A Fusion Approach for Exploring the Key Factors of Corporate Governance on Corporate Social Responsibility Performance

Abstract

:1. Introduction

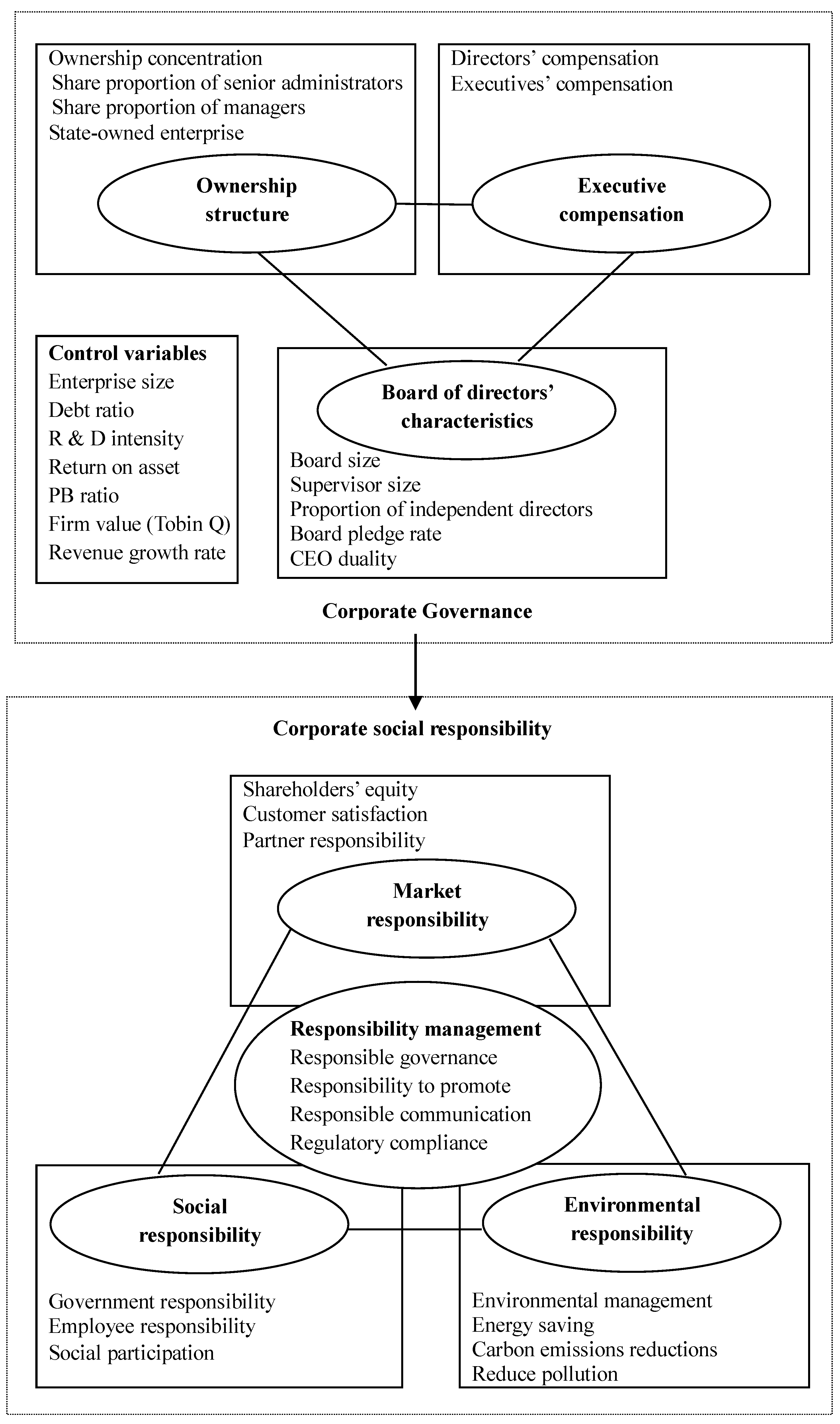

2. Corporate Governance and Corporate Social Responsibility

2.1. Board of Directors’ Characteristics

2.2. Ownership Structure

2.3. Executive Compensation

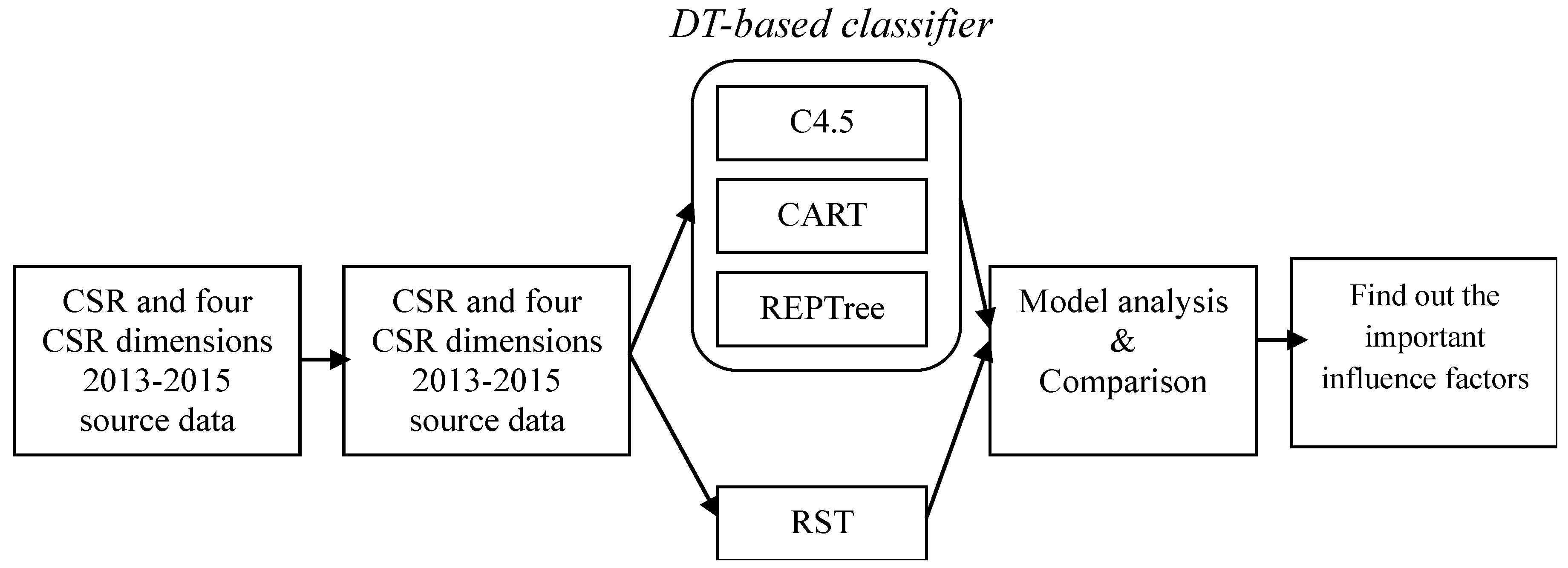

3. Data and Methods

3.1. Data and Sample Construction

3.2. Rough Set Theory:RST

3.2.1. Information Systems

3.2.2. Indiscernibility Relation and Approximation Accuracy

3.2.3. Reduction of Attributes and Core Attribute Set

3.3. Decision Tree: DT

3.3.1. Classification and Recression Tree: CART

3.3.2. C4.5 Decision Tree: C4.5

3.3.3. Reduces Error Pruning Tree: REPTree

4. Results and Analysis

4.1. Descriptive Statistics

4.2. Analysis of Empirical Results

5. Conclusions

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A. Technique for Order Preference by Similarity to an Ideal Solution (TOPSIS)

- ➣

- Step 1: Normalize the decision matrix.The decision matrix can be normalized by Equation (A1).where denotes the normalized value.

- ➣

- Step 2: Compute the weighted normalized decision matrix.Equation (A2) expresses the weighted normalized decision matrix.where the relative weight of the th criterion is expressed as , and all the weights are aggregated to 1 ().

- ➣

- Step 3: Determine the positive ideal () and negative ideal solution ().

- ➣

- Step 4: Compute the Euclidean distance for each alternative grounded on the positive ideal solution and negative ideal solution.

- ➣

- Step 5: Calculate the relative distance of each alternative to the ideal solution.The relative closeness of alternative with respect to is determined by Equation (A5).

- ➣

- Step 6: Determine the best alternative.

References

- Aguilera, R.; Jackson, G. The cross-national diversity of corporate governance: Dimensions and determinants. Acad. Manag. Rev. 2003, 28, 447–465. [Google Scholar] [CrossRef]

- Diamond, M.R. Corporations, a Contemporary Approach; Carolina Academic Press: Durham, NC, USA, 2015. [Google Scholar]

- Rekker, S.A.; Benson, K.L.; Faff, R.W. Corporate social responsibility and CEO compensation revisited: Do disaggregation, market stress, gender matter? J. Econ. Bus. 2014, 72, 84–103. [Google Scholar] [CrossRef]

- Ye, Q.; Li, Z. Do independent directors play a political role? Evidence from independent directors death events? China J. Account. Res. 2017, 10, 295–316. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Investor protection and corporate valuation. J. Financ. 2002, 57, 1147–1170. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar] [CrossRef]

- Zafar, F.; Akram, M. A novel decision-making method based on rough fuzzy information. Int. J. Fuzzy Syst. 2018, 20, 1000–1014. [Google Scholar] [CrossRef]

- Gill, A. Corporate governance as social responsibility: A research agenda. Berkeley J. Int. Law 2008, 26, 452. [Google Scholar]

- Bhaduri, S.N.; Selarka, E. Corporate Governance and Corporate Social Responsibility of Indian Companies; Springer: Singapore, 2016. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility and financial performance: Correlation or misspecification? Strateg. Manag. J. 2000, 21, 603–609. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- Zahra, S.A. Public and corporate governance and young global entrepreneurial firms. Corp. Gov. 2014, 22, 77–83. [Google Scholar] [CrossRef]

- Sheldon, O. The Philosophy of Management; Sir Isaac Pitman & Sons: Bath, UK, 1923. [Google Scholar]

- Bowen, H.R. Social Responsibility of the Businessman; Harper and Row: New York, NY, USA, 1953. [Google Scholar]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Maignan, I.; Ralston, D. Corporate social responsibility in Europe and the U.S.: Insights from businesses’ self-presentations. J. Int. Bus. Stud. 2002, 33, 497–514. [Google Scholar] [CrossRef]

- Forker, J.J. Corporate governance and disclosure quality. Account. Bus. Res. 1992, 22, 111–124. [Google Scholar] [CrossRef]

- Jamali, D.; Safieddine, A.; Rabbath, M. Corporate governance and corporate social responsibility: Synergies and interrelationships. Corp. Gov. 2008, 16, 443–459. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. The integration of corporate governance in corporate social responsibility disclosures. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 15–26. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Ferrell, A.; Liang, H.; Renneboog, L. Socially responsible firms. J. Financ. Econ. 2016, 122, 585–606. [Google Scholar] [CrossRef]

- Ferrell, O.C.; Fraedrich, J. Business Ethics: Ethical Decision Making and Cases; Houghton Mifflin: Boston, MA, USA, 2015. [Google Scholar]

- Bhimani, A.; Soonawalla, K. From conformance to performance: The corporate responsibilities continuum. J. Account. Public Policy 2005, 24, 165–174. [Google Scholar] [CrossRef]

- Ackers, B. Corporate social responsibility reporting: What boards of directors need to know. Corp. Board Role Duties Compos. 2014, 10, 38–59. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorn, L. An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. J. Bus. Ethics 2006, 69, 149–162. [Google Scholar] [CrossRef]

- Sharif, M.; Rashid, K. Corporate governance and corporate social responsibility (CSR) reporting: An empirical evidence from commercial banks (CB) of Pakistan. Qual. Quant. 2014, 48, 2501–2521. [Google Scholar] [CrossRef]

- Pawlak, Z. Rough sets. Int. J. Parallel Program. 1982, 11, 341–356. [Google Scholar] [CrossRef]

- Pawlak, Z. Rough classification. Int. J. Man-Mach. Stud. 1984, 20, 469–483. [Google Scholar] [CrossRef]

- Block, J.; Wagner, M. Ownership versus management effects on corporate social responsibility concerns in large family and founder firms. J. Fam. Bus. Strategy 2014, 5, 339–346. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Building a good reputation. Eur. Manag. J. 2004, 22, 704–713. [Google Scholar] [CrossRef]

- Hung, H. Directors’ roles in corporate social responsibility: A stakeholder perspective. J. Bus. Ethics 2011, 103, 385–402. [Google Scholar] [CrossRef]

- Maclagan, P.W. Management and Morality; Sage Publications: London, UK, 1998. [Google Scholar]

- Prado-Lorenzo, J.M.; Gallego-Alvarez, I.; Garcia-Sanchez, I.M. Stakeholder engagement and corporate social responsibility reporting: The ownership structure effect. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 94–107. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Wang, H.; Kwok, C.C.Y. Family control and corporate social responsibility. J. Bank. Financ. 2016, 73, 131–146. [Google Scholar] [CrossRef]

- Cho, E.; Chun, S.; Choi, D. International diversification, corporate social responsibility, and corporate governance: Evidence from Korea. J. Appl. Bus. Res. 2015, 31, 743–764. [Google Scholar] [CrossRef]

- Gul, F.A.; Leung, S. Board leadership, outside directors’ expertise and voluntary corporate disclosure. J. Account. Public Policy 2004, 23, 351–379. [Google Scholar] [CrossRef]

- Muttakin, M.B.; Subramaniam, N. Firm ownership and board characteristics: Do they matter for corporate social responsibility disclosure of Indian companies? Sustain. Account. Manag. Policy J. 2015, 6, 138–165. [Google Scholar] [CrossRef]

- Paek, S.; Xiao, Q.; Lee, S.; Song, H. Does managerial ownership affect different corporate social responsibility dimensions? An empirical examination of US publicly traded hospitality firms. Int. J. Hosp. Manag. 2013, 34, 423–433. [Google Scholar] [CrossRef]

- Hu, Y.; Zhu, Y.; Hu, Y. Does ownership type matter for corporate social responsibility disclosure: Evidence from China? In Global Conference on Business and Finance Proceedings; The Institute for Business and Finance Research: Hilo, HI, USA, 2016; pp. 183–197. [Google Scholar]

- Walls, L.J.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Esa, E.; Zahari, A.R. Corporate social responsibility: Ownership structures, board characteristics & the mediating role of board compensation. Procedia Econ. Financ. 2016, 35, 35–43. [Google Scholar]

- Coombs, J.E.; Gilley, K.M. Stakeholder management as a predictor of CEO compensation: Main effects and interactions with financial performance. Strateg. Manag. J. 2005, 26, 827–840. [Google Scholar] [CrossRef]

- Darus, F.; Mad, S.; Yusoff, H. The importance of ownership monitoring and firm resources on corporate social responsibility (CSR) of financial institutions. Procedia Soc. Behav. Sci. 2014, 145, 173–180. [Google Scholar] [CrossRef]

- Jian, M.; Lee, K.W. CEO Compensation and corporate social responsibility. J. Multinatl. Financ. Manag. 2015, 29, 46–65. [Google Scholar] [CrossRef]

- Huang, Q.H.; Huagang, P.; Ghongwu, Z. Blue Book of Corporate Social Responsibility: Research Report on Corporate Social Responsibility of China (2015); Social Sciences Academic Press (China): Beijing, China, 2015; Available online: https://www.pishu.com.cn/skwx_ps/bookdetail?SiteID=14&ID=9131325 (accessed on 10 May 2018).

- Liu, X.; Zhang, C. Corporate governance, social responsibility information disclosure, and enterprise value in China. J. Clean. Prod. 2017, 142, 1075–1084. [Google Scholar] [CrossRef]

- Chen, W.; Li, S.; Crystal Chen, X. How much control causes tunneling? Evidence from China. China J. Account. Res. 2017, 10, 231–245. [Google Scholar] [CrossRef]

- Chiou, J.R.; Hsiung, T.C.; Kao, L.A. A study on the relationship between financial distress and collateralized shares. Taiwan Account. Rev. 2002, 3, 79–111. [Google Scholar]

- Jiraporn, P.; Chintrakarn, P. Corporate social responsibility (CSR) and CEO luck: Are lucky CEOs socially responsible? Appl. Econ. Lett. 2013, 20, 1036–1039. [Google Scholar] [CrossRef]

- Jo, H.; Songa, M.H.; Tsang, A. Corporate social responsibility and stakeholder governance around the world. Glob. Financ. J. 2016, 29, 42–69. [Google Scholar] [CrossRef]

- Graafland, J.; Smid, H. Does corporate social responsibility really make a difference? An explorative analysis for Chinese companies. China World Econ. 2014, 22, 102–124. [Google Scholar] [CrossRef]

- Kim, Y.S.; Kim, Y.; Kim, H.D. Corporate social responsibility and internal control effectiveness. Asia-Pac. J. Financ. Stud. 2017, 46, 341–372. [Google Scholar] [CrossRef]

- Cheng, C.H.; Chen, T.L.; Wei, L.Y. A hybrid model based on rough sets theory and genetic algorithms for stock price forecasting. Inf. Sci. 2010, 180, 1610–1629. [Google Scholar] [CrossRef]

- Jia, X.; Shang, L.; Zhou, B.; Yao, Y. Generalized attribute reduction rough set theory. Knowl.-Based Syst. 2016, 9, 1204–1218. [Google Scholar]

- Li, R.; Wang, Z.O. Mining classification rules using rough sets and neural networks. Eur. J. Oper. Res. 2004, 157, 439–448. [Google Scholar] [CrossRef]

- Shyng, J.Y.; Shieh, H.M.; Tzeng, G.H. Compactness rate as a rule selection index based on Rough Set Theory to improve data analysis for personal investment portfolios. Appl. Soft Comput. 2011, 11, 3671–3679. [Google Scholar] [CrossRef]

- Pawlak, Z.; Slowinski, R. Rough set approach to multiattribute decision analysis. Eur. J. Oper. Res. 1994, 72, 443–459. [Google Scholar] [CrossRef]

- Quinlan, J.R. Induction of decision trees. Mach. Learn. 1986, 1, 81–106. [Google Scholar] [CrossRef]

- Quinlan, J.R. Simplifying decision trees. Int. J. Man-Mach. Stud. 1987, 27, 221–234. [Google Scholar] [CrossRef]

- Quinlan, J.R. C4.5: Programs for Machine Learning; Morgan Kaufmann: Burlington, MA, USA, 1993. [Google Scholar]

- Breiman, L.; Friedman, J.; Olshen, R.; Stone, C. Classification and Regression Trees; Chapman & Hall: Belmont, CA, USA, 1984. [Google Scholar]

- Kao, L.J.; Chiu, C.C.; Chiu, F.Y. A Bayesian latent variable model with classification and regression tree approach for behavior and credit scoring. Knowl.-Based Syst. 2012, 36, 245–252. [Google Scholar] [CrossRef]

- Karabadji, N.E.I.; Seridi, H.; Bousetouane, F.; Dhifli, W.; Aridhi, S. An evolutionary scheme for decision tree construction. Knowl.-Based Syst. 2017, 117, 166–177. [Google Scholar] [CrossRef]

- Chang, C.L.; Chen, C.H. Applying decision tree and neural network to increase quality of dermatologic diagnosis. Expert Syst. Appl. 2009, 36, 4035–4041. [Google Scholar] [CrossRef]

- Chan, C.C. A rough set approach to attribute generalization in data mining. Inf. Sci. 1998, 107, 169–176. [Google Scholar] [CrossRef]

- Chang, T.M.; Hsu, M.F.; Lin, S.J. Integrated news mining technique and AI-based mechanism for corporate performance forecasting. Inf. Sci. 2018, 424, 273–286. [Google Scholar] [CrossRef]

- Kao, L.; Chiou, J.; Chen, A. The agency problems, firm performance and monitoring mechanisms: The evidence from collateralised shares in Taiwan. Corp. Gov. 2004, 12, 389–402. [Google Scholar] [CrossRef]

- Stanwick, P.A.; Stanwick, S.D. The relationship between corporate social performance, and organizational size, financial performance, and environmental performance: An empirical examination. J. Bus. Ethics 1998, 17, 195–204. [Google Scholar] [CrossRef]

- Tang, Z.; Tang, J. Stakeholder–firm power difference, stakeholders’ CSR orientation, and SMEs’ environmental performance in China. J. Bus. Ventur. 2012, 27, 436–455. [Google Scholar] [CrossRef]

- Molloy, L.; Erekson, H.; Gorman, R. Exploring the Relationship between Environmental and Financial Performance. Paper Presented at Workshop on Capital Markets and Environmental Performance, Sponsored by: U.S. Environmental Protection Agency, Laguna Beach, CA, USA, 25–27 October 2002. [Google Scholar] [CrossRef]

- Rahim, M.M.; Alam, S. Convergence of corporate social responsibility and corporate governance in weak economies: The case of Bangladesh. J. Bus. Ethics 2014, 121, 607–620. [Google Scholar] [CrossRef]

- Rokach, L. Ensemble-based classifiers. Artif. Intell. Rev. 2010, 33, 1–39. [Google Scholar] [CrossRef]

- Lin, S.J.; Chang, C.; Hsu, M.F. Multiple extreme learning machines for a two-class imbalance corporate life cycle prediction. Knowl.-Based Syst. 2013, 39, 214–223. [Google Scholar] [CrossRef]

- Wu, T.C.; Hsu, M.F. Credit risk assessment and decision making by a fusion approach. Knowl.-Based Syst. 2012, 35, 102–110. [Google Scholar] [CrossRef]

- Jahanshahloo, G.R.; Hosseinzadeh, L.F.; Izadikhah, M.V. An algorithmic method to extend TOPSIS for decision-making problems with interval data. Appl. Math. Comput. 2006, 175, 1375–1384. [Google Scholar] [CrossRef]

- Wang, Y.M.; Elhag, T.M.S. Fuzzy TOPSIS method based on alpha level sets with an application to bridge risk assessment. Expert Syst. Appl. 2006, 31, 309–319. [Google Scholar] [CrossRef]

- Hu, K.H.; Chen, F.H.; Tzeng, G.H.; Lee, J.D. Improving Corporate Governance Effects on an Enterprise Crisis Based on a New Hybrid DEMATEL with the MADM Model. J. Test. Eval. 2015, 43, 1395–1412. [Google Scholar] [CrossRef]

- Kumar, P.R.; Ravi, V. Bankruptcy prediction in banks and firms via statistical and intelligent techniques—A review. Eur. J. Oper. Res. 2007, 180, 1–28. [Google Scholar] [CrossRef]

- Lin, S.J. Integrated artificial intelligence-based resizing strategy and multiple criteria decision making technique to form a management decision in an imbalanced environment. Int. J. Mach. Learn. Cybern. 2017, 8, 1981–1992. [Google Scholar] [CrossRef]

- Lin, S.J.; Hsu, M.F. Incorporated risk metrics and hybrid AI techniques for risk management. Neural Comput. Appl. 2017, 28, 3477–3489. [Google Scholar] [CrossRef]

- Hu, S.K.; Tzeng, G.H. Strategizing for Better Life Development Using OECD Well-being Indicators in a Hybrid Fuzzy MCDM Model. Int. J. Fuzzy Syst. 2017, 19, 1683–1702. [Google Scholar] [CrossRef]

- Westphal, J.D.; Zajac, E.J. A behavioral theory of corporate governance: Explicating the mechanisms of socially situated and socially constituted agency. Acad. Manag. Ann. 2013, 7, 607–661. [Google Scholar] [CrossRef]

- Hwang, C.L.; Yoon, K. Multiple Attribute Decision Making: Methods and Applications; Springer: Heidelberg, Germany, 1981. [Google Scholar]

- Zhang, X.Y.; Wang, J.Q.; Hu, J.H. On novel operational laws and aggregation operators of picture 2-tuple linguistic information for MCDM problems. Int. J. Fuzzy Syst. 2018, 20, 958–969. [Google Scholar] [CrossRef]

| Variable Name | Description and Calculate Method | Source |

|---|---|---|

| Independent variables | ||

| Board size (X1) | Number of directors | Hung [31]; Liu & Zhang [46] |

| Supervisor size (X2) | Number of supervisors | Forker [17] |

| Proportion of independent directors (X3) | Number of outside directors/the number of total directors | Muttakin & Subramaniam [37]; Esa & Zahari [41]; Liu & Zhang [46]; Chen et al. [47] |

| Board pledge rate (X4) | Number of collateralized shares by directors and supervisors/shareholders held by directors and supervisors | Chiou et al. [48] |

| CEO duality (X5) | A dummy variable that equals one if the CEO served as a board chairman and 0 otherwise. | Gul & Leung [36]; Block & Wagner [29]; Muttakin & Subramaniam [37] |

| Ownership concentration (X6) | Number of share held of the top 10 major shareholders/the number of shares outstanding | Darus [43]; Cho et al. [35] |

| Share proportion of senior administrators (X7) | Number of shares by senior executives/the number of shares outstanding | Chen et al. [47] |

| Share proportion of managers (X8) | Number of shares by managers/the number of shares outstanding | Paek [38] |

| State-owned enterprise (X9) | 1 for State-owned enterprise; 0 for others. | Esa & Zahari [41]; Liu & Zhang [46] |

| Directors’ compensation (X10) | Total annual compensation of top three directors | Esa & Zahari [41] |

| Executives’ compensation (X11) | Total annual compensation of top three senior executives | Rekker et al. [3]; Jian & Lee [44]; Liu & Zhang [46] |

| Control variables | ||

| Enterprise size (X12) | Natural logarithm of total assets | Jiraporn & Chintratarn [49]; Darus [43]; Esa & Zahari [41]; Liu & Zhang [46]; Jo et al. [50] |

| Debt ratio (X13) | Total liabilities/total assets | Jian & Lee [44]; Esa & Zahari [411]; Jo et al. [50] |

| R & D intensity (X14) | Natural logarithm of (Research and development expenditure/Net sales) | McWilliams & Siegel [10]; Block & Wagner [29]; Jian & Lee [44]; Graafland & Smid. [51]; Jo et al. [50] |

| Return on asset (X15) | Net income/total assets | Prado-Lorenzo et al. [33]; Block & Wagner [29]; Jo et al. [50] |

| PB ratio (X16) | Share price/Book value per share | Kim et al. [52] |

| Firm value (Tobin Q) (X17) | (Common and preferred stock market value + Long-term liabilities market value + Short-term liabilities market value)/(Equity book value + Liabilities book value) | Paek [38] |

| Revenue growth rate (X18) | (Revenue this year/Revenue last year) − 1 | McWilliams & Siegel [10]. |

| Variables | Maximum Value | Minimum Value | Average Value | Standard Deviation |

|---|---|---|---|---|

| Y1: Responsibility management | 100 | 0 | 37.43 | 33.56 |

| Y2: Market responsibility | 100 | 0 | 42.85 | 27.85 |

| Y3: Social responsibility | 96 | 0 | 39.23 | 27.41 |

| Y4: Environmental responsibility | 91 | 0 | 32.43 | 27.76 |

| Y5: CSR | 87 | 0 | 38.50 | 27.25 |

| X1: Board size | 15 | 5 | 9.44 | 2.22 |

| X2: Supervisor size | 12 | 2 | 4.22 | 1.66 |

| X3: Proportion of independent directors (%) | 66.67 | 33.33 | 38.98 | 7.99 |

| X4: Board pledge rate (%) | 92.88 | 0 | 7.79 | 16.85 |

| X5: CEO duality (dummies) | - | - | - | - |

| X6: Ownership concentration (%) | 98.45 | 2.89 | 59.09 | 24.58 |

| X7: Share proportion of senior administrators (%) | 53.57 | 0 | 1.60 | 6.15 |

| X8: Share proportion of managers (%) | 83.99 | 0 | 3.65 | 11.59 |

| X9: State-owned enterprise (dummies) | - | - | - | - |

| X10: Directors’ compensation | 27,137,000 | 92,300 | 3,199,211 | 4,209,330 |

| X11: Executives’ compensation | 34,361,840 | 235,000 | 3,838,006 | 4,815,822 |

| X12: Enterprise size | 21.6 | 14.23 | 17.69 | 1.66 |

| X13: Debt ratio (%) | 90.87 | 9.14 | 59.76 | 17.25 |

| X14: R & D intensity (%) | 13.35 | 0 | 1.91 | 2.52 |

| X15: Return on asset (%) | 19.05 | −13.33 | 4.28 | 4.49 |

| X16: PB ratio (X16) (%) | 1750.84 | 20.07 | 168.22 | 173.77 |

| X17: Firm value (Tobin Q) | 11,119.29 | 70.18 | 769.29 | 1093.55 |

| X18: Revenue growth rate (%) | 4.28 | −0.41 | 0.07 | 0.37 |

| Responsibility Management | Market Responsibility | Social Responsibility | Environmental Responsibility | CSR | |

|---|---|---|---|---|---|

| C4.5 | X12,X4,X6,X9,X1 | X4,X12,X3 | X12,X4,X7,X9,X5 | X12,X14,X4 | X4,X12,X9,X2 |

| REPTree | X4,X12,X16 | X12,X4,X6 | X12,X4,X14 | X12,X4,X13 | X12,X14,X6,X4 |

| CART | X12,X14,X6X7 | X12 | X12 | X12,X14,X4 | X12,X7 |

| Rough Set theory | X4,X12,X13 | X4,X12,X14,X18 | X4,X12,X15 | X4,X13,X14 | X4,X12,X13 |

| Model | Dependent Variable/Dimension | Overall Accuracy | Type I Error | Type II Error |

|---|---|---|---|---|

| C4.5 | Responsibility management | 84.30 | 83.40 | 85.20 |

| Market responsibility | 82.70 | 80.20 | 85.20 | |

| Social responsibility | 84.10 | 83.00 | 85.20 | |

| Environmental responsibility | 83.10 | 82.40 | 83.80 | |

| Corporate Social Responsibility (CSR) | 82.90 | 80.60 | 85.20 | |

| REPTree | Responsibility management | 72.90 | 75.20 | 70.60 |

| Market responsibility | 73.10 | 75.60 | 70.60 | |

| Social responsibility | 78.50 | 82.60 | 74.40 | |

| Environmental responsibility | 77.50 | 80.60 | 74.40 | |

| Corporate Social Responsibility (CSR) | 72.80 | 75.00 | 70.60 | |

| CART | Responsibility management | 81.60 | 82.80 | 80.40 |

| Market responsibility | 81.60 | 82.20 | 81.00 | |

| Social responsibility | 82.90 | 83.20 | 82.60 | |

| Environmental responsibility | 83.00 | 83.60 | 82.40 | |

| Corporate Social Responsibility (CSR) | 81.30 | 82.40 | 80.20 | |

| RST | Responsibility management | 84.70 | 84.80 | 84.60 |

| Market responsibility | 83.90 | 83.20 | 84.60 | |

| Social responsibility | 86.50 | 86.00 | 87.00 | |

| Environmental responsibility | 85.70 | 86.00 | 85.40 | |

| Corporate Social Responsibility (CSR) | 84.20 | 83.80 | 84.60 |

| Model | Dependent Variable/Dimension | Overall Accuracy | Type I Error | Type II Error |

|---|---|---|---|---|

| C4.5 | Responsibility management | 2 | −1 | 2 |

| REPTree | −3 | −3 | −3 | |

| CART | −1 | −1 | −1 | |

| RST | 2 | 0 | 2 | |

| C4.5 | Market responsibility | 0 | −2 | −2 |

| REPTree | −3 | −3 | −3 | |

| CART | 1 | 0 | −1 | |

| RST | 1 | 2 | 1 | |

| C4.5 | Social responsibility | 2 | −1 | −1 |

| REPTree | −3 | −2 | −3 | |

| CART | 0 | −1 | −1 | |

| RST | 2 | 2 | 2 | |

| C4.5 | Environmental responsibility | −1 | 0 | 0 |

| REPTree | −3 | −3 | −3 | |

| CART | 0 | 0 | 1 | |

| RST | 1 | 2 | 2 | |

| C4.5 | Corporate Social Responsibility (CSR) | 1 | 0 | 2 |

| REPTree | −3 | −3 | −3 | |

| CART | 1 | 1 | −1 | |

| RST | 2 | 1 | 1 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, K.-H.; Lin, S.-J.; Hsu, M.-F. A Fusion Approach for Exploring the Key Factors of Corporate Governance on Corporate Social Responsibility Performance. Sustainability 2018, 10, 1582. https://doi.org/10.3390/su10051582

Hu K-H, Lin S-J, Hsu M-F. A Fusion Approach for Exploring the Key Factors of Corporate Governance on Corporate Social Responsibility Performance. Sustainability. 2018; 10(5):1582. https://doi.org/10.3390/su10051582

Chicago/Turabian StyleHu, Kuang-Hua, Sin-Jin Lin, and Ming-Fu Hsu. 2018. "A Fusion Approach for Exploring the Key Factors of Corporate Governance on Corporate Social Responsibility Performance" Sustainability 10, no. 5: 1582. https://doi.org/10.3390/su10051582

APA StyleHu, K.-H., Lin, S.-J., & Hsu, M.-F. (2018). A Fusion Approach for Exploring the Key Factors of Corporate Governance on Corporate Social Responsibility Performance. Sustainability, 10(5), 1582. https://doi.org/10.3390/su10051582