The Effect of Trust on Acquisition Success: The Case of Israeli Start-Up M&A

Abstract

1. Introduction

2. Theory and Hypotheses Development

3. Methodology

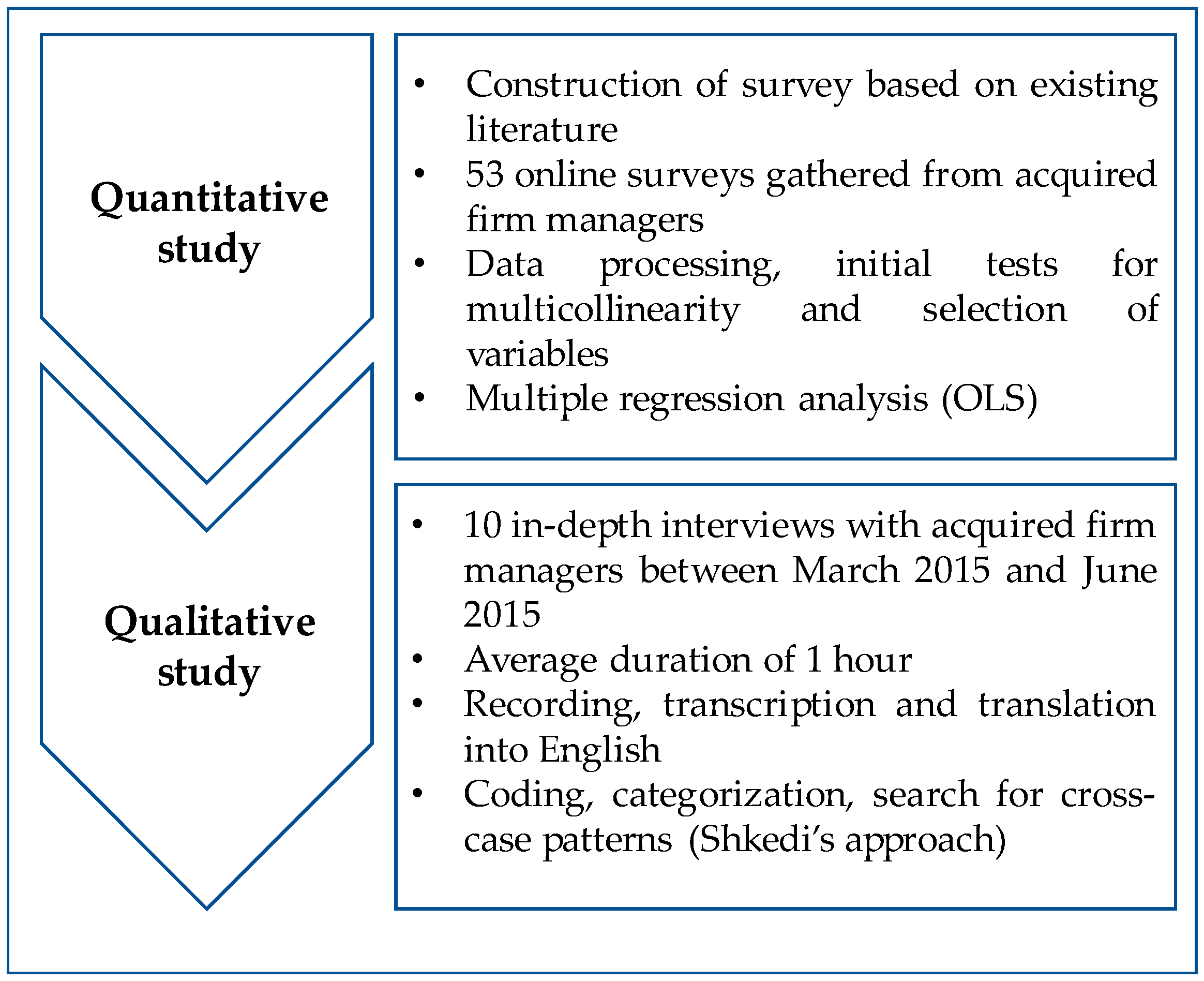

3.1. Quantitative Study

3.1.1. Data Collection

3.1.2. Operationalization of Variables

3.2. Qualitative Study

4. Results

4.1. Quantitative Results

4.2. Qualitative Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Construct | Items | Scale |

|---|---|---|

| Dependent Variables | ||

| Performance | Please specify, to what extent the expectations you had before the merger were indeed materialized after its completion: In your opinion—to what extent did the planned merger process was conducted in a similar manner (1) To what extent did the merger’s results meet your expectations (2) In your opinion, to what extent the goals that were set before the merger were achieved (3) Expectations for improvement in company’s decision-making (4) expectations about the company’s ability to meet its forecast regarding its performance (5) | To a very small extent—1; to a very large extent—5 |

| Satisfaction with the merger | To what extent do you agree with the following statements: I was satisfied with the results of the merger (1) The integration process was successful in my opinion (2) I was not satisfied with the way the merger has been implemented (3) I was pleased with the performance of the Company’s management (4) to what extent did the merger meet your expectations of it (5) | To a very small extent—1; to a very large extent—5 |

| Independent Variables | ||

| Retained autonomy | How your company’s management (Acquired) was involved in making these decisions during the merger: Setting performance goals (1) Managing research and development budgets (2) Providing work plan priorities (3) Building periodic company budget (4) Establishing procedures and practices (5) Managing purchases, suppliers and subcontractors (6) Building and managing an employee recruitment plan (7) | Liability of the acquiring company—1; acquired company’s liability—5 |

| Trust | To what extent do you agree with the following statements: I had a feeling I could trust management during the merger (1) Senior management exercised, upon completion of the merger, the promises given to us prior to the merger (2) Management has consistently implemented the policy of the Company in all of its units (3) I thought that the merger could harm the way things are done in the organization (4) I thought the merger and the change followed, would be beneficial for me (5) I thought that if management is entering a merger process, it must have good reasons to think that the merger is necessary for the company’s success (6) | Strongly disagree—1; definitely agree—5 |

References

- Bloomberg Global M&A Market Review Q1 2018. Available online: https://data.bloomberglp.com/professional/sites/10/Bloomberg-Global-MA-Legal-Ranking-Q1-2018.pdf (accessed on 29 May 2018).

- Li, J.; Li, Y.; Shapiro, D. Knowledge seeking and outward FDI of emerging market firms: The moderating effect of inward FDI. Glob. Strateg. J. 2012, 2, 277–295. [Google Scholar] [CrossRef]

- Faulkner, D.; Teerikangas, S.; Joseph, R.J. Introduction. In Handbook of Mergers & Acquisitions; Faulkner, D., Teerikangas, S., Joseph, R., Eds.; Oxford University Press: Oxford, UK, 2002; pp. 1–18. ISBN 0198703880. [Google Scholar]

- Stahl, G.K.; Larsson, R.; Kremershof, I.; Sitkin, S.B. Trust dynamics in acquisitions: A case survey. Hum. Res. Manag. 2011, 50, 575–603. [Google Scholar] [CrossRef]

- Marks, M.L.; Mirvis, P.H. Making mergers and acquisitions work: Strategic and psychological preparation. Acad. Manag. Perspect. 2001, 15, 80–92. [Google Scholar] [CrossRef]

- King, D.R.; Dalton, D.R.; Daily, C.M.; Covin, J.G. Meta-analyses of post-acquisition performance: Indications of unidentified moderators. Strateg. Manag. J. 2004, 25, 187–200. [Google Scholar] [CrossRef]

- Risberg, A. Employee experiences of acquisition processes. J. World Bus. 2001, 36, 58–84. [Google Scholar] [CrossRef]

- Vaara, E. Post-acquisition integration as sensemaking: Glimpses of ambiguity, confusion, hypocrisy, and politicization. J. Manag. Stud. 2003, 40, 859–894. [Google Scholar] [CrossRef]

- Van Dick, R.; Ullrich, J.; Tissington, P.A. Working under a black cloud: How to sustain organizational identification after a merger. Br. J. Manag. 2006, 17, S69–S79. [Google Scholar] [CrossRef]

- Sarala, R.M.; Junni, P.; Cooper, C.L.; Tarba, S.Y. A Sociocultural Perspective on Knowledge Transfer in Mergers and Acquisitions. J. Manag. 2016, 42, 1230–1249. [Google Scholar] [CrossRef]

- Amiot, C.; Terry, D.; Jimmieson, N.; Callan, V. A longitudinal investigation of coping processes during a merger: Implications for job satisfaction and organizational identification. J. Manag. 2006, 32, 552–574. [Google Scholar] [CrossRef]

- Väänänen, A.; Pahkin, K.; Kalimo, R.; Buunk, B.P. Maintenance of subjective health during a merger: The role of experienced change and pre-merger social support at work in white-and blue-collar workers. Soc. Sci. Med. 2004, 58, 1903–1915. [Google Scholar] [CrossRef] [PubMed]

- Angwin, D.N.; Paroutis, S.; Connell, R. Why good things Don’t happen: The micro-foundations of routines in the M&A process. J. Bus. Res. 2015, 68, 1367–1381. [Google Scholar] [CrossRef]

- Haunschild, P.R.; Moreland, R.L.; Murrell, A.J. Sources of resistance to mergers between groups. J. Appl. Soc. Psychol. 1994, 24, 1150–1178. [Google Scholar] [CrossRef]

- Terry, D.J.; Callan, V.J.; Sartori, G. Employee adjustment to an organizational merger: Stress, coping and intergroup differences. Stress Med. 1996, 12, 105–122. [Google Scholar] [CrossRef]

- Veiga, J.; Lubatkin, M.; Calori, R.; Very, P. Research note measuring organizational culture clashes: A two-nation post-hoc analysis of a cultural compatibility index. Hum. Relat. 2000, 53, 539–557. [Google Scholar] [CrossRef]

- Seo, M.; Hill, N.S. Understanding the human side of merger and acquisition: An integrative framework. J. Appl. Behav. Sci. 2005, 41, 422–443. [Google Scholar] [CrossRef]

- Puranam, P.; Singh, H.; Zollo, M. Organizing for innovation: Managing the coordination-autonomy dilemma in technology acquisitions. Acad. Manag. J. 2006, 49, 263–280. [Google Scholar] [CrossRef]

- Zollo, M.; Meier, D. What is M&A performance? Acad. Manag. Perspect. 2008, 22, 55–77. [Google Scholar]

- Homburg, C.; Bucerius, M. A marketing perspective on mergers and acquisitions: How marketing integration affects postmerger performance. J. Mark. 2005, 69, 95–113. [Google Scholar] [CrossRef]

- Avram, D.O.; Kühne, S. Implementing responsible business behavior from a strategic management perspective: Developing a framework for Austrian SMEs. J. Bus. Ethics 2008, 82, 463–475. [Google Scholar] [CrossRef]

- Salvato, C.; Lassin, U.; Wiklund, J. Dynamics of external growth in SMEs: A process model of acquisition capabilities emergence. Schmalenbach Bus. Rev. 2007, 59, 282–305. [Google Scholar] [CrossRef]

- Dooley, L.; O’Sullivan, D. Managing within distributed innovation networks. Int. J. Innov. Manag. 2007, 11, 397–416. [Google Scholar] [CrossRef]

- Zaks, O.; Polowczyk, J.; Trąpczyński, P. Success factors of start-up acquisitions: Evidence from Israel. Entrep. Bus. Econ. Rev. 2018, 6, 201–216. [Google Scholar] [CrossRef]

- Avnimelech, G.; Schwartz, D. Structural changes in mature venture capital industry: Evidence from Israel. Innov. Manag. Policy Pract. 2009, 11, 60–73. [Google Scholar] [CrossRef]

- Dashti, Y.; Schwartz, D.; Pines, A. High technology entrepreneurs, their social networks and success in global markets: The case of Israelis in the US market. In Current Topics in Management; Rahim, A., Ed.; Transaction Publishers: Piscataway, NJ, USA, 2008; Volume 13, pp. 131–144. ISBN 978-0762301508. [Google Scholar]

- De Fontenay, C.; Carmel, E. Israel’s silicon wadi: The forces behind cluster formation. In Building High Tech Clusters: Silicon Valley and Beyond; Bresnahan, T., Gambardella, A., Eds.; Cambridge University Press: Cambridge, UK, 2004; pp. 40–77. ISBN 978-0521143486. [Google Scholar]

- Akerlof, G.A.; Shiller, R.J. Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism; Princeton University Press: Princeton, NI, USA; Oxford, UK, 2009; ISBN 978-0691145921. [Google Scholar]

- Kahneman, D.; Lovallo, D.; Sibony, O. Before you make that big decision. Harv. Bus. Rev. 2011, 89, 50–60. [Google Scholar] [PubMed]

- Thaler, R.H. From homo economicus to homo sapiens. J. Econ. Perspect. 2000, 14, 133–141. [Google Scholar] [CrossRef]

- Camerer, C.F.; Loewenstein, G. Behavioral Economics: Past, Present, Future. 2002. Available online: http://www.hss.caltech.edu/~camerer/ribe239.pdf (accessed on 30 March 2018).

- Arrow, K.J. Principals and Agents: The Structure of Business; Harvard Business School Press: Boston, MA, USA, 1985. [Google Scholar]

- Chrupała-Pniak, M.; Grabowski, D.; Sulimowska-Formowicz, M. Trust in Effective International Business Cooperation: Mediating Effect of Work Engagement. Entrep. Bus. Econ. Rev. 2017, 5, 27–50. [Google Scholar] [CrossRef]

- Inkpen, A.; Currall, S.C. The coevolution of trust, control, and learning in joint ventures. Org. Sci. 2004, 15, 586–599. [Google Scholar] [CrossRef]

- Krug, J.A.; Nigh, D. Executive perceptions in foreign and domestic acquisitions: An analysis of foreign ownership and its effect on executive fate. J. World Bus. 2001, 36, 85–105. [Google Scholar] [CrossRef]

- Chua, C.H.; Engeli, H.P.; Stahl, G. Creating a new identity and high performance culture at Novartis. In Mergers and Acquisitions: Managing Culture and Human Resources; Stahl, G.K., Mendenhall, M.E., Eds.; Stanford Business: Stanford, CA, USA, 2005; pp. 379–400. ISBN 9780804746618. [Google Scholar]

- Rousseau, D.M.; Sitkin, S.B.; Burt, R.S.; Camerer, C. Not so different after all: A cross-discipline view of trust. Acad. Manag. Rev. 1998, 23, 393–404. [Google Scholar] [CrossRef]

- Vanhala, M.; Heilmann, P.; Salminen, H. Organizational trust dimensions as antecedents of organizational commitment. Knowl. Proc. Manag. 2016, 23, 46–61. [Google Scholar] [CrossRef]

- Maguire, S.; Phillips, N. ‘Citibankers’ at Citigroup: A study of the loss of institutional trust after a merger. J. Manag. Stud. 2008, 45, 372–401. [Google Scholar] [CrossRef]

- Stahl, G.K.; Sitkin, S.B. Trust dynamics in acquisitions: The role of relationship history, interfirm distance, and acquirer’s integration approach. In Advances in Mergers and Acquisitions; Cooper, C.L., Finkelstein, S., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2010; pp. 51–82. ISBN 978-0-85724-465-9. [Google Scholar]

- Capron, L. The long-term performance of horizontal acquisitions. Strat. Manag. J. 1999, 20, 987–1018. [Google Scholar] [CrossRef]

- Very, P.; Lubatkin, M.; Calori, R.; Veiga, J. Relative Standing and the Performance of Recently Acquired European Firms. Strat. Manag. J. 1997, 18, 593–614. [Google Scholar] [CrossRef]

- Schoar, A. Effects of corporate diversification on productivity. J. Financ. 2002, 57, 2379–2403. [Google Scholar] [CrossRef]

- Ranft, A.L.; Lord, M.D. Acquiring new technologies and capabilities: A grounded model of acquisition implementation. Org. Sci. 2002, 13, 420–441. [Google Scholar] [CrossRef]

- Puranam, P.; Singh, H.; Zollo, M. The Inter-Temporal Tradeoff in Technology Grafting Acquisitions; Working Paper; London Business School: London, UK, 2002. [Google Scholar]

- Öberg, C. Network imitation to deal with sociocultural dilemmas in acquisitions of young, innovative firms. Thunderbird Int. Bus. Rev. 2013, 55, 387–403. [Google Scholar] [CrossRef]

- Graebner, M.E.; Eisenhardt, K.M.; Roundy, P.T. Success and failure in technology acquisitions: Lessons for buyers and sellers. Acad. Manag. Perspect. 2010, 24, 73–92. [Google Scholar] [CrossRef]

- Gomez, C.; Rosen, B. The leader-member exchange as a link between managerial trust and employee empowerment. Group Org. Manag. 2001, 26, 53–69. [Google Scholar] [CrossRef]

- Hurley, R.F. The Decision to Trust. Harv. Bus. Rev. 2006, 84, 55–62. [Google Scholar] [PubMed]

- Stanley, D.J.; Meyer, J.P.; Topolnytsky, L. Employee cynicism and resistance to organizational change. J. Bus. Psychol. 2005, 19, 429–459. [Google Scholar] [CrossRef]

- Van Dam, K. Employee attitudes toward job changes: An application and extension of Rusbult and Farrell’s investment model. J. Occup. Organ. Psychol. 2005, 78, 253–272. [Google Scholar] [CrossRef]

- Simons, T. Behavioral integrity: The perceived alignment between managers’ words and deeds as a research focus. Organ. Sci. 2002, 13, 18–35. [Google Scholar] [CrossRef]

- Creswell, J.W.; Clark, V.L.P.; Gutmann, M.L.; Hanson, W.E. Advanced mixed methods research design. In Handbook of Mixed Methods in Social & Behavioral Research; Tashakkori, A., Teddlie, C., Eds.; Sage: Thousand Oaks, CA, USA, 2003; pp. 209–240. [Google Scholar]

- Creswell, J.W. Mixed method research: Introduction and application. In Handbook of Educational Policy; Cijek, T., Ed.; Academic Press: San Diego, CA, USA, 1999; pp. 455–472. [Google Scholar]

- Ivankova, N.V.; Creswell, J.W.; Stick, S.L. Using Mixed-Methods Sequential Explanatory Design: From Theory to Practice. Field Methods 2006, 18, 3–20. [Google Scholar] [CrossRef]

- Creswell, J.W.; Clark, V.L.P. Designing and Conducting Mixed Methods Research; Sage: Thousand Oaks, CA, USA, 2007; ISBN 978-1412927918. [Google Scholar]

- Homburg, C.; Bucerius, M. Is speed of integration really a success factor in acquisitions and acquisitions? An analysis of the role of internal and external relatedness. Stratg. Manag. J. 2006, 27, 347–367. [Google Scholar] [CrossRef]

- Coff, R. How buyers cope with uncertainty when acquiring firms in knowledge-intensive industries: Caveat emptor. Organ. Sci. 1999, 10, 144–161. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of business economic performance: An examination of method convergence. J. Manag. 1987, 13, 109–122. [Google Scholar] [CrossRef]

- Graebner, M.E. Momentum and serendipity: How acquired leaders create value in the integration of technology firms. Stratg. Manag. J. 2004, 25, 751–777. [Google Scholar] [CrossRef]

- Ranft, A. Knowledge Preservation and Transfer During Post-Acquisition Integration. In Advances in Mergers and Acquisitions; Cooper, C., Finkelstein, S., Eds.; JAI: New York, NY, USA, 2006; Volume 5, pp. 51–67. ISBN 978-70-7623-1337-2. [Google Scholar]

- Oreg, S. Personality, context, and resistance to organizational change. Eur. J. Work Organ. Psychol. 2006. [Google Scholar] [CrossRef]

- Van Dam, K.; Oreg, S.; Schyns, B. Daily work contexts and resistance to organisational change: The role of leader–member exchange, development climate, and change process characteristics. Appl. Psychol. 2008, 57, 313–334. [Google Scholar] [CrossRef]

- Wanberg, C.R.; Banas, J.T. Predictors and outcomes of openness to changes in a reorganizing workplace. J. Appl. Psychol. 2000, 85, 132–142. [Google Scholar] [CrossRef] [PubMed]

- Schoenberg, R. Measuring the performance of corporate acquisitions: An empirical comparison of alternative metrics. Br. J. Manag. 2006, 17, 361–370. [Google Scholar] [CrossRef]

- Holt, D.T.; Armenakis, A.A.; Feild, H.S.; Harris, S.G. Readiness for organizational change: The systematic development of a scale. J. Appl. Behav. Sci. 2007, 43, 232–255. [Google Scholar] [CrossRef]

- Meyer, J.P.; Allen, N.J. Commitment in the Workplace: Theory, Research, and Application; Sage: Thousand Oaks, CA, USA, 1997; ISBN 978-0761901051. [Google Scholar]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Stratg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Cammann, C.; Fichman, M.J.; Klesh, J.R. Assessing the attitudes and perceptions of organizational members. In Assessing Organizational Change: A Guide to Methods, Measures, and Practices; John Wiley & Sons, Inc.: New York, NY, USA, 1983; pp. 71–138. [Google Scholar]

- Shkedi, A. Words of Meaning: Qualitative Research-Theory and Practice; Tel-Aviv University Ramot: Tel-Aviv, Israel, 2003; ISBN 9780471894841. (In Hebrew) [Google Scholar]

- Nikandrou, I.; Papalexandris, N.; Bourantas, D. Gaining Employee trust after acquisition. Empl. Relat. 2000, 22, 334–355. [Google Scholar] [CrossRef]

- Barkema, H.G.; Bell, J.H.J.; Pennings, J.M. Foreign entry, cultural barriers and learning. Stratg. Manag. J. 1996, 17, 151–166. [Google Scholar] [CrossRef]

- Almor, T. Conceptualizing Paths of Growth for Technology-Based Born-Global Firms Originating in a Small-Population Advanced Economy. Int. Stud. Manag. Org. 2013, 43, 56–78. [Google Scholar] [CrossRef]

- Zaheer, A.; Castañer, X.; Souder, D. Synergy sources, target autonomy, and integration in acquisitions. J. Manag. 2011, 39, 604–632. [Google Scholar] [CrossRef]

- Vaara, E.; Sarala, R.; Stahl, G.K.; Björkman, I. The impact of organizational and national cultural differences on social conflict and knowledge transfer in international acquisitions. J. Manag. Stud. 2012, 49, 1–27. [Google Scholar] [CrossRef]

- Colman, H.L.; Lunnan, R. Organizational identification and serendipitous value creation in post-acquisition integration. J. Manag. 2011, 37, 839–860. [Google Scholar] [CrossRef]

| Characteristics | # (N = 53) | % | |

|---|---|---|---|

| Number of employees | 5–50 | 24 | 45.3 |

| (in the acquired company)/size | 51–200 | 13 | 24.5 |

| 201− | 16 | 30.2 | |

| 0 | 25 | 47.2 | |

| Previous experience in M&A | 1 | 14 | 26.4 |

| 2+ | 14 | 26.4 | |

| Age (group) | 20–39 | 6 | 11.3 |

| 40–59 | 42 | 79.2 | |

| 60+ | 5 | 9.4 | |

| 1–4 | 16 | 30.2 | |

| Tenure (years) | 5–9 | 19 | 35.8 |

| 10− | 18 | 34 | |

| Time since the merger | −2 | 16 | 30.2 |

| announcements (years) | −4 less | 22 | 41.5 |

| 4+ more | 15 | 28.3 |

| Variable | Min | Max | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Retained autonomy (1) | 1 | 5 | 2.61 | 0.88 | |||||||

| Knowledge transfer1 (2) | 1 | 5 | 3.15 | 1.03 | 0.038 | ||||||

| Knowledge transfer2 (3) | 1 | 5 | 3.44 | 1.03 | 0.002 | 0.366 ** | |||||

| Trust (4) | 1.33 | 5 | 3.27 | 0.88 | 0.267 * | 0.184 | 0.445 ** | ||||

| Readiness for change (5) | 1.8 | 4.8 | 3.75 | 0.68 | 0.188 | 0.144 | 0.285 * | 0.516 ** | |||

| Performance (6) | 1 | 5 | 3 | 0.95 | 0.058 | 0.362 ** | 0.204 | 0.524 ** | 0.245 * | 0.398 ** | |

| Satisfaction with acquisition (7) | 1 | 5 | 2.99 | 1.12 | 0.15 | 0.382 ** | 0.426 ** | 0.704 ** | 0.327 ** | 0.519 ** | 0.834 ** |

| Variable | B | SE B | β | t | ||

|---|---|---|---|---|---|---|

| Independent variables | ||||||

| Retained autonomy (H1) | −0.31 | 0.18 | −0.29 | −1.77 | ||

| Trust (H2) | 0.74 | 0.25 | 0.65 | *** | 2.94 | |

| Control variables | ||||||

| Knowledge transfer1 | 0.4 | 0.15 | 0.42 | ** | 2.66 | |

| Knowledge transfer2 | −0.07 | 0.14 | −0.07 | −0.49 | ||

| Readiness for change | −0.28 | 0.24 | −0.20 | −1.14 | ||

| Intention to leave | −0.40 | 0.12 | −0.47 | *** | −3.39 | |

| Gender | −0.78 | 0.48 | −0.22 | −1.62 | ||

| Education level | 0.31 | 0.29 | 0.15 | 1.06 | ||

| No. of employees | 0.08 | 0.3 | 0.04 | 0.28 | ||

| Previous merger experience | −0.30 | 0.25 | −0.15 | −1.19 | ||

| Time from notice to merger | −0.45 | 0.3 | −0.24 | −1.52 | ||

| R2 | 0.69 | |||||

| F | 3.74 ** | |||||

| Variable | B | SE B | β | t | ||

|---|---|---|---|---|---|---|

| Independent variables | ||||||

| Retained autonomy (H1) | −0.20 | 0.18 | −0.16 | −1.12 | ||

| Trust (H2) | 0.86 | 0.26 | 0.65 | ** | 3.34 | |

| Control variables | ||||||

| Knowledge transfer1 | 0.32 | 0.15 | 0.29 | * | 2.11 | |

| Knowledge transfer2 | 0.11 | 0.14 | 0.11 | 0.8 | ||

| Readiness and commitment to change | −0.35 | 0.25 | −0.21 | −1.40 | ||

| Intention to leave | −0.33 | 0.12 | −0.34 | ** | −2.76 | |

| Gender | −0.25 | 0.49 | −0.06 | −0.52 | ||

| Education level | 0.39 | 0.29 | 0.17 | 1.34 | ||

| No. of employs | −0.28 | 0.3 | −0.13 | −0.93 | ||

| Previous merger experience | −0.13 | 0.25 | −0.06 | −0.50 | ||

| Time from notice to merger | −0.26 | 0.3 | −0.12 | −0.86 | ||

| R2 | 0.75 | |||||

| F | 5.25 *** | |||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trąpczyński, P.; Zaks, O.; Polowczyk, J. The Effect of Trust on Acquisition Success: The Case of Israeli Start-Up M&A. Sustainability 2018, 10, 2499. https://doi.org/10.3390/su10072499

Trąpczyński P, Zaks O, Polowczyk J. The Effect of Trust on Acquisition Success: The Case of Israeli Start-Up M&A. Sustainability. 2018; 10(7):2499. https://doi.org/10.3390/su10072499

Chicago/Turabian StyleTrąpczyński, Piotr, Ofer Zaks, and Jan Polowczyk. 2018. "The Effect of Trust on Acquisition Success: The Case of Israeli Start-Up M&A" Sustainability 10, no. 7: 2499. https://doi.org/10.3390/su10072499

APA StyleTrąpczyński, P., Zaks, O., & Polowczyk, J. (2018). The Effect of Trust on Acquisition Success: The Case of Israeli Start-Up M&A. Sustainability, 10(7), 2499. https://doi.org/10.3390/su10072499