Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy)

Abstract

1. Introduction

2. The Development of Green Buildings in Italy and in the World

3. The Market Investigated: Real Estate for Management Use in Milan

4. Hedonic Prices and Absorption Rates in Green Properties

5. Sustainability Turns into Value: Survey Results

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- IPCC. Global Warming of 1.5 C. 2018. Available online: http://www.ipcc.ch/report/sr15/ (accessed on 13 November 1988).

- RICS. Supply, Demand and the Value of Green Buildings. Rics Research. 2012. Available online: http://www.breeam.es/images/recursos/inf/informe_rics_supply_demand_and_the_value_of_green_buildings.pdf (accessed on 21 October 2018).

- Micelli, E.; Mangialardo, A. Recycling the City—New Perspective on the Real-estate Market and Construction Industry. In Smart and Sustainable Planning for Cities and Regions; Bisello, A., Vettorato, D., Stephens, R., Elisei, P., Eds.; Springer: Cham, Switzerland, 2015; pp. 115–125. [Google Scholar]

- Brown, D.; Dillard, J.; Marshall, R.S. Triple Bottom Line: A Business Metaphor for a Social Construct; School of Business Administration, Portland State University: Portland, OR, USA, 2006. [Google Scholar]

- McGraw Hill Construction. Green Building Smart Report; McGraw Hill: Bedford, UK, 2008. [Google Scholar]

- Fuerst, F.; Mcallister, P. Green Noise or Green Value? Measuring the Price Effects of Environmental Certification in Commercial Buildings; School of Real Estate and Planning, Henley Business School, University of Reading: Reading, MA, USA, 2008. [Google Scholar]

- Fuerst, F.; Mcallister, P. Pricing sustainability: An empirical investigation of the value impacts of green building certification. In Proceedings of the American Real Estate Society Conference, Captiva Island, FL, USA, 10–14 April 2008. [Google Scholar]

- Attardi, R.; Cerreta, M.; Sannicandro, V.; Torre, C.M. Non-compensatory composite indicators for the evaluation of urban planning policy: The Land-Use Policy Efficiency Index. Eur. J. Oper. Res. 2018, 264, 491–507. [Google Scholar] [CrossRef]

- Boyd, T.; Kimmet, P. The Triple Bottom Line Approach to Property Performance Evaluation; School of Construction Management and Property, Queensland University of Technology: Brisbane, Australia, 2006. [Google Scholar]

- Fedrizzi, R.S.; Morri, G.; Pavesi, A.S.; Soffietti, F.; Verani, E. Uno strumento per la creazione di valore nella realizzazione di edifici sostenibili: La certificazione LEED. Territorio Italia 2016, 2, 37–47. [Google Scholar] [CrossRef]

- Morri, G. Greenbuilding sustainability and market premium in Italy. J. Eur. Real-Estate Res. 2013, 6, 303–332. [Google Scholar] [CrossRef]

- Matisoff, D.C.; Noonan, D.S.; Mazzolini, A.M. Performance or market benefits? The case of LEED certification. Environ. Sci. Technol. 2014, 48, 2001–2007. [Google Scholar] [CrossRef] [PubMed]

- Energy and Sustainability. Available online: https://www.cbre.it/it-it/servizi/settori/energy-and-sustainability (accessed on 13 November 2018).

- Documenti e Risorse. Available online: http://www.gbcitalia.org (accessed on 13 November 2018).

- Chappell, T.W.; Corps, C. High Performance Green Building: What’s It Worth? Investigating the Market Value of High Performance Green Buildings; Cascadia Region Green Building Council: Seattle, WA, USA, 2010. [Google Scholar]

- Pavesi, A.S.; Verani, E. Introduzione Alla Certificazione LEED®: Progetto, Costruzione, Gestione—Ottimizzazione del Processo Edilizio Secondo i Principi Della Sostenibilità; Maggioli Editore: Rimini, Italy, 2012. [Google Scholar]

- Chegut, A.; Eicholtz, P.; Kok, N. The Value of Green Buildings—New Evidence from the United Kingdom. Available online: http://immobilierdurable.eu/images/2128_uploads/Chegut_Eichholtz_Kok_green_value_in_the_uk.pdf (accessed on 13 November 2018).

- Robinson, S.; McAllister, P. Heterogeneous Price Premiums in Sustainable Real Estate? An Investigation of the Relation between Value and Price Premiums. Joisre 2015, 1, 1–20. [Google Scholar]

- Antoniucci, V.; Marella, G. The influence of building tipology on the economic feasibilityof urban developments. Int. J. Appl. Eng. Res. 2018, 15, 4946–4954. [Google Scholar]

- Antoniucci, V.; Marella, G. Is social polarization related to urban density? Evidence from the Italian housing market. Landsc. Urban Plan. 2018, 177, 340–349. [Google Scholar] [CrossRef]

- Del Giudice, V.; Salvo, F.; DE Paola, P. Resampling Techniques for Real Estate Appraisals: Testing the Bootstrap Approach. Sustainability 2018, 10, 3085. [Google Scholar] [CrossRef]

- Warren-Myers, G. The value of sustainability in real estate: A review from a valuation Perspective. J. Prop. Invest. Financ. 2012, 30, 115–144. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E. Rethinking the Construction Industry Under the Circular Economy: Principles and Case Studies. In Smart and Sustainable Planning for Cities and Regions; Bisello, A., Vettorato, D., Laconte, P., Costa, S., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Fuerst, F.; McAllister, P. New evidence on the green building rent and price premium. In Proceedings of the Annual Meeting of the American Real Estate Society, Monterey, CA, USA, 3 April 2009. [Google Scholar]

- Entrop, A.G.; Brouwers, H.J.H.; Reinders, A.H.M.E. Evaluation of energy performance indicators and financial aspects of energy saving techniques in residential real estate. Energy Build. 2010, 42, 618–629. [Google Scholar] [CrossRef]

- D’Alpaos, C.; Bragolusi, P. Approcci valutativi alla riqualificazione energetica degli edifici: Stato dell’arte e future sviluppi. Valori e Valutazioni 2018, 20, 1–15. [Google Scholar]

- Altomonte, S.; Schiavon, S. Occupant satisfaction in LEED and non-LEED certified buildings. Build. Environ. 2013, 68, 66–76. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E. Off-site Retrofit to Regenerate Multi-family Homes: Evidence from Some European Experiences. In International Symposium on New Metropolitan Perspectives; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- McGraw Hill Construction. Green Building Smart Report; McGraw Hill: Bedford, UK, 2009. [Google Scholar]

- Warren-Myers, G.; Reed, R. Sustainability: Measurement and valuation?—Insight from Australia and New Zealand. In Proceedings of the 15th Annual Pacific Rim Real Estate Society Conference, Sydney, Australia, 18–21 January 2009. [Google Scholar]

- Zieba, M.; Belniak, S.; Gluszak, M. Demand for sustainable Office space in Poland: The results from a conjoint experiment in Krakow. Prop. Manag. 2013, 31, 404–419. [Google Scholar] [CrossRef]

- Gabe, J.; Rehm, M. Do tenants pay energy efficiency rent premiums? J. Prop. Invest. Financ. 2014, 32, 333–351. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J.D. Investment Returns from Responsible Property Investments: Energy Efficient, Transit-Orientated and Urban Regeneration Office Properties in the US from 1998–2008; Working Paper; Responsible Property Investing Center, Boston College and University of Arizona Benecki Center for Real Estate Studies, Indian University: Boston, MA, USA, 2009. [Google Scholar]

- Forte, F.; Russo, Y. Evaluation of users satisfaction in public residential housing—A study in the outskirtsof Naples, Italy. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2017; Volume 245, pp. 52–63. [Google Scholar]

- Fuerst, F.; McAllister, P. Green noise or green value? Measuring the effects of environmental certification on office value. Real Estate Econ. 2011, 39, 45–69. [Google Scholar] [CrossRef]

- Kok, N.; Kahn, M.E. The Value of Green Labels in the California Housing Market, 2012, UCLA Institute of the Environment and Sustainability. Available online: http://www.environ-ment.ucla.edu/newsroom/the-value-of-green-la-bels-in-the-california-housing-market/ (accessed on 13 November 2018).

- Bienert, S.; Schuzenhofer, C.; Leopoldberger, G.; Bobsin, K.; Leugtob, K.; Huttler, W.; Popescu, D.; Mladin, E.C.; Iasi, T.; Rodica, B.; et al. Integration of Energy Performance and life-Cicle Costing into Property Valuation Practice, 2011. Report Summary. Available online: http://immovalue.e-sieben.at/pdf/immvalue_result_oriented_report.pdf (accessed on 13 November 2018).

- Meins, E.; Burkhard, H.-P. Der Nachhaltigkeit von Immobilien Einen Finanziellen Wert Geben; ESI Immobilienbewertung—Nachhaltigkeit inclusive: Zürich, Switzerland, 2009. [Google Scholar]

- RICS. Supply, Demand and the Value of Green Buildings. Available online: https://www.isurv.com/downloads/download/1492/supply_demand_and_the_value_of_green_buildings_rics (accessed on 13 November 2018).

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency—Evidence from Ireland. Energy Econ. 2012, 40, 943–952. [Google Scholar] [CrossRef]

- Brounen, D. Kok, N. On the economics of energy labels in the housing market. J. Environ. Econo. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef]

- SBi. Cost-optimal Levels of Minimum Energy Performance Requirements in the Danish Building Regulations. Available online: https://sbi.dk/Pages/Cost-optimal-levels-of-minimum-energy-performance-requirements-in-the-Danish-Building-Regulations.aspx (accessed on 13 November 2018).

- Popescu, D.; Bienert, S.; Schutzenhofer, C.; Bozau, R. Impact of energy efficiency measures on the economic value of buildings. Appl. Energy 2012, 89, 454–463. [Google Scholar] [CrossRef]

- Audanaert, A.; De Boeck, L.; Roelants, K. Economic analysis of the profitability of energy—Saving architectural measures for the achievement of the EPBD standard. Energy 2010, 35, 2965–2971. [Google Scholar] [CrossRef]

| Increased Market Value (%) | Rental Premium (%) | Type of Certificate | Data Origin | References | Country |

|---|---|---|---|---|---|

| Average: 10.90 | Average: 6.10 | LEED | Perception | [5] | USA |

| Average: 6.80 | Average: 1.00 | LEED | Perception | [28] | USA |

| LEED: 9.94; Energy Star: 5.76 | Average: 8.93 | Energy Star | Empirical data | [29] | USA |

| LEED: 16 | LEED: 3; Energy Star: 5 | Energy Star | Empirical data | [29] | USA |

| LEED: 35; Energy Star: 31 | LEED: 6; Energy Star: 5 | LEED-Energy Star | Empirical data | [29] | USA |

| LEED: 17.30; Energy Star: 8.62 | Energy Star | Empirical data | [23] | USA | |

| LEED: 9; Energy Star: 9 | LEED-Energy Star | Empirical data | [36] | USA | |

| Minimum: 4.71; maximum: 13.60 | - | Empirical data | [37] | Germany | |

| Minimum: 3.97; maximum: 15.17 | - | Empirical data | [37] | Germany | |

| Minimum: 6.60; maximum: 15.90 | Minimum: 0.41; maximum: 5.87 | - | Empirical data | [37] | Switzerland |

| Relative to D-labelled houses: A/B: 5; C: 1.7; E: −0.7; F: −0.9; G: −6.8 | - | Empirical data | [38] | UK | |

| Average: 28 | BREEAM | Empirical data | [39] | UK | |

| Average: 10 | Average: 6 | BREEAM | Empirical data | [7] | UK |

| Relative to D-labelled houses: A: 9.3; B: 5.2; C: 1.7; E: 0; F/G: −10 | Empirical data | [40] | Ireland | ||

| Relative to D-labelled houses: A: 10.2; B: 5.5; C: 2.1; E: −0.5; F: −2.3; G: −4.8 | Empirical data | [41] | Netherlands | ||

| Relative to D-labelled houses: A/B: 6.4; C: 6; E: −0.7; F: −12.3; G: −19.4 | Empirical data | [42] | Denmark | ||

| Average: 10% | Perception | [11] | Italy |

| Neighborhood | Year | Minimum Real Estate Market Value | Maximum Real Estate Market Value | Average Market Value | Percentage of Increase Compared to the Average Value |

|---|---|---|---|---|---|

| CBD | 2018 | 6.700 | 9.200 | 7.950 | +36% |

| 2008 | 4.900 | 6.800 | 5.850 | ||

| Porta Nuova | 2018 | 6.500 | 8.000 | 7.250 | +110% |

| 2008 | 2.800 | 4.100 | 3.450 |

| Summary | ||||

|---|---|---|---|---|

| R-squared | 0.183168 | |||

| Adjusted R2 | 0.151751 | |||

| Standard deviation | 59.30195 | |||

| Observations | 55 | |||

| Variance analysis | ||||

| DF | Sum of squares | Mean square | F ratio | |

| Model | 3 | 41,035.90 | 20,503.5 | 5.8303 |

| Error | 52 | 182,859.53 | 3515.7 | Prob > F |

| C.total | 54 | 223,878.44 | 0.0552 | |

| Parameters evaluation | ||||

| Evaluation | ST. Error | T ratio | ||

| Intercept | 412.95182 | 12.9596 | 31.94 | <0.0001 |

| Submarket | 44.020393 | 18.52337 | 2.85 | 0.0107 |

| Type of certification | 15.285029 | 7.012145 | 2.18 | 0.0338 |

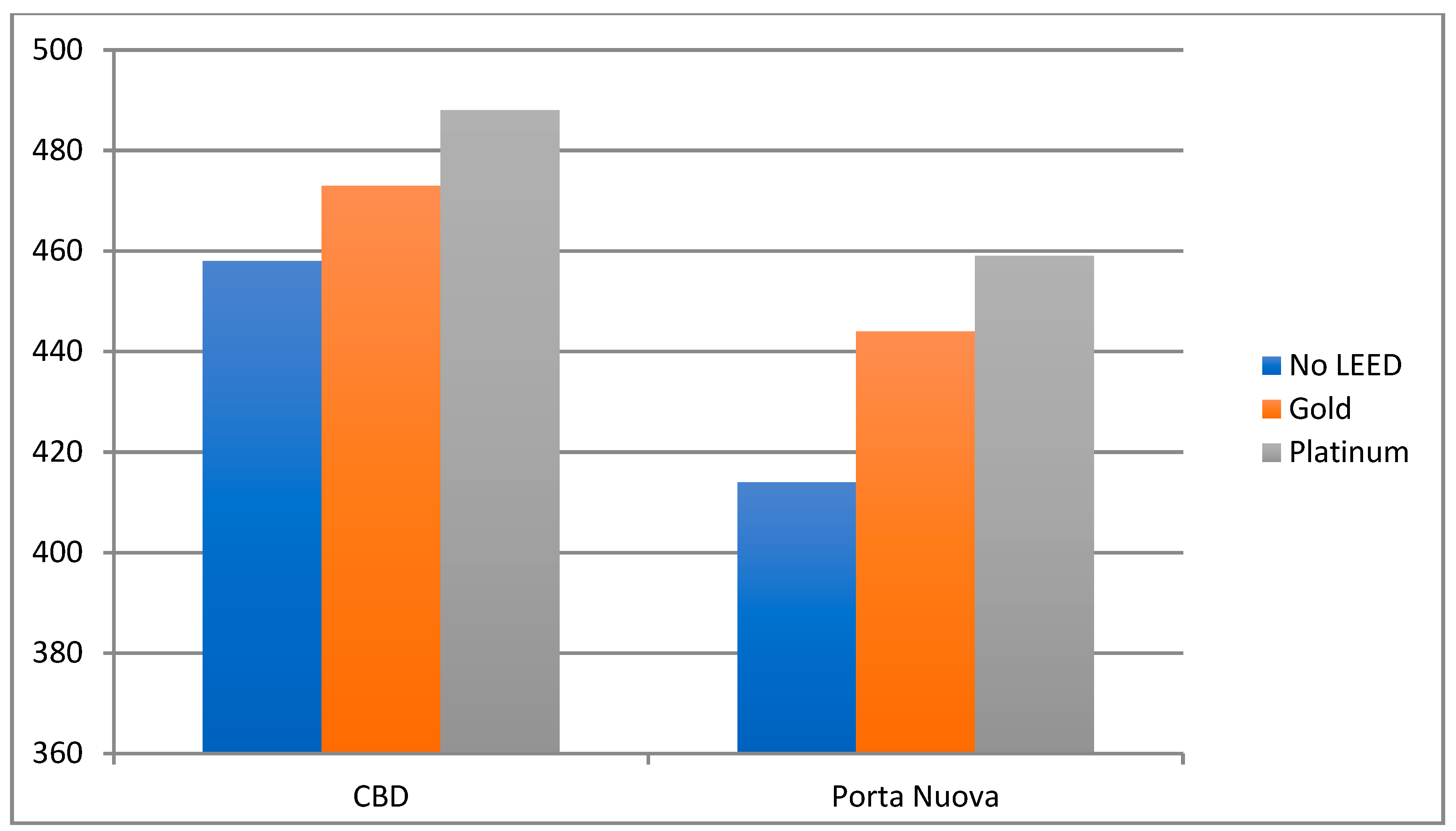

| Market Rent | Neighborhood | Price (+44 Euro) | Type of Certificate | Price +15 Euro |

|---|---|---|---|---|

| 414 | CBD +11% | 458 | None 0% | 458 |

| Gold +7.38% | 488 | |||

| Platinum +11.08% | 503 | |||

| Porta Nuova +0% | 414 | None 0% | 414 | |

| Gold +7.38% | 444 | |||

| Platinum +11.08% | 459 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mangialardo, A.; Micelli, E.; Saccani, F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability 2019, 11, 12. https://doi.org/10.3390/su11010012

Mangialardo A, Micelli E, Saccani F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability. 2019; 11(1):12. https://doi.org/10.3390/su11010012

Chicago/Turabian StyleMangialardo, Alessia, Ezio Micelli, and Federica Saccani. 2019. "Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy)" Sustainability 11, no. 1: 12. https://doi.org/10.3390/su11010012

APA StyleMangialardo, A., Micelli, E., & Saccani, F. (2019). Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability, 11(1), 12. https://doi.org/10.3390/su11010012