1. Introduction

In recent years, many cities have been severely affected by extreme floods, such as the river flooding in Thailand in 2011 [

1], the storm flooding in New York and New Jersey in 2012 caused by Hurricane Sandy [

2], the flooding along the Elbe in Germany in 2013 [

3], and the storm flooding in Houston in 2017 by Harvey [

4]. The enormous deaths, injuries, and economic loss caused by extreme floods have gained much attention worldwide. Shanghai, located at the estuary of the Yangtze River and low-lying coastal zones, is considered to be the most vulnerable city to coastal floods among the world’s 9 deltaic coastal cities [

5] and ranks as one of the top 20 cities in the world in terms of population exposure and property exposure to floods [

6]. In the future, more frequent extreme storm floods are expected to occur in this city due to the combined effects of increased tropical cyclone intensities with global warming and the acceleration of sea level rises [

7,

8], severe land subsidence resulting from rapid urbanization, and the drastic transformation of the underwater terrain in the Yangtze River estuary attributed to large-scale construction projects [

9,

10,

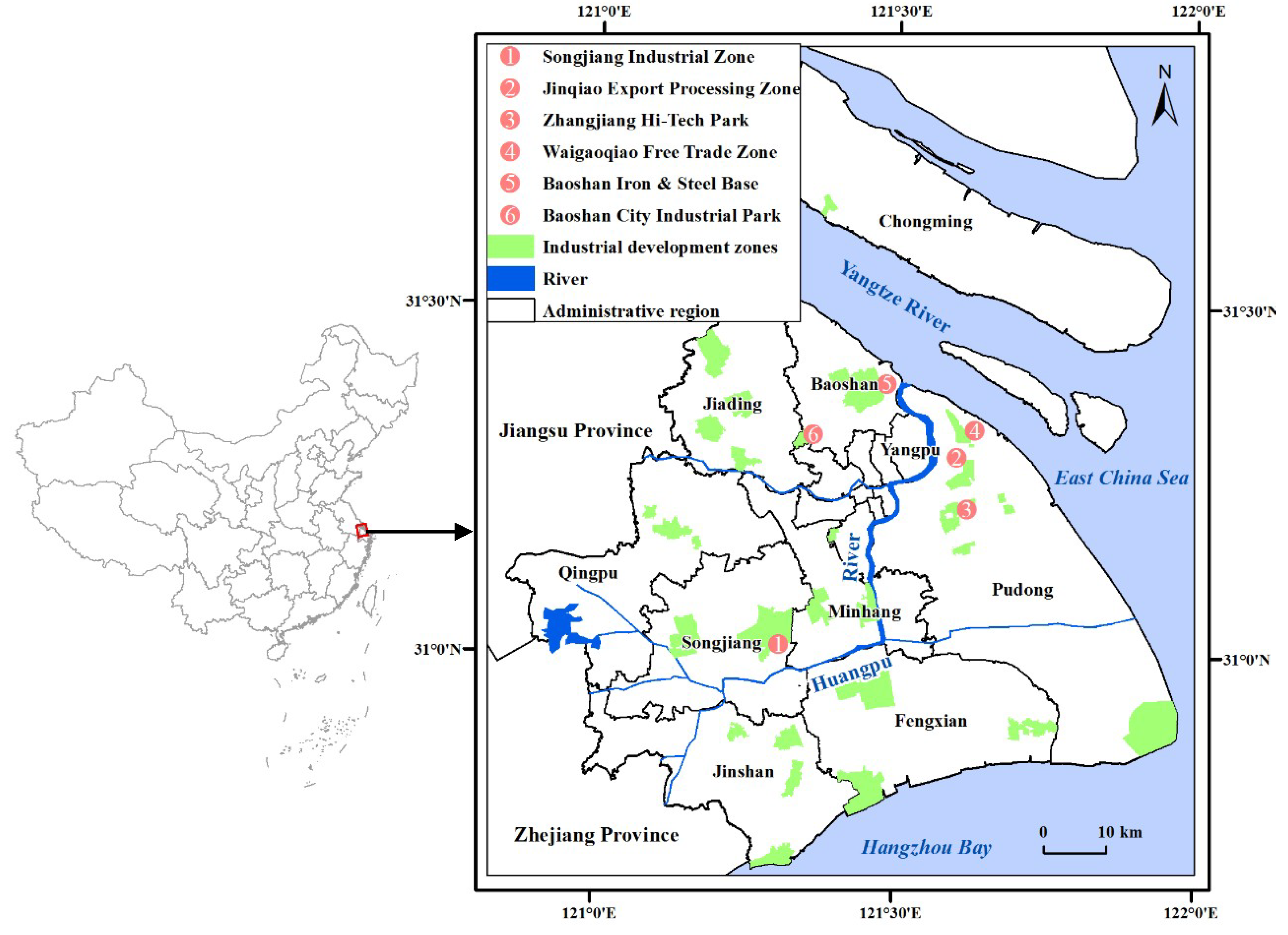

11]. Particularly, the consequences would be more devastating in the case of compound flood events of extreme rainstorms, astronomical high tides, storm surge, and upstream floods. Shanghai is one of the most important manufacturing hubs in China and in the world. Many manufacturing plants and facilities are distributed in riverine and coastal lowlands, and are prone to coastal floods. Because of the strong linkage of the manufacturing industry, if affected by extreme storm floods, the damaged firms in Shanghai would trigger serious system-wide indirect losses and impacts in the local region, the entirety of China, and the world. Therefore, effectively assessing the manufacturing industry’s potential economic losses/risk and then to improving its adaptability/resilience to extreme storm floods are becoming urgent issues in the context of global climate change.

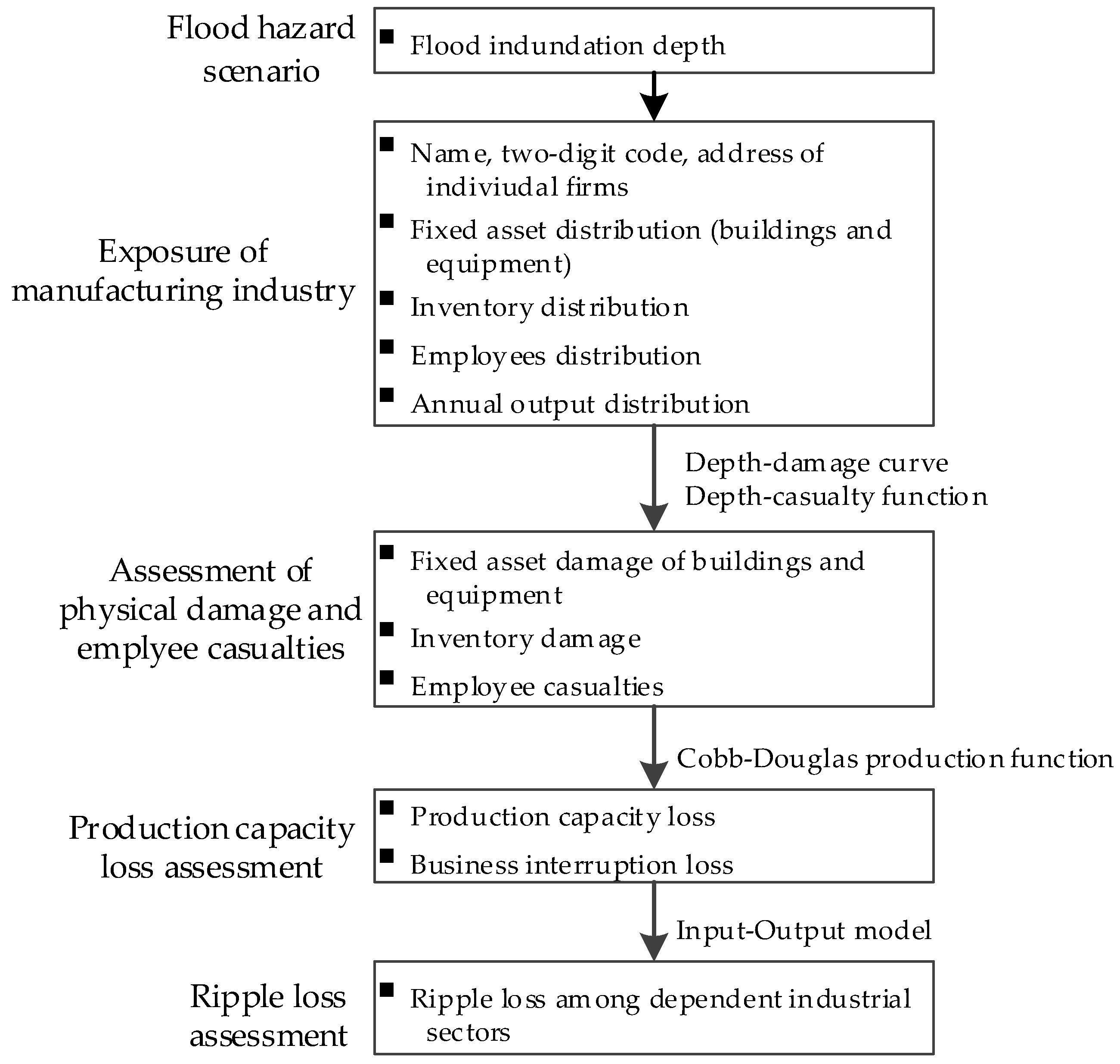

The industrial system is a complex network composed of inter-linked firms/sectors. From the perspective of disaster impact propagation in the industrial system, the physical damage, production capacity loss (or business interruption loss), and ripple loss would be induced successively [

12]. Floods may initially cause physical damage to industrial facilities such as buildings, equipment, and inventories. Afterwards, the asset damage and labor shortages may lead to production capacity losses in the affected areas, which can be regarded as the inoperable part of normal production capacity. If stagnation and recovery time are considered, production capacity loss can be deduced to business interruption loss. Finally, due to the inter-linkage of firms/sectors, it may further trigger system-wide indirect ripple losses. Physical damage is usually categorized as a direct loss, while production capacity loss and ripple loss are categorized as an indirect loss [

13]. Traditionally, physical damage assessment originates from the engineering community [

14] and is mainly used for the design of structural defense measures and the calculation of insurance premiums. The most frequently adopted approach for physical damage assessment is to apply vulnerability functions developed either with intensive post-disaster surveys of affected individual elements at a micro scale, or with detailed scenario-based hazards and resulting damage simulations. Production capacity loss assessment is often sponsored by private stakeholders and generally applied for business continuity planning (BCP). The system-wide indirect ripple loss is a key issue of concern for governments and the public. In contrast to physical damage assessment, most econometric models for indirect ripple loss assessment such as Input-Output (IO) and Computable General Equilibrium (CGE) are often performed at an aggregated and macro scale, in which input parameters at sector scales are needed [

15,

16]. Owing to the differences in domains, objectives, methods and scales, the research of physical damage assessment, production capacity loss assessment and ripple loss assessment are isolated from one another to some extent.

The gaps make it difficult to sufficiently understand how the damage to individual elements of single nodes (hubs or critical infrastructure) may influence the industrial system as a whole [

16,

17], and to completely estimate the potential economic loss. Currently, the affected-sector losses used as inputs to IO and CGE models are mostly derived from ex-post surveys, which constrains their utilization for indirect ripple loss assessment at the post-disaster recovery and reconstruction phase. Thus, from the perspective of ex-ant risk analysis, it is necessary to develop an integrated assessment methodology that combines hazard scenario simulation, exposure analysis of industrial system, physical damage and production capacity loss assessment at local nodes, and indirect system-wide ripple loss estimation. Such a methodology will help to comprehensively simulate the amplification effect of disaster impacts in industrial systems, and better understand the interactions between intrinsic economic dynamics and external shocks [

16].

Economic loss assessment is an essential part of disaster risk management and can provide crucial information for risk analysis, risk mapping, and optimal decisions on mitigation measures. A number of previous studies [

18,

19,

20,

21] focus on the estimation of the flood-induced physical damage using depth-damage curves. However, the direct physical damage only accounts for a small proportion of the total economic loss in catastrophic events [

12,

22], and cannot provide sufficient information for decision-making. Other studies [

23,

24,

25] have developed integrated systems to assess the direct loss and indirect loss with coupled hydro-economic models, but the following issues in these models need to be addressed. First, the manufacturing industry is taken as a whole for depth–damage curves without considering the differences of asset exposure and vulnerability within various sectors. Second, the exposure mapping and physical damage estimation are often based on land use types with an assumption that asset values are evenly distributed for a certain land use type. This method does not take into account the density distribution of industrial activities. Third, direct physical damage (i.e., stock loss) rather than production capacity loss (i.e., flow loss) is used as input to IO and CGE models, which does not consider the marginal productivity of input factors and the production process from input factors to final products.

In comparison with other sectors such as private households and agriculture, assessing economic loss of floods in manufacturing industry is more challenging. First, due to the high variability and scarcity of data available in the manufacturing industry, the transfer of asset values and physical damage functions within sectors is problematic [

26]. Second, the diverse production process from input to final output in different industrial sectors makes it difficult to model the transformation from physical damage of input factors to output loss. Third, because of the complex inter-linkage, it is hard to identify, define and estimate the indirect ripple loss. In metropolitan areas where industrial activities are highly concentrated, insufficient economic loss estimation may lead to an incomplete understanding of potential disaster risk and biased decision-making.

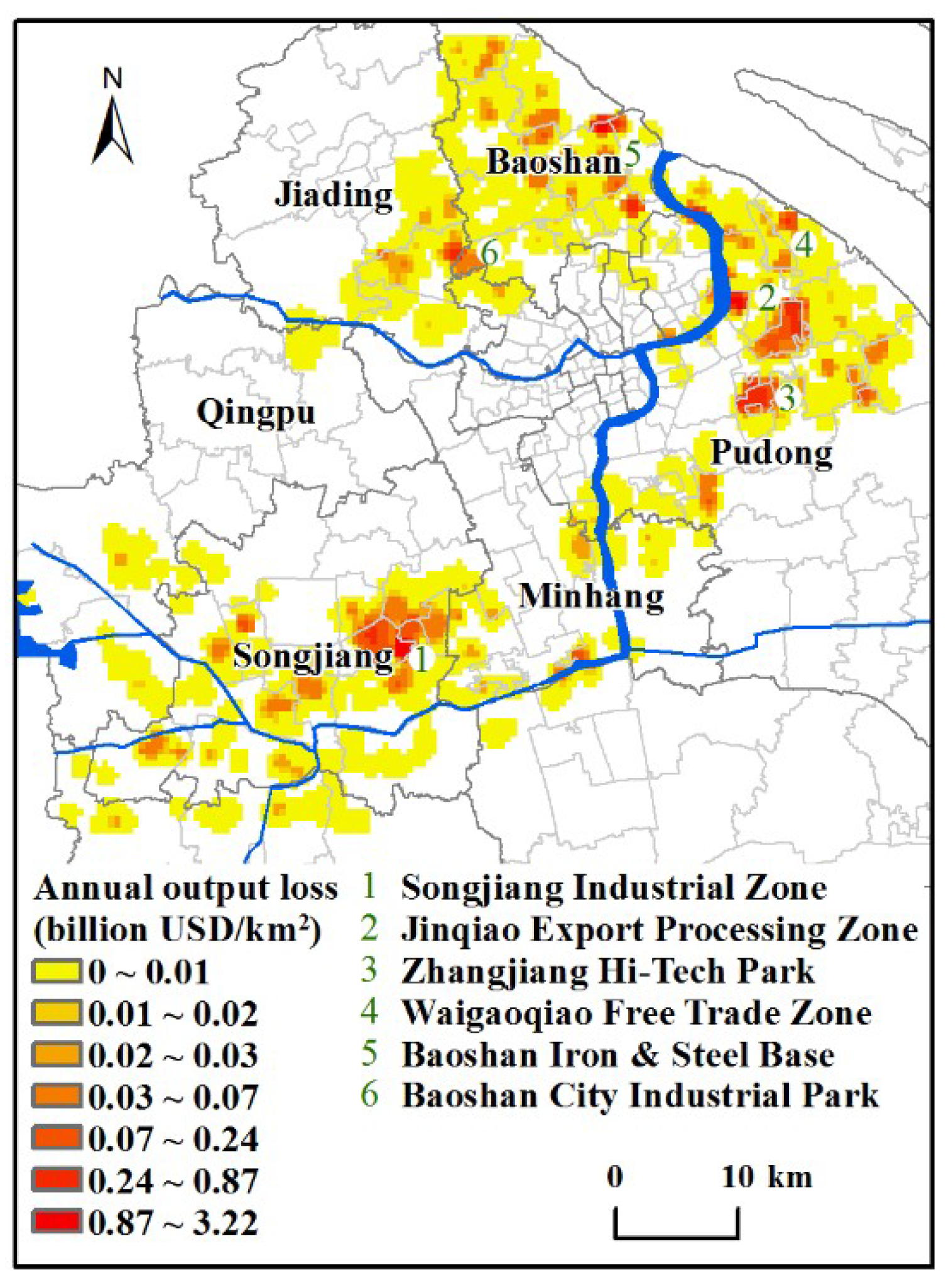

In view of the above problems, we develop an integrated methodology for assessing physical damage, production capacity loss, and inter-sector ripple loss using the depth-damage curve, Cobb-Douglas production function and IO model. This methodology is then applied to detailed individual manufacturing firms in the Shanghai metropolitan area to simulate the disaster impact propagation from local individual firms to the entire industrial system and comprehensively estimate the resulting direct and indirect economic losses and their spatial distribution. The results may provide a reasonable basis for cost-benefit analysis of structural measures, insurance premium, BCP, and public financial appraisals.

4. Discussions

How to reasonably simulate direct loss and indirect loss as a function of increasing hazard intensity is highly concerned by the academic community. In this study, an integrated framework is proposed for assessing physical damage, production capacity loss and inter-sector ripple loss coupling depth-damage curve, Cobb-Douglas production function and IO model.

The integrated methodology in this paper presents the following improvements over previous studies. First, detailed firm-level census data rather than land use or administrative region data are applied to exposure analysis and mapping, which eliminates the assumption of evenly distribution of asset value within a certain land use type. It also avoids the disaggregation of economic statistics and the likely consequent uncertainty. Second, instead of taking the manufacturing industry as a whole, classified depth-damage curves are developed to assess the physical damage of fixed assets and inventory for different manufacturing classes. This reveals the differences of asset exposure and vulnerability of various sectors within the manufacturing industry. Third, production capacity loss (i.e., flow loss) rather than physical damage (i.e., stock loss) is used as an input to the IO model, which takes the marginal productivity of input factors into consideration. Classified Cobb-Douglas production functions are applied to transform the physical damages of asset and labor into production capacity loss. Cobb-Douglas functions are built based on individual firm data from which differences in returns-to-scale at firm level are concerned. This approach overcomes the weakness of constant returns-to-scale assumption [

14] Finally, IO model is utilized in this study not only to evaluate the system-wide indirect ripple loss triggered by affected manufacturing industry, but also to identify the most vulnerable and critical sectors (nodes) within the regional industrial networks for disaster risk prevention.

However, there are still some uncertainties and problems to be studied in the future. First, the damage curve is recognized as the primary source of uncertainty in flood damage estimation [

49]. Because of the lack of detailed and reliable post-flood loss data in the study area, the depth-damage curves used for physical damage assessment are mainly developed from HAZUS-MH, which need to be further localized and calibrated in the future. Second, Cobb-Douglas function is performed to transform physical damage into annual output loss. Different understandings and parameter settings in the Cobb-Douglas function may lead to uncertainty in annual output loss estimation. It is essential to develop optimal production functions for different sectors and regions based on their specific characteristics. Third, IO model and CGE model are commonly used for the indirect system-wide ripple loss assessment. The estimated ripple loss obtained from IO model can be further compared and verified with the CGE model.

5. Conclusions

From the perspective of ex-ante risk analysis, we develop an integrated multi-process and multi-scale assessment methodology for economic loss evaluation caused by floods in the manufacturing industry. Given a hazard intensity scenario, the resulting physical damage, production capacity loss and inter-sector ripple loss can be estimated successively.

The results show that, given no floodwall protection, a scenario of a 1000-year storm flood would cause approximate direct asset damages of US $21 billion to affected manufacturing firms, including fixed asset damage of US $12 billion and inventory damage of US $9 billion. The damage hotspots are found in and around several key industrial development zones, due to their high level of inundation depth, high density of asset exposure, and water-susceptible industrial structure. The shortage of input productive factors of asset and labor would further lead to production capacity loss of US $25 billion to affected manufacturing firms/sectors. During the transformation from physical damage to production capacity loss, the amplification ratio varies across manufacturing classes and industrial development zones with specific structures. In addition, the affected manufacturing industry would indirectly result in ripple losses of US $60 billion among dependent sectors, which implies a significant multiplier effect. Our results have important implications for reasonable cost-benefit analysis of structural flood control measures such as dike upgrading and tidal barrier construction of Huangpu River, as well as for manufacturing firm location planning and resilience strategy decision-making.