1. Introduction

Over the last few decades, economic growth and globalization have made a significant impact on natural resources. Resources held in common, such as oceans, rivers, air, and parklands, are subject to massive degradation [

1]. These “open access” or “common pool resources” phenomena are explained by the tragedy of the commons [

2]. From an economic perspective, the internalization of external costs through market mechanisms and incentive systems is viewed as a solution to this problem [

3]. Take, for example, the Kyoto Protocol, which was devised as an attempt to have industrialized countries commit to stabilizing greenhouse emissions by punishing parties that exceed the assigned amount of emissions [

4]. Environmental taxes can help to manage environmental problems by internalizing environmental costs and creating economic incentives for the public and businesses to promote ecologically sustainable activities [

5].

Decision makers concerned by the use and management of open access resources are commonly organized as a team, defined as a collection of specialized agents whose efficiency as a group is greater than as individuals [

6]. Understanding and developing effective teams is a challenging issue [

7], because teamwork contributes substantially to organizational success [

7], especially when firms are also concerned about sustainability. However, team production commonly faces the problem of measuring individual productivity as a condition to implement incentives to achieve an efficient allocation of individual resources. In fact, when individual productivities cannot be observed or measured, compensation rules based on the output value lead to inefficient outcomes owing to “free rider” and moral hazard problems [

8].

From an economic viewpoint, the attempt to minimize this inefficiency leads agents to search for and implement different types of organizations [

9] or to implement incentive systems and optimal contracts [

8]. In this paper, we focus on the implementation of an “up-front pay” framework as an additional mechanism to improve efficiency and even sustainability if team production is linked to environmental or common pool resources issues.

In this context, studies in behavioral economics provide support for up-front pay as a solution that can overcome the inefficiencies in teamwork. In general, subjects have a higher tendency to continue an endeavor once an investment in money, effort, or time has been made [

10], because subjects feel that “they have invested too much to quit” [

11], and they have a greater aversion to losses than to incentives from gains [

12]. There is some relevant research in the public goods and environmental economics fields related to the impact of up-front pay and team efficiency. For example, a hierarchical solution was proposed, by which team members commit to the public good by paying a deposit to an authority prior to the contribution [

13]. These parameters suggest that an up-front pay solution might improve efficiency and sustainability in team production.

The effect of up-front pay has received attention from psychologists and behavioral researchers. When players are forced to make an initial payment they expect others to avoid strategies that always result in losses, even when such strategies are more profitable [

14]. This selection principle makes sense under the assumption that subjects are more concerned about losing a given amount of wealth than gaining it [

15]. Team members are prone to taking decisions to recoup sunk costs rather than ignoring them [

10,

16,

17]. Given that teams are the basic unit of performance for most organizations [

18], we conclude that organizations formed by inefficient teams are not sustainable. In other words, team efficiency is a sufficient condition for an organization to be sustainable [

19], that is capable of surviving and creating wealth [

20,

21].

Experimental economics provides a new perspective and avenues for policy makers and scholars [

22,

23] in the sustainability area. The effects of non-cooperative behavior have been studied in the laboratory in different contexts such as public goods [

24,

25], natural resources [

26,

27], and team production [

28]. This paper adds new evidence and theoretical insights to the role of entry costs in teamwork. In this vein, previous experimental studies have proposed different research designs with some interesting findings, such as that charging an entry fee to team members creates higher payoff equilibria [

14], and that the price of the right to play does indeed communicate information about the strategy coordination problem [

29].

Our research proposes an experimental design that includes an up-front pay mechanism in team production and allows us to test its ability to induce cooperation and efficiency in resource allocation. In particular, we compared contributions of teams with no up-front pay, called “free play teams” (control treatment) to those teams with an “optimal entry cost” before deciding on their effort or contribution levels. With a simple design of a two-player minimum effort game, we tested the theoretical prediction that teams made up by members who make an up-front payment equal to the efficient total output achieve a more efficient equilibrium than those formed by “free play teams”, namely, those with no up-front pay. In addition, we tested the hypothesis that a higher up-front pay entails better performance. Finally, we looked into the determinants of the subjects’ exerted efforts by studying the effects of different variables such as own and partner’s past decisions, beliefs, gender, self- belief about the up-front pay effect, nationality or time spent on making decisions.

2. Theoretical Model and Predictions

According to Holmstrom’s [

8] definition a “team” is characterized as follows: (1) members’ capabilities in the team are subject to technological constraints represented by a production function,

, where

y is the output value and

the vector comprising each member’s contribution; (2) the production function

F is featured as a “team technology”, which implies that individuals, given the same level of input, can obtain a higher level of output if they participate in the team than if they do not; (3) each member owns one and only one input and hence,

ai is the contribution of member

i; (4) each member bears the total cost of allocating her resource to the productive activity of the team; the cost of each individual’s resource is

where

is an increasing and convex function in

ai for all

i. Therefore, the team’s net profit or surplus will be given by

; (5) the utility function of member

i of the team is

for

i = 1, 2, …,

N, where

Si is the function that determines the output sharing. This sharing rule depends exclusively on the output value of the team (

y); and (6) any member can obtain an alternative utility of zero if she leaves the team.

2.1. Efficient Solution and the Nash Equilibrium with “Free Play Teams”

The Pareto-efficient solution to the team problem is given by:

Thus, the efficient solution to the team problem, and , is achieved when the marginal revenue of the team equals its marginal cost.

But team members are assumed to behave rationally, and therefore they maximize their own utility, given the contributions of the remaining team members, i.e.,

The solution to the above problem is actually the Nash equilibrium and its first order conditions are:

The above expression differs from (2) because when the number of members of a team is equal or greater than two (N ≥ 2). Thus, the above equilibrium is not efficient.

2.2. Up-Front Pay as Guarantee for Team Members

Assuming now that members can afford an “up-front pay” equal to the total efficient output minus each member’s part of the output, i.e.,

, the payoff function is:

where

Then individual utility can be represented as

Thus, the Nash equilibrium is the solution to the following maximization problem:

As is a constant, first order conditions of the above problem are,

It becomes clear that conditions (2) and (8) are equivalent, and hence the Nash equilibrium represented by (8) is efficient.

Notice that the efficient solution is only achieved when the sum of the fees paid as “up-front pay” by all members equals the value of the output at the efficiency level, that is, . Otherwise, if the aggregate up-front pay is less than N-1 times the efficient output, i.e., the payoff function cannot guarantee that each member will receive the total value of the team output. For instance, let us assume that “up-front pay” and the payoff are the same for all members, and , respectively. In this case the value of K that makes it possible to share N times the value of the total output at the efficient level is . However, if the effective up-front pay is lower than namely, with , the individual payoff cannot be greater than . Therefore, we can conclude that the efficiency of the “up-front pay” should become lower as the up-front pay decreases.

3. Methods

3.1. The Minimum Effort Coordination Game

Coordination games have been widely used in real problems observed in companies and industries [

28]. Several studies using minimum effort coordination games (MECGs) have analyzed the impact on experimental outcomes of parameters such as group size [

30,

31,

32], cost of effort [

33], money back guarantees [

31] or entry fees [

14].

In our study, the MECG framework is used to make two types of comparisons within three treatments. In the first comparison, we study the effect of up-front pay on the contributions of team members compared to the control “free play teams” treatment (between subjects treatment). In the second comparison, with a within subject treatment we examine the impact of changing the fee amount (“optimal entry” cost vs. “medium entry” cost treatments). The above experiments consider teams formed by two members who simultaneously and privately exert an effort level or contribution. Contributions are natural numbers between zero and fifty that team members wish to devote to the collective task, namely, , }. The production process is represented by Leontief technology, which implies that the inputs should be used in fixed (technologically pre-determined) proportions, as there is no substitutability between factors. In other terms, inputs are considered “pure complements” as deviations from the fixed proportion between inputs imply an obvious loss. The proportion of the two inputs is 1:1 to produce 2 units of output. Hence, the output is determined by the minimum effort of the two participants, and any effort higher than the minimum is assumed to be a loss.

We make two comparisons: the first analyzes “free play teams” versus “optimal entry cost teams”. In the first treatment (free play teams), the payment function () is determined by the double of the minimum contribution of the couple () minus the contribution of subject i in round/period t.

The dilemma of player i in this treatment is to predict and choose the minimum effort of the group taking into account that any deviation from this value implies a net utility loss.

In the second and third treatments the utility functions include the up-front pay as a constant in the payoff function. For the second treatment, a fee of

100 units is required to be paid before taking every decision. In this case, the payoff function turns out to be 4 times the minimum effort:

As presented, the games corresponding to all treatments have multiple Nash equilibria in pure strategies, namely, but only the maximum contribution for both subjects is Pareto-efficient, i.e., .

Finally, in the third treatment in order to quantify the effect of the amount of the up-front pay, members now pay a lower amount (75) as a mandatory fee before deciding their contribution in each period. In this treatment, called “medium entry cost teams”, the output is computed as three times the minimum effort that guarantees the fact that the maximum contribution leads to the efficient output level.

To sum up,

corresponds to the (Pareto-optimal) equilibrium in all treatments [

34]. However, any situation in which

is a Nash equilibrium in pure strategies in all treatments [

35]. The only difference between the experimental treatments is in the amount of the up-front pay. The logic for the comparison between the “no up-front pay” (

K1 = 0) and that with an optimal entry cost (

K2 = 100) is that the latter is expected to push higher contributions and create an environment of concern for sustainability from team members, knowing that there is a sunk cost to pay, and that if any member tries to free ride on the other, then the minimum effort is lower for both. In the second comparison, it might be thought that a higher up-front payment (

K2 = 100 vs.

K3 = 75) would push contributions upwards more strongly.

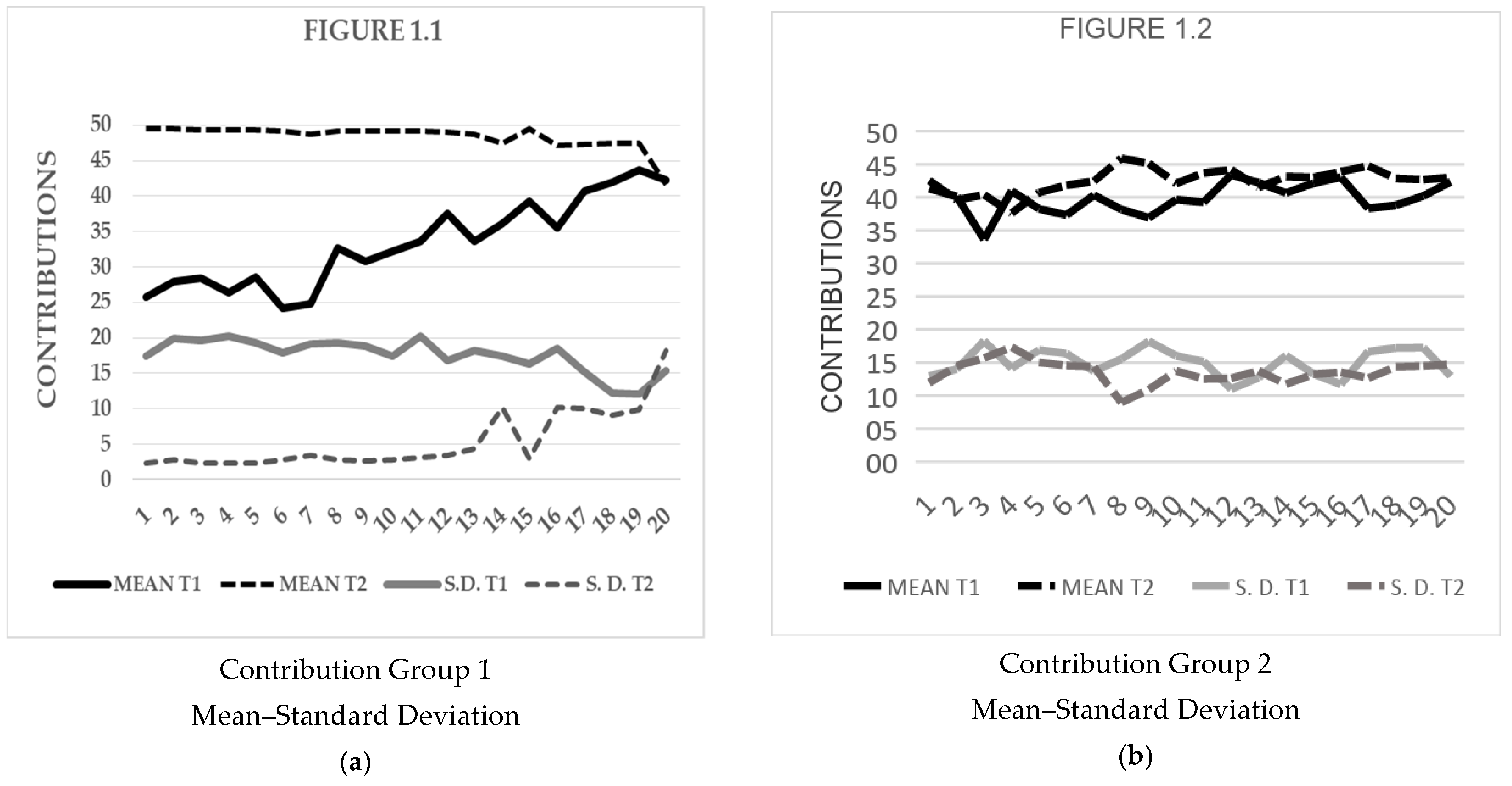

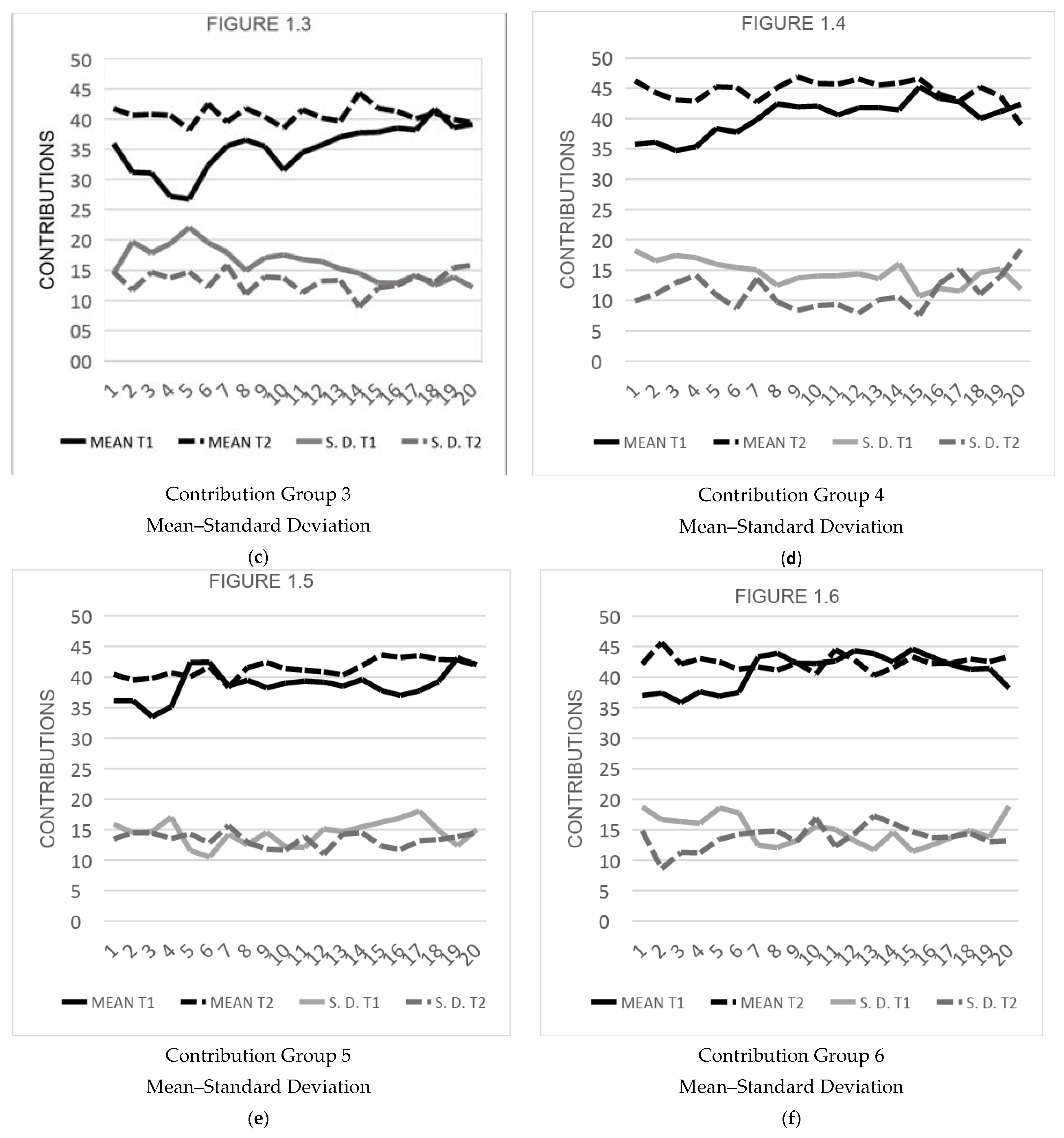

3.2. Procedures

The experiment was programmed in the Ztree toolbox [

36] and performed in the computer room of the Faculty of Economics and Management at the University of Salamanca. The experiment involved two groups of subjects: the first, which was called “free play teams”, had 152 participants, all of them just playing one treatment of 20 consecutive rounds. The second group (“up-front pay” teams) had 184 subjects who participated in two treatments performed consecutively and in the same order: first, the “optimal entry cost treatment” and then, the “medium entry cost treatment”. Subjects of these two treatments also played 20 rounds per treatment and they received an initial endowment of 100 when playing the “optimal entry cost” treatment and 80 when playing the “medium entry cost” treatment. All subjects were students of undergraduate programs (Economics and Business Administration) of the aforementioned University.

Subjects were considered unexperienced as they had never participated in a similar activity before and were incentivized according to their performance during the experiment and in terms of their payoffs. Before the experiment started, we carried out the following tasks: (1) participants read the instructions (see

Appendix A) and any doubts were privately answered; (2) to verify that they had correctly understood the information provided, we asked the participants to fill in a form with some questions that we reviewed before starting the experiment; In this questionnaire we also collected data about the participants (gender, degree of studies and nationality) for control purposes and we also elicited their previous belief about the effect of paying an initial fee on contributions; (3) subjects were required to complete a round test consisting of three consecutive decisions that allowed participants to familiarize themselves with the software. Teams were formed by randomly selecting pairs of subjects in each session. Information exchange between team members was not allowed and hence, subjects remained unaware of her/his team mate’s identity. All treatments consisted of 20 consecutive decisions or rounds. In each round, the subject had to choose her own contribution to the teamwork and register her guess about the partner’s contribution. Response time was unrestricted and registered by the software. After every round, the software reported: (1) contributions and profits and payoffs of both team members after their last choice and (2) the accumulated profits of all past rounds. Subjects of the “free play” treatment were gathered into 8 groups organized according to the availability of the participants’ schedules and limited to a maximum of 20 participants per group. Unlike the “free play” treatment, subjects of the “up-front pay” scenario successively performed two treatments, namely, “optimal entry cost” and “medium entry cost”. Therefore, the comparison of data between the “optimal” and “medium” entry cost treatments was performed through a within-subject approach (i.e., subjects of both treatments remained unchanged). Alternatively, the comparison of data of the above treatments versus the “free play” treatment involved a between-subjects design (subjects were different). The composition of the team remained unchanged in both treatments. After concluding the first treatment, we reminded participants that decisions for the next treatment were independent from past decisions, as indicated in the instruction sheet. Thus, the start of a new treatment involved the restart of a new game. For the “medium entry cost treatment” participants proceeded directly to perform the experiment as previous pilot tests were omitted. In the “up-front pay” treatments, 6 groups of a maximum of 32 participants were made.

3.3. Hypothesis

As commented in

Section 3.1, the MECG has multiple and symmetrical equilibria, which are characterized by the fact that all players choose the same contribution, although only the maximum is optimal for both subjects (

). Nevertheless, findings from previous experiments on the repeated MECG reveal that subjects rarely tend to coordinate at maximum effort [

28]. The introduction of an “up-front pay” scheme in this game led us to formulate the following propositions:

P1: The efficient and more sustainable equilibrium in “up-front pay” requires maximum contribution (i.e., Cit = 50, i = 1, 2) of team members.

P2: The loss avoidance principle improves coordination in more efficient equilibria.

P3: The efficiency of the Nash equilibrium in a team increases with the up-front pay.

Consistently with our proposition P1, the solution proposed in our work to overcome inefficiency and encourage sustainability is the consideration of an efficient level of up-front pay for participating in a team production related to, for instance, natural resources exploitation. To be efficient, the sum of the up-front pay should equal the efficient level of outcome, and also “signaling and incentives system to coordinate individuals” have been proposed in production systems [

37]. A payment in advance can be viewed as an investment which leads to efficient outcomes in different contexts [

29]. Open access culture in the management of natural resources must be replaced with more appropriate property rights regimes and governance structures [

38]. For instance, in the Tasmanian abalone fishery case [

39], a quota system is established, based on division of a total allowable catch (TAC) into quotas, with shares that can be traded. Along this line, empirical work in marine natural resources challenges researchers to come up with the development of appropriate economic policy and management measures relating to property (e.g., tourism, coastal urban and property development, agricultural activities impacting on the marine ecosystem and general marine activities). Cooperatives are increasingly proposed as solutions for sustainable fisheries management [

40]. Other related examples are the cases of the Ningaloo Marine Park, Western Australia, Queensland Hervey Bay, and Great Barrier Reef Park [

41].

Therefore, the main hypothesis of this work posits that up-front pay schemes, represented by payoff functions such as those in Equations (10) and (11), increase cooperation in teamwork and encourage far more concern for sustainability. Our first hypothesis (H1) can be expressed as follows:

Hypothesis 1 (H1). The contribution of team members facing an “up-front pay” rewarding framework is higher than those facing a “zero entry cost” framework.

Another variable that might determine contributions are beliefs, specially a subject’s expectations about others’ willingness to contribute in the first rounds (P2). From this perspective, the “loss avoidance” principle is likely to apply. Under this principle, subjects tend to reject strategies that result in certain losses for themselves as they only consider strategies that might result in a gain. Charging a fee to play creates coordination on more efficient equilibria [

14]. Beliefs prior to playing a coordination game can influence which equilibrium they eventually coordinate upon [

42]. We tested in our first comparison the effect of the eventual relevance of the “loss avoidance” principle.

Hypothesis 2 (H2). Subjects’ contributions improve coordination when there is a prior belief about up-front pay; as a result, selection is done through the loss avoidance principle.

For the second and third treatment, the teams were kept the same, the difference between treatments being the amount of the up-front pay. Indeed, increasing up-front franchise fees encourages efficiency and profitability [

43]. There is also evidence that coordination does improve when the fee rises and is publicly announced (i.e., public costs) [

14,

31]. Consistent with these findings:

Hypothesis 3 (H3). The contribution of team members facing an optimal “up-front pay” rewarding framework is higher than that of a suboptimal “up-front pay” framework.

5. Discussion

This research analyses the effect of up-front pay schemes on the efficiency and sustainability of team production systems. For this purpose, we adopt an experimental approach and examine contributions of teams with and without an up-front payment and for different up-front pay amounts. With a simple MECG design, our study considers two scenarios: the first compares up-front pay teams with the standard case of teams that do not have to deposit a fee, whereas the second compares higher to lower up-front payments.

In this framework we find that: (1) Up-front pay teams indeed contribute significantly more and thus are more concerned about sustainability than teams that do not face the up-front pay requirement; (2) subjects exhibit different selection principles: when the entry cost is zero (“free play treatment”), partner’s past contribution shows a lower impact on current subject’s contribution as the entry cost increases. Given the sign and significance of the interaction term (“Treatment” X “Partner’s lagged contribution”), we can conclude that the loss avoidance principle is a plausible explanation for this outcome. In addition, the positive impact of the variable “Self believe Up front” on subject’s contribution also adds support to the loss avoidance hypothesis; and (3) decreases in the amount of the up-front pay do not seem to slow down convergence to efficient and sustainable solution.

Our research represents a relevant contribution for the implementation of techniques leading to efficient production and economic sustainability. We propose a mechanism based on up-front pay guarantees that encourages not only efficiency, but also sustainability when collective production is linked to natural resources exploitation. Such a mechanism is similar to different policies created to diminish environmental damage by internalizing its effects; the main difference is that it promotes subjects for cooperation when different natural resources or interrelated activities (team technology) are being handled. Previous works about the effects of sunk costs or selling the right to play [

8,

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28] are mainly concerned with the individual behavior rather than with collective or team behavior

. Our work adds new insights in two main aspects: First, we focus on team production by considering entry cost as a mechanism to improve efficiency in teams; and second, our experimental outcomes are based on theoretical models capable to offer prescriptions on optimal entry costs.

On the other hand, this study has certain limitations that should be addressed in future research. In particular, subjects facing entry costs played the treatments in the same order. Under this experimental design, we cannot control for potential learning effects. It would be interesting to randomize the order of pay up front treatments to control for such effects and to check to what extend our rejection of hypothesis 3 might be induced by learning effects.

All in all, and although our result is directly oriented to solving the free riding problems in teamwork within the firm, it has applications in many economic situations. As a result, future work should be devoted to study of the other pillars of sustainability, where similar proposals are demanded by policy makers.