The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks

Abstract

:1. Introduction

2. Literature

2.1. Divestment

2.2. Event Studies

2.3. Efficient Market Hypothesis

2.4. Stakeholder Theory and Social Norms

3. Method

3.1. Sample and Data

3.2. Event Windows

3.3. Sample Selection

3.4. Expected and Abnormal Returns

3.5. Statistical Model

4. Results

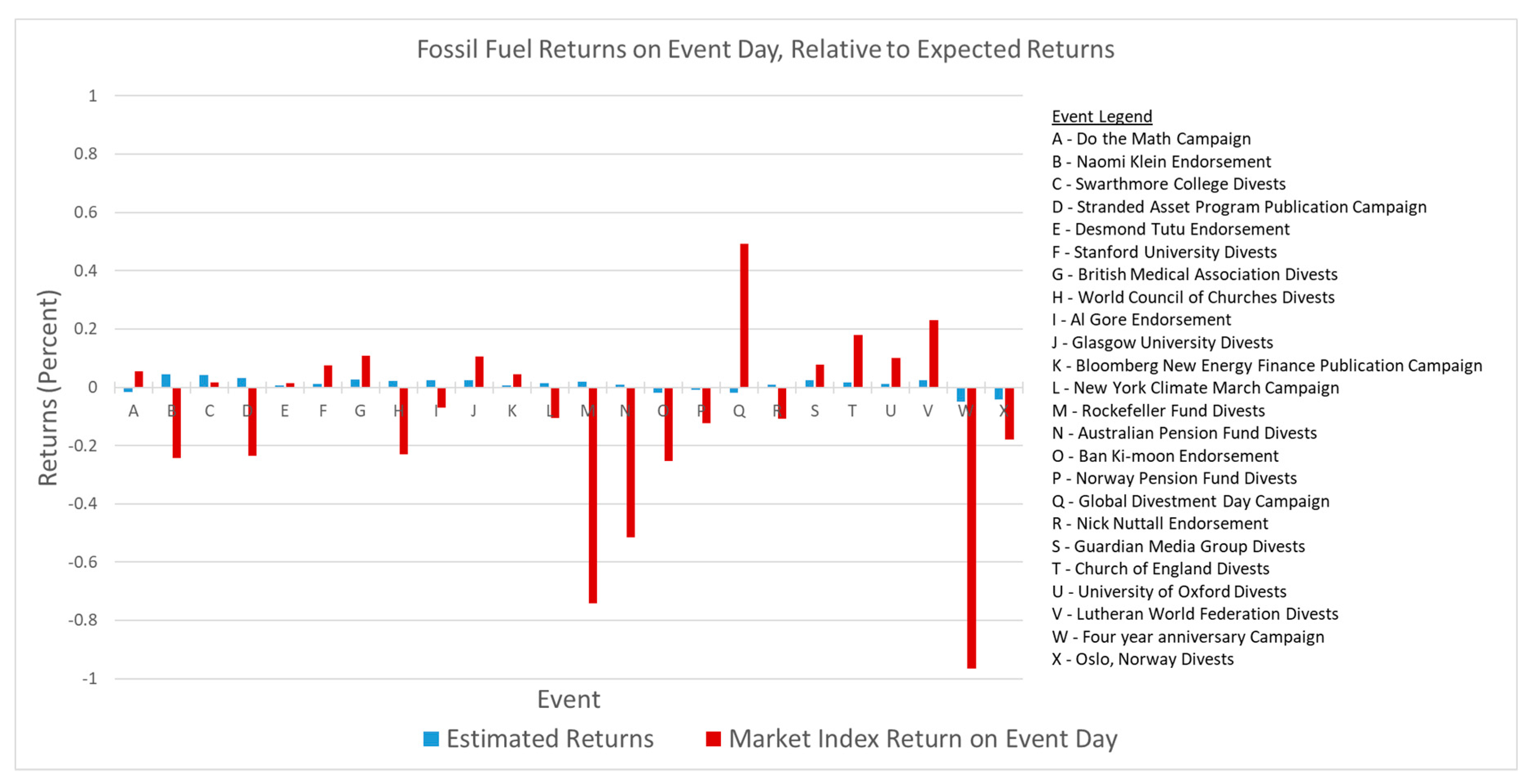

4.1. Descriptive Statistics

4.2. Independent Tests

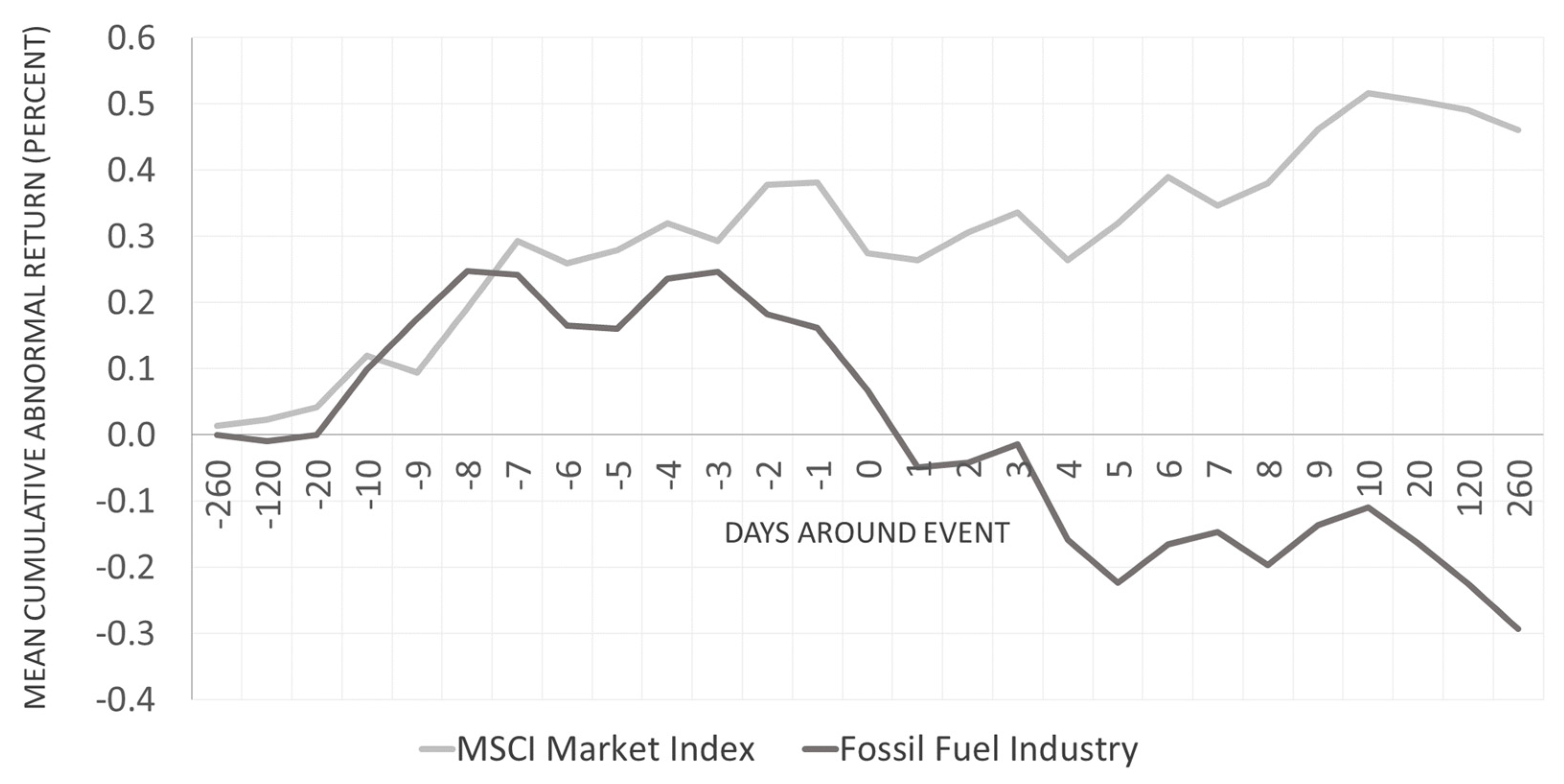

4.3. Aggregate Tests

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Quéré, C.L.; Andres, R.J.; Boden, T.; Conway, T.; Houghton, R.A.; House, J.I.; Marland, G.; Peters, G.P.; der Werf, G.R.; Ahlström, A.; et al. The global carbon budget 1959–2011. Earth Syst. Sci. Data 2013, 5, 165–185. [Google Scholar] [CrossRef]

- Hansen, J.; Sato, M.; Kharecha, P.; Beerling, D.; Berner, R.; Masson-Delmotte, V.; Pagani, M.; Raymo, M.; Royer, D.L.; Zachos, J.C. Target Atmospheric CO2: Where Should Humanity Aim? Open Atmos. Sci. J. 2008, 2, 217–231. [Google Scholar] [CrossRef]

- Van der Ploeg, F. The safe carbon budget. Clim. Chang. 2018, 147, 47–59. [Google Scholar] [CrossRef] [Green Version]

- Alcaraz, O.; Buenestado, P.; Escribano, B.; Sureda, B.; Turon, A.; Xercavins, J. Distributing the Global Carbon Budget with climate justice criteria. Clim. Chang. 2018, 149, 131–145. [Google Scholar] [CrossRef]

- Meinshausen, M.; Meinshausen, N.; Hare, W.; Raper, S.C.B.; Frieler, K.; Knutti, R.; Frame, D.J.; Allen, M.R. Greenhouse-gas emission targets for limiting global warming to 2 °C. Nature 2009, 458, 1158–1162. [Google Scholar] [CrossRef] [PubMed]

- Cripps, P. $1.8bn Coalition Divest from Fossil Fuels, Reinvest in Clean-Tech. Navitas Capital, 21 February 2014. [Google Scholar]

- Eltman, F. NYC sues, divests from oil firms over climate change. ABC News, 11 January 2018. [Google Scholar]

- Mooney, A. Growing number of pension funds divest from fossil fuels. Financial Times, 28 April 2017. [Google Scholar]

- Macdonald-Korth, D.; Harnett, E.; Caldecott, B. Fossil Fuel Company Investor Relations (Ir) Departments and Engagement on Climate Change. 28 October 2018. [Google Scholar]

- Rubin, J. The Case for Divesting from Fossil Fuels in Canada. 25 October 2016. [Google Scholar]

- Clark, G.L.; Monk, A.H.B. The Norwegian Government Pension Fund: Ethics over Efficiency. Rotman Int. J. Pension Manag. 2010, 3. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Investor implications of divesting from fossil fuels. Glob. Financ. J. 2018, 38, 30–44. [Google Scholar] [CrossRef]

- Trinks, A.; Scholtens, B.; Mulder, M.; Dam, L. Fossil Fuel Divestment and Portfolio Performance. Ecol. Econ. 2018, 146, 740–748. [Google Scholar] [CrossRef] [Green Version]

- Hunt, C.; Weber, O. Fossil fuel divestment strategies: Financial and carbon related consequences. Organ. Environ. 2018. [Google Scholar] [CrossRef]

- Ansar, A.; Caldecott, B.; Tilbury, J. Stranded Assets and the Fossil Fuel Divestment Campaign: What Does Divestment Mean for the Valuation of Fossil Fuel Assets; University of Oxford: Oxford, UK, 2013. [Google Scholar]

- Harris, L.; Gurel, E. Price and volume effects associated with changes in the S&P 500 list: New evidence for the existence of price pressures. J. Finance 1986, 41, 815–829. [Google Scholar]

- Kaempfer, W.H.; Lehman, J.A.; Lowenberg, A.D. Divestment, Investment Sanctions, and Disinvestment: An Evaluation of Anti-Apartheid Policy Instruments. Int. Organ. 1987, 41, 457–473. [Google Scholar] [CrossRef]

- Cogan, D. Tobacco Divestment and Fiduciary Responsibility: A Legal and Financial Analysis; Investor Responsibility Research Center: Washington, DC, USA, 2000.

- Wander, N.; Malone, R.E. Selling off or selling out? Medical schools and ethical leadership in tobacco stock divestment. Acad. Med. 2004, 79, 1017–1026. [Google Scholar] [CrossRef] [PubMed]

- Bechky, P.S. Darfur, Divestment, and Dialogue. 2009. Available online: https://www.law.upenn.edu/journals/jil/articles/volume30/issue3/Bechky30U.Pa.J.Int%27lL.823%282009%29.pdf (accessed on 31 May 2019).

- Fabozzi, F.J.; Ma, K.C.; Oliphant, B.J. Sin stock returns. J. Portf. Manag. 2008, 35, 82. [Google Scholar] [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Paum, A. Stranded Assets: What Next? 2015. Available online: http://www.businessgreen.com/digital_assets/8779/hsbc_Stranded_assets_what_next.pdf; (accessed on 3 June 2019).

- Green, J.; Newman, P. Disruptive innovation, stranded assets and forecasting: the rise and rise of renewable energy. J. Sustain. Financ. Invest. 2017, 7, 169–187. [Google Scholar] [CrossRef]

- Hunt, C.; Weber, O.; Dordi, T. A comparative analysis of the anti-Apartheid and fossil fuel divestment campaigns. J. Sustain. Financ. Invest. 2017, 7, 64–81. [Google Scholar] [CrossRef]

- Monasterolo, I.; Battiston, S.; Janetos, A.C.; Zheng, Z. Vulnerable yet relevant: the two dimensions of climate-related financial disclosure. Clim. Chang. 2017, 145, 495–507. [Google Scholar] [CrossRef] [Green Version]

- Green, F. Anti-fossil fuel norms. Clim. Chang. 2018, 150, 103–116. [Google Scholar] [CrossRef] [Green Version]

- Vaughan, A. Fossil fuel divestment: a brief history. The Guardian, 8 October 2014. [Google Scholar]

- Moss, J. The Morality of Divestment. Law Policy 2017, 39, 412–428. [Google Scholar] [CrossRef]

- Finley-Brook, M.; Holloman, E.; Finley-Brook, M.; Holloman, E.L. Empowering Energy Justice. Int. J. Environ. Res. Public Health 2016, 13, 926. [Google Scholar] [CrossRef]

- Butler, C.; Butler, D.C. Philanthrocapitalism: Promoting Global Health but Failing Planetary Health. Challenges 2019, 10, 24. [Google Scholar] [CrossRef]

- Dawkins, C.E. Elevating the Role of Divestment in Socially Responsible Investing. J. Bus. Ethics 2016, 1–14. [Google Scholar] [CrossRef]

- Caldecott, B.; Dericks, G. Empirical calibration of climate policy using corporate solvency: A case study of the UK’s carbon price support. Clim. Policy 2018, 18, 766–780. [Google Scholar] [CrossRef]

- Jaccard, M.; Hoffele, J.; Jaccard, T. Global carbon budgets and the viability of new fossil fuel projects. Clim. Chang. 2018, 150, 15–28. [Google Scholar] [CrossRef]

- Dowling, G. How Good Corporate Reputations Create Corporate Value. Corp. Reput. Rev. 2006, 9, 134–143. [Google Scholar] [CrossRef]

- Fombrun, C.; Shanley, M. What’s in a Name? Reputation Building and Corporate Strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar]

- Jones, K.; Rubin, P.H. Effects of harmful environmental events on reputations of firms. In Advances in Financial Economics; Emerald Group Publishing Limited: Bingley, UK, 2001; Volume 6, pp. 161–182. [Google Scholar]

- MacKinlay, A.C. Event Studies in Economics and Finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Fama, E.F. Efficient Capital Markets: II. J. Finance 1991, 46, 1575–1617. [Google Scholar] [CrossRef]

- Fama, E.F.; Fisher, L.; Jensen, M.C.; Roll, R. The Adjustment of Stock Prices to New Information. Int. Econ. Rev. (Philadelphia) 1969, 10, 1–21. [Google Scholar] [CrossRef]

- Boehmer, E.; Masumeci, J.; Poulsen, A.B. Event-study methodology under conditions of event-induced variance. J. Financ. Econ. 1991, 30, 253–272. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Measuring security price performance. J. Financ. Econ. 1980, 8, 205–258. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lo, A.; MacKinlay, A.C. The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1997; Volume 2. [Google Scholar]

- Cowan, A.R. Nonparametric event study tests. Rev. Quant. Financ. Account. 1992, 2, 343–358. [Google Scholar] [CrossRef]

- Lyon, J.D.; Barber, B.M.; Tsai, C.L. Improved methods for tests of long-run abnormal stock returns. J. Finance 1999, 54, 165–201. [Google Scholar] [CrossRef]

- Johnston, M.A. A review of the application of event studies in marketing. Acad. Mark. Sci. Rev. 2007, 11, 1–31. [Google Scholar]

- Kothari, S.P.; Warner, J.B. The Econometrics of Event Studies. 2004. Available online: https://dx.doi.org/10.2139/ssrn.608601 (accessed on 31 May 2019).

- Wagner, A.F.; Zeckhauser, R.J.; Ziegler, A. Unequal Rewards to Firms: Stock Market Responses to the Trump Election and the 2017 Corporate Tax Reform. AEA Pap. Proc. 2018, 108, 590–596. [Google Scholar] [CrossRef]

- Cheung, A.W.K. Do Stock Investors Value Corporate Sustainability? Evidence from an Event Study. J. Bus. Ethics 2010, 99, 145–165. [Google Scholar] [CrossRef]

- Amer, E. The Penalization of Non-Communicating UN Global Compact’s Companies by Investors and Its Implications for This Initiative’s Effectiveness. Bus. Soc. 2018, 57, 255–291. [Google Scholar] [CrossRef]

- Ammann, M.; Bauer, C.; Fischer, S.; Muller, P. The Impact of the Morningstar Sustainability Rating on Mutual Fund Flows. Univ. St.Gallen Sch. Financ. Res. Pap. 2017. [Google Scholar] [CrossRef] [Green Version]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Herbohn, K.; Gao, R.; Clarkson, P. Evidence on Whether Banks Consider Carbon Risk in Their Lending Decisions. J. Bus. Ethics 2017, 1–21. [Google Scholar] [CrossRef]

- Mukanjari, S.; Sterner, T. Do Markets Trump Politics? Evidence from Fossil Market Reactions to the Paris Agreement and the U.S. Election. 2018. Available online: https://gupea.ub.gu.se/handle/2077/55957 (accessed on 31 May 2019).

- McWilliams, A.; Siegel, D. Event Studies in Management Research: Theoretical and Empirical Issues. Acad. Manag. J. 1997, 40, 626–657. [Google Scholar]

- Meznar, M.B.; Nigh, D.; Kwok, C.C.Y. Effect of Announcements of Withdrawal from South Africa on Stockholder Wealth. Acad. Manag. J. 1994, 37, 1633–1648. [Google Scholar]

- Posnikoff, J.F. Disinvestment from South Africa: They did Well by Doing Good. Contemp. Econ. Policy 1997, 15, 76–86. [Google Scholar] [CrossRef]

- Teoh, S.H.; Welch, I.; Wazzan, C.P. The Effect of Socially Activist Investment Policies on the Financial Markets: Evidence from the South African Boycott*. J. Bus. 1999, 72, 35–89. [Google Scholar] [CrossRef]

- Wright, P.; Ferris, S.P. Agency Conflict and Corporate Strategy: The Effect of Divestment on Corporate Value. Strateg. Manag. J. 1997, 18, 77–83. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.; Teoh, S.H. Issues in the Use of the Event Study Methodology: A Critical Analysis of Corporate Social Responsibility Studies. Organ. Res. Methods 1999, 2, 340–365. [Google Scholar] [CrossRef] [Green Version]

- Malkiel, B.G.; Fama, E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Finance 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Fama, E.F. Multiperiod consumption-investment decisions. Am. Econ. Rev. 1970, 60, 163–174. [Google Scholar]

- Heinkel, R.; Kraus, A.; Zechner, J. The Effect of Green Investment on Corporate Behavior. J. Financ. Quant. Anal. 2001, 36, 431. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. The Anatomy of Value and Growth Stock Returns. Financ. Anal. J. 2007, 63, 44–54. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Gregory, A.; Tharyan, R.; Whittaker, J. Corporate Social Responsibility and Firm Value: Disaggregating the Effects on Cash Flow, Risk and Growth. J. Bus. Ethics 2014, 124, 633–657. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Hirschman, A.O. Exit, Voice, and Loyalty: Responses to Decline in Firms, Organizations, and States; Harvard University Press: Cambridge, MA, USA, 1970; ISBN 9780674276604. [Google Scholar]

- King, B.G.; Soule, S.A. Social Movements as Extra-Institutional Entrepreneurs: The Effect of Protests on Stock Price Returns. Adm. Sci. Q. 2007, 52, 413–442. [Google Scholar] [CrossRef] [Green Version]

- Durand, R.B.; Koh, S.; Limkriangkrai, M. Saints versus Sinners. Does morality matter? J. Int. Financ. Mark. Inst. Money 2013, 24, 166–183. [Google Scholar] [CrossRef]

- Fauver, L.; McDonald, M.B. International variation in sin stocks and its effects on equity valuation. J. Corp. Financ. 2014, 25, 173–187. [Google Scholar] [CrossRef]

- Liston, D.P. Sin stock returns and investor sentiment. Q. Rev. Econ. Financ. 2016, 59, 63–70. [Google Scholar] [CrossRef]

- Corrado, C.J. Event studies: A methodology review. Account. Financ. 2011, 51, 207–234. [Google Scholar] [CrossRef]

- Fossil Free. What Is Fossil Fuel Divestment? 2014. Available online: https://gofossilfree.org/divestment/what-is-fossil-fuel-divestment/ (accessed on 3 June 2019).

- Dyckman, T.; Philbrick, D.; Stephan, J. A Comparison of Event Study Methodologies Using Daily Stock Returns: A Simulation Approach. J. Account. Res. 1984, 22, 1–30. [Google Scholar] [CrossRef]

- Treynor, J.L. Market Value, Time, and Risk. SSRN 1961. Available online: https://dx.doi.org/10.2139/ssrn.2600356 (accessed on 31 May 2019).

- Collins, D.W.; Dent, W.T. A Comparison of Alternative Testing Methodologies Used in Capital Market Research. J. Account. Res. 1984, 22, 48–84. [Google Scholar] [CrossRef]

- Alexeyev, J.; Connolly, L.; Di Rosa, L.; Francis, T.; Palmier, M. The Carbon Underground 2015. 2015. Available online: https://www.sindark.com/genre/FFI_The-Carbon-Underground-200-2016_26-July-2016.pdf (accessed on 3 June 2019).

- Ekwurzel, B.; Boneham, J.; Dalton, M.W.; Heede, R.; Mera, R.J.; Allen, M.R.; Frumhoff, P.C. The rise in global atmospheric CO2, surface temperature, and sea level from emissions traced to major carbon producers. Clim. Chang. 2017, 144, 579–590. [Google Scholar] [CrossRef]

- Heede, R. Tracing anthropogenic carbon dioxide and methane emissions to fossil fuel and cement producers, 1854–2010. Clim. Chang. 2014, 122, 229–241. [Google Scholar] [CrossRef]

- Shue, H. Responsible for what? Carbon producer CO2 contributions and the energy transition. Clim. Chang. 2017, 144, 591–596. [Google Scholar] [CrossRef] [Green Version]

- Ohlson, J.; Rosenberg, B. Systematic Risk of the CRSP Equal-Weighted Common Stock Index: A History Estimated by Stochastic-Parameter Regression. J. Bus. 1982, 55, 121–145. [Google Scholar] [CrossRef]

- Lo, A.W.; MacKinlay, C.A. An econometric analysis of nonsynchronous trading. J. Econ. 1990, 45, 181–211. [Google Scholar] [CrossRef] [Green Version]

- Dodd, P.; Warner, J.B. On corporate governance: A study of proxy contests. J. Financ. Econ. 1983, 11, 401–438. [Google Scholar] [CrossRef]

- Kolari, J.W.; Pynnönen, S. Event study testing with cross-sectional correlation of abnormal returns. Rev. Financ. Stud. 2010, 23, 3996–4025. [Google Scholar] [CrossRef]

- Patell, J.M. Corporate Forecasts of Earnings Per Share and Stock Price Behavior: Empirical Test. J. Account. Res. 1976, 14, 246–276. [Google Scholar] [CrossRef]

- Diaz-Rainey, I.; Robertson, B.; Wilson, C. Stranded research? Leading finance journals are silent on climate change. Clim. Chang. 2017, 143, 243–260. [Google Scholar] [CrossRef]

- Meznar, M.B.; Nigh, D.; Kwok, C.C.Y. Announcements of Withdrawal From South Africa Revisited: Making Sense of Contradictory Event Study Findings. Acad. Manag. J. 1998, 41, 715–730. [Google Scholar]

- Carney, M. Breaking the Tragedy of the Horizon—Climate change and financial stability. Speech given Lloyd’s London by Gov. Bank Engl. 2015, 29, 220–230. [Google Scholar]

- TCFD. Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures. 2015. Available online: https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Report-062817.pdf (accessed on 3 June 2019).

- Erickson, P.; Lazarus, M. Would constraining US fossil fuel production affect global CO2 emissions? A case study of US leasing policy. Clim. Chang. 2018, 150, 29–42. [Google Scholar] [CrossRef]

- Kiyar, D.; Wittneben, B.; Kiyar, D.; Wittneben, B.B.F. Carbon as Investment Risk—The Influence of Fossil Fuel Divestment on Decision Making at Germany’s Main Power Providers. Energies 2015, 8, 9620–9639. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The Cost of Capital, Corporation Finance and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Kartha, S.; Caney, S.; Dubash, N.K.; Muttitt, G. Whose carbon is burnable? Equity considerations in the allocation of a ‘right to extract.’. Clim. Chang. 2018, 150, 117–129. [Google Scholar]

- Forsell, N.; Turkovska, O.; Gusti, M.; Obersteiner, M.; den Elzen, M.; Havlik, P. Assessing the INDCs’ land use, land use change, and forest emission projections. Carbon Balance Manag. 2016, 11, 26. [Google Scholar] [CrossRef]

- Walsh, B.J.; Rydzak, F.; Palazzo, A.; Kraxner, F.; Herrero, M.; Schenk, P.M.; Ciais, P.; Janssens, I.A.; Peñuelas, J.; Niederl-Schmidinger, A.; et al. New feed sources key to ambitious climate targets. Carbon Balance Manag. 2015, 10, 26. [Google Scholar] [CrossRef]

- Fernández-Martínez, M.; Vicca, S.; Janssens, I.A.; Sardans, J.; Luyssaert, S.; Campioli, M.; Chapin, F.S., III; Ciais, P.; Malhi, Y.; Obersteiner, M.; et al. Nutrient availability as the key regulator of global forest carbon balance. Nat. Clim. Chang. 2014, 4, 471–476. [Google Scholar] [CrossRef] [Green Version]

| Date | Divestment Pledge |

|---|---|

| 2013-05-14 | Kissel, M. (2013). Opinion: Swarthmore Under Student Siege. Wall Street Journal. |

| 2014-05-06 | Crooks, E. (2014). Stanford endowment votes to sell coal mining shares. Financial Times. |

| 2014-07-11 | Vaughan, A. (2014) World Council of Churches rules out fossil fuel investments. The Guardian. |

| 2014-06-25 | Medact. (2014). UK Doctors Vote to End Investments in the Fossil Fuel Industry. |

| 2014-09-22 | Calia, M. (2014). Rockefeller Fund Seeks to Shed Fossil-Fuel Investments. Wall Street Journal. |

| 2014-10-07 | Smyth, J. (2014). Australian pension fund LGS drops coal assets. Financial Times. |

| 2014-10-08 | Brooks, L. (2014) Glasgow becomes the first university in Europe to divest from fossil fuels. The Guardian. |

| 2014-11-23 | Marriage, M. (2014) Norway’s largest pension fund vows to drop coal mine holdings. Financial Times. |

| 2015-04-01 | Mance, H & Clark, P. (2015). Guardian Media Group to sell shares linked to fossil fuels. Financial Times. |

| 2015-04-30 | Clark, P. (2015). Church of England blacklists coal and tar sands investments. Financial Times. |

| 2015-05-18 | Clark, P. (2015). University of Oxford to spurn coal and tar sands investments. Financial Times. |

| 2015-06-23 | Lutheran World Federation. (2015). LWF announces the decision not to invest in fossil fuels. LWF. |

| 2015-10-20 | Carrington, D. (2015). Oslo divests from coal companies. The Guardian. |

| Date | Divestment Endorsement |

| 2013-05-01 | Klein, N. (2013). Naomi Klein: Time for Big Green to Go Fossil Free. The Nation. |

| 2014-04-10 | Tutu, D. (2014). Desmond Tutu: We need an apartheid-style boycott to save the planet. The Guardian. |

| 2014-08-06 | Gore, A. & Blood, D. (2014). Strong economic case for coal divestment. Financial Times. |

| 2014-11-04 | Ki-moon, B. (2014) Ban Ki-Moon Endorses Fossil Fuel Divestment. UNFCCC. |

| 2015-03-15 | Carrington, D. (2015). Climate change: UN backs fossil fuel divestment campaign. The Guardian. |

| Date | Divestment Campaign |

| 2012-09-19 | 350.org (2012). Do the Math: We’re jumpstarting a new movement, and we need your help. 350.org. |

| 2013-10-07 | Ansar, A., Caldecott, B., & Tilbury, J. (2013). Stranded assets and the fossil-fuel divestment campaign: what does divestment mean for the valuation of fossil fuel assets? Stranded Asset Program, SSEE, University of Oxford. |

| 2014-08-25 | Bullard, N. (2014). Fossil-fuel divestment: a $5 trillion challenge. Bloomberg New Energy Finance. |

| 2014-09-19 | Foderaro, L.W. (2014). New York Climate March: Taking a Call for Climate Change to the Streets. New York Times. |

| 2015-02-12 | Mathiesen, K; Howard, E; & Shabbir, N. (2015). Global Divestment Day: ‘We are ready for urgent action on climate change’. The Guardian. |

| 2015-09-22 | Crooks, E. (2015). Funds worth $2.6tn pledge to dump coal. Financial Times. |

| Descriptive Statistics | ‘Carbon Underground’ between 2012 and 2015 | MSCI ACWI Benchmark between 2012 and 2015 | ‘Carbon Underground’ Around Events | MSCI ACWI Benchmark Around Events |

|---|---|---|---|---|

| Average Daily Return of Security | 0.000 | 0.000 | −0.011 | 0.017 |

| Cumulative Return Over Time | −0.534 | 0.035 | −0.293 | 0.461 |

| Median | 0.000 | 0.000 | −0.005 | 0.019 |

| Standard Deviation | 0.012 | 0.005 | 0.062 | 0.051 |

| Skewness | −0.234 | −0.986 | −0.183 | −0.326 |

| Kurtosis | 9.765 | 9.695 | −0.643 | −0.238 |

| Date | Announcement | (−1,1) | (−10,10) | ||||

|---|---|---|---|---|---|---|---|

| CAAR | BMP | p-Value | CAAR | BMP | p-Value | ||

| 2012-09-19 | Do the Math Campaign | −0.008 | 7.54 | <0.001 ** | 0.017 | 6.73 | 1.000 |

| 2013-05-01 | Naomi Klein Endorsement | −0.003 | 2.91 | 0.002 ** | 0.008 | 2.66 | 0.996 |

| 2013-05-14 | Swarthmore College Divests | −0.005 | 3.37 | <0.001 ** | 0.006 | 1.90 | 0.972 |

| 2013-10-07 | SAP Publication Campaign | −0.003 | 2.59 | 0.005 ** | −0.002 | 0.81 | 0.208 |

| 2014-04-10 | Desmond Tutu Endorsement | 0.000 | 0.31 | 0.620 | 0.009 | 2.66 | 0.996 |

| 2014-05-06 | Stanford University Divests | 0.001 | 0.61 | 0.729 | −0.005 | 1.33 | 0.092 |

| 2014-07-11 | World Council of Churches Divests | −0.002 | 1.67 | 0.047 ** | −0.003 | 0.85 | 0.197 |

| 2014-06-25 | British Medical Association Divests | −0.002 | 2.15 | 0.016 ** | −0.001 | 0.42 | 0.337 |

| 2014-08-06 | Al Gore Endorsement | −0.005 | 2.42 | 0.008 ** | 0.005 | 1.62 | 0.947 |

| 2014-08-08 | Glasgow University Divests | 0.002 | 1.68 | 0.953 | −0.003 | 1.10 | 0.137 |

| 2014-08-25 | BNEF Publication Campaign | −0.001 | 1.19 | 0.117 | 0.004 | 0.92 | 0.821 |

| 2014-09-19 | New York Climate March Campaign | −0.010 | 5.99 | <0.001 ** | −0.042 | 8.47 | <0.001 ** |

| 2014-09-22 | Rockefeller Fund Divests | −0.011 | 6.34 | <0.001 ** | −0.046 | 9.57 | <0.001 ** |

| 2014-10-07 | Australian Pension Fund Divests | −0.005 | 4.95 | <0.001 ** | −0.043 | 11.66 | <0.001 ** |

| 2014-11-03 | Ban Ki-moon Endorsement | −0.001 | 0.62 | 0.269 | 0.002 | 0.50 | 0.691 |

| 2014-11-24 | Norway Pension Fund Divests | 0.001 | 0.67 | 0.749 | −0.057 | 8.22 | <0.001 ** |

| 2015-02-12 | Global Divestment Day Campaign | 0.009 | 7.81 | 1.000 | 0.025 | 4.27 | 1.000 |

| 2015-03-16 | Nick Nuttall Endorsement | −0.006 | 3.29 | 0.001 ** | −0.025 | 7.38 | <0.001 ** |

| 2015-04-01 | Guardian Media Group Divests | 0.003 | 1.56 | 0.941 | 0.036 | 9.29 | 1.000 |

| 2015-04-30 | Church of England Divests | 0.003 | 1.79 | 0.963 | −0.011 | 2.54 | 0.006 ** |

| 2015-05-18 | University of Oxford Divests | −0.006 | 3.57 | <0.001 ** | −0.022 | 5.07 | <0.001 ** |

| 2015-06-23 | Lutheran World Federation Divests | 0.005 | 2.95 | 0.998 | −0.059 | 8.82 | <0.001 ** |

| 2015-09-22 | Four-year anniversary Campaign | −0.019 | 8.56 | <0.001 ** | 0.004 | 1.03 | 0.849 |

| 2015-10-20 | Oslo, Norway Divests | −0.015 | 7.02 | <0.001 ** | 0.015 | 3.65 | 1.000 |

| Event Day/Interval | AAR | CAAR | BMP Test | p-Value |

|---|---|---|---|---|

| −260 | −0.025 | −0.025 | ||

| −10 | 0.066 | 0.041 | 0.537 | 0.296 |

| −9 | 0.045 | 0.086 | 0.959 | 0.169 |

| −8 | 0.049 | 0.126 | 0.239 | 0.406 |

| −7 | −0.038 | 0.087 | −0.427 | 0.335 |

| −6 | −0.109 | −0.021 | 1.084 | 0.140 |

| −5 | −0.037 | −0.059 | 0.373 | 0.355 |

| −4 | 0.044 | −0.016 | 0.774 | 0.220 |

| −3 | −0.022 | −0.038 | 1.085 | 0.140 |

| −2 | −0.095 | −0.133 | 0.244 | 0.404 |

| −1 | −0.054 | −0.187 | 1.253 | 0.106 |

| 0 | −0.127 | −0.314 | 1.758 | 0.040 * |

| 1 | −0.148 | −0.462 | 1.221 | 0.112 |

| 2 | −0.026 | −0.488 | 0.091 | 0.464 |

| 3 | 0.004 | −0.492 | 0.324 | 0.373 |

| 4 | −0.177 | −0.669 | 0.462 | 0.322 |

| 5 | −0.098 | −0.767 | −0.325 | 0.373 |

| 6 | 0.026 | −0.741 | 0.609 | 0.272 |

| 7 | −0.013 | −0.755 | 0.127 | 0.450 |

| 8 | −0.083 | −0.837 | 1.163 | 0.123 |

| 9 | 0.029 | −0.808 | 0.609 | 0.271 |

| 10 | −0.006 | −0.814 | 0.196 | 0.422 |

| (−1,1) | −0.327 | 1.950 | 0.026 * | |

| (−10,10) | −0.792 | 1.293 | 0.099 |

| (−1,1) | (−10,10) | |||||

|---|---|---|---|---|---|---|

| CAAR | BMP | p-Value | CAAR | BMP | p-Value | |

| PANEL A | ||||||

| All Events | −0.327 | 1.950 | 0.026 * | −0.792 | 1.293 | 0.099 |

| PANEL B | ||||||

| Events with Positive Estimation Windows | −0.393 | 2.146 | 0.017 ** | −1.230 | 2.149 | 0.016 ** |

| Events with Negative Estimation Windows | −0.300 | 1.869 | 0.032 ** | −0.611 | −0.940 | 0.174 |

| PANEL C | ||||||

| Campaign Events | −0.534 | 3.010 | 0.001 ** | 0.082 | 0.610 | 0.271 |

| Pledge Events | −0.344 | 2.218 | 0.014 * | −0.688 | 0.901 | 0.185 |

| Endorsement Events | −0.283 | 1.784 | 0.038 * | 0.035 | 0.011 | 0.496 |

| PANEL D | ||||||

| Events prior to NY Climate March | −0.250 | 1.931 | 0.027 ** | 0.300 | 1.088 | 0.139 |

| Events post NY Climate March | −0.392 | 1.966 | 0.025 ** | -1.716 | 3.307 | 0.000 ** |

| Expected Returns Models | Statistical Test | t-Value |

|---|---|---|

| Mean Model | CSect | −0.18 |

| CDA | −0.47 | |

| PatellZ | −0.13 | |

| BMPZ | 0.06 | |

| Sign | 0.585 | |

| Market OLS | CSect | −1.11 |

| CDA | −4.58 ** | |

| PatellZ | −1.65 * | |

| BMPZ | −1.51 | |

| Sign | −0.55 | |

| Capital Asset Pricing Model | CSect | −1.43 |

| CDA | −5.73 ** | |

| PatellZ | −1.88 * | |

| BMPZ | −1.76 * | |

| Sign | −1.476 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dordi, T.; Weber, O. The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks. Sustainability 2019, 11, 3122. https://doi.org/10.3390/su11113122

Dordi T, Weber O. The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks. Sustainability. 2019; 11(11):3122. https://doi.org/10.3390/su11113122

Chicago/Turabian StyleDordi, Truzaar, and Olaf Weber. 2019. "The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks" Sustainability 11, no. 11: 3122. https://doi.org/10.3390/su11113122

APA StyleDordi, T., & Weber, O. (2019). The Impact of Divestment Announcements on the Share Price of Fossil Fuel Stocks. Sustainability, 11(11), 3122. https://doi.org/10.3390/su11113122