1. Introduction

A significant portion of the gross domestic product of most industrialized countries is produced in their metropolitan regions: cities, towns, and other local government (LG) entities. By 2025, 600 cities in the world are projected to generate more than 60% of global GDP [

1]. In Europe, 67% of GDP is generated in these areas [

2], while in the U.S., Canada, and Australia, the figures are 85%, 72%, and 80%, respectively [

3,

4,

5]. Similar percentages exist for some of the so-called non-industrialized countries, especially those in Latin America and Asia-Pacific, where the percentages range from 60% to 80% [

6,

7]. Moreover, even if the portion of GDP produced in a region’s metropolitan areas is relatively low, the public expenditures that take place in these areas can be a significant portion of total public expenditures. In China, expenditures in LGs constitute more than 80% of total public expenditures, one of the highest percentages in the world [

8]. It thus seems clear that improved financial management of LGs is a key ingredient in the future growth, prosperity, and sustainability of both industrialized and non-industrialized countries across the globe, especially in an era where crises may require them to be ready for resilience [

9].

Land finance is a term with very Chinese characteristics in LGs’ fiscal setting, and it is a phenomenon that attracts much public attention in recent years. Land finance means that LGs’ fiscal revenue is very dependent on the revenue from transferring multiannual land use rights. In China, with respect to the land ownership, there are two possibilities: land owned by the central state, and land collectively owned by peasants. No private ownership of land is allowed in China. LGs buy the land collectively owned by peasants, usually at a low price with the aim to urbanize. This way the ownership of these lands is converted from collective ownership to public ownership, and this represents the land finance expenditure. Then, LGs transfer the land to the real estate developers at higher prices through competitive bidding: the revenue of land finance comes from this process. It should be emphasized that the transfer from LGs to the developers refers to the land use rights, which is usually 70 years, not the ownership. Real estate developers transfer the land use rights and the apartments built to buyers. Many of the buyers are also peasants themselves. The urbanization rate in China was ca. 55% in 2014; this means that about half of Chinese are still peasants [

10], and, according to the understanding of the central government of China, the urbanization will increase further. After the 70 years expire, from the angle of law principle, the land and buildings should return to the State. However, the reality now is that buyers do not pay for the use of the land again, or pay only a very small fee [

11]. Jiang Daming, the Minister of China’s Ministry of land and resources, said to the journalists at a high-level meeting in China on 3 January 2018 that the owners do not need to pay many additional fees after the 70 years expire, and even the owners do not have to apply to the relevant departments for a renewal of the land use right; the land use right will be renewed automatically [

12]. Therefore, in fact, transferring land use rights by LGs is very similar to land selling, and LGs can only get a lump-sum that they receive just once. For this reason, the words

land selling will also be sometimes used below. Land finance can thus be viewed from two perspectives: From the perspective of the central government, it is a policy to increase the urbanization of China, and from the perspective of LGs, it is a source of capital local revenue.

After the tax-sharing reform of 1994, the revenue from land finance has become the main source of finance for LGs in China [

13].

Table 1 clearly shows that this kind of revenue accounts for about half of the total revenue of LGs in recent years, but at the same time this proportion is showing a declining trend.

1.1. Local and City Governments in China

China represents the country with the highest percentage of LGs expenditure out of total public expenditures in the world, corresponding to about 20% of national GDP [

8]. There are five levels of LG: the provincial level (province, autonomous region, municipality, and special administrative region) and, in order of importance, the city, county, township, and village levels. The central government is only responsible for national defense, diplomatic, and other related expenditures, while almost all the other functions, and thus related expenses, are borne by LGs [

14]. The four municipalities (Beijing, Shanghai, Tianjin, and Chongqing) are on the same political administrative level as the provinces, even though they are large cities. The implementation of land finance is at both municipal and city government level. There is a city classification based on their importance that divides Chinese cities into five levels [

15]. The first and second tier cities plus the four big municipalities represent the 41 major cities, which account for about a half of national GDP in 2016. The 41 major Chinese cities are listed in

Table 2.

1.2. How Did the Land Finance of China Come Up?

One reason relates to the evolution of China’s public financial system. Before 1994, the public finance system that China implemented was called Fiscal Responsibility System (FRS). According to FRS, the central government would consider the revenue of each LG in the previous years, then gave each LG a basement to handover part of the revenue to the central government. After handing over part of the revenue to the central government, LGs could arrange the remaining revenue freely. However, this public finance management of FRS did not consider the differences between different taxes. Hussain & Stern (1992) [

16] pointed out that FRS had a series of problems, for example, under this kind of system, the vitality of enterprises was bound, local protectionism increased, low level repeated construction increased, and the financial relationship between the central government and LGs under FRS was not stable and unclear. Park et al. (1996) [

17] believed that the FRS led to the bargain on the revenue between the central government and LGs, and brought about the problem of soft budget constraints; the formal fiscal transfer between different governments could not be formed.

These authors and other scholars, like Liou (2011) [

18], believed that another kind of public finance system, the Tax Sharing System (TSS), widely implemented in other market economies, would be helpful for overcoming these shortcomings. In 1994, the State Council issued a decision on the implementation of the TSS for public fiscal management. The TSS consists of three main aspects: the division of central and local taxes, the division of power and expenditure between central government and LGs, and the fiscal transfer policy. So, the budget law that China implements now is the version that was revised in 2014. The reasons why the central government implements the TSS are, on the one hand, to overcome the shortcomings of FRS, and, on the other hand, to deepen the reform of the socialist market economy of China and improve the revenue of the central government [

19,

20]. However, the TSS also leads to the problem of land finance in China. After the implementation of the TSS, the expenditure of LGs has increased, but LGs’ revenue has not raised correspondingly. We can see from

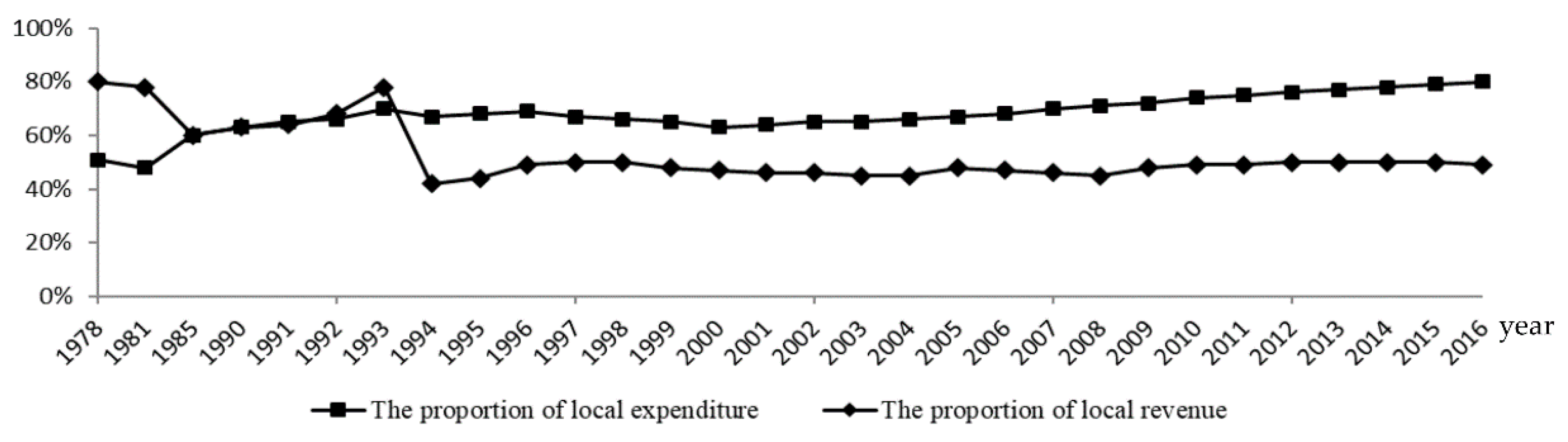

Figure 1 that from 1994, the local expenditure has increased gradually: in 2016, it accounts for about 80%, but the proportion of local revenue is just about 50%.

Table 3 portrays city governments’ main revenue and expenditure. General public expenditure refers to those daily expenditures to ensure the normal operation of cities, similar to current expenditures, and non-general public expenditure refers to those non-daily expenditures, or capital expenditures plus expenditures for debt service. Social insurance funds (pensions) are not included here, because they constitute a separate budget and financial management system. Revenues are grouped into two types: revenues from taxes and non-tax revenues. Among the latter, revenues from land finance is included. This type of revenue is used to cover “expenditure on urban infrastructure construction (1.14)”; “land finance related expenditure (2.1)” (for example, the payments for the transferring land, expenses for resettlement of peasants, and subsidies for lost crops grown on transferring land); “debt repayment expenditures (2.2)”, many of which are loans from banks also using for infrastructure construction; and related “interest expenditure (2.3)”. Details about land finance expenditures are listed in the methods section (

Table 4). It should be noted that the structure of financial reports is different in different cities, and this structure represents the “minimum common denominator” structure [

21].

According to Sun & Zhou (2014) [

22], in recent years the central government has received more than half of the total revenue, but the proportion of its total expenditure is only about 20%, causing a surplus at the central government level (used mainly to subsidize the western poor areas, or to purchase other countries’ treasury bonds) and a deficit at the level of LGs. This requires local governments to find new sources of income, and after the central government liberalized some relevant restrictions of “selling land”, the phenomenon of land finance appeared.

Another reason relates to the assessment mechanism of LGs’ officials. In China, the promotion of LGs’ officials is largely based on the growth of their local GDP [

23], and the income from land finance can be invested in real estate and other infrastructure construction. It is widely accepted that the investment of real estate and other infrastructure construction can improve the local GDP as quickly as possible [

24,

25]. Then, LGs’ officials will have a greater chance of promotion.

Therefore, the imbalance of revenue and expenditure between the central and local governments under the TSS, and the assessment mechanism of LGs’ officials based on GDP growth, cause the phenomenon of land finance in today’s China.

1.3. China is Entering a “Post-Land Finance” Era

From

Table 1, we can also notice that both the selling area and the revenue related to land finance show a downward trend in recent years, and although the revenue may increase in a certain year (as the price of land increases), the growth rate of it has slowed down. In addition, the proportion of land finance revenue to total local fiscal revenue is also becoming smaller. These are the intuitive manifestations of the land finance decline. The underlying reasons for the unsustainability of China’s land finance can be seen from the following aspects.

First, the supply of land is limited. From a macroscopic point of view, for the development of the urbanization of the country, China should supply urban development land every year and transform farmland or other kinds of agricultural land into urban construction land, but this would threaten the food security of the Chinese people [

26]. According to Huang Qifan [

27], the vice Chairman of the Financial and Economic Committee of the National People’s Congress of China, during the past 30 years since the Reform and Opening-up, China’s arable land has been reduced by more than 300 million mu (1 mu is equal to 667 square meters). In 1980, the cultivated land area of the country was 2 billion 300 million mu; by 2017, the cultivated land area had dropped to 2 billion mu, which is not enough to solve the Chinese eating problem, and therefore China has to import feed or grain from abroad every year [

28]. For example, in 2014, the self-sufficiency rate of China’s agricultural products was only about 70% [

29]. So, the red line of China’s cultivated land must be kept, which is related to the national security of China [

30]. In a word, the food security determines that China’s land supply is limited.

Second, the finiteness of urban expansion determines the unsustainability of land finance. As mentioned above, in 2014, the level of urbanization in China was about 55%. According to Shi et al. (2016) [

31], China is now in the accelerating stage of urbanization, and when the proportion of urban population accounts for about seventy percent of the total population, the growth trend of urban population will be slowed or even stagnated; then, the demand for urban land will also be stable. Therefore, when the level of urbanization tends to be stable, the current land finance model based on the expansion of urban land in China will also be difficult to continue.

Third, to a certain extent, land finance violates the social equity principle. The unfairness of land finance is mainly reflected in two respects. One the one hand, the income distribution between LGs and landless farmers is unfair [

32]. LGs take advantage of the defects of the existing land system to collect farmers’ land at low prices and sell it at high prices; in the process of the land sale, farmers have no substantial pricing power for the price of land sold [

33], and the power to operate the land is actually monopolized by LGs. Most of the income of land value added is occupied by LGs and other real estate developers at all levels, but farmers who have lost their land get only a few one-time compensation payments in the process of land expropriation. So, farmers cannot share the benefits of the growth of land value. On the other hand, intergenerational injustice exists among those LGs. As a matter of fact, current LGs tend to overdraft the land for sale, so less and less land can be sold by future LGs, and then the expansion capacity of local cities will be restricted. Furthermore, an important function of land finance is to finance urban infrastructure construction, but a government has only 5 years in office, and the governments’ land pledge loan is often left to future governments to pay back. This poses a great risk to future governments’ finances, and, also, it is extremely unfair to them. Last, besides the above aspects, the existing land financial system in China also causes low efficiency of land use, because many apartments cannot be sold out, or even if they are sold, the owners speculate and do not live there, so many of these areas become “ghost towns” [

34]. The construction of these buildings has taken a lot of manpower, financial resources, and material resources, but no one has lived in them, so the number of people on this kind of land per square kilometer can be zero. This has caused the idleness and waste of resources, because the previous arable land can even be used to grow crops. In conclusion, no matter from the perspective of demand and supply of the land, or from the perspective of fairness and efficiency, the current land finance system that Chinese LGs are now implementing is unstable and unsustainable. As a result, the revenue from land finance is decreasing, causing debt increase. This is discussed in the section below.

1.4. Local Government Debt in “Post-Land Finance” Era

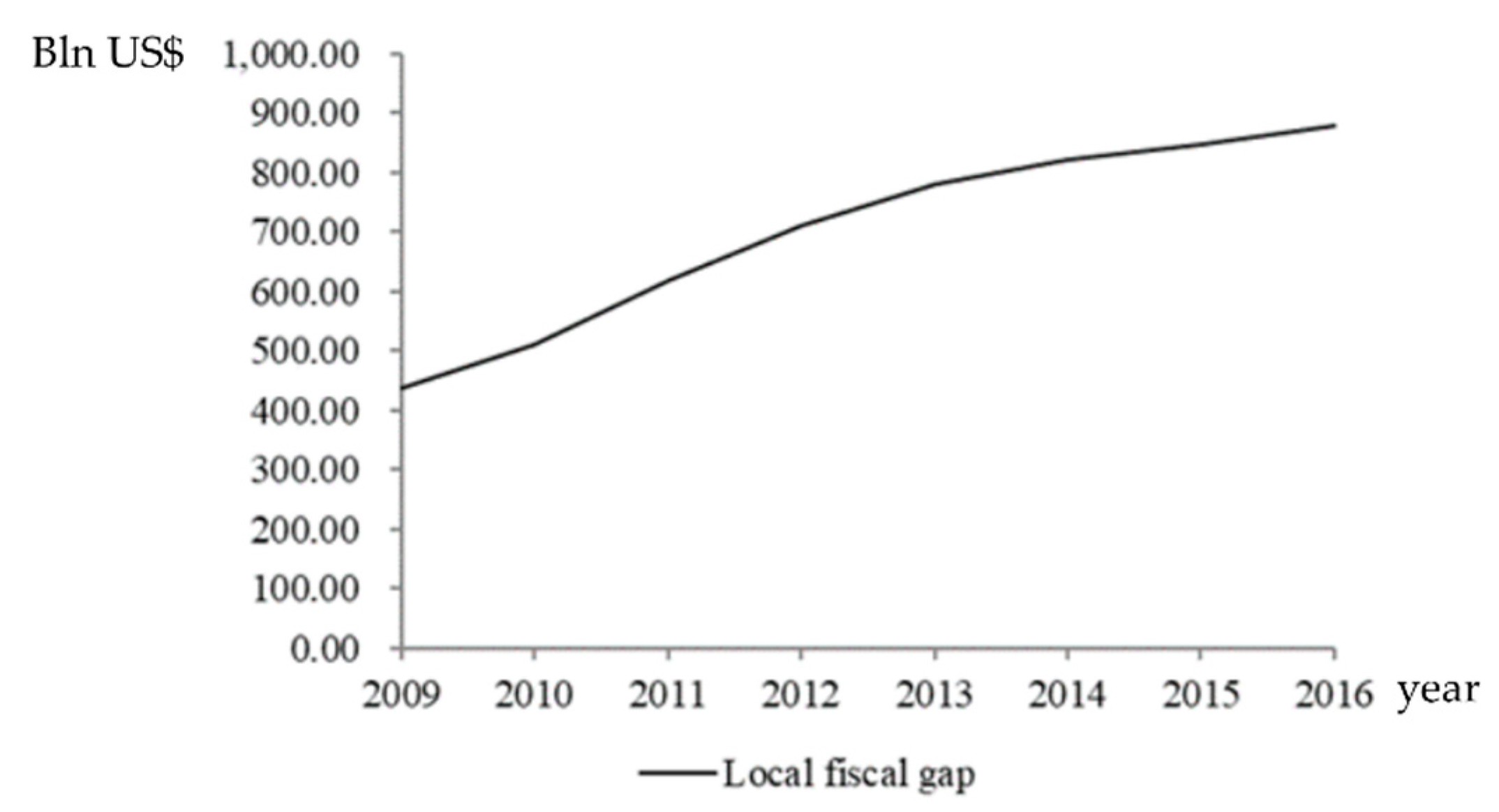

The weakening of land finance directly leads to the decrease of LGs’ revenue, and the local fiscal gap, i.e., expenditures minus revenues, is becoming greater (see

Figure 2). From the national point of view, in 2009 the gap was about 440 billion US

$, but by 2016 this had doubled (to 880 billion US

$). Chinese LGs have not many sources of financing, so the increase in local fiscal gap has inevitably lead to an increase in local debt [

35].

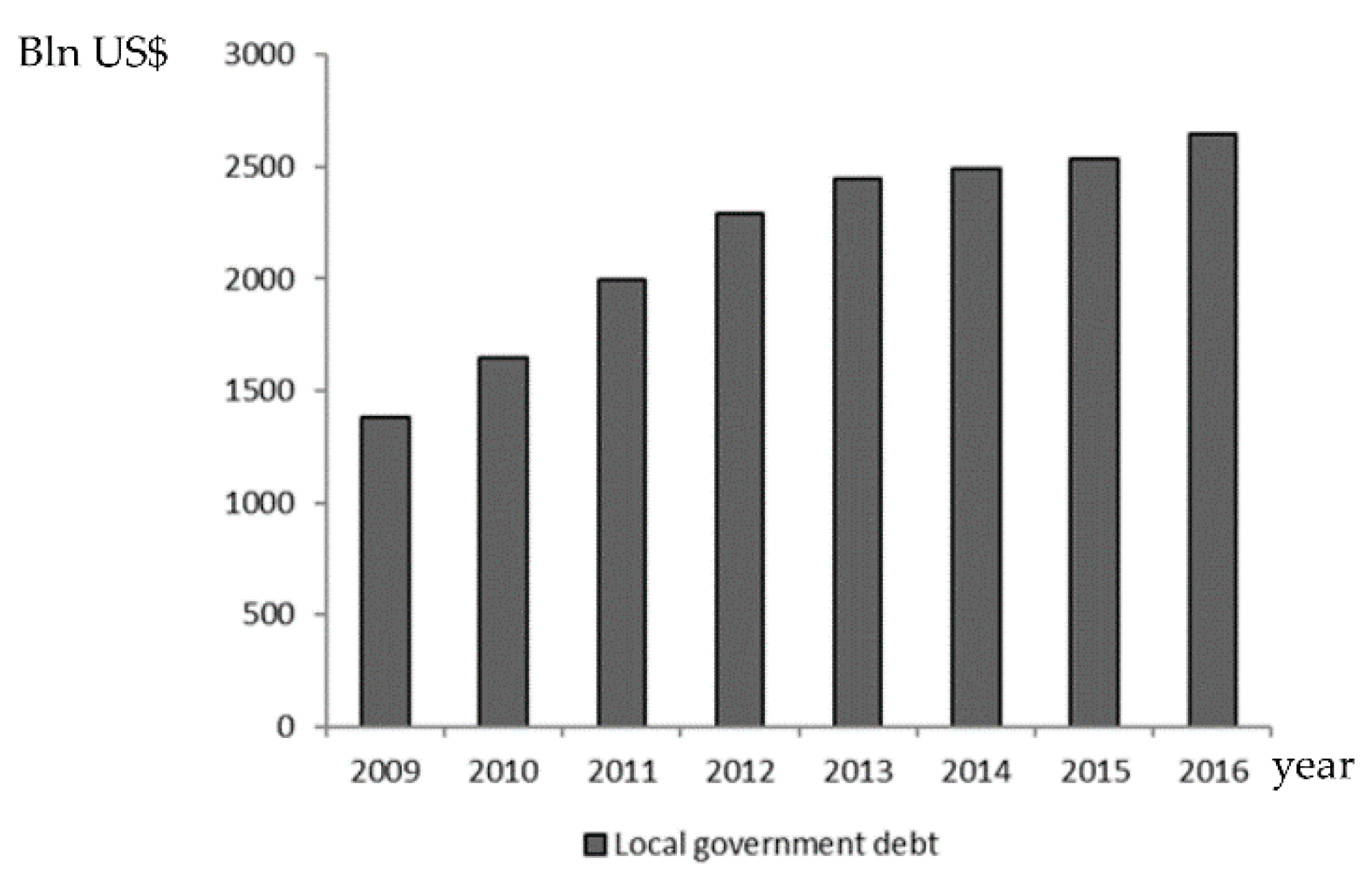

In seven years, LGs’ debt has almost doubled, going from about 1400 billion US

$ in 2009 to 2600 billion US

$ in 2016, or 30% of GDP, and about three times of the local fiscal gap (

Figure 3). So, from 2009 to 2016, Chinese LGs’ debt was increasing quickly. China’s economic growth is now slowing down; therefore, LGs may not be able to obtain sufficient income in time, and with the increase in the scale of LG debt, the pressure to pay interests of debt has also increased, which may cause LGs to fall into a vicious circle [

34]. Therefore, the sustainability of China’s LG debt is a problem worthy of attention.

Due to the lack of transparency in the data on Chinese government debt [

36], there are not many articles studying the sustainability of LGs’ debt in China. Current relevant literature is focused on provincial governments, while there is a gap in the literature on the sustainability of debt in China’s major city governments from the perspective of post-land finance era. After using certain methods to estimate the missing debt data, our article reconstructs a new model to study the debt sustainability of major city governments in China and predicts the critical value of the government debt scale from the perspective of local economic growth. In the next section, we review the relevant literature for our study. We then describe the methodology we used in

Section 3, and present the empirical test in

Section 4. Conclusions are contained in the last section.

2. Literature Review

A clear definition of sustainability of government public debt was originally proposed by Buiter (1985) [

37]. He argued that debt sustainability referred to the government’s fiscal state or capability, and that sustainable debt policy should keep the ratio of government’s net assets to GDP constant and judge whether the debt was sustainable by calculating the difference between the sustainable deficit level and the current deficit level, because the debt will not be sustainable if the current fiscal deficit is too large. Up to now, scholars have mainly understood the sustainability of government debt from three perspectives. The first understanding is from the view of the ability to raise funds, and this view is that as long as the government can borrow new debt, then the burden of government debt is sustainable. In fact, Buiter (2002) [

38] further affirms that the sustainability of government debt is that the government’s financing will not default. In other words, as long as one can guarantee the ability to pay at maturity, or one is able to get finance from the market, debt is also considered sustainable. Bajo-Rubio et al. (2010) [

39] also supported the idea that government debt sustainability depends on whether the government can borrow new debt. As long as the government can borrow enough new debt, then it can repay the old debt, and whether the government can borrow new debt depends largely on the level of the government’s net assets.

The second understanding is from the view of maintaining balance. According to this view, the sustainability of government debt refers to the debt situation that can achieve simultaneous economic growth and maintain fiscal balance at any time in the future. Blanchard & Diamond (1990) [

40] conclude that when determining the level of fiscal revenue and expenditure, the net debt of GDP shares should be a constant proportion in the target period, so as to establish debt sustainability. Keyder (2002) [

41] argues that the sustainability of government debt can be understood as the maximum debt scale and deficit level that the government can maintain, under the premise that the overall impact of debt policy on the national economy is positive. Ghosh et al. (2013) [

42] further extended the sustainability of government debt to a cross period balance, that is, to meet generation overlapping budget constraints in the long run.

The third understanding is from the perspective of solvency. According to this view, as long as the government is able to repay its debt in the future, and does not default, then thegovernment debt is sustainable. This view is little similar to the first view of the ability to raise funds, but they are different too. The former is considered from the perspective of financing, and the latter is from the perspective of whether the debt can be paid on time [

43].

Research on debt sustainability of governments has been undertaken using both micro and macro perspectives. Researchers’ studying from the micro perspective often consider the time budget constraint of governments’ revenue and expenditure, and the No-Ponzi-Game Condition model is the most commonly used model when considering the time budget constraint [

44]. The No-Ponzi-Game Condition is a kind of advanced game that can be used to test the sustainability of government debt. Specifically, to test whether government debt meets the No-Ponzi-Game Condition is also to test whether the government’s borrowing behavior meets the time budget constraint on the time path. If government debt behavior satisfies this condition, government debt is sustainable, and vice versa. Mccallum (1984) [

45] establishes a dynamic optimization model based on rational individual utility maximization, and points out that in the dynamic and effective economy, the No-Ponzi-Game is its inter-period budget constraint. He also points out that, like individuals, the time path of government borrowing behavior must also meet the cross-period budget constraint, that is, the government does not have to maintain a balance of fiscal budgets for each period, but must ensure cross-period budget balance. Hamilton & Flavin (1986) [

46] further develop McCallum’s research and use the Present-Value Constraint method to construct an iterative equation for the first time to judge whether the No-Ponzi-Game Condition holds, and test whether the government debt path satisfies intertemporal budget constraints. By applying this methodology, they discovered that the U.S. fiscal system was sustainable under current debt levels, while previous studies using traditional models were more inclined to consider it unsustainable. Futtwiler (2007) [

47] extends the iterative model by considering the effects of the interplay of interest rates, government bonds, and borrowable money markets on the sustainability of U.S. debt. Fincke & Greiner (2011), Bénassy-Quéré & Roussellet (2014), and Bartoletto et al. (2014) also study the topic using similar methods [

48,

49,

50].

There also are macro researches studying the sustainability of government debt from the perspective of economic growth. Judging from the relationship between debt and economic growth, proper debt scale can promote economic growth, but excessive debt scale can inhibit economic growth, that is, debt has a critical value effect on economic growth. Reinhart & Rogoff (2010) [

51] analyze the data of about 200 years in 44 countries and consider that the public debt-to-output ratio of 90% is a critical value. Below the threshold value, debt may have a positive effect on economic growth, but will inhibit economic growth if it exceeds this value. Checherita-Westphal & Rother (2012) [

52] find a non-linear relationship between debt-to-GDP ratio and the long term growth of GDP. They examine the non-linear relationship between debt and economic growth in 12 European countries over a 40-year period using a quadratic function and find that the inflection point was about 90–100%. There are also some other scholars who have considered more factors in their studies of the sustainability of government debt and have established more complex models. For example, Oviedo & Marcelo (2006) [

53] consider the contingent debt in their model, and Lentner (2014) [

54] considers currency effects. There are also some other articles studying the problem of the sustainability of city governments, but not from the perspective of government debt, like Alfaro-Navarro et al. (2017) [

55] and Wang & Wang (2017) [

56]. The above literature has made important contributions to the research field of the sustainability of government debt, and gives us a lot of inspiration. However, there is a lack of literature focusing on the problem of major city governments based on the background of China, who is the largest developing country and has the second largest economy in the world, not to mention that this literature does not notice the “post-land finance era” phenomenon that is taking place in China.

In our paper, first, we will reconstruct a new No-Ponzi-Game Condition model on the basis of the classic one and study the debt sustainability of China’s major city governments in the post-land finance era from a holistic perspective; so, the first research question is:

[RQ1] Is the debt of China’s major city governments sustainable in the post-land finance era at the macro level?

Since China’s LGs are unlikely to go bankrupt because of their centralized political management system, we think it is better to study the problem of the debt sustainability of China’s major city governments from a holistic perspective, just to see whether these cities’ debts are sustainable at the macro level, and not worry about the debt sustainability of each LG. Second, considering the economic growth, we will also try to predict the critical point of government debt from the macro perspective with similar method used in the related literatures reviewed in this section. Therefore, the second research question is:

[RQ2]: What is the critical point of debt burden of China’s major city governments above which sustainability is in danger?

3. Methods

Our article is focused on the 41 major city governments of China introduced in

Section 1. The data sources are the financial reports published on the official websites of the local finance bureaus in various cities and the China Financial Statistics Yearbook. The data covers fiscal years from 2010 to 2016. Although the fiscal transparency of the major cities we have chosen is relatively high, the current overall fiscal transparency in China is still not high [

36]; therefore, data on debts of some city governments in certain years cannot be obtained from official sources. In order to solve this problem, we use a method (see

Appendix A) to estimate the missing debt data [

57]. The LG’s debt considered in this article refers to the debt that a LG has the responsibility to pay back, that is, direct debt, not including the contingent debt, i.e., the liabilities formed by the government providing guarantees for the financing activities of other enterprises or institutions. STATA12.0 is used in the analysis.

The method that we use to examine the debt sustainability of China’s large city governments is the No-Ponzi-Game Condition model improved by adding the factor of land finance. This model is particularly suitable, since this model can consider the intertemporal budget constraints, and so we can study the problem of debt sustainability in its dynamic trend.

Suppose that the size of the LG’s debt, the basic budget surplus (basic fiscal revenue minus basic fiscal expenditure), and the surplus of land finance (land finance revenue minus land finance expenditure) are represented by

DEB,

BS, and

LS, respectively, and use deb to represent the debt ratio (size of debt/GDP), use

bs to represent the basic budget surplus/GDP, use

ls to represent the surplus of land finance/GDP, use

g to represent the economic growth rate, use

r to represent the interest rate of government debt, and, finally, use

t and

i to represent the year and the city, respectively. The meaning and calculation of these variables and other variables used in the model building below are listed in

Table 4 (for ease of understanding, we also have included the variables in

Appendix A here).

The size of LG debt of this year is equal to the size of LG debt of last year reduced by the basic budget surplus (BS) and the surplus of land finance (LS), that is

Buy dividing the two sides of the above equation by the nominal GDP of the t period, we can get the following:

By making

, we can get the following:

By making an iteration of Equation (3), we can get

For simplified processing, by taking

as a fixed value of

, and taking expected values of two sides of Equation (4), we can get

In the above equation, refers to the debt rate at the beginning of the t − 1 period in the i city, is the expected value.

By deforming Equation (5) and making

, we can get

From Equation (6), when the following condition is set up,

Then, the intertemporal budget constraint condition is also established as Equation (8), and vice versa.

The No-Ponzi-Game Condition refers to the government’s final debt balance, which must not be greater than zero. This condition is just a requirement of Equation (7); therefore, to test the No-Ponzi-Game Condition is the same as testing Equation (7). Since Equation (8) is equivalent to Equation (7), therefore, the testing of No-Ponzi-Game Condition can be replaced by examining if the intertemporal budget constraint condition (Equation (8)) is established.

The next step is to make the No-Ponzi-Game Condition under the rule of linear feedback. In general, the budget of this period will be affected by the previous budget and the current economic growth rate. If the feedback of basic budget surplus/GDP on debt rate is linear, then the linear equation can be expressed as following:

When the basic budget surplus of/GDP is in a steady state, then

In Equation (11), , , , , and .

In the above equations, and represent the short-term response coefficient and the long-term response coefficient of the basic budget surplus to the government’s public debt, respectively. or is greater than zero, which means that the rising of the current debt will produce a late basic budget surplus increase, so as to reduce the level of debt in the future. As a result, the greater the and , the stronger the government’s fiscal discipline.

By substituting Equation (11) into Equation (2), we can get

The above equation is a dynamic equation about the government’s debt rate. From the solving process of the differential equation, in order to make the solution of Equation (12) converge, the following condition must be met:

Through above knowledge, a convergence solution means that Equation (7) is established, that is to say, the No-Ponzi-Game Condition is met. Therefore, the Equation (14) can be considered as the specific form under the linear feedback rule of the No-Ponzi-Game Condition. So, we finally come to the conclusion that the balance of government debt will converge to

Besides using the No-Ponzi-Game Condition model to test the debt sustainability, we also plan to use a quadratic function model to predict the critical value of debt ratio. In fact, there are already scholars studying the relationship between local economic growth and the LG debt ratio who are considering different influencing factors. For example, Maghyereh (2003) [

58] considered such explanatory variables as the ratio of total capital to GDP, length of service, the ratio of external debt to GDP, and other control variables such as trade and inflation rates when he was looking for the best external debt for economic development in Jordan. When examining the debt and economic growth of 93 developing countries, Patillo et al. (2011) [

59] cited lagging behind in per capita capital income, investment rate, secondary school enrollment rate, population growth rate, and the degree of openness and fiscal balance included in total factor productivity; other external variables such as trade growth are also taken into account. When studying the relationship between debt and economic growth in developed countries and emerging economies, Woo & Kumar (2015) [

60] used the initial real GDP per capita, per capita capital, initial government consumption-GDP ratio, initial openness, initial inflation, initial financial market liquidity, trade growth rate, initial government debt, and other variables as explanatory variables. When studying the debt sustainability of 12 European countries from 1970 to 2010, Checherita-Westphal & Rother (2012) [

52] used the initial per capita GDP, the debt ratio, the square of the debt ratio, the savings rate, the growth rate, and other control variables such as fiscal policy, openness, and interest rates as explanatory variables. Baum et al. (2013) [

61] used the economic growth rate of the first lag, openness of the first lag, total capital, and GDP ratio of the first lag as explanatory variables, and EU member as a dummy variable when they analyzed the debt ratio threshold. In our study, we will, on the basis of our background knowledge of China, undertake similar research using a quadratic function model, and this will be introduced in the section below.

5. Conclusions

Land finance has represented an important fiscal revenue for city governments in China during the last twenty years. Nevertheless, due to a decline in land availability by city governments, the imminent level of saturation of urbanization, and the unfair perspective of this fiscal lever, the current land finance system is unstable and has had a role in accelerating the increase in debt burden. Based on the intertemporal budget constraint model and a linear feedback function, we have fist reconstructed a new No-Ponzi-Game condition model considering the factor of land finance to test the long-term sustainability of city governments’ debt. In the empirical test process, we have divided the sample cities into three regions: east, central, and west, and we also do the empirical analysis using both cross-sectional data and panel data. The results show that the debt of major city governments in China is sustainable at the macro level. Second, we have constructed a quadratic function model with the economic growth rate as the dependent variable, which is used to predict the critical value of the debt’s inflection point in major cities in China. We found that the critical value of the debt ratio to the economic growth rate is between 54% and 56.5%, higher than the current average debt ratio of our sample. Therefore, from this perspective, the debt of China’s major city government is sustainable. Although the static debt/GDP ratio is extraordinary high, adding a dynamic perspective (debt/GDP growth) allows one to affirm that debt is still sustainable.

Nevertheless, the debt ratio is showing a growing trend, and the debt ratio to the economic growth rate limit of ca. 54–56.5% might be reached in the near future, as debt keeps rising, and GDP growth may be reducing. Therefore, if the debt of these LGs continues to develop in accordance with the trend of 2010–2016, it is not impossible that the debt of these LGs will no longer be sustainable in the future, especially in the case of economic turbulence. In view of this, we have some suggestions concerning the risk prevention of these LG debts in China.

First, the division of financial power and authority between the LGs and the central government needs to be made more reasonable and clear. At present, the division of financial power and authority between the LGs and the central government in China is seriously unequal. LGs have to provide more public services and spend more, but local revenues are relatively small, and this places great pressure on the sustainability of LG debt. Therefore, China should clarify the power relationship between the central government and LGs, and appropriately increase the local fiscal revenue according to the principle of reciprocity.

Second, the central government should adjust and improve the current assessment mechanism of LG officials. The assessment system of LG officials, with GDP as the core, not only leads to the overexploitation of land resources, but also makes local debt continue to rise, and indirectly led to the increase of social injustice. Therefore, we suggest that governments should reduce the proportion of GDP in the assessment of officials.

Third, appropriately promote public-private partnerships (PPP) to increase the investment of private capital in government public projects so as to reduce the use of public resources. As a mode of cooperation between the government and the private sector, PPP may reduce the pressure on LGs’ expenditure and improve the operational efficiency of public service projects. However, since the PPP model is also risky, the government should be very careful when using this model and should develop proper managerial skills [

66,

67].

Fourth, we propose to speed up the legislative work on property taxes. Currently, only Shanghai and Chongqing have imposed the property taxes, and other cities have not yet collected them. Property tax is an important and rather stable source of local fiscal revenue in western developed countries. The imposition of property tax can reduce the fiscal pressure brought about by the reduction of land finance revenue in the post-land finance era, and reduce social conflicts.

Finally, there are also limits to this research. First, this paper only studies the debt sustainability of China’s major city governments in post-land finance era at the macro level, and does not give a judgment on the debt sustainability of each city government. Furthermore, though this paper predicts a critical value of the debt’s inflection point, it cannot predict when the critical value will be reached. For future research, case studies that analyze the debt sustainability of some representative city governments and studies on constructing a method to predict the arrival time of the critical value may be extremely relevant for policymakers.