The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms

Abstract

1. Introduction

2. Institutional Theory

3. Literature Review: Carbon Emissions and Firm Financial Performance

3.1. Policies Affecting Carbon Emissions in South Africa.

3.2. Empirical Study Results and the Development of the Hypothesis

4. Research Methodology

4.1. Sample

4.2. Dependent Variables

4.3. Independent Variables

4.4. Control Variables

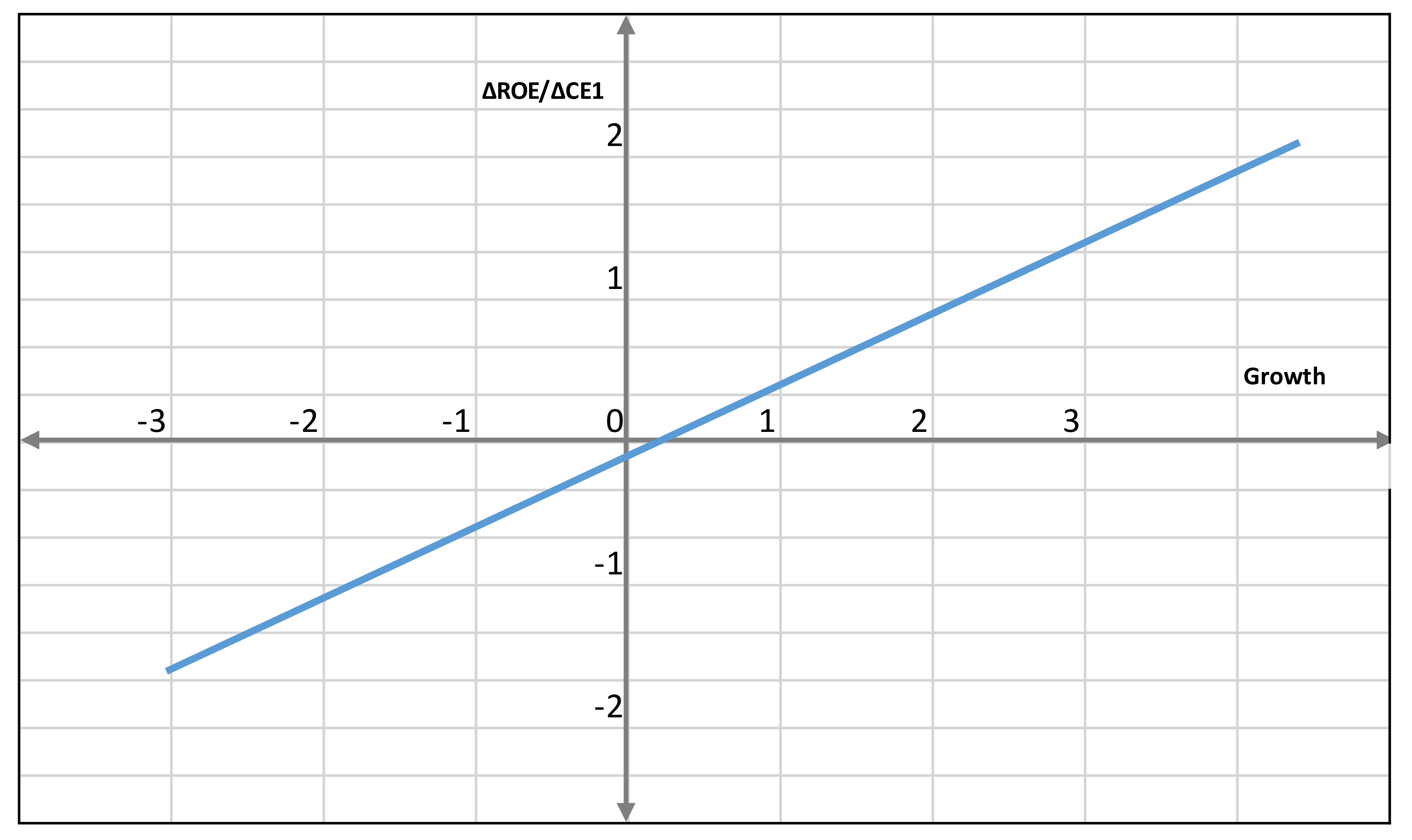

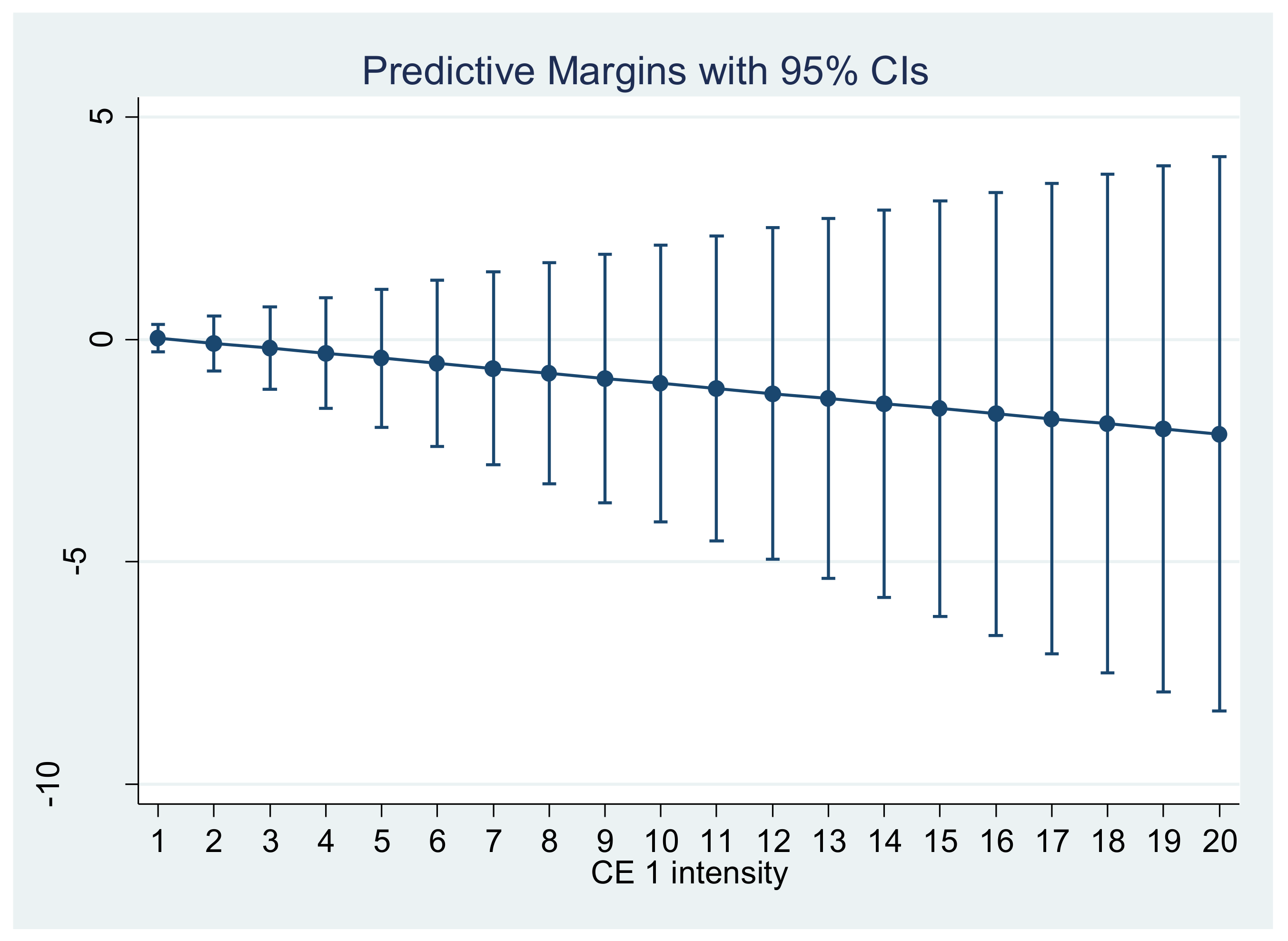

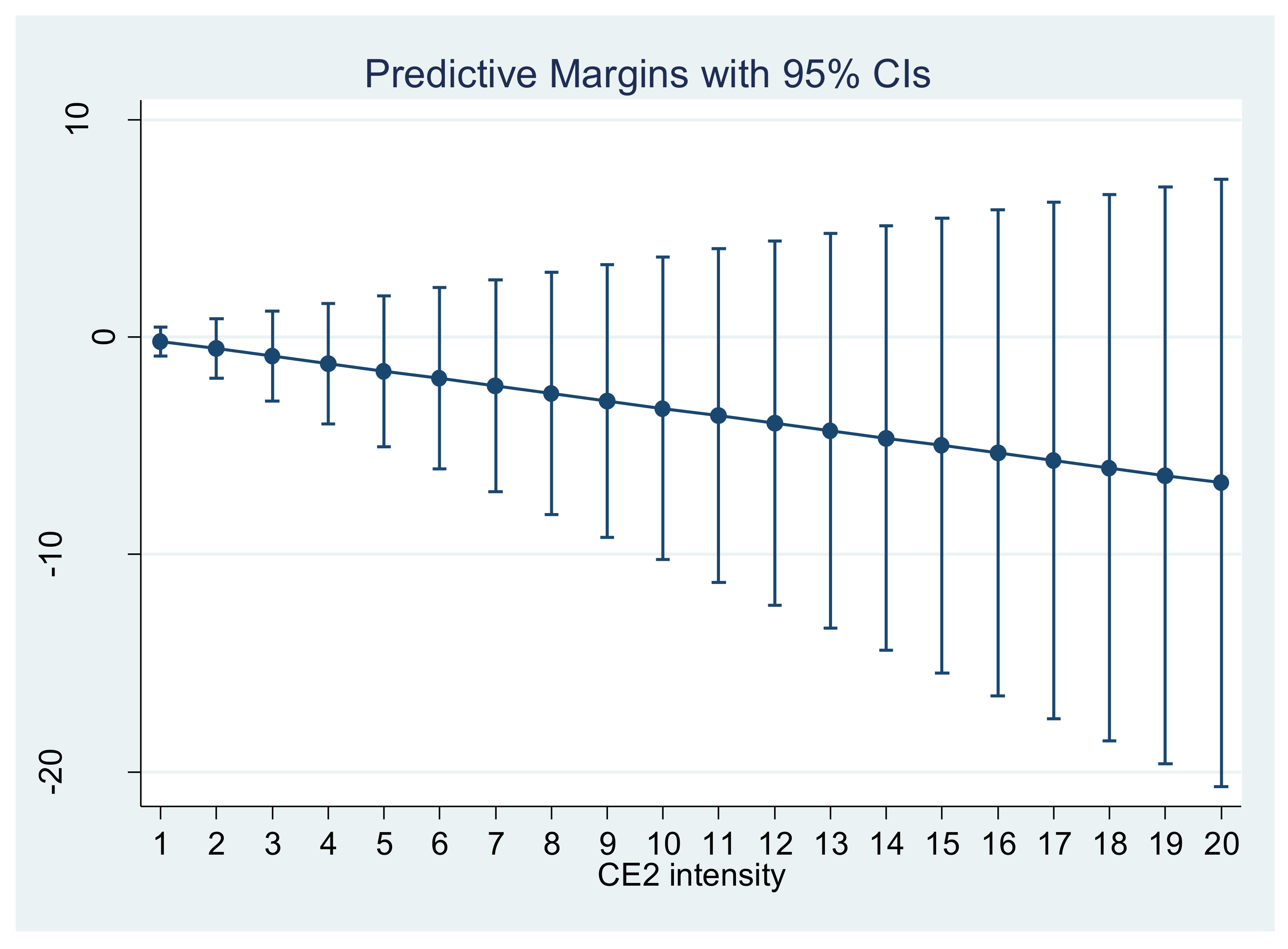

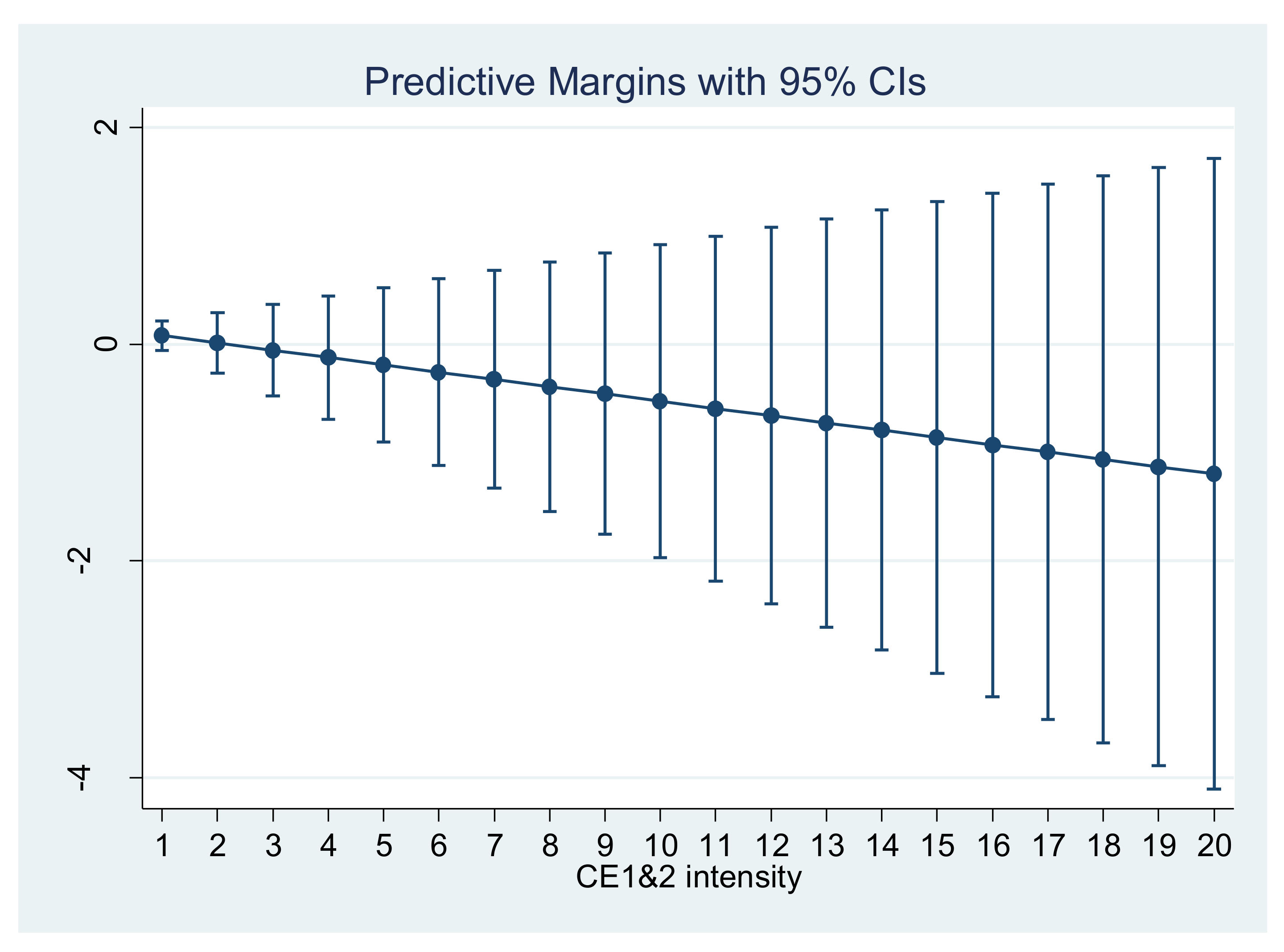

5. Results and Discussion

5.1. Discussion

5.2. Implications for Policy Makers and Business Practice

5.3. Limitations of the Study and Future Research

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

References

- World Resources Institute. The Greenhouse Gas Protocol Initiative: A Corporate Accounting and Reporting Standard; WRI Publication: Washington, DC, USA, 2001. [Google Scholar]

- Salahuddin, M.; Alam, K.; Ozturk, I. The effects of Internet usage and economic growth on CO2 emissions in OECD countries: A panel investigation. Renew. Sustain. Energy Rev. 2016, 62, 1226–1235. [Google Scholar] [CrossRef]

- Wang, M.; Liu, J.; Chan, H.; Choi, T.; Yue, X. Effects of carbon tariffs trading policy on duopoly market entry decisions and price competition: Insights from textile firms of developing countries. Int. J. Prod. Econ. 2016, 181, 470–484. [Google Scholar] [CrossRef]

- Narayan, K.; Sharma, S.S. Is carbon emissions trading profitable? Econ. Model. 2015, 47, 84–92. [Google Scholar] [CrossRef]

- Philip, D.; Shi, Y. Optimal hedging in carbon emission markets using Markov regime switching models. J. Int. Financ. Mark. Inst. Money 2016, 43, 1–15. [Google Scholar] [CrossRef]

- National Business Initiative. CDP South Africa 100 Climate Change Report; CDP South Africa Report; National Business Initiative: Sandton, South Africa, 2009. [Google Scholar]

- Department of Environmental Affairs. Greenhouse Gas Inventory for South Africa 2000–2010; Department of Environmental Affairs: Pretoria, South Africa, 2013.

- IndexMundi. South Africa—CO2 Emissions: CO2 Emissions from Gaseous Fuel Consumption (kt). Available online: http://www.indexmundi.com/facts/south-africa/co2-emissions (accessed on 16 October 2016).

- Copans, G. SA’s Carbon Emissions a Cause for Concern. Available online: http://www.engineeringnews.co.za/article/sa039s-carbon-emissions-a-cause-for-concern-2008-01-25 (accessed on 16 October 2016).

- De Villiers, C.; van Staden, C.J. Where firms choose to disclose voluntary environmental information. J. Account. Public Policy 2011, 30, 504–525. [Google Scholar] [CrossRef]

- Visser, W.A.M.T. Sustainability reporting in South Africa. Corp. Environ. Strateg. 2002, 9, 79–85. [Google Scholar]

- Scott, W.R. Institutional theory. In Encyclopedia of Social Theory; Sage: Thousand Oaks, CA, USA, 2004; pp. 408–414. [Google Scholar]

- Yigitcanlar, T.; Dur, F.; Dizdaroglu, D. Towards prosperous sustainable cities: A multiscalar urban sustainability assessment approach. Habitat. Int. 2015, 45, 36–46. [Google Scholar] [CrossRef]

- Damert, M.; Paul, A.; Baumgartner, R.J. Exploring the determinants and long-term performance outcomes of corporate carbon strategies. J. Clean. Prod. 2017, 160, 123–138. [Google Scholar] [CrossRef]

- Gonenc, H.; Scholtens, B. Environmental and financial performance of fossil fuel firms: A closer inspection of their interaction. Ecol. Econ. 2017, 132, 307–328. [Google Scholar] [CrossRef]

- Iwata, H.; Okada, K. How does environmental performance affect financial performance? Evidence from Japanese manufacturing firms. Ecol. Econ. 2011, 70, 1691–1700. [Google Scholar]

- Scott, W.R. Institutions and Organizations; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Ganda, F.; Ngwakwe, C.C. Strategic Approaches towards a Low Carbon Economy. Environ. Econ. 2013, 4, 46–55. [Google Scholar]

- Chan, H.S.; Li, H.; Zhang, F. Firm competitiveness and the European Union emissions trading scheme. Energy Policy 2013, 63, 1056–1064. [Google Scholar] [CrossRef]

- Cucchiella, F.; Gastaldi, M.; Miliacca, M. The management of greenhouse gas emissions and its effects on firm performance. J. Clean. Prod. 2017, 167, 1387–1400. [Google Scholar] [CrossRef]

- Lucas, M.T.; Noordewier, T.G. Environmental management practices and firm financial performance: The moderating effect of industry pollution-related factors. Int. J. Prod. Econ. 2016, 175, 24–34. [Google Scholar] [CrossRef]

- Ulvila, J.W.; Snider, W.D. Negotiation of international oil tanker standards: An application of multiattribute value theory. Oper. Res. 1980, 28, 81–96. [Google Scholar] [CrossRef]

- De Mare, G.; Granata, M.F.; Nesticò, A. Weak and strong compensation for the prioritization of public investments: multidimensional analysis for pools. Sustainability 2015, 7, 16022–16038. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Segura, L.; Martínez-Ferrero, J. Carbon emission reduction: The impact on the financial and operational performance of international companies. J. Clean. Prod. 2015, 103, 149–159. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, Z. Inter-firm collaborations on carbon emission reduction within industrial chains in China: Practices, drivers and effects on firms’ performances. Energy Econ. 2014, 42, 115–131. [Google Scholar] [CrossRef]

- Bruton, G.D.; Ahlstrom, D.; Li, H.L. Institutional theory and entrepreneurship: Where are we now and where do we need to move in the future? Entrep. Theory Pract. 2010, 34, 421–440. [Google Scholar] [CrossRef]

- Ganda, F. The factors which motivate carbon emissions in the long-term in South Africa: Evidence from co-integration and VEC model. Int. J. Sustain. Econ. 2018, 10, 99–122. [Google Scholar] [CrossRef]

- Fin24. Carbon Tax Laggards May Pay Dearly, Cautions Environmental Firm. Available online: https://www.fin24.com/Economy/carbon-tax-laggards-may-pay-dearly-cautions-environmental-firm-20170112 (accessed on 15 February 2018).

- Fin24. Carbon Offsets Will Make SA Economy Greener—Treasury. Available online: https://www.fin24.com/Economy/carbon-offsets-will-make-sa-economy-greener-treasury-20160620 (accessed on 15 February 2018).

- Kopidou, D.; Tsakanikas, A.; Diakoulaki, D. Common trends and drivers of CO2 emissions and employment: A decomposition analysis in the industrial sector of selected European Union countries. J. Clean. Prod. 2016, 112, 4159–4172. [Google Scholar] [CrossRef]

- Hayami, H.; Nakamura, M.; Nakamura, A.O. Economic performance and supply chains: The impact of upstream firms’ waste output on downstream firms’ performance in Japan. Int. J. Prod. Econ. 2015, 160, 47–65. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Lee, K.; Min, B.; Yook, K. The impacts of carbon emissions and environmental research and development (R&D) investment on firm performance. Int. J. Prod. Econ. 2015, 167, 1–11. [Google Scholar]

- Nishitani, K.; Kaneko, S.; Fujii, H.; Komatsu, S. Effects of the reduction of pollution emissions on the economic performance of firms: An empirical analysis focusing on demand and productivity. J. Clean. Prod. 2011, 19, 1956–1964. [Google Scholar] [CrossRef]

- Yu, Y.; Wang, D.D.; Li, S.; Shi, Q. Assessment of U.S. firm-level climate change performance and strategy. Energy Policy 2016, 92, 432–443. [Google Scholar] [CrossRef]

- Dragomir, V.D. The disclosure of industrial greenhouse gas emissions: A critical assessment of corporate sustainability reports. J. Clean. Prod. 2012, 29, 222–237. [Google Scholar] [CrossRef]

- Mao, Z.; Zhang, S.; Li, X. Low carbon supply chain firm integration and firm performance in China. J. Clean. Prod. 2017, 153, 354–361. [Google Scholar] [CrossRef]

- Rokhmawati, A.; Sathye, M.; Sathye, S. The effect of GHG emission, environmental performance, and social performance on financial performance of listed manufacturing firms in Indonesia. Procedia Soc. Behav. Sci. 2015, 211, 461–470. [Google Scholar] [CrossRef]

- Jia, J.; Xu, J.; Fan, Y. The impact of verified emissions announcements on the European Union Emissions Trading Scheme: A bilaterally modified dummy variable modelling analysis. Appl. Energy 2016, 173, 567–577. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Collins, A.; Hunt, L.C.; Vergos, K. Voluntary disclosure, greenhouse gas emissions and business performance: Assessing the first decade of reporting. Br. Account. Rev. 2018, 50, 48–59. [Google Scholar] [CrossRef]

- Misani, N.; Pogutz, S. Unraveling the effects of environmental outcomes and processes on financial performance: A non-linear approach. Ecol. Econ. 2015, 109, 150–160. [Google Scholar] [CrossRef]

- Mani, M.; Wheeler, D. In search of pollution havens? Dirty industry in the world economy, 1960 to 1995. J. Environ. Dev. 1998, 7, 215–247. [Google Scholar]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Wagner, M. How to reconcile environmental and economic performance to improve corporate sustainability: Corporate environmental strategies in the European paper industry. J. Environ. Manag. 2005, 76, 105–118. [Google Scholar] [CrossRef] [PubMed]

- Montabon, F.; Sroufe, R.; Narasimhan, R. An examination of corporate reporting, environmental management practices and firm performance. J. Oper. Manag. 2007, 25, 998–1014. [Google Scholar] [CrossRef]

- Damodaran, A. Return on Capital (ROC), Return on Invested Capital (ROIC) and Return on Equity (ROE): Measurement and Implications. Available online: http://people.stern.nyu.edu/adamodar/pdfiles/papers/returnmeasures.pdf (accessed on 21 May 2018).

- Global Reporting. GRI 305: Emissions. Available online: https://www.globalreporting.org/standards/media/1012/gri-305-emissions-2016.pdf (accessed on 10 February 2018).

- Rokhmawati, A.; Gunardi, A.; Rossi, M. How Powerful is Your Customers’ Reaction to Carbon Performance? Linking Carbon and Firm Financial Performance. Int. J. Energy Econ. Policy 2017, 7, 85–95. [Google Scholar]

- Helfert, E.R. Financial Analysis: Tools and Techniques, A Guide for Managers; McGraw-Hill: New York, NY, USA, 2001. [Google Scholar]

- Acquaah, M. Corporate management, industry competition and the sustainability of firm abnormal profitability. J. Manag. Gov. 2003, 7, 57–85. [Google Scholar] [CrossRef]

- Shaheen, S.; Malik, Q.A. Impact of Capital Intensity, Size of Firm and Profitability on Debt Financing in Textile Industry of Pakistan. Interdiscip. J. Contemp. Res. Bus. 2012, 3, 1061–1066. [Google Scholar]

- Department of Energy. Opportunities in South Africa. Available online: http://www.energy.gov.co.za/files/esources/kyoto/kyoto_sa.html (accessed on 12 June 2016).

- The Africa Report. RE: Investors Excited about SA. Available online: http://www.greenbusinessguide.co.za/re-investors-excited-sa/ (accessed on 19 June 2014).

| Variable | Obs | Mean | Median | Std. Dev | Min | Max |

|---|---|---|---|---|---|---|

| ROE | 63 | 0.1398655 | 0.1469 | 0.2240799 | −0.77478 | 0.8339 |

| ROS | 63 | −0.0033959 | 0.0657 | 1.113034 | −6.689 | 4.055 |

| ROI | 63 | 0.0941062 | 0.099 | 0.1845096 | −0.7614 | 0.5361 |

| CE1 intensity | 63 | 0.03222 | 0.002259 | 0.1354546 | 0.000000655 | 1.040447 |

| CE2 intensity | 63 | 0.060019 | 0.01419 | 0.2397786 | 0.0000319 | 1.88514 |

| CE 1&2 intensity | 63 | 0.0983333 | 0.019813 | 0.3197174 | 0.0000326 | 1.99092 |

| Growth | 63 | 0.0563492 | 0.04 | 0.1427642 | −0.27 | 0.42 |

| Firm size | 63 | 15.59418 | 16.84992 | 4.785359 | 0 | 19.2765 |

| Leverage | 63 | 0.6075706 | 0.5197 | 0.2597021 | 0.1016 | 1.2444 |

| Capital Intensity | 63 | −1.788605 | 1.1847 | 49.28138 | −306.4119 | 120.1994 |

| ROE | ROS | ROI | CE1 Intensity | CE2 Intensity | CE 1&2 Intensity | Growth | Firm Size | Leverage | Capital Intensity | |

|---|---|---|---|---|---|---|---|---|---|---|

| ROE | 1 | |||||||||

| ROS | 0.0908 | 1 | ||||||||

| ROI | 0.9451 | 0.2072 | 1 | |||||||

| CE1 intensity | 0.0235 | 0.0145 | −0.0389 | 1 | ||||||

| CE2 intensity | −0.0649 | −0.0010 | −0.0744 | 0.1661 | 1 | |||||

| CE 1&2 intensity | −0.0314 | 0.0064 | −0.0746 | 0.6848 | 0.8310 | 1 | ||||

| Growth | 0.1247 | 0.0757 | 0.1032 | −0.1018 | −0.2179 | −0.2130 | 1 | |||

| Firm size | 0.0033 | 0.4790 | 0.0359 | 0.0630 | 0.0930 | 0.0985 | 0.0676 | 1 | ||

| Leverage | 0.3889 | −0.3012 | 0.3216 | 0.1199 | 0.0428 | 0.1026 | 0.2160 | −0.3367 | 1 | |

| Capital Intensity | −0.0515 | 0.7281 | 0.0177 | 0.0148 | 0.0150 | 0.0186 | 0.1135 | 0.4729 | −0.2173 | 1 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1)—CE1 intensity | −4.559765 (0.035) | −3.364527 (0.013) | 1.59665 (0.813) |

| Firm Size | 0.016543 (0.007) | 0.0114228 (0.004) | 0.0286535 (0.576) |

| Leverage | 0.3039198 (0.036) | 0.1659243 (0.098) | −1.332425 (0.160) |

| Growth | −0.3530773 (0.305) | −0.1439686 (0.462) | 0.6853551 (0.432) |

| Capital Intensity | −0.0003708 (0.051) | −0.0000946 (0.484) | 0.0135959 (0.018) |

| Constant | −0.1651991 (0.212) | −0.0817143 (0.363) | 0.5076284 (0.684) |

| R2 | 0.3067 | 0.2752 | 0.6451 |

| No. of firms | 39 | 39 | 39 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 2)—CE2 intensity | 0.2160448 (0.727) | 0.0992573 (0.801) | −0.7468781 (0.480) |

| Firm Size | 0.012386 (0.082) | 0.008512 (0.060) | 0.0318552 (0.538) |

| Leverage | 0.2203818 (0.214) | 0.1064901 (0.372) | −1.278556 (0.169) |

| Growth | −0.2478244 (0.541) | −0.0704659 (0.773) | 0.602076 (0.481) |

| Capital Intensity | −0.000356 (0.063) | −0.0000854 (0.499) | 0.0135707 (0.019) |

| Constant | −0.0918893 (0.570) | −0.0297888 (0.781) | 0.457769 (0.713) |

| R2 | 0.1957 | 0.1550 | 0.6454 |

| No. of firms | 39 | 39 | 39 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1&2)—CE 1&2 intensity | −0.1853604 (0.740) | −0.1815578 (0.661) | −0.4678017 (0.6210) |

| Firm Size | 0.0135787 (0.058) | 0.0093879 (0.040) | 0.0315041 (0.543) |

| Leverage | 0.2381829 (0.179) | −0.0938779 (0.313) | −1.281019 (0.171) |

| Growth | −0.2796603 (0.485) | -0.0938779 (0.694) | 0.6110966 (0.478) |

| Capital Intensity | −0.0003683 (0.061) | −0.0000941 (0.474) | 0.0135783 (0.019) |

| Constant | −0.1090208 (0.499) | −0.0425199 (0.689) | 0.4610977 (0.712) |

| R2 | 0.1956 | 0.1586 | 0.6452 |

| No. of firms | 39 | 39 | 39 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1)—CE1 intensity | 0.0786266 (0.684) | −0.022563 (0.897) | −0.119916 (0.652) |

| Firm Size | −0.0304423 (0.607) | −0.0137924 (0.790) | −0.0136718 (0.873) |

| Leverage | 0.4508451 (0.220) | 0.3807736 (0.244) | 0.8803441 (0.153) |

| Growth | −0.0988409 (0.821) | −0.1874485 (0.638) | −0.4806717 (0.539) |

| Capital Intensity | 0.0267212 (0.534) | 0.033457 (0.395) | 0.0943615 (0.202) |

| Constant | 0.2551143 (0.799) | −0.0196402 (0.982) | −0.3945408 (0.793) |

| R2 | 0.1516 | 0.1317 | 0.2563 |

| No. of firms | 24 | 24 | 24 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 2)—CE2 intensity | −0.0441069 (0.555) | −0.0466677 (0.495) | −0.1034459 (0.352) |

| Firm Size | −0.0343324 (0.546) | −0.012617 (0.786) | −0.0075691 (0.924) |

| Leverage | 0.5319566 (0.089) | 0.3939161 (0.155) | 0.8614376 (0.126) |

| Growth | −0.1265455 (0.780) | −0.2058833 (0.618) | −0.1034459 (0.526) |

| Capital Intensity | 0.023246 8(0.579) | 0.0329199 (0.395) | 0.0952456 (0.205) |

| Constant | 0.2994132 (0.763) | −0.0409776 (0.960) | −0.4869225 (0.739) |

| R2 | 0.1525 | 0.1373 | 0.2626 |

| No. of firms | 24 | 24 | 24 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1&2)—CE1&2 intensity | −0.0176042 (0.842) | −0.0433976 (0.583) | −0.1141394 (0.346) |

| Firm Size | −0.0357667 (0.545) | −0.016091 (0.745) | −0.0166867 (0.839) |

| Leverage | 0.5321782 (0.175) | 0.4325626 (0.208) | −0.9749255 (0.137) |

| Growth | −0.1171681 (0.800) | −0.2103694 (0.617) | −0.534725 (0.514) |

| Capital Intensity | 0.0231885 (0.578) | 0.031171 (0.417) | −0.0166867 (0.203) |

| Constant | 0.3221392 (0.748) | 0.0060231 (0.994) | −0.0166867 (0.804) |

| R2 | 0.1491 | 0.1381 | 0.2684 |

| No. of firms | 24 | 24 | 24 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1)—CE1 intensity | −0.0615268 (0.512) | −0.1330261 (0.033) | 0.113846 (0.482) |

| Firm Size | 0.0079617 (0.108) | −0.0062387 (0.09) | 0.0313019 (0.541) |

| Leverage | 0.3780117 (0.033) | 0.2809958 (0.06) | −0.533962 (0.424) |

| Growth | 0.0300078 (0.925) | −0.0083176 (0.976) | 0.1785636 (0.805) |

| Capital Intensity | −0.0001745 (0.432) | 0.0001097 (0.5) | 0.0143316 (0.008) |

| Constant | −0.2139797 (0.173) | −0.1689555 (0.196) | −0.1551998 (0.887) |

| R2 | 0.1744 | 0.1366 | 0.5659 |

| No. of firms | 63 | 63 | 63 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 2)—CE2 intensity | −0.0939821 (0.160) | −0.0858677 (0.128) | −0.0680477 (0.584) |

| Firm Size | 0.0084872 (0.097) | 0.0064236 (0.095) | 0.0322914 (0.530) |

| Leverage | 0.3849244 (0.03) | 0.2792201 (0.063) | −0.5122709 (0.440) |

| Growth | −0.0022981 (0.995) | −0.0264655 (0.928) | 0.1317291 (0.861) |

| Capital Intensity | −0.0001758 (0.429) | 0.000106 (0.511) | 0.014336 (0.008) |

| Constant | −0.2208982 (0.160) | −0.1688753 (0.199) | −0.1734096 (0.874) |

| R2 | 0.1824 | 0.1390 | 0.5659 |

| No. of firms | 63 | 63 | 63 |

| ROE | ROI | ROS | |

|---|---|---|---|

| Carbon Emission Intensity (Scope 1&2)—CE1&2 intensity | −0.0668461 (0.259) | −0.0811846 (0.046) | −0.0076453 (0.944) |

| Firm Size | 0.00857 (0.104) | 0.0067534 (0.087) | 0.0318362 (0.536) |

| Leverage | 0.3903042 (0.033) | 0.2897833 (0.057) | −0.5198218 (0.441) |

| Growth | −0.0022392 (0.995) | −0.0388525 (0.895) | 0.156984 (0.837) |

| Capital Intensity | −0.0001722 (0.439) | 0.0001105 (0.498) | 0.0143359 (0.008) |

| Constant | −0.2245233 (0.164) | −0.176902 (0.188) | −0.16648 (0.897) |

| R2 | 0.1813 | 0.1454 | 0.5657 |

| No. of firms | 63 | 63 | 63 |

| ROE | ROI | ROS | |

|---|---|---|---|

| Carbon Emission Intensity (Scope 1)—CE1 intensity | −0.1132676 (0.470) | −0.1625311 (0.218) | 0.0323203 (0.858) |

| Firm Size | 0.0084744 (0.097) | 0.0065311 (0.083) | 0.0321098 (0.535) |

| Leverage | 0.3751932 (0.033) | 0.2793885 (0.061) | −0.5384029 (0.423) |

| Growth | −0.0324227 (0.926) | −0.0439184 (0.885) | 0.0801947 (0.918) |

| Capital Intensity | −0.0001778 (0.438) | 0.0001078 (0.512) | 0.0143264 (0.008) |

| Carbon Emission Intensity (Scope 1) × Growth | 4.155616 (0.471) | 2.369727 (0.645) | 6.547815 (0.263) |

| Constant | −0.2147446 (0.172) | −0.1693917 (0.167) | −0.1564051 (0.887) |

| R2 | 0.1821 | 0.1403 | 0.5667 |

| No. of firms | 63 | 63 | 63 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 2)—CE2 intensity | −0.34294 (0.331) | −0.4226301 (0.213) | −1.267815 (0.159) |

| Firm Size | 0.0091458 (0.097) | 0.0073145 (0.075) | 0.0354653 (0.491) |

| Leverage | 0.3864795 (0.030) | 0.2813237 (0.059) | −0.5047765 (0.444) |

| Growth | 0.0264677 (0.934) | 0.0124456 (0.964) | 0.2703561 (0.707) |

| Capital Intensity | −0.0002028 (0.323) | 0.0000694 (0.616) | 0.0142058 (0.009) |

| Carbon Emission Intensity (Scope 2) × Growth | −1.38156 (0.415) | −1.86882 (0.262) | −6.657958 (0.150) |

| Constant | −0.2242765 (0.160) | −0.1734451 (0.188) | −0.1896902 (0.862) |

| R2 | 0.1884 | 0.1551 | 0.5715 |

| No. of firms | 63 | 63 | 63 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROE | ROI | ROS | |

| Carbon Emission Intensity (Scope 1&2)—CE1&2 intensity | −0.0671052 (0.362) | −0.1115011 (0.065) | −0.0271996 (0.868) |

| Firm Size | 0.0085705 (0.107) | 0.0068055 (0.087) | 0.0318698 (0.539) |

| Leverage | 0.3903242 (0.035) | 0.2921321 (0.060) | −0.5183068 (0.447) |

| Growth | −0.002095 (0.995) | −0.0219841 (0.941) | 0.1678642 (0.827) |

| Capital Intensity | −0.0001722 (0.442) | 0.0001069 (0.511) | 0.0143336 (0.008) |

| Carbon Emission Intensity (Scope 1&2) × Growth | −0.0025607 (0.993) | −0.2996616 (0.214) | −0.1932834 (0.781) |

| Constant | −0.2245383 (0.169) | −0.1786522 (0.187) | −0.1676089 (0.879) |

| R2 | 0.1813 | 0.1486 | 0.5658 |

| No. of firms | 63 | 63 | 63 |

| Industry | Type of Emissions | Financial Performance Relationship | ||

|---|---|---|---|---|

| ROE | ROI | ROS | ||

| Clean | Scope 1 | Negative | Negative | Positive |

| Scope 2 | Positive | Positive | Negative | |

| Scope 1&2 | Negative | Negative | Negative | |

| Dirty | Scope 1 | Positive | Negative | Negative |

| Scope 2 | Negative | Negative | Negative | |

| Scope 1&2 | Negative | Negative | Negative | |

| Combined | Scope 1 | Negative | Negative | Positive |

| Scope 2 | Negative | Negative | Negative | |

| Scope 1&2 | Negative | Negative | Negative | |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ganda, F.; Milondzo, K.S. The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms. Sustainability 2018, 10, 2398. https://doi.org/10.3390/su10072398

Ganda F, Milondzo KS. The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms. Sustainability. 2018; 10(7):2398. https://doi.org/10.3390/su10072398

Chicago/Turabian StyleGanda, Fortune, and Khazamula Samson Milondzo. 2018. "The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms" Sustainability 10, no. 7: 2398. https://doi.org/10.3390/su10072398

APA StyleGanda, F., & Milondzo, K. S. (2018). The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms. Sustainability, 10(7), 2398. https://doi.org/10.3390/su10072398