Balancing Population Distribution and Sustainable Economic Development in Yangtze River Economic Belt of China

Abstract

1. Introduction

2. Consistency of Population and Economy (CPE) and Regional Economic Disparity

3. Data and Methods

3.1. Research Data

3.2. CPE Values Index

3.3. Determinants of CPE

3.4. Research Method

- y denotes CPE, is a unit vector of N × 1 order, which is related to the estimated constant term ;

- W is an n-order spatial weight matrix, which reflects the dependence between regions (In the spatial econometric analysis, a spatial weight matrix is needed to express the spatial relationships among analyzed regions. Because the principle of spatial weight matrix is based on the concept of proximity, the weights are simple to construct. In the actual spatial econometric analysis, the spatial weight matrix as determined by this method has been widely used. Therefore, this paper sets the spatial weight matrix to a matrix of binary adjacency weights. That is, if the two regions are geographically bordered, the weight is set to 1, otherwise it is set to 0.)

- is the spatial lag dependent variable, that is the endogenous interaction effect between n regions;

- is a parameter reflecting the magnitude of this effect; similarly;

- is the exogenous interaction effect of each independent variable;

- is the parameter reflecting the magnitude of this effect;

- is the regression coefficient, and the explanatory variable represents the determinants of CPE;

- is a random disturbance term;

- is a spatial individual effect, reflecting individual regions do not change with time;

- is a spatial time effect, reflecting all individual regions change with time.

4. Model Results and Analysis

4.1. Tests of Spatial Dependency

4.2. Model Selection

4.3. Results of Regression Analysis

4.4. Spillover Effect Analysis

5. Conclusions

- (1)

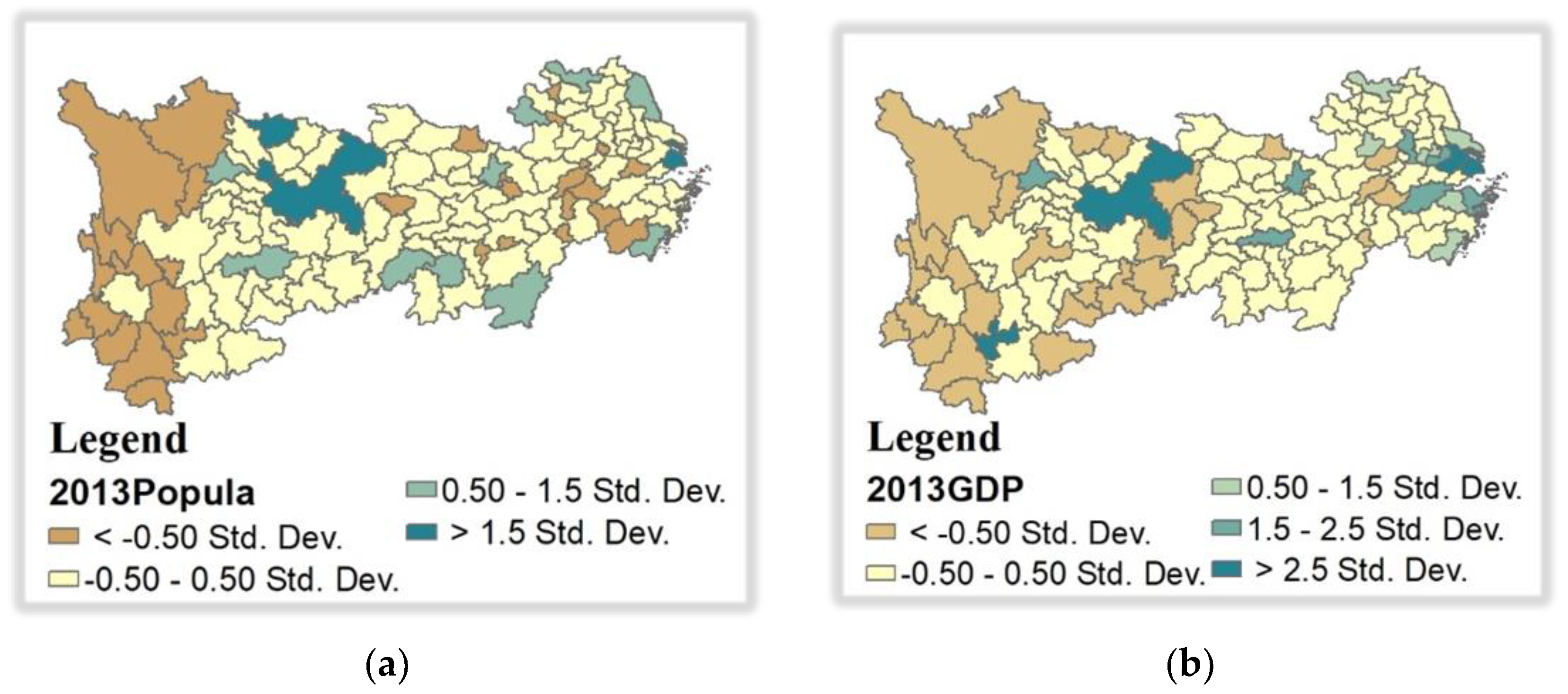

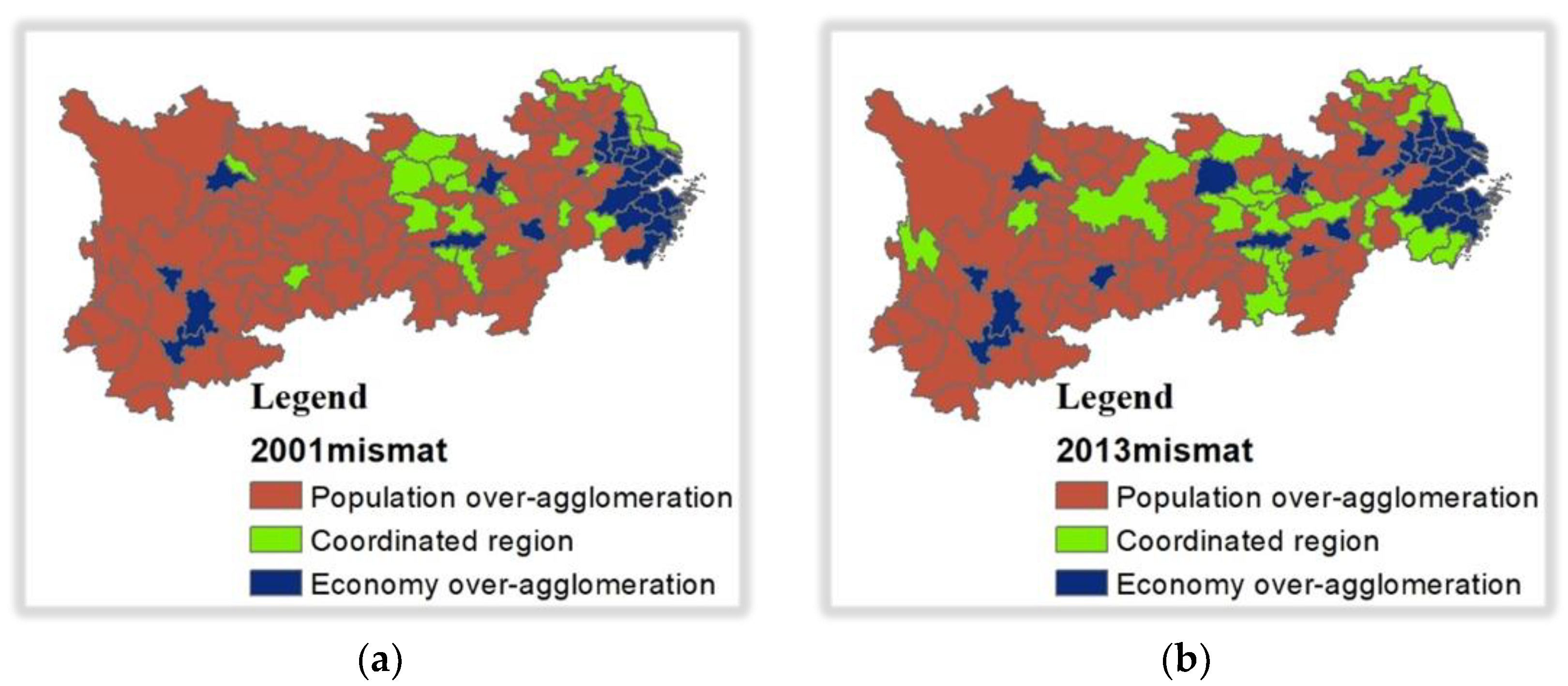

- The economic development is too spatially agglomerated in and around provincial capital cities in YREB. The population is over-agglomerated in other cities of all provinces in YREB. The results suggest the need to further strengthen the flows of population or to strengthen the economic development of small towns such as counties and towns.

- (2)

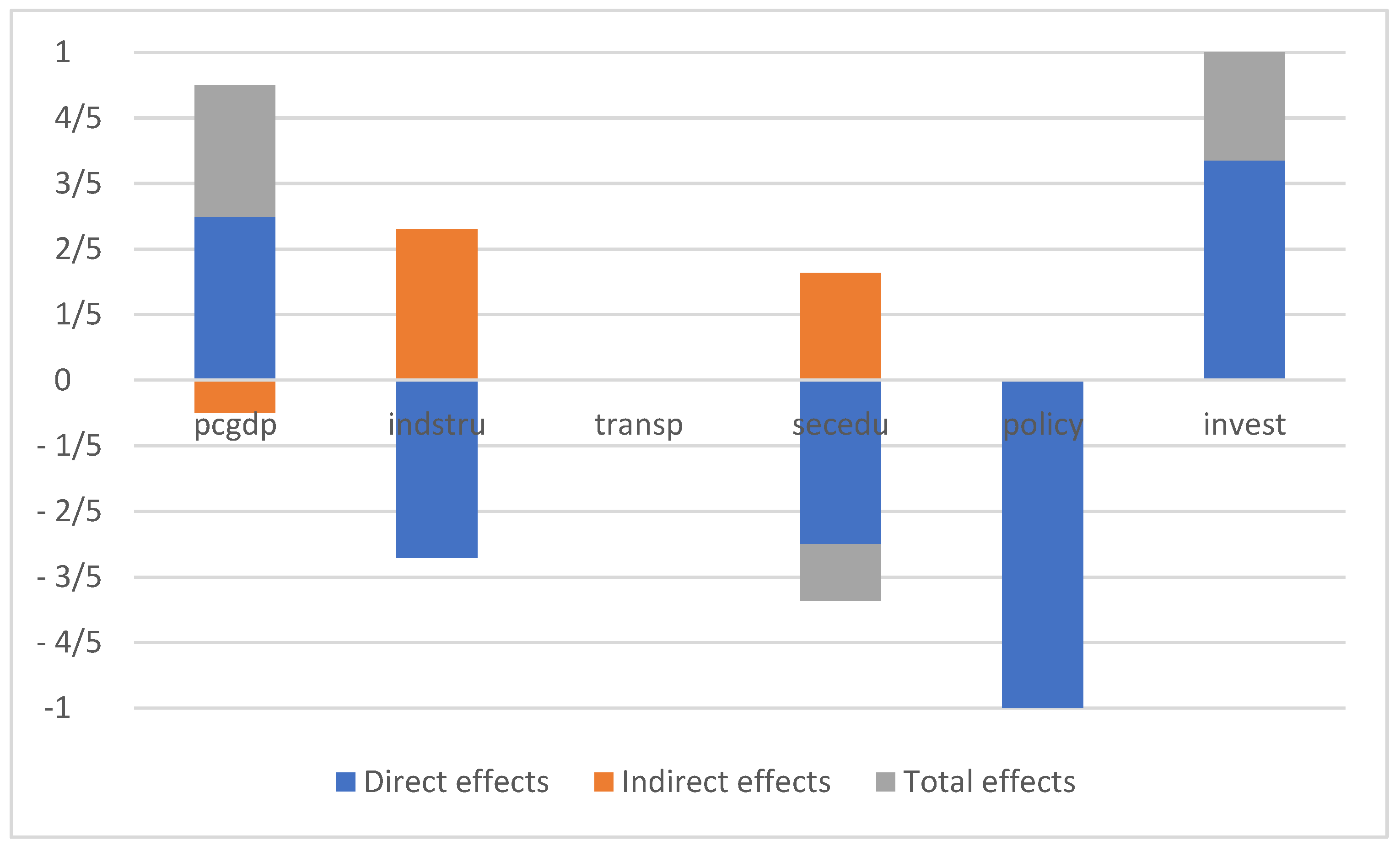

- From the perspective of the total effect, different factors have shown to have different effects on the degrees of population–economic coordination in YREB. Infrastructure changes have no significant impact on CPE values. Human capital has a negative impact on CPE values. Physical capital and per capita GDP have a positive impact on CPE values.

- (3)

- The increase in human capital has a negative impact on CPE values, but the spillover effect from core areas to adjacent areas is positive, indicating that the increase of human capital has a greater impact on core regions than on their adjacent areas. The industrial structure has the opposite direction of influence on CPE values between the region and the adjacent region. It should be noted that it is still difficult to judge which region has more effect on the imbalance of the population–economic coordination as a whole.

- (4)

- The spillover effect of per capita GDP increase is significantly negative, and the spillover effect of the human capital increase and industrial structure optimization are significantly positive. In addition, the spatial spillover effects of regional policies, physical capital, and infrastructure on CPE values are not significant.

Author Contributions

Funding

Conflicts of Interest

References

- Williamson, J.G. Regional inequality and the process of national development: A description of the patterns. Econ. Dev. Cult. Chang. 1965, 13, 1–84. [Google Scholar] [CrossRef]

- Kuznets, S. Economic Growth and Income Inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Krugman, P. Geography and Trade; Leuven University Press: Leuven, Belgium, 1991. [Google Scholar]

- Krugman, P. Development, Geography and Economic Theory; MIT Press: Cambridge, MA, USA, 1995. [Google Scholar]

- Fujita, M.; Krugman, P. The new economic geography: Past, present and the future. Pap. Reg. Sci. 2004, 83, 139–164. [Google Scholar] [CrossRef]

- Krugman, P. The new economic geography, now middle-aged. Reg. Stud. 2010, 45, 1–7. [Google Scholar] [CrossRef]

- Fingleton, B.; Fischer, M.M. Neoclassical theory versus new economic geography: Competing explanations of cross-regional variation in economic development. Ann. Reg. Sci. 2010, 44, 467–491. [Google Scholar] [CrossRef]

- Redding, S.J. Economic geography: A review of the theoretical and empirical literature. In Palgrave Handbook of International Trade; Springer: Berlin, Germany, 2013; pp. 497–531. [Google Scholar]

- Ghiglino, C.; Nocco, A. When Veblen meets Krugman: Social network and city dynamics. Econ. Theory 2017, 63, 431–470. [Google Scholar] [CrossRef]

- Gaspar, J.M. A prospective review on New Economic Geography. Ann. Reg. Sci. 2018, 6, 237–272. [Google Scholar] [CrossRef]

- Feng, Z.; Liu, X. Research on Spatial Consistency of Population Distribution and Economic Development in China. Popul. Econ. 2013, 2, 3–11. [Google Scholar]

- Xiao, Z. A Study on the Spatial Effect of the Consistency of Population and Economic Distribution in China. Popul. Res. 2013, 37, 42–52. [Google Scholar]

- Soltani, S.R.; Mahiny, A.S.; Monavari, S.M.; Alesheikh, A.A. Sustainability through uncertainty management in urban land suitability assessment. Environ. Eng. Sci. 2013, 4, 170–178. [Google Scholar] [CrossRef]

- Yang, C.; Han, H.; Song, J. Spatial Distribution of Migration and Economic Development: A Case Study of Sichuan Province, China. Sustainability 2014, 6, 6509–6528. [Google Scholar] [CrossRef]

- Yang, Q.; He, L. Spatiotemporal changes in population distribution and socioeconomic development in China from 1950 to 2010. Abrab. J. Geosci. 2017, 10, 498. [Google Scholar] [CrossRef]

- Paul, S.; Chatterjee, K. Urbanisation and consistency measurement: A study on District of North 24 Parganas, West Bengal, India. Arch. Appl. Sci. Res. 2012, 4, 2052–2067. [Google Scholar]

- Souche, S.; Mercier, A.; Ovtracht, N. The impacts of urban pricing on social and spatial inequalities: The case study of Lyon (France). Urban Stud. 2016, 53, 373–399. [Google Scholar] [CrossRef]

- Song, S.; Chu, G.S.F.; Chao, R. Inter-city regional disparity in China. China Econ. Rev. 2000, 11, 246–261. [Google Scholar] [CrossRef]

- Golley, J.; Wei, Z. Population dynamics and economic growth in China. China Econ. Rev. 2015, 35, 15–32. [Google Scholar] [CrossRef]

- National Sanitation and Health Commission of China. China’s Floating Population Development Report 2018; China Population Publishing House: Beijing, China, 2019.

- Francis, J. Asymmetries in regional labor markets, migration and economic geography. Ann. Reg. Sci. 2007, 41, 125–143. [Google Scholar] [CrossRef]

- Perroux, F. Economic Space: Theory and Applications. Q. J. Econ. 1950, 64, 89–104. [Google Scholar] [CrossRef]

- Hoover, E.M.; Giarratani, F. An Introduction to Regional Economics, 3rd ed.; Mcgraw-Hill: New York, NY, USA, 1999. [Google Scholar]

- Nijkamp, P.; Abreu, M. Regional Development Theory. In International Encyclopedia of Human Geography; Kitchin, R., Thrift, N., Eds.; Elsevier: Amsterdam, The Netherlands, 2009; Volume 9, pp. 202–207. [Google Scholar]

- Martin, R.; Sunley, P. The new economic geography and policy relevance. J. Econ. Geogr. 2010, 11, 357–369. [Google Scholar] [CrossRef]

- Zhang, J.; Guo, X. A Theory and Empirical Model of Long-term Balanced Population Development. Popul. Res. 2013, 37, 16–29. [Google Scholar]

- Hoover, E.M. Basic Approaches to the Study of Demographic Aspects of Economic Development: Economic-Demographic Models. Popul. Index 1971, 37, 66–75. [Google Scholar] [CrossRef] [PubMed]

- Niebuhr, A. Market access and regional disparities. Ann. Reg. Sci. 2006, 40, 313–334. [Google Scholar] [CrossRef]

- Egger, P.; Gruber, S.; Larch, M.; Pfaffermayr, M. Knowledge-capital meets new economic geography. Ann. Reg. Sci. 2007, 41, 857–875. [Google Scholar] [CrossRef]

- Ter Wal, A.L.; Boschma, R.A. Applying social network analysis in economic geography: Framing some key analytic issues. Ann. Reg. Sci. 2009, 43, 739–756. [Google Scholar] [CrossRef]

- Mossay, P. A theory of rational spatial agglomerations. Reg. Sci. Urban Econ. 2013, 43, 385–394. [Google Scholar] [CrossRef]

- Pessoa, A. Agglomeration and regional growth policy: Externalities versus comparative advantages. Ann. Reg. Sci. 2014, 53, 1–27. [Google Scholar] [CrossRef]

- Barbero, J.; Zofío, J.L. The multiregional core-periphery model: The role of the spatial topology. Netw. Spat. Econ. 2016, 16, 469–496. [Google Scholar] [CrossRef]

- Merton, R.K. The Matthew Effect in Science. Science 1968, 159, 56–63. [Google Scholar] [CrossRef]

- Ji, M.; Wu, Z.; Su, H.; Jiang, L. Spatial Panel Analysis of China’s Economic Growth and Institutional Change. Areal Res. Dev. 2011, 30, 1–5. [Google Scholar]

- Ge, Y. How does urbanization in China affect fertility? Based on the study of spatial panel data model. Popul. J. 2015, 37, 88–101. [Google Scholar]

- Elhorst, J.P. Matlab Software for Spatial Panels. Int. Reg. Sci. Rev. 2014, 37, 389–405. [Google Scholar] [CrossRef]

- LeSage, J.P.; Pace, R.K. Introduction to Spatial Econometrics; CRC Press Taylor & Francis Group: Boca Raton, FL, USA, 2009. [Google Scholar]

- Anselin, L. Spatial Econometric: Methods and Models; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1988. [Google Scholar]

- Elhorst, J.P. Spatial Panel Data Models; Springer: Heidelberg, Germany, 2010. [Google Scholar]

- Baltagi, B.H.; Song, S.H.; Jung, B.C.; Kon, W. Testing for serial correlation, spatial autocorrelation and random effects using panel data. J. Econom. 2007, 140, 5–51. [Google Scholar] [CrossRef]

| Year | CPE | INVEST | SECEDU | TRANSP | POLICY | INDSTRU | PCGDP |

|---|---|---|---|---|---|---|---|

| 2001 | 0.533 *** | 0.196 *** | 0.492 *** | 0.215 *** | 0.426 *** | 0.218 *** | 0.544 *** |

| 2002 | 0.545 *** | 0.295 *** | 0.625 *** | 0.171 ** | 0.415 *** | 0.204 *** | 0.549 *** |

| 2003 | 0.558 *** | 0.296 *** | 0.678 *** | 0.157 ** | 0.435 *** | 0.211 *** | 0.556 *** |

| 2004 | 0.564 *** | 0.305 *** | 0.600 *** | 0.162 ** | 0.445 *** | 0.170 ** | 0.555 *** |

| 2005 | 0.531 *** | 0.235 *** | 0.605 *** | 0.151 ** | 0.395 *** | 0.204 *** | 0.524 *** |

| 2006 | 0.504 *** | 0.236 *** | 0.550 *** | 0.097 * | 0.421 *** | 0.123 * | 0.483 *** |

| 2007 | 0.531 *** | 0.269 *** | 0.482 *** | 0.105 * | 0.443 *** | 0.102 * | 0.511 *** |

| 2008 | 0.514 *** | 0.213 *** | 0.416 *** | 0.102 * | 0.423 *** | 0.137 ** | 0.493 *** |

| 2009 | 0.502 *** | 0.367 *** | 0.289 *** | 0.126 * | 0.417 *** | 0.190 *** | 0.488 *** |

| 2010 | 0.497 *** | 0.361 *** | 0.387 *** | 0.159 ** | 0.273 *** | 0.236 *** | 0.487 *** |

| 2011 | 0.485 *** | 0.337 *** | 0.475 *** | 0.145 ** | 0.386 *** | 0.278 *** | 0.478 *** |

| 2012 | 0.440 *** | 0.339 *** | 0.503 *** | 0.142 ** | 0.331 *** | 0.299 *** | 0.442 *** |

| 2013 | 0.147 *** | 0.154 ** | 0.182 *** | 0.126 * | 0.207 *** | 0.317 *** | 0.347 *** |

| Statistic of Test | Pooled OLS | Spatial Fixed Effects | Time-Period Fixed Effects | Spatial and Time-Period Fixed Effects |

|---|---|---|---|---|

| LMlag | 182.340 | 0.154 | 43.002 | 0.866 |

| (0.000) | (0.695) | (0.000) | (0.352) | |

| R_LMlag | 0.763 | 76.457 | 11.902 | 8.809 |

| (0.382) | (0.000) | (0.001) | (0.003) | |

| LMerr | 438.454 | 15.466 | 50.791 | 0.714 |

| (0.000) | (0.000) | (0.000) | (0.398) | |

| R_LMerr | 256.877 | 91.769 | 19.691 | 8.657 |

| (0.000) | (0.000) | (0.000) | (0.003) |

| Determinants | Regression Coefficients | Determinants | Regression Coefficients |

|---|---|---|---|

| pcgdp | 1.633 *** | W*pcgdp | −0.373 *** |

| (33.713) | (−3.337) | ||

| indstru | −0.146 *** | W*indstru | 0.124 ** |

| (−4.407) | (2.477) | ||

| transp | −0.01 | W*transp | 0.001 |

| (−0.332) | (0.033) | ||

| secedu | −0.283 *** | W*secedu | 0.189 *** |

| (−7.860) | (3.296) | ||

| policy | −0.100 *** | W*policy | 0.04 |

| (−4.274) | (0.924) | ||

| invest | 0.166 *** | W*invest | −0.086 |

| (5.558) | (−1.396) | ||

| W*dep.var | 0.033 | ||

| (0.897) | |||

| R2 | 0.936 | ||

| sigma2 | 0.05 | ||

| log-L | 200.463 | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiang, H.; Yang, J.; Liu, X.; Lee, J. Balancing Population Distribution and Sustainable Economic Development in Yangtze River Economic Belt of China. Sustainability 2019, 11, 3320. https://doi.org/10.3390/su11123320

Xiang H, Yang J, Liu X, Lee J. Balancing Population Distribution and Sustainable Economic Development in Yangtze River Economic Belt of China. Sustainability. 2019; 11(12):3320. https://doi.org/10.3390/su11123320

Chicago/Turabian StyleXiang, Huali, Jun Yang, Xi Liu, and Jay Lee. 2019. "Balancing Population Distribution and Sustainable Economic Development in Yangtze River Economic Belt of China" Sustainability 11, no. 12: 3320. https://doi.org/10.3390/su11123320

APA StyleXiang, H., Yang, J., Liu, X., & Lee, J. (2019). Balancing Population Distribution and Sustainable Economic Development in Yangtze River Economic Belt of China. Sustainability, 11(12), 3320. https://doi.org/10.3390/su11123320