Exploring Carbon Pricing in Developing Countries: A Macroeconomic Analysis in Ethiopia

Abstract

1. Introduction

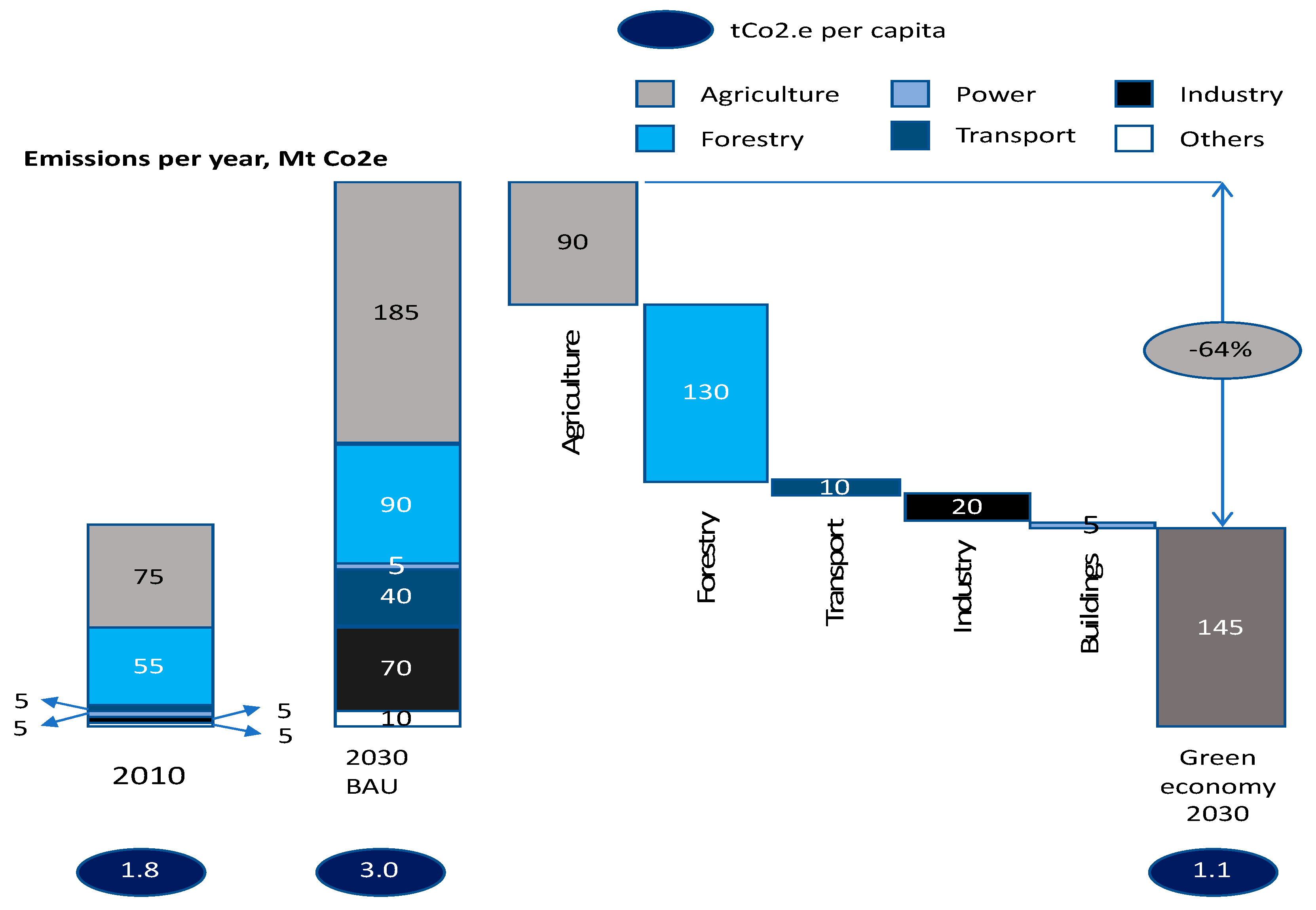

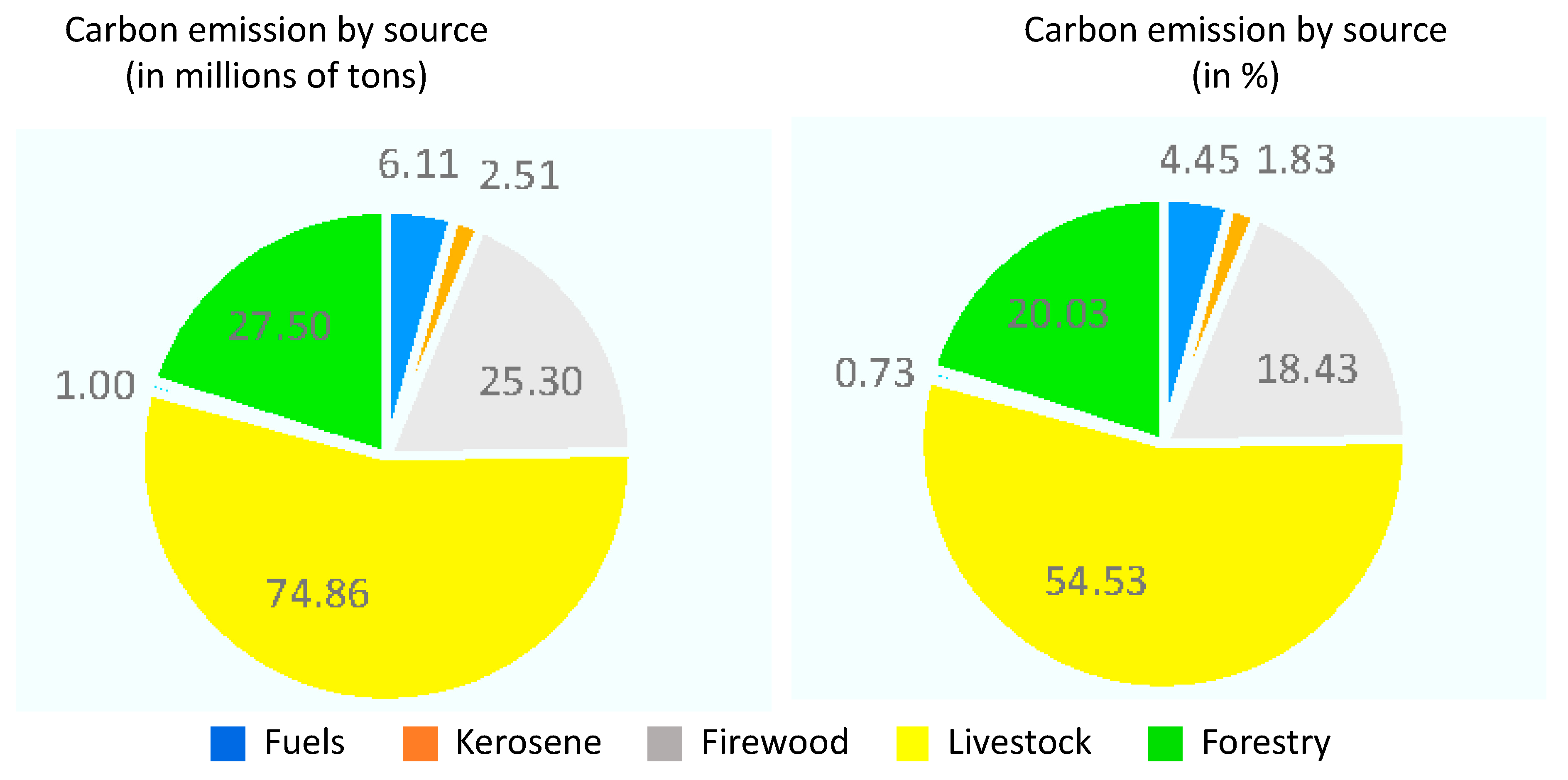

2. The Structure of the Ethiopian Economy and Its Carbon Emissions

Carbon Emission by Source

3. Methodology for Assessing the Impacts of Carbon Pricing in Ethiopia

3.1. Modeling Framework

3.2. Baseline Scenario

3.3. Policy Scenarios

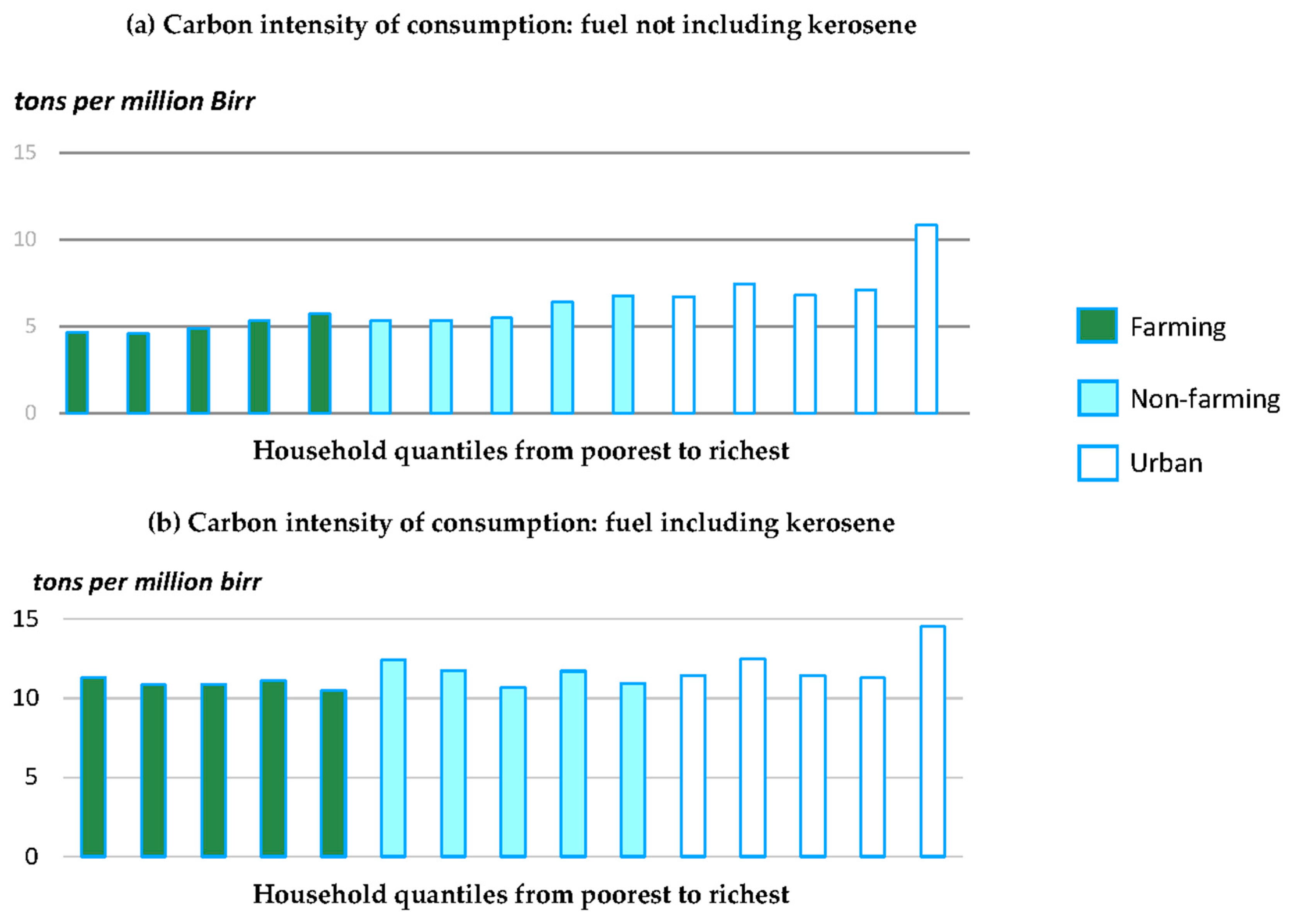

3.3.1. What Sources of Carbon to Tax

3.3.2. The Time Path of Carbon Prices

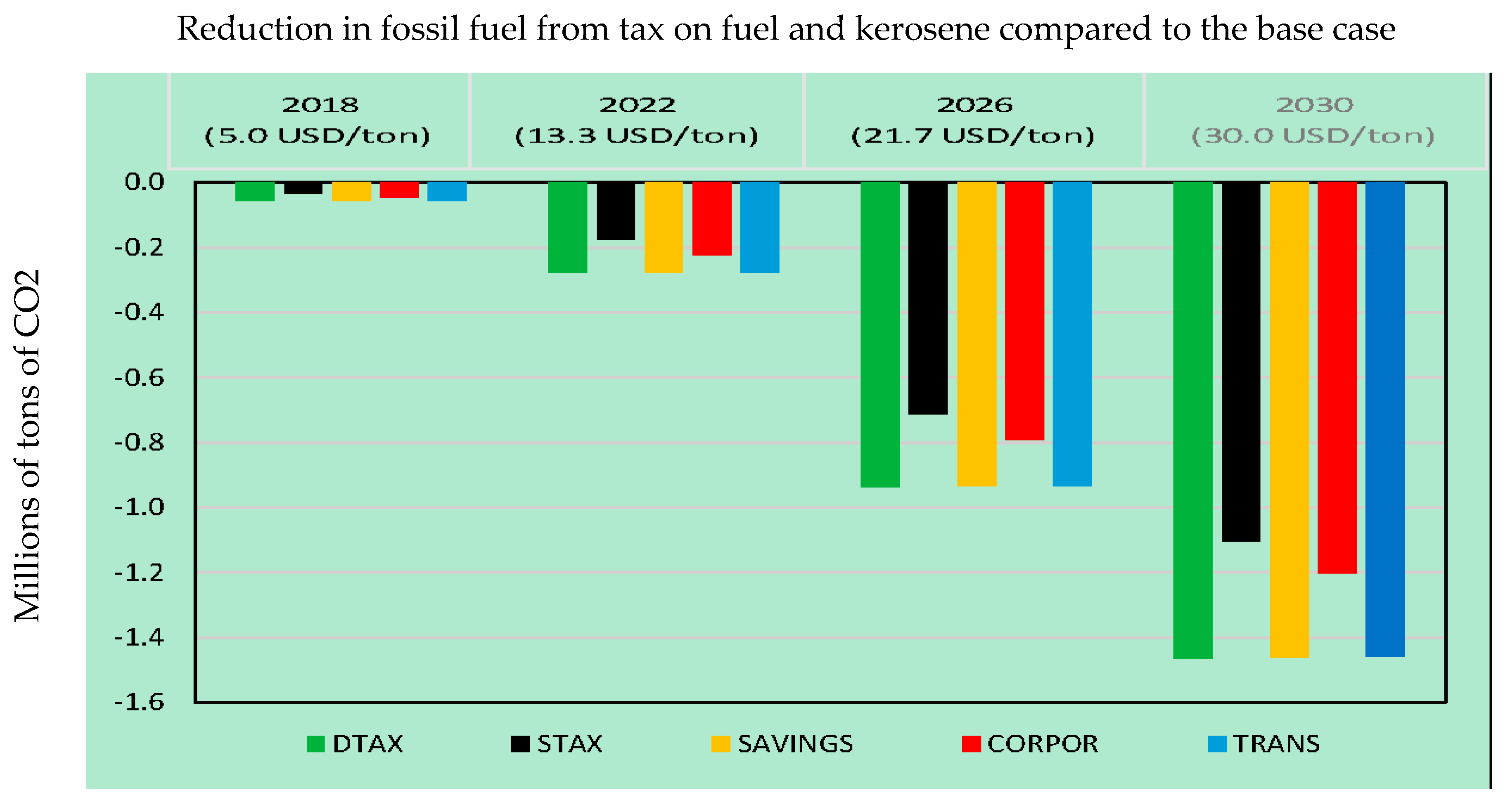

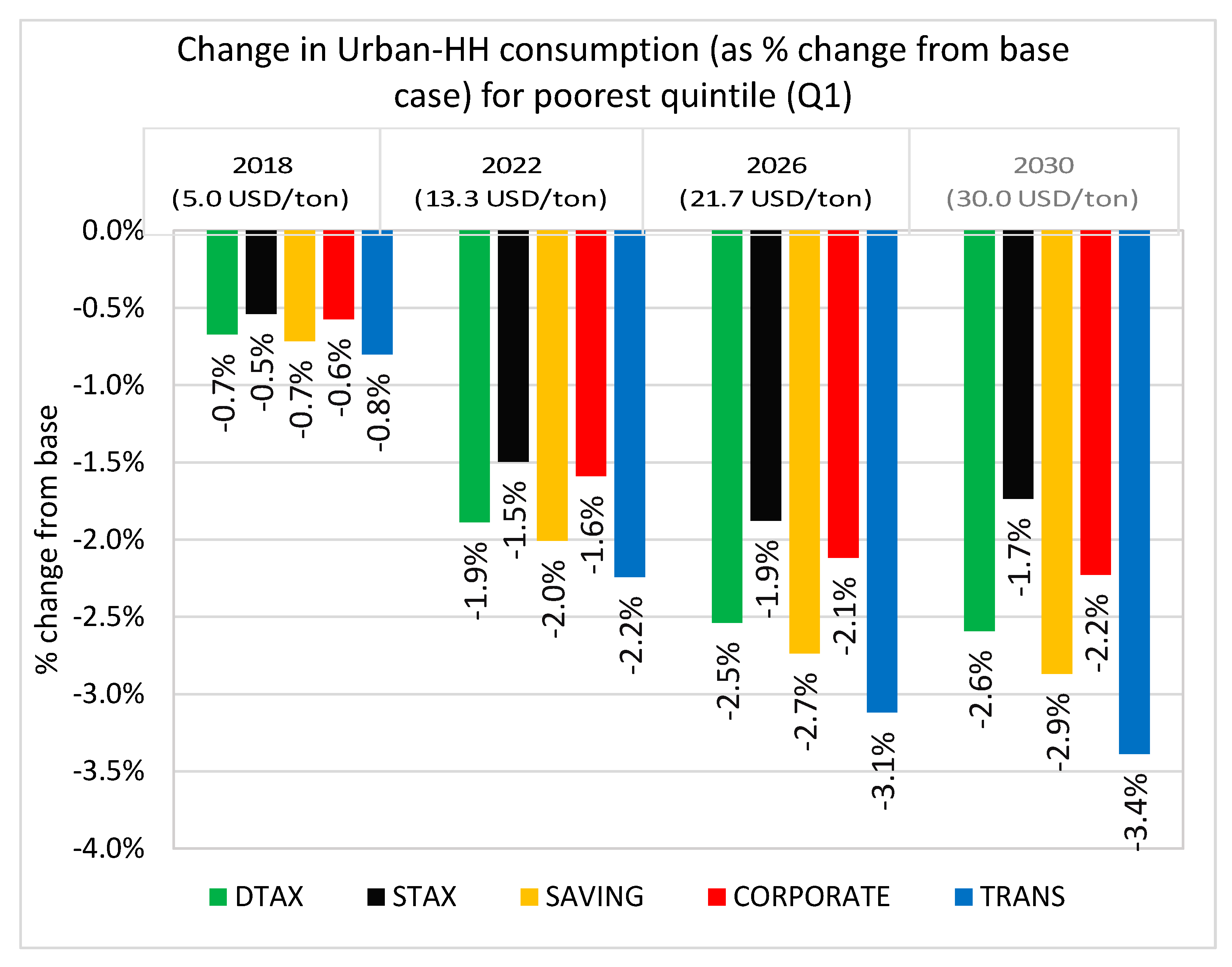

4. How to Use the Increased Carbon Revenue

- STAX—A scenario where we adopt uniform reduction of sales taxes for intermediate and final commodities.

- TRANS—A scenario where the increased government revenue is used as a lump-sum transfer payment to all households. Lump-sum transfer payments follow the same pattern of existing allocation of government transfers to each type of household. The proportion of transfers to household types is maintained. (As indicated in Appendix A, the Social Accounting Matrix has 15 types of households. The initial share refers to the government transfer to each type of household relative to overall government transfer to households. The basic premise in this scenario is that the current transfer scheme reflects the weight the government puts on the welfare of each type of household.)

- SAVINGS—A scenario where the money from carbon tax is directed to the overall saving pool where it can then be invested in the most profitable sectors.

- DTAX—A scenario where the money from carbon tax is transferred to taxpaying households in the formal sector. This is done in the form of uniform reduction of direct taxes (personal income tax).

- CORPOR—A scenario where the money is used to encourage investment by firms. This is achieved by uniform reduction of business income tax.

5. Modeling Results

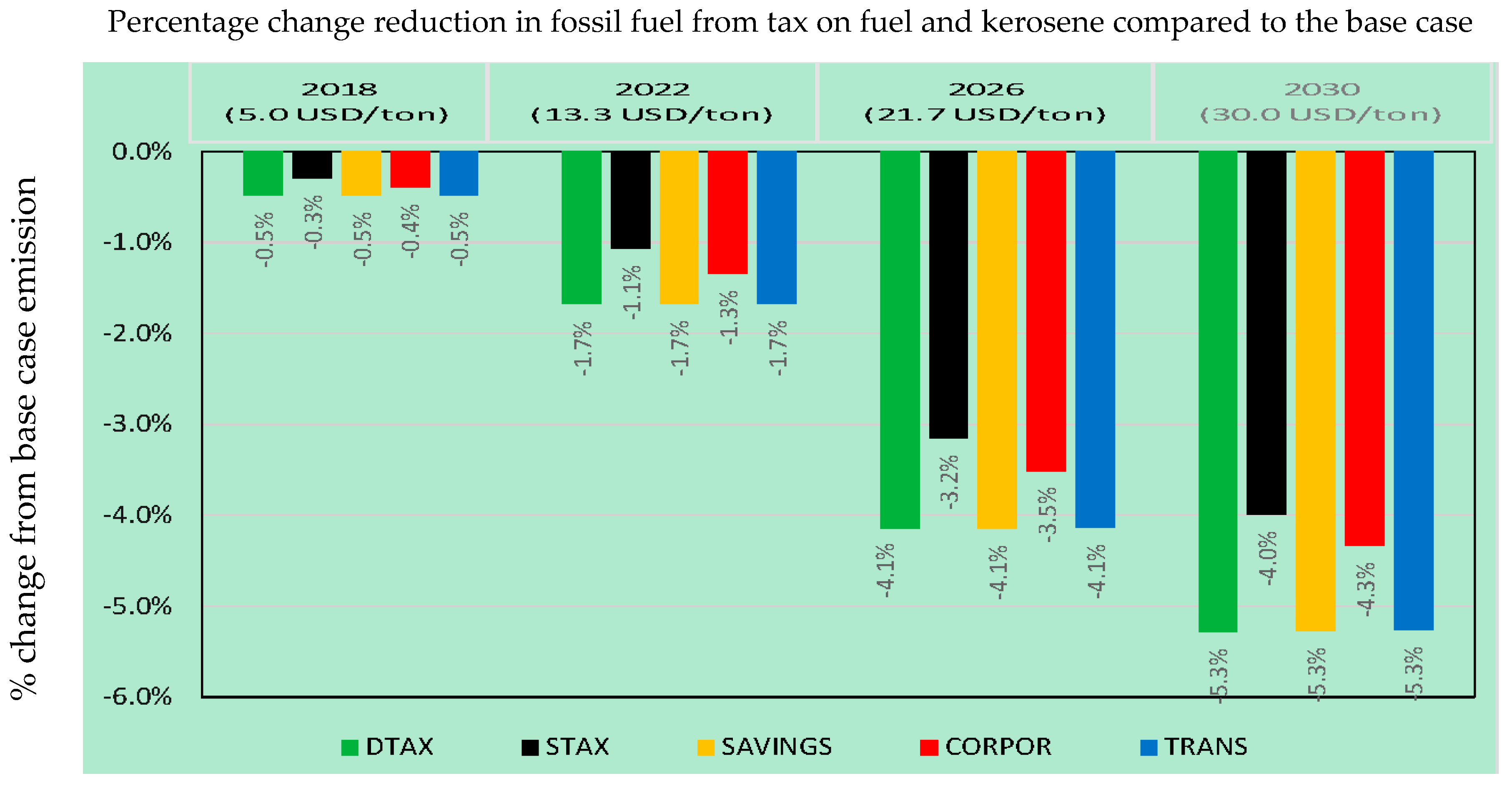

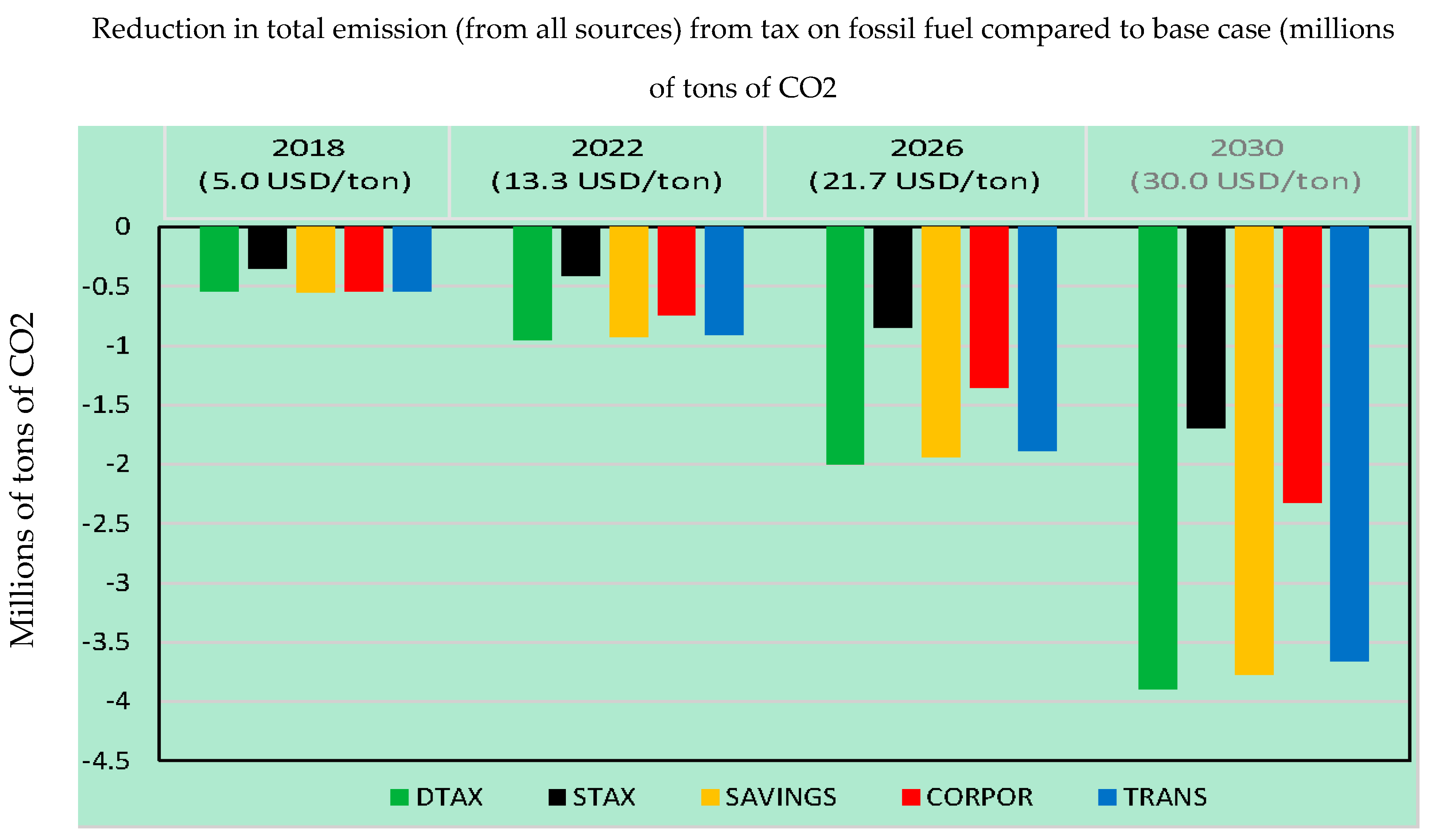

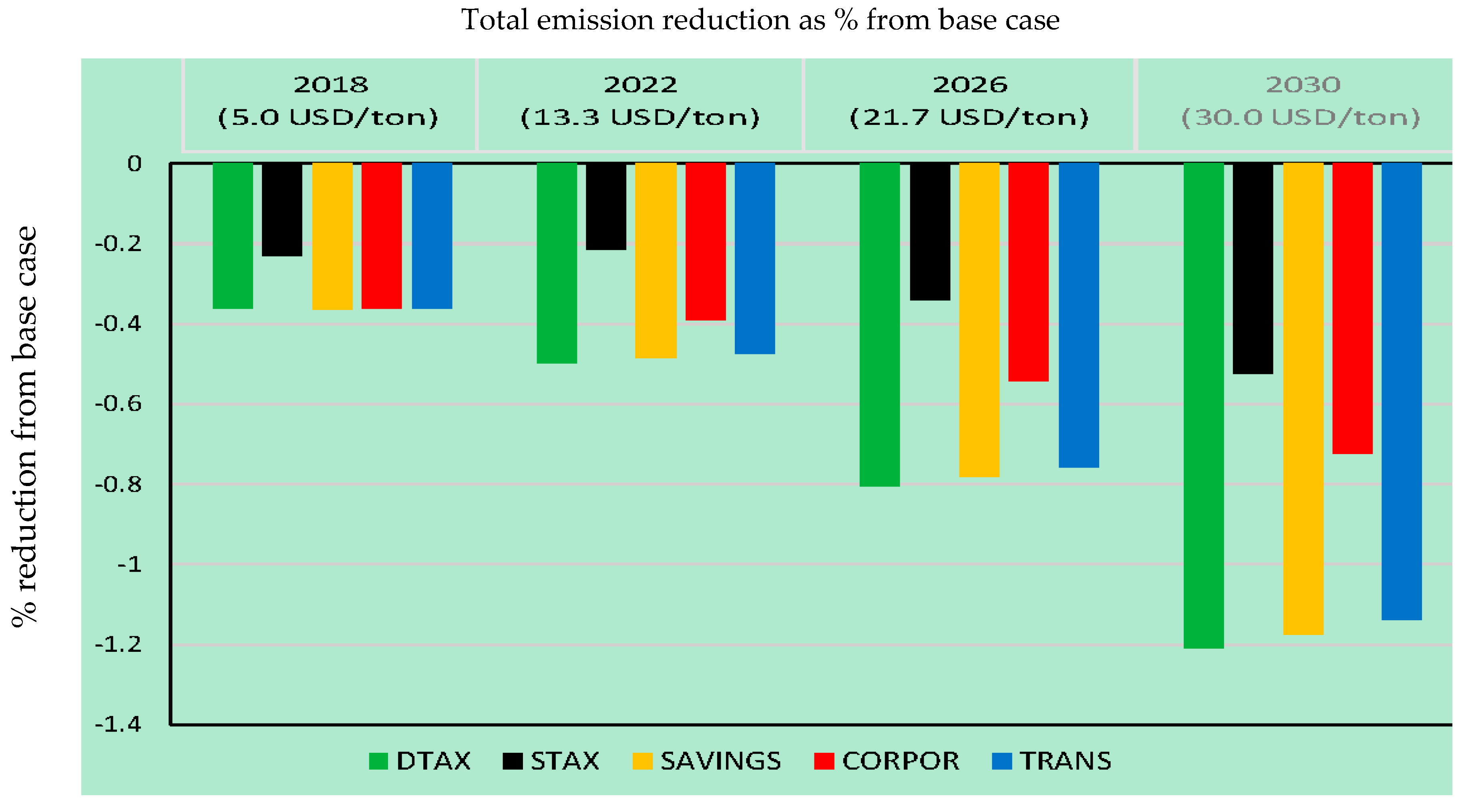

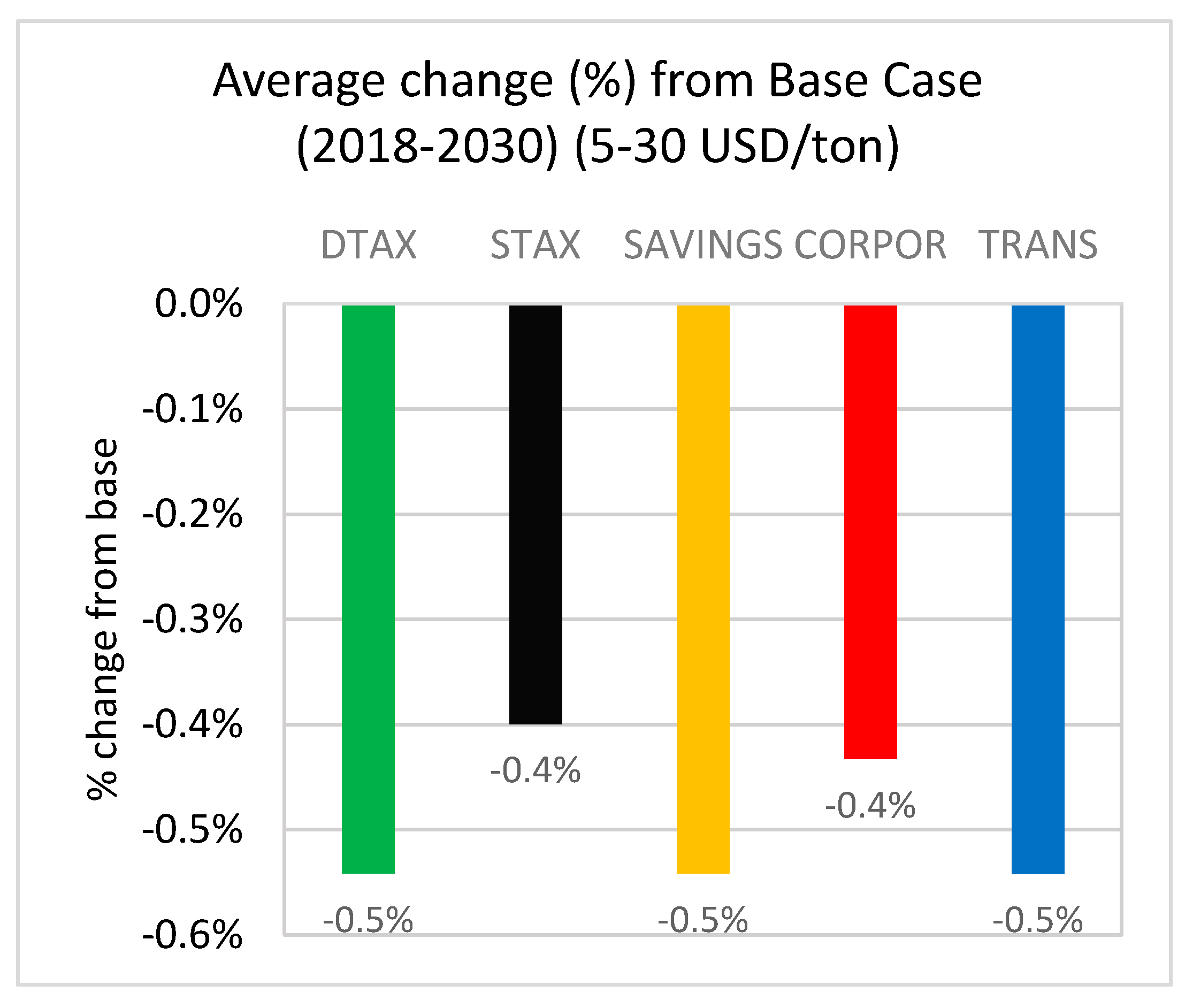

5.1. Impact on Emissions

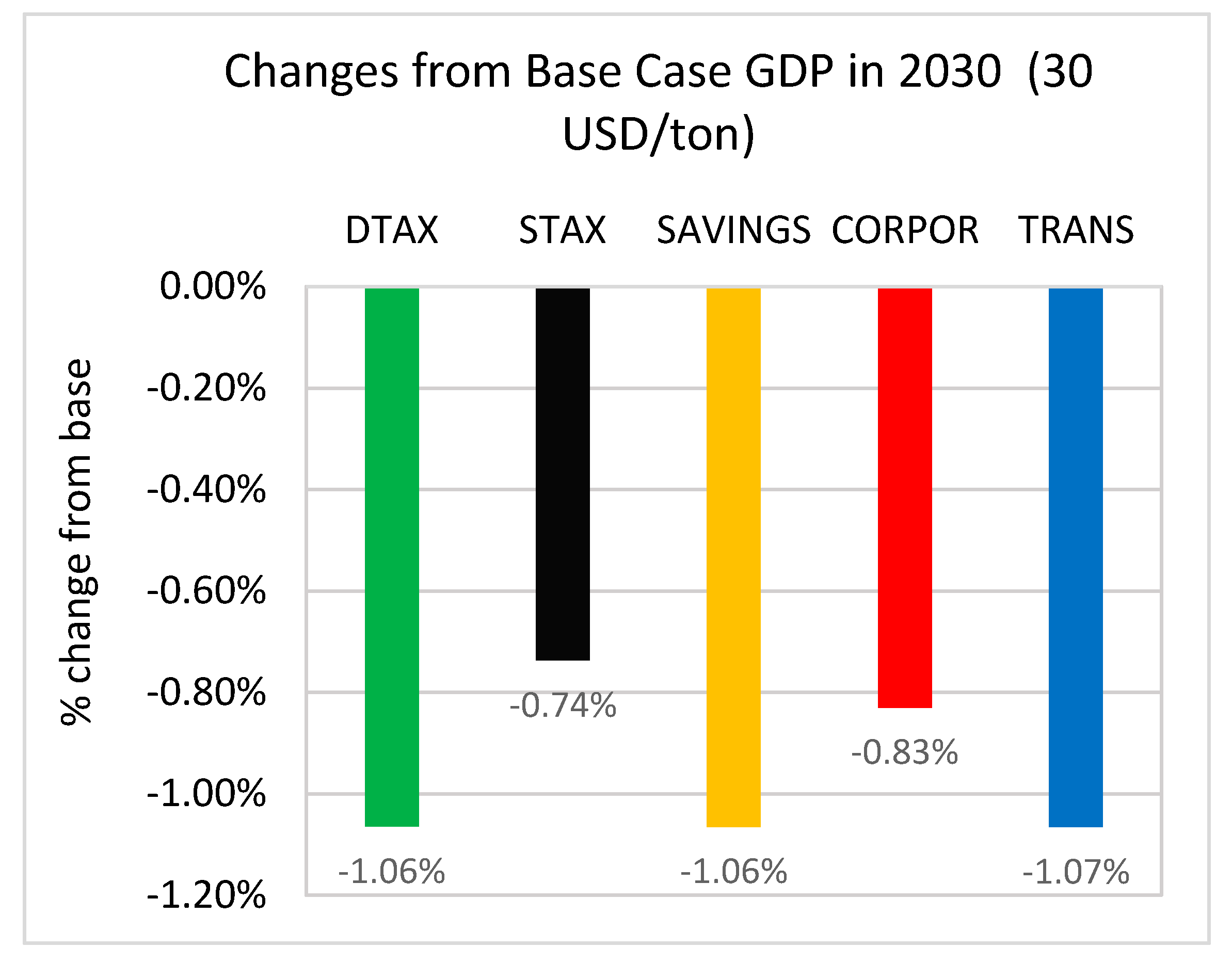

5.2. Impacts on the Economy

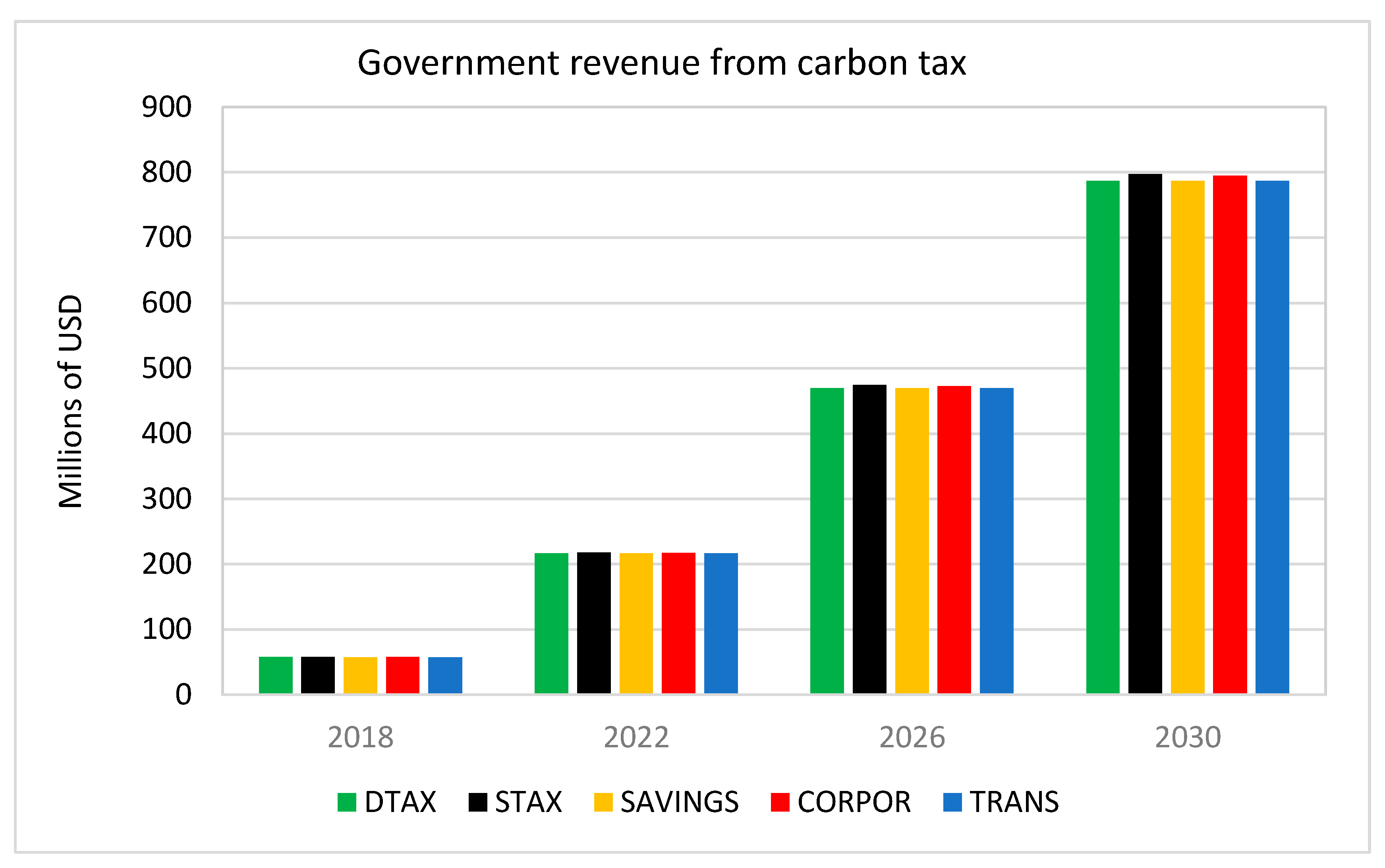

5.3. Fiscal Impacts

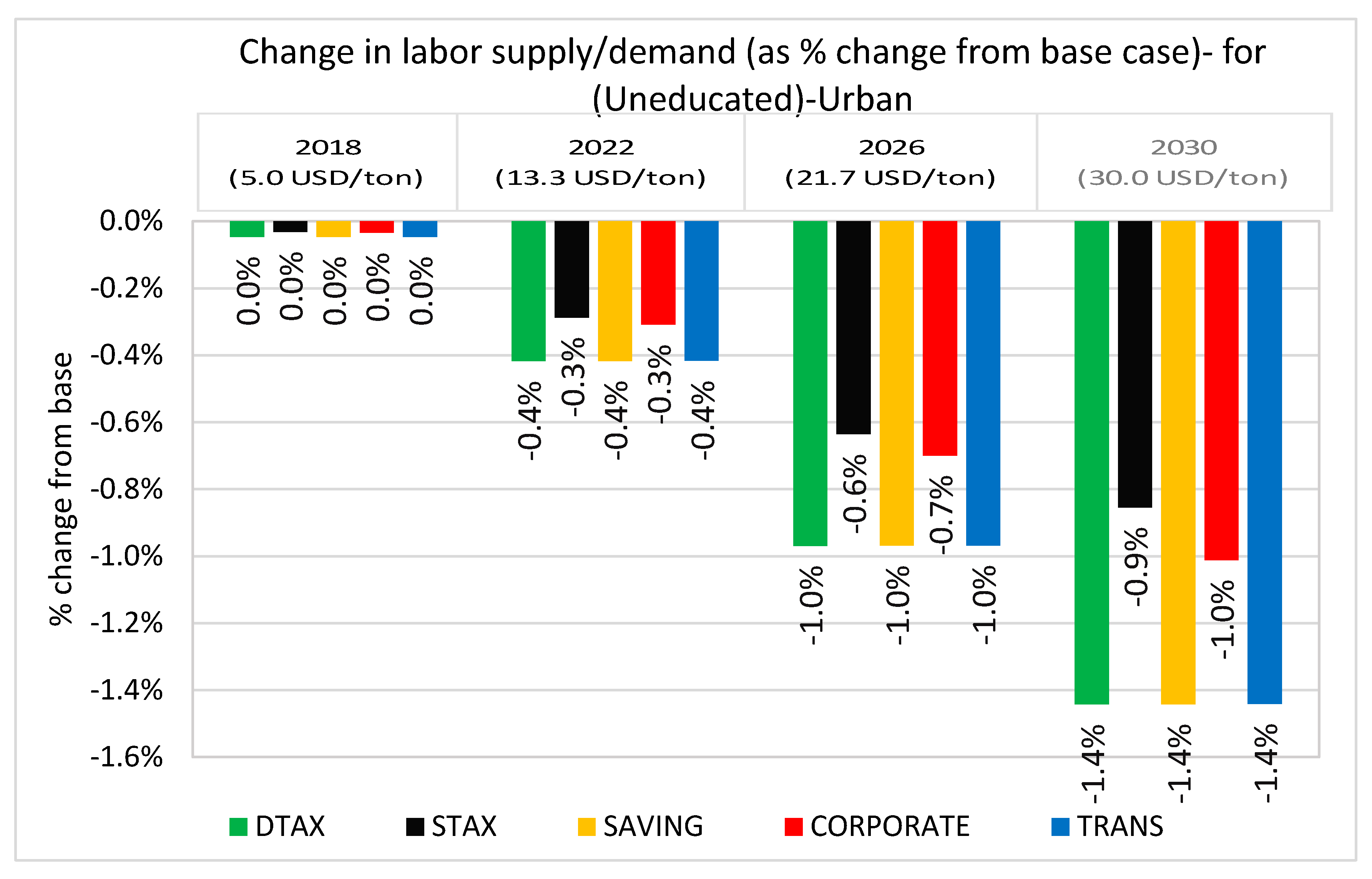

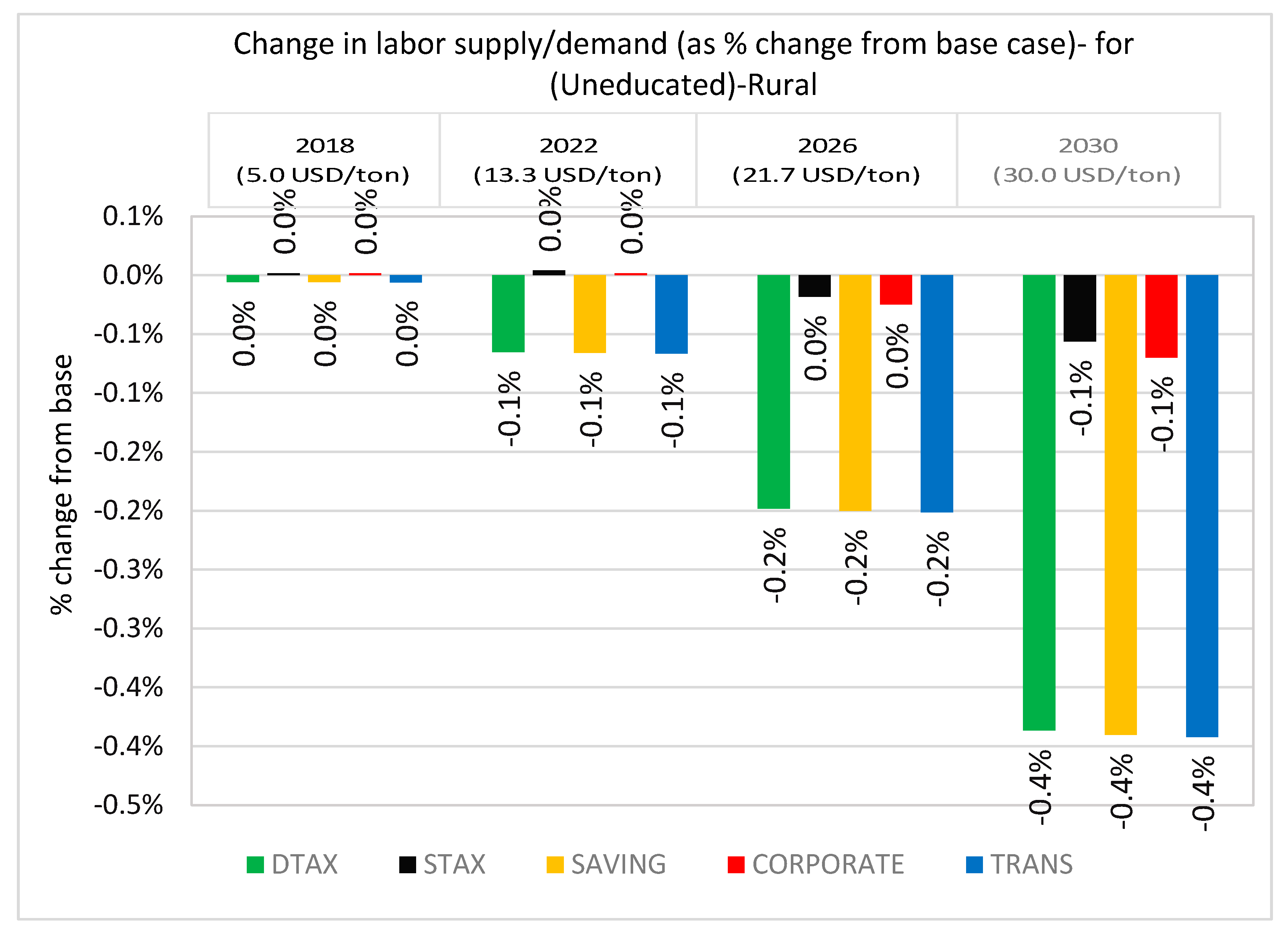

5.4. Distributional Impacts

6. Concluding Remarks

- Increase reforestation activities over and beyond what might be financed internationally through the country’s REDD program. Investments in forest recovery can provide important ecosystem benefits, including soil and watershed protection and habitat for valued species, as well as expended carbon storage. This use of revenues is well aligned with the pillars of the CRGE [6].

- Provide technology-neutral subsidies to increase affordability of improved cookstoves that use biomass fuel more efficiently or not at all, thereby reducing time spent collecting fuelwood and the substantial adverse health impacts of indoor smoke, especially for women and girls. Even if affordable alternatives to fuelwood for cooking take time to scale up in rural areas, cookstoves with improved fuel efficiency and improved ventilation can generate some improvement of indoor air quality, while reducing the level of unsustainable fuelwood harvest and the production of black carbon. Increasing access to cleaner cooking also is a pillar of CRGE [6].

- Find ways to increase the efficiency of fossil fuel use in urban transport, thereby slowing its growth and the corresponding increase in GHG emissions. This could be done through investment in more fuel-efficient and less-polluting multiple-rider transit vehicles in urban areas, thereby mitigating another major public health challenge. It would also be beneficial to use a portion of carbon pricing revenues to increase oversight of fuel quality.

Author Contributions

Funding

Conflicts of Interest

Appendix A. Supplementary Material on Methodology

Appendix B. Time Trend in the Structural Composition of the Ethiopian Economy

| Sector | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1999/00 | 2000/01 | 2001/02 | 2002/03 | 2003/04 | 2004/05 | 2005/06 | 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 | 2015/16 | |

| Agriculture | 55.3 | 56.4 | 54.5 | 49.8 | 52.1 | 52.6 | 52.3 | 51.2 | 49.5 | 47.8 | 46.5 | 44.7 | 43.1 | 42.0 | 40.2 | 38.7 | 36.7 |

| Industry | 9.7 | 9.5 | 10.2 | 11.0 | 11.0 | 10.7 | 10.6 | 10.4 | 10.3 | 10.2 | 10.3 | 10.5 | 11.5 | 13.0 | 13.8 | 15.0 | 16.7 |

| Services | 37.0 | 36.3 | 36.9 | 39.9 | 38.0 | 38.0 | 38.6 | 39.8 | 41.6 | 43.1 | 44.1 | 45.5 | 45.9 | 45.5 | 46.6 | 47.0 | 47.3 |

| Total | 100.5 | 100.5 | 100.2 | 100.3 | 100.3 | 100.3 | 100.5 | 100.5 | 100.7 | 100.7 | |||||||

| Less: FISIM | 0.6 | 0.6 | 0.4 | 0.4 | 0.5 | 0.5 | 0.6 | 0.6 | 0.7 | 0.7 | 0.7 | 0.7 | 0.6 | 0.5 | 0.6 | 0.6 | 0.7 |

| GVA at Constant Basic Prices | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

Appendix C. Carbon Content Analysis (Input-Output Multiplier Approach)

References

- World Bank. State and Trends of Carbon Pricing 2019; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- New Climate Economy. The Sustainable Infrastructure Imperative: Financing for Better Growth and Development; World Resources Institute: Washington, DC, USA, 2016. [Google Scholar]

- Gebregziabher, G.; Abera, D.A.; Gebresamuel, G.; Giordano, M.; Langan, S. An Assessment of Integrated Watershed Management in Ethiopia; International Water Management Institute (IWMI): Colombo, Sri Lanka, 2016; Volume 170. [Google Scholar]

- Haileselassie, A.; Hagos, F.; Mapedza, E.; Sadoff, C.W.; Awulachew, S.B.; Gebreselassie, S.; Peden, D. Institutional Settings and Livelihood Strategies in the Blue Nile Basin: Implications for Upstream/Downstream Linkages; IWMI: Colombo, Sri Lanka, 2009; Volume 132. [Google Scholar]

- Coady, D.; Flamini, V.; Sears, L. The Unequal Benefits of Fuel Subsidies Revisited: Evidence for Developing Countries; International Monetary Fund Working Paper 15/250; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- FDRE. Ethiopia’s Climate-Resilient Green Economy: Green Economy Strategy; Federal Democratic Republic of Ethiopia: Addis Ababa, Ethiopia, 2011. [Google Scholar]

- High-Level Commission on Carbon Prices. Report of the High-Level Commission on Carbon Prices; License: Creative Commons Attribution CC BY 3.0 IGO; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Liu, A. Tax evasion and optimal environmental taxes. J. Environ. Econ. Manag. 2013, 66, 656–670. [Google Scholar] [CrossRef]

- Angelsen, A. Policy Options to Reduce Deforestation. In Realising REDD+: National Strategy and Policy Options; Angelsen, A., Ed.; Center for International Forestry Research: Bogor, Indonesia, 2009. [Google Scholar]

- Rashid, S.; Tefera, N.; Minot, N.; Ayele, G. Fertilizer in Ethiopia: An Assessment of Policies, Value Chain, and Profitability; IFPRI Discussion Paper 01304; International Food Policy Research Institute: Washington, DC, USA, 2013. [Google Scholar]

- FDRE. The Second Growth and Transformation Plan (GTP-II); Ethiopian National Planning Commission: Addis Ababa, Ethiopia, 2015.

- Markandya, A.; González-Eguino, M.; Escapa, M. From Shadow to Green: Linking Environmental Fiscal Reforms and the Informal Economy. Energy Econ. 2013, 40, S108–S118. [Google Scholar] [CrossRef]

- Mirhosseini, S.; Mahmoudi, N.; Valokolaie, S. Investigating the Relationship between Green Tax Reforms and Shadow Economy Using a CGE Model—A Case Study in Iran. Iran. Econ. Rev. 2017, 21, 153–167. [Google Scholar]

- Bento, A.; Jacobsen, M.; Liu, A. Environmental Policy in the Presence of an Informal Sector. J. Environ. Econ. Manag. 2018, 90, 61–77. [Google Scholar] [CrossRef]

- Markandya, A. Environmental Taxation: What Have We Learnt in the Last 30 Years? In Environmental Taxes and Fiscal Reform; Castellucci, L., Markandya, A., Eds.; Macmillan: Basingstoke, UK, 2012; pp. 9–56. [Google Scholar]

- Devarajan, S.; Go, D.S.; Robinson, S.; Thierfelder, K. Tax Policy to Reduce Carbon Emissions in a Distorted Economy: Illustrations from a South Africa CGE Model. BE J. Econ. Anal. Policy 2011, 11. [Google Scholar] [CrossRef]

- Guivarch, C.; Crassous, R.; Sassi, O.; Hallegatte, S. The Costs of Climate Policies in a Second-Best World with Labour Market Imperfection. Clim. Policy 2011, 11, 768–788. [Google Scholar] [CrossRef][Green Version]

- Hafstead, M.A.C.; Williams, R.C., III. Unemployment and Environmental Regulation in General Equilibrium. J. Public Econ. 2018, 160, 50–65. [Google Scholar] [CrossRef]

- Hafstead, M.A.C.; Williams, R.C., III; Golub, A.; Meijer, S.; Narayanan, B.G.; Nyamweya, K.; Steinbuks, J. Effect of Climate Policies on Labor Markets in Developing Countries: Review of the Evidence and Directions for Future Research; Policy Research Working Paper 8332; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Thurlow, J. A Recursive Dynamic CGE Model and Microsimulation Poverty Module for South Africa; International Food Policy Research Institute: Washington, DC, USA, 2008. [Google Scholar]

- Lofgren, H.; Harris, R.; Robinson, S. A Standard Computable General Equilibrium (CGE) Model in GAMS; Microcomputers in Policy Research 5; IFPRI: Washington, DC, USA, 2002. [Google Scholar]

- Diao, X.; Thurlow, J. A Recursive Dynamic Computable General Equilibrium Model. In Strategies and Priorities for African Agriculture: Economywide Perspectives; Diao, X., Thurlow, J., Benin, S., Fan, S., Eds.; IFPRI: Washington, DC, USA, 2012; Chapter 2; pp. 17–50. [Google Scholar]

- Ahmed, H.; Tebekew, T.; Thurlow, J. The 2010/11 Social Accounting Matrix for Ethiopia: A Nexus Project SAM; IFPRI: Washington, DC, USA, 2017. [Google Scholar]

- NPC. National Economic Accounts Statistics of Ethiopia: Estimates of the 2015/16(2008 EFY); National Planning Commission: Addis Ababa, Ethiopia, 2016.

- Leontief, W. Environmental Repercussions and the Economic Structure: An Input-Output Approach. Rev. Econ. Stat. 1970, 52, 262–271. [Google Scholar] [CrossRef]

- Arndt, C.; Davies, R.; Makrelov, K.; Thurlow, J. Measuring the Carbon Intensity of the South African Economy. S. Afr. J. Econ. 2013, 81, 393–415. [Google Scholar] [CrossRef]

| Product Group | Carbon Intensity (Tons of CO2) Per Millions of Birr of Final Demand |

|---|---|

| Crops and vegetables | 21.7 |

| Livestock | 1231.6 |

| Forestry | 15.8 |

| Firewood | 1937.7 |

| Fishery | 9.7 |

| Coal | 1725.8 |

| Other mining | 6.5 |

| Food processing | 183.0 |

| Textile and leather | 44.0 |

| Wood and paper products | 2.6 |

| Fuels (petroleum other than Kerosene) | 196.7 |

| Kerosene | 262.0 |

| Chemicals | 7.4 |

| Fertilizer | 184.0 |

| Non-metal minerals | 23.8 |

| Metals and metal products | 20.5 |

| Machinery and Equipment | 2.2 |

| Vehicles | 2.3 |

| Other manufacturing | 4.3 |

| Electricity | 33.5 |

| Water | 36.5 |

| Construction and real estate | 12.4 |

| Trade | 2.7 |

| Transport | 47.5 |

| Hotel | 106.1 |

| Communication | 11.4 |

| Financial and business services | 0.6 |

| Public administration, education, health, and other services | 12.7 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Telaye Mengistu, A.; Benitez, P.; Tamru, S.; Medhin, H.; Toman, M. Exploring Carbon Pricing in Developing Countries: A Macroeconomic Analysis in Ethiopia. Sustainability 2019, 11, 4395. https://doi.org/10.3390/su11164395

Telaye Mengistu A, Benitez P, Tamru S, Medhin H, Toman M. Exploring Carbon Pricing in Developing Countries: A Macroeconomic Analysis in Ethiopia. Sustainability. 2019; 11(16):4395. https://doi.org/10.3390/su11164395

Chicago/Turabian StyleTelaye Mengistu, Andualem, Pablo Benitez, Seneshaw Tamru, Haileselassie Medhin, and Michael Toman. 2019. "Exploring Carbon Pricing in Developing Countries: A Macroeconomic Analysis in Ethiopia" Sustainability 11, no. 16: 4395. https://doi.org/10.3390/su11164395

APA StyleTelaye Mengistu, A., Benitez, P., Tamru, S., Medhin, H., & Toman, M. (2019). Exploring Carbon Pricing in Developing Countries: A Macroeconomic Analysis in Ethiopia. Sustainability, 11(16), 4395. https://doi.org/10.3390/su11164395