The Threshold Effect of China’s Financial Development on Green Total Factor Productivity

Abstract

1. Introduction

2. Theoretical Analysis and Research Review

2.1. Measurement of Green Total Factor Productivity

2.2. Technological Innovation and Green Total Factor Productivity

2.3. Foreign Direct Investment and Green Total Factor Productivity

2.4. Environmental Governance and Green Total Factor Productivity

2.5. Financial Development and Green Total Factor Productivity

3. Green Total Factor Productivity Measurement and Analysis

3.1. Green Total Factor Productivity Measurement Model

3.2. Green Total Factor Productivity Measurement Index and Data Sources

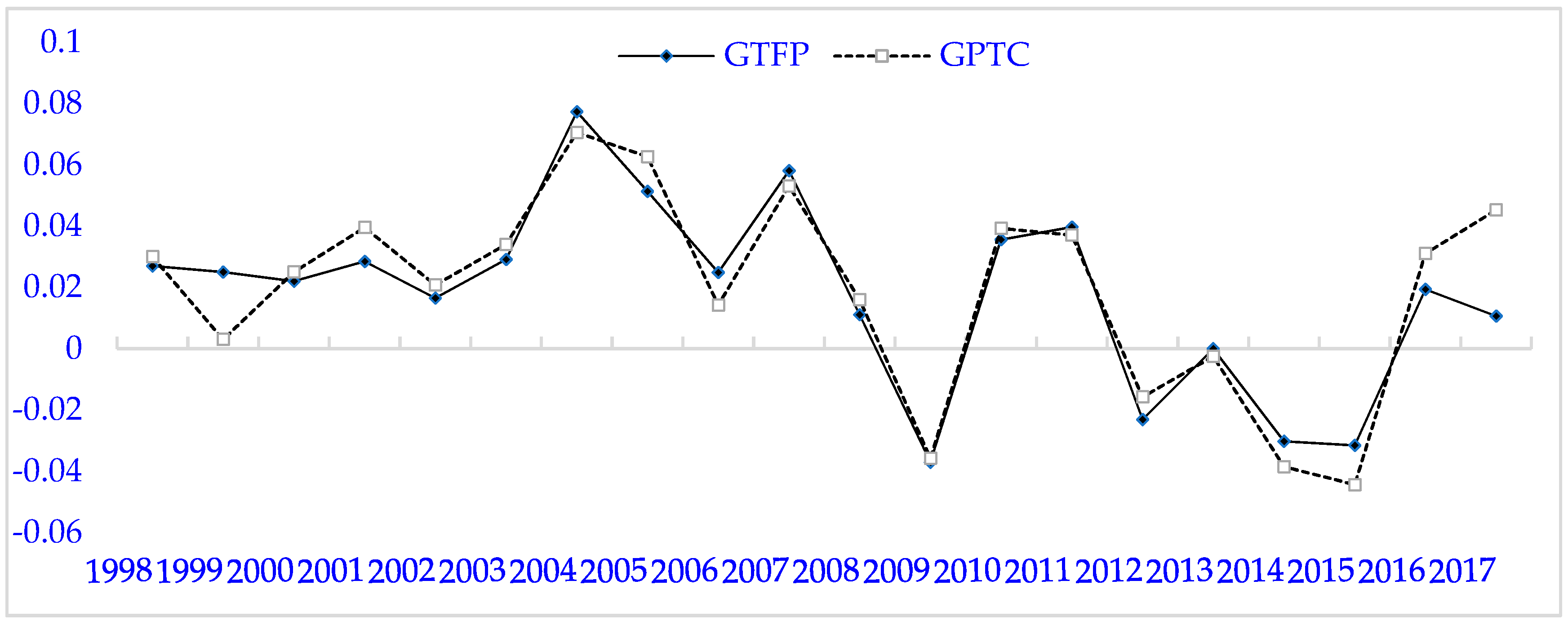

3.3. Measurement Results and Analysis of Green Total Factor Productivity

4. Empirical Analysis

4.1. Variable Selection and Description

4.2. Model

4.3. Empirical Tests

4.3.1. Data Stationarity Test and Co-Integration Test

4.3.2. Threshold Test Results

4.3.3. Threshold Regression

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Krugman, P. The Myth of Asia’s Miracle. Foreign Aff. 1994, 73, 62–78. [Google Scholar] [CrossRef]

- Arayama, Y.; Miyoshi, K. Regional Diversity and Sources of Economic Growth in China. World Econ. 2004, 27, 1583–1607. [Google Scholar] [CrossRef]

- Jin, T.; Xu, J. Discussion on the Mode of Extensive Economic Growth in China’s Transition Period. Reform 2005, 8, 18–22. (In Chinese) [Google Scholar]

- Lei, H. The Effect of Investment on Economic Growth and Investment Efficiency since the Reform in China. Ph.D. Thesis, Huazhong University of Science and Technology, Wuhan, China, 2006. [Google Scholar]

- Zhang, R. How China’s Economic Growth Turns to TFP-driven. Mod. Econ. Inf. 2014, 22, 7. (In Chinese) [Google Scholar]

- Jing, X.U.; Yang, Y.H. Study on Evaluation Method of Regional Energy Efficiency Base on SFA. Coal Econ. Res. 2012, 32, 37–44. (In Chinese) [Google Scholar]

- Zhu, S.; Xu, K. The Measurement of Total Factor Energy Efficiency in China’s Industrial Sector and Its Influencing Factors—Based on the Research of Common Frontier Law. Ind. Technol. Econ. 2015, 12, 102–113. (In Chinese) [Google Scholar]

- Zhou, R. Evaluation of Carbon Emission Efficiency in Five Northwest Provinces Based on Stochastic Frontier Model. China Bus. Rev. 2013, 32, 110–111. (In Chinese) [Google Scholar]

- Chung, Y.; Färe, R. Productivity and undesirable outputs: A directional distance Function approach. Microeconomics 1997, 51, 229–240. (In Chinese) [Google Scholar] [CrossRef]

- Chen, S. China’s Green Industrial Revolution: An Explanation from the Perspective of Environmental Total Factor Productivity (1980–2008). Econ. Res. J. 2010, 11, 21–34. (In Chinese) [Google Scholar]

- Chen, C.F. Simulated Forecast of Energy Conservation and Emission Reduction and Green Growth of China’s Industry. China Popul. Resour. Environ. 2018, 28, 148–157. (In Chinese) [Google Scholar]

- Xu, X.; Wang, X. Green Total Factor Productivity and Its Regional Differences in China: An Empirical Analysis Based on Panel Data of 30 Provinces. J. Guizhou Univ. Financ. Econ. 2016, 6, 91–98. (In Chinese) [Google Scholar]

- Färe, R.; Grosskopf, S. Theory and Calculation of Productivity Index. In Models & Measurement of Welfare & Inequality; Eichhorn, W., Ed.; Springer: Berlin, Germany, 1994; pp. 921–940. [Google Scholar]

- Fukuyama, H.; Weber, W. A directional slacks-based measure of technical efficiency. Socio Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Tone, K. Dealing with Undesirable Outputs in DEA: A Slacks-Based Measure (SBM) Approach; The Operations Research Society of Japan: Birmingham, UK, 2004. [Google Scholar]

- Wang, B.; Wu, Y.; Yan, P. Regional Environmental Efficiency and Environmental Total Factor Productivity Growth in China. Econ. Res. J. 2010, 5, 95–109. (In Chinese) [Google Scholar]

- Li, L.; Tao, F. Green Total Factor Productivity and Its Influencing Factors in Pollution-intensive Industries: An Empirical Analysis Based on the Directional Distance Function of SBM. Economist 2011, 12, 32–39. (In Chinese) [Google Scholar]

- Liu, H.; Li, C. Regional Gap and Structural Decomposition of Green Total Factor Productivity in China. Shanghai J. Econ. 2018, 6, 30–41. (In Chinese) [Google Scholar]

- Liu, Z.; Xin, L. The influence of “The Belt and Road” construction on the green total factor productivity of key provinces in China along the line. China Popul. Resour. Environ. 2018, 28, 87–97. (In Chinese) [Google Scholar]

- Yang, Z.; Luo, Z. An Empirical Study on Green Transformation Driving Factor of Economic Growth Pattern in China. Sci. Manag. Res. 2019, 37, 11–14. (In Chinese) [Google Scholar]

- Huang, Y.; Shi, Q. Research on Regional Environmental Efficiency and Total Elements of Environment in China: Based on the Analysis of SBM Model Including R&D Input. China Popul. Resour. Environ. 2015, 25, 12. (In Chinese) [Google Scholar]

- Wan, L.; Zhu, Q. The Impact of R&D Input on Industrial Green Total Factor Productivity Growth: Empirical Data from China’s Industries from 1999 to 2010. Econ. Perspect. 2013, 9, 20–26. (In Chinese) [Google Scholar]

- Jiang, N. FDI, Global Value Chain Embedding and Total Factor Productivity. J. Hebei Univ. Econ. Bus. 2019, 1, 50–59. (In Chinese) [Google Scholar]

- Zhong, J.; Zhang, Q. The Impact of Financial Market Development on Technology Spillover Effect of FDI in China and Its Threshold Effect Test. Financ. Trade Res. 2010, 21, 98–104. (In Chinese) [Google Scholar]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Tang, G.; Ni, J.; He, R. Regional Economic Development, Enterprise Environmental Protection Investment and Enterprise Value: A Case Study of Listed Companies in Hubei Province; Hubei Social Science: Wuhan, China, 2018. (In Chinese) [Google Scholar]

- Mohr, R.D. Technical Change, External Economies, and the Porter Hypothesis. J. Environ. Econ. Manag. 2002, 43, 158–168. [Google Scholar] [CrossRef]

- Zhu, J.; Wang, Y. Innovation Compensation or Following Cost? Pollution Halo or Pollution Paradise? Testing the Threshold Effect and Spatial Spillover Effect of the Double Hypothesis from the Perspective of Green Total Factor Productivity. Sci. Technol. Prog. Policy 2018, 35, 46–54. (In Chinese) [Google Scholar]

- Chen, Y.; Sun, H. Environmental Regulation and Competitive Advantage of Enterprises: Revision of Porter’s Hypothesis. Sci. Technol. Prog. Policy 2009, 26, 59–61. (In Chinese) [Google Scholar]

- Tao, Q.; Hu, H. Analysis of the Relation between Environmental Regulation and Agricultural Science and Technology Progress: A Study Based on Porter’s Hypothesis. China Popul. Resour. Environ. 2011, 21, 52–57. (In Chinese) [Google Scholar]

- Liu, H.; Zuo, W. The Influence of Environmental Regulation on China’s Provincial Green Total Factor Productivity. Stat. Decis. 2016, 9, 141–145. (In Chinese) [Google Scholar]

- Zhang, H.; Zhang, Z.; Yan, F.M. The Impact of Environmental Governance Based on Technological Distance on Enterprise Total Factor Productivity. China Popul. Resour. Environ. 2018, 28, 121–130. (In Chinese) [Google Scholar]

- Zheng, X. Empirical Analysis of the Contribution Rate of Economic Growth Factors in Zhejiang Province. Econ. Manag. 2004, 18, 66–68. (In Chinese) [Google Scholar]

- Chen, J. Technological Progress Bias, Factor Accumulation and China’s Economic Growth Dynamics—An Empirical Study Based on a New Nonparametric Decomposition Method. J. Huazhong Univ. Sci. Technol. Soc. Sci. Ed. 2018, 2. Available online: http://www.cnki.com.cn/Article/CJFDTotal-HZLS201802012.htm (accessed on 4 July 2019). (In Chinese).

- He, J.; Hao, S. Limitation and Reconstruction of the Triple Characteristics of Neoclassical Economic Man. Acad. J. 2012, 4, 73–80. (In Chinese) [Google Scholar]

- Liao, J. Research on Non-Independent Strategy Investor Behavior and Stock Market Vision. Ph.D. Thesis, Fudan University, Shanghai, China, 2011. (In Chinese). [Google Scholar]

- Romer, M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- César, C.; Liu, L. The Direction of Causality Between Financial Development and Economic Growth. J. Dev. Econ. 2003, 72, 321–334. [Google Scholar]

- Rousseau, P.L.; Wachtel, P. Inflation Thresholds and the Finance-Growth Nexus. J. Int. Money Financ. 2002, 21, 777–793. [Google Scholar] [CrossRef]

- Bassem, K. The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean Countries (SMCs). Energy Econ. 2017, 68, 19–30. [Google Scholar]

- Tu, Z.G. Total Factor Productivity and the Motive Force of Regional Economic Growth: Based on the Non-parametric Production Frontier Analysis of 28 Provinces and Cities’ Large-scale Industries from 1995 to 2004. Nankai Econ. Stud. 2007, 4, 14–36. (In Chinese) [Google Scholar]

- Gorodnichenko, Y.; Schnitzer, M. Financial Constraints and Innovation: Why Poor Countries Don’t Catch up. J. Eur. Econ. Assoc. 2013, 11, 1115–1152. [Google Scholar] [CrossRef]

- Shen, K.; Sun, W. Investment Efficiency, Capital Formation and Macroeconomic Fluctuation——An Empirical Study Based on the Perspective of Financial Development. China Soc. Sci. 2004, 6, 52–63. (In Chinese) [Google Scholar]

- Chen, G.; Li, S. Sources of Financial Development and Growth: Factor Accumulation, Technological Progress and Efficiency Improvement. South. Econ. 2009, 5, 24–35. (In Chinese) [Google Scholar]

- Zhang, X.Y.; Zhou, Y.; Bai, W. Financial Agglomeration and Industrial Productivity Improvement—Based on the Research of Intermediary Transmission Effectiveness of R&D Capital. Jilin Univ. J. Soc. Sci. Ed. 2019, 59, 32–42. (In Chinese) [Google Scholar]

- Wang, X.; Xu, Y.; Liu, T. Does financial development promote the growth of green total factor productivity in the “Belt and Road” countries. Econ. Latit. 2018, 35, 17–22. (In Chinese) [Google Scholar]

- Ma, C.; Stern, D.I. China’s changing energy intensity trend: A decomposition analysis. Energy Econ. 2008, 30, 1037–1053. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Shimamoto, K. Industrial characteristics, environmental regulations and air pollution: An analysis of the UK manufacturing sector. J. Environ. Econ. Manag. 2005, 50, 121–143. [Google Scholar] [CrossRef]

- Chami, R.; Cosimano, T.F.; Fullenkamp, C. Managing Ethical Risk: How investing in ethics adds value. J. Bank. Financ. 2002, 26, 1697–1718. [Google Scholar] [CrossRef]

- Wang, W. County Finance and Green Total Factor Productivity Growth—Evidence from the Upper Stream of the Yangtze River Economic Belt. J. Stat. Inf. 2017, 9, 69–77. (In Chinese) [Google Scholar]

- Wang, W.; Sun, F. Financial Development and Green Total Factor Productivity Growth in Ethnic Areas—Taking Wujiang River Basin as an Example. J. Yunnan Univ. Natl. 2017, 3, 106–118. (In Chinese) [Google Scholar]

- Friday, J.; Zhu, Y. Research on the Impact of Financial Development on Green Total Factor Productivity Growth—Taking the 11 Provinces (Cities) of the Yangtze River Economic Belt as an Example. Macro Qual. Res. 2018, 6, 74–89. [Google Scholar]

- Zhang, F. Theoretical and Empirical Research on the Impact of Financial Development on Green Total Factor Productivity. China Soft Sci. 2017, 9, 154–168. (In Chinese) [Google Scholar]

- Ge, P.; Huang, X.; Xu, Y. Financial Development, Innovation Heterogeneity and Green Total Factor Productivity Enhancement: Empirical Evidence from “Belt and Road”. Financ. Econ. 2018. Available online: http://xueshu.baidu.com/usercenter/paper/show?paperid=08e1d4eecd82e220e4c9f56a001f8c1d&site=xueshu_se (accessed on 4 July 2019). (In Chinese).

- Chambers, R.G.; Faure, R.; Grosskopf, S. Productivity growth in APEC countries. Pac. Econ. Rev. 1996, 1, 181–190. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.; Zhang, J. Estimation of Interprovincial Material Capital Stock in China:1952–2000. Econ. Res. J. 2004, 10, 35–44. (In Chinese) [Google Scholar]

- Wang, F.; Xie, J. Research on the Growth Rate of Green Total Factor Productivity in China by Province. Chin. J. Popul. Sci. 2015, 2, 53–62. (In Chinese) [Google Scholar]

- Wang, C.; Xie, Z. An Empirical Comparison of China’s Transcendental Logarithmic Production Function Model Based on Substitutional Elasticity. J. Hebei Geo Univ. 2014, 37, 14–19. (In Chinese) [Google Scholar]

- Liu, H.; Li, C.; Peng, Y. Spatial imbalance of green total factor productivity growth in China and its causes. Theory Pract. Financ. Econ. 2018, 39, 118–123. (In Chinese) [Google Scholar]

- Gai, M.; Kong, X.; Qu, B. Evolution Analysis of Traditional Economic Efficiency and Green Space-time Efficiency Between China’s Inter-provincial. Resour. Dev. Mark. 2016, 7, 780–787. (In Chinese) [Google Scholar]

- Wu, X.; Deng, M. Technological Innovation, Spatial Spillover and Industrial Green Total Factor Productivity of the Yangtze River Economic Belt. Sci. Technol. Prog. Policy 2018, 1, 50–58. (In Chinese) [Google Scholar]

| Measurement Method | Reference | Research Object | Estimated Result |

|---|---|---|---|

| DDF | Chen Shiyi (2010) [10] | 38 double-digit industries in China from 1980 to 2008 | Estimates without considering environmental constraints overestimate total factor productivity (TFP) |

| Chen Chaofan (2018) [11] | 36 industrial sub-sectors (2000–2014) | During 2015–2050, the green productivity of 29 sub-sectors remained increasing or not decreasing | |

| Xu Xiaohong and Wang Xia (2016) [12] | Panel data of 30 provinces in China from 2000 to 2014 | The green total factor productivity (GTFP) in the eastern developed provinces is higher than that of the central and western underdeveloped provinces | |

| SBM | Wang Bing et al. (2010) [16] | Panel data of 30 provinces and municipalities in China from 1998 to 2007 | The average rate of environmental inefficiency and the average growth rate of environmental total factor productivity are both higher than the market inefficiency average and the average growth rate of market total factor productivity |

| Li Ling and Tao Feng (2011) [17] | Pollution-intensive industries (2004–2008) | The GTFP considering undesirable output is lower than GTFP without considering undesirable output | |

| Liu Huajun and Li Chao (2018) [18] | Panel data of 30 provinces in China | GTFP of China is at a low level | |

| Liu Zhuankuo and Xin Li (2018) [19] | 2003–2016 17 key provinces along the “The Belt and Road Initiative” area in China | The development of GTFP in key provinces along the “The Belt and Road Initiative” area is generally preferable |

| Variables | Data Source and Description |

|---|---|

| Green total factor productivity (GTFP) | The static efficiency value is calculated based on the slacks-based measure (SBM) directional distance function, simultaneously fitting the maximization of desirable output growth and minimization of the undesirable output growth. The Luenberger index is calculated to obtain the GTFP. |

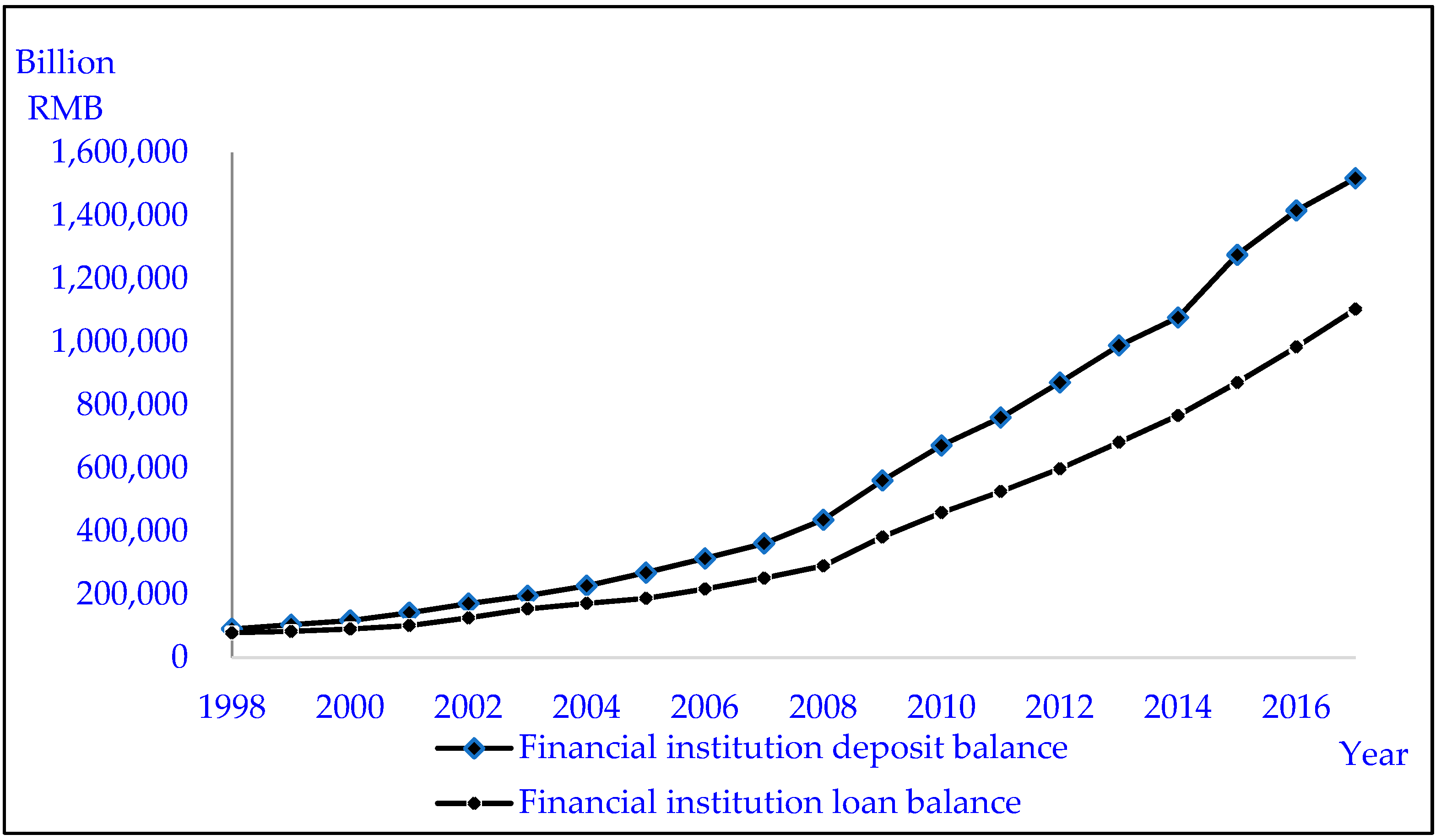

| Financial development (FD) | According to the availability of data, the sum of deposits and loans of financial institutions in different regions is selected to represent the total amount of financial activity, and the GDP of each region is selected to represent the total amount of economic activity. The level of financial development is measured as the ratio of the sum of deposits and loans of financial institutions to the gross domestic product of each region. The data on financial institutions comes from the Wind database, and the gross domestic product (GDP) of each region comes from the China Statistical Yearbook over the years. |

| Foreign direct investment (FDI) | The actual utilization of FDI expressed in U.S. dollars is converted into Renminbi according to the average exchange rate of each year, and the level of FDI is measured by the ratio of the actual utilization of FDI to GDP. The actual amount of FDI comes from the Statistical Yearbook of each province. |

| R&D (lnRD) | The logarithm of R&D expenditure ($100 million) comes from the China Science and Technology Statistics Yearbook. |

| Environmental Governance (EG) | The ratio of total investment in environmental pollution control (RMB 100 million) to GDP is selected to measure the level of environmental governance. Investment in environmental pollution control includes three parts: old industrial pollution source control, “three simultaneous” construction projects (facilities for pollution prevention and control in construction projects must be designed, constructed, and put into operation simultaneously with the main project) and urban environmental infrastructure construction. The total investment in environmental pollution control comes from the China Environmental Statistics Yearbook and China Environmental Bulletin. |

| Variable | Type of Test | Fisher-ADF Test Chi-Square Statistic | Prob. | Fisher-PP Test Chi-Square Statistic | Prob. | IPS Test Chi-Square Statistic | Prob. | Result |

|---|---|---|---|---|---|---|---|---|

| GTFP | (C, T, 0) | 209.018 | 0.39 | 249.454 | 0.36 | −8.69867 | 0.37 | Unit root exists |

| FD | (C, T, 0) | 19.1951 | 1.00 | 21.9626 | 1.00 | −6.18970 | 1.00 | Unit root exists |

| FDI | (C, T, 0) | 313.886 | 0.58 | 152.686 | 0.61 | −7.91812 | 0.42 | Unit root exists |

| lnRD | (C, T, 0) | 110.184 | 0.99 | 242.999 | 0.99 | −3.35659 | 0.89 | Unit root exists |

| EG | (C, T, 0) | 94.4686 | 0.52 | 83.7552 | 0.81 | −2.56285 | 0.51 | Unit root exists |

| DGTFP | (C, T, 0) | 447.892 | 0.00 | 2157.36 | 0.00 | −21.6624 | 0.00 | No unit root |

| DFD | (C, T, 0) | 262.280 | 0.00 | 342.043 | 0.00 | −12.7075 | 0.00 | No unit root |

| DFDI | (C, T, 0) | 389.804 | 0.00 | 650.432 | 0.00 | −15.6379 | 0.00 | No unit root |

| DlnRD | (C, T, 0) | 199.424 | 0.00 | 528.936 | 0.00 | −8.20136 | 0.00 | No unit root |

| DEG | (C, T, 0) | 395.748 | 0.00 | 1048.88 | 0.00 | −19.3647 | 0.00 | No unit root |

| t-Value | p-Value | |

|---|---|---|

| ADF | 5.3053 | 0.0000 |

| Model | F-Value | p-Value | Size of Sample | Critical Value | |||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | |||||

| Model 1 | Single threshold test | 12.519 *** | 0.002 | 300 | 8.822 | 6.31 | 4.578 |

| Double threshold test | 7.888 ** | 0.047 | 300 | 11.180 | 6.092 | 3.387 | |

| Triple threshold test | 11.993 | 0.21 | 300 | 10.001 | 6.201 | 3.982 | |

| Model 2 | Single threshold test | 27.825 * | 0.072 | 300 | 19.321 | 12.886 | 10.06 |

| Double threshold test | 25.047 *** | 0.009 | 300 | 19.984 | 16.069 | 13.12 | |

| Triple threshold test | 30.562 | 0.57 | 300 | 19.652 | 14.477 | 11.59 | |

| Model 3 | Single threshold test | 17.124 ** | 0.026 | 300 | 19.321 | 12.886 | 10.06 |

| Double threshold test | 17.354 ** | 0.018 | 300 | 19.984 | 16.069 | 13.12 | |

| Triple threshold test | 10.127 | 0.29 | 300 | 19.6525 | 14.4775 | 11.59 | |

| Model 4 | Single threshold test | 12.550 ** | 0.063 | 300 | 18.490 | 12.851 | 10.600 |

| Double threshold test | 7.692 | 0.253 | 300 | 25.619 | 16.923 | 13.108 | |

| Triple threshold test | 4.469 | 0.347 | 300 | 17.722 | 11.582 | 9.068 | |

| Model | Threshold Dependent Variable | Type | Threshold Estimates | 95% Confidence Interval |

|---|---|---|---|---|

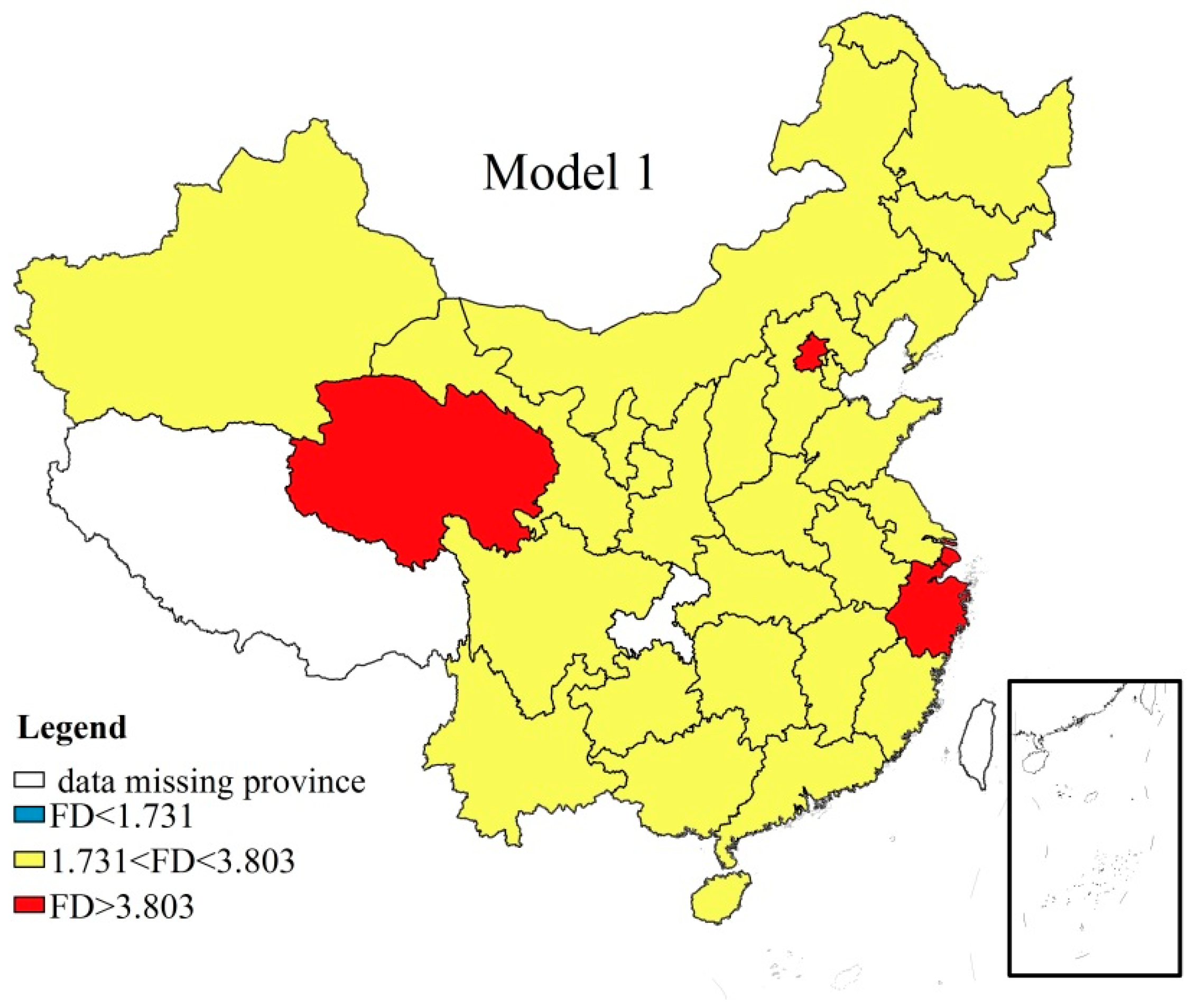

| Model 1 | FD | Single | 1.731 | (1.602, 3.408) |

| Double | 3.803 | (2.507, 4.803) | ||

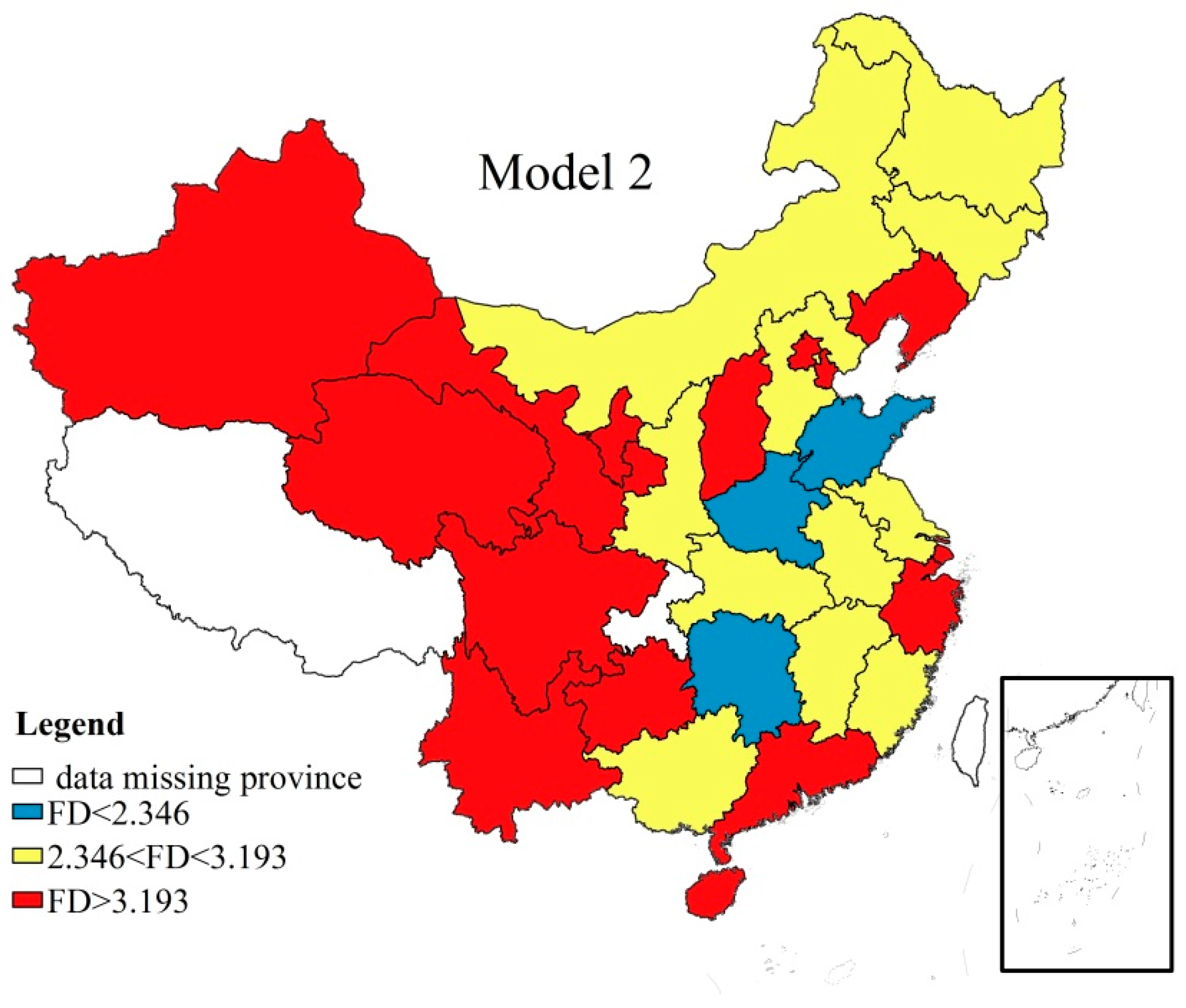

| Model 2 | FDI | Single | 2.346 | (2.342, 3.216) |

| Double | 3.193 | (3.171, 3.216) | ||

| Model 3 | lnRD | Single | 1.731 | (1.653, 1.784) |

| Double | 3.182 | (3.142, 3.209) | ||

| Model 4 | EG | Single | 1.731 | (1.602, 3.216) |

| GTFP | Coefficient | ||

|---|---|---|---|

| FD ≤ 1.731 | FD ≤ 3.803 | FD > 3.803 | |

| FD | −0.0218 * (−1.95) | 0.0387 *** (−2.15) | 0.0028 * (−1.89) |

| R2 | 0.723 | 0.681 | 0.874 |

| Sample size | 57 | 477 | 46 |

| Provinces and municipalities within different levels of financial development in 2017 | nil | Tianjin, Hebei, Shanxi, Inner Mongolia, Jilin, Heilongjiang, Jiangsu, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangdong, Guangxi, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Liaoning, Hainan, Ningxia, and Xinjiang | Beijing, Shanghai, Zhejiang, and Qinghai |

| GTFP | Coefficient | ||

|---|---|---|---|

| FD ≤ 2.346 | 2.346 < FD ≤ 3.193 | FD > 3.193 | |

| FDI | −0.5459 * (−1.75) | 0.2126 (−0.025) | 1.4132 *** (−4.69) |

| R2 | 0.627 | 0.401 | 0.865 |

| Sample size | 259 | 229 | 92 |

| Provinces and municipalities within different levels of financial development in 2017 | Henan, Hunan, and Shandong | Hebei, Shaanxi, Anhui, Jiangxi, Inner Mongolia, Guangxi, Jiangsu, Heilongjiang, Jilin, Fujian, and Hubei | Beijing, Shanghai, Gansu, Qinghai, Liaoning, Hainan, Zhejiang, Shanxi, Ningxia, Xinjiang, Guizhou, Guangdong, Yunnan, Sichuan, and Tianjin |

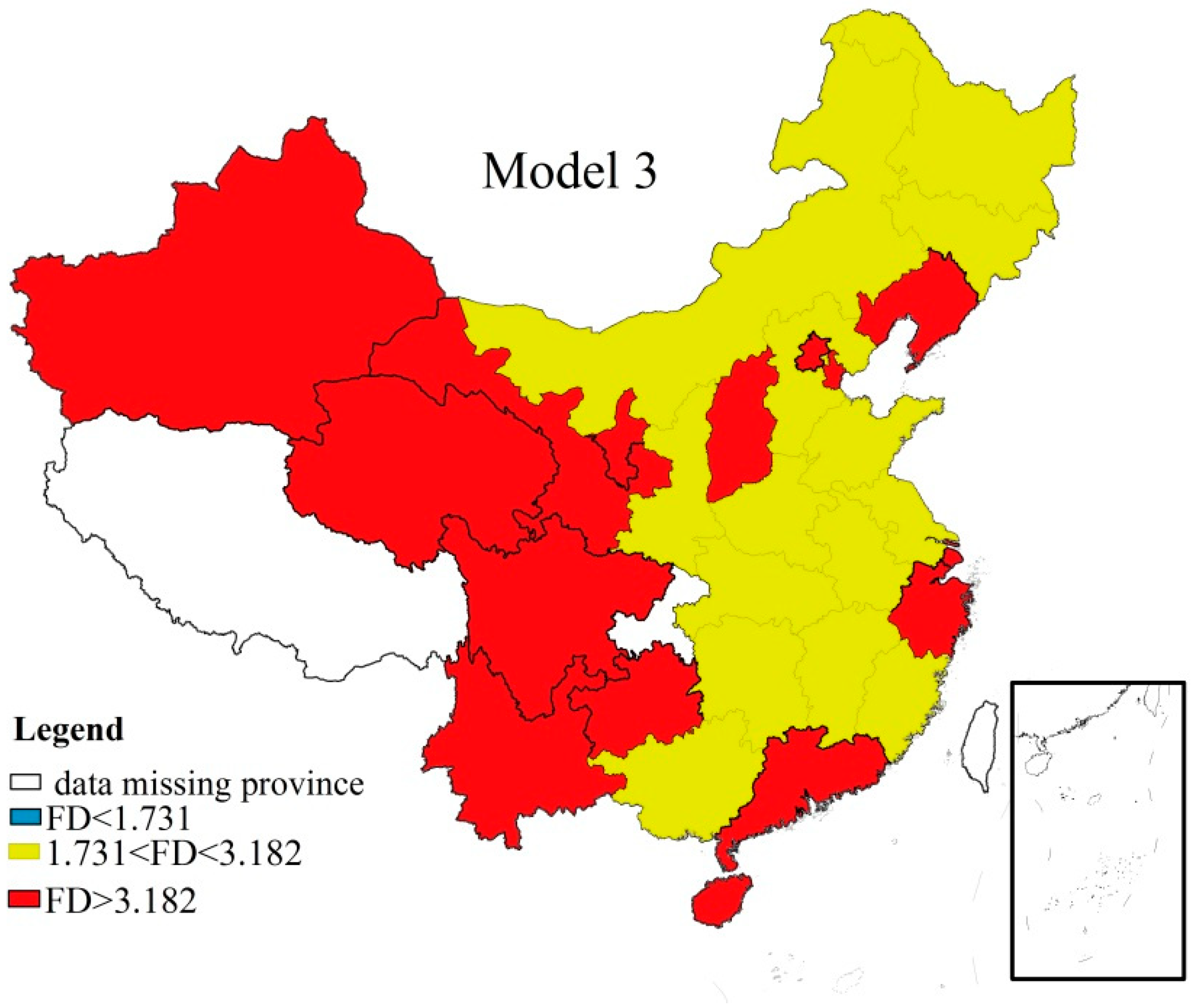

| GTFP | Coefficient | ||

|---|---|---|---|

| FD ≤ 1.731 | FD ≤ 3.182 | FD > 3.182 | |

| lnRD | 0.0069391 * (−1.95) | 0.049547 * (−1.98) | 0.0647392 *** (−5.22) |

| R2 | 0.750 | 0.741 | 0.805 |

| Sample size | 57 | 431 | 92 |

| Provinces and municipalities within different levels of financial development in 2017 | nil | Hebei, Shaanxi, Anhui, Jiangxi, Inner Mongolia, Guangxi, Jiangsu, Heilongjiang, Jilin, Fujian, Hubei, Henan, Hunan, and Shandong | Beijing, Shanghai, Gansu, Qinghai, Liaoning, Hainan, Zhejiang, Shanxi, Ningxia, Xinjiang, Guizhou, Guangdong, Yunnan, Sichuan, and Tianjin |

| GTFP | Coefficient | |

|---|---|---|

| FD ≤ 1.731 | FD > 1.731 | |

| EG | −0.0612 ** (−2.89) | 0.0904 *** (5.36) |

| R2 | 0.577 | 0.719 |

| Sample size | 57 | 523 |

| Provinces and municipalities within different levels of financial development in 2017 | nil | Beijing, Shanghai, Gansu, Qinghai, Liaoning, Hainan, Zhejiang, Shanxi, Ningxia, Xinjiang, Guizhou, Guangdong, Yunnan, Sichuan, Tianjin, Hebei, Shaanxi, Anhui, Jiangxi, Inner Mongolia, Guangxi, Jiangsu, Heilongjiang, Jilin, Fujian, Hubei, Henan, Hunan, and Shandong |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Y.; Xu, Y.; Liu, C.; Fang, Z.; Fu, X.; He, M. The Threshold Effect of China’s Financial Development on Green Total Factor Productivity. Sustainability 2019, 11, 3776. https://doi.org/10.3390/su11143776

Zhou Y, Xu Y, Liu C, Fang Z, Fu X, He M. The Threshold Effect of China’s Financial Development on Green Total Factor Productivity. Sustainability. 2019; 11(14):3776. https://doi.org/10.3390/su11143776

Chicago/Turabian StyleZhou, Yingying, Yaru Xu, Chuanzhe Liu, Zhuoqing Fang, Xinyue Fu, and Mingzhao He. 2019. "The Threshold Effect of China’s Financial Development on Green Total Factor Productivity" Sustainability 11, no. 14: 3776. https://doi.org/10.3390/su11143776

APA StyleZhou, Y., Xu, Y., Liu, C., Fang, Z., Fu, X., & He, M. (2019). The Threshold Effect of China’s Financial Development on Green Total Factor Productivity. Sustainability, 11(14), 3776. https://doi.org/10.3390/su11143776