1. Introduction

Measuring the dependence structures of government securities markets is garnering considerable attention from academia as well as from financial institutions, given the continuing expansion of the European Union (EU). In 2004, 10 countries from Central and Eastern Europe and the Mediterranean region joined the EU, which served as a historic step towards unifying Europe after several decades of division that had resulted from the Cold War. In this study, rather than investigating correlations, we propose a new approach to investigate the dependence structures among these countries’ financial markets including the investigation of general correlations as well as tail correlation.

Financial markets become integrated when economies strongly depend on one other. This process not only reduces transaction costs, but also improves the efficiency of information sharing. However, although financial integration increases overall market efficiency, it reduces the diversification benefits available to prospective investors. Thus, investigating the dynamic process of financial integration allows us not only to measure the interdependence of economies, but also to provide useful information for investors.

Here, we propose a new method for evaluating the degree to which the integration processes and risk spillovers in Central and Eastern Europe have evolved over time. To simplify our analysis, we chose Poland, the Czech Republic, and Hungary (termed as the CEEC (Central and Eastern European countries)-3 hereafter) to represent Central and Eastern Europe given that these countries have the largest economies and financial markets in the region as well as the best data availability. To represent the EU, we chose Germany because of its economic background and geographic factors. Therefore, we investigated the differences in the dependence structures of the government securities markets in the CEEC-3 and Germany.

Two types of approaches tend to be used to study dependence structures. The first type includes observation-based methods such as those based on the generalized autoregressive conditional heteroskedasticity (GARCH) framework [

1,

2]. The dynamic conditional correlation (DCC-GARCH)-based approach [

3,

4,

5] and copula-GARCH-based approach [

6,

7,

8] are representative examples. The second type is parameter-based methods. The classical analysis of this type focuses on time-varying parameters, which allows us to better characterize the dynamic correlations in government securities markets by using easy estimations. For example, Pozzi and Wolswijk [

9] employed a linear state space approach to estimate the latent factor decomposition of the excess returns or risk premiums suggested by a standard international capital asset pricing model for government bonds. They found that the government bond markets in the Eurozone under investigation were almost fully integrated by the end of 2006, showing that an important part of the achieved convergence was reversed during 2007–2009. Bekiros [

10] also provided evidence that time-varying parameter models more accurately forecast Eurozone economies than other models.

In this study, we employed a parameter-driven model, namely the generalized autoregressive score (GAS) model, to investigate the dynamic integrated process of European government securities markets. For example, Creal et al. [

11] employed the GAS model to analyze the dynamic correlation between the euro and yen, and between the euro and pound. Meanwhile, Oh and Patton [

12] and Creal and Tsey [

13] provided evidence that the GAS model could be employed with high dimensional copula to investigate the interdependence among different assets. With regard to the topics of the present study, Boubakri and Guillaumin [

14] provided evidence that financial integration was not perfect, but was increasing based on the dynamic correlation of the foreign exchange rate. Furthermore, they also showed that financial contagion occurred during the global financial crisis.

Instead of focusing on the foreign exchange rate, in this study, we investigated the integration of these countries based on interest rates (e.g., bond yields). Moreover, in contrast to the studies of Yang and Hamori [

5,

7,

8] who focused on investigating observations, we computed time-varying parameters. The technique adopted herein was based on the score function of the predictive model density at time

t by incorporating the non-linear property. In addition, in contrast to observation-driven models, the GAS model has the advantage of exploiting the complete density structure rather than only means and higher moments. Furthermore, its applications can be extended to asymmetric, long memory, and other more complicated dynamics without increasing model complexity. Therefore, by employing the GAS framework, we restructured the time-varying copula model to investigate the dynamic integrations of the government securities markets in Eastern Europe.

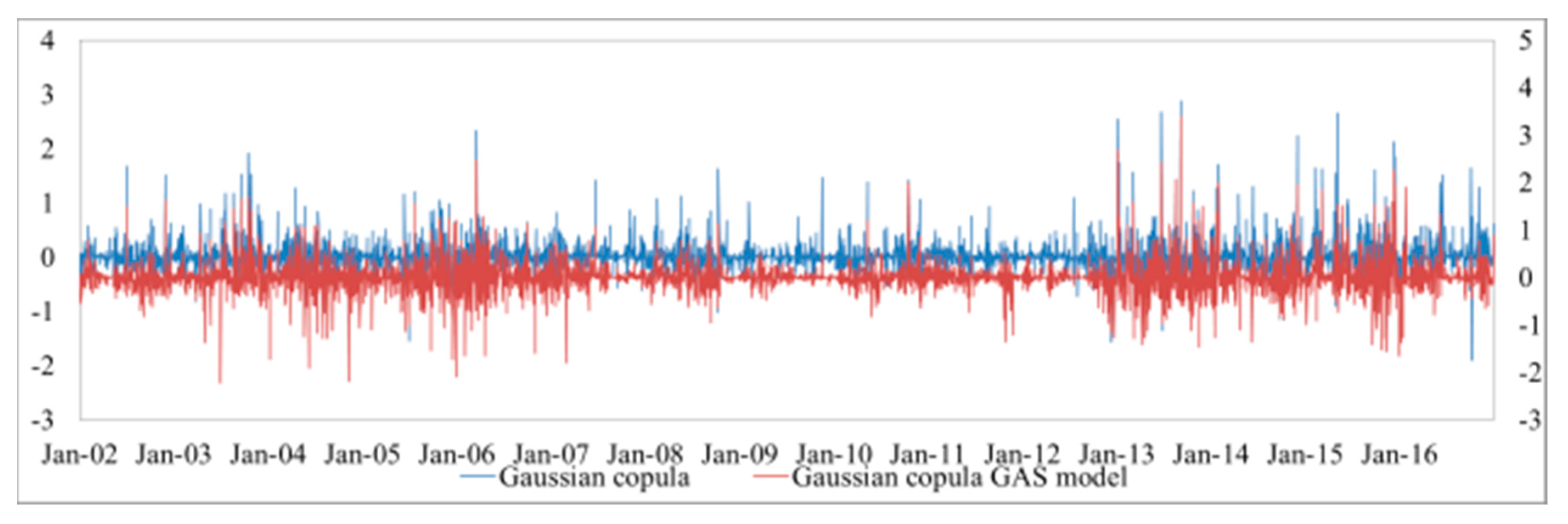

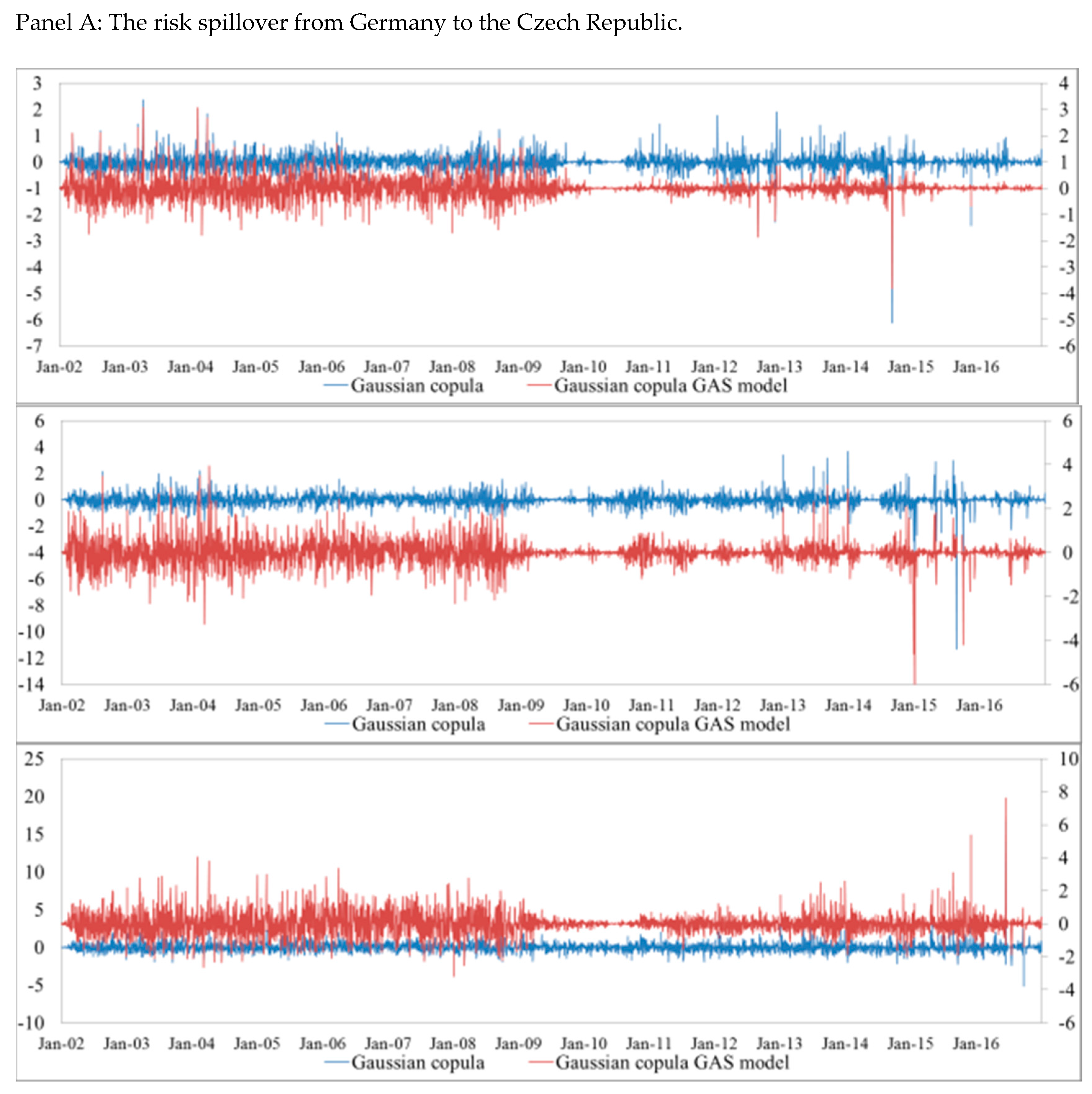

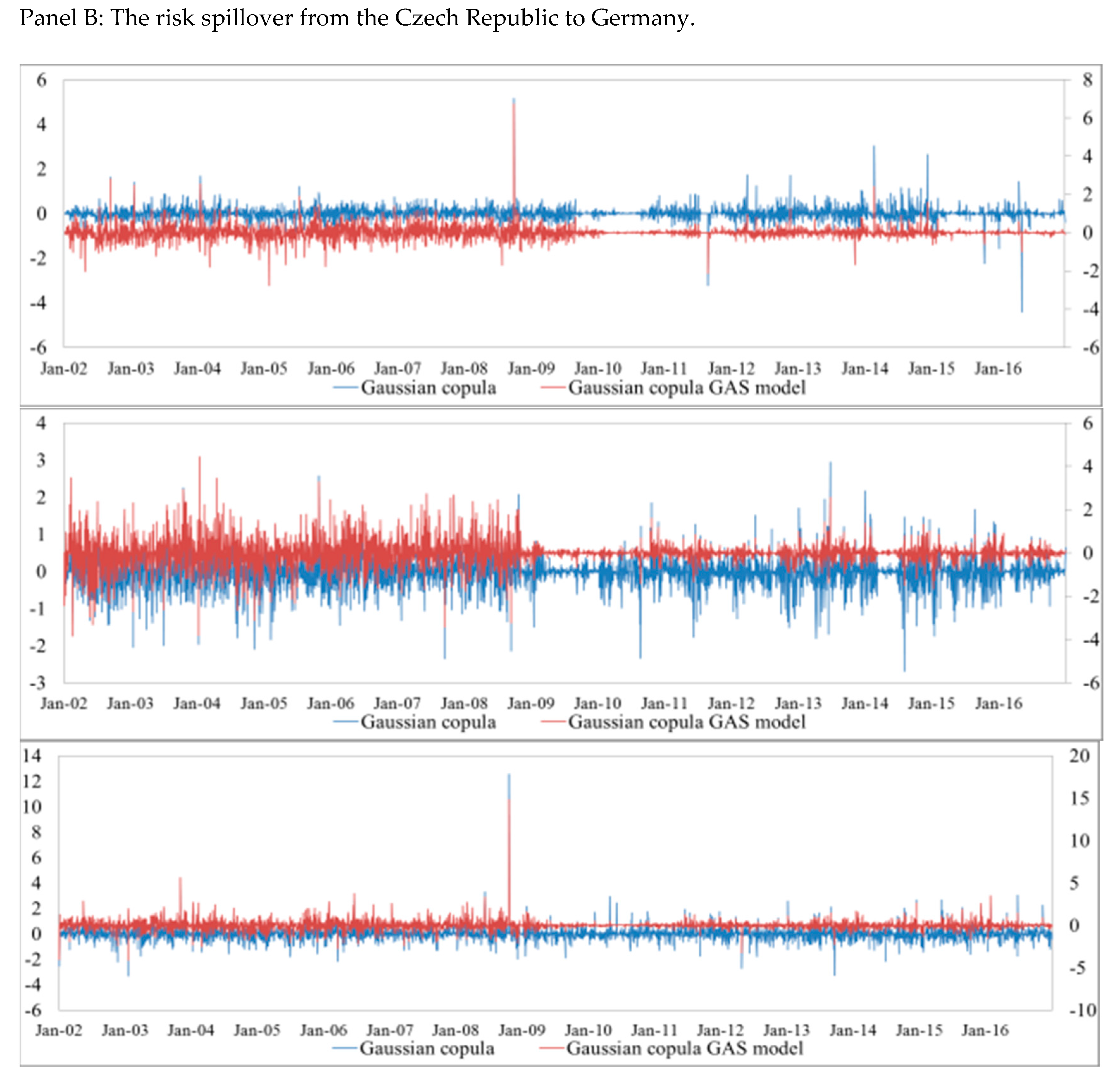

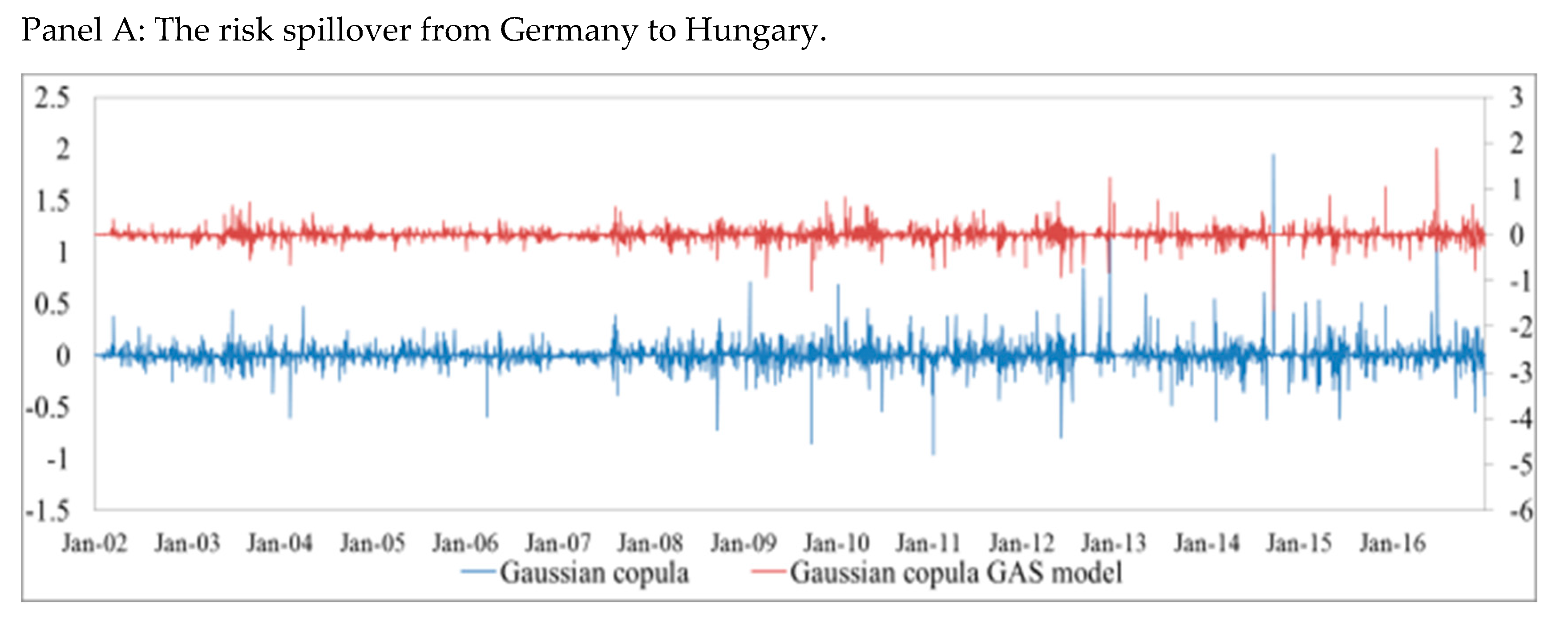

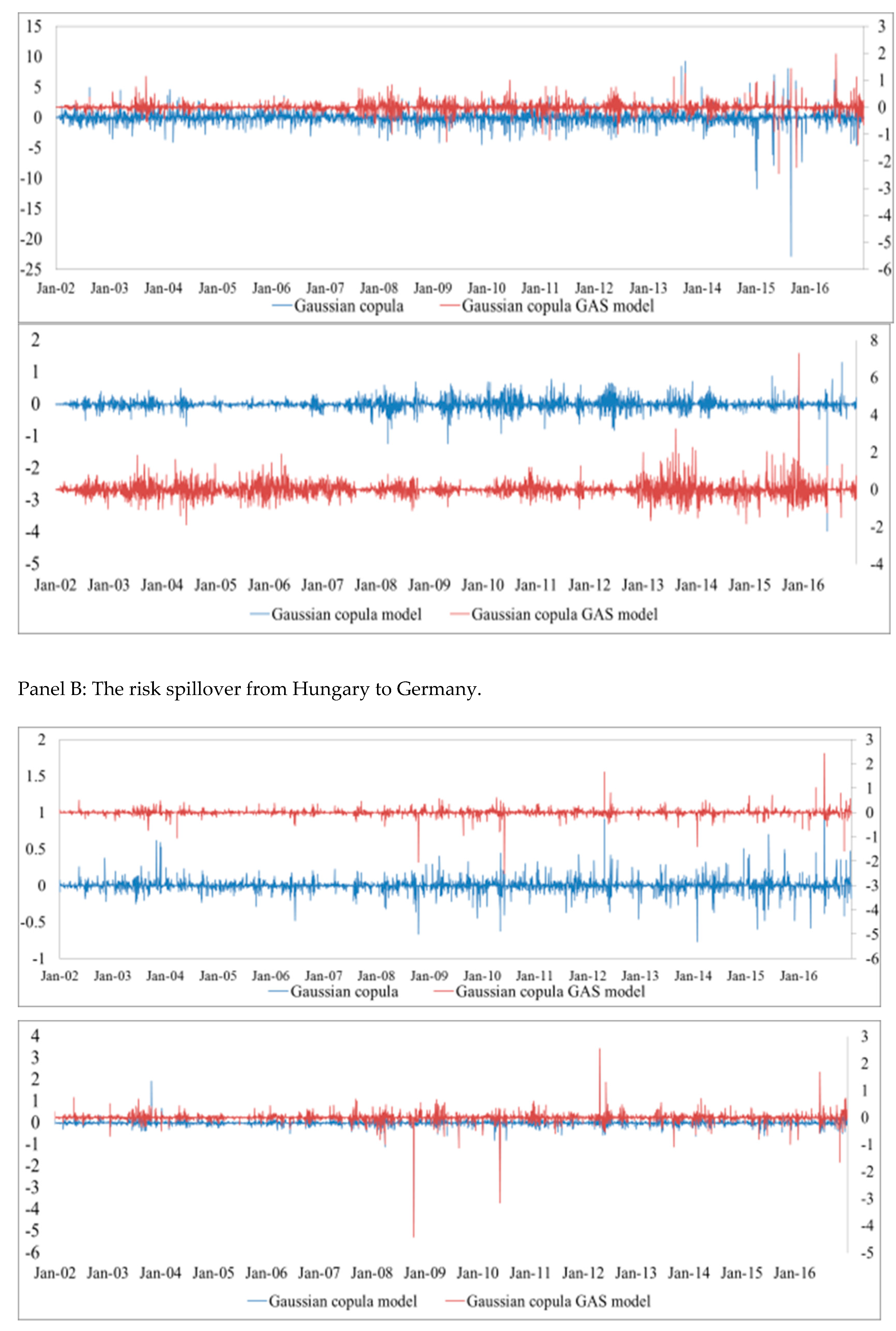

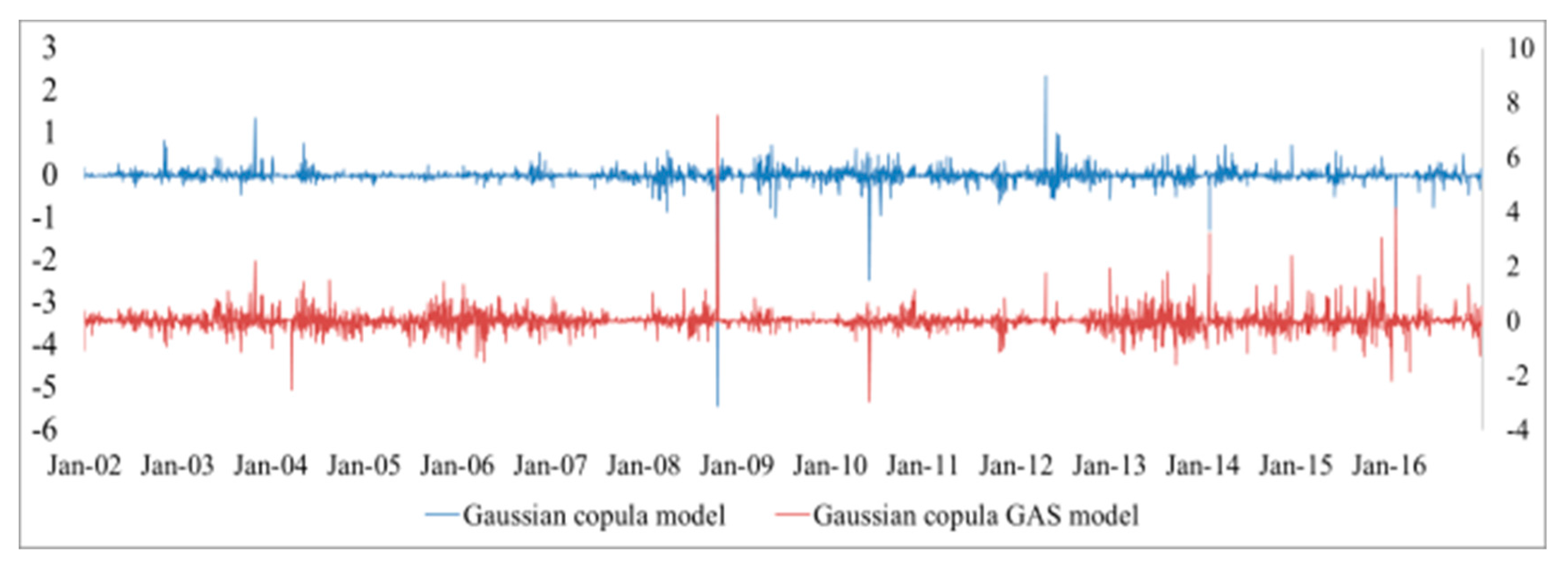

To understand the risk spillover effect between the CEEC-3 and Germany, we employed copulas to compute the conditional value-at-risk (CoVaR) by providing quantitative evidence on the systemic risk spillovers in government securities markets. Furthermore, we evaluated how the deteriorating financial position of a sovereign market could impair the performance of other government securities markets during a crisis. In particular, we used the CoVaR measures originally proposed by Adrian and Brunnermeier [

15] and generalized by Girardi and Ergün [

16], which allowed us to capture the possible risk spillovers between markets by providing information on the value-at-risk (VaR) of a market, conditional on the fact that another market is in financial distress.

By adopting a two-step procedure, we easily obtained the value of the CoVaR. In the first step, we computed the cumulative probability of the CoVaR from a copula function by assuming the cumulative probability of the VaR of the market in financial distress, and the confidence level of the CoVaR. In the second step, we obtained the value of the CoVaR by inverting the marginal distribution function for this cumulative probability. Moreover, by employing GAS specifications, we obtained more sensitive information on the risk spillover effect in the government securities markets of the CEEC-3 and Germany.

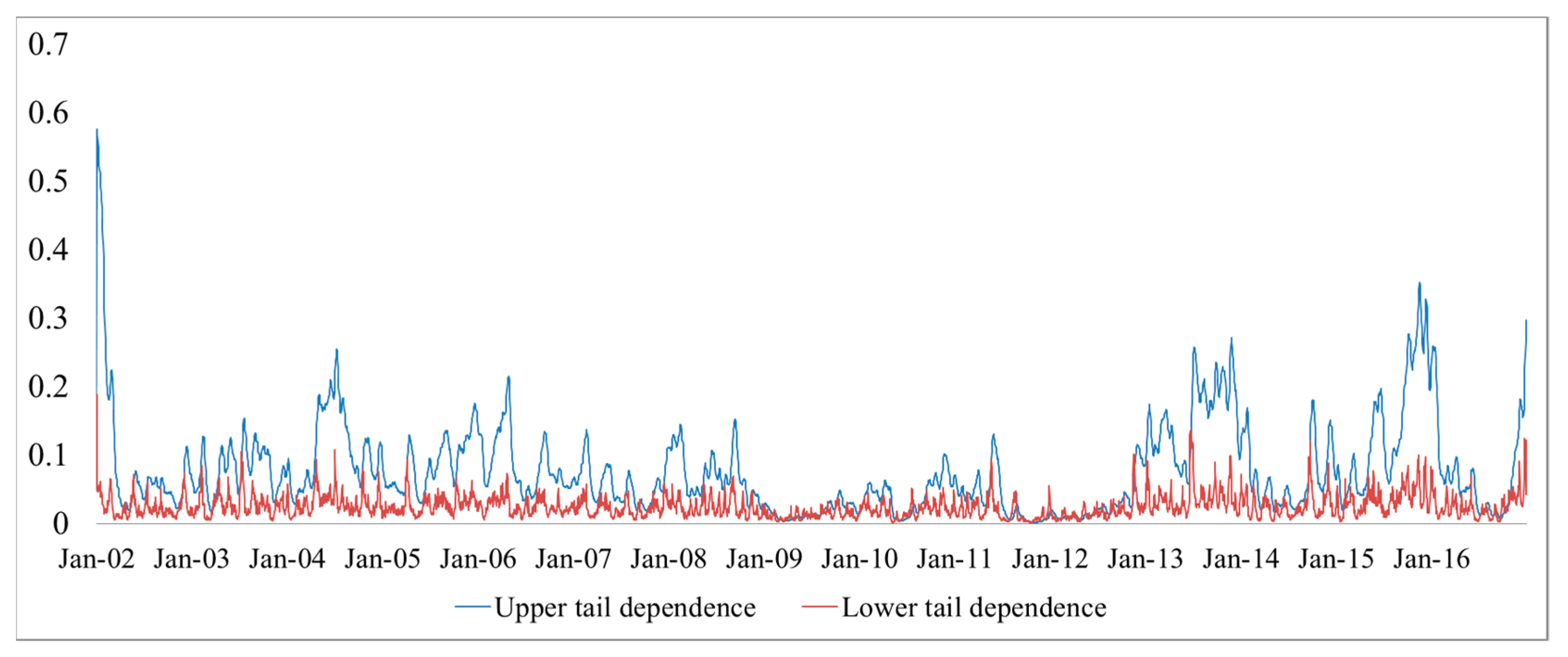

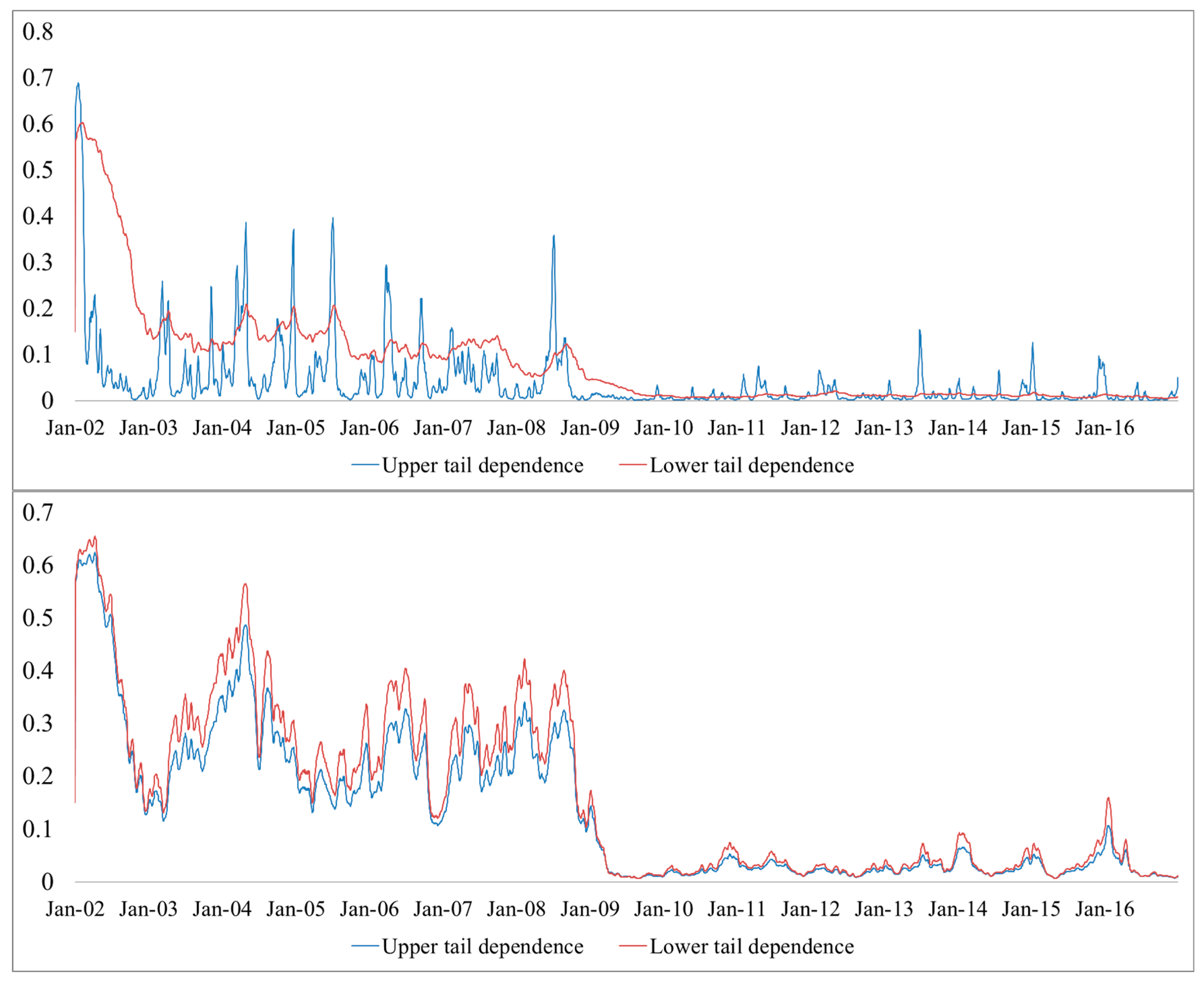

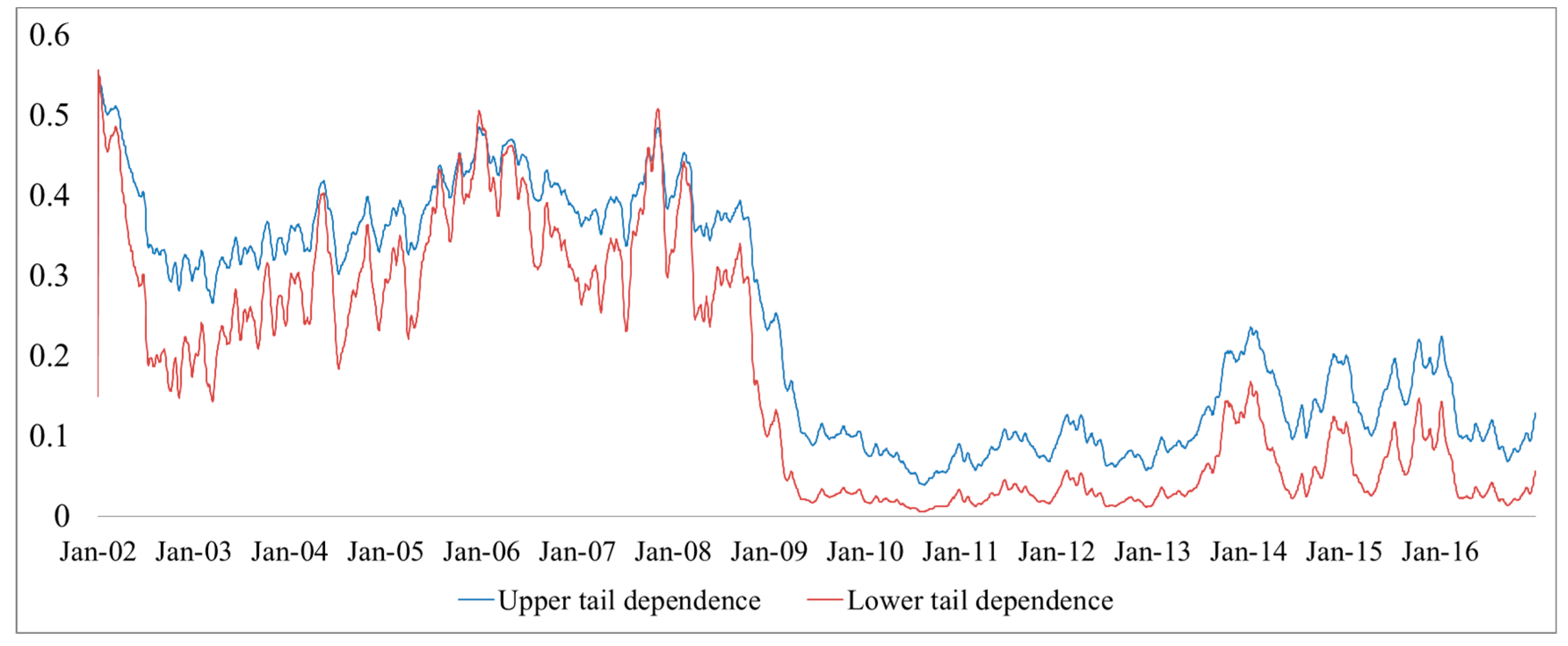

Our contributions to the body of knowledge are threefold. First, we provide more specific details on the dependence across different maturities when compared with previous studies. Second, we implemented a new approach (i.e., the GAS-based dynamic Gaussian copula) to investigate the dynamic correlations among these markets, which can provide us with more sensitive correlations to the structural changes. This approach allowed us to analyze how the degree of dependence changed according to major market events, namely the EU accession (2004), the global financial crisis (2008), and the European debt crisis (2012). Third, we compared and contrasted the risk spillover effect in the government securities markets of the CEEC-3 and Germany by employing both the Gaussian copula model and the Gaussian copula GAS model. Finally, we employed the Symmetrized Joe-Clayton copula (SJC copula; [

17]) to investigate the tail dependence of these markets and compared them with the results from the GAS-based model to verify the robustness of the results.

The remainder of this article is organized as follows.

Section 2 discusses the copulas and verifies the time-varying dependence structure.

Section 3 describes the data and statistical issues.

Section 4 provides the empirical results and

Section 5 concludes.

3. Data

To investigate the dependence of the CEEC-3 and Germany across maturities, we employed 3-month, 1-year, 3-year, 5-year, and 10-year government bond yields based on a daily frequency. In particular, we focused on 3-year, 5-year, and 10-year government bond yields and omitted 3-month and 1-year government bond yields due to the availability of data and empirical results. For instance, the short-term interest rate for 3-month and 1-year yields cannot model the stable dynamic correlation between Hungary and Germany since the estimation procedure does not converge. Thus, the data on 3-month and 1-year yields did not fit the model well as there were too many poorly fitting observations. Moreover, the marginal distribution for Poland was not well specified since the GARCH process was hardly justified.

The sample period ran from 1 January 2002 to 31 December 2016. The total dataset was comprised of 3914 valid observations. In all cases, bond returns were calculated as the first differences of the logs of yields.

Table 1 reports the descriptive statistics of the return series. Particularly, we witnessed the increasing of interest rate for the CEEC-3 countries across the different term structures during our sample periods. In addition, the negative returns of the bond yields also indicated the bad credit environment in the CEEC-3 countries where investors require higher nominal interests. The reason may be due to the saving-investment imbalance with other developed countries such as Germany, whose mean return for ten-year bond yield was still positive. Compared to Germany, the CEEC-3 countries have to deal with their debt problem. For example, the government of Hungary faces a great fiscal deficit and struggles to solve its debt problem. The results of the Jarque–Bera (JB) test showed that the null hypothesis of the normal distribution was rejected in all cases.

5. Conclusions

In this study, we investigated the dependence of the government securities markets in the CEEC-3 and Germany across maturities by employing the GAS-based dynamic Gaussian copula model. We found a high dependence of these government securities markets in the long maturity, but low dependence in the short maturity. In addition, the Czech Republic showed the highest dependence with Germany, while Hungary showed the lowest. Consistent with the findings of Pozzi and Wolswijk [

9], by employing the breakpoint test, we also confirmed that EU accession, the global financial crisis, and the European debt crisis caused structural changes in the dynamic correlation.

Furthermore, by employing the ΔCoVaR risk measure, we observed that the German systemic risk was low and relatively stable, while the CEEC-3 systemic risk was high and variant. By considering different time horizons, we showed that the long-run bond ΔCoVaR was higher than the short-run bond ΔCoVaR. This evidence on the systemic risk dynamics shows that the crisis not only had spillover effects on countries with weak economic fundamentals (e.g., Hungary, which has the highest systemic risk), but also had contagion effects for both the CEEC-3 and Germany.

We also employed the SJC copula to examine the dynamic tail dependence among these countries. By comparing and contrasting the results from the dynamic Gaussian copula, we found that both positive and negative news from Germany significantly affected dependence with the Czech Republic, with the former having a larger influence than the latter. These results also showed that the dependence structure between the CEEC-3 and Germany was asymmetric. In addition, we confirmed that the Czech Republic showed the highest dependence with Germany and that financial contagion occurred during the global financial crisis and European debt crisis.

Our results have at least one implication for policymakers and two implications for investors. For policymakers, although the integration of the financial markets in the CEEC-3 has decreased since 2008 owing to market segmentation, becoming an EU member has increased the degree of dependence with European financial markets. For investors, diversification benefits still exist, especially since the global financial crisis. In addition, the dynamic correlations for these countries are more sensitive to positive shocks, indicating that government securities markets remain a good investment, even during a crisis period. Additionally, the risk spillovers from the German government securities market may not be a large concern when compared with those from the CEEC-3 countries.