Does Environmental Tax Affect Energy Efficiency? An Empirical Study of Energy Efficiency in OECD Countries Based on DEA and Logit Model

Abstract

1. Introduction

2. Literature Review

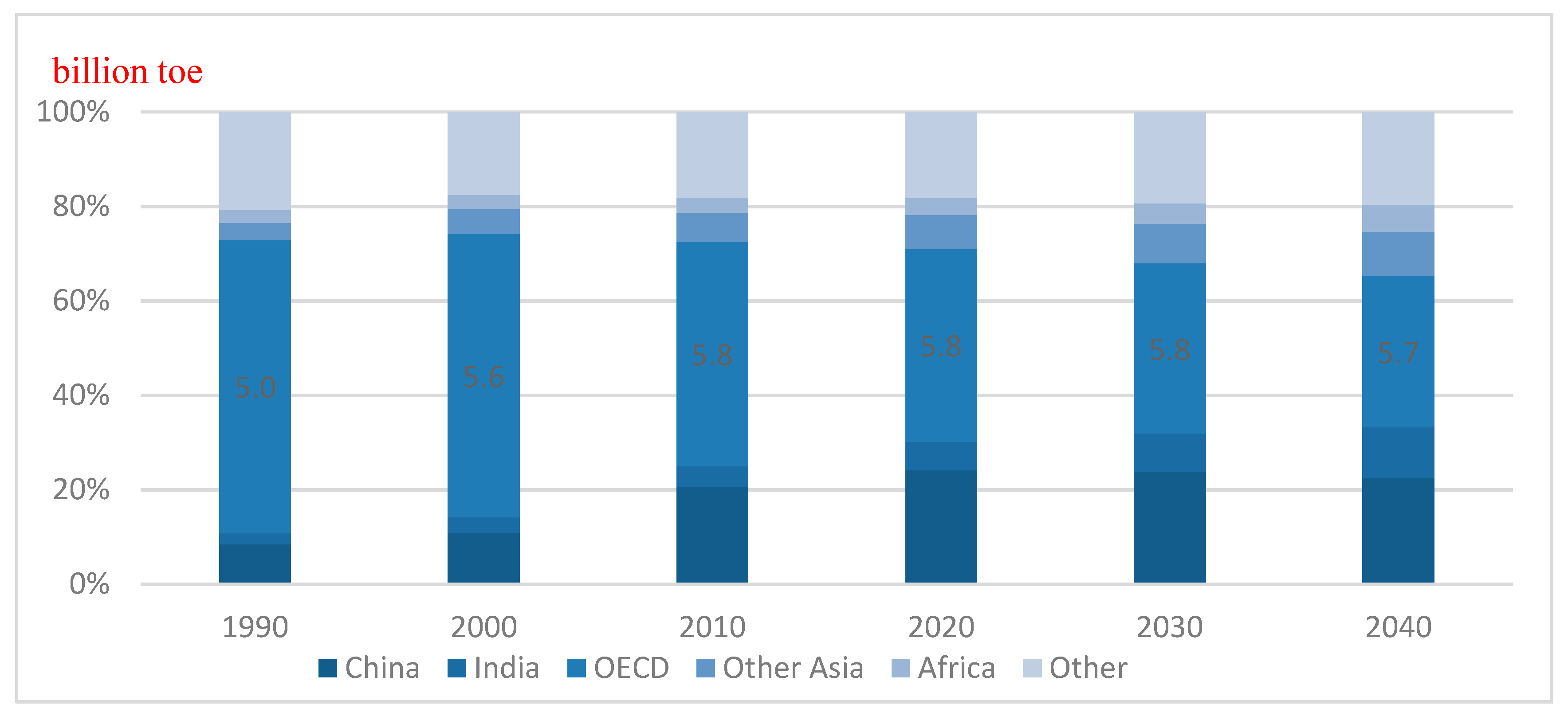

3. Data, Samples and Models

4. Empirical Results and Analysis

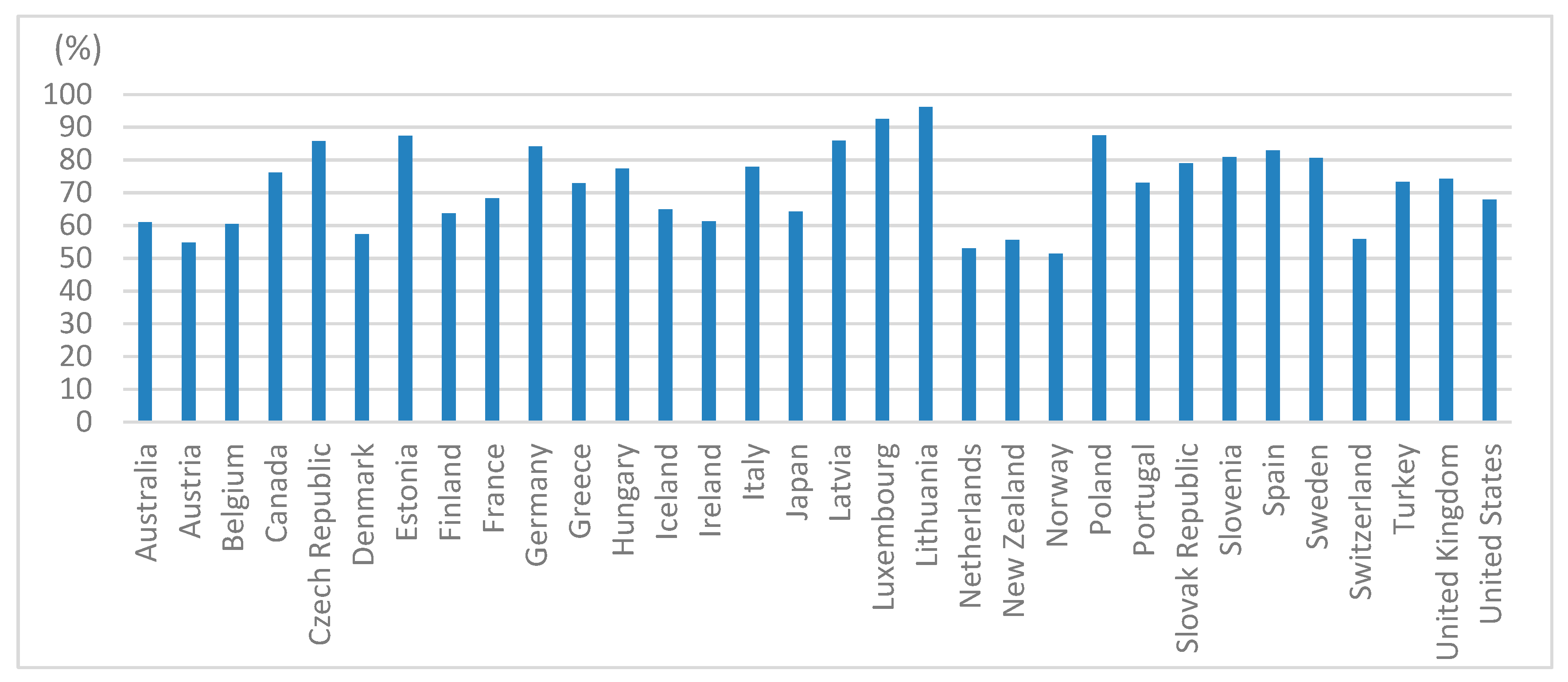

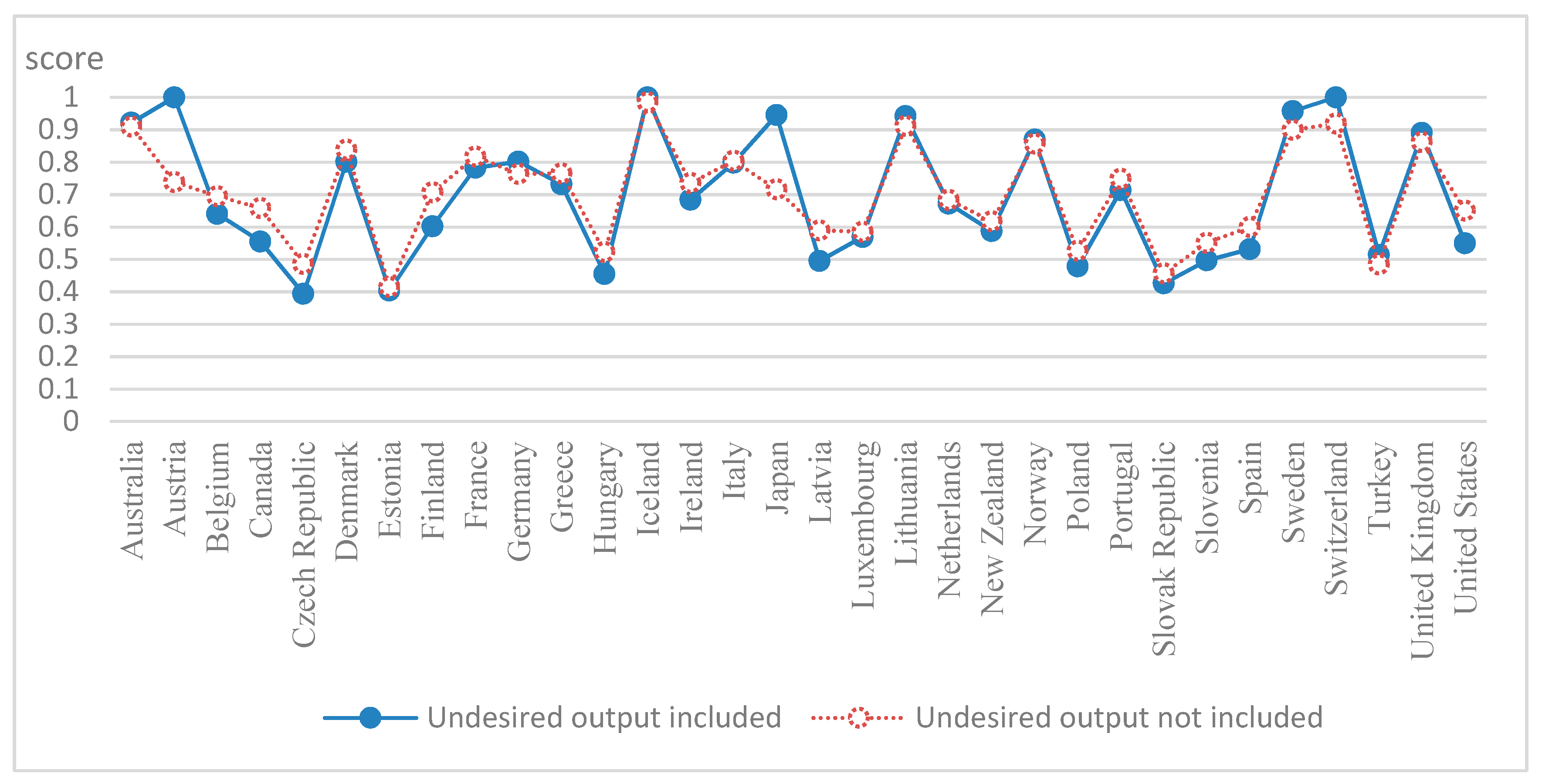

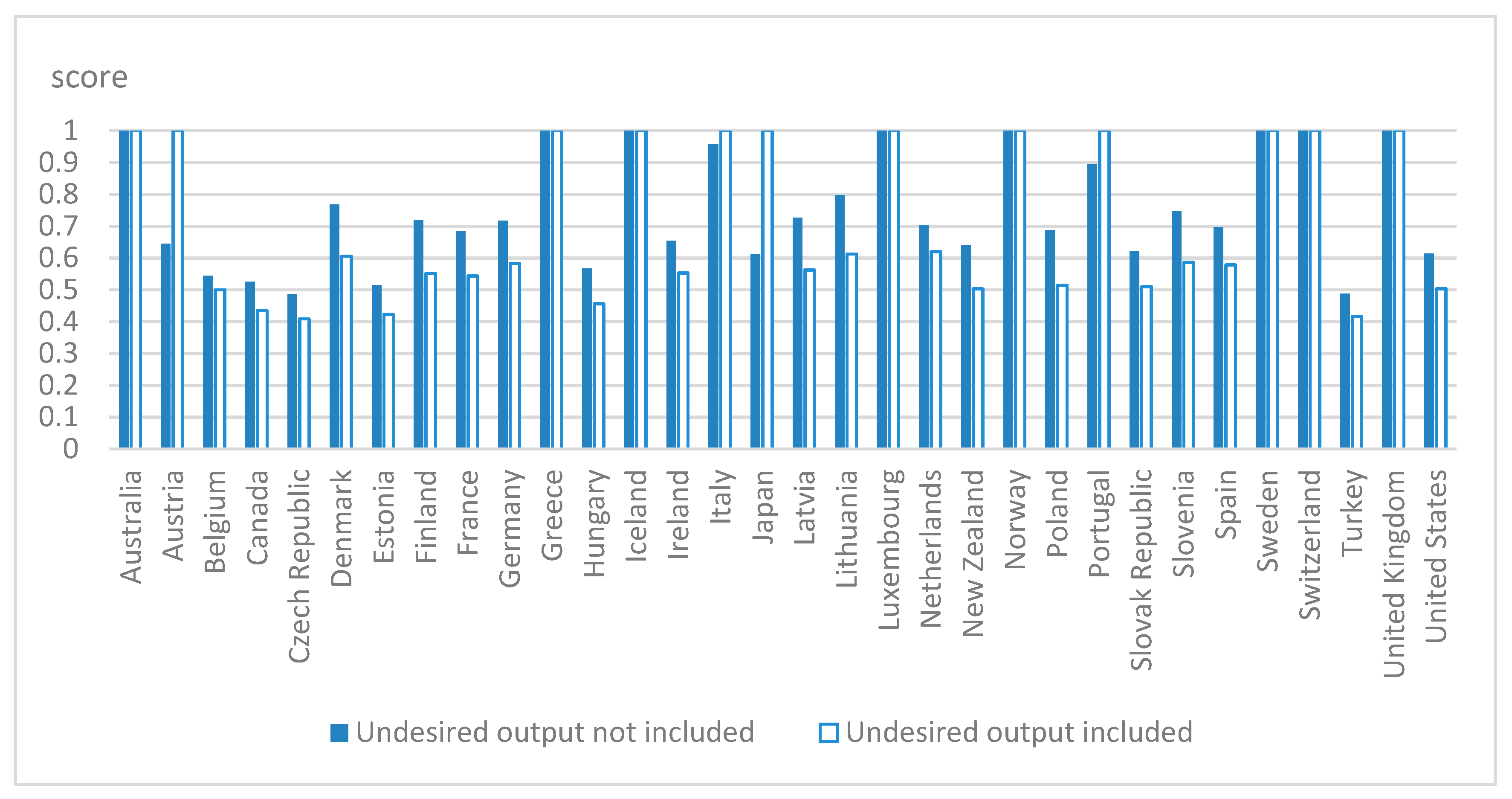

4.1. Efficiency Value Analysis

4.2. Projection Value Analysis

4.3. Energy Tax and Energy Efficiency

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Freire-González, J.; Puig-Ventosa, I. Reformulating taxes for an energy transition. Energy Econ. 2019, 78, 312–323. [Google Scholar] [CrossRef]

- Pearce, D. The political economy of an energy tax: The United Kingdom’s Climate Change Levy. Energy Econ. 2006, 28, 149–158. [Google Scholar] [CrossRef]

- Vlahinić-Dizdarević, N.; Šegota, A. Total-factor energy efficiency in the EU countries. Soc. Sci. Electron. Publ. 2012, 30, 247–265. [Google Scholar]

- Hu, J.L.; Wang, S.C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Zhang, J.J.; Joglekar, N.R.; Verma, R. Exploring Resource Efficiency Benchmarks for Environmental Sustainability. Cornell Hosp. Q. 2012, 53, 229–241. [Google Scholar] [CrossRef]

- Li, F.; Zhang, J.D.; Jiang, W.; Liu, C.Y.; Zhang, Z.M.; Zhang, C.D.; Zeng, G.M. Spatial health riskassessment and hierarchical risk management for mercury in soils from a typical contaminated site. China Environ. Geochem. Health 2017, 39, 923–934. [Google Scholar] [CrossRef] [PubMed]

- Li, F.; Zhang, J.D.; Liu, C.Y.; Xiao, M.; Wu, Z. Distribution, bioavailability and probabilistic integratedecological risk assessment of heavy metals in sediments from Honghu Lake. China Process Saf. Environ. Prot. 2018, 116, 169–179. [Google Scholar] [CrossRef]

- Li, F.; Zhang, J.D.; Liu, W.; Liu, J.; Huang, J.; Zeng, G. An exploration of an integrated stochastic-fuzzypollution assessment for heavy metals in urban topsoil based on metal enrichment and bioaccessibility. Sci. Total Environ. 2018, 644, 649–660. [Google Scholar] [CrossRef]

- Cheng, L.; Liu, J. Modeling Undesirable Factors in the Measurement of Energy Efficiency in China. In Proceedings of the 2009 International Conference on Management & Service Science, Wuhan, China, 20–22 September 2009. [Google Scholar]

- Vencheh, A.H.; Matin, R.K.; Kajani, M.T. Undesirable factors in efficiency measurement. Appl. Math. Comput. 2005, 163, 547–552. [Google Scholar] [CrossRef]

- Bian, Y.; Liang, N.; Xu, H. Efficiency evaluation of Chinese regional industrial systems with undesirable factors using a two-stage slacks-based measure approach. J. Clean. Prod. 2015, 87, 348–356. [Google Scholar] [CrossRef]

- Zeng, J.; Liu, Y.; Feiock, R.; Li, F. The impacts of China’s provincial energy policies on major air pollutants: a spatial econometric analysis. Energ. Policy 2019, 132, 392–403. [Google Scholar] [CrossRef]

- Bretschger, L.; Zurich, E. Sustainability economics, resource efficiency, and the Green New Deal. Int. Econ. Econ. Policy 2010, 7, 187–202. [Google Scholar] [CrossRef]

- Conrad, K. Energy Tax and Competition in Energy Efficiency: The Case of Consumer Durables. Environ. Resour. Econ. 2000, 15, 159–177. [Google Scholar] [CrossRef]

- Goulder, L.H. Energy Taxes: Traditional Efficiency Effects and Environmental Implications. Tax Policy Econ. 1994, 8, 105–158. [Google Scholar] [CrossRef][Green Version]

- Guo, J.Y.; Jiang, S.L.; Pang, Y.J. Rice straw biochar modified by aluminum chloride enhances the dewatering of the sludge from municipal sewage treatment plant. Sci. Total Environ. 2019, 654, 338–344. [Google Scholar] [CrossRef] [PubMed]

- Guo, J.Y.; Chen, C.; Jiang, S.L.; Zhou, Y.L. Feasibility and mechanism of combined conditioning with coagulant and flocculant to enhance sludge dewatering. ACS Sustain. Chem. Eng. 2018, 6, 10758–10765. [Google Scholar] [CrossRef]

- Abolhosseini, S.; Heshmati, A.; Altmann, J. The Effect of Renewable Energy Development on Carbon Emission Reduction: An Empirical Analysis for the EU-15 Countries. IZA Discussion Paper No. 7989. Available online: https://ssrn.com/abstract=2403126 (accessed on 1 March 2014).

- Bjorner, T.B.; Jensen, H.H. Energy taxes, voluntary agreements and investment subsidies—A micro-panel analysis of the effect on Danish industrial companies’ energy demand. Resour. Energy Econ. 2002, 24, 229–249. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. An epsilon-based measure of efficiency in DEA revisited—A third pole of technical efficiency. Eur. J. Oper. Res. 2010, 207, 1554–1563. [Google Scholar] [CrossRef]

- Yazdanie, M.; Densing, M.; Wokaun, A. Cost optimal urban energy systems planning in the context of national energy policies: A case study for the city of Basel. Energy Policy 2017, 110, 176–190. [Google Scholar] [CrossRef]

- Barbier, E.B. Endogenous Growth and Natural Resource Scarcity. Environ. Resour. Econ. 1999, 14, 51–74. [Google Scholar] [CrossRef]

| Variable | Calculation Method | Data Source | ||

|---|---|---|---|---|

| EBM-DEA Model | Input variables | Coal consumption | Million tones oil equivalent | BP Oil Company Open Data |

| Oil consumption | Million tonnes | BP Oil Company Open Data | ||

| Gas consumption | Billion cubic meters | BP Oil Company Open Data | ||

| Human resources | Total Labor Force, Millions | World Bank Database | ||

| Capital | Total Capital Formation, Current Millions of Dollars | World Bank Database | ||

| Output variables | Gross Domestic Product | US Dollar, Millions | World Bank Database | |

| Sulfur Oxides | Tonnes, Thousands | OECD Database | ||

| Nitrogen Oxide | Tonnes, Thousands | OECD Database | ||

| Carbon Monoxide | Tonnes, Thousands | OECD Database | ||

| Carbon Dioxide | Tonnes of CO2 equivalent, Thousands | World Bank Database | ||

| Methane | Tonnes of CO2 equivalent, Thousands | OECD Database | ||

| Panel Logit Model | Dependent variable | Energy Efficiency without Unexpected Output-Coal | Target consumption/Actual consumption | DEA model calculation |

| Energy Efficiency without Unexpected Output-Oil | Target consumption/Actual consumption | DEA model calculation | ||

| Energy Efficiency without Unexpected Output-Gas | Target consumption/Actual consumption | DEA model calculation | ||

| Energy Efficiency Including Unexpected Output-Coal | Target consumption/Actual consumption | DEA model calculation | ||

| Energy Efficiency Including Unexpected Output-Oil | Target consumption/Actual consumption | DEA model calculation | ||

| Energy Efficiency Including Unexpected Output-Gas | Target consumption/Actual consumption | DEA model calculation | ||

| independent variable | ENE_TAX | Energy Tax/Total Environmental Tax Revenue | OECD Database | |

| ENE_TAX(GDP) | Energy Tax/GDP | OECD Database | ||

| ENE_TAX (Total) | Energy Tax/ Total Tax Revenue | OECD Database | ||

| Control variable | Energy price | energy CPI | World Bank Database | |

| Energy structure | Fossil fuel energy consumption /total energy consumption | World Bank Database | ||

| Environmental protection technology | Environmental Protection Technology/Total Technology | OECD Database | ||

| Industrial structure | Industrial added value/GDP | World Bank Database |

| Decision Making Unit | Slack Variable | Residual Variable | ||||

|---|---|---|---|---|---|---|

| Australia | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Austria | −2.453 | 0.000 | −3.732 | −1.526 | 0.000 | 0.000 |

| Belgium | −1.911 | −3.140 | −5.873 | −1.597 | 0.000 | 0.000 |

| Canada | −13.918 | −11.977 | −66.259 | −8.437 | 0.000 | 0.000 |

| Czech Republic | −11.090 | 0.000 | 0.000 | −1.373 | 0.000 | 0.000 |

| Denmark | −1.861 | 0.000 | −0.780 | −1.038 | 0.000 | 0.000 |

| Estonia | −2.921 | −0.009 | −0.031 | −0.420 | 0.000 | 0.000 |

| Finland | −3.970 | −3.119 | 0.000 | −1.034 | 0.000 | 0.000 |

| France | −6.175 | 0.000 | −18.532 | −12.405 | 0.000 | 0.000 |

| Germany | −70.194 | 0.000 | −46.858 | −22.857 | 0.000 | 0.000 |

| Greece | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Hungary | −1.390 | −2.580 | −4.113 | −2.391 | 0.000 | 0.000 |

| Iceland | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Ireland | −1.402 | 0.000 | −1.627 | 0.000 | −13369.696 | 0.000 |

| Italy | −2.046 | −2.943 | −10.740 | −0.867 | 0.000 | 0.000 |

| Japan | −99.700 | 0.000 | −50.065 | −28.371 | 0.000 | 0.000 |

| Latvia | −0.013 | −0.410 | −0.860 | −0.828 | 0.000 | 0.000 |

| Luxembourg | −0.052 | −1.608 | −1.071 | −1.050 | 0.000 | 0.000 |

| Lithuania | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Netherlands | −8.909 | −1.580 | −21.076 | −4.603 | 0.000 | 0.000 |

| New Zealand | −0.924 | 0.000 | −2.182 | −1.119 | 0.000 | 0.000 |

| Norway | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Poland | −43.906 | 0.000 | −9.158 | −12.793 | 0.000 | 0.000 |

| Portugal | −1.175 | 0.000 | −1.132 | −2.339 | 0.000 | 0.000 |

| Slovak Republic | −2.317 | −0.409 | −0.752 | −1.060 | 0.000 | 0.000 |

| Slovenia | −1.076 | −0.428 | −0.159 | −0.752 | 0.000 | 0.000 |

| Spain | −8.550 | −0.897 | −8.560 | −15.018 | 0.000 | 0.000 |

| Sweden | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Switzerland | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Turkey | −25.096 | 0.000 | −6.734 | −12.195 | 0.000 | 0.000 |

| United Kingdom | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| United States | −280.141 | 0.000 | −411.090 | −55.094 | 0.000 | 0.000 |

| Decision Making Unit | Slack Variable | Residual Variable | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Austria | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Belgium | −1.91 | −3.14 | −5.87 | −1.60 | 0.00 | −1877.56 | −20.50 | −8333.42 | −81.72 | −1199.61 | 0.00 |

| Canada | −13.92 | −11.98 | −66.26 | −8.44 | 0.00 | −21382.73 | −820.84 | −159181.11 | −4001.69 | −60806.26 | 0.00 |

| Czech Republic | −13.06 | 0.00 | −4.39 | −3.10 | 0.00 | −3692.89 | −101.64 | −55901.45 | −559.28 | −9240.38 | 0.00 |

| Denmark | −2.03 | −3.22 | −1.86 | −1.00 | 0.00 | −4229.34 | −6.18 | −18512.78 | −175.73 | −4776.85 | 0.00 |

| Estonia | −2.92 | −0.01 | −0.03 | −0.42 | 0.00 | −546.00 | −23.99 | −13269.96 | −89.58 | −562.93 | 0.00 |

| Finland | −4.27 | −6.15 | −0.92 | −1.02 | 0.00 | −3822.93 | −38.61 | −30951.20 | −271.95 | −3138.91 | 0.00 |

| France | −7.55 | −38.45 | −32.36 | −12.30 | 0.00 | −32648.48 | −131.69 | −167077.46 | −1991.28 | −38927.21 | 0.00 |

| Germany | −74.58 | −35.72 | −60.77 | −23.05 | 0.00 | −25983.15 | −313.76 | −456592.17 | −1866.99 | −29322.45 | 0.00 |

| Greece | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Hungary | −1.88 | −0.87 | −6.49 | −3.53 | 0.00 | −3126.36 | −17.28 | −17193.68 | −350.54 | −5342.00 | 0.00 |

| Iceland | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Ireland | −1.94 | −2.30 | −3.28 | 0.00 | −26906.29 | −5133.90 | −10.81 | −19723.31 | −25.29 | −10397.93 | 0.00 |

| Italy | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Japan | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Latvia | −0.02 | −0.71 | −0.99 | −0.86 | 0.00 | −1683.89 | −3.25 | −3463.50 | −132.84 | −1681.95 | 0.00 |

| Luxembourg | −0.05 | −1.61 | −1.07 | −1.05 | 0.00 | −2836.03 | −12.26 | −3657.79 | −128.44 | −2713.74 | 0.00 |

| Lithuania | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Netherlands | −9.69 | −12.46 | −25.80 | −4.58 | 0.00 | −4391.22 | −12.65 | −91506.25 | −261.52 | −10704.96 | 0.00 |

| New Zealand | −1.13 | −4.46 | −3.86 | −1.12 | 0.00 | −8210.09 | −70.13 | −23004.99 | −631.50 | −32267.21 | 0.00 |

| Norway | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Poland | −47.42 | −5.21 | −10.65 | −15.39 | 0.00 | −16398.81 | −677.96 | −196408.58 | −2132.97 | −39254.49 | 0.00 |

| Portugal | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Slovak republic | −2.93 | 0.00 | −3.09 | −2.03 | 0.00 | −1381.87 | −39.99 | −14189.94 | −199.65 | −2993.19 | 0.00 |

| Slovenia | −1.08 | −0.43 | −0.16 | −0.75 | 0.00 | −484.54 | −8.61 | −4164.71 | −83.46 | −1512.26 | 0.00 |

| Spain | −9.78 | −24.12 | −16.73 | −15.60 | 0.00 | −10926.97 | −225.20 | −119694.07 | −1222.09 | −24237.56 | 0.00 |

| Sweden | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Switzerland | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Turkey | −29.92 | 0.00 | −23.56 | −19.01 | 0.00 | −18348.35 | −1689.41 | −122422.60 | −1174.42 | −36496.96 | 0.00 |

| United Kingdom | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| United States | −280.14 | 0.00 | −411.09 | −55.09 | 0.00 | −219419.38 | −3171.10 | −1671439.35 | −36102.14 | −394404.39 | 0.00 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX | −0.020 *** | −0.018 *** | −0.019 *** | −0.001 | 0.005 | −0.004 |

| ENE_STR | −0.009 ** | −0.008 ** | −0.006 | −0.016 *** | −0.023 *** | −0.015 *** |

| ENE_P | 0.004 | 0.002 | 0.001 | 0.004 | −0.011 | 0.009 |

| ENE_TECH | 0.068 *** | 0.064 *** | 0.083 *** | 0.041 * | 0.091 *** | 0.036 * |

| IND_STR | 0.036 *** | 0.038 *** | 0.023 * | −0.001 | 0.020 | 0.007 |

| Mean dependent var | 0.397 | 0.437 | 0.395 | 0.315 | 0.497 | 0.305 |

| S.E. of regression | 0.478 | 0.487 | 0.480 | 0.455 | 0.483 | 0.456 |

| Sum squared resid | 140.468 | 145.961 | 137.029 | 127.398 | 143.564 | 123.561 |

| Log likelihood | −400.276 | −411.542 | −389.577 | −371.851 | −406.404 | −360.921 |

| Deviance | 800.553 | 823.083 | 779.153 | 743.702 | 812.808 | 721.843 |

| Avg. log likelihood | −0.646 | −0.664 | −0.649 | −0.600 | −0.655 | −0.602 |

| S.D. dependent var | 0.490 | 0.496 | 0.489 | 0.465 | 0.500 | 0.461 |

| Akaike info criterion | 1.307 | 1.344 | 1.315 | 1.216 | 1.327 | 1.220 |

| Schwarz criterion | 1.343 | 1.379 | 1.352 | 1.251 | 1.363 | 1.256 |

| Hannan−Quinn criter. | 1.321 | 1.358 | 1.330 | 1.230 | 1.341 | 1.234 |

| Restr. deviance | 832.886 | 849.664 | 805.119 | 772.107 | 859.477 | 738.050 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX(Total) | −0.022 ** | −0.105 * | −0.028 ** | −0.161 *** | −0.006 | −0.068 |

| ENE_STR | −0.008 ** | −0.018 *** | −0.013 *** | −0.009 ** | −0.011 | −0.016 *** |

| ENE_P | −0.004 | −0.014 | −0.003 | −0.005 | −0.007 | 0.002 |

| ENE_TECH | 0.039 ** | 0.028 | 0.105 *** | 0.034 * | 0.032 | 0.022 |

| IND_STR | 0.011 | 0.084 *** | 0.009 | −0.014 | 0.133 *** | 0.041 *** |

| Mean dependent var | 0.480 | 0.810 | 0.572 | 0.543 | 0.931 | 0.594 |

| S.E. of regression | 0.498 | 0.384 | 0.483 | 0.493 | 0.252 | 0.484 |

| Sum squared resid | 152.545 | 91.022 | 139.244 | 149.788 | 39.226 | 139.559 |

| Log likelihood | −425.111 | −288.409 | −395.147 | −419.913 | −147.519 | −394.809 |

| Deviance | 850.221 | 576.817 | 790.296 | 839.825 | 295.039 | 789.618 |

| Avg. log likelihood | −0.685 | −0.464 | −0.657 | −0.676 | −0.238 | −0.657 |

| S.D. dependent var | 0.500 | 0.393 | 0.495 | 0.499 | 0.254 | 0.491 |

| Akaike info criterion | 1.385 | 0.945 | 1.332 | 1.368 | 0.491 | 1.330 |

| Schwarz criterion | 1.421 | 0.981 | 1.368 | 1.404 | 0.527 | 1.367 |

| Hannan-Quinn criter. | 1.399 | 0.959 | 1.346 | 1.382 | 0.505 | 1.345 |

| Restr. deviance | 859.882 | 603.918 | 820.525 | 856.360 | 312.583 | 811.790 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX(GDP) | −0.303 ** | −0.232 * | −0.228 * | −0.050 | −0.319 ** | −0.020 |

| ENE_STR | −0.011 *** | −0.011 *** | −0.009 ** | −0.016 *** | −0.024 *** | −0.016 *** |

| ENE_P | 0.001 | −0.001 | −0.003 | 0.003 | −0.012 | 0.007 |

| ENE_TECH | 0.050 *** | 0.045 ** | 0.062 *** | 0.037 * | 0.089 *** | 0.031 |

| IND_STR | 0.017 | 0.019 * | 0.003 | −0.005 | 0.016 | −0.000 |

| Mean dependent var | 0.398 | 0.438 | 0.396 | 0.316 | 0.498 | 0.306 |

| S.E. of regression | 0.482 | 0.491 | 0.485 | 0.456 | 0.482 | 0.457 |

| Sum squared resid | 143.198 | 148.513 | 140.031 | 128.043 | 142.900 | 124.328 |

| Log likelihood | −405.836 | −417.019 | −395.630 | −373.225 | −405.107 | −362.600 |

| Deviance | 811.672 | 834.037 | 791.259 | 746.449 | 810.215 | 725.200 |

| Avg. log likelihood | −0.654 | −0.672 | −0.659 | −0.601 | −0.652 | −0.603 |

| S.D. dependent var | 0.490 | 0.497 | 0.489 | 0.465 | 0.500 | 0.461 |

| Akaike info criterion | 1.323 | 1.359 | 1.333 | 1.218 | 1.321 | 1.223 |

| Schwarz criterion | 1.359 | 1.395 | 1.370 | 1.253 | 1.356 | 1.260 |

| Hannan−Quinn criter. | 1.337 | 1.373 | 1.347 | 1.232 | 1.335 | 1.238 |

| Restr. deviance | 834.732 | 851.317 | 806.974 | 774.417 | 860.874 | 740.421 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX | −0.103 *** | −0.141 * | −0.233 *** | −0.066 | −0.072 | −0.235 *** |

| ENE_STR | −0.024 ** | −0.060 ** | −0.078 * | −0.004 | −0.024 | −0.085 |

| ENE_P | −0.010 | 0.016 | 0.033 | 0.018 | 0.082 | 0.020 |

| ENE_TECH | 0.050 ** | 0.081 ** | 0.024 ** | 0.090 | 0.186 | 0.032 |

| IND_STR | 0.454 *** | 0.612 *** | 0.861 *** | 0.393 *** | 0.367 ** | 0.830 *** |

| Mean dependent var | 0.946 | 0.989 | 0.937 | 0.970 | 0.997 | 0.929 |

| S.E. of regression | 0.140 | 0.101 | 0.107 | 0.159 | 0.061 | 0.115 |

| Sum squared resid | 4.976 | 2.746 | 2.817 | 4.983 | 1.138 | 2.539 |

| Log likelihood | −22.025 | −8.736 | −11.441 | −14.272 | −4.701 | −10.435 |

| Deviance | 44.051 | 17.473 | 22.883 | 28.545 | 9.402 | 20.870 |

| Avg. log likelihood | −0.085 | −0.032 | −0.045 | −0.071 | −0.015 | −0.053 |

| S.D. dependent var | 0.226 | 0.104 | 0.244 | 0.171 | 0.057 | 0.258 |

| Akaike info criterion | 0.208 | 0.100 | 0.130 | 0.192 | 0.063 | 0.157 |

| Schwarz criterion | 0.276 | 0.166 | 0.200 | 0.274 | 0.123 | 0.240 |

| Hannan-Quinn criter. | 0.235 | 0.127 | 0.158 | 0.225 | 0.087 | 0.190 |

| Restr. deviance | 109.038 | 33.054 | 119.312 | 53.958 | 13.463 | 101.017 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX(Total) | −0.007 ** | −0.016 *** | −0.011 ** | −0.034 *** | −0.024 *** | −0.025 *** |

| ENE_STR | −0.001 ** | 0.001 * | −0.000 ** | −0.001 | 0.001 | −0.001 |

| ENE_P | −0.001 | −0.002 | −0.001 | −0.000 | −0.002 ** | −0.001 |

| ENE_TECH | 0.015 *** | 0.013 *** | 0.021 *** | 0.013 *** | 0.015 *** | 0.009 *** |

| IND_STR | 0.016 *** | 0.020 *** | 0.015 *** | 0.013 *** | 0.022 *** | 0.019 *** |

| Adjusted R−squared | −0.064 | −0.196 | −0.015 | −0.109 | −0.250 | 0.017 |

| S.E. of regression | 0.417 | 0.268 | 0.354 | 0.370 | 0.217 | 0.335 |

| Sum squared resid | 107.142 | 44.296 | 74.573 | 84.324 | 29.072 | 66.745 |

| Log likelihood | −335.558 | −61.307 | −225.693 | −261.196 | 69.449 | −192.367 |

| Durbin-Watson stat | 0.559 | 0.605 | 0.667 | 0.870 | 0.955 | 1.096 |

| Mean dependent var | 0.546 | 0.774 | 0.631 | 0.597 | 0.857 | 0.627 |

| S.D. dependent var | 0.404 | 0.245 | 0.351 | 0.351 | 0.194 | 0.338 |

| Akaike info criterion | 1.097 | 0.214 | 0.768 | 0.857 | −0.208 | 0.657 |

| Schwarz criterion | 1.132 | 0.249 | 0.804 | 0.893 | −0.172 | 0.693 |

| Hannan-Quinn criter. | 1.111 | 0.227 | 0.782 | 0.871 | −0.194 | 0.671 |

| Including Unexpected Outputs | Without Unexpected Outputs | |||||

|---|---|---|---|---|---|---|

| Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) | |

| Dependent variable: | EEC_COAL | EEC_OIL | EEC_GAS | EEN_COAL | EEN_OIL | EEN_GAS |

| ENE_TAX(GDP) | −0.216 ** | −0.204 * | −0.194 * | −0.043 | −0.284 ** | −0.017 |

| ENE_STR | −0.008 *** | −0.006 *** | −0.005 ** | −0.009 *** | −0.019 *** | −0.008 *** |

| ENE_P | 0.002 | −0.002 | −0.004 | 0.002 | −0.008 | 0.006 |

| ENE_TECH | 0.038 *** | 0.039 ** | 0.048 *** | 0.029 * | 0.072 *** | 0.027 |

| IND_STR | 0.009 | 0.011 * | 0.001 | −0.003 | 0.013 | −0.002 |

| Mean dependent var | 0.598 | 0.538 | 0.696 | 0.516 | 0.598 | 0.506 |

| S.E. of regression | 0.382 | 0.391 | 0.385 | 0.356 | 0.382 | 0.357 |

| Sum squared resid | 112.198 | 116.513 | 115.031 | 119.043 | 126.900 | 114.328 |

| Log likelihood | −305.432 | −317.126 | −295.361 | −273.612 | −315.421 | −262.152 |

| Deviance | 711.812 | 734.143 | 691.621 | 646.513 | 710.429 | 625.164 |

| Avg. log likelihood | −0.592 | −0.581 | −0.542 | −0.581 | −0.564 | −0.561 |

| S.D. dependent var | 0.368 | 0.387 | 0.368 | 0.359 | 0.462 | 0.471 |

| Akaike info criterion | 1.211 | 1.341 | 1.226 | 1.165 | 1.261 | 1.168 |

| Schwarz criterion | 1.263 | 1.371 | 1.278 | 1.181 | 1.261 | 1.179 |

| Hannan-Quinn criter. | 1.267 | 1.281 | 1.263 | 1.185 | 1.261 | 1.138 |

| Restr. deviance | 742.166 | 791.316 | 758.253 | 682.312 | 782.153 | 637.156 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, P.; Sun, Y.; Shen, H.; Jian, J.; Yu, Z. Does Environmental Tax Affect Energy Efficiency? An Empirical Study of Energy Efficiency in OECD Countries Based on DEA and Logit Model. Sustainability 2019, 11, 3792. https://doi.org/10.3390/su11143792

He P, Sun Y, Shen H, Jian J, Yu Z. Does Environmental Tax Affect Energy Efficiency? An Empirical Study of Energy Efficiency in OECD Countries Based on DEA and Logit Model. Sustainability. 2019; 11(14):3792. https://doi.org/10.3390/su11143792

Chicago/Turabian StyleHe, Pinglin, Yulong Sun, Huayu Shen, Jianhui Jian, and Zhongfu Yu. 2019. "Does Environmental Tax Affect Energy Efficiency? An Empirical Study of Energy Efficiency in OECD Countries Based on DEA and Logit Model" Sustainability 11, no. 14: 3792. https://doi.org/10.3390/su11143792

APA StyleHe, P., Sun, Y., Shen, H., Jian, J., & Yu, Z. (2019). Does Environmental Tax Affect Energy Efficiency? An Empirical Study of Energy Efficiency in OECD Countries Based on DEA and Logit Model. Sustainability, 11(14), 3792. https://doi.org/10.3390/su11143792