Abstract

Achieving the goals of sustainable development and poverty reduction implies an important condition for access to electricity for the entire population. In the economic literature, the relationship between electricity consumption and economic growth has different perspectives. The lack of good governance within an economy, besides the deficiencies of energy resources, is a key issue in worsening energy issues for developing countries. These countries have failed to alleviate the energy crises that have hindered development prospects, amid flourishing corruption and inefficient governments. Our research, using a panel methodology, analyzes the long-term relationship between energy consumption, economic growth and good governance for 14 Central and Eastern European countries, over the period 1995–2017. The study demonstrates empirically that there is a causal relationship between electricity consumption and economic growth, underlining the fact that deficiencies in the energy system lead to slowing economic growth. The study also shows that good governance influences electricity and Gross Domestic Product (GDP) consumption, and the governments from Central and Eastern European countries have to restore good governance in the economy, creating an environment conducive to investment in the energy sector, which would increase competition and reduce inefficiencies in the production, transmission, and distribution of energy.

1. Introduction

Due to the particularities of the energy industry, European national governments considered their full involvement in the energy sector as a normal practice [1]. These peculiarities, considered as certainty for a long time, are given by: the natural monopoly of transport and distribution activities within the energy sector, which allows the vertical integration of various activities in the form of monopolies; the essential role for the community that energy plays, either as a primary resource or as electricity, which is a need for strict governmental control; the strategic nature, for any economy, of the energy sector, especially electricity, gas and, to a lesser extent, oil [2]. These features contributed on a European level to the creation of a traditional paradigm in the government–energy relationship that has dominated for decades, which can be described as a model of organization that involves central control over a primary and final energy network. The structure of this model is dictated by: exclusive rights to build and operate in the energy sector, whether of the state or concession by it; lack of any form of competition; detailed regulations; high degree of planning and strict control; vertically integrated operation; costs based on production costs [3]. The European model has been functioning for a long time, but it is becoming increasingly apparent to consumers that they are not part of the decision-making process in any of the energy system’s operating phases. Another important drawback was the fact that those who plan, lead, and operate the system do not take any risk and did not suffer if they were wrong. Consumers, in their dual quality of consumers and taxpayers, have always paid the cost of incompetence or misconduct. This rigid, traditional relationship, government–energy industry, has for some time been affected by the change that seems irreversible at the community level. Old certainties have begun to shake and the unconditional acceptance of centralized decisions has ceased to work, increasingly evident since the 1990s. The new wave of centralized regulation is the regulation of competition [4]. Natural monopolies, either State-owned or under its control, operating in a centralized technical configuration, is beginning to fall apart and reorient to customers and competition. The features of the new type of approach at the European level are different, namely: the separation of activities, to allow competition whenever possible (instead of vertical integration); the freedom to invest in competitive activities (instead of centralized planning); the freedom to contract at competitive rates (instead of the fixed tariff); access to the network and infrastructure; supervising the system by independent regulators (instead of the government); adaptation to information technology [5].

Over the past two decades, there have been a number of papers dealing with the causality between economic growth and energy, especially energy consumption [6,7,8]. The causality between growth and energy, especially total energy consumption and activity, has been the subject of a series of works over the last two decades, with the existence and direction still not clearly established [9]. The fieldwork involves two approaches: the first approach is positive (energy is a production factor and thus a requirement/inhibitor for economic and social development); the second approach is neutral (energy does not have a significant impact on economic growth) [10].

Good governance implies involvement in local or national processes in order to correctly formulate policies and key social, economic, technological, environmental, and political goals of a country or community and the proper management of resources by including the institutional framework [11]. Good governance also means using the best ways to achieve the goals mentioned above through the ability to exercise power and take good decisions involving all aspects of a country. Worldwide, there are six key indicators of good governance developed by the World Bank, namely: (1) Corruption control, (2) Government effectiveness, (3) The rule of law, (4) Violence and accountability, (5) Regulation, (6) Political stability and absence of violence. We have chosen these indicators because they are most used in the literature; they have the most sources of information and show the most available data for the studied countries.

As a consequence of economic globalization, many public goods, including the electricity market, have been privatized so that consumers can benefit from lower prices due to competition [12]. Good governance is, however, of great importance for ensuring the uninterrupted, reliable, and cheap supply of electricity to the countries concerned. A multitude of reasons generate the need to adopt good energy governance in Eastern European countries: in a broader sense, it inspires a sense of trust among people based not only on the adoption of better but ethical decisions, allowing public services to make it more efficient for all citizens; in a more restricted, energy-specific sense, it is imperative for the constant supply of clean energy to mitigate pollution and to conserve the natural resources of those countries [13].

For Central and Eastern European countries, with the exception of some works, which involve different methodologies, there are few studies addressing the causal relationship between energy and economic growth and studying the relationship with good governance is nonexistent [14,15,16,17,18]. The purpose of this article is to study the existence and direction of causality between energy consumption (total economy, industry, and households), economic growth, and good governance.

The usefulness of the analysis is due to the following reasons: firstly, amid tensions on the international energy market, there is a continuing debate at the level of the European Union on the causality between energy consumption, on the one hand, and GDP growth, on the other hand; secondly, the contribution of institutional quality through respect for democratic principles and legislative authority is an important element in relation with the energy consumption and sustainable economic growth; thirdly, in the context of the Eastern European goal of increasing energy efficiency, it is important to know what this goal would mean for GDP growth in the short and long term and which are the factors of influence.

2. Literature Review

The economic literature on the study of the relationship between energy consumption, economic growth, and good governance is in the development phase and the establishment of unanimously accepted results. The main empirical studies concerned economically developed countries (USA, EU-Euro area, China) for periods after 1995, and the methods of analysis were the most varied. In the following paragraphs, we will present the main studies on the effect of energy consumption on economic growth as well as on good governance.

Over the past three decades, in the literature on the energy economics was a strong debate about the relationship between energy consumption and economic growth, revealing the importance of energy as a production factor [19,20,21,22,23,24,25]: energy-led growth theory supporters show that energy, currently being present in all production activities, is a key factor in promoting growth; supporters of conventional economic growth theories argue that the production factors are only the three big ones (labor, capital, and nature), thus eliminating energy consumption among the determinants of economic growth [7,8,26,27,28].

The analysis of the relationship between energy consumption and economic growth by most of the previous articles uses the primary energy consumption as an indicator of energy consumption and real GDP as an indicator of economic growth as study indicators [29,30,31], making empirical findings under four hypotheses: growth hypothesis, conservation hypothesis, hypothesis feedback, and neutrality hypothesis [32].

The growth hypothesis [19,22,33,34,35] builds on the unidirectional relationship between energy consumption and growth and considers energy to make a significant contribution to economic development in a country. Thus, energy consumption can directly influence sustainable economic development, the inverse relationship not being valid, but the use of energy conservation means will have a negative impact on economic development.

The conservation hypothesis [6,24,36] consider that economic development causes an increase in energy consumption, the inverse relationship not being valid; but, unlike the first hypothesis, reducing CO2 emissions, improving energy efficiency, and waste management do not necessarily lead to a reduction in GDP. Because economic growth does not depend directly on energy consumption, measures to reduce energy consumption do not have a negative impact on economic growth.

The feedback hypothesis [37,38,39] implies the interdependence between economic development and energy consumption, where each component can act as a stimulator for the other; the change in energy consumption leads to a change in economic development, and mutual is true. Energy conservation measures will reduce economic growth and increased economic growth will be directly matched by increased energy consumption. The neutrality hypothesis states that there is no link between energy consumption and economic growth, being mutually independent, and energy conservation measures having no effect on economic development [32,40,41].

Literature in the field has analyzed in many studies the relationship between good governance (especially corruption) and economic growth, contradicting three different opinions on this subject. The first opinion argues that the low manifestation of good governance is effective in economic development, being essentially a ‘helper’ for companies that avoid unequal administrative regulations and bureaucracy. This phenomenon presents the role of lubricant for the economy, especially for most developing countries, for which commercial activities imply heavy rules and regulations [42,43,44]. The second opinion is contrary to the first: high-level corruption denies economic growth being a ‘hand that takes,’ the negative effects being due to the inefficiency of social costs and unproductive activities that diminish the available social and economic resources. This theory has investigated, since the 1990s, the mechanisms and channels through which the increased phenomenon of corruption (‘poor’ good governance) hampers economic growth [45,46,47,48,49]. In recent years, a third opinion has developed, a mixed one between the two previously mentioned. Subsequent analyses show that the increased effect of corruption on economic growth is not a linear one, depending on the quality of governance: when the quality of governance is faulty or the government system is weak, corruption can be useful for economic growth; on the contrary, in countries that have an increasing good governance, the phenomenon of corruption is negative [50,51,52,53,54].

Regarding the relationship between energy consumption and good governance (corruption), there are few studies in the field but pioneering work is still being done. Fredriksson et al. [55] analyzed 12 OECD (Organisation for Economic Co-operation and Development) countries for the period 1982–1996 and concluded that corruption reduces the effects of energy policy: increasing corruption leads to increased energy intensity (measured by the use of energy per unit of value added) and implicitly by a decrease in energy efficiency. Stern [56] analyzed 85 countries for the period 1971–2007 and discovered that the decline in corruption (increasing good governance) directly leads to an increase in energy efficiency; Nicolli and Vona [57] studied OECD countries for the period 1970–2005 and concluded that increased corruption (low-level governance) has an indirect effect on renewable energy policy through its impact on the regulation of the energy products market.

3. Data and Methodology

The estimation method in this article should analyze the causal relationships between the variables considered, meaning the energy consumption, economic growth, and good governance, allowing for the simultaneous determination of these three variables. The existing literature on energy–economic growth includes in the production function the physical capital and the labor force, but very few studies include good governance in this equation. In the production function, energy consumption is considered as a factor similar to those previously set forth [9,13,14,34,40,55,58,59].

The analysis in this article refers to 14 countries from Central and Eastern Europe (Albania, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Macedonia, Poland, Romania, Serbia, Slovakia, Slovenia) in the period 1995–2017 (for another 3 Central countries: Bosnia, Kosovo, Montenegro, there are not enough data for the entire period). The variables taken into account are the following (Table A1, Appendix A):

- -

- GDP (dependent/independent): natural logarithm of real gross domestic product in millions of Euros;

- -

- ELEC (independent/dependent): natural logarithm of final energy consumption (total country) in thousands tons of oil equivalent (TOE)

- -

- GOV (independent): Good governance measured by averaging the six indices of governance (Kaufmann et. Al., 2010) [60] control of corruption, rule of law, political instability, governmental efficiency, voice and accountability, and regulatory quality. The benefits of using the World Government indicators are given by the most sources of information and show the most available data for the studied countries. The shortcomings of using the World Government indicators are given by the discrepancy between actual and observed field data; appropriate selection of experts and their training in the field; distrust and cultural differences of respondent ordinary citizens.

- -

- GFCF (independent): Gross fixed capital formation (% of GDP)

- -

- URB (independent): The urban population (% of total population)

- -

- INF (control): Inflation (year to year %)

- -

- UNEM (control): Unemployment (year to year %)

In the baseline equation, the dependency variable is the GDP (model 1) and ELEC (model 2), following that the independent variables be all other indicators, which could change from model to model, relative to energy consumption: total or at the branches levels, industry, households, transport. The data source is EUROSTAT, statistical office of European Union, and for the good governance indicators the source used is the World Bank; the frequency of the data is annual.

In turn, good governance is involved in a capital-related variable, because an efficient banking system (capital) requires functional government institutions. Thus, the classic Cobb–Douglas production function can be written in the following way [61]:

where: Y represents GDP; A the productivity of all production factors; K physical capital; L human capital; and E represents total energy consumption.

If we logarithm the previous equation, the production function for the country i at the term t becomes:

but the overall productivity of production factors is also influenced by the quality of government institutions (firms and citizens, under the pressure of generalized corruption of weak institutions and state interventionism, react negatively because of instability and insecurity felt, unable to reach its maximum potential) [62] and the previous equation becomes:

yit = gdpit = ait + α1 × kit + α2 × lit + α3 × eit

ait = α0 + α4 (good governance) + α5 (control variables) + ε1,it

Combining Equations (2) and (3), we obtain the following formula:

gdpit = α0 + α1 × kit + α2 × lit + α3 × eit + α4 (good governance) + α5 (control variables) + ε1,it

So, the equation will be:

GDP = f(ELEC, GOV, GFCF, URB, INF, UNEM)

And by using natural logarithms (for resolving the problem of heteroscedasticity), it will become:

lnGDPit = α0 + α1 × lnELEC + α2 × lnGOV + α3 × lnGFCF + α4 × lnURB + α5 × lnINF + α6 × lnUNEM + ε1,it

As can be seen, good governance is included in the final form of the equation, taking into account the still-unclear effects by which this indicator influences GDP. Because physical capital, human capital, and energy are factors of production and directly influence GDP, it is assumed that α1, α2, and α3 are positive; in terms of good governance, negative results are expected (the poor quality of public institutions has negative effects on economic growth).

Also, we write an equation for electricity consumption (model 2):

and combining with the previous equations, the model for electricity consumption becomes:

ELEC = f(GDP, GOV, GFCF, URB, INF, UNEM)

lnELECit = α0 + α1lnGDP + α2lnGOV + α3lnGFCF + α4lnURB + α5lnINF + α6lnUNEM + ε1,it

A panel data regression is different from a simple cross-sectional regression or one using the time series, by having a double index of its variables [63,64,65].

where Yi,t is the dependent variable, Xi,t is a k-dimensional vector regression and εit are innovations for the M cross units and observed to T period, terms δi and γt are specific effects (random or fixed) for the sectional variables for certain periods of time.

Yi,t = c + αiyi,t−1 + βiXi,t + δi + γt + εit

For the robustness of the research, the dynamic panel data model was applied, the advantage of which is to eliminate many of the cross-sectional and static panel data deficiencies:

gdpit = α0 × gdpit−1 + α1 × kit + α2 × lit + α3 × eit + α4 (good governance) + α5 (control variables) + ε1,it

To avoid spourious regressions, the unit root test helped us to test the series staticity (Breitung–Das unit root test) to observe the stationary order, I (0) or I (1). If the series are I (1), we tested (Westlunf cointegration test) if there were long-term relations between the variables analyzed, taking into account the possible cross-sectional dependence. After these tests, we estimated long-run coefficients using the two Dynamic OLS (DOLS) and Fully Modified OLS (FMOLS) methodologies. This research will conclude with the estimation of short-term causality using the Granger test methodology.

For determining the cross-sectional dependence between the analysed variables, we applied the transversal dependency test (Langrage Multiplier (LM)) that was developed by Breusch and Pagan (1980). According to it, the empirical equation for the Langrage Multiplier test is modeled as follows:

where i indicates the cross-sectional dimension, the time dimension is shown by t, and x is a vector k × 1 of the independent variables. In the basic configuration of our model, the variable y represents GDP (energy consumption), and the variable x represents the energy consumption/government (GDP). We used i a and i b for revealing the individual interceptions and slope ratios for the analysed countries. Without cross-section dependence, the null-hypothesis is presented as follows:

Yit = αi + βixit + εit; for i = 1,2, ……,N; t = 1,2, ……, T

H0:

Cov(uit, ujt) for all t and i ≠ j

The alternative hypothesis of cross-sectional dependence is guided by:

H1:

Cov (uit, ujt) for at least one pair of i ≠ j

In this regard, the null hypothesis could be accepted by the cross-sectional dependence test if, for the loads factor, appears a zero environment in the cross-sectional dimension. In order to address the issues, the LM test was modified by Pesaran et al. (2008) [66], using the exact average and variance of LM statistics. If the null hypothesis first considers T→∞ and then N→∞, then the LM test is asymptotically distributed as normal.

For the stationary of the tests using panel unit root test (Breitung), if the calculated probability is appropriated to 0, then the series is stationary; if it is close to 1, then the series contains a unit root. Type unit root tests will be calculated after the model:

where: αi is constant, t is the trend, ∆Yt-1 is the value of one time-delay difference. The null and alternative hypothesis for the panel unit root test is:

HA: at least one coefficient βi is different from zero.

H0: β1 = β2 = … = βn

In Equation (3), the Breitung test statistic (2000) tests the following null hypothesis that the process is a stationary difference: H0 = − 1 = 0. The alternative hypothesis assumes that the series is stationary; this is, H1 = − 1 < 0. The specialized literature has established that the Breitung panel unit root test has the maximum power and the smallest distortion in size compared to the other panel unit root tests, and is therefore also used in this work.

In order to explain the relationship between analysed variables and according to the data series analysed I (1), it is necessary to investigate the long-term equilibrium. The results of the analysis could be altered by cross-sectional dependence, so, we will use the cointegration analysis (Westerlund and Edgerton [67]), which can, at the same time, consider cross-sectional dependence and structural breaks. The model used is:

where i = 1, …, N and t = 1, …, T represents the cross-section and the time series, respectively, and Dit is a dummy time, taking into account structural pauses. ai and bi represent intercept and slope before pause, respectively, and di and gi intercept and slope after pause, respectively.

yit = ai + hit+ ƞiDit + x′it × βi + (Ditxit)’yi + zit

Using the estimation methods by different techniques (FMOLS estimator developed by Phillips and Hansen (1990) [68] and by Saikkonen’s (1991) [69] and DOLS estimator created by Stock and Watson (1993) [70], we could perform tests on cointegrated vectors. These techniques help normally distributed estimates if panel data are used (Kao and Chiang (2001)) [71].

The FMOLS panel estimator for the coefficient β is defined as:

where zit = (zit − z) − × ∆yit × ƞt.

The panel DOLS estimator for the coefficient β is defined as:

where zit = [Xit − xi, ∆xi, t − k, …, ∆xi,t + k] is the vector of regressors.

Then, we examined the causality direction between the variables in a panel context. Engle and Granger (1987) [72]. Going from the assumption that we found a long-term balance of real GDP, energy consumption, and governance, using the Granger causality, we developed a model with a dynamic error correction representation. Data from Table 1 were given by the cointegrated model based on OLS and reveal that the traditional VAR model is increased by a time delay error correction term.

Table 1.

Pesaran test for cross-sectional dependence.

Accordingly, the Granger causality test implies the following regressions:

where all the variables are those defined above, Δ denotes the first difference of the variable and p denotes the length of the delay. The significance of the first differentiated variables provides evidence of the short-term Granger causality. Short-run causality is tested based on H0: θ12ip = 0 for all i and k and H0: θ13ip = 0 for all i and k.

4. Empirical Results

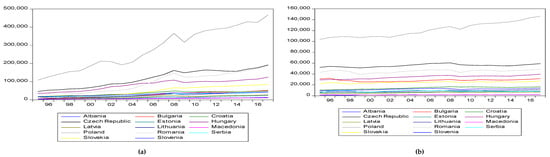

The main descriptive statistics are presented in Table 2. The GDP evolution shows an average of 70 billion euros for the Eastern European countries, with minimum values of 2.90 billion euros (for Estonia in 1995) and a maximum of 467,167 billion euros (for Poland in 2017). Of note, as in the last reporting year, manifesting significant differences between the analyzed countries: Poland, Romania, Hungary, and the Czech Republic (all have values of GDP over 100 billion euros) and in Bulgaria, Croatia, Estonia, Latvia, Lithuania, Slovenia, and Slovakia (less than 50 billion euros).

Table 2.

Summary descriptive statistics of the variables used in this paper.

GDP per capita has been steadily increasing since 1995 and, to date, with the panel average of 8326.58 euros; the maximum value being 20,800 euros (Slovenia, 2017), the minimum of 1200 euros (Bulgaria, 1997); highs of over 12,000 euros show the Czech Republic, Estonia, Latvia, Lithuania, Poland, Slovakia, and Slovenia, and less than 10,000 euros, Bulgaria, Croatia, Hungary, and Romania (Figure A1a, Appendix B).

The amount of energy consumed, as averages, is 55,959.71 gigawatt-hours, with a peak of 267,757.5 gigawatt-hours (Poland, 1996) and a minimum of 9971.97 (Latvia, 2000). The Czech Republic, Poland, and Romania show an electricity consumption of over 100,000 gigawatt-hours, the other countries having consumption below 50,000 gigawatt-hours. Consumption by industry is also differentiated: the largest is for industry, population, and transport, respectively (Figure A1b, Appendix B).

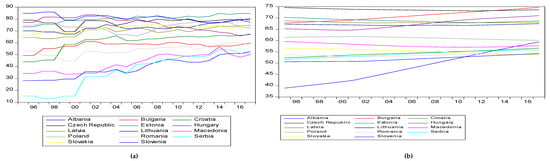

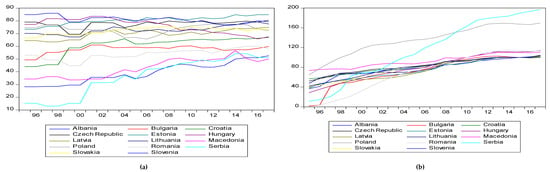

An important indicator of physical capital, the gross fixed capital formation, shows an average of 24.89; a maximum of 41.53 belongs to Estonia in 2007 and a minimum of 8.86 belongs to Croatia in 1996 (Figure A2a, Appendix B). Another important indicator, of human capital, the urban population, shows an average of 62.93; a maximum of 85.98 belongs to Lithuania in 2017 and a minimum of 50.62 belongs to Bulgaria in 1996 (Figure A2b, Appendix B). Good governance indicators have similar values for the analyzed countries: average of 70.55, maximum 85.98 in Estonia in 2016, minimum of 44.03 in Croatia in 1995 (Figure A3a, Appendix B).

Table 3 shows the values of the correlation statistics between the analyzed series and the associated probabilities. All variables are associated with GDP: electricity consumption, urbanization, and governance have a positive influence on this variable, while inflation and unemployment have negative influences; for electricity consumption, urbanization and governance have a positive influence on it, inflation and unemployment show negative influences.

Table 3.

Correlational statistics.

The results of the CD—cross-section dependence test [36] are presented in Table 1. The null hypothesis of non-dependence is rejected for all variables at a significance level of 1% and 5%; for all variables there is a transversal dependence and the variables in each country are correlated with those in another country. Under these circumstances, in the presence of cross-dependence, it is extremely important to use a root-based test that generates consistent, second-generation results.

Further, to get the correct results, we perform the root unit test on all the regression variables to determine the existence of unit roots for those series. In this article, we use the Breitung panel root test to determine whether the variables are stationary at levels or at first difference, starting from the null hypothesis that all panel series contain root units (Table 4); if the statistical value is lower than the standard value of the test, then a co-integration relationship is applied to establish first differential equilibrium.

Table 4.

Results of panel unit root tests Breitung t-stat.

The first category of panel cointegration test, as well as the first generation of unit root tests, can give errors because it does not consider structural breaks. For the second category of tests, taking into accounts both cross-section dependence and structural breaks, and based on previous results, we use the Westerlund and Edgerton (2008) [67] panel cointegration test. Table 5 shows the results obtained in the Westerlund panel cointegration test. The null hypothesis is rejected for 3 of 4 tests, thus confirming the presence of cointegration between the variables analyzed. Based on cointegration tests, we can state that for Eastern European countries, GDP, electricity consumption, and government cointegrate each other in the long term.

Table 5.

Results of the Westerlund cointegration test.

Once the cointegration relationship has been established, long-running coefficients are estimated in the next step using FMOLS and DOLS estimators. The results of the four estimates are shown in Table 6.

Table 6.

Results of long-run estimators.

The impact of total energy consumption and good governance on economic growth is revealed in model 1. The FOLS estimation results are presented below. The value of the coefficient is positive (2.327), which means that the economic development is sustained every year by 2.327 percent for the Eastern European countries. Good governance has a positive effect on economic development, the coefficient being positive of 0.064, also the urbanization is 0.322; in contrast, inflation and unemployment have negative coefficients, respectively −2.427 and −0.228 (Figure A3a,b, Appendix B). Similar studies [44,45,46,48,73,74,75] show that for the states from Eastern Europe, the relationship between economic growth and good governance (corruption) is in the defragmentation of the development theory. For all that, the coefficients from panel DOLS estimator are 1.460 and 0.056 for energy consumption and governance, respectively. At 1% level, the effect of energy consumption on GDP is positive and statistically significant and the significance of 1.460 shows that a 1% increase in energy consumption increases GDP by around 1.460%. Also, it was revealed that the effect of governance on GDP is positive and statistically significant at 1% level. The significance of 0.056 reflects that a 1% increase in governance increases GDP by 0.056%.

Model 2 looks at the impact of economic growth and good governance on energy consumption. The results of the GDP coefficient (0.239) assume that they have a positive and statistically significant effect on economic development in the Central and Eastern European region. The 1% increase in energy consumption by the population increases economic growth by 0.239, the results being similar to those obtained by [35,41,57,76,77,78,79,80,81,82]. It is also confirmed in this case the previous hypotheses: the growth energy-led hypothesis and the hypothesis of the positive effect of good government on economic development. Good governance has a positive effect (0.011), lower than that achieved by GDP. Variables inflation and unemployment have a negative and significant effect on economic growth (−0.095 and −0.007); in turn, urbanization has important positive effects (0.007). As far as the Eastern European countries are concerned, it can be seen that the relationship between economic growth and corruption is part of the second theory, namely, of defraying development, similar to the studies [44,45,47,48,83,84,85]. Using the DOLS estimator, we found that the coefficients are 0.150 and 0.003 for GDP and governance, respectively, and that, at 1% level, the GDP has a positive impact and statistically significant effect on energy consumption. The significance of 0.150 shows that a 1% increase in GDP activity determines the increase in the energy consumption, by around 0.150%. Accordingly, it was revealed the positive effect of governance on energy consumption and statistically significant at 1% level. The significance of 0.003 implies that a 1% increase in human development increases economic growth by around 0.003%.

Table 7 presents the results of the Granger causality panel for the analyzed models. Causality testing for the 14 Eastern European countries shows the directional link between electricity consumption and government spending towards GDP. Also, between GDP and governance and electric consumption, there are directional ties. These estimates for the Eastern European countries show that they have reached an adequate economic maturity, similar to that of developed countries.

Table 7.

Summary of the Pairwise Granger Causality Tests.

The causality direction has significant political implications. The knowledge of causality direction has direct implications for government policy-making on the energy sector development system, the introduction of sound governance policies that influence society as a whole.

5. Concluding Remarks and Further Development

Investigating the relationship between electricity consumption and economic growth for Central and Eastern European countries has led to contradictory results, which implies the need to open new research perspectives. Faced with previous studies, we introduced a new component, good governance, to analyze the impact of this on the initial variables. In this article, we used panel data for 14 countries from the Central and Eastern Europe for the period 1995–2017, to analyze the relationship between three variables: electricity consumption, economic growth, and good governance.

The methodology used for the analysis performed in this study consisted of panel regression; four equations were made for each analytical component: total electricity consumption, electricity consumption industry, electricity consumption population, electricity consumption in transport, for each of them was made the analysis, separately on the variables discussed: electricity–economic growth–good governance. The results obtained for the variables analyzed present two important components. The first result refers to the influence of electricity consumption on economic growth: for the Central and Eastern European countries, there is a causal and direct link between the two components, thus validating the hypothesis of the energy-led growth theory. Slightly different results, in terms of coefficients, were also obtained for the analysis of the structure of electricity consumption by sectors: industry, population, and transport. The second important outcome of the analysis is the full effect of good governance on electricity consumption and economic growth, the effect revealed by the fact that it directly affects these indicators. Yet at the same time, good governance also has an indirect effect on electricity consumption through economic growth: good governance affects economic growth, which in turn affects energy consumption.

Good governance directly affects economic growth and indirectly through energy consumption. However, the analysis also implies an encouraging result: improving good governance could lead to increased energy efficiency and stricter energy policies. The results also show a number of important policy implications: policy makers can influence economic growth through energy consumption, as a reverse approach may be true. Authorities can achieve economic growth by raising the level of human capital, and, in particular, through education. Also, encouraging results can also be achieved by improving the rule of law and government effectiveness. However, notable and immediate results can be achieved by improving the indicator of control of corruption, possibly by respecting the international conventions on Environmental Protection, the Kyoto Protocol.

Like any research, this study has its limitations. According to previous studies, the current levels of good governance are the effects of the previous measures, which lead to the idea that it is important to study the timing (the gap) where good governance affects the other indicators. Another important limitation of the study that might be considered is signaled by the effect of EU accession in this period of the analyzed countries.

Recommendations for future research can be formulated taking into account the results of the study. Firstly, it is important to control this energy–economic growth analysis and the effect of institutional quality by introducing other analysis factors: Regulatory Quality and Political Stability. Secondly, future studies could use, as a method of analysis, time series analysis instead of panel-based methodology. Thirdly, considering that we developed four separate, unique equations, we could use a system of equations that incorporate them all. Last, but not least, our analysis has been carried out globally, by country, and future studies based on energy intensity and efficiency can be carried out at the level of energy consumption per unit of production.

Author Contributions

Conceptualization, A.-M.B., G.P., and D.L.; Data curation, A.-M.B. and D.L.; Formal analysis, A.-M.B., G.P., and D.L.; Investigation, A.-M.B., G.P., and D.L.; Methodology, A.-M.B., G.P., and D.L.; Project administration, A.-M.B., G.P., and D.L.; Resources, A.-M.B., G.P., and D.L.; Software, G.P. and D.L.; Supervision, A.-M.B. and D.L.; Validation, A.-M.B., G.P., and D.L.; Visualization, A.-M.B., G.P., and D.L.; Writing—original draft, A.-M.B., G.P., and D.L.; Writing—review & editing, A.-M.B., G.P., and D.L. All authors read and approved the final manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A.

Table A1.

The used indicators according with their source.

Table A1.

The used indicators according with their source.

| Indicator | Definition | Source | Observations | Expected Sign |

|---|---|---|---|---|

| GDP | The final result of the production activity of resident producer units | Eurostat, World Bank | natural logarithm of GDP, period 1995–2017 | |

| ELEC | This consumption stands for final energy consumption | Eurostat | natural logarithm of final energy consumption (transport) in thousands tons of oil equivalent (TOE) | +/- |

| GOV | Good governance measured by averaging the six indices of governance (Kaufmann et al. 2010) [57]: control of corruption, rule of law, political instability, governmental efficiency, voice and accountability, and regulatory quality | World Bank | natural logarithm of good governance, period 1995–2017 | +/- |

| GFCF | Gross fixed capital formation (% of GDP) | World Bank | natural logarithm of gross fixed capital formation, period 1995–2017 | +/- |

| URB | The urban population (% of total) | World Bank | natural logarithm of urban population, period 1995–2017 | +/- |

| INF | Inflation (year to year %) used as control variable | Eurostat | natural logarithm of good governance, period 1995–2017 | +/- |

| UNEM | Unemployment (year to year %) used as control variable | Eurostat | natural logarithm of good governance, period 1995–2017 | +/- |

Appendix B. Graphs by Country and Variable

Figure A1.

(a) GDP for CEE Countries 1995-2018; (b) Final Consumption Energy for CEE Countries 1995–2018.

Figure A2.

(a) Gross fixed capital formation for CEE Countries 1995–2018; (b) Urban Population for CEE Countries 1995–2018.

Figure A3.

(a) Good Governance for CEE Countries 1995–2018; (b) Inflation for CEE Countries 1995–2018.

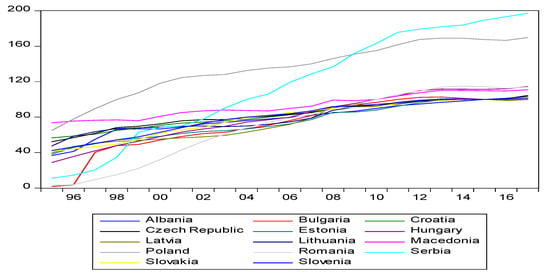

Figure A4.

Unemployment for CEE Countries 1995–2018.

References

- Bianco, V.; Manca, O.; Nardini, S.; Minea, A.A. Analysis and forecasting of nonresidential electricity consumption in Romania. Appl. Energy 2010, 87, 3584–3590. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL bound testing approach. Appl. Energy 2010, 87, 1938–1943. [Google Scholar] [CrossRef]

- Gherghina, S.C.; Onofrei, M.; Vintila, G.; Armeanu, D.S. Empirical Evidence from EU-28 Countries on Resilient Transport Infrastructure Systems and Sustainable Economic Growth. Sustainability 2018, 10, 2900. [Google Scholar]

- Zamfir, A.; Colesca, S.E.; Corbos, R.A. Public policies to support the development of renewable energy in Romania: A review. Renew. Sustain. Energy Rev. 2016, 58, 87–106. [Google Scholar] [CrossRef]

- Śmiech, S.; Papież, M. Energy consumption and economic growth in the light of meeting the targets of energy policy in the EU: The bootstrap panel Granger causality approach. Energy Policy 2014, 71, 118–129. [Google Scholar] [CrossRef]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Asafu-Adjaye, J. The relationship between energy consumption, energy prices and economic growth: Time series evidence from Asian developing countries. Energy Econ. 2000, 22, 615–625. [Google Scholar] [CrossRef]

- Lee, C.C. The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 2006, 34, 1086–1093. [Google Scholar] [CrossRef]

- Sharma, S.S. The relationship between energy and economic growth: Empirical evidence from 66 countries. Appl. Energy 2010, 87, 3565–3574. [Google Scholar] [CrossRef]

- Sorrell, S. Energy, Economic Growth and Environmental Sustainability: Five Propositions. Sustainability 2010, 2, 1784–1809. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Wang, B. The moderating role of corruption between economic growth and CO2 emissions: Evidence from BRICS economies. Energy 2018, 148, 506–513. [Google Scholar] [CrossRef]

- Sekrafi, H.; Sghaier, A. Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: A panel analysis in MENA region. J. Knowl. Econ. 2016, 9, 963–979. [Google Scholar] [CrossRef]

- Sadorsky, P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 2011, 39, 999–1006. [Google Scholar] [CrossRef]

- Apergis, N.; Danuletiu, D. Energy consumption and growth in Romania: Evidence from a panel error correction model. Int. J. Energy Econ. Policy 2012, 2, 348–356. [Google Scholar]

- Shahbaz, M.; Mutascu, M.; Tiwari, A.K. Revisiting the relationship between electricity consumption, capital and economic growth: Cointegration and causality analysis in Romania. Rom. J. Econ. Forecast. 2012, 3, 97–120. [Google Scholar]

- Shahbaz, M.; Mutascu, M.; Azim, P. Environmental Kuznets curve in Romania and the role of energy consumption. Renew. Sustain. Energy Rev. 2013, 18, 165–173. [Google Scholar] [CrossRef]

- Andrei, J.; Mieila, M.; Popescu, G.; Nica, E.; Cristina, M. The impact and determinants of environmental taxation on economic growth communities in Romania. Energies 2016, 9, 902. [Google Scholar]

- Koçak, E.; Şarkgüneşi, A. The renewable energy and economic growth nexus in Black Sea and Balkan countries. Energy Policy 2017, 100, 51–57. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P. Energy consumption and GDP revisited: A panel analysis of developed and developing countries. Energy Econ. 2007, 29, 1206–1223. [Google Scholar] [CrossRef]

- Al-Iriani, M. Energy–GDP relationship revisited: An example from GCC countries using panel causality. Energy Policy 2006, 34, 3342–3350. [Google Scholar] [CrossRef]

- Mahadevan, R.; Asafu-Adjaye, J. Energy consumption, economic growth and prices: A reassessment using panel VECM for developed and developing countries. Energy Policy 2007, 35, 2481–2490. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P. Energy consumption and economic growth in Asian economies: A more comprehensive analysis using panel data. Resour. Energy Econ. 2008, 30, 50–65. [Google Scholar] [CrossRef]

- Huang, B.N.; Hwang, M.J.; Yang, C.W. Causal relationship between energy consumption and GDP growth revisited: A dynamic panel data approach. Ecol. Econ. 2008, 67, 41–54. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. Energy consumption and real GDP in G7 countries: New evidence from panel cointegration with structural breaks. Energy Econ. 2008, 30, 2331–2341. [Google Scholar] [CrossRef]

- Ozturk, I.; Aslan, A.; Kalyoncu, H. Energy consumption and economic growth relationship: Evidence from panel data for low and middle-income countries. Energy Policy 2010, 38, 4422–4428. [Google Scholar] [CrossRef]

- Caraballo Pou, M.A.; Garcia Simon, J.M. Renewable Energy and Economic Development. An Analysis for Spain and the Biggest European Economies. Trimest. Econ. 2017, 84, 571–609. [Google Scholar] [CrossRef]

- Erol, U.; Yu, E.S.H. On the causal relationship between energy and income for industrialized countries. J. Energy Dev. 1988, 13, 113–122. [Google Scholar]

- Masih, A.; Masih, R. Energy consumption and real income temporal causality, results for a multi-country study based on cointegration and error-correction techniques. Energy Econ. 1996, 18, 165–183. [Google Scholar] [CrossRef]

- Esso, L.J. Threshold cointegration and causality relationship between energy use and growth in seven African countries. Energy Econ. 2010, 32, 1383–1391. [Google Scholar] [CrossRef]

- Yildirim, E.; Kuruoglu, D.; Aslan, A. Energy consumption and economic growth in the next 11 countries: The bootstrapped autoregressive metric causality approach. Energy Econ. 2014, 44, 14–21. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Bakhtyar, B.; Emirullah, C. The causal relationship between energy consumption and economic growth in the ASEAN-5 countries. Renew. Sustain. Energy Rev. 2015, 47, 732–745. [Google Scholar] [CrossRef]

- Tang, C.F.; Tan, B.W.; Ozturk, I. Energy consumption and economic growth in Vietnam. Renew. Sustain. Energy Rev. 2016, 54, 1506–1514. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Stern, D.I. A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ. 2003, 22, 267–283. [Google Scholar] [CrossRef]

- Ang, J.B. CO2 emissions, energy consumption and output in France. Energy Policy 2007, 35, 4772–4778. [Google Scholar] [CrossRef]

- Lee, C.C.; Chiu, Y.B.; Sun, C.H. Does One Size Fit All? A Reexamination of the Environmental Kuznets Curve Using the Dynamic Panel Data Approach. Appl. Econ. Perspect. Policy 2009, 31, 751–778. [Google Scholar] [CrossRef]

- Pao, H.T.; Fu, H.C. Renewable energy, non-renewable energy and economic growth in Brazil. Renew. Sust. Energ. Rev. 2013, 25, 381–392. [Google Scholar] [CrossRef]

- Ahamad, M.G.; Islam, A.K.M.N. Electricity consumption and economic growth nexus in Bangladesh: Revisited evidences. Energy Policy 2011, 39, 6145–6150. [Google Scholar] [CrossRef]

- Bozoklu, S.; Yilanci, V. Energy consumption and economic growth for selected OECD countries: Further evidence from the Granger causality test in the frequency domain. Energy Policy 2013, 63, 877–881. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy, output, CO2 emissions, and fossil fuel prices in Central America: Evidence from a nonlinear panel smooth transition vector error correction model. Energy Econ. 2014, 42, 226–232. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H. Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 2012, 40, 473–479. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R.; Ewing, B.T. Energy consumption, income, and carbon emissions in the United States. Ecol. Econ. 2007, 62, 482–489. [Google Scholar] [CrossRef]

- Ugur, M. Corruptions direct effects on per-capita income growth: A meta-analysis. J. Econ. Surv. 2014, 28, 472–490. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.; Thaicharoen, Y. Institutional causes, macroeconomic symptoms: Volatility, crises and growth. J. Monet. Econ. 2003, 50, 49–123. [Google Scholar] [CrossRef]

- Acemoglu, D.; Verdier, T. Property Rights, Corruption and the Allocation of Talent: A General Equilibrium Approach. Econ. J. 1998, 108, 1381–1403. [Google Scholar] [CrossRef]

- Murphy, K.M.; Shleifer, A.; Vishny, R.W. Why is Rent-Seeking so Costly to Growth? Am. Econ. Rev. 1993, 83, 409–414. [Google Scholar]

- Mauro, P. Corruption and the Composition of Government Expenditure. J. Public Econ. 1998, 69, 263–279. [Google Scholar] [CrossRef]

- Mo, P.H. Corruption and Economic Growth. J. Comparat. Econ. 2001, 29, 66–79. [Google Scholar] [CrossRef]

- Pellegrini, L.; Gerlagh, R. Corruption’s Effect on Growth and Its Transmission Channels. Kyklos 2004, 57, 429–456. [Google Scholar] [CrossRef]

- Blackburn, K.; Bose, N.; Emranul Haque, M. The Incidence and Persistence of Corruption in Economic Development. J. Econ. Dyn. Control 2006, 30, 2447–2467. [Google Scholar] [CrossRef]

- Méndez, F.; Sepúlveda, F. Corruption, Growth and Political Regimes: Cross Country Evidence. Eur. J. Political Econ. 2006, 22, 82–98. [Google Scholar] [CrossRef]

- Aidt, T. Corruption, Institutions, and Economic Development. Oxf. Rev. Econ. Policy 2009, 25, 271–291. [Google Scholar] [CrossRef]

- Méon, P.-G.; Weill, L. Is Corruption an Efficient Grease? World Dev. 2010, 38, 244–259. [Google Scholar] [CrossRef]

- Swaleheen, M. Economic Growth with Endogenous Corruption: An Empirical Study. Public Choice 2011, 146, 23–41. [Google Scholar] [CrossRef]

- Fredriksson, P.; Vollebergh, H.R.J.; Dijkgraaf, E. Corruption and Energy Efficiency in OECD Countries: Theory and Evidence. J. Environ. Econ. Manag. 2004, 47, 207–231. [Google Scholar] [CrossRef]

- Stern, D.I. Modeling international trends in energy efficiency. Energy Econ. 2012, 34, 2200–2208. [Google Scholar] [CrossRef]

- Nicolli, F.; Vona, F. The evolution of renewable energy policy in OECD countries: Aggregate indicators and determinants. In Political Economy and Instruments of Environmental Politics; Schneider, F., Kollmann, A., Reichl, J., Eds.; MIT Press: Boston, MA, USA, 2015; pp. 117–148. [Google Scholar]

- Omri, A.; Daly, S.; Rault, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries? Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: Methodology and Analytical Issues. Policy Research working paper. Available online: https://openknowledge.worldbank.org/handle/10986/3913 (accessed on 17 February 2019).

- Saidi, K.; Hammami, S. Economic growth, energy consumption and carbone dioxide emissions: Recent evidence from panel data analysis for 58 countries. Qual. Quant. 2016, 50, 361–383. [Google Scholar] [CrossRef]

- Olson, M.; Sarna, N.; Swamy, A.V. Governance and growth: A simple hypothesis explaining cross-country differences in productivity growth. Public Choice 2000, 102, 341–364. [Google Scholar] [CrossRef]

- Arminen, H.; Menegaki, A.N. Corruption, climate and the energy-environment-growth Nexus. Energy Econ. Energy Econ. 2019, 80, 621–634. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite sample properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S.; Smyth, R. Does Democracy Facilitate Economic Growth or Does Economic Growth Facilitate Democracy? An Empirical Study of Sub-Saharan Africa. Econ. Model. 2011, 28, 900–910. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Ullah, A.; Yamagata, T. A Bias-Adjusted LM Test of Error Cross-Section Independence. Econom. J. 2008, 11, 105–127. [Google Scholar] [CrossRef]

- Westerlund, J.; Edgerton, D.L. A simple test for cointegration in dependent panels with structural breaks. Oxf. Bull. Econ. Stat. 2008, 70, 665–704. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Hansen, B.E. Statistical Inference in Instrumental Variables Regressions with I (1) Processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Saikkonen, P. Estimation and Testing of Cointegrated Systems by an Autoregressive Approximation. Econom. Theory 1992, 8, 1–27. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Kao, C.; Chiang, M.-H. On the estimation and inference of a cointegrated regression in panel data. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Advances in Econometrics); Badi, H., Baltagi, T.B., Fomby, R., Hill, C., Eds.; Emerald Group Publishing Limited: Bradrod, UK, 2001; Volume 15, pp. 179–222. [Google Scholar]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Kumar, R.R.; Stauvermann, P.J.; Patel, A.; Kumar, R.D. Exploring the effects of energy consumption on output per worker: A study of Albania, Bulgaria, Hungary and Romania. Energy Policy 2014, 69, 575–585. [Google Scholar] [CrossRef]

- Nawaz, S. Growth Effects of Institutions: A Disaggregated Analysis. Econ. Model. 2015, 45, 118–126. [Google Scholar] [CrossRef]

- Chang, C.P.; Hao, Y. Environmental performance, corruption and economic growth: Global evidence using a new data set. Appl. Econ. 2017, 49, 498–514. [Google Scholar] [CrossRef]

- Alper, A.; Oguz, O. The role of renewable energy consumption in economic growth: Evidence from asymmetric causality. Renew. Sustain. Energy Rev. 2016, 60, 953–959. [Google Scholar] [CrossRef]

- Jalil, A. Energy–growth conundrum in energy exporting and importing countries: Evidence from heterogeneous panel methods robust to cross-sectional dependence. Energy Econ. 2014, 44, 314–324. [Google Scholar] [CrossRef]

- Pirlogea, C.; Cicea, C. Econometric perspective of the energy consumption and economic growth relation in European Union. Renew. Sustain. Energy Rev. 2012, 16, 5718–5726. [Google Scholar] [CrossRef]

- Işik, C.; Doğan, E.; Ongan, S. Analyzing the Tourism–Energy–Growth Nexus for the Top 10 Most-Visited Countries. Economies 2017, 5, 40. [Google Scholar] [CrossRef]

- Armeanu, D.Ş.; Vintilă, G.; Gherghina, Ş.C. Does Renewable Energy Drive Sustainable Economic Growth? Multivariate Panel Data Evidence for EU-28 Countries. Energies 2017, 10, 381. [Google Scholar] [CrossRef]

- Cheng, C.; Ren, X.; Wang, Z.; Shi, Y. The Impacts of Non-Fossil Energy, Economic Growth, Energy Consumption, and Oil Price on Carbon Intensity: Evidence from a Panel Quantile Regression Analysis of EU 28. Sustainability 2018, 10, 4067. [Google Scholar] [CrossRef]

- Zheng, W.; Walsh, P.P. Economic growth, urbanization and energy consumption—A provincial level analysis of China. Energy Econ. 2019, 80, 153–162. [Google Scholar] [CrossRef]

- Ayres, R.U.; van den Bergh, J.C.J.M.; Lindenberger, D.; Warr, B. The underestimated contribution of energy to economic growth. Struct. Chang. Econ. Dyn. 2013, 27, 79–88. [Google Scholar] [CrossRef]

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and non-renewable energy use-economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).