1. Introduction

After World War II, the rapid development of the world economy produced many environmental problems [

1,

2,

3,

4,

5]. CO

2 emissions in resource-related manufacturing showed an increasing trend due to the extensive production structure [

6], which means it is of great importance not only to improve energy consumption efficiency further and promote sustainable energy transformation [

7], but also to pay attention to the adjustment of the economic development model to avoid shifting to a higher energy consumption level [

8]. Specific approaches may include a sustainability transformation, which would require changing far more than patterns of energy supply and use [

9], and the improvement of the pace of transformation from secondary industries to tertiary industries [

8]. Moreover, promoting the principles of a circular economy and the new business models advocated by the circular economy can represent a solution that is less dependent on primary energy resources and more environmentally friendly [

10].

As we all know, achieving a sustainable economy depends on investing sufficient capital to finance the (possible) long-term transition of the real economy [

11], so a finance ecosystem approach is required that ensures complementary forms of finance for low carbon investment [

12]. Green finance is a phenomenon that combines the worlds of finance and business with environmentally friendly behavior [

13], which will provide an opportunity to achieve environmentally sustainable innovation pathways, but it does not actually prevent the environmental protection industry from facing institutional and financial criticalities in funding their investment projects [

14]. For example, the capital market frictions that arise from green investments increase the cost of external capital for enterprises that try to finance their investment projects [

15], and the presence of a multiple credit relationship could concretely hinder a firm’s investments in environmental innovations [

11].

Under the premise of solving the problem of environmental protection funding sources, the use of funds should be further considered. Renewable energy source consumption plays a significant role in economic growth [

16], which makes it meaningful to assess the importance of project finance for renewable energy projects in investment-grade countries, as well as underlying drivers [

17]. However, some financial actors skew their investment to a subset of technologies (e.g., public utilities towards offshore wind), while others spread their investments more evenly over a wide portfolio of competing technologies [

18], so we can promote the use of renewable energy to achieve environmental protection through active financial tools [

13]. On the other hand, green product innovation mediates the relationship between green process innovation and a firm’s financial performance [

19], and such innovation can create value in terms of social sustainability [

20]. In order to meet the Paris climate target, greater attention should be given to the role of innovative, low carbon, early stage businesses and the public sector’s role in addressing financial gaps for longer horizon investment requirements [

12].

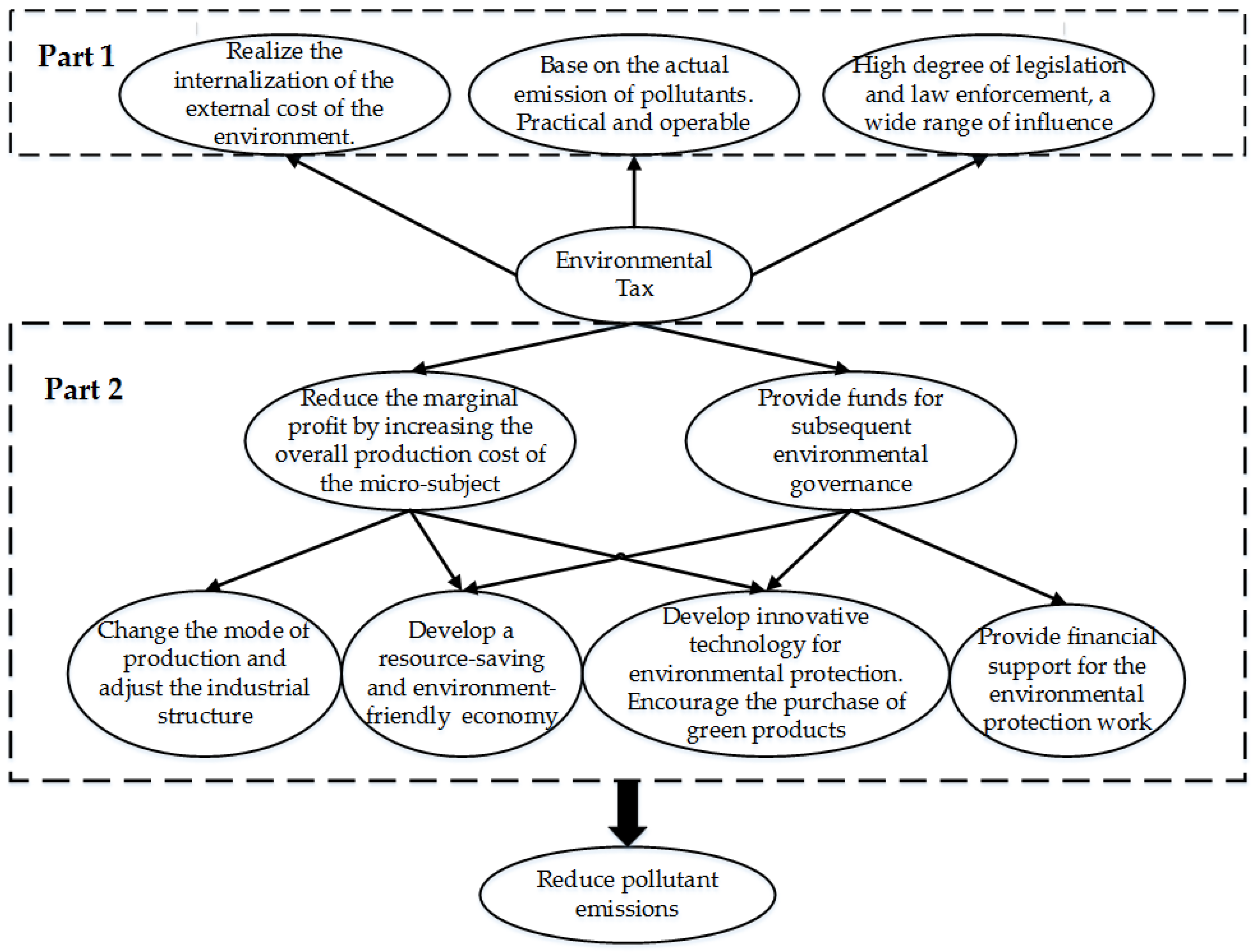

Although the transformation of consumption patterns and green innovation investment are conducive to environmental protection and environmental sustainability to a large extent, this process is hindered by problems, such as long implementation periods and shortage of funds to some extent. The mandatory and fixed nature of environmental tax solve the problem of funding sources for environmental protection, and it is generally believed that an environmental tax can provide incentives for long-term effective development, transformation of consumption patterns, and green innovation investment. The OECD has already introduced an environmental tax and has experienced a long period of development and improvement, while China has gradually established an environment-related tax system by drawing on the experience of Western countries. The development of environmental taxes in both the OECD and China are shown in

Table 1.

OECD countries and China highly praise environmental taxes, but do environmental taxes really help to reduce pollutant emissions? Patuelli et al. made a comparative study of a CGE model and a macroeconomic model and found that environmental taxes have a green dividend of carbon dioxide emission reduction [

21]. Arbolino et al. found that environmental taxes in 26 European countries improved environmental quality on the whole [

22]. Freire-González et al. proved that environmental tax reforms helped reduce pollutant emissions in 39 key industries in Spain [

23]. Similarly, Rodríguez et al. found that green tax reform makes contributions to achieving improvements in the energy–trade balance and energy independence, as well as in reduction of the energy intensity of the Portuguese economy [

24]. However, a coin has two sides; Bruvoll et al. [

25] and Lin et al. [

26] both did not agree that the “green dividend” of a carbon tax on per capita CO

2 emissions resulted in reduction in Norway. Nerudova et al. found that the Czech Republic’s environmental tax has not yet reduced carbon dioxide emissions [

27]. Carraro et al. studied whether the environmental taxes of 12 European Union countries play a role in energy saving and emission reduction in the short term, while the "green dividend" disappears in the long term [

28]. Nerudová et al. argued that environmental taxes in the 15 European Union countries have aggravated environmental pollution [

29]. Abdullah et al. also pointed out that environmental taxes in European Union and OECD countries do not have green dividends to reduce environmental pollution [

30]. Similarly, He et al. concluded that an environmental tax does not have a significantly positive effect on reducing greenhouse gas emissions in the OECD [

31]. Thus, it can be seen that scholars have extensively discussed the effects of environmental taxes on emission reduction, but there is no unified conclusion yet.

This paper collects data concerning 35 OECD countries for the period between 1994 and 2016, as well as 31 Chinese provinces for the period from 2004 to 2016, measuring the difference in pollutant emission reduction effects between OECD and China’s environmental taxes under overall and different conditions based on the green dividends of environmental taxes. Some OECD countries levied environmental taxes earlier, and China is a developing country with large emissions of pollutants. This paper studies the effect of environmental taxes in the OECD and China on pollutant emission reduction, and provides suggestions to further improve the environmental tax system, ultimately achieving the goal of global emission reduction.

There are three major contributions of this paper. Firstly, this paper enriches the research methods of existing literature. The Auto-Regressive Distributed Lag Modelling Approach (ARDL) selected for the model overcomes the endogeneity problem, while breaking through the limitations of the same order and single integer; the lag period used in data processing is more consistent with the hysteresis effect of environmental tax emission reduction effect. Secondly, this paper expands the research perspective of an environmental tax green dividend. The existing literature mainly focuses on carbon taxes and carbon dioxide. This paper takes the OECD total environmental protection tax revenue and Chinese quasi-environmental tax revenue as the main research object, and extends pollutants to sulfur oxides, nitrogen oxides, industrial solid waste, and common indicators of wastewater pollution. Thirdly, this paper enriches the international comparative literature on the effect of environmental tax reduction. On the one hand, the existing literature on international comparison of environmental taxes mainly compares the differences in environmental taxation systems between different countries, and there is very little literature on quantitative analysis of environmental tax reduction effects and international differences. On the other hand, this paper further examines the heterogeneity of emission reduction effects of environmental taxes in OECD countries and provinces in China under different groups, providing relevant data support for the formulation of national and regional differential environmental taxes. Therefore, this study makes up for the existing literature.

The paper is organized as follows.

Section 2 presents a literature review and puts forward the research hypothesis.

Section 3 defines the variables and presents the research model.

Section 4 presents the empirical results and analysis. In

Section 5, the robustness test is presented. The last section is conclusions.

3. Materials and Methods

3.1. Sample Selection and Data Sources

The main research samples include: per capita environmental taxes, greenhouse gas emissions, carbon dioxide emissions, sulfur oxides, and nitrogen oxide emissions of 35 OECD member countries from 1994 to 2016; per capita quasi-environmental tax, sulfur dioxide emissions, industrial solid waste production, ammonia nitrogen emissions, and chemical oxygen demand from wastewater of 31 Chinese inland provinces from 2004 to 2016. The control variables are related to data of population, per capita crude oil consumption, per capita coal consumption, annual growth rate of GDP, and industrial added value for the two research subjects. Among them, there are 805 valid observations of OECD member countries and 403 of Chinese provinces. All of the data in this paper were obtained from the OECD database, British Petroleum(BP), and the Chinese National Bureau of Statistics database.

3.2. Variable Interpretations

Considering the availability of data, the measurement indicators of environmental tax emission reduction effect and time range selected for the two research subjects are different. However, the indicators used can reflect the main environmental problems and environmental governance priorities of the research objects, which can better measure the overall emission reduction effects of an environmental tax on each research object. In addition, due to the lack of data in Chinese provinces before 2004 and the fact that the time of collecting environment-related taxes in China is later than that in OECD countries, it is reasonable to shorten the time range of China’s research. The specific explanation of each variable is shown in

Table 2.

In order to avoid the influence of variable measurement unit and order of magnitude difference on the experimental results, the logarithm or per capita number of selected variables are unified in this paper. Compared with cross-sectional data and time series data, panel data increases sample observations, which can obtain more dynamic information of the object of study, and are more suitable for multi-agent comparative analysis.

3.3. Research Model

According to the data characteristics of the selected variables, this paper selects the panel Auto-Regressive Distributed Lag Modelling Approach (ARDL) for research, which was first introduced by Pesaran et al. [

54] in 1995. The selection of relevant variables refers to the existing literature (Bruvoll et al. [

25], Nerudova et al. [

27], He et al. [

31], Rapanos et al. [

32]). The panel ARDL model does not limit the sample size, and takes full advantage of the lag period to show the long-term and short-term regression relationship between variables. Moreover, compared with the general linear regression model, panel ARDL is helpful in overcoming the endogenous problem among variables. Therefore, in order to verify the emission reduction effect of an environmental tax in OECD countries and provinces of China, and to compare the differences of emission reduction effects under different circumstances, this paper respectively establishes research Equations (1) and (2) for Hypothesis 1 and 2.

The dependent variable in Equation (1) is the logarithm of total greenhouse gas emissions (GHE_OC) of OECD countries, and the independent variable is the per capita environmental tax (ET_OC). The control variables are the logarithm of population (OP_OC), the per capita crude oil consumption (OIL_OC), per capita coal consumption (CA_OC), the annual growth rate of GDP (GDP_OC), and the ratio of industrial added value to GDP (IND_OC) of OECD member countries. In order to simplify the description of the model, with the independent variable ET_OC and control variables unchanged in Equation (1), GHE_OC is replaced by the logarithms of the total carbon dioxide emissions (CO2_OC), total sulfur oxide emissions (SO_OC), and total nitrogen oxide emissions (NO_OC) in turn, and then the research equations investigating the effects of OECD environmental tax reduction can be obtained one by one.

The dependent variable in Equation (2) is the logarithm of total sulfur dioxide emissions (SO2_CN) of Chinese provinces, the independent variable is the per capita quasi-environmental tax (ET_CN), and the control variables are the logarithm of population (OP_CN), the per capita crude oil consumption (OIL_CN), per capita coal consumption (CA_CN), the annual growth rate of GDP (GDP_CN), and the ratio of industrial added value to GDP (IND_CN) of Chinese provinces. In order to simplify the space, with the independent variable ET_CN and some control variables Equation (2) remaining unchanged, SO2_CN is replaced by three variables in turn: logarithm of industrial solid waste production (SW_CN), ammonia nitrogen discharge per capita (AN_CN), and chemical oxygen demand per capita (COD_CN), so as to obtain the research models for investigating the effects of environmental taxes reduction in Chinese provinces one by one. Considering that the environmental performance of an environmental tax restraining the discharge of major pollutants, such as gas pollutants, industrial solid wastes, and wastewater, may lag behind, and in order to avoid the endogenous problem of variable data, this paper will deal with the independent variables ET_OC and ET_CN with a lag period. Furthermore, considering the long-term and arduous nature of China’s sewage treatment work, environmental taxes with a lag of one, two, and three phases were added to the research model to reflect the effect of environmental taxes on reducing the major pollutants of wastewater in Chinese provinces.

In Equation (1), β is the short-term autoregressive coefficient of dependent variable GHE_OC and φ is the short-term regression coefficient between independent variable ET_OC and GHE_OC. According to hypotheses H1, φ should be negative. Here, μ, γ, χ, ω, and ν are the short-term regression coefficients between the control variables and GHE_OC. For example, μ represents the short-term regression relationship between the control variable OP_OC and GHE_OC; δ1 is the long-term autoregressive coefficient of GHE_OC and δ2 is the long-term regression coefficient between ET_OC and GHE_OC. According to hypotheses H1, δ2 should be negative, too. The long-term regression coefficients between control variables and GHE_OC are δ3 to δ7, respectively. For example, δ3 represents the long-term regression relationship between control variable OP_OC and dependent variable GHE_OC.

Similarly, in Equation (2), β is the short-term autoregressive coefficient of dependent variable SO2_CN and φ is the short-term regression coefficient between independent variable ET_CN and SO2_CN. According to hypotheses H2, φ should be negative. Here, μ, γ, χ, ω, and ν are the short-term regression coefficients between the control variables and SO2_CN. For example, μ represents the short-term regression relationship between the control variable OP_CN and SO2_CN; δ1 is the long-term autoregressive coefficient of SO2_CN and δ2 is the long-term regression coefficient between ET_CN and SO2_CN. According to hypotheses H2, δ2 should be negative, too. The long-term regression coefficients between control variables and SO2_CN are δ3 to δ7, respectively. For example, δ3 represents the long-term regression relationship between control variable OP_CN and dependent variable SO2_CN.

In both Equations (1) and (2), each variable is followed by two subscripts (such as i and t of GHE_OCit, as well as i and t-l of ET_OCi,t-l in Equation (1)). The first subscript represents a research object in panel data, and the second subscript represents the number of lag periods of the variable. Here, and (k = 1, 2, 3, …) are the first order difference term and white noise term of each variable, respectively, while Log presents the logarithm of the variable. In addition, is the intercept term for different countries and the subscript i indicates the change from 1 to N for a particular study subject. ECT is the Error Correction Term, so δ8 presents the error correction term coefficient.

5. Robustness Test

To validate the above results, this paper changes the regression method used, that is, the Generalized Linear Model (GLM) which was introduced by Nelder et al. [

55] in 1972 is applied to regress the variables in Equations (1) and (2), as shown below.

In order to stay consistent with Equations (1) and (2), the dependent variables GHE_OC and SO_OC in Equations (3) and (4) were treated by differences, respectively. To simplify the space, the GHE_OC in Equation (3) was successively replaced by CO2_OC, SO_OC and NO_OC on the premise that the independent variable ET_OC and the control variables OP_OC, OIL_OC, CA_OC, GDP_OC, and IND_OC remained unchanged. Then, the model to test the effect of OECD environmental tax on reducing pollutants was obtained. Similarly, under the premise of keeping the independent variable ET_CN unchanged and the control variables OP_CN, OIL_CN, CA_CN, GDP_CN, and IND_CN partly unchanged, the SO2_CN in Equation (4) is replaced by SW_CN, AN_CN, and COD_CN in turn, and the model for testing the effect of environmental tax on pollutant reduction in China can be obtained. Considering the consistency with Equation (2), in the equation with AN_CN and COD_CN as dependent variables, ET_CN was added with a lag of one, two, and three periods. In Equations (3) and (4), α0 is a constant term, α1 is the regression coefficient of independent variable ET_OC and dependent variable GHE_OC in Equation (3), and independent variable ET_CN and dependent variable SO2_CN in Equation (4), respectively. Here, α2 to α6 are regression coefficients of ET_OC, ET_CN, and control variables, respectively.

The results of Generalized Linear Model (GLM) validate the above regression results based on panel ARDL, which was as shown from

Table 14,

Table 15,

Table 16,

Table 17 and

Table 18. The results obtained by the two methods show great consistency.

6. Conclusions

6.1. Research Conclusion

Based on the “green dividend” theory of environmental taxes, this paper compares and analyzes the emission reduction effects of environmental taxes in 35 OECD countries and 31 inland provinces of China. Through the establishment of the panel ARDL model, the empirical tests found that on the whole, environmental tax policy helps to reduce pollutant emissions to a large extent, both in OECD countries and Chinese countries. Further analysis shows that, firstly, the environmental taxes have significant short-term emission reduction effects in both OECD member countries and Chinese administrative provinces with small or medium scales of environmental tax collection, while the long-term emission reduction effect needs to be further strengthened. This proves that the scale of environmental tax collection is not the decisive factor affecting the effect of environmental tax on reducing pollutants, which provides empirical data for countries and regions with serious environmental pollution wanting to levy an environmental tax. Secondly, the short-term emission reduction effects of environmental taxes in OECD countries with low industrial added value are relatively good, while in China, the emission reduction effects are better in provinces with high industrial added value. This shows that environmental taxes should be promoted in an orderly manner in the process of national industrialization. Thirdly, the environmental taxes of OECD countries and Chinese provinces with high economic growth levels have good short-term emission reduction effects, and the environmental taxes of OECD countries with high economic growth levels significantly reduce greenhouse gas and sulfur dioxide emissions in the long term. This shows that reducing pollution requires sufficient capital, while attaching importance to economic development as well as levying environmental taxes can provide financial support for environmental protection.

6.2. Research Enlightement

The implications of this article are as follows. Firstly, environmental taxes help to reduce pollutant emissions. Therefore, countries facing environmental pollution problems can realize the balance of economic development and environmental sustainability by levying environmental taxes.

Secondly, the characteristics of pollution costs internalized by environmental tax and the mechanisms of exemption and credit via environmental taxes can promote the adjustment of industrial structures and economic development modes. Environmental taxes can be used as an effective means to reduce pollutants in the process of industrialization.

Thirdly, emission reduction of pollutants requires sufficient economic resources. Government authorities can raise funds for environmental protection by introducing environmental taxes in the process of economic development.

The limitations and follow-up studies of this paper focus on the following aspects: there was no specific study on the pollutant emission reduction effects of specific OECD and Chinese environmental taxes (e.g., energy taxes, vehicle traffic taxes); the intermediary role of green investment and technological innovation in environmental tax pollutant emission reduction was not considered; further consideration should be given to the emission reduction effects of environmental taxes under different grouping conditions (e.g., the level of green investment and the intensity of environmental supervision).