The Nexus of FDI, R&D, and Human Capital on Chinese Sustainable Development: Evidence from a Two-Step Approach

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Step One: Semantic Network Analysis

3.1.1. Data

3.1.2. Text Mining: TF-IDF and Degree Centrality

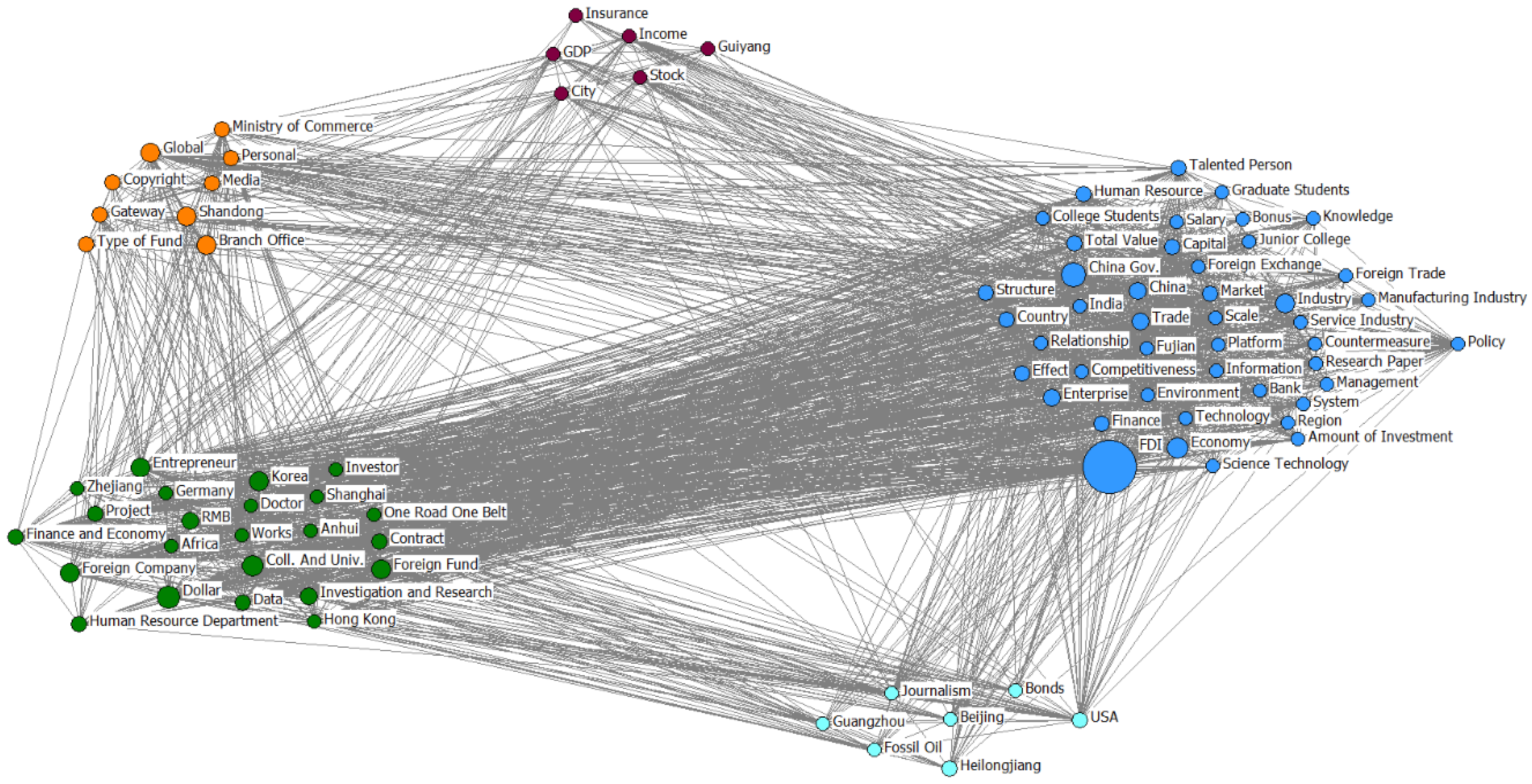

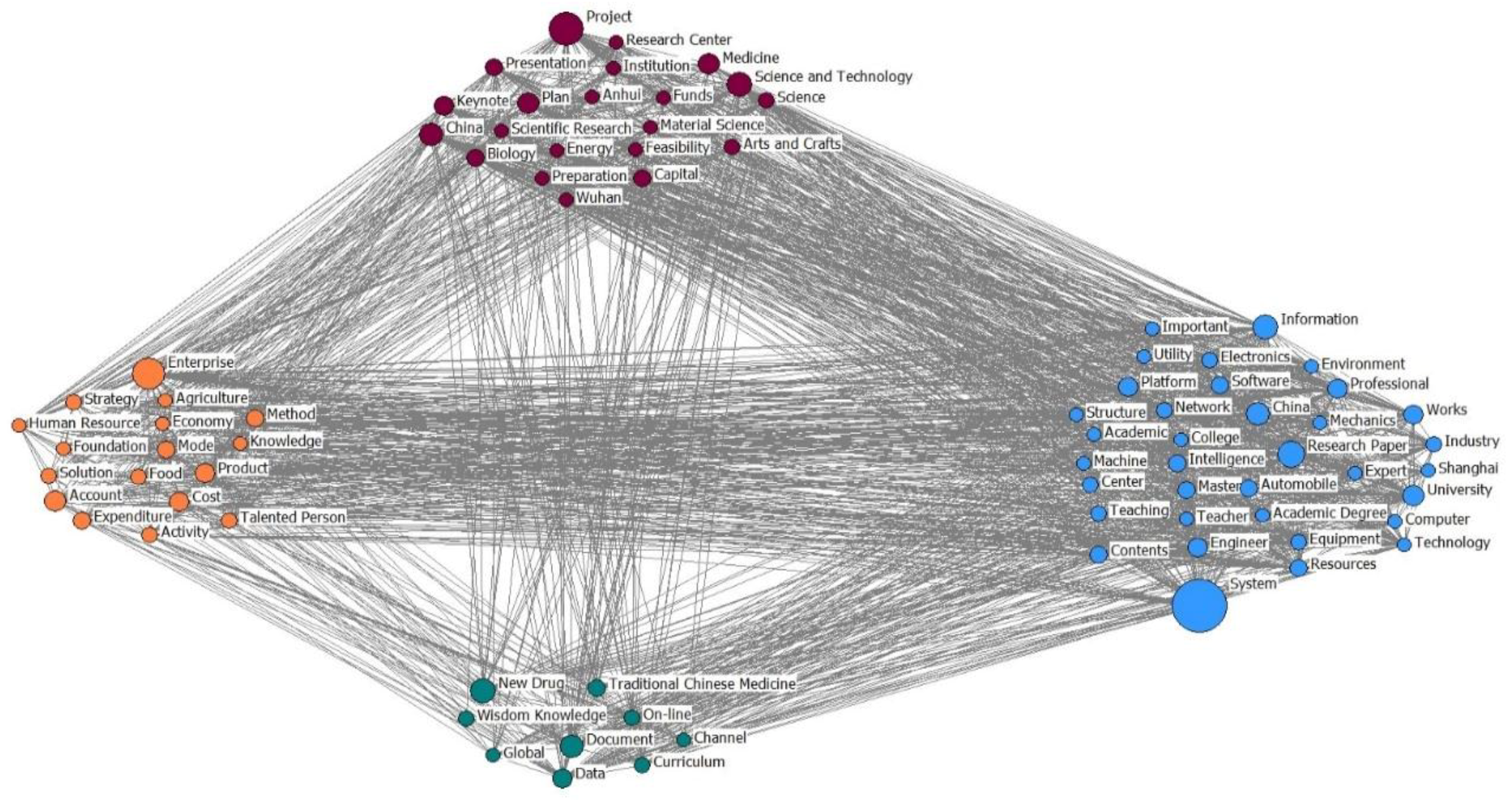

3.1.3. Results of SNA

3.2. Step Two: VECM Analysis

3.2.1. Data

3.2.2. Methodology

3.2.3. Unit Root Test

3.2.4. Cointegration Test

3.2.5. Causality Analysis Using a VECM

4. Discussion

5. Conclusions

Funding

Conflicts of Interest

Appendix A

| Words | TF-IDF | Rank | Degree Centrality | Rank | Words | TF-IDF | Rank | Degree Centrality | Rank |

|---|---|---|---|---|---|---|---|---|---|

| FDI | 542.714 | 1 | 0.246 | 1 | Bank | 142.879 | 38 | 0.015 | 42 |

| China Gov. | 536.496 | 2 | 0.128 | 2 | Foreign Exchange | 137.295 | 39 | 0.014 | 46 |

| Korea | 487.784 | 3 | 0.038 | 14 | Countermeasure | 129.427 | 40 | 0.015 | 40 |

| Dollar | 431.138 | 4 | 0.091 | 4 | Journalism | 128.555 | 41 | 0.025 | 24 |

| Shandong | 428.459 | 5 | 0.024 | 29 | Scale | 127.316 | 42 | 0.017 | 36 |

| Economy | 407.188 | 6 | 0.097 | 3 | Service Industry | 124.423 | 43 | 0.011 | 53 |

| China | 369.276 | 7 | 0.053 | 7 | Zhejiang | 122.326 | 44 | 0.008 | 66 |

| Entrepreneur | 358.905 | 8 | 0.037 | 16 | Technology | 119.355 | 45 | 0.012 | 48 |

| Enterprise | 338.949 | 9 | 0.061 | 6 | Platform | 118.146 | 46 | 0.008 | 62 |

| Foreign Fund | 335.059 | 10 | 0.051 | 9 | One Road One Belt | 116.597 | 47 | 0.014 | 45 |

| Coll. And Univ. | 331.324 | 11 | 0.075 | 5 | System | 115.138 | 48 | 0.016 | 37 |

| Industry | 330.805 | 12 | 0.035 | 19 | Knowledge | 112.765 | 49 | 0.015 | 43 |

| Global | 324.308 | 13 | 0.045 | 10 | Investor | 111.089 | 50 | 0.016 | 39 |

| Hong Kong | 317.320 | 14 | 0.037 | 15 | Information | 98.738 | 51 | 0.015 | 41 |

| Trade | 304.533 | 15 | 0.045 | 11 | College Students | 96.755 | 52 | 0.016 | 38 |

| Foreign Company | 304.184 | 16 | 0.052 | 8 | Stock | 96.608 | 53 | 0.008 | 61 |

| Investigation and Research | 279.048 | 17 | 0.035 | 18 | Anhui | 95.287 | 54 | 0.014 | 44 |

| RMB | 278.645 | 18 | 0.042 | 12 | GDP | 93.783 | 55 | 0.007 | 68 |

| Project | 230.845 | 19 | 0.034 | 20 | Junior College | 91.589 | 56 | 0.011 | 50 |

| Ministry of Commerce | 228.511 | 20 | 0.008 | 67 | Region | 82.863 | 57 | 0.011 | 51 |

| Contract | 212.697 | 21 | 0.011 | 52 | Income | 82.746 | 58 | 0.010 | 55 |

| Talented Person | 208.732 | 22 | 0.028 | 23 | Fujian | 81.102 | 59 | 0.008 | 65 |

| Finance | 206.111 | 23 | 0.032 | 22 | India | 78.602 | 60 | 0.012 | 47 |

| Heilongjiang | 205.364 | 24 | 0.011 | 50 | Management | 76.482 | 61 | 0.010 | 59 |

| Market | 189.564 | 25 | 0.033 | 21 | Salary | 76.482 | 62 | 0.010 | 58 |

| Structure | 188.569 | 26 | 0.020 | 33 | Foreign Trade | 75.436 | 63 | 0.008 | 64 |

| Effect | 182.001 | 27 | 0.025 | 27 | Manufacturing Industry | 74.281 | 64 | 0.010 | 54 |

| USA | 181.326 | 28 | 0.020 | 32 | Doctor | 73.396 | 65 | 0.010 | 56 |

| Data | 170.532 | 29 | 0.036 | 17 | Guangzhou | 73.396 | 66 | 0.006 | 70 |

| Capital | 169.421 | 30 | 0.023 | 29 | Bonds | 69.911 | 67 | 0.009 | 60 |

| Human Resource | 165.191 | 31 | 0.041 | 13 | Competitiveness | 66.908 | 68 | 0.006 | 72 |

| Shanghai | 161.706 | 32 | 0.018 | 34 | Africa | 65.896 | 69 | 0.008 | 63 |

| Country | 155.271 | 33 | 0.025 | 26 | Graduate Students | 65.542 | 70 | 0.006 | 69 |

| Relationship | 152.256 | 34 | 0.021 | 31 | Beijing | 65.241 | 71 | 0.006 | 71 |

| Policy | 150.206 | 35 | 0.018 | 35 | Works | 63.293 | 72 | 0.006 | 73 |

| Research Paper | 148.161 | 36 | 0.025 | 35 | Science Technology | 59.073 | 73 | 0.010 | 57 |

| Finance and Economy | 143.795 | 37 | 0.023 | 30 | Bonus | 56.803 | 74 | 0.006 | 74 |

| Words | TF-IDF | Rank | Degree Centrality | Rank | Words | TF-IDF | Rank | Degree Centrality | Rank |

|---|---|---|---|---|---|---|---|---|---|

| System | 587.789 | 1 | 0.122 | 1 | Contents | 156.080 | 42 | 0.025 | 17 |

| Technology | 554.518 | 2 | 0.105 | 2 | Activity | 147.661 | 43 | 0.018 | 33 |

| Project | 482.430 | 3 | 0.051 | 4 | Talented Person | 147.661 | 44 | 0.017 | 36 |

| Enterprise | 424.206 | 4 | 0.059 | 3 | China | 144.794 | 45 | 0.020 | 27 |

| New Drug | 362.651 | 5 | 0.034 | 10 | Arts and Crafts | 144.437 | 46 | 0.018 | 34 |

| Information | 323.184 | 6 | 0.046 | 8 | Solution | 140.098 | 47 | 0.012 | 57 |

| Research Paper | 301.616 | 7 | 0.051 | 5 | Wisdom Knowledge | 140.015 | 48 | 0.002 | 82 |

| Document | 300.674 | 8 | 0.023 | 21 | Strategy | 137.831 | 49 | 0.012 | 58 |

| Plan | 291.122 | 9 | 0.019 | 29 | Center | 130.492 | 50 | 0.016 | 41 |

| Science and Technology | 285.639 | 10 | 0.046 | 7 | On-line | 128.555 | 51 | 0.014 | 49 |

| Account | 282.847 | 11 | 0.023 | 22 | Material Science | 126.404 | 52 | 0.012 | 61 |

| Medicine | 268.921 | 12 | 0.028 | 14 | Science | 123.944 | 53 | 0.014 | 47 |

| China | 262.495 | 13 | 0.048 | 6 | Machine | 123.794 | 54 | 0.007 | 78 |

| Cost | 244.710 | 14 | 0.027 | 16 | Funds | 122.326 | 55 | 0.008 | 77 |

| Keynote | 243.562 | 15 | 0.013 | 51 | Global | 120.646 | 56 | 0.009 | 73 |

| Product | 241.485 | 16 | 0.024 | 20 | Industry | 119.160 | 57 | 0.014 | 48 |

| Platform | 240.823 | 17 | 0.031 | 11 | Computer | 118.044 | 58 | 0.013 | 52 |

| Mode | 231.099 | 18 | 0.018 | 35 | Expert | 116.755 | 59 | 0.008 | 75 |

| Expenditure | 230.836 | 19 | 0.015 | 46 | Feasibility | 116.210 | 60 | 0.004 | 80 |

| University | 228.511 | 20 | 0.040 | 9 | College | 110.904 | 61 | 0.016 | 38 |

| Automobile | 227.051 | 21 | 0.024 | 18 | Energy | 110.635 | 62 | 0.011 | 68 |

| Traditional Chinese Medicine | 224.117 | 22 | 0.020 | 26 | Shanghai | 110.635 | 63 | 0.011 | 67 |

| Capital | 219.775 | 23 | 0.017 | 37 | Human Resource | 109.888 | 64 | 0.013 | 50 |

| Presentation | 205.260 | 24 | 0.019 | 31 | Knowledge | 109.741 | 65 | 0.012 | 55 |

| Resources | 203.983 | 25 | 0.029 | 12 | Agriculture | 107.602 | 66 | 0.011 | 66 |

| Academic Degree | 199.626 | 26 | 0.013 | 53 | Economy | 107.438 | 67 | 0.019 | 30 |

| Data | 198.793 | 27 | 0.021 | 25 | Mechanics | 107.202 | 68 | 0.012 | 54 |

| Works | 194.081 | 28 | 0.028 | 13 | Institution | 105.079 | 69 | 0.012 | 60 |

| Professional | 193.823 | 29 | 0.019 | 28 | Important | 103.972 | 70 | 0.010 | 71 |

| Intelligence | 187.768 | 30 | 0.019 | 32 | Foundation | 103.020 | 71 | 0.016 | 39 |

| Engineer | 186.855 | 31 | 0.028 | 15 | Anhui | 101.938 | 72 | 0.008 | 74 |

| Master | 184.159 | 32 | 0.010 | 69 | Preparation | 101.938 | 73 | 0.007 | 79 |

| Method | 179.280 | 33 | 0.024 | 19 | Scientific Research | 101.938 | 74 | 0.011 | 64 |

| Software | 179.280 | 34 | 0.021 | 24 | Wuhan | 101.268 | 75 | 0.010 | 70 |

| Biology | 179.195 | 35 | 0.022 | 23 | Structure | 94.830 | 76 | 0.011 | 62 |

| Equipment | 169.713 | 36 | 0.015 | 43 | Utility | 94.605 | 77 | 0.011 | 65 |

| Teaching | 165.952 | 37 | 0.011 | 63 | Channel | 93.575 | 78 | 0.004 | 81 |

| Curriculum | 160.803 | 38 | 0.012 | 59 | Teacher | 90.273 | 79 | 0.015 | 44 |

| Electronics | 159.424 | 39 | 0.016 | 40 | Environment | 89.704 | 80 | 0.009 | 72 |

| Network | 158.686 | 40 | 0.015 | 45 | Research Center | 88.533 | 81 | 0.012 | 56 |

| Food | 156.286 | 41 | 0.015 | 42 | Academic | 87.036 | 82 | 0.008 | 76 |

Appendix B

References

- Zhu, L.; Jeon, B.N. International R&D spillover: Trade, FDI, and information technology as spillover channels. Rew. Int. Econ. 2007, 15, 955–976. [Google Scholar]

- Jing, C.; Song, Y.H. FDI in China: Institutional evolution and its impact on different sources. In Proceedings of the 15th Annual Conference of the Association for Chinese Economics Studies Australia (ACESA), Melbourne, Australia, 2–3 October 2003; Available online: http://mams.rmit.edu.au/l85gl0z02ukp.pdf (accessed on 18 January 2018).

- Caves, R. Multinational Enterprise and Economic Analysis, 2nd ed.; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Dunning, J.; Lundan, S. Multinational enterprises and the global economy. Trans. Corp. 2010, 19, 103–106. [Google Scholar] [CrossRef]

- Bravo-Ortega, C.; Marin, A.G. R&D and productivity: A two-way avenue? World Dev. 2011, 39, 1090–1107. [Google Scholar]

- Cameron, G.; Proudman, J.; Redding, S. Technological convergence, R&D, trade and productivity growth. Eur. Econ. Rev. 2005, 49, 775–807. [Google Scholar]

- Coe, D.T.; Helpman, E.; Hoffmaister, A.W. International R&D spillovers and institutions. Eur. Econ. Rev. 2009, 53, 723–741. [Google Scholar]

- Kafouros, M.I. R&D and productivity growth: Evidence from the UK. Econ. Innov. New Technol. 2005, 14, 479–497. [Google Scholar]

- O’Mahony, M.; Vecchi, M. R&D, knowledge spillovers and company productivity performance. Res. Policy 2009, 38, 35–44. [Google Scholar]

- Borensztein, E.; Gregorio, J.D.; Lee, J.W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Xu, G.; Wang, R. The effect of foreign direct investment on domestic capital formation, trade and economic growth in a transition economy: Evidence from China. Glob. Econ. J. 2007, 7, 1524–5861. [Google Scholar]

- Zhang, Q.; Felmingham, B. The role of FDI, exports and spillover effects in the regional development of China. J. Dev. Stud. 2002, 38, 157–178. [Google Scholar] [CrossRef]

- Chen, C.L. Do inland provinces benefit from coastal foreign direct investment in China? China World Econ. 2015, 23, 22–41. [Google Scholar] [CrossRef]

- Jeon, Y.; Park, B.I.; Ghauri, P.N. Foreign direct investment spillover effects in China: Are they different across industries with different technological levels? China Econ. Rev. 2013, 26, 105–117. [Google Scholar] [CrossRef]

- Ha, Y.J.; Giroud, A. R&D spillovers from foreign direct investment (FDI): The role of firm-level heterogeneity. In Proceedings of the 36th EIBA Annual Conference, Porto, Portugal, 9–11 December 2010. [Google Scholar]

- Hsu, P.H.; Tian, X.; Xu, Y. Financial development and innovation: Crosscountry evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Paunov, C. The global crisis and firm’s investment in innovation. Res. Policy 2012, 41, 24–35. [Google Scholar] [CrossRef]

- Tongue, N.; Allan, R. Growth, R&D intensity and commercial lender relationships. J. Small Bus. Entrep. 2013, 26, 109–124. [Google Scholar]

- Choi, S.B.; Williams, C. The impact of innovation intensity, scope, and spillovers on sales growth in Chinese firms. Asia Pac. J. Manag. 2014, 31, 25–46. [Google Scholar] [CrossRef]

- Lamperti, F.; Mavilia, R.; Castellini, S. The role of science parks: A puzzle of growth, innovation and R&D investments. J. Technol. Transf. 2017, 42, 158–183. [Google Scholar]

- Zhang, C.; Guo, B.; Wang, J. The different impacts of home countries characteristics in FDI on Chinese spillover effects: Based on one-stage SFA. Econ. Model. 2014, 38, 572–580. [Google Scholar] [CrossRef]

- Romer, P. Endogenous technological change. J. Polit. Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Beugelsdijk, S.R.S.; Zwinkels, R. The impact of horizontal and vertical FDI on host country economic growth. Int. Bus. Rev. 2008, 17, 452–472. [Google Scholar] [CrossRef]

- Baharumshah, A.Z.; Thanoon, M.A.-M. Foreign capital flows and economic growth in East Asian countries. China Econ. Rev. 2006, 17, 70–83. [Google Scholar] [CrossRef]

- Bwayla, S.M. Foreign direct investment and technology spillovers: Evidence from panel data analysis of manufacturing firms in Zambia. J. Dev. Econ. 2006, 81, 514–526. [Google Scholar] [CrossRef]

- Javorcik, B.S. Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am. Econ. Rev. 2004, 94, 605–627. [Google Scholar] [CrossRef]

- Agosin, M.R.; Machado, R. Foreign investment in development countries: Does it crowd in domestic investment? Oxf. Dev. Stud. 2007, 33, 149–163. [Google Scholar] [CrossRef]

- Fry, M.J. Foreign Direct Investment in a Macroeconomic Framework: Finance, Efficiency, Incentives, and Distortions; Policy Research Working Paper Series 1141; The World Bank: Washington, DC, USA, 1993; Available online: https://ideas.repec.org/p/wbk/wbrwps/1141.html (accessed on 12 January 2018).

- De Mello, L. Foreign direct investment-led growth: Evidence from time series and panel data. Oxf. Econ. Pap. 1999, 51, 133–151. [Google Scholar] [CrossRef]

- Mencinger, J. Does foreign direct investment always enhance economic growth? Kyklos 2003, 56, 491–508. [Google Scholar] [CrossRef]

- Ashraf, A.; Herzer, D.; Nunnenkamp, P. The effects of greenfield FDI and cross-border M&As on total factor productivity. World Econ. 2016, 39, 1728–1755. [Google Scholar]

- Carbonell, J.B.; Werner, R.A. Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ. Geogr. 2018, 1–32. [Google Scholar] [CrossRef]

- Lipsey, R.E. Inward FDI and economic growth in development countries. Trans. Corp. 2000, 9, 67–95. [Google Scholar]

- Zhang, K.H. Does foreign direct investment promote economic growth? Evidence from East Asia and Latin America. Contemp. Econ. Policy 2001, 19, 175–185. [Google Scholar] [CrossRef]

- Durham, J.B.J. Absorptive capacity and the effects of foreign direct investment and equity foreign Portfolio investment on economic growth. Eur. Econ. Rev. 2004, 48, 285–306. [Google Scholar] [CrossRef]

- Li, X.; Liu, X. Foreign direct investment and economic growth: An increasingly endogenous relationship. World Dev. 2005, 33, 393–407. [Google Scholar] [CrossRef]

- Coe, D.T.; Helpman, E. International R&D spillovers. Eur. Econ. Rev. 1995, 39, 137–147. [Google Scholar]

- Goel, R.K.; Ram, R. Research and development expenditures and economic growth: A cross-country study. Econ. Dev. Cult. Chang. 1994, 42, 403–411. [Google Scholar] [CrossRef]

- Griffith, R.; Redding, S.; Reenen, J.V. Mapping the two faces of R&D: Productivity growth in a panel of OECD industries. Rev. Econ. Stat. 2004, 86, 883–895. [Google Scholar]

- Guellec, D.; Potterie, B.P. R&D and productivity growth: Panel data analysis of 16 OECD countries. Econ. Stud. 2001, 33, 103–126. [Google Scholar]

- Lichtenberg, F.R. R&D Investment and International Productivity Differences; NBER Working Paper No. 4161; National Bureau of Economic Research: Cambridge, MA, USA, 1992; Available online: http://www.nber.org/papers/w4161 (accessed on 10 December 2017).

- Lichtenberg, F.R.; Potterie, B.P. International R&D spillovers: A comment. Eur. Econ. Rev. 1998, 42, 1483–1491. [Google Scholar]

- Estrada, A.; Montero, J.M. R&D Investment and Endogenous Growth: A SVAR Approach. 2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract id=1494899 (accessed on 12 December 2017).

- Howitt, P.; Mayer-Foulkes, D. R&D, Implementation and Stagnation: A Schumpeterian Theory of Convergence Clubs; NBER Working Paper No. 9104; National Bureau of Economic Research: Cambridge, MA, USA, 2002; Available online: http://www.nber.org/papers/w9104 (accessed on 22 February 2018).

- Dowrick, S.; Rogers, M. Classical and technological convergence: Beyond the Solow-Swan growth model. Oxf. Econ. Pap. 2002, 54, 369–385. [Google Scholar] [CrossRef]

- Bronzini, R.R.; Piselli, P. Determinants of long-run regional productivity with geographical spillovers: The role of R&D, human capital and public infrastructure. Reg. Sci. Urban Econ. 2009, 39, 187–199. [Google Scholar]

- Teixeira, A.A.C.; Fortuna, N. Human capital, R&D, trade, and long-run productivity: Testing the technological absorption hypothesis for the Portuguese economy, 1960–2001. Res. Policy 2010, 39, 335–350. [Google Scholar]

- Bengoa, M.; Román, V.M.-S.; Pérez, P. Do R&D activities matter for productivity? A regional spatial approach assessing the role of human and social capital. Econ. Model. 2017, 60, 448–461. [Google Scholar]

- Lopez-Rodriguez, J.; Martinez-Lopez, D. Looking beyond the R&D effects on innovation: The contribution of non-R&D activities to total factor productivity growth in the EU. Struct. Chang. Econ. Dyn. 2017, 40, 37–45. [Google Scholar]

- Chung, C.; Park, H.W. Textual analysis of a political message: The inaugural addresses of two Korean presidents. Soc. Sci. Inf. 2010, 49, 215–239. [Google Scholar] [CrossRef]

- Yuan, E.J.; Feng, M.; Danowski, J.A. “Privacy” in semantic networks on Chinese social media: The case of Sina Weibo. J. Commun. 2013, 63, 1011–1031. [Google Scholar] [CrossRef]

- Danowski, J.A. Network analysis of message content. In Progress in Communication Sciences; Barnett, G., Richards, W., Eds.; Ablex: Norwood, NJ, USA, 1993. [Google Scholar]

- Doerfel, M.L. What constitutes semantic network analysis? A comparison of research and methodologies. Connections 1998, 21, 16–26. [Google Scholar]

- ICTCLAS. 2012. Available online: http://ictclas.org/ictclas_about.html (accessed on 17 September 2017).

- Son, D. Social Network Analysis; Kyungmoon: Seoul, Korea, 2002. [Google Scholar]

- Salton, G.; Buckley, C. Term-weighting approaches in automatic text retrieval. Inf. Process. Manag. 1988, 24, 193–206. [Google Scholar] [CrossRef]

- Borgatti, S.P.; Everett, M.G.; Freeman, L.C. UCINET for Windows: Software for Social Network Analysis; Analytic Technologies: Harvard, MA, USA, 2002. [Google Scholar]

- Erkan, G.; Radev, D.R. LexRank: Graph-based centrality as salience in text summarization. J. Artif. Intell. Res. 2004, 22, 457–479. [Google Scholar]

- Zhang, H.; Fiszman, M.; Shin, D.; Miller, C.M.; Rosemblat, G.; Rindflesch, T.C. Degree centrality for semantic abstraction summarization of therapeutic studies. J. Biomed. Inf. 2011, 44, 830–838. [Google Scholar] [CrossRef] [PubMed]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Cho, S.E.; Choi, M.; Park, H.W. Government-civic group conflicts and communication strategy: A text analysis of TV debates on Korea's import of U.S. beef. J. Contemp. East. Asia 2011, 11, 1–20. [Google Scholar] [CrossRef]

- Sung, B.; Park, S.-D. Who drives the transition to a renewable energy economy: Multi actor perspective on social innovation. Sustainability 2018, 10, 448. [Google Scholar] [CrossRef]

- Marques, A.C.; Fuinhas, J.A.; Menegaki, A.N. Interactions between electricity generation sources and economic activity in Greece: A VECM approach. Appl. Energy 2014, 132, 34–46. [Google Scholar] [CrossRef]

- Guilkey, D.K.; Salemi, M.K. Small sample properties of the three test of causality for Granger causal ordering in a bivariate stochastic system. Rev. Econ. Stat. 1982, 64, 668–680. [Google Scholar] [CrossRef]

- Geweke, J.; Messe, R.; Dent, W. Comparing alternative tests for causality in temporal systems: Analytic result and experimental evidence. J. Econ. 1983, 21, 161–194. [Google Scholar] [CrossRef]

- Granger, C.W.J. Some recent development in a concept of causality. J. Econ. 1988, 39, 199–211. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Phillips, P.C.B. Understanding spurious regressions in econometrics. J. Econ. 1986, 33, 311–340. [Google Scholar] [CrossRef]

- Schwartz, R. Estimating the dimension of a model. Ann. Stat. 1978, 6, 461–464. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis for cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Seker, F.; Ertugrul, H.M.; Cetin, M. The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renew. Sustain. Energy Rev. 2015, 52, 347–356. [Google Scholar] [CrossRef]

- Mai, L. China: Investing in Human Capital; OECD Observer No 290-291; Organisation for Economic Co-operation and Development: Paris, France, 2012; Available online: http://oecdobserver.org/news/fullstory.php/aid/3781/China:_Investing_in_human_capital.html (accessed on 23 May 2018).

- Kim, Y.C. Economic transition in China and Russia. Eur. Sci. J. 2015, 1, 355–366. [Google Scholar]

- Freeman, L.C. Centrality in social networks: I. Conceptual classification. Soc. Netw. 1979, 1, 215–239. [Google Scholar] [CrossRef]

| Study | Sample | Methodology | Variables | Major Findings | |

|---|---|---|---|---|---|

| Dependent Variable | Major Independent Variables | ||||

| Borensztein [10] | 69 countries (1970–1989) | SLS (Panel) | E (Economic growth) | FDI, HC (Human capital) | FDI*HC → E (+) |

| Beugelsdijk and Zwinkels [24] | 44 countries (1983–2003) | GMM (Panel) | E | HFDI (horizontal FDI), VFDI (vertical FDI) | HFDI → E (+); VFDI → E (+) in developed countries |

| Baharumshah and Thanoon [25] | 8 East Asian countries (1982–2001) | DGLS (Panel) | E | FDI, SAV (gross domestic saving), LD (long-term debt) | FDI → E (+); SAV → E (+); LD → E(+) |

| Bwalya [26] | Zambia (1993–1995) | GMM (Panel) | E (Local firms) | HFDI, VFDI, RFDI (regional FDI) | HFDI → E (−); VFDI → E(+); RFDI → E (+) |

| Javorcik [27] | CEEC 10 countries (1993–2000) | OLS (Panel) | E | HFDI, VFDI | VFDI → E (+) |

| Agosin and Machado [28] | 3 region (1970–1996) | FEM (Panel) | I (Investment-GDP ratio) | FDI | FDI → I (+) in Asia; FDI → I (+) in Africa; FDI → I (−) in Latin America |

| Fry [29] | 16 developing countries (1966–1988) | OLS (Panel) | E | FDI, SAV | FDI → SAV (−); FDI → E (−) |

| De Mello [30] | 33 countries (1980–1994) | VAR (Time series)FEM (Panel) | E | FDI | FDI → E (+) in 16 countries from OECD;FDI → E (−) in 17 countries from non-OECD |

| Mencinger [31] | 8 transition countries (1994–2001) | Granger causality test (Panel) | E | FDI | FDI → E (−) |

| Zhang [35] | 11 countries in East Asia and Latin America (1960–1997) | ECM (Panel) | E | FDI | FDI → E (+) in Singapore, Mexico, Hong Kong, Indonesia, and Taiwan |

| Ashraf et al. [32] | 123 countries (2003–2011) | GMM (Panel) | TFP (total factor productivity) | FDI | FDI has no statistically significant effect on TFP |

| Durham [36] | 80 countries (1979–1998) | OLS (Panel) | E (GDP) | FDI, EUD (education), O (trade openness) | FDI*O → E (+); EUD → E (+) in developed countries |

| Li and Liu [37] | 84 countries (1970–1999) | SLS (Panel) | E | FDI, HC | FDI → E (+); FDI*HC → E (+) in developing countries |

| Coe and Helpman [38] | 22 countries (1971–1990) | OLS (Panel) | TFP | DR&D (domestic R&D), FR&D (foreign R&D) | FR&D → TFP (+) |

| Griffith et al. [40] | 12 countries (1971–1990) | ECM (Panel) | TFP | R&D, HC) | R&D → TFP (+); HC → TFP (+) |

| Guellec and Potterie [41] | 16 OECD countries (1980–1998) | ECM (Panel) | MFP (multi-factorproductivity) | R&D (included type of business, foreign, public, government, and university) | R&D → MFP (+) |

| Lichtenberg [42] | 74 countries (1964–1989) | NLSM (Panel) | LP (labor productivity) | R&D (private funded) | R&D → LP (+) |

| Lichtenberg and Potterie [43] | 22 countries (1971–1990) | OLS (Panel) | TFP | FR&D, O | FR&D → TFP (+); O → TFP (+) |

| Estrada and Montero [44] | 7 countries (1970–2006) | SVAR (Panel) | E (GDP) | R&D (included government and private) | R&D → E (+) |

| Dowrick and Rogers [46] | 57 countries (1965–1990) | OLS, GMM(Panel) | E (heterogeneous growth) | R&D, EDU (education) | R&D → E (+); EDU → E(+) |

| Bronzini and Piselli [47] | 19 region in Italy (1980-2001) | FLMOS (Panel) | TFP | R&D, HC, ISI (infra structure investment) | R&D → TFP (+); HC → TFP (+); ISI → TFP (+) |

| Teixeira and Fortuna [48] | Portugal (1960–2001) | VAR (Time series) | TFP | R&D, HC, T (trade) | R&D → TFP (+); HC → TFP (+); T → TFP (+) |

| Bengoa et al. [49] | 17 region in Spanish (1980–2007) | DOLS (Panel) | TFP | R&D (public, private), P (patents), HC | R&D (public) → TFP (+); P → TRP (+); HC → TFP (+) |

| Lopez-Rodriguez and Martinez-Lopez [50] | 25 countries in EU (2004–2008) | OLS (Panel) | TFP | R&D, Non R&D (HC) | R&D → TFP (+); HC → TFP (+) |

| Human Capital-Related Words (TF-IDF/Degree Centrality) | ||

|---|---|---|

| Subject words | FDI | Entrepreneur (358.905/0.037), Coll. and Univ. (331.324/0.075), Talented Person (208.732/0.028), Human Resource (165.101/0.041), Research Paper (148.161/0.025), Knowledge (112.765/0.015), Investor (111.089/0.016), College Students (96.755/0.016), Junior College (91.589/0.011), Income (82.746/0.010), Salary (76.482/0.010), Doctor (73.396/0.010), Graduate Students (65.545/0.006), Works (63.293/0.006), Bonus (56.803/0.006) |

| R&D | Research Paper (301.616/0.051), University (228.511/0.040), Academic Degree (199.626/0.013), Professional (193.823/0.019), Intelligence (187.768/0.019), Engineer (186.855/0.028), Master (184.159/0.010), Teaching (165.952/0.011), Curriculum (160.803/0.012), Talented Person (147.661/0.017), Wisdom Knowledge (140.015/0.002), Expert (116.755/0.008), Human Resource (109.888/0.013), Knowledge (109.741/0.012), Teacher (90.704/0.015), Academic (87.036/0.008) |

| Subject Word | ||

|---|---|---|

| FDI | R&D | |

| Number of clusters | 5 | 4 |

| Average clustering coefficient | 5.157 | 2.263 |

| Major hub nodes | FDI, Dollar, Shandong, Entrepreneur, Branch Office, Global, Coll. and Univ., Talented Person | System, Technology, Project, Enterprise, New Drug, Research Paper, Academic Degree, Master |

| Significant keywords in the cluster (human capital perspective) | Entrepreneur, Coll. and Univ. A Talented Person, Human Resource, Research Paper | Research Paper, University, Academic Degree, Engineer, Master, Teaching, Talented Person, Wisdom Knowledge, Expert, Human Resource, Knowledge |

| Variables | ADF | PP | |||||

|---|---|---|---|---|---|---|---|

| C | CT | None | C | CT | None | ||

| GDP | Level | −1.991 | −2.761 | 0.929 | −0.743 | −2.695 | 0.282 |

| Δ | −6.121 *** | −5.958 *** | −5.739 *** | −9.229 *** | −8.947 *** | −5.500 *** | |

| FDI | Level | −0.598 | −1.713 | 2.975 | −0.598 | −1.789 | 2.777 |

| Δ | −4.601 *** | −4.494 *** | −3.168 *** | −4.597 *** | −4.489 *** | −3.077 *** | |

| RD | Level | −0.320 | −2.727 | 1.047 | −0.481 | −2.010 | 0.683 |

| Δ | −3.532 *** | −3.865 *** | −3.188 *** | −3.518 | −3.444 ** | −3.235 *** | |

| HC | Level | −2.031 | −1.952 | −1.002 | −1.898 | −1.820 | −1.422 |

| Δ | −4.542 *** | −4.616 *** | −4.654 *** | −3.741 *** | −4.546 *** | −3.877 *** | |

| HHC | Level | −3.011 ** | 0.008 | −0.954 | −2.896 * | −2.944 | −1.427 |

| Δ | −8.347 *** | −8.494 *** | −8.534 *** | −8.956 *** | −13.392 *** | −9.189 *** | |

| FDIHC | Level | −0.320 | −3.340 * | 0.659 | −1.355 | −3.317 * | −0.592 |

| Δ | −9.005 *** | −3.712 *** | −8.677 *** | −9.592 *** | −9.575 *** | −8.820 *** | |

| RDHHC | Level | −3.959 *** | −4.175 ** | −3.710 *** | −1.474 | −1.340 | −1.070 |

| Δ | −4.058 *** | −4.131 ** | −4.147 *** | −4.117 *** | −4.185 *** | −4.201 *** | |

| Models | Null Hypothesis | Trace Statistics | 5% Critical Value | Prob. | Max Eigenvalue | 5% Critical Value | Prob. |

|---|---|---|---|---|---|---|---|

| Model 1 | H0: r = 0 | 33.141 ** | 29.797 | 0.020 | 23.236 ** | 21.132 | 0.025 |

| H0: r ≤ 1 | 9.906 | 15.495 | 0.288 | 9.903 | 14.265 | 0.218 | |

| H0: r ≤ 2 | 0.003 | 3.841 | 0.955 | 0.003 | 3.841 | 0.955 | |

| Model 2 | H0: r = 0 | 47.994 ** | 29.797 | 0.000 | 38.964 ** | 21.132 | 0.000 |

| H0: r ≤ 1 | 9.030 | 15.495 | 0.363 | 8.255 | 14.265 | 0.353 | |

| H0: r ≤ 2 | 0.775 | 3.841 | 0.379 | 0.775 | 3.841 | 0.379 |

| Models | Dependent Variables | Type of Granger Causality | Inferences | |||||

|---|---|---|---|---|---|---|---|---|

| Short Run | Long Run | |||||||

| ΔGDP | ΔFDI | ΔRD | ΔFDIHC | ΔRDHHC | ETCt-1 | |||

| ΔGDP | 12.642 *** | 5.427 | 0.678 *** | FDI≥GDP;RD≠>GDP | ||||

| Model 1 | ΔFDI | 3.819 | 5.237 | 0.009 | GDP≠>FDI;RD≠>FDI | |||

| ΔRD | 13.967 *** | 25.808 *** | 0.013 *** | GDP≥RD;FDI≥RD | ||||

| ΔGDP | 15.190 *** | 19.914 *** | −0.193 *** | FDIHC≥GDP;RDHHC≥GDP | ||||

| Model 2 | ΔFDIHC | 65.001 *** | 15.211 *** | 24.520 ** | GDP≥FDIHC;RDHHC≥FDIHC | |||

| ΔRDHHC | 10.887 ** | 39.629 *** | 0.313 *** | GDP≥RDHHC;FDIHC≥RDHHC | ||||

| Model 1 | Period | Variance Decomposition of GDP: | Variance Decomposition of FDI: | Variance Decomposition of RD: | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| GDP | FDI | RD | GDP | FDI | RD | GDP | FDI | RD | ||

| 1 | 100.000 | 0.000 | 0.000 | 57.744 | 42.256 | 0.000 | 5.196 | 3.011 | 91.793 | |

| 2 | 87.815 | 11.426 | 0.758 | 73.113 | 23.863 | 3.023 | 53.172 | 1.406 | 45.422 | |

| 3 | 86.537 | 11.483 | 1.981 | 78.482 | 17.939 | 3.579 | 82.324 | 2.519 | 15.157 | |

| 4 | 86.436 | 5.584 | 7.981 | 77.944 | 12.140 | 9.916 | 92.215 | 1.413 | 6.372 | |

| 5 | 82.320 | 3.901 | 13.779 | 78.786 | 8.200 | 13.015 | 89.006 | 1.497 | 9.497 | |

| 6 | 75.875 | 5.446 | 18.678 | 76.722 | 6.498 | 16.780 | 82.146 | 2.409 | 15.445 | |

| 7 | 70.521 | 7.914 | 21.565 | 75.955 | 5.551 | 18.495 | 74.512 | 5.309 | 20.179 | |

| 8 | 67.682 | 9.978 | 22.340 | 76.522 | 4.701 | 18.777 | 68.985 | 8.804 | 22.210 | |

| 9 | 66.266 | 11.826 | 21.908 | 77.296 | 4.364 | 18.340 | 65.945 | 11.695 | 22.360 | |

| 10 | 66.649 | 12.225 | 21.126 | 78.568 | 3.886 | 17.545 | 65.453 | 13.196 | 21.351 | |

| Model 2 | Period | Variance Decomposition of GDP: | Variance Decomposition of FDIHC: | Variance Decomposition of RDHHC: | ||||||

| GDP | FDI HC | RD HHC | GDP | FDI HC | RD HHC | GDP | FDI HC | RD HHC | ||

| 1 | 100.000 | 0.000 | 0.000 | 0.111 | 99.889 | 0.000 | 34.961 | 9.886 | 55.153 | |

| 2 | 92.431 | 0.085 | 7.484 | 0.666 | 93.845 | 5.489 | 46.818 | 15.786 | 37.396 | |

| 3 | 86.651 | 0.482 | 12.867 | 9.036 | 82.328 | 8.636 | 37.850 | 16.274 | 45.877 | |

| 4 | 73.417 | 0.585 | 25.998 | 8.375 | 79.250 | 12.375 | 31.800 | 19.019 | 49.181 | |

| 5 | 59.944 | 1.600 | 38.456 | 19.070 | 51.688 | 29.242 | 26.535 | 19.421 | 54.043 | |

| 6 | 54.724 | 2.382 | 42.894 | 23.455 | 37.442 | 39.102 | 29.518 | 15.838 | 54.644 | |

| 7 | 49.747 | 3.805 | 46.447 | 20.199 | 37.253 | 42.548 | 31.541 | 14.153 | 54.306 | |

| 8 | 42.652 | 5.810 | 51.538 | 16.087 | 38.751 | 45.162 | 28.512 | 16.374 | 55.114 | |

| 9 | 37.212 | 7.356 | 55.432 | 13.162 | 38.459 | 48.379 | 25.815 | 19.219 | 54.966 | |

| 10 | 35.352 | 7.983 | 56.666 | 14.171 | 34.651 | 51.179 | 23.886 | 21.135 | 54.979 | |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, S.-D. The Nexus of FDI, R&D, and Human Capital on Chinese Sustainable Development: Evidence from a Two-Step Approach. Sustainability 2018, 10, 2063. https://doi.org/10.3390/su10062063

Park S-D. The Nexus of FDI, R&D, and Human Capital on Chinese Sustainable Development: Evidence from a Two-Step Approach. Sustainability. 2018; 10(6):2063. https://doi.org/10.3390/su10062063

Chicago/Turabian StylePark, Sang-Do. 2018. "The Nexus of FDI, R&D, and Human Capital on Chinese Sustainable Development: Evidence from a Two-Step Approach" Sustainability 10, no. 6: 2063. https://doi.org/10.3390/su10062063

APA StylePark, S.-D. (2018). The Nexus of FDI, R&D, and Human Capital on Chinese Sustainable Development: Evidence from a Two-Step Approach. Sustainability, 10(6), 2063. https://doi.org/10.3390/su10062063