Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources

Abstract

1. Introduction

2. Material and Methods

2.1. Learning Curve Method

2.2. Data Collection

3. Results and Discussion

3.1. Calculation of Learning Rate

3.2. Discussion of Technological Development, Changes in Market Environment, and Production Activities for the 30 E&P Players

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

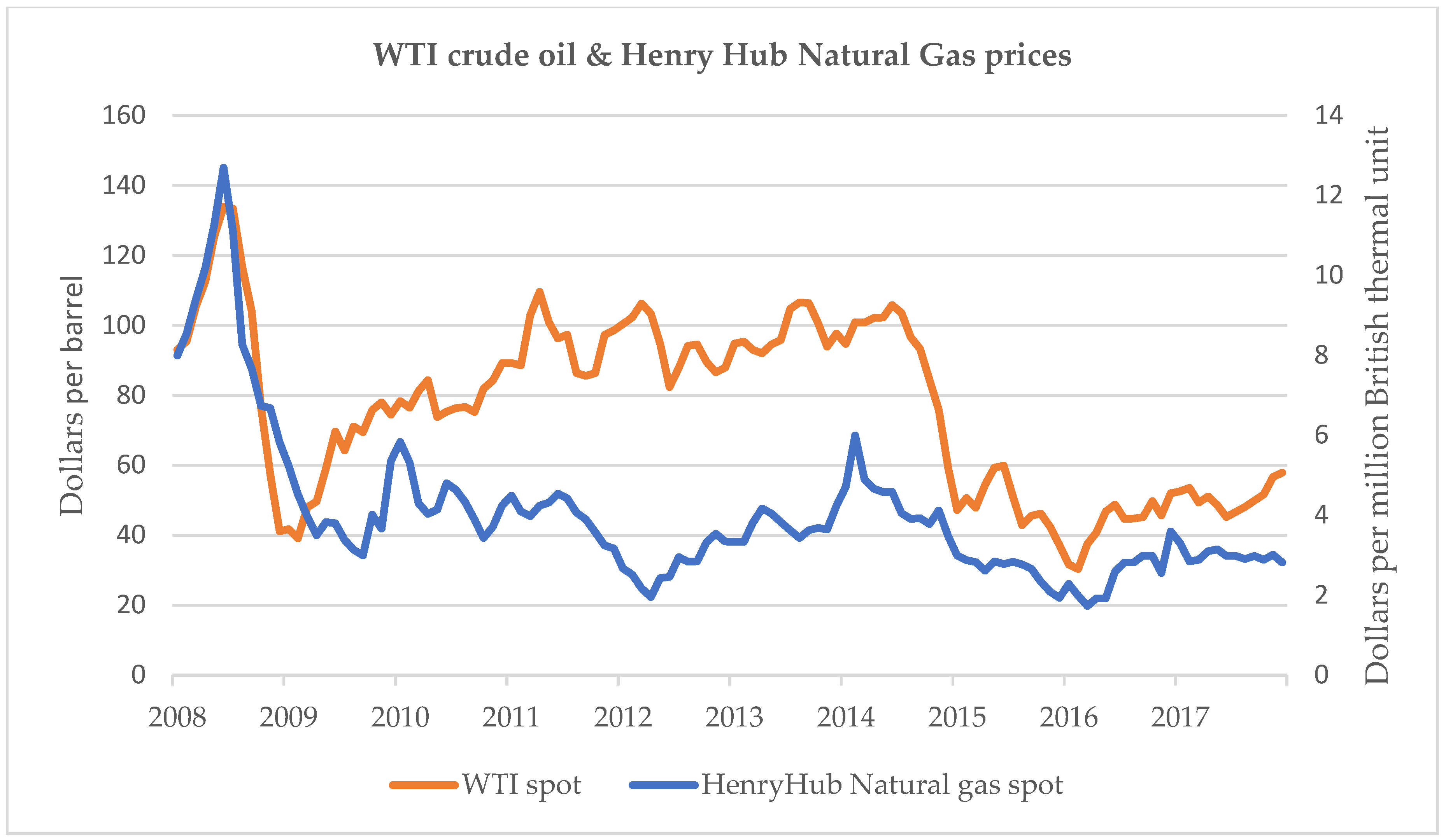

- Cushing, O.K. WTI Spot Price FOB (Dollars per Barrel). Available online: http://tonto.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RWTC&f=M (accessed on 2 July 2018).

- Henry Hub Natural Gas Spot Price (Dollars per Million Btu). Available online: http://tonto.eia.gov/dnav/ng/hist/rngwhhdm.htm (accessed on 2 July 2018).

- Curtis, T. Unravelling the US Shale Productivity Gains; Oxford Institute for Energy Studies: Oxford, UK, 2016. [Google Scholar]

- Curtis, T. Completion Design Changes and the Impact on US Shale Well Productivity; Oxford Institute for Energy Studies: Oxford, UK, 2017. [Google Scholar]

- Gao, J.; You, F. Design and optimization of shale gas energy systems: Overview, research challenges, and future directions. Comput. Chem. Eng. 2017, 106, 699–718. [Google Scholar] [CrossRef]

- Middleton, R.S.; Gupta, R.; Hyman, J.D.; Viswanathan, H.S. The shale gas revolution: Barriers, sustainability, and emerging opportunities. Appl. Energy 2017, 199, 88–95. [Google Scholar] [CrossRef]

- Wei, Y.; Kang, J.; Yu, B.; Liao, H.; Du, Y. A dynamic forward-citation full path model for technology monitoring: An empirical study from shale gas industry. Appl. Energy 2017, 205, 769–780. [Google Scholar] [CrossRef]

- Wright, T.P. Factors affecting the cost of airplanes. J. Aeronaut. Sci. 1936, 3, 122–128. [Google Scholar] [CrossRef]

- Boston Consulting Group (BCG). Perspectives on Experience; Boston Consulting Group: Boston, MA, USA, 1970. [Google Scholar]

- Bosch Franciscus, A.; van den Porter, M.E. Perspectives on Strategy. Boston Consulting Group; Kluwer Academic Publisher: Dordrecht, The Netherlands, 1997. [Google Scholar]

- Cabral, L.M.B. The learning curve, market dominance, and predatory pricing. Econometrica 1994, 62, 1115–1140. [Google Scholar] [CrossRef]

- Ibenholt, K. Explaining learning curves for wind power. Energy Policy 2002, 30, 1181–1189. [Google Scholar] [CrossRef]

- Dutton, J.M.; Thomas, A. Treating Progress Functions as a Managerial Opportunity. Acad. Manag. Rev. 1984, 9, 235–247. [Google Scholar] [CrossRef]

- Rapping, L. Learning and World War II Production Functions. Rev. Econ. Stat. 1965, 47, 81–86. [Google Scholar] [CrossRef]

- Kahouli-Brahmi, S. Technological learning in energy–environment–economy modelling: A survey. Energy Policy 2008, 36, 138–162. [Google Scholar] [CrossRef]

- Samadi, S. The experience curve theory and its application in the field of electricity generation technologies—A literature review. Renew. Sustain. Energy Rev. 2018, 82, 2346–2364. [Google Scholar] [CrossRef]

- Hong, S.; Chung, Y.; Woo, C. Scenario analysis for estimating the learning rate of photovoltaic power generation based on learning curve theory in South Korea. Energy 2015, 79, 80–89. [Google Scholar] [CrossRef]

- Fukui, R.; Greenfield, C.; Pogue, K.; van der Zwaan, B. Experience curve for natural gas production by hydraulic fracturing. Energy Policy 2017, 105, 263–268. [Google Scholar] [CrossRef]

- Kim, J.H.; Lee, Y.G. Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method. Sustainability 2017, 9, 2232. [Google Scholar] [CrossRef]

- Alchian, A.A. Reliability of progress curves in airframe production. Econometrica 1963, 31, 679–693. [Google Scholar] [CrossRef]

- Yelle, L.E. The learning curve: Historical review and comprehensive survey. Decis. Sci. 1979, 10, 302–328. [Google Scholar] [CrossRef]

- Companies Financial Fillings of The United States. Available online: https://www.sec.gov/edgar/searchedgar/companysearch.html (accessed on 2 July 2018).

- Behar, A.; Ritz, R. An Analysis of OPEC’s Strategic Actions, US Shale Growth and the 2014 Oil Price Crash; IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- Energy Monitor Worldwide. Trends in U.S. Oil and Natural Gas Upstream Costs; Energy Monitor Worldwide: Amman, Jordan, 2016. [Google Scholar]

- Turk, J.K.; Reay, D.S.; Haszeldine, R.S. Gas-fired power in the UK: Bridging supply gaps and implications of domestic shale gas exploitation for UK climate change targets. Sci. Total Environ. 2018, 616, 318–325. [Google Scholar] [CrossRef] [PubMed]

- Saussay, A. Can the US shale revolution be duplicated in continental Europe? An economic analysis of European shale gas resources. Energy Econ. 2018, 69, 295–306. [Google Scholar] [CrossRef]

| Formula (1) | C | X | n | |||

| Unit cost | Produced quantity | Decline rate | ||||

| Formula (3) | L | |||||

| Unit cost | Initial unit cost | Cumulative production | Initial production | Learning parameter | ||

| Formula (4) | PR | |||||

| Learning rate | Progress rate | |||||

| Formula (6) | O | |||||

| Oil production ratio | Coefficient of oil production ratio | |||||

| Traditional One-Factor Model, Equation (1) | ||||||

| B0 | B1 | Learning Rate | R2 | Adjusted R2 | ||

| Value | 3.5115 | −0.0452 | 3.086% | 0.018 | 0.0148 | |

| Probability | less than 0.000 | 0.0198 | 0.01977 (F-statistic) | |||

| Proposed Model,Equation (3) | ||||||

| B0 | B1 | B2 | Learning Rate | R2 | Adjusted R2 | |

| Value | 3.8575 | −0.0587 | 0.2480 | 3.989% | 0.5626 | 0.5597 |

| Probability | less than 0.000 | less than 0.000 | less than 0.000 | less than 0.000 (F-statistic) | ||

| Differences between the Traditional One-Factor Model and Proposed Model,Equations (1)–(3) | ||||||

| B0 | B1 | Learning Rate | R2 | Adjusted R2 | ||

| Value | 0.34604 | −0.0135 | 0.903% | 0.5445 | 0.5449 | |

| Probability | less than 0.000 | −0.0198 | 0.0198 (F-statistic) | |||

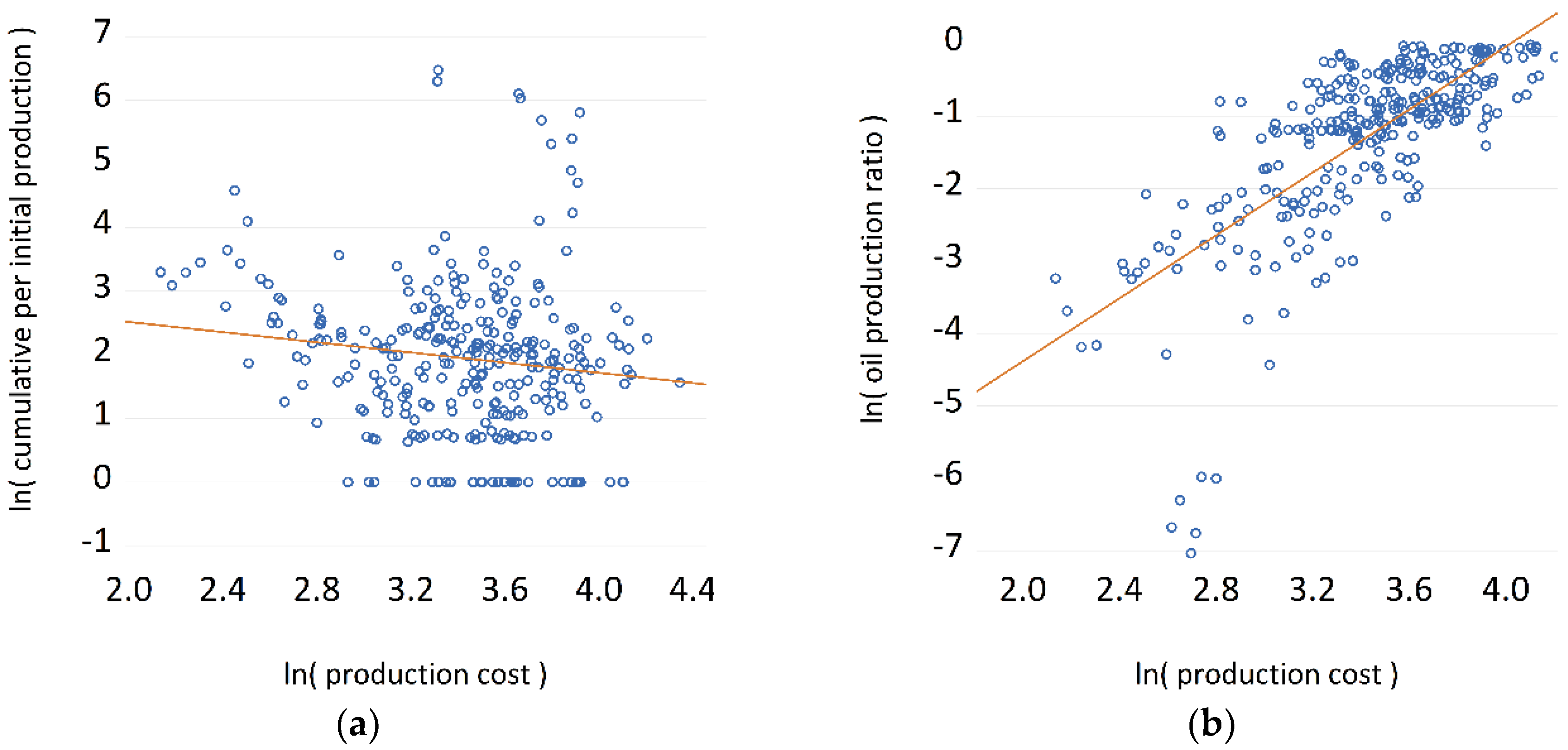

| Cumulative Production Per Initial Production, | Oil Production Ratio, | |

|---|---|---|

| Value | −0.0642 | 0.3491 |

| Probability | 0.0198 | less than 0.000 |

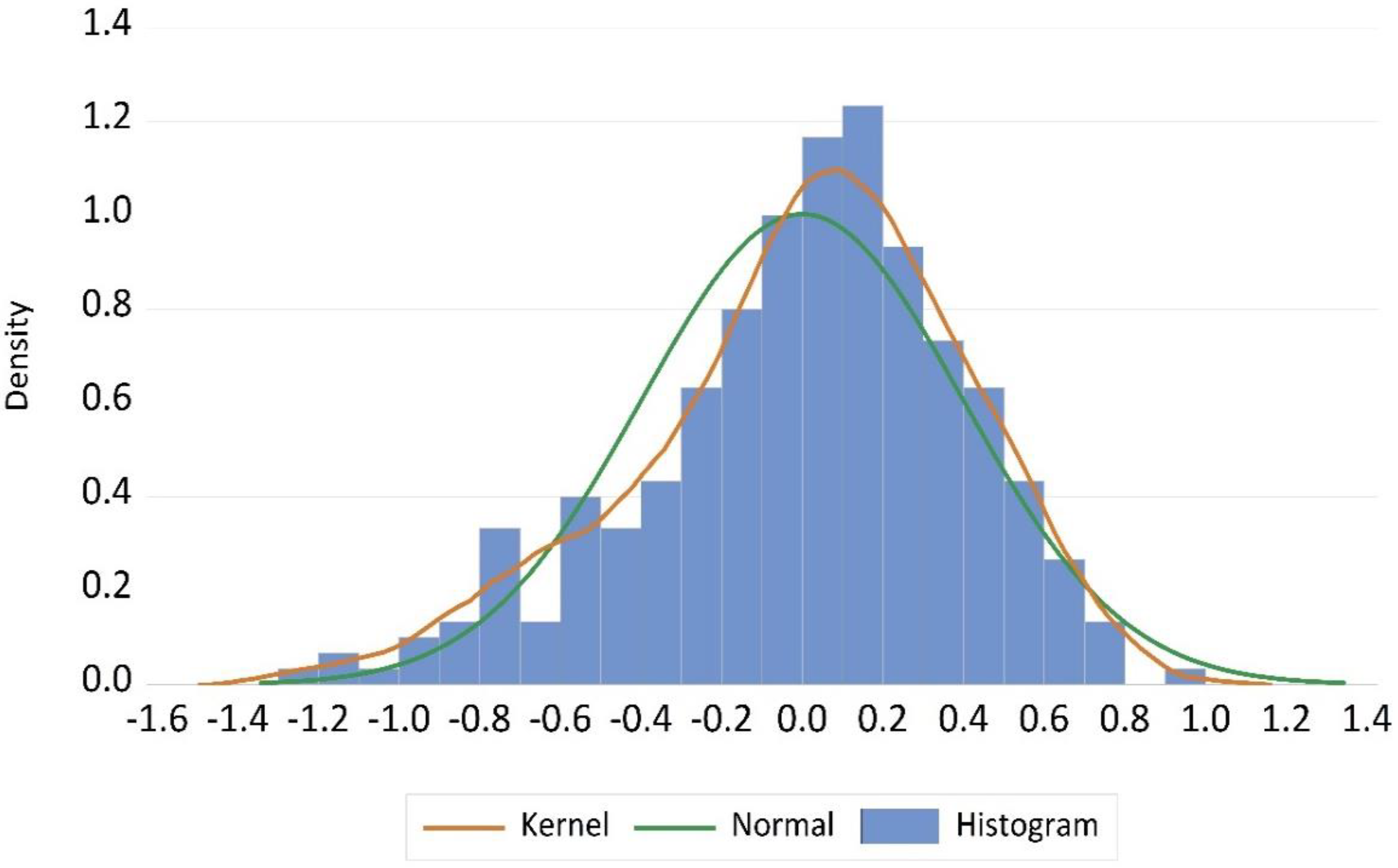

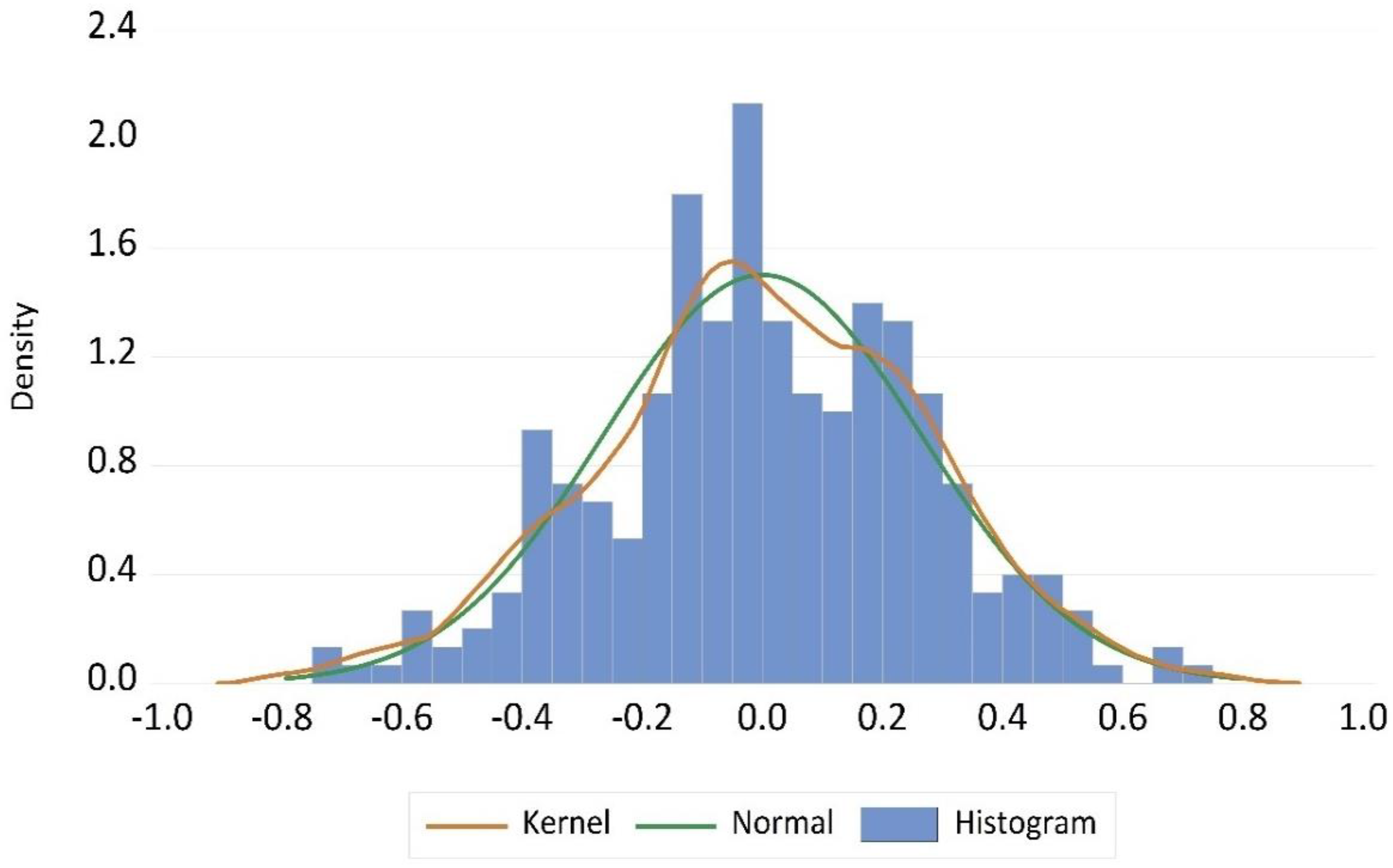

| Mean | Median | Standard Deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|

| Traditional one-factor model | 1.06 × 10−15 | 0.0463 | 0.3976 | −0.5450 | 3.0986 |

| Model proposed in this study | 3.72 × 10−16 | −0.0181 | 0.2655 | −0.1128 | 2.9018 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.-H.; Lee, Y.-G. Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources. Sustainability 2018, 10, 3322. https://doi.org/10.3390/su10093322

Kim J-H, Lee Y-G. Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources. Sustainability. 2018; 10(9):3322. https://doi.org/10.3390/su10093322

Chicago/Turabian StyleKim, Jong-Hyun, and Yong-Gil Lee. 2018. "Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources" Sustainability 10, no. 9: 3322. https://doi.org/10.3390/su10093322

APA StyleKim, J.-H., & Lee, Y.-G. (2018). Learning Curve, Change in Industrial Environment, and Dynamics of Production Activities in Unconventional Energy Resources. Sustainability, 10(9), 3322. https://doi.org/10.3390/su10093322