Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market

Abstract

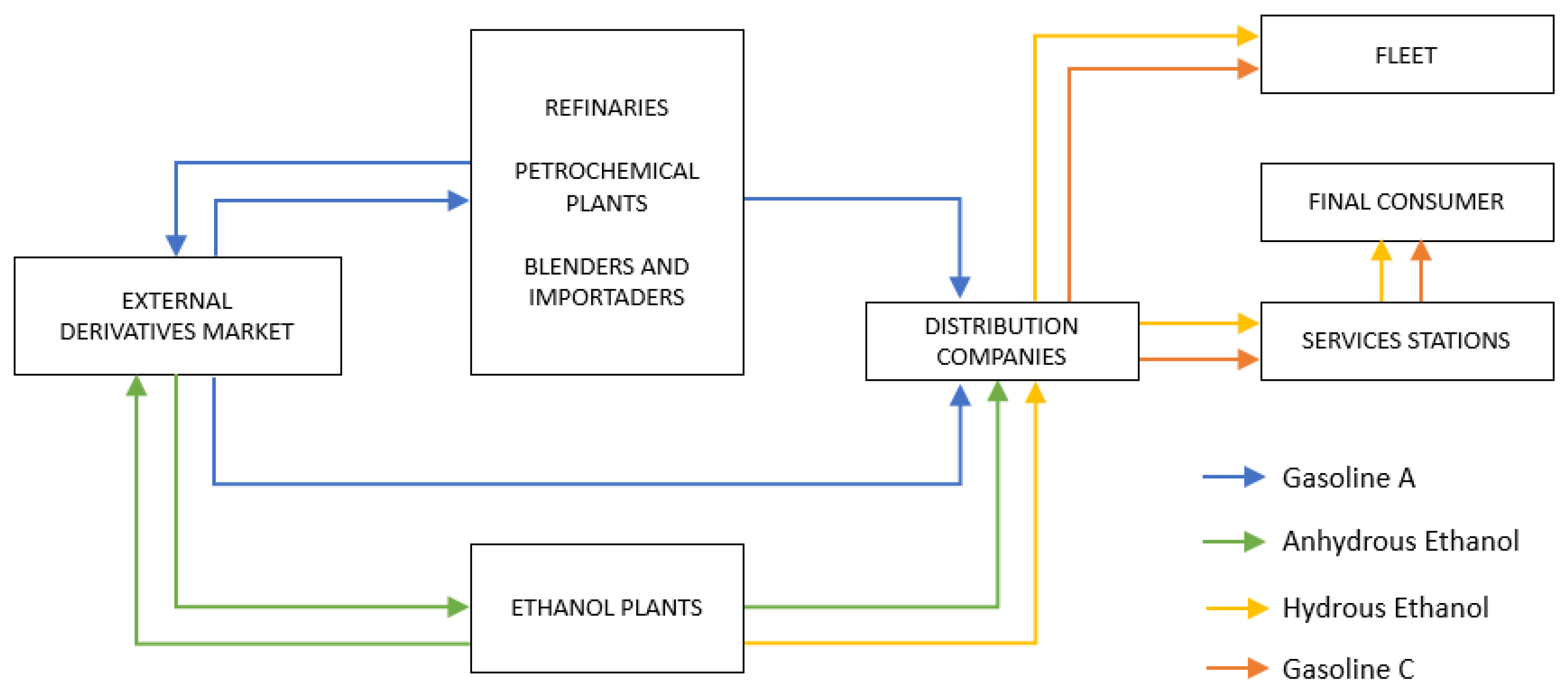

1. Introduction

2. Material and Methods

2.1. Data

2.2. Statistical Model

- Integrate two time series, and , to generate two new series and , where N is number of elements of the time series.

- Divide and in overlapping boxes of equal length s, with .

- The least squares adjustment of each time series calculates the local trend of each box, and . The covariance of the residuals is calculated by Equation (1):

- The new covariance function (Equation (2)):

- The is (Equation (3)):

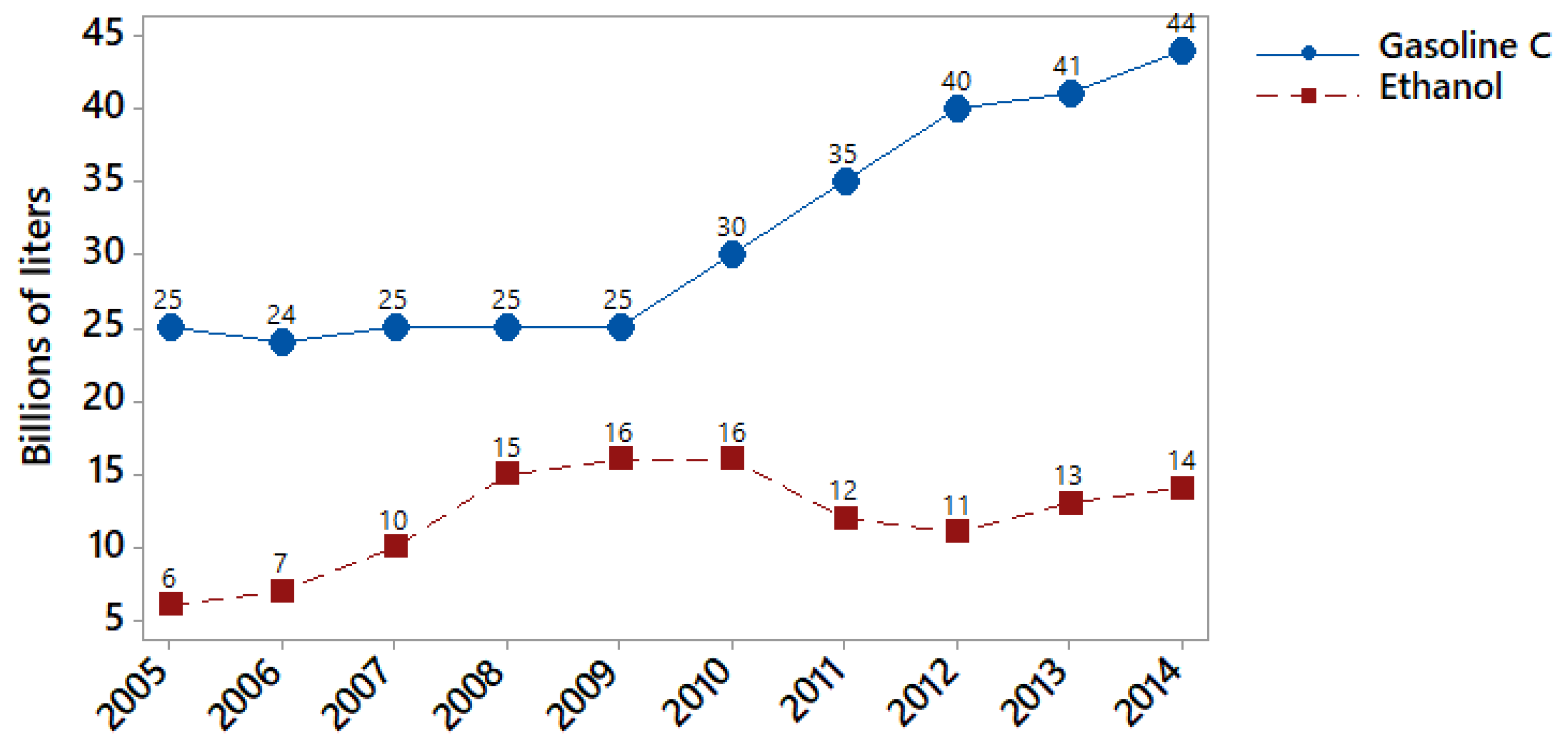

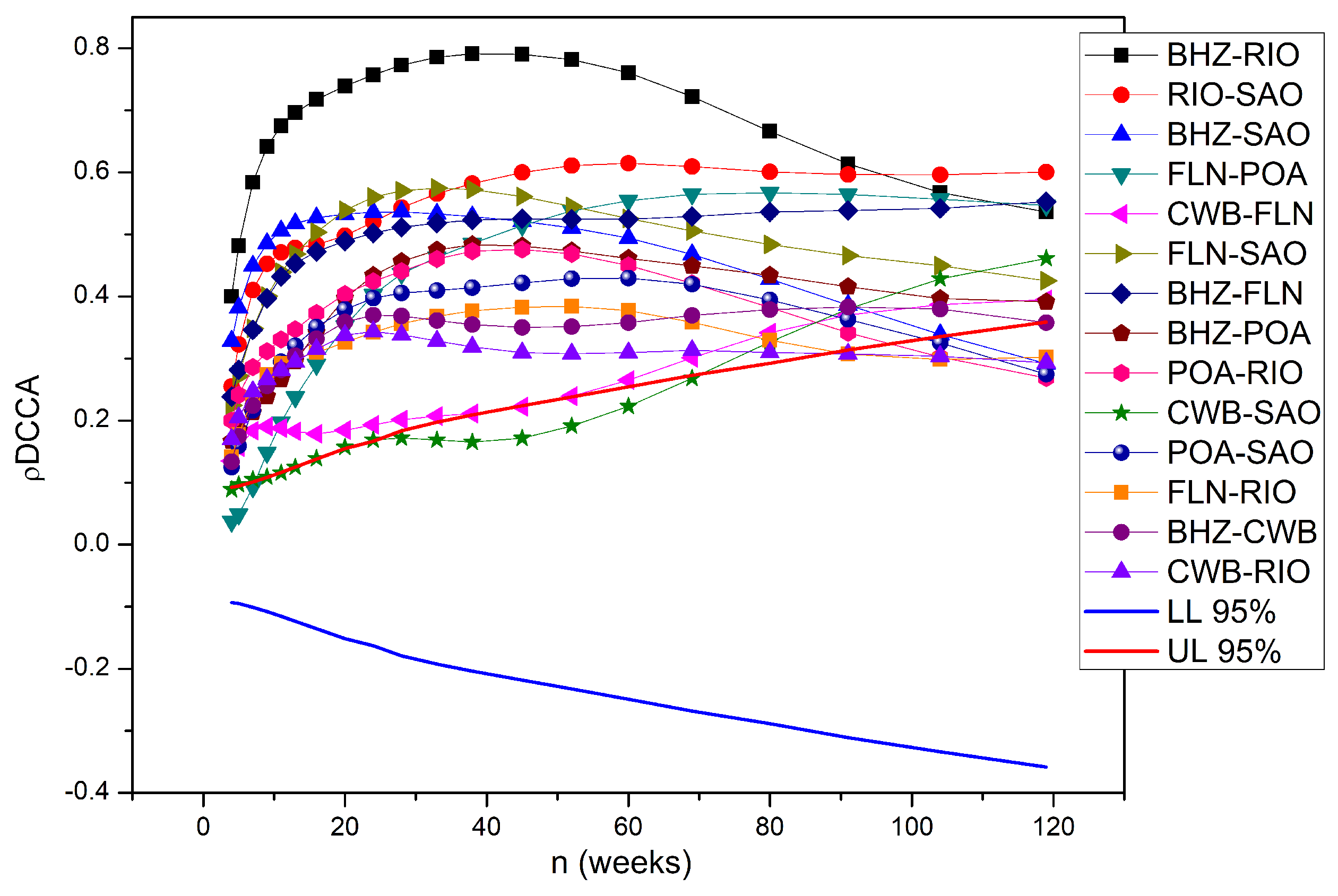

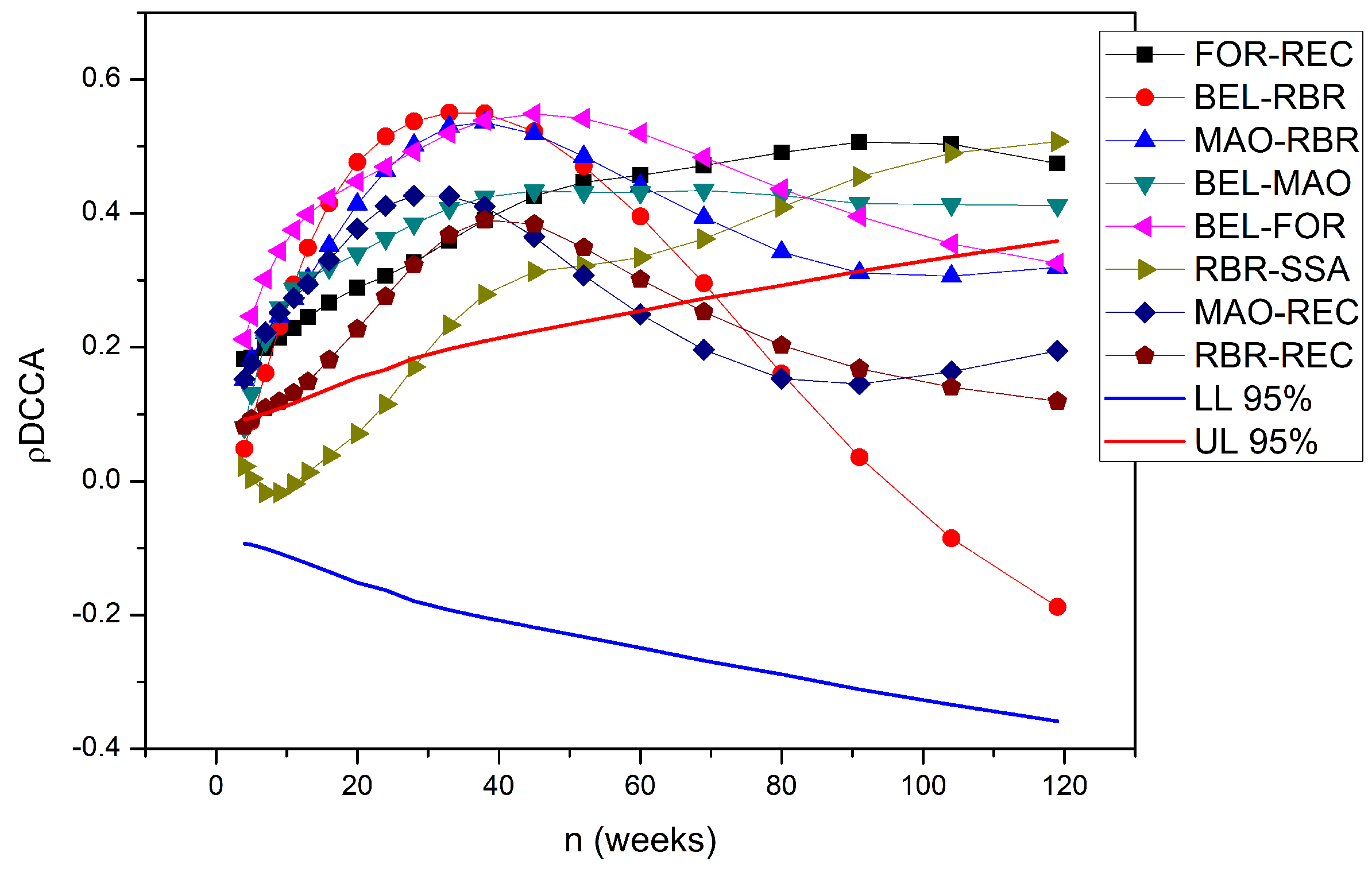

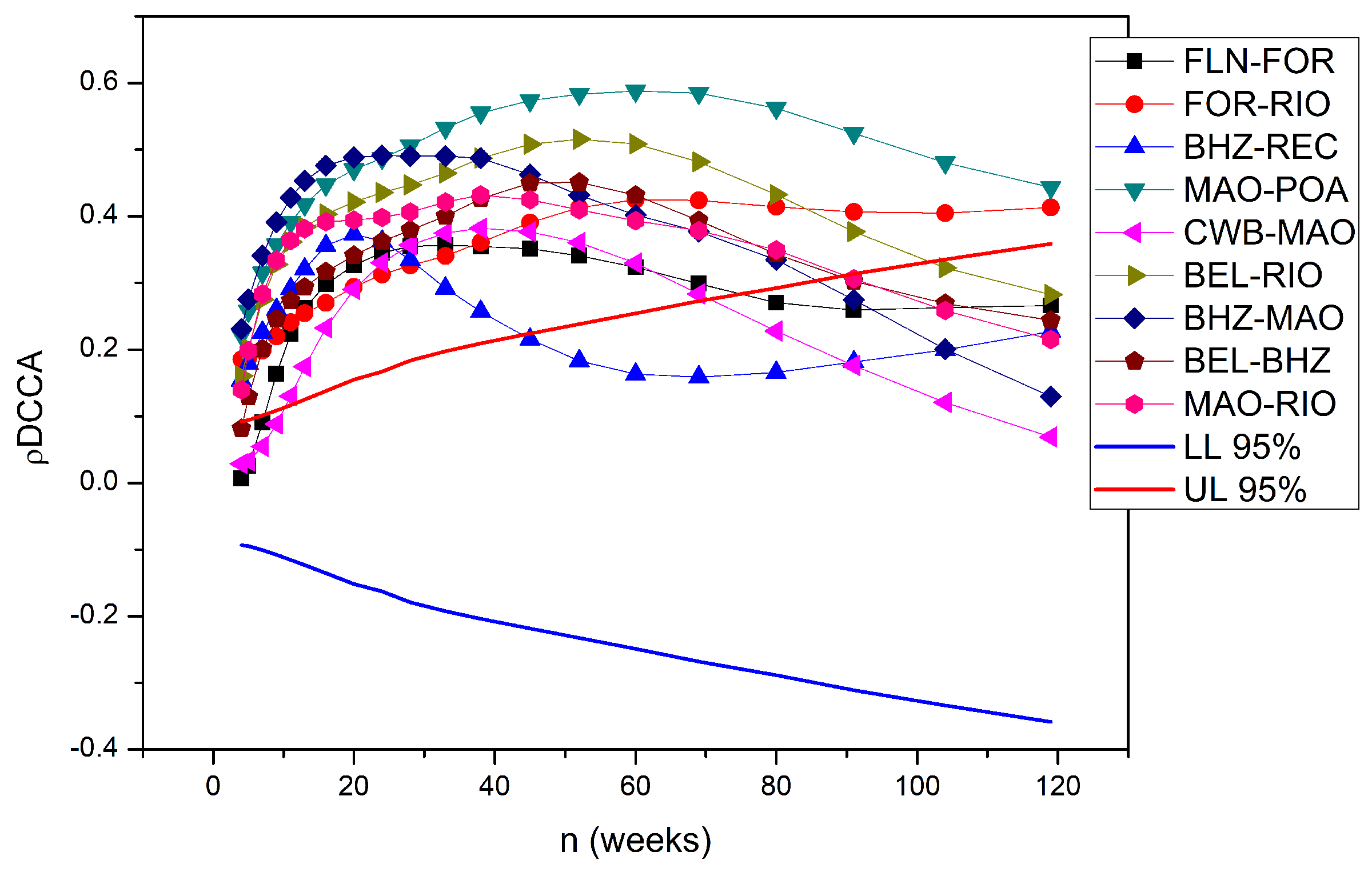

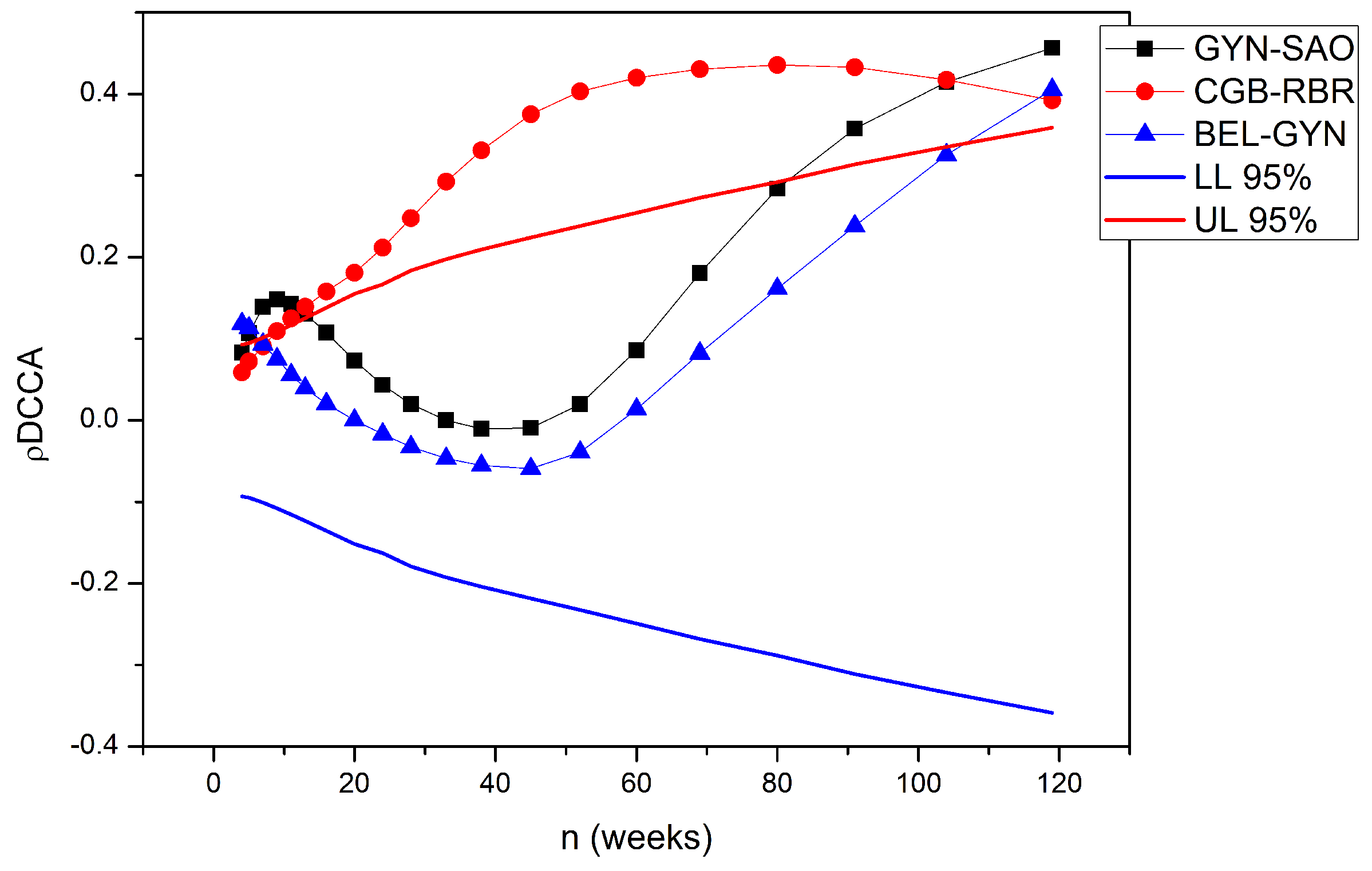

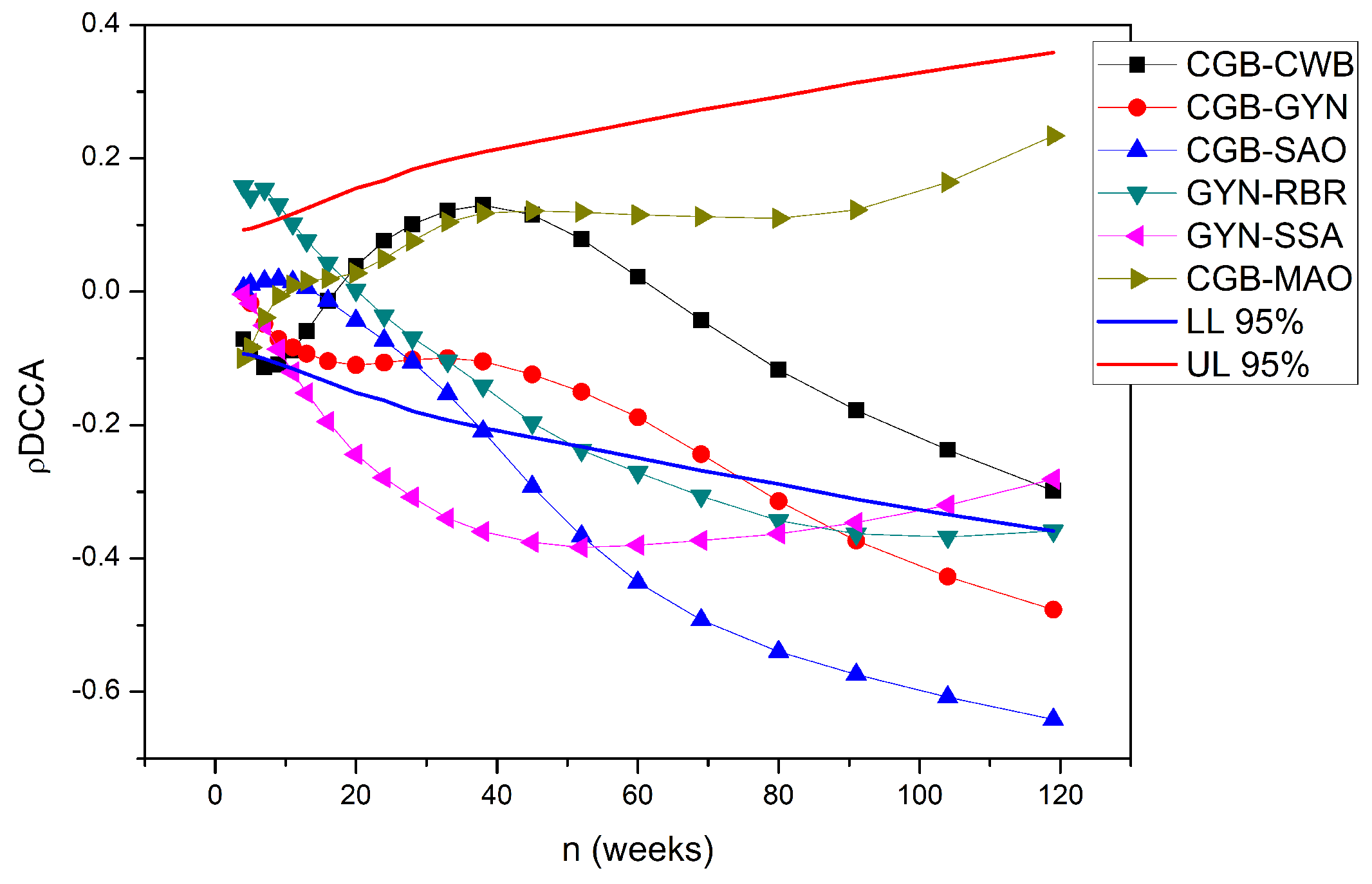

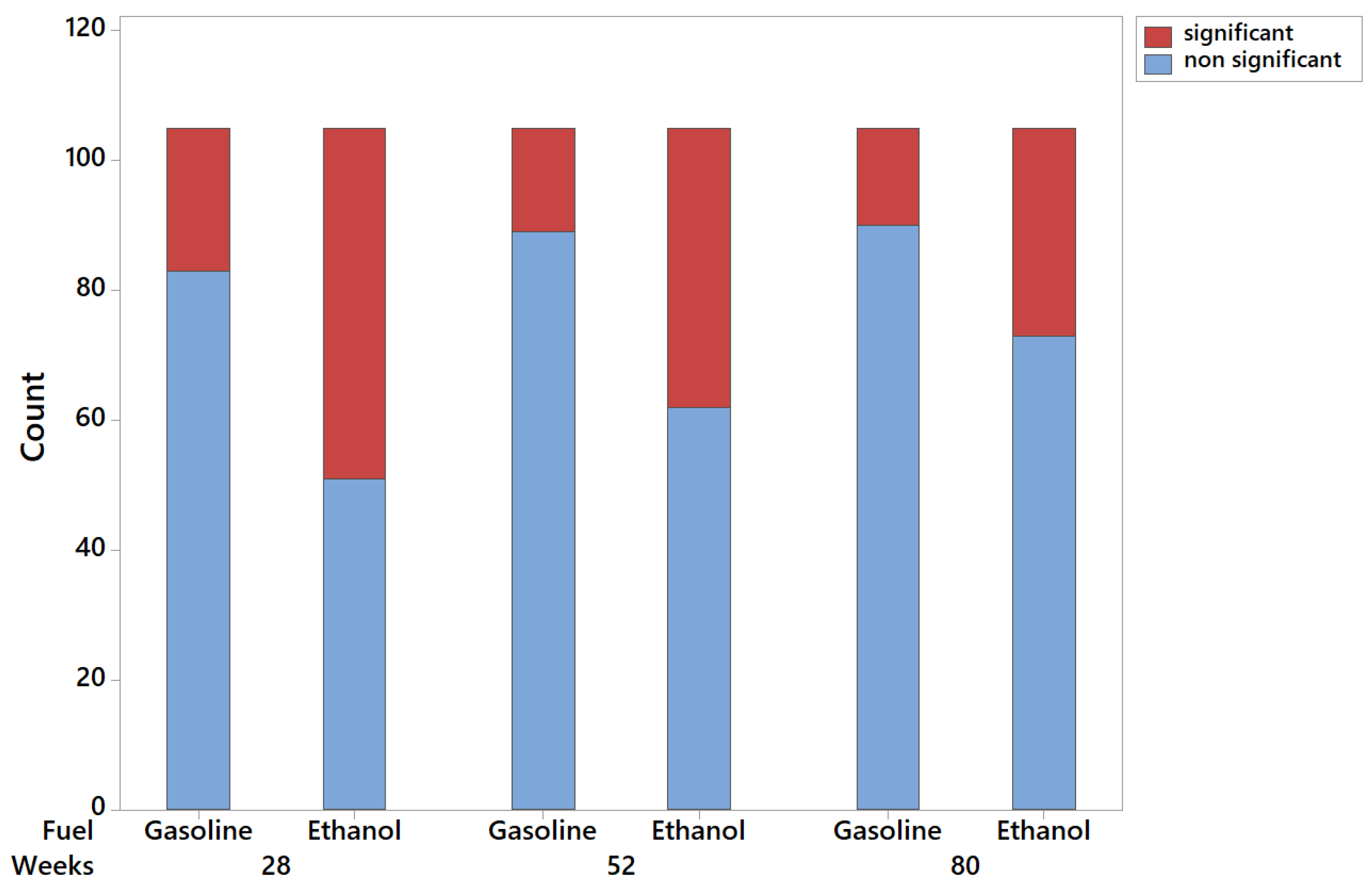

3. Results and Discussion

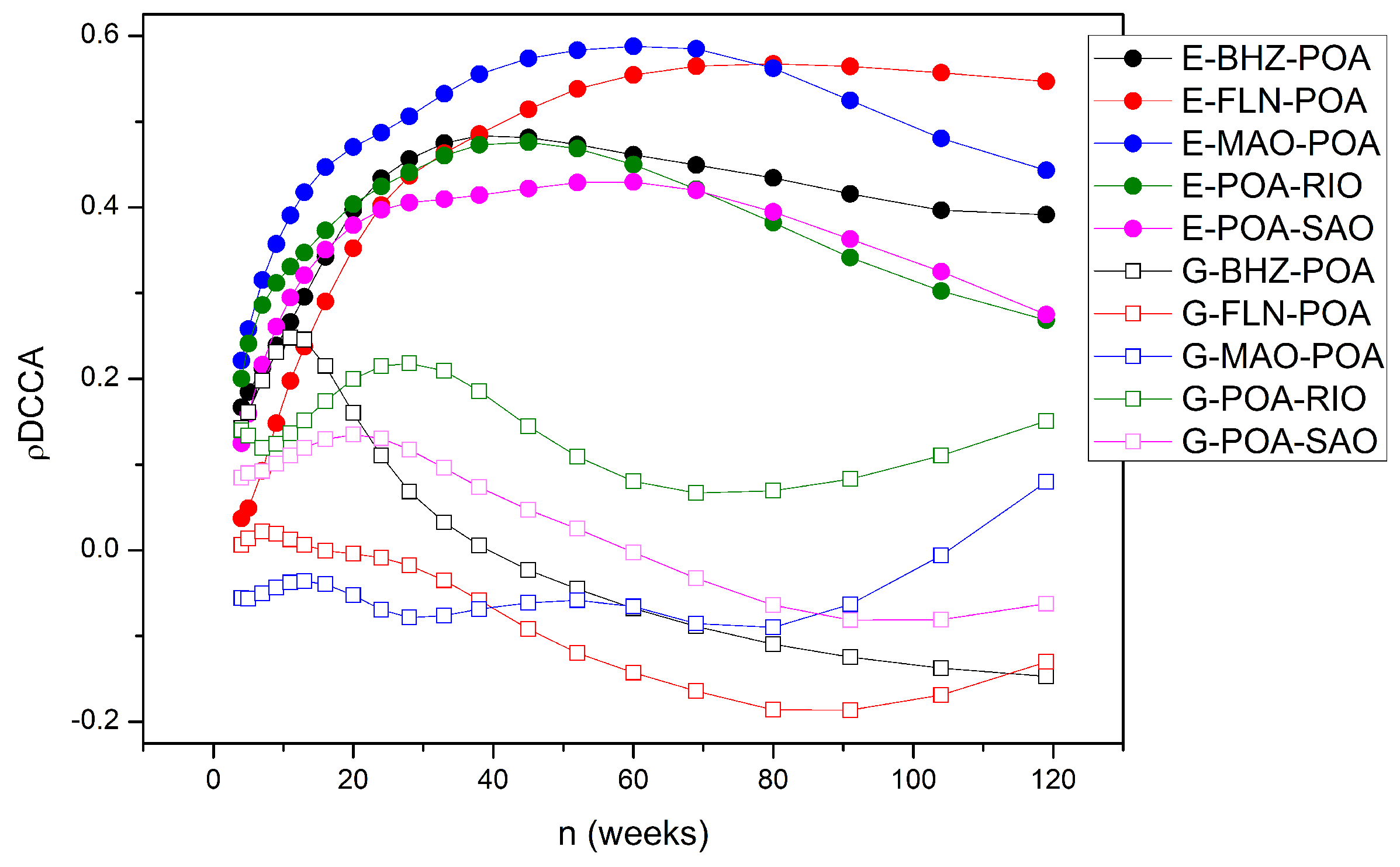

Comparison between Hydrous Ethanol and Gasoline C Retail Markets

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Cook, J.; Oreskes, N.; Doran, P.T.; Anderegg, W.R.; Verheggen, B.; Maibach, E.W.; Carlton, J.S.; Lewandowsky, S.; Skuce, A.G.; Green, S.A.; et al. Consensus on consensus: A synthesis of consensus estimates on human-caused global warming. Environ. Res. Lett. 2016, 11, 048002. [Google Scholar] [CrossRef]

- Conti, J.; Holtberg, P.; Diefenderfer, J.; LaRose, A.; Turnure, J.T.; Westfall, L. International Energy Outlook 2016 with Projections to 2040; Technical Report DOE/EIA-0484; USDOE Energy Information Administration (EIA), Office of Energy Analysis: Washington, DC, USA, 2016.

- Cook, J.; Nuccitelli, D.; Green, S.A.; Richardson, M.; Winkler, B.; Painting, R.; Way, R.; Jacobs, P.; Skuce, A. Quantifying the consensus on anthropogenic global warming in the scientific literature. Environ. Res. Lett. 2013, 8, 024024. [Google Scholar] [CrossRef]

- Gross, M. Planet with two billion cars. Curr. Biol. 2016, 26, 307–410. [Google Scholar] [CrossRef]

- Directorate-General for Research and Innovation (European Commission). Innovating for Sustainable Growth: A Bioeconomy for Europe; Publications Office of the European Union: Luxembourg, 2012. [Google Scholar] [CrossRef]

- Ollikainen, M. Forestry in bioeconomy—Smart green growth for the humankind. Scand. J. For. Res. 2014, 29, 360–366. [Google Scholar] [CrossRef]

- Richardson, B. From a fossil-fuel to a biobased economy: The politics of industrial biotechnology. Environ. Plan. C Gov. Policy 2012, 30, 282–296. [Google Scholar] [CrossRef]

- Goldemberg, J. Ethanol for a sustainable energy future. Science 2007, 315, 808–810. [Google Scholar] [CrossRef] [PubMed]

- Brazil. Decree n. 76593 de 14 de Novembro de 1975. Diário Oficial, 1975. Available online: https://www2.camara.leg.br/legin/fed/decret/1970-1979/decreto-76593-14-novembro-1975-425253-norma-pe.html (accessed on 5 April 2019).

- Kamimura, A.; Sauer, I.L. The effect of flex fuel vehicles in the Brazilian light road transportation. Energy Policy 2008, 36, 1574–1576. [Google Scholar] [CrossRef]

- Brazil. Law n. 12940 de 16 de Setembro de 2011. Diário Oficial, 2011. Available online: http://www.planalto.gov.br/ccivil_03/_Ato2011-2014/2011/Lei/L12490.htm (accessed on 5 April 2019).

- ANP. Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. 2019. Available online: http://www.anp.gov.br (accessed on 5 April 2019).

- Delgado, F.; Sousa, M.E.d.; Roitman, T. Biocombustíveis. Cad. De Biocombustíveis 2017, 4, 21–23. [Google Scholar]

- Salvo, A.; Huse, C. Is arbitrage tying the price of ethanol to that of gasoline? Evidence from the uptake of flexible-fuel technology. Energy J. 2011, 119–148. [Google Scholar] [CrossRef]

- ANP. Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Available online: http://www.anp.gov.br/images/Consultas_publicas/2018/TPC/TPC2-2018/NT_GT_TPC2_2018.pdf (accessed on 5 April 2019).

- Petrobras. Gasoline. Available online: http://www.petrobras.com.br/en/products-and-services/composition -of-sales-prices-to-the-consumer/gasoline/ (accessed on 12 May 2019).

- McCormick, K.; Kautto, N. The bioeconomy in Europe: An overview. Sustainability 2013, 5, 2589–2608. [Google Scholar] [CrossRef]

- EPE—Empresa de Pesquisa Energética. Análise de Conjuntura dos Biocombustíveis. 2017. Available online: http://www.mme.gov.br (accessed on 12 May 2019).

- Anderson, S.T. The demand for ethanol as a gasoline substitute. J. Environ. Econ. Manag. 2012, 63, 151–168. [Google Scholar] [CrossRef]

- Corts, K.S. Building out alternative fuel retail infrastructure: Government fleet spillovers in E85. J. Environ. Econ. Manag. 2010, 59, 219–234. [Google Scholar] [CrossRef]

- Shriver, S.K. Network effects in alternative fuel adoption: Empirical analysis of the market for ethanol. Mark. Sci. 2015, 34, 78–97. [Google Scholar] [CrossRef]

- Boff, H.P. Modeling the Brazilian ethanol market: How flex-fuel vehicles are shaping the long run equilibrium. China-USA Bus. Rev. 2011, 10, 245–264. [Google Scholar]

- Ferreira, A.L.; de Almeida Prado, F.P.; da Silveira, J.J. Flex cars and the alcohol price. Energy Econ. 2009, 31, 382–394. [Google Scholar] [CrossRef]

- Pessoa, J.P.; Rezende, L.; Assunção, J. Flex cars and competition in fuel retail markets. Int. J. Ind. Organ. 2019, 63, 145–184. [Google Scholar] [CrossRef]

- Nascimento Filho, A.; Pereira, E.; Ferreira, P.; Murari, T.; Moret, M. Cross-correlation analysis on Brazilian gasoline retail market. Phys. A Stat. Mech. Appl. 2018, 508, 550–557. [Google Scholar] [CrossRef]

- Zebende, G.; Brito, A.; Silva Filho, A.; Castro, A. ρDCCA applied between air temperature and relative humidity: An hour/hour view. Phys. A Stat. Mech. Appl. 2018, 494, 17–26. [Google Scholar] [CrossRef]

- Pedra, D.P.; de Oliveira Bicalho, L.M.N.; de Araújo Vilela, O.; Baran, P.H.; de Paiva, R.M.; de Melo, T.P. Metodologia Adotada pela Agência Nacional do Petróleo, Gás Natural e Biocombustíveis para a Detecção de Cartéis. 2010. Available online: http://www.anp.gov.br (accessed on 12 May 2019).

- Spearman, C. The proof and measurement of association between two things. Am. J. Psychol. 1904, 15, 72–101. [Google Scholar] [CrossRef]

- Kristoufek, L. Detrending moving-average cross-correlation coefficient: Measuring cross-correlations between non-stationary series. Phys. A Stat. Mech. Appl. 2014, 406, 169–175. [Google Scholar] [CrossRef]

- Zebende, G. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Phys. A Stat. Mech. Appl. 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Kwapień, J.; Oświkecimka, P.; Drożdż, S. Detrended fluctuation analysis made flexible to detect range of cross-correlated fluctuations. Phys. Rev. E 2015, 92, 052815. [Google Scholar] [CrossRef] [PubMed]

- Qian, X.Y.; Liu, Y.M.; Jiang, Z.Q.; Podobnik, B.; Zhou, W.X.; Stanley, H.E. Detrended partial cross-correlation analysis of two nonstationary time series influenced by common external forces. Phys. Rev. E 2015, 91, 062816. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Shang, P.; Huang, J. Several fundamental properties of DCCA cross-correlation coefficient. Fractals 2017, 25, 1750017. [Google Scholar] [CrossRef]

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685. [Google Scholar] [CrossRef] [PubMed]

- Podobnik, B.; Stanley, H.E. Detrended cross-correlation analysis: A new method for analyzing two nonstationary time series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [PubMed]

- da Silva, M.F.; Pereira, É.J.d.A.L.; da Silva Filho, A.M.; de Castro, A.P.N.; Miranda, J.G.V.; Zebende, G.F. Quantifying cross-correlation between Ibovespa and Brazilian blue-chips: The DCCA approach. Phys. A Stat. Mech. Appl. 2015, 424, 124–129. [Google Scholar] [CrossRef]

- da Silva, M.F.; Pereira, É.J.d.A.L.; da Silva Filho, A.M.; de Castro, A.P.N.; Miranda, J.G.V.; Zebende, G.F. Quantifying the contagion effect of the 2008 financial crisis between the G7 countries (by GDP nominal). Phys. A Stat. Mech. Appl. 2016, 453, 1–8. [Google Scholar] [CrossRef]

- Ferreira, P.; Pereira, É. The impact of the Brexit referendum on British and European Union bank shares: A cross-correlation analysis with national indices. Econ. Bull. 2019, 39, 335–346. [Google Scholar]

- Wang, G.J.; Xie, C.; Chen, S.; Han, F. Cross-correlations between energy and emissions markets: New evidence from fractal and multifractal analysis. Math. Probl. Eng. 2014, 2014, 197069. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Chen, S.; Yang, J.J.; Yang, M.Y. Random matrix theory analysis of cross-correlations in the US stock market: Evidence from Pearson’s correlation coefficient and detrended cross-correlation coefficient. Phys. A Stat. Mech. Appl. 2013, 392, 3715–3730. [Google Scholar] [CrossRef]

- Ferreira, P.; Dionisio, A. Revisiting covered interest parity in the European Union: The DCCA Approach. Int. Econ. J. 2015, 29, 597–615. [Google Scholar] [CrossRef]

- Ferreira, P.; Kristoufek, L. What is new about covered interest parity condition in the European Union? Evidence from fractal cross-correlation regressions. Phys. A Stat. Mech. Appl. 2017, 486, 554–566. [Google Scholar] [CrossRef]

- Da Silva, M.; da Silva Filho, A.; de Castro, A.N. Quantificando a Influência do Mercado de Câmbio nos Preços do Milho e da Soja no Município de Barreiras. Conjunt. Planej 2014, 182, 45–51. [Google Scholar]

- Bashir, U.; Zebende, G.F.; Yu, Y.; Hussain, M.; Ali, A.; Abbas, G. Differential market reactions to pre and post Brexit referendum. Phys. A Stat. Mech. Appl. 2019, 515, 151–158. [Google Scholar] [CrossRef]

- Guedes, E.; Dionisio, A.; Ferreira, P.; Zebende, G. DCCA cross-correlation in blue-chips companies: A view of the 2008 financial crisis in the Eurozone. Phys. A Stat. Mech. Appl. 2017, 479, 38–47. [Google Scholar] [CrossRef]

- Hussain, M.; Zebende, G.F.; Bashir, U.; Donghong, D. Oil price and exchange rate co-movements in Asian countries: Detrended cross-correlation approach. Phys. A Stat. Mech. Appl. 2017, 465, 338–346. [Google Scholar] [CrossRef]

- Pereira, E.J.d.A.L.; da Silva, M.F.; Pereira, H.d.B. Econophysics: Past and present. Phys. A Stat. Mech. Appl. 2017, 473, 251–261. [Google Scholar] [CrossRef]

- Stanley, H.E.; Afanasyev, V.; Amaral, L.A.N.; Buldyrev, S.; Goldberger, A.; Havlin, S.; Leschhorn, H.; Maass, P.; Mantegna, R.N.; Peng, C.K.; et al. Anomalous fluctuations in the dynamics of complex systems: From DNA and physiology to econophysics. Phys. A Stat. Mech. Appl. 1996, 224, 302–321. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. An Introduction to Econophysics: Correlation and Complexity in Finance; Cambridge University Press: Cambridge, UK, 2000; Volume 1. [Google Scholar]

- Mantegna, R.N.; Stanley, H.E. Scaling behaviour in the dynamics of an economic index. Nature 1995, 376, 46–49. [Google Scholar] [CrossRef]

- Jiang, Z.Q.; Zhou, W.X. Multifractal detrending moving-average cross-correlation analysis. Phys. Rev. E 2011, 84, 016106. [Google Scholar] [CrossRef] [PubMed]

- Kristoufek, L. Measuring correlations between non-stationary series with DCCA coefficient. Phys. A Stat. Mech. Appl. 2014, 402, 291–298. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; He, L.Y.; Chen, S. Detrended minimum-variance hedge ratio: A new method for hedge ratio at different time scales. Phys. A Stat. Mech. Appl. 2014, 405, 70–79. [Google Scholar] [CrossRef]

- Yuan, N.; Xoplaki, E.; Zhu, C.; Luterbacher, J. A novel way to detect correlations on multi-time scales, with temporal evolution and for multi-variables. Sci. Rep. 2016, 6, 27707. [Google Scholar] [CrossRef] [PubMed]

- Wang, G.J.; Xie, C.; Lin, M.; Stanley, H.E. Stock market contagion during the global financial crisis: A multiscale approach. Financ. Res. Lett. 2017, 22, 163–168. [Google Scholar] [CrossRef]

- Machado Filho, A.; Da Silva, M.; Zebende, G. Autocorrelation and cross-correlation in time series of homicide and attempted homicide. Phys. A Stat. Mech. Appl. 2014, 400, 12–19. [Google Scholar] [CrossRef]

- Podobnik, B.; Jiang, Z.Q.; Zhou, W.X.; Stanley, H.E. Statistical tests for power-law cross-correlated processes. Phys. Rev. E 2011, 84, 066118. [Google Scholar] [CrossRef] [PubMed]

- Macedo, I.; Leal, M.; Silva, J. Assessment of Greenhouse Gas Emissions in the Production and Use of Fuel Ethanol in Brazil. 2004. Available online: https://gssd.mit.edu/search-gssd/site/assessment -greenhouse-gas-emissions-60988-mon-11-16-2015-1124 (accessed on 5 April 2019).

- IBGE. Índice de Desenvolvimento Humano. Available online: https://cidades.ibge.gov.br (accessed on 10 May 2019).

| Region | City | Latitude, Longitude |

|---|---|---|

| North | Belém (BEL) | −1.382051, −48.477898 |

| Manaus (MAO) | −3.036105, −60.046593 | |

| Rio Branco (RBR) | −9.866168, −67.897189 | |

| Northeast | Fortaleza (FOR) | −3.777554, −38.533172 |

| Recife REC) | −8.061129, −34.871665 | |

| Salvador (SSA) | −12.911014, −38.331413 | |

| Central−West | Brasília (BSB) | −15.869923, −47.917428 |

| Cuiabá (CGB) | −15.594821, −56.091696 | |

| Goiânia (GYN) | −16.601095, −49.144543 | |

| Southeast | Belo Horizonte (BHZ) | −19.846098, −43.963296 |

| Rio de Janeiro (RIO) | −22.913002, −43.180002 | |

| São Paulo (SAO) | −23.589592, −46.660721 | |

| South | Curitiba (CWB) | −25.442395, −49.240417 |

| Florianópolis (FLN) | −27.670175, −48.545944 | |

| Porto Alegre (POA) | −29.993399, −51.175563 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murari, T.B.; Nascimento Filho, A.S.; Pereira, E.J.A.L.; Ferreira, P.; Pitombo, S.; Pereira, H.B.B.; Santos, A.A.B.; Moret, M.A. Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market. Sustainability 2019, 11, 4719. https://doi.org/10.3390/su11174719

Murari TB, Nascimento Filho AS, Pereira EJAL, Ferreira P, Pitombo S, Pereira HBB, Santos AAB, Moret MA. Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market. Sustainability. 2019; 11(17):4719. https://doi.org/10.3390/su11174719

Chicago/Turabian StyleMurari, Thiago B., Aloisio S. Nascimento Filho, Eder J.A.L. Pereira, Paulo Ferreira, Sergio Pitombo, Hernane B.B. Pereira, Alex A.B. Santos, and Marcelo A. Moret. 2019. "Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market" Sustainability 11, no. 17: 4719. https://doi.org/10.3390/su11174719

APA StyleMurari, T. B., Nascimento Filho, A. S., Pereira, E. J. A. L., Ferreira, P., Pitombo, S., Pereira, H. B. B., Santos, A. A. B., & Moret, M. A. (2019). Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market. Sustainability, 11(17), 4719. https://doi.org/10.3390/su11174719