An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market

Abstract

1. Introduction

1.1. Global Overview on PV Generation

1.2. Challenges with Increase of PV Penetration

1.3. Roles of ESS to Integrate PV Energy

1.4. Efforts to Promote ESS for Increase PV Generation

2. Renewable Energy Certificates

2.1. Renewable Portfolio Standard for Energy Stoarge System

2.2. Reneable Energy Certificates on Energy Stoarge System

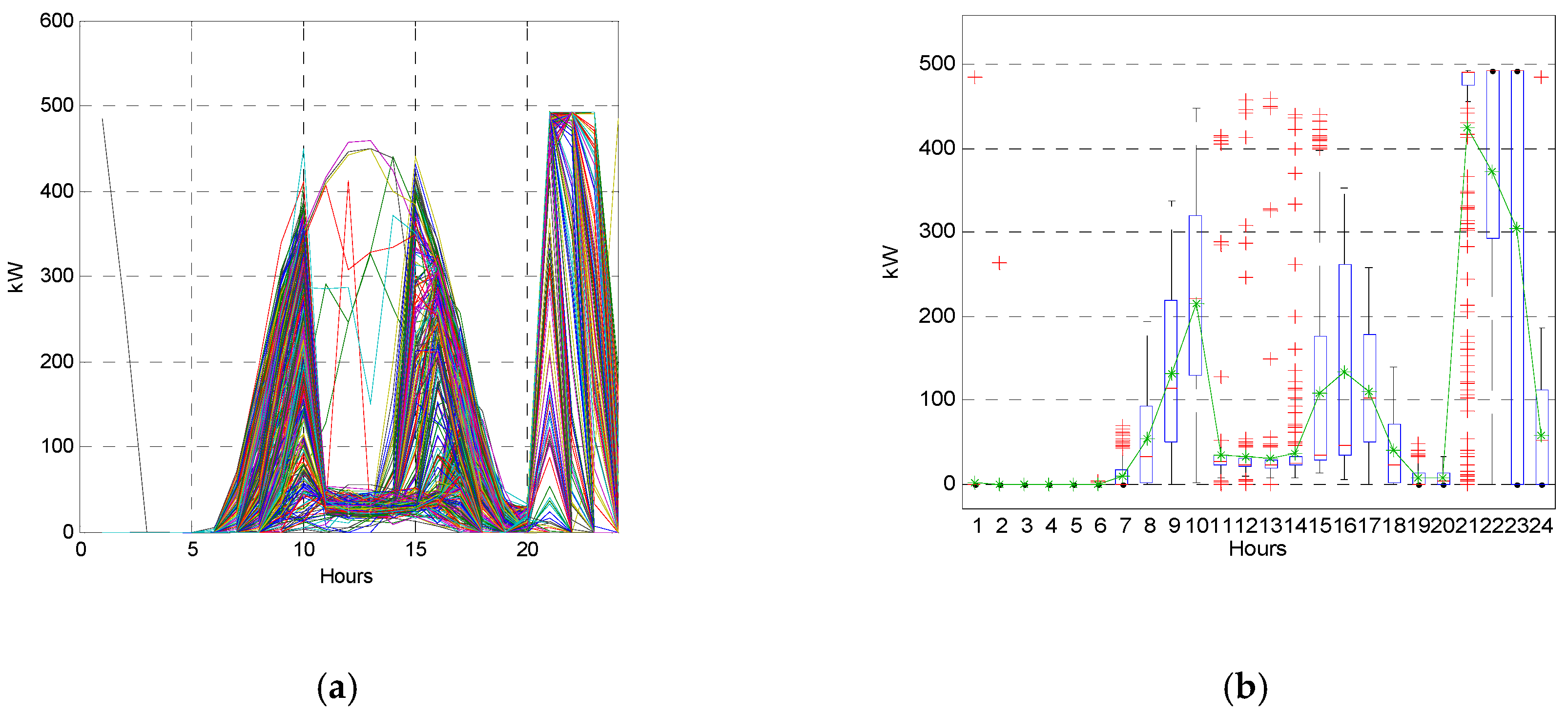

3. Numerical Study

3.1. Problem Definition and Formulation

3.2. Case Modeling and Market Analysis

3.3. Economic Feasibility Evaluation

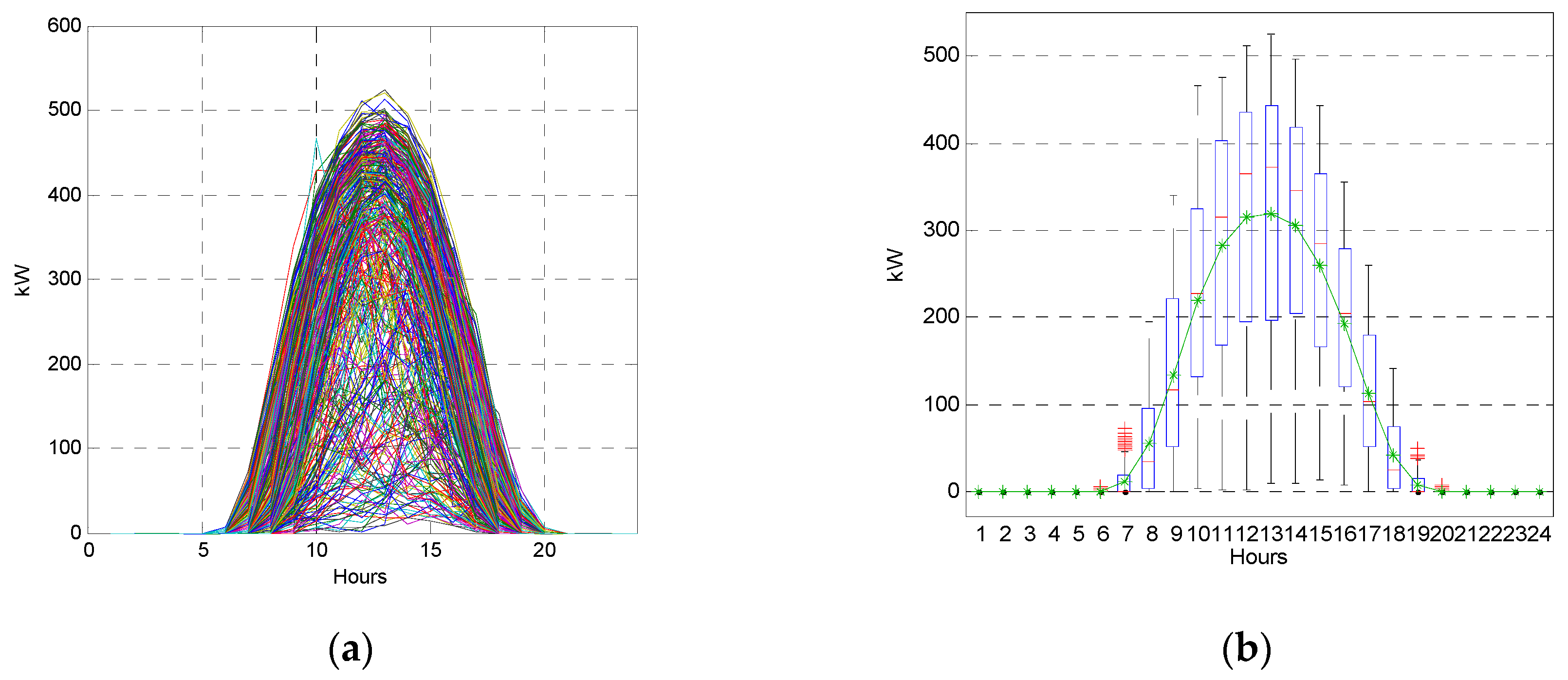

3.4. Generation Shifting Effect

4. Discussion

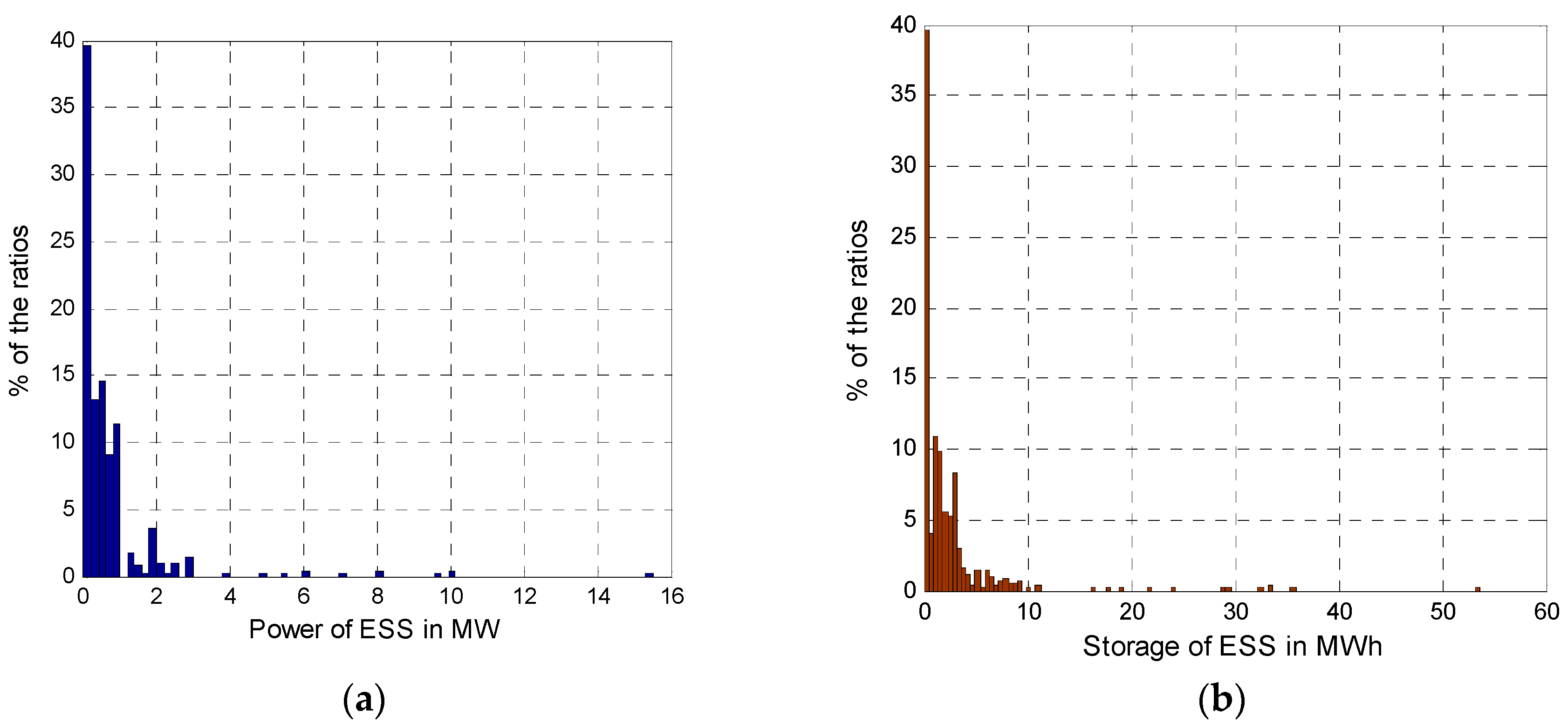

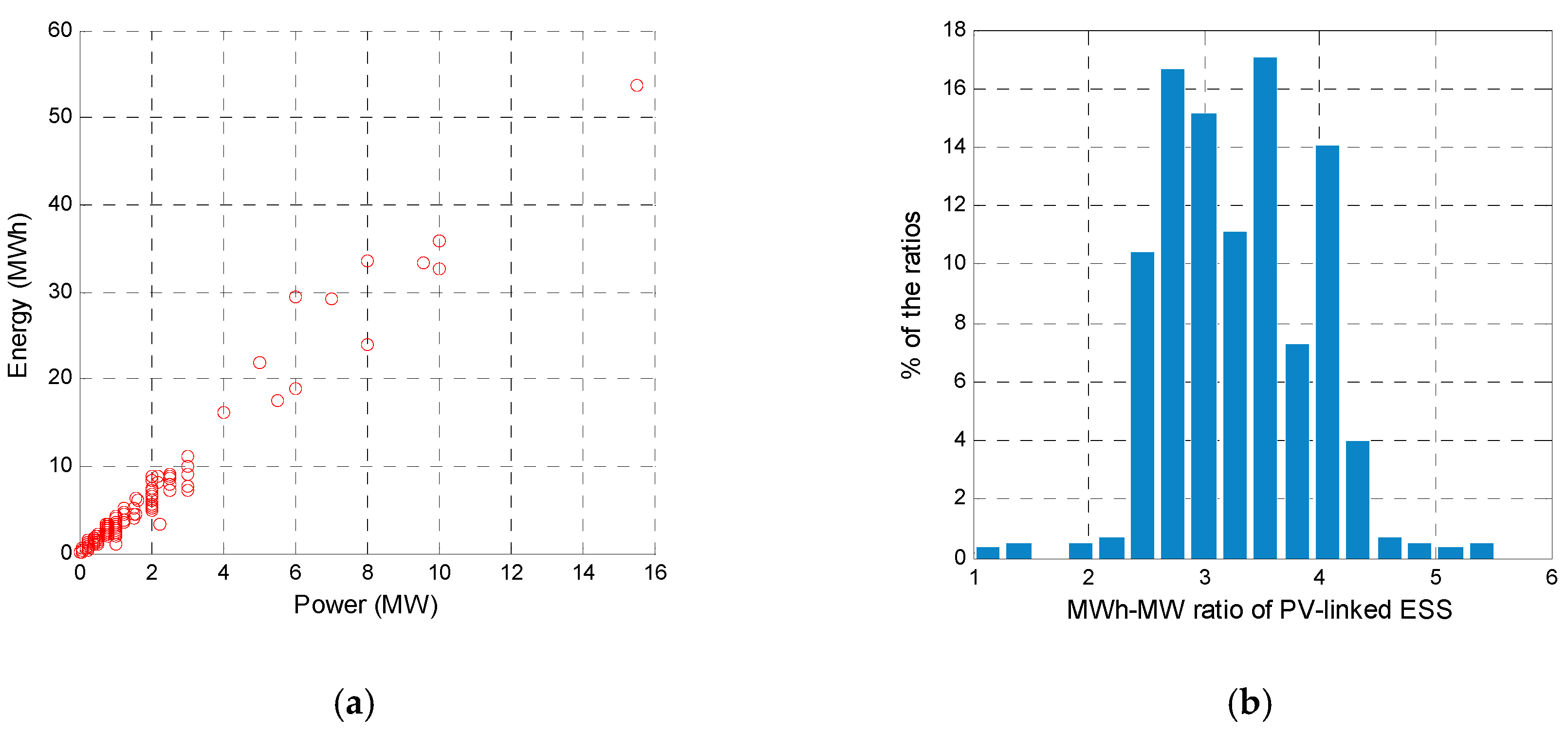

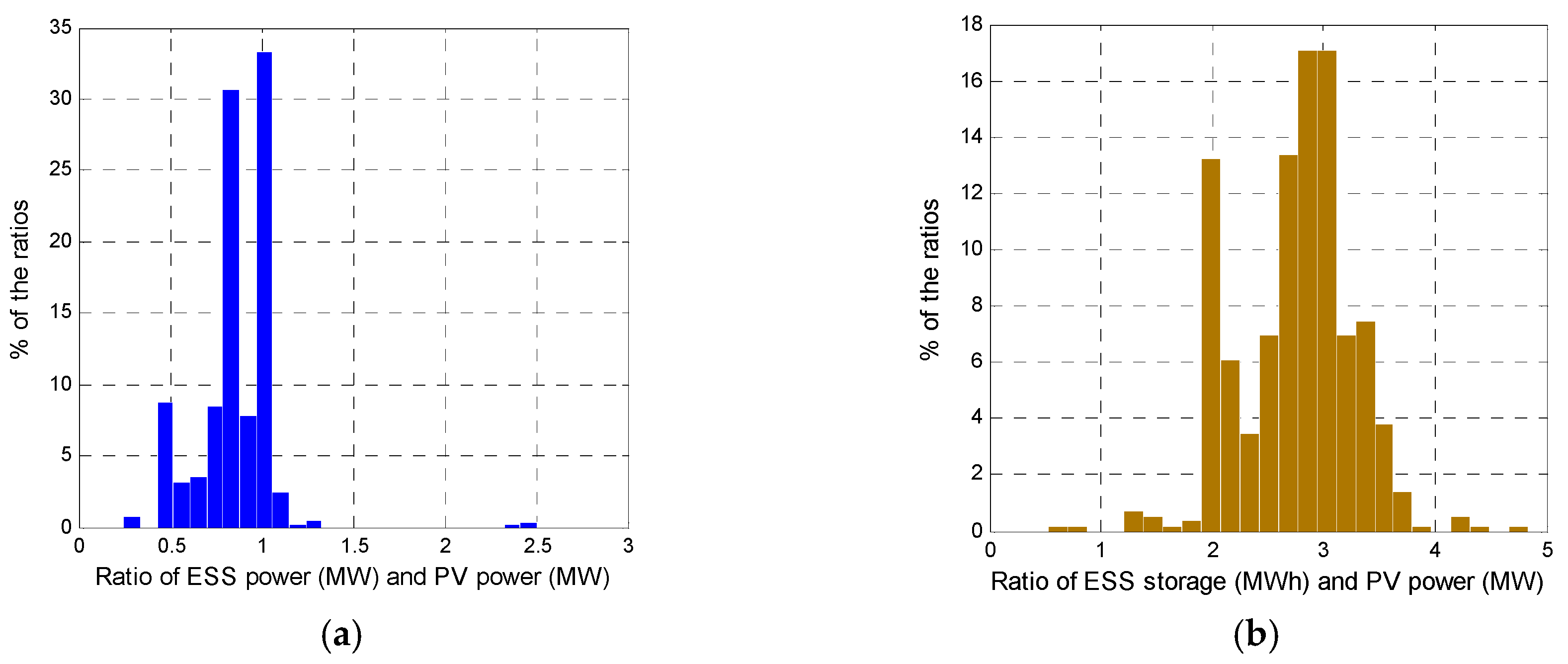

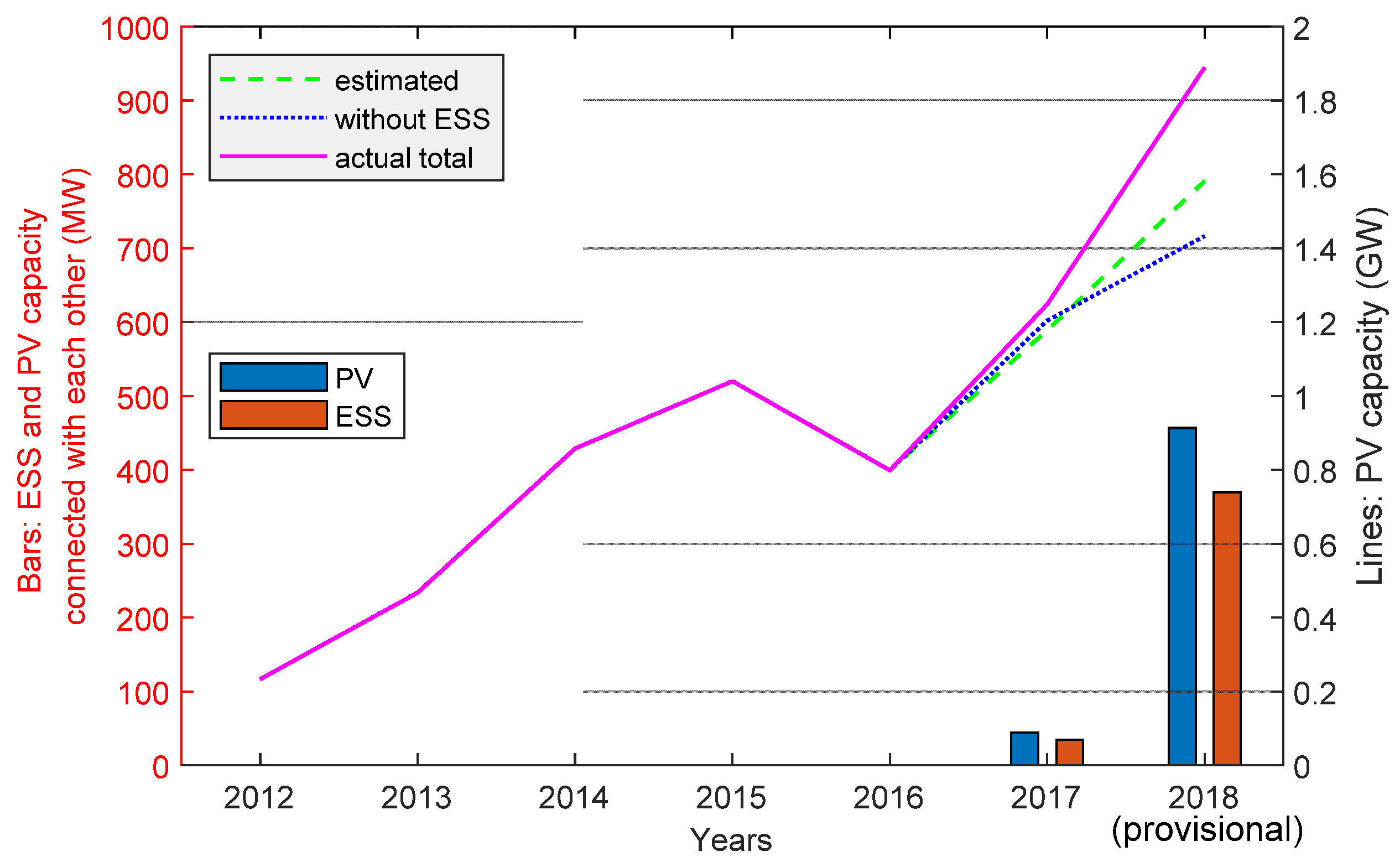

4.1. Dissemination of ESS for PV Integration

4.2. Dissemination of PV Power

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| REC granted on PV-linked ESS | |

| Weight of REC on PV-linked ESS | |

| Discharged energy from ESS during time ‘t’ | |

| Charged energy of ESS during time ‘t’ | |

| REC granted on PV power | |

| Weight of REC on PV | |

| Generated energy of PV during time ‘t’ | |

| SMP at time ‘t’ | |

| Contracted REC price | |

| Rated power of ESS in kW | |

| Storage capacity of ESS in kWh |

Abbreviation

| REC | Renewable Energy Certificate |

| RPS | Renewable Portfolio Standard |

| ESS | Energy Storage System |

| PV | Photovoltaic |

| GHG | Greenhouse Gas |

| INDC | Intended Nationally Determined Contributions |

| FIT | Feed-in Tariffs |

| GDP | Gross Domestic Product |

| PCS | Power-Conditioning System |

| PMS | Power-Management System |

| SMP | System Marginal Price |

References

- United Nations (UN). Framework Convention on Climate Change. Adoption of the Paris Agreement. Available online: https://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf (accessed on 12 December 2015).

- Zhai, Y.; Mo, L.; Rawlins, M. The Impact of Nationally Determined Contributions on the Energy Sector; Asian Development Bank: Mandaluyong City, Philippines, 2018; Available online: https://www.adb.org/sites/default/files/publication/437896/sdwp-054-nationally-determined-contributions-energy.pdf (accessed on 31 July 2018).

- World Energy Investment 2019; International Energy Agency: Paris, France, 2019; Available online: https://www.iea.org/wei2019/ (accessed on 14 May 2019).

- Renewables 2019 Global Status Report; Renewable Energy Policy Network for the 21st Century (REN21): Paris, France, 2019; ISBN 978-3-9818911-7-1. Available online: https://www.ren21.net/wp-content/uploads/2019/05/gsr_2019_full_report_en.pdf (accessed on 10 May 2019).

- Intended Nationally Determined Contribution (INDC); United Stated of America. Available online: https://www4.unfccc.int/sites/submissions/INDC/Published%20Documents/United%20States%20of%20America/1/U.S.%20Cover%20Note%20INDC%20and%20Accompanying%20Information.pdf (accessed on 31 March 2015).

- Carbon Pollution Emission Guidelines for Existing Stationary Sources: Electric Utility Generating Units. Available online: https://www.federalregister.gov/documents/2015/10/23/2015-22842/carbon-pollution-emission-guidelines-for-existing-stationary-sources-electric-utility-generating (accessed on 23 October 2015).

- Repeal of Carbon Pollution Emission Guidelines for Existing Stationary Sources: Electric Utility Generating Units. Available online: https://www.federalregister.gov/documents/2017/10/16/2017-22349/repeal-of-carbon-pollution-emission-guidelines-for-existing-stationary-sources-electric-utility (accessed on 16 October 2017).

- Proposal: Affordable Clean Energy Rule. Available online: https://www.epa.gov/stationary-sources-air-pollution/proposal-affordable-clean-energy-ace-rule (accessed on 10 May 2019).

- Ramseur, J.L. U.S. Carbon Dioxide Emissions in the Electricity Sector: Factors, Trends, and Projections; Congressional Research Service: Washington, DC, USA, 2019. Available online: https://fas.org/sgp/crs/misc/R45453.pdf (accessed on 1 January 2019).

- Submission of Japan’s Intended Nationally Determined Contribution (INDC). Japan. Available online: https://www4.unfccc.int/sites/submissions/INDC/Published%20Documents/Japan/1/20150717_Japan’s%20INDC.pdf (accessed on 17 July 2015).

- PV Magazine. Available online: https://www.pv-magazine.com/2018/02/15/japan-to-install-up-to-7-gw-in-2018-despite-cancellation-of-14-6-gw-of-approved-capacity-report/ (accessed on 15 February 2018).

- PV Magazine. Available online: https://www.pv-magazine.com/2018/12/06/japan-postpones-fit-cuts-by-six-months-for-projects-over-2-mw/ (accessed on 6 December 2018).

- PV Magazine. Available online: https://www.pv-magazine.com/2018/10/09/japan-to-add-17-gw-of-new-solar-by-the-end-of-2020-fitch/ (accessed on 9 October 2018).

- Intended Nationally Determined Contribution (INDC); China. Available online: https://www4.unfccc.int/sites/submissions/INDC/Published%20Documents/China/1/China’s%20INDC%20-%20on%2030%20June%202015.pdf (accessed on 30 June 2015).

- Explore the World’s Greenhouse Gas Emissions. Available online: https://www.wri.org/blog/2017/04/interactive-chart-explains-worlds-top-10-emitters-and-how-theyve-changed (accessed on 11 April 2017).

- World Energy Market Insight (19-23); Korea Energy Economics Institute: Ulsan, Korea, 2019; Available online: http://www.keei.re.kr/keei/download/WEMI1923.pdf (accessed on 1 July 2019).

- Intended Nationally Determined Contribution (INDC). Korea. Available online: http://www4.unfccc.int/Submissions/INDC/Published%20Documents/Republic%20of%20Korea/1/INDC%20Submission%20by%20the%20Republic%20of%20Korea%20on%20June%2030.pdf (accessed on 30 June 2015).

- Global Green Growth Institute. Available online: http://gggi.org/site/assets/uploads/2018/10/Presentation-by-Mr.-Kyung-ho-Lee-Director-of-the-New-and-Renewable-Energy-Policy-Division-MOTIE.pdf (accessed on 5 November 2018).

- Cornot-Grandolphe, S. South Korea’s New Electricity Plan: Cosmetic Changes or a Breakthrough for the Climate? Institut Francais des Relations Internationales (ifri): Paris, France, 2018; Available online: https://www.ifri.org/en/publications/editoriaux-de-lifri/edito-energie/south-koreas-new-electricity-plan-cosmetic-changes-or (accessed on 28 February 2018).

- Kato, T.; Suzuoki, Y. Large-Scale Penetration Impact of Photovoltaic Power Generation System on Utility Power Plants. In Proceedings of the 2009 Transmission & Distribution Conference & Exposition: Asia and Pacific, Seoul, Korea, 26–30 October 2009. [Google Scholar] [CrossRef]

- Denholm, P.; Ela, E.; Kirby, B.; Milligan, M. The Role of Energy Storage with Renewable Electricity Generation; National Renewable Energy Laboratory: Golden, CO, USA, 2010. Available online: https://www.nrel.gov/docs/fy10osti/47187.pdf (accessed on January 2010).

- Shivashankar, S.; Mekhilef, S.; Mokhlis, H.; Karimi, M. Mitigating methods of power fluctuation of photovoltaic (PV) sources—A review. Renew. Sustain. Energy Rev. 2016, 59, 1170–1184. [Google Scholar] [CrossRef]

- Zahedi, A. Maximizing solar PV energy penetration using energy storage technology. Renew. Sustain. Energy Rev. 2011, 15, 866–870. [Google Scholar] [CrossRef]

- What the Duck Curve Tells Us about Managing a Green Grid; California ISO: Folsom, CA, USA, 2016; Available online: https://www.caiso.com/Documents/FlexibleResourcesHelpRenewables_FastFacts.pdf (accessed on 10 August 2019).

- Denholm, P.; O’Connell, M.; Brinkman, G.; Jorgenson, J. Overgeneration from Solar Energy in California: A Field Guide to the Duck Chart; National Renewable Energy Laboratory: Golden, CO, USA, 2015. Available online: https://www.nrel.gov/docs/fy16osti/65023.pdf (accessed on 18 November 2015).

- Sovacool, B.K. The intermittency of wind, solar, and renewable electricity generators: Technical barrier or rhetorical excuse? Util. Policy 2009, 17, 288–296. [Google Scholar] [CrossRef]

- Jain, P. Energy Storage in Grids with High Penetration of Variable Generation; Asian Development Bank: Mandaluyong City, Philippines, 2017; Available online: https://www.adb.org/sites/default/files/publication/225731/energy-storage-grids.pdf (accessed on 28 February 2017).

- Ulbig, A.; Borsche, T.S.; Andersson, G. Impact of Low Rotational Inertia on Power System Stability and Operation. IFAC Proc. 2014, 47, 7290–7297. [Google Scholar] [CrossRef]

- Moosavian, S.M.; Rahim, N.A.; Selvaraj, J.; Solangi, K.H. Energy policy to promote photovoltaic generation. Renew. Sustain. Energy Rev. 2013, 25, 44–58. [Google Scholar] [CrossRef]

- Mueller, S.; Vithayasrichareon, P. Getting Wind and Sun onto the Grid; International Energy Agency (IEA): Paris, France, 2017; Available online: https://www.iea.org/publications/insights/insightpublications/Getting_Wind_and_Sun.pdf (accessed on 16 March 2017).

- Denholm, P.; Margolis, R. Energy Storage Requirements for Achieving 50% Solar Photovoltaic Energy Penetration in California; National Renewable Energy Laboratory: Golden, CO, USA, 2016. Available online: https://www.nrel.gov/docs/fy16osti/66595.pdf (accessed on 12 August 2016).

- Dvorkin, Y.; Fernandez-Blanco, R.; Kirschen, D.S.; Pandzic, H.; Watson, J.; Silva-Monroy, C.A. Ensuring Profitability of Energy Storage. IEEE Trans. Power Syst. 2017, 32, 611–623. [Google Scholar] [CrossRef]

- Hill, C.A.; Such, M.C.; Chen, D.; Gonzalez, J.; Grady, W.M. Battery Energy Storage for Enabling Integration of Distributed Solar Power Generation. IEEE Trans. Smart Grid 2012, 3. [Google Scholar] [CrossRef]

- Rudolf, T.; Papastergiou, K.D. Financial analysis of utility scale photovoltaic plants with battery energy storage. Energy Policy 2013, 63, 139–146. [Google Scholar] [CrossRef]

- Denholm, P.; Margolis, R.M. Evaluating the limits of solar photovoltaics (PV) in electric power systems utilizing energy storage and other enabling technologies. Energy Policy 2007, 35, 4424–4433. [Google Scholar] [CrossRef]

- Moore, J.; Shabani, B. A Critical Study of Stationary Energy Storage Policies in Australia in an International Context: The Role of Hydrogen and Battery Technologies. Energies 2016, 9, 674. [Google Scholar] [CrossRef]

- Norwood, Z.; Goop, J.; Odenberger, M. The Future of the European Electricity Grid Is Bright: Cost Minimizing Optimization Shows Solar with Storage as Dominant Technologies to Meet European Emissions Targets to 2050. Energies 2017, 10, 2080. [Google Scholar] [CrossRef]

- Beaudin, M.; Zareipour, H.; Schellenberglabe, A.; Rosehart, W. Energy storage for mitigating the variability of renewable electricity sources: An updated review. Energy Sustain. Dev. 2010, 14, 302–314. [Google Scholar] [CrossRef]

- Zsiborács, H.; Baranyai, N.H.; Vincze, A.; Zentkó, L.; Birkner, Z.; Máté, K.; Pintér, G. Intermittent Renewable Energy Sources: The Role of Energy Storage in the European Power System of 2040. Electronics 2019, 8, 729. [Google Scholar] [CrossRef]

- Eyer, J. Electric Utility Transmission and Distribution Upgrade Deferral Benefits from Modular Electricity Storage; Sandia National Laboratories: Albuquerque, NM, USA, 2009. Available online: https://prod-ng.sandia.gov/techlib-noauth/access-control.cgi/2009/094070.pdf (accessed on 30 June 2009).

- Jo, B.; Jung, S.; Jang, G. Feasibility Analysis of Behind-the-Meter Energy Storage System According to Public Policy on an Electricity Charge Discount Program. Sustainability 2019, 11, 186. [Google Scholar] [CrossRef]

- Holt, E.; Olinsky-Paul, T. Does Energy Storage Fit in an RPS? Clean Energy States Alliance: Montpelier, VT, USA, 2014; Available online: https://www.cesa.org/assets/2014-Files/CESA-Energy-Storage-and-RPS-Holt-June2014.pdf (accessed on 30 June 2014).

- Renewable Portfolio Standards (RPS). Available online: http://www.energy.or.kr/renew_eng/new/standards.aspx (accessed on 9 August 2019).

- Johnston, V. Storage Portfolio Standards: Incentivising Green Eenrgy Storage. J. Environ. Sustain. Law 2014, 20. Available online: http://scholarship.law.missouri.edu/jesl/vol20/iss2/3 (accessed on 16 June 2015).

- Analysis of Solar Photovoltaic and Wind Power Utilization Rate and Generation Cost by Region. Korea Power Exchange: 625, Bitgaram-ro, Naju-si, Jeollanam-do, Republic of Korea. 2018. Available online: https://onerec.kmos.kr/mobile/downloadBbsFile.do?atchmnflNo=22012 (accessed on 31 December 2018).

| Announced Date | REC Weight | Applicable Period 1 |

|---|---|---|

| 19 September 2016 | 5.0 | 2016, 2017 |

| 29 June 2018 | 5.0 | 2018, 2019 |

| 4.0 | 2020 |

| Rated power (PV) | 600 kW |

| Battery type | Lithium-ion |

| Rated power (ESS) | 600 kW |

| Storage capacity | 1800 kWh |

| Round-trip efficiency | 89% |

| Depth of discharge | 80% |

| Maintenance cost | 0.2% of capital cost, annually |

| Contract term of PV | 20 years |

| Contract term of ESS | 15 years |

| SMP base price (USD) | 69.57 |

| Upper limit price of SMP + one REC | 162.25 |

| REC weight for PV | 1.0 |

| REC weight for PV-linked ESS | 5.0 |

| Initial Cost | Payback Years | B/C Ratio | IRR (%) | NPV (USD) | |

|---|---|---|---|---|---|

| Without ESS | 1,043,478 | 9.15 | 1.39 | 5.65 | 516,284 |

| With ESS | 2,139,130 | 7.45 | 1.56 | 9.28 | 1,513,093 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jo, B.-K.; Jang, G. An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market. Sustainability 2019, 11, 4337. https://doi.org/10.3390/su11164337

Jo B-K, Jang G. An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market. Sustainability. 2019; 11(16):4337. https://doi.org/10.3390/su11164337

Chicago/Turabian StyleJo, Byuk-Keun, and Gilsoo Jang. 2019. "An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market" Sustainability 11, no. 16: 4337. https://doi.org/10.3390/su11164337

APA StyleJo, B.-K., & Jang, G. (2019). An Evaluation of the Effect on the Expansion of Photovoltaic Power Generation According to Renewable Energy Certificates on Energy Storage Systems: A Case Study of the Korean Renewable Energy Market. Sustainability, 11(16), 4337. https://doi.org/10.3390/su11164337