1. Introduction: Underinvestment and Underconsumption in the General Theory

In the General Theory of Employment, Interest, and Money (1936) (hereafter, the GT), John Maynard Keynes emphasized that unemployment arises when investment is insufficient to cover the difference between production at full capacity and aggregate consumption when occupation is in that situation [

1] (p. 27). Therefore, underinvestment is the main cause of unemployment in the GT. Underinvestment takes place when entrepreneurs’ future profits expectations are below the interest rate [

1] (p. 370). And entrepreneurs’ future profits expectations depend mainly on the current demand for ordinary consumption [

1] (p. 106). Thus, in the GT, the demand for capital depends mainly on the demand for consumption [

1] (p. 106).

The GT develops a clear connection between the income multiplier and the accelerator of investment. The accelerator or acceleration principle is a theory of investment that incorporates the principle of effective demand into the dynamic analysis [

2]. This theory of investment, developed even before the publication of the GT, is based solely on effective demand. The accelerator principle implies that investment depends exclusively on

expected changes in income. Dynamic Keynesian macroeconomics has its root in the attempt of combining the multiplier and the accelerator. This was carried out by [

3] in his famous article of 1939, and soon followed by [

4]. The models that combine the multiplier with the accelerator are known as multiplier-accelerator models or, following the words of [

5], Supermultiplier models. We document, however, that even before [

3], Keynes had in mind that the income multiplier had to be accompanied by the investment accelerator.

If we look at the simple (without considering public and external sectors) Keynesian aggregate demand identity (

), where

is output,

is the propensity to consume of the community,

is the incremental capital-output ratio (the amount of capital required to increase each unit of total output), and

is the derivative of

with respect to time, we have that the sustainable rate of growth (the growth rate that allows the forces of supply and demand to evolve pari passu over time) is

. This is, in fact, a version of the warranted rate of growth of [

3]. Since

is unknown,

must be considered as the firms’ expectations of the growth rate of aggregate consumption. Entrepreneurs’ expectations about the evolution of consumption must be exogenous, or, at least, cannot be mechanically linked to the evolution of effective output, otherwise Harrodian dynamic instability appears (for recent states of the art on Harrodian instability, see [

6,

7,

8,

9]). (Dejuán 2005, 2017) [

10,

11], following [

12], emphasize that the expected rate of growth of permanent aggregate demand is the variable that guides investment and, therefore, is the key variable in a multiplier-accelerator system.

So far, we have stated that, according to the GT, unemployment is caused when the actual propensity to consume infers an incentive to invest such that the resulting investment is not enough to cover the difference between production at full capacity and aggregate consumption when occupation is in that situation [

1] (p. 27). According to Keynes, a socially inadequate income distribution causes consumption, and therefore investment, to be below the level that permits reaching full employment [

1] (p. 373).

Keynes states that the remedy for an insufficient level of investment lies in various measures designed to increase the propensity to consume by the redistribution of incomes [

1] (p. 324). Therefore, according to Keynes, the task of the State aimed at reaching full employment consists in adjusting the propensity to consume with the incentive to invest [

1] (p. 379).

The GT endorses public intervention aimed at redistributing income to socially adjust consumption and investment, and thus to achieve full employment. The State can modify secondary income distribution via final public expenditure. In sum, public expending helps socially adjust private consumption and investment, thus making the relationship between both variables relatively sustainable over time.

In the following sections, we test the empirical validity of Keynes’s postulates about the relationship between consumption and investment. Our aim is to test whether there exists a positive causal relationship running unidirectionally from consumption to investment. Therefore, we test the empirical validity of the notion of investment in the multiplier-accelerator model presented by [

4], which is a version of the model developed by [

3].

According to mainstream economics, sustained on the marginalist theoretical corpus of the nineteenth century systematized and deepened by [

13], capital consists of a fund of consumption goods through which consumption can be postponed (see [

14], pp. 36–7). The existence of a decreasing demand schedule for capital that is elastic to the interest rate assures that a rise in ‘foresight’ saving is matched by additional capital accumulation that will lead, given the labor supply, to a higher per-capita capital endowment [

15] (p. 223).

According to this approach, investment can fall below full-capacity saving only in the troughs of the economic cycle, where the shortfall of investment can be explained as ‘frictions’ due either to the functioning of the monetary system, which prevents interest rates from quickly adjusting to the return on capital or to periodic crises in entrepreneurs’ ‘psychological state of confidence’ that make investment spending inelastic with respect to interest rates, or to both circumstances operating together [

16] (p. 112).

This notion of investment has led many economists to test the saving-investment nexus. Reference(Feldstein and Horioka, 1980) [

17] empirically examined the relationship between savings and investment. Their results were mixed and contradictory, giving rise to the well-known Feldstein–Horioka puzzle. Since then, many authors have empirically tested whether savings and investment are cointegrated. References [

18,

19,

20,

21,

22,

23] are probably the most influential of a long list of empirical papers that try to solve the Feldstein–Horioka dilemma. For the moment, there is no consensus in the existing empirical literature regarding the Feldstein–Horioka puzzle [

24] (p. 167).

This conventional savings-investment approach states that increased saving leads to higher economic growth through higher capital formation [

25] (p. 2167). According to this approach, a weak domestic saving–investment correlation must be explained by a high international capital mobility. However, the neoclassical saving–investment nexus that states that domestic saving in northern countries finds an automatic debouche in investment in southern countries is not robust to the capital critiques of the 1950s and the 1960s (see [

26] for a recent state of the art of the capital controversies). In light of this criticism, there is no automatic mechanism that translates the larger (potential) saving supply into domestic or foreign investment, since a fall in the interest rate does not affect investment either in the domestic economy or in that of other countries.

Our approach is different to the conventional approach exposed above. As stated, Keynes tried to explain that, within the limits of full productive capacity utilization, a larger amount of investment does not require a prior reduction in consumption, and that the higher level of output and income generated by the greater degree of capacity utilization generates savings equal to the decisions to invest [

15]. Our paper contributes to the literature in two ways. First, to the best of our knowledge, this is the first paper that applies the nonlinear causality test of [

27] to estimate Keynesian models. Second, even though our paper is closely related to the extensive literature inspired by the [

28] model, to the best of our knowledge, this is the first paper that analyzes a cointegrating relationship between domestic consumption and domestic investment.

We use quarterly data from the United States (U.S.) between 1947 and 2018. We control for the wage mass, considering that changes in its tendency can affect both consumption and investment decisions. Even though we control for the wage mass, we do not focus on the effects that income (re)distribution has on consumption and on investment, as the models inspired by [

28] do (for recent developments of these models, see [

29,

30,

31,

32,

33]).

We first analyze whether there is a long-run equilibrium relationship among the variables. Then, we test for linear and non-linear causal relationships between consumption and investment. The variables under study are influenced simultaneously by the evolution of output, but if there is cointegration between these variables, then they share a common long-run trend, and the causality relationships between them are statistically valid, regardless of other variables influencing them. Therefore, a cointegration analysis is crucial for our investigation.

3. Empirical Results

Table 1 reports the unit root tests results. The unit root tests results indicate that the variables are not stationary in level at the 1% significance level. Besides, the first differences of the series are stationary at the 1% level. Therefore, the variables are integrated of order one at the 1% significance level (

Table 1).

After testing for unit root, we apply the ARDL bounds test to investigate the existence of cointegration among the variables. We estimate the model with a constant and with a constant and a linear trend. In both specifications, the

F-statistic values (11.67 and 7.91) are higher than the upper-bound critical values (5 and 5.85) at the 1% significance level. Therefore, the variables are cointegrated at the 1% level (

Table 2).

As a robustness check, we apply the Johansen and Juselius (1990) approach to test for cointegration between investment and consumption (controlling for the wage mass). We select the lag order that minimizes the BIC and the AIC, considering a lag length up to 12. We verify the absence of autocorrelation and heteroskedasticity in the residuals.

Table A1 and

Table A2 (in

Appendix A) show that there are at most two cointegration vectors at the 5% significance level. Accordingly, our findings suggest the existence of cointegration among the three variables at the 5% level.

Table 3 reports the ARDL regression equation for both the long run and the short run. We observe a positive and statistically significant relationship between investment and consumption in the short and in the long run.

As a robustness check, we estimate the parameters of the long-run equilibrium relationship between investment and consumption (controlling for the wage mass) by applying dynamic ordinary least squares (DOLS) and fully modified ordinary least squares (FMOLS). These estimators deal effectively with regressors’ endogeneity and serial correlation in the errors. The FMOLS and the DOLS estimated equations show that consumption has a positive and statistically significant long-run effect on investment (

Table A3 in

Appendix B), thus confirming the results of the ARDL regression presented in

Table A3. Since we use the variables in logarithms, these coefficients can be interpreted as long-run elasticities.

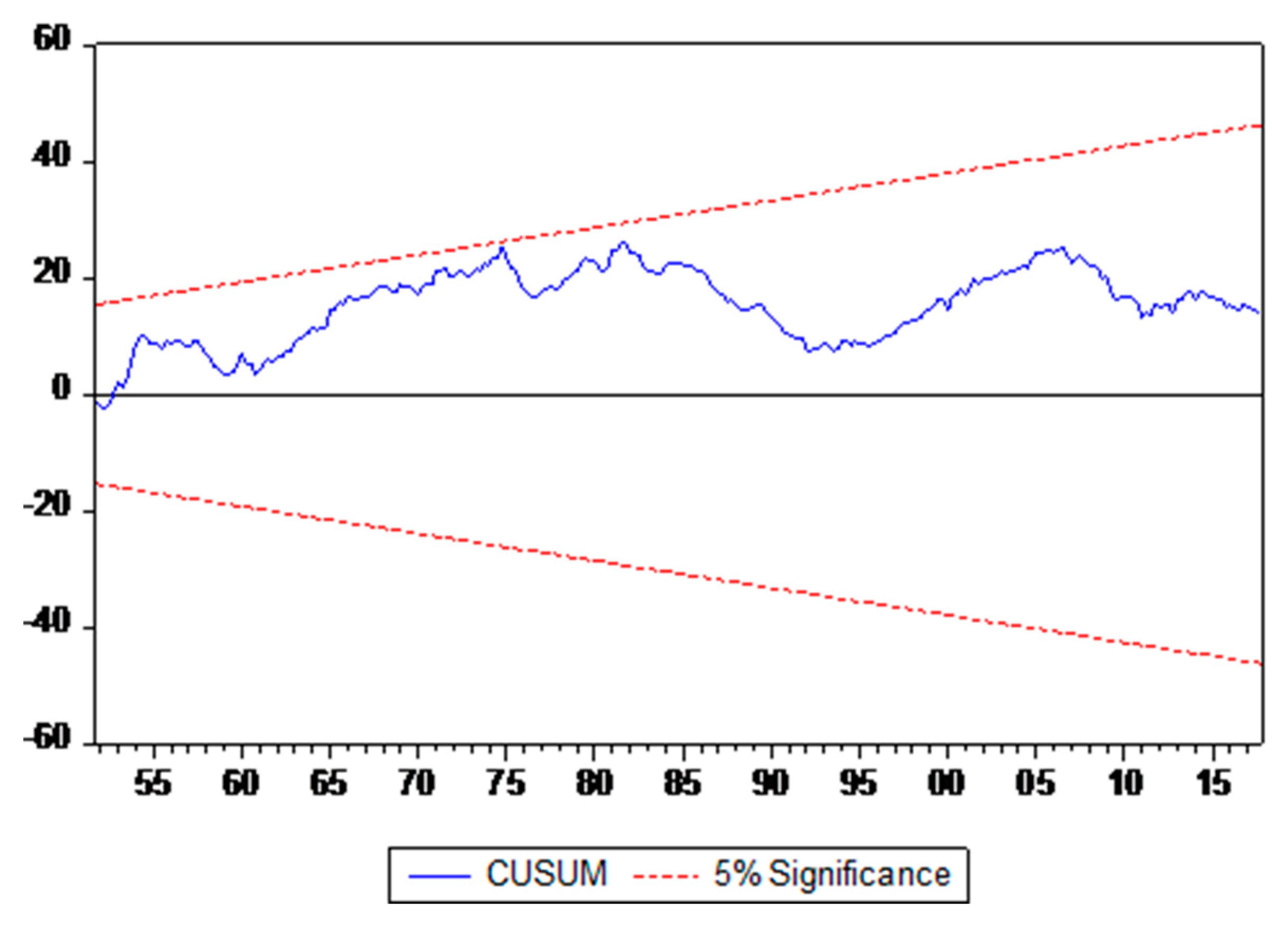

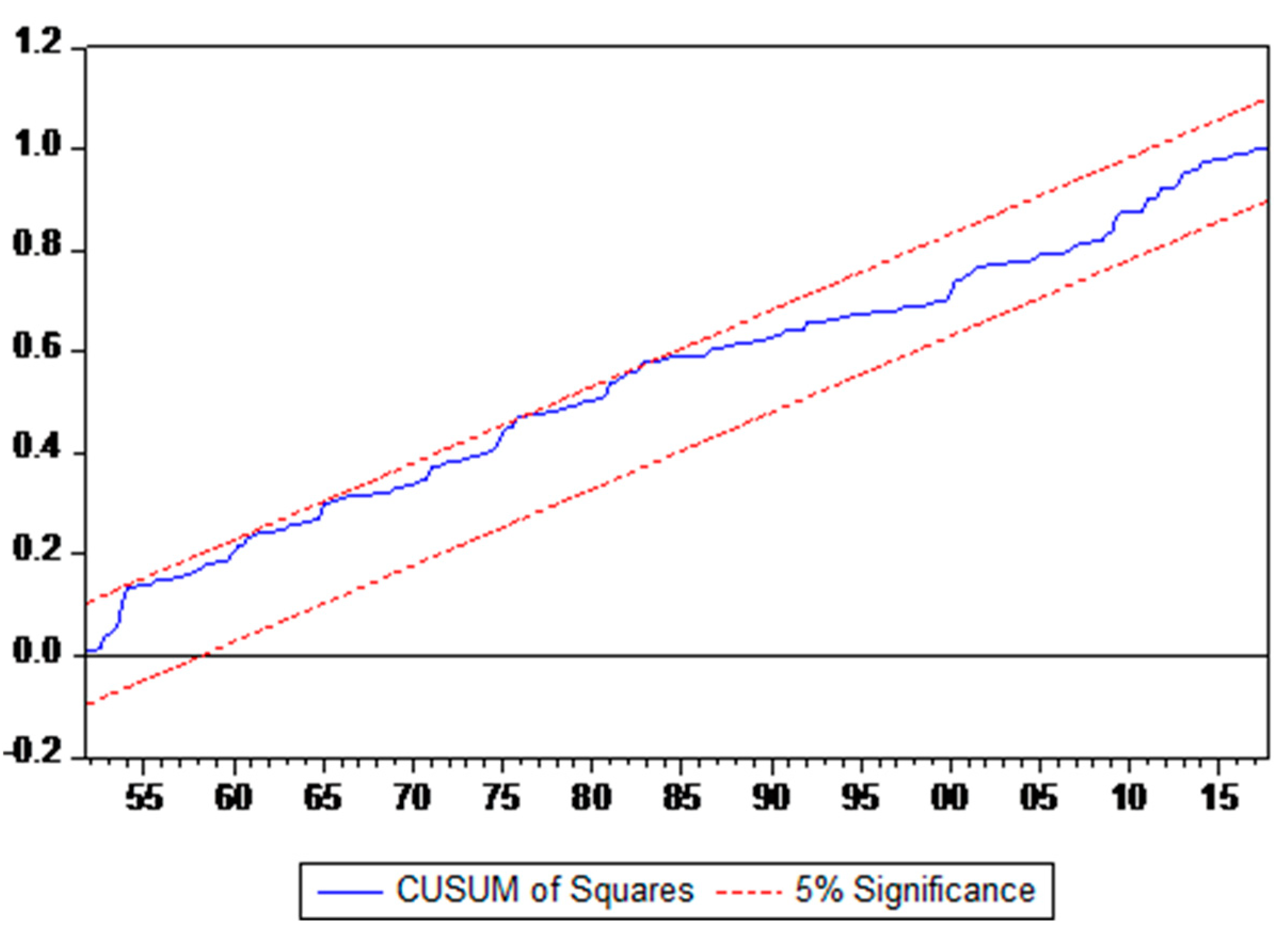

We apply standard diagnostic tests to ensure that the ARDL model is well specified. We conduct serial correlation, normality, and heteroscedasticity tests. The Lagrange Multiplier (LM) test indicates the absence of serial correlation in the residuals at the 5% level. The Harvey test of heteroscedasticity suggests no heteroscedasticity. The Jarque-Bera test shows that the residuals of the model are normally distributed. Finally, we apply the cumulative sum of the recursive residuals tests (hereafter CUSUM and CUSUMSQ), proposed by [

51] to examine the stability of the parameters of the ARDL model. The graphs plots are displayed in

Figure A1 and

Figure A2 (

Appendix C). The CUSUM and CUSUMSQ tests indicate stability in the coefficients.

Figure A1 and

Figure A2 show that the blue line does not cross the 5%-critical-value lines (red lines); therefore, the ARDL coefficients are stable at the 5% level. In

Table 3, we only show the ARDL regression output of the model with a constant, but we obtain similar results in all the tests when we apply them to the model with a constant and a linear trend.

Next, we apply linear Granger-causality tests between consumption and investment. We know that investment affects output and, therefore, consumption (and the wage mass). What we investigate through the linear Granger-causality approach, however, is whether consumption is the primum movens with respect to investment.

Through the error correction representation of the ARDL model of Equations (6) and (7), we can test for short-run and long-run Granger-causality between the variables. The standard Wald test indicates that the coefficients of consumption in the investment equation are positive and statistically jointly significant, indicating the existence of positive causality running from consumption to investment. On the other hand, the coefficients of investment in the consumption equation (

Table A4 in

Appendix D) are not statistically jointly significant. It indicates that there is positive linear causality running unidirectionally from consumption to investment in the short run. The coefficients of the error correction term in both equations are negative and significant. It indicates, on the one hand, that consumption and the wage mass jointly Granger-cause investment in the long run, and, on the other hand, that investment and the wage mass jointly Granger-cause consumption in the long run. Nevertheless, since investment does not Granger-cause consumption in the short run, according to the notion of long-run causality of [

52], we conclude that there is linear long-run Granger-causality running unidirectionally from consumption to investment.

As a robustness check, we carry out the linear Granger-causality test of [

44]. The optimal lag length,

, is chosen by the SIC and AIC. The results of the [

44] test also suggest that there is positive linear causality, running unidirectionally from

to

, at the 5% significance level (

Table A5 in

Appendix D).

We also estimate a VECM through the traditional approach of [

45] (

Table A6 in

Appendix D) for robustness. The VECM equation with

as dependent variable presents an error correction term of −0.13 with a

p-value of 0.00. On the other hand, the VECM equations with

and

as dependent variables present positive error correction terms parameters with

p-values of 0.08 and 0.29, respectively. Then, the weak exogeneity test indicates that investment is the only variable that in the event of any shock adjusts to the long-run equilibrium relationship. Thus, investment is the only weakly endogenous variable of the system at the 5% significance level. We also employ the VECM to test for short-run linear causality between investment and consumption. The coefficients of the VECM and the Wald tests indicate positive linear Granger-causality running unidirectionally from consumption to investment at the 5% significance level. Therefore, these results coincide with those of the ARDL model presented in

Table 3.

After applying linear Granger-causality tests to the raw data, we carry out the nonlinearity test on the VECM residuals. This detects if the causal relationship found in the linear analysis prevails. As expected, the linear causal relationship previously found disappears after VECM filtering. We can conclude, therefore, that the linear causality relationship between and is due to first moment effects (i.e., causality in the mean).

On the other hand, the BDS test results on the VECM residuals reveal a nonlinear structure in the residuals (

Table 4). Therefore, it becomes necessary to implement the nonlinear Granger-causality test.

Since the DW test of nonlinear causality assumes stationarity of the underlying data, we apply the test on the first-differenced series. Following the two-step process suggested by [

27], we first apply the test on the raw data to detect the presence of nonlinear causal relationships among the variables. We use a lag order of one and employ the bandwidth method suggested by [

27] to estimate the bandwidth of the test, which resulted in

We find nonlinear Granger-causality running unidirectionally, from

to

, at the 5% significance level (

Table 5).

Next, we apply the DW test on the filtered residuals of the VECM (because we have verified that the variables are cointegrated), to verify whether the nonlinear causal relationship between consumption and investment is genuinely nonlinear. The causal relationship previously found disappears after VECM filtering. It suggests that the causal relationship is not explained exclusively by the nonlinear components of the variables.

We now apply the same analysis but conditioning on Government Expenditure,

. As proxy for

, we employ “Real Government Consumption Expenditures and Gross Investment, Billions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted.” In this four-variable model, we use a lag length of one and the bandwidth method by [

27] to estimate the bandwidth of the test, which resulted in

After controlling for

, the nonlinear causal relationship between

and

vanishes. According to [

27], this finding indicates that

drives the nonlinear causal relationship between

and

.

This result has economic sense and supports the statements of the GT. We interpret this in line with the idea that permanent aggregate demand guides investment decisions [

11,

12]: public expenditure guarantees households certain goods and services. Then, the dynamics of households’ consumption becomes sufficiently persistent to determine the evolution of private investment. Therefore, consumption sustains investment because public expenditure allows the former to have a sufficiently permanent trajectory to be considered as a guide for investment decisions.

4. Conclusions

This paper analyzes the relationship between investment and consumption that the General Theory (1936), by John Maynard Keynes, postulates. We test the empirical relationship between consumption, , and investment, with quarterly data from the US economy. We find cointegration and linear Granger-causality running unidirectionally from to in the US between 1947 and 2018. Nevertheless, this linear causal relationship dies out after VECM filtering, indicating that this causality relationship is significant only in the mean. The nonlinear analysis confirms this causality relationship, suggesting the existence of nonlinear causality running unidirectionally from to .

On the other hand, when we control for Public Expenditure,

, the nonlinear causal relationship running from

to

disappears. According to [

27], this finding indicates that

drives the nonlinear causal relationship between

and

: in the absence of

,

would not nonlinearly cause

. We interpret this in line with the idea that it is permanent aggregate demand that guides investment decisions [

11,

12]: without the presence of public expenditure, entrepreneurs would not consider that private consumption evolves in a sufficiently persistent way, and therefore it would not drive their investment decisions.

Our results contribute to the literate and are of special interest for policy makers in the United States. We find evidence of a positive equilibrium relationship between aggregate consumption and investment that the conventional literature on economics overlooks. We also recall that this long-run nexus and the causality relationship running unidirectionally from consumption to investment are sustained by public intervention in the economy through final public expenditure. Therefore, our results call for national economic policies aimed at incrementing public expenditure.

During the first decades after the Word War, in the United States and Europe prevailed the view that public intervention was desirable for promoting effective demand and economic growth. The redistribution of income, due to progressive taxation and especially through final public expenditure, was considered as favorable to the growth of ‘private consumption outlay’ [

53]. Nevertheless, the well-known monetarist revolution of the 1970s, which brought back the main pre-Keynesian postulates, stated that public intervention would displace saving and investment and, therefore, would be detrimental for capital accumulation and growth. We believe that in this context, the results of our paper constitute an important contribution to the debate.