Empirical Study on Annual Energy-Saving Performance of Energy Performance Contracting in China

Abstract

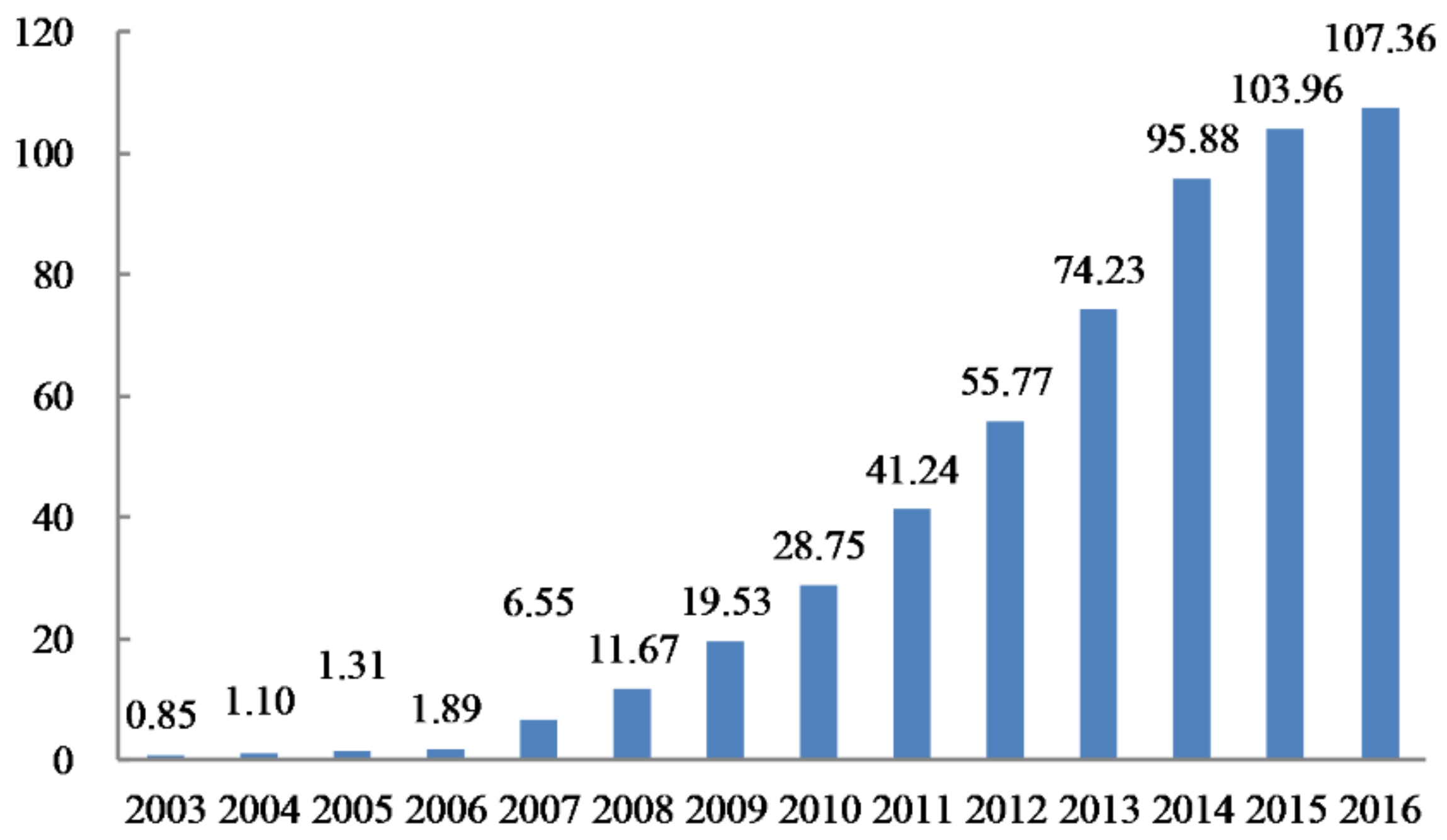

:1. Introduction

2. Data of Annual Energy-Saving Performance

2.1. Data Sources

- project name;

- project owner;

- project undertakers; and

- contents of case (technical principle and application fields, concrete contents of EE promotion, project implementation situation); and

- annual energy saving quantity and annual cost saving of the project (computational method of energy saving quantity); and

- business model; and

- revamping cost and financing channels; and

- project highlights.

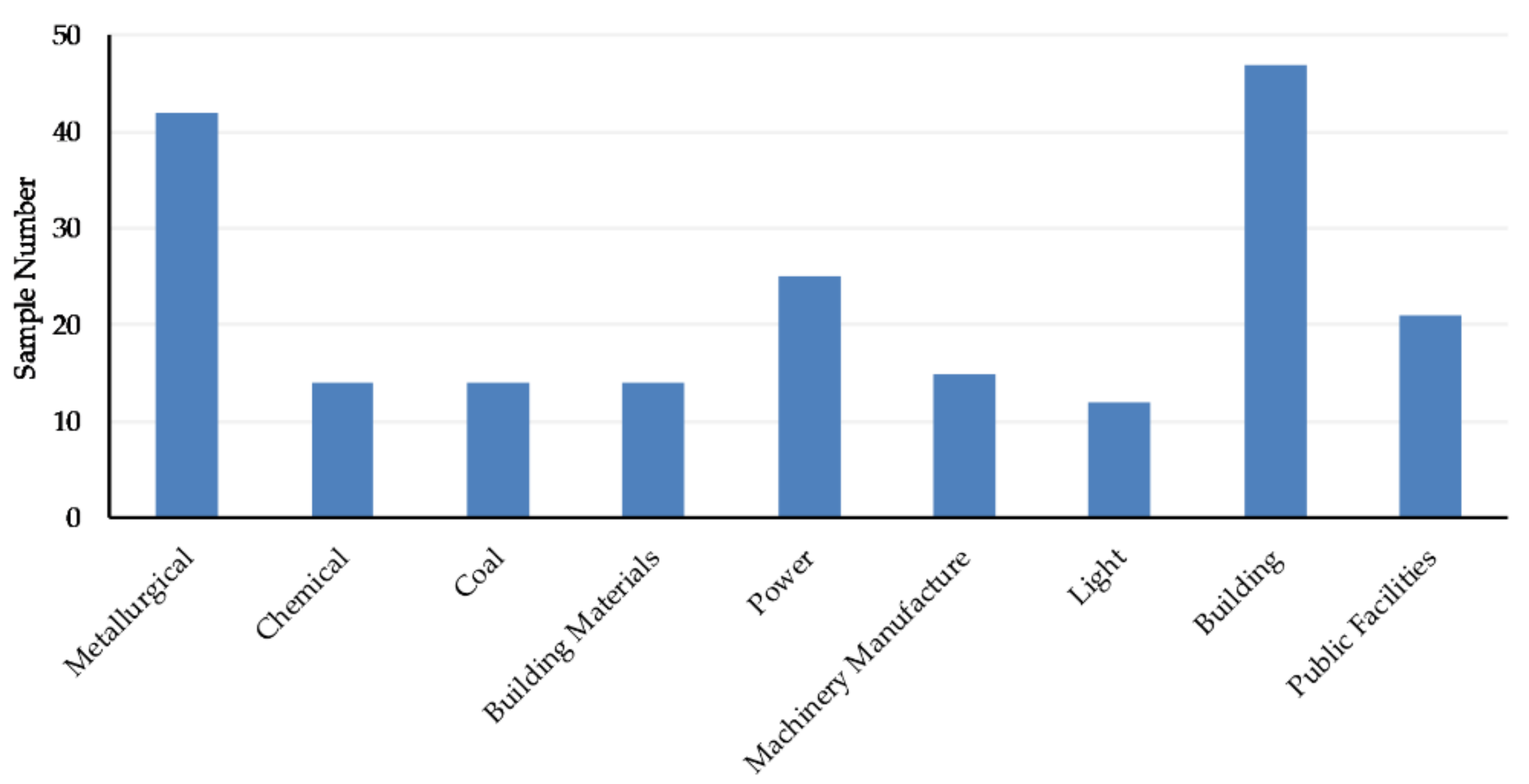

2.2. Descriptive Statistics

3. Regression Analysis of Annual Energy-Saving Performance

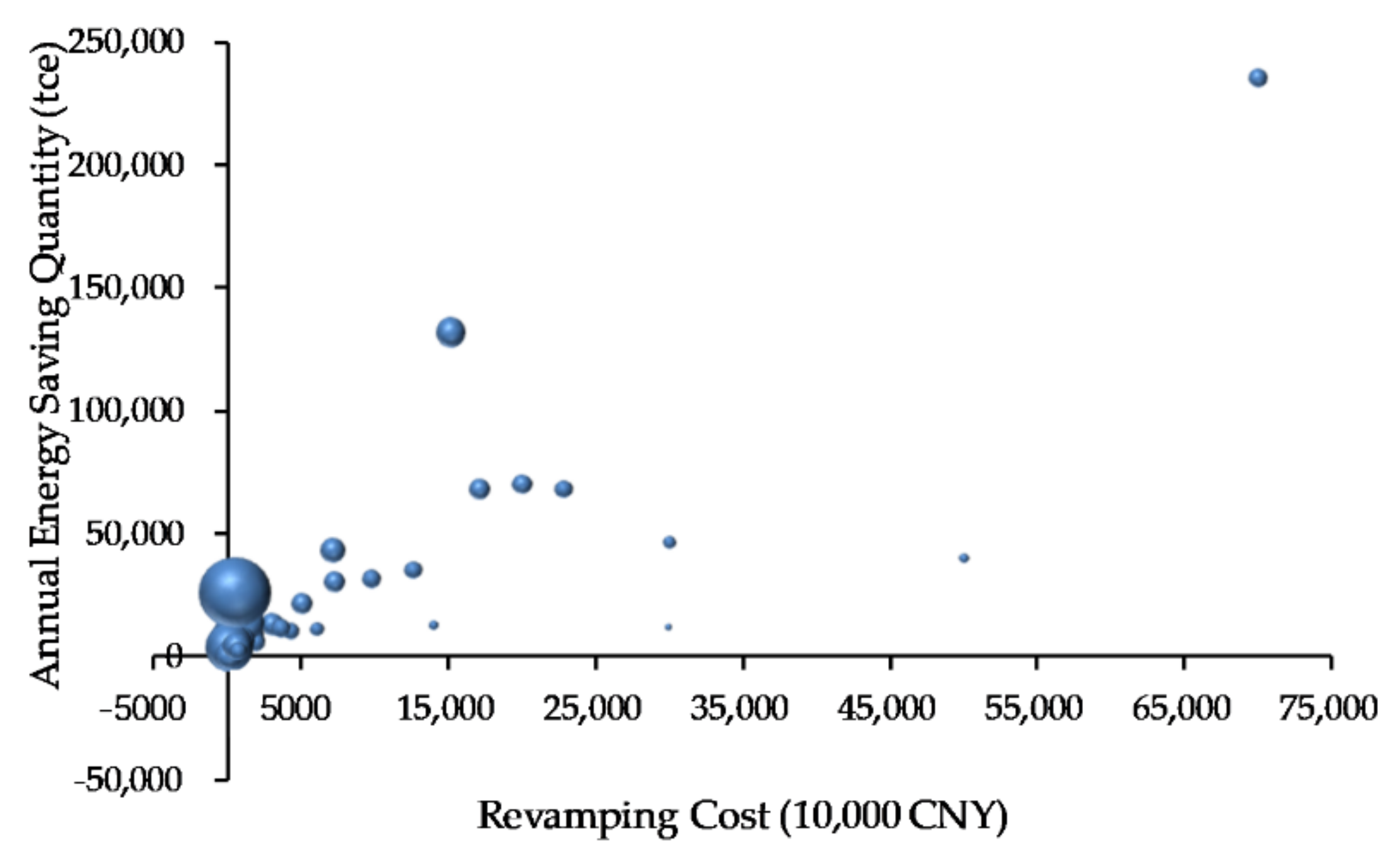

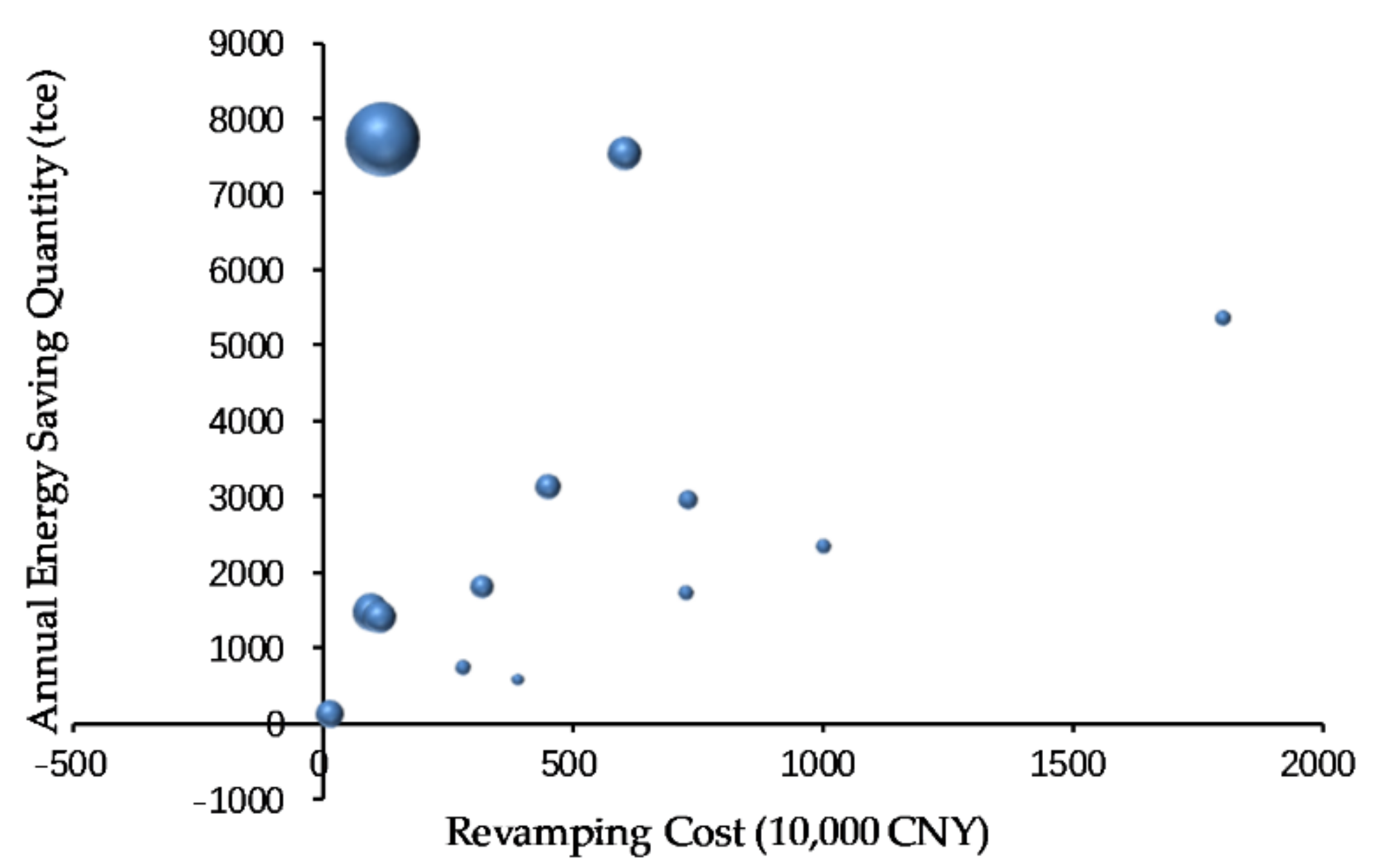

3.1. Relationship of Annual Energy-Saving Quantity in Terms of Revamping Cost

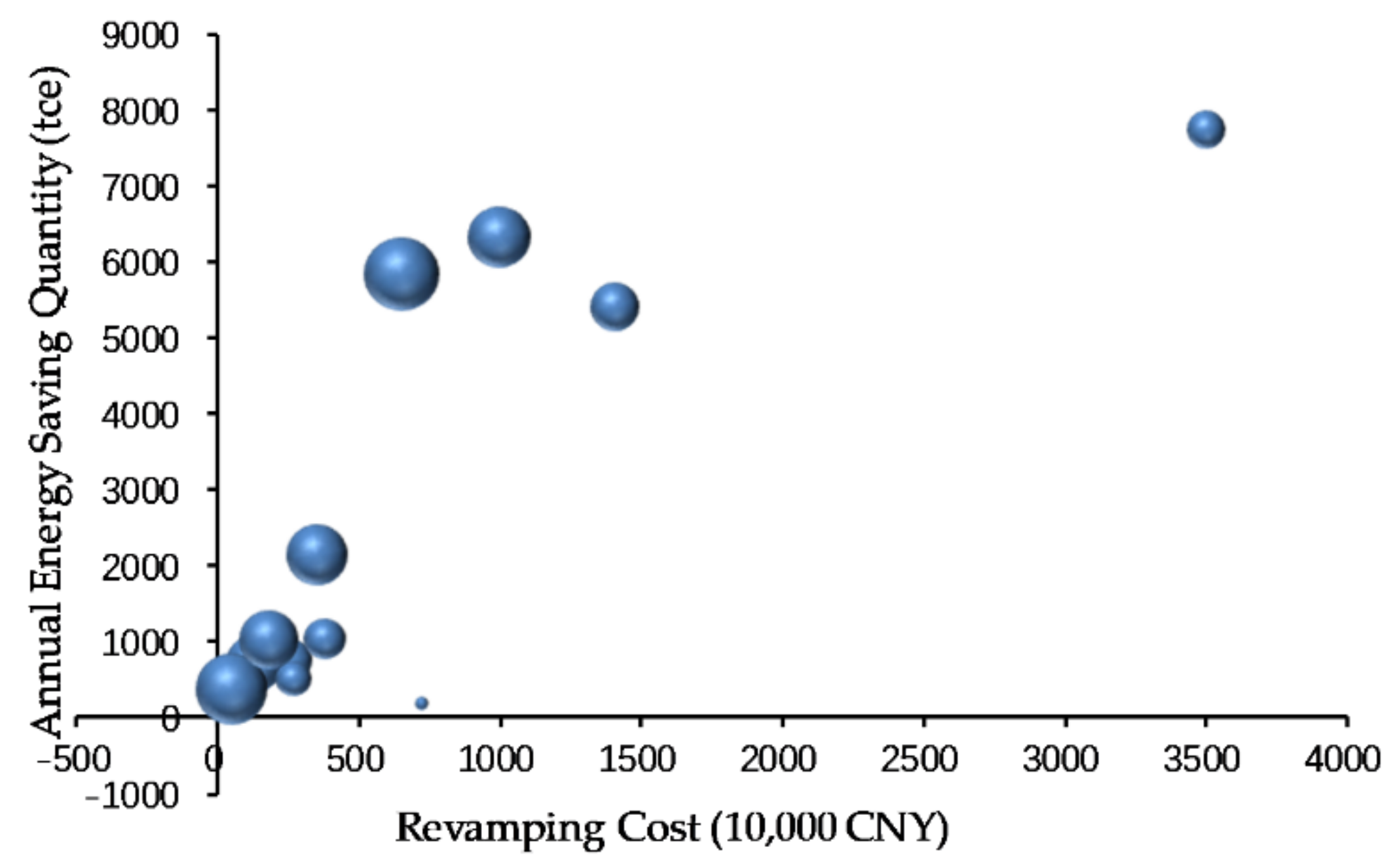

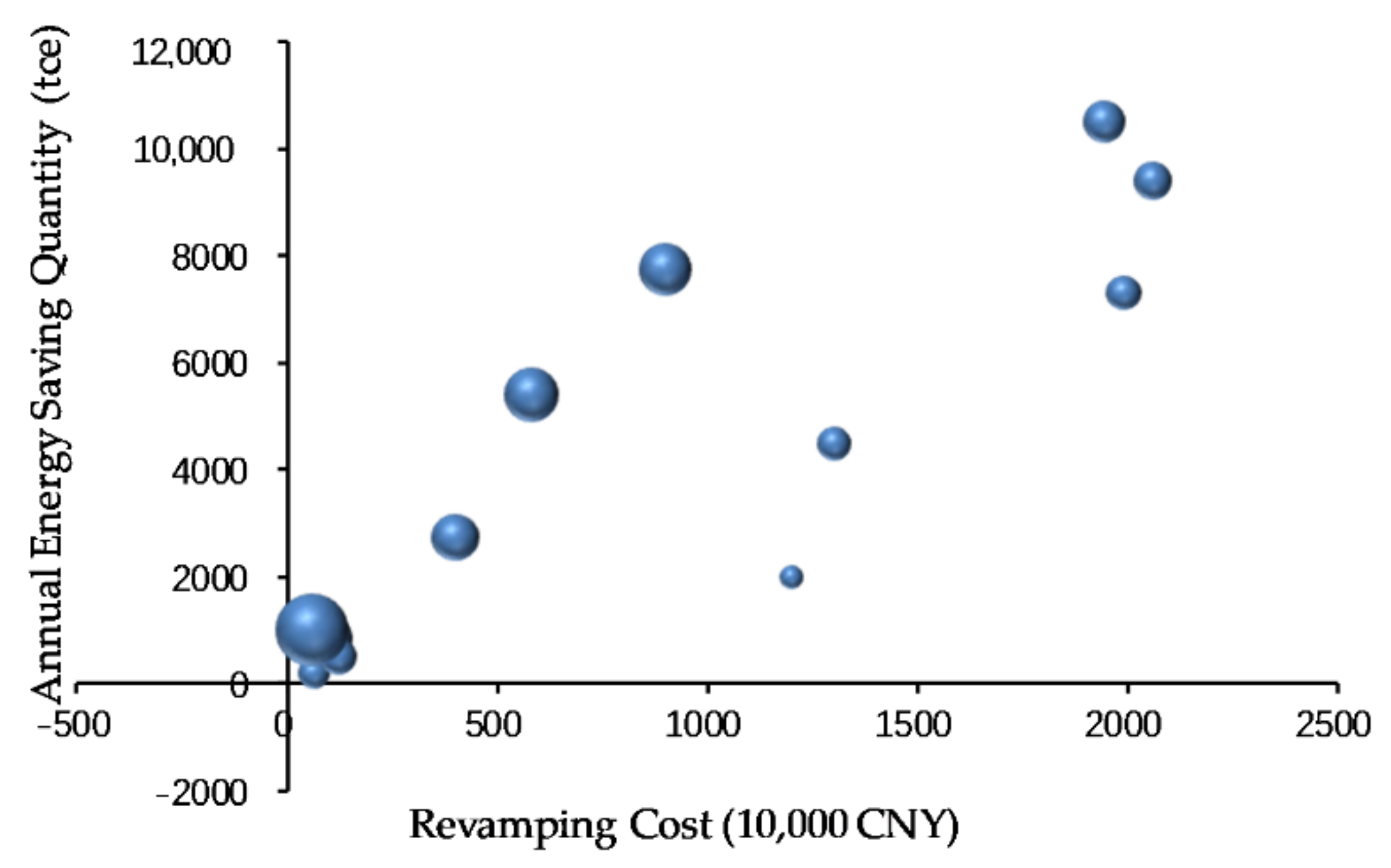

3.1.1. Light, Building Materials, Metallurgical, Building, and Public Facilities Subsectors

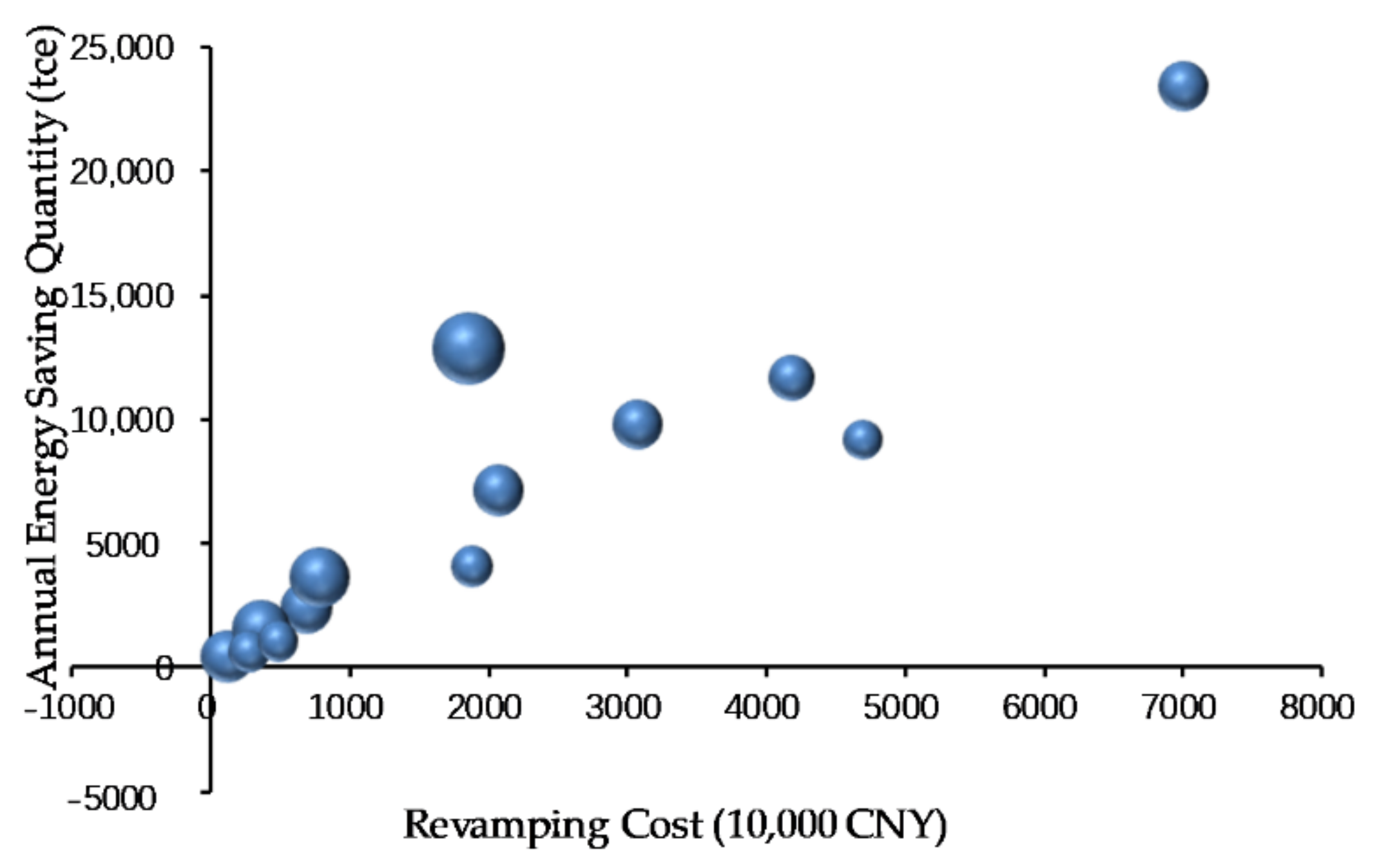

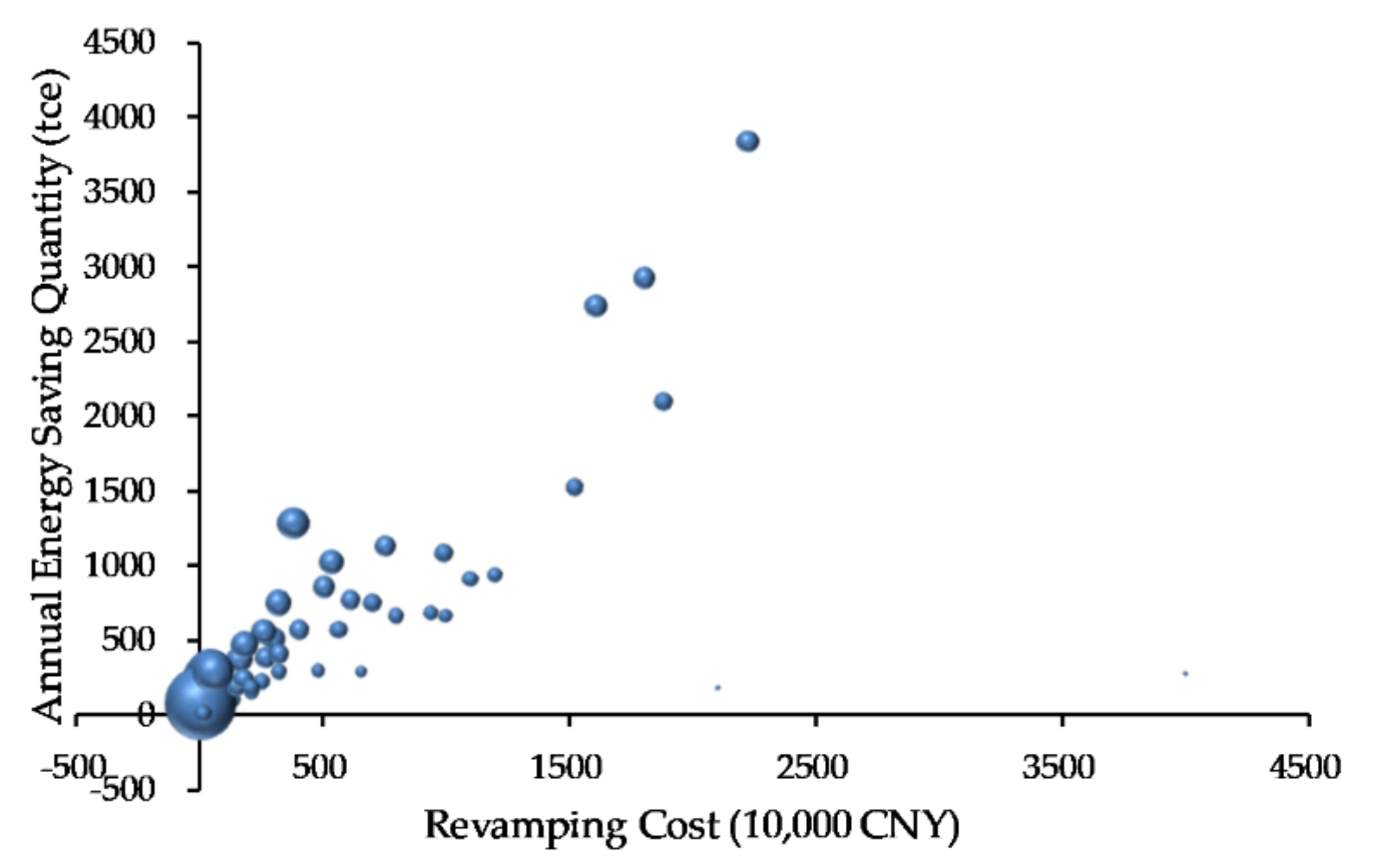

3.1.2. Chemical Subsector

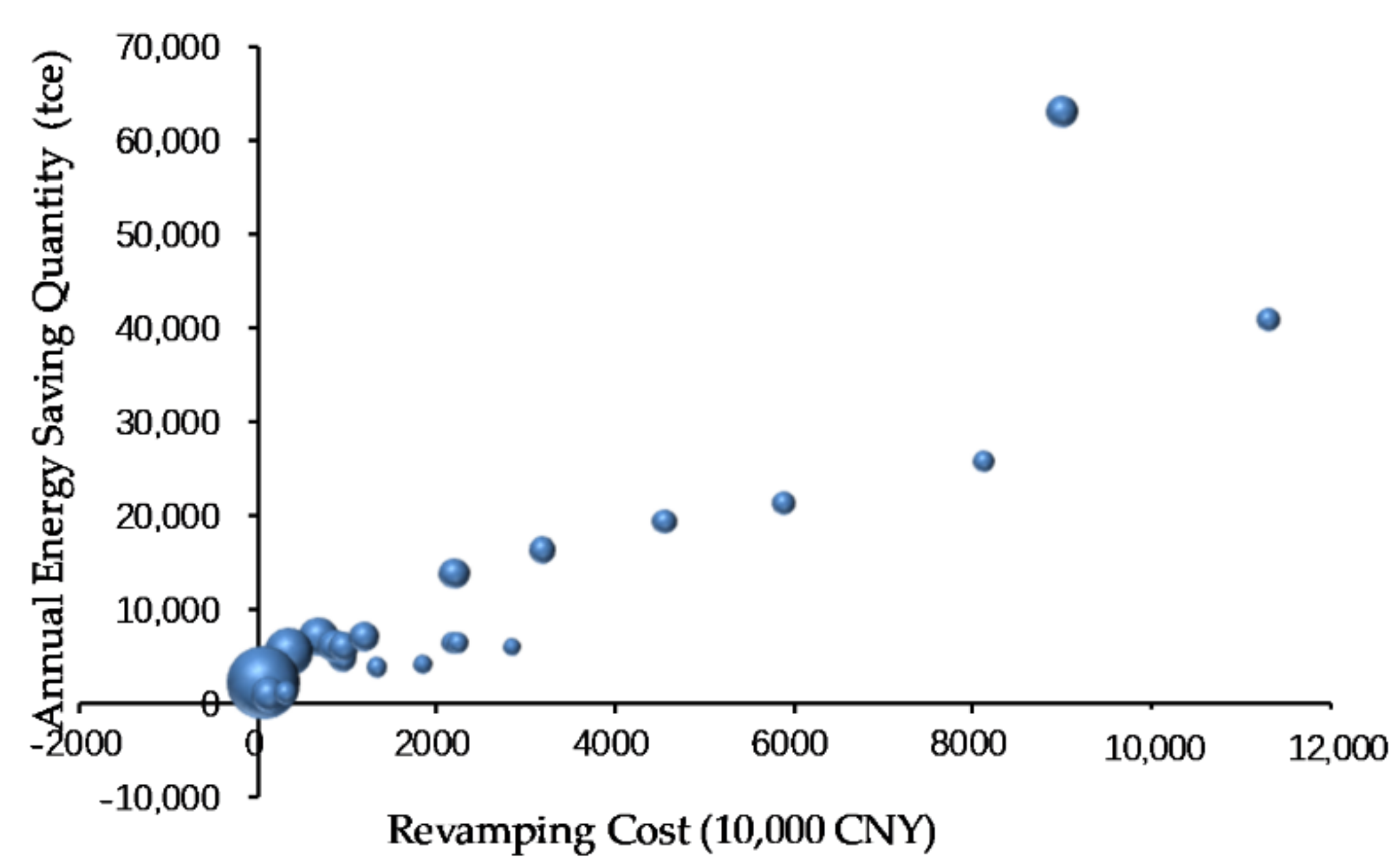

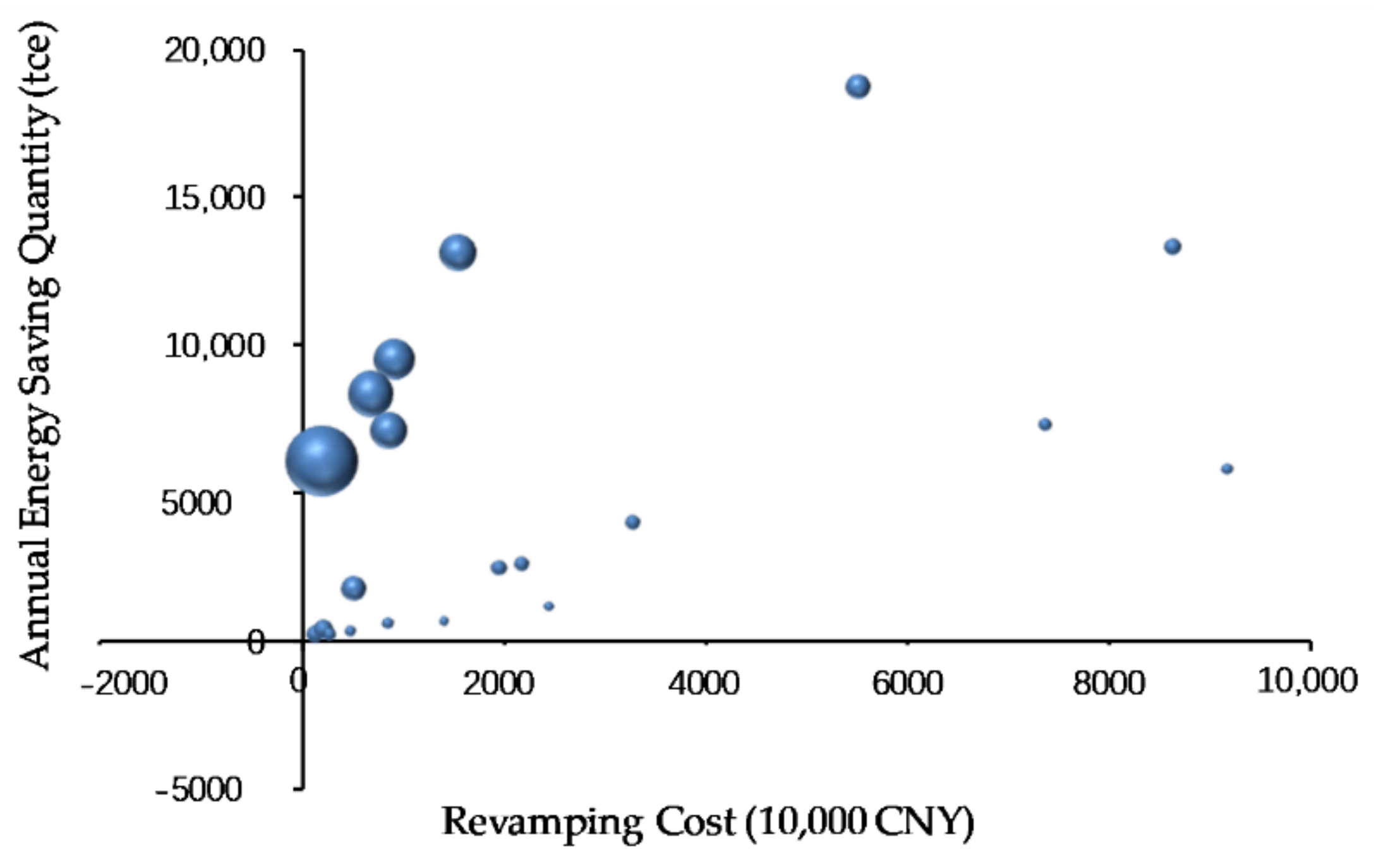

3.1.3. Coal Subsector

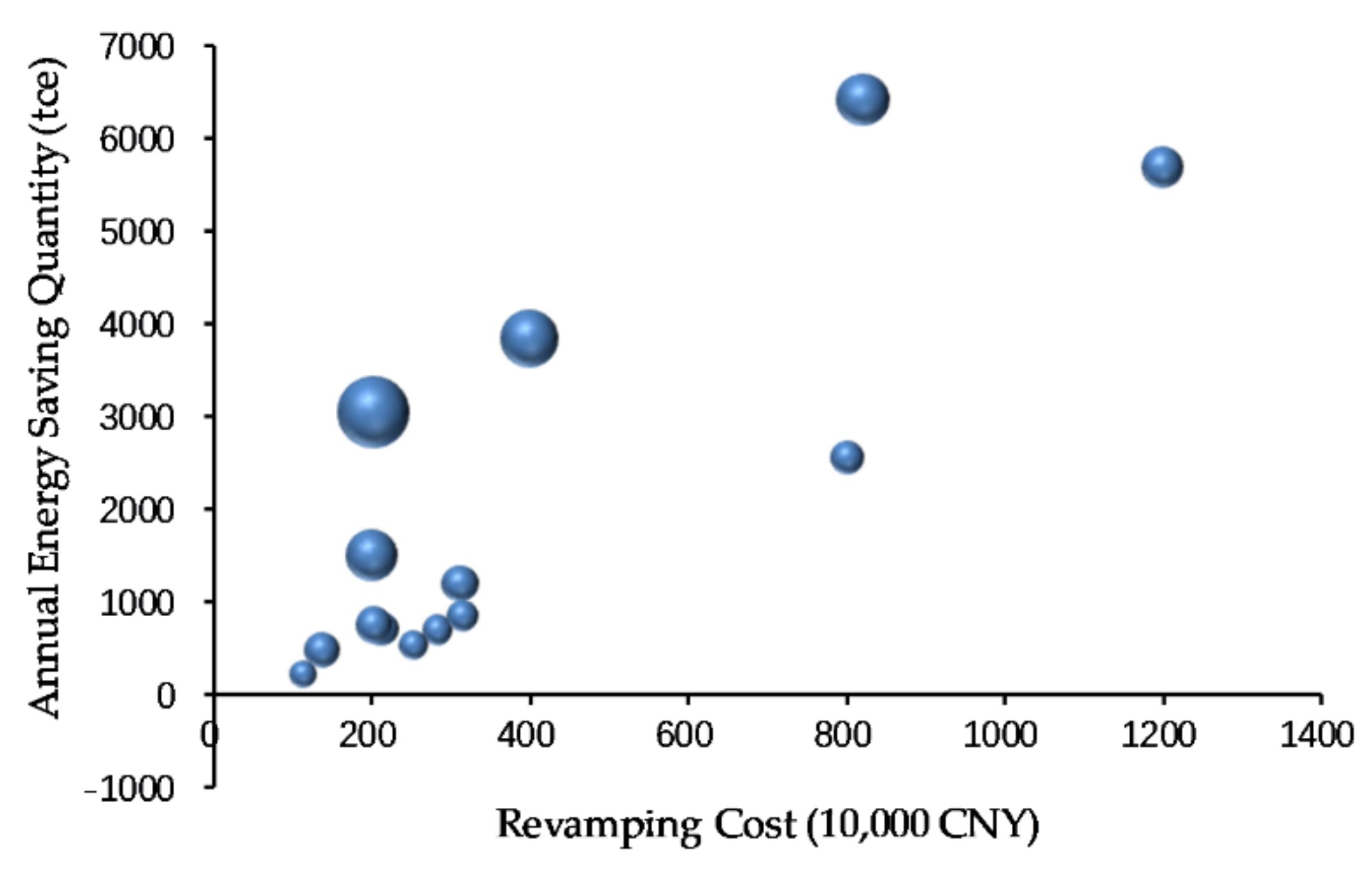

3.1.4. Machinery Manufacture and Power Subsectors

3.2. Relationship of Annual Cost Saving in Terms of Revamping Cost

3.3. Results

4. Research on the Influencing Factors of Revamping Cost

4.1. Multiple Linear Regression Method of Revamping Cost

- one constant term: 3.021;

- one dependent variable: ;

- three numerical variables: , and ; and

- ten categorical variables: eight subsectors; whether or not the sample is financed; whether or not the sample enjoys financial incentive or tax preference.

4.2. Analysis of Factors Influencing Revamping Cost

4.2.1. The Subsectors

4.2.2. Financing

4.2.3. Financial Incentive or Tax Preference

4.2.4. Registered Capital

4.2.5. Contract Period

5. Results and Discussion

5.1. Key Findings

5.1.1. Annual Energy-Saving Performance Based on Revamping Cost

5.1.2. Influencing Factors of Revamping Cost

5.2. Policy Implications

5.2.1. The Government Can Guide ESCos to Innovate EE Promotion Technology

5.2.2. The Government Need Clarify ESCos’ Exit Mechanism

5.2.3. The Government Should Innovate Financing Mechanism and Improve the Market Credit Environment

5.3. Discussion

6. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

| Subsector | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| Machinery Manufacture | Regression | 35,436,882.655 | 1 | 35,436,882.655 | 24.766 | 0.000 |

| Residual | 17,170,546.550 | 12 | 1,430,878.879 | |||

| Total | 52,607,429.206 | 13 | ||||

| Chemical | Regression | 7.878 | 1 | 7.878 | 11.668 | 0.006 |

| Residual | 7.427 | 11 | 0.675 | |||

| Total | 15.304 | 12 | ||||

| Light | Regression | 14.754 | 1 | 14.754 | 40.424 | 0.000 |

| Residual | 3.650 | 10 | 0.365 | |||

| Total | 18.403 | 11 | ||||

| Coal | Regression | 62,747,324.159 | 2 | 31,373,662.079 | 12.191 | 0.003 |

| Residual | 23,161,090.616 | 9 | 2,573,454.513 | |||

| Total | 85,908,414.774 | 11 | ||||

| Building Materials | Regression | 17.148 | 1 | 17.148 | 121.341 | 0.000 |

| Residual | 1.555 | 11 | 0.141 | |||

| Total | 18.703 | 12 | ||||

| Power | Regression | 4,149,422,721.139 | 1 | 4,149,422,721.139 | 105.636 | 0.000 |

| Residual | 903,447,660.773 | 23 | 39,280,333.077 | |||

| Total | 5,052,870,381.912 | 24 | ||||

| Metallurgy | Regression | 90.841 | 1 | 90.841 | 157.424 | 0.000 |

| Residual | 23.082 | 40 | 0.577 | |||

| Total | 113.923 | 41 | ||||

| Building | Regression | 26.185 | 1 | 26.185 | 46.761 | 0.000 |

| Residual | 22.959 | 41 | 0.560 | |||

| Total | 49.144 | 42 | ||||

| Public Facilities | Regression | 15.296 | 1 | 15.296 | 11.107 | 0.004 |

| Residual | 24.790 | 18 | 1.377 | |||

| Total | 40.086 | 19 | ||||

| Subsector | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| Machinery Manufacture | Regression | 597,789.255 | 1 | 597,789.255 | 68.207 | 0.000 |

| Residual | 113,937.200 | 13 | 8764.400 | |||

| Total | 711,726.454 | 14 | ||||

| Chemical | Regression | 9.458 | 1 | 9.458 | 26.843 | 0.000 |

| Residual | 3.876 | 11 | 0.352 | |||

| Total | 13.334 | 12 | ||||

| Light | Regression | 14.801 | 1 | 14.801 | 82.811 | 0.000 |

| Residual | 1.787 | 10 | 0.179 | |||

| Total | 16.589 | 11 | ||||

| Coal | Regression | 1,266,923.556 | 1 | 1,266,923.556 | 26.334 | 0.000 |

| Residual | 481,096.179 | 10 | 48,109.618 | |||

| Total | 1,748,019.735 | 11 | ||||

| Building Materials | Regression | 18.098 | 1 | 18.098 | 56.760 | 0.000 |

| Residual | 3.826 | 12 | 0.319 | |||

| Total | 21.924 | 13 | ||||

| Power | Regression | 44.090 | 1 | 44.090 | 249.928 | 0.000 |

| Residual | 4.057 | 23 | 0.176 | |||

| Total | 48.148 | 24 | ||||

| Metallurgy | Regression | 66.636 | 1 | 66.636 | 111.143 | 0.000 |

| Residual | 23.982 | 40 | 0.600 | |||

| Total | 90.619 | 41 | ||||

| Building | Regression | 32.833 | 1 | 32.833 | 90.270 | 0.000 |

| Residual | 16.368 | 45 | 0.364 | |||

| Total | 49.201 | 46 | ||||

| Public Facilities | Regression | 10.739 | 1 | 10.739 | 17.756 | 0.001 |

| Residual | 10.886 | 18 | 0.605 | |||

| Total | 21.625 | 19 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| Constant | 3.020673 | 0.892696 | 3.383764 | 0.0009 |

| Machinery manufacture subsector | −1.030871 | 0.404814 | −2.546531 | 0.0120 |

| Chemical subsector | −0.341498 | 0.469324 | −0.727639 | 0.4681 |

| Light subsector | −0.781959 | 0.488855 | −1.599572 | 0.1121 |

| Coal subsector | 0.170786 | 0.525832 | 0.324792 | 0.7459 |

| Building materials subsector | −0.209356 | 0.440275 | −0.475511 | 0.6352 |

| Power subsector | −0.230760 | 0.385362 | −0.598814 | 0.5503 |

| Building subsector | −1.155329 | 0.391073 | −2.954256 | 0.0037 |

| Public Facilities subsector | 0.112704 | 0.446362 | 0.252495 | 0.8011 |

| Financing | 1.423285 | 0.283553 | 5.019462 | 0.0000 |

| Financial incentive or tax preference | −0.063197 | 0.357215 | −0.176916 | 0.8598 |

| Log(REGE) | 0.372210 | 0.076802 | 4.846377 | 0.0000 |

| Log(REGY) | 0.012741 | 0.049293 | 0.258464 | 0.7965 |

| T | 0.086389 | 0.023537 | 3.670422 | 0.0004 |

| R-squared | 0.473740 | Mean dependent var | 6.656395 | |

| Adjusted R-squared | 0.421114 | SD dependent var | 1.678460 | |

| S.E. of regression | 1.277049 | Akaike info criterion | 3.419146 | |

| Sum squared resid | 212.0109 | Schwarz criterion | 3.707878 | |

| Log likelihood | −232.1785 | Hannan–Quinn criter | 3.536470 | |

| F-statistic | 9.002013 | Durbin–Watson stat | 2.214652 | |

| Prob(F-statistic) | 0.000000 | |||

| Acronym | ESCo | EPC | ECU | CNY | tce | EE |

| Full Name | Energy Service Company | Energy Performance Contracting | Energy-Consuming Unit | Chinese Yuan | Ton of standard coal equivalent | Energyefficiency |

| Acronym | HVAC | gce | ||||

| Full Name | Heating, ventilation, and air-conditioning | Gram of standard coal equivalent | Annual energy-saving quantity | Revamping cost | Average annual energy-saving quantity of unit investment | Annual energy-saving quantity of unit investment |

| Acronym | ||||||

| Full Name | Light subsector | Building materials subsector | Metallurgicalsubsector | Building subsector | Public facilities subsector | Chemical subsector |

| Acronym | ||||||

| Full Name | Coal subsector | Machinery manufacture subsector | Power subsector | Annual cost saving | Average annual cost saving of unit investment | Coefficient of variation |

| Acronym | ||||||

| Full Name | Standard deviation | Average value | Registered capital of the ESCo | Registered capital of the ECU | Contract period | The project doesn’t belong to machinery manufacture subsector |

References

- Statistical Communiqué of the People’s Republic of China on the 2016 National Economic and Social Development. Available online: http://www.stats.gov.cn/tjsj/zxfb/201702/t20170228_1467424.html (accessed on 6 August 2017).

- Global Energy Statistical Yearbook 2017. Available online: https://yearbook.enerdata.net/total-energy/world-energy-intensity-gdp-data.html (accessed on 18 September 2017).

- Law of the People’s Republic of China on Conserving Energy. Available online: http://www.gov.cn/flfg/2007-10/28/content_788493.htm (accessed on 1 August 2017).

- Energy Development Plan for Eleventh Five-Year. Available online: http://ghs.ndrc.gov.cn/ghwb/gjjgh/200709/P020070925542065049508.pdf (accessed on 12 July 2017).

- Energy Development Plan for Twelfth Five-Year. Available online: http://www.gov.cn/zwgk/2013-01/23/content_2318554.htm (accessed on 12 July 2017).

- Energy Development Plan for Thirteenth Five-Year. Available online: http://www.ndrc.gov.cn/zcfb/zcfbtz/201701/W020170117335278192779.pdf (accessed on 12 July 2017).

- China Energy Service Company (ESCO) Market Study. Available online: http://www.ifc.org/wps/wcm/connect/742aad00401df888898aff23ff966f85/IFC+final+ESCO+report-EN+.pdf?MOD=AJPERES (accessed on 6 November 2018).

- White Paper: Unleashing Energy Efficiency Retrofits through Energy Performance Contracts in China and the United States. Available online: http://www.globalchange.umd.edu/data/epc/EPC_Market_Opportunity_Paper_final0429.pdf (accessed on 24 December 2018).

- The Opinion of Speeding up the Implementation of Energy Performance Contracting and Promoting the Development of Energy-saving Service Industry. Available online: http://www.gov.cn/zwgk/2010-04/06/content_1573706.htm (accessed on 13 May 2017).

- General Technical Rules for Energy Performance Contracting. Available online: http://hzs.ndrc.gov.cn/newjn/201010/W020101025315177548454.pdf (accessed on 28 April 2017).

- Hu, J.R.; Zhou, E.Y. Engineering risk management planning in energy performance contracting in China. In Systems Engineering Procedia, Proceedings of the 4th International Conference on Engineering and Risk Management (ERM), Fields Inst, Toronto, ON, Canada, 28–30 October 2011; Wu, D.D., Ed.; Elsevier Science BV: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Wu, Z.J.; Dong, X.C.; Pi, G.L. Risk Evaluation of China’s Petrochemical Energy Performance Contracting (EPC) Projects: Taking the Ningxia Petrochemical Company as an Example. Nat. Gas Ind. 2017, 37, 112–119. [Google Scholar]

- Li, Y. AHP-Fuzzy evaluation on financing bottleneck in energy performance contracting in China. In Energy Procedia, Proceedings of the 2011 2nd International Conference on Advances in Energy Engineering (ICAEE), Bangkok, Thailand, 27–28 December 2011; Elsevier Science BV: Amsterdam, The Netherlands, 2012. [Google Scholar]

- Li, Y.; Qiu, Y.M.; Wang, Y.D. Explaining the contract terms of energy performance contracting in China: The importance of effective financing. Energy Econ. 2014, 45, 401–411. [Google Scholar] [CrossRef]

- Kostka, G.; Shin, K. Energy conservation through energy service companies: Empirical analysis from China. Energy Policy 2013, 52, 748–759. [Google Scholar] [CrossRef]

- Qian, D.; Guo, J.E. Research on the energy-saving and revenue sharing strategy of ESCOs under the uncertainty of the value of Energy Performance Contracting Projects. Energy Policy 2014, 73, 710–721. [Google Scholar] [CrossRef]

- Xu, P.P.; Chan, E.H.W.; Visscher, H.J.; Zhang, X.L.; Wu, Z.Z. Sustainable building energy efficiency retrofit for hotel buildings using EPC mechanism in China: Analytic Network Process (ANP) approach. J. Clean. Prod. 2014, 107, 378–388. [Google Scholar] [CrossRef]

- Energy Performance Contracting Needs Continuous Promotion by Government. Available online: http://www.yicai.com/news/5247068.html (accessed on 22 December 2017).

- Wei, D. The thought and solution of energy management contracting development. J. Shandong Univ. (Philos. Soc. Sci.) 2016, 6, 118–126. [Google Scholar]

- Sun, H. EPC Practice; China Economic Publishing House: Beijing, China, 2012; p. 15. ISBN 978-7-5136-1334-7. [Google Scholar]

- Walter, T.; Sohn, M.D. A regression-based approach to estimating retrofit savings using the Building Performance Database. Appl. Energy 2016, 179, 996–1005. [Google Scholar] [CrossRef]

- Backlund, S.; Eidenskog, M. Energy service collaborations–it is a question of trust. Energy Effic. 2013, 6, 511–521. [Google Scholar] [CrossRef]

- Deng, Q.L.; Zhang, L.M.; Cui, Q.B.; Jiang, X.L. A simulation-based decision model for designing contract period in building energy performance contracting. Build. Environ. 2014, 71, 71–80. [Google Scholar] [CrossRef]

- Lee, P.; Lam, P.T.I.; Lee, W.L.; Chan, E.H.W. Analysis of an air-cooled chiller replacement project using a probabilistic approach for energy performance contracts. Appl. Energy 2016, 171, 415–428. [Google Scholar] [CrossRef]

- Lu, Y.J.; Zhang, N.; Chen, J.Y. A behavior-based decision-making model for energy performance contracting in building retrofit. Energy Build. 2017, 156, 315–326. [Google Scholar] [CrossRef]

- Deng, Q.L.; Jiang, X.L.; Cui, Q.B.; Zhang, L.M. Strategic design of cost savings guarantee in energy performance contracting under uncertainty. Appl. Energy 2015, 139, 68–80. [Google Scholar] [CrossRef]

- Qiu, Y.M.; Padmanabhan, P. Consumers’ Attitudes towards Surcharges on Distributed Renewable Energy Generation and Energy Efficiency Programs. Sustainability 2017, 9, 1475. [Google Scholar] [CrossRef]

- ESCo Committee of China Energy Conservation Association. EPC Industry Development Report (2011–2015); China Architecture and Building Press: Beijing, China, 2017; ISBN 978-7-5136-4648-2. [Google Scholar]

- ESCo Committee of China Energy Conservation Association. Energy Performance Contracting Cases (2011–2015); China Economic Publishing House: Beijing, China, 2017; pp. 3–625. ISBN 978-7-5136-4577-5. [Google Scholar]

- State Grid Energy Research Institute. 2016 Analysis Report of Energy Saving and Electricity Saving in China; China Electric Power Press: Beijing, China, 2017; pp. 8–10. ISBN 978-7-5198-0179-3. [Google Scholar]

- Building Energy Conservation Research Center, Tsinghua University. 2017 Annual Report on China Building Energy Efficiency; China Architecture and Building Press: Beijing, China, 2017; pp. 15–18. ISBN 978-7-112-20573-8. [Google Scholar]

- Larsen, P.H.; Goldman, C.; Satchwell, A. Evolution of the U.S. energy service company industry: Market size and project performance from 1990–2008. Energy Policy 2012, 50, 802–820. [Google Scholar] [CrossRef]

- Vendors as Industrial Energy Service Providers. Available online: http://aceee.org/sites/default/files/pdf/white-paper/vendors.pdf (accessed on 1 January 2018).

- Wooldridge, J.M. Introductory Econometrics: A Modern Approach, 5th ed.; South-Western Cengage Learning: Mason, OH, USA, 2009; pp. 228–237. ISBN 978-1-111-53104-1. [Google Scholar]

- Goldman, C.; Hopper, N.; Osbom, J.G. Review of US ESCO industry market trends: An empirical analysis of project data. Energy Policy 2005, 33, 387–405. [Google Scholar] [CrossRef]

- Thirteenth Five-Year Plan for Energy Conservation and Environmental Protection Industry. Available online: http://hzs.ndrc.gov.cn/newzwxx/201612/t20161226_832641.html (accessed on 19 December 2017).

| Main Categories | Subsector | Description of Transformation Contents |

|---|---|---|

| Industry | Metallurgical | Includes only the processes. |

| Chemical | Includes only the processes. | |

| Coal | Includes only the processes. | |

| Building materials | Includes only the processes. | |

| Power | Includes only the processes. | |

| Machinery manufacture | Includes only the processes (e.g., industrial lighting system transformation, waste heat utilization of compressors). | |

| Light | Includes only the processes. | |

| Building | Building subsector | Includes only the infrastructure (e.g., upgrading elevators, reconstruction of building envelopes). |

| Public Facilities | Public facilities subsector | Includes the processes (e.g., industrial waste heat recovery) or the infrastructure (e.g., lighting system transformation, optimization of central heating pipe networks) as well. |

| Subsector | EE Promotion Technologies |

|---|---|

| Metallurgical | Dehumidification transformation of blast furnaces, motor modification, direct reduction of solid waste by rotary hearth furnaces, steam back-pressure power generation byproducts, reform of water pump systems, waste heat generation of electric stove low-temperature flue gas, substitution fuel oil for cold coal gas, retrofit of circulating water systems, recovery of waste heat from slag water, recovery of residual heat from slag steam, heating furnace reformation, power generation with sintering residual heat, sintering waste heat recovery, retrofit of dust removal systems, coal gas recovery, top gas recovery turbine power generation in blast furnaces, waste heat generation of flue gas from submerged arc furnaces, dry quenching waste heat power generation, cooling tower hydraulic fans, flue gas waste heat generation of electric furnaces, retrofit of compressed air systems, recovery of waste heat from dead steam in self-made power plants, lighting system transformation, cooling. |

| Chemical | Recovery of residual heat of reboiler solvent, heating furnace reformation, recovery of waste heat from high-temperature slag, boiler retrofit, cooling tower hydraulic fans, retrofit of compressed air systems, recovery of waste heat from hydrochloric acid furnaces, motor modification, hydrogen recovery and heat recovery in pure terephthalic acid projects, reformation of water pump systems, retrofit of circulating water systems, retrofit of airtight electric furnaces. |

| Coal | Transformation of static var generator in substations, cooling tower hydraulic fans, recovery of waste heat from flue gas of coke ovens, dry quenching and waste heat generation, motor modification, waste heat utilization of compressors, retrofit of gas blower systems, low-pressure steam pumps, reform of water pump systems, waste heat generation of calciners, energy monitoring and management systems. |

| Building Materials | Waste heat generation of cement production lines, motor modification, waste heat generation of glass production lines, retrofit of ball mills. |

| Power | Lighting system transformation, waste heat utilization of circulating water, motor modification, retrofit of compressed air systems, waste heat generation of coke oven flue gas, optimization of urban heating networks, boiler retrofit, recovery of waste heat from boiler flue gas, compound phase changing heat exchangers, reform of water pump systems, transformation of warm air heaters, transformation of heat exchangers, retrofit of combustion systems, transformation of steam turbines, vacuum-pumping systems of steam ejectors, waste heat utilization of flue gas in photovoltaic glass kilns, retrofit of air preheaters, automatic regulating system for air inlet of cooling towers, photovoltaic tracking systems, energy monitoring and management systems. |

| Machinery Manufacture | Lighting system transformation, heating furnace reformation, retrofit of compressed air systems, waste heat utilization of compressors, motor modification, waste heat utilization of circulating water, harmonic control and reactive power compensation, electric feed servo energy saving systems, circulating fluidized beds, biodiesel, steam recovery, steam accumulation, regenerative combustion, ladle baking by gas jet, closed counterflow cooling tower, energy monitoring and management systems. |

| Light | Retrofit of circulating water systems, boiler retrofit, reform of water pump systems, motor modification, transformation of injection molding machines, waste heat recovery from wastewater, waste heat recovery of desiccant, solar photothermal utilization, biogas power generation, mechanical vapor recompression evaporators. |

| Building | Reform of heating or cooling, chilled water storage systems transformation, ventilation transformation, hot water transformation, lighting system transformation, cookers transformation, upgrading elevators, reconstruction of building envelopes, power distribution transformation, optimization of water supply, use of water, cold chain transformation, swimming pool heating transformation, solar thermal utilization, combined cooling heating and power utilization, establishing energy management systems, establishing battery management systems. |

| Public Facilities | Motor modification, boiler retrofit, lighting system transformation, heat exchange station transformation, reform of cooling and ventilation in stations, optimization of central heating pipe networks, industrial waste heat recovery, energy monitoring and management systems. |

| Subsector | Number of Samples |

|---|---|

| Machinery Manufacture | 14 |

| Chemical | 13 |

| Light | 12 |

| Coal | 12 |

| Building Materials | 13 |

| Power | 25 |

| Metallurgy | 42 |

| Building | 43 |

| Public Facilities | 20 |

| Total | 194 |

| Subsector | Variables | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | |

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| Machinery Manufacture | Revamping cost | 5.159 | 1.037 | 0.821 | 4.977 | 0.000 |

| (Constant) | 26.455 | 514.475 | 0.051 | 0.960 | ||

| Chemical | 1/Revamping cost | −39.415 | 11.539 | −0.717 | −3.416 | 0.006 |

| (Constant) | 7.872 | 0.252 | 31.191 | 0.000 | ||

| Light | ln(Revamping cost) | 0.829 | 0.130 | 0.895 | 6.358 | 0.000 |

| (Constant) | 15.227 | 12.499 | 1.218 | 0.251 | ||

| Coal | Revamping cost | 5.911 | 1.888 | 2.021 | 3.131 | 0.012 |

| Revamping cost **2 a | −0.001 | 0.001 | −1.286 | −1.993 | 0.077 | |

| (Constant) | −265.899 | 863.878 | −0.308 | 0.765 | ||

| Building Materials | ln(Revamping cost) | 0.965 | 0.088 | 0.958 | 11.015 | 0.000 |

| (Constant) | 4.113 | 2.586 | 1.591 | 0.140 | ||

| Power | Revamping cost | 4.292 | 0.418 | 0.906 | 10.278 | 0.000 |

| (Constant) | 367.430 | 1612.215 | 0.228 | 0.822 | ||

| Metallurgy | ln(Revamping cost) | 0.746 | 0.059 | 0.893 | 12.547 | 0.000 |

| (Constant) | 28.861 | 13.121 | 2.200 | 0.034 | ||

| Building | ln(Revamping cost) | 0.562 | 0.082 | 0.730 | 6.838 | 0.000 |

| (Constant) | 16.765 | 8.338 | 2.011 | 0.051 | ||

| Public Facilities | ln(Revamping cost) | 0.696 | 0.209 | 0.618 | 3.333 | 0.004 |

| (Constant) | 17.868 | 26.849 | 0.665 | 0.514 | ||

| Subsector | Std. Error of the Estimate | |||

|---|---|---|---|---|

| Machinery Manufacture | 0.821 | 0.674 | 0.646 | 1196.193 |

| Chemical | 0.717 | 0.515 | 0.471 | 0.822 |

| Light | 0.895 | 0.802 | 0.782 | 0.604 |

| Coal | 0.855 | 0.730 | 0.670 | 1604.199 |

| Building Materials | 0.958 | 0.917 | 0.909 | 0.376 |

| Power | 0.906 | 0.821 | 0.813 | 6267.402 |

| Metallurgy | 0.893 | 0.797 | 0.792 | 0.760 |

| Building | 0.730 | 0.533 | 0.521 | 0.748 |

| Public Facilities | 0.618 | 0.382 | 0.347 | 1.174 |

| Subsector | Variables | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | |

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| Machinery Manufacture | Revamping cost | 0.658 | 0.080 | 0.916 | 8.259 | 0.000 |

| (Constant) | 18.748 | 38.346 | 0.489 | 0.633 | ||

| Chemical | ln(Revamping cost) | 0.688 | 0.133 | 0.842 | 5.181 | 0.000 |

| (Constant) | 6.105 | 4.731 | 1.291 | 0.223 | ||

| Light | ln(Revamping cost) | 0.831 | 0.091 | 0.945 | 9.100 | 0.000 |

| (Constant) | 2.285 | 1.313 | 1.741 | 0.112 | ||

| Coal | Revamping cost | 0.355 | 0.069 | 0.851 | 5.132 | 0.000 |

| (Constant) | 101.811 | 81.428 | 1.250 | 0.240 | ||

| Building Materials | ln(Revamping cost) | 0.867 | 0.115 | 0.909 | 7.534 | 0.000 |

| (Constant) | 1.346 | 1.088 | 1.238 | 0.240 | ||

| Power | ln(Revamping cost) | 0.865 | 0.055 | 0.957 | 15.809 | 0.000 |

| (Constant) | 1.229 | 0.475 | 2.588 | 0.016 | ||

| Metallurgy | Revamping cost | 0.262 | 0.024 | 0.866 | 10.964 | 0.000 |

| (Constant) | 590.687 | 392.447 | 1.505 | 0.140 | ||

| Building | ln(Revamping cost) | 0.641 | 0.068 | 0.817 | 9.501 | 0.000 |

| (Constant) | 3.078 | 1.236 | 2.491 | 0.017 | ||

| Public Facilities | ln(Revamping cost) | 0.604 | 0.143 | 0.705 | 4.214 | 0.001 |

| (Constant) | 6.367 | 6.589 | 0.966 | 0.347 | ||

| Subsector | Std. Error of the Estimate | |||

|---|---|---|---|---|

| Machinery Manufacture | 0.916 | 0.840 | 0.828 | 93.618 |

| Chemical | 0.842 | 0.709 | 0.683 | 0.594 |

| Light | 0.945 | 0.892 | 0.881 | 0.423 |

| Coal | 0.851 | 0.725 | 0.697 | 219.339 |

| Building Materials | 0.909 | 0.825 | 0.811 | 0.565 |

| Power | 0.957 | 0.916 | 0.912 | 0.420 |

| Metallurgy | 0.866 | 0.750 | 0.744 | 2211.686 |

| Building | 0.817 | 0.667 | 0.660 | 0.603 |

| Public Facilities | 0.705 | 0.497 | 0.469 | 0.778 |

| Subsector | ||||

|---|---|---|---|---|

| Machinery Manufacture | 5.1 | 0.76 | ||

| Chemical | 11.0 | 1.31 | ||

| Light | 6.4 | 0.89 | ||

| Coal | 4.6 | 0.66 | ||

| Building Materials | 3.4 | 0.56 | ||

| Power | 6.4 | 0.53 | ||

| Metallurgy | 6.8 | 0.95 | ||

| Building | 2.1 | 0.52 | ||

| Public Facilities | 4.6 | 0.56 | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ruan, H.; Gao, X.; Mao, C. Empirical Study on Annual Energy-Saving Performance of Energy Performance Contracting in China. Sustainability 2018, 10, 1666. https://doi.org/10.3390/su10051666

Ruan H, Gao X, Mao C. Empirical Study on Annual Energy-Saving Performance of Energy Performance Contracting in China. Sustainability. 2018; 10(5):1666. https://doi.org/10.3390/su10051666

Chicago/Turabian StyleRuan, Hongquan, Xin Gao, and Chaoxuan Mao. 2018. "Empirical Study on Annual Energy-Saving Performance of Energy Performance Contracting in China" Sustainability 10, no. 5: 1666. https://doi.org/10.3390/su10051666

APA StyleRuan, H., Gao, X., & Mao, C. (2018). Empirical Study on Annual Energy-Saving Performance of Energy Performance Contracting in China. Sustainability, 10(5), 1666. https://doi.org/10.3390/su10051666