Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

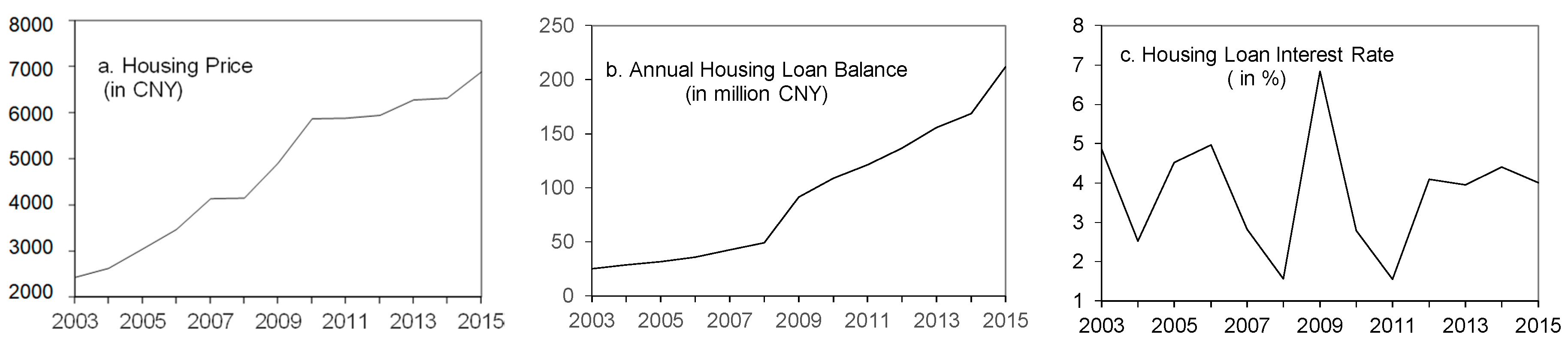

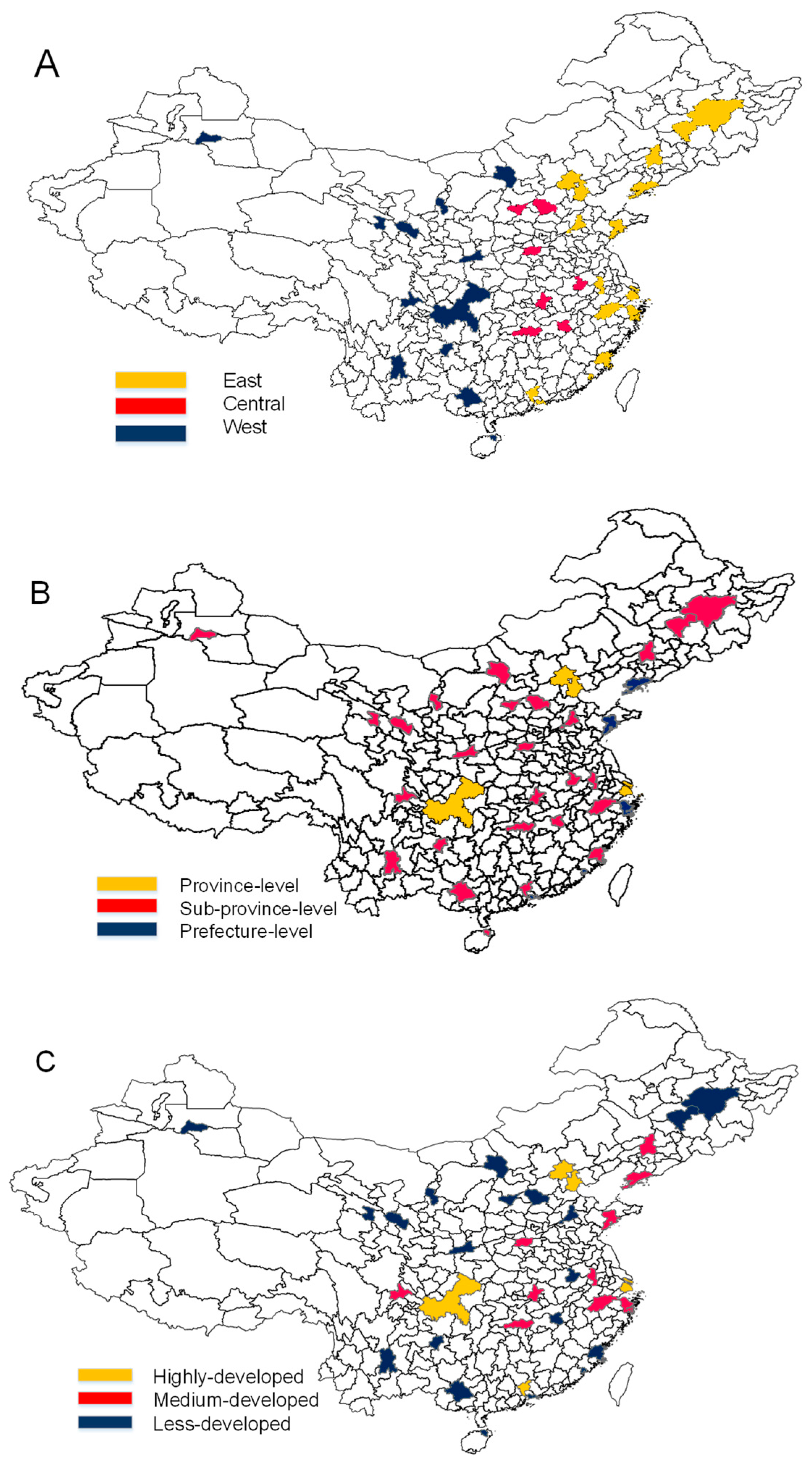

3.1. Data

3.2. Analytical Methods

4. Results

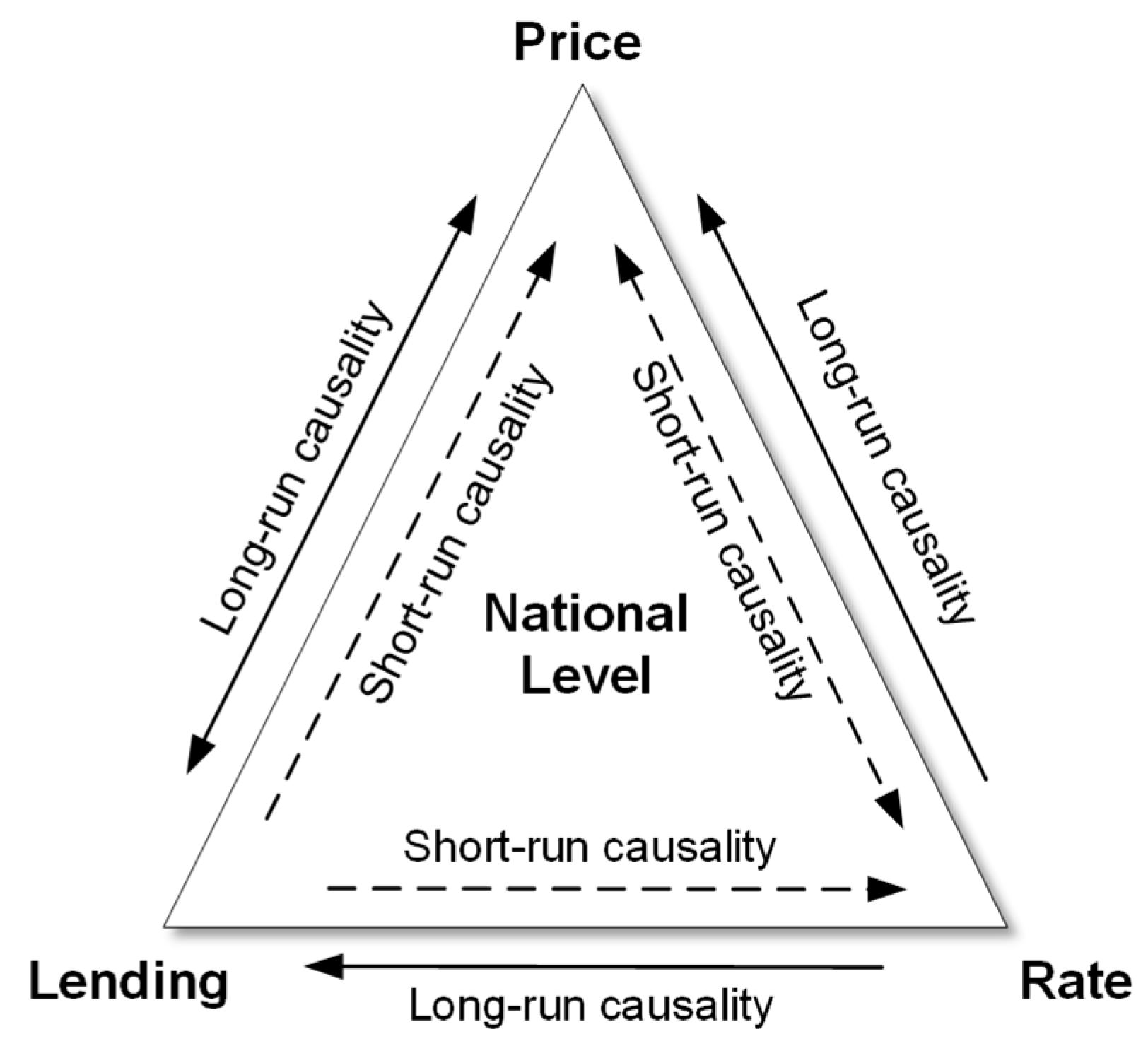

4.1. Nation-Level Effects

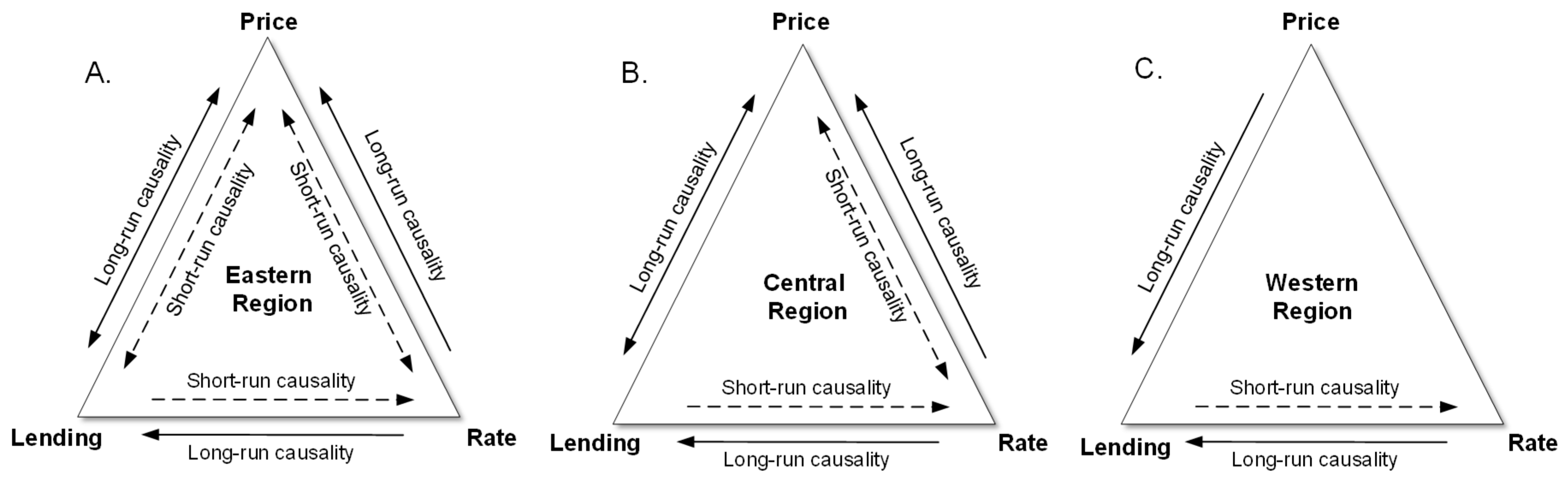

4.2. Region-Level Effects by Geographical Location

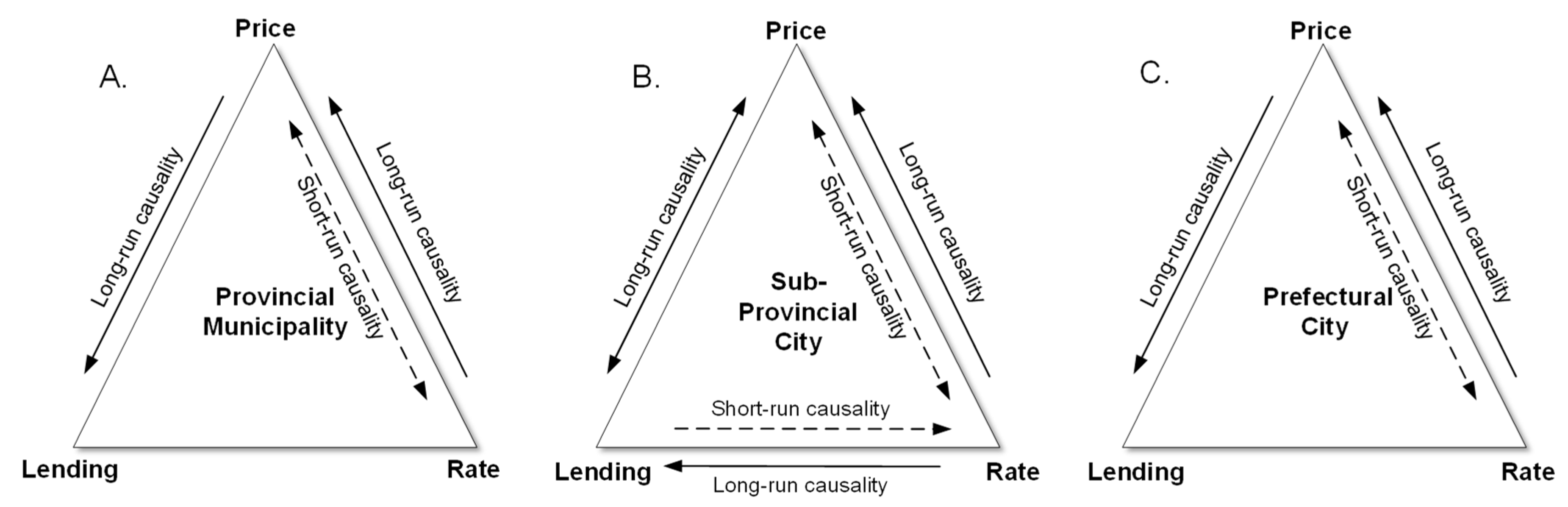

4.3. Region-Level Effects by Administrative Hierarchy

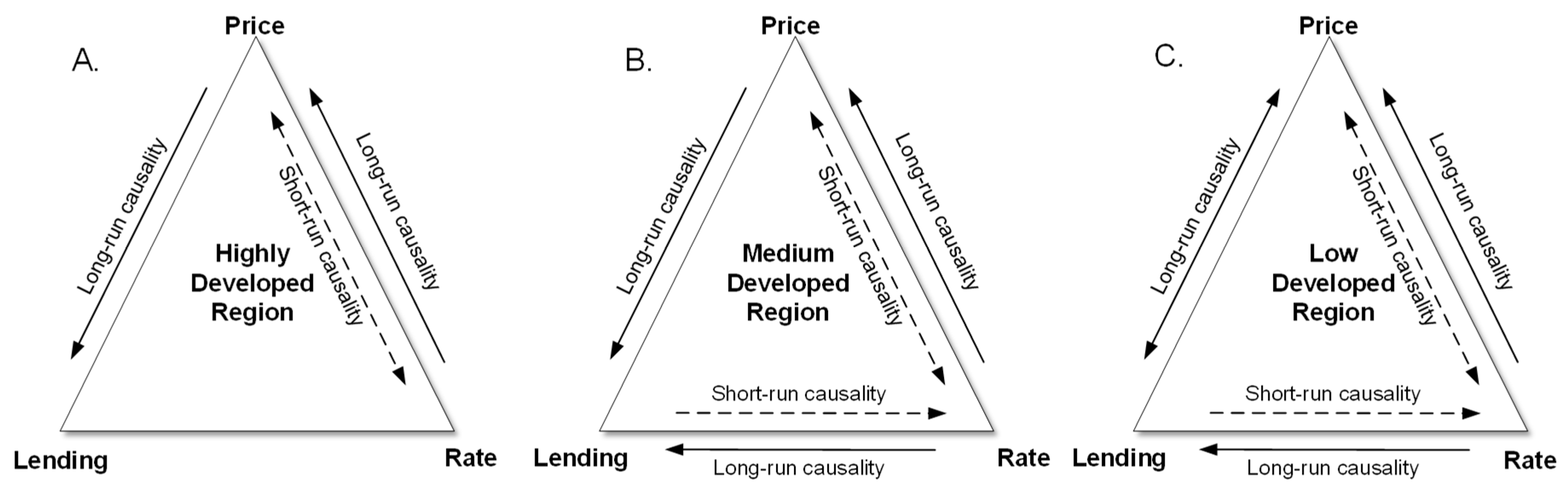

4.4. Region-Level Effects by Level of Economic Development

4.5. City-Level Effects

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Gan, X.; Zuo, J.; Wu, P.; Wang, J.; Chang, R.; Wen, T. How affordable housing becomes more sustainable? A stakeholder study. J. Clean. Prod. 2017, 162, 427–437. [Google Scholar] [CrossRef]

- Glaeser, E.; Huang, W.; Ma, Y.; Shleifer, A. A real estate boom with Chinese characteristics. J. Econ. Perspect. 2017, 31, 93–116. [Google Scholar] [CrossRef]

- Cerutti, E.; Dagher, J.; Dell’Ariccia, G. Housing finance and real-estate booms: A cross-country perspective. J. Hous. Econ. 2017, 38, 1–13. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Bostic, R.W.; Longhofer, S.D.; Redfearn, C.L. Land leverage: Decomposing home price dynamics. Real Estate Econ. 2007, 35, 183–208. [Google Scholar] [CrossRef]

- Saiz, A. The geographic determinants of housing supply. Q. J. Econ. 2010, 125, 1253–1296. [Google Scholar] [CrossRef]

- Somerville, C.T.; Holmes, C. Dynamics of the affordable housing stock: Microdata analysis of filtering. J. Hous. Res. 2001, 12, 115–140. [Google Scholar]

- Mills, E.S. An aggregative model of resource allocation in a metropolitan area. Am. Econ. Rev. 1967, 57, 197–210. [Google Scholar]

- Muth, R.F. Cities and Housing: The Spatial Pattern of Urban Residential Land Use; University of Chicago Press: Chicago, IL, USA, 1969. [Google Scholar]

- Koebel, C.T.; McCoy, A.P.; Sanderford, A.R.; Franck, C.T.; Keefe, M.J. Diffusion of green building technologies in new housing construction. Energy Build. 2015, 97, 175–185. [Google Scholar] [CrossRef]

- Sanderford, A.R.; McCoy, A.P.; Keefe, M.J. Adoption of Energy Star certifications: Theory and evidence compared. Build. Res. Inf. 2018, 46, 207–219. [Google Scholar] [CrossRef]

- Kaza, N.; Quercia, R.; Tian, C. Home Energy Efficiency and Mortgage Risks. J. Policy Dev. Res. 2014, 16, 279–299. [Google Scholar]

- Tu, C.C.; Eppli, M.J. An empirical examination of traditional neighborhood development. Real Estate Econ. 2001, 29, 485–501. [Google Scholar] [CrossRef]

- Rauterkus, S.Y.; Thrall, G.I.; Hangen, E. Location efficiency and mortgage default. J. Sustain. Real Estate 2010, 2, 117–141. [Google Scholar]

- Tsatsaronis, K.; Zhu, H. What drives housing price dynamics: Cross-country evidence. BIS Q. Rev. 2004, 65–78. [Google Scholar]

- Kashyap, A.K.; Stein, J.C. Monetary policy and bank lending. In Monetary Policy; The University of Chicago Press: Chicago, IL, USA, 1994; pp. 221–261. [Google Scholar]

- Oikarinen, E. Household borrowing and metropolitan housing price dynamics-Empirical evidence from Helsinki. J. Hous. Econ. 2009, 18, 126–139. [Google Scholar] [CrossRef]

- Otrok, C.; Terrones, M.E. House Prices, Interest Rates and Macroeconomic Fluctuations: International Evidence. 2005. Available online: https://www.frbatlanta.org/-/media/documents/news/conferences/2005/housing2005/otrokterrones.pdf (accessed on 24 January 2018).

- Beltratti, A.; Morana, C. International House Prices and Macroeconomic Fluctuations. J. Bank. Financ. 2010, 34, 533–545. [Google Scholar] [CrossRef]

- Manganelli, B.; Morano, P.; Tajani, F. House Prices and Rents. The Italian experience. WSEAS Trans. Bus. Econ. 2014, 11, 219–226. [Google Scholar]

- Manganelli, B.; Tajani, F. Macroeconomic variables and real estate in Italy and USA. Ital. J. Reg. Sci. 2015, 14, 31–48. [Google Scholar] [CrossRef]

- Li, S.; Mao, S. Exploring residential mobility in Chinese cities: An empirical analysis of Guangzhou. Urban Stud. 2017, 54, 3718–3737. [Google Scholar] [CrossRef]

- Zou, G.L.; Chau, K.W. Determinants and sustainability of house prices: The case of Shanghai, China. Sustainability 2015, 7, 4524–4548. [Google Scholar] [CrossRef] [Green Version]

- Chen, A. China’s urban housing reform: Price-rent ratio and market equilibrium. Urban Stud. 1996, 33, 1077–1092. [Google Scholar] [CrossRef]

- Wu, J.; Gyourko, J.; Deng, Y. Evaluating the risk of Chinese housing markets: What we know and what we need to know. China Econ. Rev. 2016, 39, 91–114. [Google Scholar] [CrossRef]

- Zheng, S.; Kahn, M.E.; Liu, H. Towards a system of open cities in China: Home prices, FDI flows and air quality in 35 major cities. Reg. Sci. Urban Econ. 2010, 40, 1–10. [Google Scholar] [CrossRef]

- Guo, X.; Zheng, S.; Geltner, D.; Liu, H. A new approach for constructing home price indices: The pseudo repeat sales model and its application in China. J. Hous. Econ. 2014, 25, 20–38. [Google Scholar] [CrossRef]

- Shen, L. Are house prices too high in China? China Econ. Rev. 2012, 23, 1206–1210. [Google Scholar] [CrossRef]

- Ren, Y.; Xiong, C.; Yuan, Y. House price bubbles in China. China Econ. Rev. 2012, 23, 786–800. [Google Scholar] [CrossRef]

- Zhou, X.; Gibler, K.; Zahirovic-Herbert, V. Asymmetric buyer information influence on price in a homogeneous housing market. Urban Stud. 2015, 52, 891–905. [Google Scholar] [CrossRef]

- Reichert, A.K. The impact of interest rates, income, and employment upon regional housing prices. J. Real Estate Financ. Econ. 1990, 3, 373–391. [Google Scholar] [CrossRef]

- Liang, Q.; Cao, H. Property prices and bank lending in China. J. Asian Econ. 2007, 18, 63–75. [Google Scholar] [CrossRef]

- Chu, Y. Credit constraints, inelastic supply, and the housing boom. Rev. Econ. Dyn. 2014, 17, 52–69. [Google Scholar] [CrossRef]

- Favara, G.; Imbs, J. Credit supply and the price of housing. Am. Econ. Rev. 2015, 105, 958–992. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Gertler, M. Agency costs, collateral, and business fluctuations. Am. Econ. Rev. 1986, 79, 14–31. [Google Scholar]

- Kiyotaki, N.; Moore, J. Credit cycles. J. Polit. Econ. 1997, 105, 211–248. [Google Scholar] [CrossRef]

- Gerlach, S.; Peng, W. Bank lending and property prices in Hong Kong. J. Bank. Financ. 2005, 29, 461–481. [Google Scholar] [CrossRef]

- Anundsen, A.K.; Jansen, E.S. Self-reinforcing effects between housing prices and credit. J. Hous. Econ. 2013, 22, 192–212. [Google Scholar] [CrossRef]

- Coleman, A. Credit Constraints and Housing Markets in New Zealand; No. DP2007/11; Reserve Bank of New Zealand: Wellington, New Zealand, 2007. [Google Scholar]

- Kim, H.; Park, S.; Lee, S.H. House price and bank lending in a premium submarket in Korea. Int. Real Estate Rev. 2012, 15, 1–42. [Google Scholar]

- Martin, H.; Hanson, A. Metropolitan area home prices and the mortgage interest deduction: Estimates and simulations from policy change. Reg. Sci. Urban Econ. 2016, 59, 12–23. [Google Scholar] [CrossRef]

- Li, J.; Xu, Y. Evaluating restrictive measures containing housing prices in China: A data envelopment analysis approach. Urban Stud. 2016, 53, 2654–2669. [Google Scholar] [CrossRef]

- Chiang, S. Rising residential rents in Chinese mega cities: The role of monetary policy. Urban Stud. 2016, 53, 3493–3509. [Google Scholar] [CrossRef]

- Bloom, B.; Nobe, M.E.C.; Nobe, M.D. Valuing Green Home Designs: A Study of ENERGY STAR Homes. J. Sustain. Real Estate 2011, 3, 109–126. [Google Scholar]

- Aroul, R.R.; Hansz, J.A. The Role of Dual-pane Windows and Improvement Age in Explaining Residential Property Values. J. Sustain. Real Estate 2011, 3, 142–161. [Google Scholar] [CrossRef]

- Dastrup, S.R.; Zivin, J.G.; Costa, D.L.; Kahn, M.E. Understanding the Solar Home price premium: Electricity generation and “Green” social status. Eur. Econ. Rev. 2012, 56, 961–973. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalization of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Aroul, R.R.; Rodriguez, M. The Increasing Value of Green for Residential Real Estate. J. Sustain. Real Estate 2017, 9, 112–130. [Google Scholar]

- Poterba, J.M.; Weil, D.N.; Shiller, R. House price dynamics: The role of tax policy and demography. Brook. Pap. Econ. Act. 1991, 2, 143–203. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Gyourko, J.; Saks, R.E. Why have housing prices gone up? Am. Econ. Rev. 2005, 95, 329–333. [Google Scholar] [CrossRef]

- Ewing, R.; Cervero, R. Travel and the built environment: A meta-analysis. J. Am. Plan. Assoc. 2010, 76, 265–294. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kahn, M.E. Sprawl and urban growth. In Handbook of Regional and Urban Economics; Elsevier: Amsterdam, The Netherlands, 2004; pp. 2481–2527. [Google Scholar]

- Zhao, D.; McCoy, A.P.; Smoke, J. Resilient Built Environment: New Framework for Assessing Residential Construction Market. J. Archit. Eng. 2015, 27, B4015004. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Liu, Y.; Yan, B.; Zhou, Y. Urbanization, economic growth, and carbon dioxide emissions in China: A panel cointegration and causality analysis. J. Geogr. Sci. 2016, 26, 131–152. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P. Energy consumption and economic growth in Asian economies: A more comprehensive analysis using panel data. Resour. Energy Econ. 2008, 30, 50–65. [Google Scholar] [CrossRef]

- Niu, S.; Ding, Y.; Niu, Y.; Li, Y.; Luo, G. Economic growth, energy conservation and emissions reduction: A comparative analysis based on panel data for 8 Asian-Pacific countries. Energy Policy 2011, 39, 2121–2131. [Google Scholar] [CrossRef]

- Ferguson, C.A.; Bowman, A.W.; Scott, E.M.; Carvalho, L. Model comparison for a complex ecological system. J. R. Stat. Soc. 2007, 170, 691–711. [Google Scholar] [CrossRef]

- Park, B.U.; Mammen, E.; Lee, Y.K.; Lee, E.R. Varying coefficient regression models: A review and new developments. Int. Stat. Rev. 2015, 83, 36–64. [Google Scholar] [CrossRef]

- Hastie, T.; Tibshirani, R. Varying-coefficient models. J. R. Stat. Soc. 1993, 55, 757–796. [Google Scholar]

- Gao, T.M. Econometric Analysis and Modeling—Eviews Applications and Examples; Tsinghua University Press: Beijing, China, 2006. [Google Scholar]

- Sanderford, A.R.; McCoy, A.P.; Zhao, D.; Koebel, C.T. Inventing the House: Case-Specific Studies on Housing Innovation; Momentum Press: New York, NY, USA, 2016. [Google Scholar]

- Ebner, A. A micro view on home equity withdrawal and its determinants: Evidence from Dutch households. J. Hous. Econ. 2013, 22, 321–337. [Google Scholar] [CrossRef]

- Turk, R. Housing Price and Household Debt Interactions in Sweden; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Seo, D.; Chung, Y.S.; Kwon, Y. Price Determinants of Affordable Apartments in Vietnam: Toward the Public–Private Partnerships for Sustainable Housing Development. Sustainability 2018, 10, 197. [Google Scholar] [CrossRef]

| Unit Root | Variable | LLC | ADF-Fisher | PP-Fisher |

|---|---|---|---|---|

| Levels | lnH | −2.506 ** | 36.079 | 33.067 |

| lnGDP | 0.148 | 35.761 | 26.953 | |

| lnL | 2.147 | 25.439 | 23.663 | |

| R | −0.117 | 31.139 | 75.375 | |

| First difference | ΔlnH | −11.112 ** | 209.165 * | 216.456 ** |

| ΔlnGDP | −6.716 ** | 126.713 ** | 129.903 ** | |

| ΔlnL | −17.985 ** | 361.359 ** | 369.587 ** | |

| ΔR | −38.940 * | 696.183 ** | 702.114 ** |

| Statistic | Panel v | Panel rho | Panel PP | Panel ADF | Group rho | Group PP | Group ADF |

|---|---|---|---|---|---|---|---|

| lnH–lnL | −1.581 | 0.238 | −4.251 ** | −4.995 ** | 2.598 | −3.852 ** | −5.431 ** |

| lnH–R | −4.440 | −14.079 ** | −14.075 ** | −14.085 ** | −8.930 ** | −16.982 ** | −16.990 ** |

| R–lnL | −1.731 | −3.025 ** | −16.061 ** | −16.562 ** | −0.058 | −15.897 ** | −18.043 ** |

| Location | Statistic | Panel v | Panel rho | Panel PP | Panel ADF | Group rho | Group PP | Group ADF |

|---|---|---|---|---|---|---|---|---|

| Eastern | lnH–lnL | −0.829 | −0.333 | −4.482 ** | −4.922 ** | 1.279 | −4.414 ** | −5.245 ** |

| lnH–R | −2.999 | −8.675 ** | −9.594 ** | −9.510 ** | −5.220 ** | −11.586 ** | −11.468 ** | |

| R–lnL | 1.563 | −2.271 * | −4.060 ** | −4.442 ** | −0.277 | −5.254 ** | −5.478 ** | |

| Central | lnH–lnL | 1.822 * | −1.232 | −2.034 * | −3.532 ** | 0.242 | −1.272 | −3.296 ** |

| lnH–R | −1.986 | −5.739 ** | −6.369 ** | −6.308 ** | −3.453 ** | −7.693 ** | −7.609 ** | |

| R–lnL | 0.642 | −1.938 * | −3.506 ** | −3.544 ** | −1.145 | −5.627 ** | −6.688 ** | |

| Western | lnH–lnL | −0.907 | −0.045 | −2.560 ** | −2.861 ** | 1.642 | −1.829 * | −2.306 * |

| lnH–R | −2.602 | −7.523 ** | −8.335 ** | −8.258 ** | −4.530 ** | −10.070 ** | −9.962 ** | |

| R–lnL | 1.766 * | −3.613 ** | −5.692 ** | −5.488 ** | −2.071* | −8.140 ** | −7.972 ** |

| Hierarchy | Statistic | Panel v | Panel rho | Panel PP | Panel ADF | Group rho | Group PP | Group ADF |

|---|---|---|---|---|---|---|---|---|

| Provincial | lnH–lnL | −0.224 | −0.357 | −2.802 ** | −2.748 ** | 0.474 | −3.236 ** | −3.186 ** |

| lnH–R | −1.499 | −4.350 ** | −4.803 ** | −4.762 ** | −2.621 ** | −5.797 ** | −5.740 ** | |

| R–lnL | 1.388 | −2.690 ** | −7.230 ** | −5.755 ** | −1.496 | −7.922 ** | −6.136 ** | |

| Sub-Provincial | lnH–lnL | −1.690 | 0.565 | −2.682 ** | −3.245 ** | 2.655 | −1.938 * | −3.504 ** |

| lnH–R | −3.830 | −11.066 ** | −12.264 ** | −12.150 ** | −6.662 ** | −14.818 ** | −14.658 ** | |

| R–lnL | 2.655 ** | −4.719 ** | −7.446 ** | −7.362 ** | −2.542 ** | −10.830 ** | −11.234 ** | |

| Prefectural | lnH–lnL | −0.122 | −0.342 | −2.733 ** | −3.665 ** | 0.396 | −2.876 ** | −3.529 ** |

| lnH–R | −1.673 | −4.838 ** | −5.348 ** | −5.303 ** | −2.908 ** | −6.455 ** | −6.391 ** | |

| R–lnL | 1.160 | −2.994 ** | −8.850 ** | −7.405 ** | −1.662 * | −9.900 ** | −8.505 ** |

| Level | Statistic | Panel v | Panel rho | Panel PP | Panel ADF | Group rho | Group PP | Group ADF |

|---|---|---|---|---|---|---|---|---|

| High | lnH–lnL | −0.577 | −0.224 | −2.991 ** | −3.465 ** | 0.805 | −3.319 ** | −3.737 ** |

| lnH–R | −1.836 | −5.321 ** | −5.891 ** | −5.838 ** | −3.206 ** | −7.114 ** | −7.040 ** | |

| R–lnL | 1.433 | −1.848 * | −2.556 ** | −2.672 ** | −0.082 | −2.697 ** | −2.830 ** | |

| Medium | lnH–lnL | −0.993 | 0.291 | −2.279 * | −2.366 ** | 1.436 | −2.217* | −2.608 ** |

| lnH–R | −2.373 | −6.850 ** | −7.573 ** | −7.507 ** | −4.119 ** | −9.145 ** | −9.053 ** | |

| R–lnL | 1.359 | −1.708 * | −3.276 ** | −3.628 ** | −0.610 | −4.806 ** | −5.308 ** | |

| Low | lnH–lnL | −1.092 | 0.282 | −2.293* | −3.003 ** | 2.033 | −1.754 * | −3.379 ** |

| lnH–R | −3.272 | −9.462 ** | −10.487 ** | −10.390 ** | −5.698 ** | −12.673 ** | −12.536 ** | |

| R–lnL | 1.406 | −3.726 ** | −6.461 ** | −6.396 ** | −2.107* | −9.703 ** | −9.981 ** |

| Group | n | City | Lending Supply | Lending Rate | ||||

|---|---|---|---|---|---|---|---|---|

| β1 | S.E. | Interval | β2 | S.E. | Interval | |||

| I | 7 | HA | 0.687 ** | 0.184 | (0.327, 1.048) | −1.464 * | 0.747 | (−2.928, 0.000) |

| HZ | 0.575 ** | 0.195 | (0.194, 0.958) | −1.567 * | 0.755 | (−3.046, −0.088) | ||

| NB | 0.676 ** | 0.182 | (0.320, 1.033) | −1.836 * | 0.725 | (−3.257, −0.414) | ||

| SY | 0.205 ** | 0.075 | (0.058, 0.352) | −1.479 * | 0.709 | (−2.868, −0.089) | ||

| SZ | 0.316 * | 0.149 | (0.025, 0.607) | −2.799 ** | 0.664 | (−4.100, −1.498) | ||

| UR | 0.195 * | 0.094 | (0.011, 0.378) | −2.041 ** | 0.765 | (−3.540, −0.543) | ||

| XM | 0.684 ** | 0.145 | (0.400, 0.968) | −2.579 ** | 0.692 | (−3.936, −1.222) | ||

| II | 7 | CQ | 0.488 ** | 0.114 | (0.265, 0.711) | −1.429 | 0.750 | (−2.899, 0.042) |

| FZ | 0.617 ** | 0.180 | (0.264, 0.970) | −1.559 | 0.821 | (−3.168, 0.051) | ||

| HR | 0.334 ** | 0.110 | (0.118, 0.550) | −1.087 | 0.788 | (−2.631, 0.458) | ||

| KM | −0.265 * | 0.129 | (−0.518, −0.013) | −0.464 | 0.744 | (−0.993, 1.922) | ||

| SH | 0.455 ** | 0.112 | (0.235, 0.675) | −0.325 | 0.782 | (−1.858, 1.208) | ||

| SJ | 0.380 ** | 0.112 | (0.160, 0.599) | −0.281 | 0.749 | (−1.748, 1.187) | ||

| YC | 0.536 ** | 0.159 | (0.224, 0.848) | −0.885 | 0.785 | (−2.423, 0.653) | ||

| III | 1 | WH | 0.241 | 0.192 | (−0.136, 0.619) | −1.541 * | 0.715 | (−2.942, −0.140) |

| IV | 20 | BJ | 0.065 | 0.117 | (−0.164, 0.294) | −0.371 | 0.686 | (−1.715, 0.973) |

| CC | 0.354 | 0.195 | (−0.028, 0.736) | −1.515 | 0.831 | (−3.144, 0.113) | ||

| CD | 0.044 | 0.137 | (−0.224, 0.311) | −0.736 | 0.676 | (−2.061, 0.590) | ||

| CS | 0.226 | 0.162 | (−0.091, 0.542) | −1.507 | 0.783 | (−3.041, 0.028) | ||

| DL | −0.125 | 0.145 | (−0.410, 0.160) | 0.175 | 0.814 | (−1.420, 1.770) | ||

| GY | 0.228 | 0.179 | (−0.123, 0.579) | −0.523 | 0.745 | (−1.982, 0.937) | ||

| GZ | −0.165 | 0.137 | (−0.433, 0.103) | −0.214 | 0.780 | (−1.742, 1.314) | ||

| HO | 0.075 | 0.118 | (−0.158, 0.307) | 1.336 | 0.777 | (−0.187, 2.860 | ||

| HF | 0.068 | 0.161 | (−0.248, 0.384) | −0.254 | 0.789 | (−1.800, 1.292) | ||

| JN | −0.061 | 0.185 | (−0.425, 0.302) | −0.546 | 0.779 | (−2.072, 0.980) | ||

| LZ | 0.111 | 0.098 | (−0.081, 0.302) | 0.085 | 0.731 | (−1.347, 1.517) | ||

| NC | 0.133 | 0.148 | (−0.156, 0.423) | −0.425 | 0.784 | (−1.962, 1.112) | ||

| NJ | 0.317 | 0.185 | (−0.045, 0.679) | −0.023 | 0.780 | (−1.551, 1.505) | ||

| NN | 0.187 | 0.193 | (−0.191, 0.565) | −0.370 | 0.807 | (−1.952, 1.212) | ||

| QD | −0.221 | 0.160 | (−0.535, 0.093) | −0.127 | 0.810 | (−1.714, 1.459) | ||

| TJ | 0.187 | 0.200 | (−0.204, 0.579) | −0.738 | 0.712 | (−2.134, 0.659) | ||

| TY | 0.161 | 0.164 | (−0.161, 0.483) | −0.674 | 0.691 | (−2.028, 0.680) | ||

| XA | −0.126 | 0.124 | (−0.368, 0.117) | −0.744 | 0.771 | (−2.255, 0.768) | ||

| XN | 0.130 | 0.113 | (−0.091, 0.351) | −0.507 | 0.749 | (−1.974, 0.961) | ||

| ZZ | −0.420 | 0.089 | (−0.217, 0.133) | 1.070 | 0.743 | (−0.385, 2.526) | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Y.; Zhao, D.; Sanderford, A.; Du, J. Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities. Sustainability 2018, 10, 642. https://doi.org/10.3390/su10030642

Jiang Y, Zhao D, Sanderford A, Du J. Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities. Sustainability. 2018; 10(3):642. https://doi.org/10.3390/su10030642

Chicago/Turabian StyleJiang, Yongsheng, Dong Zhao, Andrew Sanderford, and Jing Du. 2018. "Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities" Sustainability 10, no. 3: 642. https://doi.org/10.3390/su10030642

APA StyleJiang, Y., Zhao, D., Sanderford, A., & Du, J. (2018). Effects of Bank Lending on Urban Housing Prices for Sustainable Development: A Panel Analysis of Chinese Cities. Sustainability, 10(3), 642. https://doi.org/10.3390/su10030642