1. Introduction

In Italy, it has always been difficult to collect reliable data on the real estate market—particularly transaction prices for residential properties—given the opacity of the information available. More precisely, transaction prices are not easily usable for the difficulty in collecting data from the deeds of sale, which makes it difficult to obtain statistically significant samples of real sale prices. Thus, listing prices are crucial information, allowing us to overcome the lack of transparency and the limits of analyses. Furthermore, it is even more lacking a true “information organization” with analyses based on updated databases connected among each other, according to the interoperability principles, so that the Italian case is even hardly comparable to European or international experiences.

Keeping into consideration the actual availability of data and information, the possibility to have a structure for permanently monitoring and analyzing the real estate market is fundamental.

Unfortunately, in Italy, given the market opacity, the creation and implementation of property market observatories seem to be very complex and expensive. Nevertheless, some Italian examples can be mentioned; among these, the Property Market Observatory—PMO (Osservatorio del Mercato Immobiliare—OMI) of the Revenue Agency (Agenzia delle Entrate), is particularly relevant (

https://wwwt.agenziaentrate.gov.it/servizi/Consultazione/ricerca.htm). Created at an institutional level, the OMI covers the entire national territory, monitoring the real estate market in the Italian Municipalities. Every six months, it publishes the real estate quotation prize for each territorial segment in which the Municipalities are segmented (PMO Zones), by providing a range of minimum/maximum value expressed per surface unit, in Euro per square meter, and location, according to the building typology and conservation state. The prevalent value is provided in the presence of more than one preservation state for one typology.

Besides the PMO, which represents an example, as said, at the national and local level, few other experiences are developed at least partially different in terms of approaches and methodologies adopted. Among the observatories of the Italian real estate market can be mentioned, for example: Nomisma, a Society for economic studies and real estate observatory (

http://www.nomisma.it/index.php/it/temi/immobiliare/osservatorio-immobiliare); Scenari Immobiliari, an independent institute for studies and researches, with Real Value, a real estate values database at Italian level (

https://www.real-value.it); Cresme, an economic and social research center for the construction market, with the Information System for market potentiality and distribution network analysis (

http://www.edilbox.it/sistemi-informativi/potenziali-vendita.aspx); Tecnoborsa, Chamber of Commerce system organization for the development and regulation of real estate economics—National Observatory on the Real Estate Market (

http://www.tecnoborsa.com/ONMI-%E2%80%93-Osservatorio-Nazionale-sul-Mercato-Immobiliare); Borsa Immobiliare Italiana, the Italian real estate excahange (

https://www.bii.it/); FIAIP, Italian federation of Italian real estate agents, with the FIAP Observatories, for example the FIAIP Observatory of properties in Turin and Province (

http://www.osservatoriofiaiptorino.it/); Tecnocasa Group, residential observatory (

https://news.tecnocasagroup.it/ufficio-studi/osservatorio_residenziale/); immobiliare.it, which produces data on properties prices in Italy (

https://www.immobiliare.it/mercato-immobiliare/). Furthermore, other observatories are developed by Italian Universities, directed to monitoring the market prevalently at the urban level, for example the Poliba Center for Real Estate of the Politecnico di Bari.

Thus, the aim of this paper is to present an example of a structure for permanently monitoring and analysing the real estate market at the local level, the Turin Real Estate Market Observatory (TREMO), focusing at the methodological steps followed for its implementation, highlighting the research addresses (opened and on progress) based on its data warehouse, and reflecting on possible future implementation according to the interoperability viewpoint. The Turin’s observatory, in fact, can be considered innovative for different reasons: The relevance of TREMO as a meaningful experience for Italy, considering the specificity of our Country due to the lack of transparency in property market; the different methodological framework implemented, in comparison to other systems—including also the international examples of open-source databanks—also due to the variety of the data analyzed.

Furthermore, it differs from other cases in that it uses all the information systems potentialities: Assuming the social dimension of the real estate market, it connects databases on values to databases on social-economic structure of the population and to other databases considered relevant for interpreting and predicting market dynamics.

Lastly, it is worth presenting the case for the “quality process” implemented, finalized to guarantee the robustness of the analyses through a strict control of data surveys and statistical principles application.

For these reasons, the paper could support in growing the knowledge on the topic and in disseminating the practices among Countries affected by opacity of the information available. Created following the Presidential Decree 138/1998 and the Regulation of the Ministry of Finance, the structure is based on a data-warehouse, composed by geographic databases implemented in time, which has led to historic price observations of the residential market. Currently, the TREMO is a Territorial Information System that observes the real estate market systematically and continuously with the aim to support public and private subjects interested in growing market transparency: It is conceived as a tool aimed at monitoring, analyzing, and providing knowledge to support the management and planning of the territory and services, and to support also the needs of the operators of the sector. More precisely, the research can be useful for subjects involved in management and planning of the territory or services, and in the programming of intervention, for public administrations in governance activities and in policies definition, for private subjects such as developers or real estate market operators, for private investors and citizens in their investment choices, for real estate advisors, researchers and scholars. Even if referred to the local level, the case of Turin’s observatory is particularly interesting for some reasons.

Firstly, the real estate market dynamics that the city has faced in the last decades. In fact, immediately before the economic-financial crisis, Turin dealt with some interventions that have left urban signs on the city both as regards building and environmental quality. Among these, the urban policies introduced with Municipal Master Plan of 1995, the projects for the 2006 Olympic games, the projects for the railway link and the underground, and the perspectives introduced by great transformation areas (e.g., the “Variant of Master Plan 200”, in the central-Northern area of the town).

Secondly, under a scientific viewpoint, the TREMO’s structure allows us to explore models and methodologies application. On the basis of the observatory databases, several studies and researches, focusing on the Turin’s real estate residential market, have been developed during time: Among these, analysis on the determinants of the listing/transaction prices, and on transaction dynamics; studies for supporting the local real estate fiscal system, analysis on supply and demand behaviors, analysis on the correlation between social/housing vulnerability and prices. Besides the results, methodological advantages are possible on the basis of the extensive information, assuming that the spatial requisites of the data and its georeferencing constitute the main discriminant in choosing among descriptive statistics, multi-varied or spatial analysis methods.

In this paper, after presenting the observatory’s “architecture” and its methodological framework, some research experiences are mentioned, highlighting the aims, the models used, and the main results. Focus is posed at studies and research experiences more relevant under a social viewpoint.

The paper is articulated as follows: In

Section 2 the case study—the Turin Real Estate Market Observatory—is presented, in

Section 3 the fundamental methodological aspects of the monitoring structure are illustrated. In

Section 4 the results of analyses and experiences conducted on the basis of the observatory’s databases are presented.

Section 5 concludes the work.

2. Case-Study: The Turin Real Estate Market Observatory

The TREMO is a monitoring structure created after the definition of the Municipal Microzones in Turin, Northern Italy (

Figure 1). Microzones are geographical submarkets, determined by considering price level, building characteristics, accessibility, presence of services, green areas, etc. A specific methodology was previously defined for the identification of the Microzones and related boundaries, on the bases of the Presidential Decree 138/1998 “Regulation providing measures aimed at the general review of census zones, of the urban real estate assessable values and related criteria, and of census commissions implementing article 3, paragraphs 154 and 155, of Law No. 662 dated 23 December 1996”, and the Regulation of the Ministry of Finance. The TREMO’s activities start in 2000, in synergy among the institutional partners—Politecnico di Torino (Department of Architecture and Design) with the Municipality of Turin, and successively the Chamber of Commerce, Agriculture and Handicrafts of Turin, as well as category Associations; specific agreements with the partners are formalized during the years.

In this paper, the TREMO is assumed as a case-study: As said in the Introduction Section, it represents an example of a structure for permanently monitoring and analysing the real estate market. The monitoring process is organized according to a workflow based on a consolidated methodological path, pursuing the principle of interoperability. As described in the following Section, the solidity of the analyses is guaranteed throughout a strict “quality control process” which verifies the numerousness and spatial distribution of the data collected. Furthermore, it is guaranteed by specific sampling modalities, by the identification of outliers and the representativeness of the prevalent building categories in each Microzone, considering building characteristics with respect to the randomness of the data sampled.

The values and the dynamics of the real estate market and building activity are constantly monitored, for different aims: To support the knowledge of the real estate values—prevalently listing prices—dynamics with reference to the 40 Microzones as specific territorial segments; to support real estate developers and private citizens in orienting investments; to support the public and private subjects in territorial governance, in planning and programming of interventions; to support the evaluation of projects’ economic sustainability; to test statistical methodologies and models for the real estate market analysis.

3. Methodological Aspects

The TREMO’s structure is organized as a Geographical Information System (GIS), with different databases and related sources. Some relevant methodological aspects, followed during the years for creating and implementing the structure, are mentioned in the following sub-sections.

3.1. Databases and Sources for Implementing the TREMO’s Geographical Information System

The structure of the GIS is the result of the creation and implementation of databases over the years. In

Figure 2 the organization of the TREMO’s data warehouse is illustrated, with reference to the effective databases and related sources, and also with reference to some potential databases, selected among the others, being interesting for future/on progress researches. Furthermore, some of the most relevant databases related to concluded researches are mentioned.

Firstly, a distinction has to be made between real estate market databases, territorial and environmental databases, and databases related to the population. In the first group—real estate market database—the “internal” databases are included: These are created and implemented by the TREMO’s working group. Among these, the databases related to the ordinary monitoring activity are continuously implemented, being directed to the systematic analysis of the market. Some others, related to specific projects developed during the years, are related to concluded activities. Similarly, databases from external sources (related to the real estate market, the territory and environment, and to the population) are related to specific and temporarily research activities, in some cases potential and future researches.

Very recently, according to an interoperability perspective, pursued in the last years of TREMO’s activity, the collaboration with the Turin’s Municipality has led to the creation and implementation of a new database, named “BCD-TREMO”. The new database is created aiming at monitoring and analyzing the new buildings, integrating the TREMO’s databases with the data collected into specific documents—the Building Cadastre Documents—BCD—. These documents must be presented in Cadastre by sector operators, for declaring the construction of a new building, or a variation of an existing one (e.g., in the case of change of use, new distribution of indoor spaces, fractioning, etc.). This new database opens to interesting analysis, allowing for monitoring of the Turin’s activity in the construction sector.

3.2. The “Quality Process” and Computerized Analysis Procedures

Assuming that the meaningfulness of the data used can guarantee the robustness of the analysis, a rigid quality control process (the “quality process”) was launched in 2008, with the aim to progressively improve the methodologies used for observing the real estate market and strengthen the statistical data processing on the databases, improving the qualitative level of the analyses.

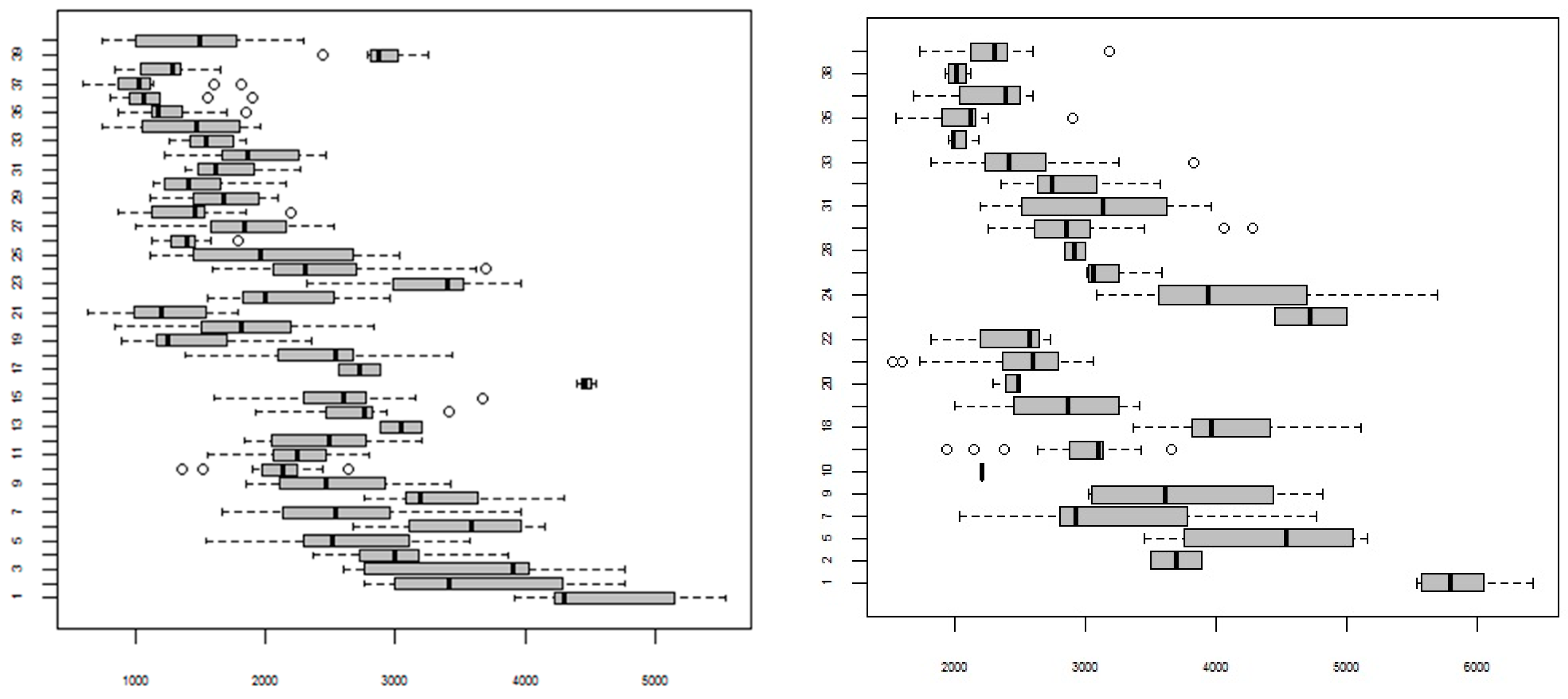

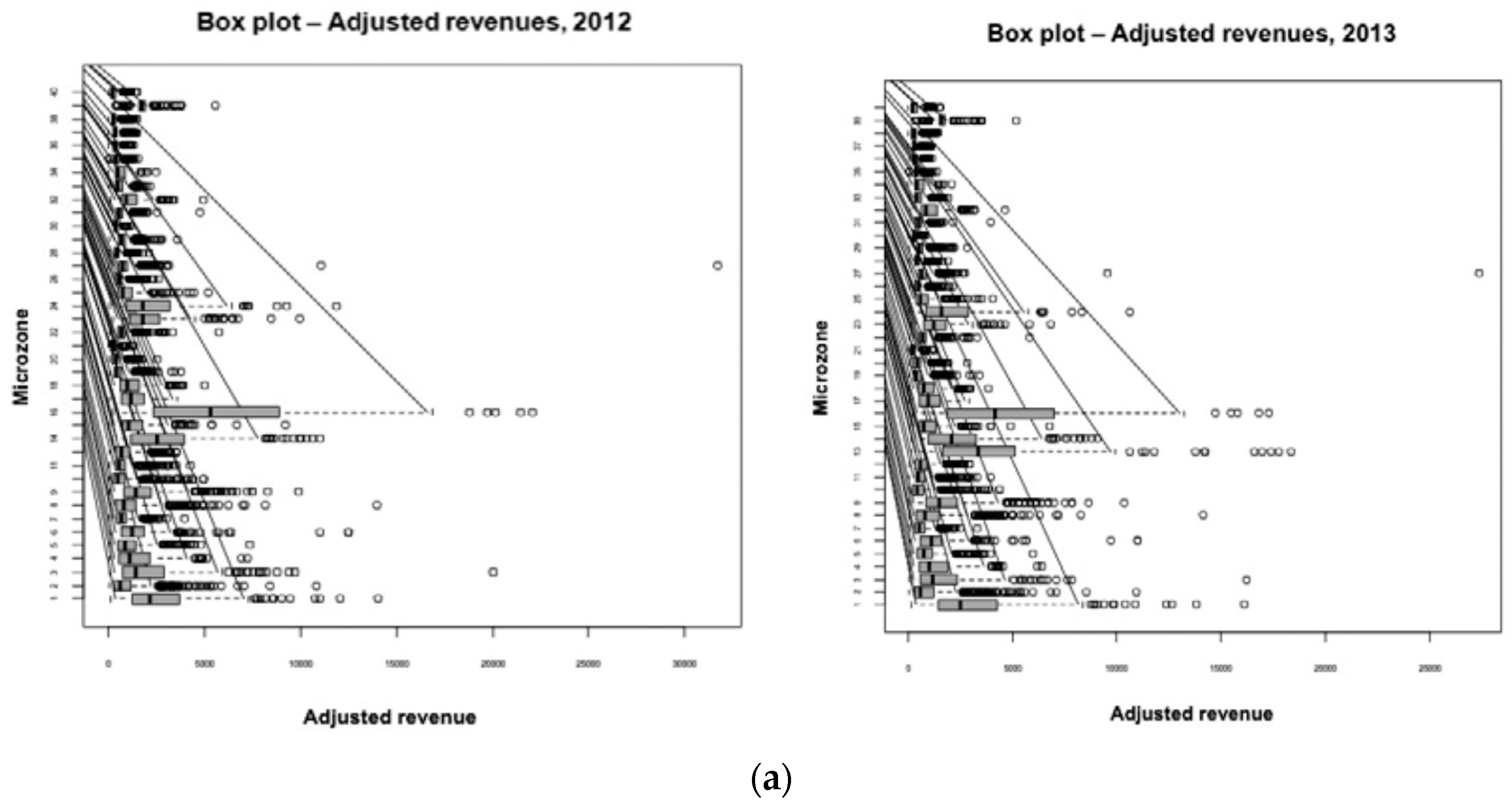

The first phase of the quality process consists in the implementation of refined sampling modalities, aimed at producing stratified samples on the basis of different relevant characteristics of the observed properties. Furthermore, automated methodologies for identifying and selecting outliers are implemented. More precisely, the numerousness and spatial distribution of the data collected is verified, enabling to shorten the time necessary for collecting and processing data, guaranteeing a higher coverage of the territory and a greater homogeneity of the surveys in the 40 Microzones. The review process enabled to reduce the number of Microzones with an insufficient statistical numerousness of sampling data (statistical reliability is guaranteed when the sample presents at least seven surveys) (see the examples in

Figure 3a,b).

Statistics for controlling and verifying the reliability and relevance of the data and results of the methodological applications are produced; for each Microzone (and related sub-sampling), the Error Profile calculation is developed. Besides the elementary descriptive statistics, the Error Profile is aimed at identifying possible sampling errors (outliers) and highlighting anomalous values as regards the ordinariness of the market. For each Microzone the confidence intervals, Box-plots, and the normality hypothesis test are calculated. The descriptive statistics conducted allow us to strengthen the knowledge of market value dynamics in the residential sector, for example by identifying possible concentrations (and related entities) in the real estate value variation phenomena, by identifying the possible effects on the boundaries of the 40 municipal Microzones and facilitating the sub-segmentation of the extended Microzones. The variable processed by descriptive statistics is the listing price, and within the ambit of the “Real Estate Agents” database also the transaction price is analyzed, as well as the time of permanence of the properties on the market and the difference between the average listing price and the average transaction price (delta prices).

Further, explorative analyses of the data collected through random sampling for each Microzone and inferential estimate are produced.

A crucial step of the analysis is the comparison among sampling investigations repeated in different years, with variable populations for each year considered. The results of the statistical investigation are supported by the production of various hierarchic output documents (tables, graphs, concise indexes, comments and statistical conclusions, Error Profile of the investigation). As said before, in order to limit the statistical errors that can arise in each phase of the statistical investigation is associated the sampling investigation with the Error Profile (or Quality Profile), through which all the analysis operations and possible error sources are explored. By implementing more complex statistical procedures, the Error Profile aims at analyzing the effect of the error of each operation not only in terms of sampling and non-sampling error, but also on the overall error.

As known, the Error Profile in a sampling investigation takes into consideration the presence of the statistical error, which can be defined in terms of discrepancy between the real value and the value observed (or value acquired, or value available); in our case, it is produced by analyzing estimators for the interval estimate of the parameters; sampling distributions; anomalous values (through Box-plots); graphs and indexes. Once the outliers are identified, the anomalous values can be eliminated from the sampling upon when they are actually the result of errors committed during the analysis, and are not related to an actual market behaviour [

1]. More solid estimators can be used (for example, the trimmed mean). The interval estimate is calculated through the Bootstrap method if operating in the presence of small or not normal sampling. Furthermore, Box-plots enable us to infer considerations on the level of the distribution symmetry, and Error-bar (confidence intervals) are (graphically) used to identify interval of values whose extremes depend on the estimate and on the variance of the estimator. This interval, with confidence, includes the parameter object of the estimate.

Further analyses are produced every six months, also with the support of graphs (density distribution of sampling prices, price distribution curve of the theoretical normal, etc.), in order to complete the analysis of the outliers. Notice that computerized analysis procedures are implemented in order to obtain, simultaneously, graphics and outputs in an automatic modality (see the example in

Figure 4).

The second phase of the quality process is based on the sampling stratification of each Microzone considering listing prices, keeping into account the territorial heterogeneity and the building characteristics of each Microzone. The assumption is that the differentiation of the property category related to the different transaction values can generate, through the random surveys, heterogeneous sampling, but this could not always be representative of the prevailing building categories in each Microzone, even if statistically relevant. For this reason, the “building category” statistical variable is introduced, in order to represent the heterogeneity of the building and to produce an ordinary sampling for each Microzone, representative of the prevailing building categories. Preliminarily, a historic-urban analysis is conducted, for identifying for each Microzone possible historic territorial portions and the prevailing “building category”. To define the optimal sampling criteria, the real estate market sub-segments—defined from a territorial viewpoint—which operate as non-correlated markets, are individuated. To analyze correctly the market of the city it is necessary to represent the main sub-segments in which it is composed, also within the single Microzones. Furthermore, since the dynamicity of each market is different, a random sampling on the entire city of Turin may not provide sufficient data for covering the territory.

Starting from these premises, a stratified sampling methodology is defined, which allows us to examine all sub-segments while producing inferential analysis. The procedure consists in dividing the population in sub-populations (market segments) and in forming a random sampling for each sub-population. When the sampling numerousness allows it, it is possible to make inference in every sub-population and describe the entire population highlighting its heterogeneity. The difficulty is in obtaining a single and forecasting result on the entire population.

The methodology applied for the used residential segment (database “Old Buildings—Stratified Samples per Microzones”) consists in the following steps: Definition of the complete sampling for each Microzone, through the collection of real estate offers; definition of the ordinary sampling for each Microzone, through the stratification of the complete sampling with reference to the “building category” characteristic; determination and comparison of the main statistical indicators on the complete and ordinary sampling; accurate analysis of the extreme values of the complete sampling and the report of the minimum and maximum values not belonging to the ordinary sampling.

The quality process consists also in the stratification of the complete sampling in every Microzone with reference to the prevailing building category, in order to allow the observation of the market behaviour and to identify ordinary sub-sampling with reference to the prevailing categories. The cleaning of the sampling from the outliers is carried out, and the non-ordinary units are included in the complete sampling. Furthermore, the market is analyzed starting from a non-ordinary sampling (complete sampling), assuming that the complete sampling provides an overall view of the Microzone market avoiding to exclude portions of market, and that the complete sampling presents a higher numerousness and, therefore, a greater statistical relevance (see for example

Figure 5).

Notice that the second phase of the process continues for the new/completely restructured residential segment. Special attention in this case is devoted to the floor allocation of the housing units, able to influence on the listing prices, considering that this is among the characteristics that mostly condition prices, particularly for new buildings. Once the price of a typical unit in a work site is established, the differences among the units are defined mainly on the basis of the floors: Observing the distribution of the values related to each Microzone (database “New buildings—Stratified samples per Microzones”), in many cases the tail values refer to units located on ground/mezzanine floors and first floor (inferior tails) or on the last floor/attic (higher tails), thus significantly moving away from the mean values. Therefore, sometimes the minimum and maximum values are not very relevant for defining the value trend in each Microzone. Thus, it is necessary to stratify the sampling surveyed as regards the characteristics of “floor allocation”, with reference to the total number of floors and the building typology, in order to obtain an ordinary sampling more representative of the sub-markets in each Microzone.

A crucial step of the methodology is also represented by the punctual analysis of the extreme values. This step is aimed at verifying that minimum punctual values and maximum punctual values, highlighted as outliers, are related to listing prices of apartments located in buildings included in the prevailing “building category” of each examined Microzone. In the example presented in

Figure 6, the Box-plot analysis is applied firstly on the stratified samples per Microzones, then to the complete sample (Turin).

Summarizing, the steps for the second phase of the process with reference to new/completely restructured segments are as follows: Definition of the complete sampling for each Microzone, through survey of the real estate offers; definition of the ordinary sampling for each Microzone, through the stratification of the complete sampling (stratification with reference to the “building typology” and stratification with reference to the floor of the housing unit and the number of floors of the building); determination and comparison of the main statistical indicators on the complete and ordinary sampling; analysis of the extreme values of the complete sampling and the report of the minimum and maximum values not belonging to the ordinary sampling.

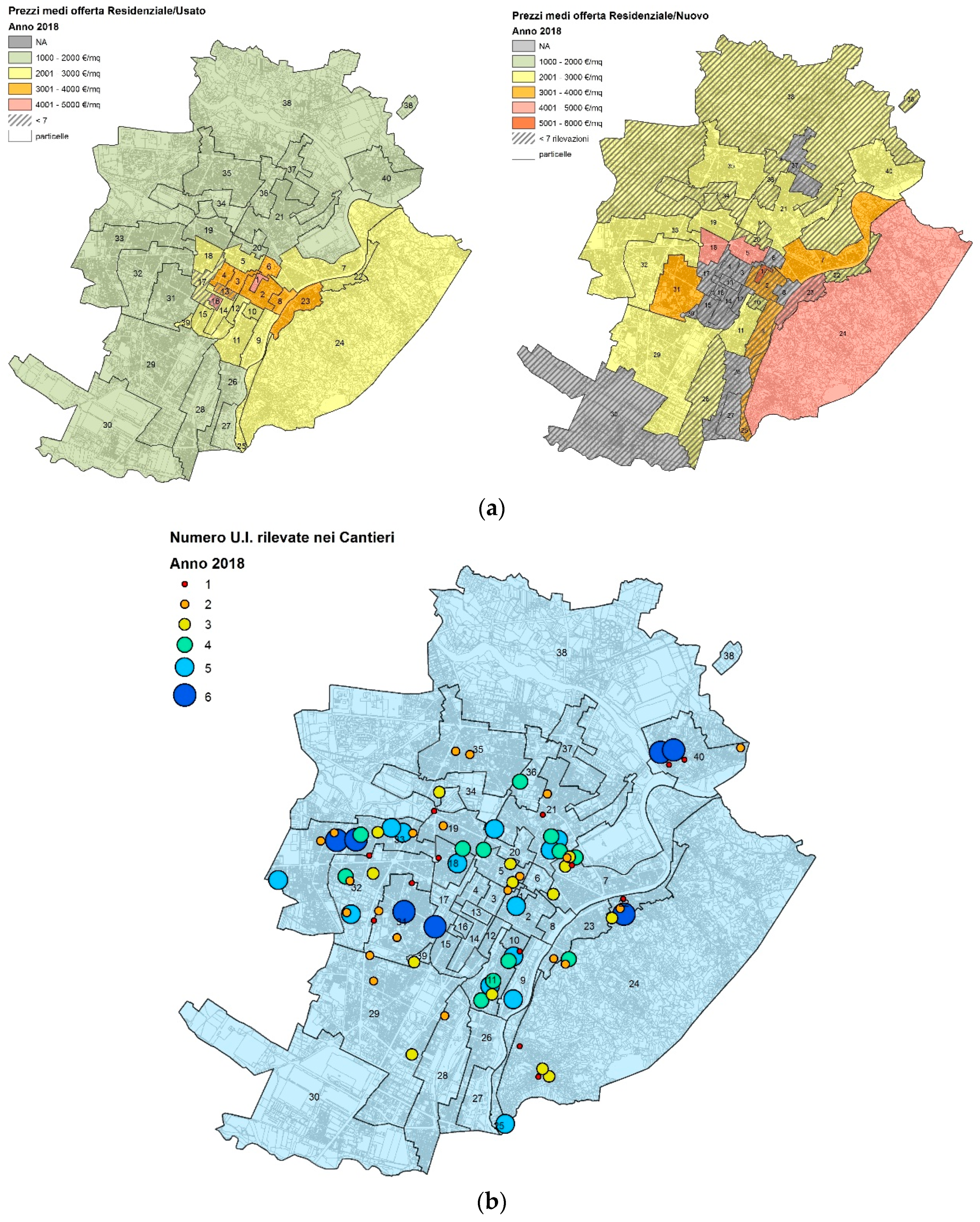

As a first result of the monitoring activity and of the descriptive analyses, thematic maps can be produced for different aims (see examples in

Figure 7a,b).

3.3. The Monitoring Process

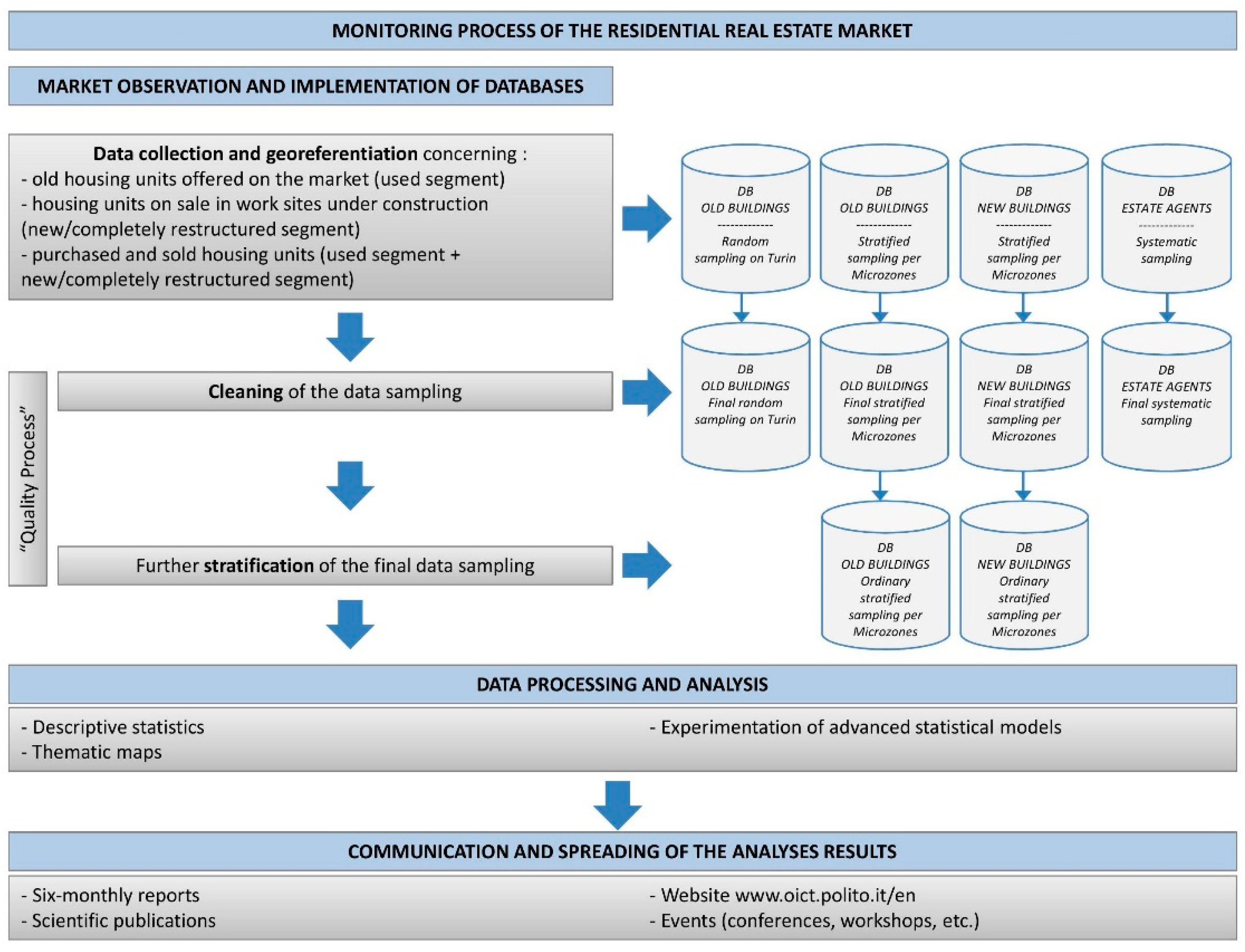

On the base of the quality process described above, the current monitoring process of the residential real estate market can be schematized as follows (see

Figure 8).

Notice that every six months the TREMO updates the real estate market trend of the city of Turin according to the process described above. The data processed and analysed by the TREMO are periodically published on the website

www.oict.polito.it/en.

4. Analyses and Research Experiences

The TREMO’s databases are the basis for implementing both descriptive and statistical analyses, in particular multi-varied and spatial statistic models. As mentioned before, the spatial component of the datum and its georeferencing constitute the main discriminant in choosing among descriptive statistics, multi-varied or spatial analysis methods, improving the estimate of the market prices. As known, among the multi-varied statistic models, the most common are: Factor Analysis, Cluster Analysis, Conjoint Analysis, Variance Analysis, Multiple Regression Analysis, Structure Equation Models, Discriminant Analysis; among the spatial statistic models, these can be mentioned: Non-parametric Spatial Regression Models (Local Regression Models, GWR), Spatial Mixed Effects Models, Geostatistical Models, Spatial Clustering.

The TREMO’s extensive information is processed selecting the models by taking into consideration, on the one hand, the project’s aims, and on the other hand the spatial requisites of the data. In the following sub-sections, some research experiences are synthesized, mentioning the aims and the models used with the main results. Notice that a selection of the experiences with a higher social impact is presented.

4.1. Analysis on the Determinants of the Listing/Transaction Prices, and on Transaction Dynamics

In Reference [

2], the impact of house characteristics on the selling process is explored. Assuming the Turin’s residential market, and by mean of hedonic analysis [

3,

4,

5,

6], the impact of building characteristics, apartment characteristics and location on the bargaining outcome are compared, in order to quantify the overall contribution of characteristics and location to prices and bargaining outcome [

7]. Then, the association between each characteristic and listing price, and between each characteristic and transaction price, is analyzed (according to the methodology introduced by [

8]. As a result, the study demonstrates a low association between structural characteristics and bargaining outcome, whilst location shows to be the most relevant factor in the negotiation: Location amenities/disamenities—modelled by a geographical segmentation [

9,

10]—may be attractive or unattractive depending on the buyers, confirming the importance of territorial segments.

A following study [

11] explores the listing behaviours of agents and sellers, by analyzing the listing prices and the predicting power of the house features described in advertisements. A traditional hedonic model is performed both on houses put on the market by agents and on houses put on the market by sellers [

12]. Furthermore, a hedonic analysis is performed, firstly for computing the coefficient of determination for any characteristic, and secondly for measuring the overall contribution to the listing price of the characteristics described in advertisements. The results show the presence of factors affecting listing prices, which are not revealed to buyers in real estate advertisements, whilst the presence of characteristics that do not affect the listing price but are described in advertisements was also found. Thus, it is concluded that agents and sellers seem to have different behaviours. As a consequence, the listing behaviour of agents and sellers and the predicting power of the observable characteristics can support the use of listing prices in real estate valuations. In fact, the potential presence of unobservable factors affecting the listing prices could be a source of bias in estimating the value of houses. This conclusion can support the listing strategies, strictly linked to the choice of listing prices [

13,

14,

15,

16].

In

Table 1, an exampling output of the regression application is presented: The regression coefficient related to the overall contribution of characteristics to listing prices, calculated firstly by performing the regression analysis to explain listing prices, secondly to explain sellers listing prices.

The location effect on selling and asking prices, and on properties liquidity, is explored in Reference [

17], through a spatial analysis [

10,

18,

19,

20,

21], starting from studies on the spatial autocorrelation of prices [

22,

23,

24]. In this research experience, a new approach is proposed in order to measure the relative improvement in price and asset liquidity prediction, when the location is known, as opposed to when the location is unknown [

4,

25,

26]. The location is represented through geographical submarkets, which in turn are represented by the Turin’s Microzones. Empirical evidence of the submarket impact on house prices is found; on the contrary, the liquidity of the market, considering the time on the market and the discount ratio as proxy, results not associated with geographical submarkets.

As with the previous studies stress, in Italy selling prices are not public information and therefore listing prices are a key aspect for market analyses. These are also used by real estate appraisers for estimating house values. Literature supports the use of listing prices as a proxy of transaction prices [

25]. Nonetheless, the availability of databases concerning the listing/transaction prices enables to analyse the real prices as well as the listing prices. As said, in Italy this is unusual and more frequently listing prices are used in the analyses.

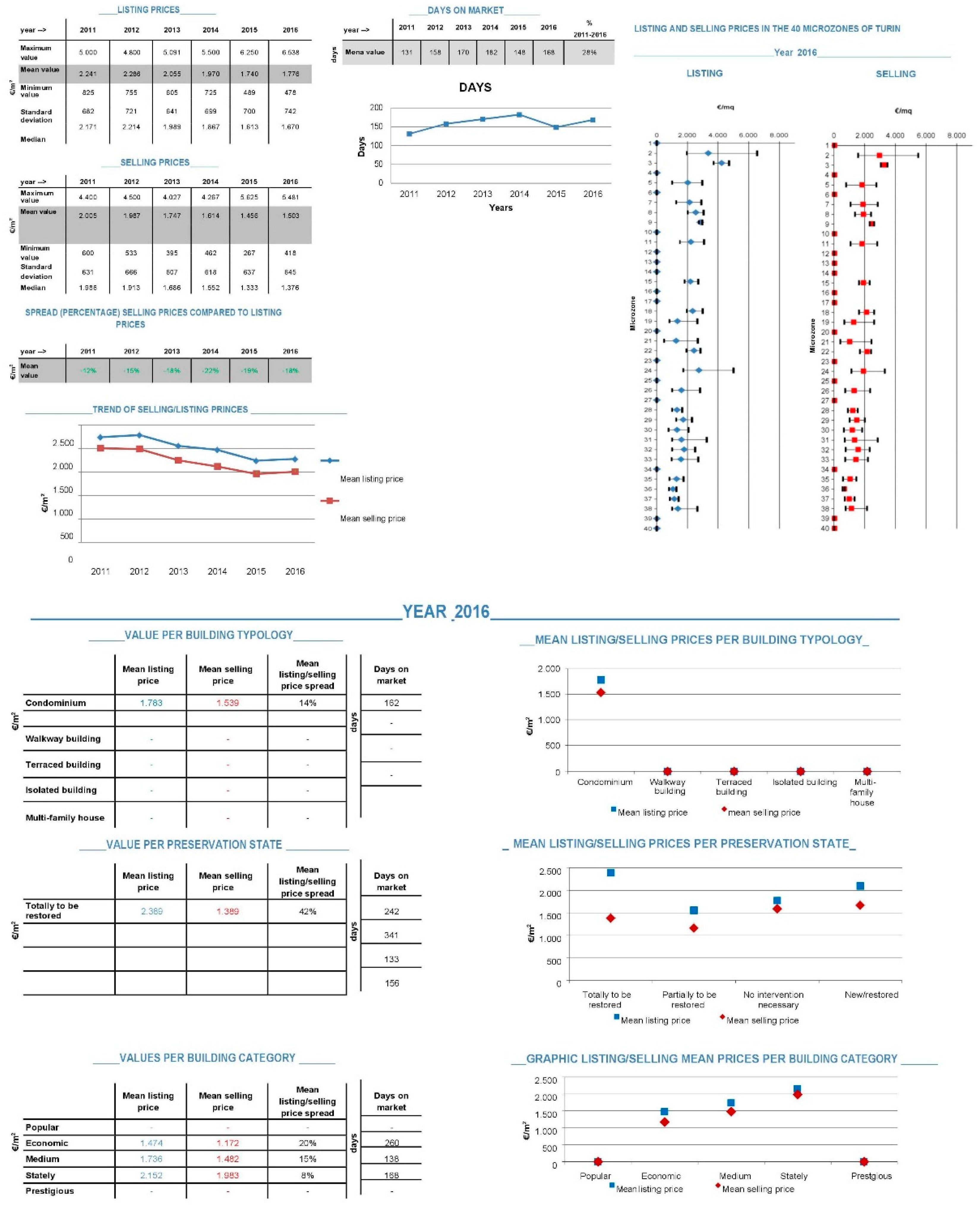

Some research experiences conducted on the TREMO’s databases—when Real Estate Agents database is available—concern: Data analysis of the correlation between the variables “Listing Price-Transaction Price” and “Transaction Time” related to a series of annuities; comparison between the databases “Residential-Used” and “Real Estate Agents” for specific periods; comparison, for the single annuities, of samplings extracted from the database “Real Estate Agents” containing apartments actually sold, with samplings extracted from the database “Residential-Used” with apartments on sale (including the shares of the unsold); analysis of the relationship between the lowering of prices in the negotiation phase—measured on the difference between the listing prices and the transaction prices (Delta Prices)—and the liquidity of the market—measured on the days of permanence on the market (Time On Market)—starting from the sampling of housing units sold in a series of annuities contained in the database “Real Estate Agents”; analysis of the impact of the characteristics of the building/housing unit on price and the sale time on a sampling extracted from the database “Real Estate Agents” for a series of annuities; analysis of the historical territorial segments for the Turin’s Microzones; analysis of location influence on real estate prices.

Figure 9 presents an example of analyses outputs produced on the entire city, and on an exampling Microzone.

4.2. Studies for Supporting the Local Real Estate Fiscal System

In view of the cadastral reform (Law No. 662 of 1996), studies for supporting the local real estate fiscal system are conducted on the basis of TREMO’s databases. In investigating the real estate tax system, it is assumed that cadastral values are totally disconnected from the transaction real estate market values, and therefore from their characteristics and qualities. The estimate of the real estate values is a fundamental step in the methodologies proposed, aimed at identifying the anomalies, iniquities and distortions of the current revenue system. The studies based on the non-correspondence between the values and the characteristics of the properties, assume to pass from rooms to square metres, pursuant to Presidential Decree 138/1998, as a first intervention on the actual cadastral values in order to eliminate the iniquity produced by using the cadastral room.

Thus, specific studies aimed at defining the value of the city’s building areas are produced, starting from the incidence of positional factors (the location variable expressed with reference to the city’s geographic submarkets carried out in the Microzone) in determining values: The effect of location on values is studied through price spatial analysis models and, at the same time, on property liquidity. The analyses provide empirical evidence of the impact of sub-markets on housing prices while, on the contrary, it shows that liquidity, expressed through the time of permanence on the market and the discount rate, is not associated to geographic sub-markets.

On the base of the results of these first studies, in more recent studies [

27,

28], an operational methodology for determining correction coefficients to apply to land registry values is proposed, on the basis of the marginal contribution of the location of a property to the determination of its market value. The works analyse the possibility to use market values of census Microzones to determine location-related coefficients to correct land registry (taxable) values. Thus, empirical coefficients are experimented to apply to current cadastral values in order to reduce the spread between current cadastral values and market prices, correcting the inequity produced by the current property taxation system within the same city and among various cities. Operatively, the methodology is based on two assumptions: The introduction of statistical spatial models [

20], and the identification of geographical segments to be introduced into the regression models as dummy variables [

10].

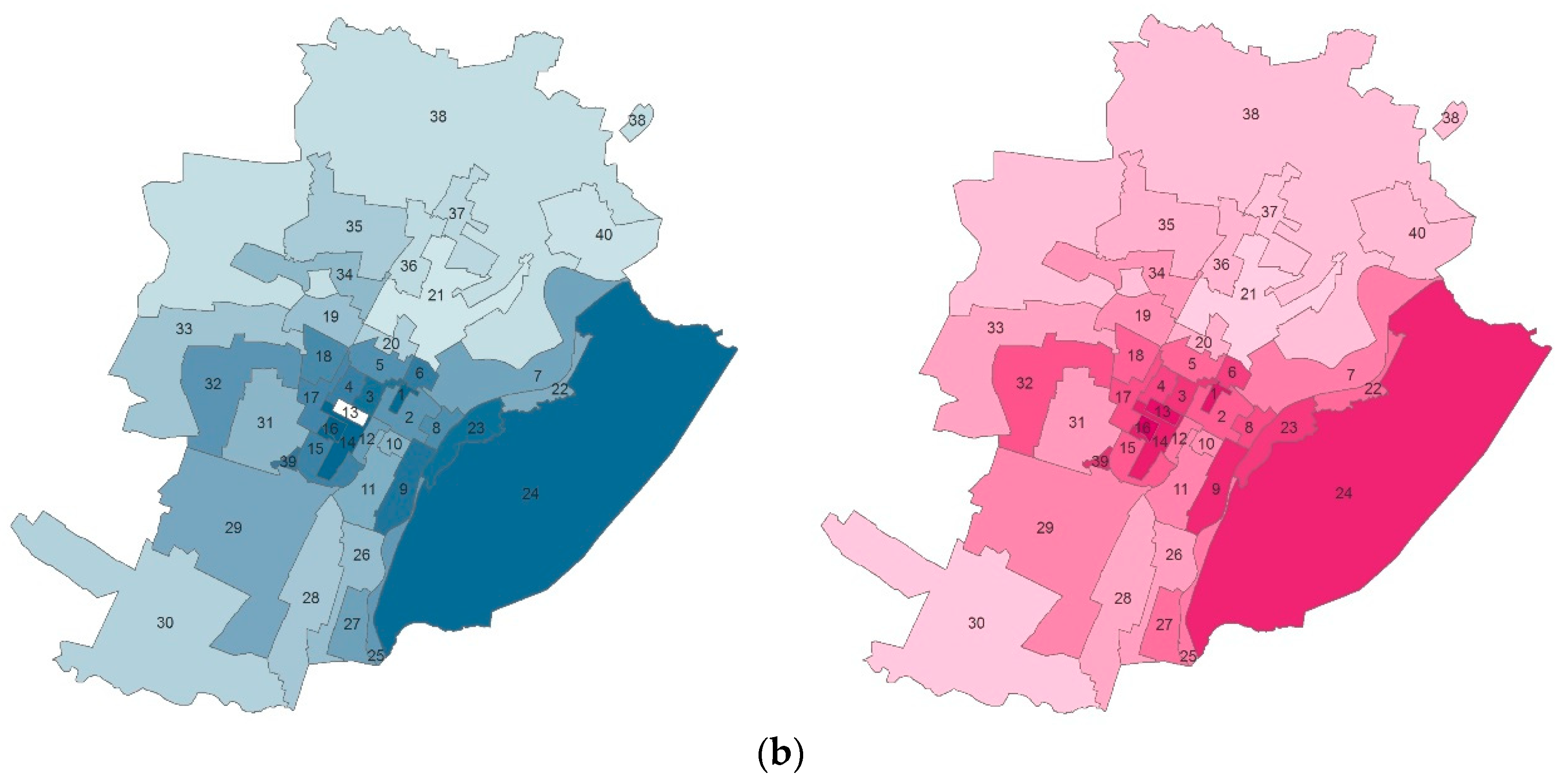

The empirical location adjustment coefficients are calculated for each Microzone, and then tested for identifying the Microzones in which the adjusted cadastral revenues increase/decrease. In

Figure 10a, the Box-plots with the adjusted revenues for each Microzones are presented, considering as an example the years 2012 and 2013. In

Figure 10b, the thematic maps with the mean adjusted revenues distributions per Microzone are presented.

Notice that even in the context of the studies for supporting the real estate fiscal system revision, the spatial statistical techniques are fundamental: The comparison between the forecasting of prices by using the geographic segments approach and spatial statistic enables to verify if the Microzone can explain the spatial variation of prices and, therefore, identify value correctives depending on the position, according to principles of fiscal equity.

4.3. Analysis of Supply and Demand Behaviours

First experiences, focused on the study of the behaviour dynamics at the basis of choices, found on house mobility in Turin, by analyzing the characteristics of buyers and of the real estate properties. The study of the behaviour dynamics at the basis of housing choices is carried out, in several Microzones, by analyzing also the relationship between the built fabric and housing strategies, represented by the social-economic, professional, personal characteristics, and by purchasing modalities, with reference to the buyers’ patrimonial components.

Successively, through multi-varied and spatial statistical models, studies on the gentrification phenomena, spontaneous or induced, are developed with the aim to understand if and in what measure several spontaneous processes and policies were able to trigger effects on the market of housing units located in the zones of interest, including the possible enhancement effects in patrimonial terms [

29].

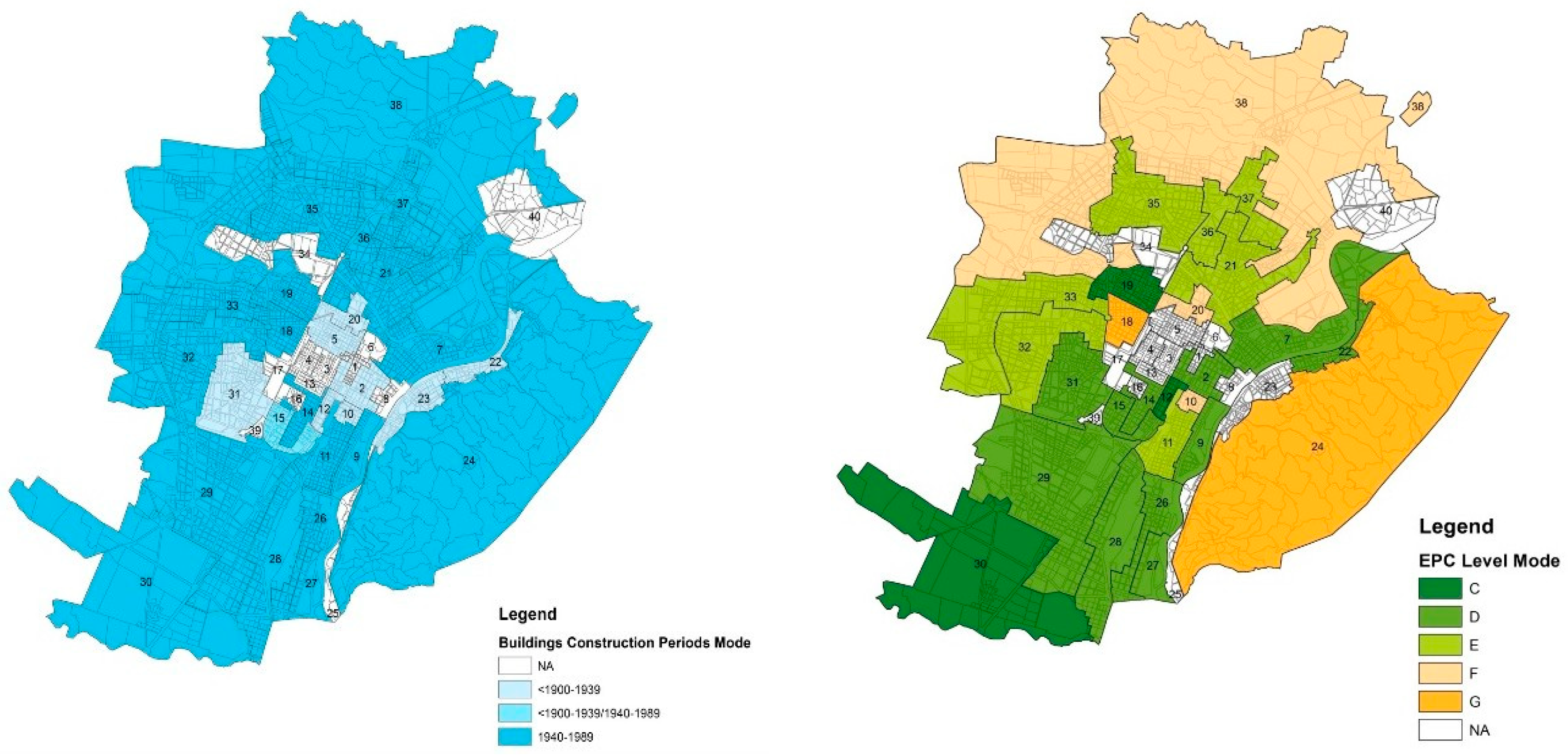

More recently, attention is given to the relevance of the energy performance level of buildings on listing/transaction prices investigation. The aim is to analyze the influence of building energy performance requisites through the Energy Performance Certificate (EPC) on supply and demand behaviours. In fact, in Italy, implementing the European Directive 2010/31/EU-EPBD Recast, the EPC has become mandatory in deeds of sale since 2010 and in real estate advertisements since 2012. From operators (Real Estate Agents database) and from the preliminary analysis carried out since 2012 on the first data sampling, the level of energy performance of a building does not seem to be an important factor in real estate market dynamics.

More precisely, in a first study [

30] the evidence of the impact of EPC on listing prices (on listing behaviour) is analyzed by mean of Hedonic regression analysis, assuming the recent international literature on the topic [

31,

32,

33,

34,

35,

36,

37,

38,

39,

40,

41,

42,

43,

44,

45,

46,

47,

48,

49,

50,

51,

52].

Considering a sample of 577 apartments collected in 2012 from real estate advertisements websites in Turin, two regression models are tested. The first is directed to analyze the relation between listing prices and house characteristics on web advertisements, demonstrates that house characteristics are fundamental factors in the selling process, under the agent’s viewpoint. The second considers the previous characteristics but the EPC level is also included, for identifying the price variation produced. The results show a weak (in correspondence to a low level of EPC) or absent influence, even in the model tested with Microzones clusters.

In a following study [

53], assuming also the literature of the previous work, the impact of the EPC on house prices and to market liquidity is analyzed, considering old buildings. A hedonic model is applied to explain the variables of listing price, transaction price, time on the market and bargaining outcome, considering a sample of about 900 transactions in Turin (period 2011–2014). In this second work, besides EPC labels, the building construction period and the main features of dwellings are included in the model. The result is twofold: Firstly, a hedonic model shows that low EPC labels are priced in the market although EPC labels explained only 6–8 per cent of price variation; secondly, a full hedonic model, which included apartment characteristics, shows that EPC labels had no impact on prices.

As an example,

Figure 11 shows the building construction periods distribution for each Microzone in Turin, and the correspondent EPC distribution: The sample considered in the study is mainly characterized by old dwellings with low EPC labels.

As stressed before, the availability of georeferenced databases enables more in-depth analyses of dynamicity, market values, social-economic changes.

For example, the spatial econometric techniques that derive from hedonic models, assuming that the object of the consumers’ preferences is made by the characteristics of the property and not by the property itself. Studies with Kriging models and grid models, specifically the Geographical Weighted Regression (GWR), are applied also in conjunction with panel data approaches [

54]. The GWR approach allows us to test the usefulness of the georeferenced data, enabling us to estimate the real estate regardless of the territorial sub-segmentation in Microzones, reducing errors deriving from spatial multicollinearity and self-correlation. Besides the results, these models open to the advancements presented below.

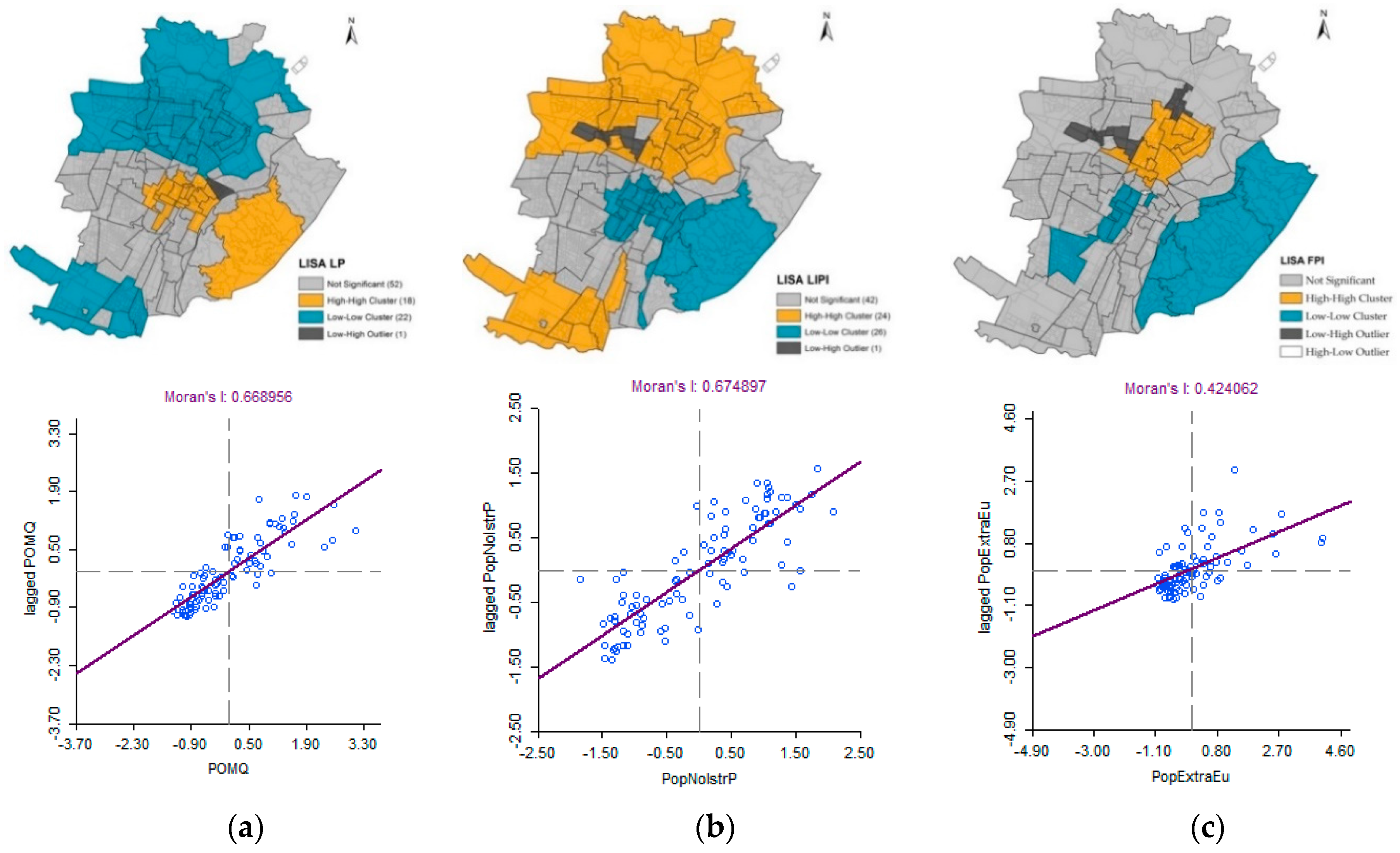

4.4. Analyses of the Spatial Dependence between Social/Housing Vulnerability and Property Prices

In Reference [

55], spatial analyses are illustrated for calculating the spatial autocorrelation in property prices [

23,

56,

57] and the presence of spatial dependence [

18] between social vulnerability indicators and property prices, using a sample of georeferenced data (years 2011–2017). The territorial unit used in the study is the historical territorial segment [

9,

58]. More precisely, the study tries to identify particularly fragile social sectors of the population, by analyzing different indicators to measure the economic and social conditions of the population, aiming to explore the relationship between social and territorial vulnerability [

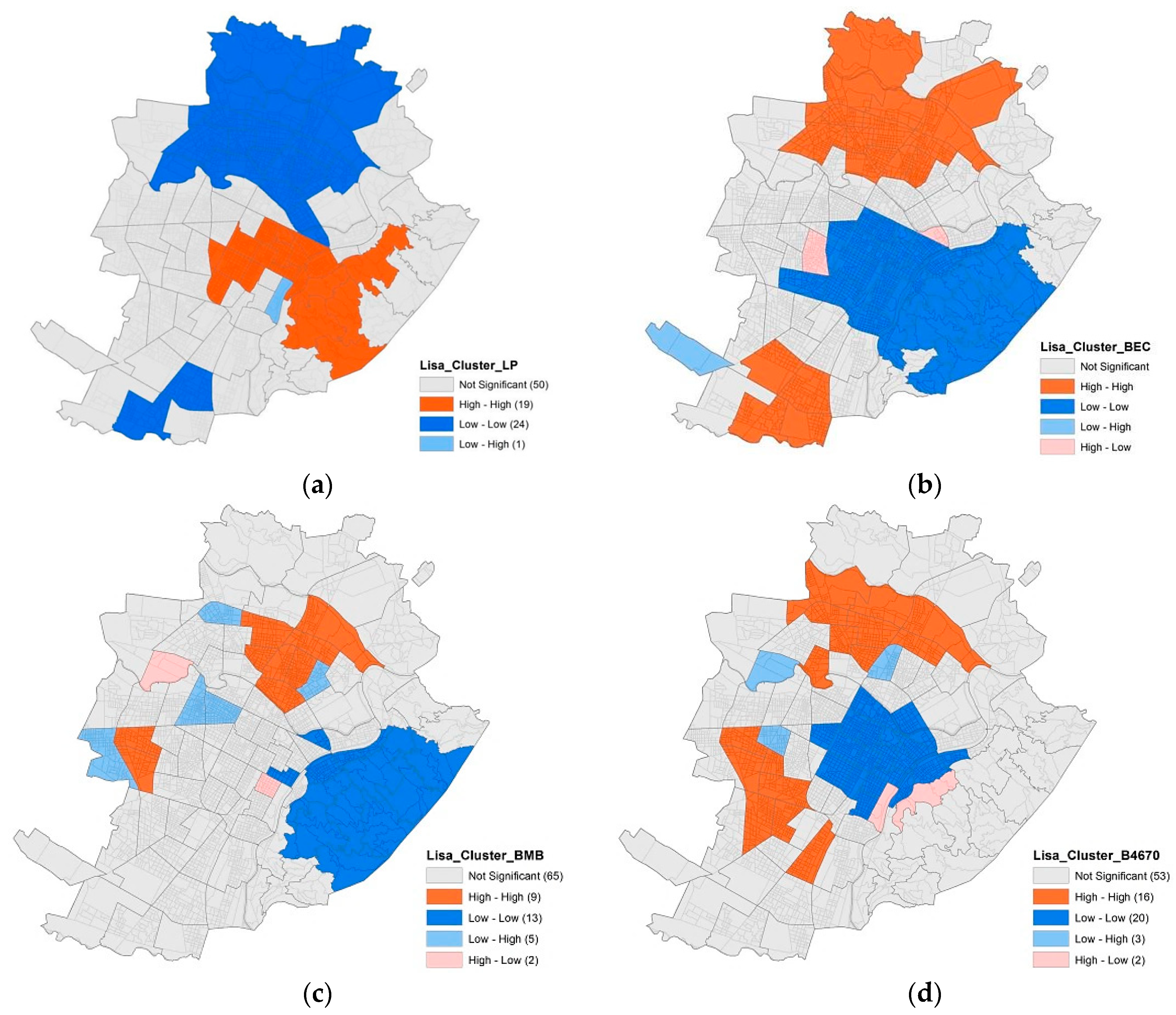

59,

60] and the real estate market in Turin. In the study it is assumed that the spatial analyses can help to identify spatial latent components and variables in the process of price determination. A three-phase approach is proposed: The identification and analysis of a set of social and territorial vulnerability indicators; the application of a traditional hedonic approach to measure their influence on property listing prices; spatial regression analyses application in order to investigate the spatial autocorrelation and the presence of spatial dependence between 2 significant indicators (Low Education Population Indicator—LEPI; Foreign Population Indicator (FPI) and prices. The results of the analyses highlight the presence of spatial dependence and a certain reverse correspondence between the spatial clusters obtained for property prices and those obtained with LEPI: The LEPI High-High LISA Cluster corresponds to the LP Low-Low LISA Cluster, and vice versa (

Figure 12).

In Reference [

61], spatial analyses are performed, to calculate the spatial autocorrelation in property prices [

22,

57,

58] and the presence of spatial dependence [

18] between different housing vulnerability indicators and property prices. The sample used is composed of georeferenced data (years 2011–2017), considering the statistical zone as a territorial unit. It is assumed that housing vulnerability is a dimension strictly related to the buildings’ physical features and to the socio-economic condition of the occupants of the buildings [

62]. Thus, three housing vulnerability indicators, representative of fragile buildings’ physical features (Economical Buildings and Council housing—BEC; Buildings in a mediocre or bad state of conservation—BMB; Buildings built between 1946 and 1970—B4670) are analyzed and the presence of spatial dependence and their influence on property prices determination process are investigated. The study highlights that the presence of economical buildings and council houses (BEC) is spatially correlated with property prices and have a significant, negative influence on them (see for example

Figure 13).

5. Conclusions

In this paper the Turin’s real estate observatory was presented, as an example of structure for permanently monitoring and analysing the real estate market at the local level. The focus was given to the methodological steps followed for its implementation, highlighting the research experiences developed on data warehouse basis, and reflecting on possible future implementation according to the interoperability viewpoint.

Some methodological aspects related to the architecture of the observatory and the data-warehouse organization were illustrated, focusing on the quality process introduced into the monitoring process framework, in order to guarantee robust data for the analyses and models applications. Then, the results of the most relevant research experiences, based on the extensive information of the observatory, were synthetically illustrated, emphasizing their social impacts. Among the researches, there were mentioned studies for the real estate tax system within the ambit of the cadastre reform, on the assumption that cadastral values are totally disconnected from the transaction real estate market values, and from their characteristics and qualities; studies on the incidence of positional factors—the location variable—in determining values; analysis of the determinants of asking/transaction prices, of the dynamics of transactions, of supply and demand behaviours; studies on the relevance of the energy performance of buildings on prices; study on behaviour dynamics at the basis of choices and house mobility, by analyzing the characteristics of buyers and of the real estate; studies on the gentrification phenomena, spontaneous or induced, through multi-varied and spatial statistical models, and, lastly, some recent researches about the social and housing vulnerability by means of spatial statistic approaches.

The research experiences presented in the paper demonstrates some of the potential deriving from the availability of a Geographic Information System, able to connect very different data, varying from values, to social aspects and characteristics of the population.