The Role of the Eco-Industrial Park (EIP) at the National Economy: An Input-Output Analysis on Korea

Abstract

1. Introduction

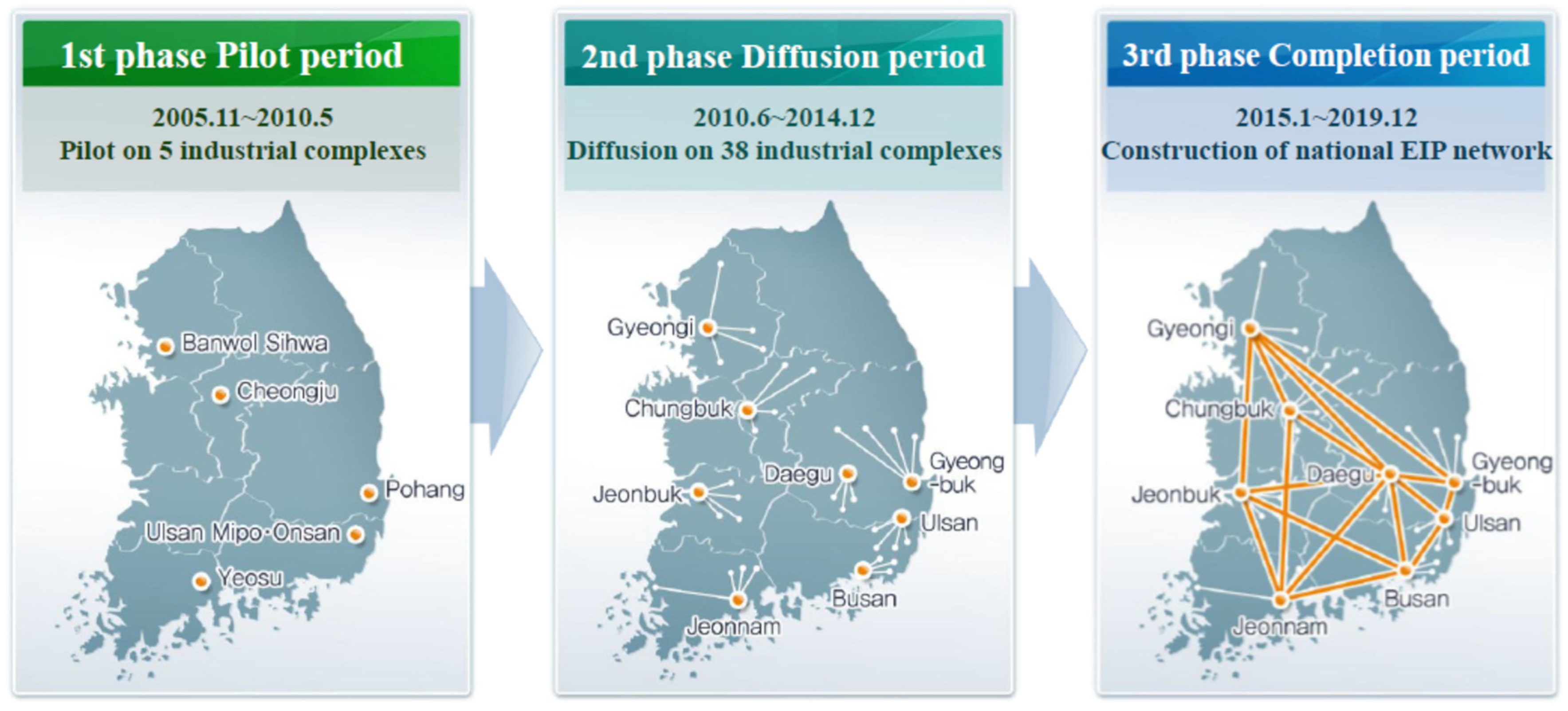

2. Overview on Korea’s National EIP Program

3. Methodology

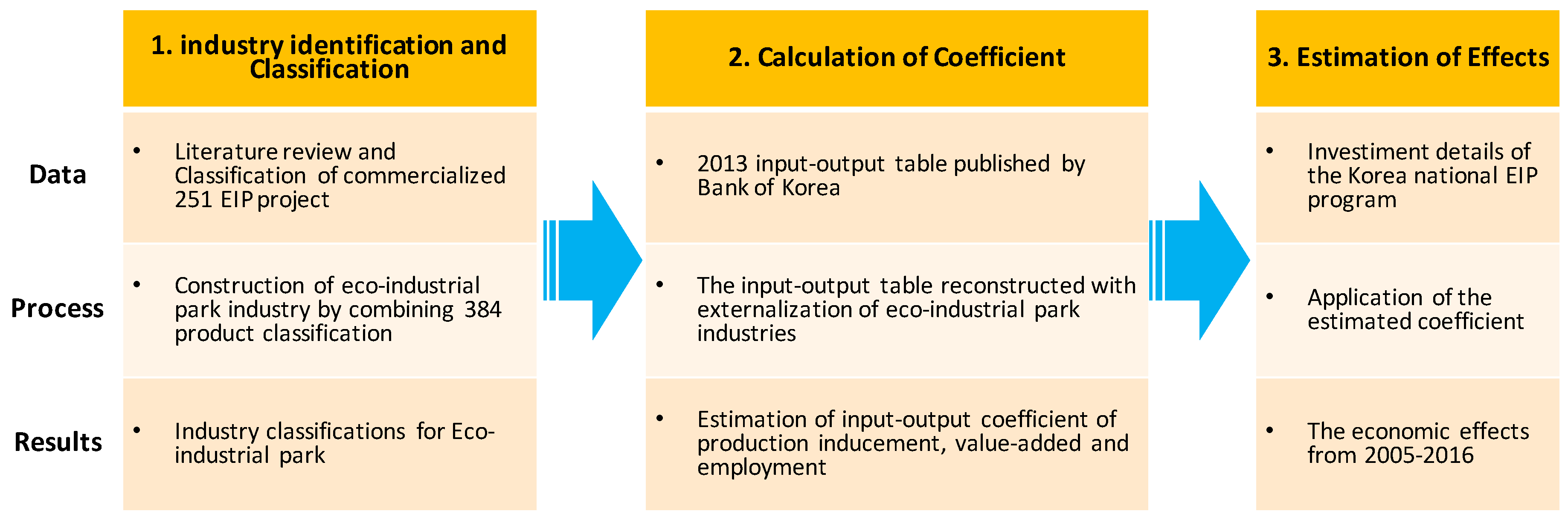

- Firstly, the eco-industrial park industry was externalized based on the literature and classification of 251 reported commercialized EIP projects.

- Secondly, input-output coefficients and inducement coefficients for production, value-added, and employment were calculated by reconstructing the input-output table with externalization of the eco-industry park industry.

- Thirdly, the effect of investment for eco-industry park was analyzed based on the calculated coefficients, and estimated the impact with the actual investment data available.

3.1. EIP Industry Identification and Sector Integration

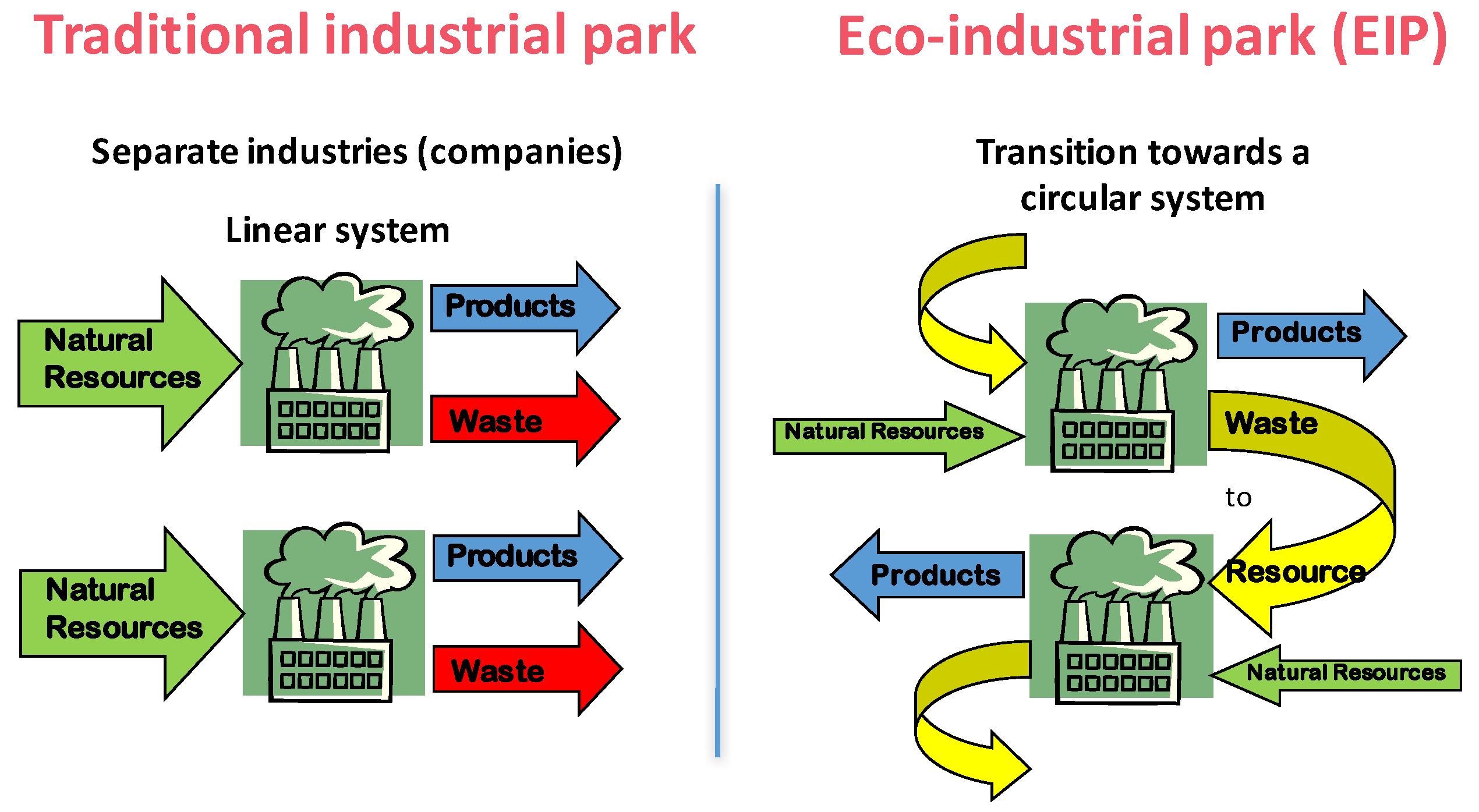

3.1.1. EIP Definition and Relationship to the National Economic System

3.1.2. Sector Integration Scheme for EIP Industries

3.2. Calculation of EIP Sector Related Coefficient and Evaluation on the Economic Impacts

3.2.1. Demand-Driven Model

3.2.2. Supply-Driven Model

3.2.3. Leontief Price Model

4. Results and Discussions

4.1. Inducement Effects for Production, Value-Added, and Employment

4.2. Inter-Industry Linkage Effect

4.3. Sectoral Supply Shortage Effect

4.4. Pervasive Effect of Price Change

5. Conclusions and Policy Implications

5.1. Main Findings and Conclusions

5.2. Implications

- Our results reveal that there are actual forward and backward linkage effects between the EIP sector and other economic sectors. However, current EIP evaluation indicators are actually focused on material flow analysis-based indicators (environmental performance), such as direct pollutant mitigation and resource conservation effects, which lack an identification on such economic push and pull effects. A better investigation on this issue can be good incentives for more companies to engage in the industrial symbiosis and hereby support a better EIP construction, e.g., future EIP evaluation indicators can reflect that the future trajectory of EIP development puts stronger emphasis on industrial symbiotic links.

- The IOA approach was approved to be an effective tool to quantify such economic effects of EIP promotion, while the knowledge is not well included into the national economy accounting system. Hence it is suggested to reform the current system (e.g., current sector classification cannot reflect such business innovation) to better present the cost-benefits of such environmentally-oriented business innovation, so that the policy-makers can read more clear market response signals of EIP promotion. By doing so, it will help top designers to incorporate EIP into national economic system planning.

- Finally, Korea has done well on EIP project commercialization, while, for most countries, EIP is still a pure environmental innovation. Hence the knowledge of this paper is hoped to forward a mind change to treat industrial symbiosis and EIP as an environmental, as well as a business, innovation, which enables changing the perception of industries and create new business values via the whole supply chain. Based on such perceptions, more market-oriented incentives can be designed to support EIP promotion.

5.3. Research Limitations and Future Concerns

Supplementary Materials

Author Contributions

Funding

References

- Kharrazi, A.; Qin, H.; Zhang, Y. Urban Big Data and Sustainable Development Goals: Challenges and Opportunities. Sustainability 2016, 8, 1293. [Google Scholar] [CrossRef]

- Rodić, L.; Wilson, C.D. Resolving Governance Issues to Achieve Priority Sustainable Development Goals Related to Solid Waste Management in Developing Countries. Sustainability 2017, 9, 404. [Google Scholar] [CrossRef]

- Dong, J.F.; Wang, Q.; Deng, C.; Wang, X.M.; Zhang, X.L. How to Move China toward a Green-Energy Economy: From a Sector Perspective. Sustainability 2016, 8, 337. [Google Scholar] [CrossRef]

- Dong, L.; Fujita, T.; Zhang, H.; Dai, M.; Fujii, M.; Ohnishi, S.; Geng, Y.; Liu, Z. Promoting low-carbon city through industrial symbiosis: A case in China by applying HPIMO model. Energy Policy 2013, 61, 864–873. [Google Scholar] [CrossRef]

- Mattoni, B.; Gugliermetti, F.; Bisegna, F. A multilevel method to assess and design the renovation and integration of Smart Cities. Sustain. Cities Soc. 2015, 15, 105–119. [Google Scholar] [CrossRef]

- Dong, L.; Fujita, T.; Dai, M.; Geng, Y.; Ren, J.; Fujii, M.; Wang, Y.; Ohnishi, S. Towards preventative eco-industrial development: an industrial and urban symbiosis case in one typical industrial city in China. J. Clean. Prod. 2016, 114, 387–400. [Google Scholar] [CrossRef]

- Wells, P.; Zapata, C. Renewable Eco-industrial Development. J. Ind. Ecol. 2012, 16, 665–668. [Google Scholar] [CrossRef]

- Martín Gómez, A.M.; Aguayo González, F.; Marcos Bárcena, M. Smart eco-industrial parks: A circular economy implementation based on industrial metabolism. Resour. Conserv. Recycl. 2018, 135, 58–69. [Google Scholar] [CrossRef]

- Pai, J.-T.; Hu, D.; Liao, W.-W. Research on eco-efficiency of industrial parks in Taiwan. Energy Procedia 2018, 152, 691–697. [Google Scholar] [CrossRef]

- Susur, E.; Hidalgo, A.; Chiaroni, D. A strategic niche management perspective on transitions to eco-industrial park development: A systematic review of case studies. Resour. Conserv. Recycl. 2019, 140, 338–359. [Google Scholar] [CrossRef]

- Dong, L.; Dai, M.; Liang, H.; Zhang, N.; Mancheri, N.; Ren, J.; Dou, Y.; Hu, M. Material flows and resource productivity in China, South Korea and Japan from 1970 to 2008: A transitional perspective. J. Clean. Prod. 2017, 141, 1164–1177. [Google Scholar] [CrossRef]

- Kim, H.-W.; Dong, L.; Choi, A.E.S.; Fujii, M.; Fujita, T.; Park, H.-S. Co-benefit potential of industrial and urban symbiosis using waste heat from industrial park in Ulsan, Korea. Resour. Conserv. Recycl. 2018, 135, 225–234. [Google Scholar] [CrossRef]

- Dong, L.; Liang, H.; Zhang, L.; Liu, Z.; Gao, Z.; Hu, M. Highlighting regional eco-industrial development: Life cycle benefits of an urban industrial symbiosis and implications in China. Ecol. Model. 2017, 361, 164–176. [Google Scholar] [CrossRef]

- Dong, L.; Wang, Y.; Scipioni, A.; Park, H.-S.; Ren, J. Recent progress on innovative urban infrastructures system towards sustainable resource management. Resour. Conserv. Recycl. 2018, 128, 355–359. [Google Scholar] [CrossRef]

- Herczeg, G.; Akkerman, R.; Hauschild, M.Z. Supply chain collaboration in industrial symbiosis networks. J. Clean. Prod. 2018, 171, 1058–1067. [Google Scholar] [CrossRef]

- Berkel, R.V.; Fujita, T.; Hashimoto, S.; Fujii, M. Quantitative Assessment of Urban and Industrial Symbiosis in Kawasaki, Japan. Environ. Sci. Technol. 2009, 43, 1271–1281. [Google Scholar] [CrossRef]

- Dong, L.; Gu, F.; Fujita, T.; Hayashi, Y.; Gao, J. Uncovering opportunity of low-carbon city promotion with industrial system innovation: Case study on industrial symbiosis projects in China. Energy Policy 2014, 65, 388–397. [Google Scholar] [CrossRef]

- Shi, L.; Yu, B. Eco-Industrial Parks from Strategic Niches to Development Mainstream: The Cases of China. Sustainability 2014, 6, 6325–6331. [Google Scholar] [CrossRef]

- Taddeo, R.; Simboli, A.; Ioppolo, G.; Morgante, A. Industrial Symbiosis, Networking and Innovation: The Potential Role of Innovation Poles. Sustainability 2017, 9, 169. [Google Scholar] [CrossRef]

- Dou, Y.; Luo, X.; Dong, L.; Wu, C.; Liang, H.; Ren, J. An empirical study on transit-oriented low-carbon urban land use planning: Exploratory Spatial Data Analysis (ESDA) on Shanghai, China. Habitat Int. 2016, 53, 379–389. [Google Scholar] [CrossRef]

- Lombardi, D.R.; Laybourn, P. Redefining Industrial Symbiosis. J. Ind. Ecol. 2012, 16, 28–37. [Google Scholar] [CrossRef]

- Mannino, I.; Ninka, E.; Turvani, M.; Chertow, M. The decline of eco-industrial development in Porto Marghera, Italy. J. Clean. Prod. 2015, 100, 286–296. [Google Scholar] [CrossRef]

- de Jong, M.; Joss, S.; Schraven, D.; Zhan, C.; Weijnen, M. Sustainable–smart–resilient–low carbon–eco–knowledge cities; making sense of a multitude of concepts promoting sustainable urbanization. J. Clean. Prod. 2015, 109, 25–38. [Google Scholar] [CrossRef]

- Geng, Y.; Fujita, T.; Park H-s Chiu, A.S.F.; Huisingh, D. Recent progress on innovative eco-industrial development. J. Clean. Prod. 2015, 114, 1–10. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: the expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2015, 114, 11–32. [Google Scholar] [CrossRef]

- Martin, M.; Harris, S. Prospecting the sustainability implications of an emerging industrial symbiosis network. Resour. Conserv. Recycl. 2018, 138, 246–256. [Google Scholar] [CrossRef]

- Pilouk, S.; Koottatep, T. Environmental performance indicators as the key for eco-industrial parks in Thailand. J. Clean. Prod. 2017, 156, 614–623. [Google Scholar] [CrossRef]

- Afshari, H.; Farel, R.; Peng, Q. Challenges of value creation in Eco-Industrial Parks (EIPs): A stakeholder perspective for optimizing energy exchanges. Resour. Conserv. Recycl. 2018, 139, 315–325. [Google Scholar] [CrossRef]

- Bellantuono, N.; Carbonara, N.; Pontrandolfo, P. The organization of eco-industrial parks and their sustainable practices. J. Clean. Prod. 2017, 161, 362–375. [Google Scholar] [CrossRef]

- Fang, K.; Dong, L.; Ren, J.; Zhang, Q.; Han, L.; Fu, H. Carbon footprints of urban transition: Tracking circular economy promotions in Guiyang, China. Ecol. Model. 2017, 365, 30–44. [Google Scholar] [CrossRef]

- Lee, M.K.; Yoo, S.H. The role of the capture fisheries and aquaculture sectors in the Korean national economy: An input–output analysis. Mar. Policy 2014, 44, 448–456. [Google Scholar] [CrossRef]

- Chiu, R.H.; Lin, Y.C. Applying input-output model to investigate the inter-industrial linkage of transportation industry in Taiwan. J. Mar. Sci. Technol. 2012, 20, 173–186. [Google Scholar]

- Kim, K.; Jung, J.K.; Choi, J. Impact of the Smart City Industry on the Korean National Economy: Input-Output Analysis. Sustainability 2016, 8, 649. [Google Scholar] [CrossRef]

- Giljum, S.; Dittrich, M.; Lieber, M.; Lutter, S. Global Patterns of Material Flows and their Socio-Economic and Environmental Implications: A MFA Study on All Countries World-Wide from 1980 to 2009. Resources 2014, 3, 319–339. [Google Scholar] [CrossRef]

- Schandl, H.; West, J. Material Flows and Material Productivity in China, Australia, and Japan. J. Ind. Ecol. 2012, 16, 352–364. [Google Scholar] [CrossRef]

- Jung, S.; Dodbiba, G.; Song, H.C.; Fujita, T. A novel approach for evaluating the performance of eco-industrial park pilot projects. J. Clean. Prod. 2013, 39, 50–59. [Google Scholar] [CrossRef]

- Ko, S.C. Eco-Industrial Park (EIP) Initiatives Toward Green Growth: Lessons from Korean Experience; Springer: London, UK, 2014. [Google Scholar]

- Park, H.S.; Rene, E.R.; Choi, S.M.; Chiu, A.S. Strategies for sustainable development of industrial park in Ulsan, South Korea—From spontaneous evolution to systematic expansion of industrial symbiosis. J. Environ. Manag. 2008, 87, 1–13. [Google Scholar] [CrossRef]

- Park, J.M.; Park, J.Y.; Park, H.S. A review of the National Eco-Industrial Park Development Program in Korea: progress and achievements in the first phase, 2005–2010. J. Clean. Prod. 2016, 114, 33–44. [Google Scholar] [CrossRef]

- Heo, J.Y.; Yoo, S.H.; Kwak, S.J. The Role of the Oil Industry in the Korean National Economy: An Input-Output Analysis. Energy Sources Part B Econ. Plan. Policy 2010, 5, 327–336. [Google Scholar] [CrossRef]

- Yoo, S.H.; Yoo, T.H. The role of the nuclear power generation in the Korean national economy: An input–output analysis. Prog. Nucl. Energy 2009, 51, 86–92. [Google Scholar] [CrossRef]

- Ghosh, A. Input-Output Approach in an Allocation System. Economica 1958, 25, 58–64. [Google Scholar] [CrossRef]

- Wu, R.H.; Chen, C.Y. On the application of input-output analysis to energy issues. Energy Econ. 1990, 12, 71–76. [Google Scholar] [CrossRef]

- Hirschman, A.O. The Strategy of Economic Development; Yale University Press: New Haven, CT, USA, 1958. [Google Scholar]

- Jones, L.P. The Measurement of Hirschmanian Linkages. Q. J. Econ. 1976, 90, 323–333. [Google Scholar] [CrossRef]

- Oosterhaven, J. Leontief versus Ghoshian Price and Quantity Models. South. Econ. J. 1996, 62, 750–759. [Google Scholar] [CrossRef]

| Year | IS Project Proposal (No) | Feasibility Support (No) | Participating Firms (No) | Feasibility Completion (No) | Commercialization and In Operation (No) | Success Ratio (%) |

|---|---|---|---|---|---|---|

| 2005 | 22 | 22 | 90 | - | - | - |

| 2006 | 43 | 18 | 112 | 2 | - | - |

| 2007 | 35 | 24 | 160 | 5 | 1 | 14.3 |

| 2008 | 22 | 17 | 81 | 10 | 2 | 17.6 |

| 2009 | 53 | 35 | 150 | 31 | 10 | 27.1 |

| 2010 | 61 | 39 | 126 | 23 | 17 | 42.2 |

| 2011 | 72 | 44 | 203 | 48 | 20 | 42.0 |

| 2012 | 79 | 52 | 217 | 40 | 33 | 52.2 |

| 2013 | 65 | 45 | 143 | 46 | 35 | 57.6 |

| 2014 | 69 | 41 | 161 | 57 | 41 | 60.7 |

| 2015 | 74 | 51 | 182 | 41 | 38 | 65.0 |

| 2016 | 60 | 48 | 206 | 52 | 38 | 66.2 |

| Total | 655 | 436 | 1831 | 355 | 235 | 66.2 |

| Unit | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Projects (in operation) | Number | 1 | 3 | 13 | 30 | 50 | 83 | 118 | 159 | 197 | 235 | |

| 1st | By-products | ton | 0 | 38 | 154 | |||||||

| 1st | Energy | toe | 4 | 27 | 72 | |||||||

| 1st | Wastewater | ton | 0 | 0 | 37 | |||||||

| 1st | CO2 | ton CO2eq | 12 | 73 | 184 | |||||||

| 2nd | By-products | ton | 501 | 930 | 1713 | 2541 | 3635 | |||||

| 2nd | Energy | toe | 169 | 302 | 491 | 734 | 992 | |||||

| 2nd | Wastewater | ton | 0 | 110 | 168 | 216 | 36,774 | |||||

| 2nd | CO2 | ton CO2eq | 442 | 564 | 916 | 1107 | 1406 | |||||

| 3rd | By-products | ton | 5213 | 6849 | ||||||||

| 3rd | Energy | toe | 1347 | 1731 | ||||||||

| 3rd | Wastewater | ton | 36,790 | 36,791 | ||||||||

| 3rd | CO2 | ton CO2eq | 1778 | 2058 | ||||||||

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|

| Projects (in operation), A | 1 | 3 | 13 | 30 | 50 | 83 | 118 | 159 | 197 | 235 |

| Economic benefits, B = C + D (B/A) | 3.9 (3.9) | 19.5 (6.5) | 73.2 (5.6) | 186.9 (6.2 | 357.8 (7.2) | 614.9 (7.4) | 926.4 (7.9) | 1331.1 (8.4) | 1848.1 (9.4) | 2422.6 (10.3) |

| Cost savings, C | 2.9 | 10.3 | 38.6 | 94.5 | 166.3 | 263.2 | 394.1 | 554.3 | 745.7 | 943.2 |

| Revenue, D | 1.0 | 9.2 | 34.7 | 92.5 | 191.5 | 351.7 | 532.3 | 776.7 | 1102.4 | 1479.4 |

| Investments, E (B/E) | 0.9 (4.3) | 7.9 (2.5) | 60.7 (1.2) | 119.9 (1.6) | 167.7 (2.1) | 259.1 (2.4) | 376.4 (2.5) | 591.2 (2.3) | 623.6 (3.0) | 761.3 (3.2) |

| Codes | Sectors | Codes | Sectors | Codes | Sectors |

|---|---|---|---|---|---|

| 01 | Agricultural, Forest, and Fishery Products | 11 | Machinery and Equipment | 21 | Food Services and Accommodation |

| 02 | Mined and Quarried Products | 12 | Electronic and Electrical Equipment | 22 | Communications and Broadcasting Services |

| 03 | Food and Beverages Products | 13 | Precision Instruments | 23 | Finance and Insurance Services |

| 04 | Textile and Leather Products | 14 | Transportation Equipment | 24 | Real Estate and Leasing |

| 05 | Wood and Paper Products, Printing | 15 | Other Manufactured Products and Outsourcing | 25 | Professional, Scientific, and Technical Services |

| 06 | Coal and Petroleum Products | 16 | Electricity, Gas and Steam | 26 | Business Support Services |

| 07 | Chemical Products | 17 | Water Supply, Waste and Remediation Service | 27 | Public Administration and Defense |

| 08 | Non-metallic Mineral Products | 18 | Construction | 28 | Educational Services |

| 09 | Primary Metal Products | 19 | Wholesale and Retail Trade | 29 | Health and Social Welfare Services |

| 10 | Metal Products | 20 | Transportation | 30 | Cultural and Other Services |

| - | - | - | - | 31 | Eco-industrial park products and services |

| Effects | Model Equation | Content |

|---|---|---|

| Production inducement | represents the emission variation of the other sectors with except of sector H, is the Leontief inverse matrix of reduced input coefficient matrix, with elimination of the row and column of sector H, denotes a column vector except for an element of sector H, identifies the scalar of the change in the sectorial gross output of H | |

| Value-added inducement | represents the value-added of the other sectors with except of sector H, represents the matrix of reduced diagonal matrix of value-added coefficient upon eliminating the row and column of sector H | |

| Employment inducement | represents the number of employees for each sector expect for sector H, represents the variation, represents the matrix of a reduced diagonal matrix of employment coefficient upon eliminating the row and column of sector H |

| Codes | Sectors | Inducing effect | |||||

|---|---|---|---|---|---|---|---|

| Production | Value-Added | Employment | |||||

| (KRW) | Ranks | (KRW) | Ranks | (Person/billion KRW) | Ranks | ||

| 001 | Agricultural, Forest, and Fishery Products | 0.0112 | 15 | 0.0061 | 10 | 0.2947 | 3 |

| 002 | Mined and Quarried Products | 0.0042 | 25 | 0.0024 | 20 | 0.0142 | 21 |

| 003 | Food and Beverages Products | 0.0114 | 14 | 0.0018 | 23 | 0.0286 | 19 |

| 004 | Textile and Leather Products | 0.0104 | 17 | 0.0024 | 21 | 0.0453 | 14 |

| 005 | Wood and Paper Products, Printing | 0.0122 | 13 | 0.0032 | 18 | 0.0479 | 13 |

| 006 | Coal and Petroleum Products | 0.0717 | 2 | 0.0049 | 13 | 0.0036 | 29 |

| 007 | Chemical Products | 0.1368 | 1 | 0.0270 | 2 | 0.0563 | 11 |

| 008 | Non-metallic Mineral Products | 0.0060 | 22 | 0.0017 | 24 | 0.0118 | 24 |

| 009 | Primary Metal Products | 0.0626 | 3 | 0.0097 | 6 | 0.0490 | 12 |

| 010 | Metal Products | 0.0151 | 8 | 0.0046 | 14 | 0.0377 | 16 |

| 011 | Machinery and Equipment | 0.0142 | 11 | 0.0040 | 16 | 0.0443 | 15 |

| 012 | Electronic and Electrical Equipment | 0.0089 | 20 | 0.0024 | 22 | 0.0132 | 22 |

| 013 | Precision Instruments | 0.0026 | 26 | 0.0008 | 27 | 0.0095 | 26 |

| 014 | Transportation Equipment | 0.0055 | 23 | 0.0012 | 25 | 0.0111 | 25 |

| 015 | Other Manufactured Products and Outsourcing | 0.0148 | 9 | 0.0061 | 9 | 0.1072 | 8 |

| 016 | Electricity, Gas and Steam | 0.0439 | 5 | 0.0114 | 4 | 0.0319 | 18 |

| 017 | Water Supply, Waste and Remediation Service | 0.0073 | 21 | 0.0044 | 15 | 0.0014 | 30 |

| 018 | Construction | 0.0016 | 27 | 0.0005 | 29 | 0.0127 | 23 |

| 019 | Wholesale and Retail Trade | 0.0539 | 4 | 0.0277 | 1 | 0.7368 | 1 |

| 020 | Transportation | 0.0412 | 6 | 0.0142 | 3 | 0.4610 | 2 |

| 021 | Food Services and Accommodation | 0.0106 | 16 | 0.0039 | 17 | 0.1799 | 5 |

| 022 | Communications and Broadcasting Services | 0.0127 | 12 | 0.0055 | 12 | 0.0704 | 10 |

| 023 | Finance and Insurance Services | 0.0198 | 7 | 0.0101 | 5 | 0.1096 | 7 |

| 024 | Real Estate and Leasing | 0.0102 | 18 | 0.0075 | 8 | 0.0375 | 17 |

| 025 | Professional, Scientific, and Technical Services | 0.0147 | 10 | 0.0083 | 7 | 0.1658 | 6 |

| 026 | Business Support Services | 0.0090 | 19 | 0.0060 | 11 | 0.2382 | 4 |

| 027 | Public Administration and Defense | 0.0007 | 29 | 0.0005 | 28 | 0.0061 | 27 |

| 028 | Educational Services | 0.0003 | 30 | 0.0002 | 30 | 0.0049 | 28 |

| 029 | Health and Social Welfare Services | 0.0015 | 28 | 0.0008 | 26 | 0.0219 | 20 |

| 030 | Cultural and Other Services | 0.0052 | 24 | 0.0025 | 19 | 0.1052 | 9 |

| Impacts on Other Sectors | 0.6201 | 0.1820 | 2.9576 | ||||

| EIP sector | 1.0000 | 0.1670 | 3.4937 | ||||

| Total | 1.6201 | 0.3489 | 6.4512 | ||||

| Codes | Sectors | Forward Linkage Effects | Ranks | Backward Linkage Effects | Ranks |

|---|---|---|---|---|---|

| 001 | Agricultural, Forest, and Fishery Products | 0.7119 | 17 | 0.7174 | 23 |

| 002 | Mined and Quarried Products | 0.4261 | 28 | 0.7555 | 20 |

| 003 | Food and Beverages Products | 0.6787 | 19 | 1.0262 | 11 |

| 004 | Textile and Leather Products | 0.6722 | 21 | 0.9456 | 13 |

| 005 | Wood and Paper Products, Printing | 0.7762 | 14 | 1.2110 | 6 |

| 006 | Coal and Petroleum Products | 1.2511 | 6 | 0.5551 | 30 |

| 007 | Chemical Products | 2.2272 | 3 | 1.4570 | 4 |

| 008 | Non-metallic Mineral Products | 0.5702 | 24 | 1.1041 | 10 |

| 009 | Primary Metal Products | 3.2954 | 2 | 2.8641 | 1 |

| 010 | Metal Products | 0.8436 | 10 | 1.5222 | 3 |

| 011 | Machinery and Equipment | 0.7685 | 15 | 1.1761 | 7 |

| 012 | Electronic and Electrical Equipment | 0.8865 | 9 | 0.8183 | 16 |

| 013 | Precision Instruments | 0.4822 | 26 | 0.9105 | 14 |

| 014 | Transportation Equipment | 0.6744 | 20 | 1.1607 | 8 |

| 015 | Other Manufactured Products and Outsourcing | 0.7847 | 13 | 1.0049 | 12 |

| 016 | Electricity, Gas and Steam | 1.6058 | 4 | 1.3705 | 5 |

| 017 | Water Supply, Waste and Remediation Service | 0.8265 | 12 | 2.2068 | 2 |

| 018 | Construction | 0.4337 | 27 | 1.1318 | 9 |

| 019 | Wholesale and Retail Trade | 1.4616 | 5 | 0.7261 | 22 |

| 020 | Transportation | 1.1016 | 7 | 0.6663 | 26 |

| 021 | Food Services and Accommodation | 0.6645 | 22 | 0.8534 | 15 |

| 022 | Communications and Broadcasting Services | 0.8314 | 11 | 0.7390 | 21 |

| 023 | Finance and Insurance Services | 0.9597 | 8 | 0.6839 | 24 |

| 024 | Real Estate and Leasing | 0.6992 | 18 | 0.5760 | 29 |

| 025 | Professional, Scientific, and Technical Services | 0.7216 | 16 | 0.6766 | 25 |

| 026 | Business Support Services | 0.6355 | 23 | 0.6162 | 27 |

| 027 | Public Administration and Defense | 0.3986 | 30 | 0.5385 | 31 |

| 028 | Educational Services | 0.3783 | 31 | 0.5818 | 28 |

| 029 | Health and Social Welfare Services | 0.4133 | 29 | 0.7854 | 19 |

| 030 | Cultural and Other Services | 0.5250 | 25 | 0.8034 | 18 |

| 031 | EIP | 4.2947 | 1 | 0.8155 | 17 |

| Codes | Sectors | Supply Shortage Effects | Sectoral Price Effects | ||

|---|---|---|---|---|---|

| (KRW) | Ranks | (%) | Ranks | ||

| 001 | Agricultural, Forest, and Fishery Products | 0.0304 | 9 | 0.0523 | 6 |

| 002 | Mined and Quarried Products | 0.0007 | 30 | 0.0094 | 25 |

| 003 | Food and Beverages Products | 0.0282 | 10 | 0.0399 | 9 |

| 004 | Textile and Leather Products | 0.0218 | 14 | 0.0609 | 4 |

| 005 | Wood and Paper Products, Printing | 0.0138 | 19 | 0.0902 | 1 |

| 006 | Coal and Petroleum Products | 0.0162 | 18 | 0.0034 | 29 |

| 007 | Chemical Products | 0.1157 | 2 | 0.0068 | 26 |

| 008 | Non-metallic Mineral Products | 0.0115 | 23 | 0.0675 | 3 |

| 009 | Primary Metal Products | 0.2659 | 1 | 0.0068 | 27 |

| 010 | Metal Products | 0.0618 | 7 | 0.0697 | 2 |

| 011 | Machinery and Equipment | 0.0426 | 8 | 0.0290 | 15 |

| 012 | Electronic and Electrical Equipment | 0.0757 | 5 | 0.0332 | 14 |

| 013 | Precision Instruments | 0.0077 | 26 | 0.0449 | 7 |

| 014 | Transportation Equipment | 0.0727 | 6 | 0.0264 | 17 |

| 015 | Other Manufactured Products and Outsourcing | 0.0208 | 15 | 0.0525 | 5 |

| 016 | Electricity, Gas and Steam | 0.0772 | 3 | 0.0034 | 30 |

| 017 | Water Supply, Waste and Remediation Service | 0.0050 | 28 | 0.0056 | 28 |

| 018 | Construction | 0.0769 | 4 | 0.0346 | 13 |

| 019 | Wholesale and Retail Trade | 0.0271 | 11 | 0.0139 | 21 |

| 020 | Transportation | 0.0199 | 16 | 0.0358 | 11 |

| 021 | Food Services and Accommodation | 0.0219 | 13 | 0.0437 | 8 |

| 022 | Communications and Broadcasting Services | 0.0101 | 24 | 0.0133 | 22 |

| 023 | Finance and Insurance Services | 0.0096 | 25 | 0.0115 | 23 |

| 024 | Real Estate and Leasing | 0.0137 | 20 | 0.0139 | 20 |

| 025 | Professional, Scientific, and Technical Services | 0.0128 | 21 | 0.0175 | 19 |

| 026 | Business Support Services | 0.0039 | 29 | 0.0185 | 18 |

| 027 | Public Administration and Defense | 0.0069 | 27 | 0.0112 | 24 |

| 028 | Educational Services | 0.0121 | 22 | 0.0277 | 16 |

| 029 | Health and Social Welfare Services | 0.0230 | 12 | 0.0361 | 10 |

| 030 | Cultural and Other Services | 0.0173 | 17 | 0.0350 | 12 |

| Total and Weighted Average | Total: 1.123 | Weighted Average: 0.0269 | |||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, H.-W.; Dong, L.; Jung, S.; Park, H.-S. The Role of the Eco-Industrial Park (EIP) at the National Economy: An Input-Output Analysis on Korea. Sustainability 2018, 10, 4545. https://doi.org/10.3390/su10124545

Kim H-W, Dong L, Jung S, Park H-S. The Role of the Eco-Industrial Park (EIP) at the National Economy: An Input-Output Analysis on Korea. Sustainability. 2018; 10(12):4545. https://doi.org/10.3390/su10124545

Chicago/Turabian StyleKim, Hyeong-Woo, Liang Dong, Seok Jung, and Hung-Suck Park. 2018. "The Role of the Eco-Industrial Park (EIP) at the National Economy: An Input-Output Analysis on Korea" Sustainability 10, no. 12: 4545. https://doi.org/10.3390/su10124545

APA StyleKim, H.-W., Dong, L., Jung, S., & Park, H.-S. (2018). The Role of the Eco-Industrial Park (EIP) at the National Economy: An Input-Output Analysis on Korea. Sustainability, 10(12), 4545. https://doi.org/10.3390/su10124545