1. Introduction

PPP (Public–Private Partnership) refers to a partnership between government and private investors, which cooperate during the construction period of public facilities projects, or to provide public goods and services [

1]. The signing of the franchise agreement between the government and the private investors can clarify the rights and obligations of both parties. PPP model, as a positive and effective way to mobilize the finance of private capital, was first proposed by the British government in the 1990s [

2,

3]. With the beginning of the public utilities’ socialization process, PPP models were recognized and adopted in more and more countries [

4]. In recent years, PPP model has been widely applied in China’s infrastructure construction projects. It has attracted social capital to solve the problem of insufficient funds effectively for the public utilities fields in urban development, and accelerated the pace of development in China’s public utilities and infrastructure industries [

5]. There were 14,220 projects, with a total investment of 17.8 trillion Yuan, covering 31 provinces (including autonomous regions and municipalities), the Xinjiang corps and 19 industries in China before September 2017. However, there are still some sewage treatment PPP projects that have not achieved the win–win relationship successfully, such as Wuhan Tangxun Lake waste water treatment plant, Changchun Huijin waste water treatment plant, etc. An important reason for these failures is the conflicts and disputes between the government and concessionaire which arises from the improper concession period and hinders the successful operation of the entire project [

6].

At present, the decision method of PPP project concession period is mainly based on net present value (NPV) method, game theory and Monte Carlo simulation method. The NPV method is based on the net present value of the expected cash flow obtained by the project company during the project concession period to determine the PPP project concession period [

7]. The PPP project concession period decision model was constructed based on DCF (Discounted Cash Flow) method. It is believed that the project is investable only when the net cash flow of the project reaches the expected return of the concessionaire; thus, the time point that satisfies the condition is the concession period of the project [

5]. However, in addition to meeting the expected benefits of the concessionaire, PPP project concession period also needs to meet the government’s requirements that the project can still be operated for a period after the handover. Supplementary model [

8] of the traditional NPV method was proposed by adding the dimension of the government decision. Social efficiency, as an important decision-making criterion, has often been neglected [

9,

10]. Therefore, three criteria with different social utilities for government and concessionaire in the negotiations [

9] and a theoretical model including social benefits and costs [

9] were put forward. On the foundation of the NPV method, scholars have constructed the corresponding concession period decision model according to the specific characteristics of traffic [

11], environmental protection [

12] and other PPP projects in different fields. The traditional concession period decision-making methods are based on the idea of discounting the cash flow generated in the future. They are suitable for projects with deterministic conditions under which income is stable and investment risk is low. However, for projects with high risk, high uncertainty, and long payback periods, the NPV method can hardly assess the project value.

Game theory argues that there is a disagreement between the interests of concessionaire and government in determining the PPP project concession period. The process of project concession period negotiation in a joint consultation can be attributed to a question of the game between the government and the concessionaire [

4]. “Cutting-cake” model under the complete information dynamic game theory is helpful for determining the concession period of PPP projects with relatively stable future returns and predictable project life [

13]. Appropriate extension of the concession period is conducive to encourage the project company to increase construction investment and improve the quality of project construction as well as management technology [

14]. The game theory can effectively solve the conflict of interests and risks between the government and the concessionaires in the concession period [

15].

Monte Carlo Simulation, as an effective tool for the analysis of risk impacts, has been widely recommended by risk management guides [

16,

17,

18]. The critical risk factors include project product flow, construction cost, construction period, toll price, discount rate, operation and maintenance costs, etc. [

9,

19]. Investment and operation period [

9], income and cost [

9,

19], and random variables [

12] may be constructed as functional forms, which are simulated by Monte Carlo methods, directly or indirectly, to provide conditions for obtaining the concession period. Information-intensive computations and high-speed computer comprise the platform of Monte Carlo method. Through reasonable modeling, the complex research object is transformed into the simulation and calculation of the random numbers and its digital features, and the approximate solution with good properties can be obtained [

20].

The real options analyzing method is regarded as a forceful supplement for the traditional approach. Since Professor Stewart Myers, S.C [

21] proposed the definition of real option in 1998, the theory has been gradually accepted and developed rapidly in real options investment decision-making and the real options evaluation. Within a limited time, the real options holders could choose investment plan flexibly or make managing decisions according to the price changes of the subject matter [

22]. The basic theory of the cluster analysis of real options was the theoretical study of the financial options price done by Black Scholes and Merton. However, since the B-S model was a price option model targeting constantly changing price, it cannot meet the demand of realistic application. Therefore, Cox, Ross and Rubinstein (1979) proposed the Binomial Model, which is a discrete pricing method based on basic asset price instead of constantly changing price [

23]. At present, the real options theory has been applied to the field of fundamental facility projects. Feng and Wu (2003) suggested an efficient way to solve the expressway project decision-making by correcting previous decisions on expressway investment decision-making [

24]. The real options evaluation method is to analyze the future uncertainty of investment projects, supposing the investment projects’ uncertainty may bring new investment opportunities, extra income, and much greater investment value to the investors. The real options evaluation method has advantages and disadvantages over traditional NPV method in the following aspects: the strategic importance and potential value of the project can be fully considered using the real options evaluation method. This kind of flexible managing decision-making method can fit with the changing projects, find new investment opportunities in changeable market environment, and create more income.

To compensate for the shortcomings of the NPV method, which is not suitable for PPP projects with high risks and long payback periods, and to increase flexibility of the negotiation, this paper plans to introduce the real option value and risk sharing into the traditional concession period decision model so that the potential value of the project will be considered. Using the advantages of game theory in the distribution of risks and benefits, the distribution coefficient of option value is obtained through this process to further improve the model and realize the reasonable distribution of the interests and risks between the government and the investor. Finally, the real case is simulated by Monte Carlo method to verify the effectiveness of the model. Thus, the paper is ordered in the following steps. Firstly, related studies on NPV, Game theory, Monte Carlo simulation method, and real options analyzing method are reviewed in

Section 1. Then, a new a model for PPP and its process is presented in

Section 2. A case study illustrates the application of the model in

Section 3.

Section 4 provides a discussion and conclusion. Although more factors should be considered more reasonable results, the model built in this paper gives an idea and view to the solution in the PPP project, which has its practical importance.

2. The Concession Period Determination Model

2.1. The NPV Calculation Model

Using the traditional NPV method, the incomes acquired in the concession period will be discounted to the present value by certain discount rate, enabling the investors to calculate net present value of the project, as shown in Formula (1):

in which

is project’s income in the

ith year;

is the project’s outcome in the

ith year;

is the project’s discount rate; and

is the project’s period.

Different from other projects, the whole life cycle of PPP projects can be divided into two stages: the operating concession stage and after-handover stage. As the two main participants, the investors pay more attention to the former phase while the government emphasizes more on the latter one. The two participants evaluate the project and determine the concession period from different angles and standpoints to analyze the problems.

The investor’s investment decision depends on their evaluation of the projects, and the reference indexes of evaluation include the cash flow, incomes and benefits in the operation period. As for the government, the operation and income after handover are more important.

Thus, the concession period determination model from the perspective of investors is shown in Formula (2):

where

is the project’s concession period. Through the application of project’s financial evaluation theory, the investors can decide whether a project is worthy of investing by comparing its net present value with the predicted income. The investors can accept the net present value for the project’s predicted income if it exceeds the predicted amounts, which shown as Formula (3).

in which

is the predicted rate of return on investment, and

is the amount of investment.

Therefore, the determination model on basic NPV method of investors is shown in Formula (4):

For the government, the PPP project concession period decision needs to consider the following points: whether the price of the product or service provided by the project is acceptable and affordable; the implementation of the project must comply with laws and regulations and must not cause excessive pollution and destruction to the environment; and, in a certain period after the handover, the project should still be operational and profitable, and in a status of active development. The first two points mainly affect the government’s determination of the concession price and judgment of whether the project can be executed, while the last one directly influences the government’s decision on the project life span. Compared with the investors who mainly focus on the profitability, the government pays more attention to social benefits of the project. Thus, the government will accept the project as long as the discounted cash flow is above zero.

Thus, the concession period determination model from the perspective of government is shown as Formula (5):

in which

is the project life span.

From the perspective of both the private investors and the government, we can get a comprehensive model, which is shown as Formulas (6) and (7):

2.2. The Model of the Value and Risk Distribution

The real option method used for determining the PPP project concession period is an advanced method based on traditional methods. With this method, various options for the project are closely related to the value evaluation of the project, and different project options continue to interact with each other, thus affecting the value of the project. However, the method cannot identify all the options of the project. Meanwhile, due to the interaction between various options, it is impossible to calculate the universal option value by simple accumulation of different options. Therefore, applying the option theory to the analysis and decision of project concession period only demonstrates that the project option value acts as a vital role in practice, and it is still necessary to examine the scope and form of this value according to the reality.

Based on the discussion above, this paper establishes a model used for determining the project concession period with real option method, which is shown as Formulas (8) and (9):

where

is a single option value and is possessed by the private investors.

In general, the option value is occupied by the holder. However, in some perspectives, investors will distribute the option to the endorser with certain rules. Such a distribution should not be regarded as a concession made by the holder and the investor for holding the option, including compromise and payments. Considering the existence of this distribution, investors can only share a part and not all of the option value, so it is unwise for investors to adopt all the option value to evaluate the project. Aiming for a more reasonable calculation model, this paper establishes a new computing model with the option value allocation coefficient:

where

is the option proportion of the private investor, and

is the option proportion of the government.

2.3. The Model of the Value and Risk Distribution under Government Guarantee

To increase the confidence and interest of the investors, the government may provide a guarantee such as a product guarantee, price guarantee, tax incentives , etc. However, all these guarantees bring a burden to the government, increasing the option value of the project. In other words, the product, price, and policy are also seen as risks, which are all taken by government without division of incomes. To solve the problem, a new model is established considering the effect of encouraging the investors and the fair to the government at the same time.

To simply the model, several parameters are defined:

where

is the value of the actual products without government guarantee, and

is the output value of the investor when the government does not refer guarantee during the concession period.

is the value of the government from the end of the concession period to the end of the project.

where

is the uncertain part of the profit which excess the baseline that is appointed by the two sided.

is the upper limit income of the products.

is the upper limit cost corresponding to the upper limit of the product.

The value of the investor is as following:

where

is the value guarantied by government.

Its decision-making model can be expressed as:

where

is the total profits of the government.

Solving by Lagrange multiplier method,

gets the result:

The value of the government is as follows:

Its decision-making model can be expressed as:

Solving it by Lagrange multiplier method,

gets the result:

Combining minimum limit of investor and the government, obtains the following two conditions:

From the analysis, the government and the investor should reach an agreement on the value of , , and . Based on the principle of matching risk with profits, at the period of , should be at least equal to , which may be offered by the government before the negotiation. In other words, if the government has more anti-risk ability, it give guarantee to the investor, which means it takes on the risks, thus it should get some value in another way, while at the same not reducing the confidence of the investor.

If a project is feasible, its value of the whole life must at least meet the expected profit of the investor. However, in practice, the government and the investor may have conflict on the value of before they reach an agreement.

As for the value of and , the two sides may have different points. is the average rate of the return of the same industry. is the return rate above the maximum rate of return when investing in other projects. Thus, only when , the investor would agree to reach an agreement. The two sides can get the optimum solution by game theory.

In principle, it can be an indefinite game between the two sides. Assume that:

- (1)

both sided are willing to reach an agreement;

- (2)

both and are all result after carefully thinking; and

- (3)

the two side are equals during the negotiation, that is neither side has an advantage against the other, e.g. the government may consider other investors while the investors have other projects.

Through a game between the two parts, the equalitarianism solution is obtained:

3. Case Study: Changping Sewage Treatment Plant (STP) Project

3.1. Background of the Project

Changping district is located in the northwest of Beijing city, shown in

Figure 1, with eight streets, four regions, 14 towns and a total population of 1,908,00 in 2016, according to national economic and social development statistical bulletin of Changping District 2016. Considering rapid economic development has negative influence on the environment, more emphasis has been gradually put to the environmental protection of Changping New City. Changping sewage treatment plant is responsible for sewage treatment of the older neighborhoods of Changping. Due to the adjusted Changping District planning, the expansion area lying at the east coast of Dongsha River is planned to be transformed into sewage treatment plant watershed area. The rapid development of the east expansion area has attracted a group of productive corporations and residents resulting in a growth of domestic and industrial sewage and population increase. Since the government aims to improve the old pipe network and build new pipes in the east area, more sewage in the Changping sewage treatment plant is predicted. Therefore, it is necessary to improve the existing processing capability of Changping sewage treatment plant.

According to the request of bidding, the investors selected by tendering should set up the project company in Changping District, and should be authorized by the Water Authority and the project company in a way of signing a Concession Agreement with district government, which grants the project concession to the project company. During the concession period, the project company has exclusive rights to invest, construct, operate and manage the Phase II project of Changping Reclaimed Waterworks using the BOT (Build–Operate–Transfer) financing mode and bear the costs, responsibilities and risks by itself as well. Once the concession expires, the project company should transfer the whole Changping Reclaimed Water Plant Phase II project to the District Water Authority or its designated institutions for free. During the concession period, the District Water Authority has rights to supervise the construction, operation and maintenance of the project, as well as responsibility to supply sewage water and afford the service fee for the reclaimed water treatment.

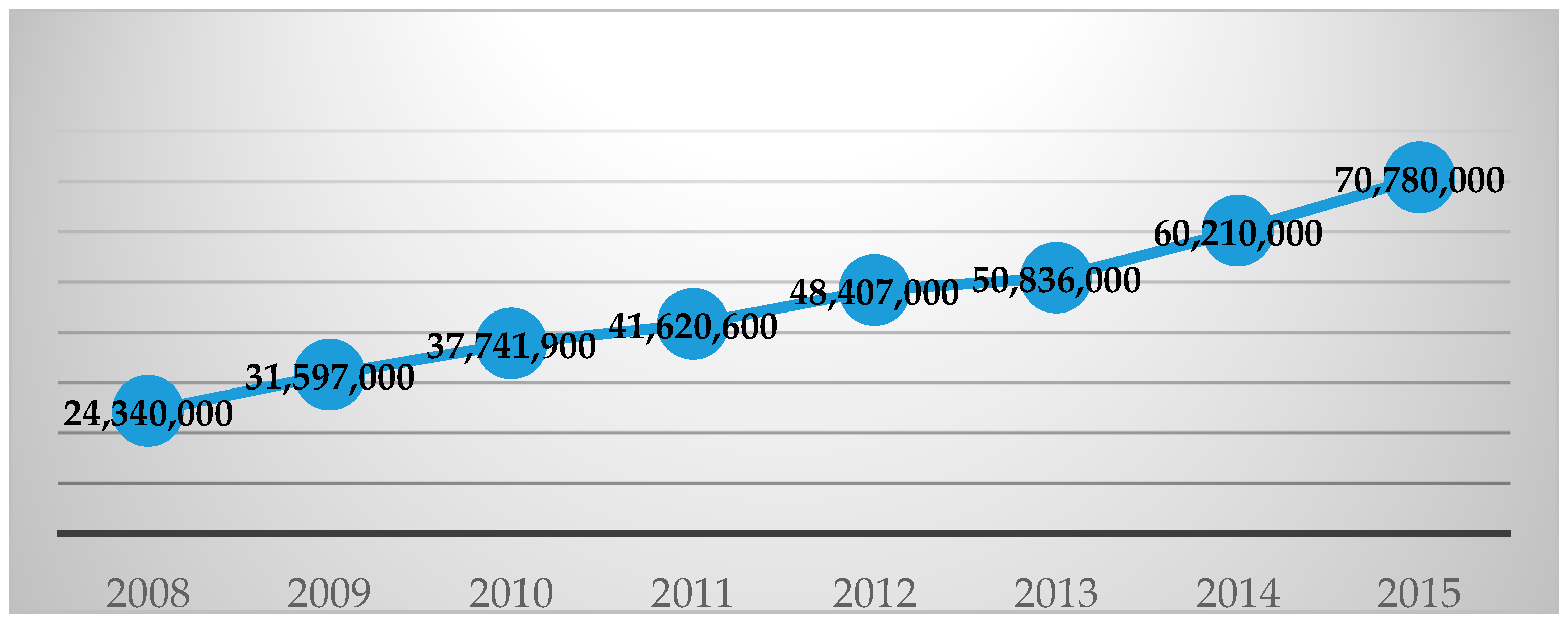

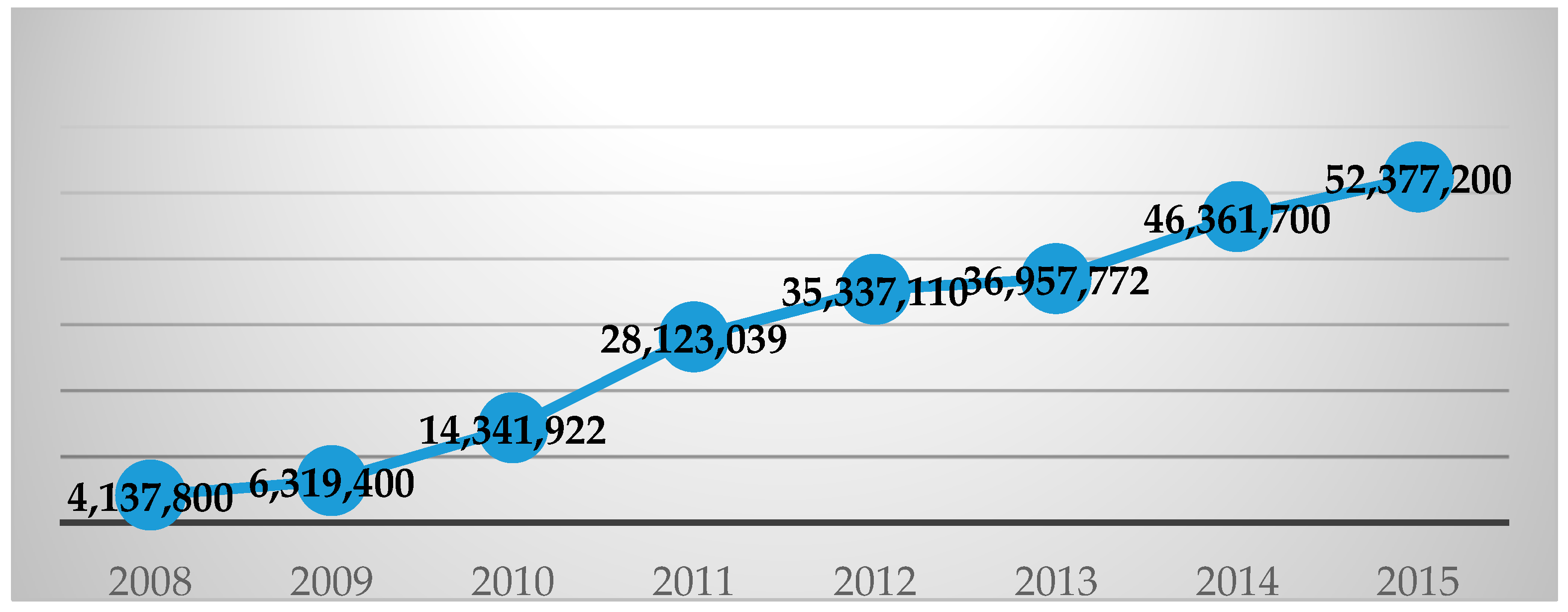

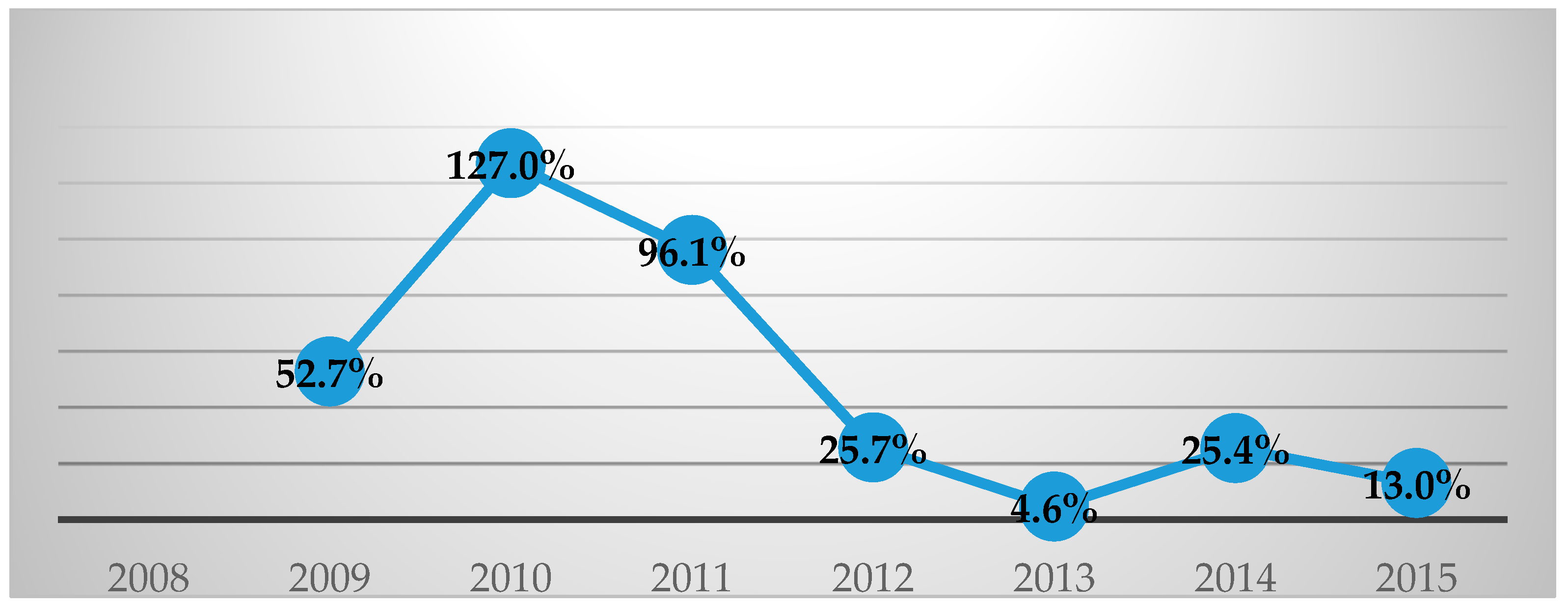

According to the

Annuaire Statistique of Changping, the sewage information from 2009 to 2015 are shown as

Table 1 and

Figure 2,

Figure 3 and

Figure 4. From the table and pictures, the sewage quantity and the total amount of centralized sewage (part of the whole sewage that disposed by factories) of Changping city have been increasing annually, as has the link relative ratio of centralized sewage. Because the government pays high attention to environmental pollution and has put strict limitations on sewage discharge and disposal, the increasing trend of relative ratio of centralized sewage in 2009, 2010, and 2011 were relatively high, and then relatively gentler in the later years, but still with growing speed.

3.2. The Key Risk Factor and Option Value of the Project

According to the statistics of city’s sewage treatment capacity over the years, the future sewage treatment capacity can be predicted to some extent. However, with the fast development of society and rapid increase of urbanization, historical data cannot meet the need of future sewage treatment capacity. To relieve the bidders’ concerns caused by the uncertainty of the sewage treatment capacity, the Urban Development Office chooses to sign the contract in the form of “Take-or-Pay”, which is originally an act on the international conventions and rules for the supply of natural gas. When used in the sewage treatment industry, “Take-or-Pay” can be understood like this: if the actual sewage treatment capacity is lower than the guaranteed amount, the government departments will pay sewage treatment costs to the project company according to the guaranteed amount and the standard price of sewage treatment; however, if the actual sewage treatment capacity is too high and even higher than upper control limit set by the government, the government will pay sewage treatment costs to the project company partly according to the actual sewage treatment capacity and the standard price of sewage treatment. In fact, the subsidy is a security option for the company. Because the value of the security option is mainly from the sewage flows, government subsidies will finally increase the value of the project during the concession period.

Assume that

is the project’s charge price,

is defined as the actual value of sewage treatment capacity for one year, and the lowest amount of sewage treatment of government guaranteed in that year is

. In this case, there are two different possible solutions. If

, the project actual income is

, and the actual sewage treatment capacity is not less than the minimum value of the government guarantee; that is, the guarantee option is not activated and the option value is zero. If

, the government will subsidize private investors in accordance with the guaranteed sewage treatment capacity and the private investors can be regarded as the implementation of the guarantee option because the actual sewage treatment capacity is less than the minimum amount of government guarantees; in this situation, the project actual income is

and security option value is

. Hence,

is defined as the guarantee provided by the government in the

i years of the project and

is defined as the uncertain value in the

i year of the project; they can be expressed as:

The value of the guarantee option uncertain part can be obtained by discounting and adding the option income at each year of the operation period, which can be written as:

where

is the risk-free interest rate.

3.3. Related Parameters

The total private investment of the project is ¥147.89 million, of which 30% is capital and the remaining 70% is bank loan. The project depreciates in straight-line depreciation method, with the depreciation period of 25 years, and the asset surplus of 5%. The depreciation and the net margin could be used for the bank loan.

The preliminary project life cycle is determined as 30 years; the project construction period is one year; and, after completion of the project, there is a one-year trial operation, which is included in the concession period. The production of the trial period should achieve 60% of its full capacity and reach its full capacity the following year. The government starts to carry out guarantee option when it reaches its full capacity, which is the third year.

The private investors expect a return rate of 12.5% after careful calculations that consider a series of factors such as the industry and company income level, corporate performance and qualification, the competitors, etc. The average rate of the return of the same industry is 8.3%, as estimated by the government, so the optimal return rate is 10.4%, according to Formula (2.30). The bank loan interest rate is 5.7% and the risk-free interest rate is the ten-year bond interest rate in 2015, 4.4%, the discount rate of the investor is 7.4%, and the income tax rate for the project is 25%, regulated by the law of tax.

(1) Sewage treatment price

According to the agreement reached by the project winning unit and the Beijing Municipal Water Affairs Bureau, the project sewage treatment unit price is 2.79 Yuan/m

3. The design capacity of the waste treatment is 50,000 m

3 per day. The cost of the sewage disposal is shown in

Table 2 with an estimated production 13.64 million m

3 per year.

(2) The estimation of the production per year

Pichayapan [

25], Garvin and Cheah [

26], and Iyer and Sagheer [

27] used geometric Brownian motion in their respective papers to describe the probability distribution of traffic for the following reasons: (1) the data described by geometric Brownian movement are the same as traffic volume, which is independent to each other; (2) geometric Brownian movement only considers positive data, which is similar to the real traffic volume; and (3) geometric Brownian motion is relatively simple to calculate with the starting point of time data and data fluctuations in the expectations and variance, and the future value can be predicted. Besides, the above data are relatively easy to acquire in the description of the probability distribution of traffic volume, so geometric Brownian motion can be used to describe the probability distribution of traffic volume. Geometric Brownian motion can also be used in describing the probability distribution of the amount of sewage treatment. Assuming that the current sewage treatment capacity is

, according to geometric Brownian movement, the sewage treatment capacity of the next phase can be expressed as:

where

is the expectation of rate of change in the amount of sewage treatment;

is the standard deviation of the rate of change of sewage treatment capacity; and

obeys

distribution. According to the statistics of sewage treatment capacity in Changping District included in the Beijing Statistical Yearbook, as shown in

Table 1 and

Figure 1,

Figure 2 and

Figure 3,

is 2.6%, and

is 6.7%.

is 8,760,000 m

3, and its average amount is 13,645,500 m

3 after 100 times simulation.

3.4. Calculation Results

From the model built above, important factors of the project’s concession period include NPV, option value, the distribution coefficient between government and private investors, the concession period, and the price. The calculating process is shown in

Figure 5.

- (1)

From the analysis above, the average quantity of the sewage is 13,645,500 m3, thus the whole life span needs to meet the income rate in 29.35 years. Thus, the whole life span is preliminarily decided as at least 30 years.

- (2)

According to the set of dates in

Table 3, the result of the Monte Carlo simulation with the principle that, when the simulation result is more than its capacity, its capacity should be taken as the actual amount, its full capacity is 18,250,000 m

3.

- (3)

Calculation of concession period using the traditional NPV method: Using the data of sewage quantity in

Table 3, the concession period calculated through the traditional NPV is demonstrated in

Table 4.

Consequently, the concession period of this project calculated by interpolation method is:

- (4)

Taking the option value and distribution coefficient into consideration, the concession period is calculated based on the sewage data in

Table 3, Based on the concession period resulting from the traditional method (26.55 years), the annual present value of the government guarantee and the annual present value of the project above the limit value are shown in

Table 5.

The value of using Formula (26) is . That is to say, when the production is above the limit number, the government and the investor will share the excess part with the government: investor ratio of 0.47:0.53.

- (5)

The concession period with only the government guarantee and no option value share is calculated. The concession period only with the government guarantee is shown as

Table 6.

Consequently, the concession period of this project calculated by interpolation method is:

The concession period will have a time gap of 3.14 year between considering the share value above the limit amount and not considering that part. Thus, if the government wants to take back the project, it can use the method without considering the share value, but it will bring financial burden to itself. Otherwise, if it does not want to take the financial burden, it can use the method considering the share value.

- (6)

The price with fixed concession period is calculated.

In some cases, the concession period of the PPP project is determined by the government before the bids. The calculation model can give the government a guide to decide the price of sewage treatment either considering the government guarantee and the share value or considering the government guarantee only.

Thus, suppose that the concession period is determined by the government, and its sewage treatment price is 2.83 Yuan per m

3 using trial method, the details are shown in

Table 7.

The total the present worth of government guarantee is 11,663,200 Yuan. The total present worth of the project above the limit value is 22,781,800 Yuan. The value of

. Its sewage treatment price is 2.75 Yuan per m

3 if only considering the government guarantee, but the cumulative present worth of the project is 152,445,300 Yuan, less than the expected project incomes, meaning that it needs more years, 28.59 years, in this simulation to meet the expected revenue. The details are shown in

Table 8.

3.5. Comparison of the Results under Different Application Environments

From analyses above, several decisions can be made under different situations, as shown in

Table 9 and

Table 10.

If the sewage treatment price is fixed, this decision model can give the two sides a reference on deciding the concession period. If they choose the government guarantee and the option value, the concession will be longer, but the burden of the government will be less; otherwise, if they choose the government guarantee only, the concession period will be shorter, the government can get control right of the project, and the investor can recoup the costs and the expected return in advance, but the government will have some financial burden.

If the concession period if fixed, this decision model can give the two sides a reference on deciding the sewage treatment price. If they choose the government guarantee and share option value, the price will be higher, but the burden of the government will be less; otherwise, if they choose government guarantee only, the sewage treatment price is lower and the social benefits will increase but the government will have some financial burden.

Even though the calculation example demonstrates the usefulness of the model, there are some concerns. The specific performances are: (1) the real volatility of sewage treatment capacity is constantly changing but the volatility is invariable in geometric Brownian motion; (2) the real volatility of sewage treatment capacity may not necessarily be subject to normal distribution, its distribution might present greater kurtosis so that it might have more sewage treatment volatility; and (3) tn this case, the data are obtained from Monte Carlo simulation, which has a lot of randomness and has much effect on the results. In the future, scholars can take advantage of other distribution functions in statistics to describe the change of sewage treatment capacity to make the simulation results more realistic and calculate the concession period more accurately. In reality, concession contracts also contain some other warranty conditions and the project might have many options at the same time. Its impact on value of PPP projects can also be the emphasis of future research.

4. Discussion and Conclusions

Concession period and the price of sewage treatment are some of the most important content in concession contracts of PPP project and they can determine whether the project is successful and profitable. This paper constructed a new model for calculating the concession period and price based on real options and risk allocation. On the one hand, this method makes the model more reasonable. On the other hand, it provides reference for other benefit distribution issues between private investors and government.

This paper applies the model to a sewage treatment plant in Beijing for empirical test and simulates the sewage quantity of this project through Monte Carlo Simulation. The result shows that the project’s concession period and price are different when real option and risk sharing are considered simultaneously or respectively, thus providing greater negotiating space for government’s decision with investing companies. As a result, it reduces the project risk carried by the investors and increases the government’s controlling power of the project. On the other hand, the sewage treatment project has a great impact on daily life of local residents, so whether it can operate successfully not only concerns the company and the government but also the quality of life of the city. The sewage treatment industry could also promote the development of other industries such as pipeline engineering river regulation projects, etc., and it also bring much benefit on environment improvement, called for by the government of China and all over the world. Because the PPP model in China is still immature, this method and model could not only be used in sewage treatment industry but also in other PPP projects, such as roads, railways airports and so on.

The model proposed in this paper presents several calculation methods under different situation: (1) calculation of concession period taking the option value and distribution coefficient into consideration when sewage treatment price is fixed; (2) calculation of the concession period only with the government guarantee without the option value share when fixed sewage treatment price is fixed; (3) calculation of the sewage treatment price taking the option value and distribution coefficient into consideration when the concession period is fixed; and (4) calculation of the sewage treatment price only with the government guarantee without the option value share when the concession period is fixed. If the government wants to take authority of the project, that is, shorten the concession period, then it should either give the private investors a relatively higher sewage treatment price or guarantee the private investors a low quantity of sewage treatment. At the same time, the government should take some risks, such as the sewage treatment quantity, policy, and external environment change after the concession period, and the government should have its own management team that is at least as efficient as the private company, which may be a big problem for the government after transfer, as private companies generally have an advantage over the government on the level of management and sewage treatment. Under this situation, the private company may have a short concession period, less risks and recover the investment in advance, but lose some opportunity to earn much more overall. When the concession period is long, the private company should take more risks and have a relatively low sewage treatment price, but have the opportunity to earn more.

Even though the model presented in this paper brings a reference and much benefits to the government and private companies during their negotiation, it still has some deficiencies. First, the model mainly considers price and concession period , but there are many other factors that should also be considered such as the rise in labor price and raw material cost, new technology which may reduce the material cost, inflation, the government policy, global economic turmoil, etc., which may also have an important influence on the operation of the project, so further study should be taken on the negotiation among the operation period, as the life of the PPP project is generally 20–30 years or even longer. Secondly, the model is very flexible; the two sides may have conflicts on which situation to use, so many other factors should be taken into account in practical engineering. Third, the case takes a set of simulation as an example to illustrate the application of the model, but the production of sewage treatment plays an important role on prediction results and a big influence on operation during the execution of the contract, so further studies are still needed on more precise prediction methods of simulation in future.