Exploring Carry Trade and Exchange Rate toward Sustainable Financial Resources: An application of the Artificial Intelligence UKF Method

Abstract

1. Introduction

2. Literature Review

2.1. Sustainable Financial Resources

2.2. Heterogeneous Agents

2.3. Research Gaps

3. Theoretical Model

3.1. Hypothesis and Derivation of the Model

3.2. Switching Mechanism for Agents

3.3. Model Solution

4. Methodology

4.1. Introduction of the UKF

4.2. Procedures

5. Results

5.1. Data Description

5.2. Model Estimation and Testing

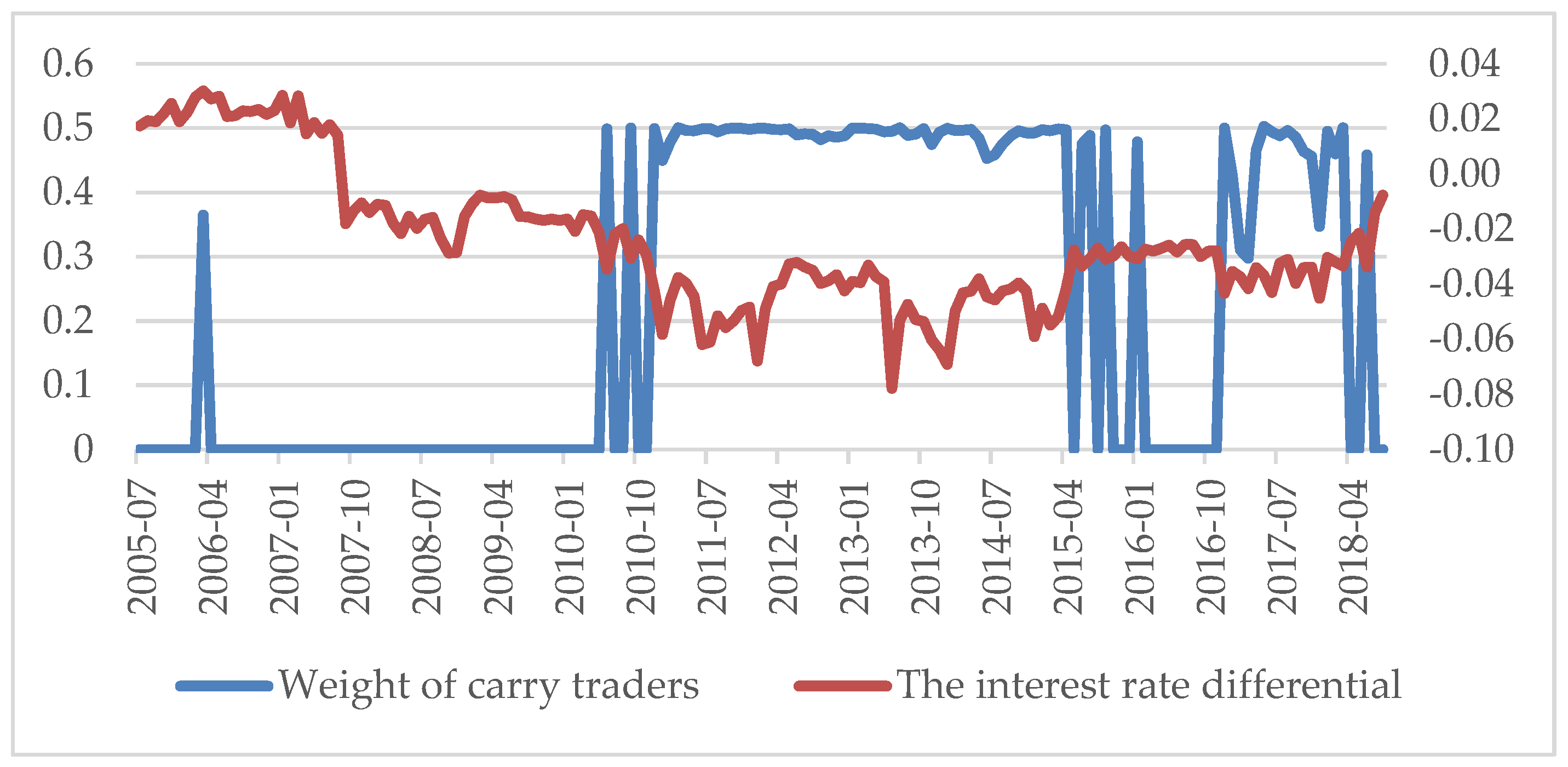

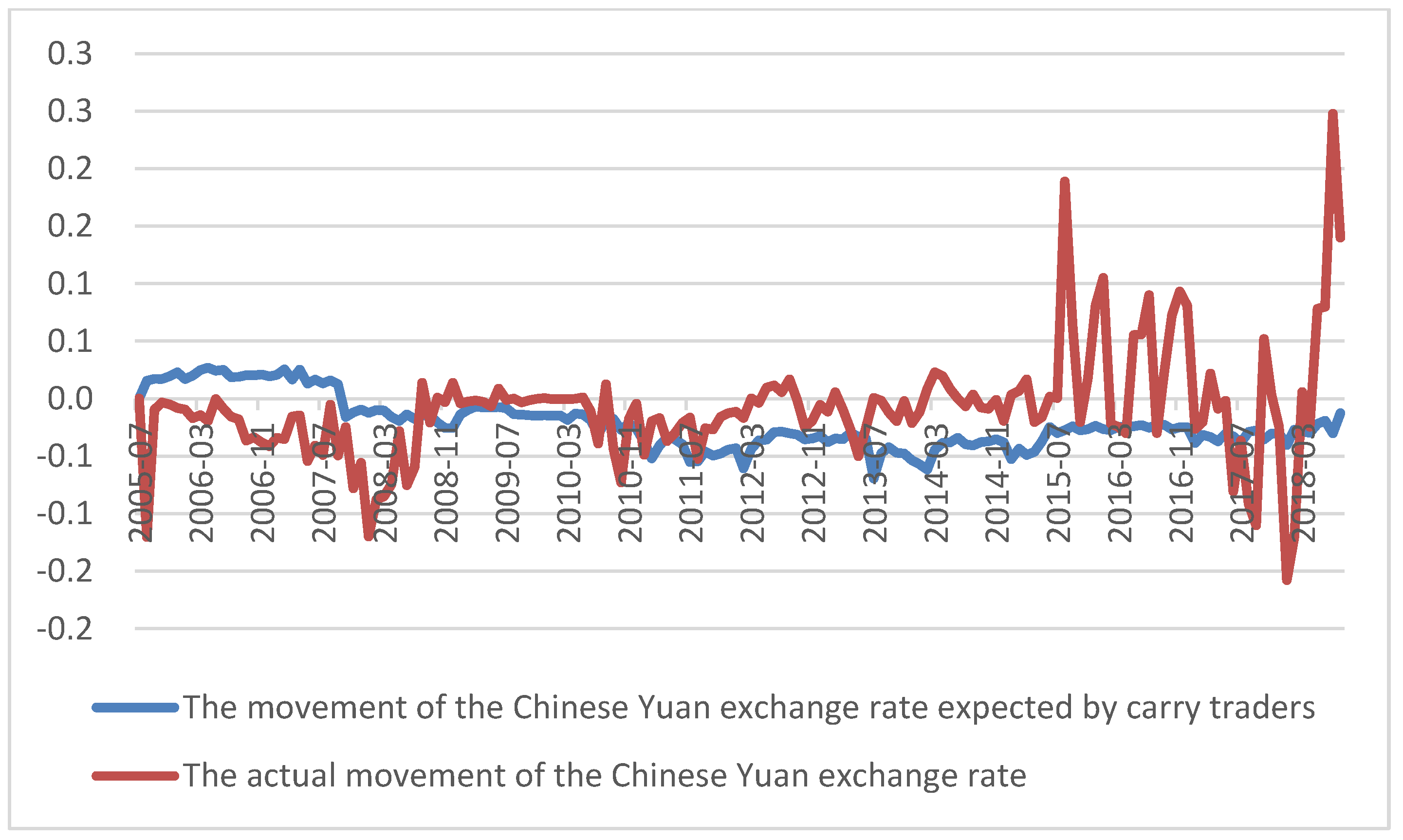

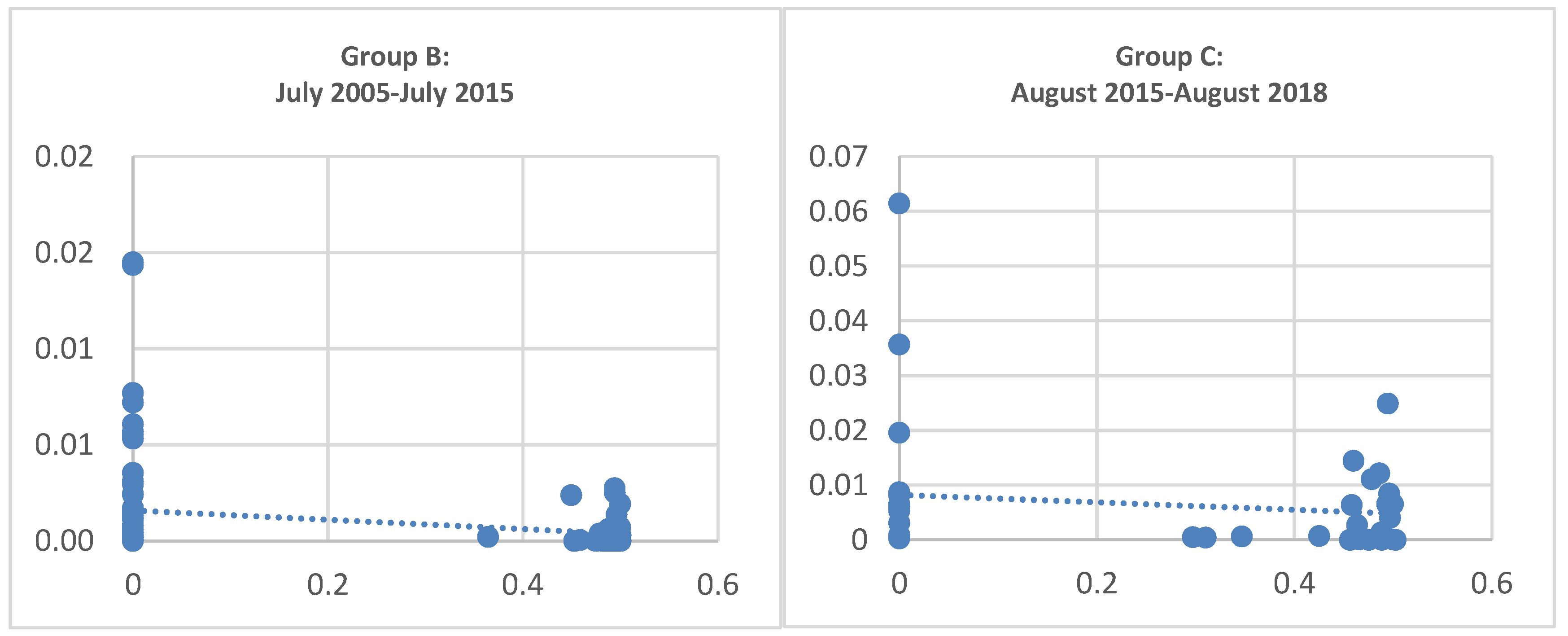

5.3. Other Results and Analysis

6. Implications

6.1. Theoretical Implications

6.2. Managerial Implications

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. 2008, 8, 360–387. [Google Scholar] [CrossRef]

- Wu, K.-J.; Tseng, M.-L.; Lim, M.-K.; Chiu, A.S.F. Causal sustainable resource management model using a hierarchical structure and linguistic preferences. J. Clean. Prod. 2019. In press. [Google Scholar] [CrossRef]

- Feng, M.; Cheng, H. RMB exchange rate regime reform and the Trilemma facing LOEs. China Financ. Econ. Rev. 2016, 4, 1–15. [Google Scholar] [CrossRef]

- Sussangkarn, C. Comments by Chalongphob Sussangkarn, on The Economics of RMB Internationalization. Asian Econ. Pap. 2016, 15, 127–130. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, F.; Huang, J.; Shenoy, C. Hot money flows and production uncertainty: Evidence from China. Pac.-Basin Financ. J. 2018, in press. [Google Scholar] [CrossRef]

- Zhu, J.; Guo, K.; Ai, M.; Zhao, Y.; Bai, X. The further opening up of China’s financial sector. China Econ. J. 2018, 11, 44–53. [Google Scholar] [CrossRef]

- Frankel, J.A.; Froot, K.A. Chartists, fundamentalists, and trading in the foreign exchange market. Am. Econ. Rev. 1990, 80, 181–185. [Google Scholar]

- Spronk, R.; Verschoor, W.; Zwinkels, R. Carry trade and foreign exchange rate puzzles. Eur. Econ. Rev. 2013, 60, 17–31. [Google Scholar] [CrossRef]

- McGuire, P.; Upper, C. Detecting FX Carry Trades. BIS Q. Rev. 2007, 3, 8–9. [Google Scholar]

- Baillie, R.T.; Chang, S.S. Carry trades, momentum trading and the forward premium anomaly. J. Financ. Mark. 2011, 14, 441–464. [Google Scholar] [CrossRef]

- Shehadeh, A.; Li, Y.; Moore, M. The Forward Premium Bias, Carry Trade Return and the Risks of Volatility and Liquidity. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2789141 (accessed on 5 June 2019).

- Cao, S.; Huang, H.C.; Liu, R.R.; MacDonald, R. The term structure of exchange rate predictability: Commonality, scapegoat, and disagreement. J. Int. Money Financ. 2018, in press. [Google Scholar] [CrossRef]

- Jongen, R.; Verschoor, W.F.C.; Wolff, C.C.P.; Zwinkels, R.C.J. Explaining dispersion in foreign exchange expectations: A heterogeneous agent approach. J. Econ. Dyn. Control 2012, 36, 719–735. [Google Scholar] [CrossRef]

- Raffestin, L. Foreign Exchange Investment Rules and Endogenous Currency Crashes. Available online: ftp://ftp.repec.org/opt/ReDIF/RePEc/laf/CR16-EFI01.pdf (accessed on 5 June 2019).

- Li, X.P.; Wu, C.F. Carry trade, heterogeneous expectation and micro exchange rate determination. J. Manag. Sci. China 2018, 6, 1–11. (In Chinese) [Google Scholar]

- Dominguez, M.K. Central bank intervention and exchange rate volatility. J. Int. Money Financ. 1998, 17, 161–190. [Google Scholar] [CrossRef]

- Ruan, Q.; Bao, J.; Zhang, M.; Fan, L. The effects of exchange rate regime reform on RMB markets: A new perspective based on MF-DCCA. Phys. A Stat. Mech. Appl. 2019, 522, 122–134. [Google Scholar] [CrossRef]

- Brundtland Commission. Report of the World Commission on Environment and Development: Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Mebratu, D. Sustainability and sustainable development: Historical and conceptual review. Environ. Impact Assess. Rev. 1998, 18, 493–520. [Google Scholar] [CrossRef]

- Collier, Z.; Wang, D.; Vogel, J.T.; Tatham, E.K.; Linkov, I. Sustainable roofing technology under multiple constraints: A decision analytic approach. Environ. Syst. Decis. 2013, 33, 261–271. [Google Scholar] [CrossRef]

- Marchese, D.; Reynolds, E.; Matthew, E.; Bates, E.M.; Heather Morgan, H.; Susan Spierre Clark, S.S.; Igor Linkov, L. Resilience and sustainability: Similarities and differences in environmental management applications. Sci. Total Environ. 2018, 613–614, 1275–1283. [Google Scholar] [CrossRef]

- Capra, F. The systems view of life; a unifying conception of mind, matter, and life. Cosm. Hist. J. Nat. Soc. Philos. 2015, 11, 242–249. [Google Scholar]

- Costanza, R.; Patten, C.B. Defining and predicting sustainability. Ecol. Econ. 1995, 15, 193–196. [Google Scholar] [CrossRef]

- Ben-Eli, U.M. Sustainability: Definition and five core principles, a systems perspective. Sustain. Sci. 2018, 13, 1337–1343. [Google Scholar] [CrossRef]

- Smith, F. Environmental Sustainability: Practical Global Applications; CRC Press: Boca Raton, FL, USA, 2019. [Google Scholar]

- Yaron, J.; Schreiner, M. Development Finance Institutions: Measuring Their Subsidy; The World Bank: Washington, DC, USA, 2001. [Google Scholar]

- ul Haque, A.; Kot, S.; Imran, M. The Moderating Role of Environmental Disaster in Relation to Microfinance’s Non-financial Services and Women’s Micro-enterprise sustainability. J. Secur. Sustain. Issues 2019, 8, 355–373. [Google Scholar] [CrossRef]

- Schrippe, P.; Ribeiro, D.L.J. Preponderant criteria for the definition of corporate sustainability based on Brazilian sustainable companies. J. Clean. Prod. 2019, 209, 10–19. [Google Scholar] [CrossRef]

- Weinrauch, J.D.; Mann, O.K.; Robinson, P.A.; Pharr, J. Dealing with Limited Financial Resources: A Marketing Challenge for Small Business. J. Small Bus. Manag. 1991, 29, 44–54. [Google Scholar]

- Briers, B.; Pandelaere, M.; Dewitte, S.; Warlop, L. Hungry for Money: The Desire for Caloric Resources Increases the Desire for Financial Resources and Vice Versa. Psychol. Sci. 2006, 17, 939–943. [Google Scholar] [CrossRef] [PubMed]

- Archer, D.; Moser-Boehm, P. BIS Paper. Available online: https://www.bis.org/list/bispapers/index.htm (accessed on 5 June 2019).

- Cohn, J.; Deryugina, T. Firm-Level Financial Resources and Environmental Spills; NBER: Cambridge, MA, USA, 2018; NBER Working Paper No. 24516. [Google Scholar]

- Zhang, D.; Zheng, W. Less financial constraints, more clean production? New evidence from China. Econ. Lett. 2019, 175, 80–83. [Google Scholar] [CrossRef]

- Dinçer, H.; Hacıoğlu, Ü.; Beyaztaş, F. Financial Problems of the Small- and Medium-Sized Enterprises and Solution Suggestions. In Handbook of Research on Developing Sustainable Value in Economics, Finance, and Marketing; IGI Global: Harrisburg, PA, USA, 2015; pp. 355–372. [Google Scholar]

- Allen, H.; Taylor, M.P. Chartist, noise and fundamentals in the London foreign exchange market. Econ. J. 1990, 100, 49–59. [Google Scholar] [CrossRef]

- MacDonald, R.; Marsh, I.W. Currency forecasters are heterogeneous: Confirmation and consequences. J. Int. Money Financ. 1996, 15, 665–685. [Google Scholar] [CrossRef]

- Brock, W.A.; Hommes, C.H. A rational route to randomness. Econometrica 1997, 65, 1059–1095. [Google Scholar] [CrossRef]

- Brock, W.A.; Hommes, C.H. Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J. Econ. Dyn. Control 1998, 22, 1235–1274. [Google Scholar] [CrossRef]

- De Grauwe, P.; Grimaldi, M. Exchange Rate Puzzles: A Tale of Switching Attractors. Eur. Econ. Rev. 2006, 50, 1–33. [Google Scholar] [CrossRef]

- Manzan, S.; Westerhoff, F.H. Heterogeneous expectations, exchange rate dynamics and predictability. J. Econ. Behav. Organ. 2007, 64, 111–128. [Google Scholar] [CrossRef]

- Dewachter, H.; Houssa, R.; Lyrio, M.; Kaltwasser, P.R. Dynamic forecasting rules and the complexity of exchange rate dynamics. Rev. Bus. Econ. 2011, 56, 454–471. [Google Scholar]

- De Grauwe, P.; Markiewicz, A. Learning to forecast the exchange rate: Two competing approaches. J. Int. Money Financ. 2013, 32, 42–76. [Google Scholar] [CrossRef][Green Version]

- Ter Ellen, S.; Verschoor, F.C.W.; Zwinkels, C.J.R. Dyn.pectation formation in the foreign exchange market. J. Int. Money Financ. 2013, 37, 75–79. [Google Scholar] [CrossRef]

- Li, X.; Chen, H. Modeling RMB exchange rate determination from the perspective of behavioral. J. Manag. Sci. China 2012, 8, 72–83. (In Chinese) [Google Scholar]

- Buncic, D.; Piras, G.D. Heterogeneous agents, the financial crisis and exchange rate predictability. J. Int. Money Financ. 2016, 60, 313–359. [Google Scholar] [CrossRef]

- Stanek, F.; Kukacka, J. The impact of the Tobin tax in a heterogeneous agent model of the foreign exchange market. Comput. Econ. 2018, 51, 856–892. [Google Scholar] [CrossRef]

- Pojarliev, M.; Levich, R. Detecting crowded trades in currency funds. Financ. Anal. J. 2011, 67, 26–39. [Google Scholar] [CrossRef]

- Byrne, P.J.; Ibrahim, M.B.; Sakemoto, R. Common information in carry trade risk factors. J. Int. Financ. Mark. Inst. Money 2018, 52, 37–47. [Google Scholar] [CrossRef]

- Husted, L.; Rogers, J.; Sun, B. Uncertainty, currency excess returns, and risk reversals. J. Int. Money Financ. 2018, 88, 228–241. [Google Scholar] [CrossRef]

- Lee, S.S.; Wang, M. The impact of jumps on carry trade returns. J. Financ. Econ. 2019, 2, 433–455. [Google Scholar] [CrossRef]

- Pojarliev, M.; Levich, R. Do professional currency managers beat the benchmark? Financ. Anal. J. 2008, 64, 18–30. [Google Scholar] [CrossRef]

- Pojarliev, M.; Levich, R. Trades of the living dead: Style differences, style persistence and performance of currency fund managers. J. Int. Money Financ. 2010, 29, 1752–1775. [Google Scholar] [CrossRef]

- Auer, R.B.; Hoffmann, A. Do carry trade returns show signs of long memory? Q. Rev. Econ. Financ. 2016, 61, 201–208. [Google Scholar] [CrossRef]

- Shehadeh, A.; Erdos, P.; Li, Y.; Moore, M. US Dollar Carry Trades in the Era of “Cheap Money”. Czech J. Econ. Financ. 2016, 66, 374–404. [Google Scholar] [CrossRef]

- Anatolyev, S.; Gospodinov, N.; Jamali, I.; Liu, X.C. Foreign exchange predictability and the carry trade: A decomposition approach. J. Empir. Financ. 2017, 42, 199–211. [Google Scholar] [CrossRef]

- Mulder, A.; Tims, B. Conditioning carry trades: Less risk, more return. J. Int. Money Financ. 2018, 85, 1–19. [Google Scholar] [CrossRef]

- Beckmann, J.; Czudaj, R. The impact of uncertainty on professional exchange rate forecasts. J. Int. Money Financ. 2017, 73, 296–316. [Google Scholar] [CrossRef]

- Copeland, L.; Lu, W. Dodging the steamroller: Fundamentals versus the carry trade. J. Int. Financ. Mark. Inst. Money 2016, 42, 115–131. [Google Scholar] [CrossRef]

- Wu, C.C.; Wu, C.C. The asymmetry in carry trade and the U.S. dollar. Q. Rev. Econ. Financ. 2017, 65, 304–313. [Google Scholar] [CrossRef]

- Berg, A.K.; Mark, C.N. Measures of global uncertainty and carry-trade excess returns. J. Int. Money Financ. 2018, 88, 212–227. [Google Scholar] [CrossRef]

- Berg, A.K.; Mark, C.N. Where’s the Risk? The Forward Premium Bias, the Carry-Trade Premium, and Risk-Reversals in General Equilibrium. J. Int. Money Financ. 2019, in press. [Google Scholar] [CrossRef]

- Byrne, P.J.; Sakemoto, R. Carry Trades and Commodity Risk Factors. J. Int. Money Financ. 2019, in press. [Google Scholar] [CrossRef]

- Fernández-Herraiz, C.; Prado-Domínguez, J.A.; Pateiro-Rodríguez, C.; García-Iglesias, M.J. The role of the enhanced carry to risk on currency policy: The Mexican Peso. Appl. Econ. 2019, 51, 1808–1816. [Google Scholar] [CrossRef]

- Cho, D.; Han, H.; Lee, K.N. Carry trades and endogenous regime switches in exchange rate volatility. J. Int. Financ. Mark. Inst. Money 2019, 58, 255–268. [Google Scholar] [CrossRef]

- Beckmann, J.; Czudaj, R. Exchange rate expectations since the financial crisis: Performance evaluation and the role of monetary policy and safe haven. J. Int. Money Financ. 2017, 74, 283–300. [Google Scholar] [CrossRef]

- Yamani, E. Diversification role of currency momentum for carry trade: Evidence from financial crises. J. Multinatl. Financ. Manag. 2019, in press. [Google Scholar] [CrossRef]

- Ellen, S.; Verschoor, W.F.C. Heterogeneous Beliefs and Asset Price Dynamics: A Survey of Recent Evidence. In Uncertainty, Expectations and Asset Price Dynamics. Dynamic Modeling and Econometrics in Economics and Finance; Jawadi, F., Ed.; Springer Nature Switzerland AG: Cham, Switzerland, 2018; Volume 24, pp. 53–75. [Google Scholar]

- Huang, Y.C.; Tsao, C.Y. Discovering Traders’ Heterogeneous Behavior in High-Frequency Financial Data. Comput. Econ. 2018, 51, 821–846. [Google Scholar] [CrossRef]

- Mussa, M. The Exchange Rate, The Balance of Payments and Monetary and Fiscal Policy Under A Regime of Controlled Floating. In Flexible Exchange Rates and Stabilization Policy; Herin, J., Lindbeck, A., Myhrman, J., Eds.; Palgrave Macmillan: London, UK, 1977; pp. 97–116. [Google Scholar]

- Baillie, T.R.; Osterberg, P.W. Why do central banks intervene? J. Int. Money Financ. 1997, 16, 909–919. [Google Scholar] [CrossRef]

- Mundell, R.A. Capital Mobility and Stabilization Policy Under Fixed and Flexible Exchange Rates. Access Can. J. Econ. Political Sci./Rev. Can. Econ. Sci. Polit. 1963, 29, 475–485. [Google Scholar] [CrossRef]

- Fratzscher, M.; Menkhoff, L.; Sarno, L.; Schmeling, M.; Stoehr, T. Systematic Intervention and Currency Risk Premia. Available online: https://quantpedia.com/Blog/Details/systematic-interventions-of-central-banks-and-major-currency-risk-premiums (accessed on 5 June 2019).

- Sarno, L.; Taylor, P.M. Official Intervention in the Foreign Exchange Market: Is It Effective and, If So, How Does it Work? J. Econ. Lit. 2001, 39, 839–868. [Google Scholar] [CrossRef]

- Chinn, M.; Meese, R. Banking on currency forecasts: How predictable is change in money? J. Int. Econ. 1995, 38, 161–178. [Google Scholar] [CrossRef]

- Engel, C.; Lee, D.; Liu, C.; Liu, C.; Wu, S.P.Y. The uncovered interest parity puzzle, exchange rate forecasting, and Taylor rules. J. Int. Money Financ. 2018, in press. [Google Scholar]

- Chakraborty, A.; Evans, G.W. Can perpetual learning explain the forward premium puzzle? J. Monet. Econ. 2008, 55, 477–490. [Google Scholar] [CrossRef][Green Version]

- Eckstein, Z.; Wolpin, K.I. The specification and estimation of dynamic stochastic discrete choice models. J. Hum. Resour. 1989, 24, 562–598. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Nagel, S.; Pedersen, L.H. Carry Trades and Currency Crashes; NBER Working Paper; National Business of Economic Research: Cambridge, MA, USA, 2008; No. w14473. [Google Scholar]

- Julier, J.S.; Uhlmann, K.J. A New Extension of the Kalman Filter to Nonlinear Systems. 1997. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.5.2891&rep=rep1&type =pdf (accessed on 5 June 2019).

- Li, P.; Zhang, T.S.; Ma, B. Unscented Kalman filter for visual curve tracking. Image Vis. Comput. 2004, 22, 157–164. [Google Scholar] [CrossRef]

- Leven, F.W.; Lanterman, D.A. Unscented Kalman Filters for Multiple Target Tracking with Symmetric Measurement Equations. IEEE Trans. Autom. Control. 2009, 54, 370–375. [Google Scholar] [CrossRef]

- Soken, E.H.; Hajiyev, C. Pico satellite attitude estimation via robust unscented Kalman filter in the presence of measurement faults. ISA Trans. 2010, 49, 249–256. [Google Scholar] [CrossRef]

- Uhlmann, K.J. Dynamic Map Building and Localization: New Theoretical Foundations. Ph.D. Thesis, University of Oxford, England, UK, 1995. [Google Scholar]

- Van Der Merwe, R. Sigma-Point Kalman Filters for Probability Inference in Dynamic State-Space Models. Ph.D. Thesis, OGI School of Science & Engineering, Oregon Health & Science University, Portland, OR, USA, 2004. [Google Scholar]

- Menkhoff, L.; Sarno, L.; Schmeling, M.; Schrimpf, A. Carry trades and global foreign exchange volatility. J. Financ. 2012, 67, 681–718. [Google Scholar] [CrossRef]

| Mean | St. dev. | Max | Min | Skewness | Kurtosis | ||

|---|---|---|---|---|---|---|---|

| Group A: July 2005–August 2018 | |||||||

| Chinese yuan rate | 6.777 | 0.594 | 8.222 | 6.104 | 1.004 | 2.955 | |

| Foreign interest rate | 0.011 | 0.017 | 0.052 | 0.000 | 1.405 | 3.429 | |

| Domestic interest rate | 0.035 | 0.014 | 0.078 | 0.010 | 0.232 | 2.794 | |

| Change in foreign exchange reserves | 151.819 | 414.936 | 1125.960 | −1079.220 | −0.442 | 3.748 | |

| Current account balance | 248.246 | 165.834 | 612.862 | −320.020 | −0.007 | 3.545 | |

| Group B: July 2005–July 2015 | |||||||

| Chinese yuan rate | 6.830 | 0.661 | 8.222 | 6.104 | 0.736 | 2.213 | |

| Foreign interest rate | 0.012 | 0.019 | 0.052 | 0.000 | 1.143 | 2.548 | |

| Domestic interest rate | 0.035 | 0.015 | 0.078 | 0.010 | 0.316 | 2.597 | |

| Change in foreign exchange reserves | 243.003 | 386.851 | 1125.960 | −928.040 | −0.370 | 3.644 | |

| Current account balance | 207.009 | 144.523 | 604.621 | −320.020 | 0.033 | 4.983 | |

| Group C: August 2015–August 2018 | |||||||

| Chinese yuan rate | 6.603 | 0.198 | 6.918 | 6.298 | 0.059 | 1.785 | |

| Foreign interest rate | 0.007 | 0.006 | 0.019 | 0.000 | 0.666 | 2.155 | |

| Domestic interest rate | 0.038 | 0.009 | 0.057 | 0.027 | 0.382 | 1.877 | |

| Change in foreign exchange reserves | −146.377 | 364.251 | 240.340 | −1079.220 | −1.284 | 3.825 | |

| Current account balance | 383.103 | 160.950 | 612.862 | −109.390 | −1.168 | 5.176 | |

| Parameter | Value | Explanation |

|---|---|---|

| (0, 1) | Speed of mean reversion | |

| (0, 1) | Extrapolation parameter of the chartists | |

| (0, 1) | Importance of the interest rate differential in forecasting the exchange rate | |

| (1, 10) | Intensity of choice parameter | |

| (0.1, 1) | Importance of the interest rate differential in forecasting the fundamental exchange rate | |

| (0, 6) | Coefficient of risk aversion for fundamentalists | |

| (0, 6) | Coefficient of risk aversion for chartists | |

| (0, 6) | Coefficient of risk aversion for carry traders | |

| (2, 20) | Coefficient of foreign exchange intervention | |

| (2, 20) | Coefficient of domestic trade balance |

| Group A: July 2005–August 2018 | Group B: July 2005–July 2015 | Group C: August 2015–August 2018 | |

|---|---|---|---|

| 0.414 * | 0.097 * | 0.472 * | |

| 0.863 * | 0.873 * | 0.698 * | |

| 0.892 * | 0.484 * | 0.505 * | |

| 7.443 ** | 10.000 *** | 7.782 * | |

| 0.812 *** | 0.925 *** | 0.843 *** | |

| 3.350 * | 5.240 * | 1.198 * | |

| 0.122 * | 0.102 * | 0.115 * | |

| 2.954 * | 2.248 * | 2.720 * | |

| 2.433 ** | 2.984 ** | 2.278 ** | |

| 2.780 ** | 2.284 ** | 2.132 ** | |

| Log-likelihood value | −166.339 | −73.412 | −64.333 |

| Taylor’s inequality | 0.248 | 0.080 | 0.290 |

| Residual-based ADF statistic | −6.376 *** | −2.653 *** | −2.970 *** |

| Group A: July 2005–August 2018 | Group B: July 2005–July 2015 | Group C: August 2015–August 2018 | |

|---|---|---|---|

| 0.919 * | 0.011 * | 0.793 * | |

| 0.892 * | 0.661 * | 0.912 * | |

| 4.085 * | 8.329 * | 7.210 * | |

| 0.855 *** | 0.848 *** | 0.993 *** | |

| 5.326 * | 3.031 * | 2.842 * | |

| 0.106 * | 0.115 * | 0.103 * | |

| 2.006 ** | 2.219 ** | 3.051 ** | |

| 2.962 ** | 2.087 ** | 3.952 ** | |

| Log-likelihood value | −142.666 | −59.600 | −70.416 |

| Taylor’s inequality | 0.155 | 0.228 | 0.060 |

| Residual-based ADF statistic | −5.024 *** | −3.126 *** | −4.990 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Q.; Wu, K.-J.; Tseng, M.-L. Exploring Carry Trade and Exchange Rate toward Sustainable Financial Resources: An application of the Artificial Intelligence UKF Method. Sustainability 2019, 11, 3240. https://doi.org/10.3390/su11123240

Zhang Q, Wu K-J, Tseng M-L. Exploring Carry Trade and Exchange Rate toward Sustainable Financial Resources: An application of the Artificial Intelligence UKF Method. Sustainability. 2019; 11(12):3240. https://doi.org/10.3390/su11123240

Chicago/Turabian StyleZhang, Qian, Kuo-Jui Wu, and Ming-Lang Tseng. 2019. "Exploring Carry Trade and Exchange Rate toward Sustainable Financial Resources: An application of the Artificial Intelligence UKF Method" Sustainability 11, no. 12: 3240. https://doi.org/10.3390/su11123240

APA StyleZhang, Q., Wu, K.-J., & Tseng, M.-L. (2019). Exploring Carry Trade and Exchange Rate toward Sustainable Financial Resources: An application of the Artificial Intelligence UKF Method. Sustainability, 11(12), 3240. https://doi.org/10.3390/su11123240