Performance Analysis of Peer-to-Peer Online Lending Platforms in China

Abstract

:1. Introduction

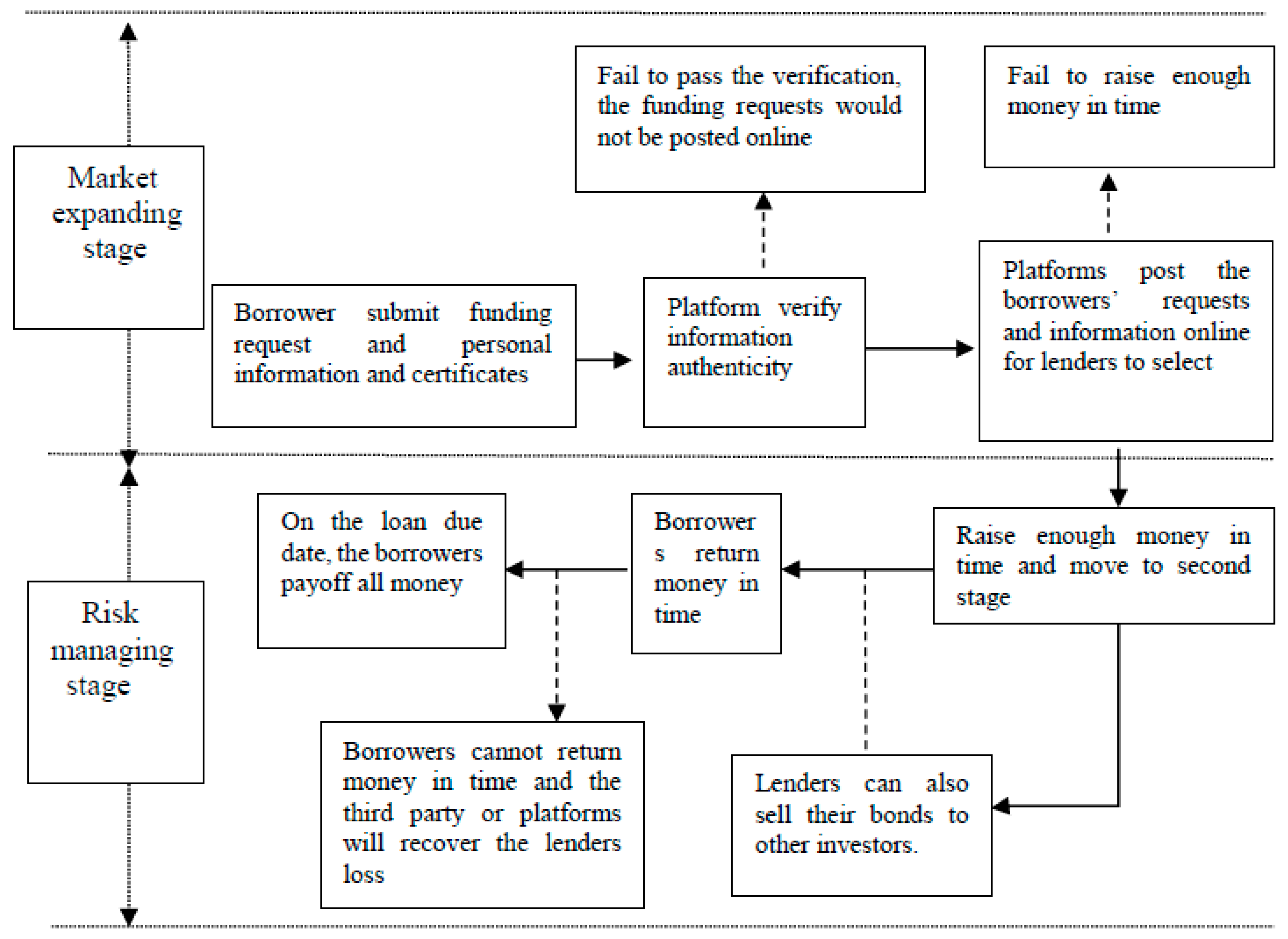

2. Operating Mechanism of P2P Platforms

3. Methods and Data

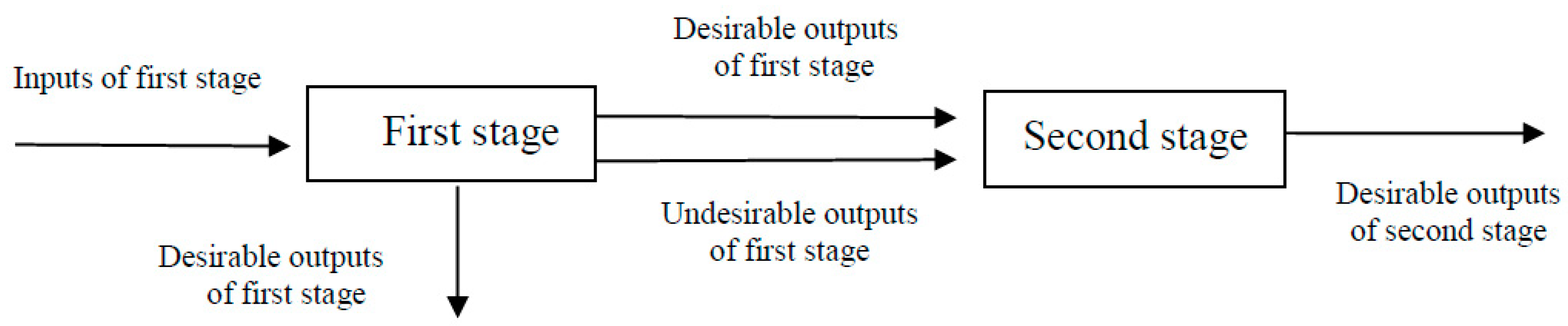

3.1. Two-Stage SBM Model Considering Undesirable Outputs

3.2. Two Stage NCG-SBM Model

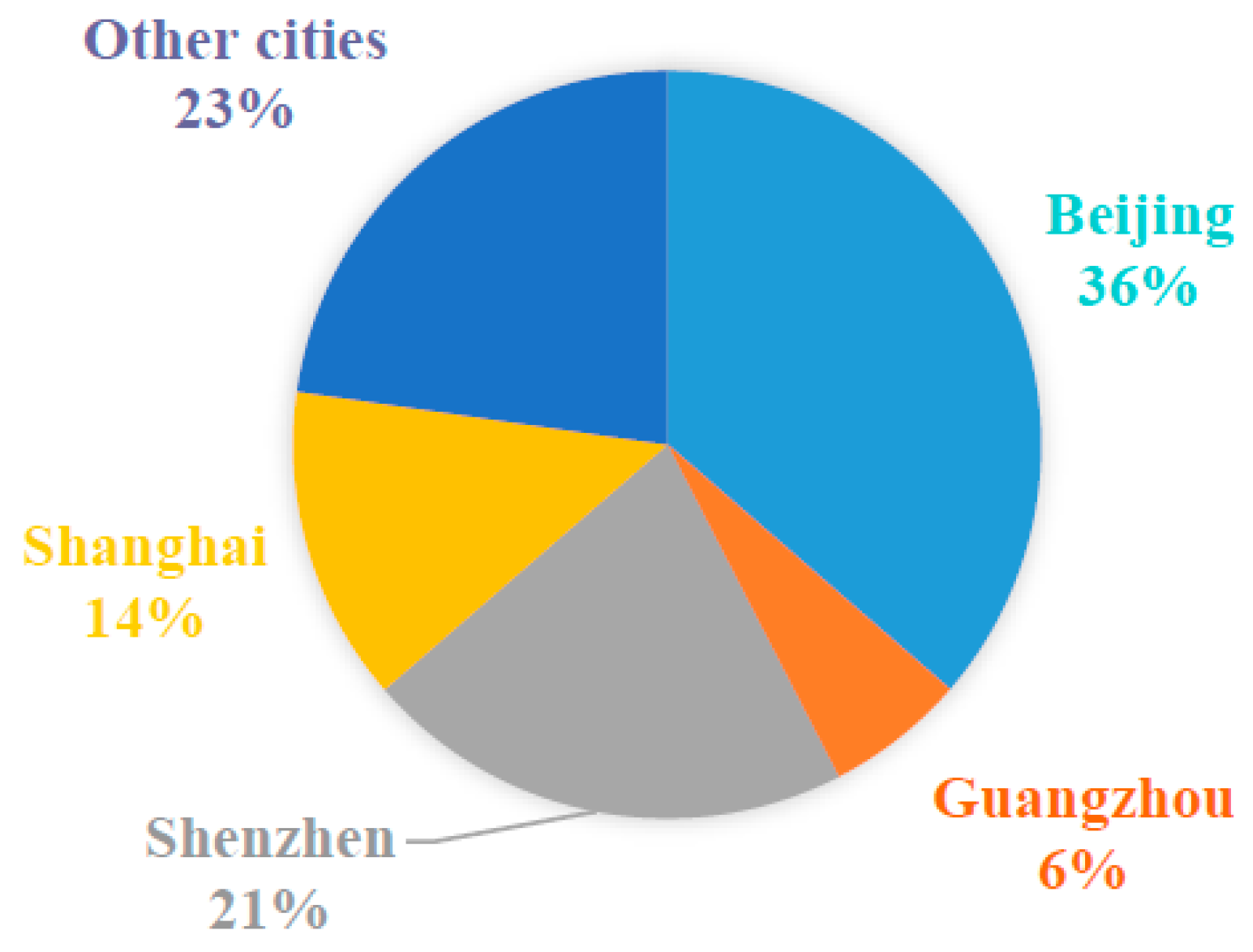

3.3. Data Sources and Descriptions

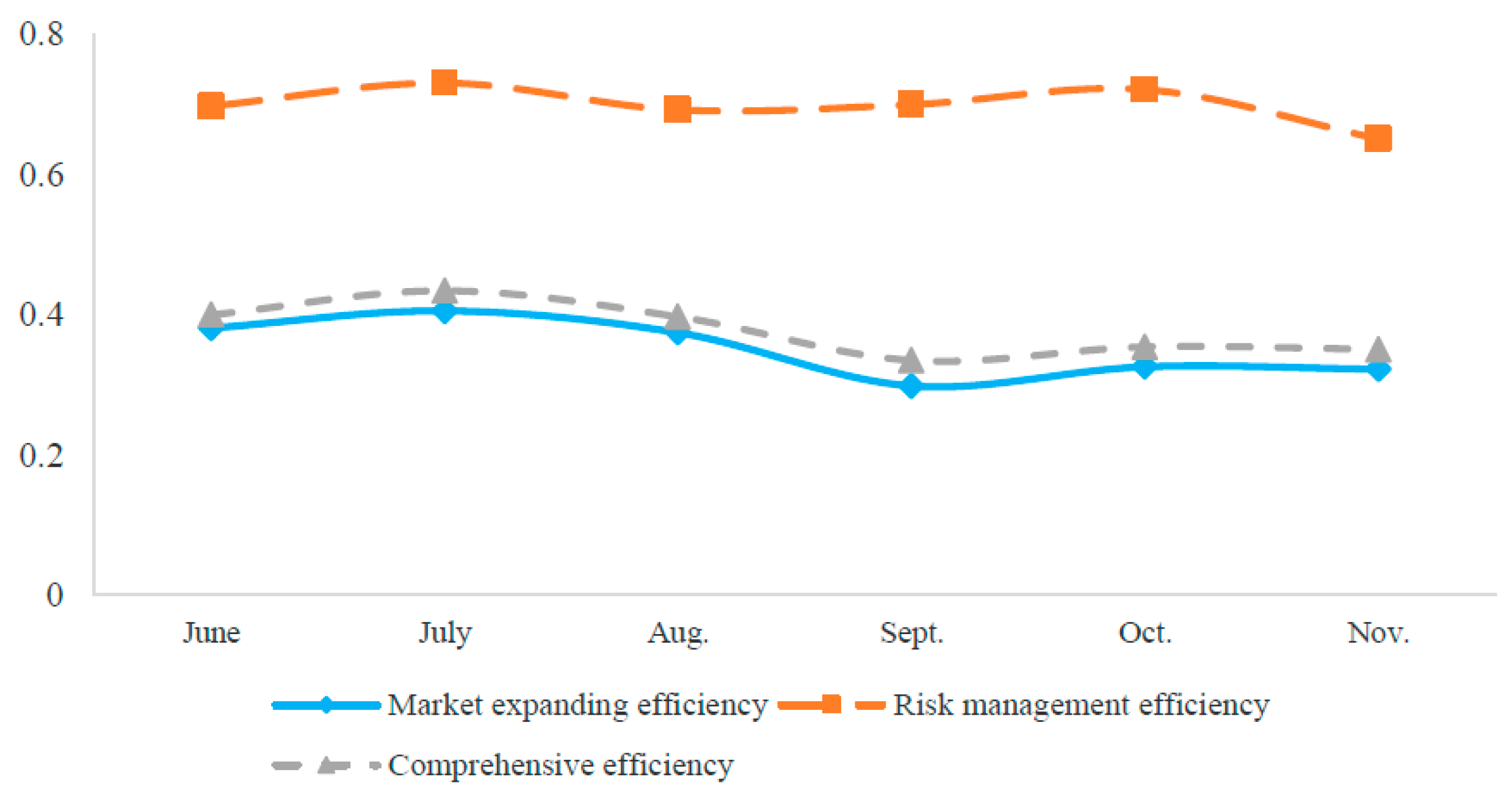

4. Result Analysis

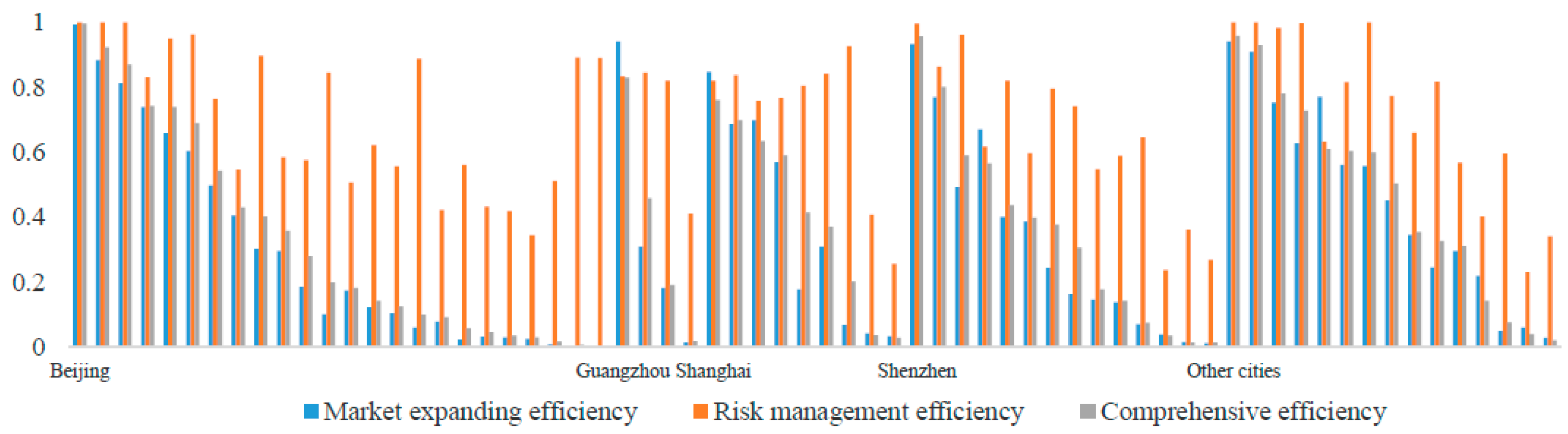

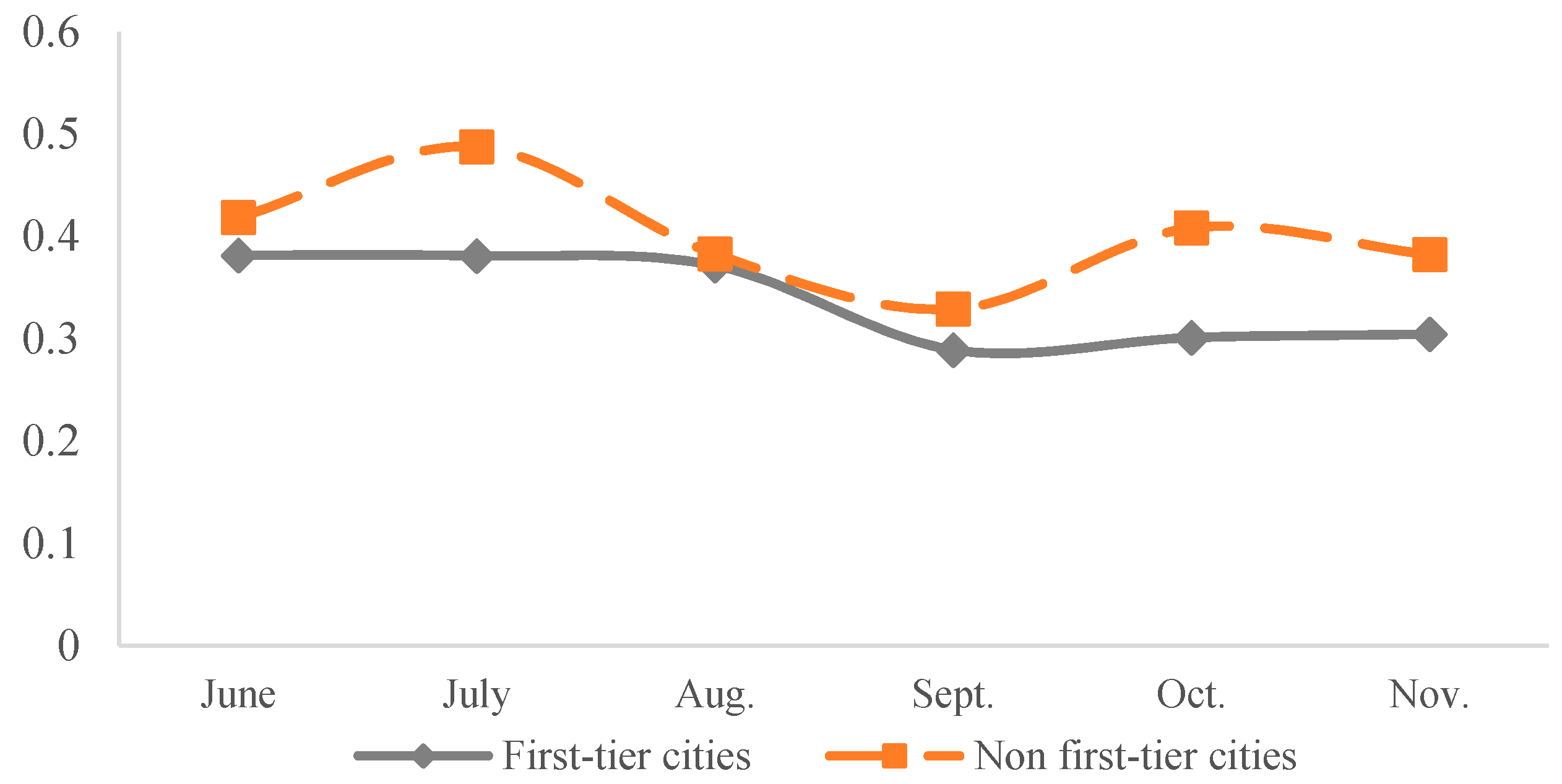

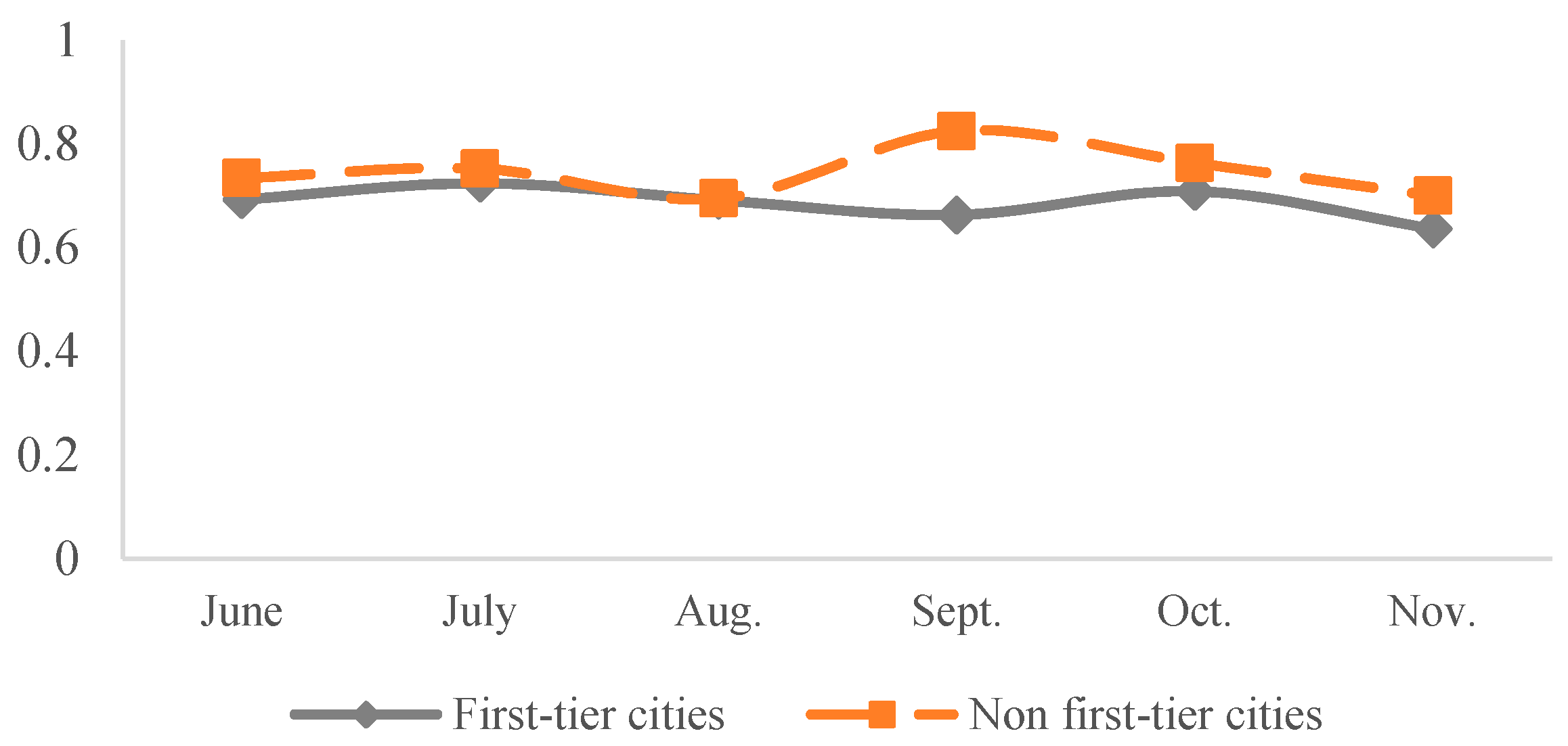

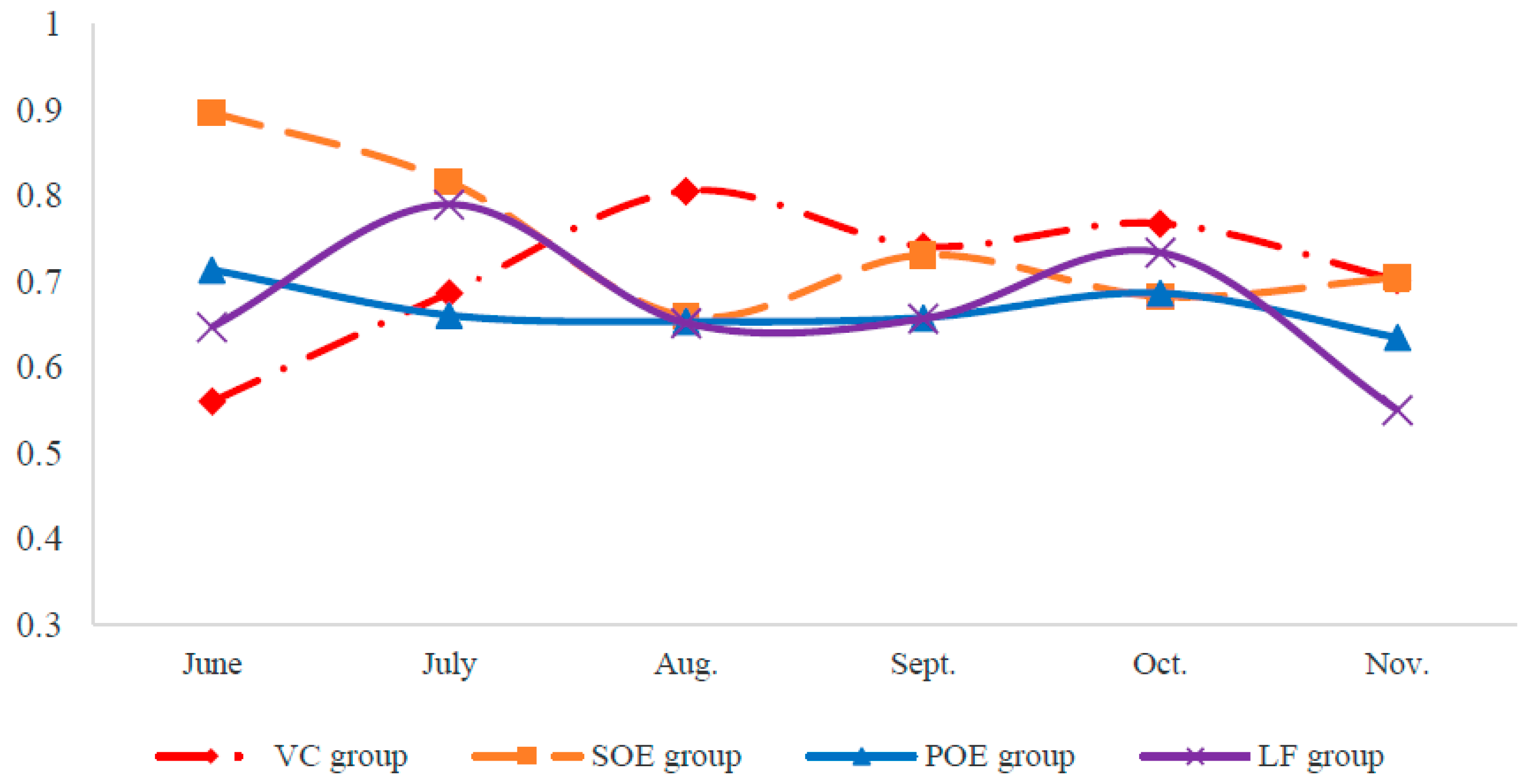

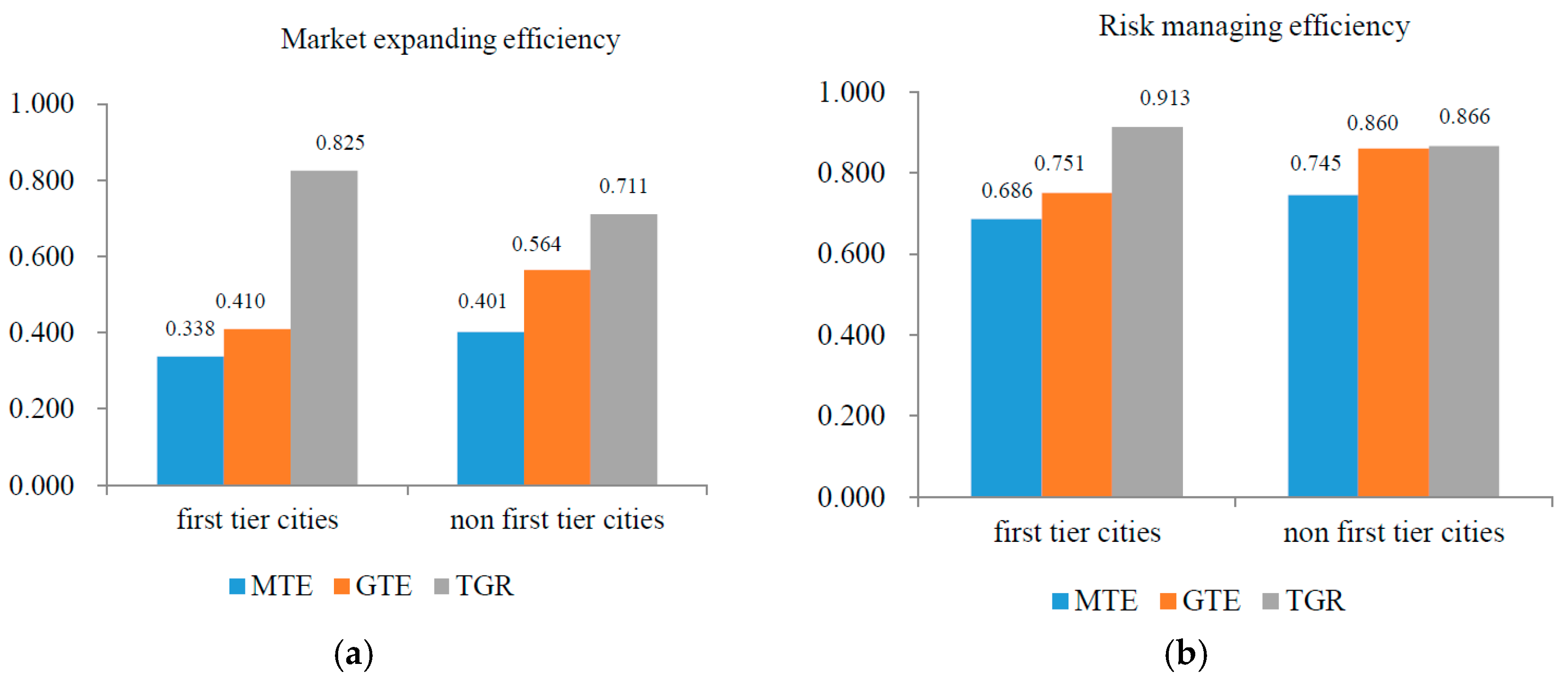

4.1. Time Trends and Spatial Characteristics

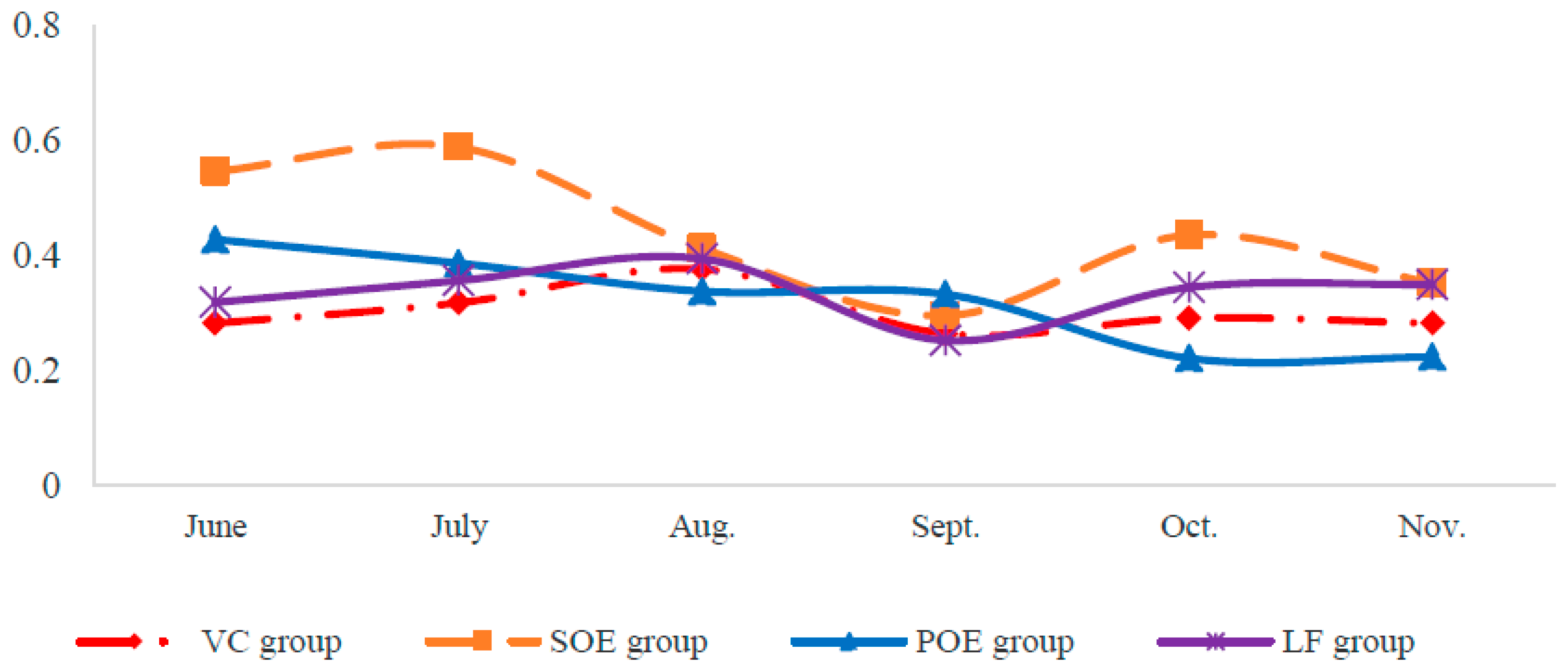

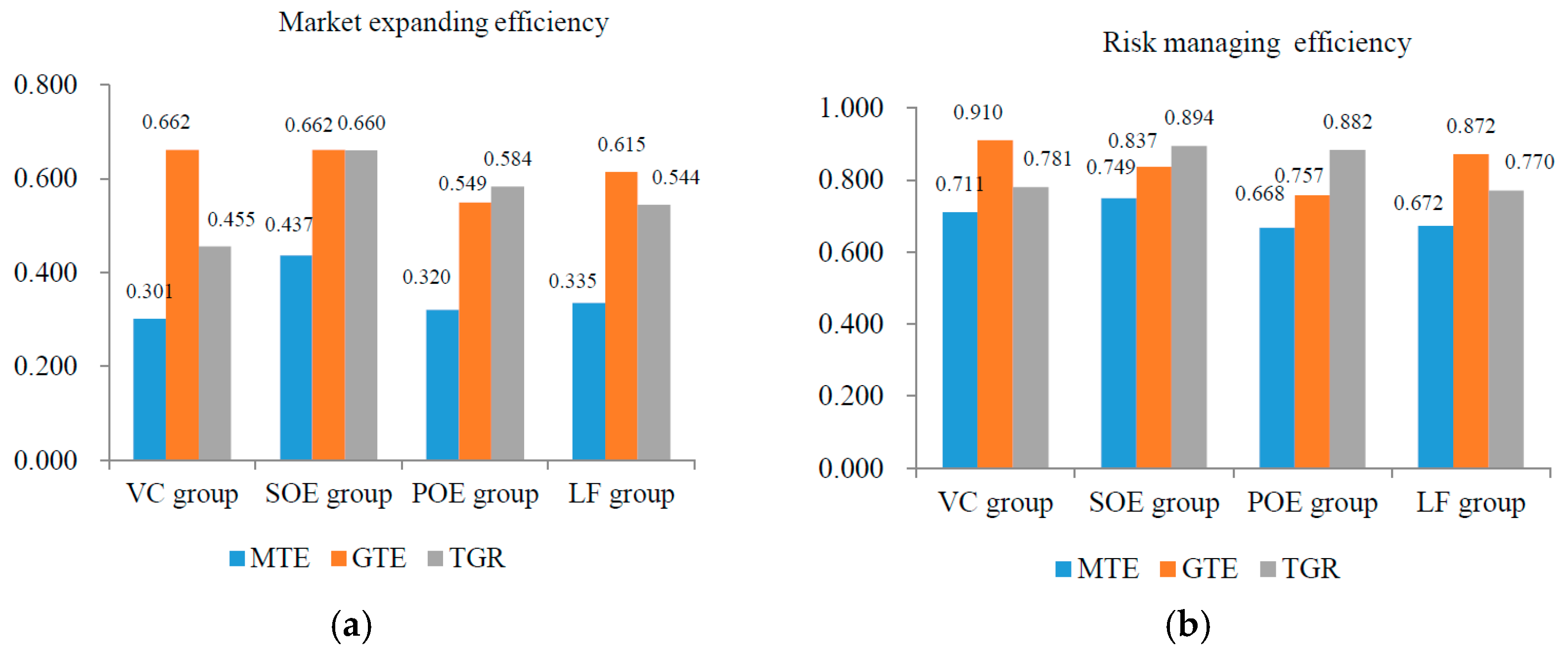

4.2. Efficiency Gap between Different Ownership Types

4.3. Two-Stage Inefficient Source Analysis

4.4. Robustness Check: A Meta-Frontier Approach

5. Conclusions and Enlightenment

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Beck, T.; Demirguc-Kunt, A.; Martinez Peria, M.S. Reaching Out: Access to and Use of Banking Services Across Countries; The World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Duarte, J.; Siegel, S.; Young, L. Trust and credit: the role of appearance in peer-to-peer lending. Rev. Financ. Stud. 2012, 25, 2455–2484. [Google Scholar] [CrossRef]

- Herzenstein, M.; Sonenshein, S.; Dholakia, U.M. Tell me a good story and I may lend you money: The role of narratives in peer-to-peer lending decisions. J. Market Res. 2011, 48, S138–S149. [Google Scholar] [CrossRef]

- Barasinska, N.; Schäfer, D. Is Crowdfunding Different? Evidence on the Relation between Gender and Funding Success from a German Peer-to-Peer Lending Platform. Ger. Econ. Rev. 2014, 15, 436–452. [Google Scholar] [CrossRef]

- Emekter, R.; Tu, Y.; Jirasakuldech, B.; Lu, M. Evaluating credit risk and loan performance in online Peer-to-Peer (P2P) lending. Appl. Econ. 2015, 47, 54–70. [Google Scholar] [CrossRef]

- Liao, L.; Ji, L.; Zhang, W.Q. Education and credit: evidence from P2P lending platform. J. Financ. Res. 2015, 3, 146–159. (In Chinese) [Google Scholar]

- Dorfleitner, G.; Priberny, C.; Schuster, S.; Stoiber, J.; Weber, M.; Castro, I.D.; Kammler, J. Description-text related soft information in peer-to-peer lending–Evidence from two leading European platforms. J. Bank. Financ. 2016, 64, 169–187. [Google Scholar] [CrossRef]

- Ravina, E. Love & Loans: The Effect of Beauty and Personal Characteristics in Credit Markets. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1101647 (accessed on 19 June 2018).

- Paravisini, D.; Rappoport, V.; Ravina, E. Risk aversion and wealth: Evidence from person-to-person lending portfolios. Manag. Sci. 2016, 63, 279–297. [Google Scholar]

- Zhang, J.; Liu, P. Rational herding in microloan markets. Manag. Sci. 2012, 58, 892–912. [Google Scholar] [CrossRef] [Green Version]

- Chen, D.; Lin, Z. Rational or Irrational Herding in Online Microloan Markets: Evidence from China. SSRN Electron. J. 2014. [Google Scholar] [CrossRef]

- Aysan, A.F.; Karakaya, M.M.; Uyanik, M. Panel stochastic frontier analysis of profitability and efficiency of Turkish banking sector in the post crisis era. J. Bus. Econ. Manag. 2011, 12, 629–654. [Google Scholar] [CrossRef]

- Lensink, R.; Meesters, A. Institutions and bank performance: A stochastic frontier analysis. Oxf. Bull. Econ. Stat. 2014, 76, 67–92. [Google Scholar] [CrossRef]

- Ruggiero, J. A comparison of DEA and the stochastic frontier model using panel data. Int. Trans. Oper. Res. 2007, 14, 259–266. [Google Scholar] [CrossRef]

- Silva, T.C.; Tabak, B.M.; Cajueiro, D.O.; Dias, M.V.B. A comparison of DEA and SFA using micro- and macro-level perspectives: Efficiency of Chinese local banks. Phys. Stat. Mech. Appl. 2016, 216–223. [Google Scholar] [CrossRef]

- Chen, X.; Skully, M.; Brown, K. Banking efficiency in China: Application of DEA to pre-and post-deregulation eras: 1993–2000. China Econ. Rev. 2005, 16, 229–245. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. A directional slacks-based measure of technical inefficiency. Soc. Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Eskelinen, J.; Halme, M.; Kallio, M. Bank branch sales evaluation using extended value efficiency analysis. Eur. J. Oper. Res. 2014, 232, 654–663. [Google Scholar] [CrossRef]

- BI, G.B.; Liang, L.; Yang, F. A DEA-Based Efficiency-Measuring Model for Two-Stage Production Systems with Constrained Resources. Chin. J. Manag. Sci. 2009, 17, 71–75. (In Chinese) [Google Scholar]

- Fukuyama, H.; Weber, W.L. A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega 2010, 38, 398–409. [Google Scholar] [CrossRef]

- Paradi, J.C.; Rouatt, S.; Zhu, H. Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega 2011, 39, 99–109. [Google Scholar] [CrossRef]

- Akther, S.; Fukuyama, H.; Weber, W.L. Estimating two-stage network slacks-based inefficiency: An application to Bangladesh banking. Omega 2013, 41, 88–96. [Google Scholar] [CrossRef]

- Maghbouli, M.; Amirteimoori, A.; Kordrostami, S. Two-stage network structures with undesirable outputs: A DEA based approach. Measurement 2014, 48, 109–118. [Google Scholar] [CrossRef]

- Wanke, P.; Barros, C. Two-stage DEA: An application to major Brazilian banks. Expert Syst. Appl. 2014, 41, 2337–2344. [Google Scholar] [CrossRef]

- An, Q.; Chen, H.; Wu, J.; Liang, L. Measuring slacks-based efficiency for commercial banks in China by using a two-stage DEA model with undesirable output. Ann. Oper. Res. 2015, 235, 13–35. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Network DEA: A slacks-based measure approach. Eur. J. Oper. Res. 2009, 197, 243–252. [Google Scholar] [CrossRef] [Green Version]

- Bian, Y. Eco-efficiency evaluation of non-cooperative game two-stage production system. J. Manag. Sci. China 2012, 7, 11–19. [Google Scholar]

- Li, Y.; Chen, Y.; Liang, L.; Xie, J. DEA models for extended two-stage network structures. Omega 2012, 40, 611–618. [Google Scholar] [CrossRef]

- Xia, Q.; Li, M.; Wu, H.; Lu, Z. Does the Central Government’s Environmental Policy Work? Evidence from the Provincial-Level Environment Efficiency in China. Sustainability 2016, 8, 1241. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Zhu, J. Handbook on Data Envelopment Analysis, 2nd ed.; Springer: New York, NY, USA, 2011; pp. 199–200. [Google Scholar]

- O’Donnell, C.J.; Rao, D.S.P.; Battese, G.E. Metafrontier frameworks for the study of firm-level efficiencies and technology ratios. Empir. Econ. 2008, 34, 231–255. [Google Scholar] [CrossRef]

| Commercial Bank | P2P Platforms | |

|---|---|---|

| First stage | A deposit-generation stage. Banks combine labor, physical capital, and financial equity capital to raise deposits, which serve as an intermediate output. | A market expanding stage. Platforms help finance for borrowers. The average funding time, average loan interest rate and number of requests are inputs. Number of lenders, total lending volume, borrowing balance for per borrower and the average maturity of loans (intermediate) are outputs. The undesirable output is due balance (intermediate). |

| Second stage | A deposit-utilization stage. In the second stage, banks use the deposits raised from the first stage to produce loans and securities investments. In the second stage some loans might become non-performing, with borrowers unable to make full or even partial repayment. | A risk managing stage. The platforms think of lenders’ risk management. The average maturity of loans and due balance are treated as the inputs of the second stage. The outputs of the second stage are dispersity, liquidity and transparency. |

| Variables | Implications | |

|---|---|---|

| First Stage | Average funding time | The time total time taken when the loan is 100% funded. (unit: hour) |

| Average loan interest rate | The average interest rate of loans. It reflects the borrowers’ costs and the lenders’ benefit. (unit: %) | |

| Number of requests | The funding requests sponsored by the borrowers. | |

| Number of lenders | It reflects the activation of the supply side. | |

| Total lending volume | The total money that is successfully funded by the borrowers via the platforms (unit: 10-thousands RMB). | |

| Borrowing balance of per borrower | The personal financing scale of each borrower, and it reflects the financing abilities of borrowers. (10-thousands RMB) | |

| Intermediate Outputs | Average maturity of loans | A longer maturity means of a higher availability of the funding money to the borrowers. (month) |

| Due balance | Total money that is to be repaid (10-thousandsRMB) | |

| Second Stage | Dispersity | Index constructed by Wangdaizhijia. The dispersity index is for measuring the systematic risk of a platform, since we all know the famous motto that “never put all eggs in a single basket”. (unit: %) |

| Liquidity | Index constructed by Wangdaizhijia. The liquidity index reflects a platform’s ability to manage the mismatch problem of different loans. (unit: %) | |

| Transparency | Index constructed by Wangdaizhijia. The transparency index reflects information disclosure status. (unit: %) |

| Variables | Max | Min | Mean | Std. Dev. |

|---|---|---|---|---|

| Average funding time | 9403.82 | 0.00 | 382.37 | 899.83 |

| Average loan interest rate | 16.54 | 0.50 | 9.86 | 2.39 |

| Number of requests | 1,780,027.00 | 16.00 | 77,656.35 | 253,475.00 |

| Number of lenders | 273,722.00 | 32.00 | 22,493.41 | 39,861.68 |

| Total lending volume | 3,947,869.00 | 2039.35 | 119,738.50 | 384,846.30 |

| Borrowing balance of per borrower | 3873.43 | 0.15 | 203.90 | 438.04 |

| Average maturity of loans | 218.18 | 0.52 | 8.22 | 12.68 |

| Due balance | 10,098,488.00 | 6297.32 | 485,334.90 | 1,304,055.00 |

| Dispersity | 94.26 | 5.89 | 58.31 | 20.52 |

| Liquidity | 100.00 | 6.80 | 68.47 | 15.83 |

| Transparency | 70.88 | 0.00 | 40.54 | 10.52 |

| First Stage | Second Stage | |

|---|---|---|

| Average funding time | 0.32 | -- |

| Average loan interest rate | 0.16 | -- |

| Number of requests | 0.31 | -- |

| Total lending volume | 0.42 | -- |

| Number of lenders | 21.56 | -- |

| Borrowing balance of per borrower | 154.26 | -- |

| Average maturity of loans | 3.30 | 0.003 |

| Due balance | 0.13 | 0.03 |

| Dispersity | -- | 0.06 |

| Liquidity | -- | 0.48 |

| Transparency | -- | 1860.563 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, P.; Chen, Y.; Zhou, Z.; Wu, H. Performance Analysis of Peer-to-Peer Online Lending Platforms in China. Sustainability 2018, 10, 2987. https://doi.org/10.3390/su10092987

Song P, Chen Y, Zhou Z, Wu H. Performance Analysis of Peer-to-Peer Online Lending Platforms in China. Sustainability. 2018; 10(9):2987. https://doi.org/10.3390/su10092987

Chicago/Turabian StyleSong, Pingfan, Yunzhi Chen, Zhixiang Zhou, and Huaqing Wu. 2018. "Performance Analysis of Peer-to-Peer Online Lending Platforms in China" Sustainability 10, no. 9: 2987. https://doi.org/10.3390/su10092987

APA StyleSong, P., Chen, Y., Zhou, Z., & Wu, H. (2018). Performance Analysis of Peer-to-Peer Online Lending Platforms in China. Sustainability, 10(9), 2987. https://doi.org/10.3390/su10092987