Abstract

Since the mid-2000s, start-ups have increasingly become the driving force of new jobs and growth engines for advanced countries, and emerging nations are striving to vitalize start-ups through active government support policies. However, approximately 30% of start-ups shut down within two years of their foundation. Accordingly, this study determines the factors affecting the business sustainability of start-ups as based on available government support and provides suggestions to increase the effectiveness of the government-supported projects. This study conducted a survey of 273 start-ups in Korea, and empirically analyzed whether factors such as entrepreneurship, market orientation, and network affected business sustainability by using flow experience and entrepreneurial satisfaction as mediators. The results found that entrepreneurship affected business sustainability with flow experience and entrepreneurial satisfaction as the mediators, while market orientation affected business sustainability using flow experience as the mediator, and network affected business sustainability with entrepreneurial satisfaction as the mediator.

1. Introduction

The global craze of start-ups has been in effect since the mid-2000s and the trend is expected to continue. In 2018, start-up investments worth USD 99.5 billion were made in the United States alone, which was the largest amount in history, and at least a 30% increase from 2017 [1]. Leading global IT companies such as Google, Facebook, Uber, and Airbnb have brought innovation to the transportation and lodging industry, while Dropbox has popularized the Cloud service, and Xiaomi is often referred to as the Apple of China. All these companies emerged with the start-up craze and have increased their enterprise value by tens of billions of dollars in a short time, growing into world-renowned companies. Start-ups perform a key role in creating new jobs. Since the economic depression of 2009, small and medium-sized enterprises (SMEs) have taken up to 95% of all companies in OECD countries (Organization for Economic Co-operation and Development), with start-ups particularly contributing to the creation of around 60–70% of new jobs [2].

In keeping pace with this trend, the importance of start-ups is increasing at the national level as a breakthrough to secure new growth engines and create jobs worldwide [3]. Silicon Valley in the USA; Tel Aviv, Israel; and London, England each feature highly developed start-up environments, and are considered by other countries as the best practices of successful start-up ecosystems [4]. Japan established a law for supporting SMEs that lowered the minimum capital of incorporation from JPY 10 million to JPY 1 to create a boom of start-ups in 2002. As a result, the individual angel investments in early-stage start-ups increased significantly to JPY 2.5 billion in 2015, and VC (venture capital) investments also increased to more than JPY 90 billion in 2016 [5]. Since China stated the economic development policy of “Widespread Entrepreneurship and Innovation” in 2015, the start-up craze has expanded throughout China, and the Chinese government is emphasizing “innovation through entrepreneurship” as a new growth engine. Moreover, they are creating an environment in which it is relatively easy to obtain external capital, such as through venture capital, private investors, and government subsidies when raising funds for initial expenses, instead of using the owner’s equity or capital [6].

Korea is also focusing on nurturing new industries and start-ups to enhance national competitiveness by changing the current industrial structure that is focused on large corporations and conglomerates. Start-ups are activated by the government’s active support in overcoming the issues of rapid aging and youth unemployment, and accordingly, there is an increase in the government’s direct and indirect support projects, such as nurturing and supporting pre-entrepreneurs, developing and supporting exports of new products, and providing finances and tax support [7]. However, while the start-ups that are based on angel and corporate investments in advanced countries are growing into corporate giants, or core companies that lead new industries and achieve quantitative growth through upfront investments and mergers, the start-ups that are based on government support in Korea are showing low survival rates and limitations in growth [8].

Generally, approximately 30% of start-ups end in closure within two years of their foundation [9], which is why business sustainability through survival and growth, in addition to the foundation of start-ups, is a critical issue in terms of individual income and national economy. Through government support, various external programs may continuously have positive effects on the performance of start-ups [10]. Thus, there is a need for a differentiated support strategy that considers the business sustainability and competency enhancement of start-ups, rather than a standardized support [11].

Based on a systematic review of 126 special issue articles, published between 1988 and 2018 [12], we identified trends focusing on SME internationalization and various forms of international new ventures. The investigation addressing organizational performance and how to achieve sustainable enterprise excellence has received considerable attention from researchers [13]. However, while there are many studies on the success factors and entrepreneurship of start-ups, not many focus on business sustainability through the survival and growth of the start-ups [14].

Accordingly, this study is to emphasize the need for business sustainability of start-ups based on government support and discusses the direction for inducing sustainability. This study empirically analyzes the effects of the fundamental business attributes required by start-ups such as entrepreneurship, market orientation, and network of business sustainability through flow experience and entrepreneurial satisfaction by examining small start-ups based on the support of the Korean government, thereby analyzing the key factors to induce business sustainability of start-ups based on government support. In the rapidly changing environment due to the Fourth Industrial Revolution and technological innovation, government policies and support programs for industrial and business ecosystems must change from sponsorship that focuses on financial support, to the concept of social investment that enhances the management competencies of entrepreneurs, along with the continuous survival and growth of start-ups [15]. In this aspect, this study will provide specific implications for finding the direction of the strategic development of start-ups as supported by the government at the national level.

2. Literature Review

2.1. Government Policies and Support of Start-Ups

A start-up can be defined as a project-based organization or company in various business fields that commercializes a new business model by combining innovative ideas or advanced technologies to deal with uncertain environments [16]. According to the support for SMEs Act in Korea, start-ups are defined as individual businesses or corporations that are in operation for less than seven years since commencement [17]. The scope does not include fields like finance, insurance, and real estate. Therefore, the start-ups that are based on government support can be defined as start-ups that received government support in the early stages since foundation, or during the preparation for establishment [18].

Due to the global trend of low growth, there is an increasing social consensus that supports the growth of large corporations, and SMEs alone are not enough to secure new growth engines for economic development. Accordingly, major countries such as the USA, Japan, and China are actively implementing entrepreneurship and start-up development policies according to their own situations [3]. In the USA, the Obama administration implemented the Start-up America Initiative, which supported innovative entrepreneurs in the private sector, and actively pursued innovative start-ups and venture investments by enacting the 2012 JOBS Act (Jumpstart Our Business Start-ups Act) to facilitate financing for start-ups [19]. The Trump administration is also issuing administrative orders for deregulation and is constantly carrying out support policies by establishing the Office of American Innovation within the White House Office. Moreover, various entrepreneurial ecosystems (state governments, universities, large corporations, investors, incubators, etc.) are activated in large cities such as Silicon Valley, San Francisco; Silicon Alley, New York; and Silicon Beach, Los Angeles, which greatly contribute to economic revitalization and urban development.

Japan also plans to establish a venture ecosystem as a strategy of national growth. According to the Japanese government’s 2017 Growth Strategy, their goal is to create an environment for the cycle of innovation within society by building partnerships among research institutes such as universities, large corporations, governments, and private ventures, thereby doubling the ratio of venture capital investments of GDP by 2022 [20]. China began to focus on entrepreneurship-related policies upon entering the 2000s, and enacted a law on the promotion of SMEs in 2002 through which they established support policies for the development of SMEs in five sectors: finance, entrepreneurship, technological innovation, market development, and social services. Since the enactment of this law, over 50 major policies related to SMEs were announced, with reformation of the legislative system and establishment of the support system at the local government level [6]. According to the state administration for the market regulation in China in 2018 (CEIC data), the number of newly established companies had increased rapidly since 2014, resulting in 6.07 million start-ups in 2017 alone [21]. In addition, major countries such as England, France, Germany, India, and Canada are also implementing various entrepreneurship and start-up support policies at the government level, in order to build an innovation-driven economy and secure new growth engines without falling behind the wave of the Fourth Industrial Revolution [4].

The recent acceleration of global competition and the development of technology has dramatically increased productivity in Korea, and start-ups are encouraged as an alternative to jobless growth as focused in conglomerates. This is because entrepreneurship resolves the pending issues of unemployment and provides a boost to the stagnant economy, nurturing future economic agents [22]. According to the 2018 announcement from Statistics Korea, the 2016 survival rate of start-ups is 65.3% for the first year after foundation, 50.7% after two years, and 41.5% after three years, indicating that at least 50% of start-ups disappear within two to three years [23]. These low survival rates are due to the failure of designing a strategic structure that considers the competencies and marketability of start-ups, such as an increase in investment that is suitable for the market structure or innovativeness of business, and a consideration of business sustainability that is in line with the fosterage of start-ups at the national level that would reduce unemployment rates and promote employment [24]. There is an insufficient level of support associated with the entrepreneurial finance that is necessary for overcoming the death valley of start-ups. It is necessary to analyze the constraint factors and provide alternatives to resolve this, so that young people can choose entrepreneurship over employment as an important policy alternative to overcome the unemployment rates [25].

According to the 2018 start-up survey announced by the Korean Ministry of SMEs and Start-ups, in April 2019 there are over two million SMEs that are less than seven years old, 13.1% of which benefited from the government’s support policy. Moreover, the most common form of government support was from policy funds at 86.9%, followed by entrepreneurship education at 9.7%, R&D support at 3.8%, facilities and spaces at 3.2%, mentoring/consulting at 2.7%, commercialization support at 2.3%, market and marketing support at 1.0%, and networking events at 0.8%. According to the 2019 Entrepreneurial Support Notice by the Ministry of SMEs and Start-ups, the government’s start-up support project for 2019 has a total budget of KRW 1.118 trillion across 14 government departments, which is an increase of 43.4% from 2018, and does not include policy funds. Here, the size of support from the Ministry of SMEs and Start-ups, the primary department in entrepreneurial support, accounts for 89.2% [26].

Previous studies explain that government support performs a positive role in entrepreneurship [27], and Im and Jeon [7] subdivided the entrepreneurial support system into support in terms of taxes, finances, technology, management, and entrepreneurial infrastructures. They found that the government’s entrepreneurial support system has a positive effect on the entrepreneurial intentions of potential entrepreneurs. Companies that received government support survived for a relatively longer period than those that did not receive support [28], and higher satisfaction in the entrepreneurial support program resulted in a greater performance of start-ups [29]. Solomon et al. [9] analyzed the counseling hours of external experts and the survivability of business by examining the start-ups that received entrepreneurial support, determining that the support program had a positive effect. As a result of analyzing start-ups that received management or technological support, the support in primary business functions like marketing, financial management, and operations was more effective for low performing start-ups, while the support in secondary business functions like human resources and raising capital had a great effect on high performing start-ups [11].

However, though there is an increasing number of successful companies as a result of the start-up craze, 90% of the companies are still frustrated with the valley of death [30]. It is difficult for start-ups to successfully enter the market without first establishing core strategies and taking proper measures in the initial market entry process, while keeping pace with the rapid changes in the market environment. Less than 1% of the start-ups succeeded in the initial public offering (IPO) beyond the valley of death [31]. Like other countries, Korea sets the basic direction of start-up promotion policies so that creative ideas can lead to business start-ups. The Korean government is providing spaces, start-up funds, start-up education, consulting, and global expansion programs with the intention to increase the survival rates and constant growth of start-ups, but there are limitations in producing continuous results [32].

2.2. Business Success and Sustainability of Start-Ups

Many studies state that the competencies necessary for the success of start-ups are entrepreneurship, market orientation, network, technological innovation, and government support as shown in Table 1. Buli [33] emphasized that entrepreneurial orientation and market orientation are particularly important. Acosta et al. [34] stressed the importance of competencies such as market orientation, network capability, and entrepreneurial orientation. Ahn et al. [35] categorized various competency factors into entrepreneurial competencies, technological competencies, and management competencies. Previous studies on start-ups that are based on government support also show the importance of these competencies, such as Park et al. [36] who emphasized that entrepreneurship and the intentions of entrepreneurs are very important for start-ups that receive government support. Lee and Ha [37] emphasized the importance of entrepreneurship and entrepreneurial competencies, among which market orientation, marketing competencies, and networking competencies are considered important. Furthermore, Jeong et al. [38] proved that elements of entrepreneurship, such as innovativeness and risk taking, had a significant effect on entrepreneurial satisfaction.

Table 1.

Necessary competences of start-up.

While previous studies on the start-ups of the 2000s emphasized factors such as innovativeness, proactiveness, and risk taking with a focus on entrepreneurship, the studies after 2010 stressed the importance of the market environment factors of companies, such as the market orientation, networking, and management competencies. This is because countless start-ups fail to overcome the valley of death within one to three years from their foundation, as they fail to consider other competencies such as the use of external resources, or market-oriented marketing beyond ideas or technologies [37]. Accordingly, this study determines the relationship between the three factors to the business sustainability of start-ups: entrepreneurship, market orientation, and network.

First, business growth and the sustainability of start-ups are generally introduced to have a high correlation with entrepreneurship [34,38,49,50]. Zahra [51] discovered that there is a significant relationship related to entrepreneurship measured in terms of innovativeness, proactiveness, and risk taking, to the sustained growth of a company. Horne [52] argued that the entrepreneur’s knowledge, skills, and abilities are features that are difficult for competitors to develop or imitate, and thus are competencies that have a significant impact on the development and growth of start-ups. Moreover, Tehseen and Ramayah [53] claimed that such competencies of entrepreneurs are closely related to the competitive advantage and differentiation points of start-ups, thereby laying an important foundation for long-term company growth.

Second, market orientation has been studied by many researchers as a key factor for companies to generate profits from customers and secure sustained competitive advantage [48,54,55,56]. Peter and Waterman [55] argued that a business can continue to grow only if it can maintain market orientation in a market environment with severe changes where the demands of the end consumers are diversified and subdivided. Choi and Lee [57] analyzed that innovation performance is increased by customer orientation, which gives top priority to customer satisfaction by determining customer needs, rather than by competitive orientation that prepares for the threats from competitors in the rapidly changing market environment. Start-ups must, in the end, reinforce market orientation to constantly lead start-up ideas to business success, by fulfilling new customer values within fierce competition [39,40,41].

Third, the network may also be an important factor for a company’s success and business sustainability. This is because the network owned by the individual entrepreneur has a significant effect of continuously developing the business [58]. A network not only helps overcome the obstacles faced by start-ups but is useful to perceive the opportunities necessary for promoting entrepreneurial success [59]. Moreover, it has a positive effect on the growth of start-ups and sustained investment [60]. Entrepreneurs attempt to contact existing entrepreneurs or people in the field that have similarities to their business in the initial stages of a start-up where they face the most difficulties [61,62]. Through this network, they can overcome the various difficulties in the process of business foundation and establish the grounds to maintain a successful start-up [63].

2.3. Start-Up Competencies and Flow Experience

A flow state refers to an “autotelic experience” which is caused by intrinsic motivation. Csikszentmihalyi [64] stated that an “autotelic experience” is a “behavior done not with the expectation of some future benefit but simply to experience it as a reward” and is thus a highly pleasant and enjoyable experience. Jackson and Marsh [65] claimed that an autotelic experience induces the interest in the relevant incident as a precondition, as well as a final output of flow experience, thereby it is a cycle that maintains flow experience. Hoffman and Novak [66] explained that an increased flow leads to increased investigative actions, and people in a flow state enjoy goal-oriented behaviors without specific external rewards in a boosted sense of consciousness, while Trevino and Webster [67] claimed that people willingly take certain actions as innocent flow emotions, such as “enjoyment”.

Flow experience has the same quality as an immersion that indicates the best emotion, the ultimate pleasant experience, and a happy mental state when there is optimum interaction between the given environment and the actions of individuals in daily life [68]. Moreover, researchers that studied the content characteristics of the activities that promote flow claimed that it can be induced by activities that require appropriate skills and present a proactive attitude and clear goal [64,69].

Baumann and Scheffer [70] argued that people with frequent flow experience tend to be more immersed in performing complicated tasks than others. Moreover, people with frequent flow experience have challenging goals, curiosity, and flexible thinking, and are more open to new possibilities and enjoy experimenting with new ideas [71,72]. Csikszentmihalyi [73] presented increased productivity and problem solving as elements that create flow experience for entrepreneurs. Since then, many scholars have emphasized the importance of this problem-solving spirit and productivity [67,74]. Moreover, Aleksic et al. [75] studied the ability of start-ups in implementing ideas by targeting CEOs and CTOs of start-ups, and found that flow experience is related to intention and idea implementation.

Accordingly, this study provides the following hypotheses to assess whether business competency factors such as entrepreneurship, market orientation, and the network of start-ups, based on government support, have a positive effect on flow experience:

Hypothesis 1.

(H1) The entrepreneurship of start-ups based on government support will have a positive effect on flow experience.

Hypothesis 2.

(H2) The market orientation of start-ups based on government support will have a positive effect on flow experience.

Hypothesis 3.

(H3) The network of start-ups based on government support will have a positive effect on flow experience.

2.4. Start-Up Competencies and Entrepreneurial Satisfaction

In general, “satisfaction” in business management is a variable used in relation to customer satisfaction and is measured as a non-financial performance of consumer products and corporate brands [76]. However, satisfaction with business can be considered in terms of companies rather than consumers, where financial and non-financial performance can be considered [77]. Since it is difficult to estimate the quantitative indicators necessary in measuring the company’s performance in the initial stages of a start-up, objective performances such as the sales and earnings rate or subjective performances such as the expected achievement and satisfaction is measured [37]. Moreover, Hughes and Morgan [78] defined non-financial satisfaction as related to markets, technologies, and human resources after business start-up as entrepreneurial satisfaction. The concept of entrepreneurial satisfaction is a subjective feeling about the business field in which entrepreneurs started their business, and satisfaction is the state of being that is contentment without deficiency [37]. Thus, entrepreneurial satisfaction can be measured by non-financial factors such as the pleasantness of business operation, enthusiasm about business, sense of achievement in business, and attainment of business stability [38,79]. Some studies also claim that positive entrepreneurial satisfaction in addition to financial performance has a significant effect on the sustained growth of a business [80].

Small start-ups have a high correlation between entrepreneurial satisfaction and entrepreneurship, and the CEO’s entrepreneurship must be high in order to improve entrepreneurial satisfaction [37,38,51]. Moreover, according to the definition by Hughes and Morgan [78] markets, technologies, or human resources may bring entrepreneurial satisfaction after a business start-up. If the items of start-ups succeed through commercialization, and promote sales and overseas expansion, this may increase the satisfaction of entrepreneurs or their companies [54,81]. Furthermore, company growth after a business start-up strengthens human resources, expands business networks, and increases the company’s competencies and size, which also leads to entrepreneurial satisfaction [61].

Based on the literature review, this study provides the following hypotheses that assess whether business competency factors such as the entrepreneurship, market orientation, and network of start-ups based on government support can have a positive effect on entrepreneurial satisfaction:

Hypothesis 4.

(H4) The entrepreneurship of start-ups based on government support will have a positive effect on entrepreneurial satisfaction.

Hypothesis 5.

(H5) The market orientation of start-ups based on government support will have a positive effect on entrepreneurial satisfaction.

Hypothesis 6.

(H6) The network of start-ups based on government support will have a positive effect on entrepreneurial satisfaction.

2.5. Flow Experience, Entrepreneurial Satisfaction, and Business Sustainability

In business studies, most studies measure the effectiveness and efficiency with a focus on the financial performance of business operations, but now there is more emphasis on the importance of non-financial performance or the intangible assets according to the changes in the business environment [77]. For start-ups, business sustainability is the most important factor that must be considered, along with the performance after foundation [14]. The meaning of corporate sustainability is to lower the dependence on the government’s finances by achieving economic independence, and to be able to operate the organization through market sales in a consistent and stable manner [82]. Lim [83] presented corporate sustainability as the sustained employment, sustained sales increase, sustained government support, and sustained competitiveness of a business, and Krueger and Carsrud [84] explained that the attitudes or experiences of entrepreneurs in the process of business start-up may serve as a key variable in the sustainability of entrepreneurial intention and behavior. The intention to sustain a business can be related to positive attitudes such as flow experience, or the engagement that entrepreneurs feel subjectively about their business field [85].

As mentioned above, flow has the same features as immersion, and indicates the best emotions, the ultimate pleasant experiences, and happy mental state [68]. Moreover, as argued by Jung and Kim [38] entrepreneurial satisfaction can be related to non-financial factors such as the pleasantness of business operation, enthusiasm about business, sense of achievement in business, and attainment of business stability. Accordingly, this study provides the following hypothesis that the flow experience of start-up entrepreneurs will affect entrepreneurial satisfaction:

Hypothesis 7.

(H7) The flow experience of start-ups based on government support will have a positive effect on entrepreneurial satisfaction.

Start-ups grow in cooperation with multiple stakeholders and various investors within a social network, and thus many start-ups simultaneously generate both economic and social values [86]. Accordingly, the business sustainability of start-ups is fulfilled by continuously achieving environmental and organizational sustainability and generating economic profits, while also obtaining employment sustainability, the possibility of providing more services, and the competencies required to maintain growth engines [87].

In start-ups, the relationship with business sustainability can be examined through factors such as flow experience and entrepreneurial satisfaction. To sustain flow experience, it is necessary to constantly find greater challenges instead of repeatedly solving the same types of issues, and to continuously develop the competencies necessary to handle and overcome those challenges [73]. In general, start-ups have many challenges to constantly overcome, such as product and services testing or marketing and financial issues. Flow experience may play a positive role in the ability to constantly implement ideas to resolve these challenges that have been building up [75]. Moreover, entrepreneurial satisfaction is the concept of satisfaction or dissatisfaction obtained from a consistency or inconsistency between the entrepreneur’s expectations in the preparation stage and the actual performance after business start-up, and this entrepreneurial satisfaction affects the intention to sustain the business [80].

Based on the literature review, this study provides the following hypotheses that the flow experience and entrepreneurial satisfaction of start-ups based on government support will have a positive effect on business sustainability:

Hypothesis 8.

(H8) The flow experience of start-ups based on government support will have a positive effect on business sustainability.

Hypothesis 9.

(H9) The entrepreneurial satisfaction of start-ups based on government support will have a positive effect on business sustainability.

3. Research Method

3.1. Research Method

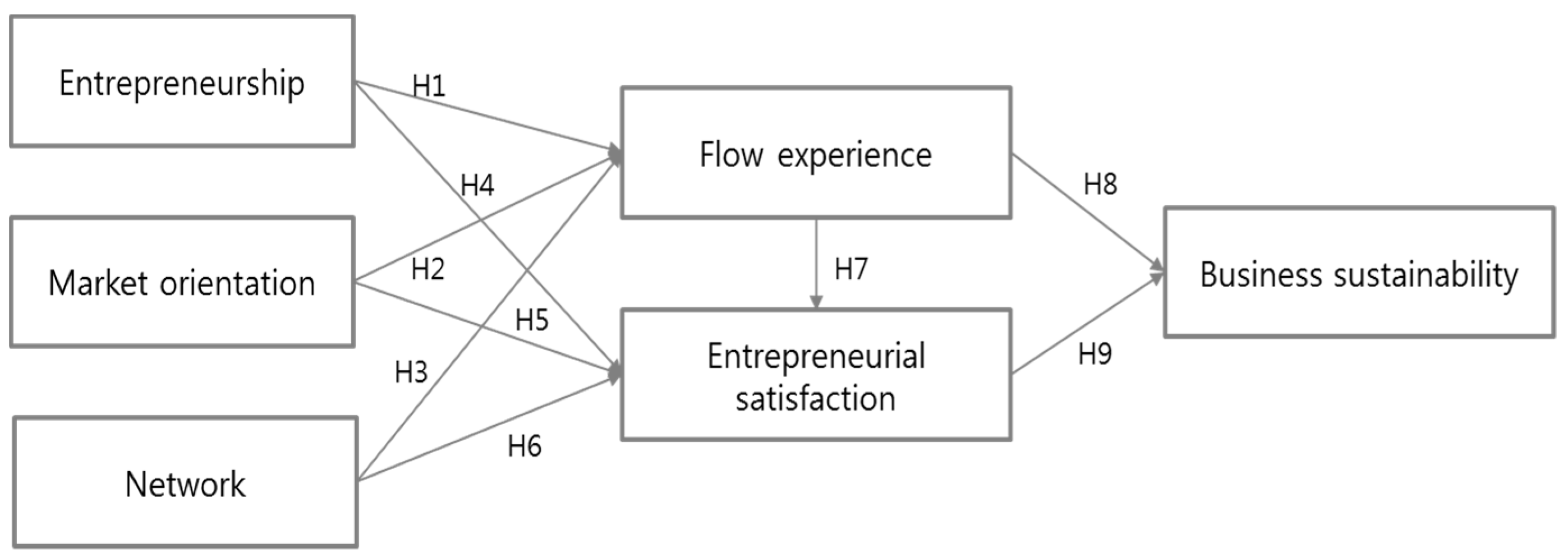

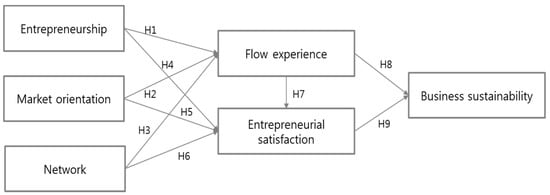

This study analyzes the key attributes to promote the business sustainability of start-ups with a focus on their short survival rates and is based on government support, and empirically verifies the relationship between the business sustainability, flow experience, and entrepreneurial satisfaction. Accordingly, this study surveyed start-ups that were supported by the government, and verified the effects of entrepreneurship, market orientation, and the network of entrepreneurs in relation to the business sustainability, with flow experience and entrepreneurial satisfaction as the mediators. The research model as shown in Figure 1 is designed with the research hypotheses provided as based on the literature review.

Figure 1.

Research model.

This study conducted a survey on the entrepreneurs of start-ups that had received government support through the Center for Creative Economy and Innovation (CCEI), a support agency for entrepreneurship and start-ups. The sample survey was conducted by founders and presidents of the start-ups for 30 days from 25 March to 24 April 2019 with the cooperation of 17 local CCEIs. A total of 297 surveys were collected by web questionnaires on 58.2% response rate. Finally, 273 responses were used for analysis and 24 excluded due to unfaithful or inappropriate responses (subjects not regarded as entrepreneurs). For data analysis, an SPSS 24.0 was used for demographic characteristics, descriptive statistics, and explorative factor analysis. AMOS 25.0 was used for the confirmatory factor analysis to analyze the structural equation model, model testing, and path analysis. Finally, the Sobel Test was used to measure the direct/indirect effects and total effects in order to verify the mediated effect, and the maximum likelihood estimation (MLE) was used to measure the coefficients.

3.2. Variables and Analytical Approach

Each variable was measured as based on the survey, and the items were rated on a 5-point Likert scale (1 = strongly disagree, 5 = strongly agree). The operational definitions and measurement items of the variables are designed as based on the literature review shown in Table 2. The independent variables were entrepreneurship, market orientation, and network. To begin with, entrepreneurship refers to the attitude of pursuing innovation in products or markets and taking risks by proactively coping with competitors. Based on the studies by Miller [87] and Zara [51], this study categorized the factors into innovativeness, proactiveness, and risk taking, presenting a total of six survey items, with “acceptability of innovative ideas” and “creativity of seizing opportunities” for innovativeness; “enthusiastic practice” and “active behavior” for proactiveness; and “new challenges” and “pursuit of opportunities” for risk taking. Market orientation refers to the culture of collecting information about customers and competitors and spreading it within the organization, handling competitors through cooperation among departments based on this information and giving priority over creating customer values [81]. This study provided three items for the survey based on the study by Choi and Lee [49]. These were: “setting customer satisfaction as the vision and goal”, “perceiving that satisfying customer desire is the key factor of competition”, and “preparing to meet customer needs”. This study defined network in terms of the social network of entrepreneurs and considered that entrepreneurs are dependent on their network in the early stages of a business start-up. Moreover, based on the studies by Manning et al. [88] and Kwon [89], this study provided three items: “having someone to depend on in a business crisis”, “having a business role model”, and “having a mentor in the business process”.

Table 2.

Variable definition.

The mediator variables were flow experience and entrepreneurial satisfaction. Flow experience indicates a behavior done not for the expectation of a future benefit but rather to simply experience it as a reward, thus is a highly pleasant and enjoyable experience. Based on the causal structural model on flow by Hoffman et al. [90] this study measured the flow experience with a total of 12 items, three items each from the four factors of ‘challenge’, ‘attention’, ‘pleasure’, and ‘time warp experience’, which were obtained from the most commonly used measurement variables by Lee and Ha [37] based on the literature review. Entrepreneurial satisfaction is defined by non-financial factors such as pleasantness of business operation, enthusiasm about business, achievement in business, and the attainment of business stability. This study measured this with three items: “satisfaction with entrepreneurial performance”, “pride as an entrepreneur”, and “glad to have started the business”, as based on the studies by Jung and Kim [38] and Matos & Amaral [79].

Finally, the dependent variable was business sustainability, and this study defined this as “the possibility that entrepreneurial performance (financial, non-financial performance) is enough to sustain business and can be made continuously by the entrepreneur in the long-term”. This definition considers that the business sustainability of start-ups can be fulfilled by continuously achieving financial sustainability through generation of economic profits, while also obtaining the employment sustainability, possibility of providing more services, and competencies in order to maintain growth engines. This study measured this with five items: such as ‘sustained growth’, ‘sustained employment’, ‘sustained sales increase’, ‘sustained investment’, and ‘sustained competitiveness’, as based on the studies by Lim [83] and Tur-Porcar et al. [50].

4. Results

4.1. Demographic of Respondents

The survey results showed from the total 273 respondents, 78.8% were male and 21.2% were female, with 4.4% under thirty years old, 28.9% in their thirties 38.9% in their forties, and 27.8% in their fifties or older, which shows that the highest ratio was taken up by those aged in their forties. Education levels were generally high, with 6.6% as high school graduates, 63.0% as two-year and four-year college graduates, and 30.4% from graduate school or higher. The business fields of current start-ups showed that 37.0% were in manufacturing, 33.3% were in IT and engineering, and 29.7% were in others, showing that the ratios of manufacturing and IT and engineering were very high (Table 3).

Table 3.

Demographic of respondent.

4.2. Analysis Results of Reliability and Validity

To secure the reliability and validity of the research model, this study analyzed the constructs used through the exploratory and confirmatory factor analyses. As a result of the exploratory factor analysis, one item of proactiveness and one item of risk taking were excluded from the six items of entrepreneurship, and one item was excluded from three items of network among the independent variables. Moreover, the 12 items of the flow experience as set as the mediator variable were not analyzed as a single variable. This is because the sub-variables of the flow experience were constructed into those with clearly differentiating properties, such as ‘challenge and ‘attention’ as leading variables, while ‘pleasure’ was the core concept, and ‘time wrap experience’ was the outcome variable based on the causal structural model by Hoffman et al. [90]. Therefore, to analyze flow experience as a single variable, this study chose ‘challenge’ and ‘attention’ as leading variables emphasized as the key elements that create flow experience of entrepreneurs as the sub-variables [66,67], while excluding ‘pleasure’ and the ‘time wrap experience’. Furthermore, four items (excluding the item of challenge) and one item (attention) were finally selected. All three items of entrepreneurial satisfaction (the other mediator variable) were used as they were, and all five items of business sustainability (dependent variable) were also used. Accordingly, this study conducted a confirmatory factor analysis as shown in Table 4, excluding the omitted variables, and verified the factor loadings of the measurement variables.

Table 4.

Results of reliability and convergent validity test.

The results showed that all scored 0.6 or higher, and thus can be used as latent variables. Moreover, the composite reliability also met the standard threshold requirement when all constructs were close to or higher than 0.7, as all the constructs were 0.8 or higher according to the standard set by Bhatnagar et al. [91]. According to the standard set by Anderson and Gerbing [92], the average variance extracted (AVE) must be 0.5 or higher, and all the constructs in this study were between 0.562 and 0.745, thereby securing validity. All of Cronbach’s alphas were 0.7 or higher, proving that they have convergent validity.

A correlation analysis was also conducted to verify the discriminant validity among constructs, and to review the correlation. The standard as set by Fornell and Larcker [93] was used to verify whether the squared values of the correlation coefficients were higher than the AVE. The results showed that the squared values did not exceed the AVE, as shown in Table 5, therefore clearly stating that the latent variables to be used in the analysis have secured discriminant validity.

Table 5.

Correlation matrix and average variance extracted (AVE).

4.3. Analysis Results of the Structural Model

The standards for the goodness-of-fit index (GFI) of the revised model were verified to check the fit of the model. With χ2/df = 1.746, the model met the standard of 1 <χ2/df < 3. According to Hu and Bentler [94], the model is considered as fit if the GFI and the comparative fit index (CFI) are all 0.9 or higher. This model showed significant results: the GFI = 0.903 and the CFI = 0.937. All of the GFIs met the standard, such as AGFI = 0.871, NFI = 0.888, RESEA = 0.052, according to the standard as set by Brown [95] (Table 6).

Table 6.

Model fit indices for the structural models.

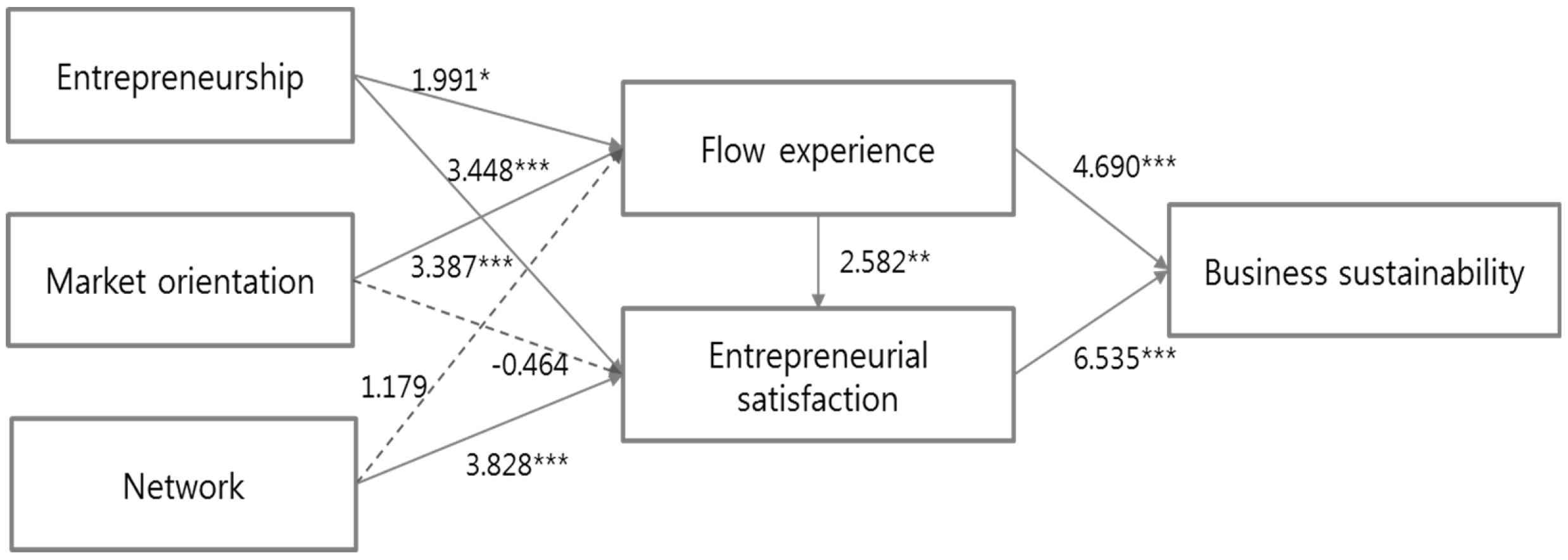

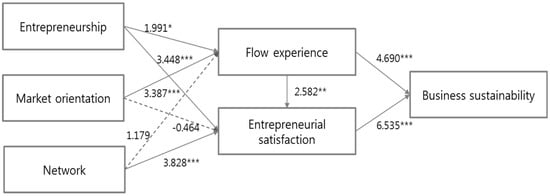

As examined in Table 7, the results of hypotheses testing showed that entrepreneurship (T value = 1.991 *) and market orientation (T value = 3.387 ***) had a positive effect on flow experience, but network did not have an effect. For entrepreneurial satisfaction, entrepreneurship (T value = 3.448 ***) and network (T value = 3.828 ***) had a positive effect, but the hypothesis was rejected for market orientation. Moreover, flow experience (T value = 2.582 **) had a positive effect on entrepreneurial satisfaction, and both flow experience (T value = 4.690 ***) and entrepreneurial satisfaction (T value = 6.535 ***) had a positive effect on business sustainability. Market orientation especially had a strong effect on flow experience, whereas network had a greater effect on entrepreneurial satisfaction, and entrepreneurial satisfaction had a greater effect on business sustainability than flow experience (Figure 2).

Table 7.

Results of hypothesis test.

Figure 2.

SEM(structural equation model) analysis of research model (Note: * p < 0.05, ** p < 0.01, *** p < 0.001).

4.4. Mediated Effect

To verify the significance of the indirect effects, the Sobel test method, in which the statistics are calculated with standard error, was used to provide direct, indirect, and total effects. As shown in Table 8, flow experience affected business sustainability with entrepreneurial satisfaction as the mediator (Sobel z = 2.407 *). As a result of analyzing the indirect effect of entrepreneurship on sustainability with flow experience as the mediator, there was no significance, but a weak indirect effect could be found (Sobel z = 1.840, p Value = 0.066). Meanwhile, entrepreneurship affected business sustainability, with entrepreneurial satisfaction as the mediator (Sobel z = 3.050 **). Market orientation affected sustainability with flow experience as the mediator (Sobel z = 2.756). Network affected sustainability with entrepreneurial satisfaction as the mediator (Sobel z = 3.309 ***), which is the opposite result from market orientation.

Table 8.

Results of indirect, direct, and total effects.

5. Conclusions

This study was conducted to empirically determine the factors affecting business sustainability and the survival rate of start-ups, as established from worldwide government support policies since the 2000s in an attempt to secure new growth engines and create jobs. The results of the analysis showed that, in start-ups based on government support, entrepreneurship had a positive effect on business sustainability with flow experience and entrepreneurial satisfaction as the mediators. Ultimately, factors such as innovativeness, proactiveness, and risk taking of entrepreneurs had a positive effect on the performance of the start-ups as well as business sustainability. Horne [52] stated that entrepreneurial skills have a unique competitiveness in start-ups that are difficult to imitate, thus entrepreneurship can serve as a critical factor in terms of mid/long-term growth and sustainable development for start-ups.

On the other hand, market orientation had a positive effect on business sustainability with flow experience as the mediator, but not on entrepreneurial satisfaction. This shows that when the market orientation of start-ups is connected to business sustainability, the flow has a more significant effect than that of satisfaction. Peter and Waterman [55] mentioned that in a market environment with severe changes, a company must maintain market orientation for sustainable growth. Accordingly, greater efforts of the start-ups in market orientation must constantly analyze customer values and adapt to the rapidly changing market environment to lead to a higher flow experience, which ultimately would have a positive effect on business sustainability. Moreover, network had a positive effect on business sustainability with entrepreneurial satisfaction as the mediator, which is contrary to market orientation. This shows that when the effect of a network is proved by leading to entrepreneurial satisfaction, it is possible to constantly reinforce the effect of a network. Moreover, as Elfring and Hulsink [59] and Dodd and Patra [96] mentioned, networking is useful to perceive opportunities that will accelerate entrepreneurial success, and networks that have an effect on inducing entrepreneurial satisfaction are highly likely to be used as the foundation for sustainable business growth as a result.

Based on these results, this study can provide three implications to set the direction for sustainable growth and development of start-ups based on government support. First, as indicated by the results, flow experience is a key variable for the business sustainability of start-ups. Previous studies [97,98,99] on flow experience argue that the flow experience of start-ups is only possible when it is supported by challenges as well as competencies and skills, and a sustained flow experience is accompanied by constant challenges and competency enhancement. Furthermore, flow experience promotes the more explorative activities of start-ups and enhances their ability to implement creative ideas. Thus, entrepreneurs must set their own challenges by being immersed in their ideas and sustain activities to enhance competencies accordingly, because flow of entrepreneurs can be a pleasure in itself in the early stages of a business start-up when there is an insufficient financial performance, as well as a factor of entrepreneurial satisfaction itself. Moreover, government support programs must be designed to secure challenges and competencies fit for the fields of entrepreneurs, from preparation before a business start-up to the early stages of business.

Second, it was found that entrepreneurial satisfaction had the greatest effect on business sustainability. Entrepreneurial satisfaction is related to non-financial performance by managing start-ups such as pleasure, achievement, and stability, which is felt subjectively by entrepreneurs through the gap between the expectations before, and the outcomes after a business start-up [100,101,102]. Therefore, entrepreneurs must perceive that their initial ideas may not be accepted in the market, and that they may pass through small failures first in order to reach a greater success. Setting a goal too high at an early stage may bring frustrations from daily failures, or even damage their intention to sustain a business due to fear of greater failures. Government support policies must also be designed to improve the entrepreneurial satisfaction of start-ups. They can consider providing customized programs to minimize the financial burden of entrepreneurs, as well as recognitions and benefits to instill their pride.

Third, based on the result that networks influences business sustainability, this study could demonstrate that the networks of entrepreneurs or start-ups may be a key resource to enable survival in the market and against fierce competition. Therefore, entrepreneurs must perceive that forming networks can be a core competency of start-ups [103,104], and thus actively participate in networking activities. Furthermore, government support policies must design suitable networking programs considering the business fields, or growth stages, of start-ups with angel investors, VCs, government support agency officials, merchandisers for local distributors, and global buyers.

Nonetheless, this study has limitations from generalizing the results, as it only regards start-ups in the Korean market. Thus, it is necessary to expand the scope of the research subjects to start-ups based on government support across all of Asia. Moreover, this study examined the factors affecting business sustainability within the scope of entrepreneurship, market orientation, and network, but since there may be various other factors affecting sustainability, it is necessary to consider a developmental model of empirical research that is based on designing a more expanded research model. Furthermore, start-ups have different environments and ecosystems depending on the business field, which is why more detailed research must be conducted when considering types of business such as manufacturing, IT, or service.

Author Contributions

All authors conceived and designed the idea of the paper; W.L. collected survey and analyzed the data and B.K. reviewed related previous literature. All authors also wrote and reviewed the manuscript. First author: W.L. Second author: B.K. (corresponding author).

Funding

This research is supported by the internal research fund from Seoul School of Integrated Sciences and Technologies (aSSIST).

Acknowledgments

We would like to thank the aSSIST for supporting the research fund and the CCEI (Center for Creative Economy and Innovation) for helping distribute the questionnaire to start-up founders.

Conflicts of Interest

The authors declare no conflict of interest.

References

- CBinsight. 2018 Was the Best Year on Record for New US Unicorns. 26 February 2019. Available online: https://www.cbinsights.com/research/us-unicorn-births-venture-capital-2018/ (accessed on 28 June 2019).

- Mayer-Haug, K.; Read, S.; Brinckmann, J.; Dew, N.; Grichnik, D. Entrepreneurial talent and venture performance: A meta-analytic investigation of SMEs. Res. Policy 2013, 42, 1251–1273. [Google Scholar] [CrossRef]

- Kuckertz, A.; Berger, E.; Allmendinger, M. What drives entrepreneurship? A configurational analysis of the determinants of entrepreneurship in innovation-driven economies. Bus. Adm. Rev. 2015, 75, 273–288. [Google Scholar]

- Arruda, C.; Nogueira, V.S.; Costa, V. The Brazilian entrepreneurial ecosystem of startups: An analysis of entrepreneurship determinants in Brazil as seen from the OECD pillars. J. Entrep. Innov. Manag. 2013, 2, 17–57. [Google Scholar]

- Kogure, Y.; Kobayashi, N.; Kawase, M.; Shirasaka, S.; Ioki, M. Proposal of entrepreneur’s behavior process for overcoming Japanese type valley of death in startup companies. Rev. Integr. Bus. Econ. Res. 2019, 8 (Suppl. S3), 102–112. [Google Scholar]

- Kwak, H.; Rhee, M. Comparative study of a startup ecosystem in Seoul, Korea and Chengdu, China. Asia-Pac. J. Bus. Ventur. Entrepreneurship 2018, 13, 131–154. [Google Scholar]

- Im, G.S.; Jeon, I.O. A study on entrepreneurship support systems affecting the entrepreneurial intention of the potential founder. J. Korea Contents Assoc. 2015, 15, 422–432. [Google Scholar] [CrossRef]

- Kim, S.; Kim, Y.; Lee, J.; Kim, B.; Suh, Y.; Koo, W.; Hong, W.; Ko, H. Impact analysis of government startup support programs; Science and Technology Policy Institute: Sejong City, Korea, 2017. [Google Scholar]

- Solomon, G.T.; Bryant, A.; May, K.; Perry, V. Survival of the fittest: Technical assistance, survival and growth of small businesses and implications for public policy. Technovation 2013, 33, 292–301. [Google Scholar] [CrossRef]

- Geho, P.R.; Frakes, J. Financing for small business in a sluggish economy versus conflicting impulses of the entrepreneur. Entrep. Executive 2013, 18, 89–101. [Google Scholar]

- Seo, J.H.; Perry, V.G.; Tomczyk, D.; Solomon, G.T. Who benefits most? The effects of managerial assistance on high-versus low-performing small businesses. J. Bus. Res. 2014, 67, 2845–2852. [Google Scholar] [CrossRef]

- Hussain, T.; Edgeman, R.; Eskildsen, J.; Shoukry, A.M.; Gani, S. Sustainable Enterprise Excellence: Attribute-Based Assessment Protocol. Sustainability 2018, 10, 4097. [Google Scholar] [CrossRef]

- Perényi, A.; Losoncz, M. A Systematic Review of International Entrepreneurship Special Issue Articles. Sustainability 2018, 10, 3476. [Google Scholar] [CrossRef]

- Koyagialo, K.F. Small Business Survivability beyond Five Years. Ph.D. Thesis, Walden University, Minneapolis, MN, USA, July 2016. [Google Scholar]

- Lofstrom, M.; Bates, T.; Parker, S.C. Why are some people more likely to become small-businesses owners than others: Entrepreneurship entry and industry-specific barriers. J. Bus. Ventur. 2014, 29, 232–251. [Google Scholar] [CrossRef]

- Eric, R. The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses; Crown Books: New York, NY, USA, 2011. [Google Scholar]

- Han, J.H.; Park, H.Y. Sustaining Small Exporters’ Performance: Capturing Heterogeneous Effects of Government Export Assistance Programs on Global Value Chain Informedness. Sustainability 2019, 11, 2380. [Google Scholar] [CrossRef]

- Hong, Y. A Study of the Corporate Performance of Enterprises with Start-up Support Programs-Focusing on the Mediating Effect of the Ability to Use Start-up Support Programs. Master’s Thesis, Chung-Ang University, Seoul, Korea, August 2017. [Google Scholar]

- Orange, D.B. Startup America: What it includes and opportunities for innovators. J. Commer. Biotechnol. 2011, 17, 123–125. [Google Scholar] [CrossRef]

- Paul, K.; Rollins, C. A comparison of startup entrepreneurial activity between the United States and Japan. J. Manag. Policy Pract. 2016, 17, 23. [Google Scholar]

- Kwon, P.O. Global Market Report 18-043; KOTRA: Seoul, Korea, 2019; ISBN 979-11-6097-874-2. [Google Scholar]

- Lee, B.G.; Jeon, I.O. The effect of entrepreneurial motivation on the entrepreneurial performance focusing on potential entrepreneurs and entrepreneurs: Mediating role of entrepreneurship. Asia-Pac. J. Bus. Ventur. Entrep. 2014, 9, 213–230. [Google Scholar]

- Statistics Korea. Startup Survival and Extinction Report; Statistics Korea: Daejeon, Korea, 2018. [Google Scholar]

- Kim, Y.; Kim, S.; Lee, J.; Lee, S. Entrepreneurship and Innovation in Korean Startups; Science and Technology Policy Institute: Sejong City, Korea, 2017. [Google Scholar]

- Lee, J.R.; Chang, G.S. Impact of startup support program on entrepreneurial self-efficacy, opportunity recognition, startup intention of undergraduate students. Asia-Pac. J. Bus. Ventur. Entrep. 2018, 13, 43–60. [Google Scholar]

- Ministry of SMEs and Start-ups. 2019 Entrepreneurial Support Notice (No.2019-1); Ministry of SMEs and Start-ups: Daejoen, Korea, 2019.

- Fonseca, L.M.; Domingues, J.P.; Pereira, M.T.; Martins, F.F.; Zimon, D. Assessment of Circular Economy within Portuguese Organizations. Sustainability 2018, 10, 2521. [Google Scholar] [CrossRef]

- Kim, H. A Study of the Influences of Public Support Programs on the Technology Innovation and Survival in the IT Small Enterprises; Science and Technology Policy Institute: Sejong City, Korea, 2008. [Google Scholar]

- Lee, Y.J.; Yang, Y. An impact of startup business performance by entrepreneurs’ perceived importance, satisfaction, and level of meeting to expectation over government startup business aid programs. Asia-Pac. J. Bus. Ventur. Entrep. 2018, 13, 31–41. [Google Scholar]

- Gompers, P.A.; Lerner, J. The Money of Invention how Venture Capital Creates New Wealth; Harvard Business School Press: Brighton, MA, USA, 2001. [Google Scholar]

- Gage, D. The venture capital secret: 3 out of 4 start-ups fail. Wall Str. J. 2012, 1–3. [Google Scholar]

- Gil, W.; Bae, H.; Sim, Y.; Kim, S. A study on the improvement the start-up support policy: Focused on the ICT start-up. Asia-Pac. J. Bus. Ventur. Entrep. 2018, 13, 117–128. [Google Scholar]

- Buli, B.M. Entrepreneurial orientation, market orientation and performance of SMEs in the manufacturing industry: Evidence from Ethiopian enterprises. Manag. Res. Rev. 2017, 40, 292–309. [Google Scholar] [CrossRef]

- Acosta, A.S.; Crespo, A.H.; Agudo, J.C. Effect of market orientation, network capability and entrepreneurial orientation on international performance of small and medium enterprises (SMEs). Int. Bus. Rev. 2018, 27, 1128–1140. [Google Scholar] [CrossRef]

- Ahn, T.; Han, D.; Kang, T. The effects of entrepreneur competence characteristics on start-up performance -Focusing on the mediating effect of the start-up support system. Asia-Pac. J. Bus. Ventur. Entrep. 2019, 14, 73–83. [Google Scholar]

- Park, N.G.; Kim, M.S.; Ko, J.W. The effect of the governments entrepreneurial support policy on entrepreneurship and entrepreneurial intention. Asia-Pac. J. Bus. Ventur. Entrep. 2015, 10, 89–98. [Google Scholar] [CrossRef]

- Lee, S.H.; Ha, K.S. A study on the influence of entrepreneurship and start-up competency on entrepreneurial satisfaction: Focusing on the moderating effect of flow experience. Asia-Pac. J. Bus. Ventur. Entrep. 2015, 10, 137–150. [Google Scholar]

- Jung, S.C.; Kim, Y.J. An empirical study on the relationship between entrepreneurship and start-up achievement considering moderating effect of government’s support policy-For start-up companies in Busan and Kyungnam regions. J. Internet Electron. Commer. Res. 2017, 17, 55–70. [Google Scholar]

- Lindsay, N.J.; Shoham, A. Entrepreneurial, market, and learning orientations and international entrepreneurial business venture performance in South African firms. Int. Mark. Rev. 2006, 23, 504–523. [Google Scholar]

- Baker, W.E.; Sinkula, J.M. The complementary effects of market orientation and entrepreneurial orientation on profitability in small businesses. J. Small Bus. Manag. 2009, 47, 443–464. [Google Scholar] [CrossRef]

- Boso, N.; Story, V.M.; Cadogan, J.W. Entrepreneurial orientation, market orientation, network ties, and performance: Study of entrepreneurial firms in a developing economy. J. Bus. Ventur. 2013, 28, 708–727. [Google Scholar] [CrossRef]

- Moon, C.H. The effects of entrepreneurial orientation and market orientation on internalization and performance in Korean venture firms. Korean J. Bus. Adm. 2013, 26, 1177–1204. [Google Scholar]

- Won, H.S. An Effect on Business Performance of S&M Business CEOs’ Entrepreneurship. Ph.D. Thesis, Gachon University, Gyeonggi-do, Korea, 2013. [Google Scholar]

- Yun, C.S. A Study on the Effects of the Market-orientation and Network Capability of Technology Start-Up Companies on New Product Development and Business Performance. Master’s Thesis, The Graduate School of Industrial & Entrepreneurial Management, Chung–Ang University, Seoul, Korea, 2014. [Google Scholar]

- Kajalo, S.; Lindblom, A. Market orientation, entrepreneurial orientation and business performance among small retailers. Int. J. Retail Distrib. Manag. 2015, 43, 580–596. [Google Scholar] [CrossRef]

- Kwak, J.G. The Effect of Market-orientation and Technology Innovation-orientation on the Innovation Activities and Performance in Companies. Ph.D. Thesis, Korea University of Technology Education, Chungnam, Korea, August 2016. [Google Scholar]

- Amin, M.; Ramayah, T.; Aldakhil, A.M.; Kaswuri, A. The effect of market orientation as a mediating variable in the relationship between entrepreneurial orientation and SMEs performance. Nankai Bus. Rev. Int. 2016, 7, 39–59. [Google Scholar] [CrossRef]

- Lee, J.M.; Kim, B.K. The effect of entrepreneurial orientation and market orientation on the firm performance: Focus on mediating role of operational capabilities in NPD. Yonsei Bus. Rev. 2018, 55, 103–131. [Google Scholar]

- Wilkund, J.; Shepherd, D.A. Where to from here? EO-as-experimentation, failure, and distribution of outcomes. Entrep. Theory Pract. 2011, 35, 925–946. [Google Scholar]

- Tur-Porcar, A.; Roig-Tierno, N.; Mestre, A.L. Factors Affecting Entrepreneurship and Business Sustainability. Sustainability 2018, 10, 452. [Google Scholar] [CrossRef]

- Zahra, S.A. Predictors and financial outcomes of corporate entrepreneurship: An exploratory study. J. Bus. Ventur. 1991, 6, 259–285. [Google Scholar] [CrossRef]

- Horne, A. The Origins of Entrepreneurship; Inc. Magazine: New York, NY, USA, 1992; pp. 49–62. [Google Scholar]

- Tehseen, S.; Ramayah, T. Entrepreneurial competencies and SMEs business success: The contingent role of external integration. Mediterr. J. Social Sci. 2015, 6, 50. [Google Scholar] [CrossRef]

- Frishammar, J.; Hörte, S.A. The role of market orientation and entrepreneurial orientation for new product development performance in manufacturing firms. Technol. Anal. Strateg. Manag. 2007, 19, 765–788. [Google Scholar] [CrossRef]

- Peters, T.J.; Waterman, R.H. In Search of Excellence; Harper and Row: New York, NY, USA, 1982. [Google Scholar]

- Choi, Y.S.; Lim, U. Contextual Factors Affecting the Innovation Performance of Manufacturing SMEs in Korea: A Structural Equation Modeling Approach. Sustainability 2017, 9, 1193. [Google Scholar] [CrossRef]

- Choi, S.B.; Lee, D.H. The effects of sub-factors of entrepreneurial and market orientations on innovation and financial performances in Korean venture and SMEs. J. Strateg. Manag. 2013, 16, 109–129. [Google Scholar]

- Cromie, S.; Birley, S. Networking by female business owners in Northern Ireland. J. Bus. Ventur. 1992, 7, 237–251. [Google Scholar] [CrossRef]

- Elfring, T.; Hulsink, W. Networks in entrepreneurship: The case of high-technology firms. Small Bus. Econ. 2003, 21, 409–422. [Google Scholar] [CrossRef]

- Shane, S.; Cable, D. Network ties, reputation, and the financing of new ventures. Manag. Sci. 2002, 48, 364–381. [Google Scholar] [CrossRef]

- Kogut, B. The network as knowledge: Generative rules and the emergence of structure. Strateg. Manag. J. 2000, 21, 405–425. [Google Scholar] [CrossRef]

- Lavie, D. The competitive advantage of interconnected firms: An extension of the resource-based view. Acad. Manag. Rev. 2006, 31, 638–658. [Google Scholar] [CrossRef]

- Kim, H.S.; Park, B.J. The demand level for business start-up education and willingness of starting a business of college students. J. Korean Entrep. Soc. 2009, 4, 139–165. [Google Scholar]

- Csikszentmihalyi, M. Good Business: Leadership, Flow, and the Making of Meaning; Viking Penguin: New York, NY, USA, 2004. [Google Scholar]

- Jackson, S.A.; Marsh, H.W. Development and validation of a scale to measure optimal experience: The flow state scale. Hum. Kinet. J. 1996, 18, 17–35. [Google Scholar] [CrossRef]

- Hoffman, D.L.; Novak, T.P. Marketing in hypermedia computer-mediated environments: Conceptual foundations. J. Mark. 1996, 60, 50–68. [Google Scholar] [CrossRef]

- Trevino, L.K.; Webster, J. Flow in computer-mediated communication: Electronic mail and voice mail evaluation and impacts. Commun. Res. 1992, 19, 539–573. [Google Scholar] [CrossRef]

- Csikszentmihalyi, M.; Csikszentmihalyi, I.S. Optimal Experience: Psychological Studies of Flow in Consciousness; Cambridge University Press: New York, NY, USA, 1988. [Google Scholar]

- Kowal, J.; Fortier, M.S. Motivational determinants of flow: Contributions from self-determination theory. J. Soc. Psychol. 1999, 139, 355–368. [Google Scholar] [CrossRef]

- Baumann, N.; Scheffer, D. Seeking flow in the achievement domain: The achievement flow motive behind flow experience. Motiv. Emot. 2011, 35, 267–284. [Google Scholar] [CrossRef]

- Ghani, J.A.; Deshpande, S.P. Task characteristics and the experience of optimal flow in human-computer interaction. J. Psychol. Interdiscip. Appl. 1994, 128, 381–391. [Google Scholar] [CrossRef]

- Ceja, L.; Navarro, J. Dynamic patterns of flow in the workplace: Characterizing within individual variability using a complexity science approach. J. Organ. Behav. 2011, 32, 627–651. [Google Scholar] [CrossRef]

- Csikszentmihalyi, M. Beyond Boredom and Anxiety; Jossey-Bass: San Francisco, CA, USA, 1975. [Google Scholar]

- Novak, T.P. Measuring the customer experience in online environments: A structural modeling approach. Mark. Sci. 2000, 19, 143–156. [Google Scholar] [CrossRef]

- Aleksić, D.; Škerlavaj, M.; Dysvik, A. The Flow of Creativity for Idea Implementation, Capitalizing on Creativity at Work; Edward Elgar: Cheltenham, UK, 2016; ISBN 9781783476497. [Google Scholar]

- Anderson, E.W.; Fornell, C.; Lehmann, D.R. Customer satisfaction, market share, and profitability: Findings from Sweden. J. Mark. Res. 1994, 58, 53–66. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The balanced scorecard-measures that drive performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar] [PubMed]

- Hughes, M.; Morgan, R.E. Deconstructing the relationship between entrepreneurial orientation and business performance at the embryonic stage of firm growth. Ind. Mark. Manag. 2007, 36, 651–661. [Google Scholar] [CrossRef]

- Fires. Entrepreneurial satisfaction among senior entrepreneurs: The moderating effect of industry experience and unemployment status (Fires reports D3.8). Available online: https://projectfires.eu/publications/reports/#cmtoc_anchor_id_13 (accessed on 5 July 2019).

- Kim, C.S. The Effect of Commercial Analysis System on the Entrepreneurial Performance, Business Continuity Intention and Entrepreneurial Satisfaction of Small Businesses. Master’s Thesis, Chung-Ang University, Seoul, Korea, 2018. [Google Scholar]

- Narver, J.C.; Slater, S.F. The effect of a market orientation on business profitability. J. Mark. 1990, 54, 20–35. [Google Scholar] [CrossRef]

- Wallace, B. Exploring the meaning(s) of sustainability for community-based social entrepreneurs. Soc. Enterp. J. 2005, 1, 77–89. [Google Scholar] [CrossRef]

- Lim, S.T. The Impact of tourism entrepreneurship on the sustainability in the creative tourism enterprise: The moderating role of government support policy. Korean J. Hosp. Tour. 2015, 24, 21–40. [Google Scholar]

- Krueger, N.F.; Carsrud, A.L. Entrepreneurial intentions: Applying the theory of planned behavior. Entrep. Reg. Dev. 1993, 5, 315–330. [Google Scholar] [CrossRef]

- Kim, K.A. A Study on Relations among Small Business Persons’ Psychological Characteristics, Entrepreneurship, Entrepreneurial Satisfaction, and Entrepreneurial Recommendation Intention-Focusing on Entrepreneurs of Dessert Cafes. Ph.D. Thesis, Department of Business Administration Graduate School, Kyungsung University, Busan, Korea, 2013. [Google Scholar]

- Mair, J.; Martí, I. Social entrepreneurship research: A source of explanation, prediction, and delight. J. World Bus. 2006, 41, 36–44. [Google Scholar] [CrossRef]

- Miller, D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Manning, K.; Bieley, S.; Norburn, D. Developing a new ventures strategy. Entrep. Theory Pract. 1989, 14, 68–76. [Google Scholar] [CrossRef]

- Kwon, S.Y. A Study on the Effect of Agri-food Potential Entrepreneurs’ Personal and Environmental Characteristics on Entrepreneurial Intention-Focusing on the Moderating Effect of Self-efficacy. Master’s Thesis, Kookmin University, Seoul, Korea, 2016. [Google Scholar]

- Hoffman, D.L.; Novak, T.P.; Yung, Y.F. Measuring the Flow Construct in Online Environments: A Structural Modeling Approach. Master’s Thesis, Owen Graduate School of Management, Vanderbilt University, Nashville, TN, USA, 1999. [Google Scholar]

- Bhatnagar, S.; Schiffter, H.; Coussios, C. Exploitation of acoustic cavitation-induced microstreaming to enhance molecular transport. J. Pharm. Sci. 2014, 103, 1903–1912. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Am. Psychol. Assoc. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Brown, E.C.; Hawkins, J.D.; Rhew, I.C.; Shapiro, V.B.; Abbott, R.D. Prevention system mediation of communities that care effects on youth outcomes. Prev. Sci. 2014, 15, 623–632. [Google Scholar] [CrossRef] [PubMed]

- Dodd, S.D.; Patra, E. National differences in entrepreneurial networking. Entrep. Reg. Dev. 2002, 14, 117–134. [Google Scholar] [CrossRef]

- Fonseca, L.M.; Domingues, J.P. Exploratory research of ISO 14001:2015 transition among Portuguese organizations. Sustainability 2018, 10, 781. [Google Scholar] [CrossRef]

- Gazetov, A.N. Support for youth (Start-up) entrepreneurship through the development of coworking spaces: Accumulated experience and perspectives. J. Appl. Econ. Sci. 2018, 13, 1029–1036. [Google Scholar]

- Brown, R.; Mawson, S.; Lee, N.; Peterson, L. Start-up factories, transnational entrepreneurs and entrepreneurial ecosystems: Unpacking the lure of start-up accelerator programmes. Eur. Plan. Stud. 2019, 27, 885–904. [Google Scholar] [CrossRef]

- Lukeš, M.; Longo, M.C.; Zouhar, J. Do business incubators really enhance entrepreneurial growth? Evidence from a large sample of innovative Italian start-ups. Technovation 2019, 82–83, 25–34. [Google Scholar] [CrossRef]

- Van Weele, M.; van Rijnsoever, F.J.; Eveleens, C.P.; Steinz, H.; van Stijn, N.; Groen, M. Start-EU-up! Lessons from international incubation practices to address the challenges faced by Western European start-ups. J. Technol. Transf. 2018, 43, 1161–1189. [Google Scholar] [CrossRef]

- Capozza, C.; Salomone, S.; Somma, E. Local industrial structure, agglomeration economies and the creation of innovative start-ups: Evidence from the Italian case. Entrep. Reg. Dev. 2018, 30, 749–775. [Google Scholar] [CrossRef]

- Fiorentino, S. Re-making urban economic geography. Start-ups, entrepreneurial support and the Makers Movement: A critical assessment of policy mobility in Rome. Geoforum 2018, 93, 116–119. [Google Scholar] [CrossRef]

- Van Stijn, N.; van Rijnsoever, F.J.; van Veelen, M. Exploring the motives and practices of university–start-up interaction: Evidence from Route 128. J. Technol. Transf. 2018, 43, 674–713. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).