 29, 2916–2925. [Google Scholar] [CrossRef]

- Lorca, Á.; Prina, J. Power portfolio optimization considering locational electricity prices and risk management. Electr. Power Syst. Res. 2014, 109, 80–89. [Google Scholar] [CrossRef]

- Zarif, M.; Javidi, M.H.; Ghazizadeh, M.S. Self-Scheduling of Large Consumers with Second-Order Stochastic Dominance Constraints. IEEE Trans. Power Syst. 2013, 28, 289–299. [Google Scholar] [CrossRef]

- Zare, K.; Moghaddam, M.P.; el Eslami, M.K.S. Demand bidding construction for a large consumer through a hybrid IGDT-probability methodology. Energy 2010, 35, 2999–3007. [Google Scholar] [CrossRef]

- Farham, H.; Mohammadian, L.; Alipour, H.; Pouladi, J. Energy procurement of large industrial consumer via interval optimization approach considering peak demand management. Sustain. Cities Soc. 2019, 46, 101421. [Google Scholar] [CrossRef]

- Mathuria, P.; Bhakar, R. Large consumer’s purchase portfolio optimization in electricity market. In Proceedings of the 2016 IEEE 6th International Conference on Power Systems (ICPS), New Delhi, India, 4–6 March 2016; pp. 1–5. [Google Scholar]

- Green, R. The Electricity Contract Market in England and Wales. J. Ind. Econ. 1999, 47, 107–124. [Google Scholar] [CrossRef]

- Rabinovich, Z.; Naroditskiy, V.; Gerding, E.H.; Jennings, N.R. Computing pure Bayesian-Nash equilibria in games with finite actions and continuous types. Artif. Intell. 2013, 195, 106–139. [Google Scholar] [CrossRef]

- Bower, J.; Bunn, D. A Model-Based Comparison of Pool and Bilateral Market Mechanisms for Electricity Trading; London Business School: London, UK, May 1999. [Google Scholar]

- Bompard, E.; Huang, T.; Yang, L. Market Equilibrium under Incomplete and Imperfect Information in Bilateral Electricity Markets. IEEE Trans. Power Syst. 2011, 26, 1231–1240. [Google Scholar] [CrossRef]

- Vasiljevska, J.; Douw, J.; Mengolini, A.; Nikolic, I. An Agent-Based Model of Electricity Consumer: Smart Metering Policy Implications in Europe. J. Artif. Soc. Soc. Simul. 2017, 20, 12. [Google Scholar] [CrossRef]

- An, B.; Gatti, N.; Lesser, V. Alternating-offers bargaining in one-to-many and many-to-many settings. Ann. Math. Artif. Intell. 2016, 77, 67–103. [Google Scholar] [CrossRef]

- Alikhanzadeh, A.; Irving, M. Bilateral electricity market theory based on conjectural variations equilibria. In Proceedings of the 2011 8th International Conference on the European Energy Market (EEM), Zagreb, Croatia, 25–27 May 2011; Volume 11, pp. 99–104. [Google Scholar]

- Yu, N.; Tesfatsion, L.; Liu, C.C. Financial bilateral contract negotiation in wholesale electricity markets using Nash bargaining theory. IEEE Trans. Power Syst. 2012, 27, 251–267. [Google Scholar] [CrossRef]

- Rashedi, N.; Tajeddini, M.A.; Kebriaei, H. Markov game approach for multi-agent competitive bidding strategies in electricity market. IET Gener. Transm. Distrib. 2016, 10, 3756–3763. [Google Scholar] [CrossRef]

- Fabra, N.; von der Fehr, N.-H.; Harbord, D. Modeling electricity auctions. Electr. J. 2002, 15, 72–81. [Google Scholar] [CrossRef]

- Fabra, N.; Fehr, N.-H.; Harbord, D. Designing electricity auctions. RAND J. Econ. 2006, 37, 23–46. [Google Scholar] [CrossRef]

- Nielsen, S.; Sorknæs, P.; Østergaard, P.A. Electricity market auction settings in a future Danish electricity system with a high penetration of renewable energy sources—A comparison of marginal pricing and pay-as-bid. Energy 2011, 36, 4434–4444. [Google Scholar] [CrossRef]

- Zhang, J.; Hu, Z.; Zheng, Y.; Zhou, Y.; Wan, Z. Sectoral Electricity Consumption and Economic Growth: The Time Difference Case of China, 2006–2015. Energies 2017, 10, 249. [Google Scholar] [CrossRef]

- Lei, N.; Chen, L.; Sun, C.; Tao, Y. Electricity Market Creation in China: Policy Options from Political Economics Perspective. Sustainability 2018, 10, 1481. [Google Scholar] [CrossRef]

- Cocco, L.; Tonelli, R.; Marchesi, M. An Agent-Based Artificial Market Model for Studying the Bitcoin Trading. IEEE Access 2019, 7, 42908–42920. [Google Scholar] [CrossRef]

- Garcia-Magarino, I.; Lacuesta, R.; Lloret, J. Agent-Based Simulation of Smart Beds With Internet-of-Things for Exploring Big Data Analytics. IEEE Access 2017, 6, 366–379. [Google Scholar] [CrossRef]

| LC Agent | Trading Volume (MWh) | Initial Bidding Price (RMB/MWh) | Reserve Price (RMB/MWh) | Bidding Coefficient |

|---|---|---|---|---|

| con1 | 1200 | 400 | 320 | 0.01 |

| con2 | 1800 | 410 | 360 | 0.005 |

| con3 | 450 | 440 | 370 | 0.008 |

| con4 | 3700 | 420 | 300 | 0.015 |

| con5 | 1100 | 390 | 330 | 0.005 |

| con6 | 1300 | 430 | 310 | 0.015 |

| con7 | 1500 | 400 | 310 | 0.01 |

| con8 | 600 | 400 | 350 | 0.002 |

| con9 | 200 | 410 | 380 | 0.002 |

| con10 | 350 | 420 | 340 | 0.008 |

| GenCo Agent | Trading Volume (MWh) | Initial Bidding Price (RMB/MWh) | Reserve Price (RMB/MWh) | Bidding Coefficient |

|---|---|---|---|---|

| gen1 | 3100 | 460 | 330 | 0.01 |

| gen2 | 4200 | 420 | 340 | 0.008 |

| gen3 | 2700 | 390 | 310 | 0.008 |

| gen4 | 1500 | 400 | 320 | 0.008 |

| gen5 | 1300 | 360 | 300 | 0.005 |

| LC Agent | Trading Volume (MWh) | Initial Bidding Price (RMB/MWh) | GenCo Agent | Trading Volume (MWh) | Initial Bidding Price (RMB/MWh) |

|---|---|---|---|---|---|

| con9 | 200 | 380 | gen5 | 1300 | 360 |

| con3 | 450 | 370 | gen3 | 2700 | 390 |

| con2 | 1800 | 360 | gen4 | 1500 | 400 |

| con8 | 600 | 350 | gen2 | 4200 | 420 |

| con10 | 350 | 340 | gen1 | 3100 | 460 |

| con5 | 1100 | 330 | |||

| con1 | 1200 | 320 | |||

| con6 | 1300 | 310 | |||

| con7 | 1500 | 310 | |||

| con4 | 3700 | 300 |

| LC Agent | Trading Volume (MWh) | GenCo Agent | Trading Volume (MWh) |

|---|---|---|---|

| con2 | 1150 | gen3 | 2700 |

| con8 | 600 | gen4 | 1500 |

| con10 | 350 | gen2 | 4200 |

| con5 | 1100 | gen1 | 3100 |

| con1 | 1200 | ||

| con6 | 1300 | ||

| con7 | 1500 | ||

| con4 | 3700 |

| Bidding Round | LC Agent | GenCo Agent | Trading Volume | Transaction Price (RMB/MWh) |

|---|---|---|---|---|

| 0 | con9 | gen5 | 200 | 360 |

| 0 | con3 | gen5 | 450 | 360 |

| 0 | con2 | gen5 | 650 | 360 |

| 7 | con2 | gen3 | 1150 | 370.06 |

| 9 | con10 | gen3 | 350 | 363.04 |

| 11 | con6 | gen3 | 1200 | 357.55 |

| 12 | con6 | gen4 | 100 | 365.28 |

| 13 | con1 | gen4 | 1200 | 361.27 |

| 14 | con4 | gen4 | 200 | 360.66 |

| 16 | con4 | gen2 | 3500 | 368.19 |

| 17 | con8 | gen2 | 600 | 361.43 |

| 17 | con7 | gen2 | 100 | 362.14 |

| 20 | con7 | gen1 | 1400 | 371.58 |

| 21 | con5 | gen1 | 1100 | 364.84 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Zheng, Y.; Yao, M.; Wang, H.; Hu, Z. An Agent-Based Two-Stage Trading Model for Direct Electricity Procurement of Large Consumers. Sustainability 2019, 11, 5031. https://doi.org/10.3390/su11185031

Zhang J, Zheng Y, Yao M, Wang H, Hu Z. An Agent-Based Two-Stage Trading Model for Direct Electricity Procurement of Large Consumers. Sustainability. 2019; 11(18):5031. https://doi.org/10.3390/su11185031

Chicago/Turabian StyleZhang, Jian, Yanan Zheng, Mingtao Yao, Huiji Wang, and Zhaoguang Hu. 2019. "An Agent-Based Two-Stage Trading Model for Direct Electricity Procurement of Large Consumers" Sustainability 11, no. 18: 5031. https://doi.org/10.3390/su11185031

APA StyleZhang, J., Zheng, Y., Yao, M., Wang, H., & Hu, Z. (2019). An Agent-Based Two-Stage Trading Model for Direct Electricity Procurement of Large Consumers. Sustainability, 11(18), 5031. https://doi.org/10.3390/su11185031