Abstract

Producer service industries are an important feature in the current development of a metropolis. Researchers from different countries are increasingly concerned about location changes and the motives of producer service sectors in cities. Given the rapid development of producer service sectors in developing countries, this study examines changes in the distribution of producer service sectors over the past decade and factors influencing them in a case study using the city of Hangzhou in China. Results show that Hangzhou’s producer service sector is still mainly concentrated in the central business district (CBD). However, a distinct trend of diffusion to suburban areas was observed, which formed several secondary clusters on the periphery of the city. Locations of the CBD, sub-centers, and professional clusters of producer service sectors established by the government are the most important factors that affect the spatial distribution of producer service sectors. The main influencing factors for the spatial evolution of producer service sectors are: (1) the high development cost and residential suburbanization of the central areas of the city promote the development of producer service sectors toward the periphery; (2) city planning has guided the clustering of producer service sectors on the city’s CBD and secondary city centers; (3) city renewal has provided personalized and diversified development space for producer service sectors; (4) incentive policies introduced by the government, such as rentals, and taxes have enhanced the orderly aggregation of producer service sectors.

1. Introduction

Given the globalization of economic development, metropolises constantly spring up and significantly affect economies across the world [1]. The industrial structures of metropolises have been focused on producer service sectors since the 1950s. The productive service industry of China is developing rapidly in the 21st century. According to the Statistical Yearbook of China’s Tertiary Industry 2017, the added-value of the productive service industry grew at an average rate of 15.91% from 2005 to 2016, but decreased to 8.67% in 2016. Nonetheless, the proportion of added-value of the productive service industry in GDP rose stably and reached 25.75% in 2016. From 2005 to 2016, total social fixed-asset investment in the productive service industry grew at an average rate of 19.49%. Moreover, the number of persons employed by the productive service industry in cities and towns, about 52,000,000, remained stable from 2004 to 2015. The proportion of foreign direct investment in the productive service industry surpassed that of the manufacturing industry for the first time in 2015. Specifically, productive services became the industry with the largest foreign direct investment, with its proportion reaching as high as 43.64% in 2016. These data amply signify that the productive service industry has achieved considerable progress in inviting foreign investment and improving its international competitiveness. Spatial changes in producer service sectors have distinct particularities in China. Moreover, the government adopts strict regulations in the process of economic development, in addition to market mechanisms similar to Western cities [2,3]. For the past three decades, China’s reform and open-door policy have given rise to the rapid development of Chinese manufacturing and service sectors while significant changes have occurred in industrial structures [4]. At the same time, more central business districts (CBDs), sub-CBDs, and office blocks are rising in big cities in China [5,6]. The types of office space tend to be diversified. In addition to traditional office buildings, old factory buildings and warehouses have been converted into office space during urban renewal. In the context of diverse office-space types, multiple-center office space structures, mobile office modes, and office suburbanization, traditional office-location theory can no longer meet the requirements of current development needs [7,8]. Existing research on the productive service industry is mostly from the perspective of the world, nation, or urban agglomeration. Few studies have focused on the microscopic urban internal structure. Hence, understanding the spatial features, influencing factors and development patterns in the productive service industry in cities is essential for government agencies. These agencies could utilize scientific data in the preparation of incentive policies for office land-use planning, office-building construction, and rental. Consequently, effective programs could lead to sustainable development of the productive service industry and urban space.

Hangzhou, which hosted the 2016 G20 (Group of Twenty finance ministers and central bank governors) summit and the 2016 B20 (Business Leaders from the G20 countries) summit, is one of cities with the fastest development of service sectors in China. This study intends to explore the characteristics of spatial evolution of producer service sectors under the dual influences of market factors and governmental factors. Similarly, this study differentiates Hangzhou from other cities in the world by conducting research on the spatial pattern evolution of urban producer service sectors in Hangzhou from 2003 to 2013 and their influential factors. This study will adopt various models, namely, spatial density, spatial autocorrelation and spatial regression.

The rest of the study is organized as follows. The second section is a literature review of the spatial evolution of producer service sectors. The third section provides an introduction to research regions and research methods. The fourth section demonstrates spatial density analysis of producer service sectors, analysis of sub-industrial distribution characteristics, and analysis results of the effects of influential factors in the inner-city space location of producer service sectors. The fifth section discusses the evolution mechanisms of spatial patterns of producer service sectors under the influence of two aspects, namely, governmental guidance and market economies. The sixth section provides the conclusion, which is then compared with conclusions obtained in other studies on regional case cities.

2. Literature Review: Inner-City Locations of Producer Service Sectors

Spatial distribution modes of producer service sectors are influenced by a variety of factors of agglomeration and diffusion at different spatial scales by different industries [9,10,11,12]. In the early stage of development of metropolises, scholars studied the location characteristics of service industries from the perspective of accessibility, transaction cost, land rentals, and information services [13]. Several empirical studies were conducted with the advent of city globalization after the 1990s. For example, scholars studied the decentralization conditions of different service sectors and office space at regional scales [14,15,16,17], and the connection pattern of producer service sectors between different cities [11,12]. In the inner scale of cities, changes in service sectors in different CBDs were discussed [12]. However, the accelerated growth of producer service sectors was generally the research hotspot of macro-scale city space structures. Micro-scale research on the inner parts of cities is relatively limited [18,19,20,21]. First, producer service sectors embody strong spatial agglomeration characteristics, given the forward and backward relevance of agglomeration economies [22]. The availability of a diversified producer service sector attracts corporate headquarters to central positions, and requirements for “face-to-face” exchanges with agglomerated high-level services. This agglomeration forms service complexity [23], which can reduce intermediate service investments’ market opportunities, production innovation, and labor costs [24,25]. Companies that benefit the most from “face-to-face” information exchanges are willing to pay the expensive land prices required for convenient locations [26].

Second, producer service sectors have exhibited a spatial trend of diffusion, particularly driven by the progress of information technologies, residential suburbanization, and the high cost of central areas [27,28,29,30]. The diffused and decentralized trend of producer service sectors started to gain attention in the 1980s as sub-centers of cities also developed the functions of producer service sectors [31,32,33,34,35]. Transformations in information technology and suppliers have forced an increasing number of companies in central areas to implement suburban expansion strategies [31,36]. Existing studies on metropolitan areas include New York, Atlanta, Los Angeles, Washington DC, Montreal [37], Sydney [38] and Seoul [39]. Many small cities that have good transport conditions and communication infrastructures and are within an hour’s drive to a metropolis have also become a place to develop service sectors [40].

Spatial distributions of the producer service sectors also differ by industries. CBDs gradually become diffused production organizations and management and administrative hubs for companies with certain branches [15,18,41]. Market demands decide the location distribution of producer service sectors in cities. The sites of financial, legal and insurance offices of service corporate headquarters are chosen in the downtown area. Industries with mixed insurance, corporate and consumer markets place less focus on real estate and accounting. By contrast, departments that offer technical services, including computer services and research, are given a high concentration in high-tech suburban cities [11,15,34,42]. Several information exchange industries that are highly dependent on “face-to-face” exchanges can be appropriately concentrated in CBDs [15,24,43,44]. Several producer service sectors, such as advertising, accountancy, management and technical services, are separated from manufacturing enterprise. Thus, they prefer to be located in sub-CBDs which are closely related to the manufacturing sector [4,40].

This study uses spatial density models, spatial autocorrelation models, and spatial econometrics regression models in a geographic information system (GIS). These models are used to measure the spatial agglomeration and diffusion levels of the producer service sectors in Hangzhou for the past 10 years in order to explain the driving force in its formation. This approach can also verify whether the existing regularities of producer service sectors in the process of spatial evolution locally and internationally are applicable to Chines cities.

3. Data and Research Methods

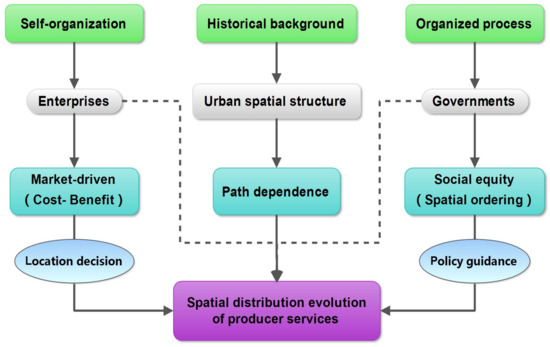

The influencing factors that affect the spatial evolution of producer service sectors can be divided into three major categories: enterprises (market-driven), urban spatial structure (path dependence), and governments (spatial ordering). The enterprises provide location decisions for the spatial evolution of producer service sectors, and the governments provide policy guidance. Therefore, we construct a study framework (Figure 1) to assess the spatial evolution of producer service sectors and its influencing factors in cities using the case study of Hangzhou, China.

Figure 1.

Study framework.

3.1. Study Area

Hangzhou is home to China’s largest online retail trading platform, Alibaba Group, and a central city south of the Yangtze River Delta region. It is one of the most developed cities in China, and is advanced in tertiary industries. In 2014, Hangzhou accommodated 407 large office buildings mostly for producer service sectors, and the buildings accumulated a total amount of 25.347 billion Yuan in state and local taxes. Seventy-eight of these offices each accumulated more than 100 million Yuan in taxes. In the last few years, the government has also planned and built special types of producer service sector clusters, such as creative parks, hi-tech parks, city complexity, and pioneer parks, in addition to traditional CBDs.

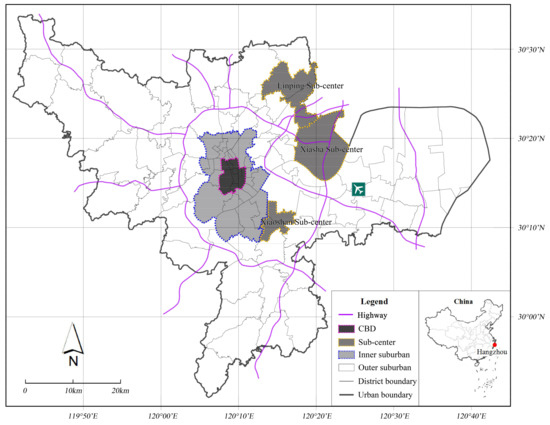

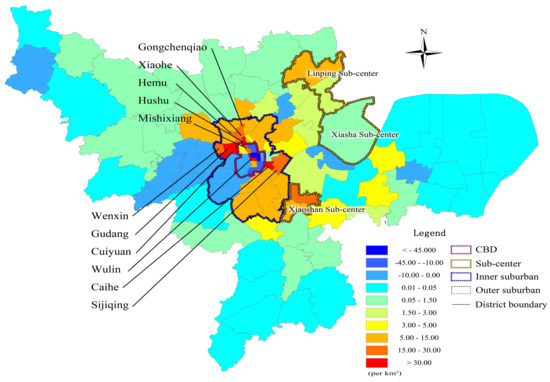

In this study, 95 streets (areas) in the main urban areas of Hangzhou are divided into four groups, namely: CBD, sub-center, near suburban, and remote suburban (Figure 2). The current central city is the main built-up urban area of Hangzhou prior to 1949, the start of the People’s Republic of China, and consistent with the urban administration management scope of 1982. This central city is considered as the CBD of Hangzhou today. The sub-center is determined in Hangzhou’s 2004 version of overall planning. Rear and remote suburban areas are divided according to the density of the population, and the population density of near suburban areas is higher than that of remote suburban areas.

Figure 2.

Map of research areas.

3.2. Data Sources

The sample data of producer service in this study is derived from official yellow pages, which are an internal common telephone directory for commercial and industrial enterprises compiled according to the nature of business and product categories. The name, address, and telephone number of registered businesses are the main content of this directory. Businesses comply with certain size requirements of the authorities, but the database does not provide specific data on employment and office scales. Lack of these data is one of the restrictions of this study and has resulted in the differences in the spatial distribution of enterprises after the scale is weighted. Therefore, the spatial forms that the present study explores refer to the concept of enterprise quantity distribution locations and not the agglomeration concept of employment and office scale referred to in previous research. The latest official yellow pages that we collected are the official yellow pages 2013. Therefore, the present study collected 21 enterprise data in producer service sectors, 8494 enterprise records in 2013, and 13,723 enterprise records in 2013 from the yellow pages. Given the lack of uniform classifications in producer service sectors, this study refers to previous research [45] and compares the Chinese National Standard Industrial Classification (CNSIC) of the National Bureau of Statistics of China and the industry classification of the North American Industry Classification System (NAICS). Twenty-one industries are then merged into five categories (Table 1).

Table 1.

Comparisons of service sector classification.

3.3. Research Methods

3.3.1. Spatial Density Analysis

This study uses the kernel density function (KDF) to calculate the magnitude per unit area based on points and polylines to fit each point and polyline into a smooth surface [46]. This approach helps prepare occurrence probability maps and identify agglomeration phenomena in research areas. This method is described in the study of Silverman [47]. This study utilizes the statistical values of producer service sectors in each street in Hangzhou in 2003 and 2013. Estimation and a smoothing treatment were conducted through KDF functions, and density values were divided into 10 grades. Changes in the spatial distribution of Hangzhou’s producer service sectors were also explored.

3.3.2. Spatial Autocorrelation Statistics

This study calculates the overall and sub-industrial Moran’s I of Hangzhou’s producer service sectors in 2003 and 2013 to compare spatial agglomeration and diffusion levels of different industries in different periods. A positive Moran’s I means that adjacent units have similar values, which indicates spatial agglomeration. A negative Moran’s I means spatial diffusion [48]. The definition of global scale Moran’s I is given as:

Representing a variable of unit I, is a spatial weight matrix; if unit I and unit j is adjacent, or . Moran’s I fluctuates between −1 and 1; means negative spatial correlation; mean positive spatial correlation; and means no spatial correlation. High value means strong correlation.

This study then identifies hot regions of spatial agglomeration and diffusion of producer service sectors in different years and the changes they underwent using local indicators of spatial autocorrelation (LISA), which is the decomposition of the global scale spatial autocorrelation statistics of global Moran’s I [49]. LISA statistics can further identify spatial position where agglomeration occurs, namely, a “hot-spot” [48]. The calculation method for the local indicators of spatial autocorrelation (LISA) is given as

Zi is the standardized form of xi, and the meaning of W (i, j) is same as the global Moran index. The sum of all local Moran’s indices is equal to the global Moran’s index. Streets with significant LISA are divided into four categories and allocated in four quadrants in the Moran scatter plot [49]. These categories are high–high, low–low, low–high, and high–low. High–high and low–low denote the height of enterprise density values of the street itself, whereas low–high and high–low denote the height of enterprise density values of adjacent streets. Identified streets denote the height of enterprise density values of the street itself and adjacent streets have significant correlation.

3.3.3. Spatial Regression Models

This study used spatial regression models to explain the influences of influencing factors of different locations on producer service sector distribution. The spatial regression model brings in spatial constant coefficient regression models for spatial effects (spatial correlation and spatial differences) [49,50]. This model includes the spatial lag model (SLM) and spatial error model (SEM). The maximum likelihood method is normally used to conduct estimation.

The influencing factors of city space are underscored from the perspectives of history, current status, and government [51]. Historical inertia and cumulative causation have a significant influence on the spatial process of producer service sectors [36,51,52]. Historical factors reflect the domicile, sunk costs, and unmovable resources of workers related to the development of producer service sectors [53]. Current status factors mainly refer to access to customers and the availability of different types of services. Governments guide site decision making of enterprises through special preferential policies [54]. This study considers the availability of variables. Twelve spatial influencing factors were selected as an explanatory variable (Table 2), and the degree of agglomeration of producer services were used as a dependent variable to establish a spatial regression model. The degree of agglomeration of producer services is calculated by the number of producer services in a street area in 2003 and 2013, that is, the enterprise densities. Although these variables are precisely related with distance (except some dummy variables), the geographical distribution with the econometrics models needs to be controlled since the distances in variables only reveal the relationships among points of enterprise location, and the spatial dependences cannot be solved in an ordinary econometrics models. Faced with a similar situation, Zhang (2016) selected a spatial regression analysis to reveal the impact of flood hazards on neighborhood house prices [55].

Table 2.

Variable table of location influencing factors.

Anselin et al. (2006) put forward a spatial regression model selection decision rule among ordinary least squares (OLS) models, spatial lag models (SLM), and spatial error models (SEM) [56]. If the Lagrange multiplier (lag) is significant, but the Lagrange multiplier (error) is not, run the spatial lag model, and vice versa. If both Lagrange multiplier (lag) and Lagrange multiplier (error) are significant, check Robust LM (lag) and Robust LM (error). If Robust LM (lag) is significant, but Robust LM (error) is not, run the spatial lag model, and vice versa. If both Robust LM (lag) and Robust LM (error) are significant, choose the one with the biggest test value. R2, Log likelihood and Akaike information criterion (AIC) are adopted to compare the model performances. The model with greater R2 and log likelihood values and a lower AIC indicates better performance (Weng et al., 2016; Voss et al., 2006) [57,58], and is selected for regression analysis. If there is a conflict between the indication given by Moran’s I and that given by the Lagrange multiplier test statistics (Anselin, 2005), we also select the model with best model performance for regression analysis.

4. Results

4.1. Spatial Distribution Pattern of Producer Service Sectors

4.1.1. Spatial Pattern and Hotspots

Hangzhou’s producer service sectors showed a diffusion spatial pattern from 2003 to 2013, with differences in industries of different service sectors (Table 3). The increased Moran’s I of information, software and communication services from 2003 to 2013 indicates that service sectors of Information, software and communication services underwent an agglomerated trend. However, Moran’s I of Rental and business services and Transportation, warehousing and postal services from 2003 to 2013 decreased, which means that the two types of service sectors showed a diffused trend. The industry with the highest agglomeration level in 2003 is Transportation, warehousing and postal services, which had a value of 0.635. The industry with the lowest level of agglomeration is Information, software and communication services at 0.299. The industry with the highest agglomeration level in 2013 is also Transportation, warehousing and postal services with a value of 0.635. The industry with the lowest level of agglomeration is Scientific and technical services at 0.366.

Table 3.

Index table of spatial agglomeration of producer service sectors.

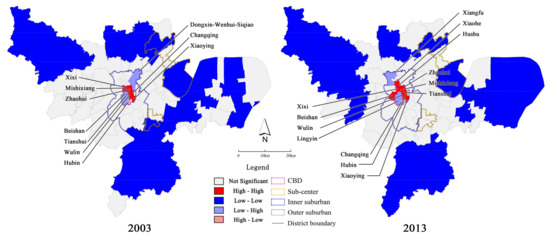

To further understand the spatial distribution features of service sectors, this study identifies the hotspot region distribution of agglomeration and diffusion by the LISA statistics (Figure 2) and the spatial density distribution patterns of producer service sectors (Figure 3). The values of overall Moran’s I, 0.627 in 2003 and 0.562 in 2013 imply that producer service sectors showed significant spatial autocorrelation.

Figure 3.

Diagram of the density of local indicators of spatial autocorrelation (LISA) agglomeration of producer service sectors.

Areas with a “high–high” value for agglomeration are mainly located in the central area of the city. The main agglomeration hotspot regions of 2013 mostly includes eight streets, which are largely the scope of the main urban area of Hangzhou city in 1990s. The typical regions are the Hubin and Wulin Square areas, and the main agglomeration hotspot areas in 2013 were more enlarged than that in 2003, which reached streets with the addition of Hushu Street, Xiaohe Street, and Lingyin Street. These added areas are mainly located in the periphery of former agglomeration areas.

Low–high area mainly refers to areas that are significantly different from their peripheral neighbors, which mostly were Shiqiao–Wenhui and Dongxi Street. These streets are the main areas expanded by the city over the past few years, and Beishan Street, which has scenic spots and parks in 2003. In 2013, this area also included Xiangfu Street, which is a commercial and economic agglomeration area that emerged in recent years.

Low–low areas are mainly sprinkled in the remote area of the city, which are largely rural areas without urban economic development.

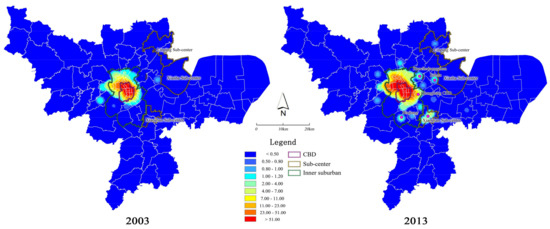

4.1.2. Spatial Density Distribution Pattern of Producer Service Sectors

The spatial density of Hangzhou’s producer service sectors in 2013 is broader than that in 2003 (Figure 4). This finding shows a pattern of agglomeration in the city’s central area and some remote areas. Compared with 2003 values, the top four grades (density range: 7.0–11.0) with the highest value in 2013 expanded outward from the central area. Similarly, the fifth grade and the sixth grade showed a form of peripheral dot-shaped agglomeration. The main areas in the density distribution expansion of the central area are the southern and northern regions of the city, as well as the CBD area of Qianjiang. Peripheral dot-shaped agglomeration areas are mainly the Linpin sub-center, Xiaoshan sub-center, Binjiang area, Jiubao, and East railway station. These areas are largely the sub-center and important external transport hub areas of the city.

Figure 4.

Kernel density function (KDF) density diagram of producer service sector.

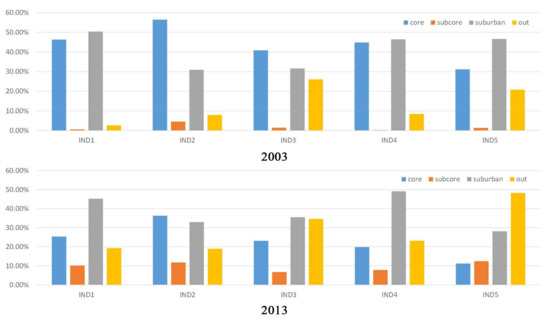

Areas with a growth rate in enterprise density of producer service sector growth, which are the highest in Hangzhou, are mainly on the periphery of the city’s central area, followed by the sub-center and near suburban. Figure 5 shows that areas with a growth rate of more than 15% are mostly Wulin Street, Caihe Street, Gudang Street and Cuiyuan Street, Hushu Street, Sijiqing Street, Xiaohe Street, Hemu Street, Wenxin Street and Gongchenqiao Street. Areas with a growth rate between 5% and 15% are near suburban in the south and north of the city, as well as Linping and Xiaoshan sub-centers. Areas with a growth rate of over 10% are mainly Tianshui Street, Changqing Street, Xiaoying Street, and Qingbo Street. Areas with most reduction are largely central areas with the highest density of urban pollution, and the periphery of scenic area of Xihu. Figure 6 shows areas with the largest quantity of distribution in 2003, which are the city’s central areas, followed by near suburban. Areas with the largest quantity of distribution in 2013 are near suburban. An apparent increase was also observed in sub-center areas. From 2003 to 2013, the proportion of enterprise number in the central areas decreased from 41.82% to 22.99%, and the proportion of enterprise number in the sub-center areas increased from 35.67% to 38.69%.

Figure 5.

Diagram of changes in spatial density of producer service sectors from 2003 to 2013.

Figure 6.

Statistical chart of differences in spatial distribution of different industries.

4.2. Differences in Spatial Distribution of Producer Service Sectors

Differences also exist among industries (Figure 6). Industries, such as Transportation, warehousing and postal services, that do not require face-to-face communication diffused the fastest, whereas industries that are heavily dependent on face-to-face communication and customers’ personal business, such as Finance and insurance services, tend to be concentrated in central areas. The industry with the largest proportion of distribution in the central areas is Finance and insurance services, the largest in near areas is Scientific and technical services, and the largest in sub-center areas and peripheral areas is Transportation, warehousing and postal services. Transportation, warehousing and postal service’s relative suburbanization level is the highest, whereas Scientific and technical services diffuses the fastest. The proportion of Rental and business services distribution in near suburban areas exceeds central areas, and the proportion of Transportation, warehousing and postal services distribution in the periphery goes beyond the central areas and near suburban. The industry with a proportion in the central areas decreasing the fastest is Scientific and technical services, the industry with proportion in the sub-center increases the fastest is transportation, warehousing and postal services, and the industry with a proportion in the peripheral areas decreasing the fastest is Transportation, warehousing and postal services.

4.3. Influencing Factors of Spatial Distribution of Producer Service Sectors

This study selects seven models to estimate the regression models of buildings. This approach was employed to investigate the relations between the distribution pattern of overall and sub-industrial producer service sectors and the city’s other types of spatial influencing factors. The comparisons among OLS models, SLMs and SEMs are shown in Table 4 and Table 5. The OLS models’ goodness-of-fit test values are lower than those of the spatial regression models. SLMs and SEMs have greates R2 than OLS models. Meanwhile, R2 and log likelihood in SEMs are greater than those in SEMs. SEMs have lower AIC than SLMs. Therefore, SEMs are selected for spatial regression analysis.

Table 4.

The comparisons among ordinary least squares (OLS) models, spatial lag models (SLM), and spatial error models (SEM) (part 1).

Table 5.

The comparison among ordinary least squares (OLS) models, spatial lag models (SLM), and spatial error models (SEM) (part 2).

Models 1–4 assessed the impacts of influencing factors on spatial distribution of producer service sectors in 2013 and 2003. Models 5–14 assessed the impacts of influencing factors on five industrial categories. Two spatial weight matrices including Queen contiguity and Euclidean distance were applied in spatial regressions in Table 6. The robust of significances of regression coefficients that were assessed by Queen contiguity and Euclidean distance in one regression model is fine. It reveals that the different spatial weight matrices do not have significant influence on the results of the regression coefficient estimation.

Table 6.

The results of spatial regression models.

Based on the regression coefficients of all industries, CBDs, sub-centers, land prices, and hi-tech parks are the most remarkable factors that affect the spatial distribution of producer service sectors. lnCBD, lnSCEN, and lnSCIP are notable negative influencing factors, which indicate that the evolution of producer service sectors from 2003 to 2013 show outward spatial diffusion. A high density in areas close to CBDs and sub-centers indicates that the city center has significant agglomeration effects. Given the advantages of economic preferential policies and convenient innovation alliances, hi-tech parks attract a high number of producer service sectors. The regression coefficient of lnSCE are positive, meaning a scenic spot is not suitable for the development of producer services. However, the regression coefficient of lnHWY of 2013 is positive, while it is not significant in 2003, which means that most producer service sectors are not sensitive to transport infrastructures. On the contrary, lnCOLL and CPR is significant in 2003, but they are not significant in 2013, which means producer service sectors had a close relationship with universities in the past; and there were few creative parks built in 2003, so the producer service sectors are not sensitive to them.

The analysis results of sub-industries show that differences exist in the key location influencing factors of different industries. Information, software and communication services is closely located to the business circle and higher education zone. This type of industry is highly dependent on the support from large crowds. Finance and insurance services is appropriately located close to the CBD, which illustrates that this type of industry tends to be agglomerated and relies on “face-to-face” communication and support of related industries. Rental and business services tends to be city’s CBD, sub-center and creative parks. This industry is also dependent on “face-to-face” communication and relevant industries. Scientific and technical services tend to be closely located in CBD and creative parks. Creative parks are special policy areas set up by the government exclusively for research and development and art-like service sectors to enable industries that meet the requirements to enjoy preferential policies in tax and rental. Transportation, warehousing and postal services tend to be distant from the CBD. Moreover, logistics and warehousing require a large warehouse close to the urban external transport hub. Thus, they are mostly distributed in the peripheral areas.

5. Discussion

5.1. Synchronized Development of Urban Spatial Expansion and Suburbanization of Producer Service Sectors

Our findings indicate that overall, several service sectors gradually back away from “face-to-face” communication because of urban spatial expansion, polycentered development, and the advancement of communication technology. High costs in central areas also promote the suburbanization of enterprises in producer service sectors. Producer service sectors show a diffusing trend, and the global Moran index in 2013 decreased from 0.562 to 0.627. The average population density of Hangzhou’s central areas in 2013 reached 20,000 people/square kilometers, with a constant increase in land prices and a decrease in traffic conditions and environmental quality. The land that can be developed in this area is limited. Thus, many service sectors that do not need frequent “face-to-face” communication, such as research and technical service sectors, are willing to be located near suburban and sub-centers. For example, Alibaba, a representative of a large e-commerce service sector, is not dependent on a “face-to-face” mode of communication. In 2009, Alibaba moved to the Binjiang block in the near suburban area from the cultural and educational block in the west of the city, and then moved to the remote suburban in the west of city, which is farther than the remote suburban. At present, in addition to the CBD in the traditional central area, Qijiang CBD, East railway station, Cuiyuan, Gudang in the near suburban have become the agglomeration areas of more emerging producer service sectors. The main industrial types in those blocks include research, technical services, leasing, and commercial services. An innovation alliance was developed by combining the higher education zone in the near suburban area. The innovation alliance was developed into an agglomeration area for producer service sectors, such as Xiasha sub-center, Binjiang, Jiubao, and other blocks.

5.2. City Planning Guides Agglomeration of Producer Service Sectors in Specific Space

Hangzhou’s city planning has guided relocations of producer service sectors from the city centre to peripheral regions with development space and a supportive environment. In the 1980s, Hangzhou municipality defined that urban functions of the city shall be shifted from industries to modern service sectors and tourism. However, until the early 2000s, many factories were still located in the scope of Hangzhou’s central urban area, which is a heavily polluted environment that affects office work and the living environment. In the city’s overall planning program of 2004, mass industrial lands in the central urban area were adjusted as service-use lands. Relocated industrial enterprises entered the peripheral industrial zone. The government formulated the Plan of Relocation of Industrial Enterprises in Urban Areas of Hangzhou and Research on Integration of Industrial parks in Urban Areas of Hangzhou. In addition, the government published a series of development strategies and incentive policies, such as “Building a City of Quality Life”, “Suppress the Second Industry and Develop the Third Industry”, and “Vacating the Cage for Better Birds”. “Vacating the Cage for Better Birds” is one of the China’s current economic development strategies, which is moving out the traditional manufacturing industry of the central city, then moving in advanced industry, in order to achieve the purpose of economic transformation and industrial upgrading. Environmental quality has improved in recent years given the completion of office buildings. Enterprises in producer service sectors have increased remarkably in numbers, especially in Xiaohe, Shiqiao, Wenhui, and Dongxin Streets.

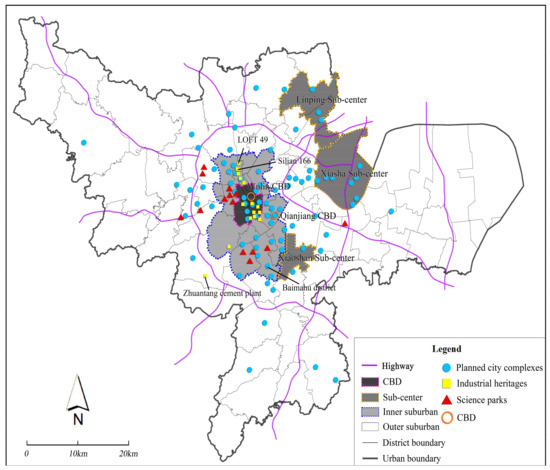

Agglomeration areas for producer service sectors are established, and professional function areas for service sectors have gradually formed. The master plan of 2004 determined the new main center of the city (Qiangjian CBD) and three sub-centers (Linping, Xiasha, and Xiaoshan) as a peripheral agglomeration area for producer service sectors [59] (Figure 7). Many professional agglomeration areas for producer service sectors, such as Cuiyuan and Xixi streets, were planned in the near suburban area. These streets are centered on information and computer services, Jiubao and East railway station focused on transportation and a number of university research parks that are distant in CBD are based on science research and technical services, such as logistics, Liuxia, Gudang, Binjiang. In addition, the government proposed a plan in 2008 to build “100 city complexes”, which are all distributed in the near suburban area, including high-proportion office buildings. After nearly a decade, the construction of the planed office buildings has been basically completed. For example, streets in the near suburban area, such as Dongxin, Xiangfu, Beishan, are areas in which mass office buildings have been completed over the past few years.

Figure 7.

Distribution map of city complexity (planned), industrial heritage, and science parks.

5.3. City Renewal Offers Personalized and Diversified Development Space to Producer Service Sectors

City renewal in many areas of Hangzhou converts existing production and residential buildings into office space and guides producer service sectors to cluster in these renewed areas through the provision of preferential policies in the aspect of rentals and taxes.

Reconstruction of industrial heritage and historical buildings provides characteristic space for the development of produces service sectors. In 2009, the Hangzhou government devised the Plan of Protection of Industrial Heritage (Buildings) in Urban Areas of Hangzhou that mainly used existing old factories and warehouses in the near suburban area. This plan combines service sector development with the protection of industrial and historical buildings and cultural tourism. For example, the “Silian 166 (Figure 8)”, LOFT 149, and Zhuantang Cement Plants are former industrial heritage buildings that have been converted into an agglomeration area for creative design service sectors (Figure 7). These conversions not only provide space for the development of producer service sectors, but also enrich the city’s historical heritage landscapes and cultural characteristics.

Figure 8.

Agglomeration area of Silian 166 creative design service sectors. (A) Hangzhou Silk Printing and Dying United Factory in the 1950s; (B,C) reconstucted Silian 166 Creative Industrial Park.

With the development of urban business circles and complexity modes, office space and supportive services are offered for the development of producer service sectors. In 2013, many buildings on both sides of the most important Yan’an business street inside Hangzhou’s Wulin CBD were reconstructed. Underground commercial space with an area of 99,910 square meters was newly created to provide diversified support services. Moreover, the Citizen Center in Qianjiang CBD, which has a gross floor area of more than 500,000 square meters, includes various cultural, entertainment, educational, and catering facilities, in addition to office space forming an office agglomeration area of “one-stop” services.

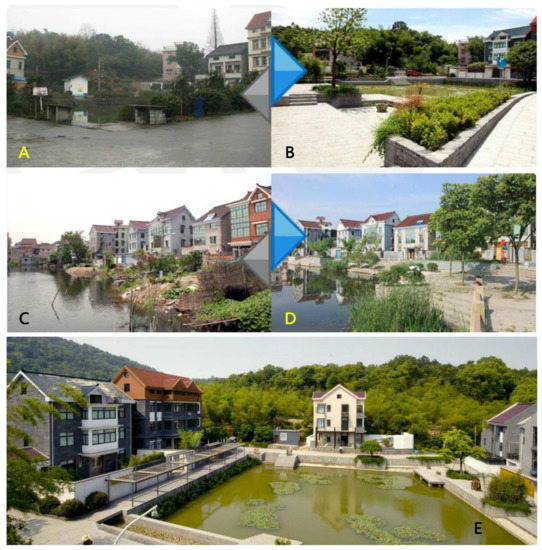

Village SOHO, which is another new spatial mode for service sectors, provides office space for producer service sectors in the city’s near suburban area. The Hangzhou government started to reconstruct villages’ residential houses in the Baimahu area into an experience-type agglomeration area for creative service sectors with the characteristics of rural scenes in 2007, where considerable science research, business, and design-like service sectored are clustered (Figure 9). Enterprises that are currently settled in the park numbered over 200. They also offer jobs to the local rural natives.

Figure 9.

Hangzhou Baimahu Nong Ju (Small Office/Home Office) SOHO creative industrial park. (A,C): villages’ residential buildings before the reconstruction; (B,D,E): creative industrial park after the reconstruction.

5.4. Governmental Incentive Policies on “Filtering Effects” Guarantee Orderly Agglomeration of Producer Service Sectors

Government policies have guided the distribution of producer service sectors in space. First, to promote balanced development incorporating social equality and regional economies, the government emphasized the well-balanced spatial distribution of producer service sectors and planed agglomeration areas for producer service sectors in multiple areas. Second, the government set up policies to guide office buildings to conduct “selective” and “professional” investment invitations through preferential policies of tax. These policies only choose related or similar enterprises on the industrial chains for sales and leasing. For example, Xixi and Cuiyuan streets are the information industrial zone of Hangzhou. Thus, businesses of computer and software service sectors are welcome. Preferential policies are offered to renowned or multinational enterprises, similar to the process of implanting a “magnet” to attract other related supportive service sectors on different production chains to cluster there. For example, after Alibaba Group migrated to the western suburban area under the guidance of the government, many medium- and small-sized Internet enterprises related to its existing industries agglomerated in its surroundings. Finally, the government has invested or planned to invest in improvement of infrastructure and supportive services to attract service sectors that were previously scattered in various locations of the city. These include the evaluation of the potential of land development in the city’s central area, expanded parking lots, construction of metro outlets, pedestrian-type reconstruction of business circles, and promotion of the agglomeration of service sectors that are dependent on “face-to-face” customer markets and crowd scales, such as leasing and business sectors. The government also planned service sectors in the surroundings of the external transport hub equipped with warehousing and logistics for mass cargo dispatches.

6. Conclusions

Hangzhou shows an agglomeration pattern for spatial distribution of producer service sectors, but with an apparent trend of suburbanization in the past decade. The spatial evolution of producer service sectors can be understood by the self-organization process of the sector under the dual influences of market factors and governmental control. The results of the self-organization process are mainly reflected in outward expansion trends driven by insufficient space in the city centre. The process of being organized is mainly embodied in the government’s overall plan for urban spatial structures and construction of mass agglomeration areas for producer service sectors in multi-type city renewal [60]. The approximation to CBD and sub-centers, science parks, and other special policy areas have the largest influence on site selection for producer service sectors. The results of this study confirm the research conducted by scholars from other countries as follows. First, this work confirms that the employment concentration of producer service sectors in space and productivity improvement effects that resulted from “face-to-face” communication [61]. The characteristics of high agglomeration in financial and insurance service sectors are consistent with the conclusions in the cases of Paris and Atlanta [15]. The findings of the relative diffusion of Scientific and technical services verifies the research results for Atlanta [62], that is, professional technicians in these types of services are not dependent on the externality of the CBD. These results also indicate the frequent use of communication technology sectors [63]. Near suburban and sub-center areas are those where producer service sectors increased mostly over the past few years because these areas can harness the benefits of agglomeration economies, reduce high costs, and the non-economy of agglomeration in the development of the central areas [64,65]. However, the particularity of the spatial evolution of producer service sectors in Chinese cities is reflected by special policy areas for producer service sectors set up by the government and the guidance effects of city planning.

Understanding regularities in industrial evolution and urban spatial development is the primary importance of research on the producer service sectors of cities. In China, where the government dominates social economies and spatial development, this finding facilitates the formulation of spatial plans to adapt to changes in social economies. Differences also exist in the development of different cities. Future studies can explore spatial relations between departments inside the same enterprise located in different regions, or between the same enterprise and enterprises that have business relationships from the perspectives of enterprise connections and labor division relations.

Acknowledgments

This work has been supported by the National Natural Science Foundation of China (No. 51578507 and 71403235), the National Social Science Fund of China (16ZDA018), the National Aeronautics and Space Administration (NASA)’s Land Cover and Land Use Program (NNX09AI32G and NNX15AD51G), Zhejiang Province Natural Science Foundation (LY18G030031), and the Philosophy and Social Science Planning Project of Zhejiang (No. 16NDJC203YB). We especially thank the three reviewers very much for their constructive comments and suggestions on our paper.

Author Contributions

Yizhou Wu designed the initial concept, collected the data and wrote the paper. Peilei Fan revised the paper. Heyuan You analyzed the data and revised the paper. All authors approved the final manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Sassen, S. The Global City: New York, London, Tokyo; Princeton University Press: Princeton, NJ, USA, 1991. [Google Scholar]

- Su, S.; Liu, Z.; Xu, Y.; Li, J.; Pi, J.; Weng, M. China’s megaregion policy: Performance evaluation framework, empirical findings and implications for spatial polycentric governance. Land Use Policy 2017, 63, 1–19. [Google Scholar] [CrossRef]

- Zhang, Q.; Su, S. Determinants of urban expansion and their relative importance: A comparative analysis of 30 major metropolitans in China. Habitat. Int. 2016, 58, 89–107. [Google Scholar] [CrossRef]

- Ke, S.; He, M.; Yuan, C. Synergy and Co-agglomeration of Producer Services and Manufacturing: A Panel Data Analysis of Chinese Cities. Reg. Stud. 2014, 48, 1829–1841. [Google Scholar] [CrossRef]

- Zhou, Y.; Huang, X.; Chen, Y.; Zhong, T.; Xu, G.; He, J.; Xu, Y.; Meng, H. The effect of land use planning (2006–2020) on construction land growth in China. Cities 2017, 68, 37–47. [Google Scholar] [CrossRef]

- You, H.; Yang, X. Urban expansion in 30 megacities of China: Categorizing the driving force profiles to inform the urbanization policy. Land Use Policy 2017, 68, 531–551. [Google Scholar] [CrossRef]

- You, H. Characterizing the inequalities in urban public green space provision in Shenzhen, China. Habitat Int. 2016, 56, 176–180. [Google Scholar] [CrossRef]

- You, H. Quantifying megacity growth in response to economic transition: A case of Shanghai, China. Habitat Int. 2016, 53, 115–122. [Google Scholar] [CrossRef]

- Bennett, R.J.; Graham, D.J.; Bratton, W. The Location and Concentration of Businesses in Britain: Business Clusters, Business Services, Market Coverage and Local Economic Development. Trans. Inst. Br. Geogr. 1999, 24, 393–420. [Google Scholar] [CrossRef]

- Yang, F.F.; Yeh, A.G.O. Spatial development of producer services in the Chinese urban system. Environ. Plan A 2013, 45, 159–179. [Google Scholar] [CrossRef]

- Yeh, A.G.O.; Yang, F.F.; Wang, J. Producer service linkages and city connectivity in the mega-city region of China: A case study of the Pearl River Delta. Urban Stud. 2015, 52, 2458–2482. [Google Scholar] [CrossRef]

- Zhao, M.; Liu, X.; Derudder, B.; Zong, Y.; Shen, W. Mapping producer services networks in mainland Chinese cities. Urban Stud. 2015, 52, 3018–3034. [Google Scholar] [CrossRef]

- Daniels, P.W. Service Industries: A Geographical Appraisal; Methuen: London, UK, 1985. [Google Scholar]

- Yi, H.; Yang, F.F.; Yeh, A.G.O. Intraurban Location of Producer Services in Guangzhou, China. Environ. Plan A 2011, 43, 28–47. [Google Scholar] [CrossRef]

- Shearmur, R.; Alvergne, C. Intrametropolitan Patterns of High-order Business Service Location: A Comparative Study of Seventeen Sectors in Ile-de-France. Urban Stud. 2002, 39, 1143–1163. [Google Scholar] [CrossRef]

- Aelst, S.V. Assessing the Functional Polycentricity of the Mega-City-Region of Central Belgium Based on Advanced Producer Service Transaction Links. Reg. Stud. 2014, 48, 1939–1953. [Google Scholar]

- Yeh, A.G.O.; Yang, F.F.; Xu, Z. Will rural urbanization produce a new producer service space in China? Habitat Int. 2017, 67, 105–117. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. From sectoral to functional urban specialisation. J. Urban Econ. 2005, 57, 343–370. [Google Scholar] [CrossRef]

- Arzaghi, M.; Henderson, J.V. Networking off Madison Avenue. Rev. Econ. Stud. 2008, 75, 1011–1038. [Google Scholar] [CrossRef]

- Ke, S. Agglomeration, productivity, and spatial spillovers across Chinese cities. Ann. Reg. Sci. 2010, 45, 157–179. [Google Scholar] [CrossRef]

- Ke, S.; Edward, F. Count on the Growth Pole Strategy for Regional Economic Growth? Spread–Backwash Effects in Greater Central China. Reg. Stud. 2010, 44, 1131–1147. [Google Scholar] [CrossRef]

- Keeble, D.; Nachum, L. Why do business service firms cluster? Small consultancies, clustering and decentralization in London and southern England. Trans. Inst. Br. Geogr. 2002, 27, 67–90. [Google Scholar] [CrossRef]

- Coffey, W.J.; Shearmur, R.G. Agglomeration and Dispersion of High-order Service Employment in the Montreal Metropolitan Region, 1981–96. Urban Stud. 2002, 39, 359–378. [Google Scholar] [CrossRef]

- Gad, G. Downtown Montreal and Toronto: Distinct Places with Much in Common. Can. J. Reg. Sci. 1999, 22, 142–147. [Google Scholar]

- Holmes, T.J.; Stevens, J.J. Geographic Concentration and Establishment Scale. Rev. Econ. Stud. 2002, 84, 682–690. [Google Scholar] [CrossRef]

- Mills, E.S.; Luan, S.L. Inner Cities. J. Econ. Lit. 1997, 35, 727–756. [Google Scholar]

- Ogawa, H.; Fujita, M. Equilibrium land use patterns in a nonmonocentric city. J. Reg. Sci. 1980, 20, 455–475. [Google Scholar] [CrossRef]

- Boiteux-Orain, C.; Guillain, R. Changes in the Intrametropolitan Location of Producer Services in Île-De-France (1978–1997): Do Information Technologies Promote A More Dispersed Spatial Pattern? Urban Geogr. 2004, 25, 550–578. [Google Scholar] [CrossRef]

- Gong, H.; Keenan, K. The Impact of 9/11 on the Geography of Financial Services in New York: A Few Years Later. Prof. Geogr. 2012, 64, 370–388. [Google Scholar] [CrossRef]

- Yuan, F.; Gao, J.; Wang, L.; Cai, Y. Co-location of manufacturing and producer services in Nanjing, China. Cities 2017, 63, 81–91. [Google Scholar] [CrossRef]

- Martinelli, F. Producer services’ location and regional development. In The Changing Geography of Advanced Producer Services; Daniels, P.W., Moulaert, F., Eds.; Belhaven Press: London, UK, 1991; pp. 70–90. [Google Scholar]

- Schwartz, A. Corporate Service Linkages in Large Metropolitan Areas A Study of New York, Los Angeles, and Chicago. Urban. Aff. Rev. 1992, 28, 276–296. [Google Scholar] [CrossRef]

- Schamp, E.W. The geography of APS in a goods exporting economy: The case of West Germany. Prog. Plan. 1995, 43, 155–171. [Google Scholar] [CrossRef]

- Wernerheim, C.M.; Sharpe, C. ‘High Order’ Producer Services in Metropolitan Canada: How Footloose Are They? Reg. Stud. 2003, 37, 469–490. [Google Scholar] [CrossRef]

- Kloosterman, R.C. Polycentric Puzzles—Emerging Mega-City Regions Seen through the Lens of Advanced Producer Services. Reg. Stud. 2008, 42, 1055–1064. [Google Scholar]

- Daniels, P.W. Service sector restructuring and metropolitan development: Processes and prospects. In Services and Metropolitan Development: International Perspectives; Daniels, P.W., Ed.; Routledge: London, UK, 1991; pp. 1–25. [Google Scholar]

- Coffey, W.J. The geographies of producer services. Urban. Geogr. 2000, 21, 170–183. [Google Scholar] [CrossRef]

- Searle, G.H. Changes in producer services location, Sydney: Globalisation, technology and labour. Asia Pac. Viewp. 1998, 39, 237–255. [Google Scholar] [CrossRef]

- Park, S.O.; Nahm, K.B. Spatial structure and inter-firm networks of technical and information producer services in Seoul, Korea. Asia Pac. Viewp. 1998, 39, 209–219. [Google Scholar] [CrossRef]

- Ženka, J.; Novotný, J.; Slach, O.; Ivan, I. Spatial Distribution of Knowledge-Intensive Business Services in a Small Post-Communist Economy. J. Knowl. Econ. 2015, 8, 1–22. [Google Scholar] [CrossRef]

- Truman, A.H.; Peter, O.M. Suburban downtowns and the transformation of metropolitan Atlanta’s business landscape. Urban Geogr. 1989, 10, 375–395. [Google Scholar]

- Li, J.; Zhang, W.; Yu, J.; Chen, H. Industrial Spatial Agglomeration Using Distance-based Approach in Beijing, China. Chin. Geogr. Sci. 2015, 25, 698–712. [Google Scholar] [CrossRef]

- Stanback, T.M. The New Suburbanization: Challenge to the Central City; Westview Press: Boulder, CO, USA, 1991. [Google Scholar]

- Taylor, P.J.; Derudder, B.; Hoyler, M.; Pain, K.; Witlox, F. European cities in globalization. In Global Urban Analysis. A Survey of Cities in Globalization; Taylor, P.J., Ni, P., Derudder, B., Hoyler, M., Huang, J., Witlox, F., Eds.; Earthscan: London, UK, 2011; pp. 114–136. [Google Scholar]

- Yeh, A.G.O. Producer services and industrial linkages in the Hong Kong–Pearl River Delta region. In Service Industries and Asia-PacificCities: New Development Trajectories; Daniels, P.W., Ho, K.C., Hutton, T.A., Eds.; Rutledge: London, UK; New York, NY, USA, 2005; pp. 150–172. [Google Scholar]

- Portnov, B.A.; Dubnov, J.; Barchana, M. Studying the association between air pollution and lung cancer incidence in a large metropolitan area using a kernel density function. SOCIO Econ. Plan. Sci. 2009, 43, 141–150. [Google Scholar] [CrossRef]

- Silverman, B.W. Density Estimation for Statistics and Data Analysis; Chapman & Hall/CRC: London, UK, 1998. [Google Scholar]

- Longley, P.A.; Goodchild, M.F.; Maguire, D.J.; Rhind, D.W. Geographic Information Systems and Science 3e; Wiley: Hoboken, NJ, USA, 2001. [Google Scholar]

- Anselin, L. Spatial Econometrics: Methods and Models; Kluwer Academic: Boston, MA, USA, 1988. [Google Scholar]

- Su, S.; Lei, C.; Li, A.; Pi, J.; Cai, Z. Coverage inequality and quality of volunteered geographic features in Chinese cities: Analyzing the associated local characteristics using geographically weighted regression. Appl. Geogr. 2017, 78, 78–93. [Google Scholar] [CrossRef]

- Han, S.S.; Qin, B. The Spatial Distribution of Producer Services in Shanghai. Urban Stud. 2009, 46, 877–896. [Google Scholar]

- Hanssens, H.; Derudder, B.; Witlox, F. Are advanced producer services connectors for regional economies? An exploration of the geographies of advanced producer service procurement in Belgium. Geoforum 2013, 47, 12–21. [Google Scholar] [CrossRef]

- Jakobsen, S.E.; Onsager, K. Head office location: Agglomeration, clusters or flow nodes? Urban Stud. 2005, 42, 1517–1535. [Google Scholar] [CrossRef]

- Parnreiter, C. Managing and governing commodity chains: The role of producer service firms in the secondary global city of Hamburg. DIE ERDE 2015, 146, 1–15. [Google Scholar]

- Zhang, L. Flood hazards impact on neighborhood house prices: A spatial quantile regression analysis. Reg. Sci. Urban Econ. 2016, 60, 12–19. [Google Scholar] [CrossRef]

- Anselin, L.; Syabri, I.; Kho, Y. Geoda: An introduction to spatial data analysis. Geogr. Anal. 2006, 38, 5–22. [Google Scholar] [CrossRef]

- Weng, M.; Pi, J.; Tan, B.; Su, S.; Cai, Z. Area deprivation and liver cancer prevalence in Shenzhen, China: A spatial approach based on social indicators. Soc. Indic. Res. 2017, 133, 317–332. [Google Scholar] [CrossRef]

- Voss, P.R.; Long, D.D.; Hammer, R.B.; Friedman, S. County child poverty rates in the US: A spatial regression approach. Popul. Res. Policy Rev. 2006, 25, 369–391. [Google Scholar] [CrossRef]

- Zhu, Q. Building Hangzhou’s new city center: Mega project development and entrepreneurial urban governance in China. Asian Geogr. 2011, 28, 3–19. [Google Scholar]

- Wu, Y.; Fan, P.; Li, B.; Ouyang, Z.; Liu, Y.; You, H. The effectiveness of planning control on urban growth: Evidence from Hangzhou, China. Sustainability 2017, 9, 855. [Google Scholar] [CrossRef]

- Wei, Y.D. Globalization, institutional change, and industrial location: economic transition and industrial concentration in China. Reg. Stud. 2008, 42, 923–945. [Google Scholar]

- Gong, H.; Wheeler, J.O. The Location and Suburbanization of Business and Professional Services in the Atlanta Area. Growth Chang. 2002, 33, 341–369. [Google Scholar] [CrossRef]

- Rubalcaba, L.; Gallego, J.; Gallo, M.T.; Garrido, R. Business services location and market factors in major European cities. Cities 2013, 31, 258–266. [Google Scholar] [CrossRef]

- Coe, N.M.; Townsend, A.R. Debunking the Myth of Localized Agglomerations: The Development of a Regionalized Service Economy in South-East England. Trans. Inst. Br. Geogr. 1998, 23, 1–20. [Google Scholar] [CrossRef]

- Jacobs, W.; Koster, H.R.A.; Oort, F.V. Co-agglomeration of knowledge-intensive business services and multinational enterprises. J. Econ. Geogr. 2014, 14, 433–475. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).