2.1. Ham Tourism in Spain

The European policy on quality (European Commission, 2006) recognizes and protects the names of certain specific products that are unique to a region or a production method. This recognition translates into quality logos that allow for the identification of products of distinctive quality in the EU and that through specific controls, also guarantee their authenticity. Two have geographical connotations (PDO and PGI), and the third is related to traditional production methods (TSG).

The regulation of the EU (European Union, 2006), on protection of geographical indications and designations of the origin for agricultural products and foodstuffs, establishes the definitions of PDO and PGI, differing in that a product with a PDO label is produced, transformed, and processed from the same geographical area. Examples of this category would be: Priego de Córdoba olive oil, Jerez wine, or La Alcarria honey; however, in a PGI product, it is not necessary that all the processes are performed in the same geographical area (examples of this other category would be Manchego lamb and Pan de Cea (bread)).

The TSG corresponds to products that have specific traits that are different from other foods of the same category. In addition, they must be produced from traditional raw materials or have a traditional or artisanal composition, mode of production or transformation. In Spain, there are only four products classified as TSGs:

jamón serrano (serrano ham) with a number of specific characteristics, certified farm milk,

torta de aceite (olive oil biscuit), or

panellets (dessert) [

22].

The EU also distinguishes products from organic production with a quality logo. This includes products whose production method preserves the structure and fertility of the soil, promotes a high degree of animal welfare and avoids synthetic chemicals such as fertilizers, pesticides, and antibiotics. Farmers use techniques that help maintain ecosystems and reduce pollution, and in the transformation of food, only a limited and very small number of additives and processing technologies can be used.

If an agri-food product is covered under a PDO, PGI, or TSG, it is synonymous with quality and will be in greater demand by the final consumer who seeks quality over quantity (agri-food consumer) or a unique tourism experience based on a quality raw material (tourist consumer) [

27].

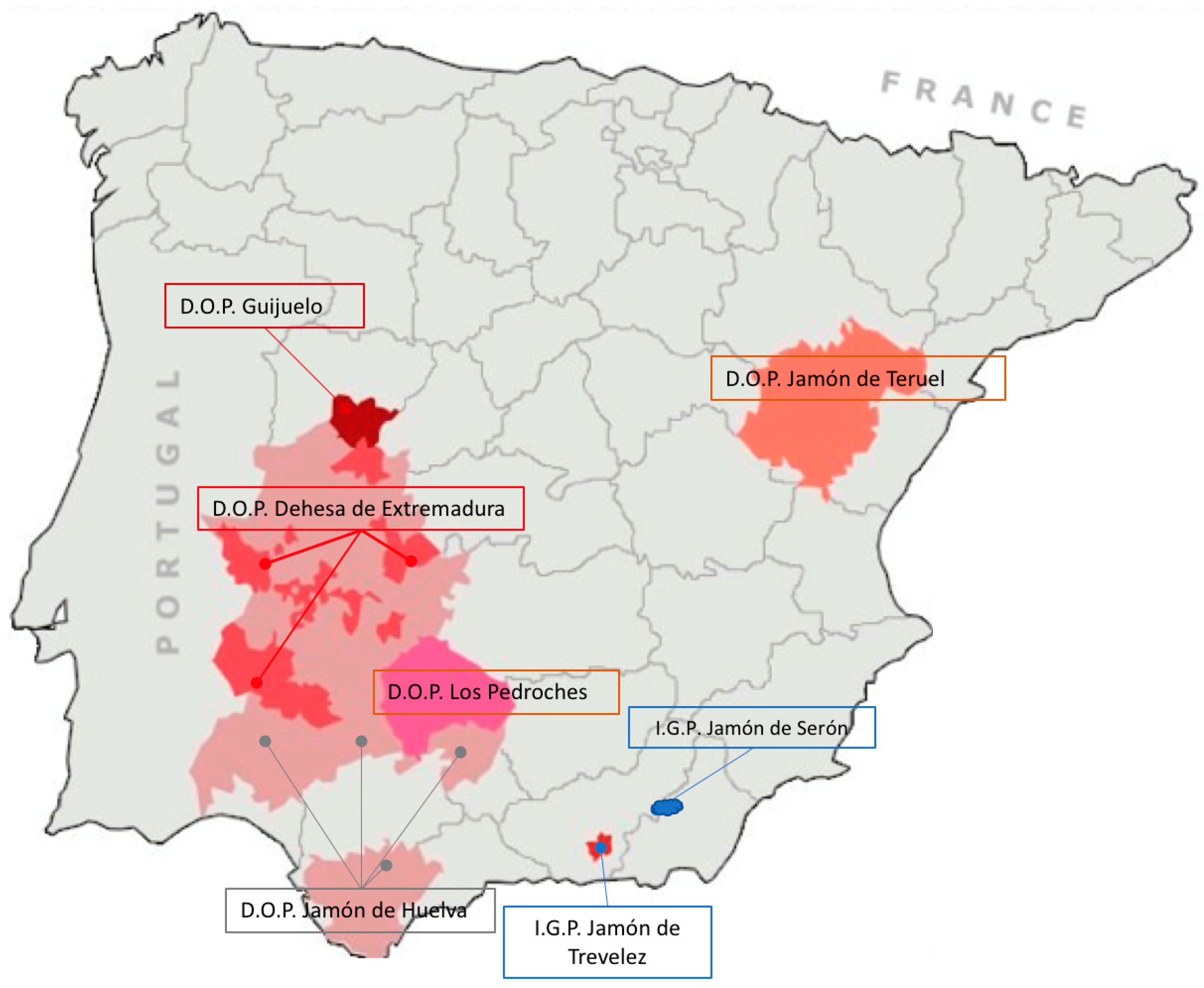

In 2019, Spain has 192 PDOs, with the product par excellence being wine with 90 PDOs, and 132 PGIs (42 of wine), while for ham there are 5 PDOs (

Figure 4), of which 4 are for Iberian ham:

Jamón de Jabugo: prepared in the mountains of Huelva, in the towns of Aracena, Cortegana, Cumbres Mayores, Jabugo, etc.;

Los Pedroches: includes the forested dehesas of 32 municipalities of the region of Los Pedroches to the north of the province of Córdoba;

Jamón de Guijuelo: reared in the foothills of the mountains of Gredos and Béjar;

Dehesa de Extremadura: located in the cork oak and holm oak dehesas and in Cáceres and Badajoz;

one PDO for serrano ham:

Jamón de Teruel: all the regions of the province of Teruel are protected for the production of pigs and the preparation of hams with PDO;

and two PGIs for serrano ham:

- ○

Jamón de Trevélez: The production scope of the pigs protected by this specified PGI covers the geographical area of Andalusia. The production and maturation of hams and front legs or shoulders are limited to nine municipalities in the region of Alpujarra Alta in the province of Granada.

- ○

Jamón de Serón: The production zone covers the Valle de Almanzara and Serón in the province of Almeria, with a mild climate, cold and dry winters and summers of moderate temperature that favour the curing of ham.

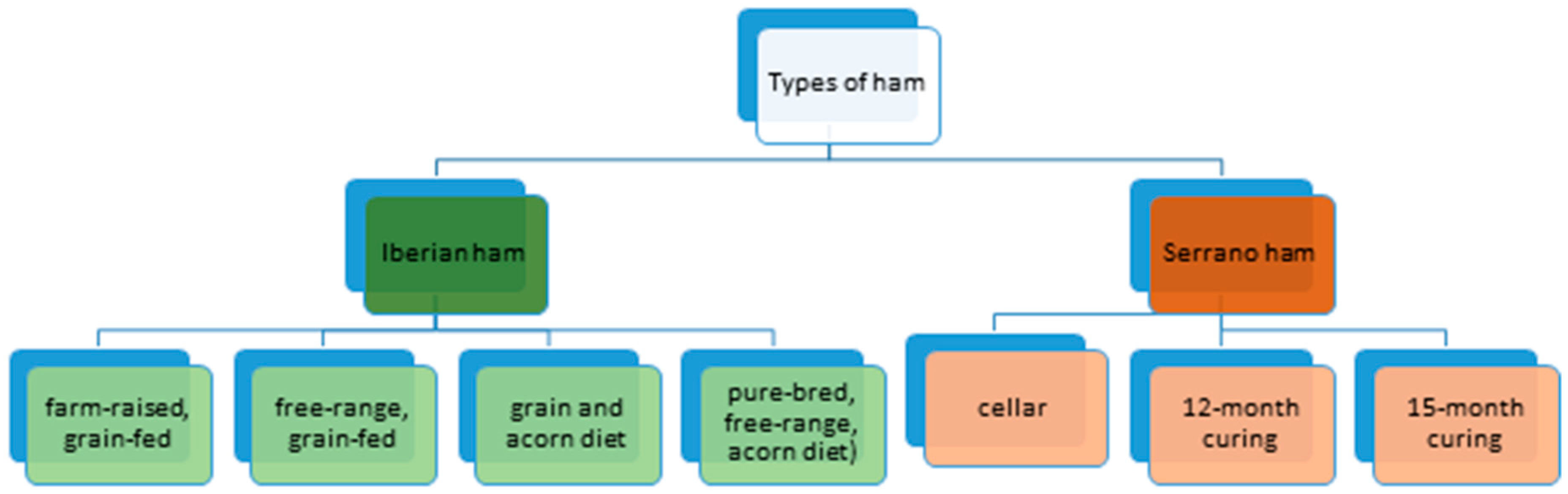

A pig is an animal that is used in Spain, both in the fresh meat and prepared meat industries. Within the latter, products such as salchichón (type of sausage), lomo (loin), and chorizo (type of sausage) stand out, with ham as the flagship product, of which some varieties can be identified. The best known are Iberian ham and serrano ham.

To classify hams as Iberian ham (

Figure 5), they must come from the Iberian pig, which must be raised in the

dehesa, a singular ecosystem in which the fundamental components of the feeding of these animals are the acorns, herbs, and stubble that create the characteristic marbled fat of Iberian ham products. This fat infiltrates the animals’ muscles, giving their meat a particular texture, flavor, and smoothness unique to Iberian acorn-fed ham.

Within the Iberian ham variety, we distinguish jamón ibérico de cebo (farm-raised, grain-fed), jamón ibérico de cebo de campo (free-range, grain-fed), jamón ibérico de recebo (grain and acorn diet), and jamón ibérico de bellota (pure-bred, free-range, acorn diet).

In contrast, the serrano ham (also known as white ham), which comes from a breed of white pigs, is usually “sweeter” than the Iberian ham due to the low degree of salting required for the drying and maturing process. This difference is largely due to the ham being cured in a cold and dry mountain climate (northerly winds coming from the high peaks of the Sierra Nevada or blowing in the province of Teruel). The quality of serrano ham are can be distinguished by its curing process: jamón de bodega (cellar), jamón de reserva (12-month curing), and jamón gran reserve (15-month curing).

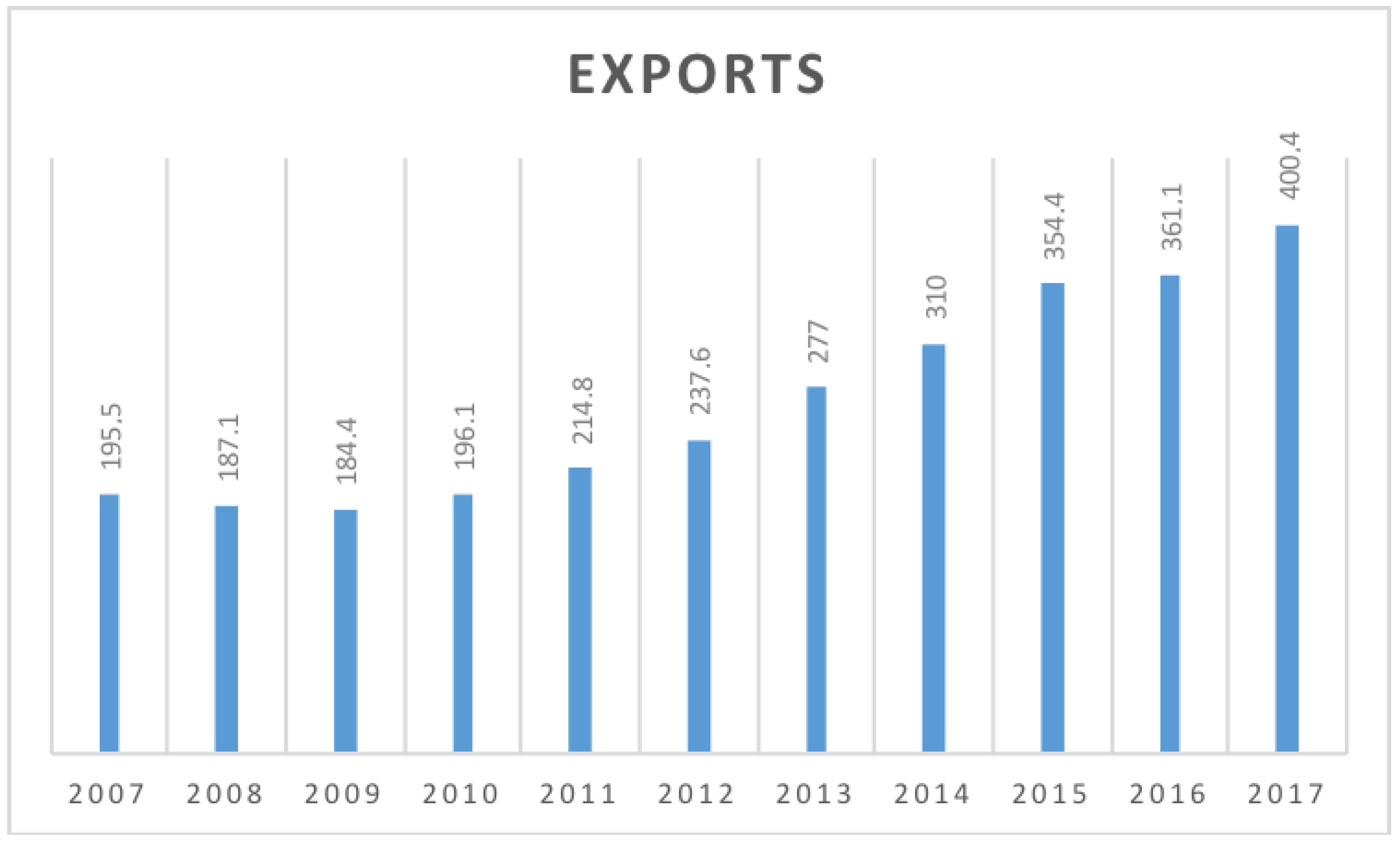

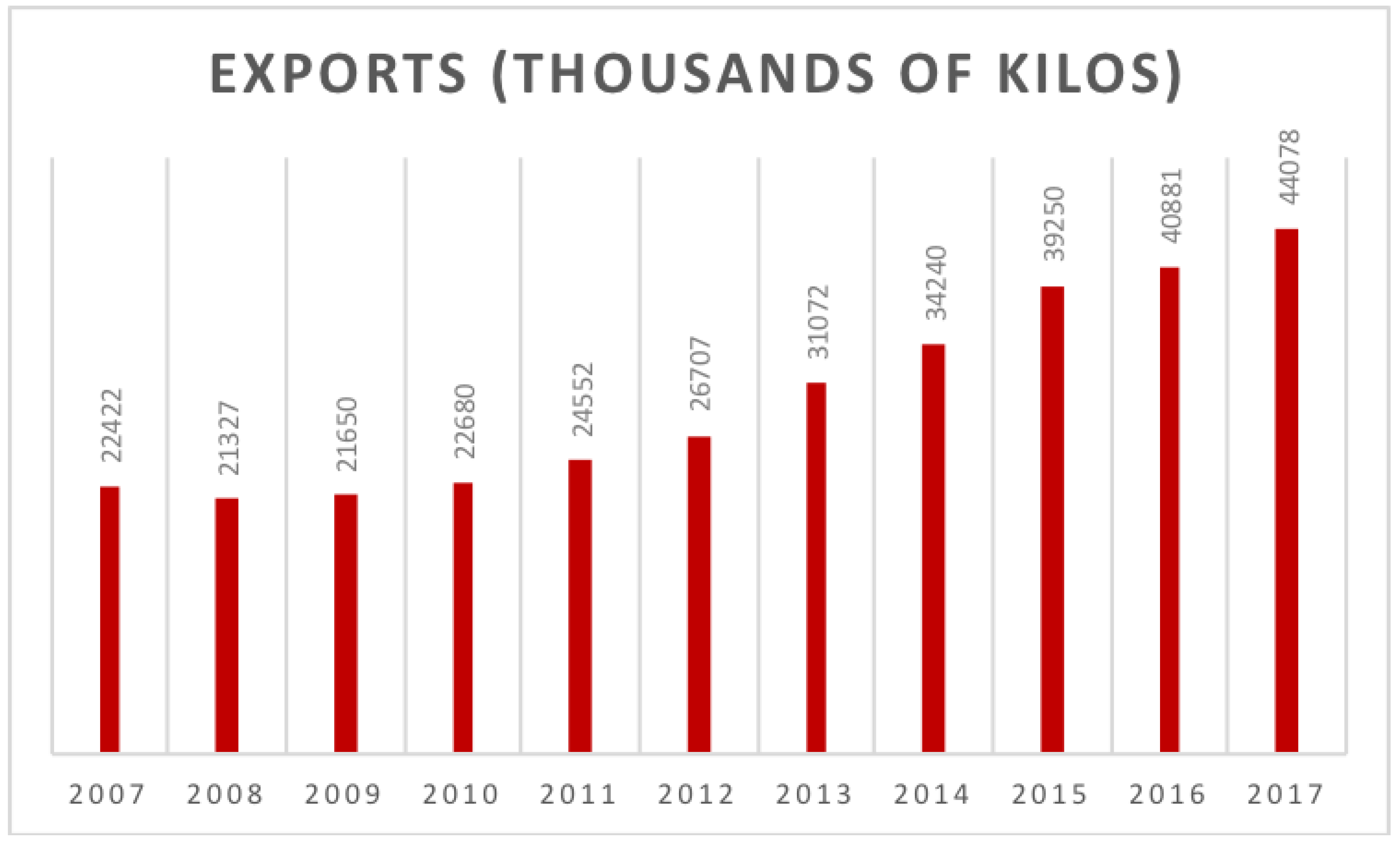

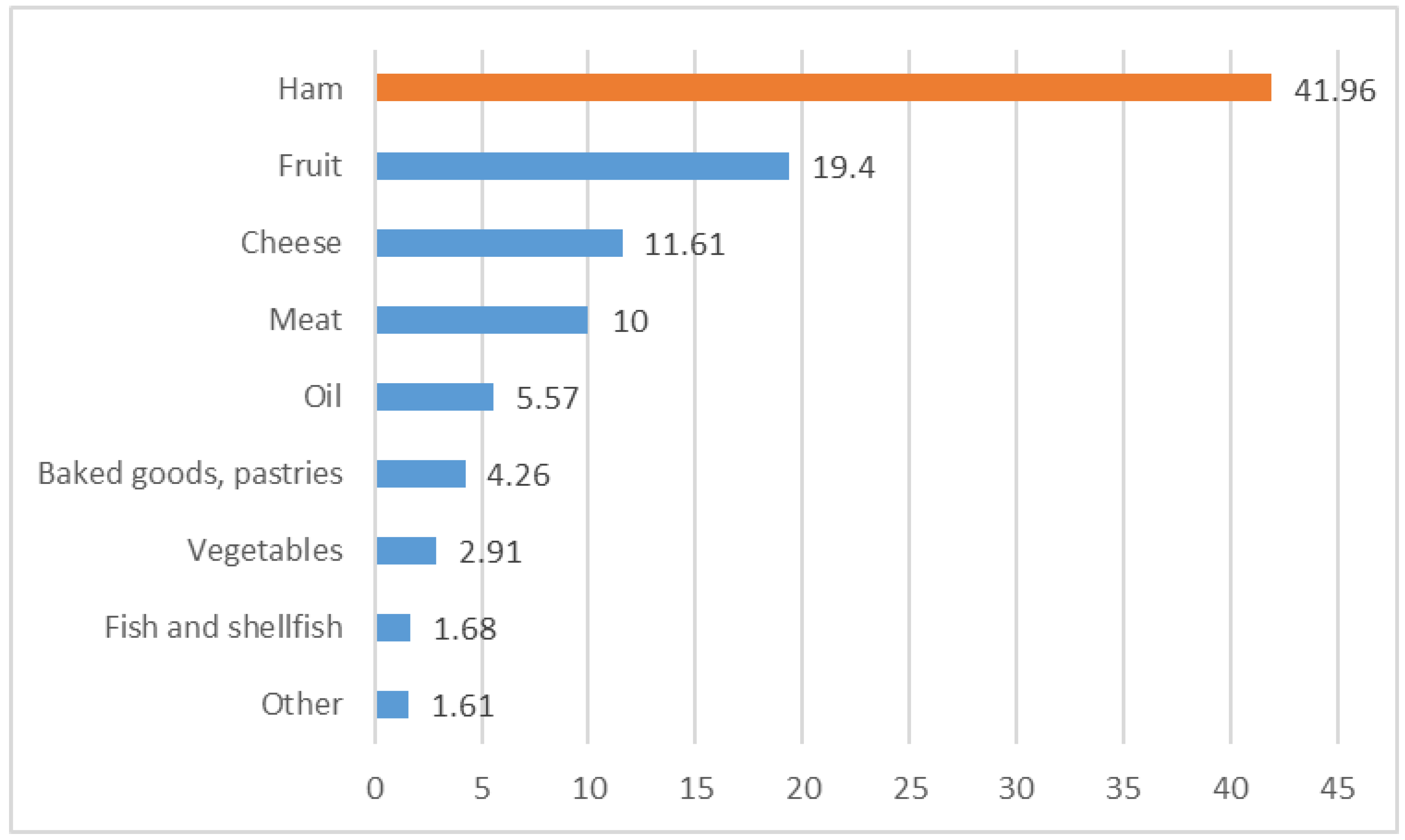

From the economic point of view and focusing on marketing data of quality products, except wine, in the year 2018 (

Figure 6), 41.96% of the market value of agricultural products and livestock protected under a PDO or PGI was for ham, followed by almost half of the remaining percentage representing fruits (19.4%) and cheeses (11.61%), and in fifth is olive oil with 5.57%, which indicates the importance of ham for its demand, being a product highly appreciated for its quality, both in the national and international market.

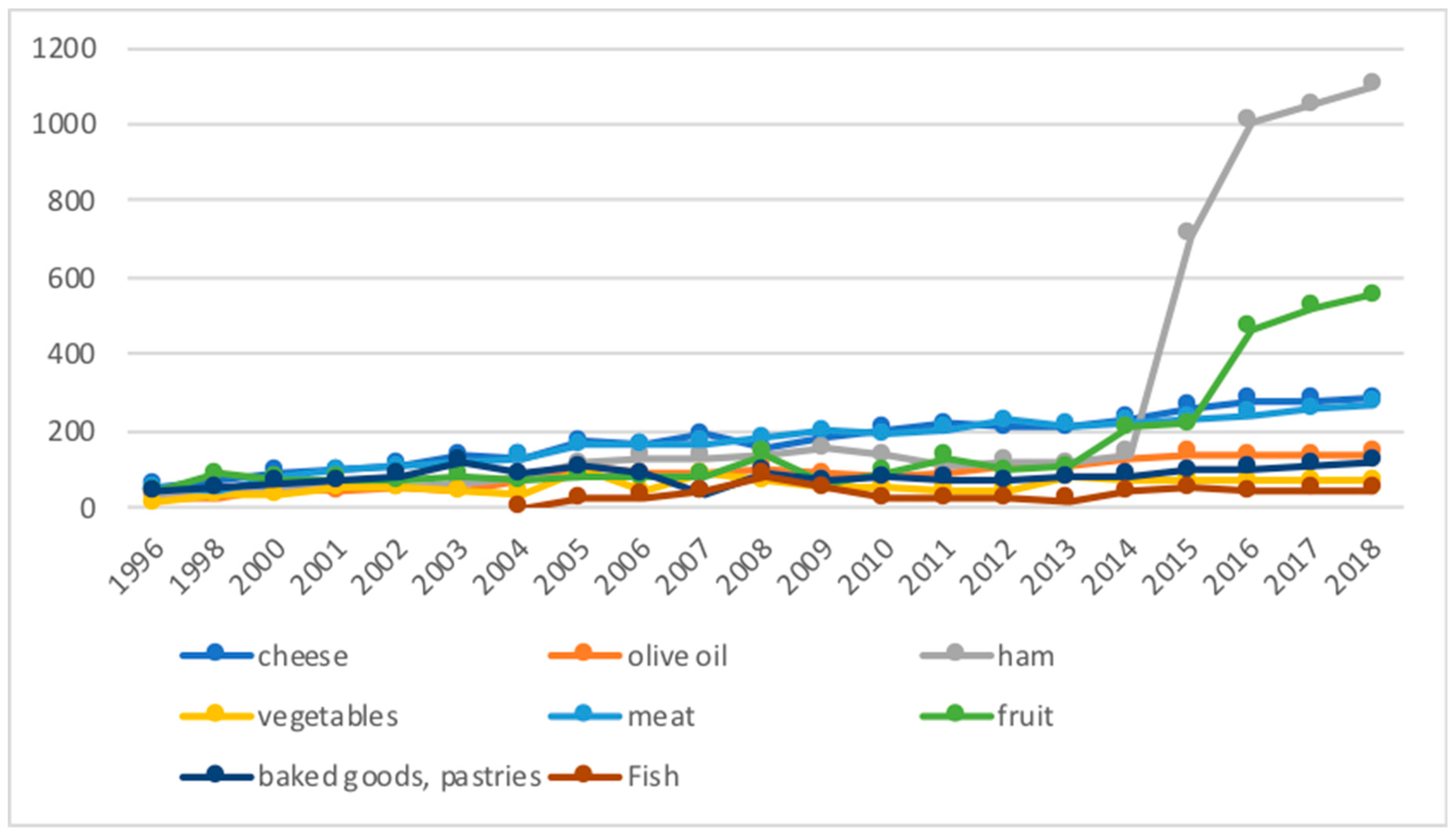

Analyzing the evolution of the main food products covered by PDOs and PGIs, the rapid growth of ham sales stood out; in 1996, only 34 million euros worth of ham was sold, while in little more than 20 years (2018), the sales rose to 1006.94 million euros, increasing by more than 288%. These findings indicate that the product is of high quality and is in great demand by the end consumers, and these are potential ham tourists because they are interested in the processes of its preparation (

Figure 7).

The destination for most of these products (

Figure 8) is the national market with more than 90% used for domestic market consumption, except for cheeses where 42.21% of the revenue comes from exports, followed by oil with 23.63%. Ham occupies the fifth place with respect to exports and domestic consumption with 16.57%, with the foreign market being a potential route that should be strengthened.

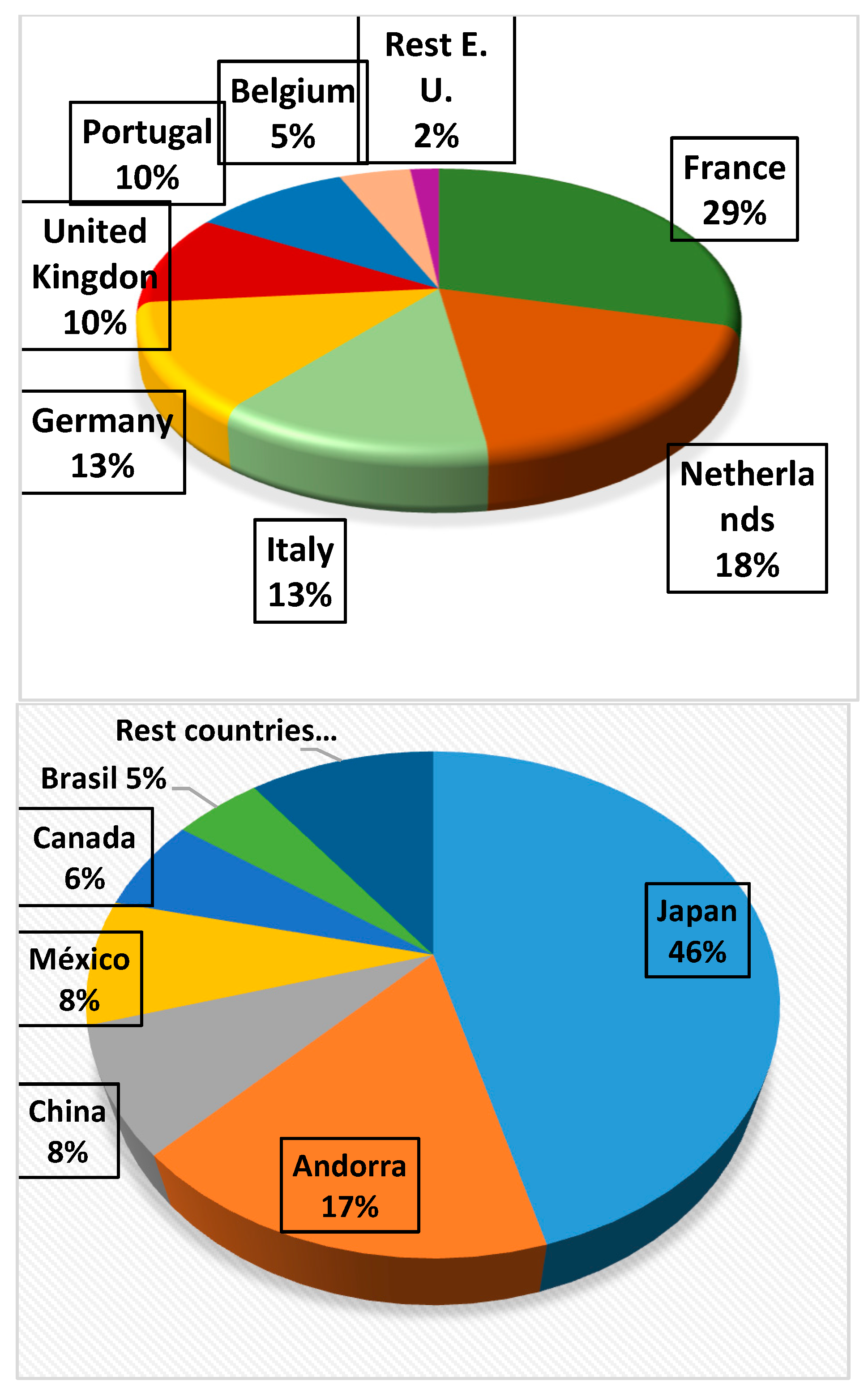

Analyzing the foreign market of the 23,023 hams sold in 2018: 14,438 corresponded to countries of the EU (62.27%), and the other 37.73% corresponded to other countries of the world (8585 hams).

Within the EU, France stands out with a 29% share of the purchases of hams, followed by the Netherlands with 18% and Italy with 13% (

Figure 9). With respect to the rest of the countries of the world, the main consumers are Japan (46%), Andorra (17%), and China and Mexico (each with 8%).

Therefore, Iberian ham is an increasingly desired product in international markets, with Spain being a country that could offer ham tourism within the gastronomic tourism sector, an initiative already launched by the Ministry of Agriculture, Food and Environment in 2013 with the project ‘Rutas del Jamón Ibérico: Implantación del club de product (Iberian ham routes: Implementation of the product club)’, with the aim to strengthen tourism and job creation in rural areas.

This initiative consists of a tourism experience for the populations with PDOs of Iberian ham (Guijuelo, Los Pedroches, Jamón de Huelva, and Dehesa de Extremadura) that demonstrate the production process of this product, its local landscape, and its context, in addition to recommended establishments for tasting.

The interregional project is developed in the 4 autonomous communities with ham PDOs, Castilla-León, Andalusia, Aragón, and Extremadura. The main objectives of the project, endowed with a subsidy of 320,000 euros from the ministry, were as follows: job creation, especially among the most disadvantaged groups in the rural world, that is, women and youth; avoiding the depopulation of these areas, as well as the conservation of biodiversity of habitats of community interest, such as the dehesas for livestock; and the development of tourism and the rural economy.

Like many initiatives, this project’s effectiveness has not been measured; therefore, the outcome of the project remains unknown. Only the private initiative and effort of the PDOs provide some information on this subject. Hence, there is a need for studies such as the one proposed in this research.

2.3. Methodology

To analyze the demand of ham tourism in Andalusia, two techniques are applied in this study:

The first technique is quantitative, based on a random sampling obtained by using a questionnaire addressed to ham tourists in Andalusia. The technical data of the survey is provided in

Table 2.

The design of the questionnaire consisted of 25 questions with dichotomous answers, Likert scales, and open responses along the lines of the following five sections:

Ham tourist socioeconomic profile: gender, age, educational level, family status, monthly income, etc.

Itinerary characteristics: price, how one learned of it, where purchased, etc.

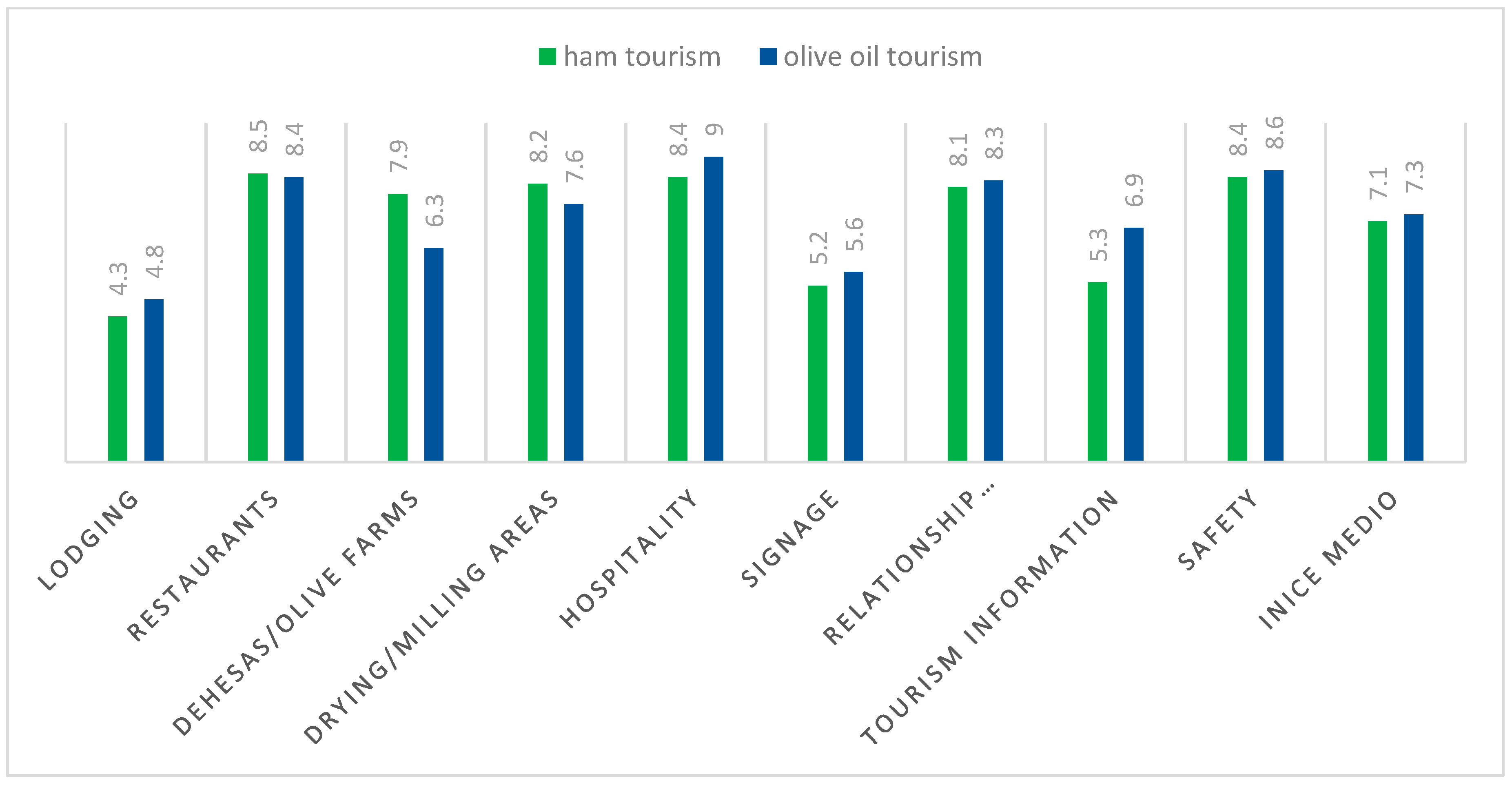

Valuations and opinions of the itinerary: accommodations, restaurants, roads, signage, customer care, etc.

Degree of satisfaction with the product: visit to the dehesas, ham drying areas, ham museums, etc.

Knowledge of the world of ham: regular ham consumption, distinguishing between Iberian ham and serrano ham, etc.

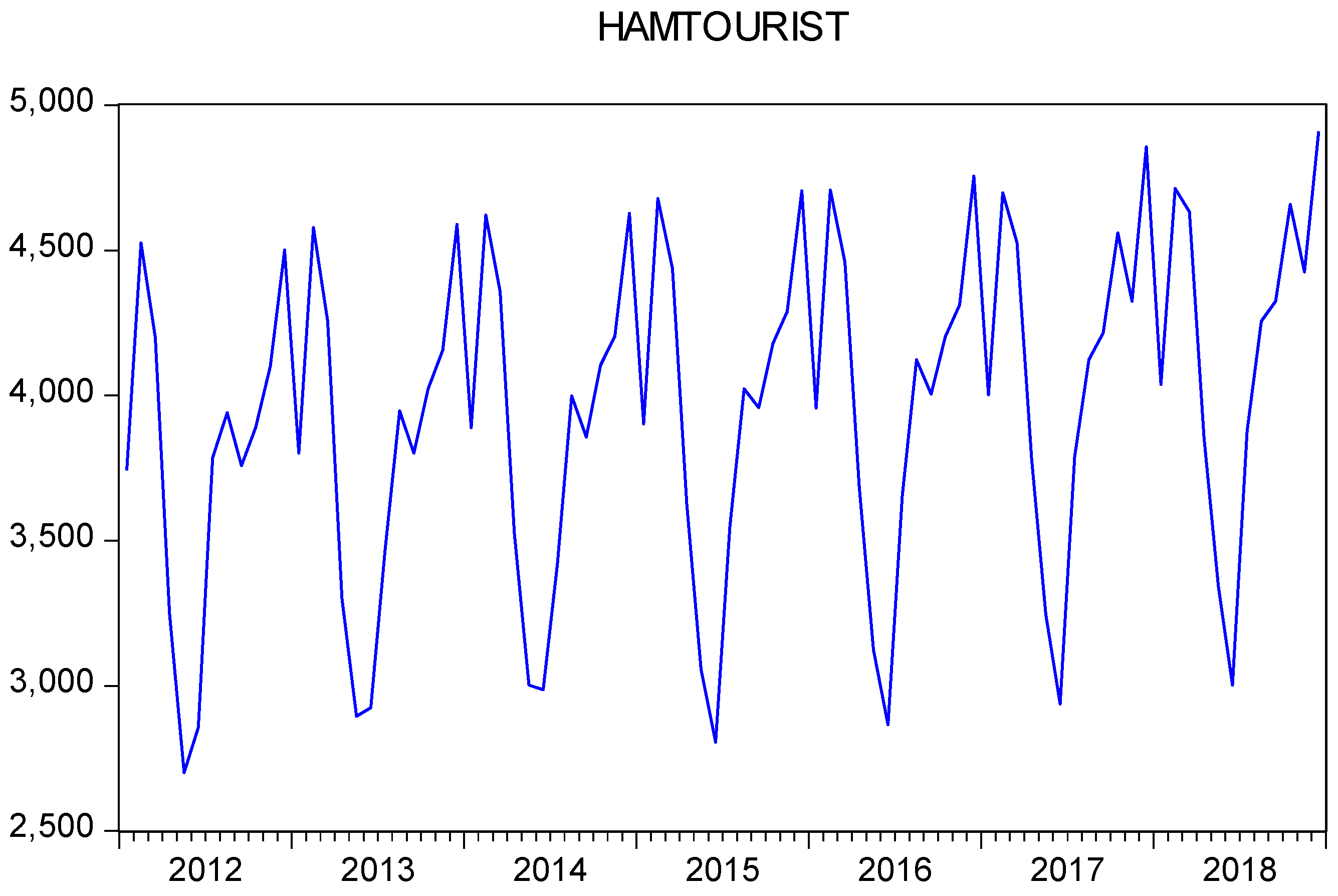

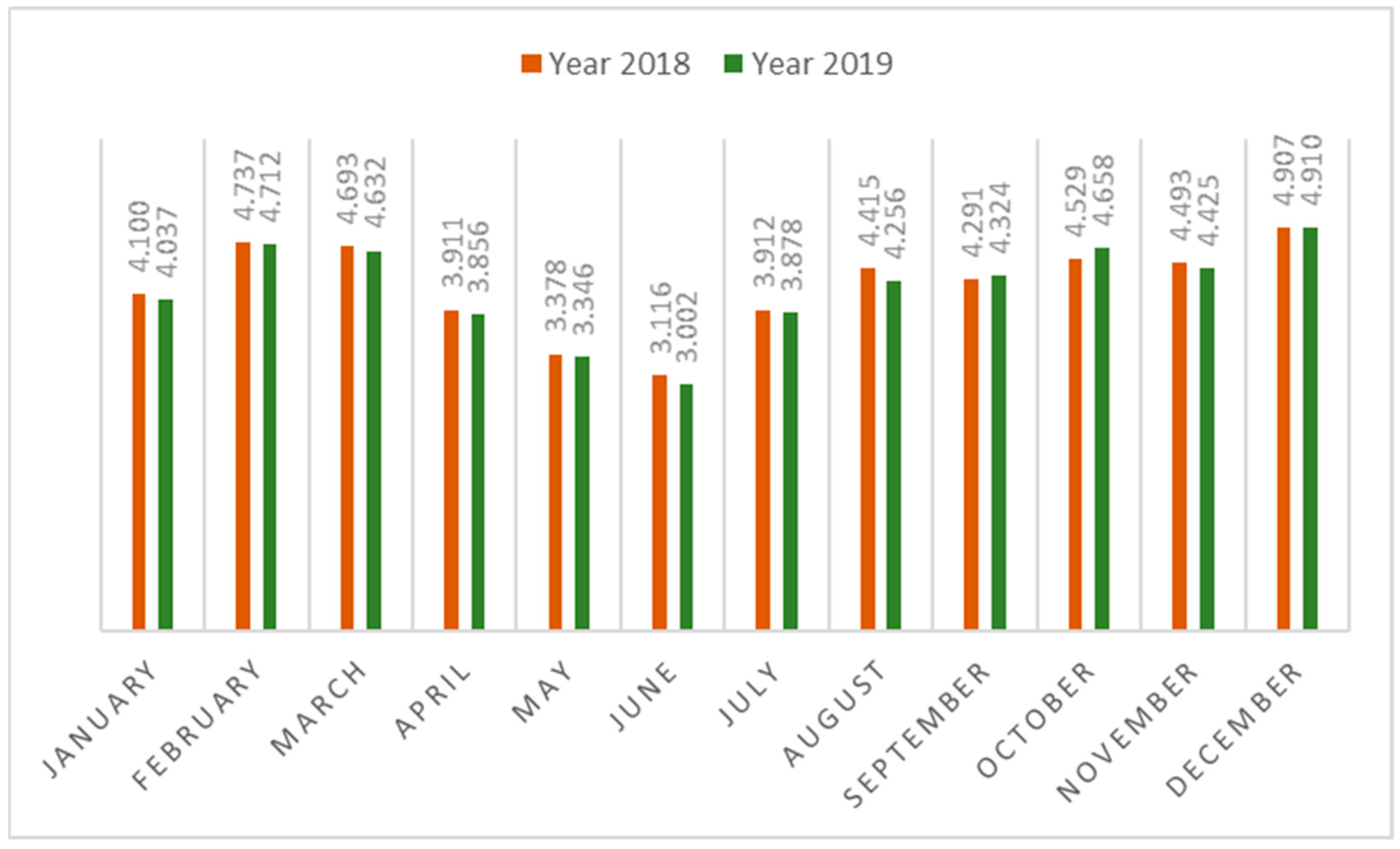

The second technique attempts to determine a model of the ham tourist in Andalusia based on a sampling (84 data) collected from January 2012 to December 2018, based on the Box–Jenkins (BJ) methodology, using ARIMA models. According to Gujarati [

28], the facilitating factor of this prediction method is in an analysis of the probabilistic, or stochastic, properties of the economic time series themselves (in this case, the number of ham tourists in Andalusia). In the time series models (BJ), the ham tourist variable can be explained over time by its past or lag values and by the stochastic error terms, giving ARIMA models an advantage of being less costly in data collection, requiring only historical observations of the data. In contrast, the main limitation of being a univariate analysis is that it does not recognize any causal relationship with the behaviour of other endogenous variables or information related to the behaviour of other explanatory variables.

Time series models have been widely used in forecasting tourism demand with a predominance of ARIMA models [

29]. According to published studies by Song and Li [

30], the different versions of the ARIMA models proposed by Box and Jenkins [

31] to identify, estimate, and diagnose dynamic models of time series, have been applied in most post-2000 studies that used time series forecasting techniques. In the case of seasonal time series analysis, these models are called SARIMA, and they are differentiated from stationary ARIMA models in that the latter consider the mean of the series constant over time, and the correlation function depends on the lag and not on the time in which it is calculated. However, the time series, in addition to random, cyclical, and seasonal variations, present a trend and seasonal components (the mean varies over time and by seasons), which makes the stationary processes unsuitable for modelling. For this reason, integrated models are introduced, thus eliminating the trend and seasonal component through these models.

The SARIMA models (p,d,q) × (P,D,Q)s are described by the following expression:

where the operators introduced in the formulas are Yt (series observed, in our case is the tourism demand of ham), Λ (represents the correction of the trend in variance of the series), Z t (series de-seasonalized and without trend, that is, is stationary), B (lag operator), (1 − B) (typical difference operator), B

s (seasonal lag operator, (1 − B

s): seasonal difference operator). The difference operators and seasonal difference operators, in general, eliminate trends and the seasonal components of the series, respectively. φ(B) is the auto-regressive polynomial of order p, corresponding to the ordinary part of the series; θ(B) is the polynomial of moving averages of order q, corresponding to the ordinary part of the series; Φ(B

s) is the p-order auto-regressive polynomial, corresponding to the seasonal part of the series; Θ(B

s) is the polynomial of moving averages of order Q, corresponding to the seasonal part of the series; a

t is the disturbance of the model; and D is the number of times the seasonal difference operators and typical difference are applied to the original series to make it stationary.

In the ARIMA and SARIMA models, the behavior of a time series is explained from the past observations of the series itself and from the past forecasting errors. Several studies have shown how ARIMA models and their different variants obtain good results in forecasting tourism demand and, in most cases, surpass other time series methods, such as the periodic auto-regression model [

32,

33], moving averages [

34], smoothed exponential [

35], non-causal basic structural model [

36], and multivariate adaptive regression splines [

37], based on these authors who support the use of ARIMA models for predicting tourism demand, has served as an argument in this study to use the models in predicting ham tourism demand. These ARIMA models have the limitation of only detecting linear relationships and assume a probabilistic distribution of the data [

38]; they do comply with the validation tests such as the Dickey–Fuller test for unit roots and with the absence of conditioned heteroscedasticity through ARCH (auto-regressive conditional heteroscedastic) models. This explains why the temporal stability of the set of causal factors that operate on the dependent variable is the key element on which the predictions are articulated through time series [

39].