1. Introduction

Foreign direct investment (FDI) has become an inevitable trend of globalization and an indispensable need of every country, especially developing ones. It is recognized as one of the important driving forces that affect the economic growth of developing countries [

1]. FDI creates favorable conditions for developing countries to exploit capital from outside and acquire modern technology and business management experience of developed countries. Hence, FDI has improved life quality by creating jobs and increasing export turnover and economic growth. Further, FDI encourages domestic enterprises to improve their business capacity by improving new technologies, productivity, and by reducing product price due to foreign competition [

2].

By definition, FDI is an activity wherein foreign investors come to a host country to establish and run their business enterprises. According to the International Monetary Fund (IMF), FDI is an investment established on the basis of long-term relationships where an organization in an economy (direct investor) gains long-term benefits from a business located in another economy. The purpose of a direct investor is to have considerable influence in managing the business located in the host economy. The Organization for Economic Co-operation and Development (OECD) defines an FDI enterprise as one having legal status or no legal status, in which a direct investor owns at least 10% of common stocks or stocks with voting rights. The important characteristic of direct investment is the intention of controlling the enterprise. However, not all countries use the 10% level to determine FDI.

According to the transaction cost approach, FDI is the most effective alternative for foreign businesses to avoid facing high domestic transaction costs [

3,

4,

5]. With the goal of maximizing profits and minimizing transaction costs, FDI contributes to increasing competitiveness, expanding the ability of the host country to export, collecting a portion of profits from foreign enterprises, and collecting foreign currency from FDI service activities. Another important benefit that FDI brings is modern technology, professional skills, and advanced management capacity. When investing in a country, the investor not only brings in capital in cash but also transfers in-kind capital such as machinery, materials, scientific knowledge, management know-how, and market access capabilities [

6,

7,

8,

9,

10,

11,

12,

13]. Hence, in the long run, these are the most fundamental benefits for the host country [

1].

With the important role of FDI in the national economy, especially in the last few decades, researchers have paid great attention to investigating, using several approaches, the influence of FDI on the economy, society, and environment of the host countries. The transaction cost approach has been utilized in recent years to investigate the impact of FDI on the long-term sustainability at both at the national and provincial levels. Transaction cost theorists believe that, although FDIs are necessary, they are not really a requirement for countries and provinces. Their belief is grounded in the fact that, in addition to the positive impact of FDI, there are several negative impacts on the long-term sustainability of the host country or provinces. This is because FDI enterprises only focus on reducing their transaction costs in order to maximize their profits [

14].

Sustainable development, according to the World Commission on Environment and Development [

15], refers to development that meets the present needs without compromising the ability to meet the needs of future generations. The Asian Development Bank (ADB) defines sustainable development as a new type of development by integrating the production process with resource conservation and environmental quality improvement. Sustainable development must ensure effective economic development, a fair society, and a protected environment. Therefore, all socioeconomic members, authorities, and social organizations must be involved in achieving the purpose of reconciling three main areas, i.e., economic, societal, and environmental. Thus, it can be understood that sustainable development is a healthy development, in which the development of an individual and the community does not damage the interests of other individuals and communities. Further, the development of the present generation does not violate the benefits of future generations. Additionally, the development of humanity does not threaten survival or degrade the habitat of other species on the planet because human life is based on maintaining natural productivity, resilience, and diversity of the biosphere [

16].

Concerning the relationship between FDI and the sustainability of the host country, in general, FDI allows countries and their provinces to take advantage of foreign capital and technology in order to realize the foremost goal of boosting economic development. Subsequently, other factors of the host countries (such as technology, production techniques, number of employed labors, labor productivity, income per capita, etc.) would be improved. In this sense, FDI positively influences the long-term sustainability of the host country and its province. FDI is an opportunity for countries and provinces to exploit their great potential for socioeconomic development.

However, FDI may have a negative impact on the sustainability of host countries and provinces [

17]. Host countries and provinces face the risk of receiving obsolete technology because foreign enterprises often transfer their outdated technology and equipment for innovating their products and improving product quality in their own country. In addition, FDI is often carried out mainly by transnational enterprises. This has raised fears that these enterprises will increase the dependence of the host country, which receives ready-made capital, technology, and network of buyers and sellers. Further, unbalanced regional development, environmental harm, and many social issues are negative impacts of FDI in relation to the long-term sustainability of host countries. Therefore, along with creating an attractive investment environment, it is essential that the government and provincial authorities should focus on choosing partners and projects consistent with the long-term sustainable development of the country. The governments of host countries can effectively do this by minimizing the negative impact caused by FDI investments and by implementing schemes to minimize transaction costs.

Given the rapid increase of FDI into developing countries in general and their provinces in particular, this study aimed to examine the impact of FDI on provincial sustainability in Vietnam. This emerging market has recorded the highest FDI growth in the Southeast Asian region in recent years [

18]. Sustainable development has been the top priority on the agenda of the Vietnamese government for the past two decades [

19,

20]. The present study is among the first attempts that apply the transaction cost approach that facilitates the objective and accurate identification of the positive and negative impacts of FDI on the long-term sustainability at the provincial level in the host country. The findings of this study are expected to have implications on designing and possibly implementing effective FDI policies in Vietnam (i.e., host country) at both the national and provincial levels. These policies would then serve to address the positive influences of FDI on the long-term growth of the economy, society, and overall environment of this host country [

10].

The remainder of this paper is structured as follows. We first provide a detailed discussion of the theoretical framework and hypotheses. Thereafter, we describe the research methodology including the variables, research field, and panel data. This is followed by a discussion of the research findings. Finally, we present key concluding remarks, practical implications, and future research directions.

4. Research Findings

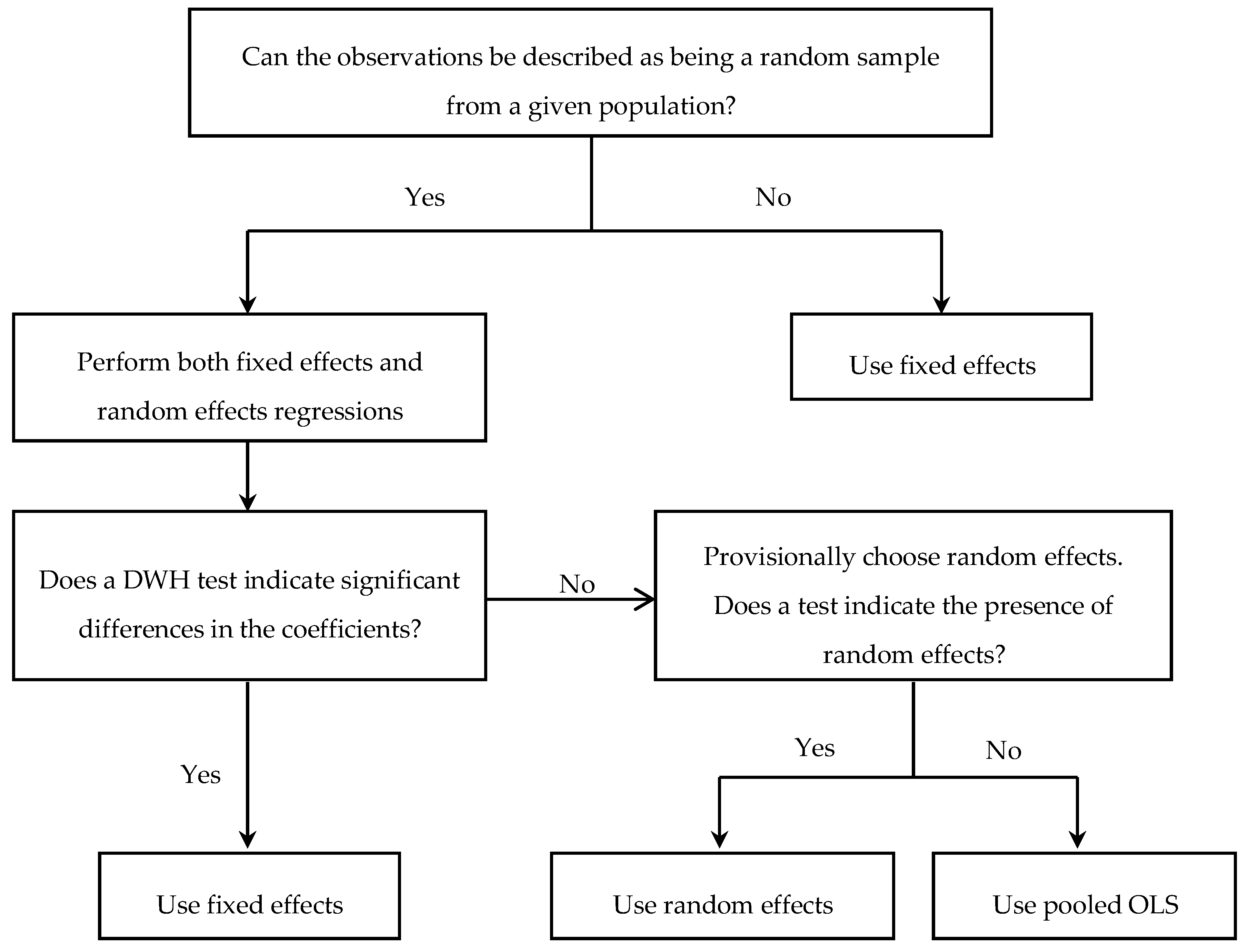

The regression results are presented in

Table 4. Accordingly, for checking the Pooled OLS, we examined the Breusch–Pagan Lagrange multiplier (LM) that is also significant by refusing the pooled OLS. Then, the significant Hausman’s test allowed us to accept the null hypothesis by indicating that the fixed effects model is appropriate [

46]. In the next step, we checked the Heteroskedasticity test for the selected fixed effects model. This significant test indicates that our fixed effects model has a heteroskedasticity problem; hence, we used the robust option to correct this regression model. Finally, the robust fixed effects model was used to assess the proposed research hypotheses.

Hypothesis 1 is partially supported. It is confirmed first by the independent variable of FDICAP that significantly and positively influences the sustainability of a province at the confidence level of 95% (Coef. = 0.084; t = 3.48;

p = 0.001). This means that the greater the capital of FDI enterprise compares to the total capital of active enterprises in a province, the higher the sustainability of a province. In fact, FDI is considered as one of the important capital sources to offset the shortage of investment capital by contributing to creating a driving force for the growth and development of a country in general and a province in particular. Relatively, our findings echo previous studies’ findings that indicated that an FDI has a positive impact on the environment [

34] and CO2 emission [

17], in contrast with some other studies that found a negative impact [

2,

16].

In fact, the reception of a large amount of foreign capital influences both total demand and total supply of the national/provincial economy. For total demand, as investment is a large part, while abnormal investment changes can have a great impact on output and income in the short term. For total supply, investment performance increases total supply (especially long-term supply), leading to increase in potential output, so product price decreases. Increased output and reduced prices allow increasing consumption, thereby stimulating production. Production development contributes to promoting socioeconomic development by increasing income for workers and improving the lives of people of the host country or host province.

Attracting foreign capital investment of provinces in particular and countries in general affects economic growth rate. Specifically, this activity promotes investment scale and technical innovation in the context of the rapid development of science technology and production forces in the world. Thus, host countries in general and provinces in particular take full advantage of comparative advantages to strengthen their internal resources.

According to the transaction cost approach, to reduce transaction costs, FDI enterprises focus on investing in high-tech industries, environmentally friendly technologies, clean energy, renewable energy, manufacturing medical equipment, health care services, education and training, etc. Therefore, attracting foreign investment capital allows provinces to undergo economic restructuring. In particular, this activity contributes to solving the development imbalances among regions in a province. Further, the industry structure, technology structure, product and labor structure, and territorial structure of provinces will be changed to better meet the socioeconomic development needs of the country.

Moreover, to minimize transaction costs, foreign investors attach importance to the application of advanced science and technology. Therefore, attracting foreign capital investment of provinces enhances their science and technology capacity. Through foreign direct investment, enterprises (mainly multinational ones) have transferred technology from their own countries or from other countries to host countries in general and host provinces in particular. Although there are many limitations due to objective and subjective factors, it is undeniable that, thanks to this transfer, provinces receive advanced techniques (including technologies that cannot be bought by trade relations) together with management experience and a trained workforce (technical qualifications, working methods, labor disciplines).

Second, the regression results show also a significant but negative impact of the variable FDIAST on the sustainability of a province at the confidence level of 95% (Coef. = −0.069; t = −3.33; p = 0.001). It means that the bigger the FDI projects with the value of fixed asset and long-term investment, the lower the provincial sustainability. Basically, big FDI projects often invest in fields such as natural mining, chemicals, industrial processing, etc. These projects negatively affect the provincial environment in particular and the host country in general.

Specifically, many FDI enterprises devastate the natural environment by over-exploiting natural resources (especially nonrenewable resources such as minerals). Thus, the greater the value of fixed assets and long-term investment, the higher the level of exploitation and destruction of natural resources in the province, which negatively affects provincial sustainability in the long term.

In addition, to minimize transaction costs, FDI manufacturing projects in provinces are one of the most important causes of environmental pollution because many FDI enterprises violate environmental protection and do not take measures to handle environmental pollution caused by waste generated in the production process. Thus, provinces face the conflict between industrial production growth, maintaining high economic growth rate with environmental pollution caused by production.

In general, big FDI projects with a high value of fixed asset and long-term investment are mainly implemented in the field of industrial production. Therefore, industrial waste that is not properly handled and strictly controlled will negatively influence provincial sustainability by causing environmental pollution and big social costs.

Moreover, the attention of FDI enterprises on long-term investment reduces the investment opportunities of domestic enterprises in the province. Under the cost transaction approach, FDI enterprises tend to pay more attention to long-term investment in the province in order to minimize their transaction costs. In the long-term, this situation affects the development and investment performance of domestic enterprises. Meanwhile, domestic enterprises are an important pillar of provincial economic development. Thus, FDI projects with the great value of fixed asset and long-term investment have a significant and negative impact on provincial sustainability.

The variable of FDIENT does not have a significant impact on the sustainability of a province. In fact, in host provinces, small and medium projects have low capital and value of fixed asset and long-term investment, while the projects that cause environmental pollution often have important capital and value of fixed asset and long-term investment. Currently, the number of small and medium FDI projects is very large, investing in many different industries, which account for a large proportion of trade, service, and tourism. The majority of them contribute positively to province sustainability.

Meanwhile, FDI projects harming province sustainability are often big ones in natural mining, chemicals, or industrial processing. It is interesting to note that some of these which are not well controlled have a serious impact on provincial sustainability. Currently, the number of FDI projects in these fields is not high. Therefore, the proportion of active FDI enterprises in each province does not have a significant impact on the sustainability of the province.

In general, (i) total FDI capital and (ii) the value of fixed assets and long-term investments of active FDI enterprises in a province are two indicators that have a significant impact on provincial sustainability. Therefore, the host provinces in particular and host countries in general should prioritize the quality of FDI projects in terms of capital, not the number of FDI projects. In particular, host provinces should focus on well controlling FDI projects with important value of fixed asset and long-term investment for ensuring provincial sustainable development.

Hypothesis 2 is not supported. There are no independent variables associated with the performance of FDI which have a significant impact on province sustainability. Our regression results show that the variable of FDITUR has no impact on the sustainability of a province at a confidence level of 95% (Coef. = −0.018; t = −1.53). Further, the variable of FDIGDP also has no significant impact on the sustainability of a province at a confidence level of 95% (Coef. = 0.029; t = 1.20). Thus, FDI projects that generate a lot of revenue or significantly contribute to the GDP of a province have no significant impact on provincial sustainability. These should support the pollution haven and both the halo and scale effects suggested by Pao and Tsai [

2].

According to the regression results, the variable of FDIOROFA does not have a significant impact on the sustainability of a province at a confidence level of 95% (Coef. = 0.001; t = 0.26). With a confidence level of 95% (Coef. = −0.005; t = −0.23), the variable of FDIROTC has no impact on the sustainability of a province. Similarly, the regression results indicate that the variable of FDIROS has no impact on the sustainability of a province at a confidence level of 95% (Coef. = −0.008; t = −1.13). Thus, the performance of FDI projects has no significant impact on the sustainability of a province. This result is explained by the transaction costs approach—specifically, with the aim of avoiding facing high domestic transaction costs, foreign investors choose FDI to minimize their transaction costs by occupying market share, enjoying tax incentives, exploiting natural resources, using cheap labor, and transferring old technologies.

Therefore, profit is the top target of FDI enterprises operating in provinces. FDI enterprises concentrate on pursuing revenues and profits but ignoring the host countries and provinces’ social and environmental responsibilities by minimizing these costs, even evading social and environmental obligations in provinces. Thus, the performance of FDI projects does not significantly affect the sustainability of province.

Note 1: Positive Impact of FDI on the Sustainability of Vietnam Provinces.

FDI projects in Vietnam provinces have contributed to stable development in all aspects of politics, security, economy, and society. Specifically, the FDI projects have promoted GDP growth by meeting the capital source for the national economy in general and provincial one in particular. Through the implementation of FDI projects, new and modern technologies have been transferred to Vietnam and its provinces to improve labor productivity and competitiveness in the market. Further, the total export turnover has increased significantly. The FDI projects solve the employment problems of the provinces. The host countries have the opportunity to participate in the global network to boost their export activities. Moreover, FDI projects contribute to the budget by making an important contribution to increasing the surplus of capital accounts and improving the balance of payments. For example, some FDI projects have positive impacts on Vietnam provinces’ sustainability, such as:

(1) The project of manufacturing tires of Kumho Asiana Group (Korea) had a total investment of 360 million USD in the Binh Duong province in 2006. This is a large FDI project in the province, which selected Ben Cat Town to build their factory. This project has made an important contribution in promoting the overall socioeconomic development of Ben Cat Town in particular and the Binh Duong province in general. In the first 6 months of 2018, the economic situation of Ben Cat Town developed considerably, with a total production value of more than 49,000 billion VND, increasing by 17.77% compared to that of the same period last year.

(2) The project of high-quality packaging production of SCG Siam Cement Group (Thailand) had a phase 1 investment capital of 140 million USD in My Phuoc 3 Industrial Zone of the Binh Duong province in 2007. The company produces all kinds of packaging in industries such as food production, apparel, footwear, and electronics. In the third quarter of 2007, its packaging manufacturing factory was built in My Phuoc 3 Industrial Zone of the Binh Duong province. The initial capital for the project was 140 million USD and is expected to be 220 million USD in total. The capacity is estimated 220,000 t/year, and 70% of the outputs are consumed domestically. This is considered to be the largest packaging manufacturing factory in Vietnam.

(3) The project of My Phuoc Eco-Urban Area was invested in and developed by SP Setia Berhad Group (Malaysia), Becamex IDC and Treasure Link. The project is built on an area of 226 h. The investment capital was up to 620 million USD and is considered as one of the biggest projects in 2007. The project was opened for sale in the first phase in October 2009, with about 10,000 houses, including villas, townhouses, and apartments. This project had a positive impact on the housing issues of the people in the province and neighboring provinces. Further, the project contributed to improving the life quality of the people due to its ecological urban nature, with the creation of many places such as parks, swimming pools, condominiums, luxury villas, entertainment and commercial areas, international schools, etc.

(4) The project of the beverage factory of Kirin Acecook Vietnam (Japan) had an investment capital of 60 million USD. This project is a joint venture between Japanese beverage group-Kirin (51%), Japanese Acecook Group (39%), and Vietnamese Acecook Company (9%). This joint-venture enterprise built its factory on a 2.7-hectare plot of land in My Phuoc II Industrial Zone of the town of Ben Cat (Binh Duong province). The first phase of the project had an investment of 34 million USD, with a design capacity of 4 million barrels/year. The second phase of the project raised the capacity to about 10 million products/year. This project contributed by providing about 500 jobs for local workers.

Hypothesis 3 is partially supported. We found that the variable of FDIEMP has a significant and positive impact on provincial sustainability at a confidence level of 95% (Coef. = 0.093; t = 3.50; p = 0.001). This means that the larger the number of employees working in the FDI sector, the higher the sustainability of a province. In fact, FDI enterprises not only create jobs and reduce unemployment significantly but also create high economic value for host provinces. Hence, these enterprises have a significant impact on provincial sustainability by improving people’s lives and the understanding of environmental protection.

In addition to minimizing transaction costs, FDI enterprises mainly invest in industries that are in line with modern development trends such as manufacturing, processing, construction, and service. These enterprises significantly influence the sustainable development of host provinces through labor restructuring from agriculture to industry and services that are consistent with the general trend of the world.

The other two variables of FDICOM (Coef. = −0.008; t = −0.53) and FDIWAG (Coef. = 0.343; t = 0.96) have no significant impact on provincial sustainability at a confidence level of 95%. Currently, the income of labor and contribution to the salary of the FDI sectors in provinces is limited. Under the transaction cost approach, to avoid facing domestic increase in transaction costs, FDI enterprises make the most of cheap labor sources in host countries in general and provinces in particular. Hence, these enterprises only focus on taking advantage of low-cost human resources but pay little attention to the training and benefits of employees in a province.

FDI enterprises focus on exploiting the labor market of an emerging economy and only pay low wages. Therefore, the income of labor and contribution to the salary of the FDI sector do not have a significant impact on provincial sustainability. In addition, in FDI enterprises, highly paid employees are mainly high-quality human resources. This partly explains why the two variables of FDICOM and FDIWAG do not have a significant impact on provincial sustainability in the current context. Empirically, Ridzuan et al. [

34] found that FDI inflows widen income disparity in the host country, which may disrupt sustainable development.

In general, the host country and its provinces should focus on increasing the number of employees working in FDI enterprises, because this indicator has a significant and positive impact on provincial sustainability. At the same time, to improve sustainability, national and provincial governments should implement solutions to promote training activities and benefits for employees in these enterprises.

Note 2: Negative Impact of FDI on the Sustainability of Vietnam Provinces.

There are some FDI projects that negatively affect the economy by exhausting natural resources and seriously influencing the environment. In particular, these FDI projects create competitive pressure on the domestic enterprises. Further, they increase the risk of importing outdated technologies affecting economic development. In addition, these FDI projects cause an imbalance between sectors of the economy because they often focus on key industries such as manufacturing and energy. In addition, some illegal organizations have poured FDI into Vietnam for money laundering. This results in several adverse consequences for the environment, such as environmental pollution, imbalance of the ecosystem, and even destroying biodiversity. For example, some FDI projects that have a negative impact on the sustainability of Vietnam provinces include:

(1) Vedan Company of the Vedan Group (Taiwan), with a total investment of 422 million USD in the Dong Nai province created the Thi Vai “dead” river because of the huge amount of waste. Vedan designed and installed its pump and technical piping system as to pump liquid waste from the lysine factory, monosodium glutamate factory, and polyglutamic acid (PGA) production factory from their tanks of 6000–7000 m3 volume and 15,000 m3 into the Thi Vai River. Vedan’s installation of its waste discharge system violates the technical process of waste treatment (wastewater and liquid waste) and the legal provisions of Vietnamese law on environmental protection.

(2) Eminence Iron and Steel Factory in the Thanh Hoa province (30 billion USD) utilized land and other resources of Vietnam. Specifically, according to the investors of this project, in the first phase, they installed four blast furnaces, each of 550 m3, all built with Chinese equipment. However, at that time, the Chinese Government only permitted them to invest and build new steel mills with a furnace scale of 1000 m3 or more. This is because steel mills of less than 1000 m3 are outdated and inefficient.

(3) The Dragon Beach eco-tourism area in the Quang Nam province (4.15 billion USD) was invested by TANO Capital Group and Global C&D Group (United States). This is considered a super project launched with the purpose of developing marine tourism in the Quang Nam province. However, in the long term, the investors did not pay the deposit and delayed their construction plans. Hence, the Quang Nam province issued a letter requesting the revocation of the license. This super project has left many serious consequences by adversely affecting the lives of people in the project area and the local development progress.

(4) Guang Lian Steel Factory in the Quang Ngai province (4.5 billion USD) is an investment project approved by the government in July 2005 and granted an investment certificate by the Ministry of Planning and Investment in September 2006. However, for 10 years, the investors of the project offered to adjust the investment certificate five times to increase capital, increase capacity, and change legal entities. The Quang Ngai province decided to withdraw this project land due to a violation of land laws in Clause 12, Article 38 of the 2003 Land Law of Vietnam. This project had a negative impact on the sustainability of the Quang Ngai province by making land wasteful while not attracting other investors.

(5) Formosa Steel Factory pollutes the sea area of Central Vietnam. The project of the Iron and Steel Complex and Son Duong Port of Hung Nghiep Formosa Ha Tinh Iron and Steel Company Limited (Formosa Ha Tinh Company) was granted an investment certificate in 2008 with a total registered investment capital of phase 1 of 10.548 billion USD. This project caused massive fish deaths in Vietnam in 2016. The massive fish deaths in the Vung Ang sea (Ha Tinh province) started on 6 April 2016 and then spread to the sea areas of Quang Binh, Quang Tri, and Thua Thien-Hue. These fish deaths had a big impact on the production and livelihood of fishermen, on coastal aquaculture households, and on sea tourism. The reason is that polluting waste from Formosa Ha Tinh Company exceeds the allowable maximum limit. The large source of waste from this enterprise’s factory contains toxins that develop a complex form, causing massive fish deaths.

5. Implications and Conclusion

This study focused on analyzing and assessing foreign direct investment and provincial sustainability using the transaction cost approach. The focused research context was Vietnam, where promoting sustainable behavior and development has become very important [

47,

48,

49]. First, we systematized the theoretical framework of FDI, sustainable development, and transaction cost approach on the relationship between FDI and the environment. On that basis, we developed three hypotheses to study the impact of FDI on provincial sustainability. We used the adjusted net savings (ANS) of World Bank to assess the sustainable development of Vietnam provinces as a dependent variable. This indicator has been used by many researchers globally to assess the sustainable development of a country or a province. The independent variables used in this research were distinguished into three groups, associated with (i) the FDI inflow stocks, (ii) employment in the FDI sector and (iii) the performance of FDI in provinces.

The independent variables measuring the FDI inflow stocks include (i) the proportion of the number of active FDI enterprises to the number of total active enterprises in a province (FDIENT), (ii) the proportion of capital of active FDI enterprises to the capital of total active enterprises in a province (FDICAP), and (iii) the proportion of fixed asset and long-term investment of active FDI enterprises to the value of total active enterprises in a province (FDIAST). The independent variables measuring the performance of FDI consist of (i) the proportion of net turnover of active FDI enterprises to this value of total active enterprises in a province (FDITUR), (ii) the proportion of GDP generated by the FDI sector to the total GDP of a province (FDIGDP), (iii) the return on value of fixed asset and long-term investment of FDI (FDIOROFA), (iv) the return on total capital of FDI (FDIROTC), and (v) the return on sales of FDI (FDIROS). The independent variables measuring employment in the FDI sector involve (i) the proportion of the number of employees in FDI enterprises to the number of employees in total enterprises in a province (FDIEMP), (ii) the proportion of compensation of FDI employees to the total compensation of total employees in a province (FDICOM), and (iii) the difference between the monthly average compensation of an employee working in an FDI enterprise and the average one (of all kinds of employees) in a province (FDIWAG).

We chose 63 provinces of Vietnam for the empirical study, using the data from statistical yearbooks of Vietnam’s provinces during the period from 2010 to 2016 to investigate the impact of FDI on provincial sustainability. In addition, the regression models used panel data and were regressed in three ways, namely (i) pooled OLS model, (ii) random effects model, and (iii) fixed effects model. Next, the Lagrange multiplier (LM) was used to select whether the random effects model or the pooled OLS model was suitable for this research. The fixed effects model and the random effects model were compared using the Hausman test.

The regression results indicated that the capital of FDI enterprises (FDICAP) and employment in the FDI sector (FDIEMP) have positive and significant impacts on province sustainability. By contrast, the value of fixed asset and long-term investment of an FDI project and province size negatively influence province sustainability. Our findings imply that host provinces in particular and host countries in general should prioritize the quality of FDI projects in terms of capital and not by the number of FDI projects. In particular, the host provinces should focus on effectively controlling FDI projects that have an important value of fixed assets and long-term investment to ensure provincial sustainability. In addition, host provinces should pay attention to increasing the number of employees working in FDI enterprises because this indicator has a significant and positive impact on provincial sustainability. At the same time, to improve sustainability, the national and provincial government should implement effective solutions to improve training activities and welfare for the employees in these enterprises.

On the basis of the research results, we propose some policy implications to improve the performance of FDI, thereby promoting the sustainability of host provinces in particular and host countries in general, as follows:

First, the government and provincial governments should institute new approaches to policy and strategy development to attract FDI to ensure provincial sustainability. Specifically, FDI attraction should concentrate on capital, not on the number of projects. At the same time, FDI projects must support industrial upgrade by helping provincial enterprises to integrate into global production networks. Policymakers should comprehensively revise the current preferential policy framework for FDI competition based on provinces’ advantages and strengths.

Second, the FDI policies should gradually reduce dependence on FDI because this dependency affects the sustainable development of provinces by making the provincial economy susceptible to risks from global economic fluctuations. At the same time, provinces should have effective policies to proactively attract FDI capital for different sectors, especially those that bring more added value, such as processing, logistics services, primary metal manufacturing, mining, etc.

Third, host countries and provinces should have specific policies that strengthen the connection between FDI enterprises and domestic suppliers to promote provincial sustainability. These policies involve the establishment of a database of FDI enterprises, suppliers, connection services, and investment promotion programs for attracting foreign investors and supporting domestic enterprises.

Fourth, host countries and provinces should systematically review legal restrictions and procedural barriers of attracting FDI in priority areas to ensure provincial sustainability by easing the rules associated with foreign investors’ ownership and capital for key fields. In addition, institutional reforms and simplification of administrative procedures should be promoted to increase the performance and transparency of FDI enterprises.

Fifth, the government and provincial government should review the policies relating to the contribution of FDI enterprises to host countries and host provinces, especially the issues relating to the environment, natural resources, labor training and development, and welfare of employees in FDI enterprises. Further, policies should focus on increasing the number of employees in FDI enterprises to ensure provincial sustainability.

Sixth, the government and provincial authorities should step up monitoring and supervising the implementation of laws on investment and enterprises in order to promptly detect and handle potential problems as well as law violations around foreign direct investment. This activity aims to limit the negative impacts of FDI on the sustainable development of provinces. At the same time, authorities should urgently issue documents guiding new laws relating to FDI and sustainable development at the provincial level to ensure the performance of FDI and sustainable development of host countries in general and provinces in particular.

This research has some significant contributions as follows:

First, we effectively validated theoretical frameworks relating to FDI, sustainable development, and the relationship between FDI and provincial sustainable development using the transaction cost approach. On that basis, we developed three hypotheses to clarify the impact of FDI on the sustainable development of host provinces.

Second, we successfully implemented empirical research on the impact of FDI on the sustainable development of host provinces. Through data collection from 63 Vietnam provinces, we used regression models such as the pooled OLS model, random effects model, and fixed effects model to determine the relationship between FDI and provincial sustainability.

Third, by collecting the data of 63 Vietnam provinces, this research partly indicates the actual situation of the socioeconomic development of Vietnam’s provinces. Since then, the Vietnam Government and provincial governments have had a better understanding of the status of FDI and its impact on sustainable development, hence implementing effective measures to promote sustainable development.

Fourth, through our research findings, we provided some objective assessments on the impacts of FDI on the sustainable development of provinces using the transaction cost approach. These assessments are important for the host countries and provinces.

Fifth, based on the research results, we proposed some policy implications to improve FDI performance, thereby promoting the sustainable development of the host countries in general and provinces in particular.

This study has also some limitations. Essentially, the available data in Vietnam have shortcomings in that they do not always clearly depict the current situation of FDI’s impact on provincial sustainability. We assessed only the indirect impacts of FDI on provincial sustainability, while the direct impacts on the environment could not be measured or assessed. We also did not have enough data on the contribution of GDP to a province’s import and export to assess the impact of this factor on provincial sustainability. In the future, further studies can possibly focus on analyzing and assessing the impact of each aspect of FDI on provincial sustainability. Additionally, future research can collectively investigate the impact of FDI-related variables and non-FDI-related factors on national and provincial sustainability.