Bridging the Gaps for a ‘Circular’ Bioeconomy: Selection Criteria, Bio-Based Value Chain and Stakeholder Mapping

Abstract

:1. Introduction

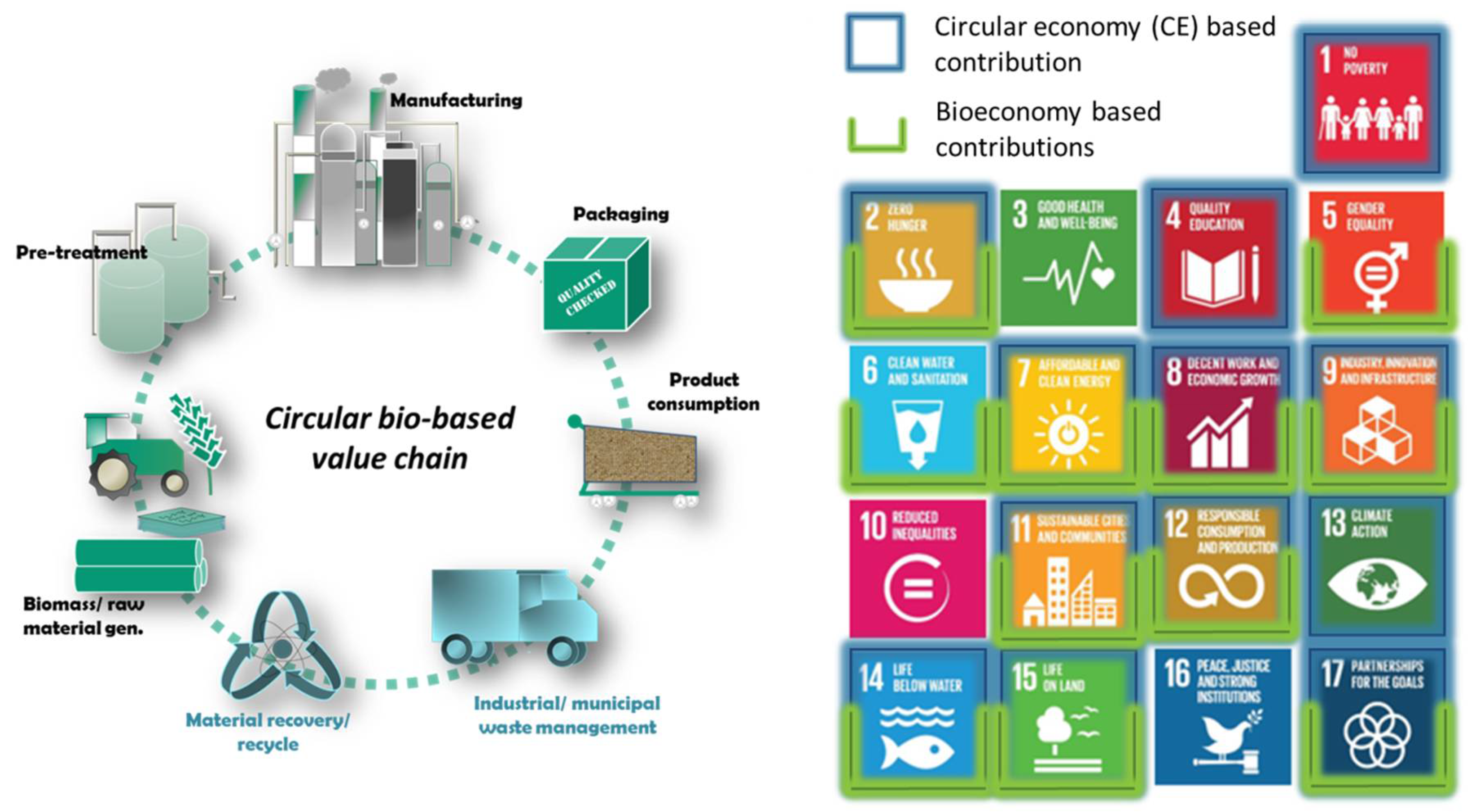

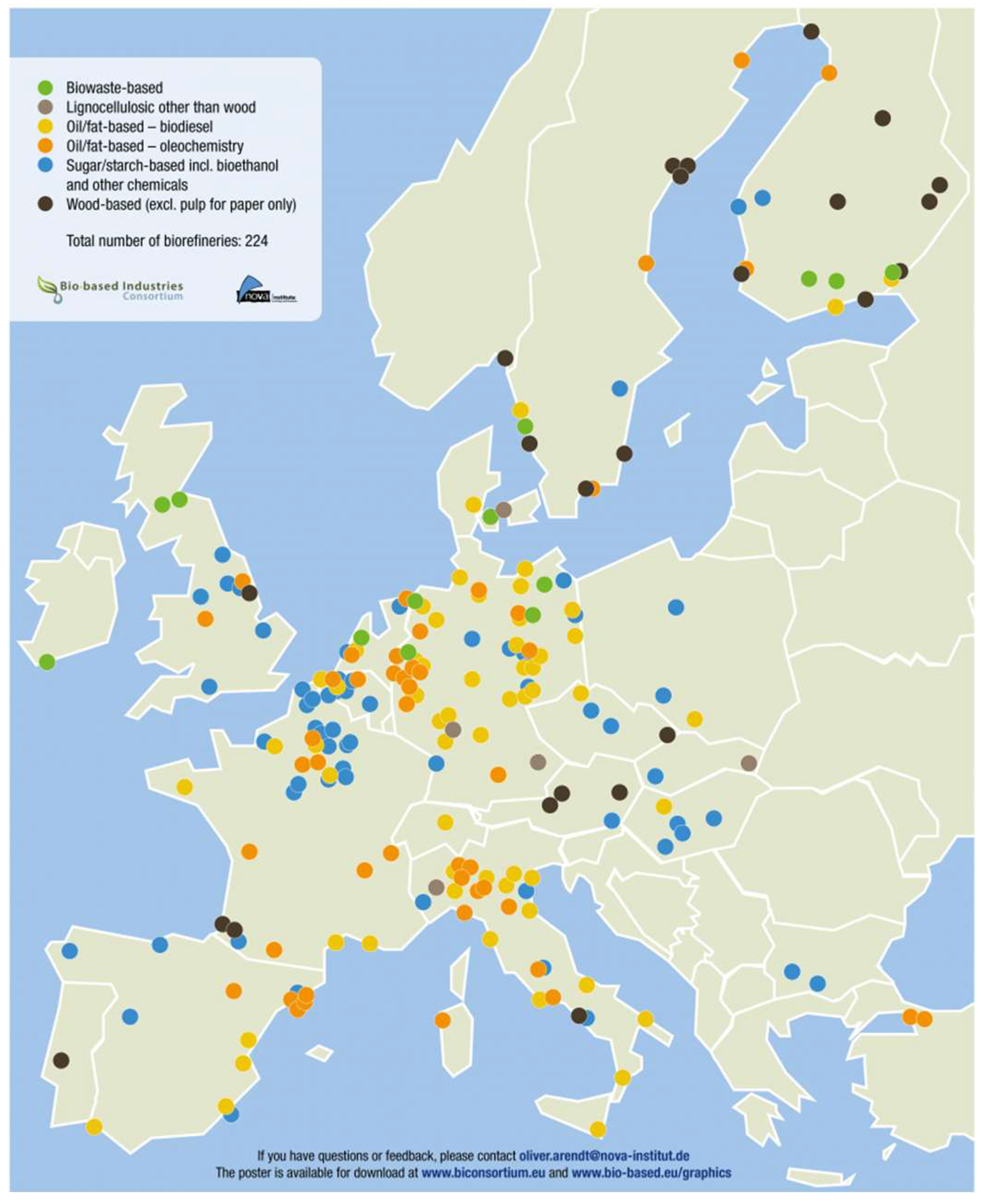

1.1. Background

1.2. Bioeconomy Strategies Initiatives

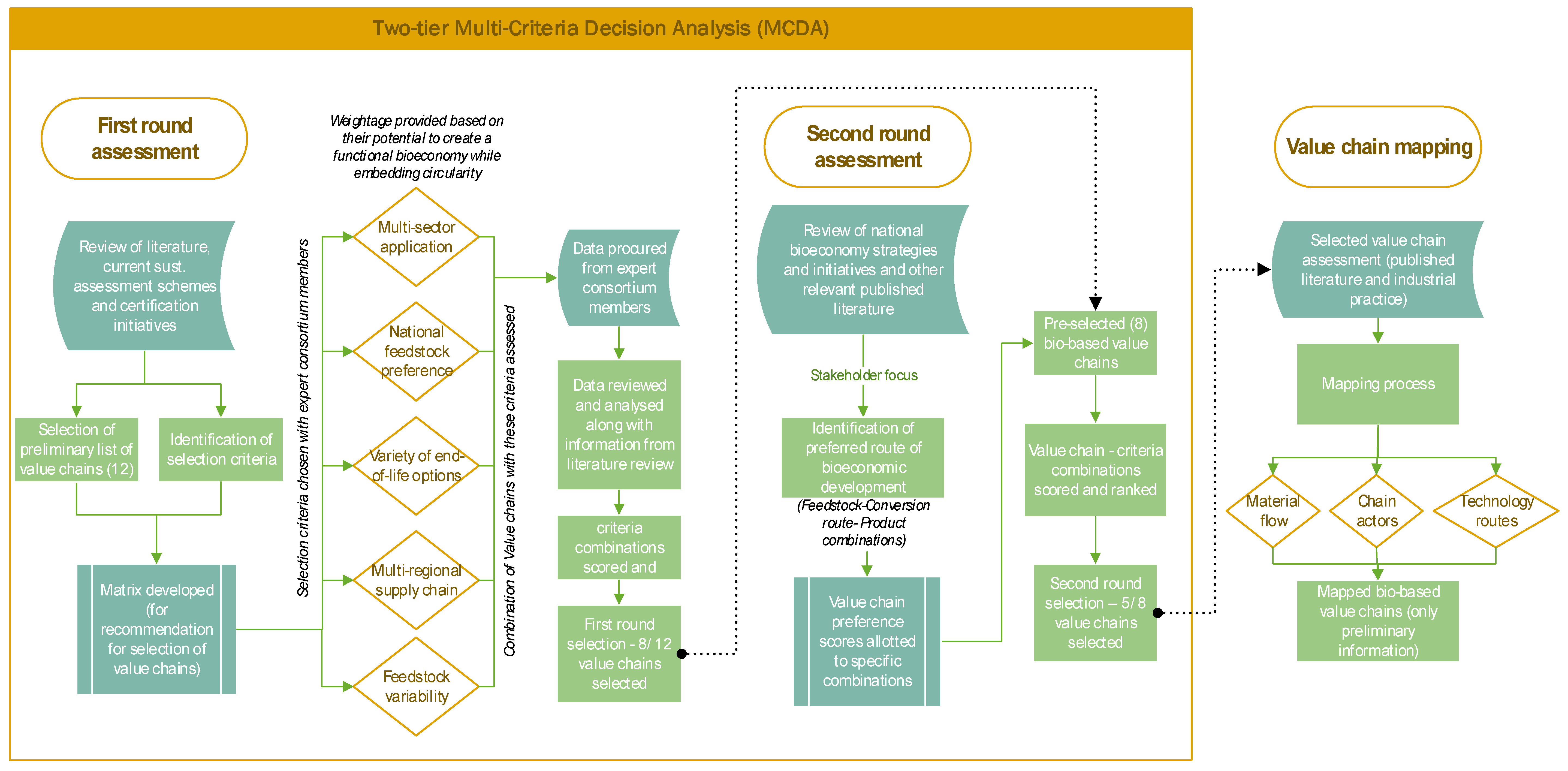

2. Methodology

2.1. Value Chain Selection Criteria

- From virgin food-based feedstock to bio-waste cascading;

- 100% bio-based to partially bio-based, value chains;

- Those with a fully-functional waste management infrastructure to those that lack one;

- Diverse product functionality.

- CEN/TS 16137:2011: Plastics—Determination of bio-based carbon content

- CEN/TS 16295:2012: Plastics—Declaration of the bio-based carbon content

- CEN/TS 16398:2012: Plastics—Template for reporting and communication of bio-based carbon content and recovery options of biopolymers and bioplastics—Data sheet

Application of These Value Chain Selection Factors with Multi-Criteria Decision Analysis

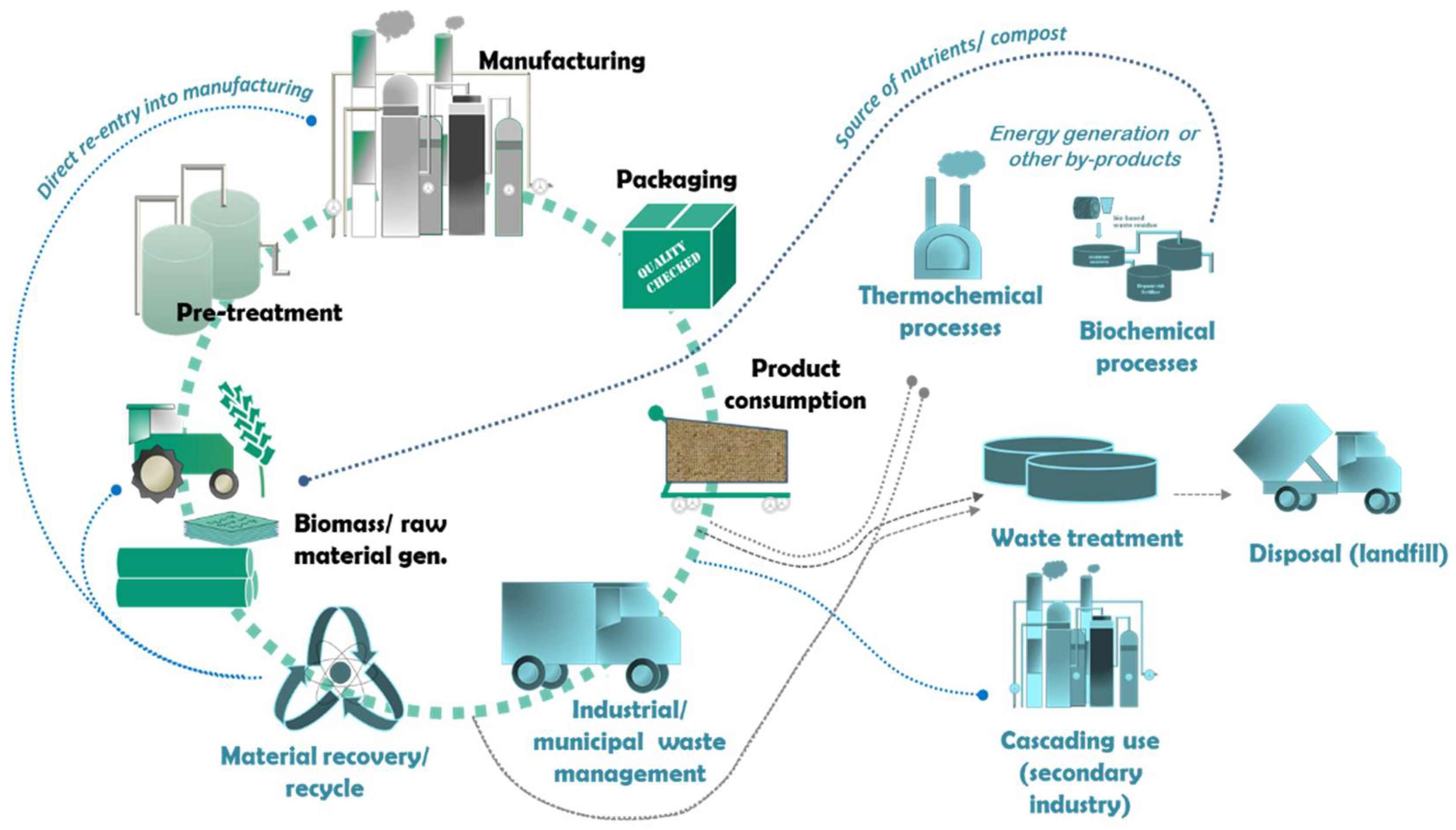

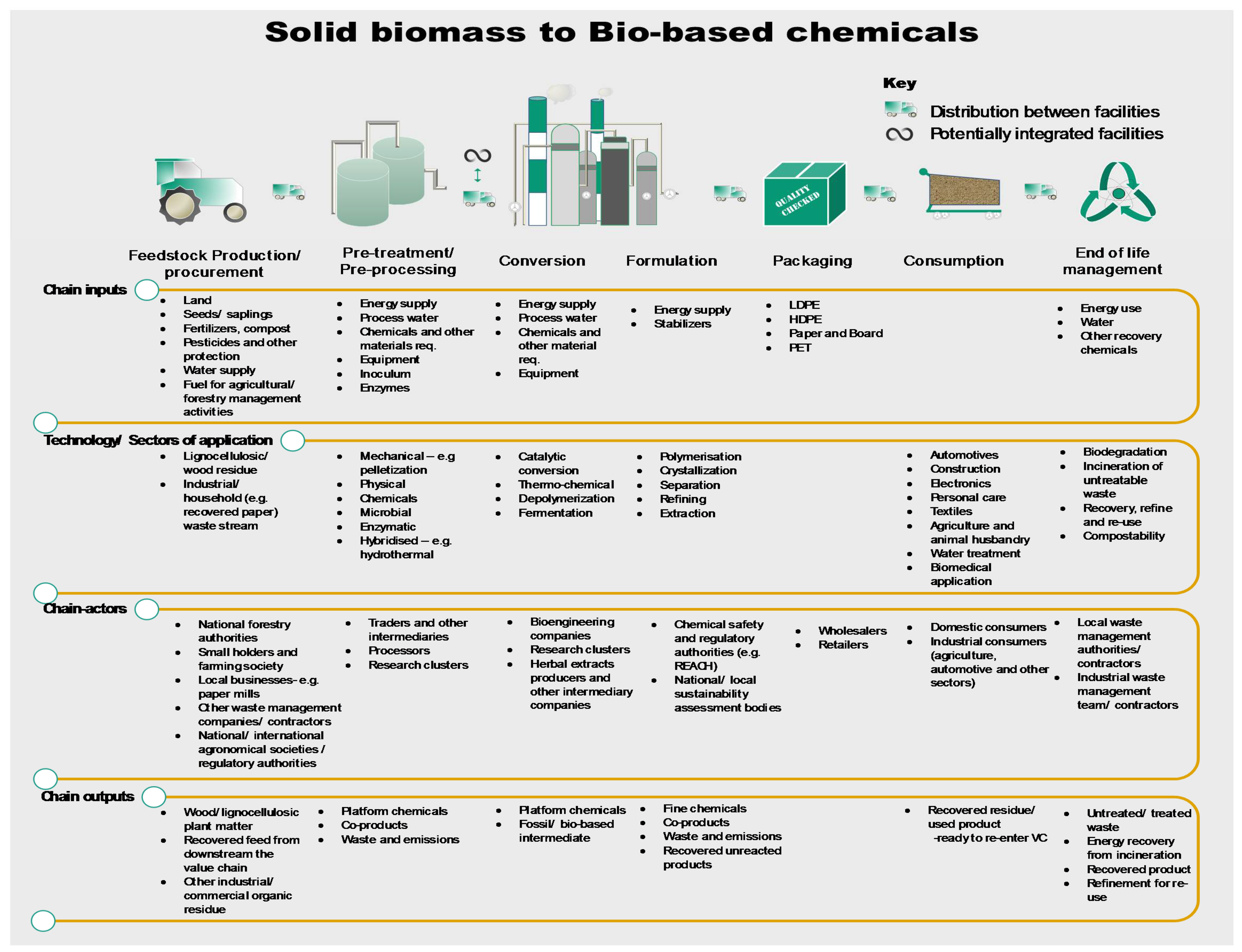

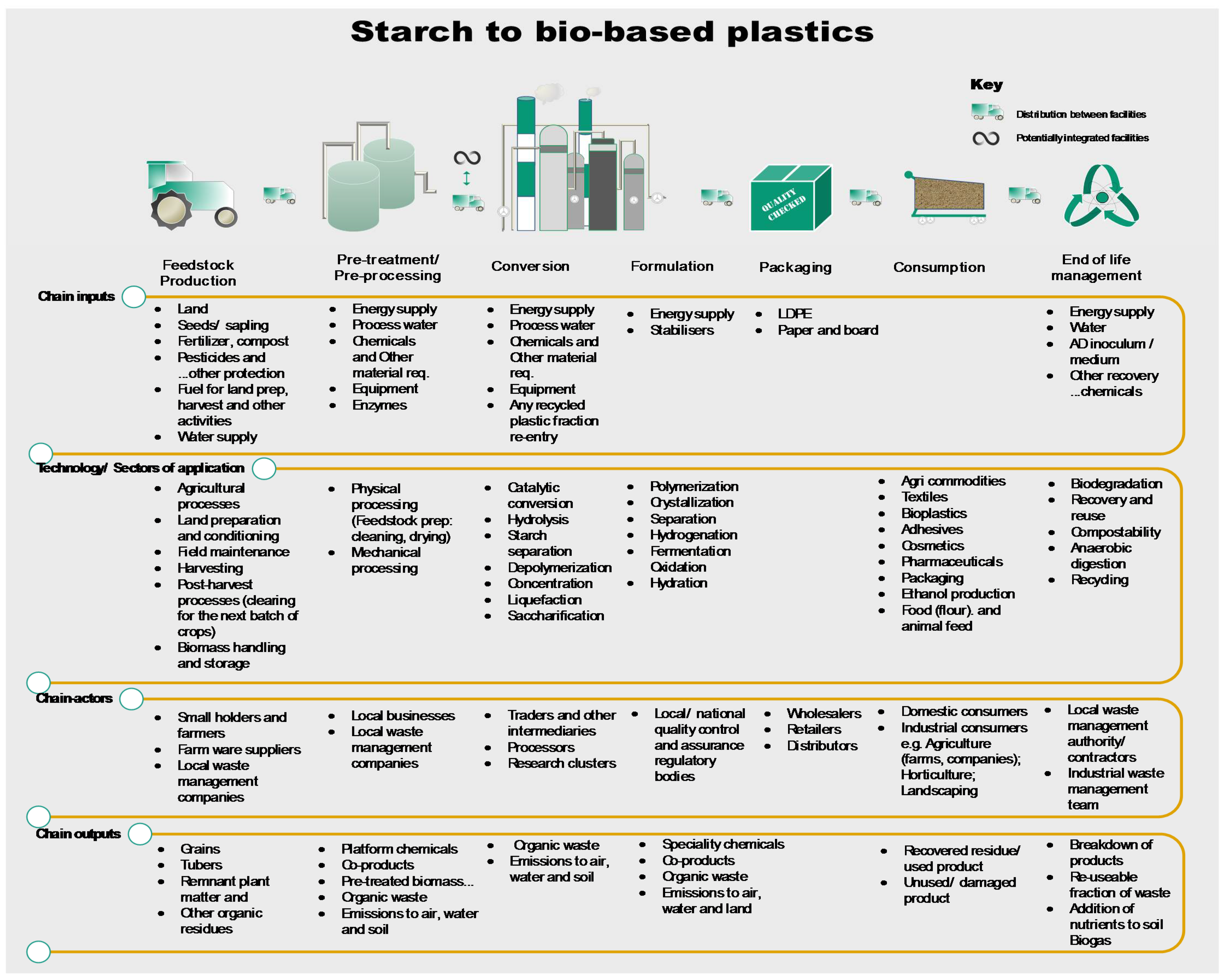

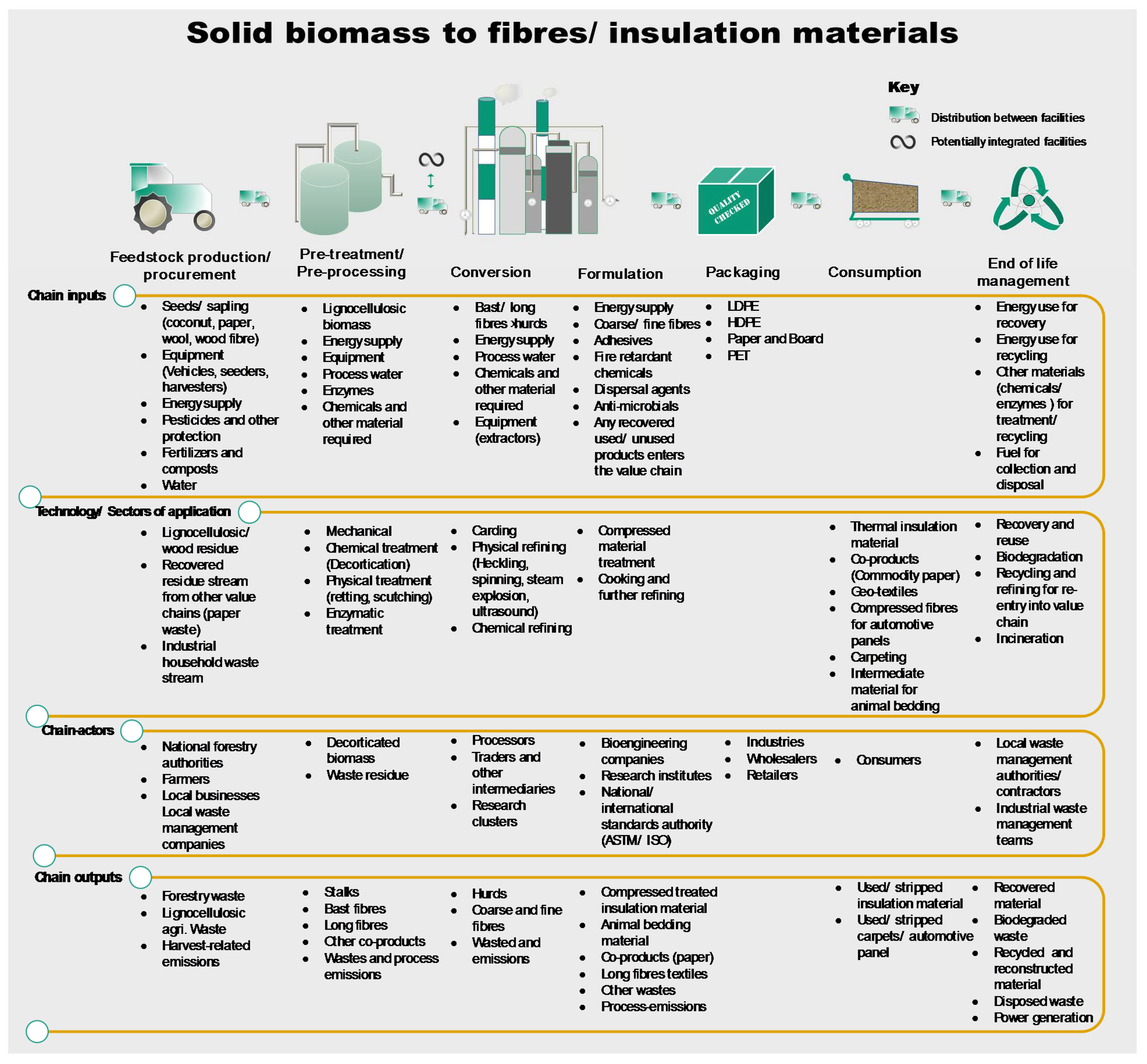

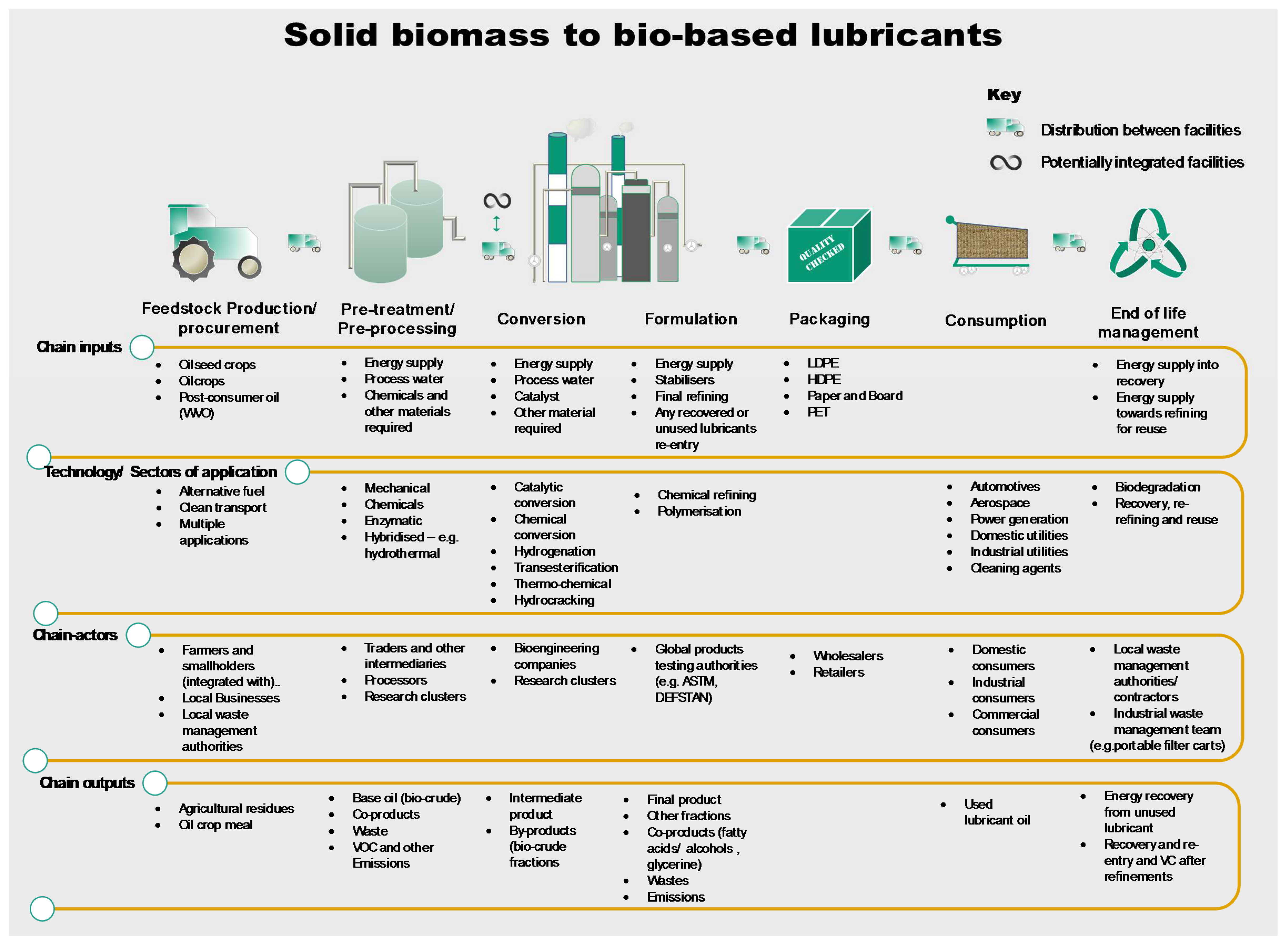

2.2. Value Chain Mapping

- Material/energy inputs and outputs, including potential products, co-products, waste and emissions;

- Sector-level contributions;

- Technology/conversion routes;

- Chain-actors or stakeholders linkages

- End-of life (variable) characteristics emphasising the fate of the outputs from each of the life cycle stages.

3. Results and Discussions

3.1. Value Chain Selection

3.2. Value Chain Mapping—Case Studies

3.2.1. Bio-Based Chemicals

3.2.2. Bioplastics

3.2.3. Other Bio-Based Products

3.3. Gaps and Challenges That Can Be Addressed

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- European Commission. Towards a Circular Economy. Available online: https://ec.europa.eu/commission/priorities/jobs-growth-and-investment/towards-circular-economy_en (accessed on 28 October 2017).

- Jurgilevich, A.; Birge, T.; Kentala-Lehtonen, J.; Korhonen-Kurki, K.; Pietikäinen, J.; Saikku, L.; Schösler, H. Transition towards Circular Economy in the Food System. Sustainability 2016, 8, 69. [Google Scholar] [CrossRef]

- Spatial Foresight; SWECO; ÖIR; Nordregio; Berman Group; Infyde. Bioeconomy Development in EU Regions. Mapping of EU Member States’/regions’ Research and Innovation Plans & Strategies for Smart Specialisation (RIS3) on Bioeconomy for 2014–2020; DG Research & Innovation, European Commission: Brussels, Belgium, 2017. [Google Scholar]

- D’Amato, D.; Droste, N.; Allen, B.; Kettunen, M.; Lähtinen, K.; Korhonen, J.; Leskinen, P.; Matthies, B.D.; Toppinen, A. Green, circular, bio economy: A comparative analysis of sustainability avenues. J. Clean. Prod. 2017, 168, 716–734. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in context of manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Frank, D. The Bioeconomy is Much More than a Circular Economy. Available online: https://www.brain-biotech.de/en/blickwinkel/circular/the-bioeconomy-is-much-more-than-a-circular-economy/ (accessed on 8 May 2018).

- Geels, D.I.F.W. The dynamics of transitions in socio-technical systems: A multi-level analysis of the transition pathway from horse-drawn carriages to automobiles (1860–1930). Technol. Anal. Strateg. Manag. 2005, 17, 445–476. [Google Scholar] [CrossRef]

- Shove, E. Putting practice into policy: Reconfiguring questions of consumption and climate change. Contemp. Soc. Sci. 2014, 9, 415–429. [Google Scholar] [CrossRef]

- Honegger, M.; Reiner, D. The political economy of negative emissions technologies: Consequences for international policy design. Clim. Policy 2018, 18, 306–321. [Google Scholar] [CrossRef]

- Tukker, A. Product services for a resource-efficient and circular economy—A review. J. Clean. Prod. 2015, 97, 76–91. [Google Scholar] [CrossRef]

- Pan, S.-Y.; Du, M.A.; Huang, I.-T.; Liu, I.-H.; Chang, E.-E.; Chiang, P.-C. Strategies on implementation of waste-to-energy (WTE) supply chain for circular economy system: A review. J. Clean. Prod. 2015, 108, 409–421. [Google Scholar] [CrossRef]

- Greene, J.P. Introduction to Sustainability. In Sustainable Plastics; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2014; pp. 1–14. ISBN 978-1-118-89959-5. [Google Scholar]

- Brosowski, A.; Thrän, D.; Mantau, U.; Mahro, B.; Erdmann, G.; Adler, P.; Stinner, W.; Reinhold, G.; Hering, T.; Blanke, C. A review of biomass potential and current utilisation—Status quo for 93 biogenic wastes and residues in Germany. Biomass Bioenergy 2016, 95, 257–272. [Google Scholar] [CrossRef]

- Pick, D.; Dieterich, M.; Heintschel, S. Biogas Production Potential from Economically Usable Green Waste. Sustainability 2012, 4, 682–702. [Google Scholar] [CrossRef]

- Gurría, P.; Ronzon, T.; Tamosiunas, S.; López, R.; García Condado, S.; Guillén, J.; Cazzaniga, N.; Jonsson, R.; Banja, M.; Fiore, G.; et al. Biomass Flows in the European Union; European Commission Joint Research Centre: Seville, Spain, 2017. [Google Scholar]

- Parisi, C.; Ronzon, T. A Global View of Bio-Based Industries: Benchmarking and Monitoring Their Economic Importance and Future Developments; JRC Technical Reports; European Commission: Brussels, Belgium, 2016. [Google Scholar]

- Bio-Based Industries Consortium Mapping European Biorefineries|Bio-Based Industries Consortium. Available online: http://biconsortium.eu/news/mapping-european-biorefineries (accessed on 1 December 2017).

- Fehrenback, H.; Köppen, S.; Kauertz, B.; Detzel, A.; Wellenreuther, F.; Brietmayer, E.; Essel, R.; Carus, M.; Kay, S.; Wern, B.; et al. Biomass Cascades: Increasing Resource Efficiency by Cascading Use of Biomass—From Theory to Practice; German Environmental Agency: Heidelberg, Germany, 2017; p. 29. [Google Scholar]

- Myllyviita, T.; Holma, A.; Antikainen, R.; Lähtinen, K.; Leskinen, P. Assessing environmental impacts of biomass production chains—Application of life cycle assessment (LCA) and multi-criteria decision analysis (MCDA). J. Clean. Prod. 2012, 29–30, 238–245. [Google Scholar] [CrossRef]

- Zanghelini, G.M.; Cherubini, E.; Soares, S.R. How Multi-Criteria Decision Analysis (MCDA) is aiding Life Cycle Assessment (LCA) in results interpretation. J. Clean. Prod. 2018, 172, 609–622. [Google Scholar] [CrossRef]

- European Parliament. Circular Economy Package: Four Legislative Proposals on Waste; European Parliamentary Research Service: Brussels, Belgium, 2016. [Google Scholar]

- European Commission. Bioeconomy Strategy: Innovating for Sustainable Growth: A Bioeconomy for Europe; European Commission: Brussels, Belgium, 2012. [Google Scholar]

- European Commission. 2030 Energy Strategy. Available online: https://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/2030-energy-strateg (accessed on 5 January 2018).

- Meyer-Kohlstock, D.; Schmitz, T.; Kraft, E. Organic Waste for Compost and Biochar in the EU: Mobilizing the Potential. Resources 2015, 4, 457–475. [Google Scholar] [CrossRef]

- STAR-ProBio. Report on Identified Environmental, Social and Economic Criteria/Indicators/Requirements and Related “Gap Analysis; STAR-ProBio: York, UK, 2017. [Google Scholar]

- Hennig, C.; Brosowski, A.; Majer, S. Sustainable feedstock potential—A limitation for the bio-based economy? J. Clean. Prod. 2016, 123, 200–202. [Google Scholar] [CrossRef]

- Budzinski, M.; Bezama, A.; Thrän, D. Monitoring the progress towards bioeconomy using multi-regional input-output analysis: The example of wood use in Germany. J. Clean. Prod. 2017, 161, 1–11. [Google Scholar] [CrossRef]

- Pagotto, M.; Halog, A. Towards a Circular Economy in Australian Agri-food Industry: An Application of Input-Output Oriented Approaches for Analyzing Resource Efficiency and Competitiveness Potential. J. Ind. Ecol. 2016, 20, 1176–1186. [Google Scholar] [CrossRef]

- CEN European Committee for Standardization. CEN/TS 16295:2012: Bio-Based Products. Requirements for Business-to-Consumer Communication and Claims. 2017. Available online: https://shop.bsigroup.com/ProductDetail/?pid=000000000030330832 (accessed on 15 August 2017).

- CEN European Committee for Standardization. BS EN 16751:2016: Bio-Based Product. Sustainable Criteria. 2016. Available online: https://standards.cen.eu/dyn/www/f?p=204:22:0::::FSP_ORG_ID,FSP_LANG_ID:874780,25&cs=1D63BAA7EABE56EB230DDAA05D6F2CE70 (accessed on 13 June 2017).

- CEN European Committee for Standardization. PD CEN/TS 16398:2012: Plastics. Template for Reporting and Communication of Biobased Carbon Content and Recovery Options of Biopolymers and Bioplastics. Data Sheet. 2012. Available online: https://shop.bsigroup.com/ProductDetail/?pid=000000000030258216 (accessed on 28 June 2017).

- CEN European Committee for Standardization. Plastics. Determination of Bio-Based Carbon Content; CEN European Committee of Standardisation: Brussels, Belgium, 2011. [Google Scholar]

- CEN European Committee for Standardization. CEN/TC 411. Available online: https://standards.cen.eu/dyn/www/f?p=204:7:0::::FSP_ORG_ID:874780&cs=112703B035FC937E906D8EFA5DA87FAB8 (accessed on 11 January 2018).

- Keegan, D.; Kretschmer, B.; Elbersen, B.; Panoutsou, C. Cascading use: A systematic approach to biomass beyond the energy sector. Biofuels Bioprod. Biorefin. 2013, 7, 193–206. [Google Scholar] [CrossRef]

- Blennow, K.; Persson, E.; Lindner, M.; Faias, S.P.; Hanewinkel, M. Forest owner motivations and attitudes towards supplying biomass for energy in Europe. Biomass Bioenergy 2014, 67, 223–230. [Google Scholar] [CrossRef]

- Greene, J.P. Sustainable Plastic Products. In Sustainable Plastics; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2014; pp. 145–186. ISBN 978-1-118-89959-5. [Google Scholar]

- Dubois, J.-L. Requirements for the development of a bioeconomy for chemicals. Curr. Opin. Environ. Sustain. 2011, 3, 11–14. [Google Scholar] [CrossRef]

- Akanbi, L.A.; Oyedele, L.O.; Akinade, O.O.; Ajayi, A.O.; Davila Delgado, M.; Bilal, M.; Bello, S.A. Salvaging building materials in a circular economy: A BIM-based whole-life performance estimator. Resour. Conserv. Recycl. 2018, 129, 175–186. [Google Scholar] [CrossRef]

- Zion Market Research Global Bio-Solvents Market Will Reach USD 9.43 Billion by 2022: Zion Market Research. Available online: http://globenewswire.com/news-release/2017/09/22/1131467/0/en/Global-Bio-Solvents-Market-Will-Reach-USD-9-43-Billion-by-2022-Zion-Market-Research.html (accessed on 6 November 2017).

- Greene, J.P. Biobased and Biodegradable Polymers. In Sustainable Plastics; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2014; pp. 71–106. ISBN 978-1-118-89959-5. [Google Scholar]

- Carrington, D. Plastic fibres found in tap water around the world, study reveals. The Guardian, 6 September 2017. [Google Scholar]

- Schwede, K. European Parliament Supports Use of Biodegradable Mulch Films. Available online: http://www.european-bioplastics.org/european-parliament-supports-use-of-biodegradable-mulch-films/ (accessed on 6 November 2017).

- European Bioplastics. Bioplastics: Facts and Figures; European Bioplastics: Berlin, Germany, 2016. [Google Scholar]

- Bio-based Industries Consortium FIRST2RUN|Bio-Based Industries Consortium. Available online: http://biconsortium.eu/library/case-studies/first2run (accessed on 14 January 2018).

- Carus, M.; Eder, A.; Dammer, L.; Korte, K.; Scholz, L.; Essel, R.; Breitmayer, E.; Barth, M. WPC/NFC Market Study 2014; Wood-Plastic Composites (WPC) and Natural Fibre Composites (NFC); Nova-Institut GmbH: Hürth, Germany, 2014. [Google Scholar]

- Alkhagen, M.; Samuelsson, A.; Aldaeus, F.; Gimaker, M.; Ostmark, E.; Swerin, A. Roadmap 2015–2025: Textile Material from Cellulose; The RISE Research Institute of Sweden: Stockholm, Sweden, 2015. [Google Scholar]

- You, F.; Tao, L.; Graziano, D.J.; Snyder, S.W. Optimal design of sustainable cellulosic biofuel supply chains: Multiobjective optimization coupled with life cycle assessment and input–output analysis. AIChE J. 2012, 58, 1157–1180. [Google Scholar] [CrossRef]

- Daneshkhu, S. Consumer Goods: Big Brands Battle with the ‘Little Guys’. Available online: https://www.ft.com/content/4aa58b22-1a81-11e8-aaca-4574d7dabfb6 (accessed on 3 May 2018).

| Sector | Value Chain |

|---|---|

| Chemicals | Cellulose to bio solvents |

| Disposable food packaging | Starch to bioplastic food packaging |

| Agriculture | Starch to bio-based mulch films |

| Fabrication | Starch to bioplastics for fabrication |

| Automotive | Vegetable fats to bio lubricants |

| Agriculture/waste management | Solid biomass to fine chemicals |

| Textiles | Cellulose to fabric |

| Food packaging | Cellulose to plastic paper cups |

| Construction | Waste biomass to insulation material |

| Construction | Waste biomass to wood-plastic composites |

| Agriculture | Polysaccharides to crop health inducers |

| Animal husbandry | Plant-based chemicals to fine chemicals |

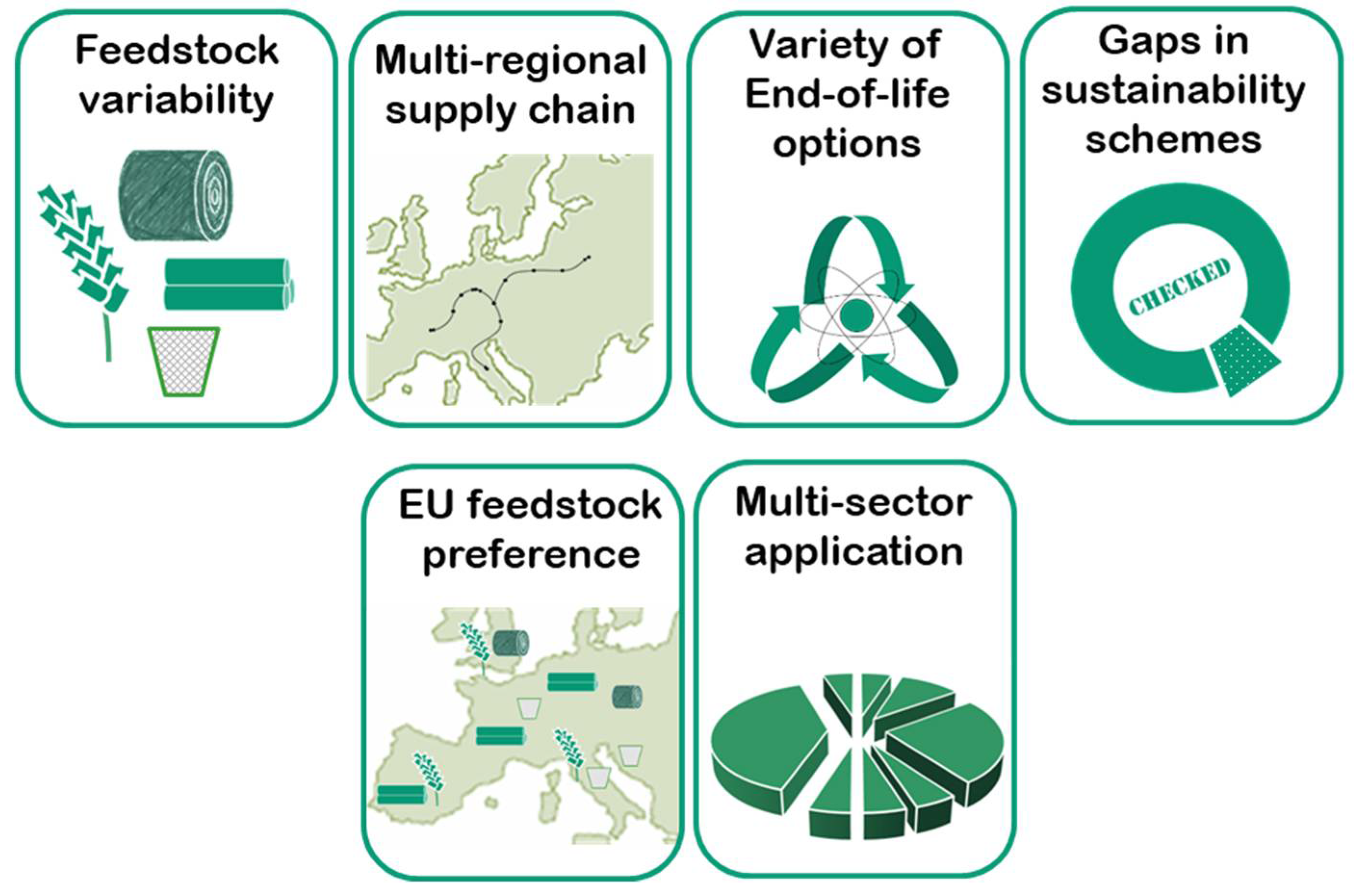

| Selection Criteria | Weighting |

|---|---|

| Feedstock variability | 0.2 |

| Gaps in certification/sustainability schemes | 0.2 |

| Multi-sector application | 0.15 |

| Variety in End-of-life options | 0.2 |

| Multi-regional supply chain | 0.15 |

| Preference within EU member states | 0.1 |

| Value Chains Targeted by the Strategies | Strategy Type | EU Chain Preference Scores |

|---|---|---|

| Bio energy and fuel production | Renewable energy | 0.74 |

| Food and beverage production | Primary food production | 0.6 |

| Crop based primary production | Using waste and residue | 0.37 |

| Animal based primary products | Using waste and residue | 0.32 |

| Forest based primary production | Using waste and residue | 0.26 |

| Bio-based material and plastics | Products/Technology and research | 0.26 |

| Marine based primary production | Primary food production | 0.2 |

| Bio-based chemicals | Products/Technology and research | 0.21 |

| Bio-based construction and furniture | Common conversion | 0.2 |

| Biorefinery | Products/Technology and research | 0.2 |

| Cosmetics and health | Biomass conversion | 0.17 |

| Sector | Value Chain | Score | Rank | Status |

|---|---|---|---|---|

| Chemical | Cellulose to bio-based solvents | 7.44 | 1 | Selected |

| Food Packaging | Starch to bio-plastics | 7.25 | 2 | Selected |

| Agriculture | Starch to bio-based mulch films | 6.62 | 3 | Selected |

| Fabrication | Starch to bioplastic framing material | 6.09 | 4 | Selected |

| Multiple sectors | Vegetable fats/plant lipids to bio-based lubricants | 5.50 | 5 | Selected |

| Textile | Cellulose to fabric | 5.50 | 6 | Selected |

| Chemical | Solid biomass to fine chemicals | 5.20 | 7 | Selected |

| Construction | Waste agri. biomass to insulation material | 4.78 | 8 | Selected |

| Food packaging | Wood/cellulose to plastic paper cups | 4.37 | 9 | - |

| Food packaging | Straw to food packaging | 4.31 | 10 | - |

| Construction | Solid biomass to wood-plastic composite | 4.00 | 11 | - |

| Agriculture | Algal polysaccharides to phytoprotectives | 3.91 | 12 | - |

| Sector | Value Chain | EU Chain Preference Scores | Final Score | Rank | Status |

|---|---|---|---|---|---|

| Food Packaging | Starch to bio-plastics | 0.63 | 4.57 | 1 | Selected |

| Agriculture | Starch to bio mulch films | 0.63 | 4.17 | 2 | Selected |

| Fabrication | Starch to frame material | 0.63 | 3.84 | 3 | Selected |

| Chemicals | Cellulose to bio-based solvents | 0.47 | 3.50 | 4 | Selected |

| Multiple sectors | Vegetable fats/plant lipids to bio-based lubricants | 0.58 | 3.19 | 5 | Selected |

| Chemical | Solid biomass to fine chemicals | 0.58 | 3.02 | 6 | - |

| Construction | Waste agri. biomass to insulation material | 0.57 | 2.72 | 7 | - |

| Textile | Cellulose to fabric | 0.31 | 1.71 | 8 | - |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lokesh, K.; Ladu, L.; Summerton, L. Bridging the Gaps for a ‘Circular’ Bioeconomy: Selection Criteria, Bio-Based Value Chain and Stakeholder Mapping. Sustainability 2018, 10, 1695. https://doi.org/10.3390/su10061695

Lokesh K, Ladu L, Summerton L. Bridging the Gaps for a ‘Circular’ Bioeconomy: Selection Criteria, Bio-Based Value Chain and Stakeholder Mapping. Sustainability. 2018; 10(6):1695. https://doi.org/10.3390/su10061695

Chicago/Turabian StyleLokesh, Kadambari, Luana Ladu, and Louise Summerton. 2018. "Bridging the Gaps for a ‘Circular’ Bioeconomy: Selection Criteria, Bio-Based Value Chain and Stakeholder Mapping" Sustainability 10, no. 6: 1695. https://doi.org/10.3390/su10061695

APA StyleLokesh, K., Ladu, L., & Summerton, L. (2018). Bridging the Gaps for a ‘Circular’ Bioeconomy: Selection Criteria, Bio-Based Value Chain and Stakeholder Mapping. Sustainability, 10(6), 1695. https://doi.org/10.3390/su10061695