Ex-Ante Analysis of Economic, Social and Environmental Impacts of Large-Scale Renewable and Nuclear Energy Targets for Global Electricity Generation by 2030

Abstract

1. Introduction

2. Methodology and Scenario Design

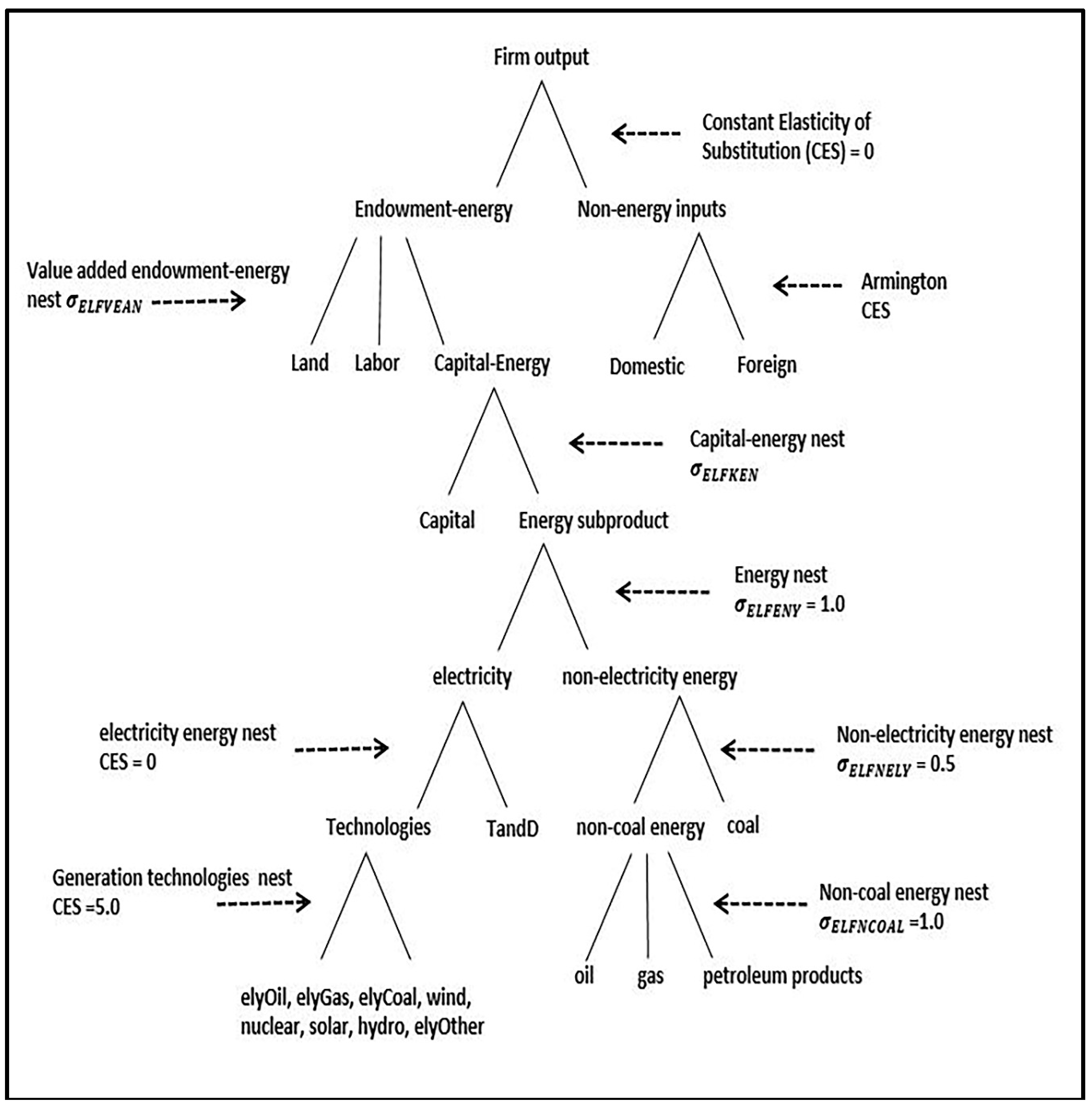

2.1. GTAP-E Model

- qpd is private consumption demand for domestic goods;

- qpm is private consumption demand for aggregate imports;

- ppt is private consumption price for composite commodities.

- qf is demand for inputs into non-coal energy sub-production;

- af is sector/region specific rate of factor i augmenting technology change;

- ELFNCOAL is elasticity of substitution in non-coal energy sub-production;

- pf is price of non-coal energy.

2.2. Technological Improvement

2.3. Scenario Description

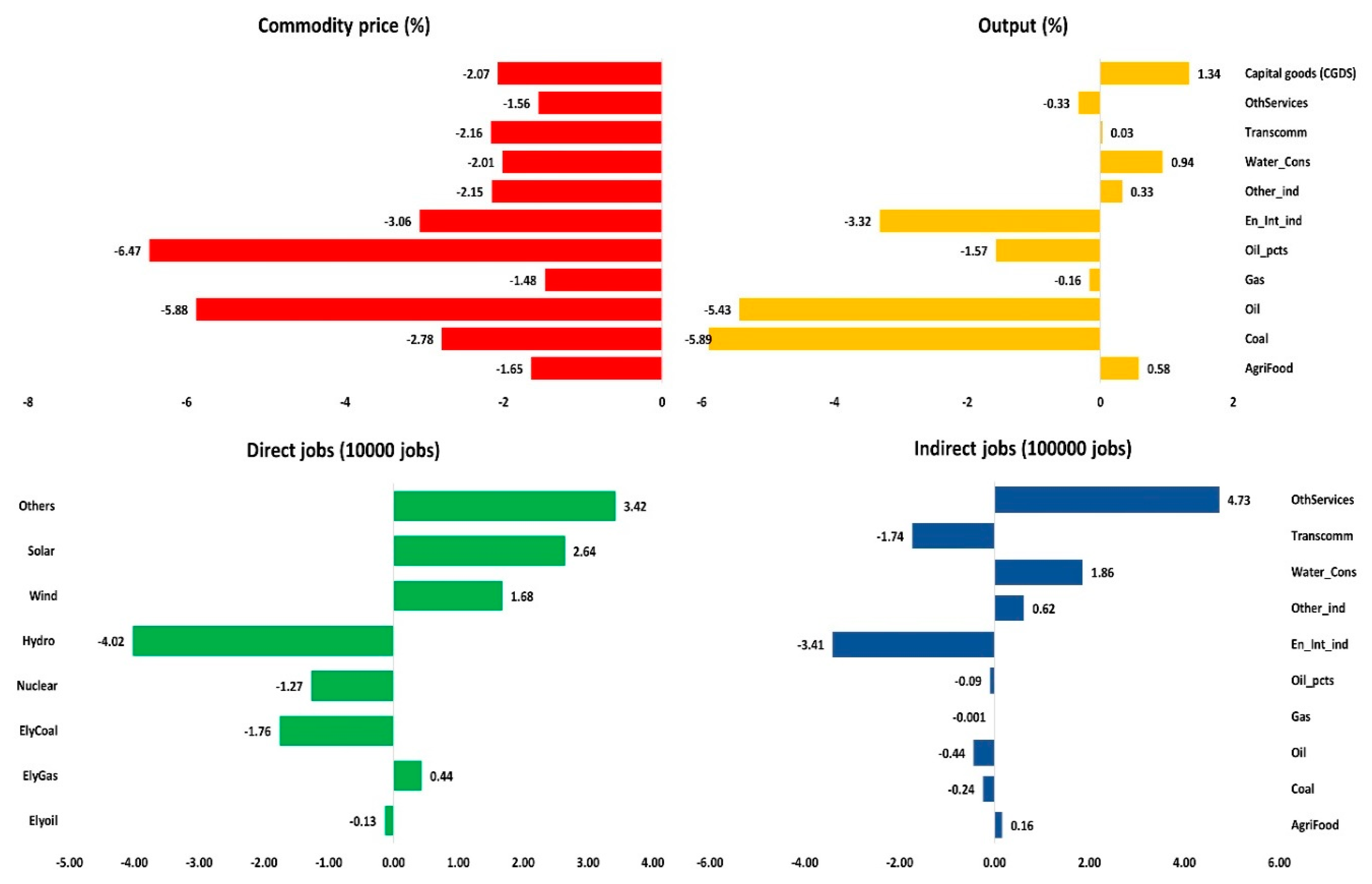

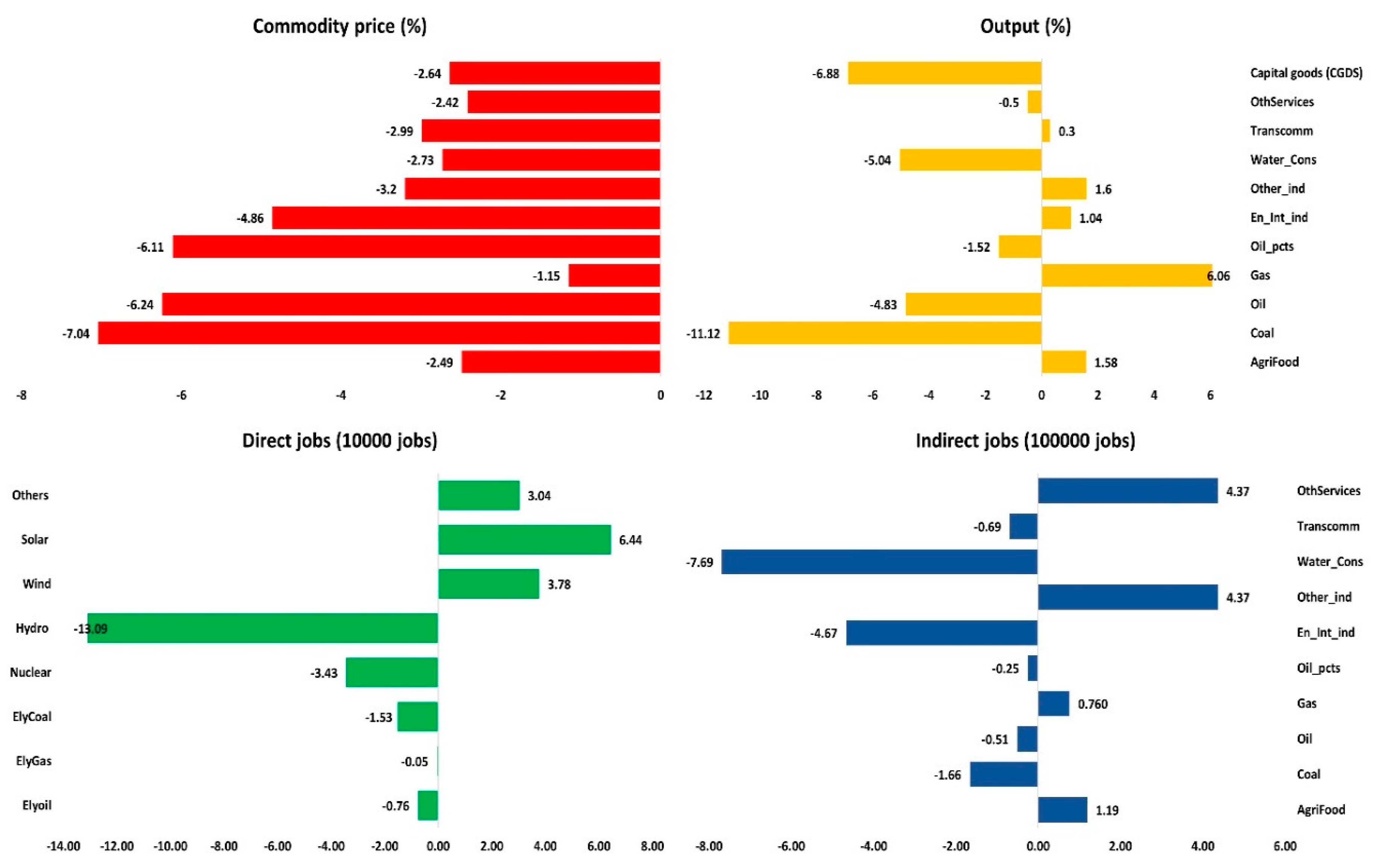

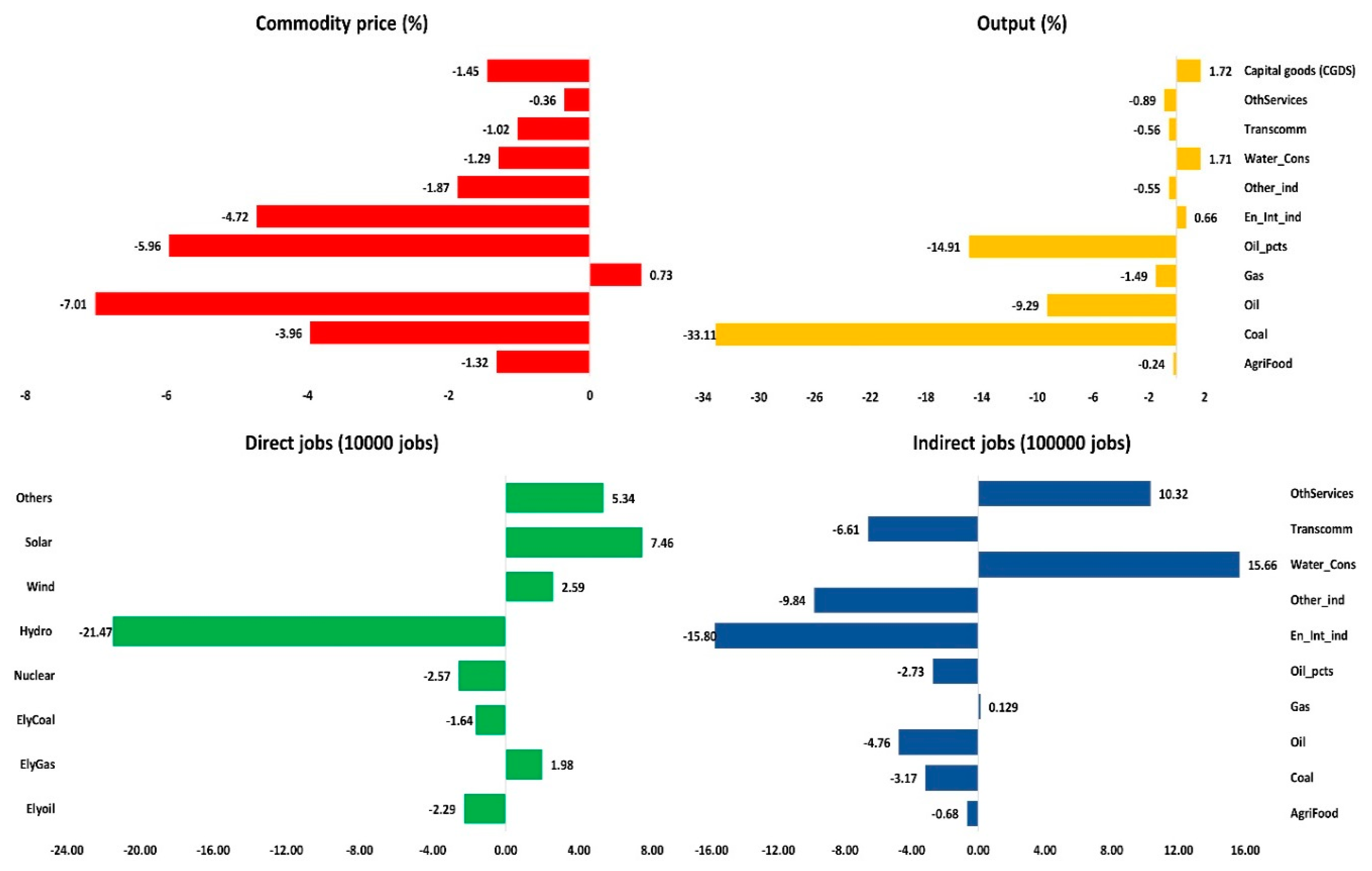

3. Results

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| GTAP-E Region | Member Countries |

|---|---|

| KSA | Saudi Arabia |

| USA | United States |

| EUROPE | Austria, Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, United Kingdom, Switzerland, Norway, Rest of EFTA, Albania, Bulgaria, Belarus, Croatia, Romania, Russian Federation, Ukraine, Rest of Eastern Europe, Rest of Europe |

| CHINA | China |

| INDIA | India |

| ROW | Australia, New Zealand, Rest of Oceania, Hong Kong, Japan, Korea Republic, Mongolia, Taiwan, Rest of East Asia, Brunei Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic, Malaysia, Philippines, Singapore, Thailand, Viet Nam, Rest of Southeast Asia, Bangladesh, Nepal, Pakistan, Sri Lanka, Rest of South Asia, Canada, Mexico, Rest of North America, Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela, Rest of South America, Costa Rica, Guatemala, Honduras, Nicaragua, Panama, El Salvador, Rest of Central America, Dominican Republic, Jamaica, Puerto Rico, Trinidad and Tobago, Caribbean, Kazakhstan, Kyrgyzstan, Rest of Former Soviet Union, Armenia, Azerbaijan, Georgia, Bahrain, Iran, Israel, Jordan, Kuwait, Oman, Qatar, Turkey, United Arab Emirates, Rest of Western Asia, Egypt, Morocco, Tunisia, Rest of North Africa, Benin, Burkina Faso, Cameroon, Cote d’Ivoire, Ghana, Guinea, Nigeria, Senegal, Togo, Rest of Western Africa, Central Africa, South Central Africa, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Mozambique, Rwanda, Tanzania, Uganda, Zambia, Zimbabwe, Rest of Eastern Africa, Botswana, Namibia, South Africa, Rest of South African Customs Union, Rest of the World |

| GTAP-E Sector | Description | Comprising |

|---|---|---|

| AgriFood | Agriculture, forestry,& fishing | Paddy rice, Wheat, Cereal grains nec, Vegetables, fruit, nuts, Oil seeds, Sugar cane, sugar beet, Plant-based fibers, Crops nec, Bovine cattle, sheep and goats, horses, Animal products nec, Raw milk, Wool, silk-worm cocoons, Forestry, Fishing |

| Coal | Coal mining | Coal |

| Oil | Oil extraction | Oil |

| gas | Gas extraction & distribution | Gas, Gas manufacture, distribution |

| oil_pcts | Petroleum products | Petroleum products |

| En_Int_ind | Energy intensive industries | Minerals nec, Chemical, rubber, plastic products, Mineral products nec, Ferrous metals, Metals nec |

| other_ind | other industries | Bovine meat products, Meat products nec, Vegetable oils and fats, Dairy products, Processed rice, Sugar, Food products nec, Beverages and tobacco products, Textiles, Wearing apparel, Leather products, Wood products, Paper products, publishing, Metal products, Motor vehicles and parts, Transport equipment nec, Electronic equipment, Machinery and equipment nec, Manufactures nec |

| water_Cons | Water and Construction | Water, Construction |

| Transcomm | Transport and Communication | Trade, Transport nec, Water transport, Air transport, Communication |

| OthServices | Other Services | Financial services nec, Insurance, Business services nec, Recreational and other services, Public Administration, Defense, Education, Health, Dwellings |

| TandD | transmission & distribution | Electricity transmission & distribution |

| elygas | Electricity from gas | Gas base and peak load |

| elyoil | Electricity from oil | Oil base and peak load |

| elycoal | Electricity from coal | Coal base load |

| nuclear | Electricity from nuclear | Nuclear base load |

| wind | Electricity from wind | Wind base load |

| hydro | Hydroelectric | Hydro base and peak load |

| solar | Electricity from solar | Solar peak load |

| elyother | Electricity from others | Other base load |

| Electricity Technology | Learning Rate |

|---|---|

| Solar | 0.11 |

| Wind | 0.06 |

| Nuclear | 0.058 |

| Hydro | −0.1 |

| Others | 0.136 |

| Billion kWh | ||||||

|---|---|---|---|---|---|---|

| SAUDI ARABIA | CHINA | INDIA | ||||

| BAU | RNE | BAU | RNE | BAU | RNE | |

| elyoil | 257.9 | 175.8 | 10 | 6 | 39 | 20 |

| elyGas | 164.9 | 60.0 | 138 | 647 | 164 | 111 |

| elyCoal | 0.0 | 0.0 | 6092 | 4353 | 1407 | 1087 |

| nuclear | 0.0 | 82.7 | 158 | 754 | 56 | 206 |

| hydro | 0.0 | 0.0 | 1454 | 1234 | 234 | 287 |

| wind | 0.0 | 12.7 | 163 | 592 | 52 | 130 |

| solar | 0.0 | 72.1 | 10 | 218 | 4 | 85 |

| others | 0.0 | 19.4 | 76 | 297 | 9 | 40 |

| USA | EUORPE | ROW | ||||

| BAU | RNE | BAU | RNE | BAU | RNE | |

| elyoil | 27 | 18 | 138 | 93 | 1119 | 375 |

| elyGas | 1421 | 1371 | 1585 | 1639 | 2412 | 2969 |

| elyCoal | 1752 | 1713 | 1611 | 1295 | 1510 | 1043 |

| nuclear | 890 | 808 | 1363 | 1341 | 419 | 746 |

| hydro | 318 | 295 | 1021 | 958 | 1969 | 1740 |

| wind | 163 | 245 | 260 | 576 | 54 | 299 |

| solar | 13 | 71 | 88 | 107 | 14 | 181 |

| others | 108 | 171 | 201 | 258 | 174 | 318 |

Appendix B

References

- U.S. Energy Information Administration. International Energy Outlook 2016; U.S. Energy Information Administration: Washington, DC, USA, 2016.

- Suttles, S.; Tyner, W.; Shively, G.; Sands, R. Economic effects of bioenergy policy in the United States and Europe: A general equilibrium approach focusing on forest biomass. Renew. Energy 2014, 69, 428–436. [Google Scholar] [CrossRef]

- Yildirim, E.; Saraç, Ş.; Aslan, A. Energy consumption and economic growth in the USA: Evidence from renewable energy. Renew. Sustain. Energy Rev. 2012, 16, 6770–6774. [Google Scholar] [CrossRef]

- Fang, Y. Economic welfare impacts from renewable energy consumption: The China experience. Renew. Sustain. Energy Rev. 2011, 15, 5120–5128. [Google Scholar] [CrossRef]

- Alam, M.J.; Begum, I.A.; Buysse, J.; Rahman, S.; Van Huylenbroeck, G. Dynamic modeling of causal relationship between energy consumption, CO2 emissions and economic growth in India. Renew. Sustain. Energy Rev. 2011, 15, 3243–3251. [Google Scholar] [CrossRef]

- Ahmad, S.; Tahar, R.M. Selection of renewable energy sources for sustainable development of electricity generation system using analytic hierarchy process: A case of Malaysia. Renew. Energy 2014, 63, 458–466. [Google Scholar] [CrossRef]

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Tsai, W.T.; Chou, Y.H. Overview of environmental impacts, prospects and policies for renewable energy in Taiwan. Renew. Sustain. Energy Rev. 2005, 9, 119–147. [Google Scholar] [CrossRef]

- Bohringer, C.; Keller, A.; van der Werf, E. Are green hopes too rosy? Employment and welfare impacts of renewable energy promotion. Energy Econ. 2013, 36, 277–285. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. CO2 emissions, energy consumption and economic growth in Turkey. Renew. Sustain. Energy Rev. 2010, 14, 3220–3225. [Google Scholar] [CrossRef]

- Ocal, O.; Aslan, A. Renewable energy consumption-economic growth nexus in Turkey. Renew. Sustain. Energy Rev. 2013, 28, 494–499. [Google Scholar] [CrossRef]

- Hoefnagels, R.; Banse, M.; Dornburg, V.; Faaij, A. Macro-economic impact of large-scale deployment of biomass resources for energy and materials on a national level-A combined approach for The Netherlands. Energy Policy 2013, 59, 727–744. [Google Scholar] [CrossRef]

- Moreno, B.; López, A.J. The effect of renewable energy on employment. The case of Asturias (Spain). Renew. Sustain. Energy Rev. 2008, 12, 732–751. [Google Scholar] [CrossRef]

- Cansino, J.M.; Cardenete, M.A.; González-Limón, J.M.; Román, R. The economic influence of photovoltaic technology on electricity generation: A CGE (computable general equilibrium) approach for the Andalusian case. Energy 2014, 73, 70–79. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Zeb, R.; Salar, L.; Awan, U.; Zaman, K.; Shahbaz, M. Causal links between renewable energy, environmental degradation and economic growth in selected SAARC countries: Progress towards green economy. Renew. Energy 2014, 71, 123–132. [Google Scholar] [CrossRef]

- Sebri, M.; Ben Salha, O. On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: Fresh evidence from BRICS countries. Public Choice 2007. [Google Scholar] [CrossRef]

- Cucchiella, F. Future Trajectories of Renewable Energy Consumption in the European Union. Resources 2018, 7, 10. [Google Scholar] [CrossRef]

- Pirlogea, C.; Cicea, C. Econometric perspective of the energy consumption and economic growth relation in European Union. Renew. Sustain. Energy Rev. 2012, 16, 5718–5726. [Google Scholar] [CrossRef]

- Organization of the Petroleum Exporting Countries (OPEC). Annual Statistical Bulletin; Organization of the Petroleum Exporting Countries: Vienna, Austria, 2016. [Google Scholar]

- Saudi Electricity Company. SEC Annual Report; Saudi Electricity Company: Riyadh, Saudi Arabia, 2015. [Google Scholar]

- King Abdullah City for Atomic and Renewable Energy (K.A.CARE). 2010. Available online: https://www.kacare.gov.sa/en/FutureEnergy/Pages/vision.aspx (accessed on 9 November 2016).

- Almutairi, K.; Thoma, G.; Burek, J.; Algarni, S.; Nutter, D. Life cycle assessment and economic analysis of residential air conditioning in Saudi Arabia. Energy Build. 2015, 102, 370–379. [Google Scholar] [CrossRef]

- Al-Abdalla, M. (Saudi Arabian General Investment Authority, Riyadh, Saudi Arabia). Personal Communication, 2017.

- Baumeister, C.; Kilian, L. Lower oil prices and the US economy: Is this time different? Brook. Pap. Econ. Act. 2016, 287–357. [Google Scholar] [CrossRef]

- Osmani, A.; Zhang, J.; Gonela, V.; Awudu, I. Electricity generation from renewables in the United States: Resource potential, current usage, technical status, challenges, strategies, policies, and future directions. Renew. Sustain. Energy Rev. 2013, 24, 454–472. [Google Scholar] [CrossRef]

- Electricity in the United States—Energy Explained, Your Guide to Understanding Energy, Energy Information Administration. 2018. Available online: https://www.eia.gov/energyexplained/index.php?page=electricity_in_the_united_states (accessed on 3 August 2018).

- Wang, Q.; Chen, X.; Jha, A.N.; Rogers, H. Natural gas from shale formation—The evolution, evidences and challenges of shale gas revolution in United States. Renew. Sustain. Energy Rev. 2014, 30, 1–28. [Google Scholar] [CrossRef]

- Nejat, P.; Jomehzadeh, F.; Taheri, M.M.; Gohari, M.; Muhd, M.Z. A global review of energy consumption, CO2 emissions and policy in the residential sector (with an overview of the top ten CO2 emitting countries). Renew. Sustain. Energy Rev. 2015, 43, 843–862. [Google Scholar] [CrossRef]

- Aslani, A.; Wong, K.-F.V. Analysis of renewable energy development to power generation in the United States. Renew. Energy 2014, 63, 153–161. [Google Scholar] [CrossRef]

- Menyah, K.; Wolde-Rufael, Y. CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 2010, 38, 2911–2915. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Hilton, I.; Kerr, O. The Paris Agreement: China’s ‘New Normal’ role in international climate negotiations. Clim. Policy 2017, 17, 48–58. [Google Scholar] [CrossRef]

- Li, J.; Wang, X. Energy and climate policy in China’s twelfth five-year plan: A paradigm shift. Energy Policy 2012, 41, 519–528. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Rafiq, S.; Bhattacharya, S. The role of technology on the dynamics of coal consumption-economic growth: New evidence from China. Appl. Energy 2015, 154, 686–695. [Google Scholar] [CrossRef]

- Yuan, J.; Na, C.; Lei, Q.; Xiong, M.; Guo, J.; Hu, Z. Coal use for power generation in China. Resour. Conserv. Recycl. 2018, 129, 443–453. [Google Scholar] [CrossRef]

- Hu, Y.; Cheng, H. Development and bottlenecks of renewable electricity generation in China: A critical review. Environ. Sci. Technol. 2013, 47, 3044–3056. [Google Scholar] [CrossRef] [PubMed]

- Kumar, A.; Kumar, K.; Kaushik, N.; Sharma, S.; Mishra, S. Renewable energy in India: Current status and future potentials. Renew. Sustain. Energy Rev. 2010, 14, 2434–2442. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Albulescu, C.T. Oil price and exchange rate in India: Fresh evidence from continuous wavelet approach and asymmetric, multi-horizon Granger-causality tests. Appl. Energy 2016, 179, 272–283. [Google Scholar] [CrossRef]

- Sati, V.P. Climate Change and Socio-Ecological Transformation; Today and Tomrrow’s Printers and Publishers: New Delhi, India, 2015. [Google Scholar]

- Shiva Kumar, B.; Sudhakar, K. Performance evaluation of 10 MW grid connected solar photovoltaic power plant in India. Energy Rep. 2015, 1, 184–192. [Google Scholar] [CrossRef]

- Heo, J.-Y.; Yoo, S.-H.; Kwak, S.-J. The Causal Relationship Between Nuclear Energy Consumption and Economic Growth in India. Energy Sources Part B Econ. Plan. Policy 2011, 6, 111–117. [Google Scholar] [CrossRef]

- Scarlat, N.; Dallemand, J.; Monforti-Ferrario, F. Renewable Energy Policy Framework and Bioenergy Contribution in the European Union—An Overview from National Renewable Energy Action Plans and, Renew. Sustain. Energy Rev. 2015, 51, 969–985. [Google Scholar] [CrossRef]

- Excise Duties: Energy Tax Rates—European Commission, (n.d.). Available online: https://ec.europa.eu/taxation_customs/business/excise-duties-alcohol-tobacco-energy/excise-duties-energy/excise-duties-energy-tax-rates_en (accessed on 25 June 2017).

- Knopf, B.; Nahmmacher, P.; Schmid, E. The European renewable energy target for 2030—An impact assessment of the electricity sector. Energy Policy 2015, 85, 50–60. [Google Scholar] [CrossRef]

- DeLlano-Paz, F.; Martínez Fernandez, P.; Soares, I. Addressing 2030 EU policy framework for energy and climate: Cost, risk and energy security issues. Energy 2016, 115, 1347–1360. [Google Scholar] [CrossRef]

- Helm, D. The European framework for energy and climate policies. Energy Policy 2014, 64, 29–35. [Google Scholar] [CrossRef]

- Brutschin, E.; Pollak, J. The European Commission 2030 Framework for Climate and Energy Policies: A Step Back? 2014. Available online: http://irihs.ihs.ac.at/id/eprint/3210 (accessed on 25 June 2017).

- Burniaux, J.; Truong, T. GTAP-E: An Energy-Environmental Version of the GTAP Model. GTAP Technical Papers. 2002. Available online: http://docs.lib.purdue.edu/cgi/viewcontent.cgi?article=1017&context=gtaptp (accessed on 26 June 2017).

- Hertel, T. Global Trade Analysis: Modeling and Applications; Cambridge University Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Burfisher, M. Introduction to Computable General Equilibrium Models; Cambridge University Press: Cambridge, UK, 2017. [Google Scholar]

- Armington, P.S. A Theory of Demand for Products Distinguished by Place of Production. Int. Monet. Fund Staff Pap. 1969, 16, 159–178. [Google Scholar] [CrossRef]

- Truong, T. GTAP-E: An Energy-Environmental Version of the GTAP Model with Emission Trading USER’S GUIDE. 2007. Available online: http://www.gtap.agecon.purdue.edu/resources/download/3552.pdf (accessed on 26 June 2017).

- Aguiar, A.; Narayanan, B.; McDougall, R. An Overview of the GTAP 9 Data Base. J. Glob. Econ. Anal. 2016, 1, 181–208. [Google Scholar] [CrossRef]

- Peters, J.C. The GTAP-Power Data Base: Disaggregating the Electricity Sector in the GTAP Data Base. J. Glob. Econ. Anal. 2016, 1, 209–250. [Google Scholar] [CrossRef]

- Capros, P.; van Regemorter, D.; Paroussos, L.; Karkatsoulis, P.; Fragkiadakis, C.; Tsani, S.; Charalampidis, I.; Revesz, T. GEM-E3 Model Doc.; European Commisions: Brussels, Belgium, 2013. [Google Scholar] [CrossRef]

- Peters, J.C. GTAP-E-Power: An Electricity-detailed Extension of the GTAP-E model. In Proceedings of the 19th Annual Conference on Global Economic Analysis, Washington, DC, USA, 15–17 June 2016; pp. 1–30. [Google Scholar]

- Cai, Y.; Arora, V. Disaggregating electricity generation technologies in CGE models: A revised technology bundle approach with an application to the US Clean Power Plan. Appl. Energy 2015, 154, 543–555. [Google Scholar] [CrossRef]

- Chateau, J.; Dellink, R.; Lanzi, E. An Overview of the OECD ENV-Linkages Model: Version 3; OECD Environment Working Papers 65; OECD Publishing: Paris, France, 2014. [Google Scholar]

- Dai, H.; Herran, D.; Fujimori, S.; Masui, T. Key factors affecting long-term penetration of global onshore wind energy integrating top-down and bottom-up approaches. Renew. Energy 2016, 85, 19–30. [Google Scholar] [CrossRef]

- European Commission. World Energy, Technology and Climate Policy Outlook; European Commission: Brussels, Belgium, 2003. [Google Scholar]

- Rubin, E.S.; Azevedo, I.M.L.; Jaramillo, P.; Yeh, S. A review of learning rates for electricity supply technologies. Energy Policy 2015, 86, 198–218. [Google Scholar] [CrossRef]

- Viebahn, P.; Nitsch, J.; Fischedick, M.; Esken, A.; Schüwer, D.; Supersberger, N.; Zuberbühler, U.; Edenhofer, O. Comparison of carbon capture and storage with renewable energy technologies regarding structural, economic, and ecological aspects in Germany. Int. J. Greenh. Gas Control 2007, 1, 121–133. [Google Scholar] [CrossRef]

- Ballesteros, A.R.; Coequyt, J.; Furtado, M.; Inventor, J.; Krewitt, W.; Mittler, D.; Schäfer, O.; Simon, S.; Teske, S.; Zervos, A. Future Investment: A Sustainable Investment Plan for the Power Sector to Save the Climate; European Council for Renewable Energy and Greenpeace: Stuttgart, Germany, 2007. [Google Scholar]

- Morris, J.; Webster, M.; Reilly, J. Electricity Investments under Technology Cost Uncertainty and Stochastic Technological Learning; MIT Joint Program on the Science and Policy of Global Change: Cambridge, MA, USA, 2016. [Google Scholar]

- U.S. Census Bureau. USCB International Data Base; U.S. Census Bureau: Suitland, MD, USA, 2016.

- Anderson, K.; Strutt, A. The changing geography of world trade: Projections to 2030. J. Asian Econ. 2012, 23, 303–323. [Google Scholar] [CrossRef]

- International Labour Organization, Estimates and Projections of Labour Market Indicators. Available online: http://www.ilo.org/global/about-the-ilo/lang--en/index.htm (accessed on 23 June 2017).

- Verdolini, E.; Vona, F.; Popp, D. Bridging the Gap: Do Fast Reacting Fossil Technologies Facilitate Renewable Energy Diffusion? The National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Rutovitz, J.; Dominish, E.; Downes, J. Calculating Global Energy Sector Jobs 2015 Methodology Update; Institutes for Sustainable Futures: Sydney, Austria, 2015. [Google Scholar]

- China: Average Income of Employees in Urban Areas by Sector 2015|Statistic, (n.d.). Available online: https://www.statista.com/statistics/278351/average-wage-of-employed-persons-in-urban-units-in-china/ (accessed on 26 June 2017).

- Bosbait, M.; Wilson, R. Education, School to Work Transitions and Unemployment in Saudi Arabia. Middle East. Stud. 2005, 41, 533–546. [Google Scholar] [CrossRef]

- United States Department of Energy. U.S. Energy and Employment Report; United States Department of Energy: Washington, DC, USA, 2017.

- Saudi Arabian Monetary Agency. Saudi Arabian Monetary Agency; Thirty-nine Annual Report; Saudi Arabian Monetary Agency: Riyadh, Saudi Arabia, 2003.

- Murphy, A.P. Konings, Do Multional Enterprises Relocate Employment to Low Wage Regions? Rev. World Econ. 2003, 142, 267–286. [Google Scholar]

- Fabo, B.; Arkkey, R.; Korde, R. Wage Index Report India: Wages and Working Conditons on the Formal Labour Market in India 2014. Available online: http://wageindicator.org/documents/publications-2015/Monster-Salarry-Index-Jan2015.pdf (accessed on 26 June 2017).

- Oostendorp, R.H. The Occupational Wages Around the World (OWW) Database; Update for 1983–2008. Available online: http://www.nber.org/oww/The Updated Occupational Wages around the World (OWW) Database May 2012.pdf (accessed on 24 June 2017).

- Ernst & Young Global Limited. The Impact of Decreasing Oil Prices on the GCC RHC Market; Ernst & Young Global Limited: London, UK, 2016. [Google Scholar]

- Dev, R.; Chaubey, P.D.S. World’ s Oil Scenario—Falling Oil Prices Winners and Losers a Study on top Oil Producing and Consuming Countries. Imp. J. Interdiscip. Res. 2016, 2, 378–383. [Google Scholar]

- Houghton, J. Global Warming: The Complete Briefing, 4th ed.; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Myhre, G.; Shindell, D.; Bréon, F.M.; Collins, W.; Fuglestvedt, J.; Huang, J.; Koch, D.; Lamarque, J.F.; Lee, D.; Mendoza, B.; et al. Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2013. [Google Scholar]

- Riahi, K.; Rao, S.; Krey, V.; Cho, C.; Chirkov, V.; Fischer, G.; Kindermann, G.; Nakicenovic, N.; Rafaj, P. RCP 8.5-A scenario of comparatively high greenhouse gas emissions. Clim. Chang. 2011, 109, 33–57. [Google Scholar] [CrossRef]

- Ma, J.; Oppong, A.; Acheampong, K.N.; Abruquah, L.A. Forecasting renewable energy consumption under zero assumptions. Sustainability 2018, 10, 576. [Google Scholar] [CrossRef]

- United Nations. Adoption of the Paris Agreement. In Proceedings of the Conference of the Parties, Paries, France, 30 November–11 Decemeber 2015. [Google Scholar]

- Ianchovichina, E.; Mcdougall, R. Theoretical Structure of Dynamic GTAP; Global Trade Analysis Project Technical Paper; Global Trade Analysis Project: West Lafayette, IN, USA, 2000. [Google Scholar]

| Scenario | Description |

|---|---|

| 1. Business As Usual (BAU) | - Account for the evolution of the global economy until 2030. - Current electricity mix remains unchanged until 2030. - Consider the technological improvements. |

| 2. Renewable and Nuclear Energy (RNE) | - Account for the evolution of the global economy until 2030. - Electricity mix that incorporates the 2030 renewable and nuclear energy targets based on IEO2016 predictions. - Consider the technological improvements. |

| Consumption | Investment | Government | Export | Import | Total | |

|---|---|---|---|---|---|---|

| KSA | −5.00 | −27.28 | −5.06 | −0.55 | −13.40 | −3.52 |

| USA | −1.58 | −0.54 | −1.57 | −4.97 | −2.37 | −1.58 |

| EUROPE | −2.89 | −7.73 | −2.88 | −1.42 | −4.76 | −2.81 |

| CHINA | −0.41 | 1.88 | −0.23 | −2.39 | 0.77 | −0.31 |

| INDIA | 0.02 | −0.21 | 0.13 | −4.24 | −3.61 | 0.03 |

| ROW | −1.02 | 0.12 | −0.99 | −4.98 | −2.95 | −1.00 |

| Region | Equivalent Variation | Terms of Trade |

|---|---|---|

| KSA | −32,965 | −5.64 |

| USA | 18,869 | 0.57 |

| EUROPE | –31,885 | −0.36 |

| CHINA | 21,788 | 1.57 |

| INDIA | 14,437 | 2.61 |

| ROW | −8560 | −0.01 |

| Region | Difference in CO2 | Million Tonne-CO2 |

|---|---|---|

| KSA | −7.90 | −61.51 |

| USA | −1.21 | −96.48 |

| EUROPE | −3.42 | −297.85 |

| CHINA | −12.35 | −2152.68 |

| INDIA | −13.16 | −881.71 |

| ROW | −6.57 | −1123.7 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almutairi, K.; Thoma, G.; Durand-Morat, A. Ex-Ante Analysis of Economic, Social and Environmental Impacts of Large-Scale Renewable and Nuclear Energy Targets for Global Electricity Generation by 2030. Sustainability 2018, 10, 2884. https://doi.org/10.3390/su10082884

Almutairi K, Thoma G, Durand-Morat A. Ex-Ante Analysis of Economic, Social and Environmental Impacts of Large-Scale Renewable and Nuclear Energy Targets for Global Electricity Generation by 2030. Sustainability. 2018; 10(8):2884. https://doi.org/10.3390/su10082884

Chicago/Turabian StyleAlmutairi, Kamel, Greg Thoma, and Alvaro Durand-Morat. 2018. "Ex-Ante Analysis of Economic, Social and Environmental Impacts of Large-Scale Renewable and Nuclear Energy Targets for Global Electricity Generation by 2030" Sustainability 10, no. 8: 2884. https://doi.org/10.3390/su10082884

APA StyleAlmutairi, K., Thoma, G., & Durand-Morat, A. (2018). Ex-Ante Analysis of Economic, Social and Environmental Impacts of Large-Scale Renewable and Nuclear Energy Targets for Global Electricity Generation by 2030. Sustainability, 10(8), 2884. https://doi.org/10.3390/su10082884