Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade

Abstract

1. Introduction

2. Literature Review

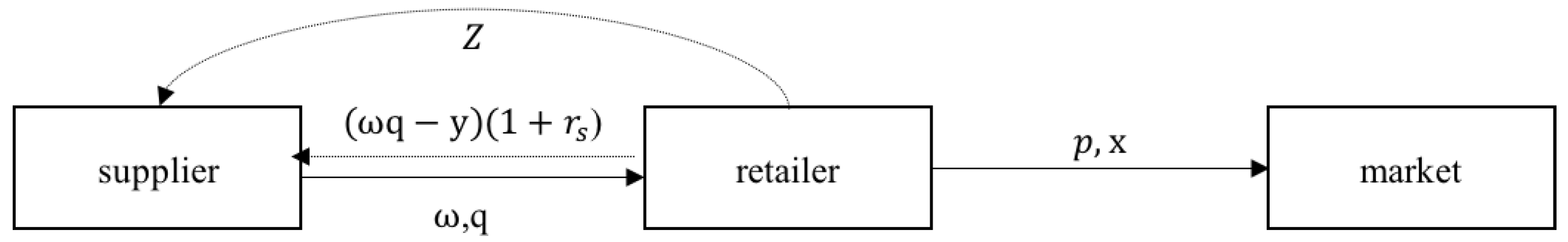

3. Modeling Framework of Supply Chain Financing

3.1. Problem Description

3.2. Notation and Assumption

- (1)

- Information is symmetrical among the supplier, retailer as well as the bank. All of them are risk-neutral and pursue the maximization of profits.

- (2)

- The bank and the supplier are assumed to face no bankruptcy risk; the retailer may face bankruptcy risk, depending on whether his liquid assets and collateral assets can cover his loan obligations.

- (3)

- The retailer is credit-worthy and will repay their loan obligations (if any) to the extent possible.

- (4)

- Goodwill cost is ignored in our model.

- (5)

- To ensure that the model has an optimal solution, we assume that the demand distribution function is continuous, steerable, and strictly increasing. We restrict our attention to demand distributions with an increasing failure rate (IFR).

- (6)

- Note that if , the retailer does not order, and if < c, the supplier is not willing to sale. To avoid trivial cases, we assume .

4. Optimal Strategies of Supply Chain Financing under Different Financing Modes

4.1. Internal Financing

4.2. External Financing

5. Numerical Examples

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Li, Y.; Chen, T.; Xin, B. Optimal Financing Decisions of Two Cash-Constrained Supply Chains with Complementary Products. Sustainability 2016, 8, 429. [Google Scholar] [CrossRef]

- Wang, Y.; Shao, Y.H.; Ou, J.Q. The Research on Trade Credit Short-term Financing in a Capital-constrained Supply Chain. In Proceedings of the International Conference on Management Science and Management Innovation, Changsha, China, 14–15 June 2014. [Google Scholar]

- Archibald, T.W.; Thomas, L.C.; Betts, J.M.; Johnston, R.B. Should start up companies be cautious? Inventory policies which maximise survival probabilities. Manag. Sci. 2002, 48, 1161–1174. [Google Scholar] [CrossRef]

- Liu, X.; Zhou, L.; Wu, Y.C.J. Supply Chain Finance in China: Business Innovation and Theory Development. Sustainability 2015, 7, 14689–14709. [Google Scholar] [CrossRef]

- Boschi, M.; Girardi, A.; Ventura, M. Partial credit guarantees and SMEs financing. J. Financ. Stab. 2014, 15, 182–194. [Google Scholar] [CrossRef]

- Serrasqueiro, Z.; Nunes, P.M. Financing behaviour of Portuguese SMEs in hotel industry. Int. J. Hosp. Manag. 2014, 43, 98–107. [Google Scholar] [CrossRef]

- Wolter, M.; Rösch, D. Cure events in default prediction. Eur. J. Oper. Res. 2014, 238, 846–857. [Google Scholar] [CrossRef]

- Ono, A.; Uesugi, I. Role of Collateral and Personal Guarantees in Relationship Lending: Evidence from Japan’s SME Loan Market. J. Money Credit. Bank. 2010, 41, 935–960. [Google Scholar] [CrossRef]

- Buzacott, J.A.; Zhang, R.Q. Inventory Management with Asset-Based Financing. Manag. Sci. 2004, 50, 1274–1292. [Google Scholar] [CrossRef]

- Niinimäki, J.-P. Nominal and true cost of loan collateral. J. Bank. Financ. 2011, 35, 2782–2790. [Google Scholar] [CrossRef]

- Rubin, J.; Wagner, R. Destroying collateral: Asset security and the financing of firms. Appl. Econ. Lett. 2015, 22, 704–709. [Google Scholar] [CrossRef]

- Voordeckers, W.; Steijvers, T. Business collateral and personal commitments in SME lending. J. Bank. Financ. 2006, 30, 3067–3086. [Google Scholar] [CrossRef]

- Trott, P. How SMEs can benefit from supply chain partnerships. Int. J. Prod. Res. 2015, 53, 1527–1543. [Google Scholar]

- Yang, S.A.; Birge, J.R.; Parker, R.P. The Supply Chain Effects of Bankruptcy. Manag. Sci. 2015, 61, 2320–2338. [Google Scholar] [CrossRef]

- Das, P.K. Financing Pattern and Utilization of Fixed Assets—A Study. Asian J. Soc. Sci. Stud. 2017, 2, 20–28. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. Trade Credit: Theory and Evidence. Rev. Financ. Stud. 1997, 10, 661–691. [Google Scholar] [CrossRef]

- Arnold, J.; Minner, S. Financial and operational instruments for commodity procurement in quantity competition. Int. J. Prod. Econ. 2011, 131, 96–106. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. The Newsvendor Problem and Price-Only Contract When Bankruptcy Costs Exist. Produ. Oper. Manag. 2011, 20, 921–936. [Google Scholar] [CrossRef]

- Lee, C.H.; Rhee, B.D. Coordination contracts in the presence of positive inventory financing costs. Int. J. Prod. Econ. 2010, 124, 331–339. [Google Scholar]

- Lee, C.H.; Rhee, B.D. Trade credit for supply chain coordination. Eur. J. Oper. Res. 2011, 214, 136–146. [Google Scholar] [CrossRef]

- Yan, N.; Sun, B. Comparative analysis of supply chain financing strategies between different financing modes. J. Ind. Manag. Optim. 2015, 11, 1073–1087. [Google Scholar] [CrossRef]

- Fisman, R.; Raturi, M. Does Competition Encourage Credit Provision? Evidence from African Trade Credit Relationships. Rev. Econ. Stat. 2004, 86, 345–352. [Google Scholar] [CrossRef]

- Yang, S.A.; Birge, J.R. How Inventory Is (Should Be) Financed: Trade Credit in Supply Chains with Demand Uncertainty and Costs of Financial Distress; Working Paper; The University of Chicago Booth School of Business: Chicago, IL, USA, 2011. [Google Scholar]

- Federgruen, A.; Wang, M. Inventory Subsidy versus Supplier Trade Credit in Decentralized Supply Chains; Working Paper; Columbia Business School: New York, NY, USA, 2010. [Google Scholar]

- Cressy, R.; Olofsson, C. The Financial Conditions for Swedish SMEs: Survey and Research Agenda. Small Bus. Econ. 1997, 9, 179–194. [Google Scholar] [CrossRef]

- Meyer, L.H. The present and future roles of banks in small business finance. J. Bank. Financ. 1998, 22, 1109–1116. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Blinder, A.S. The Federal Funds Rate and the Channels of Monetary Transmission. Am. Econ. Rev. 1992, 82, 901–921. [Google Scholar]

- Chen, X.F.; Zhu, D.L.; Ying, W.J. Financial and operation decisions in budget-constrained supply chain. J. Manag. Sci. China 2008, 11, 70–77. [Google Scholar]

- Caldentey, R.; Chen, X. The role of financial services in procurement contracts. In The Handbook of Integrated Risk Management in Global Supply Chains; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Wilner, B.S. The Exploitation of Relationships in Financial Distress: The Case of Trade Credit. J. Financ. 2000, 55, 153–178. [Google Scholar] [CrossRef]

- Baird, D.G.; Picker, R.C. A Simple Non-Cooperative Bargaining Model of Corporate Reorganizations. J. Legal Stud. 1991, 20, 311–349. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Chang, H.F. Bargaining and the Division of Value in Corporate Reorganization. J. Law Econ. Organ. 1992, 8, 253–279. [Google Scholar]

- Kordana, K.A.; Posner, E.A. A Positive Theory of Chapter 11. Soc. Sci. Electron. Publ. 1999, 74, 161–234. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Financing the Newsvendor: Supplier vs. Bank, and the Structure of Optimal Trade Credit Contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

- Padmanabhan, V.; Png, I.P.L. Returns Policies: Make Money by Making Good. Sloan Manag. Rev. 1995, 37, 65–72. [Google Scholar]

- Pasternack, B.A. Optimal pricing and return policies for perishable commodities. Mark. Sci. 2008, 27, 133–140. [Google Scholar] [CrossRef]

- Liu, J.; Wu, C. Study of a tow-level supply chain returns policy model based on the newsboy model. Chin. J. Manag. Sci. 2010, 18, 73–78. [Google Scholar]

- Wu, D. Coordination of competing supply chains with news-vendor and buyback contract. Int. J. Prod. Econ. 2013, 144, 1–13. [Google Scholar] [CrossRef]

- Wang, Z.; Ma, Z.; Zhou, Y. Financing Decisions for Confirming Warehouse with core enterprise’s Buyback Guarantee. Chin. J. Manag. Sci. 2016, 24, 162–169. [Google Scholar]

- Zhong, Y.; Zhou, Y.; Li, B.; Wang, S. The retailer’s optimal ordering and pricing policies with supply chain financing. J. Manag. Sci. China 2011, 14, 57–67. [Google Scholar]

- Yan, N.; Sun, B. Optimal strategies for supply chain financing system based on warehouse receipts financing with credit line. Syst. Eng.-Theory Pract. 2011, 31, 1674–1679. [Google Scholar]

| : Retailer’s collateral assets pledged to secure the loan. |

| : Retailer’s initial capital when purchasing |

| : Retailer’s unit retail price of the product |

| : Supplier’s unit wholesale price of the product |

| : Supplier’s unit production cost. |

| : Supplier’s unit buy-back price of the product |

| : Supplier’s interest rate for the period from order up to the end-of-season sale |

| : Bank’s interest rate for the period from order up to the end-of-season sale |

| : Retailer’s bankruptcy boundaries |

| : Retailer’s expected earnings |

| : Supplier’s expected earnings |

| : Bank’s expected earnings |

| : Retailer’s order quantity |

| : The probability density function (PDF) of the demand distribution |

| : The cumulative distribution function |

| Collateral Asset | Internal Financing | External Financing | |||||

|---|---|---|---|---|---|---|---|

| 100,000 | 612 | 251,352 | 254,504 | 653 | 284,195 | 262,904 | 363,494 |

| 120,000 | 633 | 271,625 | 263,099 | 676 | 307,312 | 275,888 | 384,396 |

| 140,000 | 657 | 291,576 | 272,594 | 703 | 330,295 | 281,804 | 403,836 |

| 160,000 | 682 | 309,586 | 283,557 | 734 | 352,822 | 290,978 | 426,214 |

| 180,000 | 704 | 327,980 | 291,240 | 765 | 374,387 | 301,112 | 448,565 |

| 200,000 | 739 | 341,627 | 306,465 | 799 | 394,999 | 314,300 | 468,486 |

| 220,000 | 762 | 358,286 | 314,303 | 832 | 414,488 | 327,192 | 489,724 |

| 240,000 | 784 | 372,104 | 323,796 | 858 | 433,318 | 337,282 | 508,111 |

| 260,000 | 816 | 382,326 | 337,607 | 890 | 450,950 | 342,050 | 521,250 |

| 280,000 | 844 | 392,778 | 349,686 | 922 | 467,558 | 357,842 | 534,893 |

| 300,000 | 872 | 400,248 | 351,786 | 953 | 483,295 | 363,804 | 545,758 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, J.; Zhu, D. Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade. Sustainability 2018, 10, 3045. https://doi.org/10.3390/su10093045

Yu J, Zhu D. Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade. Sustainability. 2018; 10(9):3045. https://doi.org/10.3390/su10093045

Chicago/Turabian StyleYu, Jianjun, and Dan Zhu. 2018. "Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade" Sustainability 10, no. 9: 3045. https://doi.org/10.3390/su10093045

APA StyleYu, J., & Zhu, D. (2018). Study on the Selection Strategy of Supply Chain Financing Modes Based on the Retailer’s Trade Grade. Sustainability, 10(9), 3045. https://doi.org/10.3390/su10093045