1. Introduction

Capital formation is crucial to economic growth. According to Solow’s theory [

1], even if the technology does not change, as long as the per capita capital continues to improve, which is called the “capital deepening process”, the economy will continue to grow. According to the data from the World Bank, China’s capital formation rate has been maintained at over 40% since the 1978 reform, which has sustained its high rate of growth. Capital accumulation has been widely regarded as an important factor in China’s phenomenal economic growth [

2,

3]. In view of the important role that investment has played, the government has always taken it as the main means of macroeconomic regulation.

However, some scholars have questioned the sustainability of this “high investment–high growth” mode. Young [

4] pointed out that this mode is not sustainable due to the lack of an internal incentive mechanism for continuous improvement. Qin and Song [

5] also believed that this mode is difficult to sustain after finding that the annual growth rate of fixed asset investment in China is higher than the average annual gross domestic product (GDP) growth rate. Since 2007, China’s economic growth rate has continued to decline. Can China’s economy regain fast growth, or will it continue to decline? The answer to this question is important to both China and the world economy.

Before answering this question, we need to first think theoretically about what level of capital stock is most suitable for China, and how to adjust the capital in order to achieve the best level. Only on this basis can we judge whether there are problems in the current growth rate, and then find ways to amend them. Therefore, this article advocates relying on the endogenous driving force of the market to achieve sustainable growth instead of pursuing a government-led increase in investment. The purpose of this study is to analyze the internal mechanism of China’s capital adjustment. As long as the rule of China’s capital adjustment is understood, the unsustainable problems of the existing mode can be solved.

China’s economy is in transition. The market mechanism is not sound, so the problems encountered have a certain particularity. For example, China’s high investment has always been accompanied by overcapacity. Under a complete market mechanism, excess capacity will force rational investors to reduce investment; that is, investors will receive timely feedback on market demand. In China, even if there is a surplus in some industries, there is still a constant increase in investment, which indicates a distortion of the relationship between investment and demand.

Therefore, this study takes the economic growth that fully satisfies the consumption demand as the best standard, and the capital stock that is required by the optimal output as the best. Economic growth theory tells us that the use of consumption to stimulate economic growth is more stable and sustainable than the investment-driven mode, and this is the main goal of the economic transformation that the Chinese government is seeking. That is, only investment that meets consumer needs is effective and achieves the requirements of sustainable growth. According to Armeanu et al. [

6], we know that sustainable development endeavors to satisfy the demands of current generations without undermining the ability of later generations to accomplish their own necessities, which include three related pillars, namely: economic, environmental, and social. The concept of sustainable growth in this study is relatively more narrow, because it does not consider the sustainability of the ecological environment. However, in a market economy system with the ultimate goal of satisfying consumer demand, if the residents all have a strong sense of environmental protection, this will naturally be reflected in their consumption decisions, since the environmental and social externalities would be taken into account when making consumer decisions. Therefore, consumer-led sustainable growth is also able to reflect the meaning of other aspects of sustainable development.

In addition, the maintenance of high investment is bound to be inseparable from sufficient and cheap financial resources. The growth rate of China’s money supply is not only far higher than that of developed countries, it is even higher than the nominal GDP growth rate. At the same time, the real interest rates of bank loans are lower than the levels that are prevailing in developed countries. As China’s consumer credit is still in its infancy, the main channel for credit funds is investment. This shows that China’s loan supply is cheap and easy to obtain, especially for the state-owned enterprises that play a leading role in the Chinese market. Thus, the discussion of China’s investment problem cannot be separated from the currency market.

As to the two characteristics of Chinese investment mentioned above, one reflects the imbalance between demand and investment in the commodity market, and the other reflects the distortion of the currency market. In order to take the two features into consideration, this study will discuss China’s capital adjustment mechanism in the IS-LM framework. It is well known that this model can depict both the commodity market and the currency market at the same time. Further, the deviation degree of real capital from its optimal level can measure the distortion degree of the market, and at the same time, the adjustment speed of capital close to its optimal level can measure the maturity of the market mechanism. Accordingly, this study selects the flexible acceleration model of investment to simulate the adjustment mechanism of China’s capital, which can capture the main features of the imperfect market in China’s transition economy [

7].

The main innovation of this study is to examine the flexible acceleration mechanism of China’s capital adjustment under a framework of IS-LM. The investment acceleration model and the IS-LM model both embody classical Keynesian thought, so the two are essentially unified. The IS-LM model is a general equilibrium model, which can make full use of the information of the macroeconomic system. This provides a guarantee for the in-depth discussion of China’s capital adjustment problem under the goal of sustainable consumption-driven growth.

The related research on capital adjustment has a long history, and it basically revolves around two problems in the theory [

8]. One is the determination of the optimal capital stock; that is, seeking the potential capital demand under the condition of maximizing profit. The other is the setting of the adjustment mechanism; that is, how to adjust the current capital stock to the optimal capital stock. At first, the classical investment theory [

9] held that capital stock and output are in a fixed proportion; under the assumption of

Kt = νYt, the original acceleration model Δ

Kt = It = νΔ

Yt is constructed, in which investment can be adjusted instantaneously with demand, Δ

Yt is the change of output, and

ν is the acceleration factor. The meaning of “acceleration” is two-way; that is, a small increase or decrease in output will cause a large increase or decrease in total investment, so

ν >1. The original model assumed that investment depends only on output growth, and the optimal capital stock in each period can be realized. This model ignored the impact of uncertainty, the financing cost, and the macro environment, which need to be particularly emphasized in the analysis of the investment behavior in developing countries [

10,

11].

Due to the inadequacy of the instantaneous adjustment of the investment with the output, Chenery [

12] and Koyck [

13] improved the model from the angle of the output adjustment and expressed the current output as the distribution lag of the previous output. Koyck also transformed the indefinite distributed lag model into a finite order autoregressive model in order to solve the econometric problem of the distributed lag acceleration model, which laid the foundation for the extensive application of the acceleration model. Cagan [

14] made the acceleration theory more explanatory with regard to reality by introducing the adaptive expectation mechanism of output adjustment into the model. However, the above improvement from the perspective of output adjustment did not fundamentally solve the problem of immediate satisfaction of the optimal level in capital adjustment. Instead, it only improved the anticipation of the output. As for how to meet the capital level of the expected output, the instantaneous realization is still assumed. The discussion on the determination of the optimal capital always stayed at the macro level, and lacked a microcosmic basis.

From the micro perspective of the enterprise, and under the hypothesis of the maximization of profit, Jorgenson [

15] established the neoclassical investment theory model by using the optimization method. The theory proved that the optimal capital level of a manufacturer depends on factors such as the output, price of the product, and cost of capital use. However, the capital adjustment was subjectively set as the distribution lag of the optimal capital stock, and did not give a perfect theoretical explanation. In this regard, Eisner and Strotz [

16] introduced the concept of the capital adjustment cost, by which they proved that the optimization path of the enterprise investment is in line with the flexible acceleration mechanism of the capital stock adjustment. Subsequently, Lucas [

17] and Tybout [

18] analyzed the impact of demand uncertainty and credit rationing on the adjustment cost, respectively, which further expanded the flexibility of the model.

At this point, the flexible and accelerated investment model based on the adjustment cost had been basically formed, which laid a theoretical foundation for a follow-up study [

19,

20,

21] about investment. The so-called flexibility is embodied in two aspects. One is the irreversibility of capital and the transaction cost caused by incomplete information being introduced into the adjustment cost. The other is that the approaching of optimal capital is no longer realized immediately, but rather a partial adjustment process. Of course, in addition to the accelerator theory, there is still Tobin’s

q theory [

22], the cash flow theory [

23], and other investment models. Investment theory is explained in Qin and Song [

5], Song et al. [

7] and Twine et al. [

11].

The structure of this article is arranged as follows. The construction of the IS-LM framework for China’s capital adjustment path is completed in the second section. The data description is set out in the third section. In the fourth section, based on 1978–2015 data in China, we conduct an empirical analysis to test whether the flexible acceleration mechanism of capital adjustment exists, and measure its role. In the fifth section, we discuss investment problems such as overinvestment and soft budget constraints. Finally, the full text is summed up, and the conclusions are set out in the sixth section.

2. Theoretical Model and Analytical Framework

This section will be divided into three parts. First, we discuss how to decide the optimal level of a demand-oriented capital stock; second, we introduce the flexible acceleration mechanism of capital adjustment; and finally, the IS-LM framework is integrated.

2.1. The Decision of Demand-Oriented Optimal Capital

One general principle of economics is that the formation of capital or investment is caused by demand. In the ideal state of complete information, given a demand

, with the aim of profit maximization, there will be a corresponding optimal capital stock

Kt, which can produce

to exactly meet the demand

in a timely manner. Unfortunately, in reality, it is often difficult to accurately match the output and demand, so if the optimal capital stock is directly set as:

There will be a mistake in theory, because the supply may be too much or too little sometimes, which is an inefficiency situation. The key to avoiding mistakes is to identify the effective components of the supply that meet the needs; however, this is difficult to directly observe and empirically capture.

To tackle this question, the study uses the state-space model in econometrics to extract and incorporate the unobservable variables (state variables,

SV), such as expectation and long-term income, into the observable model and obtain the estimation result. The state-space model is estimated by the Kalman filter, which is a powerful iterative algorithm [

24]. A state-space model consists of a signal equation and a state equation. The output expectation is introduced and used as a latent state variable, and its adaptive improvement mechanism is used as the state equation. Furthermore, the consumption equation is introduced as a signal equation to reflect the consumption-driven sustainability.

Let

denote the expectation for the output of phase

t, then the optimal capital stock is:

and the output expectation

is determined by the following state-space model:

The consumption Equation (3) introduces the lag phase of consumption to represent the consumption inertia, and ωt is the random interference term. The equation of state is transformed by the adaptive expectation equation − = (1 − ρ)(Yt − ), where the (1 − ρ) is the adjustment factor to improve the expectation.

The reasons for choosing the adaptive expectation are as follows. On the one hand, the expectation of output is often related to all aspects of the market, and China’s market economy is not perfect, so most Chinese scholars choose adaptive expectation [

25] in the output expectation setting. On the other hand, it is difficult to form rational expectations. The real rational expectations have high requirements for information and information-processing capabilities. The rules used for predictions are also very complex, and in reality, there will inevitably be information omissions in predictions [

26]. In most cases, all that can be used is the information of the past, which can prove that the rational and adaptive expectation at this time is equivalent [

27].

2.2. Capital Adjustment Mechanism

For the last part, the optimal capital stock

is obtained under the condition of sustainable consumption-driven growth. However, in reality,

Kt cannot jump to

directly because of the adjustment cost of capital. Eisner and Strotz proved that the optimal investment path is in accordance with the flexible acceleration model [

16]; that is, the capital can only be partially adjusted in a period:

where the (1 −

λ) is the adjustment coefficient, and

λ ∊ (0, 1).

Considering depreciation

δ ∊ (0, 1), the investment

It of each period includes two parts: net investment (

Kt −

Kt−1) and replacement investment

δKt−1, so:

By Equations (2), (5), and (6), the total investment

It is:

Then, the differential operation of time

t is done at the two ends of Equation (7), so we have:

By Equation (5), we know:

and it is easy to get

and

, so:

Equation (10) is the basic model for the flexible acceleration of investment. Although the model reflects the relationship between investment and expected output better, it still ignores other investment costs outside of depreciation, and does not consider the influence of macroeconomic environment variables, which limits its application. These application limits result in an empirical failure of the model, especially for developing countries such as China. Therefore, it is necessary to expand the flexible acceleration model in order for it to more closely reflect empirical practice.

2.3. Consider the Use-Cost of Capital

For the use-cost of capital, the main economic insights came from Jorgenson [

15]. He argued that the cost of capital includes not only the obvious depreciation, but also the interest on the loan to purchase the equipment, and the loss caused by the change in the equipment price. As a result, the cost of increasing a unit of capital input is

. Li and Tang [

28] argued that China’s fixed asset price index changes little relative to the consumer price index, and thus it can be ignored. In the modeling embodied in this study, the authors did consider the change in the price of capital goods, but the results of the follow-up regression were not significant. Therefore, only the interest rate is introduced here.

Twine et al. [

11] argued that the effect of the interest rate on the investment is mainly reflected in its influence on the capital adjustment coefficient, so this study introduces the linear expression of the adjustment coefficient:

and

, where

L is the lagging operator. According to the partial adjustment Formula (5) of the stock, we can get:

Considering

, and combining Equations (11) and (12), the following expression is obtained:

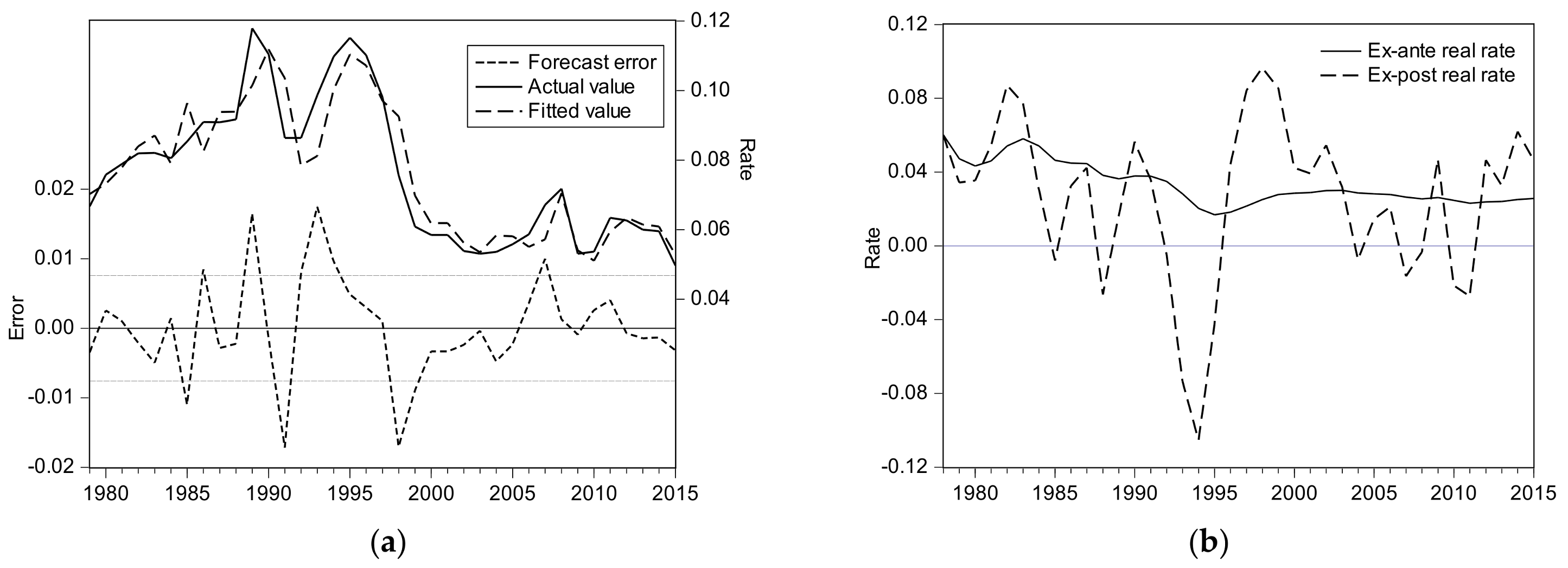

For real interest rates, it is necessary to distinguish between the ex ante interest rate and ex post interest rate. The ex ante interest rate is the difference between the nominal interest rate and the expected rate of inflation; whereas, the ex post interest rate is the difference between the nominal interest rate and the real inflation rate. As the expected inflation rate is hard to observe, the ex ante interest rate will not be obtained directly. However, since the adjustment of capital needs to be made in advance, the interest rate must be expected to be as accurate as possible before making a decision.

Gottschalk [

29] decomposed the nominal interest rate into the ex ante real interest rate and the expected inflation rate based on the Fischer equation, and completed the measurement of the ex ante real interest rate with the help of the structural vector autoregression (SVAR) model. In this study, the same decomposition method is used, but we chose the state-space model to measure it. Let

express the nominal interest rate,

express the ex ante interest rate, and

express the expected inflation rate, so:

The inflation rate

is subtracted on both sides of Equation (14); then, the observable ex post interest rate

is:

where

is the prediction error of the inflation rate. Equation (15) establishes a connection between the observable variable

and the unobservable

; however, the constant term is generally considered when the econometric regression is used, so the following equivalent form:

is used in the regression, which can be used as the signal equation of the state-space model.

In order to obtain the state transition equation of the ex ante interest rate, it is necessary to analyze the state change law of the rate

. After comparing the rational expectation and the adaptive expectation, Sabrowski [

30] concluded that the adaptive expectation is more suitable for estimations of Germany’s inflation rate. The study of Huang and Deng [

31] also showed that the residents’ expectation of inflation is irrational in China. Therefore, this study assumes that the inflation expectation is adaptive; that is,

. From iterative derivation, it is easy to obtain:

Here,

L is the lagging operator. Replacing the

in Equation (14) produces:

Most of the studies in China show that there is a stable cointegration relationship between the nominal interest rate and inflation rate, and the cointegration vector is

. The cointegration regression for

. It is easy to guess that the estimated value of parameter

should be very close to 1, so the state transition equation is set to the recursion

. Therefore, the state-space model to measure

is:

by which

can be calculated, and Equation (13) will be transformed into the following form:

The final expression of the flexible acceleration equation for capital accumulation has now been obtained, and it is then placed under the IS-LM framework to complete its estimation. The IS-LM model can provide more abundant information about the macroeconomic system, such as the influence of the money market, which is a factor that must be considered for the sustainable growth of a modern economy. The more information we get, the more accurately we can depict the path of China’s capital accumulation.

2.4. Construction of IS-LM Framework

The IS-LM model is an economic analysis framework outlined on the basis of Keynes’ macroeconomic theory [

32]. It is an important tool to describe the interrelation between the product market and the money market. We need to first establish the liquidity preference-money supply (LM) equation that characterizes the money market. Bean [

33] argued that under the IS-LM framework, the demand for money is affected by nominal interest rates, whereas the demand for goods is affected by real interest rates. The scholars have reached a consensus on this [

34,

35], so here, we choose to establish the LM equation based on nominal interest rates. Following the previous research, when the money market is balanced, the equilibrium interest rate

is mainly determined by the output expectation

, the change of the money supply

, and the interest rate in the previous period

, so:

where

is the error term, and it covers all of the information about the uncontrollable factors. Therefore, in order to reflect the uncertainty of the currency market and better fit the foresight of the investment behavior, the LM Equation (22) should be adopted to predict the nominal interest rate

before the prediction of the ex ante interest rate

, which is based on the state-space model; that is:

where

is the fitting values of the linear regression based on Equation (22), and then, we replace all of the previous

Rt with

. This treatment is actually close to the rational expectation. The meaning of rational expectation, as defined by Lucas [

17], is that people do not make systematic mistakes with their expectations. From the point of view of the probability theory, the expected value of the difference between the expected value and the actual value should be equal to zero; that is,

, and this is exactly what the measurement model requires. In addition, the adjustment of the nominal interest rate in China is generally from a policy regulation. Before it is adjusted, the society is able to form a consistent expectation that easily aligns with the government. Therefore, the consistency expectation of the linear regression for the nominal interest rate

is reasonable.

Based on the above consumption equation, the investment equation, and the interest rate equation, the following IS-LM framework is collated:

The first equation in the framework is the demand identity, in which the government expenditure and net export as exogenous policy variables are introduced, but it is still listed only for the completeness of the model. The investment - saving (IS) equation can be derived from the first three equations, representing the equilibrium of the commodity market, while the last equation is the LM equation, which represents the equilibrium of the money market.

Finally, as the objective of this study is to analyze the internal market mechanism of China’s capital adjustment, the completion of the estimation of the investment equation is the end point. The steps for the estimation of the investment equation under the IS-LM framework are as follows:

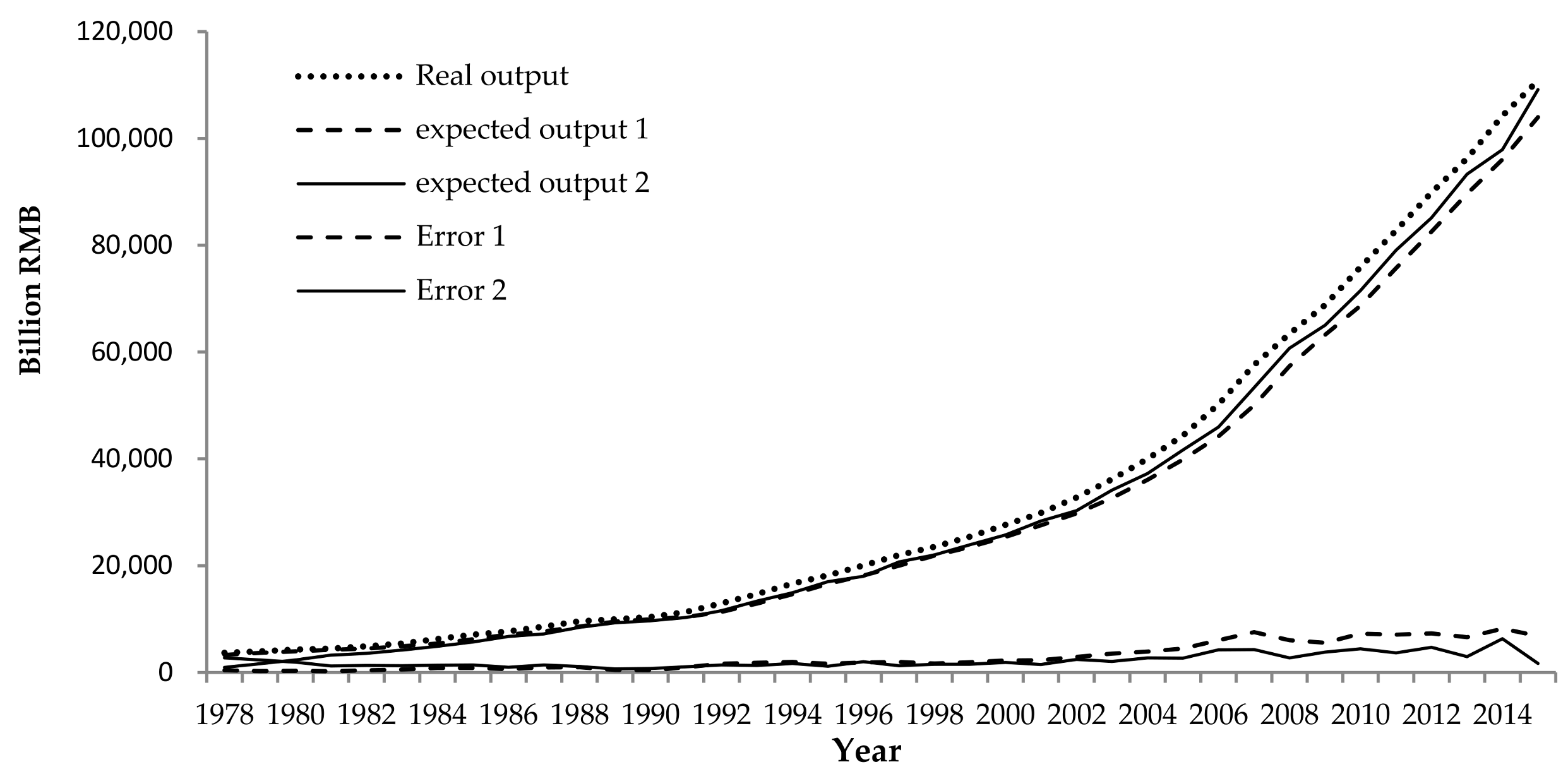

First, based on Equations (3) and (4), the output expectation is estimated with the aid of the state-space model.

Second, the fitted value of the nominal interest rate is obtained by the regression of the nominal interest rate from Equation (22).

Third, set and , then finish the estimation of the state-space model, consisting of Equations (19) and (20), and get the estimated value of the ex ante interest rate .

Finally, by using the obtained sequence and , complete the estimation of the capital adjustment Equation (21) to achieve the final econometric target of this study.

3. Data

This study uses the data for the years 1978 to 2015 in China. If there are no special instructions, the data are all derived from the CEInet Statistics Database [

36] and adjusted to 1978 as the base year.

The output

is represented by the actual GDP; however, there is no GDP deflator in China, only the GDP index, and the conversion relationship between the two is:

So, the real GDP can be calculated by using the GDP deflator and the nominal GDP data. The consumption item of GDP, which is accounted for by the expenditure method, is

, and it is converted by the GDP deflator. The rate of inflation rate

is also measured by the change rate of the GDP deflator:

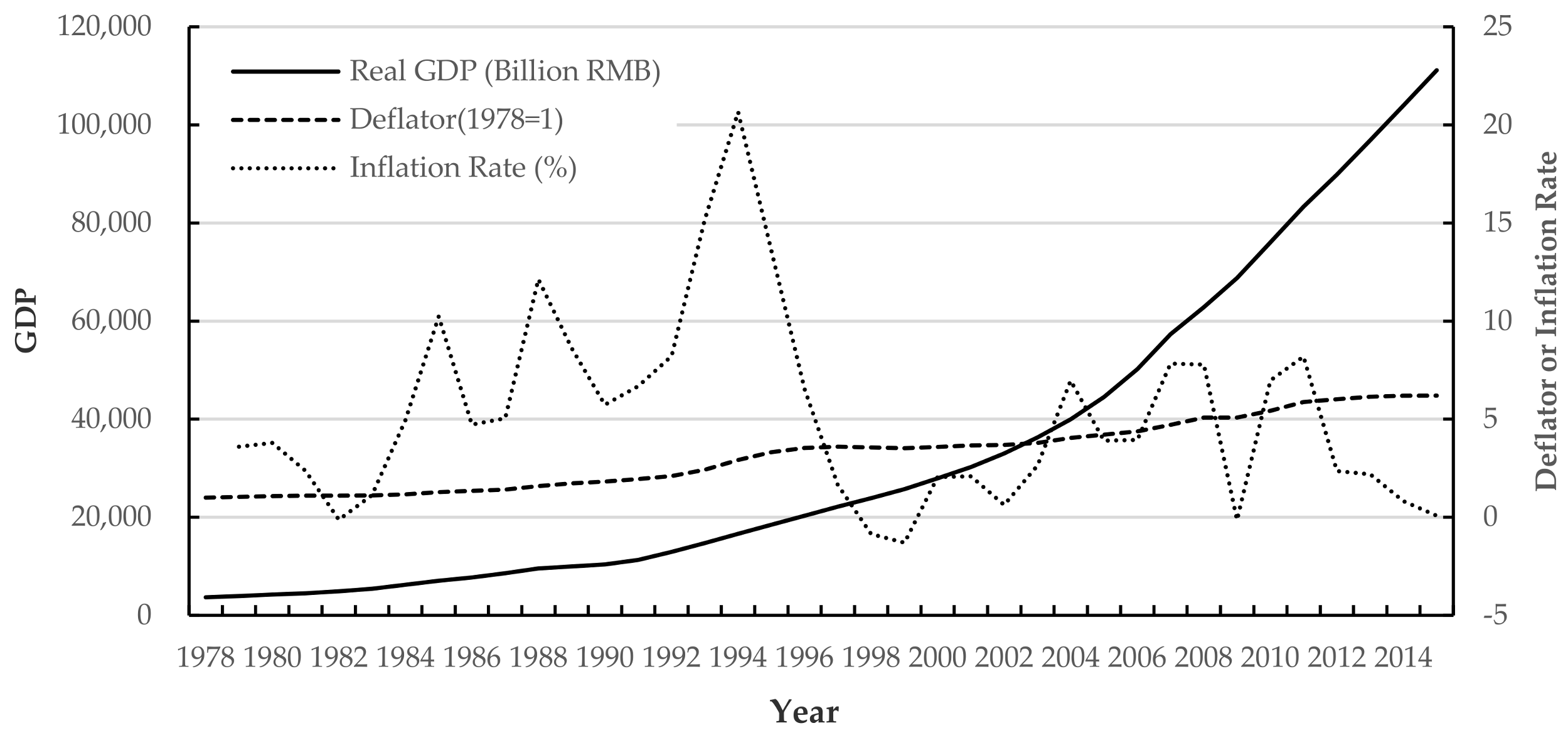

China’s actual GDP, GDP deflator, and inflation rate are then shown in

Figure 1.

For the investment

, we choose the total fixed assets formation data, and adopt the price indices of the investment in fixed assets to eliminate the impact of the price. However, these price indices in China are counted from 1991. To overcome this problem, Li [

37] considered the implicit investment deflator constructed by Zhang [

38] to be optimal after comparing a variety of remedial measures. So, we will also adopt the data of Zhang to supplement the price indices of the investment in fixed assets between 1978–1990. The investments and their price indices are displayed in

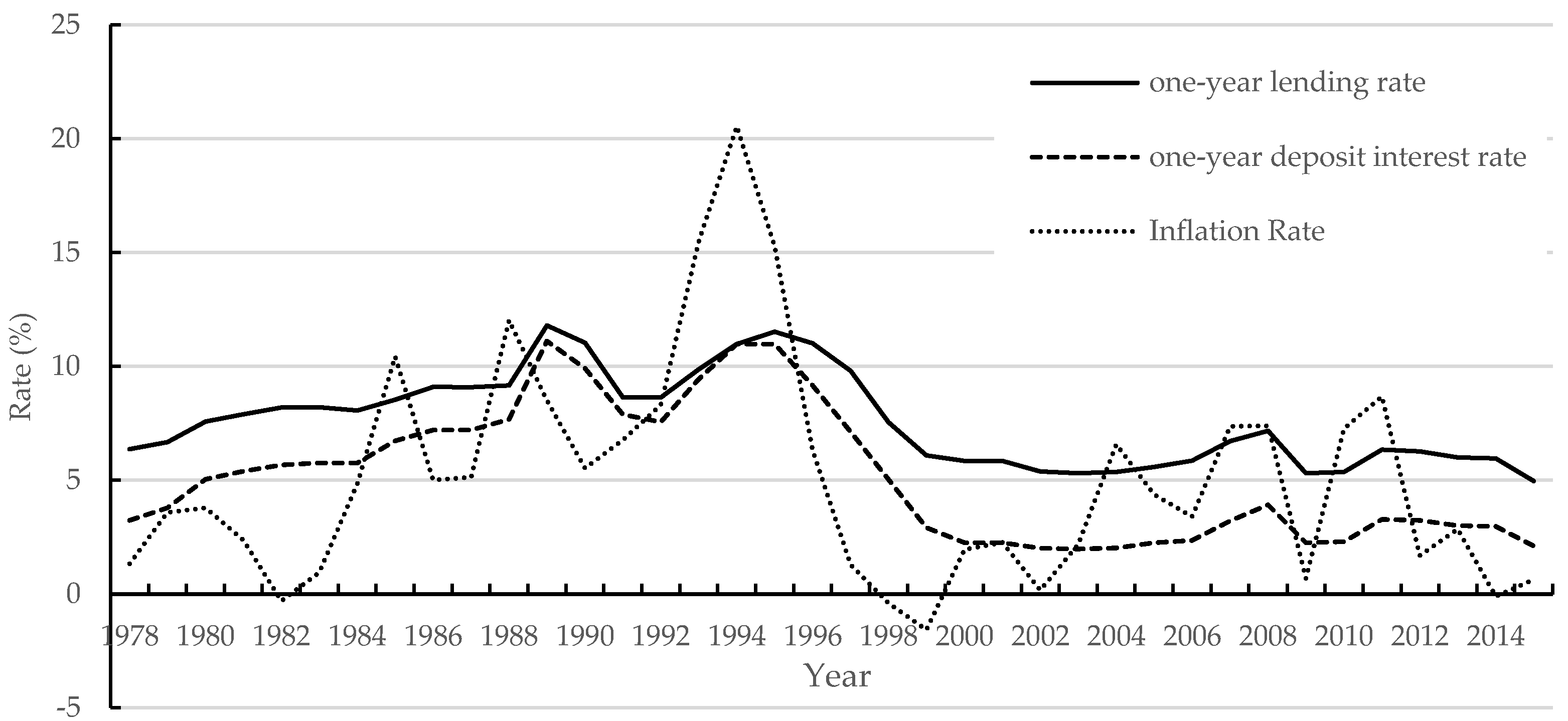

Figure 2.

The benchmark one-year lending rate is used to represent the nominal interest rate

; in fact, this is also the average interest rate, because the state only announces the date of each adjustment, and its corresponding interest rate. If the state announces more than one interest rate in a year, we calculate the weighted average according to the number of days per interest rate. However, there was no official announcement of the benchmark one-year lending rate before 1990. Fortunately, the deposit interest rate data in China have been recorded in detail since 1971. Although the interest rates of deposits and loans have been adjusted many times, the balance between the two has always been relatively stable. Furthermore, the nominal interest rate and the inflation rate have a strong correlation according to the Fisher equation. Therefore, this study first uses these two variables to carry on the linear fitting of the loan interest rate before 1990; then, based on the regression results, the loan interest rates for the years 1978 to 1990 are fitted. The regression equation is:

and its results are shown in

Table 1. Here, we only pay attention to the predictions of the data as a whole, and ignore the multiple collinearity between the deposit interest rate and the inflation rate.

The results of

Table 1 show that the R-squared value for measuring the overall fitting degree is 0.971. This ensures the credibility of predicting interest rates for the 1978–1990 years, and the results are shown in

Figure 3.

6. Conclusions

As economic growth has slowed and overcapacity has become increasingly serious, the issue of China’s economic sustainability has become a focus of attention. The government is aware of the limitations of past investment-driven models, so it is trying to transform China’s economy towards a consumption-driven model. According to economic growth theory, aside from technological progress, capital accumulation is still the main guarantee of growth. Therefore, consumption-driven growth does not mean reducing investment, but rather raising the effectiveness and rationality of investment to meet the residents’ consumption needs. In theory, we need to analyze what is the most reasonable level of capital stock in China under a demand orientation, and determine how to adjust the capital to achieve it; this was the main purpose and content of this study.

In order to reflect the transformational characteristics of China’s economy, this study chose the flexible acceleration model to characterize the capital adjustment. This model is put into an IS-LM framework to reflect the guiding role of demand in capital adjustment. When the output is expected, the resident consumption equation is used as a signal equation, which takes consumption as the initial driving force of the entire IS-LM system. This is the main contribution of this study, in our opinion.

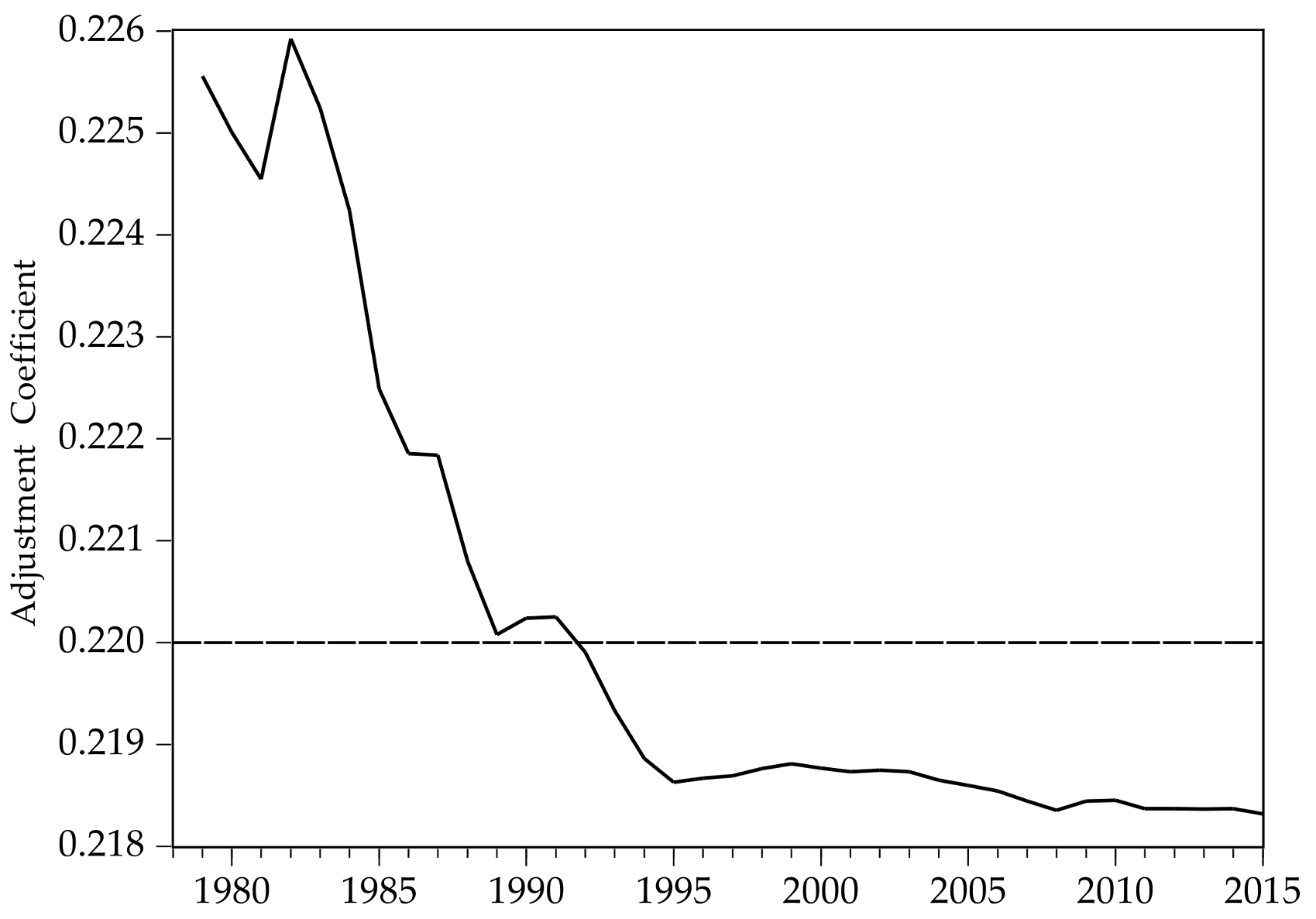

The empirical results of this study show that the flexible acceleration model fits China’s investments well, and the demand-oriented market mechanism of capital adjustment has been formed. However, the ability of the market to adjust capital is not sufficient, and the adjustment coefficient is only 0.22. This is far less than in developed countries, whose adjustment coefficient is up to 0.7 [

21]. Even worse, the adjustment coefficient shows a decreasing trend year by year. Therefore, China’s pursuit of sustainable growth driven by consumption cannot be achieved by relying solely on the adjustment of the market itself. At the same time, the calculated replacement rate of capital is as high as 0.429, indicating that China’s capital is less efficient and has serious problems in relation to capital duplication, idleness, and waste. Further, this study uses the error correction model to conduct long-term and short-term comparative analyses of the investment equation, and its results show that the impact of the interest rate on the investment is not significant in the short term. This implies that although China’s investment is stimulated by market demand, it also shows significant irrational short-sighted characteristics, and ignores the control of costs driven by output maximization, which in turn causes the path of capital accumulation to deviate from its long-term equilibrium. This is related to the policy tendency of soft budget constraints in China, especially for local governments and state-owned enterprises.

Therefore, in order to achieve sustained economic growth driven by consumption, China needs to make every effort to eliminate soft budget constraints. For example, the government and banks should treat state-owned enterprises the same as privately-owned ones, and the financial support for state-owned enterprises should depend on their profit. The government should also establish a corresponding elimination mechanism to allow state-owned enterprises to go bankrupt. Only in this way can enterprises consider cost factors when making investment decisions, and emphasize the goal of maximizing profits. Furthermore, it can reduce ineffective investments, enhance the rationality of the investments, and finally form a sound market-oriented capital allocation mechanism. Obviously, this is crucial for the sustainable growth of China’s economy. Besides, the government can use subsidies and other measures to help residents develop green, environmentally-friendly consumption habits, and in turn motivate producers to use clean and energy-saving technologies that are conducive to sustainable development. In the end, the research in this article actually implies the assumption of constant technological progress. So, we still need to emphasize the role of innovation in sustainable growth, because only innovation can create new needs in the long run, which is true for every country.